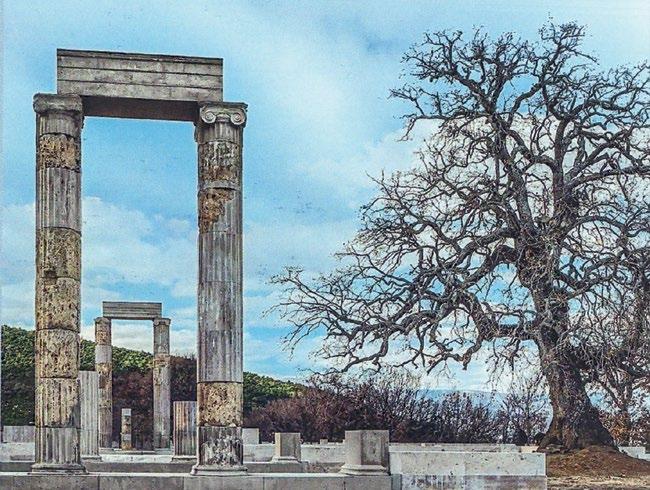

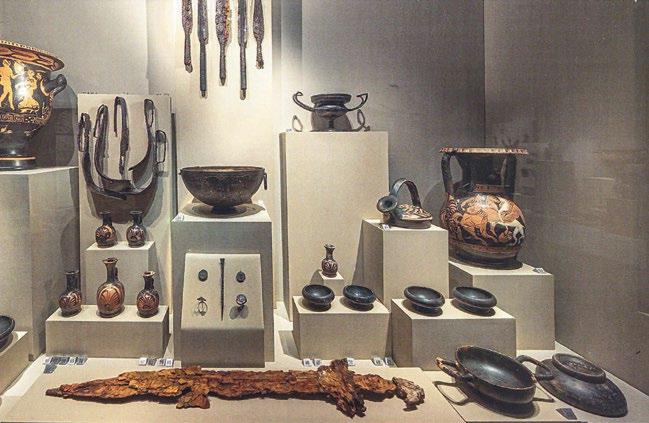

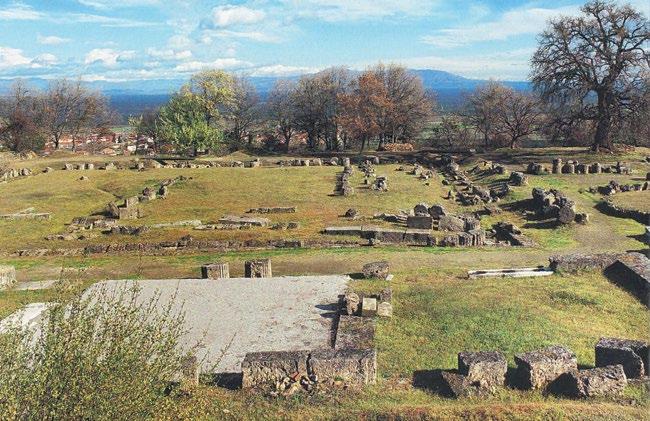

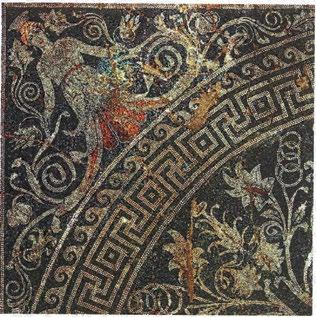

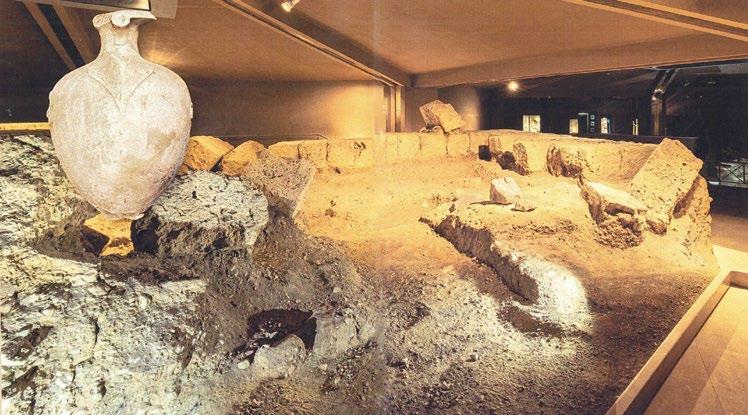

