19 minute read

CHAPTER 1. ECONOMIC WARFARE AND CORROSIVE CAPITAL AS A SEPARATE THEATER OF COMBAT OPERATIONS IN HYBRID WAR

from Analyzing Corrosive Investments into Ukraine’s Economy as an Element of Hybrid Warfare

by Center for Analytical Studies and Countering Hybrid Threats

1.1. Correlation of types of economic confrontation and hybrid war

International economic relations are a global domain of mutually beneficial existence and of confrontation. Analysis of expert materials in this field finds the use of a large set of definitions that include the word “economic”, such as economic competition, economic struggle, economic confrontation, economic war, economic opposition, and economic rivalry. It is very difficult to unambiguously arrange all these definitions according to a hierarchy that starts with initial stages and progresses to maximum escalation. And they can include one as part of another. Thus, the economic dictionary defines competition as “rivalry, struggle to achieve better results in the field of activity”2

Advertisement

The project analysts place all variants of economic confrontation within a spectrum that has “competition” and “war” at opposite ends, depending on two criteria: whether states are absent or present in such conflict, and the ultimate goal of the conflict, which can be economic or political.

Economic competition is not for the purpose of political goals on its own, but involves a change in market conditions by a business entity for its own benefit. The role of the state at this level is absent, or minimal, in the form of protectionism in the interests of the national producer.

Economic war is a social phenomenon in which a government uses economic measures to weaken the economy of another state. At the extreme pole of economic confrontation, it is conducted between antagonistic countries and involves the use of all possible types of “economic” weapons.

Of course, in the middle of this spectrum there are many options for economic confrontation, which can be used even by allied states to influence each other's economies. In 2019, for example, Japan imposed export restrictions on a number of chemical components to South Korea, which were necessary for the production of semiconductors, due to alleged suspicion of having them forwarded as dual purpose goods to North Korea.3

What is the relationship between different types of economic confrontation and “hybrid war”?

On the one hand, as mentioned above, the goal of hybrid war is the destruction or subjugation of the victim country, which can be achieved, among other ways, through the destruction of its economy. Economic war is the main tool of the aggressor country in the economic operational line. And this is understandable, since the maximum damage to the victim country can be inflicted by the maximum use of all possible types of “economic” weapons.

On the other hand, as also mentioned above, the aggressor country is trying to hide its role during hybrid war as much as possible. Therefore, as an example, the initial measures of a hybrid aggressor in the economy of the victim country can be disguised as competition (while the real goals are further occupation of the country, which is hidden).

Each of the stages of economic conflict may have signs of “hybrid threats”, the visibility of which increases with escalation, even though aggressors may wish to hide their culpability. The results of aggressive influence are

2 https://library.nlu.edu.ua/POLN_TEXT/KNIGI/KONDOR/EKONOMIC_SL_2006.pdf

3 https://focus.ua/uk/world/526164-tri-glavnye-problemy-v-otnosheniyah-yaponii-i-yuzhnoy-korei most fully manifested at the final stage of hybrid operations, when the destructive impact of the aggressor's policy becomes a concrete result in the form of destruction of key strategic enterprises, and most often, in the destruction of entire sectors of the economy. But the victim's response to such a result is often delayed, since the aggressor has achieved a devastating effect, establishing the victim country's critical economic dependence on the aggressor.

Thus, the challenge is acute: how to detect the hidden conduct of hybrid operations along the economic operational line in order to counter them at an early stage of implementation? How can potential victims distinguish between competition and economic warfare in the framework of hybrid aggression?

