Cut costs and improve deliver y times with logistics software designed for the future of the last-mile.

cxtsoftware com

EDITORIAL

Peter Sadera Editor in Chief, Sourcing Journal

Kate Nishimura Senior News & Features Editor

Glenn Taylor Logistics Editor

Angela Velasquez Executive Editor

Jasmin Malik Chua Sourcing & Labor Editor

Vicki M. Young Executive Financial Reporter

Meghan Hall Business Editor

Alex Harrell Staff Writer

Lauren Parker Director Fairchild Studio/SJ Studio

Sarah Jones Senior Editor, Strategic Content Development

Andre Claudio Staff Writer, Strategic Content

ART DEPARTMENT

Ken DeLago Art Director

Logan Case Senior Designer

Eric Pak Senior Designer

Trinity Krakora Designer

SOURCING JOURNAL ADVERTISING

Eric Hertzman Senior Director, Sales & Marketing

Deborah B. Baron Advertising Director

Darren Dort Media Coordinator

PRODUCTION

Anne Leonard Production Manager

Adeline Saez Production Manager

Therese Hurter PreMedia Specialist

FAIRCHILD MEDIA GROUP

Amanda Smith Chief Executive Officer

James Fallon Chief Content Officer

Michael Atmore Chief Brand Officer

ADVERTISING

Melissa Rocco Senior Vice President, Sales

Samantha Rumsky Advertising Director

Jennifer Petersen Advertising Director, Fashion & Luxury

Stacey Lankind West Coast Director

Amanda Boyle Beauty Director

Katherine Hogan Account Manager, Tech

INTERNATIONAL OFFICES

Olga Kouznetsova European Director, Italy

Giulia Squeri European Director, Italy

Elisabeth Sugy Rawson European Director, France

MARKETING

William Gasperoni Vice President

Christine Staley Senior Director, Marketing & Fairchild Studio

Sara Shenasky Head of Client Activation

Barbra Leung Director, Integrated Marketing

Alexa Dorfman Senior Marketing Manager

Kayla Gaussaint Associate Integrated Manager

OPERATIONS

Ashley Faradineh Director, Operations

Rosa Stancil Media Planner

Emanuela Altimani Senior Sales Coordinator

SOURCING JOURNAL IS OWNED AND PUBLISHED BY PENSKE MEDIA CORPORATION

Jay Penske Chairman & CEO

Gerry Byrne Vice Chairman

George Grobar Chief Operating Officer

Sarlina See Chief Accounting Officer

Craig Perreault Chief Digital Officer

Todd Greene EVP, Business Affairs & Chief Legal Officer

Celine Perrot-Johnson EVP, Operations & Finance

Paul Rainey EVP, Operations & Finance

Tom Finn EVP, Operations & Finance

Jenny Connelly EVP, Product & Engineering

Ken DelAlcazar EVP, Finance

Debashish Ghosh Managing Director, International Markets

Dan Owen EVP, GM of Strategic Industry Group

Brian Levine Sebior Vice President, Revenue Operations

Brooke Jaffe Vice President, Public Affairs & Strategy

David Roberson Senior Vice President, Subscriptions

Doug Bandes Head of Live Event Partnerships

Frank McCallick Vice President, Global Tax

Gabriel Koen Vice President, Technology

Jessica Kadden Senior Vice President, Programmatic Sales

Judith R. Margolin Senior Vice President, Deputy General Counsel

Ken DelAlcazar Senior Vice President, Finance

Lauren Utecht Senior Vice President, Human Resources

Marissa O’Hare Senior Vice President, Business Development

Nelson Anderson Senior Vice President, Creative

Nici Catton Senior Vice President, Product Delivery

PENSKE MEDIA CORPORATION

Adrian White Vice President, Associate General Counsel

Andrew Root Vice President, Digital Marketing

Andy Limpus Vice President, Executive Search & Head of Talent Acquisition

Anne Doyle Vice President, Human Resources

Ashley Snyder Vice President, Associate General Counsel

Brian Vrabel Head of Industry, CPG and Health

Constance Ejuma Vice President, SEO

Courtney Goldstein Vice President, Human Resources

Dan Feinberg Vice President, Associate General Counsel

Denise Tooman Vice President, Marketing, Strategic Solutions Group

Eddie Ko Vice President, Advertising Operations

Greta Shafrazian Vice President, Business Intelligence

Jamie Miles Vice President, eCommerce

James Kiernan Head of Industry, Agency Development

Jennifer Garber Head of Industry, Travel

Jerry Ruiz Vice President, Acquisitions & Operations

Joni Antonacci Vice President, Production Operations

Karen Reed Vice President, Finance

Karl Walter Vice President, Content

Katrina Barlow Vice President, Business Development

Kay Swift Vice President, Information Technology

Keir McMullen Vice President, Human Resources

Matthew Cline Head of Automotive Industry

Mike Ye Vice President, Strategic Planning & Acquisitions

Noemi Lazo Vice President, Customer Experience & Marketing Operations

Richard Han Vice President, International Sales

Scott Ginsberg Head of Industry, Performance Marketing

Sonal Jain Vice President, Associate General Counsel

Richard Han Vice President, International Sales

Scott Ginsberg Head of Industry, Performance Marketing

Sonal Jain Vice President, Associate General Counsel

THE BIGGEST VARIABLE THAT DRIVES M&A ACTIVITY IS CONFIDENCE LEVELS AMONGST DECISION MAKERS, AND THAT MEANS FOR STRATEGICS IN THE C-SUITE, IN THE BOARDROOM, AND FOR PRIVATE EQUITY FIRMS… THERE ARE A NUMBER OF THINGS THAT ULTIMATELY END UP FEEDING INTO THAT, BUT YOU CAN DEFINITELY FEEL THAT GROWING.” Jay Hofmann, J.P. Morgan

8

Global ocean shipments in the fourth quarter averaged 68 days from initial booking to clearing the gate at the final port.

12

Storage space and free trade zones are seeing an increase in demand.

14

Numerous factors at play point to price volatility in the year ahead.

The services differ depending on market coverage, reliability and costs, among other factors.

