TUC conference: spotlight on pensions under the next government THE MAGAZINE FOR MEMBERS OF THE CIVIL SERVICE PENSIONERS’ ALLIANCE

Volunteering: how one member’s work with his local group turned his life around

Annual Report 2023: special supplement with this magazine

Summer 2024 / Issue 297 / www.cspa.co.uk

Group and branch updates Readers’ letters Computer helpdesk Puzzles

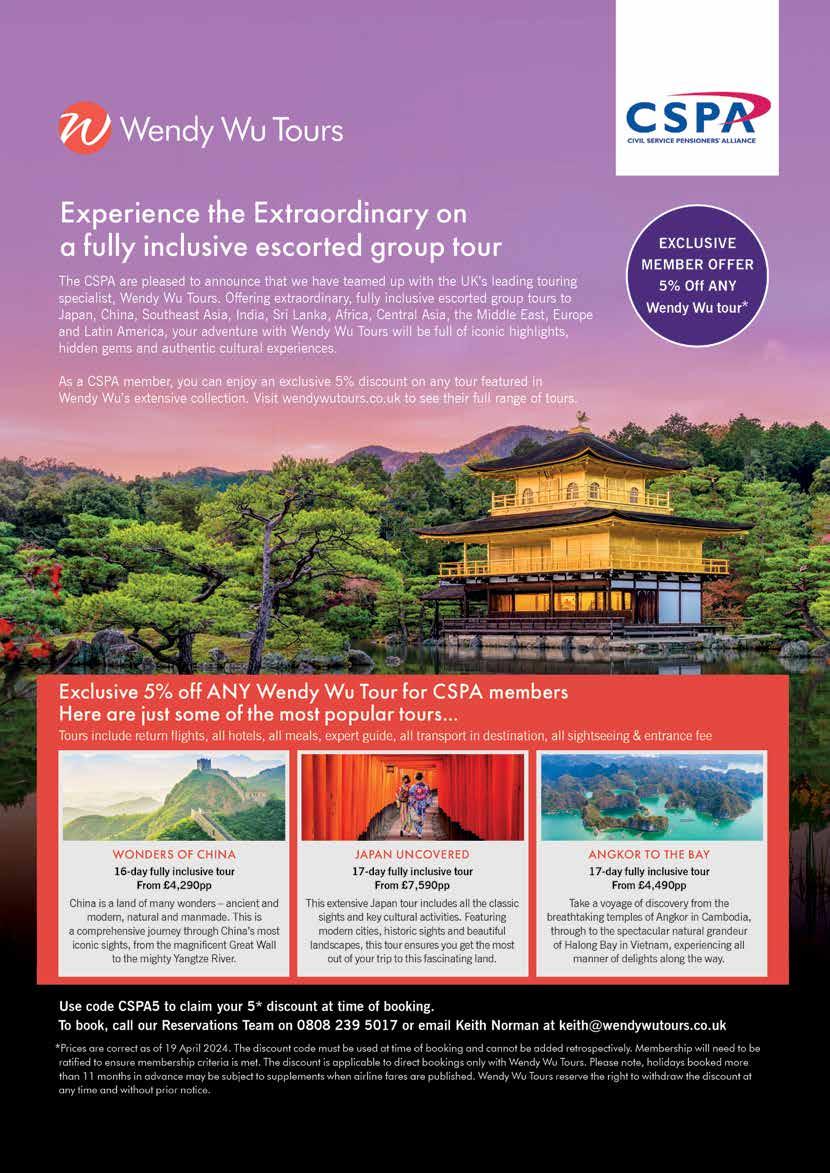

high How to get the most out of holidays designed for you

Flying

Trekking, kayaking, unwinding on the beach, city sightseeing, taking your dog for a country break – what are you doing for your holidays?

It’s that time of the year that many of us are thinking of a change of scenery. Our cover feature by Helen Nugent looks at what is popular for older travellers and finds a world of possibilities.

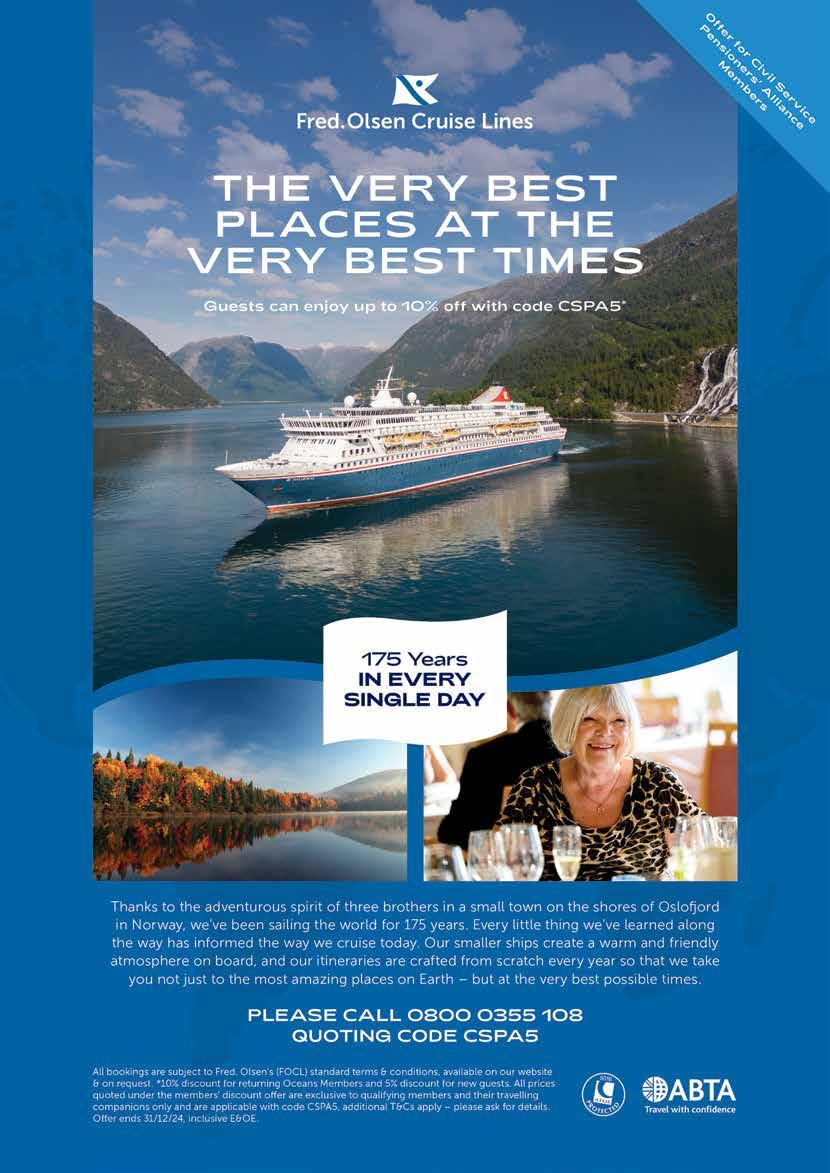

And once you’ve chosen your dream holiday, the CSPA has secured a new offering for discounted travel insurance. Check it out in our column from Deputy General Secretary David Luxton.

As we also look to a likely general election later this year, the CSPA and our partner organisations in Later Life Ambitions are looking out for the various political parties’ pledges on pensions and other issues affecting older people. Jenny Sims went to the TUC’s pension conference to hear what the unions and other groups are calling for and more details of a promise from Labour for a wideranging review of pensions and savings.

Also in this issue of The Pensioner is a Q&A with the CSPA’s new Vice Chair, Roisin Lilley, and an uplifting account of getting involved in your local CSPA group by David Foster.

I hope you enjoy this edition and your summer.

ISSN - 1360-3132

Head Office, Grosvenor House, 125 High Street, Croydon CR0 9XP 020 8688 8418 enquiries@cspa.co.uk www.cspa.co.uk

General Secretary: Sally Tsoukaris sally.tsoukaris@cspa.co.uk 020 8688 8418

Plus CSPA Treasurer Mike Sparham on the facts behind the financial figures

GENERAL SECRETARY 8

Sally Tsoukaris on recent achievements holding government to account

Christine Haswell has some handy hints on how to boost your income

Have the WASPI campaigners won the battle for compensation?

TUC CONFERENCE

Report from the recent TUC conference, Pensions Under the Next Government

BRANCH AND GROUP NEWS 16

Members’ activities across the nations over recent months

COVER STORY: TRAVEL

It’s holiday season – but those wanting to get away should keep a close eye on getting value for money

