SPOTLIGHT SUMMER ‘23 Frozen Edition Q&A with Thrive Market Frozen Category Manager Cold Chain Logistics 101 ANNOUNCING THE SHELFIES 2023 FINALISTS

WWW.STARTUPCPG.COM THE SPOTLIGHT SUMMER 2023 TABLE OF CONTENTS 03 Letter from the Editor 05 Meet the Startup CPGer Candace Choi, Data Genius 06 Handmade Frozen Pizza 12 Learnings from CoLab with Dream Pops 14 Turning Tragedy into Something Sweet How homemade cookies are reaching freezers across the country 18 Building House of Kajaana 22 Breaking into Retail How Brands are Proving Their Worth in the Freezer Aisle 26 A Deep Dive Into Thrive Market’s Frozen Section 29 Shelfies Awards 2023 Finalists 32 Cold Chain Logistics 101

Welcome to the latest edition of The Spotlight magazine: The Frozen Edition. While brands in Startup CPG have products across the temperature spectrum, we quickly discovered that the frozen category faces particularly unique challenges. Across product development, commercialization, logistics, and distribution, frozen brands experience numerous obstacles that limit their growth.

In this edition, we sit down with frozen brands — from ready-to-bake cookie dough to prepared Indian meals — to better understand their journey. We also took the time to speak with a frozen category manager and cold chain logistics experts to gain insights into trends and operations in the category. Frozen brands and non-frozen alike will find this edition chock full of valuable insights — or, if nothing else, great stories.

And tucked in this edition is a very special treat: the official list of Startup CPG’s 2023 Shelfies Awards Finalists. Congrats to all who were recognized in our most competitive Shelfies Awards to date! Stay tuned for the winners :)

We hope that you find something that speaks to you. We have a feeling you will.

Cheers, Jenna Managing Editor, The Spotlight

Jenna is the Managing Editor of The Spotlight magazine and works on Startup CPG’s marketing team. She is passionate about emerging CPG, also working as a freelance publicist and copywriter.

EDITOR'S LETTER DEAR STARTUP CPG COMMUNITY,

3

WWW.STARTUPCPG.COM

THE SPOTLIGHT

EDITORIAL TEAM

4

WWW.STARTUPCPG.COM

Jenna Movsowitz Managing Editor, The Spotlight

Grace Kennedy Staff Writer

Tamara Romčević Designer

MEET THE STARTUP CPGER:

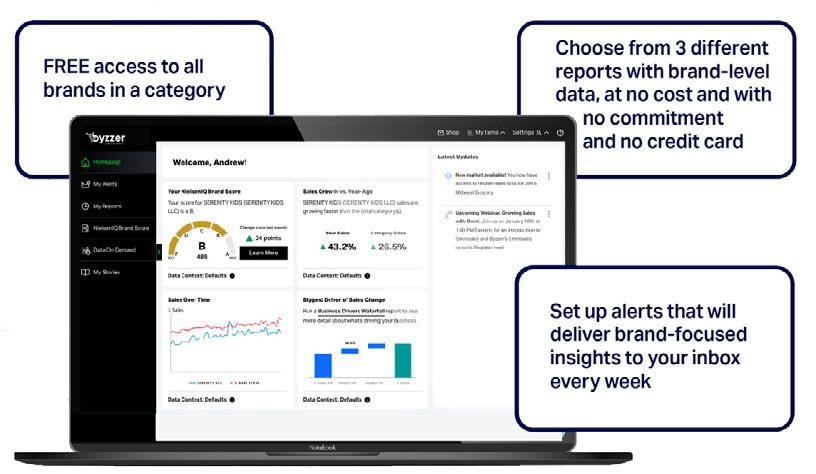

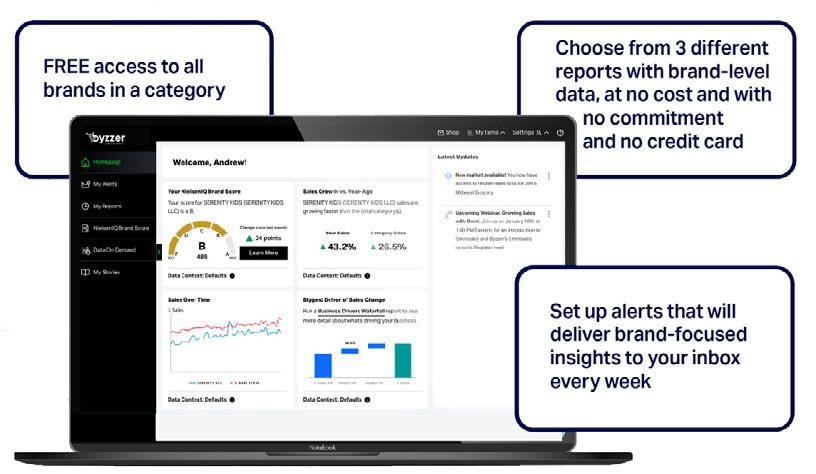

DATA GENIUS CANDACE CHOI

1 TELL US ABOUT YOUR BACKGROUND IN 3 SENTENCES.

Data is a big part of my life! After two years of economic consulting straight out of college, I moved to Kraft Heinz, where I was known as the 'analytical marketer' and owned the Oscar Mayer Bacon P&L a very commodity-driven and highly complex $900MM business. I then had the opportunity to get my MBA at Harvard Business School where I explored more of my entrepreneurial side and launched Geem Seaweed Snacks as a side project now an emerging brand!

2

3

WHAT ARE YOU PASSIONATE ABOUT (IN 5 WORDS OR FEWER)? Sharing stories.

WHAT’S BEEN THE MOST REWARDING PART OF BEING PART OF THE STARTUP CPG COMMUNITY?

The ENERGY of the Startup CPG community is unmatched. As a data genius, the most rewarding part of my job is seeing people interact and understand the data. CPG data has a bit of a learning curve, so I'm happy to provide accessible data for categories that community members are excited to see. And it's even more rewarding when my data drops show Startup CPG brands killing it!!

4

FAVORITE SNEAK-INTO-THE-KITCHEN-IN-THE-MIDDLE-OF-THE-NIGHT SNACK? If I could eat Rind Vegan Cheese every day, I would...

5 A CPG BRAND YOU EAT/DRINK EVERY DAY?

You know it's gotta be Geem's Spicy flavor :) I'm a salty snack girl, and seaweed is so nostalgic to me!

6 FAVORITE (NON-STARTUP CPG) PODCAST?

How I Built This is super inspiring to me as a new founder.

7 MOST INTERESTING THING YOU'VE LEARNED ABOUT THE CPG INDUSTRY? CPG people, especially in the startup space, are the kindest, hardest working people I know. Food is much more democratic than tech, but it's much harder and more humbling. So it makes sense that food people are driven by passion above all else!

5 WWW.STARTUPCPG.COM

By Grace Kennedy

Meet Talia di Napoli

THE HANDMADE FROZEN PIZZA BRAND SHIPPING STRAIGHT FROM ITALY

When consumers think of frozen pizza, the first image that comes to mind is not typically one of luxury. They think of broke college students quickly reheating a pizza before pulling an all-nighter or tired parents who haven’t had time to go grocery shopping. Frozen pizza, in the public imagination thus far, has been a last resort — a product that prioritizes convenience over quality, and if you want the really good stuff you have to go out to dinner or, well, go to Italy.

Enter Talia di Napoli: the premium frozen pizza brand, founded by Italy-native Edoard Freda, that is on a mission to change what frozen pizza can mean — to do away with artificial ingredients and gummy preservatives and bring high-quality Italian pizza into American’s freezers.

HOME IS WHERE THE CRYOGENICALLY FROZEN PIZZA IS

While working in luxury fragrance in New York, Freda went to visit his family in Naples. When he arrived, his uncle told him about a new pizza production facility he was working with that used no machinery other than a freezing machine. “I thought, well, that’s unusual, but it doesn’t sound very scalable.”

Still, Freda’s interest was piqued, so he went to visit the facility to get a closer look. In the facility, “Six pizza chefs were hand-making pizzas just like they do in restaurants, and then, in the center of the room, there was a machine that looked like a Hans Solo Star Wars machine that was cryogenically freezing the pizza using liquid nitrogen.” When Freda saw the setup, he thought, “This is crazy.” But in the next minute, he thought “We’re going to sell these.”

WWW.TALIADINAPOLI.COM 6

WWW.TALIADINAPOLI.COM 7

LAUNCHING TALIA DI NAPOLI

Freda immediately went back to New York and began fundraising for what would become Talia di Napoli, sure that there was a market in America for premium frozen pizza. But when he launched in 2018, the buyers and retailers he pitched were not immediately convinced. Freda says, “The beginning was terrifying, especially in retail. People were saying, ‘There is no market for this.’ We kept putting studies and e-commerce performance in front of them to convince them that people want better natural products, but most buyers would be like, ‘Son, I've been doing this for 30 years. What are you talking about?”

Freda even had a buyer burst out laughing in the middle of his presentation: “He said, ‘This is bullshit. This isn’t made by hand — it’s made in a machine,’” Freda laughs. “The industry behaved a certain way for 20, 30 years and it never changed. It was about convenience and most products [in the frozen aisle] adhered to that. And then here comes a guy with an accent who says we should sell this pizza for double the traditional price because it’s all handmade.”

Retailers will not adjust their buying habits until consumers do, Freda explains, so he spent the first two years doing everything he could to convince buyers that there was a market for his product. But when the pandemic hit in 2020, consumer behavior changed overnight and his pizzas became a hot commodity. Stuck at home, consumers were eager to experience the restaurant-quality food they missed and were willing to splurge on items like frozen pizza to get it. The need for a high-quality frozen food appeared, and Talia was waiting in the wings, ready to meet it.

“We created a product that we thought was the future and then the future came a lot quicker than anyone anticipated. Other brands haven’t caught up yet — I’m sure they're going to get to it — but we were ready. It has given us visibility in the space and allowed us to take off,” Freda explains. “Today, we make 9,000 pizzas a day with 28 pizza chefs.”

THE PROS AND CONS OF LIQUID NITROGEN

As a premium hand-made product, Talia’s priority when freezing their pizza is to ensure consumers receive the freshest possible pizza. “We want to use freezing to protect a product that is high quality rather than serve as a compromise for something fast,” Freda says.

So how do they do this? First, they fully cook the pizza before sending it to consumers, so “no one gets a raw product,” Freda explains. Second, their pizzas are frozen with liquid nitrogen as opposed to water. “In the frozen industry, you hear the term, ‘flash freezing’ a lot.” And while doing something quickly is great, the real issue is not how fast you freeze but rather what you freeze with,” Freda says. “If you use water, which is what 90% of the industry does, you’re essentially bathing the product in water, which comes with issues. You’re eliminating taste and reducing quality, and, in many cases, the FDA will require you to put additives in a product that has been frozen with water.” For Talia, whose brand is founded on the concept of providing fresh-from-Italy restaurant-quality pizza at home, these issues are deal-breakers.

Liquid nitrogen, on the other hand, allows Talia to freeze their pizzas without water. Freda says, “[Liquid Nitrogen] is put into a chamber and turns into a gas. The pizza enters the chamber where the temperature is negative 200 degrees Celsius, and the pizza freezes without water. When we take it out, the pizzas get vacuum-sealed to 90% immediately.” This process allows Talia to maintain quality while extending their pizza’s shelf-life.