22

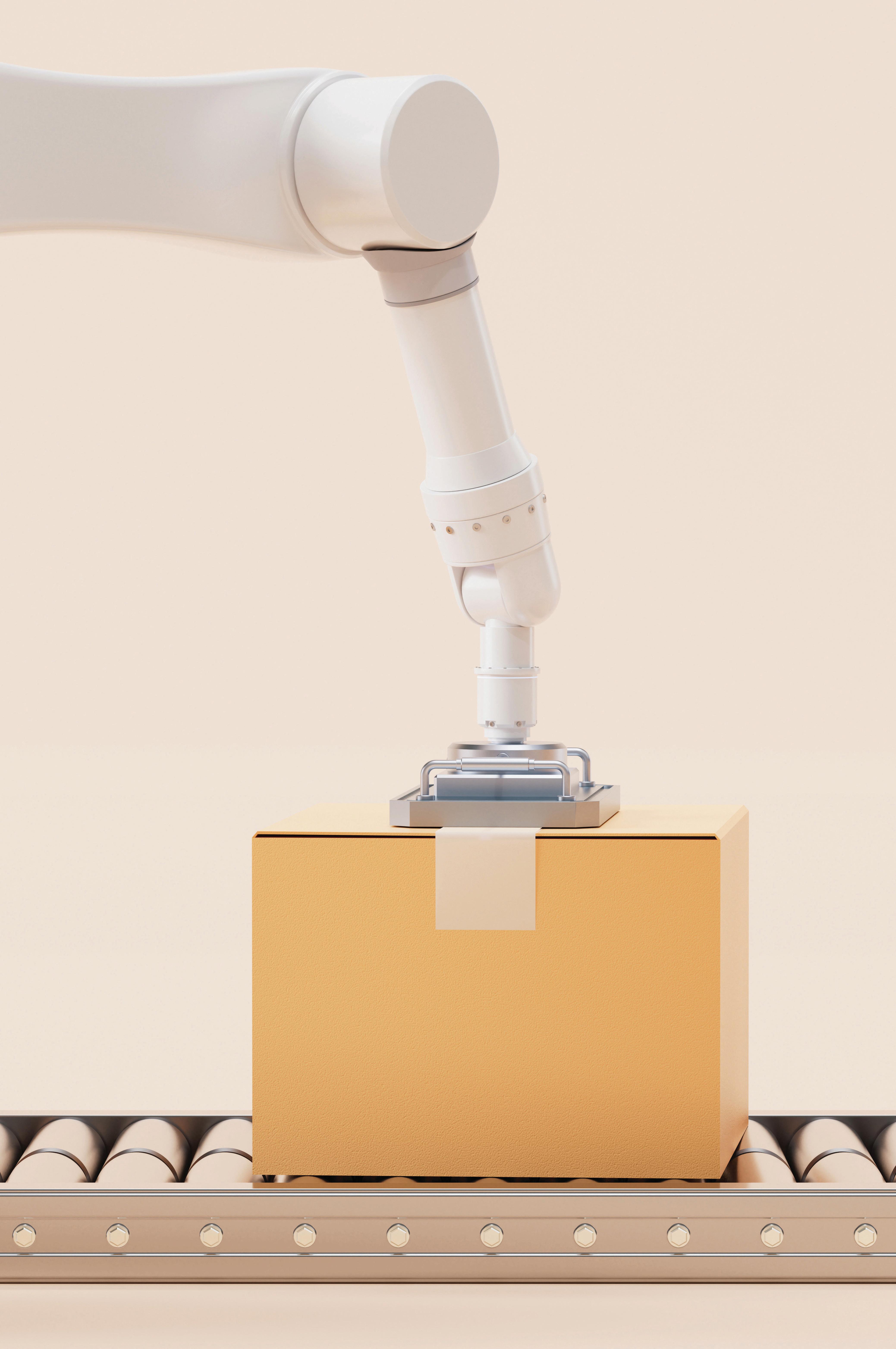

Technology has begun to get even more attention as consumers demand speed and companies have a thirst to improve ROI and increase efficiency.

26

There’s a lot of dry powder waiting to be utilized, while regulatory changes under Trump will drive M/A activity, particularly in logistics.

30

From drones to super shoes, this quartet is tackling efficiency with tech.

32 WALMART MAKES ROBOTICS MOVE

When the acquisition closes later this year, robotics company Symbotic will automate Walmart’s Accelerated Pickup and Delivery centers.

Global ocean shipments in the fourth quarter averaged 68 days from initial booking to clearing

major work stoppages at global ports and an ongoing crisis in the Red Sea marked a year of uncertainty in the container shipping world in 2024. But even as labor agreements have since been ironed out and the Suez Canal scenario brings more cautious optimism, 2025 has already shown that alleviating worldwide port congestion is no easy feat.

Across the board, 2024 was a bumpy ride that resulted in a roller coaster in ocean freight rates, alongside elevated congestion in global transshipment hubs like Shanghai and Singapore.

And for three days, all eyes were on the U.S. East and Gulf Coast ports, when the International Longshoremen’s Association (ILA) dockworkers union went on strike. While the industry had largely prepared well for the brief stoppage, it still took two-to-three weeks for ports like New York/New Jersey and Savannah to clear out the container backlog that had piled up as ships awaited outside the hubs.