DEPUTY GENERAL SECRETARY 26

David Luxton unveils a new travel insurance offer from the CSIS

020 8688 8418

enquiries@cspa.co.uk or 020 8688 8418 Freepost RTRX-RKUY-SELT

Published by: Square7 Media Ltd

Publisher: Gaynor Garton

Advertising sales: Ethan Hall hello@square7media.co.uk

Editorial production: Kate Wheal

Design and art direction: Charlotte Russell

SUMMER ISSUE 2024 | The Pensioner 3

NEWS ROUND-UP 4

MONEY 11

CAMPAIGNING 13

14

24

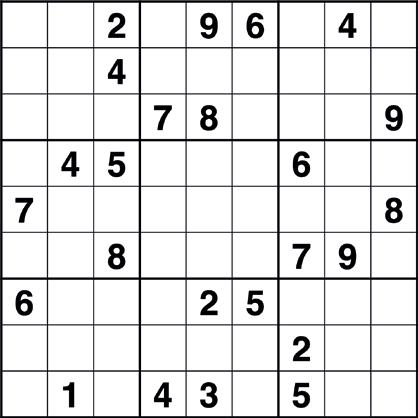

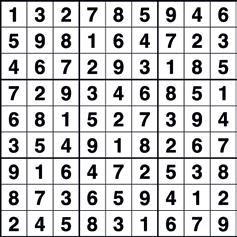

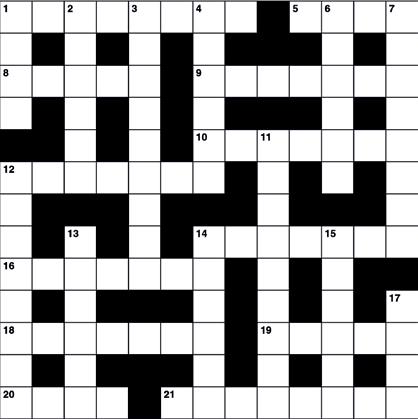

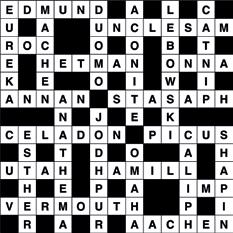

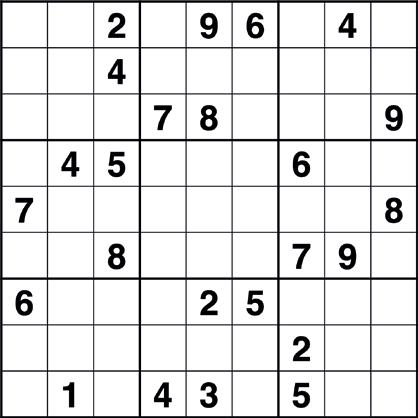

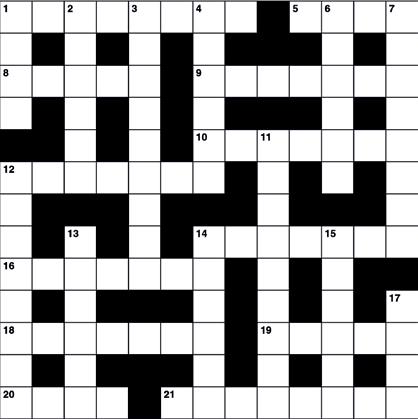

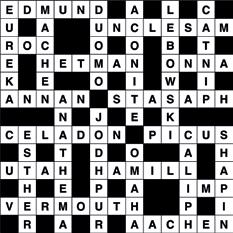

VOLUNTEERING 29 David Foster on his life-changing journey to the Bournemouth & District Group CSPA AND ME 31 New CSPA Vice Chair and NI Treasurer Roisin Lilley answers the questions PARLIAMENTARY SYNOPSIS 32 Recent pensioner developments in the four UK nations FEEDBACK 37 A selection of your letters ADVICE: LPA s 40 Affinity Solutions on the importance of setting up a lasting power of attorney HELPDESK 41 How to revive a sluggish PC CROSSWORD & SODUKO 43-44 Your chance to win a £50 M&S voucher CHRIS PROCTOR 45 Don’t ask about my health... or my age... CONTACT US 46 Editor:

editor@cspa.co.uk

Changes

address

information

Welcome Please send branch news and parliamentary reports or any other contributions for the next edition to the editor by 25 June 2024. Branches and groups with initials B, D, F, H, J, L, N, P, R, T, V, X, Z are invited to contribute – email editor@cspa.co.uk And if you need extra time to submit a report, please email the editor. Contents Front cover photo : Kelly Cheng Travel Photography 24 26 UNITED ARCHIVES GMBH / ALAMY STOCK PHOTO

Christine Buckley

of

or other

Financial advice for members

The CSPA is has teamed up with Quilter Financial Advisers to offer free initial financial advice for members. Quilter advises on a range of issues in later life, including financial planning, investments, wills, power of attorney and equity release. Getting professional help to plan your financial future in retirement and manage your wealth can greatly improve your chances of achieving your retirement goals. Whether you’re looking to grow your savings or the right way to pass on your wealth to loved ones, Quilter can help you:

• Manage your wealth to make the most of tax-efficient investment opportunities

• Protect your wealth so your family can maintain their standard of living if something should happen to you

• Retain more of your hard-earned money ethically and legally

• Preserve the value of your estate for your loved ones.

You are entitled to a no-obligation free initial financial consultation

Farewell and thanks Sandra

Sandra Roberts, the CSPA’s Membership Records Administrator, retired at the end of April after more than 24 years at CSPA head office. Sandra was the longest serving member of staff, having been appointed in June 2010, but she also spent many years before that as a volunteer at HQ.

CSPA General Secretary Sally Tsoukaris commented: “We wish Sandra everything of the best for a long and happy retirement, and thank her for everything she’s done for CSPA members and her colleagues. Sandra will be greatly

Quilter Financial Advisers is part of Quilter plc, a UK-focused full-service wealth manager, providing advice-led investment solutions and investment platform services to more than 900,000 customers.

Your need for financial advice and planning lasts a lifetime and it’s Quilter’s job to be there for you. Its advisers can build an understanding of your needs and support you every step of the way.

As a CSPA member, you are entitled to a no-obligation free initial financial consultation with a Quilter adviser to discuss your situation and find out how financial advice could benefit you.

Your adviser will take the time to get to know you, your current financial situation and your goals and can help you to design a plan as individual as you are.

If you’d like to book your free initial financial consultation, follow these three simple steps:

• Telephone Quilter on 08000 85 85 90, quoting CSPA

• We’ll match you with one of our qualified financial experts

• Your free initial consultation will be arranged.

missed, but we look forward to seeing her again at the AGM in October, when we hope she will join us as the Executive Council’s guest.”

Sandra said: “I have spent 24 very happy years with the Alliance and have formed many longstanding friendships with members of staff. We worked hard and laughed a lot.”

A century of Frank Cooper

CSPA President Brian Sturtevant and Treasurer Mike Sparham celebrated the 100th birthday of Frank Cooper, a former National Pensioners Convention (NPC) President, shortly before he died.

Frank turned 100 on 29 January and celebrated with family and friends, but celebrations also took place on 28 February at Unite HQ, where this picture was taken.

Many NPC and trade union activists who had worked with Frank over the years enjoyed an afternoon reminiscing and celebrating.

Frank had been NPC President after Jack Jones and Rodney Bickerstaffe, both hard acts to follow, but put his own stamp of kindness, consideration and good humour on the difficult challenges of campaigning for pensioner rights.

He served as President from 2005 to 2013 after a lifetime of trade union activism and political activity. He will be remembered for his long service to those in work or retired.

Brian said: “Frank never let the trials and tribulations of uncooperative governments and awkward delegates upset him. His kindness, outgoing personality and good humour got him through.

“If a problem seemed too much, it was a case of: ‘Let’s go down the pub and think about it over a pint.’ There was always a solution.”

Frank passed away on 12 March.

News SUMMER ISSUE 2024 | The Pensioner 4

Spotting scams and fighting fraud

The Crawley & District Group recently heard from Bernadette Lawrie, a financial abuse safeguarding officer at Sussex Police, writes Brian Sturtevant.

We found the talk fascinating and concerning in equal measure and would recommend this talk to all groups. Most police forces have similar departments and responsible officers who can talk to interested groups. The police are concerned about vulnerable older people

who have been tricked into handing over their hard-earned savings and keen to raise awareness of the dangers that exist. Two amazing facts emerged from the talk. First, the activities of scammers and

Fraudsters are extracting £119 billion a year from the British economy

Roisin becomes Vice Chair

Roisin Lilley is the new Vice Chair of the CSPA following a vote by the membership. The position became vacant after former Vice Chair Linda Ridgers-Waite became the Chair following the decision by previous incumbent Don Makepeace to step down.

Roisin has served on the CSPA’s Executive Council in one of the two positions reserved for women. She is also Membership Secretary and Treasurer of the CSPA’s Northern Ireland Branch.

Roisin was one of two candidates standing for election, along with

South West Regional Representative Les Calder.

She said: “I am honoured and humbled to be elected as the Vice Chair of the CSPA. Voting in CSPA elections is vital to our democratic traditions, so a sincere thanks to all groups and branches who voted, whether for me or for Les. I will strive to support the Chair, HQ staff, Executive Council and all local representatives to strengthen the CSPA in order to deliver for all CSPA members.”

• The CSPA and me, page 31

fraudsters are extracting £119 billion a year from the British economy, stealing money especially from older people like you and me.

This money, nearly all of which goes abroad, is then used to finance other criminal activity, such as drugs trafficking, arms dealing and people smuggling.

Just think of what we could do with £119 billion a year – the boost to the NHS, social care and education would be wonderful.

Second, scammers and fraudsters are becoming more sophisticated because in many foreign countries they have training colleges just to teach the criminals how to convince you their activities are genuine.

If you have ever wondered how an unusual email, phone call or website seems to know so much about you, it’s because the scammers have spent many hours researching and being trained on how they can hook you.

So beware: if an offer seems too good to be true, or the offer of an exciting romantic liaison seems irresistible, resist it and report it to the police, Action Fraud, your bank or another relevant authority.

In the next edition of The Pensioner we will be including a feature on the most common types of scam and how you can spot and avoid them.

Apology to Scotland Branch

In March, we had an issue with a mailing list generated for the distributors of the CSPA Scotland Branch newsletter, which meant it was posted in duplicate to several joint members. We have since identified the cause of the problem and taken steps to rectify it, and we are assured that members’ data security was not compromised. Nevertheless, we apologise unreservedly to all members affected for any inconvenience or upset caused.

News SUMMER ISSUE 2024 | The Pensioner 5

Retiring early and your state pension

Members who have ‘retired’ but not yet reached state pension age will have left work for a variety of reasons – caring for or being with family, for example, or due to ill health, Chris Haswell writes

Many people will have paid in the required number of years of National Insurance contributions (35 years) and some may have National Insurance credit in place to cover any years spent out of the workforce.

You may have NI credit in place to cover years spent out of work

One such NI cover is Home Responsibility Protection, which covers parents while at home with young children and claiming child benefit. This builds up their state pension entitlement but because the system changed in 2016, it doesn’t guarantee that a full new state pension will be payable once the state pension age is reached.

