JULY – SEPTEMBER 2025

JULY – SEPTEMBER 2025

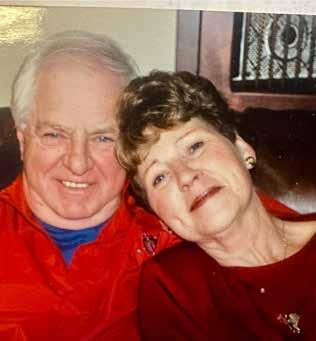

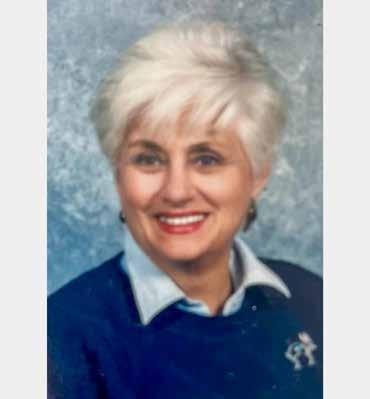

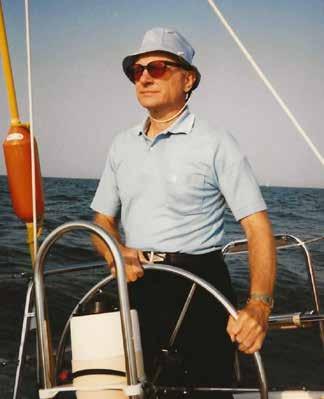

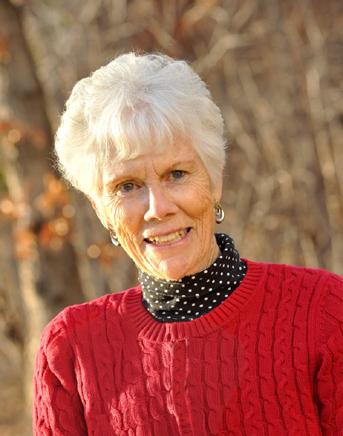

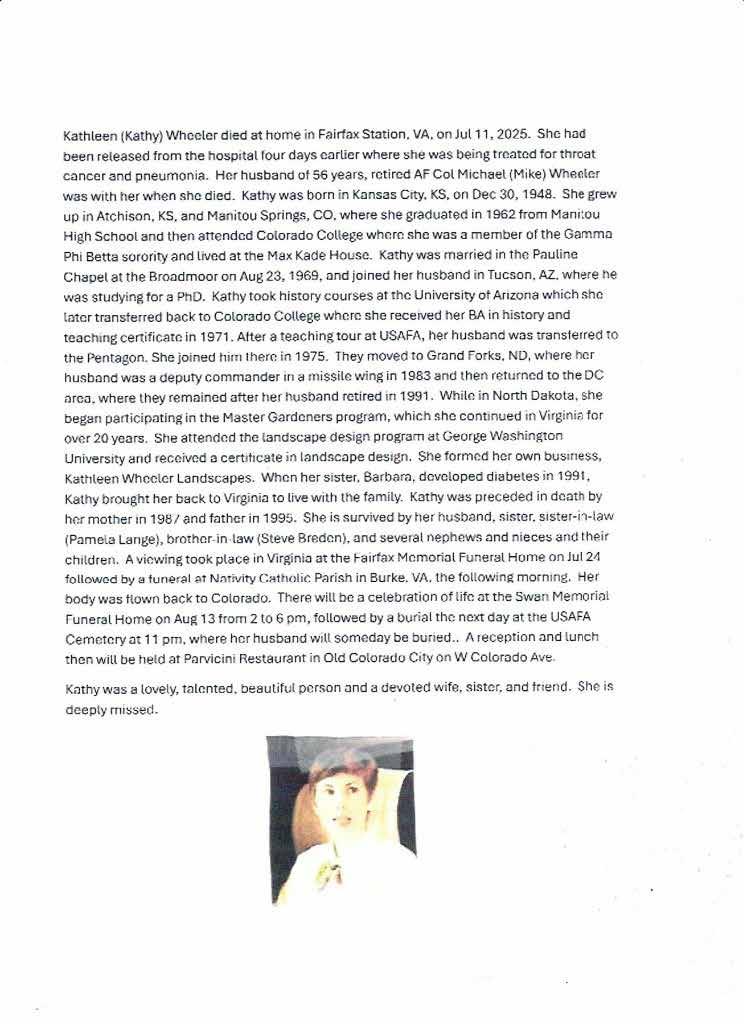

OBITUARY & REMEMBRANCE

TRIBUTE

during a family’s time of sorrow, we want to reflect on the lives of those who have recently passed. the Gazette offers this special quarterly feature to commemorate and honor those we have lost.

this edition provides a list of obituaries and memorials placed in the Gazette July 1 – September 30, 2025.

