BizAvIndia

BIZAVINDIA CONFERENCE 2023

WHAT DOES 2023 HOLD FOR INDUSTRY

GULFSTREAM LEAVING A BRIGHT SUSTAINABILITY TRAIL

UNMANNED URBAN MOBILITY

FINANCIAL HURDLES HOLDING BACK BIZAV BOOM

REPORTS – PAGE 8 ONWARDS + MORE...

INDIA AWAITS ITS TURN TO BE ON TRAJECTORY OF GROWTH

WWW.SPS-AVIATION.COM/BIZAVINDIASUPPLEMENT A SUPPLEMENT TO SP’S AVIATION VOLUME 9 • ISSUE 1

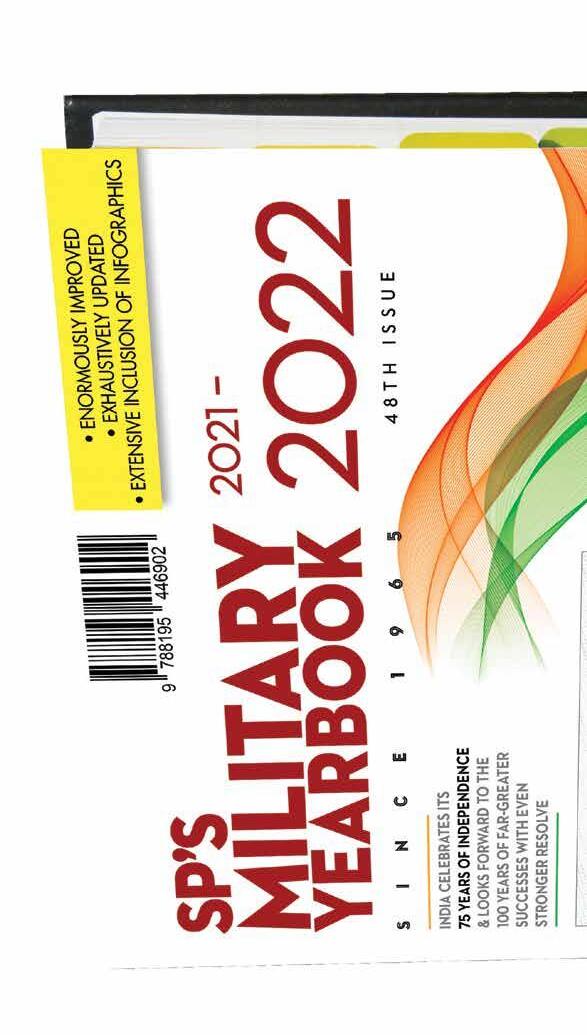

ALL NEWSP’S MILITARY YEARBOOK 21-2022 • AN INDISPENSABLE REFERENCE DOCUMENT * MOST UPDATED INDIA’S WHO’S WHO IN DEFENCE, MOST UPDATED ASIA’S WHO’S WHO IN DEFENCE & MUCH MORE.... SP’S MILITARY YEARBOOK 2021-2022 CONTENTS HEREWITH NOW!AVAILABLE BOOK YOUR COPIES, NOW: E-mail us at order@spsmilitaryyearbook.com WhatsApp us at +91 97119 33343 Call us on +91 11 24644693, 24644763, 24658322 Connect via : @SPsMYB www.spsmilitaryyearbook.com

ON THE COVER:

India’s Business Aviation industry awaits its turn to be on the trajectory of sustained and progressive growth as the country has a big ambition of being $5 trillion economy as envisioned by the Prime Minister. The persistent efforts by the industry and the industry’s association BAOA continue towards this direction. Seen here is one of the leading business jets Citation CJ4 Gen2 in flight.

Cover Photograph: Textron Aviation

PAGE 4

INDUSTRY TRENDS

What does 2023 hold for India’s General Aviation Industry?

BY SUDHIR S. RAJESHIRKE, CHIEF OPERATING OFFICER, JETCLUB EUROPE

PAGE 7

INDUSTRY GROWTH

Poised for High Growth

BY BOBBY CHADHA, CHAIRMAN AND MANAGING DIRECTOR

SRC AVIATION PVT LTD

PAGE 8

BIZAVINDIA CONFERENCE 2023 REPORT

Streamlining Growth for Indian

GA/BA Industry

BY AYUSHEE CHAUDHARY

PAGE 11

BIZAVINDIA CONFERENCE 2023 PERSPECTIVES

The Challenges & Changes of India’s GA/BA Industry

BY AYUSHEE CHAUDHARY

PAGE 14

BIZAVINDIA CONFERENCE 2023 ANALYSIS

Indian Private Helicopter Industry

Awaiting Take off

BY AYUSHEE CHAUDHARY

PAGE 16

SUSTAINABILITY GULFSTREAM

Leaving a Bright Sustainability Trail

BY AYUSHEE CHAUDHARY

PAGE 18

POLICY REFORMS

Financial Hurdles Holding Back

Indian BizAv Boom

BY ASHISH JAISWAL, CHIEF EXECUTIVE OFFICER, MODAIR

BY ASHISH JAISWAL, CHIEF EXECUTIVE OFFICER, MODAIR

PAGE 21

AVIATION IFSC PRIVATE LIMITED

TECHNOLOGY UNMANNED

Unmanned Urban Air Mobility BY AIR MARSHAL ANIL CHOPRA (RETD)

REGULAR DEPARTMENTS

2 from the editor’s desk

3 MESSAGE from PRESIDENT, BAOA

24 NEWS AT A GLANCE

Awards 2017 SPECIAL CONTRIBUTION TO BUSINESS AVIATION

1 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BizAvIndia A SUPPLEMENT TO SP’S AVIATION INDIA AWAITS ITS TURN TO BE ON TRAJECTORY OF GROWTH HOLD FOR INDUSTRY BIZAVINDIA CONFERENCE 2023 REPORTS – PAGE 8 ONWARDS + MORE...

CONTENTS

VOLUME 9 • ISSUE 1 A SUPPLEMENT TO

SP’S AVIATION 2023

GULFSTREAM BECAME THE INDUSTRY’S FIRST BUSINESS AIRCRAFT ORIGINAL EQUIPMENT MANUFACTURER TO FLY ON 100 PER CENT SUSTAINABLE AVIATION FUEL (SAF). THE FLIGHT TOOK PLACE ON A GULFSTREAM G650.

PUBLISHER AND EDITOR-IN-CHIEF

Jayant Baranwal

DEPUTY MANAGING EDITOR

Neetu Dhulia

PRINCIPAL CORRESPONDENT

Ayushee Chaudhary

BAOA MANAGEMENT

Ajay Shah

President, BAOA

Group Captain R.K. Bali (Retd), Managing Director, BAOA

CHAIRMAN & MANAGING DIRECTOR

Jayant Baranwal

PLANNING & BUSINESS DEVELOPMENT

Executive Vice President: Rohit Goel

DESIGN TEAM

Senior Designer: Vimlesh Kumar Yadav, Designer: Sonu S. Bisht

GROUP DIRECTOR – SALES & MARKETING

Neetu Dhulia

DEPUTY DIRECTOR – SALES

Rajeev Chugh

MANAGER – HR & ADMIN

Bharti Sharma

DEPUTY MANAGER – CIRCULATION

Rimpy Nischal

GROUP RESEARCH ASSOCIATE

Survi Massey

SP’S WEBSITES

Sr Web Developer: Shailendra P. Ashish

Web Developer: Ugrashen Vishwakarma

© SP Guide Publications, 2023

ADVERTISING

neetu@spguidepublications.com rajeev.chugh@spguidepublications.com

SP GUIDE PUBLICATIONS PVT LTD

A-133 Arjun Nagar, (Opposite Defence Colony) New Delhi 110003, India. Tel: +91 (11) 24644693, 24644763, 24658322

Fax: +91 (11) 24647093

E-mail: info@spguidepublications.com

Owned, published and printed by Jayant Baranwal, printed at Kala Jyothi Process Pvt Ltd and published at A-133, Arjun Nagar (Opposite Defence Colony), New Delhi 110 003, India. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, photocopying, recording, electronic, or otherwise without prior written permission of the Publishers.

Held as a standalone event, this year’s BizAvIndia conference was attended by a large number of Business Aircraft Operators Association (BAOA) members, Aviation specialists, OEM representatives as well as government officials from MoCA and DGCA.

Dear Reader, India’s growth story of becoming a $5 trillion economy by the year 2028, is awe-inspiring as envisioned by the Prime Minister Narendra Modi. The country’s business aviation industry, which contributes its role into nation-building, employment, process of economic growth, is still awaiting its turn to be on the track of progressive growth. Strained by one of the highest levels of taxation, line-up of unfriendly rules and restrictions, discouragement factors for private aircraft purchases, infrastructure limitations and lack of minimum number of FBOs in the country, the industry is struggling to get its due. The silver-lining in form of certain positive outcomes achieved by BAOA however indicates on the light of other side of the tunnel.