Under the old system, people in pension schemes such as the civil service’s (or other defined benefit occupational pensions) were contracted out of the state second pension or state earning

related pension (SERPS) and paid reduced National Insurance contributions.

It wasn’t a choice at the time, and many people didn’t realise that this was what they were doing. Their contributions went towards their old, basic state pension (from April 2024, this payment will be £169.50 per week).

For them, the occupational pension partly replaced the higher state pension payment. The arrangements were set so that the occupational pension schemes’ offer was always better than the second state pension.

After April 2016, this changed, but everyone who continued to pay in – those who were under the state pension age at the time – started paying the new, full rate of National Insurance contributions to build up a new or full state pension (which will be £221.20 per week from April 2024). This included people who had spent most of their working lives paying National Insurance under the old system.

If you decide to, or have already, stopped working before reaching the state pension age, and you are not claiming benefits to cover your National Insurance – or have arrangements in place to pay in otherwise – you might end up getting less than the full amount of state pension when you reach state pension age.

Further information

If you haven’t reached state pension age, these links can help:

• To request a state pension forecast online, go to https:// www.gov.uk/check-statepension. Or you can phone the Future Pension Centre helpline on 0800 731 0175.

• Financial services firm Lane Clark & Peacock outlines whether you can boost your state pension – https://www.lcp. com/statepensionboost

• Grandparents under state

pension age who look after young children may be able to claim NI credit – https://www. moneysavingexpert.com/family/ grandparents-childcare-credit/

• For information on NI credits see https://www.gov.uk/ national-insurance

It is a good idea to take advice before making a decision, and as a CSPA member you can access a free consultation via cspamembershipservices andbenefits.co.uk

Are you retiring comfortably?

The cost of a comfortable retirement has risen, according to the Pensions and Lifetime Savings Association (PLSA), fuelled by higher energy and food costs.

The cost of enjoying a comfortable retirement has increased from £37,300 to £43,100 for a single person and to £59,000 for a two-person household, the PLSA says.

A comfortable retirement includes spending around £130 per week on groceries and £80 a week per couple on meals, plus extra luxuries such as regular beauty treatments, theatre trips and a two-week holiday in Europe each year.

For a moderate retirement, a pension pot of £23,300 to £31,300 for a single person and £34,000 to £43,100 for a couple is needed.

This is based on spending around £100 a week on groceries, £60 a week on eating out, running a small car, and having a week’s holiday in Europe and a long weekend break in the UK.

A basic retirement requires £14,400 – up from £12,000 – for a single person. For a couple, this figure has jumped from £19,900 to £22,400.

This presumes £95 for a couple’s weekly groceries, a week’s holiday in the UK, eating out about once a month and some affordable leisure activities. It doesn’t include running a car.

News SUMMER ISSUE 2024 | The Pensioner 6

Planning our financial future

Mike Sparham, CSPA National Treasurer, on what 2023’s financial

report means for the CSPA

Included in the Annual Report supplement with this issue of The Pensioner are the Statement of Accounts for the year ending 31 December 2023. They tell a positive story as 2023 was a good year financially, with income higher than budget and expenditure (excluding project expenditure) lower than budget. There was a surplus of £103,436 before

I want to give some of the story behind the figures for 2023

taxation, which has enabled the CSPA to make investments for the future. Among other things, the budget for The Pensioner has been increased to provide improved coverage of issues affecting older people.

In addition, a digital services manager has been employed to manage the CSPA’s social media presence and update the website, and our membership database has been improved and is being data cleansed on a regular basis.

Looking at pages of figures is not the most interesting or exciting way to read about the financial situation, so in this article I want to give some of the story

behind the figures for 2023. Income was higher than budget for four main reasons: commission payments from CSIS for the sale of travel insurance policies were higher than anticipated; dividends through abrdn investment performed well; an unexpected bequest was made; and we received generous donations.

There is no guarantee that any of this will be repeated in 2024, but this income has been used to make improvements.

Unfortunately, income from subscriptions was slightly below budget, and this will be monitored closely in 2024 as it is our main source of funding.

Expenditure was lower than budget for a number of reasons, some due to positive action by the CSPA and some due to the actions of others. The CSPA took action to reduce its stationery bill, changing to a cheaper local supplier; entered a contract with Quadient to print and post group newsletters; set up a contract with Agilico to lease only one copier at a reduced rate; reduced the rent on the franking machine; and ended the Zoom contracts.

The CSPA was also helped by Lloyds Bank’s failure to charge for the direct debit payment service (a mistake they have now spotted and rectified this year) and the fact that the landlord of our HQ premises did not take up the option of a rent review.

The CSPA is planning a balanced budget this year, taking into account likely expenditure during a general election campaign. Subscription rates will remain frozen until at least January 2026 and both income and expenditure continue to be monitored closely by the Treasurer and the Executive Council.

Overall, the CSPA’s financial position is sound but it can only remain so with the continuing prudent approach that has been adopted by the Executive Council, who will be conducting a detailed review of all costs later this year.

AGM opportunity for members

CSPA members have always been able to attend the Annual General Meeting, but at their own cost. As this is a residential event, these costs are not insignificant.

The Executive Council recognises many members aren’t covered by active groups or branches that

can send delegates to the AGM. So a limited number of members can attend at a subsidised rate of £70 per night. This includes meals and accommodation in a single room. Travel costs are not included, but there is a free shuttle bus service between Coventry station and the venue.

Any member not covered by a group or

branch who would like to attend the AGM should contact us on 0208 688 8418 or email enquiries@cspa.co.uk.

Those getting the limited places will be able to vote and participate fully. This facility is available for this year but it is subject to review for subsequent AGMs.

News SUMMER ISSUE 2024 | The Pensioner 7

General secretary's

Report

Sally Tsoukaris

Welcome to the Summer edition. Time has flown and our HQ team is in full swing preparing for the 2024 Annual General Meeting. The event offers delegates a chance to make and renew friendships, hear interesting presentations and debate motions that determine our future policies and campaign agenda.

CSPA groups and branches submit motions and suggest rule amendments on members’ behalf, as well as nominating to Executive Council (EC) positions. Individual CSPA members can also attend and submit motions for debate. Please do get in touch to find out more, as advice and support is available. The deadline for the submission of AGM motions, constitutional amendments and nominations is Friday 5 July, and we will finalise our AGM delegate lists in early September.

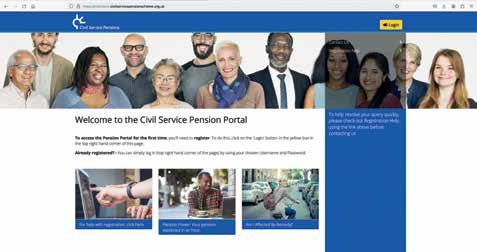

This summer, digital exclusion (or inclusion) is our focus, highlighting to decision-makers its impact on older people. We do this directly and with partners such as the NPC, Age UK and Independent Age.

Members often raise issues around access to cash, as hundreds of high-street bank branches and thousands of ATMs have closed in recent years. A Financial

Conduct Authority (FCA) report, Consumer credit and consumers in vulnerable circumstances, confirmed in 2014 that older people are more significantly affected by this than other social groups.

Continued access to cash and in-person financial services is a key demand

Continued access to cash and in-person financial services is a key demand of our Later Life Ambitions (LLA) manifesto, and in discussions with ministers and MPs. In January, the CSPA contributed evidence to the FCA consultation on access to cash.

On another digital exclusion issue, we were pleased to hear that from April, GP practices will be required to allow patients to book appointments by phone, following reports that some were forcing people to book online.

Indeed, we endorse Age UK’s

Firming up campaign links

Social care provision, and support for those in need and their families, is close to many members’ hearts, and last year’s AGM motions tasked us with raising the profile of these issues. The EC seeks to join like-minded groups to back relevant campaigns. We became one of some 60 charities and not-for-profits affiliated to the Care and Support Alliance (CSA), which aims to keep social care on the political agenda and ensure better legislation for older people, disabled

Offline and Overlooked campaign, calling for “all public services, including NHS, council services and other nationally provided public services” to be “legally required to offer and promote an affordable, easy to access, offline way of reaching and using them”. Sign Age UK’s petition online at www.ageuk.org.uk or by post at Freepost Age UK Campaigns.

According to Age UK, 2.7 million older people in the UK aren’t internet users and many find it increasingly difficult to access day-to-day necessities such as banking, medical appointments and parking.

We support Age UK’s calls for improved funding for local authorities and others to help those who want to get online. If you would like to improve your IT skills, Independent Age offers free training you can access on your own or with the help of a friend, carer or relative. Visit www. independentage.org/ hidigital or telephone 0800 319 6789.

people, those with long-term health conditions and carers.

The CSPA and others will be launching the CSA’s Show Us You Care campaign on 24 June and celebrating Social Care Promise Day on 24 July to mark the fifth anniversary of the day Boris Johnson promised, on the steps of Downing Street, to “fix social care for once and for all”.

We are also part of the Carer Poverty Coalition led by Carers UK, joining 100 organisations to campaign to end poverty among carers. The Coalition

Members can also access free IT support from BC Technologies, who are happy to assist – see page 41.

has launched a petition demanding the Carer’s Allowance be reformed to increase support for carers and reduce overpayment issues. Margaret Greenwood MP tabled questions on its behalf after government data in April indicated it was attempting to recoup Carer’s Allowance overpayments from 156,000 unpaid carers, many of whom are already below the poverty line.

The Coalition is also urging government to review its withdrawal of allowance payments when a carer reaches state pension age, causing many to suffer a fall in income as their caring responsibilities continue.

General secretary SUMMER ISSUE 2024 | The Pensioner 8

Continuing to hold government to account

I have written to government ministers and others to highlight concerns raised at the 2023 AGM. Several motions called for additional local authority funding to support adult social care services, so I wrote to minister Michael Gove:

“Local authorities provide a great many essential services to our members, as well as to other older people and vulnerable groups but, after a decade of significant public expenditure cuts, most public and local authority services are now left struggling. This results in many essential services failing to reach even basic service standards due to inadequate staffing and resources.

