March 2023 Proudly Serving Benton, Coos, Curry, Deschutes, Douglas, Jackson, Josephine, Klamath, Lane, Lincoln & Linn Counties Since 2015 The Journal for Business in Southern Oregon The Southern Oregon Business Journal is Sponsored by PEOPLE'S BANK CELEBRATES 25 YEARS IN OREGON BANKING - PAGE 21 COLUMBIA BANKING SYSTEM AND UMPQUA HOLDINGS CORPORATION COMPLETE MERGER - 32 WOMEN’S LEADERSHIP CONFERENCE OF SOUTHERN OREGON - MAY 12, 2023 - 36 SouthernOregonBusiness.com 2023 CONFERENCE: AdvanceHER: Building A Network of Leaders Women’s Leadership Conference of Southern Oregon May 12th, 2023 womensleadershipconference.net Page 36

The Southern Oregon Business Journal extends sincere thanks to the following companies for sponsoring the journal. Without their support we could not produce a FREE resource for Southern Oregon businesses.

I just got back from nearly two weeks in the UK. It was an awesome trip and very enjoyable, and it was a work trip.

Dena and I setup a basecamp in London and took trains daily to meet with business owners, employees (yes employees) and business associates, current and past.

Dr. Martens has been a client for over 20 years. We are very proud of the work we have done together and even though they are now a public company and our paths may part soon, I still look back at what we worked on together fondly and proudly.

We developed software for them to help them manage growth and then grew to become their digital e-commerce agency and stood up their first store and stayed with them as they became a global powerhouse. The growth in sales has been staggering and we were part of it. It’s pretty awesome. My team has done a brilliant job morphing as needed.

Over those years we developed a lot of friendships with current and past employees and I took advantage of the rail system to visit as many as I could each day. We averaged 3 meetings per day, sometimes an hour train ride or more apart and we did not have to rent a car.

We ate and drank in ancient pubs and even stayed one night in a mews at a castle and even crossed an item off my bucket list by attending a fund raising concert headlined by my friend Chris. He is someone I have worked with the entire journey with DM and it was wonderful to see him celebrate 25 years of singing in a local band to hundreds of adoring fans. The database programmer came alive on stage and worked the crowd into a frenzy. It was very loud, very hot and very, very special. I’ll never forget it.

When I got home I was asked to give talk to the Ashland Rotary club and update everyone on everything I have going on. I have a lot going on and I loved the opportunity to bring them all up to speed since my last talk about 5 years ago. The room was about 1/2 the size since my last update (declining membership?) And many stayed home or in their offices and enjoyed the live stream via Zoom.

I ended the talk sharing photos of my friends from the UK. Often times in business, we are so focused on solving problems we forget that we make life long friends along the way and I loved showing them off to my local friends.

I run a couple of small businesses here in Southern Oregon and we have had the pleasure of being international at Project A. Now I’m going to see if I can make another one more international as well.

Watch this space to find out what friends I make along the way.

In the mean time be sure to read about the Rogue Music Festival, Women’s Leadership Conference and People’s Bank celebrating 25 years in business.

We have some amazing things happening right here in Southern Oregon and I can’t wait for my international friends to come see what we have going on.

Founder Greg Henderson

Jim Jim@SouthernOregonBusiness.com

Jim Jim@SouthernOregonBusiness.com

PLEASE SUPPORT OUR ADVERTISERS

AMERITITLE - PAGE 4

PEOPLE’S BANK - PAGE 18

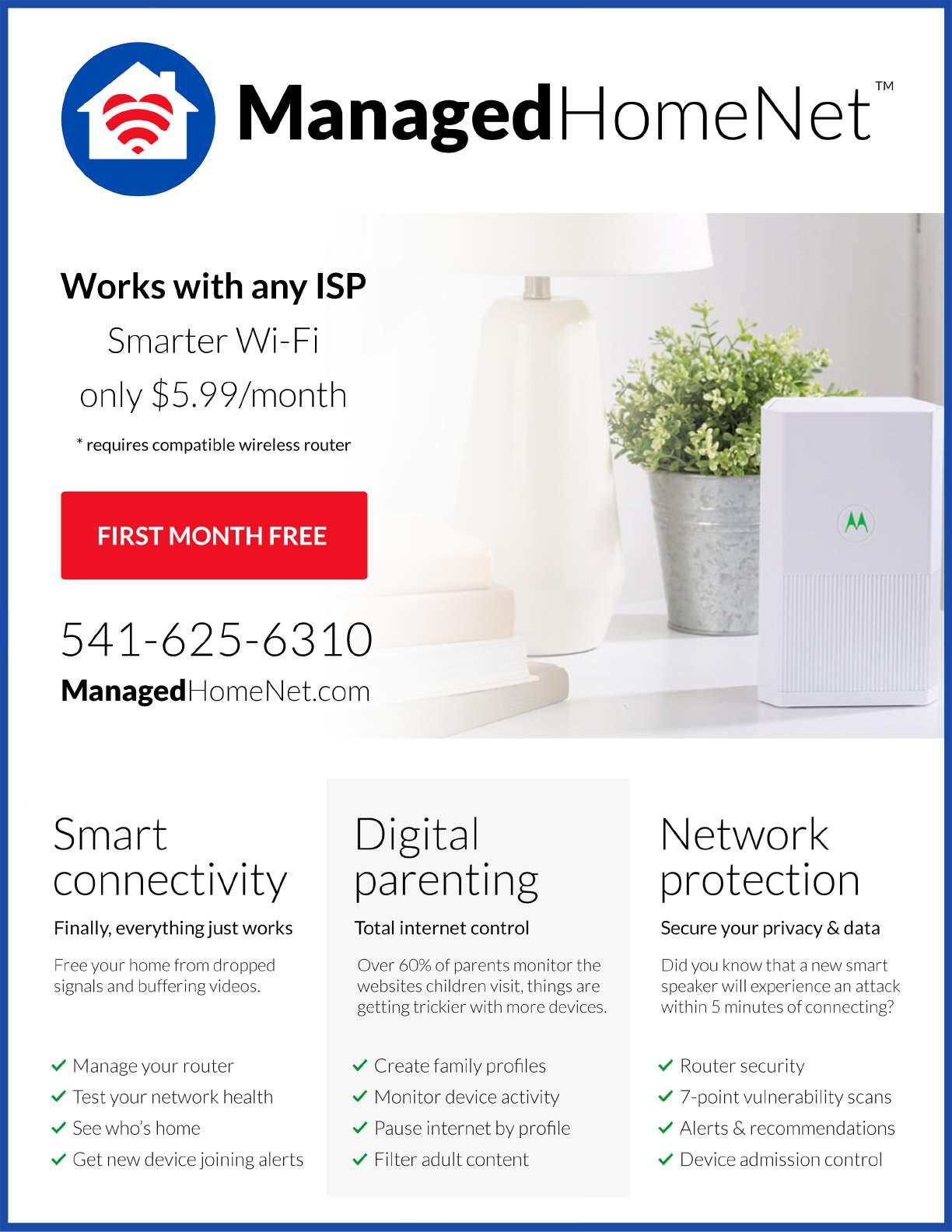

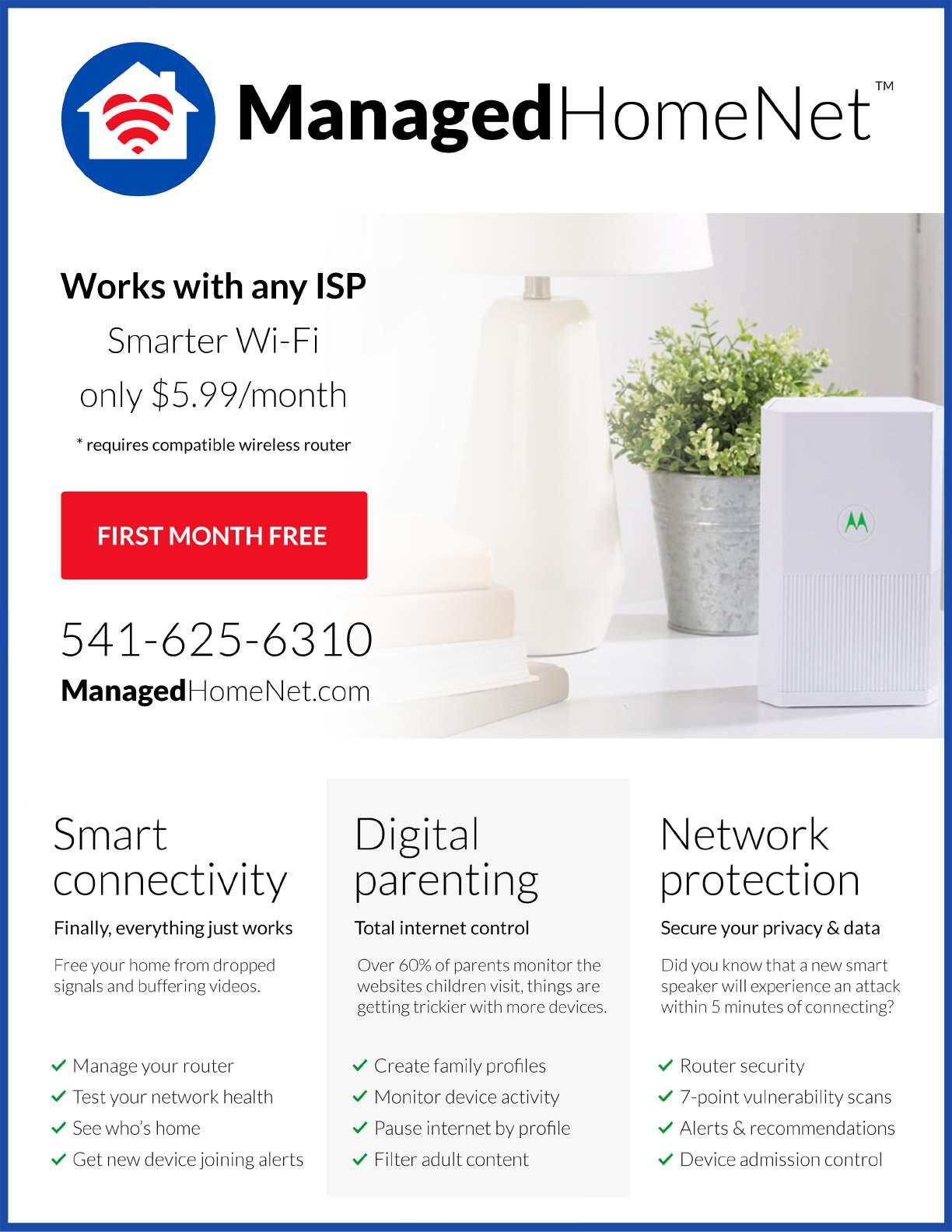

MANAGED HOME NET - PAGE 27

SOU - LEADERSHIP BEGINS HERE

SOUTHERN OREGON UNIVERSITYPAGE 26

PROJECT A - PAGE 34

| Southern Oregon Business Journal March 2023 2

A Few Words from Jim March 2023

ghenderson703@gmail.com

Greg started the Southern Oregon Business Journal in 2015 and retired in 2020.

2023 CONFERENCE: AdvanceHER: Building A Network of Leaders Women’s Leadership Conference of Southern Oregon May 12th, 2023 womensleadershipconference.net Page 36 March 2023 Proudly Serving Benton, Coos, Curry, Deschutes, Douglas, Jackson, Josephine, Klamath, Lane, Lincoln & Linn Counties Since 2015 The Journal for Business in Southern Oregon Business Journal Sponsored by PEOPLE'S BANK CELEBRATES 25 YEARS IN OREGON BANKING PAGE 21 COLUMBIA BANKING SYSTEM AND UMPQUA HOLDINGS CORPORATION COMPLETE MERGER 32 WOMEN’S LEADERSHIP CONFERENCE OF SOUTHERN OREGON MAY 12, 2023 36 SouthernOregonBusiness.com 2023 CONFERENCE: AdvanceHER: Building A Network of Leaders Women’s Leadership Conference of Southern Oregon May 12th, 2023 womensleadershipconference.net Page 36

Southern Oregon Business Journal

Universal Hydrogen Successfully Completes First Flight of Hydrogen Regional Airliner - 5

Lawmakers want no new water rights permits issued until the state audits Oregon’s water resources - 6