During the seminar BizAvIndia organised by BAOA, last month, the attendance included a good mix of operators, government representatives and various stakeholders. Crux remained that unless and until the rulebook is followed systematically as per Pankaj Joshi (Bajaj Auto Aviation Head), problems are not likely to go away. The government representatives on other hand conveyed a sense of assurance to the audience. GMR, one of the leading airport companies in India also communicated their intent towards the upcoming infrastructure contributions for the industry.

Today, the country witnesses its airlines (scheduled operators) placing orders for 100s of aircraft while the industry (non-scheduled operators – NSOP) finds it difficult to go for even single digit aircraft purchases. Once this stark anomaly starts getting reduced, the country will witness very vibrant and very enthusiastic industry poised to deliver even larger roles in the interest of the country. Until then BAOA and the industry will have to continue restless efforts towards this direction.

At this occasion, I get reminded with the statement of Ali Alnaqbi, Founder Chairman of MEBAA, he echoed during MEBAA held in December 2022 “you must shout out, you must scream out to get your place in the overall scheme of progress. If you do not do so, you will never be heard and you will have no scope of any growth and any progress”. Interestingly this statement belongs to the country / region (UAE and Middle East) which already continues witnessing spree of growth factors and the continuing happily conducive business environment for the industry. This clearly indicates that any rare scope of complacency can always be counter-productive. Always better to continue fight even if the reasons are not plenty.

We at SP’s wish our friends within business aviation fraternity ‘The Best’ as always and indeed look forward to the brightening process of future, together!

J. Baranwal Editor-in-Chief

www.sps-aviation.com/bizavindiasupplement

FROM THE EDITOR-IN-CHIEF

2 B iz AV India | ISSUE 1 | 2023

PRESIDENT

BUSINESS AIRCRAFT OPERATORS ASSOCIATION

Dear BAOA Members,

The seventh edition of BizAvIndia was organised by BAOA on March 17, 2023 at Delhi. The shifting of the venue of the event to Delhi and delinking it from Aero India show was a well-considered decision of the Governing Board of BAOA in order to ensure a larger participation of all stakeholders as well as various regulatory authorities. The response has been encouraging as the event was attended by a large number of our members, aviation specialists, OEM representatives as well as officials from the MoCA and DGCA. All the three sessions of the conference had industry experts as well as senior representatives from DGCA to respond to the queries of the industry professionals. Asangba Chuba Ao, Joint Secretary, MoCA addressed the last session and apprised the gathering about the Ministry’s focus on optimising growth of GA/BA industry in India. I would like to convey our sincere gratitude to all the stakeholders of GA/BA industry and in particular our members for their wholehearted support to make the event a grand success. The Governing Board is planning and working out the modalities to conduct a two day BizAvIndia conference cum exhibition at Delhi in 2025.

The Governing board of the BAOA is working closely with MoCA and DGCA on a number of issues. Some of these arethe way forward for fractional ownership, resolving parking issues at busy metros, steps to reduce the present lengthy certification process for induction of new aircraft, reduction of import duty on aircraft in non-commercial category. We have adopted a collaborative approach with regulatory authorities in order to understand and address each other’s concerns and priorities and accelerate the decision-making process.

On behalf of the Governing board, I wish to assure all our members and the industry stakeholders that we will continue to put in all efforts to ensure sustainable and optimal growth of GA/BA industry.

Happy Landings!

Jai Hind!

Thanks & Regards

Ajay Shah President, BAOA.

MESSAGE FROM PRESIDENT, BAOA 3 www.sps-aviation.com/bizavindiasupplement B iz AV India | ISSUE 1 | 2023

What does 2023 hold for India’s General Aviation Industry?

BY SUDHIR S. RAJESHIRKE, CHIEF OPERATING OFFICER, JETCLUB EUROPE

BY SUDHIR S. RAJESHIRKE, CHIEF OPERATING OFFICER, JETCLUB EUROPE

Ministry of Civil Aviation has taken up the mantle of becoming a true champion for the general aviation industry bringing new initiatives that will hopefully bring a lot of innovation in the industry in this year

ANEW YEAR ALWAYS brings in certain amount of hope and excitement for every industry. But 2023 may bring in true difference to India’s general aviation industry that we have been anticipating since last few years. This is because the Ministry of Civil Aviation has taken up the mantle of becoming a true champion for the general aviation industry bringing new initiatives that will hopefully bring a lot of innovation in the industry in this year.

Previously I have written about key business areas that have the potential to provide a much-needed stimulus to general aviation fleet in India and thereby increasing the economic impact on the aviation ecosystem. I will discuss four of these businesses in this article.

l Helicopter Emergency Medical Services (HEMS)

l Fixed Base Operations or the General Aviation Terminals

l Aircraft management

l Fractional aircraft programmes

4 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement INDUSTRY TRENDS

IN 2023, WE MAY SEE A CHANGE IN REGULATION ALLOWING AIRCRAFT BUYERS TO PURCHASE AN AIRCRAFT BY A COMPANY BUT OPERATED BY AN EXISTING NSOP HOLDING AVIATION COMPANY PHOTOGRAPH: Gulfstream

Let us begin with HEMS. Globally, the market size of helicopter emergency medical services (HEMS) industry is estimated at $5.9 billion as of 2021. In India, the industry is at a very nascent stage. But things are changing. There is an increased awareness and sensitivity in India about the need for saving lives, whenever it is possible to do so, irrespective of the economic impact. As a result, to kick start the HEMS industry, the Government has taken over the responsibility of conducting a pilot programme to cover the costs of medical evacu ation for those who need critical care and need to have immediate access to a hospital.

The first HEMS tender will be awarded in 2023 to an operator who will have to base a helicopter with adequate medical equipment at AIIMS, Rishikesh. This pilot programme will bring forth the ben efits of having HEMS access in remote areas. Once such initiatives are successful and there is demonstrated benefit to those whose lives are saved, the HEMS market is likely to see a wider adoption. However, the Government cannot cover the costs of emergency services for long. This is when the private HEMS operators can step in and take the business model forward. But the general public can not afford such air services provided by private HEMS providers. As a solution, this is when large insurance companies can come in. Once insurers understand the concept of issuing insurance coverages for medical evacuations, the potential for HEMS operated by

operators will increase significantly in future.

In BizAv India issue 2 in 2022, I had mentioned that business aviation FBOs provide an opportunity to transform the business aviation industry in India. FBOs provide an excellent pre and post flight customer journey experiences. They increase the attractiveness of flying for those who are pressed for time and require safety and convenience of flying general aviation. In December 2022, we saw the launch of supposedly India’s largest business

Citadel will create a home in the sky, raising your standard of living to 43,000 feet.

citadelcompletions.com

5 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement INDUSTRY TRENDS

private

PHOTOGRAPH: AAI_Official / Twitter

ONCE INSURERS UNDERSTAND THE CONCEPT OF ISSUING INSURANCE COVERAGES FOR MEDICAL EVACUATIONS, THE POTENTIAL FOR HEMS OPERATED BY PRIVATE OPERATORS WILL INCREASE SIGNIFICANTLY IN FUTURE

LIVING, CRUISING, FLYING. THREE ASPECTS OF YOUR LIFE THAT YOU SHOULD ENJOY EQUALLY.

Renderings Courtesy of Massari Design

jet terminal at Cochin International Airport. This will change the nature of business aviation operations in and out of Cochin. For sure, corporates will see the terminal as an opportunity to use business aviation more for convenience and to a certain extent, a luxurious way of undertaking air travel.

In 2023, Yamuna International Airport Private Limited, the concessionaire for developing airport at Jhewar, UP, is likely to award a long-term concession for the first greenfield FBO at Noida International Airport. The scope of the project will be to develop a world class FBO which may extend to various other ancillary services. Hence this year will mark the beginning of the development of an FBO that could attract international companies to invest in this business. Further, FBO development opportunities will also arise at new airports in Goa, Navi Mumbai and several other airports such as Lucknow, Trichy and Chennai where large scale airport capacities are getting upgraded.

Next, a huge problem being faced by a large number of companies that are in dire need of using a corporate aircraft for their business travel is that they have to either start their own aviation company by getting a Non-Scheduled Operator Permit (NSOP) or using it in private category which increases the acquisition cost by 35 per cent. Hence the number of business aircraft over the last decade has remained almost flat.

In 2023, we may see a change in regulation allowing aircraft buyers to purchase an aircraft by a company but operated by an existing NSOP holding aviation company. In just one change, this will see encourage companies to easily purchase an aircraft without the hassles of starting their own aviation companies and without significantly increasing their acquisition costs. Further, the Government will see a significant boost in GST revenues as these aircraft will be charged every time they undertake a flight by corporates themselves.

