2 minute read

Greatest Threat To Your Retirement

Do you realize that one of our greatest desires in life is also the greatest threat to your retirement? A long life is what most of us want. We want plenty of time to enjoy the fruits of our labor. We want to travel. We want to pursue hobbies. We want to spend as much time as possible with our family. We want to see our grandchildren grow up and succeed in life. A life that is cut short will miss out on many of these desires, so we want to live as long as possible. But living a long life is the number one threat to a successful retirement.

Longevity

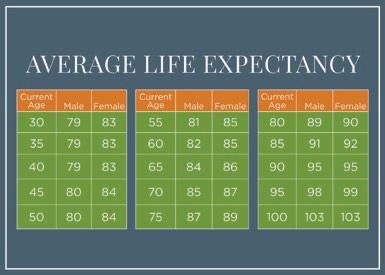

Your expected lifespan might be longer than you think. According to the Centers for Disease Control, the average life expectancy in the United States is 76.3 years for a male and 81.4 years for a female. But you should be very careful when looking at averages. Averages can be very deceiving. You will have a 50 percent chance of living longer than the average lifespan. In addition, the longer you live, the longer you are expected to live. Take a look at the table below. If you are a 50-year-old male today, your average life expectancy is 80 years. But if you are a 65-year-old male today, your life expectancy is 84 years. Your life expectancy increases as you age.

Threat Multiplier

Longevity risk is the number one risk in retirement. Here’s why: it’s not just a risk — it’s a risk multiplier of all the other risks. Let’s say you retire at age 65 and you die five years later at age 70. Would it matter if the market crashed? Nope. Would it matter if you were drawing 10 percent per year from your portfolio? Nope. Would it matter if you forgot to buy a long-term care policy? Nope. These things don’t matter because you didn’t live long enough. But if you live to be 75, 85 or 95, then it’s all the other risks that can wipe out your savings. You have to take longevity risk off the table. Pensions give you a paycheck for life, so they reduce that risk. But many people today don’t have pensions or their pensions are not sufficient. Combine that with the fact that people are living longer. And, research shows that married couples live longer than single people. You need to make sure that you have created income for life as part of your longterm retirement plan.

Bottom Line

Using rules of thumb, like the 4% Rule, will fail for the majority of retirees. That withdrawal rate is just not sustainable in the world in which we live today. So, you have to find ways to create lifetime guaranteed sources of income. Social Security is one source of lifetime guaranteed income. Pensions are another, but many people don’t have pensions or they have inadequate pensions. Most people will need other sources of lifetime guaranteed income. The only other lifetime guaranteed income source comes from the insurance industry through the use of some type of annuity product. Annuities get a lot of bad press — and rightfully so in many cases. However, eliminating the use of annuity products before you fully understand the benefits and the drawbacks can be a huge mistake. The most important step you can take is to prepare a comprehensive financial plan to determine how much lifetime guaranteed income you need. Seek the advice of a professional investment advisor who you can trust to learn how you can make sure that you don’t run out of money before you run out of life.

Randy Yeisley is a local, independent investment advisor and is the founder and president of Yeisley Financial Group, Inc., located in northeast Wichita. He can be reached by emailing advisor@yeisleyfinancial.com or by calling 316.719.2900.