THE 2025-2026 CANADIAN HOTEL INDUSTRY OUTLOOK

REVENUE MANAGEMENT

Stand out or fade away in the agentic era

Margins squeezed: Labour, food and OTA costs are biting— can asset management save the day?

This underwater hotel prototype is built to withstand tsunamis

De-escalating aggression in hotels, keeping both guests and staff safe

Building for what’s ahead

BISHA, a Luxury Collection Hotel, Toronto

CANADIAN INDUSTRY OUTLOOK HOTEL

FALL 2025

Volume 5 Issue 4 staymagazine.ca

PUBLISHER

Big Picture Conferences

EDITOR-IN-CHIEF

Stacey Newman

stacey@staymagazine.ca

DIRECTOR OF SPONSORSHIP & ADVERTISING

Mike Egan

mike@staymagazine.ca

ART DIRECTION + DESIGN

Sonya Clarry + Brienne Lim

CONTRIBUTORS

Allan Lynch, Jim Byers, Tim Wiersma, Troy Taylor, Stacey Newman, Margot Krasojević

VISIT US ONLINE staymagazine.ca

Instagram staymagazine.ca

LinkedIn Stay Magazine

BIG PICTURE CONFERENCES

45 St. Clair Avenue West, Suite 1001 Toronto, ON M4V 1K9

© Copyright 2025 All rights reserved. No part of this magazine may be reproduced without written permission from Big Picture Conferences, the publisher.

STAY is published four times per year by Big Picture Conferences. For 27 years, Big Picture has been hosting the Canadian Hotel Investment Conference (CHIC) and other go-to conferences and events for Canada’s hotel industry. For subscription inquiries, please visit staymagazine.ca/subscribe.

ISSN: 2816-7864

Key title: Stay

EDITORIAL ADVISORY BOARD

Mark Hope Senior VP, Development, Coast Hotels

Vito Curalli VP, Sales and Services, Hilton Supply Management

Rajan Taneja Director, Palm Holdings

Philippe Gadbois Chief Operating Officer, Atlific Hotels

Robin McLuskie Managing Director, Hotels, Colliers Hotels

Brian Leon President, Choice Hotels Canada

Brian Flood Vice Chairman and Practice Leader, Hospitality & Leisure, Valuation & Advisory, Cushman & Wakefield

Scott Richer VP, Real Estate and Development (Canada), Hyatt Hotels

Ed Khediguian VP, National Bank of Canada Franchise Finance

Bill Stone Co-founder and Senior Advisor, Knightstone Hotel Group

Judy Sparkes-Giannou Co-Owner, Clayton Hospitality Inc.

Deborah Borotsik Senior VP, Beechwood Real Estate Advisors

Alan Perlis CEO, Knightstone Capital Management/Knightstone, Hotel Group

Alnoor Gulamani President, Bayview Hospitality Inc.

Christina Poon General Manager, Hotel W New York – Union Square

Phil Thompson Business Lawyer, Thompson Transaction Law

Sandra Kanegawa Owner, Heritage Inn Portfolio, X-Dream

CANADIAN HOTELS ENTER FALL WITH RECORD RESULTS AND CAUTIOUS OPTIMISM

THIS FALL 2025 ISSUE OF STAY MAGAZINE LOOKS AT THE STATE OF THE CANADIAN HOTEL SECTOR AND WHERE IT IS HEADED IN OUR FALL 2025 CANADIAN HOTEL INDUSTRY OUTLOOK, WHICH BRINGS TOGETHER PERSPECTIVES FROM EXPERTS, INVESTORS, OPERATORS, LENDERS, AND ANALYSTS ACROSS THE COUNTRY.

The report shows hotels are coming off a strong summer, with record RevPAR and steady deal flow, even as challenges around financing, labour and costs remain. Contributors highlight growth in Alberta, Ontario and Quebec, while also pointing to risks tied to trade, reduced government demand and rising union activity.

In Profile, our senior contributor, Jim Byers, reports on three properties. The Queen Mary Hotel in Long Beach, California, offers travellers the chance to stay aboard a former Cunard ocean liner, rich in history and art deco design. The O2 Beach Club and Spa in Barbados shows how the luxury all-inclusive model has evolved, combining modern rooms, strong food and beverage, and a direct connection to its neighbourhood. In Toronto, the Kimpton Saint George demonstrates how a boutique hotel can balance location, design and guest service while standing out in a competitive market.

Our Snapshot section looks at asset management, where experienced operators explain how oversight of costs, contracts and OTA reliance can improve profitability. They show how data and detailed audits can uncover gaps and increase returns.

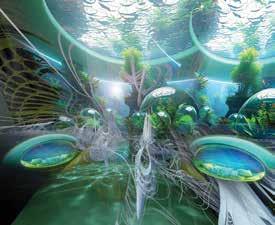

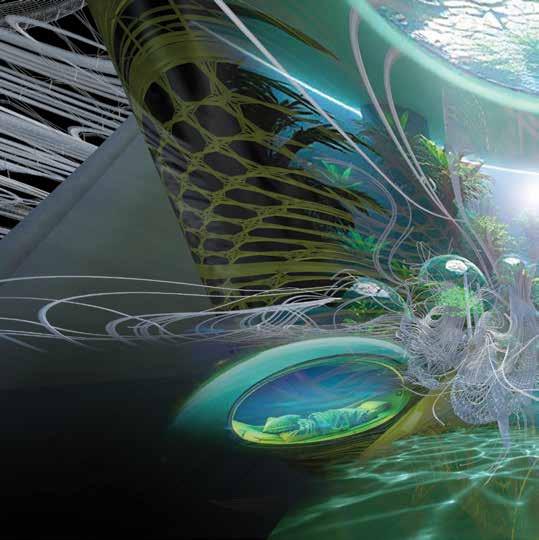

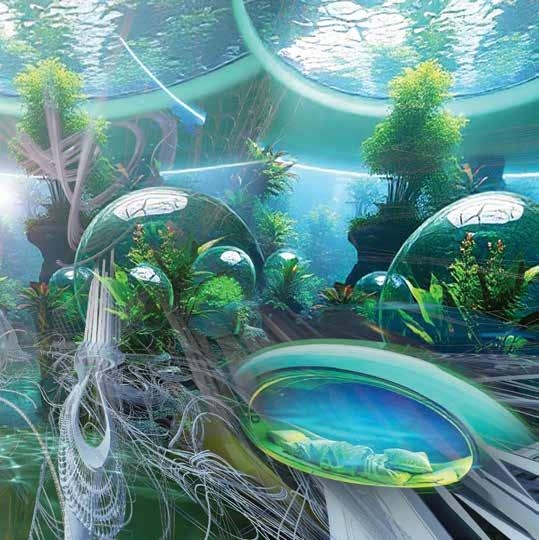

In Proof of Concept, we examine a prototype hotel designed to submerge during tsunamis. Built with marine engineering principles and powered by

renewable energy, the concept raises questions about feasibility but also points to how climate change and over-tourism are shaping hotel design.

We also share practical safety guidance from Workplace Safety & Prevention Services, which outlines how hotels can train staff to de-escalate aggressive behaviour and keep workplaces safe.

Choice Hotels Canada highlights housekeeping employees from across the country, bringing you stories and commentary from essential frontline staff in guest experience.

In the last quarter of 2025, the Canadian hotel sector is full of exciting change, evolution and an optimistic outlook toward a new year. Thank you for being part of our STAY Magazine community, and if you have stories you think we should be telling, please send us a note at staymagazine.ca.

Stacey Newman Editor-in-chief

DE-ESCALATING AGGRESSION IN HOTELS: HOW TO KEEP STAFF AND GUESTS SAFE

From Workplace Safety & Prevention Services

“A calm, confident, and well-practiced response to an agitated guest can prevent a situation from escalating into violence,” says Ayden Robertson, senior consultant with Workplace Safety & Prevention Services (WSPS).

In the hotel industry, where staff interact with a diverse range of guests, contractors, and other workers, knowing how and when to respond to aggressive behaviour is crucial. “Recognizing the early warning signs gives us an opportunity to act immediately to de-escalate, before they progress to other stages,” recommends Robertson.

Front-line hotel workers, especially front desk agents, housekeepers, and concierge staff, are often the first to encounter these situations. The best response is to remain calm, avoid a confrontational approach, and “focus on what the person really wants–which is to be heard, seen, recognized and acknowledged,” says Robertson.

Pivotal to success is preparing your staff and workplace in advance. When your staff have not been trained on how to respond in aggressive or potentially violent situations, it could expose them to an increased risk of physical and mental harm.

“For example, if someone is seen stealing something from the hotel, do you want an employee to go after them?” says Robertson. “Probably not; however, if the employee has not been given specific instructions on how to address the situation, they may respond in a way that could put them at higher risk,” he explains.