The problem with liquid nitrogen — and the reason so few brands use it — is that it is extremely expensive. “Liquid nitrogen is purely derived from electricity,” Freda explains, but with the ongoing war in Ukraine, “the cost of electricity has shot up in Europe. This means the cost of freezing with liquid nitrogen has become extremely prohibitive. But it's something that we've kept doing because it's part of our patent and our identity.” At this stage in the company, Eduoard says, “We’d rather reduce our margin than have to compromise quality.”

8 WWW.TALIADINAPOLI.COM

RECAPTURING MARGINS THROUGH E-COMMERCE

With such an expensive freezing method, how does the team at Talia offset the costs? Kat LeFata, Talia’s digital marketing director, explains, “To be honest, on liquid nitrogen specifically, the only answer is that we take the burden.”

To keep its retail price competitive with other brands, Talia takes a hit on margins for in-store shopping. To make up for some of this loss in retail, they push consumers to e-commerce where they sell their pizza at a slightly higher price — a price they justify by offering their premium flavors online that can’t be found in retail, including truffle, garlic-pesto, eggplant parmesan, and vegan. “We try to beef up the marketing and all of our efforts to drive the consumer to e-commerce,” LeFata says. “We’re making sure that e-commerce, where customers buy in bulk, is where we’re able to recapture some of that margin.”

Still, it is “very difficult to convince somebody to buy eight pizzas at a higher price point,” LeFata explains, “so we have to sell that premium experience in our marketing efforts.” To do so, LeFata recently finalized a loyalty rewards program. “It will allow people to earn points through their e-commerce purchases and other ways like following us online,” LeFata says. Consumers can even earn enough points through this loyalty program to win a free trip to Naples. “You have to buy a lot of pizza to get that,” Kat explains, “but it is a way for us to do something a little bit different than other brands that have a loyalty rewards program that offers discounts on par with Sephora or Starbucks. We're hoping to create a few unique opportunities to interact with us in the e-commerce space.”

AVOIDING STICKER SHOCK IN RETAIL

For the consumers who aren’t willing to take the plunge online, they can, of course, purchase Talia’s pizzas in retail locations. “People are like, I can't make a $100 commitment on pizza.” For the consumers who want to try before they buy or may not have the freezer space to fit eight pizzas, Talia points them to their retail locations where they sell more limited flavors.

“Retail has changed a lot over the past five years,” Freda explains. “Post-pandemic, people are looking for a much more premium and natural product at home. When we started in retail right before the pandemic, people said, ‘12 dollars for pizza? That's criminal. I’d rather go to a restaurant.’ But now, people are much more keen to have things at home, especially with inflation being so hard on restaurants. A 15-dollar pizza made by someone from Naples doesn't sound so bad.” Talia’s positioning as a natural product also helps them stand out in the freezer aisle. “Not only is [our pizza] more premium, but it's fully natural and non-GMO verified.”

To avoid sticker shock when consumers make their way down the frozen aisle, Talia relies on both PR and promotions. “In retail, the first purchase is scarier because you have a private label product which is half the price right next to our product.” To help consumers get over the initial hump, they invest in first-purchase promotions, offering consumers discounts or coupons on their first pizza. This has enabled them to bring in new customers they feel confident will keep coming back even without a promotion. “We have an extremely loyal customer. Once you buy the pizza, chances are you're going to buy it again,” Freda explains.

Talia is also aware of the retail options that may not be a fit for their product. “We don’t work with Walmart or Target because you go to those retailers for a different purpose.” Instead, Talia leans into their premium position, targeting the Whole Foods and Fresh Direct consumer who is looking for a natural, highend product and is willing to pay extra to get it.

WHO IS BUYING PREMIUM PRODUCTS AND HOW MUCH ARE THEY WILLING TO SPEND?

When Talia needed to raise their prices slightly this fall, they were nervous they might scare away even those high-end shoppers. “The cost of most of our

WWW.TALIADINAPOLI.COM 9

ingredients went up significantly. We needed to adjust accordingly while also ensuring we were raising our prices reasonably.” Talia did a deep pricing analysis to get a better sense of what consumers are willing to spend money on.

They learned that over the last two years “most people were downgrading the brand they use for household items and staples, so they could upgrade their entrees.” They were not buying as many appetizers but they were upgrading desserts and dinner entrees — that was their trade-in for going out to dinner. According to LeFata, the frozen food aisle of the grocery store is actually where families have been shopping for a night-out replacement. Furthermore, many families have been feeling the pinch of inflation, saying, “We can’t spend $100 on dinner at a restaurant that used to cost $60, but we can spend $25 on two specialty pizzas.”

Talia has also seen their demographics change significantly over the past few years. “We were catering to a much older audience — around 55 plus — but in 2022, we started catering to a younger audience. We modernized our website and made it more mobile-friendly. We started doing ads that were geared towards what you would find on Instagram reels or Tiktok. From this, we’ve seen significant change. And while we’re not catering to an audience of 25 or younger due to the price, our demographics have gone from 80% 55 plus to 50% between 35-55 and 50% above 55.”

EXPANDING THE PREMIUM CATEGORY

Looking toward the future, Freda is glad buyers are no longer laughing in his face, but he is eager to see the premium frozen category continue to grow. “I hope that the heavy consumption of cheap, unhealthy, and wasteful products diminishes and that we start to have fewer, better products rather than countless frozen pizzas we can just dish out.” Digiornio’s may always have a hold on the market for stressed-out college students, but luckily, for the rest of us, there is Talia. “The number one reaction to this pizza is, ‘I cannot believe that that's frozen pizza,” Freda says. Premium, handmade pizza straight from Italy in the comfort of your own home: What could be better?

WWW.TALIADINAPOLI.COM

10

CONGRATULATIONS to the CoLab Class of 2023!

Congratulations to Mondelez International’s SnackFutures CoLab Class of ’23!

This was our third class and we couldn’t be more proud of how these nine disruptive brands spent 12 weeks learning, sharing and collaborating with each other and our experts, aiming to get one step closer to sharing their snacks and ideas with the world.

We are also excited that CoLab is expanding. This year we launched CoLab India, focused on disruptive D2C snacking brands that are innovating across categories, form factors and GTM strategies, as well as CoLab Tech which recruited start-ups that are creating innovative solutions in sustainability, production and ingredient technologies.

Visit www.snackfutures.com to learn more!

LEARNINGS FROM COLAB WITH Dream Pops

12 WWW.STARTUPCPG.COM

International is a proud sponsor of Startup CPG

Mondelez

Startup CPG TELL ME ABOUT YOUR EXPERIENCE IN MONDELEZ INTERNATIONAL’S SNACKFUTURES COLAB.

Dave Greenfeld Founder and CEO of Dream Pops: CoLab supercharges your business. They give you all of the resources of a massive, strategic company like Mondelez — whether it’s data analytics, R&D, product innovation pipeline, sales, strategy, or merchandising. They cover a 360 view of CPG and show you how they execute it based on their portfolio of brands. Being able to talk to people running multimillion dollar businesses is invaluable.

On top of that, they bring in an agency to help you think about how to refresh your brand, marketing, communications and PR. I don't think that there could be a better resource for an emerging brand that is trying to level up and compete with bigger brands.

SCPG WHAT WAS THE MOST VALUABLE PART OF BEING IN COLAB?

DG One of the most valuable experiences through CoLab was working with SPINS. We were able to get a lot smarter about how we dissect data and think through sell-through velocities.

The other incredibly valuable experience was working with a top agency to nail down our brand messaging, including one-sentence to describe our brand and business for PR and comms. Prior to CoLab, we didn’t have a succinct way to describe Dream Pops. Now, we can clearly explain what we do: we’re a dairy-free stackable ice cream and candy. That simplified message will be a game changer for storytelling.

SCPG HOW DID DREAM POPS CHANGE OVER THE COURSE OF COLAB?

DG We also came away with a plan for channel strategy. We worked through ways to double-down on our current accounts as opposed to always pushing new distribution and sales. Seeing how their top brands merchandise or market in certain retailers — whether its geotargeted ad spend, out-of-home, or sampling — provided clear insights on how we could take advantage of those initiatives in the future.

Overall, Mondelez has been a great resource and thought partner. They helped us consider how we’re growing the business and walked us through potential pitfalls they’ve seen other brands experience.

SCPG WHAT WOULD YOU SAY TO THOSE STARTING COLAB?

DG Be aggressive with outreach. Try to meet as many people at the organization as you can. The squeaky wheel really gets the grease in this situation — there's so much opportunity and so many people you can learn from. However much you put into the program is how much you'll get out of it.

SCPG WHAT WOULD YOU SAY TO THOSE WHO ARE CONSIDERING APPLYING TO COLAB?

DG It’s great for brands of all sizes — anyone can learn from this experience. It’s worth considering the potential impact of just sitting in Mondelez for three months, and what that can do for you. Consider the long-term opportunities.

DREAM POPS’ GUIDE TO FROZEN

1. There will be barriers to entry. Frozen is challenging — which means that there is generally less competition — but it's a lot harder to scale and commercialize a product.

2. Differentiation is critical. Merchandising is hard because you're dealing with limited real estate. That’s why it’s especially important to have a product or packaging that's clearly differentiated; if you're just a regular pint, it's going to be especially hard to convince the buyer to bet on you and give you a shot. Our snackable ice cream bites are a unique form factor, and we manufacture it ourselves — I think that’s largely what's given us a chance in such a highly competitive market.

3. Bake extra costs into margins

With frozen, it’s especially important to consider freight and trade when you’re calculating margins. You have one shot in a new retailer — make sure that you'll be a top performer. If not, you’ll quickly get discontinued.

4. Don’t be romantic about it. Our ice cream bars were actually our first product, and bites came second. We are constantly watching the data and listening to our customers and have found that the bites have gotten a lot more traction and growth as of late. We're not romantic about things that aren't working; we'll get rid of them quickly. Sometimes, it's easy to fall in love with your baby. But if the products not moving or competitive, you have to get rid of it.

13 WWW.STARTUPCPG.COM

“I DON'T THINK THAT THERE COULD BE A BETTER RESOURCE FOR AN EMERGING BRAND THAT IS TRYING TO LEVEL UP AND COMPETE WITH BIGGER BRANDS.”

By Grace Kennedy

TURNING TRAGEDY INTO SOMETHING SWEET

How homemade cookies are reaching freezers across the country

WWW.SOMETHINGSWEETDOUGH.COM

14

For years, Kim Cook’s husband frequently encouraged her to sell her homemade cookies professionally — to which Kim typically responded, “No way.” Kim never wanted to run her own bakery; she had a good, stable job working in the CPG pet space, and with three daughters to support, “it never seemed like the right time. I had to be responsible and get those regular checks in the mail to support our family.”

It was never the right time — that is — until a series of tragedies forced her to reconsider. First, her husband (and father to their children), Dan, passed away unexpectedly. A few months later, she was laid off from her job. “It came to the point where I lost my husband, I lost my job, and I thought, ‘I’m like a sad country music song right now. What is going on?”

During this time, one of Kim’s daughters, Brittney, came to her with a proposition: “Maybe now is the time to do something with your baked goods.” Kim still didn’t want to open a brick-and-mortar space, but when Brittney suggested selling frozen cookie dough balls people could bake at home, something clicked. “Maybe we could make this work,” Kim thought. After coming up with the idea in August, they officially launched Something Sweet mere months later on the anniversary of Dan’s death, November 8th, and by the end of the following January, they were shipping nationwide.