Tradition is meeting innovation in today’s memorial practices, proving that even life’s final chapter can be reimagined. Today’s funerals bear little resemblance to those of the past. According to the National Funeral Directors Association, cremation surpassed traditional burials as the preferred method of laying the deceased to rest in 2015. That trend continues today, with the estimated cremation rate in the United States in 2024 at 61.9%, and the burial rate estimated at 33.2%.

The tone of funerals has also changed, with many opting to host a celebration of life characterized with bright colors, upbeat music and even laughter as loved ones remember treasured moments together.

A newer, somewhat surprising trend is not waiting for a loved one to die before officially celebrating their life. Known as living funerals, these highly customized ceremonies are actually overseen and attended by the to-be deceased. Technology is taking a more dominant role in memorials. Streaming services, virtual memorials and online tributes make it possible to pay one’s respects without traveling. Digital tools make planning the funeral or celebration faster and more convenient.

Perhaps one of the most significant changes is an environmental focus. Biodegradable polymer urns are available that release nutrients into the Earth. Tree pod burials involve wrapping the individual in an organic fiber buried where a tree will be planted. While such green options are increasingly popular, they are not yet available everywhere and must follow stringent requirements.

Water cremation, also known as alkaline-hydrolysis or aquamation, is

becoming more common because of its low-carbon footprint. Although it is far from a frequent form of disposition, it is gaining popularity and legal acceptance. Among other environmental benefits, it offers 90% energy savings over fire cremation. Of course, cost is often a key consideration. Unless the deceased’s family is wealthy, they will likely rely on the proceeds of existing life insurance policies to cover costs.

According to the NFDA, the median cost of a funeral with viewing and traditional burial in 2024 was $8,300. Cremation is less expensive, which helps to explain its growing popularity. But there are other expenses to consider. These include cemetery plots, headstones, flowers, musicians, transportation and obituaries.

The face value of life insurance policies varies greatly depending on a family’s financial situation. At minimum, financial advisors will typically recommend that a life insurance policy be purchased with a death benefit to pay for final expenses. These smaller policies, which average $5,000–$25,000, are designed solely to cover necessary costs without financially burdening family. Smaller whole life policies can accomplish the same goals. Neither, however, do much to help survivors sustain a standard of living following a death.

Determining exactly how much life insurance you and your loved ones need and the best form of coverage can be challenging, especially considering there are more options today than ever. But, with the help of an experienced life insurance agent, the process is not overwhelming. While funeral practices are in flux, one thing remains the same: a life insurance policy can help loved ones meet expenses. ❦

television storylines featuring authentic end-of-life experiences significantly increase viewers’ willingness to initiate conversations about mortality, according to new research released recently from end Well. the comprehensive study, conducted in partnership with uSc’s norman Lear center Media Impact Project, reveals that viewers exposed to realistic portrayals of death and dying were dramatically more likely to take concrete actions — from drafting advance directives to discussing care preferences with loved ones.

“We knew that while 90% of americans say talking about end-of-life care is important, only 27% have actually had these conversations,” said dr. Shoshana ungerleider, founder and board president of end Well. “research also shows that ongoing dialogue — not just documentation — leads to care that truly reflects someone’s values. Our new research demonstrates that thoughtfully crafted television content can make a huge difference in people’s willingness to talk about their wishes and begin planning for the end of life.”

Viewers who watched end-of-life storylines from “a Million Little t hings” and “ t he Gentle a rt of Swedish d eath c leaning” were significantly more likely to:

• Initiate conversations about end-oflife topics.

• Seek additional information about care options and advance planning.

• Share locations of important legal and financial documents.

• draft or update advance directives and legal documents.

