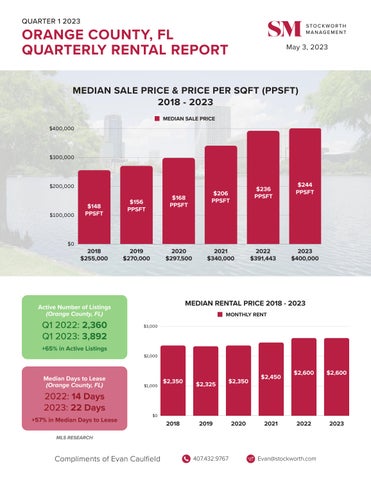

ORANGE COUNTY, FL QUARTERLY RENTAL REPORT

Q1 2022: 2,360 Q1 2023: 3,892 +65% in Active Listings

Median Days to Lease (Orange County, FL) 2022: 14 Days

2023: 22 Days

+57% in Median Days to Lease

Q1 2022: 2,360 Q1 2023: 3,892 +65% in Active Listings

Median Days to Lease (Orange County, FL) 2022: 14 Days

2023: 22 Days

+57% in Median Days to Lease

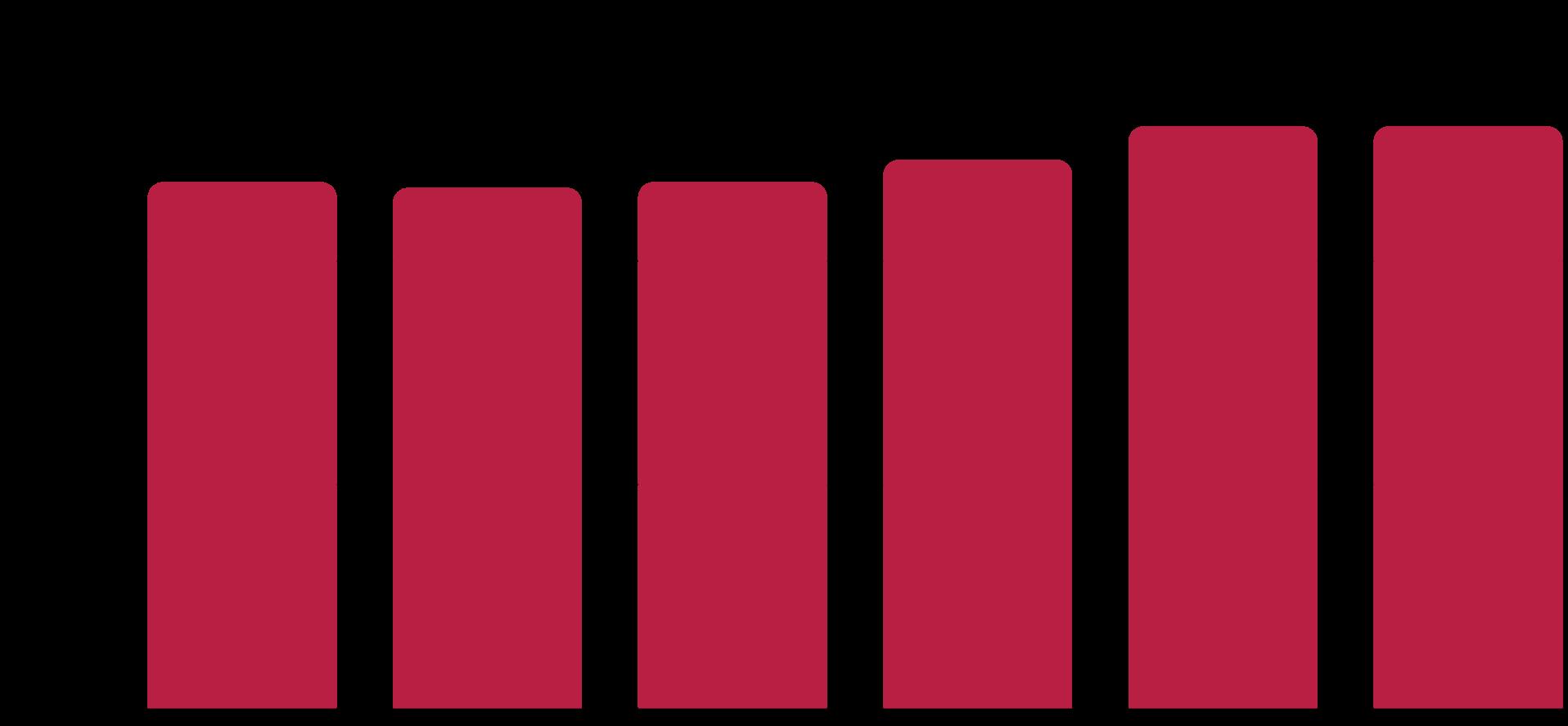

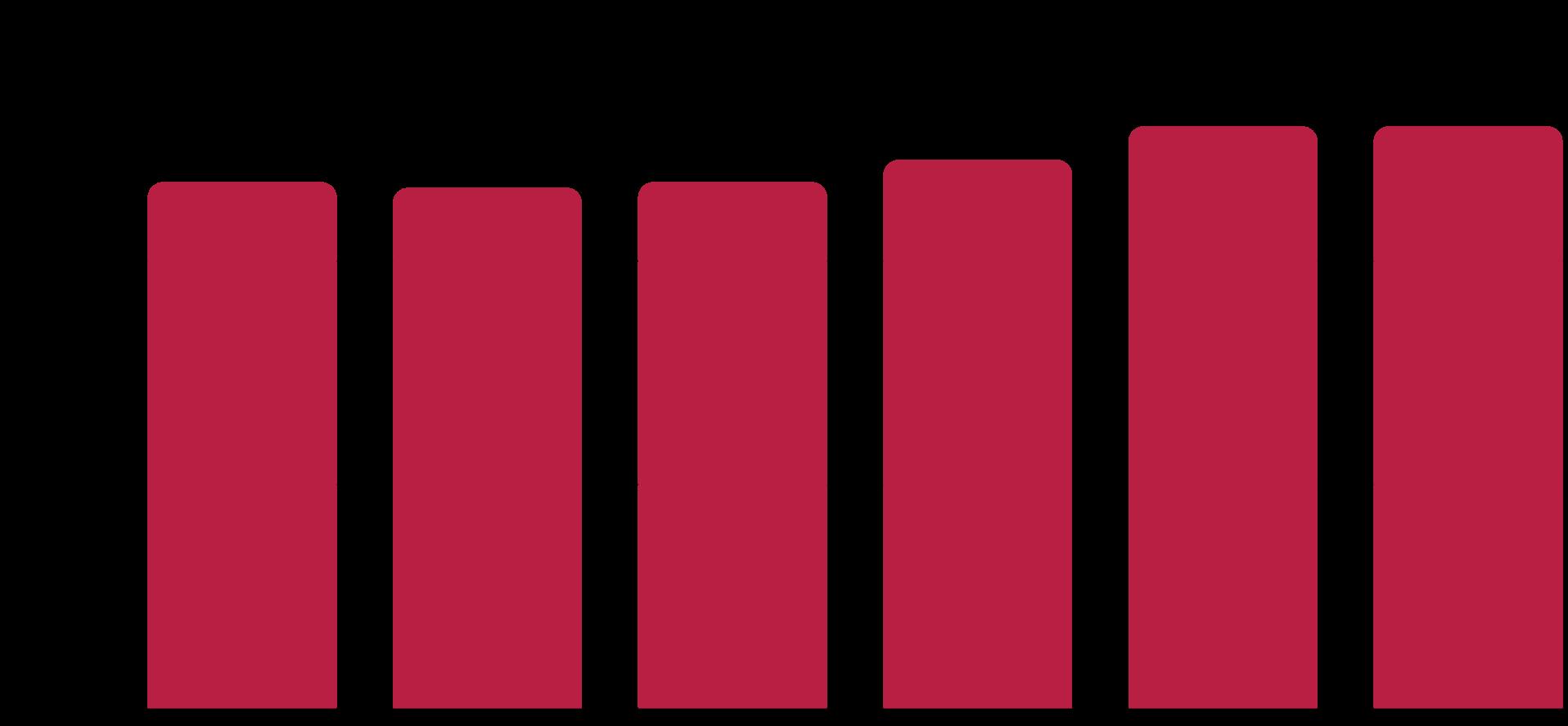

Sale Overview

As National real estate values decline, Central Florida has prevailed as one of the top markets in the United States. Unlike other areas such as San Francisco, Las Vegas, and Austin, which have seen median home prices drop as high as 13%, Orlando continues to benefit from consistent inbound migration and job growth. Over 1,000 people are moving to the area weekly, mainly from the western/ northeastern United States and overseas. As a result, the sold price per square foot in Orange County, Florida, has remained relatively consistent from $236 in 2022 to $244 in 2023.