When you have response protocols in place, employees feel empowered and more comfortable when handling these types of situations. Robertson outlines what you need to do to prepare and how to respond at each stage of aggression.

START WITH A DE-ESCALATION APPROACH

“A positive, non-reactive approach to de-escalation will help keep everyone safe,” says Robertson. When dealing with an agitated guest, remember to listen, see, recognize and acknowledge. Here are some guidelines to share with your team:

• Be empathetic: “I understand this is frustrating. Let’s see what we can do.”

• Let them speak: Don’t interrupt or rush them.

• Acknowledge the issue: “I’m sorry this happened. Let’s fix it.”

• Ask for ideas to solve the problem: “What would help resolve this for you?”

DETERMINE YOUR RISKS AND TRAIN STAFF

While de-escalation is an effective approach in many situations, it may not always lead to the desired outcome. As an employer, you must determine your risks and prepare staff with the tools and knowledge to mitigate those risks.

ASSESS YOUR RISKS

• Identify high-risk areas, such as the front desk, housekeeping floors, parking lots, and kitchens.

• Recognize vulnerable roles: night shift workers, people working alone, and room service staff. Prepare for the different types of scenarios these workers may encounter (e.g., a frustrated guest vs. an intoxicated guest).

TRAIN FOR DE-ESCALATION

• Offer scenario-based training for all staff, including roleplaying with real hotel situations (e.g., a guest yelling about a lost reservation or being stressed from travel).

• Teach staff to identify body language and tone that signal rising aggression. Empower them to recognize when de-escalation is not working and the priority becomes protecting themselves.

ESTABLISH RESPONSE PROTOCOLS FOR PROTECTION

• Ensure staff are trained on exactly what steps to take when aggression is rising despite efforts to de-escalate (e.g., call manager on duty, hotel security, police).

• Provide opportunities for employees to practice the planned response protocol for these types of potentially violent situations.

• Provide safe rooms (e.g., back office with a lock and phone).

• Create clear incident reporting and debriefing procedures.

COMMUNICATE MANAGEMENT COMMITMENT

• Make it clear to your staff that abuse is not part of the job.

• Support workers who report incidents and follow up with care.

• Provide debriefing and opportunities to talk about what happened. Continue to monitor staff after an incident.

WARNING SIGNS: Responding to the 4 stages of aggression

Once your staff have been trained and know how to react, these are the warning signs they should watch out for in frustrated guests.

STAGE 1: EARLY WARNING SIGNS

EXAMPLES: A GUEST PACING IN THE LOBBY, TAPPING FINGERS, USING CURT LANGUAGE.

RESPONSE:

• Approach calmly: “Hi, I noticed you seem upset. How can I help?”

• Maintain a respectful tone and safe distance.

• Listen actively and avoid interrupting.

• Ask for a solution: “What would make this right for you?”

STAGE 2: HOSTILE

EXAMPLES: A GUEST RAISES THEIR VOICE AT THE FRONT DESK OVER A ROOM MIX-UP.

RESPONSE:

• Stay calm and non-confrontational.

• Signal a nearby colleague or manager discreetly.

• Allow the guest to vent without interrupting.

• If possible, move the conversation to a quieter area.

STAGE 3: THREATENING

EXAMPLES: A GUEST CLENCHES FISTS, YELLS, OR POINTS AGGRESSIVELY AT STAFF.

RESPONSE:

• Keep a 2-metre distance.

• Call for immediate assistance (security or manager).

• Do not argue or make sudden movements.

• Continue to speak calmly: “I want to help, but I need you to lower your voice.”

STAGE 4: ASSAULTIVE

EXAMPLES: A GUEST PUSHES A STAFF MEMBER OR THROWS AN OBJECT.

RESPONSE:

• Do not engage physically unless trained to do so.

• Retreat to a safe area and call emergency services.

• Follow hotel protocol for incident reporting and support. By recognizing the warning signs of escalating behaviour early and responding calmly and professionally, your team can help prevent incidents from becoming dangerous. When situations do escalate, having clear protocols, support systems, and a strong management commitment ensures that no one has to face it alone.

HOW SILVERBIRCH HOTELS & RESORTS STREAMLINED FINANCIAL OPERATIONS WITH FAIRMAS

BY KINZA RAHEEL

SilverBirch Hotels & Resorts is a leading Canadian hotel operations and asset management company, managing a diverse portfolio of full-service, select-service, and extended-stay hotels. With owned and managed properties across Canada, SilverBirch is a trusted name in Canadian hospitality. Several of its managed properties use FairPlanner and FairPayroll by Fairmas to streamline financial planning and management, showing a strong, evolving partnership between Fairmas and SilverBirch Hotels & Resorts.

In a recent interview with SilverBirch’s Director, Financial Systems & Data Analytics, Rob Fontaine and Director, Operations Finance, Hao Li, we explored how Fairmas has helped transform their financial planning and analysis processes.

Li Director, Operations Finance

Rob Fontaine Director, Financial Systems & Data Analytics

Together, Fontaine and Li bring a complementary mix of technical expertise and operational insight to SilverBirch’s finance leadership. Their collaboration has been instrumental in leveraging Fairmas’ software solution to enhance both system capabilities and on-theground financial planning. Through their shared perspective, we gained a comprehensive view of how FairPlanner and FairPayroll are being used to drive more accurate, efficient, and strategic decision-making across the organization.

The challenge: Manual, error-prone tools for financial planning

Before implementing FairPlanner and FairPayroll, SilverBirch Hotels faced certain challenges in their financial planning processes. According to Li, “Before we implemented FairPlanner and FairPayroll, and based on my experience with the forecast and budget cycle, a few key challenges stood out. One major issue was the reliance on Excel-based planning tools. These spreadsheets often contained complex formulas that could be overwritten, which led to errors that were difficult to trace and correct. This not only increased the risk of inaccuracies but also required additional time to verify and validate the data.” As described by Li, the manual processes increased risks of data inaccuracies that were difficult to detect and correct, consuming valuable time and resources.

Hao

He further added, “Another challenge was related to uploading data into our centralized database. Errors caused by overwritten formulas in Excel could disrupt the upload process, creating further inefficiencies and data accuracy concerns. FairPlanner and FairPayroll helped address these issues by providing a more structured, and reliable software for planning and data management.”

By adopting FairPlanner and FairPayroll, SilverBirch gained access to structured and dependable software, significantly improving the accuracy, efficiency, and reliability of its planning and data management.

The solution: Fairmas

With the implementation of FairPlanner and FairPayroll by Fairmas, SilverBirch Hotels improved their financial planning and analysis process into a more dynamic, data-driven operation. Li explains, “We use FairPlanner most frequently for forecasting, budgeting, and what-if scenario analysis.”

The forecasting functionality has become central to their monthly planning process, allowing each property to update financial outlooks based on the latest trends and operational data. As Li notes, “Forecasting is used on a monthly basis to provide the most up-to-date outlook for each property. It allows us to incorporate the latest business trends and operational insights into our rolling forecasts efficiently.”

For annual budgeting, FairPlanner offers a structured and collaborative framework. “The software provides a structured framework to manage inputs, review assumptions, and align departmental budgets across the organization,” Li adds.

What-if analysis has also proven to be a key tool for strategic decisionmaking. “By leveraging built-in drivers, we can simulate different scenarios and assess the financial impact with reasonable accuracy. This supports more informed decision-making,” says Li. He also highlights the software’s reporting capabilities: “We use some of the reporting features, particularly the P&L reports and the P&L by department export function, which are helpful for quick analysis.”

FairPayroll, on the other hand, has brought greater clarity and control to staffing cost planning. Li explains, “It allows us to calculate costs based on built-in payroll tax rates and to create individual profiles for each employee and employee group.”

Why Fairmas? A measurable impact

SilverBirch Hotels selected Fairmas for its practical advantages in cost, flexibility, and functionality. “We chose Fairmas primarily due to the lower cost compared to other platforms we evaluated, the modular licensing model, and product features such as detailed labour planning and productivity groups,” says Fontaine. These key differentiators made Fairmas the most suitable choice for their growing needs.

The measurable benefits of the Fairmas software have been clear. “By eliminating reliance on Excel, we have avoided manual formula errors and data overwrites, which has increased the accuracy of our forecasts and budgets,” says Li. Efficiency has also improved: “The ability to compare selected scenarios directly within the FairPlanner has made it much easier and faster to evaluate options, without the need to export and manipulate reports separately.”

He also points to better transparency: “The Account Detail function allows us to easily drill down into actual postings from Business Central, making variance analysis and reconciliation more efficient.” And when it comes to planning agility: “The What-If function enables us to quickly model different operational initiatives and see the potential impact, helping us make informed decisions in the planning process.’’

A growing partnership: Would SilverBirch Hotels & Resorts recommend Fairmas?

