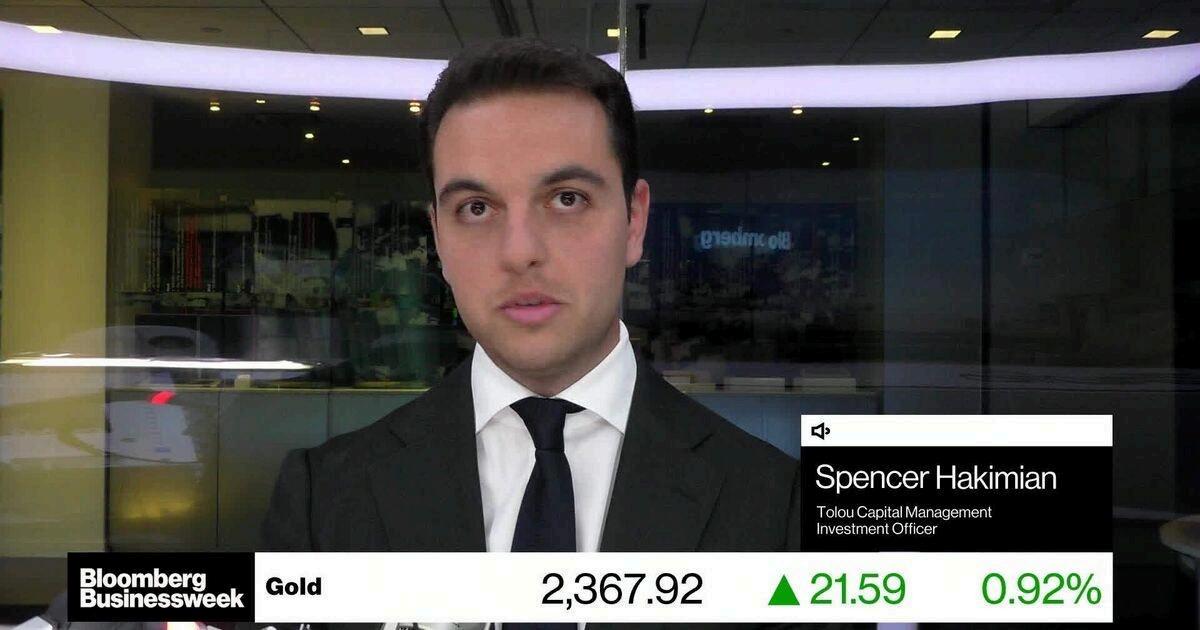

Practical Finance Steps to Build Long-Term Wealth by Spencer Hakimian

Building wealth is a gradual process that relies on informed decisions and consistent action Understanding how money works and how to manage it effectively can help you move from financial uncertainty to long-term security Several key strategies serve as the building blocks for this journey, as suggested by Spencer Hakimian.

The first step is establishing a detailed budget. A budget shows exactly how much money comes in and where it goes each month By categorizing your expenses, you can identify nonessential spending and redirect those funds toward savings or investments. Automating transfers to a savings account can help ensure this process happens consistently

High-interest debt, such as credit card balances or personal loans, can significantly slow your ability to build wealth. Interest charges reduce the amount of money you can allocate to growth Prioritizing these debts starting with the highest interest rate first can free up more of your income for productive financial activities.

Investing is a critical tool for creating wealth over time. A diversified portfolio that includes stocks, bonds, and real estate can provide both growth and stability Low-cost index funds or exchange-traded funds (ETFs) offer broad market exposure with minimal fees, making

them suitable for long-term investors Regular contributions allow you to benefit from compound growth.

Unexpected events such as job loss or medical expenses can disrupt your finances. Maintaining an emergency fund with three to six months’ worth of living expenses can prevent these situations from forcing you to withdraw from your investments. This safety net preserves your long-term growth plans during challenging times

Insurance is another essential element of wealth-building Life, health, and disability insurance provide protection against unexpected setbacks that could otherwise drain your resources Reviewing your policies and financial goals annually ensures your plan stays aligned with your changing circumstances.

By applying these practical steps budgeting, eliminating debt, investing steadily, saving for emergencies, and safeguarding your assets you can create a solid financial foundation and build long-term wealth with confidence.