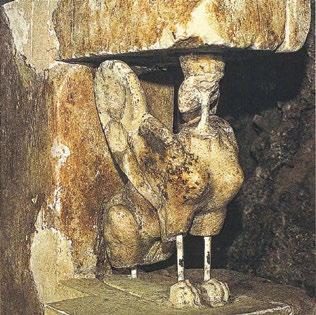

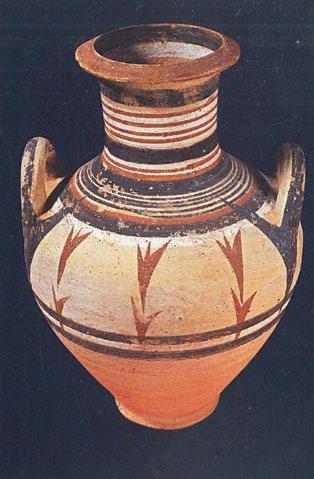

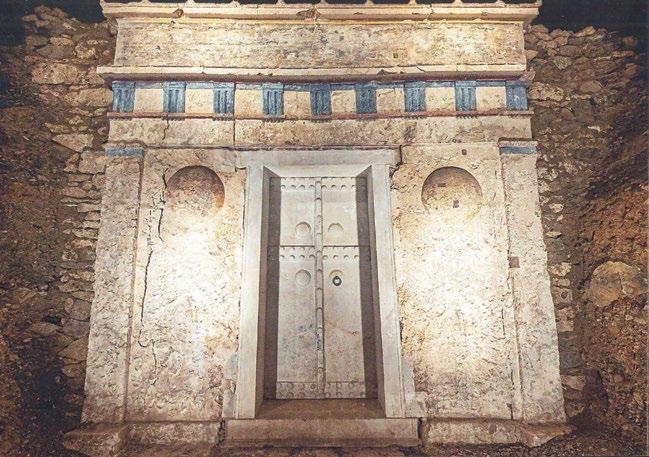

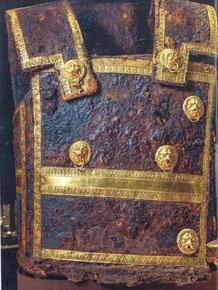

βεργίνα

Νεκρόπολη

DACIA Societate Generala De Asigurare in Bucuresci –

1876.