Just weeks after that strike, lockouts occurred at Canadian ports across Vancouver, Prince Rupert, Montreal and Quebec, before the government intervened by issuing back-to-work orders and sending their deadlocked contract negotiations to arbitration. While the Montreal lockout lasted just a few days, operations at the port took two months to get back to normal.

Labor developments like these and others in India and Germany throughout last year didn’t help the movement of vessels.

Of 88 ports analyzed by supply chain visibility platform Beacon, 60 (68 percent) recorded longer average vessel anchor times in 2024 compared to 2023. The increases were largely minor, with 34 of these 60 ports recording increases of less than two hours. However, 30 percent of ports saw increases of more than two hours and a modest 15 percent recorded reductions in congestion of more than two hours.

Additionally, global ocean shipments in the fourth quarter averaged 68 days from initial booking to clearing the gate at the final port, an eight-day increase from totals in the 2023 quarter, according to E2open’s Ocean Shipping Index.

Expect some continued congestion in 2025, particularly in the early stages of the new ocean carrier alliance networks, in which vessel operators will have to adjust to new schedules and routes.

Port congestion held up 2.65 million 20-foot equivalent units (TEUs), or 8.5 percent of the global container ship fleet as of Jan. 18, according to data from container shipping analysis firm Linerlytica, with European and Southeast Asian ports experiencing worsening delays ahead of alliance reshuffling that began Feb. 1.