“Often essential personal services are curtailed or disbanded, causing extreme levels of anxiety and distress, particularly to older people so reliant on them. Local authorities are key to enabling older and more vulnerable people to be active members of their communities, and to... maintain their health and wellbeing.

“We urge you to recognise, and speedily address, the staffing and other resource needs of all public services along with adequate local authority resourcing…”

Local government minister Simon Hoare said he was “determined to help councils make a positive change to the lives of their local residents” and the “above-inflation increase” in the local government finance settlement for 2024/25 “demonstrates how the government stands behind councils”. An extra £500 million of funding was being distributed through the Social Care Grant unveiled in January, he added.

We met Simon Hoare in April to discuss members’ concerns around local authority funding, and the need for a national strategy to reform social care. Whilst he

agreed a review of the funding model was long overdue and “shared many of our concerns”, he believed improved stability would best be achieved by three-year funding settlements and councils having access to more localised data.

Despite our efforts to press the minister on the need for a national social care

Two Million

We have sent letters to ministers Michael Gove and Victoria Atkins

framework, he would only say that whoever forms the next government, funding issues, especially over social care, could only be addressed by cross-party agreement on “sustainable solutions to give private providers the space to innovate”.

I also wrote to Local Government Association (LGA) chair Shaun Davies: “We know the LGA is working with councils at the coalface on these issues, and we want to urge you to continue to recognise and speedily address the staffing and resource needs of all public services, along with adequate local authority resourcing.”

We have since met LGA representatives to explore how we might support their campaigns for improved funding for local government services.

Letters were also sent to health secretary Victoria Atkins on NHS waiting lists, GP appointments, hospital beds, A&E services and community-based reablement, and to Northern Ireland ministers Naomi Long, Gordon Lyons and Robin Swann on age discrimination protection and the need for a Warm Homes Discount scheme in the province.

Tony McMullan and Roisin Lilley from CSPA NI and I met the Department for Communities at Stormont on 23 April (pictured left) to call for an equivalent to the Warm Homes Discount.

We discussed the fuel poverty strategy, highlighting the plight of pensioners forced to choose between heating or eating and citing the number of deaths attributable to cold weather in the cost-of-living crisis.

I represented the CSPA at an Independent Age event launching the Two Million Too Many campaign in April, hosted by LibDem pensions spokesperson Wendy Chamberlain, to spotlight pensioner poverty. Speakers included Jo Gideon MP and Work and Pensions Select Committee chair Sir Stephen Timms. The briefing document powerfully mapped out pensioner poverty around the UK, describing a hidden reality in which two million older people live in poverty, with many others facing hardship. The document said: “A damaging stereotype permeates our society: that everyone in later life is enjoying a comfortable retirement with a large pension pot, mortgage-free house and significant savings. Sadly, for many, this is not the case…”

Too Many Mega Miles Challenge

The CSPA’s HQ team joined many around the country for the Charity for Civil Servants’ Mega Miles Challenge in May – taking on personal challenges to stroll, walk, jog or even run in support of colleagues and former colleagues in need of help. We have used our website and social media to report back on the miles clocked up in aid of this very good cause.

General secretary SUMMER ISSUE 2024 | The Pensioner 9

CSPA NI Chair Stan Blayney with Sally Tsoukaris, Roisin Lillley and Tony McMullan

Ways to boost your retirement income

Chris Haswell has some top tips for getting a bit more out of your money

After another Budget that ignored pensioners, CSPA members may be looking at ways to keep costs down. Although pensions are increasing – civil service pensions by 6.7%, state pension by 8.5% – the cost of living and low tax thresholds mean pensioners are generally worse off.

The CSPA is actively campaigning for decent pensions and dignity in retirement. However, if there are ways for you to boost your income, this article gives you some ideas to think about.

• Getting what you are entitled to?

The latest annual Department for Work and Pensions take-up figures show that more than a million pensioner households are missing out on pension credit – that’s about two in five (39%) of those who are entitled to receive it. If you think you are eligible, check at: https://www.gov.uk/ pension-credit/eligibility.

The figures also show that around one in seven of those who should be claiming housing benefit to help pay their rent are missing out. You may be eligible for housing help. Check at: https://www.gov. uk/browse/benefits/low-income.

• Rent out your spare room

One popular way of boosting your retirement income is renting out a spare room in your home if you have one, as you can earn up to £7,500 a year tax-free (halved if you share the income with a

partner) under the government’s Rent a Room scheme. You need to let the room furnished and you can already be a tenant or homeowner. Find out more at: https:// www.gov.uk/rent-room-in-your-home/therent-a-room-scheme

• Rent out a parking space, garage or power tools

You can rent out free space such as a garage as storage or a parking space. For renting out storage space try https:// stashbee.com/rent-my-garage or similar – we are not recommending any particular firms, just giving examples.

To rent out power tools or similar there are companies such as FatLlama: https:// fatllama.com/

The CSPA does not necessarily endorse these companies. These sites act as middlemen putting customers and providers in touch for a fee. This is the method that has replaced using small ads in the newspapers.

• Sell homemade goods

If you are a knitter, crafter or upcycler, you can make money from your hobby by selling on Etsy (https://www.etsy.com/uk), which is a virtual shop where you can sell crafts and recycled goods.

• Sell unwanted items

You may wish to consider Facebook Marketplace (https://www.facebook.com/ marketplace/) to sell unwanted goods

locally. It is free to advertise and generally people will collect items themselves and you can deal with cash. Or you can use Ebay at https://www.ebay.co.uk/.

• Buy and sell used clothes

Buying used clothing online has become mainstream in recent times. Young people are proud to say what a bargain they got rather than brag about how much they spent. Vinted (https://www.vinted.co.uk/) is popular. Handbags are a good place to start your clearout – we often have a few that are little used (or is that just me?).

• Sell books and DVDs

A lot of us have a big collection of books we are unlikely to read again. Charity shops are overflowing after Covid and it can be a challenge to get them there. Assuming your books have barcodes (DVDs generally do), you can sell them using a Ziffit app (https://www.ziffit.com/ en-gb/) on your mobile phone – scan the barcode and the price of the book/DVD will pop up or a red ‘no thanks’. Once you have a basket of items, box them carefully and either a courier will collect them or if there’s a small amount, take your package to a locker – often in a shopping centre or petrol station. Money will then be put in your Paypal or bank account. I have used this successfully a number of times.

The CSPA continues to campaign for a decent retirement income for all. But we hope these tips might come in useful.

Money

SUMMER ISSUE 2024 | The Pensioner 11

Has WASPI won?

David Hencke on the implications of a key report

Will 3.8 million women born in the 1950s finally get some compensation for the sixyear delay in getting their pensions? The Parliamentary Ombudsman’s long-awaited report in March found there was partial maladministration by the Department for Work and Pensions in its communications to these women about the delay in their pensions. It should in theory mean some compensation for them.

The issue has been a running sore between 50s women and government for more than a decade and the ombudsman took an inordinate time – seven years – to complete the investigation.

The situation has been complicated by the fact that the people campaigning for action hardly talk to each other. And the DWP has been hostile about compensating these women from the beginning.

Women Against State Pension Inequality (WASPI) – which has about 185,000 members – decided to go to the Parliamentary Ombudsman on the grounds of maladministration. According to Angela Madden, who leads the WASPI board, the aim was to get between £10,000 and £20,000 each.

Despite favourable headlines last month, they have only been partly successful. Rob Behrens, the outgoing ombudsman, found maladministration for about 28 months of the 15-year notification period, and decided to leave the final award to Parliament because of the intransigence of the DWP to any deal. His guideline for an award works out at between £1,000 to

£2,900 each for women, some of whom lost more than £40,000.

A more radical campaigning group, Backto60, went to court on grounds of past discrimination against women and maladministration. They won the case for a judicial review, were rebuffed by the High Court and Court of Appeal, and the Supreme Court declined to hear their case, saying it was “out of time”.

The campaign goes on

The organisation has now morphed into CEDAWinLAW (named after the UN Convention for the elimination of all forms of discrimination against women and girls, which Mrs Thatcher signed up to in 1986) then applied for a second judicial review. This was to force work and pensions secretary Mel Stride into mediation talks after he refused to do so. Their case was that he had acted unlawfully in refusing mediation. Unfortunately, lack of money has led to legal action being postponed, though the group has had support from the committee running the UN Convention in Geneva to continue the fight.

Mr Stride went to Parliament before Easter to respond to the report. He promised no “undue delay” but he had to have time to study the findings in detail.

He was backed to an extent by shadow work and pensions secretary Liz Kendall, who also wanted to study the report. Both are aware that even at £1,000 per person,

they are talking about a £3.8 billion settlement and nearer £11 billion for a figure of £2,900 per person.

Labour is aware money will be tight if they win the next election. Mr Stride is also having to pay billions of pounds to existing pensioners because of errors calculating their entitlement over the years.

The government does not have to accept the ombudsman’s guidelines as he has no power to force them to do so.

Mr Stride faced a polite if critical reception from his own Tory backbenchers, the Democratic Unionist Party and Scottish National Party – not a single MP defended his position of delaying a decision for long.

Tory backbenchers, whether representing Scunthorpe – a Red Wall seat –or Stroud, pressed him for early action.

The Tories are particularly worried since the people involved are in the age group with majority support for the party – to alienate them would be fatal.

An upcoming general election is the best chance these women have of getting some money, given that WASPI is already putting pressure on the government for an announcement.

Many of the women, however, think the level of compensation is pitiful – especially if they’ve lost large sums of money. Some have had to sell their home, others are in bad health. One, Marie Greenhalgh, a presenter on Wythenshawe FM radio, told me: “If I get just £2,900, I shall convert all the money into one pound coins and throw it through the gates in Downing Street.”

