12 minute read

CORROSIVE IMPACTS OF THE RUSSIAN FEDERATION ON UKRAINE’S TITANIUM INDUSTRY

from Analyzing Corrosive Investments into Ukraine’s Economy as an Element of Hybrid Warfare

by Center for Analytical Studies and Countering Hybrid Threats

Extraction and processing of titanium is one of the strategic industries of Ukraine. The metal is used in aircraft, rockets, and shipbuilding, and only seven countries produce it: Ukraine, Kazakhstan, the U.S., Japan, China, India, and Russia.10

Ukraine has 20% of global ilmenite reserves, from which titanium is extracted. There are more than 40 deposits in Ukraine, of which 12 have been explored in detail and industrial extraction has begun.

Advertisement

3.1. Gradual establishment of control over the titanium industry of Ukraine before the start of open phase of a hybrid war (2001–2014)

Until 2014, the titanium industry of Ukraine, which included extraction and refining into intermediate goods, was under the monopoly control of oligarch Dmytro Firtash. The formation of his “titanium empire” started in 2001 and over the next 10 years he gained control over key enterprises in this industry.

The first acquisition was Mezhyrichensk Mining and Processing Plant LLC. It was registered in Zhytomyr oblast in January 2001. The beneficial owner is Dmytro Firtash,11 and the company held a special permit for the extraction of ilmenite ore from a 492-hectare section of the Mezhyrichne deposit. The estimated capacity of the enterprise is 180,000 tons of ilmenite concentrate per year. Valky-Ilmenit LLC was registered in Zhytomyr oblast, in March 2001, with Firtash as beneficial owner through a Cypriot company called Balmat Holdings Ltd.12 It’s permit allows use of the resources of the Valky-Gatskivske deposit, and the estimated capacity of the enterprise is 65 thousand tons of ilmenite concentrate per year.

In 2004, Dmytro Firtash took control of three additional enterprises, which since 1997 have been on the “List of state-owned entities of strategic value for the economy and security of the state”:

• Crimean Titan PrJSC, the only producer of titanium dioxide in Europe, and was established in August 2004 after the sale of 49% of its shares to the German company Ostchem Germany GmbH. That company’s beneficial owner is Firtash.13 In 2012, 100% of the shares went to Ostchem Germany GmbH.14 Even though after the occupation of Crimea, Crimean Titan PrJSC was re-registered in Kyiv under the name Ukrainian Chemical Products, it continued operating exclusively within the RF legislation. Dmytro Firtash retained the ownership of enterprise via the Cypriot firm Letan Investments Ltd. and the Russian company Titanium Investments LLC.15 In December 2021, according to the press service of Firtash’s Group DF, the assets of Ukrainian Chemical Products were sold to Russia’s Titanium Investments LLC.16 Estimated capacity of the enterprise is 200,000 tons of titanium dioxide per year, while up to 120,000 tons were actually produced before 2014).

10 https://uifuture.org/reports/strategiya-tytanovoyi-galuzi-ukrayiny-2030/

11 https://youcontrol.com.ua/catalog/company_deta36ils/305979

12 https://youcontrol.com.ua/catalog/company_details/31280048

13 https://ukrrudprom.ua/digest/Sploshnoy_front.html?print

14 https://zn.ua/ECONOMICS/firtash_kupil_kontrolnyy_paket_krymskogo_titana.html

15 https://news.finance.ua/ru/news/-/506529/firtash-prodal-titanovyj-biznes-v-krymu-rossiyanam

16 https://investigator.org.ua/ua/investigations/239039

• Irshansk Mining and Processing Plant and Vilnohirsk Mining and Metallurgical Plant (both leased by Crimean Titan since 2004). The estimated capacity of Irshansk MPP and Vilnohirsk MMP is 450,000 and 200,000 tons of ilmenite concentrate per year, respectively).

In 2012, the titanium empire of Dmytro Firtash expanded with another strategic enterprise: Zaporizhzhia Titanium & Magnesium Plant, the only producer of sponge titanium in Europe. The Cypriot company Tolexis Trading Limited, which belonged to Group DF of Dmytro Firtash, purchased 49% of the company. Despite the fact that the state retained a controlling 51% stake, the company itself was transferred to the oligarch's management. The estimated capacity is more than 20,000 tons of sponge titanium per year.

In fact, before the Russian invasion of Ukraine in 2014, the business structures of Dmytro Firtash had effective monopoly rights both to extraction of titanium ore and production of ilmenite concentrate and to the production of titanium products. His businesses had a market share of between 90% and 100% in each of these areas.