That number is in line with figures reported by Linerlytica in late June 2024, when 8.4 percent of

EXPECT SOME CONTINUED CONGESTION IN 2025, PARTICULARLY IN THE EARLY STAGES OF THE NEW OCEAN CARRIER ALLIANCE NETWORKS, IN WHICH VESSEL OPERATORS WILL HAVE TO ADJUST TO NEW SCHEDULES AND ROUTES.

container ships were anchored at ports and 90 of vessels arrived at the Port of Singapore later than scheduled.

Ahead of Lunar New Year, berthing delays persisted at China’s main ports of Shanghai, Ningbo and Qingdao, as high cargo volumes and vessel bunching continued to keep those gateways fully occupied. The country saw a record number of exports for December ahead of both U.S. President Donald Trump’s return to the White House and a potential second ILA strike, which was averted.

Ningbo and Qingdao saw the biggest percent changes in export times to North America, E2Open’s index said, at 28 percent lengthier routes.

As of Jan. 18, the queue-to-berth ratio at the Shanghai and Ningbo ports combined was 1.63, meaning there were 117 vessels (621,002 TEUs) at anchorage compared to 72 ships (524,404 containers) docked at the ports. The ship and TEU count both top global port totals calculated by Linerlytica.

Northern European ports Rotterdam and Antwerp have high ratios at 1.17 and 0.96 respectively, with the second- and third-most TEUs awaiting at anchorage worldwide.

The congestion at both China’s biggest ports, and two of the largest ports in Northern Europe, compounds the already extensive Asia-to-Europe route. That trade lane has already seen shipping times increase by one-to-two weeks for products being transported on vessels going around Africa’s Cape of Good Hope, rather than the Suez Canal.

According to data from Project44, shipments from Southeast Asia to Europe take 33 percent more time on average to arrive since before the Red Sea crisis, while China-to-Europe times rose by 25 percent.

As recently as late January, port congestion occurred in other major hubs including the Port of Vancouver in Canada and Sri Lanka’s Port of Colombo, the flagship seaports in each country.

Vancouver had dealt with backlogs

stemming from the pre-Lunar New Year rush into Canada’s West Coast, with the import surge outpacing available railcar supply, thus slowing the transfer of containers from the port to inland destinations. The port’s dashboard on Jan. 20 showed average dwell times of seven or more days at the Vanterm, Centerm or Deltaport terminals, and three-tofive days at Fraser Surrey Docks.

“There are still concerns that there may be an increase of trans-Pacific inventory frontloading throughout the month, in addition to Western Canada port and rail issues,” according to an ITS Logistics Freight Index. And in Colombo, another vital transshipment port on the Asia-to-Europe trade lane throughout the Red Sea crisis, vessels incurred berthing delays of up to three days. Customs delays and trucking congestion slowed down port activity, with 30 ships skipping Colombo altogether in the first two weeks of January due to the long queue. Overall, regardless of whether port congestion is directly responsible for any more slowdowns in container shipping, it’s clear that activity at the gateways continues to grow.

Drewry’s Container Port Throughput Index maintained year-over-year increases throughout 2024, with the rolling 12-month growth rate for global port handling coming in at 5.6 percent.

As per Drewry’s Jan. 21 data, December port throughput was expected to rise 1.6 percent month over month to 118 points, further building on the same 1.6 percent growth mark in November. The 118-point mark would still be down from the June 2024 peak of 119.2 points.

While January’s ceasefire agreement between Israel and Hamas could indicate a potential loosening or conclusion to any Houthi attacks on the Red Sea, the shipping industry’s caution in the wake of the deal means there are still no imminent full-time returns to the Suez Canal.

Until major container shipping firms can guarantee the safety of their employees and shippers get an assurance of consistent, uninterrupted service, many of the concerns related to ocean freight export and transit times—and congestion at major global ports—will continue even in partially impacted trade lanes.

president donald trump ascended, again, to the country’s highest office last month, bringing with him a playbook of potential trade actions that stands to impact the logistics sector for years to come. Trump’s protectionist trade agenda, which has largely centered on a single word—tariffs—began stoking anxieties among those in the business community months ago. And as the Commander in Chief settles into the Oval Office once again, many believe duties on foreign adversaries and allies alike are imminent.