SilverBirch Hotels & Resorts has seen clear value from its partnership with Fairmas, particularly in improving forecasting, budgeting, and scenario planning processes. The software has helped reduce manual errors, increase efficiency, and support informed decision-making. Li confirms this measurable impact by recommending Fairmas as a reliable solution for hotel financial planning:

“Yes, I would recommend Fairmas to other hotel groups because it brings clear improvements in forecasting, budgeting, and scenario planning. It reduces manual errors, increases efficiency, and supports more accurate and informed decision-making.”

As both teams continue to collaborate, the software is evolving to better meet SilverBirch’s needs. This growing partnership reflects a shared commitment to long-term success and unlocking the full potential of Fairmas.

The collaboration with SilverBirch highlights Fairmas’ expanding footprint in North America. It demonstrates the adaptability of Fairmas’ software to regional business needs and regulations, serving as proof of the software’s relevance and effectiveness beyond its European headquarters. The success of this partnership marks a key milestone in strengthening Fairmas’ presence in the North American hospitality industry.

IN PROFILE

BY JIM BYERS

STAY Magazine senior correspondent and frequent traveller Jim Byers has stayed in some of the best, and most interesting, hotels in the world.

Kimpton Saint George, Toronto

I love the buzz of a downtown hotel. But sometimes I crave something more serene.

The Kimpton Saint George is a fine boutique property in Toronto that’s only a few steps from the shops and museums of Bloor Street West. Yet, with the open spaces of the University of Toronto just across the road, and the leafy streets of The Annex neighbourhood just around the corner, it feels like another city.

Here’s a look at my recent stay at what is the only Kimpton hotel in Canada.

THE LOBBY

The entry/lobby area is a modest but stylish area with plenty of natural wood and curved arches, a regular architectural feature of the property. I liked the snazzy, curved light fixtures and the cozy fireplace, as well as the small but comfy seating area. There is complimentary tea, good, strong coffee in the morning, and glasses of white and red wine in the lobby every night from 5 to 6 p.m. There’s also a water bowl for your furry friends.

The bird mural on the west side of the Kimpton Saint George Hotel in Toronto

THE ROOMS

We had room 1401, which was an extra-large room. There is a spacious entryway that makes it feel more like a home than a hotel, along with minimalist, local art. I enjoyed the green-blue and hunter green accents, and the king-sized bed was super comfortable. There are enough charging places and small, marble bedside tables. Another perk I noticed was a handy ledge by the door where you could put your keys or a wallet. I also discovered that the window actually opens for fresh air.

There is a good-sized bathroom with Atelier Bloem bath amenities. All rooms have robes and a yoga mat, and a whimsical white squirrel hidden inside the stand-alone dresser, a nod to the albino squirrels sometimes seen around Toronto’s Trinity Bellwoods Park. There are 188 rooms, including 20 suites and a lovely Presidential Suite. All suites come with record players, Nespresso machines and soaker tubs. The hotel also has accessible rooms.

THE AMENITIES AND EXTRAS

There’s a good meeting space for up to 80 people (sitting) or 90 (standing), with a ground-floor view of the garden next door. The 24-hour gym has modern equipment, including Peloton, free weights, treadmills and more.

They can have a robot deliver things to your room, such as toiletries you might have forgotten or a bottle of water. I forgot to try it out. “Doh!” The hotel also has custom-designed PUBLIC bikes you can borrow. In-room beauty services are provided by Radford Studio, offering a curated selection of facial treatments, makeup services, and more. IHG One Rewards members get complimentary high-speed WiFi on all devices throughout the hotel during every stay, as well as a 2 p.m. check out. The hotel provides business services, including fax, copy and printing.

THE RESTAURANT

The hotel doesn’t manage the restaurant, but the Fortunate Fox gastropub was a solid choice on a recent weeknight. The cocktails were excellent, and there’s an eclectic wine list that goes beyond the usual suspects. I had fried calamari studded with hot peppers. The steak with fries was also good, as was the salmon, and the tender Miami short rib. I was told that new management took over on June 1, 2025, and that everything is made from scratch. There is a bright, attractive bar and a small patio on Bloor Street. Look for taco and margarita specials on Taco Tuesday, half-price bottles of wine on Wednesday, trivia nights on Thursday, and a special roast dinner on Sundays. The restaurant is also open for lunch and dinner. In-room dining is available.

THE LOCATION

The hotel is just a few steps west of the St. George subway station. There’s also paid parking directly underneath the hotel. The Royal Ontario Museum and the Bata Shoe Museum are a stone’s throw away. It’s maybe a 15-minute walk to Yonge and Bloor. The hotel is quite popular for people who have meetings at the University of Toronto St. George campus.

↑ The lobby at the Kimpton Saint George Hotel in Toronto

↓ Room 1401 at the Kimpton Saint George Hotel in Toronto

The living room in the Presidential Suite at the Kimpton Saint George Hotel in Toronto

O2 BEACH CLUB AND SPA, BARBADOS

Breathing oxygen into the luxury all-inclusive concept

All-inclusive properties in the Caribbean used to mean wild pool parties and forgettable food. But that’s rapidly changing, as names such as JW Marriott and Ritz-Carlton have embraced the concept of luxury all-inclusives.

One property that has successfully implemented the high-end, all-inclusive concept is the 02 Beach Club and Spa on the south coast of Barbados, an island long favoured by Canadians.

“02 Beach Club and Spa is aimed at ‘people who want a five-star property but like the convenience of an all-inclusive property,’” Jacqui McDermott, sales and marketing manager for O2 and Ocean Hotels Group Barbados, tells me during my visit. She explains that guests expect great wine and great culinary experiences while staying in all-inclusive environments these days.

02 Beach Club offers up both, and more. Here’s a look.

THE DESIGN

The property is a modern, elegant yet relaxed affair with bright colours and light wood tones. There are splashes of colour all around, including beach/pool umbrellas in shades of vivid pink and orange sherbet.

“A lot of places in Barbados are built or decorated in kind of a plantation style, so we wanted to do the opposite,” McDermott says.

THE ROOMS

The resort has 130 luxury rooms and suites, including swim-up rooms. All rooms include limitless access to a variety of dining options, unlimited premium international and domestic

spirits, a daily stocked mini bar, pool and beach wait service, beach sports, “How-to” classes, free golf, spa credits, and more.

Luxury Collection rooms feature modern, spacious Junior Suites for adults only, with fabulous ocean views, king bed or double queen configurations and designer touches and high-end amenities.

Concierge Collection rooms are spacious, one and two-bedroom suites offering oceanfront views, unique luxury touches and such add-ons as spa treatments and personalized grocery service.

I had a very large, ground-floor, Luxury Collection swim-up room in the new wing of the resort. The room was decked out with a super comfortable bed, a sofa bed with soft, pink pillows, a largescreen TV, a coffee maker and a mini-fridge stocked with Prosecco, beer and soft drinks. There was a cool, vibrant painting of a red octopus on the wall.

An overhead look at the beach at the O2 Beach Club and Spa in Barbados

The view from a room at the O2 Beach Club and Spa in Barbados

↑ The spa at O2 Beach Club and Spa in Barbados

My bathroom was the size of some Parisian hotel rooms, and featured a lovely stand-alone tub, a spacious rain shower big enough for two, and double sinks. My patio fronted the pool and had comfy lounge chairs and a direct view of the ocean.

THE FOOD

Guests at O2 can enjoy a variety of great dining experiences, from gourmet, indoor places to breezy outdoor decks or a barefoot meal on the beach.

ELEMENTS is steps from the water and offers fabulous ocean views. They have a Mimosa breakfast, as well as themed menus from around the globe for lunch and dinner. I had excellent shrimp crudo one night and flavourful Moroccan lamb chops. There’s live music at night, with everything from soft jazz to Bob Marley and Etta James.

ORO is a fine dining experience that offers air-conditioned comfort and fine, ninth-floor views. There’s a great selection of rums.

BLUEFIN is an open-air, beachside grill that features everything from pizza and fresh fish to burgers and salads. I had good fish tacos for lunch one day, and a fine Asian buffet dinner another.

THE POOLS AND BEACH

The adults-only pool on the west side of the hotel is very pretty. With an “open-to-all” pool on the east side of the resort. There’s a pool on the roof at one of the restaurants; it’s also adults-only, as are the two hot tubs on the second-floor sun deck.

The resort has a very nice stretch of beach, with tons of comfy loungers, wooden swings and benches.

OTHER NOTABLE FEATURES

I found the staff very accommodating. One day, it had rained (mon dieu!) a little and there were puddles on the tiles near the lobby. A worker carefully showed me where to walk so I could minimize my chances of slipping and falling.

There are many free activities for guests to enjoy, including beach volleyball, yoga, morning power walks and beach cricket.

The resort is well-equipped for weddings, honeymoons or proposal visits. They can arrange marriage licenses, provide design and decor help and even have a proposal concierge.