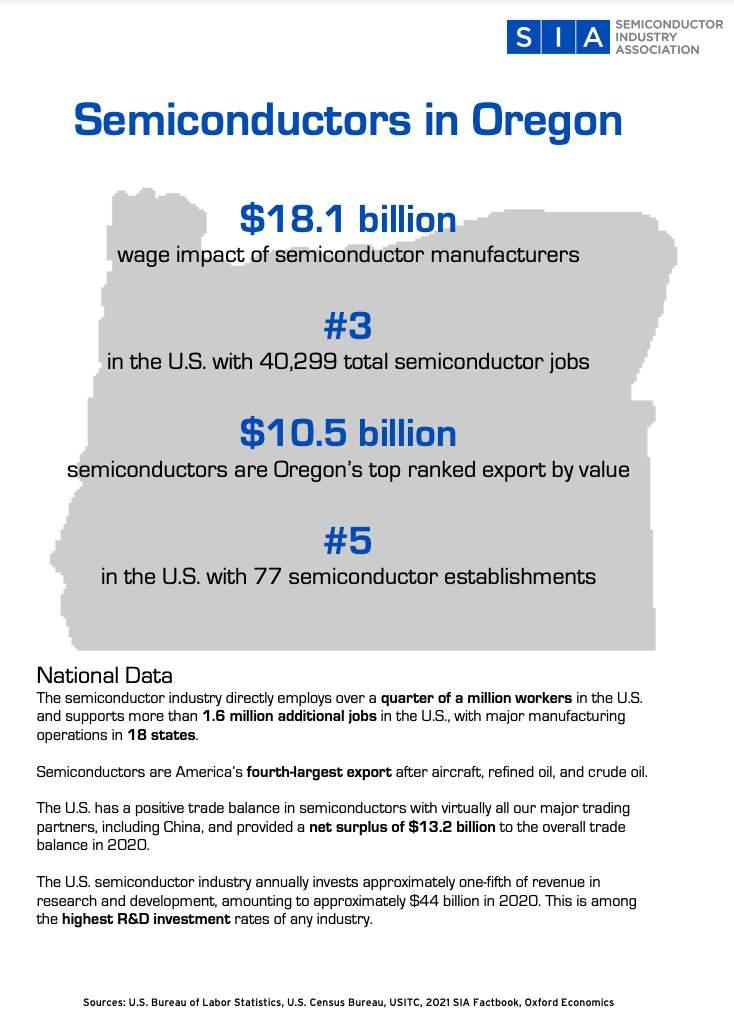

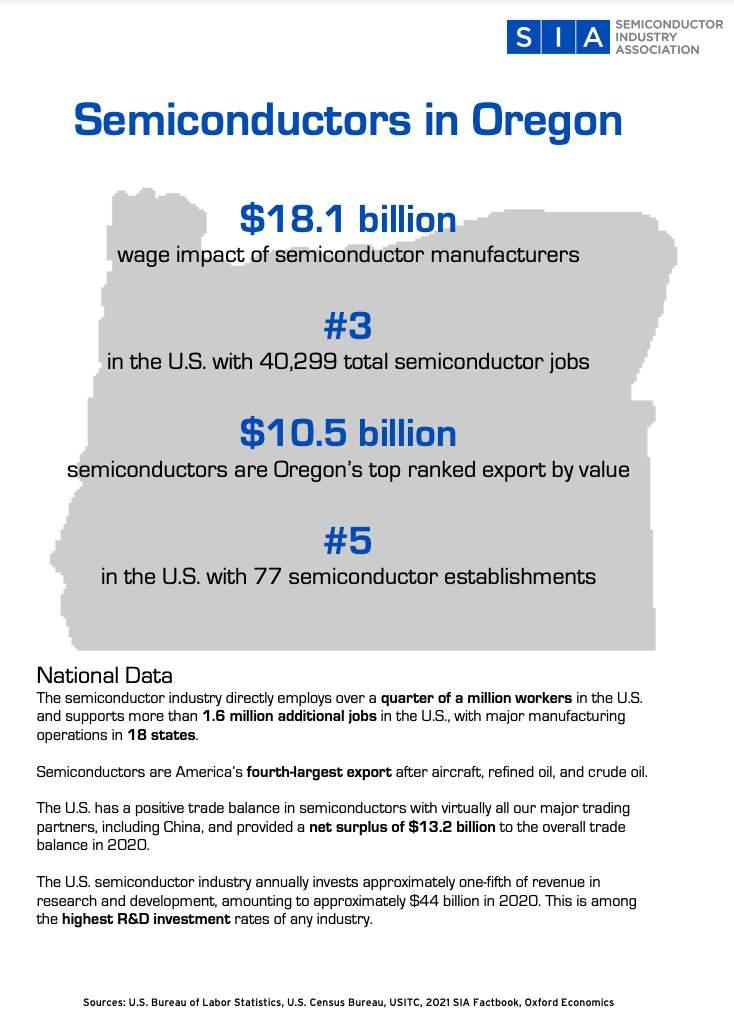

Smaller Oregon companies looking for semiconductor funding - 8

Governor Kotek Approves $1 Million to Help Small, Mid-Sized Oregon Companies Compete for CHIPS Act Funding - 10

January 2023 Employment and Unemployment in Oregon’s Counties - 12

Oregon Economic Update: Not out of the Woods Yet - 14

Oregon Economic and Revenue Forecast - March 2023 - 16

People's Bank Celebrates 25 Years In Oregon Banking - 19

Lithia & Driveway (LAD) Increases Revenue 11% and Reports Diluted EPS of $9.00 - 20

Dutch Bros Inc. Reports Fourth Quarter and Fiscal Year 2022 Financial Results - 22

Arcimoto News Recap - 24

SBDC - The Travails of Young Businesses - 28

Are We Overworking and Underthinking? - 31

Columbia Banking System and Umpqua Holdings Corporation Complete Merger - 32

Women’s Leadership Conference of Southern Oregon - May 12, 2023 - 36

Manufacturing in the Rogue Valley - 37

- 42

Project A launches new website

for Rogue Music Festival

5350 HWY 66, Ashland, Oregon 97520 www.SouthernOregonBusiness.com MARCH 2023 - TABLE OF CONTENTS

A JOURNAL FOR THE ECONOMICALLY CURIOUS, PROFESSIONALLY INSPIRED AND ACUTELY MOTIVATED

By Universal Hydrogen 3/2/2023 Press Release

By Universal Hydrogen 3/2/2023 Press Release

Universal Hydrogen Successfully Completes

First Flight of Hydrogen Regional Airliner

LOS ANGELES &

MOSES LAKE,

Wash.--(BUSINESS WIRE)--Universal Hydrogen Co., this morning flew a 40-passenger regional airliner using hydrogen fuel cell propulsion. The airplane, nicknamed Lightning McClean, took off at 8:41am PST from Grant County International Airport (KMWH) and flew for 15 minutes, reaching an altitude of 3,500 MSL. The flight, conducted under an FAA Special Airworthiness Certificate, was the first in a two-year flight test campaign expected to culminate in 2025 with entry into passenger service of ATR 72 regional aircraft converted to run on hydrogen. Representatives from

Connect Airlines and Amelia, the US and European launch customers for the hydrogen airplanes, respectively, were on hand to witness the historic flight. The company has a rapidly growing order book, today totaling 247 aircraft conversions from 16 customers worldwide, totaling over $1 billion in conversions backlog and over $2 billion in fuel services over the first ten years of operation.

“Today will go down in the history books as the true start to the decarbonization of the global airline industry and we at Connect Airlines are extremely proud of the role that we, as the first US operator, will play

in leading the way with Universal Hydrogen,” said John Thomas, CEO of Connect Airlines. Connect, which will begin regional turboprop service this spring, has placed a firstposition US order with Universal Hydrogen to convert 75 ATR 72-600 regional airplanes to hydrogen powertrains with purchase rights for 25 additional aircraft conversions. Deliveries will start in 2025. “We have committed to being North America’s first zero-emission airline and this historic flight, taking hydrogen, which can be made with nothing but sunshine and emitting only water, is a key milestone on our journey,” continued Thomas.

Southern Oregon Business Journal March 2023 | 5 SUSTAINABILITY

BY: ALEX BAUMHARDT Oregon Capital Chronicle - 3/3/2023

https://oregoncapitalchronicle.com/2023/03/03/lawmakers-want-no-newwater-rights-permits-issued-until-the-state-audits-oregons-water-resources/

Oregon’s water resources

Oregon’s water basins are being overdrawn year after year, and a strategy to protect them for future generations is desperately overdue, according to two lawmakers. State Reps. Ken Helm, D-Beaverton, and Mark Owens, R-Crane, say the Oregon Water Resources Department needs to stop issuing new water rights until it can provide data about the flow of water into and out of the state’s 20 basins each year, many of which are being sucked dry faster than the water can naturally be replaced. This is an issue across the West, where drought, river diversions and groundwater depletion have left parts of seven states scrambling to ration

what water is available to them from the Colorado River Basin.

In Oregon, a majority of water permits are for agriculture, a $5 billion a year industry in the state.

Oregon’s 20 administrative water basins. (Oregon Water Resources Department)

Helm and Owens, chair and vice chair of the House Agriculture, Land Use, Natural Resources, and Water Committee, have proposed legislation that would order the Water Resources Department to stop approving new applications until the agency has calculated how much water exists in each basin and updates its permitting rules so water is not overdrawn. Permit holders include municipalities, businesses, farmers

| Southern Oregon Business Journal March 2023 6 AGRICULTURE

Lawmakers want no new water rights permits issued until the state audits

and agricultural districts relying on irrigation.

The legislation coincides with a push by Gov. Tina Kotek, lawmakers and industry to attract more semiconductor companies to the state and a push by data centers to expand. Both are heavy water users, consuming millions of gallons of water each day.

A statewide water analysis has not taken place since the 1980s, and the agency tracks the annual use of just 17% of water rights holders.

“We have to allow our communities to understand where they’re at,” Owens said. “Is there water left in the checkbook? Is there enough water for 100 years of planning and cities? Is there enough water to make sure we meet ecological targets with fish?”

A recent report from the Oregon Secretary of State’s Office called on the Water Resources Department and other state agencies to collaborate on a unified water conservation plan.

Under the proposed legislation, the Water Resources Department would have until December 2028 to report on how much surface and groundwater exists in each basin, including rivers, streams and underground aquifers, and how much is being drawn for uses such as agriculture, manufacturing and drinking water. The department then would need to update its rules so water cannot be overdrawn. It would also require water assessments to be updated every 10 years.

The bill is on the desk of House Speaker Dan Rayfield, D-Corvallis, and is likely to be discussed by the House agricultural and natural resources committee in mid-March, according to Owens’ water policy adviser, Harmony Burright. Proposals need to be scheduled for a vote by March 17 to continue in the legislative process.

One big user

About 85% of all the water diverted from rivers, streams and aquifers in Oregon is used for agriculture, according to a 2022 report by the Water Resources Department. There are about 90,000 water rights holders in Oregon, and they wouldn’t be affected by the legislation. Nor would about 1,000 with applications in process.

If the bill passes, anyone applying for new water rights or transfers would have their application paused until the Water Resources Department wrapped up its work and rule changes.

“Our water accounts are overdrawn during the times of highest demand and there is not a plan in place to sustainably manage and maximize available water supplies,” the lawmakers wrote in a recent series of statements.

“The current system leaves communities, the economy and the environment vulnerable to water insecurity and costly conflict,” the statements said

No checks and balances

During the last 20 years, Oregon has experienced some of the driest conditions on record. Over 80% of water rights recently approved by the Water Resources Department are in areas where groundwater levels are declining, according to Danielle Gonzalez, policy section manager at the department.

In 2017, scientists at the department did not know whether groundwater was available to support the needs of 121 of 153 new water rights it issued, Gonzalez said in an email.

Mark Owens, R-Crane.

Instead, the agency asked the permit holders to collect data and stop using water if supplies ran low, she said.

That’s bad policy, the lawmakers said.

“We wouldn’t ask a financial institution to continue writing checks without first assessing the status of their accounts to ensure those checks won’t bounce,” they said.

Only about 15,000 of the 90,000 water rights holders have to report their water use to the Water Resources Department because they are a public entity, in an area managed by public authorities or because their permit requires it, the department’s 2022 report said.

Learning firsthand

Owens said the problem of overdrawn basins became clear for him in 2015 when representatives from the Oregon Water Resources Department brought out a graph of data from the 1960s and ’70s that showed that every year natural processes like rain and snow melt refilled about 196,000 acre feet of water in the Harney Basin, yet the Water Resources Department had given away rights to 216,000 acre feet of water per year from the basin – or about 10% more than was being replenished.

“That didn’t make sense,” Owens said. “‘Surely this was a mistake?’” he recalled asking water officials.

The Harney Basin was being overdrawn, and it wasn’t a mistake or the first time it had happened, the officials said.

We wouldn’t ask a financial institution to continue writing checks without first assessing the status of their accounts to ensure those checks won’t bounce

The water resources department is currently considering whether to designate the Harney Basin as a critical groundwater area, which would allow the agency to deny new permits or cut groundwater use, including setting limits on how much can be pumped.

Southern Oregon Business Journal March 2023 | 7

– State Reps. Ken Helm, D-Beaverton, and

By: Julia Shumway Oregon Capital Chronicle 3/7/2023

https://oregoncapitalchronicle.com/2023/03/07/smalleroregon-companies-looking-for-semiconductor-funding/

Smaller Oregon companies looking for semiconductor funding

CORVALLIS— In a small laboratory on HP’s Corvallis campus, a group of Oregon State University graduates are producing a chemical that will make semiconductor chips smaller, lighter and more efficient to produce.

The company, Inpria, was born out of an Oregon State University professor’s research group about 15 years ago. Now, it has 60 employees, 50 in Corvallis and 10

in Belgium. Most, including Ben Clark, Inpria’s senior vice president of engineering, graduated from OSU.

“If things go to plan, our technology should be in phones that are manufactured three years from now,” Clark told reporters and legislators on a recent tour of HP and Oregon State University’s Advanced Technology and Manufacturing Institute.

Much of the conversation around semiconductor funding and the competition among states for new federal funding has focused on new large-scale fabrication facilities, or “fabs.” Those fabs, like several Intel locations in the Hillsboro area, can require hundreds of acres and billions of dollars to build. And in Oregon, they’re unlikely to be built outside of the Portland area.

| Southern Oregon Business Journal March 2023 8 SEMICONDUCTORS

Ben Clark is among a group of Oregon State graduates working at Inpria, a Corvallis company spun out of OSU research. They are producing a chemical that will make semiconductor chips smaller, lighter and more efficient to produce. (Julia Shumway/Oregon Capital Chronicle)

But throughout the rest of the state, a network of smaller companies contribute to manufacturing semiconductor chips. As Oregon lawmakers prepare their pitch for spending $200 million to attract the state’s share of $53 billion in available federal grants and tax credits intended to grow the domestic semiconductor industry, they’re hearing from universities and companies with smaller workforces than Intel’s 22,000 Oregon employees.

That includes HP Inc., the technology company that spun out from printer giant HewlettPackard, and that has said it will bring some manufacturing jobs back to Corvallis if it receives a share of federal funding from last year’s CHIPS and Science Act.

The company has about 51,000 employees worldwide, with 2,500 employees or contractors in a 2 million square-foot facility in Corvallis. The site works closely with Oregon State University, employing 80-100 interns each year and hiring many of them full time after graduation, said Sue Richards, a former intern who’s now the global head of print microfluidics, technology and operations at HP.

“We create really great, goodpaying jobs here,” Richards told legislators before they began their tour.

HP did not allow reporters to join legislators on their tour of its facilities, citing proprietary information. But after the tour, Rep. Janelle Bynum, D-Clackamas and co-chair of the Legislature’s

Joint Semiconductor Committee, said she was surprised by the “ordinariness” of the products HP made.

“We all have a printer in our home, and I never thought that a chip was in there,” she said. “I don’t know what I thought was in the little printer cartridges – I just know I’m annoyed that I have to buy them – but there was an ordinariness to what they were producing.”

Americans take for granted the fact that ordinary technologies, like the HP printheads, were developed in the U.S. and can be produced elsewhere, Bynum continued. Recent supply chain issues tied to the COVID pandemic that resulted in semiconductor shortages affecting a wide swath of industries highlighted a need to produce more semiconductors in the U.S.