MOVING OUT OF THE HOME KITCHEN

One of the first challenges Team Cook (as Dan lovingly called their family) faced was scaling Kim’s recipes from her home kitchen experiments to reliable consumer-ready products. “I was used to doing the recipe with two sticks of butter at a time, and I’m also notorious for changing things up when I bake. My family would say, ‘If you like something Mom makes, know you’re never going to get it again because she’s not going to remember what she did.”

Kim began formalizing her recipes, and, after some tinkering, she decided — alongside her daughters — to sell Dan’s favorite cookie: an indulgent chocolate chip cookie with brown butter. Once they perfected the recipe, Brittney and Kim hustled to produce the product, get it into packaging, and move it to their warehouse for fulfillment in time for the November launch.

They were able to move so quickly in part because they kept the launch local. “We did a soft launch in November for friends, family, and community members,” Brittney says. They used sites like Facebook and NextDoor to get the word out, and “All through December and into early January we were doing local deliveries. Our cars were full of cookie dough, and we felt like little cookie elves driving around Sacramento.”

With this soft launch, Brittney and Kim knew that most of their sales were coming from what they called “pity purchases.” Kim explains, “We were the poor family that lost their husband and dad so people bought our cookie dough.” However, once they started receiv-

ing messages from people asking when they could get more, they knew they had landed on something that could go beyond their local NextDoor groups — It was time to go nationwide.

GROWING INTO A CO-MANUFACTURER

To expand beyond their immediate radius, however, they needed more space than the local kitchen they rented from a caterer who let them bake during off-hours. A few months ago, they transitioned into a larger commercial kitchen and they’re now working to partner with a co-manufacturer.

Finding a co-manufacturer, of course, is easier said than done, and with no experience in baked goods or frozen, Kim and Brittney had to do quite a bit of research. “Everything from how we found the company that does our shipping to the co-manufacturer that we're meeting with was from our good friend Google,” Kim says. They spent hours researching potential co-manufacturers to find the right one. “We wanted to make sure it was a good fit personality-wise, but it was also important to us that we would be able to go into the facility and make sure the product was to our standards.” One of the biggest issues they ran into was finding a company willing to brown the butter, Kim says. “A lot of companies wanted to do brown butter flavorings,” but this was a non-negotiable point for Something Sweet: “We want to give consumers a cookie that emulates the home-baking experience, which means real butter.”

Furthermore, as a small CPG company, they needed to find a co-manufacturer who was willing to grow with them. Britt and Kim made countless calls and inquiries to potential co-manufacturers — and more often than not didn’t receive a call back. When they did get in touch with someone they were frequently told, “You’re too small for us to work with.” Nonetheless, after speaking with several co-manufacturers, they were able to find someone who met their needs. They’re now transitioning production to the co-manufacturer.

THE HEADACHE OF SHIPPING

“FROZEN DOUGH BALLS”

Shipping nationwide also meant Something Sweet had to figure out how to keep their “frozen dough balls” frozen for the multiple days it would take to get from the warehouse to the consumer. They use insulated coolers filled with dry ice to ensure their products remain frozen from manufacturer to consumer. However, dry ice is expensive, and brands have to use at least one pound of dry ice for every day of shipping. For Something Sweet, this means including three to five pounds of dry ice in every box, which adds up quickly.

Kim and Brittney are aware of the burden high shipping costs put on consumers, so they try to take on as much of the load as they can without cutting into their profit margins too heavily. Brittney says, “We don’t want to put it all on the customer because we understand

WWW.SOMETHINGSWEETDOUGH.COM

15

that our product is premium and at a high price point, but right now, dry ice is the only viable option to keep our product frozen. Hopefully, as we grow and build volume, the shipping costs will lower for the customer.”

They are also experimenting with alternative, less-expensive shipping strategies. “We’ve tapped into the warehouse we use for their expertise and are having conversations about trying a combination of gel packs and dry ice, which would lower costs.” They haven’t yet put this in place but are planning to run test orders with this approach in the coming months.

PRICING FOR PREMIUM

Like any premium product, finding the right price to stay competitive within the market while also factoring in all of the costs associated with their offering is a tricky balancing act.

“Being at a premium price point, we tried to deliver a premium cookie. We make our dough balls extra big. They're 80 grams each, which is about three to four times the average size of refrigerated dough, so consumers are receiving a lot of dough.” Kim and Brittney explain to consumers when sampling at a farmers market or posting content online that they can cut the dough in half and bake them. When you do that, “you’ll have what we call a ‘normal size’ cookie. And people like that flexibility because then you’re getting 20 out of a bag as opposed to ten, which I think they can wrap their brains around more and justify the price.”

They are also well aware of their position as a premium product. “The people who are spending five dollars for a probiotic soda or kombucha are the same people that see the value in what we’re doing. If an Oreo is a sweet treat for someone, and that's their indulgence, then we're probably we're not going to convince them to buy our product.”

THE ADVANTAGES OF FROZEN

With all of the costs that come with shipping frozen products, why didn’t Team Cook try to sell pre-baked cookies or refrigerated dough?

For starters, Kim explains, she “didn't want to be the person that was baking at three in the morning.” Furthermore, Kim and Brittney wanted to be able to offer consumers the experience of eating a warm cookie fresh out of the oven. “[Something Sweet] gives people the ability to have that home-baked treat without the mess,” Kim explains. The frozen dough also provides flexibility for the consumer “You can bake one or two at a time or bake the whole bag. You can cut the dough balls in half, turn them into a cookie skillet, or make an ice cream sandwich.”

The frozen dough also allows Something Sweet to avoid using preservatives to make the product shelf-stable. “When you read our ingredient panel, it’s just the ingredients you would also have in your home kitchen.” Real cookies, fresh from the oven: “There is nothing better than that,” Brittney says.

DTC DROPS AND FUTURE EXPANSION

At this early stage, Something Sweet is operating on a DTC model with two product drops per month. “We allocate a certain amount of inventory each time our website opens. Every single time we've been so grateful to sell out.” They choose a date to open ordering, announce it to consumers, and keep the website open while supplies last. This approach “creates scarcity for our customers, and also helps control inventory — we are still hand-scooping our dough. The last thing we want is someone to order our product and we don’t have the inventory to fulfill it.”

Though their bimonthly drops have been quite successful thus far, Kim and Brittney hope to expand Something Sweet beyond DTC. “We're looking to be an omnichannel brand,” Kim says, and they are now in conversation with local supermarket chains in Sacramento. Still, they are no rush to be in every Whole Foods across the country right away. “For right now,” Brittney says, “we're starting local and smaller to work out the kinks and establish ourselves. I think our growth will be organic, but it will literally be one bag at a time.”

They are also working with several schools in the area to support their fundraising drives. Students will sell Something Sweet dough and Something Sweet will give a percentage of the proceeds back to the school. This is both altruistic and allows them to develop relationships with local community members and expand their audience. Furthermore, because they are making donations from the sales, it functions as a tax write-off. “It’s a win-win for us,” Kim says. “We’re able to eliminate all the shipping costs because we deliver one pallet to the school, they’ll put it in their walk-in freezers, and then they’ll be responsible for the rest.”

LEVERAGING SOCIAL MEDIA AND INFLUENCERS

Beyond the day-to-day logistics of a CPG brand, Brittney and her sisters, each of whom has a background in marketing, prioritize brand-building online. “In the beginning, [Something Sweet] was kind of confusing for consumers. They were like, what is in the bag? Is it baked?” Brittany explains, “What plays in our mind constantly when creating content is who, what, when, where, and why. I know it sounds like elementary school, but it helps us to remember that there are people who are going to see the video and engage with our brand for the first time.” Brittney and her sisters also try to remember that only some people are home bakers. “Baking often intimidates people, so we try to make it as simple as possible for those non-bakers and show them step-by-step in our content so they feel like, ‘Oh, I can do that.’”

The Something Sweet team has also utilized influencer outreach. But as any small brand knows, sending free samples can be expensive — and that is only compounded by the extra costs associated with shipping frozen goods. Brittney and her sisters have been strate-

16 WWW.SOMETHINGSWEETDOUGH.COM

gic about which influencers to reach out to, primarily focusing on “micro-influencers.” Brittney explains, “As a bootstrapped company, we don’t have a big budget for paid influencer posts. We’ve been so grateful to the influencers we’ve sent our product to who have loved the product and then shared it naturally on their own.” Their strategic outreach has paid off, and influencer outreach has proven to be a huge driver in growing Something Sweet’s audience.

THE VULNERABILITY OF CPG

Thus far, Kim and her daughters have been surprised by all of the kind feedback they’ve received. “The DMs and messages we get from people are amazing. People who love the cookies send us words of encouragement and others have reached out to say they’re going through a

hard time and our cookies provided comfort.”

Brittney created a Slack channel to get “even closer with our customers,” and plans to use the platform to not only build community, but also get feedback on future product launches. “We want our customers to walk this journey with us. We couldn’t do this without them, so we want them to be an active part of it.”

Still, while much of the feedback has been positive, Kim admits she “wasn’t necessarily prepared for how vulnerable it would feel to put myself and our family out there.” She continued, “99% of people that try the cookies love them, but we will get the random comment that says something like ‘Your cookie is too sweet,’ and we just have to laugh because we’re literally called ‘Something Sweet.” No matter the naysayers, Kim says, “I’ve learned that you kind of have to just close your eyes and jump in — the people who love your product will catch you on the other side.”

WWW.SOMETHINGSWEETDOUGH.COM 17

"YOU CAN BAKE ONE OR TWO AT A TIME OR BAKE THE WHOLE BAG. YOU CAN CUT THE DOUGH BALLS IN HALF, TURN THEM INTO A COOKIE SKILLET, OR MAKE AN ICE CREAM SANDWICH."

By Jenna Movsowitz

Building House of Kajaana

THE CROWN JEWEL OF THE FREEZER

WWW.HOUSEOFKAJAANA.COM

18

You probably don’t think of the freezer as the sexiest place in the kitchen. For many, the freezer is an afterthought, a throwaway place for leftovers and cartons of Ben & Jerry’s with exactly one remaining bite. But for Sabah Ashraf, the freezer is — and always has been — a secret treasure chest.

Sabah Ashraf grew up outside of Boston in an Indian household, surrounded by fresh Indian food at all times. Her childhood freezer regularly housed homemade Indian food, and she grew up on the belief that reheated frozen food is “just as good, if not better than the fresh dish, in a convenient and beautiful way.” It was with this passion for the oft-forgotten appliance and authentic Indian cuisine that she founded House of Kajaana, the plant-based Indian meal brand crafted to be the crown jewel of any freezer.

THE “RIGHT” TIME TO BUILD

Ashraf has been working with consumer brands for her entire career: starting in investment banking, then private equity working with manufacturers, and finally creating products at Frog Design. Through this work, she learned how to pair business creativity with delighting a customer — and soon grew the confidence to transition from a service provider to the founder of her own brand.

Her concept for frozen Indian meals, just like the ones she grew up adoring, had never felt more relevant; during COVID, consumers grew tired of cooking, but still craved delicious, healthy, premium food. And when a childhood passion just so happens to meet a white space in the market, it becomes time to bring an idea to life.