1.2. Ways of conducting economic war

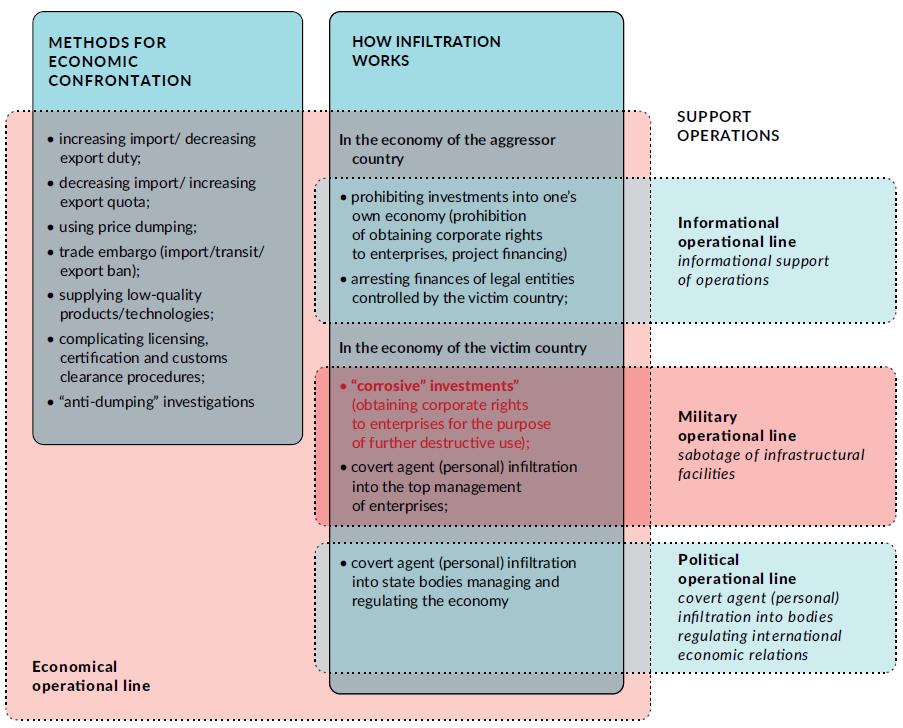

The aggressor country conducts economic war in two ways (Fig. 1.1):

• the method of “confrontation” with the economy of the victim country

• the method of “infiltration” into the victim country's economy

Ways of Conducting the Economic War

CONFRONTATION without establishing control over enterprises of the victim country

INFILTRATION including establishing control over enterprises of the victim country

The method of confrontation with the economy by the aggressor country includes measures of the authorities and special services of the aggressor country aimed at weakening the economy of the victim state without establishing control over its enterprises, which can include:

• changing import and export duties

• changing import and export quotas

• trade embargos, including prohibiting, importing, exporting, or transiting goods

• supply of low-quality products

• complication of licensing, certification, and customs clearance procedures

• using price dumping

• anti-dumping investigations

For example, from 2014 to 2018, Russia banned the import of 46 types of goods from Ukraine4 while introducing a ban on the transit of goods to Kazakhstan5 and other countries.

Experts and scientists called these measures the main means of trade wars in different studies.

The method of infiltration into the economy includes the measures implemented by authorities and special services of the aggressor country aimed at weakening the economy of the victim state along with establishment of real or hidden control over the enterprises of the victim country, as well as measures to prevent or eliminate infiltration into its own economy. This method involves:

• bans on investments in the aggressor’s economy (such as obtaining corporate rights to enterprises or financing)

• the seizure of financial assets of legal entities controlled by the victim country

• corrosive investments (obtaining corporate rights to enterprises for the purpose of further destructive use)

• covert agents infiltrating, in person, the top management of enterprises in the victim country

It should be noted that operations along the economic operational line are accompanied by operations in other operational lines.

In particular, in the political operational domain, covert agent infiltrations, in person, into the state management and regulation bodies of the victim country's economy, are carried out along with similar covert agent infiltration into bodies regulating international economic relations.

All operations in the economic operational line are, as a rule, accompanied by informational operations such as the discrediting or popularization of elements of a victim’s economy or oversight of it, such as a relevant regulatory body, business entity, industry, product, technology, management decision or economic policy.

It is also possible to separately consider the sabotage of critical infrastructure facilities as operations supporting economic warfare along the military operational line.

Thus, hybrid operations represent a set of operations along different operational lines. They are carried out in a coordinated manner, in line with a single plot and plan, under the leadership of a single decision-making center. Operations along the economic operational line constitute one of these components, and can be the main operation, depending on the purpose of the comprehensive operation, with operations along other operational lines serving complementary roles.

4 https://espreso.tv/news/2018/12/29/yaki_tovary_rosiya_zaboronyla_vvozyty_z_ukrayiny_spysok

5 https://www.bbc.com/ukrainian/news-39026928

The toolkit for conducting hybrid war is shown in Fig. 1.2.