Hotel officials told me the eighth-floor Acqua Spa is the only elevated spa on the island and has the only Hammam steam spa. There are floor-to-

ceiling windows overlooking the grounds and the ocean. Their massage treatments are excellent.

Unlike some Caribbean resorts, O2 Beach Club and Spa is very much part of the neighbourhood. It’s in the St. Lawrence Gap area, a lively part of the island with tons of shops, markets and restaurants and the resort is just 15 minutes from the airport, so you get more time to enjoy your stay!

COURTESY OF JIM

BYERS

A sunset on the beach at the O2 Beach Club and Spa in Barbados

↓ A room at the O2 Beach Club and Spa in Barbados

↑ A view from one of the rooms at the O2 Beach Club and Spa in Barbados

The Queen Mary, Long Beach, CA

A hotel that served for years as the most luxurious cruise ship on the planet.

The word “unique” gets tossed around far too easily in the travel and hospitality world. But when you’re talking about a hotel that served for years as the most luxurious cruise ship on the planet and that formerly floated the seven seas with the likes of Queen Elizabeth, it just might be acceptable to use that kind of terminology.

The Queen Mary was once the pride of the Cunard line, a fleet, glamorous ship that carried the crème de la crème of society. Sadly, cruise holidays fell out of fashion with the dawn of the jet plane age, and the ship was decommissioned. She scuttled her way to California and has been docked in the harbour since 1967.

My wife and I were lucky enough to stay the night earlier this year and have a tour, which gave us a real glimpse into the golden age of travel, an era our guide called “a dazzling display of decadence and style.”

THE HISTORY

Legend has it that Cunard wanted to name the ship the Queen Victoria. Company officials went to then King George V to give him the news.

“We have decided to name our new ship after England’s greatest queen,” meaning Queen Victoria, the King’s grandmother. Upon which the King is reported to have stated, “My wife (Queen Mary) will be delighted that you are naming the ship after her.” Oops.

The ship was a force of nature when she first sailed in 1936. She also drew the biggest celebrities of her day, wealthy passengers with immense trunks to handle the seven or eight clothing changes that society demanded at the time. No tiny carry-

↑ The Queen Mary hotel in Long Beach, California

Public space on the Queen Mary hotel in Long Beach, California

ons in crowded overhead bins for these folks, at least not the ones on the top decks.

The ship was used to ferry soldiers across the Atlantic Ocean during World War II. They painted her grey and covered the portholes so German subs couldn’t see the lights at night. The ship was designed to carry 3,000 passengers, but at times carried more than 16,000 soldiers. They even filled in the swimming pools to give soldiers a place to sleep. We were told the ship was so fast the German U-boats couldn’t catch up, and that she was never attacked by Axis forces.

Celebrity guests over the years include Ella Fitzgerald, Winston Churchill, Bob Hope and

many others. Paul McCartney held a big party at the docked Queen Mary hotel when he released his album, “Venus and Mars,” in 1975.

The Queen Mary has been used to film scenes for many a movie, including Pearl Harbor, The Aviator, Being John Malkovich, and The Poseidon Adventure.

The cabin class main dining room, which was three decks high, had a motorized ship that raced along a track to show passengers where the ship was at any one time. Call it early GPS.

THE ROOMS

There are 364 rooms and 15 suites on the ship. Our room was M115, a large suite with tons of polished wood, a comfortable bed, a small bathroom, a desk, and two portholes. There were several photos of British royalty and Winston Churchill on the walls.

I wasn’t able to get a tour of the rooms, but the hotel offers a variety of room styles, including suites, staterooms, family staterooms and accessible rooms.

THE DETAILS

Our tour guide told us there are no fewer than 56 types of wood on board the ship, including English sycamore, Burmese teak and glorious cedar from Honduras. There are also tons of lovely art deco touches and dreamy murals.

One of the fun things to check out is the indoor children’s playroom, which has a small slide that was first tested by the future Queen Elizabeth and Princess Margaret.

The promenade that circles the boat is a fine place to enjoy the California weather, which is probably nicer than the North Atlantic most days. The story goes that a prominent British Olympian named David George Burghley once raced the distance of the promenade in 57 seconds, while wearing street clothes.

THE BAR

We didn’t have a meal on the ship, but we did check out the Observation Bar, a decadent, old-school affair with tons of atmosphere and art deco touches. The bar itself is a half-circle and reminds me of the shape of a wine or beer barrel.

There was a fine band playing oldies and swing tunes when we popped in, and a few folks were dancing in period costumes, including flapper outfits and 1930s-looking striped suits. Their attire lent a celebratory air, and we enjoyed a couple of fine cocktails while we watched folks spin around the dance floor.

MISCELLANEOUS

We did a day tour, but you can stay the night or try a haunted tour. The Steam and Steel Tour takes engineering fans into the depths of the ship to check out the boilers and generators.

The hotel is available for meetings, weddings and other events.

Long Beach is about 30-40 minutes south of the Los Angeles International Airport. Better yet, fly into the cute, easy-to-navigate Long Beach Airport.

COURTESY OF JIM BYERS

COURTESY OF VISIT LONG

BEACH/QUEEN MARY HOTEL

The Observation Bar on the Queen Mary hotel in Long Beach, California

A room on the Queen Mary hotel in Long Beach, California

Kimpton Saint George Hotel

Crowne Plaza Saint John Harbour View

avid hotel Toronto - Vaughan Southwest

Holiday Inn & Suites Montreal Centre-ville Ouest

CANADIAN INDUSTRY

5.

6.

IN THE FINAL QUARTER OF THE YEAR, INTEREST RATES HAVE DECREASED, AND THE HOTEL INDUSTRY IN CANADA IS GOING STRONG. NORTH AMERICAN AND GLOBAL ECONOMIC UNCERTAINTIES CONTINUE TO AFFECT THE SECTOR, BUT STRONG SUMMER PERFORMANCE, RESILIENT LEISURE DEMAND, AND AN EXCITING TRANSACTIONAL YEAR TO DATE FORM THE FOUNDATION OF A CAUTIOUSLY CONFIDENT OUTLOOK FOR 2026.

In August 2025, Canada’s hotels recorded 80.7 per cent occupancy (its highest level since 2014), ADR of $250.18 and the highest RevPAR on record of $202.01, according to CoStar.

CoStar also reports that year-to-date (YTD) August 2025, Canada’s hotels posted RevPAR of $145.59, ADR of $217.15 and 67 per cent occupancy.

Investment activity has held steady, with buyers disciplined and sellers adjusting to firmer valuations. Regional hot spots have emerged in Alberta, Ontario, and parts of Quebec. And, while financing conditions evolve in step with shifting Bank of Canada policy, hotels have attracted considerable interest from investors, including some who are typically interested in traditional real estate assets.

Finally, labour challenges remain, development pipelines are expanding, and brand strategies are reshaping competition.

TRANSACTIONS

TRANSACTION VOLUME IN THE CANADIAN HOTEL

SECTOR MAINTAINED A CONSTANT PACE THROUGHOUT 2025, MARKING A CONTINUATION OF THE INDUSTRY’S STEADY, MULTI-YEAR IMPROVEMENT. WITH THE OPERATIONAL AND FINANCIAL IMPACTS OF THE PANDEMIC HAVING LARGELY SUBSIDED, MARKET FUNDAMENTALS SUPPORTED A CONSISTENTLY ACTIVE AND GROWING INVESTMENT CLIMATE.

“The first half of 2025 saw hotel investment remain steady, with a consistent volume of deals anticipated for the remainder of this year. Transaction activity will continue to be dominated by smaller/mid-size deals, and competition remains strong for limitedservice and focused-service properties.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“We’re seeing a healthy pace of deal flow, and I expect that to continue into early 2026. The fundamentals are strong, and while the market isn’t overheated, there’s a steady confidence among buyers and sellers. Institutional capital is back, but it’s the mid-market trades (owner-operators and regional players) that are really driving volume. 2024 transaction volume exceeded $2 billion, up 17 per cent YoY, with 2025 expected to match or slightly exceed this level. Momentum is driven by record operating performance, strong liquidity, and renewed institutional interest. The market remains anchored in mid-market trades by Canadian owner-operators, with large portfolio deals returning.”

- Ed Khediguian, VP, National Bank of Canada Franchise Finance

“For Canadian hotel transaction activity as we close out 2025 and head into 2026, I anticipate a steady but selective market. We’re seeing continued interest in well-located, wellperforming assets, particularly those with strong operational fundamentals. The overall volume might be slightly down from peak periods, but the quality of transactions should remain high.”