• Help aging parents with decluttering and legacy planning.

• discuss specific care preferences and medical decisions.

“When people see death and dying portrayed with honesty, humor and compassion, it gives them permission to begin the conversations that matter most,” said tracy Wheeler, executive director of end Well. “ television isn’t just entertainment — it’s a rehearsal space for real life.”

t he research identified three key elements that make end-of-life storytelling effective:

1. Real life reflected: a uthentic portrayals showing supportive communities helped viewers envision how to offer or receive care with compassion and dignity.

2. Humor included: Strategic use of humor made difficult topics more accessible and relatable.

3. Grounded in expertise: collaboration with medical and psychological professionals ensured both accuracy and authentic emotional responses during life’s most vulnerable moments.

J.J. duncan, producer of “ t he Gentle a rt of Swedish death cleaning,” said: “ before grief leveled my world, I was funny. Laughing is my favorite. If we could bring levity to this dark topic that was so very taboo in people’s minds, then we could help others with handrails as they walked their own paths of grief.”

a s the legal and ethical landscape around end-of-life care continues

to evolve, the findings suggest that entertainment industry partnerships could significantly advance public health goals around advance care planning and mortality literacy.

About the research

t he study examined viewer responses to end-of-life storylines from two popular shows: the series finale of “a Million Little t hings,” featuring Gary’s terminal diagnosis and desire to die with dignity, and “ t he Gentle a rt of Swedish death cleaning” episode about Shana preparing for death after a stage 4 lung cancer diagnosis. Participants were randomly assigned to view either the end-of-life storylines or control clips from the same shows without mortality themes.

“Storytelling has the power to transform how we die,” said dr. u ngerleider. “ t hrough honest, nuanced portrayals of end-of-life experiences, popular culture can help build the emotional and practical literacy we need to care for ourselves and each other in our final chapters.” ❦

More than half of a mericans care about the mark they leave on the world (54%) — and even more about the impression they leave on their loved ones (80%), according to new research.

a survey of 2,000 adults found that over half of a mericans say they want to leave a positive legacy on this earth, and their age may be a factor.

t he survey explored how getting older has shifted people’s mindsets, finding that eight in 10 have noticed a difference in the way they think as they age (82%).

One respondent shared that they no longer “sweat the small stuff,” while another realized that “time’s the real currency” — one shared they are making a point to “fit more in life each day.”

Embracing appreciation with age

a s they have gotten older, 61% appreciate little things more and 53% take the time to savor good moments.

Half of the respondents appreciate the beauty in life more (49%) and a similar percentage ensure that they make every day count (45%).

t he survey conducted by talker research on behalf of ethos found that the average a merican thinks about getting older about five times a week — although one in five revealed they think about it at least once a day (18%).

When they think about aging, the top goal that comes to mind is remaining close with friends and family (50%) above all.

Other common desires are wanting to watch their family grow (42%), leaving things behind for their loved ones (36%) and leaving their family in a good financial place (35%).

a majority of people surveyed have received a sentimental item passed down from a family member (58%) — naming “a vintage family photo album,” “a handmade quilt passed down from my mother remind(ing) me of her warmth and care,” and their “great grandfather’s watch … He carried it in wartime and it is engraved.”

to carry on the tradition, 59% will leave something behind for their family, with those who are currently parents being more likely to do this (68% vs. 45%).

However, just half admit they have had “the talk” with their loved ones about what happens when they are gone, with parents being more keen on this (56% vs. 41%).

“Just 45% of adults revealed they’ve spoken about their ‘last wishes’ with a loved one,” said n ichole Myers, chief

underwriter from ethos. “Parents particularly expressed a bit more worry. but whether or not you are a parent, it’s a good time to start thinking about your ties to the people around you and the legacy you want to leave for them.”

What sparks the conversation a lthough difficult, this conversation was sparked by natural aging (44%) and the process of preparing their will (33%).

t hose who avoided the conversation about the end of their life with loved ones said it is because they do not want to think about it (28%), it has not come up naturally (25%) or because they do not think it is time for that conversation yet (25%).

On average, respondents think conversations about what happens after their passing should happen at about 53 years old, but half think it should happen sooner (52%).

While many are thinking ahead, nearly two-thirds of those surveyed do not have a working will (65%), including about half who are seniors.