1.3.

The term corrosive investment includes two words that define its essence.

“Investment” involves purchasing fixed assets, intangible assets, corporate rights, and securities in exchange for funds or property. In this case, it involves the acquisition of corporate rights of the victim country’s enterprises.

“Corrosive” implies negative consequences for the economy of the victim country or positive consequences for the aggressor country from such an investment.

Thus, corrosive investment is a method of economic warfare, which consists in making direct or indirect investments in the real sector of the state's economy in order to obtain corporate rights to the enterprises of the victim country, which are ultimately aimed at harming its economy and national interests.

In addition to the above two main signs of corrosive investments, there is sometimes a third indicator – the level of antagonism in the international relations of the aggressor country and the victim country. The aggressor often attempts to hide this until a certain time.

For example, Russian propaganda and officials, including the president of the Russian Federation, claimed fraternal feelings towards the Ukrainian people, declaring that the two peoples are essentially one nation. The elusiveness and pacifism in these statements are disguising an aggressive denial of Ukraine’s right to exist.

1.4. Subjects of corrosive investments

The first indicator of corrosive investment involves establishment of control over an economic entity of the victim country via control of a certain share of its stock or equity.

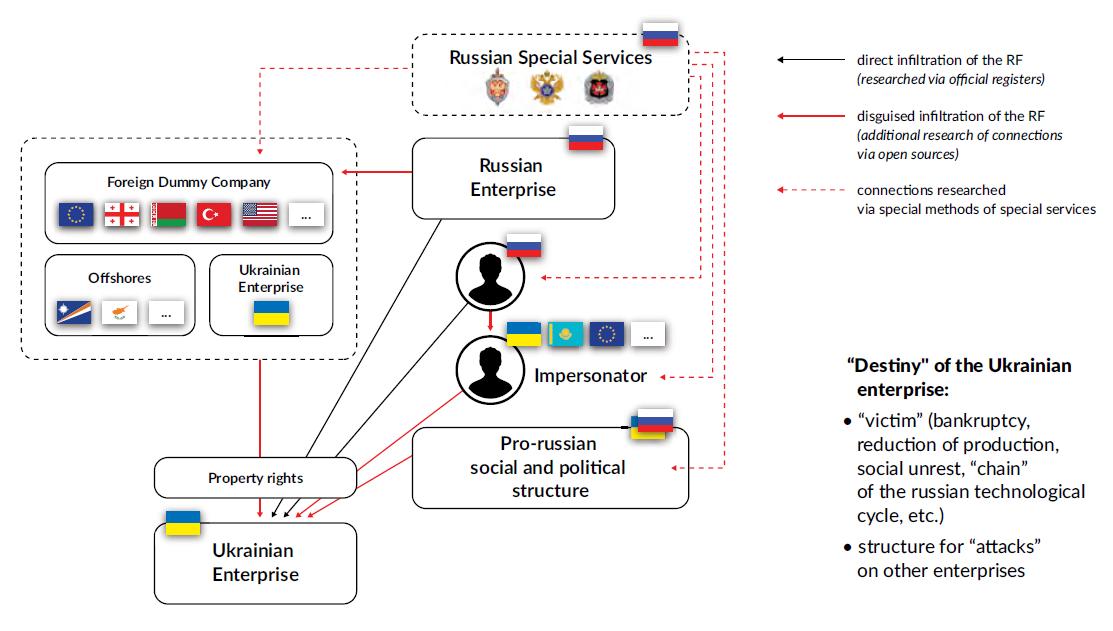

When considering the Russian Federation as an aggressor country, the project analysts distinguish 5 variations of infiltration agents (Fig. 1.3):

• a Russian enterprise

• a citizen of the Russian Federation

• a third country enterprise or a Ukrainian enterprise controlled by the Russian Federation a pro-Russian public and political structure or its representative

• a third person covertly controlled by the Russian Federation, with no external signs of this connection

At the same time, the subjects of infiltration may have connections with the Russian special services.

The first two options can be called direct infiltration; the others are disguised. But it is possible to identify infiltration via state public registers.