The business of aircraft management by professional aviation companies have changed the nature of business internationally and it is high time the concept of separate owner and operator is recognised in India. This change will bring high quality aircraft management companies in India as well as reduce DGCA oversight significantly. Lastly, the Government will see a surge in GST revenue and thus this will be a win-win situation for everyone in the ecosystem.

Finally, one business model that will supercharge the face of the business aviation industry in India will be the aircraft fractional ownership model. 2023 will see some form of fractional model (may not be pure asset based fractional ownership) that is likely to be initiated. In brief, aircraft fractional ownership model solves the key pain points of serious business aviation. It reduces initial acquisition costs of purchasing an aircraft, significantly reduces operating expenses by spreading it across several other co-owners, simplifies payment for flying hours, saves tax through depreciation benefits and enables asset value protection through a buy-back option.

This fundamental model has changed the face of business aviation in the western countries and, if executed well, will help increase the number of business aircraft by democratising the use of business aviation. However, the Government is likely to ensure that the business model is executed in phase wise so that likely users will gain knowledge of the business model before they commit to a long-term fractional programme.

Therefore, I consider 2023 as the year that will bring positive changes to the business aviation industry. The Ministry of Civil Aviation is doing everything possible to ensure that all hurdles that prevent an industry from growing are removed and ease of doing business in the general aviation industry is simplified thereby providing much needed impulse to this stagnant industry. BAI

6 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement INDUSTRY TRENDS

PHOTOGRAPH: Pawan Hans

NOT ALL LOCATIONS IN INDIA HAVE THE BASIC INFRASTRUCTURE TO BUILD AND SUPPORT A SMALL AIRSTRIP; HENCE ARE BEST SERVED BY HELICOPTERS

Poised for High Growth

BY BOBBY CHADHA, CHAIRMAN AND MANAGING DIRECTOR SRC AVIATION PVT LTD

A higher use of private jets during Covid and now a robust economy is pushing Corporate Aviation to newer heights in India

THE BUSINESS AVIATION INDUSTRY in India is poised for exponential growth in the coming years. We are seeing business getting back to pre-Covid levels and lots of tailwinds pushing corporate traffic to record levels. One of the collateral benefits from Covid was the increased attention corporate executives now pay to safety (including personal safety). As a result, many now opt not to travel commercial and instead choose the safety that comes from using private jets. We can see this in the types of clients we are servicing now. Many of them are new users of private jets and they are all doing it to avoid the risk of infection associated with congested airports and commercial flying.

The corporate aviation industry in India is also benefiting from the strength of the Indian economy and the need among global com-

panies to diversify manufacturing away from China. There is a direct correlation between the economy and corporate aviation. A growing economy attracts global companies which are always exploring new markets and manufacturing opportunities to reduce costs. India presents a unique combination of a huge consumer market, a large skilled workforce, and an open, democratic, and business-friendly political system. As a result, we are seeing increased traffic flow from foreign investors eager to do business in India.

Barring some unforeseen global event, I believe this growth will continue in the coming years. It is my hope that the government will continue with policies that attract FDI, and also work with stakeholders in the industry to minimise hurdles to corporate aviation. BAI

7 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement INDUSTRY GROWTH

COVID SHIFTED THE ATTENTION OF CORPORATE EXECUTIVES TOWARDS BIZAV DUE TO SAFETY; AND MANY NOW OPT FOR THE SAFETY THAT COMES FROM USING PRIVATE JETS

PHOTOGRAPH: Dassault Aviation

Streamlining Growth for Indian GA/BA Industry

BY AYUSHEE CHAUDHARY

BY AYUSHEE CHAUDHARY

SEVENTH EDITION OF THE BizAvIndia conference was held in Delhi on March 17, 2023. This was the first time the conference was organised in the National Capital. Going forward, the conference would be held every odd year in Delhi and every even year alongside the airshow, Wings India. Being held not on the sides of the airshow but as a standalone event in itself, this BizAvIndia conference spoke volumes of the growth of the Business Aircraft Operators Association (BAOA) as an organisation and its growing strength. The strong presence of stalwarts from the industry both from the operators as well the regulators side also showcased the sincerity and accessibility of the platform that BAOA has managed to create.

“Traditionally, BizAv has been held one day prior to the airshow. However, this year, a conscious decision was made to host the event in Delhi and delink it from the airshow to encourage greater participation. BAOA has been working transparently and democratically for over a decade, thanks to the efforts of our founding President, Rohit Kapur, and our Managing Director, Group Captain Bali. They have established a solid foundation for

The seventh BizAvIndia conference, organised by BAOA, was held in Delhi for the first time

our organisation, and we are grateful for their contributions,” said Ajay Shah, President BAOA.

The Business Aviation industry has undergone a sea change over the past decade in India and has gained much needed recognition in recent years. The utility of Business Aviation, as a productivity tool and a contributor to economic development, is becoming more evident. The industry has been advocating that this should serve as the prime rationale to put in place an appropriate framework enabling industry’s growth and its role in channelising economic and social benefits throughout India. Some significant changes in terms of perspectives, policies, infrastructure, etc have come about in the industry. However, there is still a long way to go when it comes to certain pain points, finances being a major cause of concern. During the conference, the industry experts gathered to discuss the vision for the industry in the coming decade and touched upon many important issues including financing, infrastructure, leasing, helicopter aviation, GIFT city, regulations, etc.

“The goal today is to gain a better understanding of each other's specific roles in aviation. While our focus is on operating air operations

8 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 REPORT

PHOTOGRAPHS:

BAOA

ASANGBA CHUBA AO, JOINT SECRETARY, MINISTRY OF CIVIL AVIATION, ADDRESSING DELEGATES AT THE SEVENTH BIZAVINDIA CONFERENCE

“THE DEMAND FOR SMALLER AIRCRAFT IS EXPECTED TO GO UP. WITH AN INCREASING NUMBER OF AIRPORTS COMING UP, MORE INTEREST IN THE SECTOR AS WELL AS IN THE COUNTRY ON A GLOBAL LEVEL, MORE ACTIVITY AND MORE DEVELOPMENT FOR THE SECTOR, ALL THESE WILL ENSURE THE INDUSTRY’S GROWTH GOING AHEAD.”

— ASANGBA CHUBA

AO,

JOINT SECRETARY, MINISTRY OF CIVIL AVIATION

profitably, their (the regulators) focus is on ensuring safety,” said Group Captain Rajesh Bali, Managing Director, BAOA while referring to the presence of the Ministry and the regulatory body, Directorate General of Civil Aviation (DGCA) at the conference. “We need to balance the conversations at these events by understanding each other's respective jobs and collaborating more effectively with regulators in the future.”

Group Captain Bali also drew attention towards a study conducted by ICAO (International Civil Aviation Organisation) in 2012 that predicted a year-on-year growth rate of 10 per cent for the first 10 years, followed by a growth rate of seven per cent and an additional five per cent in the last five years, resulting in a total of approximately 4,000 small aircraft. However, since then, the number of operators has decreased from 137 to 103, and the number of aircraft has only recently started to increase after a period of decline.

The reasons for this decline might be multiple, but most industry experts underlined that it comes down to the ease of doing business that for now is rough terrain for the General Aviation/Business Aviation (GA/BA) sector in India, specifically because of the financials.

SOME KEY DEVELOPMENTS

While there are certainly gaps that the industry recognises, many also look at this being a good opportunity to tap into. Dr Vandana Agarwal, Ex-Senior Economic Adviser (Additional Secretary), Ministry of Civil Aviation (MoCA) echoed this sentiment as she sees a huge market for growth of the GA/BA industry in India going forward. She called attention to various aspects that the government had looked at including tax framework, management, fragmented ownership in order to reduce cost, in order to ease the burden on all the operators and also to correct some trends that were being seen through Non-Scheduled Operations (NSOP) usage.

“The other area we looked at very strongly was the Maintenance, Repair and Operations (MRO). If you have contracts with foreign MRO vendors in foreign locations and the matter is subcontracted to India, you have zero GST on your MRO services and even if you do

direct contracting with India MRO, what used to be 18 per cent, we have brought it down to five per cent,” she said adding that the MRO tax regime is now in place, and it should be effectively implemented.

Infrastructure has been another area of constant concern for the GA/BA industry in India. BAOA has earlier talked about their efforts with the government where they are working on expanding the infrastructure especially FBOs. In a significant step, Delhi got its first exclusive General Aviation terminal in 2020.