While parents are more on top of it (41% vs. 25%), there is still plenty to learn.

Six in 10 who do not have a will said that having more education on how to begin or the steps to making a will would encourage them to begin creating one (58%).

“ t he average a merican mistakenly thinks it takes about eight weeks to wrap up the legalities after a loved one passes away — and that is a significant underestimate,” said Myers. “Proper education for how to handle end-of-life proceedings is important. So many are under the impression that it’s a quick process, and the reality is that it can take up to 15 months. to help keep things moving smoothly, people should feel comfortable discussing their wishes with family and friends. Keeping everything organized in an estate plan or a will can help.”

What will respondents leave behind for their families?

• Money

• Inheritance

• a car

• Jewelry

• Heirloom furniture

• Sports card collection

• House

• Lasting memories

• Strong values

• Stocks

• Pictures

• Life insurance

• a rtwork

• Sword collection

Survey methodology

talker research surveyed 2,000 general population a mericans; the survey was commissioned by ethos and administered and conducted online by talker research between July 23 and July 28. ❦

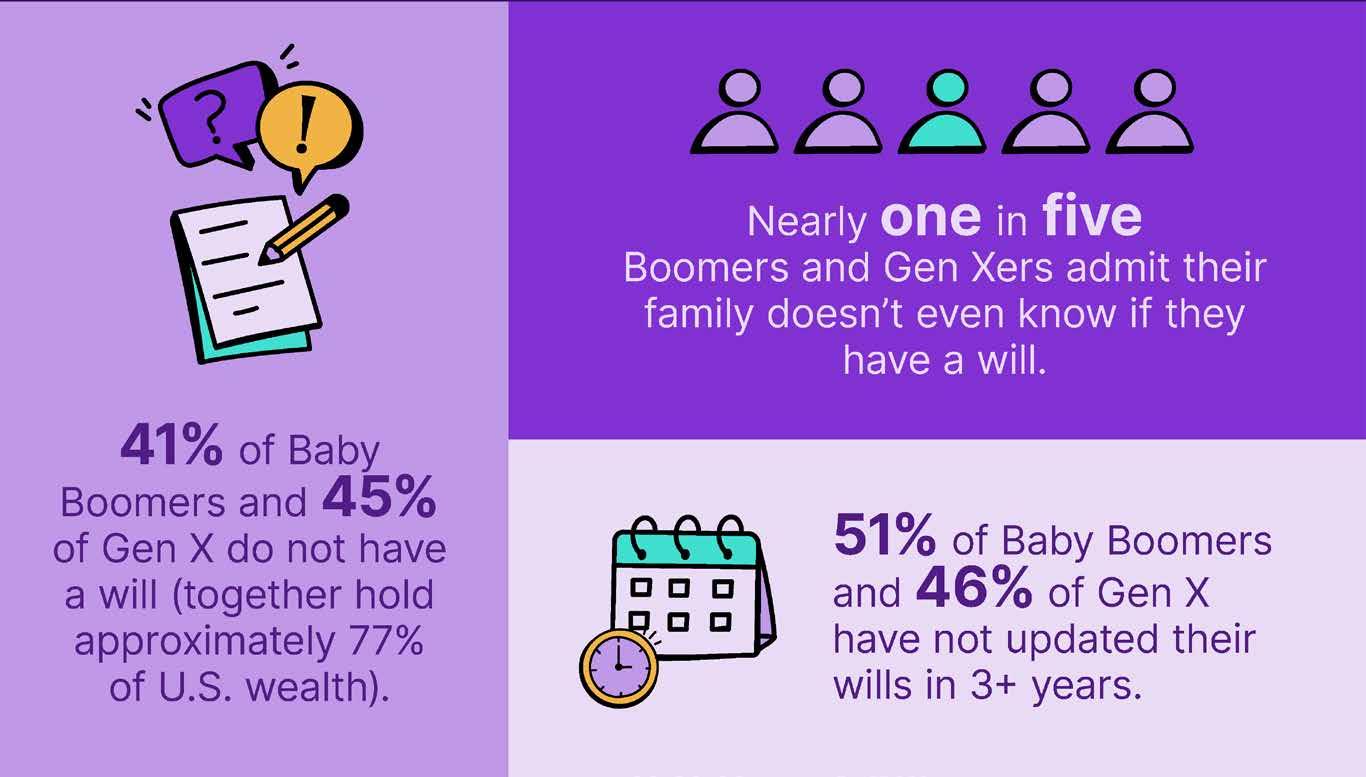

t he largest private asset transfer in history is facing a significant hurdle, as a new LegalShield study reveals nearly half of baby boomers (41%) and Gen Xers (45%) do not have basic estate planning documents like a will.