1.5. Negative consequences of corrosive investments

Obtaining corporate rights to business entities of the victim country allows the aggressor country to implement the following actions through real or fictitious owners:

• artificial blocking or termination of the economic activity of enterprises, or the destruction of them with managerial actions, such as filing for bankruptcy despite positive financial indicators and profitability.

In 2008, the pro-Russian politician O. Tsarev, who controlled the only producer of offset paper in Ukraine, the Dnipropetrovsk Paper Factory, declared bankruptcy despite positive indicators of financial activity. This made Ukraine dependent on Russian imports of paper and finished printed products (described in section 5).

• theft of information about the controlled entity, such as its personnel, technologies, operations, counterparts, clients, data, or scope of cooperation

• use of economic levers to carry out operations along other operational lines, such as artificially creating a crisis to provoke a social unrest, or financing protest activities

In 2014, the former Minister of Internal Affairs of Bulgaria, Tsvetan Tsvetanov testified in an interview to The Financial Times that in 2013 the protests against Chevron's shale projects in the country, as well as antigovernment demonstrations that led to the resignation of the ruling cabinet, took place according to a scenario developed by Russia and implemented with the help of Moscow-controlled Bulgarian businessmen.6

• using a business of the victim country as a pretext for carrying out destructive or illegal activities, such as financing organized crime and terrorism, controlling political projects, or money laundering

The report of the European Commission published in October 2022 on the risks of money laundering and terrorist financing indicated the existence of thousands of companies controlled by Russians (including subjects of EU sanctions) in EU countries in the fields of real estate, construction, hospitality, finance and energy that launder money, as well as sponsor destabilizing activities in other countries.7

• using economic assets of the victim country in one's own economic interests with harmful consequences for the victim country, such as establishing control over the raw material base of the victim country to produce weapons of destruction

Since the beginning of the 2000s, the Russian Federation has established control over the titanium industry of Ukraine, via the controlled oligarch D. Firtash, and used it exclusively for its own defense-industrial complex, primarily in the production of combat aircraft and helicopters. At the same time, the pro-Russian oligarch sabotaged the modernization of the Zaporizhzhia titanium-magnesium plant, which made it impossible to develop a domestic processing enterprise and, as a result, to obtain potential high profits from the production of finished titanium rolled products (described in section 3).

6 https://www.ft.com/content/e011d3f6-6507-11e4-ab2d-00144feabdc0?siteedition=intl#axzz3KkkKmaCQ

7 https://www.spiegel.de/wirtschaft/unternehmen/eu-noch-immer-31-000-firmen-in-russischer-hand-a-b2327912-50a9-4d34- 9aa9100643f3f9a3

Conclusions to Chapter 1

1. Hybrid warfare is a complex socio-political phenomenon associated with conflicts between states, people, national and social groups. The efforts are focused on achieving the goal by conducting operations along political, economic, and informational operational lines. The involvement of the armed forces is of limited nature, in the form of special and peacekeeping operations. The aggressor tries to achieve its goal without declaring war or admitting its involvement in the events.

2. The goal of the aggressor state in hybrid war is the destruction or subjugation of the victim state. The actions of such aggressor states along all operational lines are carried out in the form of operations that have a hierarchical structure and are implemented comprehensively according to a single plot and plan.

3. Confrontations along economic operational lines feature levels of escalation, starting with competition and rising to economic warfare. Given that the aggressor country tries to hide its role in the hybrid war as much as possible, each of the stages of the economic confrontation may come with indicators of hybrid aggression, but its visibility increases as the escalation level of such confrontation increases.

4. The aggressor country conducts economic warfare in two ways: collision with the economy of the victim country and infiltration into the economy of the victim country. These methods are distinguished by the absence or presence of real or disguised control over enterprises, economic sectors, resources, or management bodies in the economy of the victim country.

5. One of the methods of infiltration into the economy of the victim country is corrosive investment, which consists of making direct or indirect investments in the real sector of the state's economy in order to control the enterprises of the victim country. These investments are ultimately aimed at harming its economy and national interests, and sometimes also ensuring the sustainable functioning of the aggressor country's own economy through additional damage to the victim country.

6. The main features of corrosive investments are:

• presence of an infiltration agent that is directly or indirectly controlled by the aggressor country

• making decisions that are illogical from the point of view of commerce, which have negative consequences for the economic activity of enterprises subject to established control

• whilst individual corrosive investments may not on their own rise to a systemic threat, a group of them together can rise to that level of concern

• another country's attempt to connect resolution of economic issues in international relations with political matters.