Sanjiv Edward, Chief Commercial Officer, Delhi International Airport Limited (DIAL) spoke about the private terminal opened at Delhi. “A dedicated GA terminal was opened at DIAL, India's first private jet terminal, with a capacity of 150 ATMs/day and 50 pax/hr, catering to Code-C type aircraft. The area covers 4.5 acres adjacent to the existing General Aviation Terminal at Indira Gandhi International Airport, with four parking hangars accommodating aircraft with up to 21.2m wingspan, an apron, fire fighting system, operational offices, and restrooms.” Further the GA terminal’s expansion plans include upcoming covered parking, and a second terminal coming up as a mirror image of the first, along with more hangars. This infrastructure development is expected to attract more business jet operators in India.

DIAL is working on the building blocks of the GA hub including a faster turnaround of business planes, dedicated parking slots, an online system for food booking, premium services for passengers, customised requests, and support services for GA aircraft, etc.

The DGCA is also increasingly interacting with the industry to identify initiatives that must be taken. The regulator made some progress in assessing the threshold for smaller aircraft and NSOP and GA aircraft, stated Captain G. Shivkumar, Deputy CFOI, DGCA HQ. "The threshold time has been increased to 90 minutes without additional documentation, which was previously 60 minutes. We have also made changes to the Flight Duty regulations, which have benefited the industry.”

Dr Agarwal highlighted GIFT city that has been a centre of conversation in the industry, since its inception. The GIFT City (Gujarat International Finance Tec-City) is a global financial and technology

9 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 REPORT

“WE ARE COMMITTED TO ADDRESSING THE CONCERNS OF THE INDUSTRY AND ADVOCATING FOR OPTIMAL SOLUTIONS WITH REGULATORY AUTHORITIES.”

— AJAY SHAH, PRESIDENT, BAOA

hub that promises to offer single-window clearances and approvals under one umbrella. The GIFT City initiative is a financial jurisdiction that is entirely different from the rest of India. It offers full currency convertibility, including for the rupee, and about 18 trade entities have registered themselves for rupee trading. Additionally, there are numerous foreign and Indian banks, alternative investment funds, and major insurance companies in GIFT City. There is also a dedicated unified regulator called the IFSC Authority, where five regulators handle the approval process simultaneously including the Reserve Bank of India (RBI), the SEZ (Special Economic Zone) or the International Financial Services Centre (IFSC) regulator. In the first 15 years of establishing your company, you can also choose any block of 10 years to have zero corporate tax. This makes it easy to set up operations, and you can register more than one special purpose vehicle on one address, reducing the cost of manpower.

THE WAY FORWARD

Asangba Chuba Ao, Joint Secretary, MoCA said, “Given the nature of the sector, it is difficult for even good analysts to give an exact prediction right now. However, more people are flying today. These flyers will eventually graduate to upper levels for example the business class people would eventually move to private flying. The upgrade and the rising number of flyers will lead the push. The demand for smaller aircraft is also expected to go up. With an increasing number of airports coming up, more interest in the sector as well as in the country on a global level, more activity and more development for the sector, all these will ensure the industry’s growth going ahead.”

Additionally, ways must be identified to handle the issue of hangarage charges versus housing charges, stated Dr Agarwal. “Looking forward, we must consider the impact of the recent catastrophes and how they have changed the game. The Indian GA industry should focus not only on the domestic market for passengers and cargo but also on cross-trades, such as serving other countries' needs. I think until you get that under your belt, you will always under perform as far as the vision of India's GA industry is concerned. To achieve this vision, it's essential to ensure that financing is green financing. I urge all of you to look into financing your asset acquisition through green financing as much as possible,” she said.

In the tussle between operators and regulators, the conference also touched upon the lack of experts in the regulatory body and the inconsistencies on the part of the regulator as well as the operators. Captain Shivkumar added, “The DGCA lacks expertise, particularly in the area of GA. While our expertise may be limited, we are open to suggestions from the industry and will continue to work towards safer and more efficient aviation operations as we must find a way to meet our requirements without compromising safety. We cannot simply replicate the regulations of other developed nations, as the size and development of our aviation industry is different. It is also important to note that the

DGCA is not a training organisation. We are facilitators and not responsible for providing Flight Operations Inspectors (FOIs) or conducting flight checks.” Operators must ensure that they have adequate pilots for their aircraft and that they comply with regulations for training and proficiency checks. “The Civil Aviation Requirement (CAR) mandates that training be conducted once a year for non-scheduled and GA pilots either on the aircraft or in a simulator. Many operators have overlooked this and assumed that a proficiency check is sufficient,” he added.

Touching upon funds and finances, Dr Agarwal added that there are now alternative funds that are setting themselves up to deal exclusively with aviation finance. “However, Indian banks are also available, and they are now getting conditioned to look at financing aircraft as assets. Although Indian banks are more comfortable financing larger transactions, we could pursue delegated financing with a share of the asset being mortgaged for smaller aircraft financing. Online financing mechanisms could also be explored for small aircraft financing to gain traction.”

Sunny Guglani, Head of Airbus Helicopters, Airbus India and South Asia & Chairman, FICCI task force on Helicopter and General Aviation shared, “India has not fully tapped the potential of helicopter aviation, which can contribute to nation-building. Airbus is partnering with India to achieve this goal. Airbus has the largest team on the ground in India for helicopters, showing how much it believes in the country.”

“India has great potential for growth. There's a great chance of synergy too with JSSI. It certainly is one of the strongest markets in the middle run and in the long run,” said Serdar Tamer, Director, Business Development, Jet Support Services, Inc. (JSSI).

Despite the COVID period, there has been a significant spike in movements and activity, with a noticeable increase in the booking of charter flights in India. Sanjiv added, “The Asia Pacific market is experiencing a higher growth rate compared to other regions. India's GA opportunity is growing, as the country ranks 12th in the list of Ultra High Net Worth Individuals (HNIs), who may drive demand for GA business. India's G20 Presidency is also an impactful event that will create further momentum that needs to be sustained, leading to a business aircraft market.”

Some of the focus points of GA business in India that came out from the session include:

l Increase leasing facilities in India

l Exploring green financing and delegated financing

l Quick implementation of fractional ownership

l Drive consolidation of industry and services

l Prioritise GA at par with scheduled operators

l Ease of regulatory process for approvals and operating license

l Support infrastructure development like MRO and Hangars

l Tapping into helicopter aviation

l Need for experts in the regulatory body

l Following proper training procedures. BAI

10 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 REPORT

“A DEDICATED GA TERMINAL WAS OPENED AT DIAL, INDIA'S FIRST PRIVATE JET TERMINAL, WITH A CAPACITY OF 150 ATMS/DAY AND 50 PAX/ HR, CATERING TO CODE-C TYPE AIRCRAFT.”

— SANJIV EDWARD, CHIEF COMMERCIAL OFFICER, DIAL

The Challenges & Changes of India’s GA/BA Industry

BY AYUSHEE CHAUDHARY

THE PANDEMIC HAD PROVEN to be a positive force in changing the perception that people largely held for the private aviation industry. With the COVID-19 virus hitting the world, the private aviation market did not see a downfall that was as severe as in the commercial aviation market. It rather witnessed a surge in demand for flights by business jets. The last couple of years ever since COVID hit the world have been a very interesting time for the GA/BA globally,” remarked Rohit Kapur, President, JETHQ Asia during the 7th BizAvIndia Conference.

“After the initial shock, there was a surge in demand for charters and people wanting to purchase aircraft, resulting in a significant explosion in the industry. This kind of growth has not been seen in the last 15 years or so, and as a result, the OEMs were overwhelmed with demand. The pre-owned market also experienced a surge in demand, causing prices to rise to unprecedented levels, and even after these price hikes, finding good quality products was challenging. The charter industry also experienced a surge

in demand, but they did not have enough aircraft to meet the demand, putting stress on the infrastructure, MRO, and supply chain,” Kapur added.

The hike in demand during the pandemic was as much as double for some of the operators. So much so that coping with the increasing demand for private jets had become a challenge for the operators of private jets. This was the scenario globally. The Indian General Aviation/Business Aviation (GA/BA) industry also witnessed some of these positive trends and more importantly the due attention came upon this sector of aviation.

Mahesh Iyer, President, Titan Aviation Group underlined that the aviation industry has the potential to be a game-changer. With the right owner’s mentality, businesses can make a lasting impact by flying in private jets, getting deals done and generating revenue through goodwill. Additionally, contributing to the aviation department can further enhance the industry's growth.

The aviation industry in India has undergone significant changes

11 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 PERSPECTIVES

The years, since the pandemic took over the world, have been an interesting time for the global GA/BA industry

PHOTOGRAPHS: BAOA

ROHIT KAPUR, PRESIDENT, JETHQ ASIA ADDRESSING THE CONFERENCE DELEGATES

“THE GOAL TODAY IS TO GAIN A BETTER UNDERSTANDING OF EACH OTHER'S SPECIFIC ROLES IN AVIATION. WHILE OUR FOCUS IS ON OPERATING AIR OPERATIONS PROFITABLY, THE REGULATORS FOCUS IS ON ENSURING SAFETY. WE NEED TO BALANCE THE CONVERSATIONS AT THESE EVENTS BY UNDERSTANDING EACH OTHER'S RESPECTIVE JOBS AND COLLABORATING MORE EFFECTIVELY IN THE FUTURE.”