By 2014, more than 50% of the ilmenite concentrate produced at Firtash's enterprises was exported to the RF, and Crimean Titan PrJSC supplied about 30% of supply to the Russian titanium dioxide market.17 The key customer was the Russian metallurgical company VSMPO-AVISMA Corporation PrJSC. A quarter of its shares belong to the Russian state corporation Rostech of S. Chemezov, one of the closest associates of the President of the RF, Vladimir Putin. It supplies titanium products used in production of helicopters and other Russian military equipment, 18 19 20 as well as bulletproof vests and bulletproof helmets for servicemen of the Armed Forces of the RF.

In fact, for many years, the titanium industry of Ukraine, while represented by business structures controlled by Firtash, largely worked in the interests of the defense complex of the RF.

17 https://infomalin.biz/news/ekonomika/zhitomir/yakshcho-irshanskiy-gzk-ta-vilnogirskiy-gmk-ne-postavlyat-sirovinu-krimskiy- titanzupinitsya.html

18 https://ru.wikipedia.org/wiki/ВСМПО-Ависма

19 https://fedpress.ru/urfo/econom/news_kompany/id_209291.html

20 http://gurkhan.blogspot.com/2017/10/blog-post_3.html

3.2. The role of the Ukrainian titanium industry for the RF

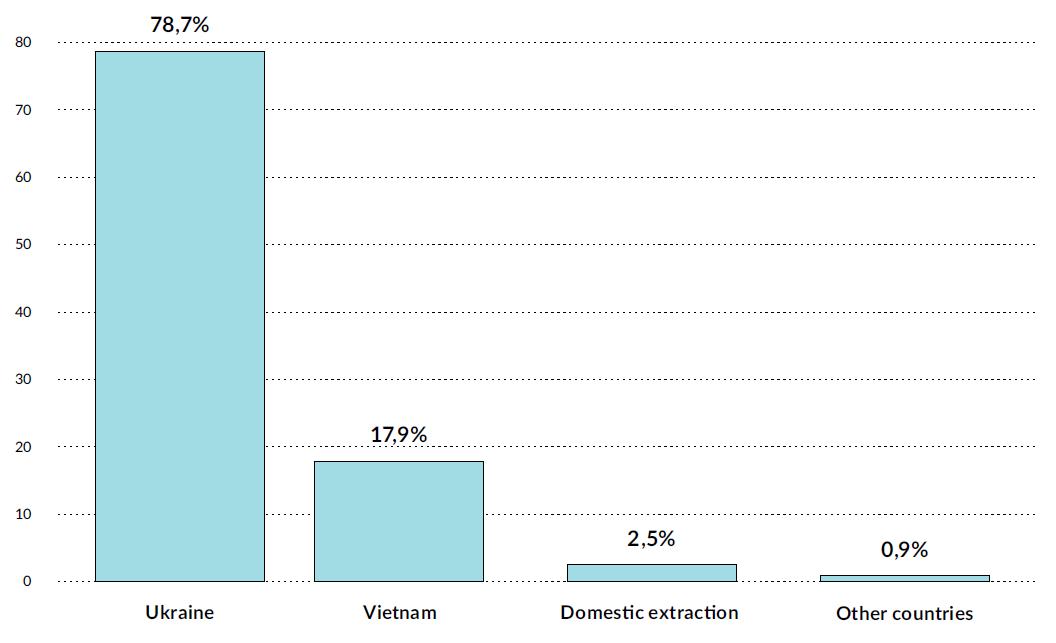

Supplies of Ukrainian ilmenite are critically important for Russia (Fig. 3.1). According to Russian experts, domestic consumption of titanium ore and concentrates in the RF amounted to 216,000 tons in 2021, of which only 8.8 tons were Russian raw materials. The share of imports was about 97%. Ukraine was and now remains the main supplier of ilmenite concentrate, at roughly 80% of the total. Another 38.7 thousand tons came from Vietnam (17.9%) and other countries – less than 2 thousand tons.21

Russia has a very potent titanium mineral and raw material base, with 12.5% of the global reserve. But currently only the Tugansk Mining and Processing Plant is engaged in the production of ilmenite in the RF. Due to low industrial capacity, a lack of necessary financing, as well as the lower quality of titanium raw materials in terms of chemical composition as compared to Ukrainian ilmenite, the intensification of production at the Tugansk MPP continues too slowly. According to the most optimistic forecasts of Russian experts, Russia will be able to reject the imports of Ukrainian titanium ilmenite completely no earlier than 2035.22