Bynum has a degree in electrical engineering and worked as an associate at Boeing but now owns several Portland-area McDonald’s restaurants because she couldn’t find a job in her field when she moved to Oregon. She said growing the semiconductor industry also means making sure that a diverse group of students have the opportunity to work in a high-paying industry.

The industry has a better return on investment than many fields, whether people are coming out of high school or community college and taking manufacturing apprenticeships or graduating with high-level degrees, Bynum said.

“We shouldn’t walk away from our Silicon Forest, like we did 20 years ago when I came here,” she said. “I’m an engineer and there was nothing for me. We shouldn’t walk away from that investment again.”

Bynum said she was impressed by HP, where she saw a diverse workforce. But she said OSU’s demographics need to improve. The college of engineering has about 8,000 male students and only 2,400 female students, and about one-third of the student body are people of color.

“There’s no shortage of smart kids who are first-generation college students, who are Black, who are Latino, who have come from migrant farms, who have been in the foster care system, who have been incarcerated,” Bynum said. “There is no shortage of talent in this state.”

The legislative semiconductor committee tentatively plans to vote Wednesday on a bill to create a $190 million fund for semiconductor companies to expand in Oregon, give universities $10 million to research semiconductors and grant Gov. Tina Kotek the authority to sidestep lengthy land use applications to quickly make land outside city limits developable for semiconductor manufacturing.

Southern Oregon Business Journal March 2023 | 9

By Business Oregon Press Release https://www.oregon.gov/newsroom/Pages/NewsDetail.aspx? newsid=87721

Governor Kotek Approves $1 Million to Help Small, Mid-Sized Oregon Companies Compete for CHIPS Act Funding

Governor’s Recommended Budget also includes $200 million to help Oregon seize opportunities in advanced manufacturing

Oregon is aggressively pursuing opportunities to bring home a portion of the $52 billion for semiconductor manufacturing and research made available under the federal CHIPS and Science Act. To that end, today Governor Tina Kotek announced a new,

$1 million grant program to help small and mid-sized Oregon businesses prepare competitive applications for the once-in-a-generation infusion of federal funds.

“Oregon is going to make the most of this historic opportunity

| Southern Oregon Business Journal March 2023 10 BUSINESS OREGON

Photo from Business Oregon - https://www.oregon.gov/biz/programs/SRF_semiconductor/Pages/default.aspx

and that includes supporting the innovators who deserve access to the CHIPS Act funds and need support to navigate all of the federal requirements,”

Governor Kotek said.

The grant program, which will be funded through Business Oregon’s Strategic Reserve Fund, is part of a larger strategy to ensure Oregon firms are allocated as much of the federal funding as possible.

Governor Kotek is also urging the legislature to pass a significant investment to help Oregon seize this moment –her recommended budget includes $200 million to create a new Opportunity Fund for advanced manufacturing business expansion and recruitment, particularly semiconductor firms taking advantage of the federal CHIPS Act.

“The national movement to expand domestic semiconductor production is great news for Oregon,”

Governor Kotek said. “We can and will continue to be a global leader in advanced manufacturing and semiconductor innovation.”

Business Oregon is now developing the final rules and processes for the $1 million program. The funding will be distributed as grants to private semiconductor firms in Oregon to help with costs associated in

preparing an application, including third party costs or professional services. The program will consider how applicants will serve historically underserved groups to create family-wage manufacturing jobs.

Business Oregon will also offer information sessions to Oregon businesses to help them maximize the federal CHIPS Act

funding awards. Over the course of the next four years, Business Oregon Regional Development staff will act as concierges to small and mid-sized businesses in Oregon applying for CHIPS Act funding, providing both funding and technical assistance, directly and through economic development partners.

Southern Oregon Business Journal March 2023 | 11 –

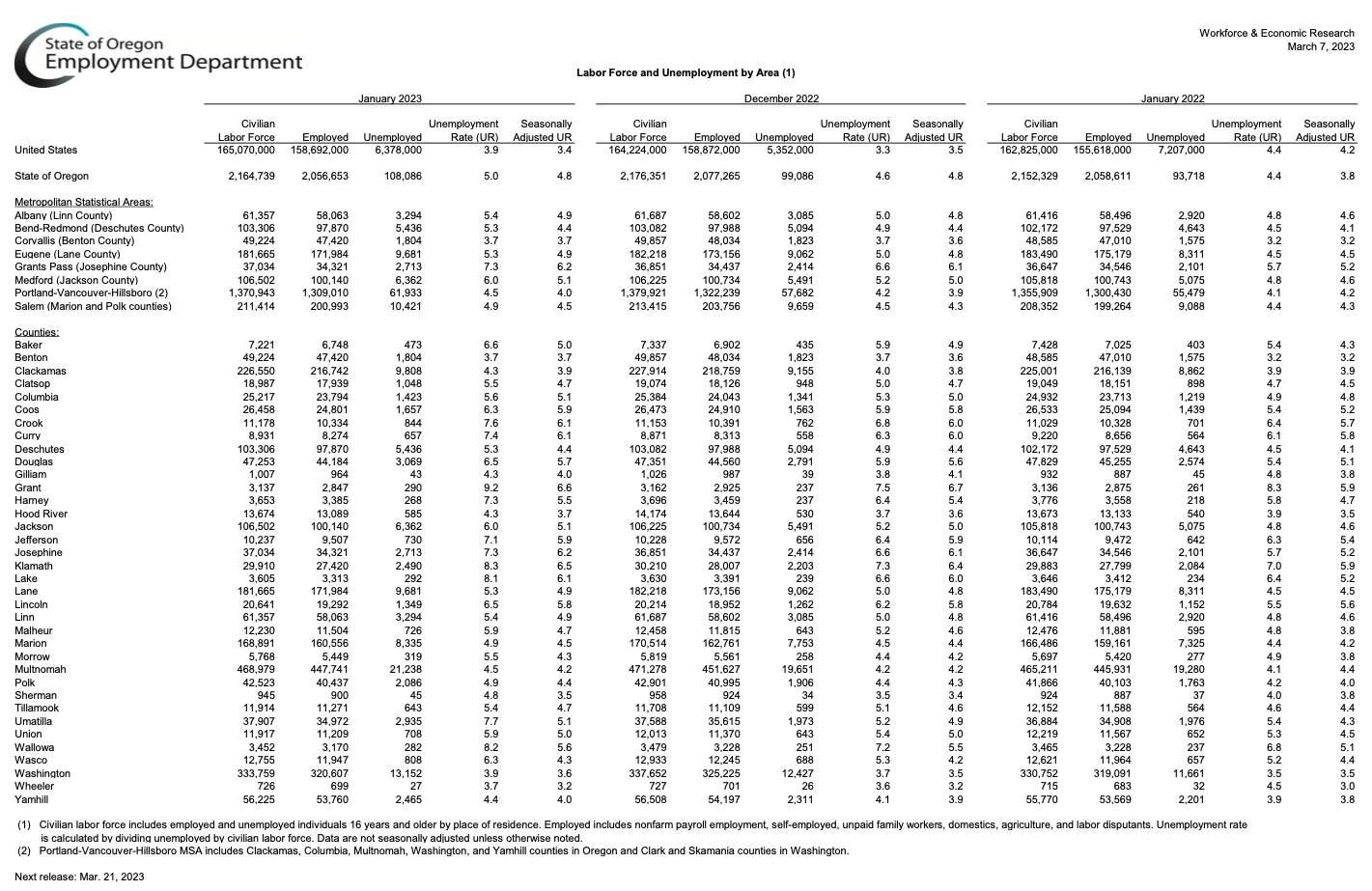

By Oregon Employment Department News

https://www.qualityinfo.org/-/navigating-the-employer-database

January 2023 Employment and Unemployment in Oregon’s Counties

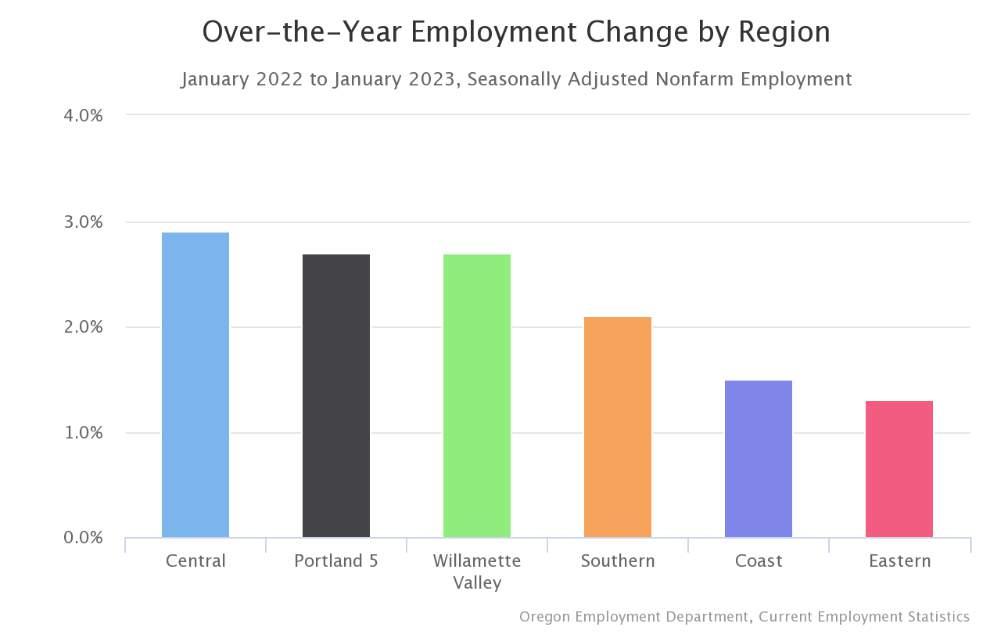

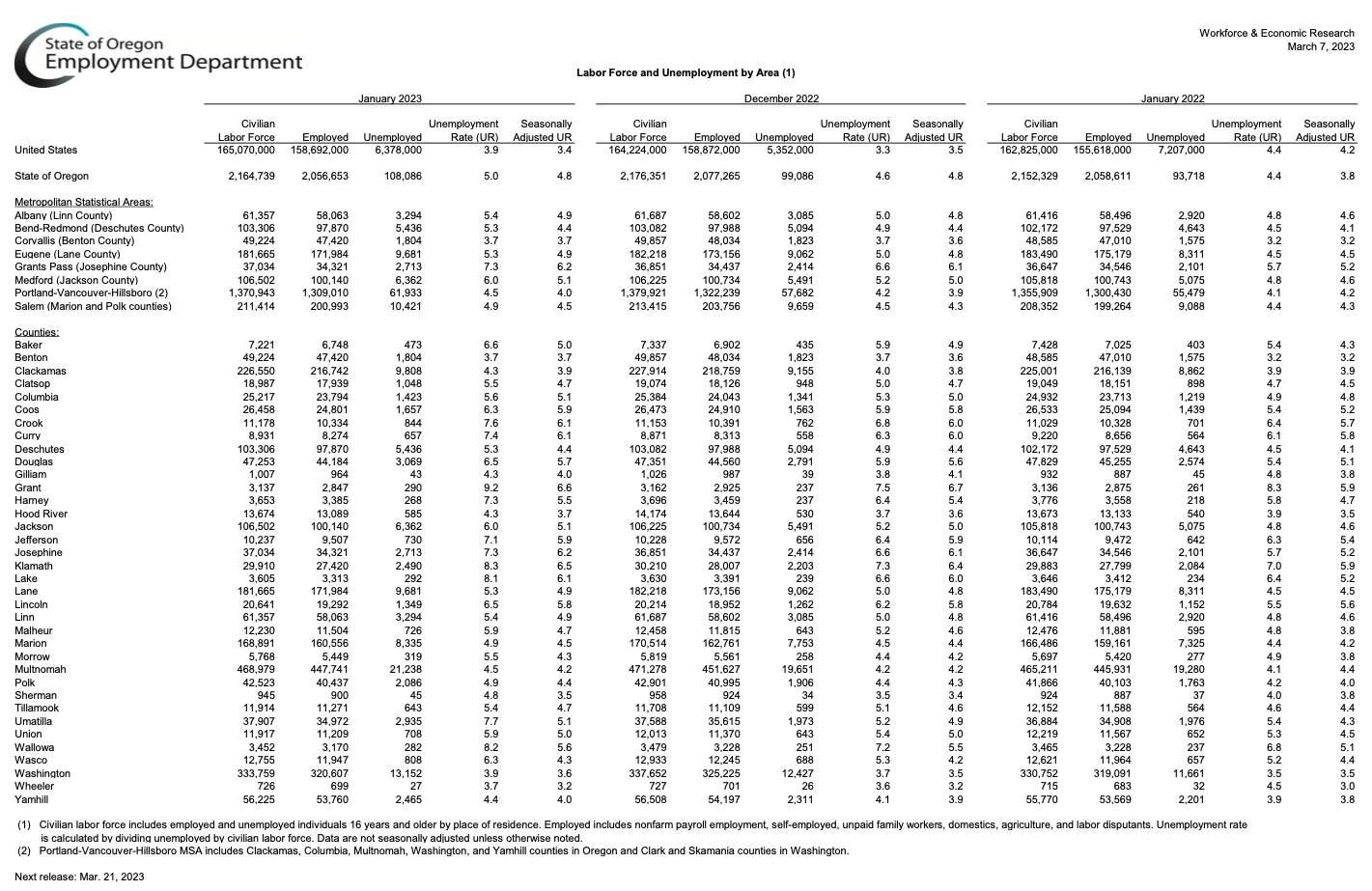

In January, unemployment rates increased in 27 of Oregon’s counties over the month, remained constant in seven, and decreased in two. Seventeen counties had unemployment rates at or below the statewide unemployment rate of 4.8%, and one county had a rate at or below the U.S. rate of 3.4%. Grant County had Oregon’s highest seasonally adjusted unemployment rate (6.6%) in

January. Other counties with relatively high unemployment rates were Klamath (6.5%), Josephine (6.2%), Crook (6.1%), Curry (6.1%), and Lake (6.1%). Wheeler County registered the lowest unemployment rate (3.2%) in January. Other counties with relatively low unemployment rates included Sherman (3.5%), Washington (3.6%), Benton (3.7%), and Hood River (3.7%). Between January 2022