— GROUP CAPTAIN RAJESH BALI, MANAGING DIRECTOR, BAOA

“INDIA HAS THE POTENTIAL TO SHOW A SIMILAR UPWARD TURN IN BUSINESS AVIATION AS COMMERCIAL AVIATION, GIVEN THE IDEAL CONDITIONS FOR BIZAV IN THE COUNTRY. THE TERRAIN, SMALL TOWNS, HILLS, AND EXCLUSIVE AIRPORTS MAKE IT PERFECT FOR PRIVATE JETS.”

— RAJAN MEHRA, CEO, CLUB ONE AIR

in recent times, making it a major player on the world stage, echoed Rajan Mehra, CEO, Club One Air. With world leaders visiting the country frequently, India has become the focus of global attention, not just in aviation but also in geopolitics and trade, he added. “There has been an explosion in commercial aviation, with Air India, IndiGo, and the new Akasa airline all buying bulk orders of aircraft, increasing their fleet and making their mark. This growth is unprecedented, similar to what was seen in the US probably 25 years ago. While the business aviation industry is showing improvement with more orders and planes, it is not booming like commercial aviation. However, this growth is likely to affect the business aviation industry as well.”

CHALLENGES & CHANGES

Staying optimistic, Mehra stated that India has the potential to show a similar upward turn in business aviation as commercial aviation, given the ideal conditions for BizAv in the country. “The terrain, small towns, hills, and exclusive airports make it perfect for private jets. However, there are some constraints, including mental, regulatory, and perception-related challenges that need to be addressed.”

Some of the major challenges to be underlined include the rule-making process, the tariff, ground handling charges, security concerns as well as the utilisation rate. The panelists during the conference brought to light some other major challenges that have been a cause of concern for them as they navigate the industry.

“One of the major challenges for companies in this sector is managing expenses. To address this issue, promoting and recognising Aircraft Management companies can

help streamline the process of managing a fleet of aircraft. Although there are many regulations in place, we must execute them in a constructive way to ensure efficient operations,” said Iyer.

He further added that it is crucial to encourage smaller NSOPs (Non-Scheduled Operators) to collaborate with larger aircraft management companies that have the resources to provide proper due diligence and take care of their aircraft. By doing so, these smaller companies can grow their business while also ensuring safe and efficient aviation practices.

Funding, tax regime, ground handling charges, heavy import duties, discrepancies at the level of permissions, have been a constant discussion point for the industry, an ongoing debate. Despite the availability of funds, taxes remain a major pain point.

Captain Pankaj Joshi, CEO, Head Aviation, Bajaj Auto highlighted, “One of the biggest issues faced by private operators is aircraft parking. Operators often have to fly their aircraft for hours to find a suitable parking space, which is a national waste of resources. For example, a Pune-based company like ours that has been operating for 50 years in the city was asked to park their aircraft in Bangalore, which is an hour and a half away. The regulatory environment in India is also a cause for concern, with the development of infrastructure and changes in rules and regulations presenting additional challenges. Operators face difficulties in understanding which rules apply in which situations, leading to confusion and delays. Beyond parking issues, pilots are also experiencing difficulties in obtaining their license renewals due to the lack of designated parking for aircraft. These issues must be addressed to ensure the growth and

12 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 PERSPECTIVES

INDIA HAS THE POTENTIAL TO SHOW A SIMILAR UPWARD TURN IN BUSINESS AVIATION AS COMMERCIAL AVIATION, GIVEN THE IDEAL CONDITIONS FOR BIZAV IN THE COUNTRY

“IT IS CRUCIAL TO ENCOURAGE SMALLER NSOPS (NON-SCHEDULED OPERATORS) TO COLLABORATE WITH LARGER AIRCRAFT MANAGEMENT COMPANIES THAT HAVE THE RESOURCES TO PROVIDE PROPER DUE DILIGENCE AND TAKE CARE OF THEIR AIRCRAFT. BY DOING SO, THESE SMALLER COMPANIES CAN GROW THEIR BUSINESS WHILE ALSO ENSURING SAFE AND EFFICIENT AVIATION PRACTICES.”

— MAHESH IYER, PRESIDENT, TITAN AVIATION GROUP

“ONE OF THE BIGGEST ISSUES FACED BY PRIVATE OPERATORS IS AIRCRAFT PARKING. OPERATORS OFTEN HAVE TO FLY THEIR AIRCRAFT FOR HOURS TO FIND A SUITABLE PARKING SPACE, WHICH IS A NATIONAL WASTE OF RESOURCES."

— CAPTAIN PANKAJ JOSHI, CEO, HEAD AVIATION, BAJAJ AUTO

development of the private aviation industry in India. Additionally, the interpretation of rules causing differences in opinions and the further hassle to operate has to be eliminated.”

Group Captain Bali of BAOA brought to notice that prior parking permission for NSOP in any case is not required, like it was waved off for helicopters, same way it is being done, just at what level it has been implemented is something we are yet to confirm but it has been agreed, and we will get it implemented too.

Kapur also pointed out, “To address these issues, there needs to be greater interaction between private aviation operators and the government. Operators themselves need to form committees to discuss their problems and work towards finding solutions. Young leaders should also step up and be supported in their efforts to effect change.”

Giving context of the scenario, Captain Shanker Manrai, Technical Advisor (HSAAC), MoCA presented the scenario of the industry that ten years ago, the scheduled aircraft segment had about 305 aircraft, and now it has increased to over 700, representing an 87 per cent rise. However, for the non-scheduled aviation industry, there were 298 aircraft ten years ago, and we have only seen an increase of 19 aircraft, bringing us to 317. This growth is completely off from what was anticipated. Ten years ago, there were 146 operators, and now there are only 94, with 93 operators perishing. This reflects the nature of this industry. “The basic problem for the aviation industry, especially for the nonscheduled segment, is the affordability on

both ends for operators and consumers/passengers. Another fundamental issue is accessibility on every level to access aircraft and reach any destination. This means that end points are there for operators. The biggest blocker is policy, and from policy flows regulation. We don't see rationality, flexibility, and implementability in the policies and regulations. There are a lot of inconsistencies, and the efficiency of airspace is also an important part. The PBN implementation plan is underway, and coordination with upcoming airports is also being worked upon for smoother functioning,” he added.

The panel also brought out that the industry is now gaining recognition as a potential engine for economic growth as well. The perception that business aviation is only for the rich is changing, and the government is beginning to pay more attention to this sector. Overall, India is well positioned to become a major player in both commercial and business aviation, with the right policies and mindset, added Mehra.

CAPTAIN SHANKER MANRAI, TECHNICAL ADVISOR (HSAAC), MOCA, SAID “THE BASIC PROBLEM FOR THE AVIATION INDUSTRY, ESPECIALLY FOR THE NON-SCHEDULED SEGMENT, IS THE AFFORDABILITY ON BOTH ENDS FOR OPERATORS AND CONSUMERS/ PASSENGERS.”

“Looking ahead to 2023, the industry is expected to see some sort of correction as the current demand levels are not sustainable. While some people are predicting a crash, demand is still high, and the requirement for people to buy will continue. However, the current seller's market is likely to see some sort of correction, including pricing, which will be balanced out. It is already evident that the supply of aircraft is starting to correct a bit. In 2023, there will be stable demand with some correction, and in 20242025, the industry is expected to move forward strongly,” Kapur remarked. BAI

13 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 PERSPECTIVES

Indian Private Helicopter Industry Awaiting Take Off

BY AYUSHEE CHAUDHARY

BY AYUSHEE CHAUDHARY

HELICOPTERS HAVE BEEN TERMED as among the most versatile machines that can cater to various transportation needs of the country including better connectivity; medical transit, tourism, etc and yet Indian helicopter aviation is still awaiting its take off. With only 300 or so helicopters nationwide, their potential for travel, mining, business trips, and medical services still remains largely untapped. At the BizAvIndia conference held in Delhi, the regulators and the industry experts came together to deliberate what is hampering helicopters from growing in India and what is the way forward to make the fleet grow at least to double in the next couple of years.

According to Statista, the industry still remains in the nascent stage. As of 2019, the country had less than 250 registered and operational civil helicopters and over 1,000 helipads across the country. Even after the COVID pandemic, not much has changed; rather the numbers have seen a downward trend due to multiple factors such as regulatory bottlenecks and high operational costs. This fleet size formed less than a per cent of the worldwide copter fleet.