CHAPTER 2. OBJECTS OF CORROSIVE INVESTMENTS

There is no doubt about the fact that the aggressor country inflicts its main hybrid strikes on the objects of strategic importance in the economic domain of the victim country.

Ukrainian legislation uses two terms with the word “strategic”: industry and enterprise. This creates two methodical approaches to search for corrosive investments.

The first approach involves assessing the general indicators of the industry or sub-industry over time and identifying inherent interrelated negative dynamics. These can include indicators of corrosive investments such as decreases in production, the bankruptcy or liquidation of enterprises, a lack of supply of goods or services, or an increased level of dependence of the industry’s enterprises on a particular country. The first approach also involves seeking causes for these indicators, and the identification of enterprises, persons or countries that caused the negative consequences. This is the deductive approach, “from the industry to the enterprise”, because the signs of corrosive investments in specific enterprises of the victim country are identified at the final stage of research.

The second approach involves analyzing the fate of enterprises that are strategic for the economy and security of Ukraine, identifying the signs of corrosive investments made by the aggressor country, such as negative consequences for the enterprise and the presence of corporate and legal infiltration, as well as further analysis of their impact on the general indicators of the industry performance and its dynamics. This is the inductive approach, “from the enterprise to the industry”.

At the initial stage of the project, analysts focused on the second method, because detection of corrosive investments is directly related to the analysis of enterprises. However, this approach may not provide an overall picture, since some enterprises in the industry may not be defined as strategic by the Government. For example, there are more than 30 enterprises in the paper manufacturing industry but only three identified as strategic. Therefore, at the second stage of research, the analysts switched to analysis of the negative hybrid impact on the strategic industry as a whole and, as a result, to identification of corrosive investments taking into account the negative trends in the industry itself.

2.1. Strategic economic sectors

In 2020, the Ministry of Strategic Industries of Ukraine developed a draft resolution of the Cabinet of Ministers of Ukraine “On different matters of developing the industrial complex of Ukraine”, which lists 17 strategic industries and distribution of their accountability to state bodies.8 In particular, the following industries were identified:

• defense industry

• fuel and energy industry

• transport industry

• agro-industrial complex

• aviation and rocket and space industry

• telecommunications and communications

• machine building

• metallurgical and mining industry

8 https://www.facebook.com/photo/?fbid=112621537336030&set=pcb.112621590669358

• chemical Industry

• food Industry

• light industry

• glass and porcelain and ceramic industry

• furniture production and woodworking industry

• publishing industry

• geological exploration

• construction and construction materials

• pharmaceuticals

In order to precisely assess the corrosive effect of an aggressor country (in our case, the Russian Federation), it is necessary to conduct a study of all above-mentioned branches of the economy according to a certain methodology. Such a study will reveal detail such as the dominant industries that were attacked, identify the mechanisms of the aggressor's actions in each of the industries as well as the actors who performed the infiltration into the industry.

It is impossible to conduct the study of all strategic branches of the economy for the presence of corrosive investments within the time available. Moreover, each of the branches may have dozens of sub-branches. The “fuel and energy industry” includes oil, gas, coal extraction and their transportation, oil refining, and fuel use, for example. The “metallurgical and mining industry” includes ferrous and non-ferrous metallurgy, metallurgy of rare earth metals and the mining of various types of ores. The specified sub-sectors may be the subject of research at further stages of the project implementation.

Thus, two sub-sectors were chosen as examples for the study of corrosive investments for which elements of Russia's negative impact were repeatedly covered in the informational domain,: titanium extraction (Chapter 3) and oil refining (Chapter 4).

2.2. Enterprises with strategic status for the economy and security of Ukraine: Quantitative indicators

In accordance with the Law of Ukraine “On Management of State-Owned Entities”, the declaration of an enterprise status as “strategic for the economy and security” is made by the Cabinet of Ministers of Ukraine (CMU).

The project team selected for generalization 30 regulatory and legal acts of the CMU that declared, amended, and abolished this status.