Campaign

SUMMER ISSUE 2024 | The Pensioner 13

Do the right

Poor communications about pensions policies and people’s financial entitlements at retirement was a recurring theme at the TUC’s annual pensions conference.

The conference was, coincidentally, held the week before publication of the Parliamentary and Health Service Ombudsman’s decision on the longrunning WASPI (Women Against State Pension Inequality) case, which argued that women were not properly informed of the rise in state pension age from 60 to 66 to bring them into line with men.

The Ombudsman agreed with WASPI and ordered the government to “do the right thing” and pay them compensation –see https://www.ombudsman.org.uk/ publications.

Evidence that state pension provision is unfair to many – including women and people with disabilities and from ethnic minorities – was given by several speakers, as well as attendees themselves.

Keynote speaker Liz Kendall, shadow work and pensions secretary, pledged that a pensions and savings review by a Labour government (announced by shadow chancellor Rachel Reeves in January) would cover state and private pensions as well as pension fund investments. This was warmly welcomed.

Kendall said the review was “absolutely vital” as two decades after the Pensions Commission was launched – “when the coalition government introduced Labour’s policy of auto-enrolment” –progress had stalled. “Financial security in retirement is at the heart of our future plans,” she added.

The review will also look at barriers to UK pension funds investing more in the UK – an issue touched on in later sessions, including the final one about the role of pensions in infrastructure investment.

Commenting on Chancellor Jeremy Hunt’s recent Budget, Kendall said that it

had left eight million pensioners £1,000 a year less well off. And the £46 billion plan to scrap National Insurance contributions begged the question: how would pensions be paid for?

TUC assistant general secretary Kate Bell told delegates in her welcome speech that the TUC would support Labour’s pensions and savings review, and also the idea of a new Pensions Commission.

The TUC had five priorities for any incoming government, she said:

• Tackle under-saving by getting more low-paid workers into work-placed pensions and raising employers’ contributions

The TUC will support the idea of a new Pensions Commission

• Address “shocking levels of inequality that mean women’s pensions... are 40% lower than men’s and that black and minority ethnic and disabled workers face alarming pension gaps”

• Keep going with the triple-lock

• Increase the state pension – “the main source of income for most pensioners”

• Reverse and re-open defined benefit schemes.

Role of the state pension

Jan Shortt, general secretary of the National Pensioners Convention, which has joined Unite and the Scottish Pensioners’ Forum in the 68 Is Too Late campaign, chaired the session. She said the NPC had been calling on the government for some years for “a national debate” on pensions.

Caren Evans, national officer of Unite, said the union had carried out a survey among 10,000 members across different sectors, including health and construction,

asking if people thought they could work until they were 68, and if not, why not.

In response, many said they didn’t believe they would be able to work past 66, for physical or mental health reasons.

Chris Brooks, head of policy at Age UK, confirmed: “State pension age has a bad impact on people on low incomes. We need to look at how we can mitigate the impact on people who are struggling to keep working, particularly those in disadvantaged groups who can’t work.”

He warned: “‘Pensioner poverty is not going away.” It still affects two million pensioners, particularly groups such as people with disabilities, ethnic minorities, single older women and those renting their home.

His personal view was: “We need a national debate about the role of the state pension, how it sits alongside the wider retirement income system, how it works with private pensions and means-tested universal benefits and other forms of income and what value it should be set at.”

Brooks added: “It feels like there’s been a lack of direction. We don’t really know where we’re heading. There’s a lot of debate needed to help us move forward.”

Even the triple-lock will fall short of the minimum retirement income living standard of £14,000 for single people and £22,000 for couples, he said.

Brooks added it was “tragic” that about a third of eligible claimants do not take up pension credit (around 800,000 people) for various reasons – they don’t know about it, it’s too complicated or they are ashamed to apply. A review was needed on how people accessed pension credit.

Sasjkia Otto, senior researcher at the Fabian Society, said the thinktank would soon be publishing a report on its research among older workers. “Older workers are often last in line when it comes to support –which is already in short supply – such as occupational health,” she said.

Conference report

SUMMER ISSUE 2024 | The Pensioner 14

thing!

Not enough employers are investing in hiring and retaining older workers, and many older workers are being pushed into jobs for which they are unsuitable or that make them ill, Otto continued.

The report will call for a broader package of social support to give security for people of all ages and a “rethink” for over-60s. “Some people are going to need access to pension-level benefits before they reach state pension age,” said Otto.

One delegate, who said she lived alone, asked why she was only entitled to a 25% council tax discount and not 50% on the tax paid by a couple. This was “unfair”, and she suggested it could be campaigned on to make older single pensioners’ lives a little easier.

Auto-enrolment: next steps

Patrick Thomson, head of research analysis and policy at Phoenix Insights, said auto-enrolment (AE) reforms had made millions more savers, but 17 million adults in the UK weren’t saving enough for the retirement they expected.

Four groups of defined contributions (DC) savers were of particular concern:

• The financially struggling – 4.6 million people (15% of DC savers) expect a retirement income less than the Pensions and Lifetime Savings Association (PLSA) minimum living standard; and to rent in retirement

• The undersavers – 12.4 million people (40% of DC savers) expect at least the PLSA minimum but aren’t on track to meet their retirement expectations; on middle incomes; current renters who plan to buy before retirement

• The downgraders – 3.7 million people (12% of DC savers) expect at least the PLSA minimum and look on track to achieve what they expect, though that won’t be enough to maintain their preretirement standard of living; mostly middle/higher earners; homeowners

Jenny Sims reports back from the TUC conference Pensions Under the Next Government, held in London on 13 March

• The unsure – 5.8 million people (19% of DC savers) don’t or can’t give an expected retirement income if asked; disproportionally those aged 45-54; expecting to rent in retirement.

As Thomson warned: “Only 14% are happily on track.”

A framework for how and when to increase default workplace contributions was needed, delegates heard. An annual government assessment of whether AE savings levels were achieving decent retirement outcomes was also called for – and if falling short, could contributions be raised?

Tim Pike, head of modelling at the Pensions Policy Institute, said: “Although we have an infinitely more straightforward state pension system, we now have a considerably more complex private pension system under which the concept of a pension has been replaced by a savings pot. Providing practical solutions to help people manage complexity will be crucial to retirement outcomes in future.”

During workshop discussions and the conference’s main sessions, speakers and attendees agreed it was often difficult for people to get clear and detailed information about

their pension savings and entitlements at retirement, particularly if they had had several jobs and contributed to different pension pots. A review was needed.

The conference ended with a discussion on the role of pensions schemes in infrastructure investment. Sir John Armitt CBE, chair of the National Infrastructure Commission, made the case for companies (the risk takers) to invest globally wherever they found the best opportunities.

Conference report

SUMMER ISSUE 2024 | The Pensioner 15

News

A round-up of recent activities in branches and groups around the UK

ENGLISH REGIONS: LONDON REGION

If you are a national CSPA member in London but not receiving group newsletters, you are probably classified as a ‘no group’ member allocated to one of the closed groups in our region, so please read on.

Not being in a local group can significantly weaken your voice in the CSPA’s democratic conduct of its business.

You may wish to come along to the most convenient for you of the two informal meet-up events detailed here. You will be

We can consider the possibility of restarting a local group

able to meet me, and possibly somebody from one or more of the active groups nearest to the venue.

I will take any general questions or thoughts that you may have about the CSPA, we can consider whether there is any possibility of restarting a local group, and also explore the ways in which you might join an existing group if you so wish.

I do not work for JD Wetherspoon’s, but as most people know what to expect in their premises, both events are in their establishments. Both will run from 11:30am for at least an hour. This is earlier than for the informative meetings in Epsom, Southgate and Bexleyheath back in

January, as the venues should be quieter before the lunch period. I will be carrying a copy of The Pensioner, although you may spot me earlier from my distinctive shirt! The meet-up options are:

• Thursday 11 July, 11:30am, The Richmal Crompton, 23 Westmoreland Road, Bromley BR1 1DS. The nearest station, Bromley South, is diagonally opposite the venue. Many bus routes pass nearby.

• Tuesday 16 July, 11:30am, Moon Under Water, 44 High Street, Watford WD17 2BS. The main Watford Junction station is a 10- to 15-minute walk from the venue, but various bus routes are available. Any London council Freedom Pass holders using National Rail from central London should purchase an extension ticket for the leg beyond Harrow & Wealdstone. Or to keep your journey free, switch to the Overground at that station – but watch touch-in/touch-out requirements.

I look forward to seeing you there.

David Owen, Regional Representative

SOUTHERN

Worthing & District

We kicked off 2024 with excellent talks after the main business of the meetings, though urgent scrambling was required to fill gaps when some speakers had to pull out for one reason or another.

We enjoyed a fascinating talk about light and the way we see images in February, with some amazing and infuriating trompes l’oeil. In March we had an Antiques Road Show with a local expert valuing personal valuables (or not). In April, an expert from the National Crime Agency was due to talk about firearms threats.

In the summer, Jo Carr will be making a return visit on 28 June to talk to us about ‘frailty’ – or to put it another way, age resilience.

On 19 July, we will be having an outing to Tangmere Military Aviation Museum, followed by lunch at a local pub.

Then on 16 August we will have afternoon tea at Highdown, which proved popular last year.

On 27 September we will be visited by Air Ambulance Kent,

SUMMER ISSUE 2024 | The Pensioner 16

and group news

Branch

GREATER LONDON

Hillingdon & District

Following our last reported meeting for August, we held an open meeting in September, where there was the usual lively discussion on subjects for future meetings and places to visit.

We considered group circulars and correspondence with our regional secretary on matters that could concern the group, especially on amalgamating groups and/or incorporating members not in an active group to an active one.

The October meeting was also open and there was consideration of a range

We have had some lively discussion on future meetings and visits

of future activities, talks and dining out.