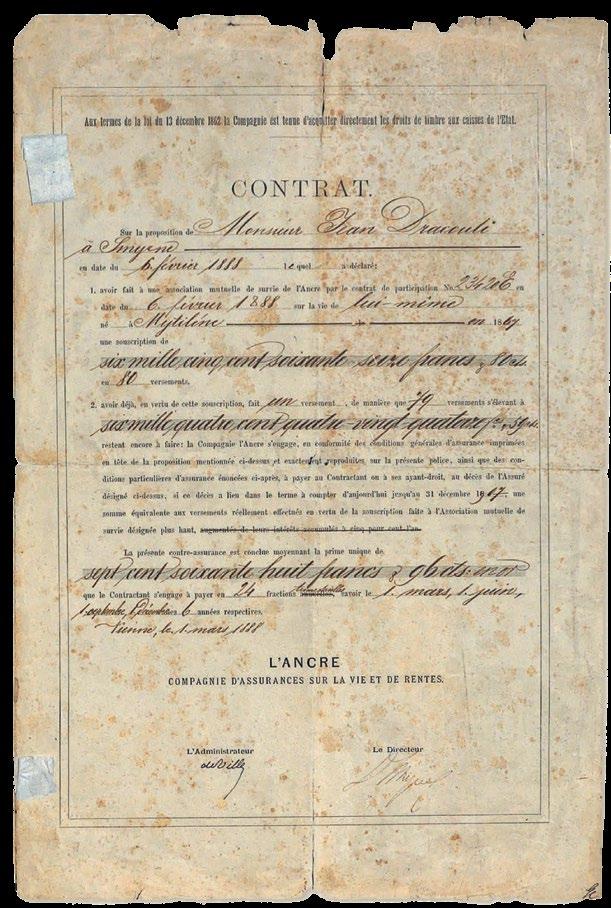

L’ANCRE Compagnie d’ assurances sur la vie et de rentes

1888.

GUARDIAN FIRE & LIFE ASSURANCE

(Solvency II)

Gerling-Konzern Allgemeine Versicherungs-Aktiengesellschaft

Gerling-Konzern Hellas.

Gerling Konzern Allgemeine VersicherungsAktiengesellschaft/Greek Branch και Gerling Konzern Speziale Kreditversicherungs-Aktiengesellschaft/Greek Branch.

21/3/2025

31/12/2024

30/9/2024

30/9/2024

30/6/2024

30/6/2024

31/3/2024

31/3/2024

31/12/2023

31/12/2023

30/9/2023

30/9/2023

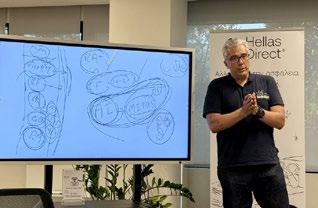

CHIEF OPERATIONS OFFICER, ALLIANZ

H Allianz

Grivalia Hospitality

S.A.

υπηρεσιών

Eurolife FFH Asigurari de Viata S.A., η οποία

άρχισε τη λειτουργία της τον Σεπτέμβριο του 2007, κατέγραψε ασφάλιστρα ύψους

€3,8 εκατ. (2023: €3,3 εκατ.). Για τη

χρήση 2024, οι ζημίες χρήσης προ

φόρων της θυγατρικής ανήλθαν σε €1.159 χιλ. (2023: ζημίες €1.332 χιλ.)

μερίδια αγοράς, η εταιρεία συγκέντρωσε το 3,1% της συνολικής

(2023:

Η

EUROLIFE

εταιρείας Εurolife FFH Asigurari Generale S.A. ανέρχεται σε €7.779 χιλ. (RON 32.141 χιλ.). Η Eurolife FFH AEAZ, όπως και η Eurolife FFH AΕΓΑ είναι θυγατρικές της Eurolife FFH Insurance Group Α.Ε. Συμμετοχών, η

Costa Luxembourg Holding S.à.r.l. (εφεξής Costa), η

(1 Jean Piret, L-2350 Luxembourg).

Η Costa

Colonnade Finance Sàrl»,

Fairfax).

Fairfax Financial Holding Limited (ο

Fairfax Financial Holding Limited,

ARAG

ARAG

Partner

άνοιγμα

9. Numele si adresa asiguratului (sau a utilizatorului vehiculului) Name and address of the Policyholder (or vehicle User) Cernat Iulian Str. Mihail Eminescu 212

10. Această carte a fost eliberată de: This Card has been issued by: INTERAMERICAN HELLENIC INSURANCE COMPANY S.A. ATENA - SUCURSALA BUCUREŞTI

Bd. Iancu de Hunedoara, nr. 54B, et. 4, aripa fata, Bucuresti, Sector 1, 011745 Romania

Tel: TBD

Fax: TBD w www anytime ro auto@anytime ro

11. Semnătura asigurătorului Signature of Insurer

Informaţii utile [opţional pentru piaţa naţională să indice informaţii suplimentare]

Această carte este valabilă în ţările în care căsuţa corespunzătoare de mai jos nu este barată (pentru mai multe informaţii, vă rugăm să accesaţi www.cobx.org).