There are more than 3,000 enterprises listed as strategic in the resolutions of the CMU from 1997 to 2021. That total was halved by removing duplicate listings. After clarifying the operational status of all these enterprises, it was determined that as of the beginning of 2022, 879 enterprises (55%) are in operation, 16 are located in the occupied territory and have not been re-registered under Ukrainian legislation, 337 have been liquidated, and 289 have started a bankruptcy case (Table 2.1). Information on two enterprises was not found in open registers according to a preliminary check.

Thus, it is possible to note that in the entire period about 42% of enterprises were withdrawn from “operational” status, and were either liquidated or are at different stages of bankruptcy.

Based on their main activities, they belonged to 17 sections of the economy of Ukraine, according to the state classifications.

Reviewers analyzed seven sections of the economy with the largest number of enterprises included into the List of Strategic Enterprises.9

According to the general indicators, the most vulnerable sectors were the “processing industry”, with about 50% of enterprises now defunct, “mining industry and quarry development” (about 47% ) and “scientific and technical activities” (about 35%).

The main “strike” was “inflicted” on the processing industry thus depriving Ukraine of income from added value in production and also turning the country into a supplier of agrarian goods and raw materials to the world economy. Moreover, this led to a standstill or reduction of production at the respective enterprises along the supply chain of liquidated entities.

Destruction of one-third of the enterprises in the scientific and technical sector deprived the domestic economy of progress in development, led to Ukraine's dependence on foreign technologies (the cost of which in some cases exceeded the cost of products created using them), as well as the outflow of scientific personnel.

9 During the analysis, reviewers disregarded sectors with the minimum number of enterprises from the List of Strategic Enterprises, as well as the sectors considered “non-strategic”, including “agriculture” (7 enterprises), “activities in the sector of administrative and auxiliary services” (4), “mandatory social insurance” (6), “education” (3), “health care and provision of social assistance” (2), “wholesale and retail trade”; and “repair of motor vehicles and motorcycles”.

The cessation of the existence of strategic enterprises is only type of damage to the economy and security of Ukraine.

Over the 25 years of existence of the List of Strategic Enterprises, several hundreds of business entities in various branches of Ukrainian economy have been excluded from it (Fig. 2.1). While the first edition in 1997 listed more than 1,100 enterprises, today there are only 285.

Operational Liquidated Bankruptcy

“Strategic” enterprises

Enterprises excluded from the list of “strategic” ones

Naturally, mechanical mathematics does not allow making an objective picture. There are at least two established reasons for this:

• “Legal liquidation”, in which an enterprise changes its form (such as from a joint-stock company or JSC to a limited liability company, or LLC), name or registration number. The “old” structure is legally liquidated, while in fact the company operates and manufactures products (for example Lutsk Cardboard and Paper Mill PrJSC, which was a strategic enterprise, was liquidated and the Lutsk Cardboard and Paper Factory of Ukraine LLC was created instead).

• reorganization of individual small regional state enterprises into regional branches of a single enterprise (28 enterprises of “Ukrtelecom” became one enterprise with 27 regional branches)

Reasons for excluding an enterprise from the list may also include:

• elimination of an ineffective structure, which actually lost “strategic” status due to certain reasons, or because it requires significant maintenance costs

• transfers of its assets to controlled affiliated structures or the domestic oligarchy for the purpose of obtaining profits for the new owner instead of the state (enrichment of the oligarchy)

• transfer of its assets to another structure, which is interested not in production facilities, but in the land title, and the enterprise is liquidated by the new owner in order to use the land for another profitable project

Naturally, objective numbers must be searched for in the process of a detailed review of all excluded enterprises, which was not possible to do within the timeframe of the project.

2.3. Specific features of regulatory and legal support in development of the List of Strategic Enterprises of Ukraine

Analysis of legal and regulatory acts assigning strategic status to enterprises, as well as procedures for administering the List, proved the lateness, incoherence and unsystematic nature of this process.

Legal regulation was expected to include a sequence of the following actions:

1) The definition of the “strategic enterprise” concept from the perspective of exceptional importance for the defense and economic potential of Ukraine.

2) The development of criteria for assigning enterprises to the category “strategic for economy and security of the state”.

3) The development of requirements for state protection of strategic enterprises, such as limiting or forbidding private ownership.