That is why the Kremlin is extremely interested in preserving Dmytro Firtash's titanium empire and in the further predatory use of Ukraine as a raw material appendage of Russia's titanium industry. Evidence of this can be seen in the continuation of direct supplies of ore and ilmenite concentrate to the RF by the Ukrainian enterprises controlled by Dmytro Firtash even after the beginning of the Russian invasion of Ukraine in 2014. Moreover, until 2018, Ukrainian exports to Russia accounted for about 40% of Ukrainian exports and about 80% of Russian supply. (see Attachment 1. Volumes of Ukrainian extraction and exports of titanium ores and concentrates by country in natural units in 2014–2022), and decreased significantly in the last 4 years only.

21 https://dprom.online/mtindustry/rossijskij-titan-ot-legend-k-realnosti/

22 https://www.vedomosti.ru/business/articles/2021/06/01/872351-litsaholding-rosatoma

3.3. Ukraine's actions to eliminate hybrid threats of the RF in the titanium industry, and the transformation in the hybrid warfare methods of the RF after 2014

Since 2014, the titanium business of Dmytro Firtash and its relationships with Russia has been the focus of attention of the senior management and law enforcement agencies of Ukraine. Despite the excessive lateness in making governance decisions, the authorities have implemented a number of specific actions over the past eight years to stop the trade in strategic raw materials with the aggressor country:

• In 2014, after the end of the lease term of Irshansk MPP and Vilnohirsk MMP by Crimean Titan PrJSC of Dmytro Firtash, the Cabinet of Ministers of Ukraine and the Ministry of Economic Development of Ukraine endorsed the government’s right to make both enterprises subsidiaries of the state enterprise United Mining and Chemical Company.

• In 2016, the Security Service of Ukraine initiated criminal proceedings against officials of Zaporizhzhia Titanium & Magnesium Plant LLC for supplying sponge titanium to the non-controlled territory of Ukraine under Art. 258–5 of the Criminal Code of Ukraine (financing of terrorism).23

• In June 2016, the Specialized Anti-Corruption Prosecutor's Office of Ukraine initiated the return of the entire property complex of Zaporizhzhia Titanium & Magnesium Plant LLC to the full ownership of the state by terminating the contract with the Cypriot company Tolexis Trading Ltd., controlled by Dmytro Firtash, due to failure of the latter to fulfill investment obligations. The final court decision in favor of the state was adopted in May 2022.24

• At the beginning of 2017, the Military Prosecutor's Office of Ukraine initiated criminal proceedings against companies controlled by Dmytro Firtash for supplying titanium to occupied Crimea through Mezhyrichensk Mining and Processing Plant LLC and Valky-Ilmenite LLC.25

• In June 2018, following the decision of the National Security and Defense Council of Ukraine, special economic sanctions were applied to Russia-based Titanium Investments LLC, which helped business structures of Dmytro Firtash to legalize the operations of the illegally withdrawn capacities of Crimean Titan PrJSC in the temporarily occupied territory and in the interests of the aggressor.26

• In June 2021, following the decision of the National Security and Defense Council of Ukraine, personal special economic sanctions were applied directly to Dmytro Firtash.27

• In July 2021, the State Geology and Subsoil Service of Ukraine revoked the special permit of Valky-

• Ilmenite to extract the apatite and ilmenite ores in the Stremyhorod deposit in Zhytomyr oblast.28

• In August 2021, the State Geology and Subsoil Service of Ukraine revoked the special permit of Mezhyrichensk Mining & Processing Plant LLC to use the resources of the Selyshchansk deposit of titanium ores.29

• In January 2022, the Antimonopoly Committee of Ukraine initiated a legality audit of the sale of assets of Crimean Titan, which had been renamed Ukrainian Chemical Products, to Russia-based Titanium Investments LLC.30

• In October 2022, the State Bureau of Investigations appealed to the Cabinet of Ministers of Ukraine to initiate proceedings by the National Security and Defense Council of Ukraine to sanction the forced

23 http://zp.nashigroshi.org/2018/02/12/sbu-rozhlyadaje-versiyu-pro-finansuvannya-kombinatom-firtasha-teroryzmu/

24 https://finbalance.com.ua/news/sap-sud-ostatochno-zabrav-u-firtasha-zaporizkiy-titano-mahniviy-kombinat