THE “RIGHT” TIME TO BUILD

Ashraf has been working with consumer brands for her entire career: starting in investment banking, then private equity working with manufacturers, and finally creating products at frog design and IDEO. Through this work, she learned how to pair business creativity with delighting a customer — and soon grew the confidence to transition from a service provider to the founder of her own brand.

Her concept for frozen Indian meals, just like the ones she grew up adoring, had never felt more relevant; during COVID, consumers grew tired of cooking, but still craved delicious, healthy, premium food. And when a childhood passion just so happens to meet a white space in the market, it becomes time to bring an idea to life. Enter: House of Kajaana

TAKING HOUSE OF KAJAANA FROM CONCEPT TO CO-MAN

Ashraf began building House of Kajaana on a foundation of clear non-negotiables. She knew she wanted a 100% plant-based, gluten-free, nut-free, authentically Indian product — made from the highest quality local ingredients and packaged responsibly. Determined to build an all women team, Ashraf brought on her first full-time hire Lili Cohen out of the gates, as well as over a dozen female consultants. She also desperately wanted to work with the highly-celebrated Anita Jaisinghani of Pondicheri — her

favorite chef of all time — to develop the recipes.

“I approached Anita, knowing she had no idea who I was, and told her my idea for House of Kajaana,” recalls Ashraf. “She said that people had been pitching her throughout her career, but she had never seen a plan like this — she was immediately on board.” With every must-have secured in her toolkit, Ashraf and her dream team began testing recipes for what would ultimately be their core collection of meals: Cauliflower Tikka Masala, Roasted Butternut Saag, and Coconut Malabar Curry. This also kicked off the development of a multi-category product roadmap.

With a department dedicated to sourcing, House of Kajaana’s co-man was perfectly suited to meet their strict requirements for every single ingredient. “They took our ingredient list and found the highest quality in-season and cost-effective local ingredients,” Ashraf recalls. To this day, their co-man sources the best quality ingredients for each individual run, keeping seasonality keenly in mind.

Once they sourced their ingredients, the co-man’s R&D and QA teams and nutritionists kicked off their commercialization phase, working closely on nutritionals, costs, and flavor profiles. “We started with a delicious flavor, making sure that we held on to traditional aspects of crafting Indian meals such as properly popping the spices, then fought for every single gram of protein and fiber.“

Because each of their meals consists of a rice component and a vegetable component — and is served in a fully recyclable paper tray — they also paid special attention to moisture levels. “You want to intentionally make a couple of bad decisions in a plant run,” Ashraf advises. “We made one rice component with the exact moisture level we thought it should be, and the other two with dialed-up and dialed-down moisture. We knew that, until we do it at scale, we're never going to learn perfection.” During this run, they also discovered that certain ingredients — particularly spices — don’t rack up on a one-to-one basis. As the size of the production run increases, the ratio changes; smaller amounts cover more ground.

WWW.HOUSEOFKAJAANA.COM

19

GETTING INTO CONSUMER HANDS

With a perfected product in hand, House of Kajaana was ready to launch — beginning with branding. Working with a team member in Calcutta and esteemed designer, Blair Richardson, they focused on "creating a brand that was authentically Indian that would sing and stand out on shelves."

For Ashraf, a celebratory box is so much more than just an aesthetic pleasure: it’s a gift of joy. “In Indian culture, sending meals is an act of love,” she says. Whether a “thinking of you” or an extension of condolences, House of Kajaana’s six-meal boxes (or “treasure chests”) are the heart of their DTC site.

At the same time, the team knows that the majority of their business will ultimately not come from DTC sales. Their first retailer was Pop Up Grocer’s flagship location in New York — and they did not take the opportunity for granted. “We had non-stop coffee dates with staff members and shoppers in the store, and asked friends to post pictures holding our product in-store to build awareness,” reports Ashraf. They also signed up for Pop Up Grocer’s brand support activations, because “no one knows their customers better than they do.” And their early results were impressive: NYU students and hybrid workers alike repeatedly purchased their meals for a quick, healthy desk lunch or easy dinner.

Soon after their Pop Up Grocer launch, House of Kajaana secured Fresh Direct, a major e-tailer in New York. Now, their OG fans from Pop Up Grocer can order House of Kajaana on Fresh Direct and find it on their doorstep in mere hours. “This is a dream sequencing for brands,” says Ashraf.

LOOKING AHEAD

With their sights set on brick-and-mortar, the House of Kajaana team has been meticulous about collecting data for future partners. To demonstrate their early successes, they invested in Fresh Direct’s data platform. “We wanted to understand actual customer behavior,” says Ashraf. “How many households were buying, which products they chose, which they were re-ordering, how often first buyers were buying the full collection, and — perhaps the most compelling stat for us — how many new customers we are bringing to the category.”

“While we have not been on shelf long enough to have statistically significant data, in our first month, over 70% of customers buying House of Kajaana meals were new to buying in our frozen category.” This data point demonstrates that they are driving incremental growth in the frozen category, which is an especially compelling claim for frozen category buyers.

SOLIDIFYING THE VALUE OF FROZEN

While the Pandemic certainly catalyzed new interest in the freezer, Ashraf believes the shift in consumer behavior is here to stay. “People are realizing that the real estate in their freezer is so unbelievably valuable,” she says. Her hottest take on frozen? “Looking at consumers’ behavior, I believe that freezers and refrigerators will be inverse in the future. Freezers will be larger than refrigerators.”

For now, we’ll have to make do with our snug freezer space. And I, for one, will always have room for a full treasure chest of House of Kajaana’s three ridiculously delicious meals.

20 WWW.HOUSEOFKAJAANA.COM

“IN OUR FIRST MONTH, OVER 70% OF CUSTOMERS BUYING HOUSE OF KAJAANA MEALS WERE NEW TO BUYING IN OUR FROZEN CATEGORY”

WWW.HOUSEOFKAJAANA.COM 21

By Grace Kennedy

Breaking into Retail

HOW BRANDS ARE PROVING THEIR WORTH IN THE FREEZER AISLE

WWW.STARTUPCPG.COM

22

When Johnathan Bonnell first launched Wholly Veggie with his co-founder in 2017, they had no interest in wading into the frozen aisle. “I remember looking at the frozen aisle at the time and barely seeing anyone walking down there. You just didn’t get the foot traffic.” Still, as interest in frozen grew, Wholly Veggie decided to branch out of the refrigerated set with a frozen cauliflower wing in December 2019. Their timing was right, Bonnell says, and “when the pandemic hit a few months later, our frozen products just took off.”

Bonnell’s experience is not unique: the onset of the pandemic brought more consumers than ever to the frozen aisle — with frozen food sales increasing by over 20% in 2020. However, frozen’s growth has slowed over the last two years as pandemic restrictions lifted and consumers became more price-conscious. Though frozen sales are still higher than they were pre-pandemic, brands can no longer rely on pandemic surges to drum up sales. Now more than ever, retail is an essential space for frozen brands to reach consumers (especially with the challenges and costs associated with shipping frozen DTC). But with frozen retail space at such a premium, how do you not only get your product stocked but also actually convince consumers to buy it?

FORMULATING A RETAIL STRATEGY

First things first, brands will need a strategy to approach prospective retailers. This strategy should not be, “I’ll work with any retailer who will take me.” Brands need to consider not only their capacity, but also where their ideal consumers shop.

David Gotlib, founder of the frozen appetizer brand Savorly, found success launching Savorly in local specialty stores before expanding further into the region. “The strategy we went with,” Gotlib explains, “which I see a lot in CPG in general, was to start with natural and specialty stores and then scale into more conventional and mass retailers.” With this strategy, Savorly was able to build brand recognition without taking on too much, too soon. Savorly is now stocked in both Whole Foods and Target (among others), which requires the brand to balance very different consumer bases. Successfully navigating these differences is “all about the story you tell and finding overlap in the lifestyle of both of those consumers,” Gotlib says.

Savorly also says no to a lot of opportunities. Gotlib explains, “Sometimes it's because it’s too soon but sometimes it's because we've tried stocking Savorly in something similar and we have a pretty good feeling that it won't work — or at least it won’t work right now. It's a matter of assessing the opportunity and being truthful about what is best for your brand. It’s always hard to say no to dollar signs, but it can save you a headache in the future.

DRIVING CONSUMERS TO THE FROZEN AISLE

No matter how many people the pandemic drove to frozen food, capturing consumer attention in the frozen aisle is still challenging. The frozen aisle is most shoppers' last stop before check-out, and

they are less likely to linger and peruse new brands with a freezer blasting cold air in their faces.

Bonnell explains, “One of the fundamental challenges we find in frozen snacking and entrees is that it's still perceived as a ‘nice-to-have’ versus a ‘must-have.’ So you have to be very clear and focused on the problem your product solves. Otherwise, you're just going to be discretionary.” The thing is, he says, “If you're too generic, you're going to have a solution that everyone else has. If it’s too specific, you might be solving a problem people don't even know they have and they're not going to buy it. It’s a fine balance between the two.”

Bonnell and his team are working on a new iteration of their packaging to better communicate the problem Wholly Veggie is solving: “People don’t eat enough vegetables,” Bonnell says. “We want our packaging to reinforce the association between vegetables and our product. The problem we’re solving is vegetable consumption, so the more we can keep making the connection between that problem and Wholly Veggie being a solution, the more we can win.”

Beyond clearly marketing the problem your brand solves, drawing consumers to the frozen aisle requires “a lot of efforts in trade-spend with the retailers,” Gotlib explains. In particular, utilizing promos, endcaps, and demos.

RUNNING PROMOS

Promos can be especially useful when applied to first purchases as consumers are much more willing to purchase a new-to-them product when it is paired with the dopamine rush of a discount. In a 2023 study from Advanced Solutions, fifty-four percent of shoppers said they will buy new frozen items with a coupon or trial offer.

Furthermore, running promos is essential given high inflation rates. “In this economic climate, running discounts is one of the best ways to move

WWW.STARTUPCPG.COM

23

product,” Bonnell explains. “We'd love to get back into cool, fun activations and brand-building experiences, but for right now, we're just having to double down right now on the most effective ways to move product.”

END CAPS

Bonnell also urges brands to take advantage of end cap space (if they can get it). “On a case-by-case basis, you need to understand what the additional secondary displays are for frozen in each specific store so you can try to get them.” The problem is that it is much harder to receive endcap space in larger stores where small brands are going up against private-label products. “Target has frozen end caps but those are usually reserved at that scale. Typically, committees review proposals for frozen end caps and you have to be a big mover to get it. Or with Walmart, you can’t even propose your brand specifically for an end cap — the space is a massive premium, so if you’re going to be in an end cap, it has to be a product that like Totino’s that is going to move hundreds of units per store per week.”

That said, end caps are not off the table for small CPG brands. Smaller stores are much more willing to showcase a new brand if you’re a good partner to them in return. “The independent markets are real opportunities for brands to get the staff engaged and talking about the product, and then they become advocates for your brand and are more likely to give endcap space.”

DEMOS AND SAMPLING

Each brand we spoke with said sampling is an essential, if time-consuming, aspect of connecting with consumers. Recent research backs this up: 46% of consumers say they are more willing to purchase a frozen item after trying a free sample. Bonnell says, “If someone gave me 100 grand a month to spend as I choose, I would put 50 grand into brand awareness initiatives, and the other 50 grand into sampling.”