Whether he makes good on his controversial universal baseline tariff scheme, levies duties on China, hits the BRICS Alliance with tariffs or taxes Mexican and Canadian goods—or some combination of A, B, C and D—Trump’s trade plans are going to shake up sourcing. And as American firms face new questions about where to manufacture, how much inventory to bring in and how to store it, logistics players will be key to keeping the supply chain humming.

“It’s going to change the way a lot of businesses do business—and their supply chains,” Scott Taylor, leader of the foreigntrade zones practice area Sandler, Travis & Rosenberg, P.A., told Sourcing Journal of Trump’s agenda.

The trade expert said the current situation harkens back to the early days of the punitive duties placed on China-made goods during

Trump’s first term. At the time, “People were scrambling for warehouse space,” he said. “We’d get calls saying, ‘We need a Foreign Trade Zone immediately to offset this new cost that we have.’”

“I fully expect, based on conversations the last 30 to 60 days with companies, that we’re going to see a strong demand for warehouses in general, but especially for those for imported products that may not be subject to duties right now,” he added.

According to Taylor, STR clients “across the board” believe new duties will be a key issue in 2025—it’s just a matter of what they will look like. A number of companies have been preparing for the potential trade actions by frontloading orders for months, attempting to squeeze inventory into the U.S. under the wire before any duties take effect.

E President Donald Trump

G Analysts believe warehousing capacity will decrease in 2025 relative to last year as companies stake their claims to the space.

“A lot of companies, if they can expedite certain shipments that were already going to happen later on in the year, they’ll bring them in as early as they can and get ahead of the curve,” he added.

Ergo, there stands to be an acceleration in demand for warehouse space.

Taylor’s expertise is in Foreign Trade Zones, or FTZs, which allow companies to import products from overseas and store them, deferring the payment of duties until the merchandise is sold to the end customer (usually a retailer). Storing goods this way allows brands to avoid paying a large duty bill up front on products that may not be sold all at once, and there’s no time limit on how long merchandise can remain in an FTZ.

While apparel businesses once saw inventory as more of a liability than an asset, and didn’t want to hold too much in storage,

Covid changed that mentality, Taylor said. With a gauntlet of supply chain issues plaguing brands and retailers for years, many now see the value in storing some critical merchandise close to their end markets. In fact, it has become “a new norm,” he said.

Now that major changes to trade relationships are on the table, “I think there will be a lot more companies that maybe didn’t need warehouses that might need them now,” Taylor said.

“When you look at a 25-percent tariff on anything from Canada, anything from Mexico… Even if that’s a smaller percentage, a lot of those products have been duty-free through USMCA treatments,” Taylor explained. If brands don’t stand to see those free-trade agreement benefits anymore, they’ll need to find cost savings elsewhere.

“There are a lot of companies that have Foreign Trade Zones that are expanding, and they have even before these new tariffs,” Taylor said. “I think we’ll see more of that in 2025.”

Fashion is “one of the major industry clusters” currently utilizing FTZs to facilitate commerce in the U.S. “Most major companies have a Foreign Trade Zone; at least one, maybe three, four in the United States, in the apparel and footwear industry,” he added. “The major distribution companies for clothing and apparel see duty rates up to 20 to 25 percent on some products, and so there’s a deferral savings, even if it’s all ultimately sold in the U.S.”

Of course, buying into new warehousing capacity will come at a cost, and companies will need to determine whether the price of storing product in an FTZ or bonded warehouse actually offsets the cost of paying increased duties.

While warehouse demand is poised for growth, Taylor said he hasn’t yet seen a marked increase in pricing. “I think there are enough warehousing companies that are out there bidding for the work, especially the major 3PLs, that maybe that keeps their cost down to a reasonable amount,” he said. “I think it’s a highly competitive area for any new warehousing work for companies.”

Asked whether he believes warehousing, and logistics strategy more broadly, stands to remain a key focus for companies in the years to come, Taylor said, “It has to be. Because you could pick up the paper or plug in every morning, and there will be a new trade policy online, or a new tariff on some country, and you’ve got to be ready to adapt if you’re a company doing business in the U.S.”