În fiecare ţară vizitată, Biroul acelei ţări garantează acoperirea prin asigurare pentru prejudiciul cauzat prin utilizarea vehiculului menţionat mai sus, în conformitate cu legea din acea ţară privind asigurarea obligatorie. Pentru identificarea Biroului relevant, vă rugăm să verificaţi verso-ul cărţii.

A B BG CY(*) CZ D DK E EST F FIN

GR H HR I IRL IS L LT LV M N

NL P PL RO S SK SLO CH AL AND AZ

BIH MA MD MK MNE SRB(**) TN TR UA

(**)Răspunderea asigurătorului, prevăzută în documentele de asigurare eliberate pentru Republicile Azerbaidjan, Cipru și Serbia este limitată la aria geografică a acestor state care este sub controlul guvernelor respective. Pentru mai multe informaţii, consultaţi http://gc-territorial-validity.cobx.org

CONTRACT DE ASIGURARE DE RĂSPUNDERE CIVILĂ AUTO RCA

INTERAMERICAN HELLENIC INSURANCE COMPANY S.A. ATENA - SUCURSALA BUCUREŞTI

Broker/Agent

*CCodul categoriilor de veh cule:

A. AUTOTURISM/CAR B. MOTOCICLU/MOTORCYCLE C. AUTOCAMION SAU TRACTOR/LORRY OR TRACTOR D. BICICLETA CU MOTOR/CYCLE FITTED WITH AUXILIARY ENGINE

Seria RO/19/A19/PD nr 270626

Tel.: 0000 000 000 R.C. J2025033442009 C.U.I. 51767670

Sucursala/Agenţia -Cod CC10101

Nume / Denumire

Asigurat/ Proprietar

Cernat Iulian

C.U.I. / C.N.P. Proprietar: 1810626044875

Nume / Denumire

Asigurat/ Utilizator

C.U.I. / C.N.P. Utilizator:

Adresa Asigurat/Utilizator: Tel: E-mail:

Cernat Iulian

1810626044875

Str. Mihail Eminescu 212iulian.cernatt@gmail.com

Conducatori auto declarati: Cernat Iulian 1810626044875

(Nume, Prenume, C.N.P.)

Fel, Tip, Marcă, Model Vehicul: A,MERCEDES, E 220

Nr. înmatriculare/înregistrare: BC01THT

Nr. identificare - Serie CIV / Nr. de inventar WDD2120021B065530 / N776081

Capacitate cilindrică / Putere: 2143 / 125,00

Nr. locuri/masă totală maximă autorizată: 5 / 2300

Valabilitate Contract de la 23/07/2025 până la 22/07/2026 Contract emis în data de 27/06/2025

Prima de asigurare 1281.990000000 LEI, Clasă Bonus-Malus: B8

Tarif de decontare directă 100 LEI Total plată 940,62 LEI

Nr. rate 1 Valoare rate R1:940,62 LEI, Date scadente R1: Încasată cu 10270626 în data de

Limita de despăgubire pentru vătămari corporale şi deces: 6.070.000

Limita de despăgubire pentru daune materiale: 1.220.000

Contractul de asigurare cuprinde urmatoarele acoperiri si servicii suplimentare: Decontare directa

Observaţii:

Condiţiile contractuale sunt cele prevăzute prin dispoziţiile Legii nr. 132/2017 privind asigurarea obligatorie de răspundere civilă auto pentru prejudicii produse terţilor prin accidente de vehicule şi tramvaie şi cele ale legislaţiei secundare emise de către A.S.F. în aplicarea acesteia. Acestea pot fi completate şi cu alte prevederi ce sunt stabilite de comun acord de către asigurat şi asigurător şi sunt prevăzute într-un act addiţional la prezentul contract.