Sampling as a frozen brand, however, can be frustrating. For one, you can’t merely show up at the store with readymade products. Lane Levine, founder of frozen artisan grilled cheese brand A Friendly Bread, has had his fair share of

sampling challenges: “You have to find a working outlet, lug a toaster oven around that gets full of caked-on cheese by the end of the session, and deal with all of these other challenges,” Levine says.

Brands should also know that sampling might not provide a windfall in sales. Bonnell explains, “You’re often burning cash. It's almost impossible to break even in the frozen demo experience. You’d have to sell hundreds of units, and the best case scenario when you're sampling is if you sell as high as 50 units.” To encourage sales while demo-ing, Gotlib admits, “I have literally dragged people from my demo station to the frozen section to show them our product.”

Even if you don’t break even, Levine explains, “Demo-ing is more about the retailer feeling like you're on board and a good partner. You show up and then they're more willing to allow you to do a promo or give you end cap space if it’s available.”

At first, many founders will choose to do their own demos, but as their brand grows, many outsource the work to an individual or an agency. When choosing who to work with, Bonell says, “There are a lot of sampling agencies, but I find the ones that work best are the people that focus on a specific region and don't waver from there. They know the stores they’re working with better and can manage the people effectively.”

Working with agencies may be cost-prohibitive for some, so small brands can also choose to work with individuals. Levine works with an individual who was recommended to him by a retailer. “They said, ‘We love when this guy does demos — here is his number. Now he handles two major retailers for me, which is super helpful.”

IS IT TIME FOR A BROKER?

As brands expand into retail, when is the right time to start working with a broker? Sometimes, brokers will decide for you. Levine says, “I didn't quite think I was ready for a broker, but I got called by a few because they found my product and wanted to work with me.” Their unprompted interest gave Levine an advantage when it came time to negotiate the contracts. Furthermore, because Levine had already established A Friendly Bread in several retail locations, some brokers were willing to waive retainers and/or

minimums and agreed to a commission-only contract.

When deciding who to work with, Levine turned to mentors, friends, and his UNFI account rep for references. “I’m a little inexperienced working with brokers, so I wanted someone that will send a follow-up email after our interview, is nice, and has a pricing structure that works for me. I don't have investment funding, so I kind of need the commission-only structure. And I need people that when I talk to them about the accounts I need help with, they know what I'm talking about and have worked with those accounts before.”

If you’re trying to decide if it’s time to bring on a broker, consider if your growth is being thwarted without one. If you already have a few retail accounts and want to expand outside of your region or into larger stores that require more infrastructure, it may be time to work with a broker. Gotlib recommends Green Spoon, who is Savorly’s national broker. “They do an amazing job, and we've had great results so far.” Of course, he says, “You can’t control everything, but working with a broker helps.”

LANDING ON A VIABLE PRICE

Landing on a retail price that will appeal to consumers and buyers alike while maintaining viable margins for the business is an ongoing challenge for all CPG brands no matter if they are frozen or not.

To set your price, Gotlib says, “It’s about viability. How much does it cost to make and what profit margins do you need to be a functioning company in CPG? And then, compare that price to other products in the space you want to position yourself in. Is it priced right for that market?”

Levine’s product was turned down by Whole Foods and Sprouts due to its price, but, despite this, Levine says, “I decided to stay firm on price because I knew there was enough reception for it. I would love to reduce my price in the future when I have better economies of scale. But for now, for stores that are concerned about price, I don’t think it would make a difference if I were to take it down 50 cents. In their mind, this product should be half the price and I can't do that. We won't be able to meet in the middle. If you're not okay with 5.99, then you're likely not going to be okay with 5.29.”

24 WWW.STARTUPCPG.COM

Levine justifies his price to consumers and buyers by comparing it to other convenient lunch and dinner options. “A restaurant grilled cheese is going to cost you around $12, and your other lunch option if you are concerned about quality might be a fancy salad that you'll DoorDash which is around $16 or $20. So 5.99 stacks up pretty well against that.”

Still, he says, “We do get some pushback from consumers when we're doing demos, but that's always going to be the case. Any product that's not the price of an Eggo waffle is going to get push-back on price.”

INFLATION WAVES

Landing on a desirable price for your product has only grown more challenging in an unstable economy. Bonnell explains, “Food and beverage is one of the first industries to see consumer reaction to inflation because it's something you buy, if not every week, at least twice

a month. The elasticity on price that consumers felt during COVID changed over the past 12 months. If your product was perceived on the edge of too-expensive before, it is now definitely too expensive. So, private label has reaped the rewards of a consumer who's looking to buy cheaper.”

Furthermore, he says, “It’s not just brands that are facing supply chain cost increases. Grocery retailers are having to factor in inflation and the added burden of labor increases into the price of the product. Brands are getting this double-whammy effect, and you as a brand are left asking, ‘What do I do here? Do I suck it up or do I issue an everyday low-cost to close the gap between our product and private label?” Wholly Veggie has been running everyday deals and adjusted its promotional strategy as they ride out the wave of inflation. “It's pretty new for us, so we'll see the impact. But the reality is we're just trying to lower the cost for the consumer on an everyday basis.”

READING THE TEA LEAVES

Over the last few years, frozen CPG products have been on quite the rollercoaster in retail. The pandemic sent their sales soaring and then inflation brought them back down to earth. Right now, frozen CPG brands are forced to “read the tea leaves a bit,” Bonnell says. “We're just waiting for things to like normalize. Units are down in recent months and there's a lot of nervousness around the next Fed hike. We're watching the trends in frozen and there is a lot of shakeout happening right now. Tattooed Chef filed for chapter 11, and a lot of companies are going through restructuring — that might make space in the frozen aisle for other people to take those slots.”

So what does this all mean for frozen brands like A Friendly Bread, Savorly, and Wholly Veggie? “It's a chance to prove that we've got great products,” Bonnell says. “Retailers just need to give us the opportunity to get in there, execute, and demonstrate that.”

WWW.STARTUPCPG.COM 25

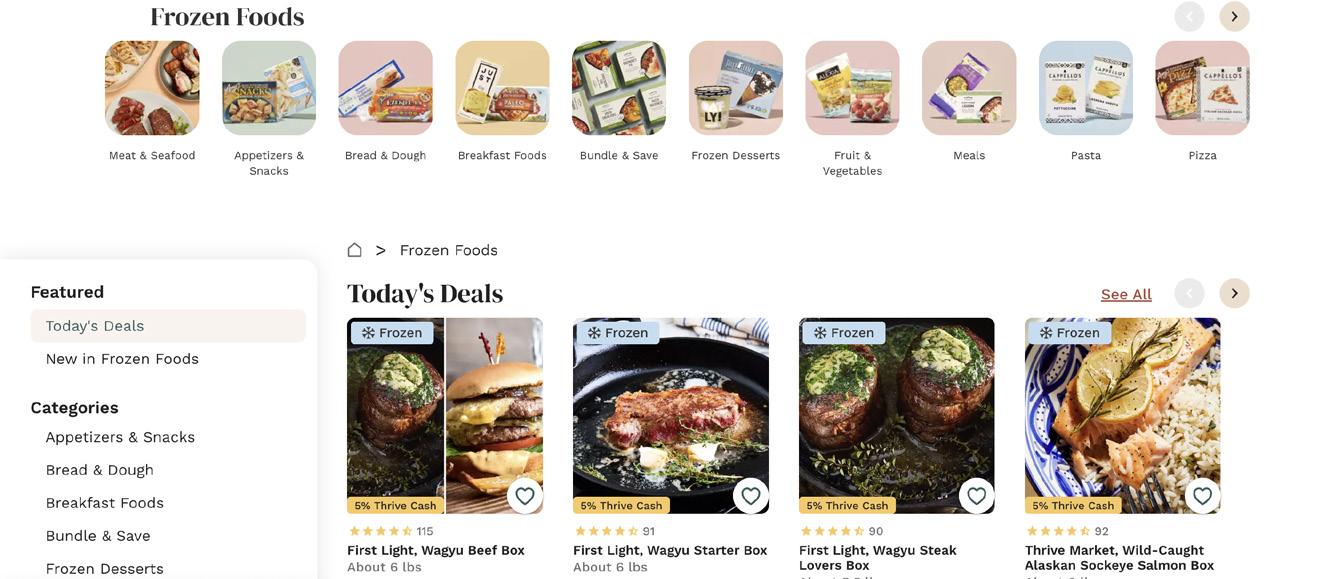

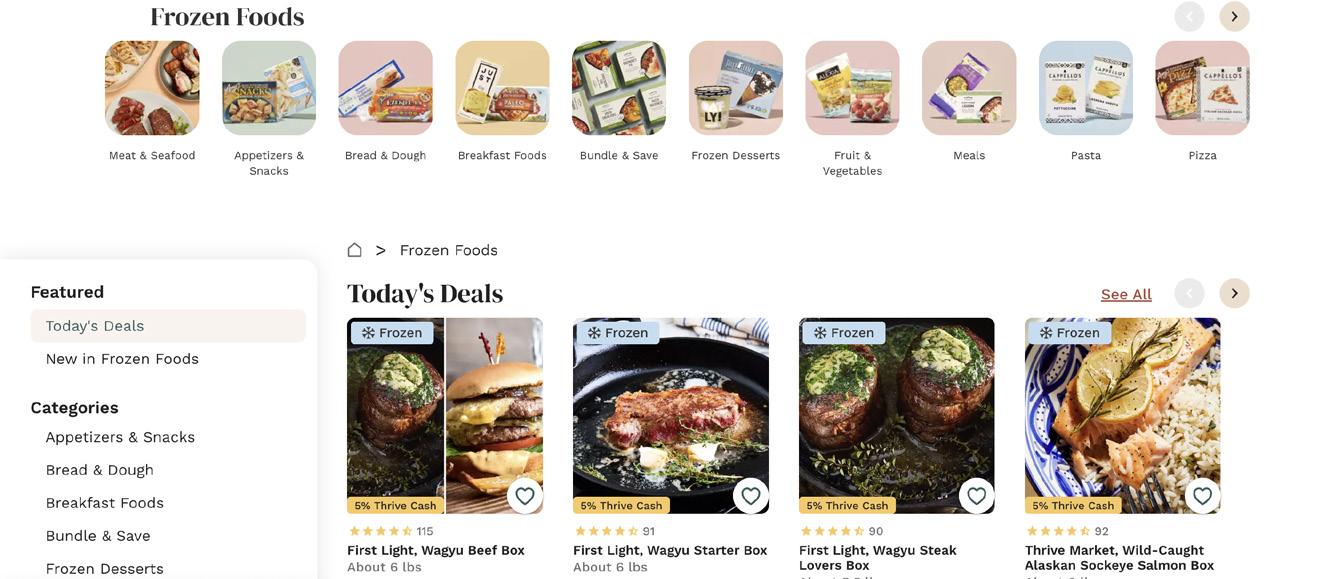

A DEEP DIVE INTO THRIVE MARKET’S FROZEN SECTION

26 WWW.STARTUPCPG.COM

with Senior Category Manager Heather Brand

We sat down with Heather Brand, Senior Category Manager for Frozen Foods and Meat & Seafood at Thrive Market, for a behind-the-scenes perspective on Thrive’s Frozen set — as well as tips for how to pitch to and succeed on Thrive.