Captain Manu Chaudhary, Dy. CFOI, DGCA drew a parallel between defence and civil helicopter fleet mentioning that in the Air Force during his three years term, the number of helicopters had gone up. “But when I joined DGCA, I was surprised that the helicopter industry was 300 helicopters in 2013 and now we are at

240. There is tremendous scope for which we have to work collaboratively. We are devising a lot of methods, so that without interfering with fixed wing airplanes, helicopters can fly unrestricted.”

Group Captain Rajesh K. Bali, MD, BAOA also shared some points from earlier discussion:

l Optimal utilisation of defence pilots, especially the ones in Mi-17 fleet, should be ensured by tweaking current DGCA’s CARs for conversion to civil license.

l Subsidies by the government should not be limited by any time frame but rather be decided based on the actual growth of demand in remote/inaccessible areas and the gradual increase in the frequency of flights.

l Subsidies or VGF should be provided to local residents of the areas, not to the tourists; this is open to discussion but this is what we believe.

Colonel Sanjay Julka, Technical CEO, Club One Air brought to light the almost stagnant state of the industry since almost half a decade. “I am participating after about 5-6 years in a BAOA function and the discussions that used to happen five years ago on helicopters are still the same and that is not very encouraging.” He also underlined that there’s a new category of drones, eVTOL aircraft etc in the market now which are taking on half the roles of the helicopter all across the world. “So, the decrease in number is everywhere but we need to really see why we

14 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement BIZAVINDIA CONFERENCE 2023 ANALYSIS

Helicopters are the most versatile machine and we aim to at least double the helicopter fleet in India by 2026, said Group Captain Bali, Managing Director, BAOA

PHOTOGRAPH: Global Vectra Helicorp

THE NUMBER OF HELICOPTERS IN INDIA HAVE SEEN A DOWNWARD TREND DUE TO MULTIPLE FACTORS SUCH AS REGULATORY BOTTLENECKS AND HIGH OPERATIONAL COSTS

are not able to exploit their potential as we should and operate helicopters at night. We need to start highlighting the support roles that this industry contributes to.”

He also suggested that even if High Net Worth Individual is traveling, charge the tax if he is going to a developed place like say Hyderabad or Mumbai but if he is going to an underserved and unserved area, don’t charge as much tax; show how important it is for that person to reach those such areas and develop them. This is the focus we need to have from General Aviation (GA). As far as finance is concerned, when you have to buy a car, you may even get 100 per cent of the finance but the case is not the same for aircraft because it is not seen as an asset. The government should step in and say we are going to have HEMS. Also, for essential flights too there should be no duty at all like we got it removed for medical flights.

Finance has been an aviation pain point and continues to be so in all the segments; helicopters being no different. However, the industry strongly feels the need for the separation of certain rules for rotors and fixed wings, which is missing at present. Harsh Vardhan Sharma, Director at Himalayan Heli Services highlighted the issue of expense, “The one main impediment is that the government has levied 2.5 per cent duty on import, whether you are leasing or buying and it is quite discouraging. There is great demand for single engine helicopters and operators want to bring the aircraft but the duty is a great hurdle. We have been putting our case to MoCA to see that this duty is discontinued so that we are able to bring medium lift and heavy lift helicopters as well.”

“We are constantly working in collaboration with the industry to understand the concerns and explore the potential of the industry. I look forward to solutions for operating charter jets and am confident that our partnership will grow stronger and stronger. All the initiatives, whether it’s fractional ownership, HeliSewa or construction of heliports or the small aircraft segment, all will become reality very soon and will try our best to achieve so that our people can take the benefit of air transportation services as well as see burgeoning growth in business aviation sector,” ensured Usha Padhee, Principal Secretary, Commerce and Transport Department, Government of Odisha.

Talking on the demand being positive in the industry, Rohit Mathur, CEO, Heritage Aviation also echoes that in the last few years, there is huge demand for helicopters. “There’s a lot of demand, the fixed wing industry and the private jet industry are able to encash on those demands, but the helicopter industry is yet to. People who are into helicopters are small aircraft operators, we don’t have the backing of big corporations and raising finance is a nightmare. No Indian bank is ready to finance unless we give them 120-130 per cent collateral and foreign financial institutions are not comfortable working with small operators. So, within BAOA we should plan a strategy and take this issue to the government in a targeted way and convince them. Let’s say, we can pay 20 per cent, rest let it be financed. Our banks have that much liquidity today but with aviation they just have some negative setbacks, they are doing it with other industries. The ecosystem we have today is very favourable. Let us find experts in this field, engage with them, develop a strategy and give the industry people some relief.”

Captain Jitender Harjai, RWSI stressed, “The stage is not yet set for the growth of the helicopter industry in India. Before we get into

the logistics and regulatory changes, I want to underline that foremost, we need the intention of building the nation. And nation building requires the ‘will to do”; not for us but for the next generation.” The hurdles include stringency in regulations, lack of infrastructure, absence of understanding the instrument (helicopter), the commercial environment, as well as the concessions/considerations, he added. “The government needs to step up; we understand operations cannot be funded for life time but subsidies, concessions can be given so that operations don’t become a burden on the operator.”

Asangba Chuba Ao, Joint Secretary, MoCA also mentions that in the last round of UDAN which was basically for small aircraft, mainly for helicopters, the kind of response received was overwhelming. Even though it was a leap of faith and we are still waiting to see how it takes off, this has certainly made us realise even more strongly that this is an area where we see a lot of interest as well as potential.

There are many issues when it comes to operations involving routes, airways, permissions, etc and that needs to be changed along with the mindset. Some of the expectations for growth of helicopter as laid out during the conference included:

l The controller and ATS services’ people need to be given a specific understanding of the helicopter operations. ATC special training programme should be set.

l There are dedicated VFR (Visual Flight Rules) routes available throughout the world in which helicopters fly unrestricted, we have to work towards facilitating those too.

l We have to prepare and the operators are advised to start training for night operations because night operations is a reality and to make this industry grow, the helicopter should be able to take off at any time.

l Helicopter flying in far-flung areas won't be financially viable because the people it caters to are not financially that strong so support of state government or the national government will be required to sustain the operators who can fly to these far-flung areas.

l There should be a reasonable cost for the operator to sustain and for the user to hire it.

l Timely availability at various locations and 24x7 connectivity

l Connectivity up to the last mile as in UDAN 4.2.

l Regulations are interpreted as per the liking and comfort of different people responsible; this needs to be addressed.

l GST has become every operator’s concern and needs to be looked into.

l Infrastructure to be improvised with heliports/helipads as well as for landing permissions, pins approach.

l Have dynamic pricing, reduce unnecessary commerce loads.

l Relaxation in handling and landing charges; custom duty.

l Availability of AvGAS 100 LL.

l Allowing temporary landings.

From financial hurdles to perception problems, infrastructural issues to restrictive regulations, the helicopter industry in India is seeking the ease of flying helicopters and having access to more airspace so as to increase the fleet which will further increase employment, facilitate more movement and in turn aid the economy. BAI

15 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement

BIZAVINDIA CONFERENCE 2023 ANALYSIS

SUBSIDIES BY THE GOVERNMENT SHOULD NOT BE LIMITED BY ANY TIME FRAME BUT RATHER BE DECIDED BASED ON THE ACTUAL GROWTH OF DEMAND IN REMOTE/ INACCESSIBLE AREAS AND THE GRADUAL INCREASE IN THE FREQUENCY OF FLIGHTS

Leaving a Bright Sustainability Trail

BY AYUSHEE CHAUDHARY

SUSTAINABILITY IS BECOMING NOT just the talk of the town but the drill of the business going forward in the business aviation industry and Gulfstream is leaving no stone unturned to mark its place amongst the leading sustainable players. Gulfstream Aerospace recently received four National Business Aviation Association (NBAA) Sustainable Flight Department Accreditations.

The newly established programme recognises Gulfstream for sustainability leadership across locations. This programme was launched in 2022 by NBAA to recognise “business aviation entities meeting exceptional environmental sustainability standards”. Ever since the industry pledged the target of achieving net zero carbondioxide emissions by 2050, NBAA has been even more proactive

Gulfstream added more feathers to its hat, earning NBAA Sustainable Flight Department Accreditations recently

towards encouraging and supporting industry initiatives through such programmes.

“We appreciate the partnership with NBAA to recognise our sustainability efforts,” said Mark Burns, President, Gulfstream. “These accreditations encompass our holistic commitment to leading our industry toward its goals for carbon neutrality, and we are proud to be the first original equipment manufacturer to be identified for these efforts across all four categories — flight, ground support, operations and infrastructure.”