25 https://www.epravda.com.ua/news/2017/04/6/623525/

26 http://iplex.com.ua/doc.php?regnum=89977248&red=10000399fe217d0f7c5902fa494d0ea20d6fa3&d=5

27 https://www.president.gov.ua/documents/2662021-39265

28 https://nadra.info/2021/07/10-special-permits-from-the-decision-of-the-national-security-and-defense-council-were-revoked/

29 https://suspilne.media/154714-kompania-firtasa-vtratila-titanove-rodovise-cerez-finansuvanna-terorizmu/

30 https://www.facebook.com/amc.gov.ua/posts/299321375567197 confiscation of property and application of special economic sanctions against Mezhyrichensk Mining and Processing Plant due to it “belonging to Russian structures or citizens”.31

The actions taken by Ukraine had significant positive consequences – in 2022, because of problems with supply of ilmenite ore from Ukraine, Crimean Titan PrJSC was forced to reduce its own production by 50%.32 In fact, in 2021–2022, the direct export of Ukrainian titanium raw materials to Russia stopped completely.

However, the management of Ukrainian titanium industry companies controlled by Dmytro Firtash resorted to the use of so-called “ilmenite schemes”, according to which up to 50% of titanium concentrate was exported to the RF through the temporarily occupied territory and foreign dummy companies.

Thus, analysis of the table “Volumes of Ukrainian extraction and exports of titanium ores and concentrates by country in natural units in 2014–2022” (Attachment 1) indicates a significant increase in supplies of ilmenite concentrate to the Czech Republic, Turkey, and Egypt. There were more than 50 incriminating materials published in domestic and Western mass media, which clearly demonstrated that in most cases the exporting companies of the specified countries acted in the interests of Russia in order to satisfy the titanium needs of the aggressor state.

In 2016, Valky-Ilmenite LLC owned by Dmytro Firtash sent at least 130,000 tons of ilmenite concentrate to Russia directly from the Ukrainian port of PIvdennyi. The scheme changed in 2017, as identified by investigative journalists, when ilmenite exports began to be routed through Turkish ports. M28ore than 85,000 tons of Ukrainian ilmenite concentrate went to Crimea33 via the Turkish city of Samsun alone.

Also, in 2014–2015, according to the information revealed by SBU, Zaporizhzhia Titanium & Magnesium Plant LLC controlled by Dmytro Firtash delivered 2,778 tons of sponge titanium worth UAH 352 million to the temporarily occupied territory of Donetsk oblast. Later, some was re-exported to the RF, and the rest was used for financing the terrorist activity of illegal armed formations of the RF in the territory of Ukraine.34

According to the published investigations of Ukrainian and foreign journalists, several times ilmenite concentrate of Ukrainian origin arrived in Russia from the Ukrainian state enterprise United Mining and Chemical Company (SE UMCC), which was established in 2014 by merging former assets of Dmytro Firtash –the Vilnohirsk Mining and Metallurgical Plant in Dnipropetrovsk oblast and the Irshansk Mining and Processing Plant in Zhytomyr oblast. Moreover, investigative journalists have repeatedly noted that this is happening due to the preserved influence of Dmytro Firtash over the management of SE UMCC.35

Since 2020 the Czech company Belanto Trade has become one of the buyers of ilmenite concentrate produced by the SE UMCC. A Czech corporate structure was used because Czech law allows for trading companies of this type to be incorporated with very little dedicated capital: just 120 Czech crowns, or USD 5.40 according to foreign-exchange rates as of February 2023. Journalists revealed that the company was purchasing ilmenite concentrate produced by the Irshansk MPP in October 2020, which was later unloaded at the port of occupied Feodosia. At the same time, the Security Service of Ukraine sent an official letter to management of SE UMCC to stop shipping products under the contract with Belanto Trade but the warning was ignored.

31 https://dbr.gov.ua/news/dbr-peredalo-do-kmu-spisok-rosijskih-kompanij-ta-gromadyan-shhodo-vklyuchennya- ih-do-sanacijnogospisku

32 https://gmk.center/ua/news/krymskomu-titanu-ne-hvataet-ilmenitovoj-rudy-iz-ukrainy-2/

33 https://investigator.org.ua/ua/publication/207396/

34 http://zp.nashigroshi.org/2018/02/12/sbu-rozhlyadaje-versiyu-pro-finansuvannya-kombinatom-firtasha-teroryzmu/

35 https://biz.censor.net/resonance/3233668/skandali_ta_koruptsya_scho_vdbuvatsya_v_obdnanyi_grnichohmchnyi_kompan

From November 2020 to March 2021, as part of eleven shipments, SE UMCC shipped more than 78,000 tons of ilmenite concentrate to the Czech company, which, according to customs documents, were allegedly sent to Turkey, but also ended up in the occupied Crimea.