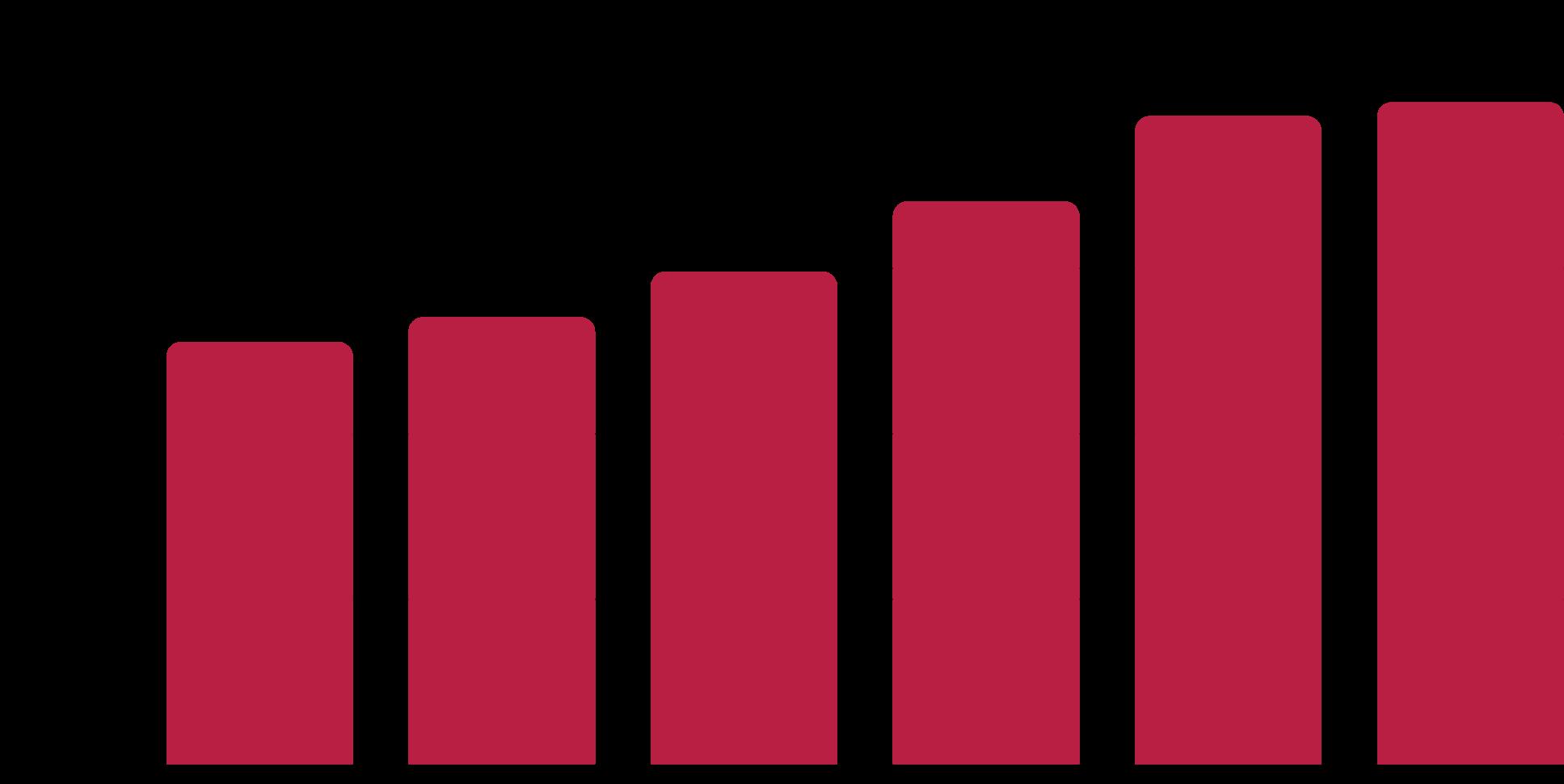

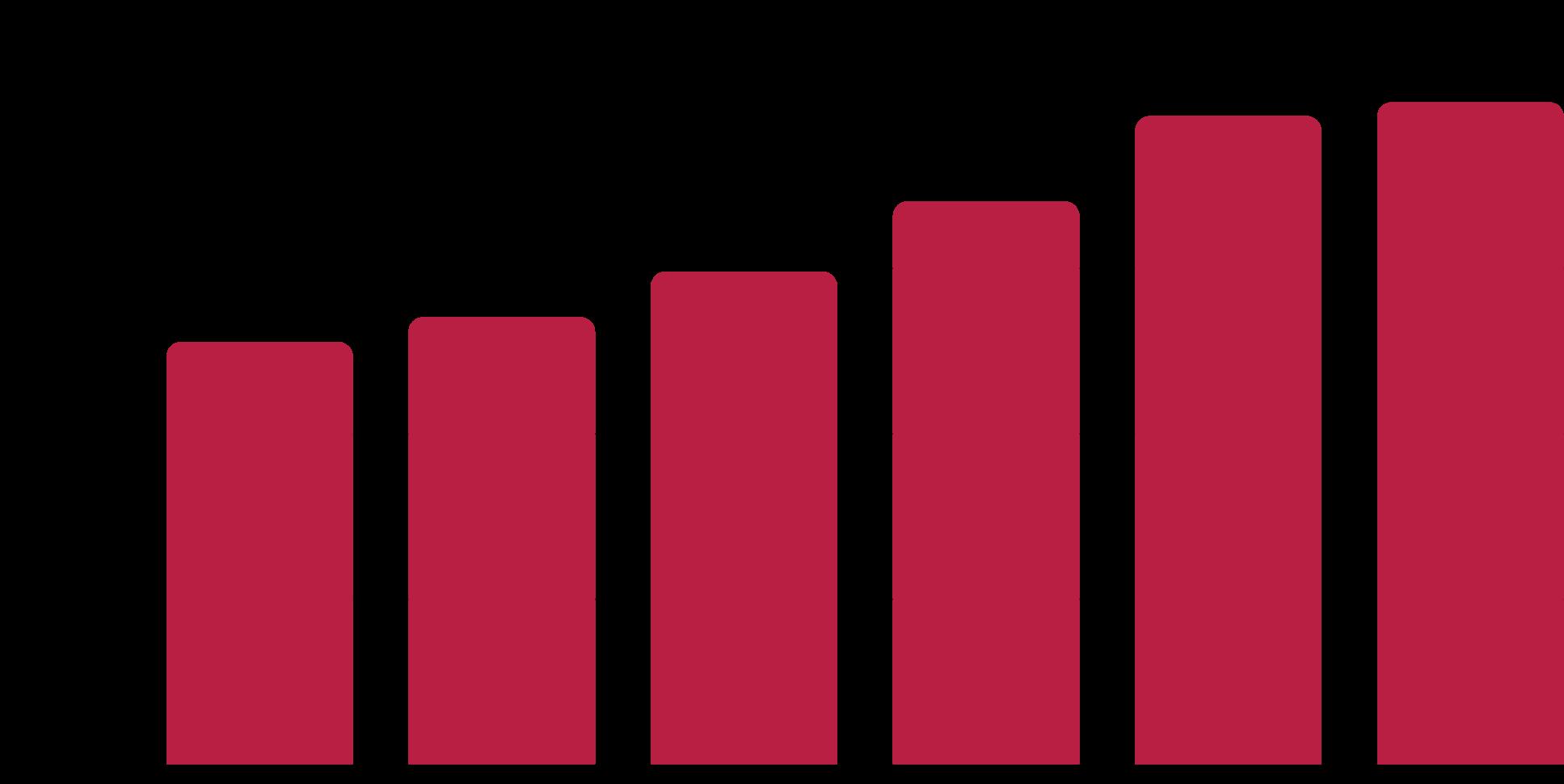

Rental Overview

One cause for concern is the single-family and multi-family rental inventory within Orange County. Active rental listings in the county increased 65% from Q1 to the start of Q2 2023. In addition, multifamily units under construction jumped 49% from 2021 to 2022. As a result, median vacancy rates have climbed from 14 to 22 days over the last year, signaling more competition and longer time on the market. It’s important to note that despite the jump in vacancies, we’re within the same levels from 2013

to 2020. Lastly, the absorption rate or total leased units has increased by 32% in Q1 2023, an indication that demand remains strong, as supply comes into balance.

Conclusion

Despite rising inventory, Central Florida rental values have held up well. Median rental prices remain at $2,600 in 2023, as they were in 2022. Although it’s yet to be determined, 2023 rental prices may stay flat due to the incoming supply from residential and multi-family developers. Provided inbound migration matches the new properties available, it’s likely that we continue to see a relatively stable market as we head into Q2.

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this article should be construed as investment advice.

Sources: Stellar-MLS, SmartAsset, RentCafe, US Census Bureau, Orlando Economic Partnership, Fannie Mae, Freddie MAC, Orlando Regional Realtor Association