Prior to the accreditation, Gulfstream also became the industry’s first business aircraft original equipment manufacturer to fly on 100 per cent Sustainable Aviation Fuel (SAF). The flight took place on a Gulfstream G650 from Gulfstream’s worldwide headquarters in

16 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement SUSTAINABILITY GULFSTREAM

PHOTOGRAPH: Gulfstream

GULFSTREAM IS LEADING THE INDUSTRY CLOSER TO DECARBONISATION

“THESE ACCREDITATIONS ENCOMPASS OUR HOLISTIC COMMITMENT TO LEADING OUR INDUSTRY TOWARD ITS GOALS FOR CARBON NEUTRALITY, AND WE ARE PROUD TO BE THE FIRST ORIGINAL EQUIPMENT MANUFACTURER TO BE IDENTIFIED FOR THESE EFFORTS ACROSS ALL FOUR CATEGORIES — FLIGHT, GROUND SUPPORT, OPERATIONS AND INFRASTRUCTURE.” — MARK BURNS, PRESIDENT, GULFSTREAM

Savannah and was flown in partnership with engine supplier RollsRoyce on the G650 BR725 engine.

“At Gulfstream, leading our industry closer to decarbonisation is a long-standing priority, and testing, evaluating and promoting new developments in SAF takes us another step closer to that goal,” said Burns. “Gulfstream has long prioritised sustainable products and practices through innovations in aerodynamics, aircraft technologies, engineering, manufacturing and infrastructure, as well as in facilities operations and our investments in SAF research and development.”

Gulfstream’s sustainability strategy encompasses three pillars — energy and emissions; operations; and culture and learning — and supports industry goals established by the NBAA, the General Aviation Manufacturers Association (GAMA) and the International Business Aviation Council (IBAC). The goals are a 2 per cent improvement in fuel-efficiency per year from 2010 to 2020; carbon-neutral growth from 2020 onward; and net-zero carbon dioxide emissions by 2050.

The SAF that was used in the test consisted of two components: HEFA (Hydroprocessed Esters and Fatty Acids), produced from waste fat and plant oils by low-carbon fuel specialist World Energy in Paramount, California, and SAK (Synthesised Aromatic Kerosene) made from plant-based sugars by Wisconsin-based Virent Inc.

This in-development and fully sustainable fuel eliminates the need for the addition of further petroleum-based components and enables a 100 per cent drop-in SAF that can be used in existing jet engines and infrastructure without any modifications, the company explained. This sustainable fuel has the potential to reduce net CO2 life cycle emissions by nearly 80 per cent compared with conventional jet fuel, with the possibility of further reductions.

In addition, Gulfstream highlighted its facilities that include more than 2.2 million square feet of green buildings both in the US and the UK. The company also underlined that its increased focus on sustainable operations has reduced its greenhouse gas emissions by 18 per cent since 2014 while expanding facilities by 30 per cent.

With over 3,000 aircraft in service around the world, Gulfstream ensured that together with its parent company General Dynamics, it is consistently investing in the future, dedicating resources to researching and developing innovative new aircraft, technologies and services. With a fleet that includes the super-midsize Gulfstream G280, the high-performing Gulfstream G650 and

Gulfstream G650ER, and a next-generation family of aircraft including the all-new Gulfstream G400, the award-winning Gulfstream G500 and Gulfstream G600, the flagship Gulfstream G700 and the ultralongrange Gulfstream G800, Gulfstream offers an aircraft for every mission.

G700 WORLD TOUR

Following the accreditation, Gulfstream also announced that the Gulfstream G700 achieved 25 speed records on the recently completed G700 world tour. Gulfstream flew two fully outfitted G700 production test aircraft to more than 20 countries across six continents to demonstrate the aircraft’s performance capabilities and the flexibility and comfort of the most spacious cabin in the industry. Gulfstream had announced the extensive world tour in October 2022. The G700 world tour commenced directly after the two aircraft appeared at the 2022 NBAA Business Aviation Convention & Exhibition (NBAA-BACE) and built on the test programme’s impressive real-world performance capabilities, which already include eight international city-pair speed records.

In total, the two G700 outfitted aircraft traveled 53,882 nautical miles/99,789 kilometers over more than 180 hours of flying. The world tour speed records are pending approval by the US National Aeronautic Association and Fédération AéronautiqueInternationale in Switzerland for recognition as world records. Gulfstream listed some notable record runs achieved by the G700:

l Savannah to Riyadh, Saudi Arabia, in 12 hours, 36 minutes at an average speed of Mach 0.90 to begin the international portion of the tour

l Istanbul, Turkey, to Van Don International Airport in Vietnam, in 9 hours, 2 minutes at an average speed of Mach 0.90

“THE G700 WORLD TOUR WAS A TREMENDOUS SUCCESS. SHOWCASING THE OUTFITTED AIRCRAFT TO OUR CUSTOMERS AND PROSPECTS AROUND THE WORLD BOLSTERED THE ALREADY STRONG DEMAND WE ARE SEEING FOR THE G700.” — MARK BURNS, PRESIDENT, GULFSTREAM

l Riyadh to Melbourne, Australia, in 13 hours, 39 minutes at an average speed of Mach 0.87

l Christchurch, New Zealand, to Los Angeles in 12 hours, 13 minutes at an average speed of Mach 0.87.

The two G700 production test aircraft interiors showcased the industry’s only ultragalley, with more than 10 feet/3 meters of counter space; a grand suite with fixed bed and bright, spacious lavatory with full vanity and shower; an ultrahigh-definition dynamic circadian lighting system; an all-new award-winning seat design; and the lowest cabin altitude in the industry at 2,916 ft/889 m when flying at 41,000 ft/12,497 m. BAI

17 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement

SUSTAINABILITY GULFSTREAM

Financial Hurdles Holding Back Indian BizAv Boom

BY ASHISH JAISWAL, CHIEF EXECUTIVE OFFICER, MODAIR AVIATION IFSC PRIVATE LIMITED

The increasing demand that the industry is witnessing, requires enhanced infrastructure, more & better pieces of equipment and a higher requirement of skilled manpower

18 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement POLICY REFORMS

ILLUSTRATION: SP's Team

THE AVIATION SECTOR IS on a comeback from the post-Covid situations that we faced during the last many months. The new opportunities, new customers and the return of existing customers all contribute to the increase in the business. Additionally, the experience thus far has been very encouraging due to the government initiatives also to boost the aviation sector, whether in terms of issuing new licenses for flying training institutes, development of underserved and unserved airports, new lease to the RCS-UDAN scheme etc have created a high demand for aircraft in the country.

The coming years are expected to see high numbers of aircraft induction and we are poised to cater a significant piece of the pie to the Non-Scheduled Aviation and Flight Training Organisations. With our current focus on aircraft finance and lease to the flight training institutes, we anticipate closing 20 such inductions by the end of the next financial year.

The increasing demand that the industry is witnessing, requires enhanced infrastructure, more & better pieces of equipment and a higher requirement of skilled manpower. However, there are certain areas that need more focus to see the industry grow to its potential, especially the finances and funds that are a major concern for the industry.

FACILITATING FUNDS & FINANCES

The growth of the business aviation industry in India has been hampered by persistent financial challenges. While the non-scheduled business is thriving, there is still a dearth of funds to finance the growing demand for aviation services, particularly with respect to movable property. Despite the opportunities presented by the International Financial Services Centre (IFSC), laws and regulations make it difficult for Indian banks to provide asset financing. As a result, banks currently focus solely on working capital and other fund requirements, leaving a significant gap in the market for asset financing.

Moreover, the high cost of acquisition is a critical factor that adversely affects the growth of business aviation in India, resulting in longer break-even periods and entry barriers. Although the GIFT City project was envisioned as a positive development for business aviation, it is currently adding to the cost of acquisition. Furthermore, Indian businesses are structuring their transactions outside of India, despite the existence of IFSC GIFT City, leading to additional costs.

International banks have not yet set up financing systems in India, exacerbating the challenges faced by the Indian diaspora. While orders for aircraft from manufacturers such as Boeing and Airbus are benefiting from the present situation, the immediate benefits to India will only materialise after the fleet comes into operation, which could take months or years. To address these challenges, the government could create a pool of funds or allow for more robust financing systems to cover the gap. Such measures would provide much-needed support for the business aviation industry in India, enabling it to realise its full potential.

FRACTIONAL OWNERSHIP, LEASING & TAXES

The Indian business aviation industry has been eagerly waiting for the implementation of fractional ownership. The benefits it can provide, such as shared investment and depreciation advantages, have been widely discussed. However, the advantages of fractional ownership have not yet been realised in India due to a lack of clarity on regulations and financial incentives. If fractional ownership regulations are clarified, it could encourage multiple companies to jointly fund an investment and share in the benefits.

Joint funding by multiple companies could help alleviate financial barriers to ownership, but clear financial incentives are necessary for fractional ownership to be a feasible investment. Therefore, the announcement of fractional ownership regulations could initiate much-needed momentum in the Indian business aviation industry.