- Alnoor (Al) Gulamani, president, Bayview Group of Companies

“Transactions have been very busy through 2025. I expect transaction activity, whether that’s developing new assets or trading assets, to grow in 2026. Hotels have garnered a lot of interest from real estate investors, including some who have historically been more interested in traditional real estate assets. Hotels have performed very well over the last five years, coming out of a very dark time five years ago. At the same time, some traditional assets, like light industrial, residential condo development, and office, have been challenged over the last few years.”

- Stephen Vermette, managing director & RVP | Western Canada business properties finance | Canadian commercial banking, BMO Financial Group

“It’s always hard to predict transaction volume in Canada, just due to the concentration of ownership of most hotels in major markets. That really limits opportunity. You do have some of the requirements for increased volume, with performance slowing in most markets and renovation capex still required in many hotels. That may lead to owners selling off certain hotels to not have to put the funds in themselves.”

- Alan Perlis, chief executive officer, Knightstone Capital Management Inc.

“I believe the Canadian hotel transaction market remains relatively subdued, particularly in Ontario and other major urban centres across the country. While a few high-profile deals over the past six months may give the impression of an active market, the reality is that most buyers remain on the sidelines, waiting for the right opportunities to emerge—especially in Ontario.”

- Rajan Taneja, managing director, Palm Holdings

“The balance of 2025 will likely be similar to activity in the first half of the year, which reflects traditional transaction trends in normalized years. I anticipate a similar year in 2026, provided economic trade wars don’t escalate beyond the current situation.”

- Curtis Gallagher, principal, Canadian hospitality lead, Avison Young

“Investment activity remains strong, supported by solid fundamentals and ample liquidity on both the equity and debt side. Hotels continue to deliver attractive yields relative to other asset classes, drawing both existing owners and new investors to the space. 2025 volume has been fueled by several headline transactions in major markets, alongside fluid mid-market trading across Ontario, Alberta, Quebec, and the Maritimes.”

- Jessi Carrier, senior vice-president | hotels, Colliers International

“There have been fewer trades overall, but some high-profile deals: Brookfield bought the Shangri-La Vancouver; Pacific Reach acquired the Ritz-Carlton Toronto and brought in Dilawri Group of Companies as a capital partner.”

- Carrie Russell, senior managing partner, HVS

“Fast forward to today, and the industry in Canada is seeing unprecedented levels of RevPAR, far in excess of pre-pandemic levels. That’s driving positive momentum in financial performance and related hotel valuations, and I expect we’ll continue to see increasing levels of transaction activity as we head into 2026.”

- Brian Leon, chief executive officer, Choice Hotels Canada

SENTIMENT: BUYERS DISCIPLINED, SELLERS REALISTIC

“The Canadian hotel market continues to thrive with RevPAR strength and liquidity across all segments. This performance has fueled acquisitions, conversions, refinancing, and new construction. With other real estate sectors facing challenges, hotels have become the ‘golden child’ of asset classes, offering stability, yield, and consistent growth. Travel, tourism, and corporate lodging trends have proven more durable, drawing banks, credit unions, pension funds, and private capital into the market. CFO Capital projects healthy two to three per cent annual growth, reinforcing lender confidence and investor appetite.”

- Mark Kay, principal/president, CFO Capital

“Seller motivation is rising, driven by succession planning and strategic repositioning. On the buy side, U.S. investors are leaning in, taking advantage of the currency spread. That’s creating a competitive edge in markets like Ontario and Alberta. Overall, sentiment is positive, but tempered by a lack of available product, which is keeping valuations firm. Investor confidence remains high, with national average price per key nearing $200,000, up 18 per cent YoY. Sellers are motivated by succession planning, rising operating costs, and strategic portfolio rationalization. U.S. buyers are increasingly active, leveraging FX advantages of up to 28 per cent due to CAD/USD spread. Limited product availability is creating a seller’s market, especially in Ontario and Alberta.”

- Ed Khediguian, VP, National Bank of Canada

Franchise Finance

“There are some shifts in both buyer and seller sentiment that may shape how deals come together in the next 12 to 18 months. On the buy side, investors are becoming more disciplined and more focused in pursuing the right opportunities. I’m noticing a bigger focus from investors for assets with proven performance and certainty of future income levels, as well as a preference to own properties with lower operational complexity. Although financing remains readily available, lenders remain disciplined, and it is steering buyers towards exploring creative deal structures (i.e., seller take-back mortgages, owner/operator joint ventures). There is more attention on assets in secondary and tertiary markets, including properties that can be repositioned or rebranded.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“Sellers are generally holding firm on pricing, expecting values to remain strong. Buyers, however, are becoming more discerning, focusing on yield and long-term potential. This dynamic could lead to a slight slowdown in deal velocity if expectations aren’t aligned, but it also creates opportunities for well-capitalized and strategic investors.”

- Alnoor (Al) Gulamani, president, Bayview Group of Companies

SENTIMENT:

“Hospitality remains the most resilient sector, which explains the surge of new entrants prioritizing hotel lending and investment. Owners of stabilized hotels are increasingly turning to refinancing as a strategy to unlock trapped equity, driven by strong cash flow. At the same time, succession planning, operating cost pressures, and portfolio repositioning are motivating sellers. Demand recovery has outpaced expectations, supporting higher valuations and drawing institutional lenders that are looking for growth exposure. These dynamics are creating opportunities in acquisitions, conversions, and new construction, with liquidity fuelling further investment across the country.”

- Mark Kay, principal/ president, CFO Capital

“For those owners with mid to largesize portfolios, there appears to be a stronger motivation to sell non-strategic or underperforming properties. Sellers are focused on deal certainty and a desire to transact with strong, proven buyers, which is creating opportunities for well-capitalized investors who can move quickly.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“Buyers remain highly competitive for Ontario and GTA assets, particularly as interest rates have declined significantly. Given the limited supply currently available, many are exploring secondary markets, including smaller cities and regions such as the Maritimes. This trend is expected to continue. Currently, the majority of sales are being driven by larger institutional investors, people retiring and looking to get out of the business, and a few through select receivership processes.

-

Rajan Taneja, managing director, Palm Holdings

“In order to transact, both buyer and seller will need to act reasonably to agree on price based on the specific deal situation. That includes applicable cap rate, renovation and/or repositioning cost, supply-demand dynamics and anticipated future performance.”

- Curtis Gallagher, principal, Canadian hospitality lead, Avison Young

“Heightened competition and strong valuations are driving favourable sell-side conditions, though investors are looking for immediate cash flow, which makes existing assets, even those requiring repositioning comparably attractive due to high construction costs and timelines.”

- Robin McLuskie, managing director | hotels,

Carefully curated, elegant and unmistakably a cut above.

Colliers International

REGIONAL AND ASSET HOT SPOTS

CONTRIBUTORS HIGHLIGHT GROWING INVESTMENT INTEREST

IN LIMITED-SERVICE, SELECTSERVICE AND EXTENDEDSTAY HOTELS, ALONG WITH PROPERTIES THAT CAN BE UPGRADED OR REBRANDED. THE GTA REMAINS A FOCUS, ALBERTA IS GAINING MOMENTUM, AND CERTAIN LEISURE AND SECONDARY MARKETS ARE ALSO ATTRACTING CAPITAL.

“Major markets are always in demand, though investment opportunities are limited. Investors are looking beyond urban centres for investment with secondary markets across northern Ontario, the Maritimes, and Quebec tied to major infrastructure projects gaining attention.”

- Jessi Carrier, senior vice-president | hotels, Colliers International

“I believe investors will continue to target limited-service and focusedservice hotels and properties that can be repositioned through renovation, rebranding, or operational improvements. Although capex costs have increased, assets that show clear upside will remain attractive. Geographically, the GTA will likely remain the most active market; however, as interest broadens, Alberta is gaining more attention, along with Montreal and the surrounding markets throughout Quebec. Atlantic Canada continues to appeal to groups, as markets in the region offer attractive pricing and demonstrate growth potential.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“I expect limited-service and selectservice hotels in major urban centres and key drive-to leisure destinations to attract the most interest. Secondary markets with strong demographic growth and tourism appeal will also be on the radar.”

- Alnoor (Al) Gulamani, president, Bayview Group of Companies

“In the GTA, Ontario, and the top five to seven urban markets across Canada, investor demand remains concentrated on mid-market branded hotels such as Hampton Inn and Marriott Courtyard, along with extended-stay properties. These segments continue to attract strong interest given their resilient performance and broad appeal. At the same time, larger full-service assets in Toronto, Vancouver, and Montreal remain highly sought after, underscoring the enduring demand for prime hotels in Canada’s major gateway cities.”

- Rajan Taneja, managing director, Palm Holdings

“In the West, Vancouver has been getting a lot of attention and has for the last 12 to 18 months. There’s been coverage of a hotel shortage in Vancouver. The development environment has improved, even in a very expensive place to build, and there’s a hotel-room supply challenge. Some assets have come offline and haven’t been replaced. Calgary is another market drawing attention. With the new BMO Convention Centre, there’s significant convention capacity but constrained hotel-room supply.

