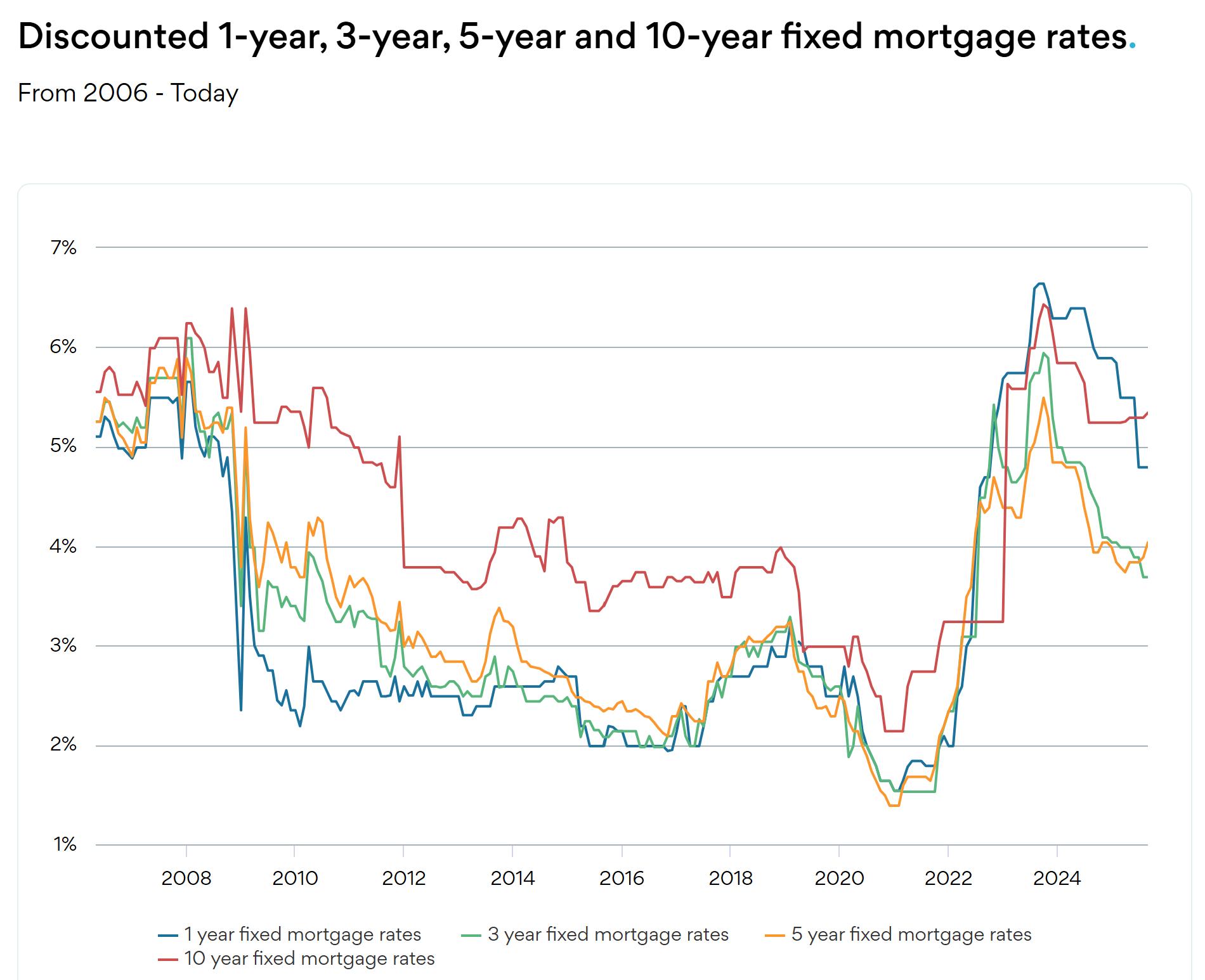

With the summer coming to a close, we are pivoting from a rate shock to a rate relief, and that shift is beginning to change buyer psychology. After the Bank of Canada’s September 17 cut, the policy rate now sits at 2.50 percent, down from 2.75 percent, with the Bank Rate at 2.75 percent and the deposit rate at 2.45 percent. That is the lowest policy rate in three years, and the Bank has signaled it is prepared to ease further if risks rise. Analysts framed the move against a softer job market and easing inflation pressures. The Canadian dollar dipped slightly, but the more important local effect is mortgage pricing and sentiment. When financing becomes less punitive, fence sitters start to run the numbers again. That is exactly the pressure release valve we are seeing now.