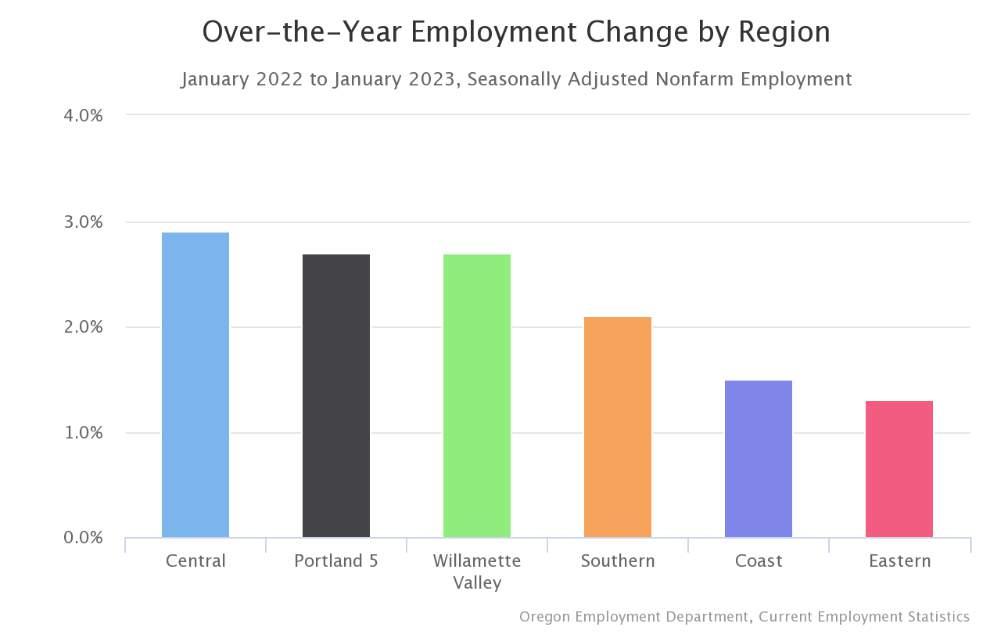

and January 2023, total nonfarm employment rose in all six broad regions across Oregon. Central Oregon experienced the fastest job growth over the year at 2.9%. Employment also grew at a relatively fast pace in the five Portland-metro counties (2.7%), the Willamette Valley (2.7%), and Southern Oregon (2.1%). Growth was slowest along the Coast (1.5%) and in Eastern Oregon (1.3%).

| Southern Oregon Business Journal March 2023 12 BUSINESS OREGON

Southern Oregon Business Journal March 2023 | 13

by Amy Vander Vliet March 6, 2023 State of Oregon Employment Department

https://www.qualityinfo.org/documents/20126/114224/ Labor+Force+and+Unemployment+by+Area/ 32601647-7c36-5685-7712-167f85391887

Oregon Economic Update: Not out of the Woods Yet

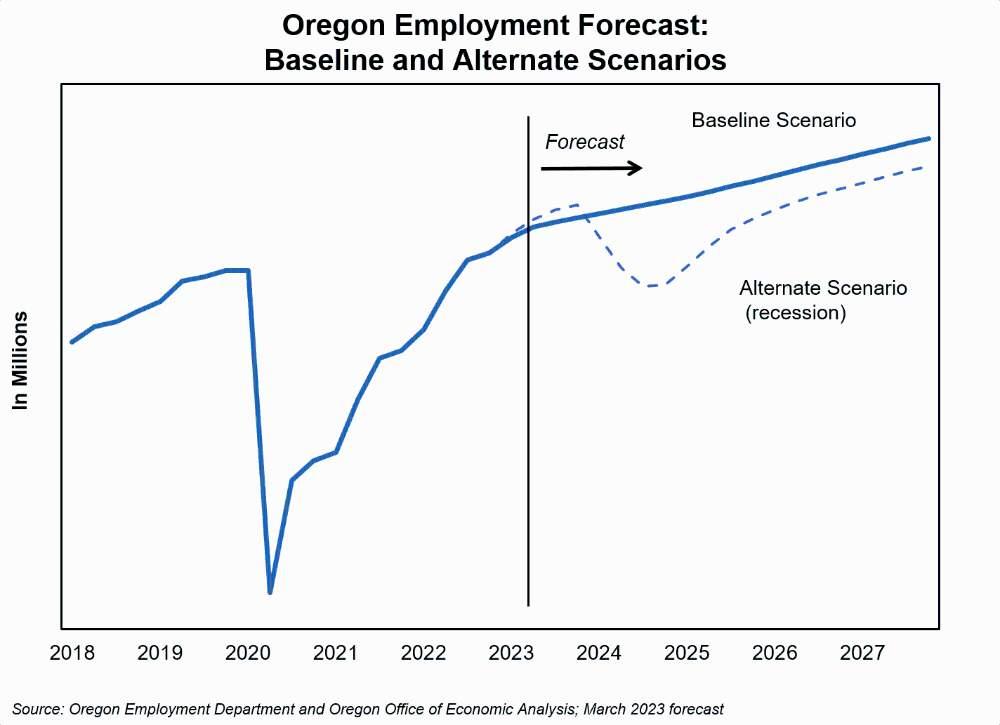

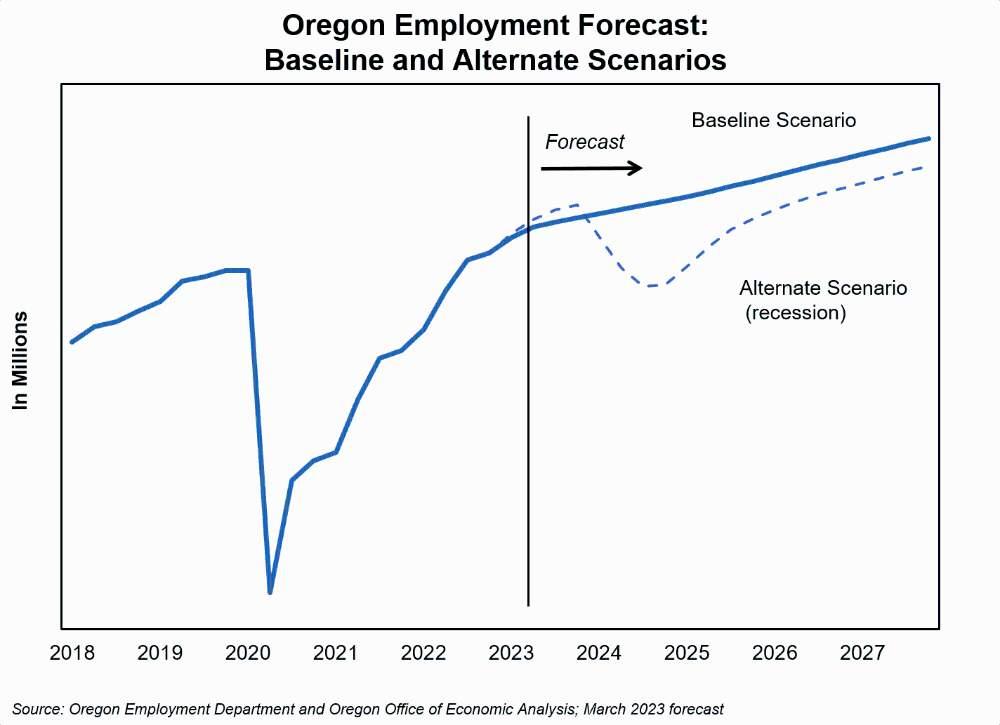

The risk of a recession, at least in the near term, has lessened in recent months as inflation has slowed. Yet inflation is still well above the Federal Reserve’s target rate, and the nation remains in the midst of an inflationary economic boom. At this point

in the economic cycle, it’s unclear whether the Fed is successfully engineering a soft landing – where interest rate hikes are enough to bring down inflation without job losses – or if the lagged impacts of rate increases will tip the economy into recession

further down the road. For now, the Oregon Office of Economic Analysis (OEA) believes we will avoid a recession this year but the likelihood of one in 2024 or 2025 is still uncomfortably high, according to their latest quarterly forecast.

| Southern Oregon Business Journal March 2023 14 BUSINESS OREGON

Reasons for Optimism

The OEA lists three reasons why they believe we will avoid a recession this year:

Declining inflation. Since October, the nation has seen relatively slower inflation. The U.S. Consumer Price Index is running around 5% (annualized); considerably slower than the pace throughout much of 2022. If it continues to slow, then the soft landing becomes increasingly likely. But if it starts ticking up, the Fed will need to raise rates again, possibly resulting in a recession a year or two down the road. But not this year.

Economic resilience.

Consumer and business spending slowed in 2022 due in large part to rising interest rates. Home sales and new single-family housing starts plummeted, and manufacturing activity weakened towards the end of the year. We had a ‘goods recession’, as OEA calls it. Yet no major layoffs. There are several possible reasons for this, including builders and manufacturers working through backlogs, and companies holding onto employees even as sales slowed given how many firms struggled to find workers coming out of the pandemic recession (‘labor hoarding’). Or perhaps layoffs have just been

delayed rather than averted. OEA is leaning towards the latter scenario, pointing to a recent rebound in consumer spending and a normalizing sales-to-inventory dynamic that bodes well for manufacturing.

Strong labor market: Initial claims for unemployment insurance in Oregon are at or near record lows for this time of year. Likewise for continuing claims, a measure of how quickly unemployed workers are able to find jobs after losing one. As of December, there were 1.5 job openings in Oregon for every unemployed worker. In other words, nearly everyone who wants a job has one.

Alternative Scenario

In normal times, forecasting is challenging. Today we are dealing with three major shocks to the economy: the pandemic, the energy price spike resulting from the war in Ukraine, and the sharpest rise in interest rates in decades. We are also dealing with a booming economy as measured by job growth, wages, spending, and unemployment. Add to this the unknown outlook

for inflation, uncertainty surrounding the impact of recent rate hikes, and an increasingly cautious Federal Reserve, and forecasting beyond this year becomes nearly impossible.

That said, OEA provides an alternative scenario to the soft landing: boom/bust. In this situation, interest rate hikes (past and future) result in a recession beginning in early 2024. Between now and then, households have spent down their savings, resulting in a weaker consumer when the recession hits. This will lead to a moderate recession with more layoffs than expected. Oregon would see three quarters of job losses totaling 3%, or 60,000 jobs. Growth resumes in late 2024, and it will take six quarters to fully recover the losses.

Southern Oregon Business Journal March 2023 | 15

by Press Release State of Oregon Employment Department https://www.oregon.gov/das/OEA/Documents/forecast0323.pdf

Oregon Economic and Revenue Forecast - March 2023

EXECUTIVE SUMMARY

March 2023

Either the economic storm clouds have parted, or we are in the eye of the hurricane. Any near-term recession fears are fading with each month of somewhat lower inflation and the continued economic boom.

However, the Federal Reserve must still navigate the choppy waters of a tight labor market, fast wage growth, easing financial conditions, and strong household finances and consumer spending. All of these are likely to keep the underlying trend in inflation above the Fed’s target for the foreseeable future. Last quarter our office made a late 2023 mild

| Southern Oregon Business Journal March 2023 16 BUSINESS OREGON

recession the most likely outcome for the Oregon economy, primarily due to the fact there had been zero slowdown in inflation at that time.

Today, there have been a few months of somewhat lower inflation. Even as the underlying trend in inflation remains twice as fast as the Federal Reserve’s target, this is a noticeable slowing from much of last year. The Fed is also starting to ease off the brakes and wait for the impact of past interest rate increases to cool the economy in the months ahead.

What this means for the forecast is that the potential recession dynamics, while still very real, are likely pushed further out. The current baseline forecast no longer calls for a recession this year, but for the economic soft landing and continued expansion.

While every month of slower inflation increases the probability of a true soft landing, it is likely that the Fed has more work to do. Additional interest rates increases, and holding them higher for longer are likely need to cool demand and inflation. However, the clear near-term strength in the economy in terms of jobs, income and spending, along

with the uncertainty of the exact timing of any potential recession makes forecasting one so far in advance challenging, if not impossible.

As Oregon heads into the upcoming 2023-25 biennium, the inflationary economic boom continues. Personal and corporate tax collections continue to outstrip expectations. When combined with an improved economic outlook, policymakers are expected to have additional General Fund revenues during the current legislative session as they craft the 2023-25 budget. Although the recent news has been good, there remains a significant amount of uncertainty as the biennium winds down.

The 2023 tax filing season has yet to truly begin. Much more will be known when the May 2023 forecast is produced, which will determine the Close of Session forecast and be used to set the thresholds for the balanced budget and any potential kicker calculations.

Along with uncertainty surrounding the tax season, there is also the heightened risk of recession next biennium. Given the currently elevated levels of taxable business and investment forms of income, an economic downturn would result in large losses of General Fund

revenues. While Oregon’s General Fund is volatile over the business cycle, the state’s overall revenue system has become less so in recent years.

The increases in consumption based taxes should help reduce overall volatility in Oregon’s tax system as consumer spending is more stable during downturns than is taxable income.

The unexpected revenue growth in the current biennium has left Oregon with unprecedented balances, followed by a record kicker in 2023-25. The projected personal kicker is $3.9 billion, which will be credited to taxpayers when they file their returns in 2024.

The projected corporate kicker is $1.5 billion, which will be retained in the General Fund for K-12 educational spending. Once the 2023-25 biennium is behind us, Oregon’s major revenue sources are expected to bounce back quickly.

However, growth over the extended horizon will continue to be constrained by demographics, with the babyboom population cohort earning and spending less.

Read the full forecast at https:// www.oregon.gov/das/OEA/ Documents/forecast0323.pdf

Southern Oregon Business Journal March 2023 | 17

We put people frst.

We proudly serve our local communities anytime, anywhere with our many Oregon branches and eBanking services.

Ashland Branch

BRANCHES

Medford Branches

1528 Biddle Road

Medford, OR 97504

541-776-5350

1311 East Barnett Road

Medford, OR 97504 541-622-6222

Albany Branch

333 Lyon Street SE Albany, OR 97321 541-926-9000

1500 Siskiyou Boulevard

Ashland, OR 97520 541-482-3886

Central Point Branch

1017 East Pine Street

Central Point, OR 97502 541-665-5262

Eugene Branch

360 E 10th Ave, Suite 101 Eugene, OR 97401 541-393-1070

Grants Pass Branch

509 SE 7th Street

Grants Pass, OR 97526 541-955-8005

We offer Mortgage Loans in ALL our locations.

