Great News for the Downtown Orlando Condo Market.

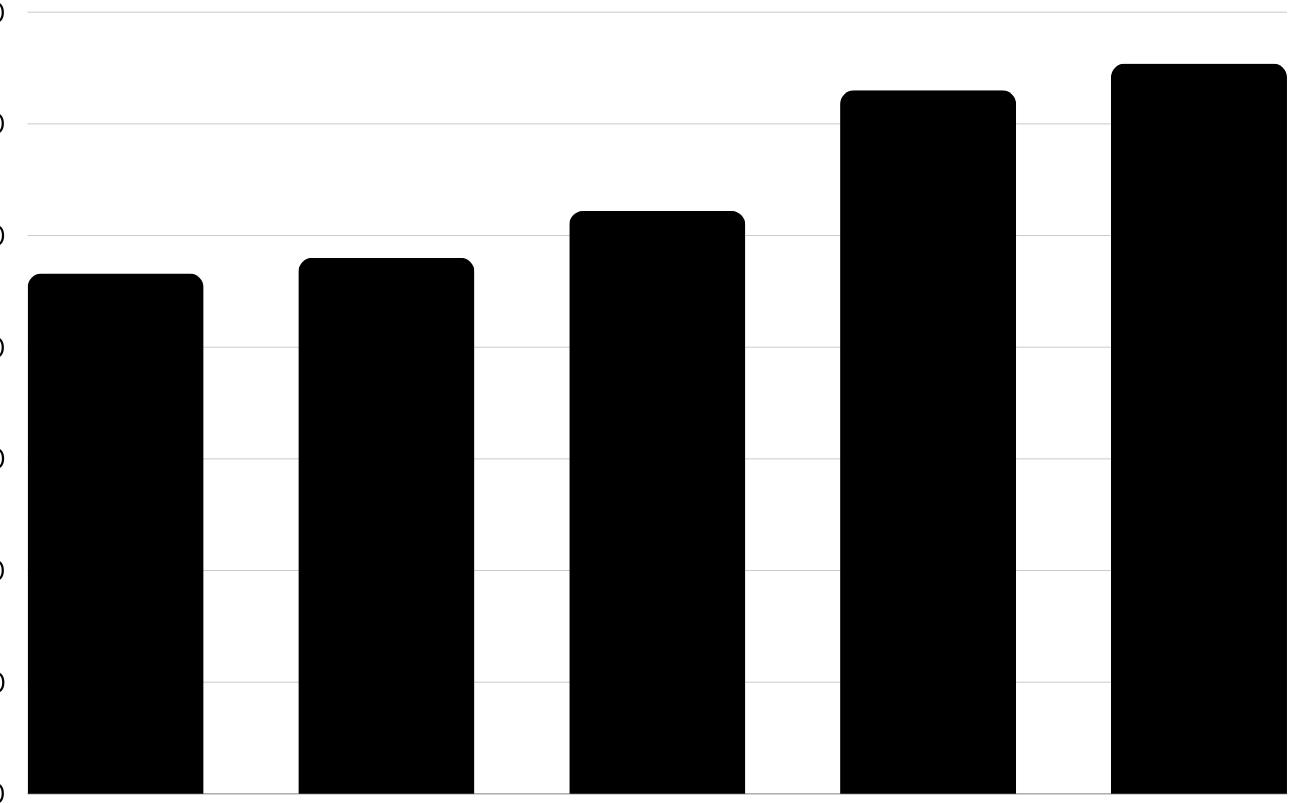

The sold price per square foot increased to a record high of $327, despite fears of a recession and murmurs of a real estate correction. The 30-year fixed-rate mortgages started around 6.5% in January, went as high as 7.79% in October, and eventually dropped back to 6.6% by the end of the year. Inventory increased by a whopping 45%, creating more market competition. Despite this, total units for sale were still the second lowest in the last decade. It would take another 30-40% increase to start matching levels from 2014 to 2020.

Not All Sunshine and Rainbows

Insurance rates for many buildings increased from 30-40%. Florida passed S.B. 4-D, a bill that requires condominium and cooperative association buildings that are three stories or taller to undergo milestone structural inspections with new requirements, reserve funds to pay for future long-term maintenance costs, and more. As a result, many buildings in downtown Orlando were forced to increase monthly assessment dues and/or require a one-time special assessment. This increase in dues affects primary owners, investors, and potential buyers concerned about high monthly costs and the possibility of dues increasing further.

Critical Metrics in 2024

While it’s impossible to predict the future, there are some critical metrics to watch in 2024. As mentioned earlier, inventory will be important, especially if the units for sale continue to rise rapidly. Increased days on the market are another factor, with units staying on the market 12 days longer than in 2022. Lastly, mortgage rate applications

decreased 12% from the previous year. This correlates with the number of sales, hitting the second lowest level in the last decade. With 75% of the buyer pool requiring financing, fewer buyers searching for condos means less demand. Combining the increased taxes, assessment dues, and interest rates (approaching 7% again), many buyers may question condos as a primary residence or investment.

Opportunities Abound ~

Second Most Valuable Market in US Central Florida’s real estate market is unique from the rest of the country. With more than 1,500 people relocating to the area every week and a higher concentration of transferred wealth than any other location in the United States, it is no surprise that Florida has surged to become the second-most valuable housing market in the country. Buyers interested in city living and walkable amenities will consider purchasing condominiums in the downtown area. Another advantage of the downtown market is that it is not competing with new construction inventory. There is only one future project currently in progress. This reduced competition means buyers looking for downtown condos must inevitably focus on existing buildings.

I track the market daily and would love to show you our proprietary strategies for maximizing your Downtown Orlando living and ownership experience. Contact me for a complimentary valuation of your property.

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this article should be construed as investment advice.

Sources: U.S. Bureau of Labor Statistics, U.S. Census Bureau, U.S. Department of Housing and Urban Development, Orlando Regional Realtor Association, Stellar MLS, Freddie Mac.