LegalShield’s annual Make- a -Will Month consumer survey finds a mericans are not having important conversations about estate planning, setting the stage for possible lost value and family conflict.

t his lack of planning by older generations leaves their Millennial and Gen Z heirs with significant and possibly costly uncertainty as a historic $84 trillion wealth transfer builds momentum expected to carry beyond 2045.

t his lack of planning also sets the stage for something most millennials dread: family conflict.

“ t he greatest risk to this $84 trillion wealth transfer isn’t taxes — it’s silence,” said Warren Schlichting, LegalShield ceO. “a n estate plan is essential, combined with open dialogue. Without planning and

conversation, a mericans risk trading family fortune for family feuds.”

t he LegalShield survey of over 1,000 u.S. adults, conducted in June 2025, underscores the high stakes of this transfer, revealing that a clear majority of the next generation — including 63% of millennials — is already counting on an inheritance.

even when estate plans exist, the study found a wall of silence can be just as damaging as having no plan at all.

• n early one in five (19%) baby boomers and Gen Xers admit their family doesn’t even know if they have a will.

• t he silence is mutual: 42% of millennials and Gen Zers expecting an inheritance have not discussed it with the person leaving it to them.

• a key result is anxiety: t he top inheritance-related fear for millennials is emotional, not financial. Fifty-eight

percent of millennials fear family conflict more than financial fears such as taxes.

t he study reveals a critical failure to plan among the generations holding the most wealth.

• Forty-one percent of baby boomers and 45% of Gen Xers — the two generations holding approximately 77% of u.S. private wealth according to the Federal reserve — do not have a will.

• a mong those with wills, many are dangerously out of date: 51% of baby boomers and 46% of Gen Xers have not updated estate planning documents in more than three years.

the pressure is especially high for Gen Xers, who are caught in the unique position of expecting to inherit from their

parents while also planning to leave wealth to their children. this “sandwich generation” role fuels their financial anxiety.

One more dimension adds to the unease: 78% of Gen Xers report uncertainty about the economy, making them more concerned about protecting their assets.

“the silence between generations jeopardizes far more than just financial assets,” said Wayne Hassay, a LegalShield provider attorney. “People think estate planning is only about who gets the house, but it’s much more. It protects your kids, directs healthcare decisions and handles digital assets. an attorney helps ensure no piece is missed, preventing a legal nightmare for your loved ones later on.”

Study methodology: the LegalShield survey was conducted in June 2025 among 1,018 u.S. adults. the data was segmented by generation (Gen Z, millennials, Gen Xers, baby boomers) to analyze attitudes and behaviors toward estate planning and the generational wealth transfer. ❦

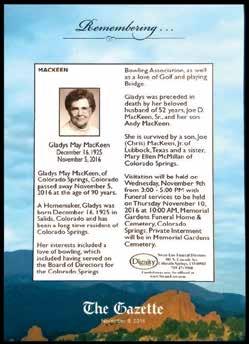

When you place an obituary notice or celebration of life in The Gazette, you may order a special keepsake to remember your loved one. This beautiful handmade plaque is composed of the obituary and the name of our newspaper, along with a beautiful graphic. Bookmarks are also available. For additional memorial options, please call 719-636-0101

The Gazette accepts obituaries, death notices, celebrations of life, service information and life tributes as paid notices. The deadline is 2 p.m. Monday – Friday for the next day’s publication; 3 p.m. Friday for Sunday and Monday publication.

Notices may be sent by email to obits@gazette.com or submitted at placead.gazette.com/adportal/gaz-obits/index.html or submitted by mail to:

The Gazette Obituaries/Celebrations of Life Desk 30 East Pikes Peak Avenue, Suite 100 Colorado Springs, CO 80903

If you need further assistance, please call 719-636-0101.