Jacksonville Branch

185 E. California Street Jacksonville, OR 97530 541-702-5070

Klamath Falls Branch

210 Timbermill Drive

Klamath Falls, OR 97601 541-273-2717

Lebanon Branch

1495 South Main Lebanon, OR 97355 541-223-7180

Salem Branch

315 Commercial Street SE, Suite 110 Salem, OR 97301 503-468-5558

NMLS#421715

Conventional Government Construction Jumbo

COMMUNITY BANKING

By Press Release - 3/3/2023

https://www.peoplesbank.bank/about/press-release---march-3-2023

PEOPLE'S BANK CELEBRATES 25 YEARS IN OREGON BANKING

Medford, OR—March 2, 2023 marks the 25th anniversary for People’s Bank of Commerce, headquartered in Medford, Oregon. 25 years ago, two senior management bankers with diverse banking backgrounds seized an opportunity to offer a community bank in Southern Oregon. Ken Trautman and Mike Sickels recognized the possibilities of filling a need that was being lost during the common trend of bank mergers. From its inception, People’s Bank grew its community footprint to include Ashland, Central Point, Grants Pass, Jacksonville, and Klamath Falls. In 2017 the bank acted on their strategic goal of diversification with the acquisition Steelhead Finance, an accounts receivable factoring company founded in 1981. Geographic diversification was achieved in early 2021 through a merger with Willamette

Community Bank, which added branches in Lebanon, Albany, and Salem.

Concurrent with People’s Bank celebrating their 25th anniversary, the bank is also excited to announce the opening of a new branch in Eugene, Oregon. In late 2022, a loan production office was opened in the downtown area and, as of March 1, 2023, that office is now a full-service branch, making Eugene the bank’s 11th branch location.

“It’s been an amazing experience to not only witness the prosperous growth of this company, but to be a part of its success,” says Julia Beattie, President. “We have an amazing team committed to serving our communities and it is this commitment that allows us to continue to build on the bank’s success to date.”

“Community banking is such a vital part of a growing community. I am beyond

proud of what we have built,” says CEO Ken Trautman. “On behalf of the employees and directors of People’s Bank, I would like to thank our customers for their belief and trust over the last 25 years.”

People's Bank of Commerce is a community bank headquartered in Medford, Oregon, with branches in Medford, Ashland, Central Point, Jacksonville, Grants Pass, Klamath Falls, Albany, Lebanon, Salem, and now in Eugene. For more information about People's Bank of Commerce, visit www.peoplesbank.bank or contact Brande Cowden, marketing officer, at 541-774-7653.

Southern Oregon Business Journal March 2023 | 19

By Press Release https://investors.lithiadriveway.com/press-releases/le5kakyke01r4id0hui

Announces Dividend of $0.42 per Share for Fourth Quarter

MEDFORD, Ore., Feb. 15, 2023 /PRNewswire/ -Lithia & Driveway (NYSE: LAD) today reported the highest fourth quarter revenue in company history.

Fourth quarter 2022 revenue increased 11% to $7.0 billion from $6.3 billion in the fourth quarter of 2021.

Fourth quarter 2022 net income attributable to LAD per diluted share was $9.00, a 6% decrease from $9.57 per diluted share reported in the fourth quarter of 2021. Adjusted fourth quarter 2022 net income attributable to LAD per diluted share was $9.05, a 21% decrease compared to $11.39 per diluted share in the same period of 2021. Unrealized foreign currency gains positively impacted earnings per share by $0.13.

Fourth quarter 2022 net income was $250 million, a 15% decrease compared to net income of $293 million in the same period of 2021. Adjusted fourth quarter 2022 net income was $251 million, a 28% decrease compared to adjusted net income of $348 million for the same period of 2021.

Lithia & Driveway (LAD) Increases

Revenue 11% and Reports Diluted EPS of $9.00

As shown in the attached nonGAAP reconciliation tables, the 2022 fourth quarter adjusted results exclude a $0.05 per diluted share impact resulting from noncore charges, specifically non-cash unrealized investment loss, insurance reserves, and acquisition expenses, partially offset by a net gain on the sale of stores. The 2021 fourth quarter adjusted results were $1.82 per diluted share, net of non-core charges related to a non-cash unrealized investment loss, acquisition expenses, and insurance reserves, partially offset by a net gain on sale of stores.

Fourth Quarter-Over-Quarter Comparisons and 2022 Performance Highlights:

• Revenues increased 11%

• New and used unit growth was 5% and 9%, respectively

• Total vehicle gross profit per unit of $5,691, down $1,191

• Driveway averaged more than 2 million monthly unique visitors in Q4

• Driveway Finance penetration rate rose to over 13% in Q4, originated over $600 million

• Service, body, and parts revenues increased 18%

• Adjusted SG&A as a percentage of gross profit was 62.8%

• Total outstanding share count was reduced by 10%

"The Lithia & Driveway team had another great year with a solid finish in the final quarter of 2022

| Southern Oregon Business Journal March 2023 20

LITHIA MOTORS

across all our businesses. Operational excellence is critical across our core in-store operations, growing omnichannel offerings and captive finance arm. We are nimbly adjusting to the environment and focused on achieving our 2025 Plan. Our balance sheet is well capitalized and we're executing on the growth initiatives across our segments. With the significant capital engine we have built, we are well positioned for further consolidation in our sector," said Bryan

DeBoer, Lithia & Driveway, President and CEO.

Full year 2022 revenue increased 24% to a record $28.2 billion from $22.8 billion in 2021.

Full year 2022 net income attributable to LAD per diluted share increased 21% to $44.17 from $36.54 for 2021. Adjusted net income attributable to LAD per diluted share increased 11% to $44.42 from $40.03 for 2021. Unrealized foreign currency losses negatively impacted earnings per share by $0.54. Full year 2022 net income attributable to LAD increased 19% to $1.3 billion from $1.1 billion for 2021. Adjusted net income attributable to LAD increased 9% to $1.3 billion for 2022 from $1.2 billion for 2021.

As shown in the attached nonGAAP reconciliation tables, the 2022 adjusted results exclude a $0.25 per diluted share net noncore charge related to a non-cash unrealized investment loss, acquisition expenses, and

insurance reserves, partially offset by a net gain on sale of stores. The 2021 adjusted results exclude a $3.49 per diluted share net noncore charge related to a non-cash unrealized investment loss, acquisition expenses, loss on redemption of senior notes, insurance reserves, and asset impairment.

Full Year-over-Year Operating Highlights:

• Record full year revenues of $28.2 billion

• Used vehicle retail sales increased 29.9%

• F&I per unit increased 12.3% to $2,203

• Total vehicle gross profit per unit increased 7.6% to $6,300

• Driveway transactions increased by 272% to nearly 38,000

• Driveway Finance scaled portfolio to over $2 billion

Corporate Development

During the fourth quarter, LAD acquired a total of nine stores. These stores are expected to generate more than $560 million in annualized revenues. Notably in the quarter, we entered into two new states with Glenn's Freedom, our first store in Kentucky and expanded our footprint to Colorado, acquiring Ferrari of Denver. Finally, we added to our network in Texas, acquiring Meador Chrysler, Dodge, Jeep, Ram (CDJR), the second largest CDJR store

in Dallas/Fort Worth. In the same period, we divested a total of four stores, for a combined $160 million in annualized revenues. In 2022, Lithia acquired thirty-one stores, for a total of $3.5 billion in acquired revenues, offset by thirteen sales, totaling $663 million in revenues. In 2023, Lithia acquired one store in February expected to add $50 million in annual revenues. Since announcing the 2025 Plan in July 2020, we have acquired a total of $13.9 billion in annualized revenues.

Balance Sheet Update

LAD ended the fourth quarter with approximately $1.6 billion in cash and availability on our revolving lines of credit. In addition, unfinanced real estate could provide additional liquidity of approximately $0.5 billion.

Dividend Payment and Share Repurchases

The Board of Directors approved a dividend of $0.42 per share related to fourth quarter 2022 financial results. The dividend is expected to be paid on March 24, 2023 to shareholders of record on March 10, 2023.

During Q4, we repurchased just over 174,000 shares at a weighted average price of $198. In 2022, LAD repurchased approximately 2.4 million shares at a weighted average price of approximately $276. Under the current share repurchase authorization, approximately $501 million remains available.

Southern Oregon Business Journal March 2023 | 21

By Press Release Dutch Bros

https://investors.dutchbros.com/news/news-details/2023/Dutch-Bros-Inc.-ReportsFourth-Quarter-and-Fiscal-Year-2022-Financial-Results/default.aspx

Annual Revenues Increased Almost 50% Year-over-Year to $739.0 million Driven by 133 New Systemwide Shop Openings in 2022

Welcomes New President, Christine Barone

Issues Additional Guidance for 2023

GRANTS PASS, Ore.--(BUSINESS WIRE)--

Dutch Bros Inc. (NYSE: BROS; “Dutch Bros” or the “Company”) one of the fastest-growing brands in the food service and restaurant industry in the United States by location count, today reported financial results for the fourth quarter and year ended December 31, 2022.

Joth Ricci, Chief Executive Officer of Dutch Bros Inc., stated, “In 2022, we delivered another strong year of growth with revenue increasing almost 50% to $739.0 million, driven by 133 new shop openings systemwide. For the third consecutive year, we have exceeded our new shop development targets, doubling our shop count since March 2019, despite unprecedented disruption to communities and the economy. These results are a testament to our team’s ongoing ability to execute our proven strategy. As we continue on our 30+ year growth journey, we’re entering 2023 in a position to build market share, supported by our strong people development and new shop pipelines.”

He added, “This year, we are targeting 150 new systemwide shops, which will enable us to achieve our five-year goal of 800 systemwide shops by year-end. Additionally, we expect to be within striking distance of $1 billion in revenue in 2023 and 1,000 systemwide shops by the first half of 2025, creating jobs and opportunities for our employees and the communities in which we serve.”

He added, “On February 6, we welcomed Christine Barone as our new President. Christine will be instrumental in our next phase of growth, helping ensure we are scaling the business in a meaningful,

Dutch Bros Inc. Reports Fourth Quarter and Fiscal Year 2022 Financial Results

efficient and effective way as we navigate market uncertainty.”

Fourth Quarter 2022 Highlights:

• Opened 30 new shops, 26 of which were company-operated, across 11 states.

• Total revenues grew 44.1% to $201.8 million6 as compared to $140.1 million in the same period of 2021.

• System same shop sales2 declined (0.6)%, inclusive of the impact of our fortressing strategy, which results in sales being transferred from existing shops to new ones, as compared to the same period in 2021 and grew 15.2% on a 3-year stacked basis3. Company-operated same shop sales declined (2.1)%, inclusive of the impact of our fortressing strategy, as compared to the same period of 2021 and grew 16.2% on a 3-year stacked basis3.

• Company-operated shop revenues increased 53.7% to $175.5 million6, as compared to $114.2 million in the same period of 2021.

• Company-operated shop gross profit was $38.8 million as compared to $16.6 million4 in the same period of 2021. In the fourth quarter of 2022, company-operated shop gross margins, which includes 220bps of pre-opening expenses and 210bps of Dutch Rewards loyalty app breakage related to 20216, improved to 22.1%. Year-over-year, company-operated shop gross margins increased 760bps.

• Company-operated shop contribution5, a non-GAAP financial measure, grew 129.2% to $50.0 million as compared to $21.8 million4 in the same period of 2021. In the fourth quarter of 2022, company-operated shop contribution margins, which includes 220bps of pre-opening expenses and 210bps of Dutch Rewards loyalty app breakage

related to 20216, improved to 28.5%. Year-over-year, company-operated shop margins increased 940 bps.

• Selling, general, and administrative expenses were $50.6 million (25.1% of revenue) as compared to $41.4 million4 (29.5% of revenue) in the same period of 2021.

• Adjusted selling, general, and administrative expenses5, a nonGAAP financial measure, were $38.1 million (18.9% of revenue) as compared to $28.1 million4 (20.1% of revenue) in the same period of 2021.

• Net loss was $(2.8) million6 as compared to $(8.2) million4 in the same period of 2021.

• Adjusted EBITDA5, a non-GAAP financial measure, grew 115.7% to $29.8 million6 as compared to $13.8 million4 in the same period of 2021.

• Adjusted net income5, a non-GAAP financial measure, was $4.8 million6 as compared to $5.1 million4 in the same period of 2021.

• Net loss per share of Class A and Class D common stock - diluted6 was $(0.01)6 as compared to net loss per share of $(0.03) in the same period of 2021.

• Adjusted net income per fully exchanged share of common stock5, a non-GAAP financial measure, was $0.036 as compared to $0.03 in the same period of 2021.

Full Year 2022 Highlights:

• Opened 133 new shops, 120 of which were company-operated, across 11 states.

• Total revenues grew 48.4% to $739.0 million6 as compared to $497.9 million in 2021.

• System same shop sales2 grew 1.0%, inclusive of the impact of our fortressing strategy, which results in

| Southern Oregon Business Journal March 2023 22

DUTCH BROS

sales being transferred from existing shops to new ones, as compared to 2021 and 11.4% on a 3-year stacked basis3. Company-operated same shop sales grew 0.6%, inclusive of the impact of our fortressing strategy, as compared to 2021 and 10.4% on a 3year stacked basis3.

• Company-operated shop revenues increased 58.4% to $639.7 million6, as compared to $403.7 million in 2021.

• Company-operated shop gross profit was $121.3 million as compared to $86.7 million4 in 2021. In 2022, company-operated shop gross margins, which includes 280bps of pre-opening expenses and 50bps of Dutch Rewards loyalty app breakage related to 20216, improved to 19.0%. Year-over-year, companyoperated shop gross margins decreased 250 bps.

• Company-operated shop contribution5, a non-GAAP financial measure, grew 53.1% to $157.6 million as compared to $103.0 million4 in 2021. In 2022, companyoperated shop contribution margins, which includes 280bps of preopening expenses and 50bps of Dutch Rewards loyalty app breakage related to 20216, improved to 24.6%. Year-over-year, company-operated shop margins decreased 90 bps.

• Selling, general, and administrative expenses were $183.5 million (24.8% of revenue) as compared to $264.5 million4 (53.1% of revenue) in 2021.

• Adjusted selling, general, and administrative expenses5 were $136.4 million (18.5% of revenue) as compared to $96.5 million4 (19.4% of revenue) in 2021.

• Net loss was $(19.3) million6 as compared to $(117.9) million4 in 2021.