- Stephen Vermette, managing director & RVP | Western Canada business properties finance | Canadian commercial banking, BMO Financial Group

“Ontario continues to lead, with strong interest in both urban and resort markets. Alberta is gaining traction, especially Calgary, and B.C. remains attractive despite pricing headwinds. Investors are gravitating toward full-service and upscale focused-service assets with repositioning potential. Flexibility around PIPs is a key differentiator. Full-service hotels lead in pricing at $283,000 per key, followed by focused service at $228,000. Ontario accounts for 52 per cent of national volume, led by the GTA, Muskoka, and secondary cities. Alberta accounts for 18 per cent of national volume, while B.C. and Quebec each account for 10 per cent, with activity concentrated in Calgary, Vancouver, and Montreal. Investors favour midscaleto-upscale assets with repositioning potential and flexible PIP timelines.”

- Ed Khediguian, VP, National Bank of Canada Franchise Finance

“Leisure destinations are strong. Short-term rental rules have created compression in places like Victoria and Kelowna. Vancouver and Toronto are holding. Montreal is softer. Through August: Montreal RevPAR down about 3 per cent year to date; Vancouver up about two and a half per cent. Alberta is a standout: Edmonton up almost eight per cent, Calgary up over 10 per cent.”

- Carrie Russell, senior managing partner, HVS

“Institutional and Ontario/B.C. capital is flowing into Alberta, drawn by the province’s diversification efforts, hotel performance gains, and relative affordability. Alberta’s resilience through oil shocks and COVID has brought smart money back”

- Robin McLuskie, managing director | hotels, Colliers International

“With recent positive performance trends and a perception of future growth opportunities, we’re seeing increased interest from hotel investors in some of the resource markets, particularly in Alberta.”

- Brian Leon, chief executive officer, Choice Hotels Canada

“Victoria is also attracting interest. I’d put it behind Vancouver and Calgary, but it’s on the radar. For us, once a week, someone knocks on our door about a mixed-use new development project that includes a hotel: ‘How do we go about doing this?’ The biggest shift we’re seeing is new development, and you can attach that comment to several markets, typically the primary markets in Western Canada.”

- Stephen Vermette, managing director & RVP | Western Canada business properties finance | Canadian commercial banking, BMO Financial Group

FINANCING AND CAPITAL FLOWS

CAPITAL IS AVAILABLE, BUT LENDERS ARE HISTORICALLY SELECTIVE, ESPECIALLY MAJOR NATIONAL FINANCIAL INSTITUTIONS, WITH REGARD TO HOTELS. RECENT BANK CONSOLIDATIONS HAVE EXPANDED CAPACITY, AND COMPETITION HAS PUSHED RATES DOWN SLIGHTLY. INTERVIEWEES POINT TO POTENTIAL BANK OF CANADA RATE CUTS AND A PIPELINE THAT IS CHARACTERIZED BY MORE NEW CONSTRUCTION OPPORTUNITIES, WHICH COULD STRENGTHEN CONDITIONS FURTHER.

“Access to capital will depend on the resilience of hotel performance relative to other real estate sectors. Conservative underwriting, bond yield volatility, and cautious appraisals remain factors, but hotels continue to carry a stronger case than struggling sectors like office or residential condos. Institutional lenders, credit unions, and private capital are prioritizing hospitality, drawn by higher leverage availability, stable yields, and consistent demand. New development is returning, often in mixed-use formats, and conversions will continue to attract attention because they deliver more viable returns than office assets. For developers and owners, access to capital will come from presenting well-structured projects that align with this appetite for stability and growth.”

- Mark Kay, principal/president, CFO Capital

“Recent consolidation has increased debt availability for hotels, with RBC’s acquisition of HSBC and National Bank’s purchase of CWB expanding Schedule A presence in the sector. Lenders remain focused on sponsor strength and overall deal quality.”

- Jessi Carrier, senior vice-president | hotels, Colliers International

“The debt market is highly supportive, with strong liquidity and competitive rates. The slowdown in other asset classes has redirected significant capital toward hotels. Relationships remain key.

- Robin McLuskie, managing director | hotels, Colliers International

“As we approach 2026, the outlook for hotel transactions looks promising. Potential rate cuts by the Bank of Canada and a more supportive lending environment could boost buyer confidence and lead to more optimistic underwriting.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“Acquisition financing is available up to 75 per cent loan-to-value, and construction financing can reach up to 75 per cent loan-to-cost, with some projects achieving 80 per cent. Office-tohotel conversions have emerged as a new frontier, where rising vacancies and escalating costs are pushing developers to reposition obsolete office assets. Refinancing activity is also strong, with owners using debt to fund new acquisitions or development, diversify into other asset classes, or redeploy equity. With five-year bond rates in the mid-four to low-five per cent range, hotels continue to attract capital. Lenders are competing to put money out, and hospitality is one of the few sectors delivering the performance they need.”

- Mark Kay, principal/president, CFO Capital

LABOUR AND OPERATIONS

LABOUR PRESSURES REMAIN A CONCERN. UNION ACTIVITY HAS INCREASED IN SOME MARKETS, AND RELIANCE ON TEMPORARY FOREIGN WORKERS CONTINUES. RISING COSTS ARE STILL CITED AS A DRAG ON PERFORMANCE AND A KEY FACTOR IN DEAL EVALUATIONS.

“Hotels currently have a workable labour base, but TFWs remain important. There has been more job action as unions seek gains after the post-COVID recovery—for example, the Sheraton Guildford and the Radisson in Richmond, which settled after a prolonged strike.”

- Carrie Russell, senior managing partner, HVS

“We are syndicating larger exposures and having conversations with a number of parties. The market is receptive to finding capital and has the appetite to serve the sector. I think that will continue to grow into next year, in part because institutions that traditionally didn’t serve the sector are starting to come to the table. Some may have capital to deploy that isn’t being deployed in traditional spaces, so they’re looking for different sectors to support. For hoteliers seeking financing, I think the environment will continue to improve at a proper, reasonable pace. Anyone dealing with a Canadian bank knows we don’t typically whipsaw. We’re thoughtful in our approach. It takes time to develop appetites, but things are moving in a more open, positive way for hoteliers. As for BMO, we’ve supported the industry through good and challenging times and that won’t change as I look forward.”

- Stephen Vermette, managing director & RVP | Western Canada business properties finance | Canadian commercial banking, BMO Financial Group

“Traditional lending has tightened considerably. Even with rate cuts from the Bank of Canada, elevated bond yields are keeping borrowing costs high. Stress-testing is rigorous, and many deals aren’t making it past underwriting. That said, private capital is stepping in, not offering discounts but demanding higher returns in exchange for speed and flexibility. These players are reshaping deal structures and timelines. Hospitality lending is down >40 per cent YoY in Q3 2025, especially for flagged and seasonal assets. Despite BoC rate cuts (from 5 per cent to 3 per cent), bond yields remain elevated, keeping borrowing costs high. Stress-testing at 7–8 per cent is common, causing deals to fail underwriting thresholds. Private capital (family offices, HNWIs) is filling the gap, demanding higher yield premiums to compensate for risk and speed. These lenders offer customized structures, flexible covenants, and fast execution, but at higher cost of capital.”

- Ed Khediguian, VP, National Bank of Canada Franchise Finance

“Investors continue to focus on factors such as labour costs and capex/PIP obligations as they evaluate deals. For wellcapitalized buyers who are prepared to act quickly, there will be opportunities to acquire properties across the country.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“Going forward, there will be a shift toward developing new assets. Other traditional real estate sectors are slowing down. Costs are better contained today than at the height of supply-chain issues, when cost containment was very difficult. There’s more certainty and consistency around costs. Access to trades and labour is probably a little better because activity is shifting away from some traditional real estate assets.“

- Stephen Vermette, managing director & RVP | Western Canada

DEVELOPMENT PIPELINE AND BRAND EXPANSION

NEW HOTEL DEVELOPMENT IS STARTING TO PICK UP AFTER A SLOW PERIOD. INTERVIEWEES POINT TO MORE PROJECTS IN THE PIPELINE, TARGETED BRAND GROWTH, AND THE CONTINUED EXPANSION OF LARGE CHAINS ACROSS MULTIPLE MARKET SEGMENTS.

“After a slow start to the year, feasibility work has picked up. Expect higher new-room supply over the next three to four years than in the past decade. Not an oversupply concern at this point, but the pipeline is larger.”

- Carrie Russell, senior managing partner, HVS

“Surpassing 200 open hotels in Canada is described as a powerful testament to the company’s momentum in the market. With a strategic brand mix that includes the fastest-growing categories in the industry, Hilton says it continues to deliver for owners, guests and communities nationwide.”