Heather Brand is the Senior Category Manager for Frozen Foods and Meat & Seafood at Thrive Market, the healthfirst membership for conscious living. She launched the full Frozen Foods catalog during the Summer of 2021 and is responsible for selecting, onboarding, and managing the entire Frozen Foods assortment for Thrive Market. Heather focuses on growing the Frozen assortment and finding new innovative products for Thrive Market’s 1.2M members.

Startup CPG WHAT TRENDS ARE YOU CURRENTLY SEEING IN THE FROZEN SPACE?

Heather Brand For a while, there was a focus on restriction and a more binary way of eating: either you’re on keto or you’re not, paleo or not, etc. Now, restriction isn’t the focus, and the binary has softened. Take the flexitarian diet, for example — it’s more of a gray area, not so hard and fast, and there is a larger focus on ingredients. Keto callouts are more background noise — perhaps a customer is looking for certain aspects of keto like low-sugar or lowcarb, but they don't necessarily have to identify as a “Keto customer” to purchase those products.

I've been trying to actively reflect that in our assortment by featuring products that cater to all of those lifestyles and dietary needs, with more of a focus on vegetable-forward, less-processed ingredients. Members are purchasing across the spectrum, and not necessari-

ly honing in on those dietary tribes.

Convenience is also still a huge driving force behind frozen. We’re seeing so much innovation within frozen meals, breakfast foods, appetizers and snacks. These categories cater to our members’ busy lifestyles, offering quick, satisfying options without compromising on taste and nutrition. Brands like Kevin's Natural Foods and Feel Good Foods drive the appetizer, snack and breakfast categories. They prioritize ingredients and are very upfront with their sourcing standards — and see a lot of success onsite.

I’ve also been seeing a lot of frozen foods “rebrand” as not just convenient, but also the healthier option. Frozen preserves the nutritional quality and ingredient integrity, while maintaining convenience.

SCPG DESCRIBE THE BEHINDTHE-SCENES OF CUSTOMER PURCHASE TO RECEIPT.

HB An order is placed and routed through our fulfillment team, then placed in the appropriate fulfillment center. From there, our FC team moves through pick line, and preps and packs the order with dry ice. The order is then placed and shipped generally Monday through Wednesday, within 48 hours of ordering. From there, we have a last-mile carrier that picks up and delivers to the customer.

For Thrive in particular, it’s important to call out our “no air shipping” policy.

27 WWW.STARTUPCPG.COM

Air freight has five times the carbon footprint of ground shipping. In 2015, we offset our carbon footprint from shipping. Maintaining this with frozen is logistically very tough, and we've made sure to hone in on our operational strengths to ensure the customer receives a fully frozen package.

SCPG HOW DOES THIS FACTOR INTO COST?

HB Frozen orders have to meet a $65 minimum for the box to ship, and $120 minimum for free shipping. This allows us to ensure financial integrity on all sides to ship to the customer.

At the same time, this minimum can be helpful for new product discovery; customers often want to build their box to hit the minimum threshold. This encourages them to try some new items that they weren't necessarily considering at first, and then come back and buy them again.

SCPG HOW ARE BRANDS SUCCEEDING ON THRIVE BEYOND THE PRODUCT LEVEL?

HB We’ve seen a greater emphasis on innovative, eco-conscious packaging. We’re seeking out brands with packaging that

minimizes waste, is easily recyclable, and can ship and maintain its quality from fulfillment centers to the consumer. Maintaining product integrity from start to finish is really important for brands to consider.

Promotions also help drive customer trial. If a member was afraid to try a new item, but saw that it was on promo and paired with additional lifestyle images demonstrating use case the member is more likely to try it. Our members are buying their everyday items on Thrive, but they also often try new products before checkout — especially to hit the $65 minimum for frozen.

When a new brand comes onto Thrive, they partner with our marketing team and go through the entire marketing menu to discuss which plans work best for them, whether it’s an SMS promotion, branded TPR, or email campaign.

SCPG WHAT ARE SOME “GREEN FLAGS” YOU LOOK OUT FOR DURING A PITCH?

HB I appreciate when a brand really customizes their pitch to the retailer. Every retailer is looking for different qualities in their products, so it’s always a green flag

when a brand understands Thrive Market and how we cater to our members.

For example, it's not necessarily a bonus for me to see that a product and brand is carried by every major retailer across the US. I like to source unique products and brands that are exclusive to our members, and really add value to our frozen assortment. I love to work with smaller brands and be their intro into the retailer space — to help them understand how to work with distribution, broaden their network, and better understand how to work with retail partners.

I also always value when they know about their products. I know that seems like CPG 101, but I really want to know that they’re intentional with their sourcing, that they can answer to the quality of their ingredients, etc. This is how Thrive values our products.

This is an added bonus, but I always appreciate when a brand offers category insights. This helps us understand why the product or brand fulfills a need for us. Go on site before before you pitch, and understand what we already have in our assortment. How does your product add value to that? How does your price point fit in?