• Adjusted EBITDA5, a non-GAAP financial measure, increased 8.4% to $91.2 million6 as compared to $84.1 million4 in 2021.

• Adjusted net income5, a non-GAAP financial measure, was $25.2

million6 as compared to $51.4 million4 in 2021.

• Net loss per share of Class A and Class D common stock - diluted was $(0.09)6 as compared to $(0.28) in 2021.

• Adjusted net income per fully exchanged share of common stock5, a non-GAAP financial measure, was $0.166 as compared to $0.32 in 2021.

Outlook

Dutch Bros is providing the following fullyear 2023 outlook:

• Total system shop openings in 2023 are expected to be at least 150, of which at least 130 shops will be company-operated.

• Total revenues are projected to be between $950 million and $1 billion.

• Same shop sales growth is estimated to be in the low single digits. At this point we have no plans to take additional menu pricing in 2023. We expect low-single digits growth from pricing to roll-over into 2023 from menu pricing taken in 2022.

• Adjusted EBITDA is estimated to be approximately $125 million. This includes approximately $8 million in labor investments related to wage increases in federal minimum wage markets and approximately $11 million in mandated wage increases in markets that do not adhere to the federal minimum wage standard. This Adjusted EBITDA estimate includes our present assumption around no menu price increases in 2023.

• Capital expenditures are estimated to be in the range of $225 million to $250 million, which includes approximately $15 million to $20 million for our new roasting facility projected to open in 2024.

reconciling items. We are unable to provide guidance for these reconciling items because we cannot determine their probable significance, as certain items are outside of our control and cannot be reasonably predicted due to the fact that these items could vary significantly from period to period. Accordingly, reconciliations to the corresponding GAAP financial measure is not available without unreasonable effort.

2

Same shop sales is defined in the section “Select Financial Metrics”.

3

3-Year Stack is calculated as current quarter same shop sales growth plus the sum of the same shop sales growth from the same period of the prior two years. Same shop sales data is based on different shop bases for each time period.

4

The Company’s historical results have been revised to reflect an immaterial error correction related to employee sick leave accrual. For additional information, see sections “Consolidated Statements of Operations”, “Company-operated Shop Results”, and “Supplemental Reconciliation of GAAP Actuals to NonGAAP Actuals”.

5

Reconciliation of GAAP to non-GAAP results is provided in the section “NonGAAP Financial Measures”.

6

For the three months and year ended December 31, 2022, we recognized loyalty app breakage revenue of $7.4 million, including $4.9 million for points collected prior to January 1, 2022 that expired on December 31, 2022.

We have not reconciled guidance for Adjusted EBITDA to the corresponding GAAP financial measure because we do not provide guidance for the various

Southern Oregon Business Journal March 2023 | 23

1

https://www.arcimoto.com/media/pr

Arcimoto to Begin 2023 Vehicle Production for Spring Deliveries

2023 vehicle deliveries to start in March with new features and improvements

EUGENE, Ore., Feb. 21, 2023

(GLOBE NEWSWIRE) -- Arcimoto, Inc.® (NASDAQ: FUV), makers of rightsized, ultra-efficient electric

vehicles, announced that it will start 2023 vehicle production on FUV and Deliverator with plans for first deliveries beginning in March. Headlining the model year 2023 product update is the new steering system that will deliver improved handling and maneuverability at all speeds while reducing steering effort by more than 40% from prior models. “During our internal testing, and pilot rollout the feedback from drivers was resoundingly positive in terms of

feel and responsiveness,” said Dwayne Lum, Arcimoto Chief Product Officer. “Additionally, this is not restricted to 2023 models. Our team committed to creating a post-production version that prior model year FUV owners could elect to deploy for a small fee through our service organization,” added Mr. Lum. Arcimoto ended Q4 2022 with the most successful quarter yet delivering 89 vehicles. In 2022, Arcimoto delivered 228 customer vehicles, which

| Southern Oregon Business Journal March 2023 24

ARCIMOTO

Arcimoto News Recap

By Press Release

increased the total number of Arcimoto vehicles on the road to more than 500.

“As we begin first deliveries in 2023, we continue to focus on improving vehicle drive quality, manufacturing cost down efforts and increasing our brand reach to grow both our consumer and commercial sales volume,” said Jesse Fittipaldi, Arcimoto Interim CEO. “Our efforts will be directed at driving sales of FUV and Deliverator and lowering manufacturing costs on these products this year.”

Arcimoto Announces $6 Million in Additional Funding

Additional funding comes shortly after closing a $12 million public offering on January 20th

EUGENE, Ore., Feb. 22, 2023 (GLOBE NEWSWIRE) -- Arcimoto, Inc.® (NASDAQ: FUV), makers of rightsized, ultra-efficient electric vehicles, announced today they received $6 million in additional funding by means of a real estate loan on their Eugene, Oregon factory. This additional financing comes shortly after the $12 million public offering that closed on January 20th. A portion of the net proceeds from the offering were used to repay the convertible note with 3i. The remaining funding will be used

for working capital and general corporate purposes.

“We announced this week the start of 2023 production with new steering features and improvements on the FUV and Deliverator. This additional funding paired with our efforts in reducing vehicle costs and increasing sales gives the team practical confidence as we continue to focus on the growth of FUV and Deliverator programs,” said Jesse Fittipaldi, Arcimoto Interim CEO.

Arcimoto Opens Vehicle Sales in 4 New States

Arcimoto expands into additional West and East Coast key markets, opening customer orders in Connecticut, North Carolina, South Carolina, and New Mexico with deliveries starting this Spring

EUGENE, Ore., March 01, 2023 (GLOBE NEWSWIRE) -- Arcimoto, Inc.® (NASDAQ: FUV), makers of rightsized, ultra-efficient electric vehicles, today announced that it is now accepting vehicle orders from customers in Connecticut, North Carolina, South Carolina, and New Mexico, with first customer deliveries expected to begin in the first half of 2023. This comes shortly after announcing the start of 2023 production with new steering features and improvements on the FUV and Deliverator.

“We are excited to introduce Arcimoto to some of the top EV markets in the country, home to many of the most beautiful places to FUV,” said Arcimoto Chief Experience Officer Lynn Yeager. “This expansion is important to our continued growth of both consumer and commercial channels. Today, we began reaching out to preorder customers in these states with the opportunity to order their vehicle.” To design and reserve your vehicle, please visit https:// www.arcimoto.com/order

Arcimoto vehicles are now available in California, Oregon, Washington, Hawai’i, Nevada, Arizona, New Mexico, Florida, New York, New Jersey, Connecticut, Pennsylvania, Maryland, Virginia, Washington D.C., North Carolina, South Carolina, and Georgia. Customers outside of these states can place a $100 refundable preorder to be the first to know when Arcimoto opens in their region.

About Arcimoto, Inc.

Arcimoto is a pioneer in the design and manufacture of rightsized, ultra-efficient, incredibly fun electric vehicles for everyday mobility. Built on the revolutionary three-wheel Arcimoto Platform, our vehicles are purpose-built for daily driving and local delivery, all at a fraction of the cost and environmental impact of traditional gas-powered vehicles.

Southern Oregon Business Journal March 2023 | 25

sou.edu • 855-470-3377

“SOU gave me the opportunity to grow and to change my life and to help change the lives of other people.”

ANGELICA RUPPE MS ’86

By Marshall Doak, SOU SBDC Director

By Marshall Doak, SOU SBDC Director

The Travails of Young Businesses

Small Business Assistance

Congress stepped up and formed the U.S. Small Business Administration (SBA) in 1953 to: “aid, counsel, assist and protect, insofar as is possible, the interests of small business concerns.” The SBA has become the lead Agency for business assistance from a Federal perspective for the past 70 years. The SBA has a number of resources available to help individual businesses stay alive and build success.

For rural areas, the United States Department of Agriculture – Rural Development (USDA RD) programs provide a range of services to the small business community in non-urban areas. Business Oregon has technical assistance as does the Small Business Development Centers scattered around the State.

Free Money for Your Business Startup!

Many new businesses become sidetracked looking for ‘free’ money. There is nothing better than free money, right? Is ‘free’ money available now? Where is it? How do I get some?

If you were to ask enough people to find out why new business failures are so high, you would probably end up with 100 reasons for the failures. To borrow an analogy from Benjamin Franklin concerning his experience developing the lightbulb:

“I didn't fail the test, I just found 100 ways to do it wrong.”

Benjamin Franklin

Sometimes, young businesses remind me of lightbulbs.

Small business assistance comes in a number of forms and as ubiquitous as the SBA’s programs are, in many cases they are unknown as some of those programs are accessed through partner organizations, an example being many of their lending programs. The State of Oregon has a number of these types of programs also, from technical assistance through direct lending programs, most often when lending opportunities are not available from the private sector lenders.

The answers were an easy ‘NO!’ until a few years ago, when the unprecedented COVID-19 Pandemic shutdown issues caused the Federal Government to print billions of dollars and distribute them all around the nation to small businesses. As a result, many businesses have been weaned onto free money distributions and have been kept alive from the liquidity injections. But nowadays, things have reverted back to where businesses that are able to generate sales and cash receipts and earn profits are growing successfully once more. The ‘free’ money is gone and the temporary safety net has been withdrawn.

| Southern Oregon Business Journal March 2023 28 SMALL BUSINESS DEVELOPMENT CENTER

Photo by Alessandro Bianchi on Unsplash

Of course, there are still a few ‘outlier’ business grants for research or value-added agricultural products development. These are programs that have been around for some time and pertain to only a very small portion of businesses. They are directed at a very narrow segment of the business population for specific purposes that support the public’s needs. On occasion, there are programs available to select businesses made available as part of Diversity, Equity and Inclusion measures, but they are sporadic and typically of low amounts. On occasion, private foundations will have a grant opportunity in a sector that is an interest area for that Foundation. Typically though, these are directed at non-profit organizations. That’s about it.

OH, there never really was any money made available to startups, as the COVID money was directed at maintaining viability and employment levels in businesses that were already in business when the emergency was declared.

We are Back to Where We Were, or are We?

Being in business is tough. It is not becoming easier, and the nearterm forecast is the trend continues to drift towards increasing difficulty. In other words, more of the same we have become used to. The businesses that will survive in the future are those that:

• Have established a market and are successfully defending it

through great client service and satisfaction rates;

• Are keeping their trained employees who are more productive than new ones who need extensive training;

• Have capital or have access to capital so that cash-flow issues are mitigated and growth capital is not difficult to obtain;

• Have unique value propositions that customers cherish through regular patronage;

• Maintain a creative and innovative edge;

• Have a plan for growth and articulate it to all stakeholders, and;

• Are great communicators and facilitators.

However, to me the ‘feel’ of business today seems different than it did before the COVID-19 Pandemic. I don’t know what it is so I can’t describe it to you, but the feel of the business culture seems different. More reserved maybe. Perhaps it is because it seems that we are due to go into recession or macro events in the world have shifted the focus off of what businesses need in order to thrive.

Regardless, We Need to Be Prepared for the Best and Worst of Times Now

Over the past six years, I have written extensively regarding the planning process, the reasons to plan, and the benefits that can be gained through proper planning and the execution of those plans.

Repetitive entreaties for us all to plan our organizations’ strategies for the principal elements of our business’s needs. As a review, these are:

• Market: Taking care of customers so they stay; branding; promotions; outreach and persuasive sales techniques; increasing customer numbers and satisfaction rates

• Operations: Running lean; employee empowerment; enterprise efficiencies; detail on safety; incorporating new: processes, materials, products and techniques

• Finance: Knowing your costs, markups and margins; using your data to inform decisionmaking; strengthening your banking ties; benchmarking your performance

• Executive: All the fun stuff - the visioning and modeling of outcomes; development of new markets and/or products and services; building a company culture that creates legacy --- OR ---

“We can fail the test, and stop at 99 ways of doing it wrong.”

Marshall Doak

Marshall Doak is the Director of the Southern Oregon University Small Business Development Center and a huge supporter of innovation and the community that forms around innovation in the economy. In private practice, he works with businesses that plan to transition to new ownership within the next five years, assisting them to build value that can be converted to retirement income when the business sells. He can be reached through: mdoak06@gmail.com or 541-646-4126.

Southern Oregon Business Journal March 2023 | 29

by Greg Henderson

by Greg Henderson

Are We Overworking and Underthinking?

Or just underthinking?

Fifty years, maybe 25, is enough to realize a need to replace or repair most everything. The problem is not our plans, it’s the execution of them. New Year resolutions often fail before the end of January. Good resolutions, bad execution.

Advice I received from a coworker in 1968, it came from his uncle; “You need to work two full-time jobs to make it. One to live on, the other to save for future needs and retirement.” He was convinced he was right; I wasn’t so sure.

We worked in a plywood mill near Springfield. He also worked a fulltime job at a lumber mill pulling lumber from a green chain. Both jobs were tiring and demanding. He was thinking ahead by 30 or 40 years. Work harder not smarter.

Today many of us are living on tomorrow’s money. Schools, businesses, waste water treatment plants, cities and families don’t feel the critical need to prepare for what they know is facing them somewhere into the future. We wrongly believe progress is achieved by borrowing from our future, or the futures of our children and grandchildren. Debt grows, futures are offered as collateral. We sign a contract of indentured servitude, convinced this is our way to progress.

America’s small towns are dying because of that idea of progress. They have been for nearly two- hundred years, from the day they were first built. And it’s our fault, we Americans; intentionally unsatisfied with things the way they are. Nothing is ever quite good enough. We build obsolescence into all our creations, even our children (by improperly educating them). Almost everything wears out, and we know it. Depreciation knowledge is common but our preparations for it are far more uncommon than wise.

Our shortcomings are manifold. We plan but fail to execute. Our hasty obsession with completing projects without concern for the sustainability of what we’re building gets in our way. American’s are more often in a “hurry up mode” than a “let’s think about it first mode”.

Work harder, not smarter could be our greatest downfall.

We build houses expecting to replace them rather than expecting them to last. Beautiful churches are called anchors of our communities until the ring of the Sunday chime tolls for the last time and the anchor fades away. Repair? Rebuild?

Sustainable is the braggards word of the day, knowing he has never done anything that could be called

sustainable. Sustainable is just another word for temporary. Planning has nothing to do with maintenance or replacement until the original is near collapse and demolition. Starting a community or business comes with intense planning including dozens of instructions and suggestions. Sustaining them is a different set of thoughts altogether. Bridges will eventually crumble after years of neglect and poor maintenance.