On 15 October two members represented the group at a recital to mark the 300th anniversary of the Abraham-Jordan organ, now in St George’s Church, Southall. The organ was first installed in St George’s Church, St Botolph in the City of London in 1723. On the demolition of that church in 1900, the organ was gifted to the parishioners of St George’s, Southall, who in recent years arranged funding for its full restoration.

In November we had an unusual talk by a local artist on illustrating books for mainly Asian children.

Our December meeting produced a comprehensive talk and slide show by a freeman of the City of London concerning aspects of the administration of the City by the Common Council and Ward

Sussex. And on 27 October there will be something a bit different, with the Sing Out Sisters choir performing.

We will round off the year on 29 November with a talk from the local Coastwatch. And our Christmas lunch is scheduled for 13 December – the committee is researching venues.

We are still being spoiled with beautiful water colours and humorous cartoons from our talented member Trevor Andrews, circulated weekly to the group electronically. If anyone would like to give us a presentation next year, or knows someone who

might, please contact the chairman. We meet on the last Friday of most months in the Durrington Community Centre and warmly welcome new members or one-off visitors, who would just pay a £3 attendance fee. Any general queries can be addressed to the chairman (details below) or any membership issues to Marion Tarbuck at marion.tarbuck@ gmail.com or on 07904 14184.

Chair: Frank Jones, 19 Saltings Way, Upper Beeding, West Sussex BN44 3JH Tel: 07500 478097

Email: francisjgjones@hotmail.com

representatives and Aldermen. We also heard about the background to the 42 Livery Guilds and the Guild Halls, their history and activities today, often different from their historical purposes.

The start of 2024 involved the chair telling members about recent events in the CSPA over the past 15 months, to show members the benefits we have, plus the need to take CSPA aims out to the wider public, especially to potential parliamentary candidates.

Our Winter Lunch on 17 January was held at the Crown & Treaty, an ancient coaching inn situated on the Uxbridge boundary with Bucks on what used to be the main London to Oxford highway.

The February meeting heard an informative talk from two local Macmillan support centres on breast and prostrate cancers. The speakers discussed what people should do to reduce the chances of contracting either condition.

In March we had another interesting, and at times amusing, talk by a magistrate from the local courts.

Our group AGM was set for April and a report will follow.

John Echlin, Chair

Kingston Upon Thames & District

We meet the last Tuesday of the month (except July, August and December, when we go out for a Christmas meal) in Marion Hill House, Tadworth Avenue, New Malden KT3 6DJ. We are close to bus routes including 213, 152, 265 and K1, and a 10- to 15-minute walk from New Malden train station. There is limited parking at Marion Hill House.

Our meetings are from 2pm to 4pm including tea, coffee and biscuits on arrival. We discuss issues relevant to the CSPA and wider issues of concern to pensioners. We then usually have a talk.

Recent speakers have covered subjects ranging from the War Graves Commission, the Bugatti Queen, Elvis Presley, and the St James’s area of London. They have all been very interesting.

New members will be very welcome. If you are interested in attending a meeting or would like more information about our group, please get in touch with us using the contact below.

Business secretary: Marion Williams

Email: williamsmarion408@gmail.com

Branch and group news SUMMER ISSUE 2024 | The Pensioner 17

AviationPhotographer, CC BY-SA 4.0

Sea Vixen FAW.2 XJ580 at the Tangmere Military Aviation Museum

East Solent

The East Solent Group continues to hold well-attended meetings on the second Wednesday of each month between 10am and 12 noon at St Faith’s Parish Church, Bulson Hall, Victoria Square, Lee-on-the-Solent PO13 9NF. There is level access and free parking, and the X5 bus route is nearby.

We have a range of talks, one each month during the year, usually with a musical interlude at Christmas with a choir. Talks this year will include:

• Water, slaughter and trade – a history of Southampton

• The life of Sir Laurence Olivier

• Signing 4 Fun

• Shining Light Singing Group

SOUTH WEST

Bath & District

We have taken the painful decision to close our group. This is due to a number of factors, but principally falling numbers and our inability to recruit new members to take over the running of the group.

Our final meeting will take place on 18 June at the Hare & Hounds in Bath from 2.30pm to 4pm. We hope to issue our final newsletter as soon as possible following the meeting. I would like to thank all those who have supported our group over many years, and a special thanks to our committee who have devoted their time and efforts in keeping the group active in difficult times.

Chair: Alf Riley, 43 St Clements Court, Chippenham SN14 0JF Tel: 01249 323 755 Email: rly347@aol.com

East Devon

Our AGM was held on 22 April at St Sidwell Community Centre, Sidwell Street, Exeter, where motions for the October conference were considered and elections for chair, secretary, treasurer, membership secretary and committee members took place.

• A Midsummer Special

• Christmas and other problems

• Christmas entertainment.

We also arrange a summer lunch and a Christmas lunch and trips throughout the year, including gardens, Christmas markets and short seaside breaks. After our monthly meetings some of us adjourn to a local pub or restaurant for lunch, to which anyone is welcome.

In March we held our AGM and were pleased to welcome National Treasurer

In December last year we merged with Gosport North Group

Our local newsletters are sent to all in our group and produced by Clive Roberts (secretary), who has done this excellent work for years.

Les Calder, our chair and Executive Committee member for the South West, recently attended the National Pensioners Convention biennial conference near Stafford as a delegate for the CSPA. He spoke to support the necessity of maintaining an acceptable bus service and the essential funding required.

As an EC member, Les has also been involved in attending working parties concerning the regional group structure and future AGM issues, which he chaired.

When the position of CSPA Vice Chair became vacant, Les was nominated for

Mike Sparham as our guest speaker. On 1 December last year we merged with the Gosport North Group, and we welcome any members of that group to join us.

Secretary: Alan Shepherd, 92 Hunts Pond Road, Southampton SO31 6QW

Email: shepherdalan23@yahoo.co.uk

Mob: 07895 787704

this position by groups in our region. However, Northern Ireland Branch treasurer Roisin Lilley was elected. Our general meetings, to which all are invited, are held in Exeter as notified by newsletter. Our officers/ committee currently comprises only six individuals – we need more members to be involved and to attend meetings.

In the Spring 2024 edition of The Pensioner (page 7), Les invited members in ‘closed groups’ in our region to an online chat to try and establish contact to enable better representation for those members now without an active group.

This type of online contact is extended here to any in our East Devon area who may be interested in a similar communication session if they get in touch.

Finally, as our local meeting expenses are not met by CSPA HQ, we do need donations from time to time to keep us going.

If any members in East Devon Group or any closed groups would like to support us in this way or if you have any query regarding the CSPA overall, contact:

Les Calder Tel: 01626 830266

Email: landmcalder@btinternet.com or Clive Roberts Tel: 07541 246576

Email: clive.dee.roberts@talk21.com

Branch and group news SUMMER ISSUE 2024 | The Pensioner 18

Bargate gatehouse, Southampton

WESSEX

Exeter Cathedral

NORTH WEST

Greater Manchester

The group meets at the Methodist Central Buildings on Oldham Street, Manchester M1 1JQ. All meetings begin at 11am and finish at 1pm. Meetings for 2024 include:

• Wednesday 12 June (conference motions)

• Wednesday 18 September (mandating meeting)

• Wednesday 23 October (conference report)

• Wednesday 11 December (Christmas lunch, 12 noon)

We also hold a quarterly social event in Stockport, at the Old Rectory, on the first Thursday of each quarter. The next are on 6 June, 5 September and 5 December, all commencing at 12 noon.

It’s that time of the year when the begging bowl comes out. We receive no funds from HQ, so we must raise funds for local expenses, donations and subscriptions to bodies such as the NPC Northwest Pensioners Association and Act for Inclusion. We raise funds by two methods: direct donations and a 200 Club, for which a quarter of what we raise goes to group funds and the remainder is given in prize money. The new annual cycle started in March, but if you join now the cost will be £9 for the remainder of the cycle, with a monthly prize. Donations can be sent to Harry Brett at 46 Severn Way, Holmes Chapel, Crewe CW4 8FT.

The AGM took place on Wednesday 13 March and the following were reelected for another 12 months: Linda

Martin (chair), Pam Flynn (secretary), Harry Brett (treasurer), Peter Sanger (membership secretary).

Contact Harry Brett Tel: 07999 874864 Email: h_brett@sky.com

Liverpool & District

At the group AGM on 4 March, the following were elected: Gillian Hill (chair), Sue Munroe (secretary), Harry Brett (treasurer). The meeting schedule for 2024/25 is:

• Monday 3 June – to determine

Greater Manchester holds a quarterly social event in Stockport

conference motions and decide delegates for the AGM

• Monday 30 September – to mandate delegates for conference 9-10 October

• Monday 2 December – Christmas lunch and short meeting

• Monday 3 March – 2025 AGM

The group meets at 11am at the Geek Retreat, 70 Church Street, Liverpool L1 3AY. We are asking members for donations to group funds – send to Harry Brett, 46 Severn Way, Holmes Chapel, Crewe CW4 8FT or pay direct to: Lloyds Bank, sort code 30-99-50, account 16487962, name CSPA Liverpool.

Contact Harry Brett Tel: 07999 874864

Email: h_brett@sky.com

Wirral

Since the Group AGM on 12 March, the group has reconstituted itself with a new committee. We now have a new minutes secretary (Tina Haslam), membership secretary (Jane Mansell) and two committee members (Cynthia Morgan and Brian McLean).

At our first post-Covid committee meeting on 23 April, a campaign strategy for the general election was discussed at length. Can I appeal to all members to join in this debate at the next meeting at 10am, 11 June, at Upton Victory Hall, Salacre Lane, Upton, Wirral CH49 OTL.

Please note the time. I hope to see as many of you as possible. New members are particularly welcome, as are any returning active members. Please let me know you can attend.