In April-May 2021, the UMCC once again shipped ilmenite concentrate to occupied Crimea via Belanto Trade. Ilmenite was delivered to the railway station in Russian Belgorod, and from there to the port of Kavkaz, and then to occupied Crimea. Cameras recorded transshipping of the ilmenite in the Southern Sea Trade Terminal of the port of Kavkaz on April 14 of the same year.36

In March 2021, the research group SeaKrime discovered that 11,800 tons of ilmenite were exported by the ship Yunus Emre from the port of Chornomorsk, Ukraine, to Damietta, Egypt, where it was later transferred to the Syrian ship Laodicea and sent to occupied Sevastopol for Crimean Titan PrJSC.37

In 2019 and 2020, SE UMCC directly supplied Russian enterprises with titanium products worth almost UAH 732 million.38

Conclusions to Chapter 3

1. Due to the poor development of the titanium mining industry since the times of the USSR, Russia has a critical dependence on Ukrainian raw materials. This led the aggressor country to establish full control over the Ukrainian ilmenite mining industry. By carrying out hybrid operations, Russia addressed two objectives in the economic domain at once – preferential provision of strategic raw materials to its own military industrial complex and making impossible the development of the Ukrainian titanium processing industry independent of influence from the Russian Federation. As a result, dual control in the economic domain has become one of the many levers of Russia's political control over Ukraine.

2. Until 2014, corrosive investments served as the main method of establishing control, both in the form of direct establishment of control over enterprises of the titanium industry through obtaining corporate rights as well as in the form of leasing enterprises of this industry from the state. Such investments were made when Ukrainian prime ministers were friendly to Russian interests, such as Viktor Yanukovych and Mykola Azarov. The period was characterized by the export of more than 50% of ilmenite concentrate produced at enterprises owned by Dmytro Firtash to the Russian Federation and the export of titanium dioxide from Crimean Titan PrJSC to the Russian Federation. This provided for about 30% of the Russian market of titanium dioxide; as well as the actual lack of investments in the only processing enterprise in Ukraine, the Zaporizhzhia Titanium & Magnesium Plant.

3. After the start of the first phase of Russia's open invasion of Ukraine in 2014, Ukrainian authorities took measures to return part of titanium assets owned by Dmytro Firtash back to state ownership, applying sanctions against Russian enterprises in the industry, and initiating criminal proceedings against officials of domestic enterprises controlled by Dmytro Firtash. These measures had a partial effect, as Crimean Titan PrJSC was forced to reduce its own production by 50%). In order to maintain covert control over the Ukrainian titanium industry and exports to the Russian Federation, Russia used new methods:

• The export of raw materials to the Russian Federation via the occupied territories of Donetsk and Luhansk oblasts. Until 2017, there was no ban on transporting goods to the occupied territories in Ukraine.

• The establishment of new transportation routes for the raw materials from Ukraine via Egypt and Turkey using dummy companies.

36 https://genichesk.ipc.org.ua/uk/2021/11/ilmenitova-shema-firtasha-cheska-lanka/

37 https://usm.media/obyski-v-chernomorskom-morportu-gbr-arestovala-partiyu-ilmenita/

38 https://investigator.org.ua/ua/investigations/236675/

• Covert agents representing Dmytro Firtash infiltrated the top management of SE UMCC. Management of SE UMCC does not formally have the authority to check the buyers of its products, which is an additional enabling factor facilitating the exporting of Ukrainian ore and ilmenite concentrate to the Russian Federation.

4. Addressing the problem requires a comprehensive approach, which should include:

• accelerating investigations based on established facts concerning the trade between business structures of Dmytro Firtash and the aggressor country

• replacing corrupt members of the SE UMCC management team

• approval from the Cabinet of Ministers of Ukraine of special criteria for selection and admission of intermediary firms to the domestic market for exporting Ukrainian titanium raw materials and products

• expanding powers and strengthening the responsibility of the State Service of Expert Control of Ukraine to track the end consumers of titanium raw materials and products of Ukrainian origin.