The examples of construction projects and collateral improvements and their rates of depreciating value are plentiful enough to estimate the life expectancy of new construction. If we know a school will need to be replaced in 50 years, shouldn’t we build into the community agreement a plan to save for that future investment? If your car will not be serviceable in ten years, shouldn’t you begin saving for that future expense at the beginning instead of scrambling for financing when the old clunker refuses to start?

Don’t point fingers. We’re all guilty. Like a coach said in Junior High school, “Use your head for something besides a hat rack.”

Southern Oregon Business Journal March 2023 | 31

Photo by kevin turcios on Unsplash

Greg Henderson is the retired founder of the Southern Oregon Business Journal. A University of Oregon graduate and a six year U.S. Air Force veteran. Contact him at ghenderson703@gmail.com

By Press Release

https://www.prnewswire.com/news-releases/columbia-banking-systemand-umpqua-holdings-corporation-complete-merger-301758616.html

Two Leading Community Banks

Based in the Northwest

Combine to Create One of the Largest Banks Headquartered in the West

TACOMA, Wash. and PORTLAND, Ore., March 1, 2023 / PRNewswire/ -- Columbia Banking System, Inc. ("Columbia") (Nasdaq: COLB), the parent company of Columbia Bank, and Umpqua Holdings Corporation ("Umpqua"), the parent company of Umpqua Bank, announced today the closing of their previously announced merger, combining the two premier banks in the Northwest to create one of the largest banks headquartered in the West.

Columbia Banking System and Umpqua Holdings Corporation Complete Merger

The new institution now ranks as a top-30 U.S. bank and offers a combination of robust commercial, small business and consumer capabilities, expertise, local decisionmaking and a personalized approach to customer service. In addition to providing

Columbia Banking System and Umpqua Holdings Corporation Complete Merger

expanded capabilities and enhanced products and services for consumers and businesses of all sizes, the bank retains Columbia's and Umpqu a's long-standing community focus. The combined bank previously announced an $8.1 billion commitment over five years towards enhancing affordable homeownership access, small business formation and growth, and philanthropic and community development initiatives in communities across its eightstate footprint.

"Bringing together the Northwest's leading banks is a historic achievement and holds enormous potential to benefit our associates, customers, and communities, as well as to drive our company's long-term growth. I'm especially proud of our associates whose hard work, perseverance, and truly collaborative spirit made this combination of like-minded banks possible," said Clint Stein, CEO of Columbia and Umpqua Bank. "As we look to the future and the full integration of our new company, we remain laser focused on leveraging our scale advantages to provide a

premium banking experience for our customers."

"Today marks the beginning of an exciting new chapter for our company," said Cort O'Haver, Executive Chair of the Board of Columbia. "We have tremendous opportunity to deliver enhanced shareholder returns by building upon our combined bank's commitment to the success and prosperity of all our stakeholders."

The combined organization has more than $50 billion in assets with approximately $37 billion in loans and $45 billion in deposits throughout an eight-state footprint that spans some of the most dynamic commercial markets and vibrant local economies in the western U.S. All branches of the combined company will operate under the Umpqua Bank banner once the integration is completed. Umpqua Bank's corporate headquarters remain in Lake Oswego, Oregon and the holding company, Columbia Banking System, Inc., remains headquartered in Tacoma, Washington. In addition to Umpqua Bank, the company consists of other major subsidiaries and divisions

| Southern Oregon Business Journal March 2023 32 BANKING

including Columbia Trust Company, Columbia Wealth Advisors and Columbia Private Bank, which operate under the banner of Columbia Wealth Management, as well as Financial Pacific Leasing, Inc. The combined company will trade under Columbia's ticker symbol (COLB) on the Nasdaq Stock Market.

Customers Should Continue to Bank as They Normally Do

Umpqua Bank will initially operate under both the Umpqua Bank and Columbia Bank brands, and customers will continue to conduct business through their respective Umpqua and Columbia branches, websites, and mobile apps. The company expects to combine its systems and services in the first quarter of 2023. Umpqua Bank customers can find additional information at www.umpquabank.com/ columbia, and Columbia Bank customers can find additional information at www.columbiabank.com/ umpqua.

Board of Directors

The combined company's Board of Directors consists of 14 members, with seven directors from Columbia and seven directors from Umpqua:

Cort L. O'Haver, Executive Chair

Craig D. Eerkes, Lead Independent Director

Mark A. Finkelstein

Eric S. Forrest

Peggy Y. Fowler

Randal L. Lund

Luis F. Machuca

S. Mae Fujita Numata

Maria M. Pope

John F. Schultz

Elizabeth W. Seaton

Clint E. Stein

Hilliard C. Terry, III

Anddria Varnado

Closing Details

At the effective time of the merger on February 28, 2023, each share of Umpqua common stock was converted into the right to receive 0.5958 of a share of Columbia common stock, with Umpqua shareholders receiving cash in lieu of fractional shares.

Former Umpqua shareholders collectively represent approximately 62% of the combined company. Shares of Umpqua ceased trading prior to the opening of the Nasdaq Stock Market on March 1, 2023.

About Columbia

Columbia (NASDAQ: COLB) is headquartered in Tacoma, Washington and is the parent company of Umpqua Bank, an award-winning western U.S.

regional bank based in Lake Oswego, Oregon.

In March of 2023, Columbia and Umpqua c ombined two of the Pacific Northwest's premier financial institutions under the Umpqua Bank brand to create one of the largest banks headquartered in the West and a top-30 U.S. bank.

With over $50 billion of assets, Umpqua Bank combines the resources, sophistication and expertise of a national bank with a commitment to deliver personalized service at scale.

The bank operates in Arizona, California, Colorado , Idaho, Nevada, Oregon, Utah, and Washington State and supports consumers and businesses through a full suite of services, including retail and commercial banking; Small Business Administration lending; institutional and corporate banking; and equipment leasing.

Umpqua Bank customers also have access to comprehensive investment and wealth management expertise through Columbia Wealth Advisors and Columbia Trust Company, a subsidiary of Columbia. Learn more at www.columbiabankingsyste m.com.

Southern Oregon Business Journal March 2023 | 33

541-488-1702

Sponsors

Southern Oregon Business Journal March 2023 | 35 REACH YOUR TARGET ADS THROUGH Send your ad copy to: Jim@SouthernOregonBusiness.com Jim Teece - Publisher Thousands of Business People get a chance to see your ad in the monthly Business Journal.

The Southern Oregon Business Journal extends sincere thanks to the following companies for their continued presence as important cogs in the wheels of industry in southern Oregon. Please check out our advertisers. We appreciate them for supporting the Southern Oregon Business Journal. People’s Bank - Page 18 SOU - Page 26 Amerititle - Page 4 Project A - Page 34 Managed Home Net Page 27 sou.edu 855-470-3377 “SOU gave me the opportunity to grow and to change my life and to help change the lives of other people.” ANGELICA RUPPE MS ’86 Angelica Ruppe LBH Ad Full Page 2021.indd

Dena and I have sponsored the Women’s Leadership Conference of Southern Oregon in the past. We have watched them grow since they started in 2013 and love what they do and how they do it. I wanted to help promote this years event and found this info on their website.

“The WLC grew out of a desire to see more women represented in leadership roles in business and the community. This desire is not just about inspiring women to step up as leaders, but also about encouraging women to use their voice and share their stories.”

“We are dedicated to providing personal inspiration and practical application to promote more equitable representation of women leadership in our community — at every career level and all stages of personal growth.”

Women’s Leadership Conference of Southern Oregon - May 12, 2023

“Every May, we put on a large conference in Southern Oregon. We bring in national and regional speakers and create a day of inspiration, connection, and rejuvenation. Throughout the year, we also offer several micro-events.”

“Our mission is to foster leadership in business, government, and non-profit organizations, that more fully reflects our community.”

2023 CONFERENCE: AdvanceHER: Building

A Network of Leaders

May 12th, 2023, Ashland Hills Hotel www.womensleadershipconference.net

Tickets now on sale. HYBRID conference Includes -conference networking event on Thursday evening, May 11th.

Carolyn Stern

Carolyn Stern is a certified Emotional Intelligence and Leadership Development Expert, professional speaker, and university professor. Carolyn’s emotional intelligence courses and modules have been adopted by top universities in North America.

Libby Gill

Libby Gill knows change. In her consulting, coaching, and keynotes Libby helps her clients:

• Reframe change as an opportunity for massive growth

• Re-energize your best performers to reach their full potential

• Reinvent your corporate culture to embrace ambiguity

| Southern Oregon Business Journal March 2023 36

LEADERSHIP

2023 Keynote Speakers Announced

By Press Release State of Oregon Employment Department

https://www.qualityinfo.org/-/manufacturing-in-the-rogue-valley?redirect=%2Frogue-valley