28 WWW.STARTUPCPG.COM

STARTUP CPG SHELFIES AWARDS

Presented by

WE

ARE THRILLED TO BE ANNOUNCING…

The 2023 SHELFIES FINALISTS

HYGIENE

l Kushae - Gentle 2-N-1 Foaming Feminine Wash

l Viv - Viv Cup

l Woo More Play - Coconut

Love Oil

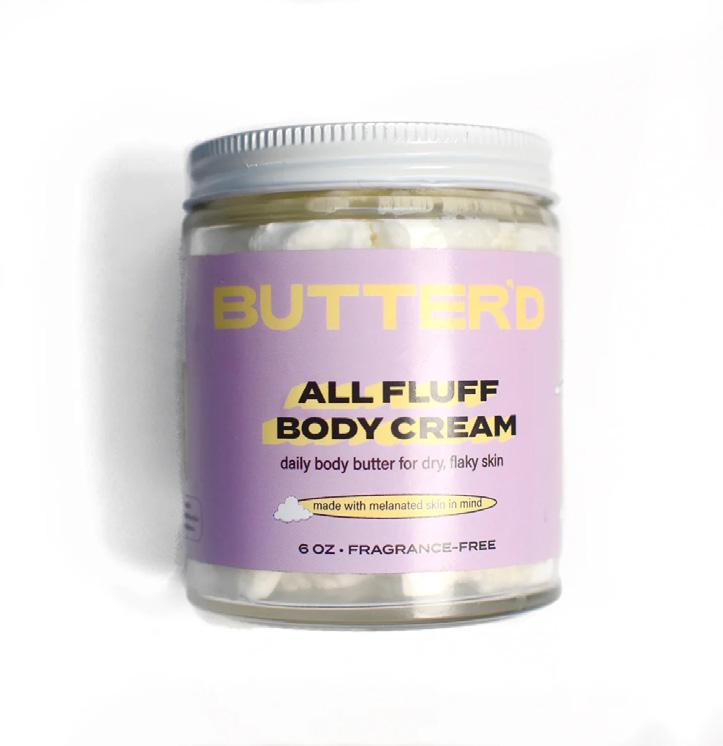

BODYCARE

l Pedestrian Project - Walker’s Cream

l Shikohin - Enchanting Dry

Body Oil

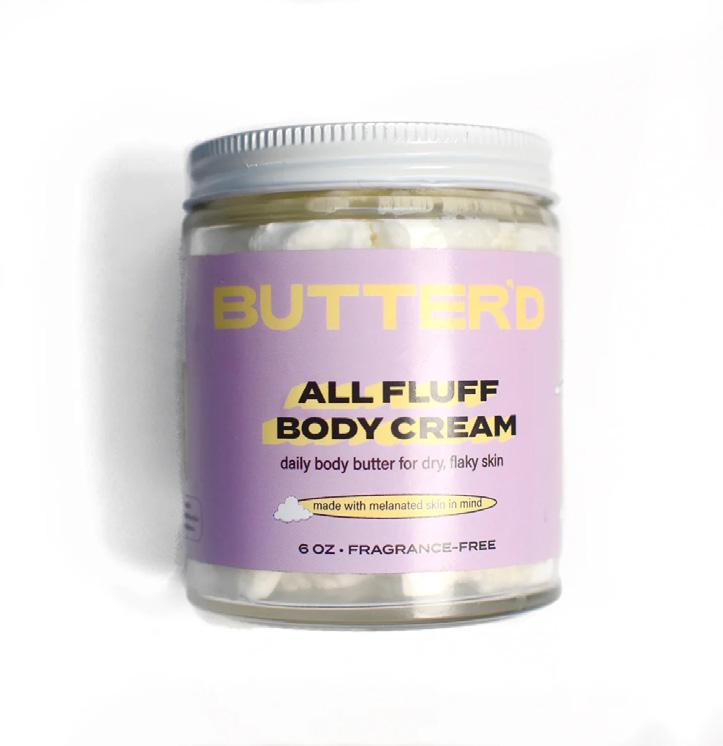

l Butter’d Bodycare - All Fluff

Body Cream

SKINCARE

l Journ - Kauai Color Corrector

l Daybird - Tinted Skincare

l Radixir - Confidence Serum

SUPPLEMENTS

l Funk It Wellness - Cycle Bites

l Jaded CBD - Sleep Tight

Gummies

l Bonny - Berry Beauty Prebiotic

Fiber Supplement

l Tend Prenatal - Lemon Berry

Daily Prenatal Vitamin Bar

29

WWW.STARTUPCPG.COM

STARTUP CPG SHELFIES AWARDS

SWEET SNACKS

l Booskies Cookies - Peanut

Butter Chocolate Chip

l Trupo Treats - Chocolate + Peanut Butter Crisp Wafer Bar

l Better Sour - Pomegranate Tangy

l Carolyn’s Krisps - Cinna Krisps

DESSERT AND BAKING MIXES

l Sweetkiwi - Cookies & Cream

Whipped Greek Yogurt

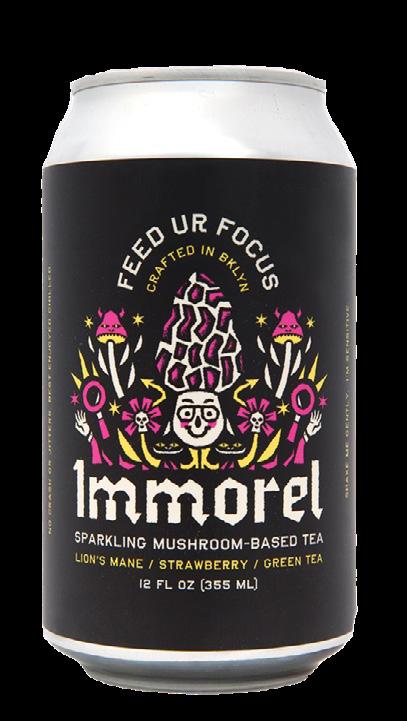

BEVS WITH BENEFITS

l Cultivate - Mango Wellness Soda

l All Phenoms - Superboost

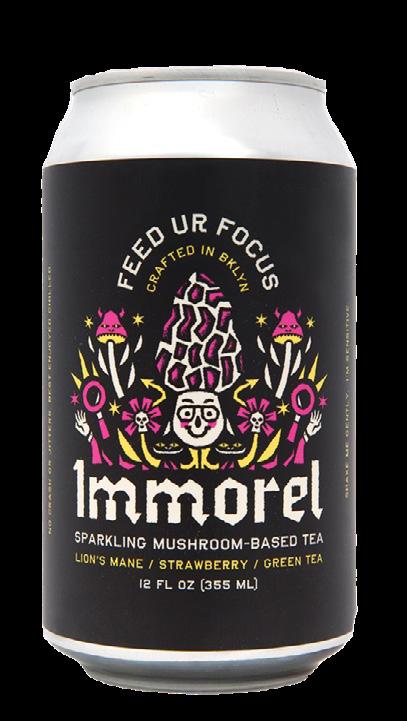

l Immorel - Feed Ur Focus

l Recoup Wellness - Lemon

Lime Ginger

NON-ALCOHOLIC

l Hiyo - Blackberry Lemon

l Hooch Booch - Rose

Corpse Reviver

l Exeer - Mint Soother

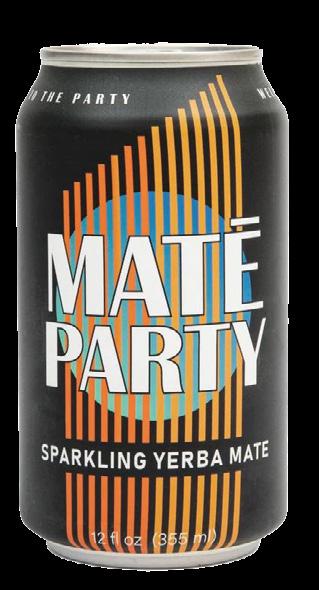

RTD TEA

l The BAD Tea Co - Chai

l Twrl Milk Tea - Ube Milk Tea

l Kinship Milk Tea - Earl Grey

Milk tea

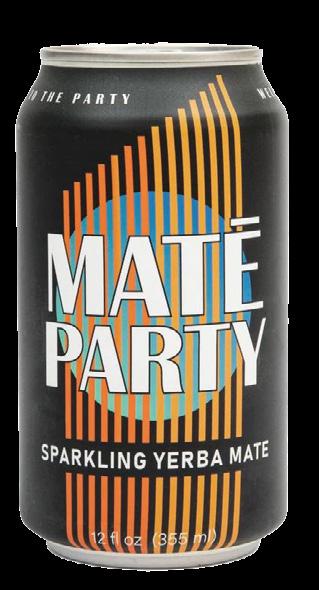

l Mate Party - Sparkling Yerba Mate

ALCOHOLIC BEVERAGES

l Whist - Lychee

l Krushwell - Passionfruit Hibiscus

l Tequio - Sparkling Blanco

l Crooked Owl - Jalepino

Hard Tepache

SAVORY SNACKS

l Marimix - Hatch Chile Lime

l 470 Baking Co - Original

Sourdough Crisps

l Geem - Just Salty

l Absurd Snacks - Rockin’