The mortgage rate picture validates what clients are already hearing. Posted rates still look high, but discounted five year fixed rates at major lenders are in the low to mid 4s for well qualified, insured borrowers, and variable options are once again pricing below many fixed offers. CIBC is advertising 4.21 percent insured on a five year fixed, RBC is posting 4.42 percent insured, and BMO is in a similar range on promotional products. Independent rate aggregators show comparable quotes, and they note the prime rate has fallen to 4.70 percent as a result of the Bank of Canada’s cuts. For planning conversations, it is fair to budget around 4.2 to 4.8 percent for mainstream five year terms, noting that uninsured and complex borrower files will price higher, and that lender discretion matters.

The psychological effect of rates that begin with a 3 or a low 4 is real. The Globe and Mail’s coverage captured this dynamic plainly. As rates slip toward or below 4 percent, a barrier breaks for many would be buyers, especially

those who have been renewing at much higher levels than expected. We are enticipating 2-3 rate decreases between now and April. This is echoed by bank economists who have publicly suggested that sub 4 percent mortgage pricing could become mainstream if the easing cycle continues. For our clients, the practical takeaway is not to chase the last tenth of a point. When the cost of waiting begins to exceed the cost of acting, the market moves faster than headlines.

On the ground in Greater Victoria, August closed quietly but with some key divergences by property type. The Victoria Real Estate Board reported 525 sales in August, down 3.7 percent year over year and off 22.8 percent from July. Inventory ended August at 3,600 active listings, which is 12.8 percent higher than a year ago and 2.8 percent lower than July. That mix produces balanced conditions overall. The important split is that single family sales rose 6.3 percent year over year, while condominium sales fell 16 percent to 152 transactions. That is the tell for where stress is building and where opportunities are ripening.

Condominiums are under the most pressure right now, and the proof is in both volume and value. The MLS HPI benchmark for a condo in the Victoria Core was approximately $551,300 in August, down 1.4 percent from August 2024, and down from July’s $563,300. In contrast, the single family benchmark in the Core sits near $1,308,100, up 1.6 percent year over year, though a touch below July. That spread captures our two realities. Families have been returning to detached product as rates eased and as new listings improved choice, while the condo segment is digesting more supply and more cautious buyers. For sellers of condos, pricing discipline and condition matter more this fall. For buyers, selection and negotiating leverage are the best in several years.

Victoria’s municipal landscape is evolving in ways that matter for clients. The City of Victoria’s Missing Middle Housing program allows houseplexes, corner townhouses, and heritage infill, up to six homes on a standard lot in Traditional Residential areas, without removing existing zoning. After amendments adopted in December 2023 to simplify approvals, the program is now embedded, and its intent is straightforward. It creates gentle density in established blocks. In practice, it expands the range of ground oriented alternatives for move up condo owners who want a door on the street.

Saanich has implemented Small Scale Multi Unit Housing zoning that allows three, four, or six units on many residential lots within the Urban Containment Boundary, often without a rezoning and with exemptions from form and character permits for smaller projects.

Sidney has updated its zoning bylaw, in line with new provincial legislation, to create more housing opportunities and flexibility for property owners. The updated bylaw removes the old “single-family dwelling” category and replaces it with the broader term “dwelling unit,” allowing up to three or four units on lots previously zoned for single-family use. Depending on lot size—up to three units on properties under 280 m² and up to four units on larger lots—owners will be able to choose from a range of housing configurations to meet their needs, such as four townhomes, a single-family home with a suite plus garden suites, or even a small four-unit apartment building. Adjustments to building heights, setbacks, and other regulations are being introduced to make these options practical, ultimately giving residents more freedom to create housing that reflects their lifestyle, whether that means building multi-generational homes or maximizing rental potential.

This shift is designed to ensure Sidney’s housing supply evolves in step with the diverse needs of the community.

The District of North Saanich has released its first annual Housing Targets Report under BC’s Housing Supply Act, outlining progress toward the Province’s goal of 419 new homes by 2030, with an initial target of 60 homes in the first year. While only 12 new homes were completed between August 2024 and July 2025, the District focused on laying a strong foundation for future growth by adopting a new Official Community Plan (OCP), launching zoning updates to guide housing to the right areas, and reviewing infrastructure capacity to support responsible development. Adopted in July 2025 after extensive community consultation, the OCP strikes a balance between creating new housing near transit and preserving North Saanich’s cherished rural and agricultural character, ensuring that growth moves forward in a thoughtful, sustainable way that reflects community values.