Contractul RCA, inclusiv orice act adiţional sau anexă la acesta, constituie titlu executoriu pentru ratele scadente şi neachitate, în conformitate cu prevederile art. 5 alin. (3) din Legea nr. 132/2017 privind asigurarea obligatorie de răspundere civilă auto pentru prejudicii produse terţilor prin accidente de vehicule şi tramvaie. Contractul RCA dă dreptul persoanei prejudiciate, în cazul producerii unui prejudiciu, să se poată adresa pentru efectuarea reparaţiei oricărei unităţi reparatoare auto, în condiţiile legii, fără nicio restricţie sau constrângere din partea asigurătorului RCA

să-i influenţeze opţiunea.

Amiabila aplicaţia gratuită care digitalizează procesul constatării amiabile

Linda Nieuwenhuizen, Chief Commercial Officer

Interamerican.

Linda Nieuwenhuizen, Chief Commercial Officer

Interamerican,

Linda Nieuwenhuizen, Chief Commercial Officer

Interamerican,

Η Interamerican

Η

Linda Nieuwenhuizen, Chief Commercial Officer

Στιγμιότυπα από τα Interamerican Sales Awards 2024.

Juerg Schiltknecht,

Baloise

Baloise

Lebensversicherung AG, κ. Juerg Schiltknecht,

Baloise

Juerg Schiltknecht

— In which phase is the proposed merger between Baloise and Helvetia?

The proposed merger between Baloise and Helvetia was announced in April 2025, in May the extraordinary general meetings of both companies overwhelmingly approved the merger and we are in the process of obtaining all

Baloise Lebensversicherung

required regulatory and legal approvals.

— What is the estimated timeline for the legal and operation unification of both companies?

We expect the closing of the transaction to happen somewhere in Q4 of this year, but obviously it depends on obtaining all regulatory and legal approvals first. After closing, we have the ambition to unify both companies as fast as possible. Nevertheless, we expect the whole operational integration to last until 2028.

— How did the insurance market in Switzerland and abroad welcome the proposed merger between Baloise and Helvetia?

There’s a strong strategic rationale for this proposed merger that was also acknowledged by the market. This is also reflected by the high approval rates at the extraordinary general meetings which exceeded 95%.

— What would be the plans of the new Group for the European market and are there any plans outside Europe?

It is too early to have any joint plans for the combined Group, as we are still two separate, competing companies waiting for the proposed merger to be approved by the relevant authorities. As Baloise, we would like to host

J. Schiltknecht.

a capital markets day after closing, likely in Q1 of 2026, during which the combined Group would give an update on future plans.

— In how many countries would the new Group be present?

Subject to obtaining the approvals of the competent authorities, Baloise and Helvetia will be present in eight European markets. Currently, both companies have operations in Switzerland and Germany, otherwise they are complementary. In addition, Helvetia also operates outside of Europe in the areas of specialty lines and active reinsurance.

— What would be the total business volume after the merger between Baloise and Helvetia?

On a pro forma basis and subject to obtaining the necessary approvals, Helvetia and Baloise would have around CHF 20 bn business volume in 2024. The split between non life and life would be around 60% to 40%. In terms of market cap

the combined Group would be one of the leading insurance companies in Europe and number two in terms of business volume in the joint home market Switzerland.

— Are you happy with Atlantic Union’s results for 2024 and for the 1st quarter 2025?

I am once more very happy with the performance of Atlantic Union. It has demonstrated its strength in 2024 and delivered again very convincing results and we see the path of success to continue in 2025. Not only this and last year, but over many years, Atlantic Union has sustainably delivered very good results. This is on the one hand the achievement of a well thought through strategic approach. On the other hand, a strategy alone is never good enough, it also needs to be implemented and executed. This is one of the top strengths of Atlantic Union, its leadership team that together with its longstanding employees really created in my view something special in the Greek insurance market.