Manufacturing in the Rogue Valley

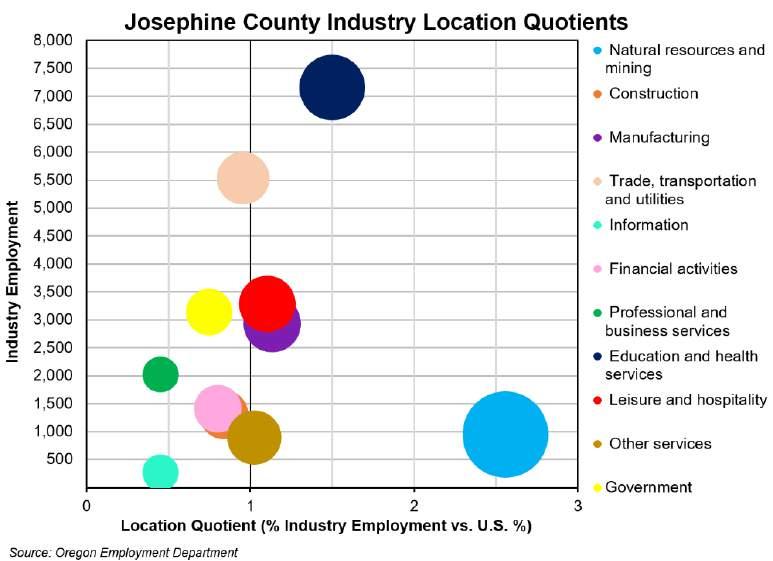

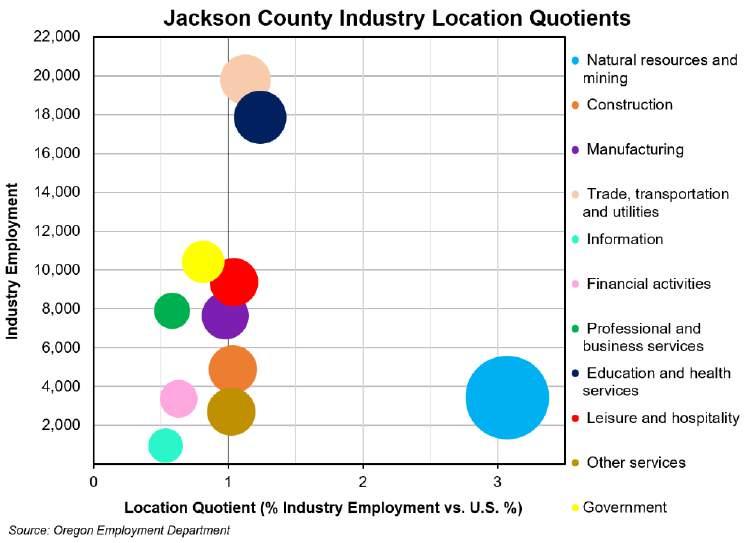

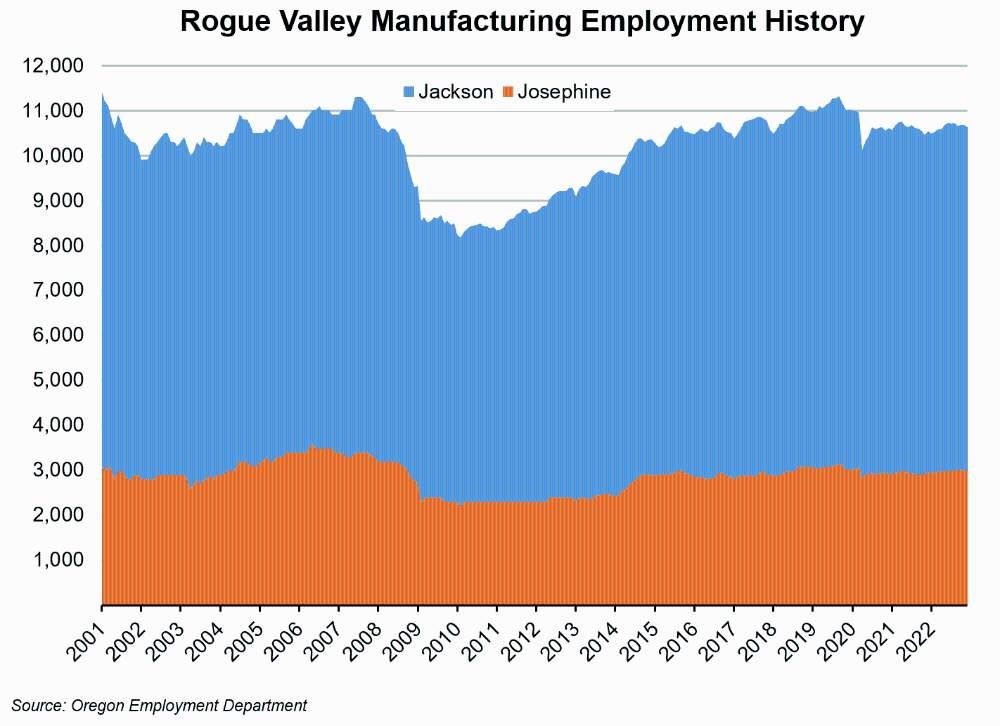

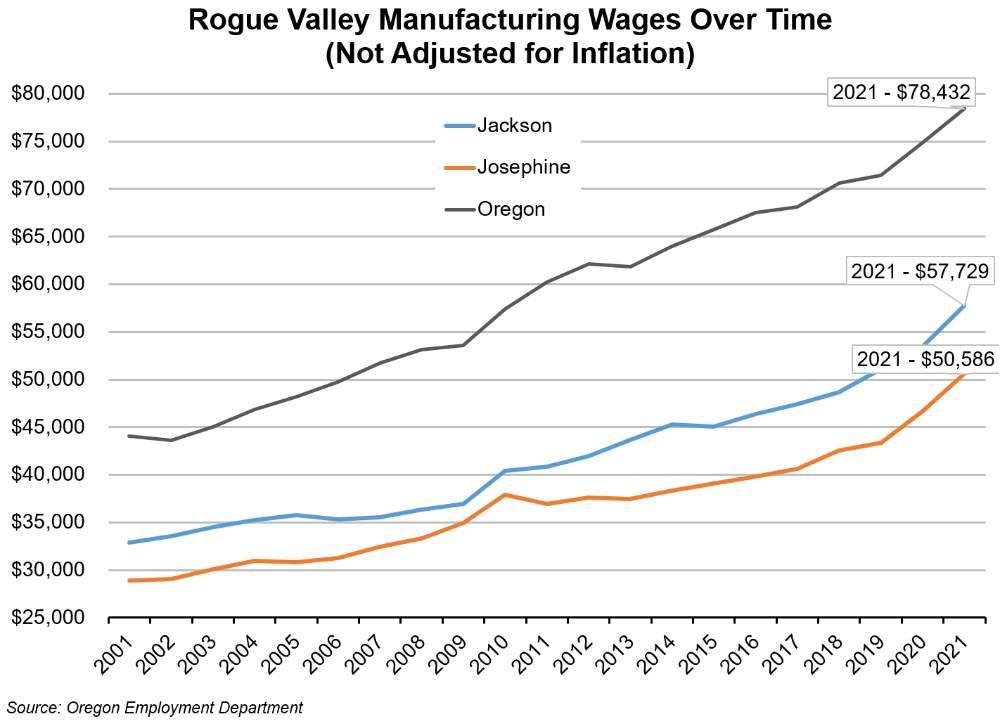

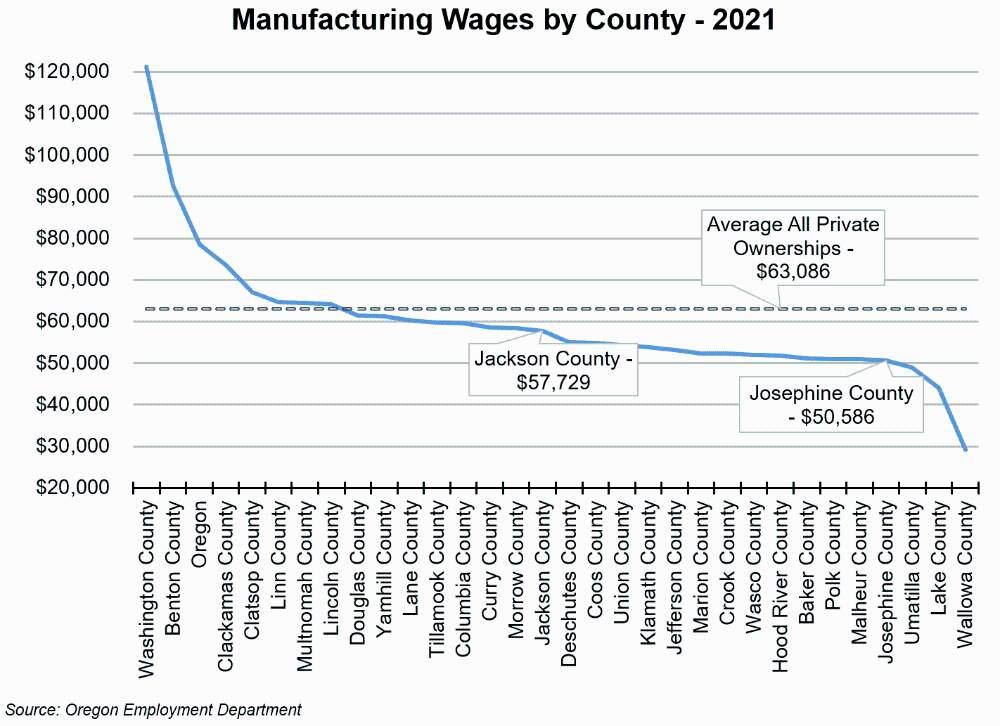

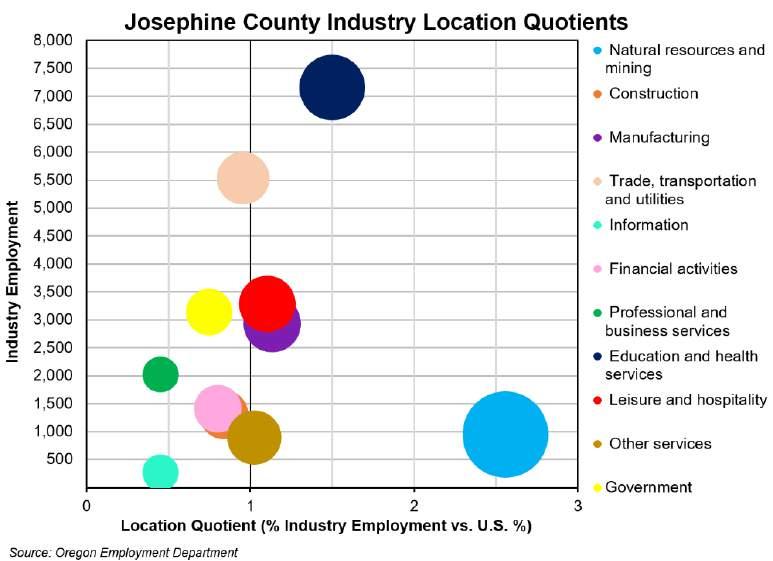

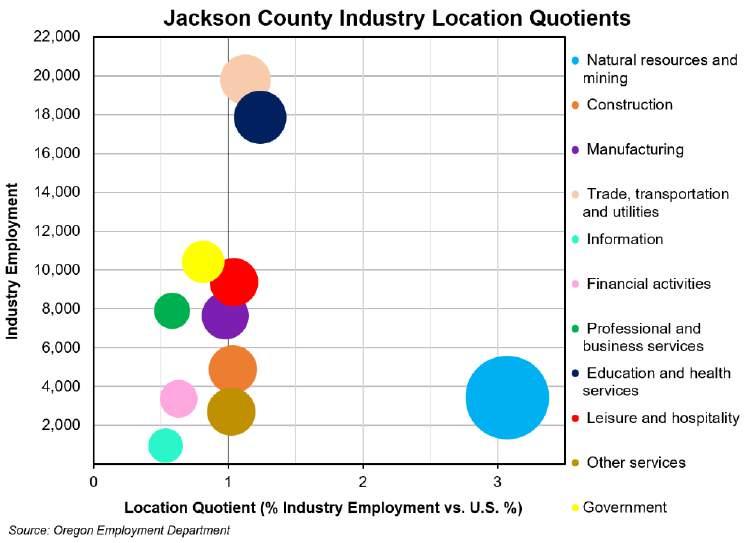

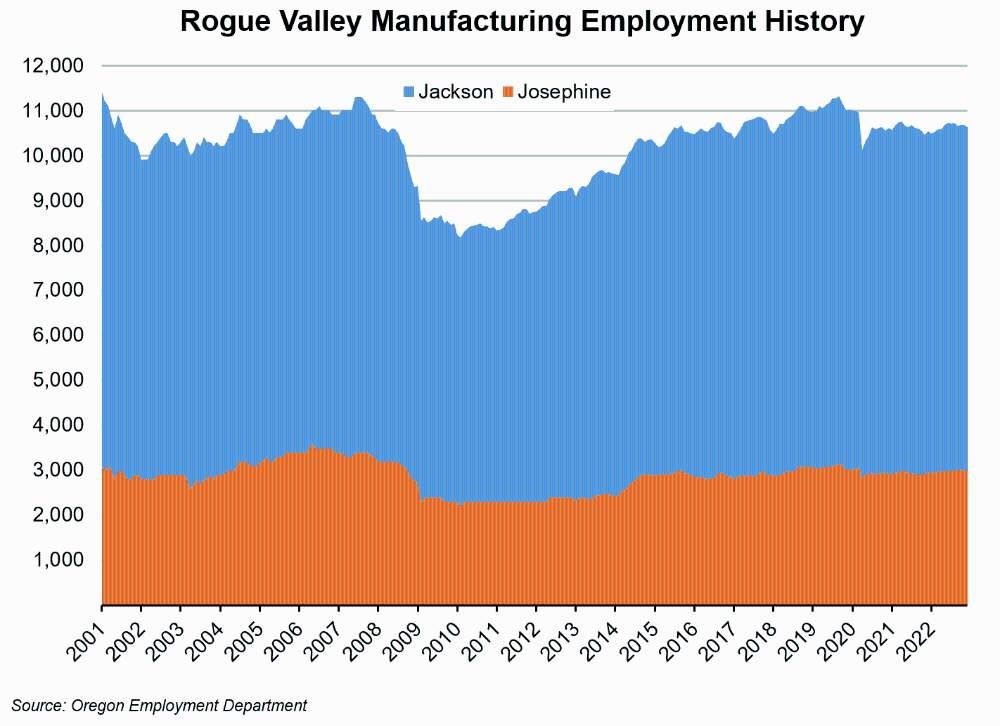

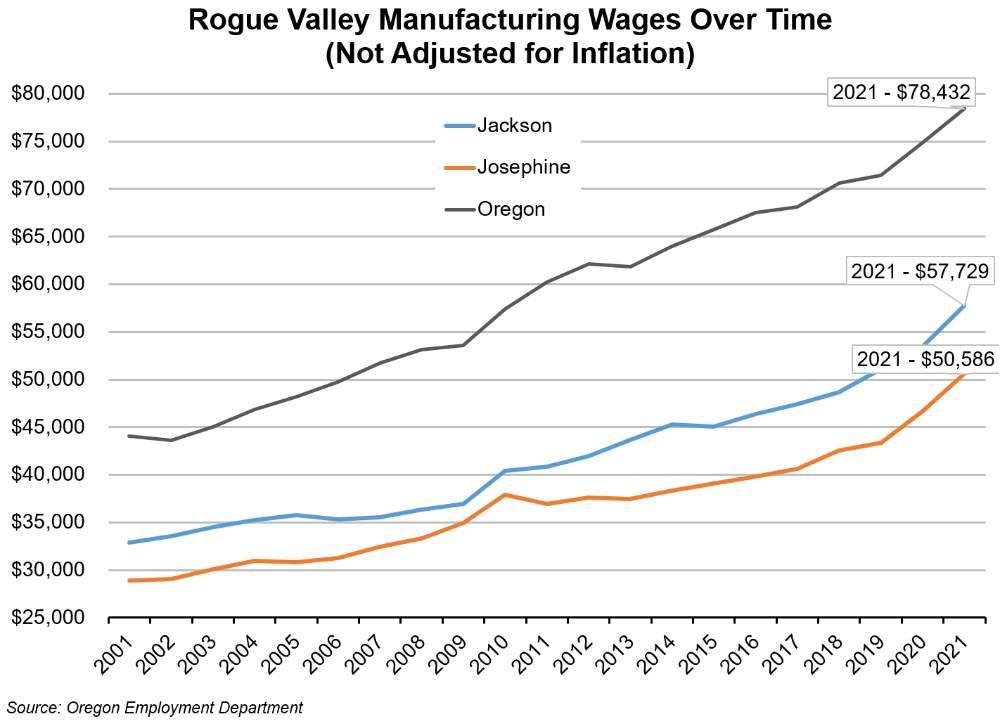

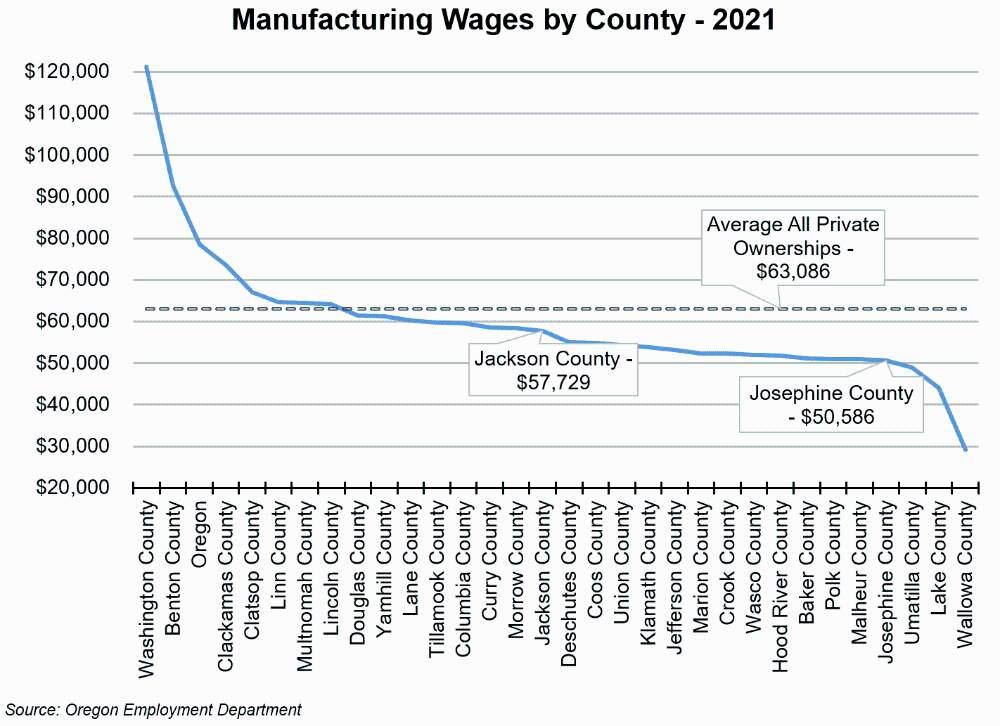

Manufacturing employed 186,367 Oregonians in 2021, which is about 12% of total private payroll coverage at the statewide level. Zooming in on the sector within the Rogue Valley, manufacturing employed 10,575 Southern Oregonians in 2021, which is about 10% of total private coverage within the Rogue Valley. The manufacturing sector in Southern Oregon umbrellas an eclectic blend of firms that produce different goods such as wood, food and beverages, transportation equipment, plastics, metals, computers and electronics, and furniture. More information on the employment and wages of the specific

industries within manufacturing in Jackson County or Josephine County can be found at the Employment Department’s research website QualityInfo.org.