4) Determination of the procedure for developing the List of Strategic Enterprises (authority of state structures, private sector, experts, etc.)

5) Development and administration of the list.

This process was not followed. A first list appeared in 1997, but the first criteria were not published until 2003. Requirements were not introduced until 2009, and administrative procedures were set by 2010. As a result, we have:

• No clear and integral definition of the “strategic enterprise” concept

• Unsystematic regulatory guidance

• Lateness (6 years between some of the legal facts) What are the consequences of such disorganization?

1. Inconsistency between the privatization process and the identification of enterprises as strategic ones for the state caused the existence of two different lists: a “List of entities that are not subject to privatization due to their national significance” introduced in 1995, and a “List of enterprises of strategic value for the economy and security of the state” introduced in 1997.

As the comparison of both lists demonstrates, only 10% of strategic enterprises were identified as not subject to privatization. Thus, the vast majority of strategic enterprises remained potentially eligible for privatization by private, including Russian, businesses.

Based on results of research conducted by specialists of the Center for Economic Development, more than 11,000 medium and large enterprises were privatized from 1995 to 1998. The largest demand was enjoyed by enterprises of the metallurgical complex (26% of the total), the electric power industry (25%) and the chemical and petrochemical industry (19%).

Thus, after privatization a significant number of strategic industrial entities remained out of the focus of the government authorities developing the List of Strategic Enterprises. Even today almost one third of enterprises on the list are representatives of these industries.

2. Inconsistency of actions committed by the state authorities during development of the List of Strategic Enterprises resulted in the first edition of the list omitting 97 enterprises controlled by the State Committee on Oil, Gas and Oil Refining Industry of Ukraine, 25 entities under the Ministry of Defense of Ukraine, in particular aircraft and armored vehicle and tank repair plants, five entities under the Ministry of Transport of Ukraine including the State International Airport Boryspil, the Crimean National Center for Control and Testing of Space Engineering, the Sevastopol Institute of Nuclear Energy and Industry and others.

Conclusions to Chapter 2

1. During hybrid war, the aggressor country is interested in bringing the strategic sectors of the economy of the victim country to a standstill or in establishing full control over such sectors for further use in its own interests exclusively. One of the effective methods is corrosive investments in enterprises of strategic industries. These are enterprises of strategic importance for the security and economy of the country.

2. The project used two research methods: a focus “from the industry to the enterprise” (assessing general indicators of the industry and its sub-industries over time, establishment of related negative dynamics, research of their causes, and identification of enterprises, persons or countries that caused negative consequences for the strategic industry), and a focus “from the enterprise to the industry” (establishing signs of corrosive investments by the aggressor country, negative consequences for the strategic enterprise, and analyzing their impact on the general indicators of the industry and their dynamics, including negative ones.)

3. It was not possible to conduct such studies for approximately 70 to 80 sub-sectors and more than 330 destroyed strategic enterprises because of the amount of time allotted to conducting the study.

At the same time, it is relevant to consider the possibility of conducting studies of strategic industries within the framework of further stages of the project, which will facilitate identifying the general regularities of the process and finding indicators of destructive hybrid operations.

4. Analysis of liquidated strategic enterprises in Ukraine from 1998 to 2021 shows that the most vulnerable sectors were the “processing industry” (about 50% of enterprises were liquidated), the “mining industry and quarry development” (about 47%) and “scientific and technical activity” (about 35%).

5. Analysis of legal acts regulating the endorsement or revocation of strategic status to an enterprise, as well as the procedure for managing the list of such enterprises, identified the lateness, incoherence, and unsystematic nature of this process, which led to establishment of control over strategic enterprises by the oligarchy and representatives of the aggressor country. The list-development process was disrupted by corruption on the part of Ukrainian authorities. When conducting comprehensive operations in the economic and political domains, the aggressor used both the shortcomings of Ukrainian legislation and the corruption component (directly or under cover) to achieve specific goals of corrosive infiltration into strategic industries. Corrupt manifestations of Ukrainian officials and the power of the oligarchy are favorable factors for implementation of hybrid operations of the aggressor country. They also negatively affected the prospects for Ukraine's membership in the EU. Both factors must be accounted for if European integration of Ukraine is to become a possibility.