Leasing is also a potential financing option in the Indian business aviation industry that can be explored to support growth. However, the feasibility of this option is dependent on the availability of clean funds and the regulatory environment. Although leasing has been adopted by some players in the industry, the reluctance of bigger players to lease out smaller aircraft may impede the growth of leasing in this market. To facilitate leasing as a viable financing option, policies that support this option should be implemented, and infrastructure should be improved. The establishment of International Financial Services Centres (IFSCs), for instance, can attract more investment and foster the growth of the industry. By fostering an enabling environment, the Indian business aviation industry can leverage leasing to access the necessary capital for expansion and progress.

The Indian business aviation industry faces a demand-supply gap due to high taxes, which impedes its growth. Specifically, the Goods and Services Tax (GST) on aircraft leasing is currently set at 18 per cent, and the applicability of this tax to all forms of aviation requires clarification. In addition, the industry requires policy changes in key areas such as GST, fractional ownership, finance, and maintenance, repair, and overhaul (MRO) to enable its development. The finance aspect, in particular, poses a significant challenge as the high cost of investment deters financiers from providing funds, given the relatively low Return on Investment (ROI). It is imperative that policymakers provide immediate attention and simplification to address this challenge and provide the necessary funds and back support to make the industry viable. Building things domestically, rather than importing them from outside of the country, is essential for the holistic growth of business aviation in India.

INFRASTRUCTURE

The business aviation sector in India has witnessed some progress in terms of infrastructure development, although much remains to be done to fully realise its potential. Despite the growth in the number of airports and passengers, the Indian MRO (Maintenance Repair Overhaul) industry is currently operating at only 15-20 per cent of

19 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement

POLICY REFORMS

THE HIGH COST OF ACQUISITION IS A CRITICAL FACTOR THAT ADVERSELY AFFECTS THE GROWTH OF BUSINESS AVIATION IN INDIA, RESULTING IN LONGER BREAK-EVEN PERIODS AND ENTRY BARRIERS

its capacity. To facilitate the growth of the industry, concerted efforts are needed to establish more MRO shops in the country.

While FBOs (Fixed Base Operators) hold promise as a valuable concept in the Indian market, the industry is not yet mature enough to support it. An increase in corporate travel is necessary for FBOs to become a viable proposition. However, the high cost of setting up FBOs poses a significant challenge, and usage fees alone may not be sufficient to cover the costs. FBOs must also invest in MRO services, lounges, and related activities to become profitable.

The situation with respect to infrastructure in the Indian business aviation sector underscores the need for continued investment and development to ensure its long-term growth and success. By taking appropriate measures to address the challenges facing the industry, India can establish itself as a significant player in the global business aviation market.

There exists a substantial opportunity for Delhi to emerge as a prominent international hub, particularly due to its strategic location between Singapore and Dubai. Employing a hub and spoke structure and creating beyond and behind connections for international routes can lead to positive growth for the region. The optimisation of

bilateral agreements and exploration of potential beyond and behind connections can foster a more efficient way of operating flights. For instance, a code-share agreement was established between American Airlines and Air Sahara for cities around Chicago and Chicago to Delhi several years ago, demonstrating the potential of such connections. Utilising Delhi as an international hub can further enhance these opportunities, particularly with recent infrastructure enhancements and expansion of terminals. Moreover, beyond and behind connections on the East and West side of routes can be leveraged to transport passengers to Delhi and then disseminate them on their own network, along with cities like Hyderabad and Bengaluru.

The aviation industry holds immense potential for innovation and optimisation, which would necessitate collaboration among airlines and airports, as well as further research and structuring to explore these opportunities. BAI

ModAir Aviation IFSC Private Limited, is one of the leading Leasing and Finance Companies based at IFSC GIFT City, Gandhinagar, Gujarat. (Thoughts of Ashish Jaiswal were put on paper by Ayushee Chaudhary, Principal Correspondent of SP Guide Publications, to bring you this article).

20 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement POLICY REFORMS

ILLUSTRATION: SP's Team

THE SITUATION WITH RESPECT TO INFRASTRUCTURE IN THE INDIAN BUSINESS AVIATION SECTOR UNDERSCORES THE NEED FOR CONTINUED INVESTMENT AND DEVELOPMENT TO ENSURE ITS LONG-TERM GROWTH AND SUCCESS

Unmanned Urban Air Mobility

BY AIR MARSHAL ANIL CHOPRA (RETD)

BY AIR MARSHAL ANIL CHOPRA (RETD)

UNMANNED URBAN AIR MOBILITY (UUAM) is the next happening thing in civil aviation. UUAM is the future mode of transport offering aerial passenger transport within or between cities. Advances in unmanned aerial systems, battery and electric propulsion technology are the main factors that have facilitated UUAM. It is thus possible to use unmanned aerial vehicles that can take-off and land vertically (VTOL) for intra-urban passenger transportation. Many companies are developing the next generation VTOL vehicles. Passenger acceptance and potential passengers’ value of time, are the two key factors for going ahead. The UUAM vehicle could either be rotary-wing, fixed-wing or hybrid cruise vehicles. There is the

The UUAM operations will require a separate, newly created airspace with a new set of rules and standards. Integrating them with the current ATC system will be very complex and is unlikely.

need to understand the landscape of relevant questions surrounding the implementation of UUAM. The urban airspace would have to look at safety-related factors, social factors, system factors, and aircraft factors.

UUAM EVOLVES

The fact that unmanned aerial vehicles (UAV) have been successfully flying since 1970s, and the safety record has been continuously improving, has given confidence for UUAM. Removing pilots dramatically increases payload and reduces labour costs. Meanwhile, the advances in civil aviation have seen the boom in less expensive civil travel and light personal jets since the 1990s. Well managed air-

21 B iz AV India | ISSUE 1 | 2023 www.sps-aviation.com/bizavindiasupplement TECHNOLOGY UNMANNED

PHOTOGRAPH: Wisk Aero

ACCOMMODATING EXPONENTIALLY GROWING UUAM TRAFFIC WILL REQUIRE INNOVATIVE SOLUTIONS IN AIR TRAFFIC MANAGEMENT, COMMUNICATION, NAVIGATION, AND SURVEILLANCE

lines have pulled ahead of the pack. Now as the world begins to reach inflection point, there are signs of hot competition over UUAM aircraft, too. UUAM evolved from the Advanced Air Mobility (AAM), a joint initiative of the FAA, NASA, and the industry to develop an air transportation system that moves passengers and cargo with new electric (i.e. green) air vehicles in various geographies previously under-served by traditional aviation. Nearly 150 companies worldwide are in the race with under-testing UUAM prototypes, to make aircraft not just flyable, but viable. The controllers initially designed for small UAVs were not robust enough for passenger flights. Advances in Artificial Intelligence (AI) are greatly supporting UUAM.

PUBLIC CONFIDENCE

The public is still sceptical. A survey by Booz Allen Hamilton for NASA found that only 21 per cent of people would feel comfortable flying alone in an automated aircraft – though that number increased to 40 per cent if they were accompanied by other passengers that they knew. Two factors should increase public acceptance: the advent of self-driving cars and trucks, and the introduction of rugged, accurate flight systems.

ELECTRIC AND HYBRID PROPULSION

The use of electric motors in multi-rotor designs for “lift-and-cruise” including use of fixed/tilt wings are evolving. Electric motors are coming from the experience of automotive industry. Hybrid-electric turbo-generator are being combined with rugged turbine engines fed by conventional or bio-derived jet fuel that power motors or high-capacity batteries. Energy efficiency - the endurance of batteries will be an issue for UUAM. More efficient rotors, use of lightweight materials, would support minimal energy consumption. Efficiency is better at lower altitudes but it clashes with noise pollution.

THE ELECTROMECHANICAL ACTUATORS

drones were clearly unacceptable. The leading UUAM companies are looking to install true fly-by-wire computers derived from airliners, but as small as hardcover book. All these will have a triplex architecture for equalising inputs and commands.

COLLISION AVOIDANCE

While, UUAM vehicles will have to have more degrees of freedom, they can freely choose their position, altitude, heading, and speed, which increases airspace capacity and reduce flying costs. However, these concepts require high technological capabilities, such as dynamic geofences and advanced sense-and-avoid capabilities, to maintain the required safety levels. Some such features already exist in drone swarms. Collision avoidance algorithms, avoidance maps, and path-planning would be required.

SEVERAL AGENCIES ARE DEVELOPING

Most UUAM companies are currently flying their prototypes at small airports or over remote test ranges. Once they are brought into urban environment, collision avoidance technologies will become critically important. Very compact traffic collision avoidance system and enhanced ground proximity warning system made up of multiple electronic beams using a small phased array are under testing. Safety considerations would also mean avoiding collisions with buildings. Buildings are then the “no-fly” zones where flying is, understandably, prohibited.

WEATHER RELATED ISSUES