Rosemary Sea Salt

l Kula - Strawberry and Cake

Sandwich

l Bake Me Healthy - Dark

Chocolate Fudgy Brownie

l Goddess Mousse - Vegan

Raspberry Chocolate Mousse

PREPARED MEALS

l House of Kajaana - Cauliflower

Tikka Masala

l NoBull - Original

l 18 Chestnuts - Butternut

Squash Pear Soup

PLANT-BASED ALTERNATIVES

l Seeductive Foods - Marinated

Feta

l Rebel Cheese - Truffle Brie

l Sobo Foods - “Pork” & Chive

Dumplings

l Ghost Town Oats - Oat Milk

30

WWW.STARTUPCPG.COM

BREAKFAST FOODS

l Full of Beans Kitchen - Pancake & Waffle Mix

l Crafty Counter - Wunder Eggs

Hard Boiled

l LL’s Kitchen - Sweetheart

Crunch Granola

l Oat of the Ordinary - Blueberry

Cinnamon Oatmeal

DIPS, SPREADS, NUT BUTTERS

l One Trick Pony - Kinda Crunchy

Peanut Butter

l Rooted Fare - Black Sesame

Crunchy Butter

l Growee - Curry Zucchini

SPICES AND CONDIMENTS

l Lucky 22 - Secret Blend

l Matriark Foods - Gentle

Marinara Sauce

l Desert Dust - Original

Desert Dust

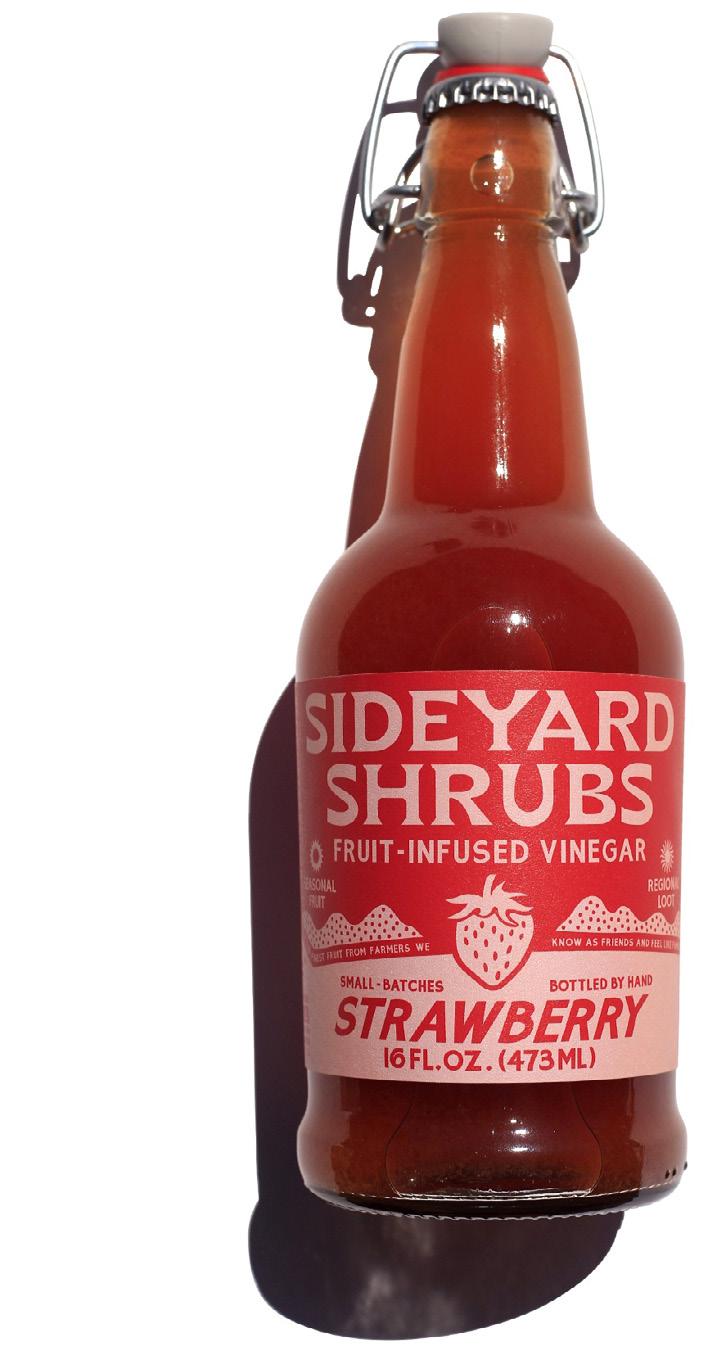

OILS AND VINEGARS

l Single and Fat - Extra Virgin

Olive Oil

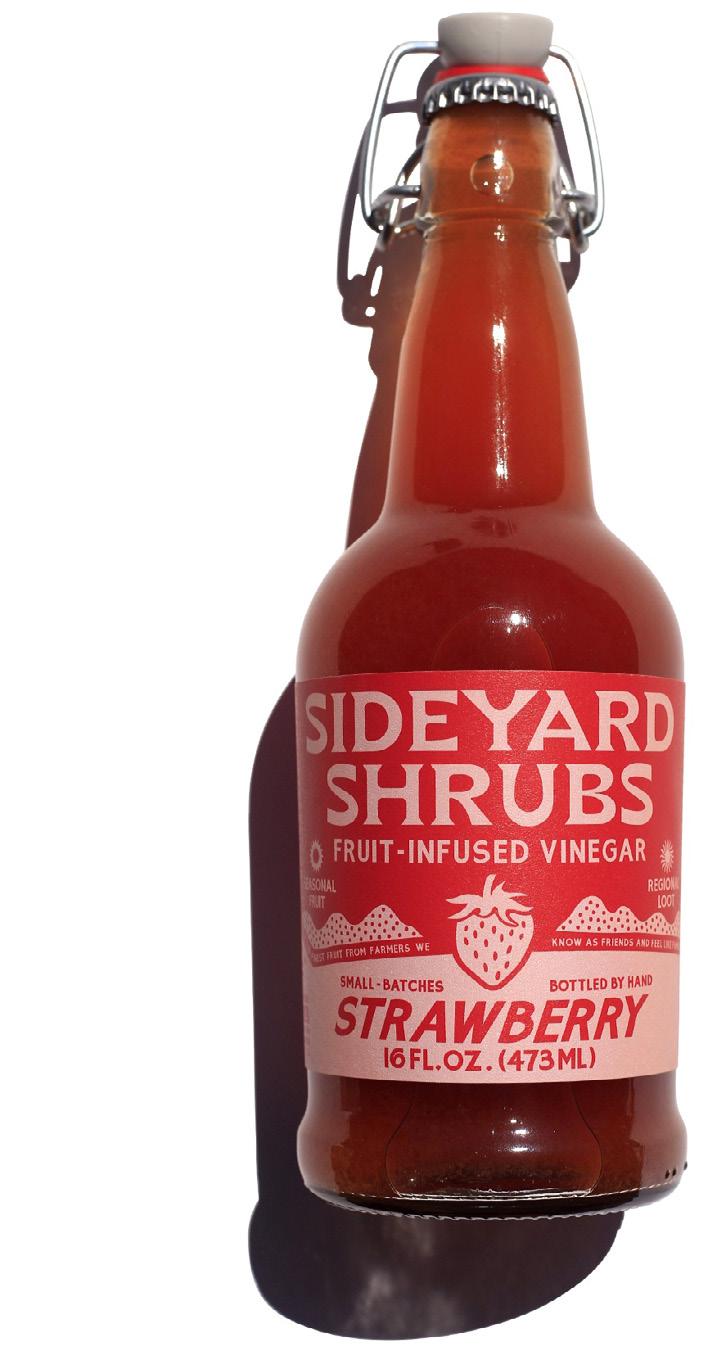

l Sideyard Shrubs - StrawberryInfused Vinegar

l Bellemille - Extra Virgin Olive Oil

COFFEE AND TEA

l Malu Coffee - The Classic House Blend

l Good Pharma - No Worries Herb & Jujube Seed Tea

l Three Keys Coffee - Cafe Blend

l Open Eye - Masala Chai

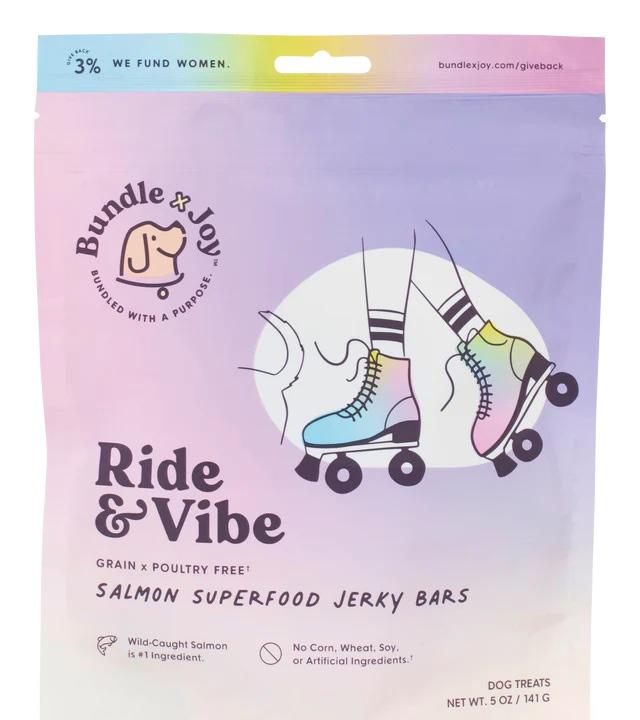

PETS

l Petaluma - Roasted Peanut

Butter & Sweet Potato

Baked Food

l A Better Treat - A Better Dog

Food Salmon - Raw You Can See

l Homescape Pets - Mussel

Mobility

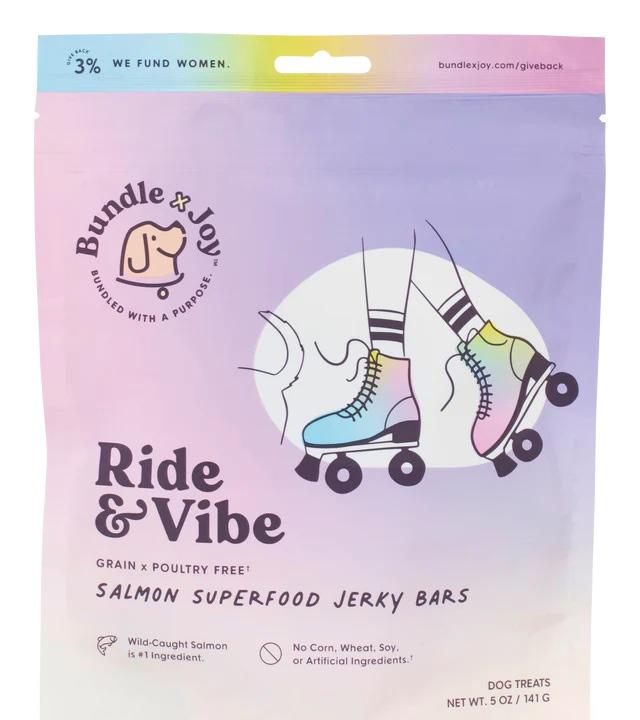

l Bundle x Joy - Ride & Vibe

Salmon Superfood Jerky Bars

BRANDING

l Geez Louise

l Mala Girl

l Savorly

l Up to Good

KIDS

l Begin Health - Growing Up Prebiotics

l Theo’s Mats - Eco-Friendly Disposable Placemats

l Kekoa Foods - Shawarma, Artichoke & Cauliflower

Squeeze Pouch

l Beyond the Bib - Thai Green

Coconut Sauce

WWW.STARTUPCPG.COM

COLD CHAIN LOGISTICS 101

We spoke with two experts in the field to better understand the behind-the-scenes of cold chain: Barry Handwerger of Cold Track, a 3PL that works exclusively with refrigerated and frozen brands, and Andrew Bott, a supply chain and operations consultant with 15+ years of experience in CPG, most recently as the Vice President of supply chain at Caulipower.

Here’s what we learned.

GEOGRAPHY FIRST

The first thing Bott does when working with brands on navigating cold chain logistics is to establish geography. “Where are the products being manufactured? And where does the product need to go? Based on those two things, and perhaps a few other parameters depending on your business, you can triangulate where you want your warehouse or warehouses to be located.”

Bott says most startups will want to begin with one warehouse that services the majority of customers. “There's additional risk in building a second warehouse from product obsolescence, shelf life shipping, and plenty of other factors. A lot of larger or medium-sized companies are still operating out of one facility.”

Brands will also need to consider geography as they consider the retailers they want to be stocked in and the viability of shipping DTC nationwide. What brands

need to understand, Bott says, is that “the longer the distance a product travels on a truck, the more costs you have. So, how do I solve to get the least common denominator on how far my product travels on a truck to each location?”

STARTING WITH YOUR CO-MANUFACTURER

Once you’ve established your geography, you need freezer space to store your product. 3PLs like ColdTrack often have minimums that startups may not be able to meet as small brands, and while brands can work with 3PLs with lower minimums, in Handwerger’s opinion, “you get what you pay for.”

If you cannot meet 3PL minimums, Handwerger and Bott both recommend partnering with your co-manufacturer. Many manufacturers have storage space adjacent to their production facility, and they may allow you to store your products and ship them from that location, Bott explains. “If that’s within the capabilities of your co-man, that’s a great option because you don't have to pay for a truck to get your product from the co-man to another warehouse.”

That said, Bott explains that brands will often hit a ceiling when partnering with their co-man. “Maybe [the co-man] doesn’t want to split the space, or they just don't have the space anymore. As your business continues to grow, or if you want

to expand into another co-manufacturer, it becomes a little trickier to execute.”

Handwerger recommends brands begin outsourcing to a 3PL when they are shipping “a few hundred orders per week steadily and growing.” Building up to this point takes time, patience, and investment, Handwerger explains: “For most brands, it tends to be a crawl, walk, run model.”

STORAGE CAPACITY IS TIGHT

To make matters more challenging for brands still in the “crawl” stage, frozen storage space comes at a massive premium. “Historically, capacity has been very tight [in cold storage],” Bott says. “The utilization percentage in warehouses was in the 80 to 90% range earlier this year. So the cold storage warehouses that exist are pretty darn full.” When seeking out a partner, brands will likely need to compromise on their wish list to find someone who has space in their freezer. “If there are three key things you want, you can probably find a warehouse that has two out of the three and you have to prioritize,” Bott says. Bott is hopeful, however, that more space will open up over the next few years. “Because there's been so much consolidation in cold storage, there is a lot of money flowing into the space to establish new warehousing groups and get new regional players on the map,” says Bott.

32 WWW.STARTUPCPG.COM

33 WWW.STARTUPCPG.COM

THE DEAL WITH FROZEN DTC

Whether you’re working with a co-man or a 3PL, shipping your product to retailers versus direct-to-consumer are two entirely different beasts. And when it comes to DTC in frozen, many brands will choose to forgo it almost entirely due to the high costs of shipping. Bott explains, “If you have a product that has enough margin to support the high costs or consumers are willing to pay a high shipping cost, DTC might be good for you.” Bott has found that frozen food companies that want to get into e-commerce often prioritize click and collect, group local delivery through a retailer, Amazon Prime, or Walmart Plus. Traditional DTC in frozen is possible. But brands do need to be strategic to manage costs and incentivize consumers to purchase. “Between the box, the liner, gel packs or dry ice, shipping, and labor, DTC tends to cost around $25-35 a box,” Handwerger says. Furthermore, “you can’t tell someone it’s going to be $20 to ship, so a lot of brands have minimums of $100150, and then consumers get free shipping.” This allows the brands to absorb high shipping costs without sacrificing their margins or putting an unnecessary burden on consumers.

*Given these challenges, why attempt shipping DTC at all?*

l It provides the opportunity to better understand and learn from customers.

l You can offer exclusive SKUs to extend your “shelf space.”

l You can test things on the DTC market and get feedback before a “hard launch.”

l It builds brand awareness.

Handwerger’s advice is to keep DTC operations as simple as possible. “We deal with a lot of brands who have around 150 SKUs, and it’s so complicated.” That’s fine later on in your business, Handwerger

says, but “when you're starting, you're not doing enough volume to take up so much space in my warehouse. People say 80% of your sales are from 20% of your products. So give me the 20%, don’t give me everything. Streamline and give us the big mover items.”

Handwerger also says that subscription-based products tend to do particularly well in DTC, including meat and seafood deliveries, meal companies, and pet food. Set yourself up for success by offering “something that people consume regularly.”

SHIPPING CONSIDERATIONS

3PLs like Cold Track specifically work with brands to optimize their DTC operations to lower costs and streamline efficiency. One of their biggest priorities? Making sure that the product is actually frozen upon receipt. In Handwerger’s opinion, “If you want something to arrive frozen, you need to ship it with dry ice. If the product is frozen in my warehouse, and I put gel packs in the box — even for one day shipping — it’s going to slack out a little bit.”

The risk of a melting product arriving at the customer’s door, Handwerger argues, is not worth the potential money you will save by using gel packs over dry ice. “If [a shipment] fails, and you've got $100 worth of food in there, you will have an unhappy customer. Then you potentially have to give them a refund or replace the box. It could cost you $200, when you could have spent $3 on dry ice.”

To avoid failed shipments, brands must conduct test runs. Cold Track does a “friends and family run” before going live to consumers. “We pack your boxes for you with the recommended amount of dry ice and then we send out 10-20 packages throughout the country.” From this run, they can pinpoint any issues before the product is in the hands of consumers, who will be more than happy to point the issues out for you or write a negative review online. “You get one shot,” Handw-

erger says, “and if you don't lock somebody in with a good experience, they're going elsewhere.”

Brands also need to accommodate weather patterns when shipping. “Dry ice is negative 180 degrees, but when it’s 110 in Texas, it doesn’t last that long,” Handewerger says. Bott echoes this sentiment: “You might need to overnight a package when you’re shipping to Texas in the summer, whereas if you’re shipping to the midwest in the winter, the package might be able to go by ground over two days.”

To help brands make informed shipping decisions, Cold Track built out an AI-powered platform that makes recommendations based on the forecast. Cold Track’s program also monitors for any extreme weather patterns that may disrupt shipping and notifies the brand. Regardless of if your brand is using AI or your iPhone’s weather app, brands need to pay close attention to the weather to both save costs where possible and avoid disappointed consumers.

BETTER-FOR-YOU PACKAGING

Handwerger also encourages brands to consider the liner they include when shipping DTC. “The box is a box — whether you put your name on it or not doesn't make a difference, but the liner that goes inside of the box is really important.” Handwerger urges brands to use a recyclable lining, especially if they’re on a subscription model. “If someone buys your product once a year and you send it to them in styrofoam, they might not remember that it was not a great experience,” he says. “But if they’re ordering once a month, and they're seeing your box with styrofoam every few weeks, it’s a terrible experience.”

Premium and better-for-you consumers are often more environmentally-conscious and do not want to receive products filled with liners that have to go into a landfill. Instead of styrofoam, Handwerger recommends brands use recyclable or bio-

34 WWW.STARTUPCPG.COM

degradable liners such as Temper Pack or Green Cell Foam.

SHIPPING TO RETAIL

Shipping products to retail locations is far simpler than DTC, but there are still “a variety of different factors to consider,” Bott says. Some retailers, like Walmart, have their own warehouses, and brands ship directly to the retailer’s warehouse. Other retailers pull from distributors like UNFI (Whole Foods) and KeHE (Sprouts).

When working with distributors, brands

will find that some may want to pick up the product from the facility themselves while others will ask the brand to order a truck and deliver the product to the distributors. Bott says, “There are different ways [trucking] can be managed, and it becomes a decision that is largely based on cost and service.”

WHAT YOU NEED TO KNOW

At the end of the day, frozen brands need to understand what they are getting into as