Contact Mike Lawler

Email: mike.lawler@live.com

Branch and group news SUMMER ISSUE 2024 | The Pensioner 19

Ellesmere Canal

Stockport

SCOTLAND BRANCH

We would like to advise members that the following articles were prepared for the editorial deadline in March, for this edition of the magazine. The branch AGM this year was held in the Maldron Hotel, Glasgow, on 25 April and a report will be in the next branch newsletter and the Autumn edition of this magazine.

As you read this, the branch will be in summer recess and hopefully those who registered to go on the summer outing will have enjoyed their visit to the Kelpies, the Falkirk Wheel and Callander House.

Membership issues

Member meetings continue be held at The Griffin, 266 Bath Street, Glasgow G2 4JP (opposite the King’s Theatre). There is an entrance to the private room in Elmbank Street for those not wishing to go through the bar. Meetings are usually held on the first Thursday of February, May, September and November and the start time will remain at 1:30pm.

Please note the next meeting is on the second Thursday of September, which is 12 September.

If you have any membership matters you wish to update, such as change of address, you can contact Michael Kirby by email or phone as listed below.

Branch newsletters have helped keep members informed of matters of interest, especially those in remote areas who cannot attend meetings or have no internet access.

Word of mouth is one of the best ways of recruiting new members, so if you

know anyone who would like to join, please contact Michael Kirby to see if they are eligible – email: Michael.Kirby@ cspa.co.uk or tel: 07969 405263.

Members are also reminded we have a new website: www.cspascotland.org.uk.

Member meetings continue to be held at The Griffin in Glasgow

Special notice

Apologies to any Scotland Branch members who have not received copies of The Pensioner magazine or the branch newsletters. If any member reading this knows of anyone still not receiving these, please ask them to contact CSPA head office on 020 868 8418, giving their name, address and, if known, membership number, as the branch officers are not responsible for the distribution listings held on the HQ database.

Scotland groups

All previously announced, all groups in Scotland are now closed. However, should any members wish to make further enquiries about creating a new group in your area, please contact the branch administrator listed below.

Christine McGiveron, 12 Benmore, Prestwick, Ayrshire KA9 2LS

Tel: 01292 891033

Email: Christine.McGiveron@cspa.co.uk

NORTHERN IRELAND BRANCH

AGM at Stormont

After last year’s 70th anniversary AGM in Belfast City Hall, the venue this year was the Long Gallery in Northern Ireland’s Parliament Buildings (see photos overleaf).

Forty members attended a successful meeting. Having been welcomed by President Alastair Hunter and Chair Stan Blayney, Secretary Tony McMullan presented the committee’s annual report. Treasurer Roisin Lilley outlined the branch’s financial position and current membership levels.

Two guest speakers gave interesting and informative addresses. First, CSPA General Secretary Sally Tsoukaris covered the recent Budget, the triple-lock, pension overpayments, the role of The Pensioner magazine, McCloud judgement and gender provision. She also thanked the Northern Ireland Branch and their representatives for their ongoing support to the CSPA.

Viki Oliveira from the Charity for Civil Servants gave a comprehensive report on the role and function of the charity –including the astonishing revelation that the charity is approached for support every two seconds. Chair Stan Blayney presented her with a £3,000 donation from the branch.

The 2024/25 branch committee was elected. Longstanding committee member Sam Caul, who has served with distinction for more than 20 years, stood down and was presented with a card and gift by President Alastair Hunter.

Branch newsletter

The fourth edition of the branch newsletter was issued to all members

Forty members attended a successful AGM at Stormont

Branch and group news SUMMER ISSUE 2024 | The Pensioner 20 ›

Callander House

in late March. It included articles on: the return of the Northern Ireland Assembly and a warning to politicians not to forget the needs of pensioners; an update on the Department for Infrastructure position on the concessionary fares scheme; the opportunity to appoint a power of attorney; advance details of the CSPA NI AGM; Northern Ireland civil service pension increases; and regular features such as Remember When… and the Specsavers offer.

Included for the first time was a Quick Quiz with two £25 M&S vouchers as prizes. It was very popular indeed!!

Pension increases

Although the government had confirmed that the civil service pension would rise by 6.7% for pensioners in Great Britain, it is not automatically applied to retirees in

the Northern Ireland Pension Scheme as it has its own approval mechanisms.

We wrote to Civil Service Pensions in March seeking confirmation that the 6.7% pension increase would apply to Northern Ireland civil service pensioners. We were grateful to receive written confirmation that this award had been accepted and would be implemented from early April.

Retirement seminars

The Department of Finance, which runs pre-retirement seminars for prospective civil service pensioners, has agreed that material from CSPA NI, setting out what we do and encouraging people to join, will be included in future seminars.

NPC NI Dignity Day

The branch committee was represented at the National Pensioners Convention NI Annual Dignity Day at Belfast City Hospital, where members handed out leaflets about the NPC Pensioners Manifesto to visitors and staff.

Specsavers voucher

The exclusive Specsavers deal continues to be very popular. To date 176 members have requested a £20 voucher – saving members overall a total of £3,520.

Annual membership fee renewal

The branch is keen that members pay

AGM 2024: Ireland’s newly elected committee (left) and (above l-r) the branch’s president, treasurer, chair and secretary

their annual membership fee via their civil service pension as it saves CSPA NI both time and money. Any member who does not pay via their civil service pension should have received a membership renewal letter from membership secretary Roisin Lilley,

Please encourage your retired civil service friends to join

advising them that their membership fee is now due. Our fee is unchanged from last year, at £18 a year.

Please note that if you have travel insurance, it is invalidated if you are not a paid-up member of the CSPA. Please contact Roisin at roisincspa@ gmail.com if you did not receive a letter or not yet paid.

Membership numbers

The current membership stands at a steady 3,740. However, we could always do with more. It strengthens our hand when making representations to Civil Service Pensions Branch, government departments and service providers. Please encourage your retired civil service friends or family to join. Go on, you know it makes sense.

Branch and group news SUMMER ISSUE 2024 | The Pensioner 23

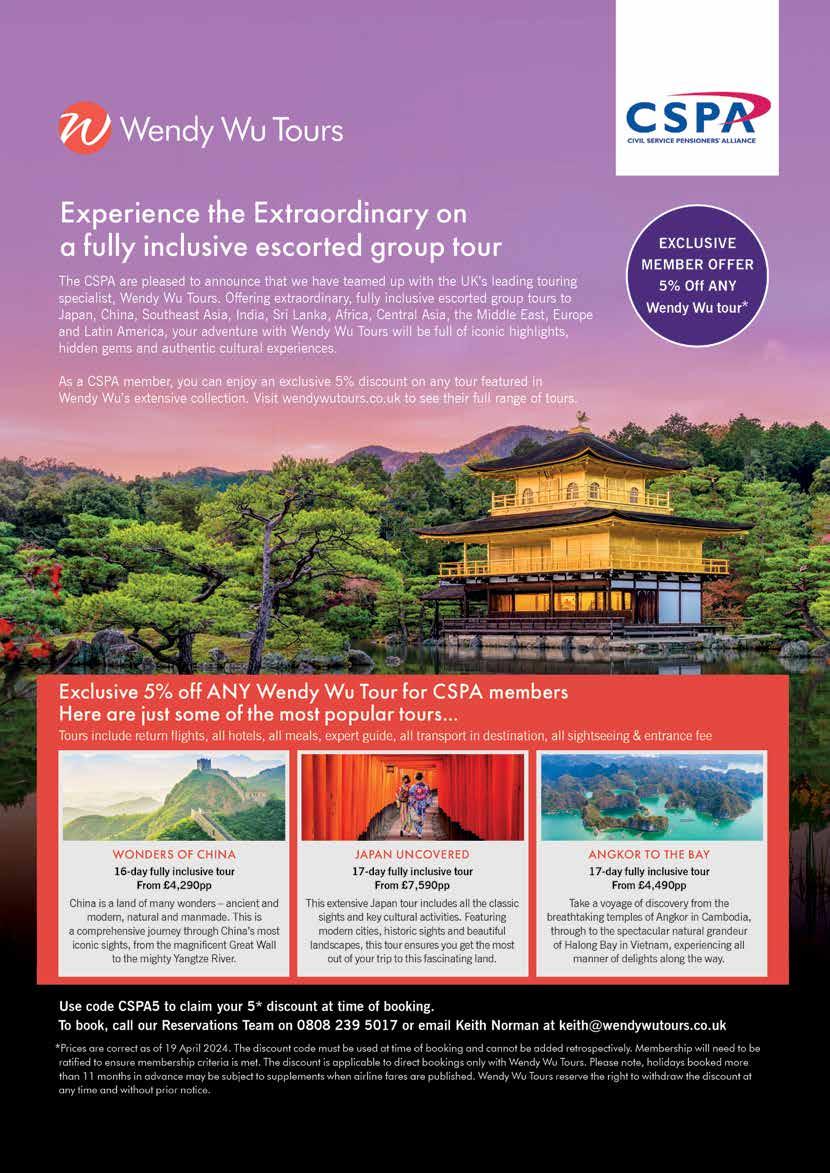

Holidays with a silver lining

There are more options than ever for over-50s wanting to get away, but for those looking for value for money, Helen Nugent has some words of warning

Is age just a number when going on holiday? With the over-50s’ desire for travel strong, and the proportion of solo tourists within that demographic on the rise, travel companies have cottoned on to the power of the silver pound.

Where once Saga dominated the over-50s market, today there are offerings from many firms, all keen to provide the older generation with never-to-be-forgotten trips. And it’s a sector that shows no sign of decline.

A recent survey by Saga found that 39% of people expect to travel more in 2024, rising to 43% for those aged between 50 and 69.

According to Saga’s Travel Trends 2024 research among its customers, 56% of respondents are already holding at least one booking for 2024, but they expect to take three holidays.

As to preferred destinations, about a third have signed up for an ocean cruise. And while two thirds are planning a home break this year, European city getaways are also in vogue.