- Matt Wehling, senior vice-president, development, U.S. and Canada, Hilton

“Choice Hotels recently announced the entry of its upscale brand, Cambria Hotels, into Canada, with a new build property set to open in Thunder Bay in 2026. We want to drive targeted growth in high-performing markets, while also exploring markets that haven’t been discovered yet.”

- Brian Leon, chief executive officer, Choice Hotels Canada

CONTINUED →

Defining Durability since 1947.

Milnor’s V-Series open-pocket cylinder Washer-Extractors range from 40-160 lb capacities.

Times have changed since Milnor built its first commercial laundry machine, but Milnor’s dedication to quality construction and durability hasn’t. Our washer-extractors are built with high-quality components designed to last. Plus, each model design is tested in a significant out-of-balance state for over 1,000 hours at maximum extraction speed, which is why you see so many Milnor machines working for decades in laundries around the world. And that’s why you will continue to see machines bought today working well in the future. Find out more at milnor.com.

DEVELOPMENT PIPELINE AND BRAND EXPANSION

“If you’re a real estate developer more typically focused on those sectors, hotels are getting your attention because they’ve performed so well. We’re having lots of conversations with traditional real estate developers who say, ‘We have land and plans to do those traditional things; we’re putting those to the side and considering how to integrate hotels into that plan.’ There’s a pipeline of activity likely to come from those conversations.”

- Stephen Vermette, managing director & RVP | Western Canada business properties finance | Canadian commercial banking, BMO Financial Group

“Growth strategy is driving the rise of new brands. Large parent companies keep adding brands to continue developing in markets that already host their existing flags. Competitors create equivalents, so you see parallel brand grids across Marriott, Hilton, Hyatt and IHG.”

- Carrie Russell, senior managing partner, HVS

“Hilton is emphasizing focusedservice, extended-stay and lifestyle brands, expanding in destinations ranging from iconic city centres to emerging leisure and event hubs across the country. Extendedstay is one of Hilton’s strongestperforming categories, having doubled in size over the past decade with the Homewood Suites by Hilton and Home2 Suites by Hilton brands.”

- Matt Wehling, Senior VicePresident, Development, U.S. and Canada, Hilton

“Acquisition financing is leading the charge. Refinancing remains challenging, with many deals being repriced monthly or failing stress tests. New construction is slowly coming back, but mostly in mixed-use formats where hotel components are part of broader development plays. Ontario and B.C. are leading here, but it’s still a selective environment. Acquisitions dominate due to scarcity of product and high construction costs. ”

- Ed Khediguian, VP, National Bank of Canada Franchise Finance

PERFORMANCE OUTLOOK

MARKET GROWTH THIS YEAR HAS BEEN DRIVEN MORE BY RATE THAN OCCUPANCY. EXECUTIVES EXPECT SOFTER PERFORMANCE IN SOME MARKETS AS GOVERNMENT DEMAND EASES, BUT MANY ANTICIPATE GRADUAL RECOVERY INTO 2026, HELPED BY CORPORATE AND GROUP TRAVEL RETURNING AND INTERNATIONAL EVENTS BOOSTING DEMAND.

“The market experienced weaker results in H1, but a strong summer has helped most markets pace ahead of last year. Overall growth will be moderate this year, primarily driven by ADR growth.”

- Brian Flood, vice chairman and practice leader, hospitality & leisure, valuation & advisory, Cushman & Wakefield

“National occupancy is around 66.5 per cent through year-end. FIFA 2026 will be significant for Vancouver and Toronto, but we are not projecting a large national occupancy jump. Rate growth is expected in the two to three per cent range.”

- Carrie Russell, senior managing partner, HVS

“Across most of the markets where we operate, revenues have been declining over the past three to four months. The strong growth seen over the last two years has now come to an end, largely driven by the wind-down of government business that had been filling hotels, particularly in airport markets. As this supply returns to the broader market and is gradually absorbed over the coming months, I expect 2025 to remain a soft year overall. That said, I anticipate a gradual recovery beginning in 2026, with growth slowly starting to return.”

- Rajan Taneja, managing director, Palm Holdings

“I believe growth next year will be led more by rate, as we should see moderate demand that allows for optimized pricing. However, occupancy should also see steady improvement as corporate and group travel continues to normalize.”

- Alnoor (Al) Gulamani, president, Bayview Group of Companies

“Our expectations are that 2026 will be another positive year for our sector. We expect unit growth for the balance of the year and into 2026, a solid mix of asset tiers and a well-established footprint across the country that will help position us for even further success. ADR will still contribute more towards overall increases than will be gained through occupancy.”

- Brian Leon, chief executive officer, Choice Hotels Canada

RISKS AND OPPORTUNITIES

INTERVIEWEES POINT TO WEAKER DEMAND IN MARKETS TIED TO U.S. TRADE, REDUCED IMMIGRATIONRELATED BUSINESS, AND MORE FREQUENT UNION ACTION. ON THE OPPORTUNITY SIDE, LOWER INTEREST RATES, STRONG LEISURE DEMAND AND EVENTS LIKE FIFA 2026 ARE EXPECTED TO SUPPORT PERFORMANCE, ESPECIALLY FOR WELLCAPITALIZED BUYERS.

“Business and government relations with the U.S. are key. General economic malaise could weaken investor confidence. Markets reliant on U.S. commerce will be challenged.”

- Curtis Gallagher, principal, Canadian hospitality lead, Avison Young

“Markets which are reliant on U.S. trade or industries such as auto and certain materials will continue to experience weakened demand. Other factors impacting demand in 2026 will be the introduction of new supply and the reduction in government contract demand in some submarkets.”

- Brian Flood, vice chairman and practice leader, hospitality & leisure, valuation & advisory, Cushman & Wakefield

“Markets that recorded strong results from Immigration, Refugees and Citizenship Canada (IRCC) business will take longer to recover under reduced demand.”

- Curtis Gallagher, principal, Canadian hospitality lead, Avison Young

“Potential rate cuts by the Bank of Canada and a more supportive lending environment could boost buyer confidence. Events like FIFA 2026 and strong resort demand are anticipated to continue driving performance metrics in certain markets. For well-capitalized buyers who are prepared to act quickly, there will be opportunities to acquire properties across the country.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“Marriott’s acquisition of CitizenM, and Sonder joining Marriott through a long-term licensing and distribution agreement, it will be interesting to see how they play out and affect the market.”

- Alan Perlis, chief executive officer, Knightstone Capital Management Inc.

OUTLOOK 2026

2026 OUTLOOK IS CAUTIOUSLY OPTIMISTIC, CONTINGENT ON RATE STABILITY, FX TRENDS, AND GEOPOLITICAL CLARITY.

“The pipeline for new construction opportunities is shifting the most; it’s growing. The next two to four years will include some very large projects that may take a number of years to complete. There’s a lot of work to do between now and then. Refinancings and acquisitions will continue. We have a lower-rate environment today than, say, the last two years, which will generate activity. Trading of assets remains positive because hotels have performed well and continue to attract interest from investors who haven’t traditionally participated in the sector. New construction’s pathway is going to grow because rates have come down, the cost environment for construction is better and traditional developers are casting an eye away from things they built frequently in the past and more toward or at least including hotels as part of broader developments.”

- Stephen Vermette, managing director & RVP |

“I expect transaction activity to remain muted through the balance of the year, with momentum beginning to build again. Looking ahead, with interest rates easing further, I anticipate that 2026 will bring increased transaction activity as more owners come to market, motivated by the ability to achieve stronger pricing.”

- Rajan Taneja, managing director, Palm Holdings

“As we look towards 2026, expect overall transaction activity to remain steady relative to last year, and if interest rates ease and travel demand improves, additional buyers will enter the market. We may see more value-add opportunities as the number of hotels needing renovation or repositioning grows. Buyers are extending their focus further across the country, with more groups looking outside of the major metropolitan areas.”

- Sylvia Occhiuzzi, senior vice-president, Beechwood Real Estate Advisors

“In 2026, markets will continue to feel the impact of U.S. policies and a weaker economy, with weaker to flat corporate demand growth coupled with weaker group demand in some major markets. Overall growth will be modest in 2026.”

- Brian Flood, vice chairman and practice leader, hospitality & leisure, valuation & advisory, Cushman & Wakefield

PROTOTYPE HOTEL DIVES BENEATH THE WAVES TO WITHSTAND TSUNAMIS

FROM MARGOT KRASOJEVIĆ AND STAY MAGAZINE

A new prototype hotel in the Pacific Ocean is positioning itself at the frontier of hospitality innovation.

Designed by architect Margot Krasojević for China’s Ministry of Environment and Ecology, the project envisions a floating, submersible structure that draws heavily from marine engineering. The concept is not only about creating an extraordinary destination for travellers, but also about adapting hospitality design to a future defined by climate risks, energy transition and new guest expectations.