Oak Bay is moving, albeit under firm provincial direction. Under Bill 44, Oak Bay must update zoning and the Official Community Plan to make room for more housing, including small scale multi unit formats across the community, and the District has acknowledged the requirements and deadlines. The province has shortened timelines and has signaled it will intervene if milestones are missed. For our clients who long considered Oak Bay “zoned out” of entry options, this shift is meaningful. It points to future diversification of product and price points in a municipality that historically offered few.

Esquimalt and Vic West illustrate how corridor planning becomes real product. The Esquimalt Road corridor has several underway or imminent projects, including

Factory Block in Vic West, with occupancy targeted for 2026, and longer planned communities like Roundhouse in Vic West moving toward buildout. These projects add hundreds of doors within existing urban fabric, close to services and transit, exactly the settings buyers ask for when they trade space for location. More supply in these nodes pressures older strata inventory to compete on condition and strata health.

There is a second, quieter force adding stress to the condo segment. Operating costs and capital planning have become more visible to buyers. Even with reports of strata insurance premiums softening for some portfolios in 2025, many buildings are raising fees to rebuild contingency reserves and to meet deferred maintenance. Buyers are reading depreciation reports more closely, and lenders are asking better questions. Buildings that demonstrate healthy reserves and a realistic renewal plan still trade. Buildings that cannot show that story get priced by risk, a challenge for sellers needing to list in this market. This is healthy for the long term and uncomfortable in the short term.

When we put these pieces together a pattern emerges. Detached and townhome product in core family neighborhoods remains relatively resilient. Balanced conditions and slightly rising inventory give move up buyers time to act without panic. The condo market, especially in older buildings and in investor heavy cohorts, is the clear buyer’s market. Sales are down 16 percent year over year, the benchmark is lower than a year ago, and a high share of new construction starts are apartments that will compete on finish and location. That combination produces better selection, more

frequent price adjustments, and stronger conditions for conditional offers. For our buyer clients, this is leverage.

What does this mean for Stockus & Parry client strategy in October and November. For condo buyers, this is a season to be selective and firm about fundamentals. Target buildings with strong reserve funds, proven maintenance programs, and transparent governance. Use the increasing supply to negotiate on price, closing flexibility, and strata fee adjustments where appropriate. If you are financing, align your rate hold with a realistic completion window. With discounted five year fixed insured rates hovering in the low to mid 4s and variables competitive again, lock when the numbers for the specific unit work, not just when a headline looks good. The cost of missing the right unit can exceed the savings from eking out a slightly lower rate later.

For condo sellers, clarity beats hope. Price to today’s buyer, not last spring’s comparable. Address minor deficiencies to remove buyer hesitation. If your building’s governance or planning story is strong, bring it to the conversation early. Most buyer agents are asking for strata documents before putting pen to paper. In a market where buyers have choice, trust is a negotiating asset. Use it to shorten time on market and to protect your proceeds.

For detached and townhome sellers, the advice is measured but positive. Demand has held up better, and families who delayed moves in 2023 and early 2024 are re engaging. Inventory is still only moderately higher than last year, and well presented homes in the right school catchments trade. The right pricing band remains narrow. List inside the market rather than above it, and use the first two weeks to capture the most serious buyers who have been watching closely.

The data supports that approach. Single family sales rose year over year even as total transactions dipped, and the benchmark has modestly appreciated year over year.

The macro risk section of any market note should be honest. If the economy weakens faster than expected, the Bank could cut further, but job losses can dent buyer confidence. If inflation re accelerates, lenders could hold the line on discounts even with a lower policy rate. For now, the Bank’s own communications and independent reporting frame September’s cut as a response to a cooling economy rather than a victory lap. That argues for stability in mortgage pricing with a modest downward bias rather than a straight line drop. Plan for that middle path, not for extremes.

To close with client ready bottom lines. Buyers of condos and townhomes are in the best position they have been in for several years. Listings are up year over year, condo transactions are down double digits, and benchmarks are lower than last year in the Core. That is leverage. If you want to trade up from a condo to a townhouse or a small house, the spread is attractive right now because the entry asset is the weaker leg and the target asset is more resilient. Sellers of well located detached homes should stay focused and pragmatic. Price for the first 14 days, prepare meticulously, and lead with transparency. Mortgage shoppers should confirm affordability with today’s discounted rates and hold a rate that matches their timeline. There is no prize for guessing the exact bottom, but there is value in securing the right home at a fair, financed price.