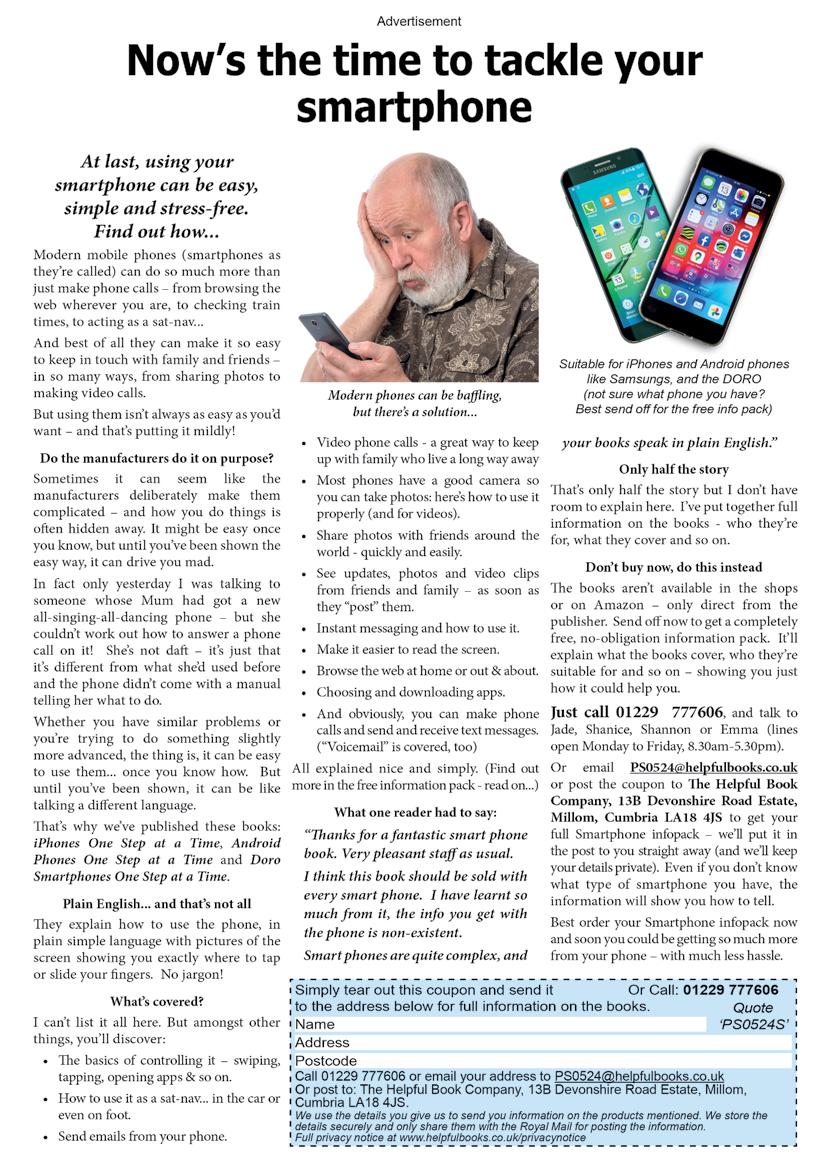

But are holidays for the over-50s good value for money? An all-inclusive cruise may sound appealing and a guided city tour with pre-booked hotels seems hassle-free, but these kind of travel deals sometimes have hidden charges.

Then there’s the single supplement – the bane of many people who travel solo. Let’s take a closer look at what you get for your money.

First, it’s helpful to clarify just what constitutes an over-50s holiday. Tim

Williamson, customer director at Responsible Travel, has some ideas. Year-on-year, his travel company has seen a 22% rise in bookings for its over50s range of trips.

“For me, holidays when you’re over 50 are about opportunity,” he says. “If you’re fit and want a challenge, more active adventures shouldn’t be shut off. Perhaps the kids have left home, or you may have retired and you’re ready for a new adventure of your own. We’ve seen a rise in trekking, kayaking and wildlifetracking tours among the over-50s.

“Others prefer a cultural tour but may want to explore a place differently –swapping a coach trip for a cycling tour, a luxury cruise for a small ship tour.”

Steve Parker, product development director at Staysure, a travel insurance provider for the over-50s, agrees that

“If

you’re fit and want a challenge, active breaks shouldn’t be shut off”

individuals are no longer defined by their age when booking holidays – but they know what they want.

“Many individuals over 50 prioritise relaxation and leisure during their holidays, opting for activities such as beach vacations, spa retreats or cruises to unwind and de-stress,” he says. “With more time and resources available post-retirement, they often seek

opportunities for cultural exploration –visiting historical sites and museums or experiencing local cuisines.

“While some prefer relaxation, it’s clear there is a huge appetite for adventure and travel among all age groups, especially since the pandemic.”

Value for money

But while the appetite for adventure is alive and well among the over-50s, so is the ambition for good value for money. Setting a realistic budget is key, as is choosing a destination that matches this in terms of accommodation and the cost of living.

Take advantage of being able to travel during off-peak periods. By avoiding school and national holidays, travellers can snap up last-minute deals and discounts. But it’s also important to plan ahead – or have a checklist if you do decide to book at the eleventh hour.

If you prefer to take your time though, don’t leave important things such as booking accommodation, transportation and activities too late.

Last-minute offers can be beneficial, but so is thinking ahead, as Becky O’Connor, director of public affairs at online pension provider PensionBee, explains. “Making reservations in advance can help to secure the best deals and provide a wider range of options,” she says. “Travellers should also ensure they’re aware of any travel restrictions, such as visa requirements and entry regulations for their destination, to ensure they

Travel

SUMMER ISSUE 2024 | The Pensioner 24

Holiday snap: five-day cruise

We asked someone who had paid for a specialist over-50s holiday whether they found it good value. Journalist Jan Orchard and her partner chose a fiveday Saga holiday to see if they liked it, and also in the hope that it would be stress-free – Jan’s partner had had a stroke and was liable to wander off.

She says: “Sapphire was an old ship but very comfortable and with brilliant service. Since then, we have travelled several times on their fab new ship, Discovery, to Norway, the Canaries, Bordeaux and the Scottish islands.

aren’t denied entry or face other complications on arrival.”

She adds: “Considerations should be made for health and accessibility concerns. Choosing destinations and activities that accommodate physical limitations or health issues is crucial for a comfortable and enjoyable trip.”

Meanwhile, hidden ‘extras’ abound on all sorts of holidays. Common add-ons include gratuities, excursions, food, drinks and internet access. So scrutinise the small print before signing up.

And if you’re a solo traveller, you’ll need to have your wits about you. In many cases, a premium surcharge is applied to someone holidaying alone.

Accommodation vendors argue that single travellers should expect to pay for the luxury of having a room to themselves, while other firms justify the ‘single supplement’ because people on

“It’s good value because everything is included – a private car to the ship, all drinks, meals and gratuities, though

All aboard: Geirangerfjord, Norway (centre) and Puerto de Mogan, Gran Canaria (bottom)

their own are thought to spend less on food, drinks and entertainment.

So, if you’re over 50 and embarking on a solo trip, do your homework.

Saga’s data shows a big increase in solo travellers booking holidays in 2024 (20% of its customers plan to travel alone this year) and some travel companies don’t penalise single men or women.

Travel insurance

Another key cost issue is travel insurance. Traditionally, the older you are, the more expensive the policy, but there are good-value deals if you know where to look – and what to look for.

“Begin by evaluating the coverage limits across different aspects, such as medical expenses, trip cancellation and baggage loss/delay,” says Parker from Staysure. “Ensure these limits are suitable for your requirements and the

you can tip if you want to. Prices look higher than other cruise lines, but if you add in the drinks and everything else, it evens out. There is no extra charge for the specialist restaurants.

“Also, the Saga ships have big, comfortable cabins with balconies and room service included. It is a completely stress-free holiday, especially if you are travelling with someone disabled.

“I would say the entertainment isn’t great, but there are good crafts sessions, a nice spa, a library and very nice food. Excursions are included, and tend to be of the coach party type, but give a snapshot of the destination. There are also chargeable excursions that are a little more active.”

destinations you plan to visit. And for older travellers, adequate coverage for medical expenses, including repatriation, is very important.

“Ensure the policy covers preexisting conditions, as well as any exclusions or specific criteria that may apply. It’s essential to ensure the policy aligns with your unique medical needs.

“Consider the duration and frequency of your trips. Some policies impose restrictions on trip length or the number of days per trip.

“And be mindful of any age-related restrictions on the policy, as certain insurers impose limitations or shorten trip durations for older travellers.

“Carefully review the policy’s exclusions and limitations to understand what is not covered. This includes activities, sports and geographical restrictions.”

Travel

SUMMER ISSUE 2024 | The Pensioner 25

Happy holidays!

As summer approaches, David Luxton points us towards a new travel insurance scheme

Mungo Jerry captured the spirit of summer in 1970 with a one-hit wonder, In the Summertime.

It’s a summer I remember well as I’d just left school and moved to London to start my first job in the civil service in the DHSS. Ted Heath had just been elected prime minister –though he too turned out to be a onehit wonder. After a difficult few years, he lost the February 1974 election to Harold Wilson and returned to his passion of sailing.

Fifty-four years on, the Mungo Jerry song still evokes feel-good nostalgia, especially after such a soggy spring. But even the rain-sodden spring had a feelgood factor. During the local government and mayoral elections in May, the prime minister and the leader of the opposition both committed to retaining the state pension triple-lock for the five-year duration of the next parliament.

Clearly aimed at the pensioner vote, but welcome news nonetheless, it ensures the safeguard for state pension increases each April based on the higher of inflation, average earnings growth or 2.5%. The commitment meets a key demand of our Standing by Pensioners manifesto, launched in the House of Commons in November 2023 with our partners in Later Life Ambitions (LLA).