The hotel is composed of three vertical structures tethered to the seabed. Each structure houses

Striated steel frame containing inflable salvage pontoons

Array of weighted masts which provide stability buoyancy

Hoded steel structure wrapping round hotel pods

Inflatable salvage pontoon elements

Reinforced acrylic hotel dome and atrium containing hotel room pods

Tension leg steel cables attached to seabed

Ballast tanks

Hotel pods and Hyperbaric chambers

Submersible hotel atrium

Photon turbines attached to buoyancy masts

Fully submerged Submersible Tsunami hotel. Image by Margot Krasojević.

a series of reinforced acrylic pods that form the habitable spaces. Wrapped around them is an inflatable façade system that operates like a giant life jacket. These pockets inflate to stabilize the hotel when floating and expand to resist tilt in heavy seas. When the hotel needs to submerge, such as during a tsunami alert, the jackets deflate, ballast tanks flood, and the structures descend beneath the surface.

The process mirrors submarine technology. Motors retract the towers downward, while controlled ballast flooding lowers the structures into deeper water. Once submerged, the pressureresistant acrylic pods protect occupants, while the façade system can be reinflated to assist resurfacing once conditions stabilize.

Every guestroom is equipped with a hyperbaric chamber to support safe pressure adjustments during these transitions. The design even borrows lessons from the way humpback whales sleep upside down, using their unique airflow and buoyancy management as a guide for how ballast chambers should be positioned to balance density and volume across the pods.

PHOTONIC TURBINES: POWERING RESILIENCE AND OPERATIONS

One of the hotel’s most ambitious features is its renewable power system. Each structure is fitted with masts supporting photonic wind turbines, which integrate fibre-optic sensors to monitor blade strain, temperature and vibration. This continuous feedback allows predictive maintenance, higher performance and longer turbine lifespan.

For operators, this translates to three strategic advantages. First, energy autonomy, since the hotel can operate off-grid in remote waters. Second, operational stability, as the turbines’ structural spacing also serves to stabilize the towers, reducing the risk of collision or tilt. Third, data-led maintenance, with predictive monitoring, reducing downtime and extending asset life, lowering long-term operational costs.

This approach places renewable energy generation not as a peripheral add-on, but as an integral stabilizing and monitoring system, something hotel operators may find increasingly relevant as energy efficiency, emissions reductions and resilience converge.

LOCATION: WHY DEEP WATER IS SAFER

The chosen site, about 50 miles off Taiwan and 150 miles from mainland China’s volcanic arc, is strategic. Tsunami science shows that waves are less destructive in deep water than when they reach shallow coastal shelves, where wave amplitude increases and becomes destructive. By lowering itself beneath the surface, the hotel aims to bypass the violent forces that devastate shoreline resorts.

For travellers, the remoteness creates both opportunity and challenge. Access is by helicopter or boat. Once on site, the experience is positioned as a blend of cruise ship familiarity and frontier exploration: a fixed float system that bobs with waves, yet offers a stable, anchored base in uncharted waters.

ADDRESSING OVER-TOURISM BY OPENING NEW FRONTIERS

Beyond engineering, the concept addresses a growing market issue: over-tourism. Popular coastal resorts face environmental stress, infrastructure overload and political challenges linked to rising visitor numbers. By creating a destination offshore, the submersible hotel offers an alternative, new ground for exploration that relieves pressure on land-based sites.

The design is not just an architectural novelty but a possible tool for demand distribution. If deployed strategically, similar offshore assets could redirect high-yield travellers toward less congested zones, aligning with broader sustainability objectives in tourism.

Hyperbaric chambers and vivariums located in hotel atrium. Image by Margot Krasojević.

FEASIBILITY AND OPERATIONAL QUESTIONS

While visionary, the project raises key questions for operators. Construction logistics will be complex, as reinforced acrylic pods, inflatable façades and photonic turbines require offshore assembly expertise more common in oil and gas. Capital costs are likely to be high, given the bespoke engineering involved. Maintenance will be intensive, as offshore conditions accelerate wear, although predictive monitoring is a mitigating factor. Insurance and safety frameworks for hyperbaric-equipped guest accommodation will need definition. Market acceptance is also uncertain, relying on a relatively small segment of adventurous, high-spending travellers.

ARCHITECTURE INFORMED BY MARINE ENGINEERING

Krasojević’s design makes a larger point: the transfer of marine engineering knowledge into hospitality architecture. Oil rigs, submersibles and floating platforms like the RP FLIP have demonstrated how structures can perform under

Experience the Difference

Ownership groups across Canada trust us to optimize performance for independent hotels and resorts as well as multi-national hotel brands such as Marriott, IHG, Hilton, Choice and Wyndham. Your success is our success.

extreme wave and pressure conditions. By borrowing these principles, the hotel concept signals a potential direction for future projects in flood-prone or offshore environments.

For hoteliers facing rising sea levels, more intense storms and fragile coastlines, these approaches may eventually filter into mainstream resort development. The idea of tethered, buoyant or even submersible structures may become part of a resilience toolkit.

ADAPTABILITY BEYOND HOTELS

While conceived as a hotel, the system is described as a flexible typology. Offshore research stations, floating energy hubs or even temporary habitable environments could use similar design principles. For governments and private investors, this adaptability increases potential returns on research and development.

STRATEGIC IMPLICATIONS FOR HOSPITALITY LEADERS

The submersible hotel represents a merging of trends: climate adaptation, renewable energy integration, guest appetite for frontier experiences and the search for alternatives to overburdened coastal resorts.

Key takeaways include the need for strategies in flood- and storm-prone areas, integration of renewable systems as core operational infrastructure, clear communication to guests about safety and comfort in submersible environments, and careful positioning to attract high-value, experience-driven travellers.

The submersible hotel concept demonstrates how far hotel design can stretch when informed by engineering disciplines outside its usual sphere. While it remains a prototype, it forces the industry to confront questions of viability, safety and market demand in environments once considered inaccessible.

By lowering itself beneath the surface, the hotel aims to bypass the violent forces that devastate shoreline resorts.” “

ABOUT THE ARCHITECT

Margot Krasojević studied at the Architectural Association School of Architecture and The Bartlett, UCL, and worked with Zaha Hadid Architects. Her practice now operates in Belgrade, Beijing and Qatar, focusing on renewable energy integration and dynamic environmental design. Her previous projects include hydroelectric homes and hotels, hempcrete-based agricultural facilities and disaster-resistant housing typologies. She has won multiple awards, including the 2018 LEAF Award for Best Future Building and the WAN Awards in 2020 and 2021. Her work has been exhibited internationally, including the Futurium in Berlin, the Smithsonian in Alaska and the Design Museum in London. Current projects involve hotel designs in Qatar and Jeddah, Saudi Arabia, in collaboration with NEOM and China’s Ministry of Environment and Ecology.

Hyperbaric chambers lining hotel atrium. Image by Margot Krasojević.

BEHIND THE SCENES:

CHOICE HOTELS CANADA STAFF SHARE THEIR HOUSEKEEPING JOURNEYS

FROM CHOICE HOTELS CANADA

From among its franchised hotels, Choice Hotels Canada is proud to spotlight four exceptional hotel-level team members whose dedication, professionalism, and care help shape guest experiences every day. From Halifax to Val-d’Or, and from Petawawa to Gander, these employees embody the strength and spirit of housekeeping, a role that remains the foundation of the hospitality industry.

Mercedes Brummell, housekeeping supervisor, Quality Inn & Suites in Petawawa, Ont.

Mercedes Brummell began her career as a housekeeper before working her way up to housekeeping supervisor at the Quality Inn & Suites in Petawawa. In her current role, Brummell rotates between housekeeping, laundry, and supervisory shifts.

Brummell speaks English, though she has long wanted to learn French to better assist guests. She has spent two years in housekeeping at the Quality Inn & Suites, a time she describes as both enjoyable and rewarding.

Brummell says the best part of her job is working with an incredible team. “Everyone works hard to get the jobs completed, and all departments are always willing to jump in wherever needed. This is by far the best team and place of employment I’ve had,” she says. Over time, she has also built meaningful relationships with returning guests, many of whom consider the hotel a second home.

While Brummell loves her work, she admits there are tasks she likes less. Cleaning drains, she says, is the most unpleasant! The nature of housekeeping also comes with unusual discoveries. Brummell recalls guests stuffing fake cash all over a room, dentures forgotten behind, and a pizza box hidden in a drawer.

For Brummell, her proudest moment came when she was recognized for a

full year of maintaining perfectly clean rooms. She credits her bosses and team for supporting her, as well as her own dedication and determination. “Every day I use all my knowledge and apply it towards training staff and giving the guests a top-notch experience,” says Brummell.

To succeed in the role, Brummell stresses the importance of hard work, communication, thoroughness, and passion. She believes in putting herself in the guests’ shoes to deliver a higher level of service.