According to Dale Rogers, professor in the Department of Supply Chain Management at Arizona State University, warehousing demand showed slow, steady growth throughout 2024, and he agrees that trend could accelerate in 2025.

PRICES DO.” Dale Rogers, Arizona State University

Rogers created the Logistics Managers Index (LMI), which tracks trends and developments in the logistics industry. The LMI score takes into account inventory levels and costs, warehousing capacity, utilization, and prices, along with transportation capacity, utilization, and prices. Calculated using a diffusion index, any reading above 50 indicates the expansion of a sector while any reading below 50 indicates contraction.

Retailers predict that inventory levels will increase “significantly” over the next 12 months—a departure from leaner inventory strategies that characterized both 2023 and 2024, the December LMI report said. “By bringing inventories forward now, retailers hope to avoid putting any increased costs stemming from potential tariffs on consumers that are already tired from the inflation of 2021-2022,” it added.

A reflection of the growing inventory levels, analysts believe warehousing capacity will decrease in 2025 relative to last year as companies stake their claims to the space. Despite estimates by the Industrial Info Resources (IIR) that $9 billion worth of warehousing and distribution projects are under construction in the U.S.—and logistics service providers (LSPs) such as Prologis and C.H. Robinson making significant investments along the U.S.-Mexico border—the demand for space will outpace the growing capacity.

Warehousing prices, too, are projected to expand at the “robust rate,” the report said.

Rogers said he has tracked a curious evolution in the warehousing space in recent years.

“Over the last 35 to 40 years, we’ve been consolidating down to fewer warehouses, and we’ve made them mostly big, millionsquare-foot facilities,” across states like Pennsylvania, Georgia, Indiana, Ohio and California, he explained. But with the advent of e-commerce and players like Amazon, that trend reversed, and distribution centers and warehouses began cropping up far and wide to get closer to end consumers.

As such, the market for warehouses has become more competitive, especially in recent years. During the Covid crisis, companies scrambled for space, hoping to stockpile goods amid overseas supply chain and transportation slowdowns. Commercial real estate firms doubled down on their warehousing portfolios as office buildings and shuttered (and many remain closed, years later).

According to Rogers, pandemic-era warehouse contracts are now expiring, “and owners are greatly increasing the prices on the renegotiation of the new contract.” However, warehousing capacity, unlike transportation logistics, is relatively inflexible. Capacity does not expand or contract with ease, and therefore, “warehousing prices move a lot slower—both up and down—than transportation prices do.”

When asked whether Trump’s protectionist trade agenda and the tariffs in particular stand to have a meaningful impact on companies’ warehousing strategies, Rogers said he was doubtful based on his recent conversations.

“There’s nervousness about Trump, but there’s also belief that he’s not going to go through with this threat—that it would be so disruptive that there’s no way this could happen. So people are less frightened today than they were say in July or August,” he said. “It could absolutely wreck the economy if he decides to go through with what he threatened, but it seems unlikely to the people who are running these businesses.”

Instead, projected warehousing expansion (and price increases) may be tied to other factors snarling the supply chain, from the seemingly constant threat of U.S. port strikes to simmering geopolitical conflicts, he believes.

From his perspective, leaders ultimately aren’t willing to stake their logistics strategies on mere rhetoric, especially when the president has a history of changing his mind. “It’s like, don’t pay attention to what he says; watch what he does. So, we’ll see,” Rogers said.

Numerous factors at play point to price volatility in the year ahead. by Glenn Taylor

container prices in 2024 were defined by volatility, and that is likely to continue to keep up into 2025 as a new presidential administration takes shape and more vessels are deployed.

Last year’s rates were impacted by a series of disruptions, including the year-long Red Sea crisis and ensuing port congestion, a three-day strike at U.S. East and Gulf Coast ports, a bridge collapse in Baltimore and even a brief global IT outage, among other unexpected obstacles.

With concerns of a second East and Gulf Coast port strike being averted in early January, a brief spike in ocean spot freight rates at the turn of the year appears to have been halted, giving breathing room for a softer start to 2025. Importers had been frontloading goods into the U.S., contributing to the prior rate increases in December.

“The effect is catching fire immediately. Rates are coming down on many of the directly impacted trade lines,” said Peter Sand, chief analyst at freight rate benchmarking platform Xeneta.

According to the Xeneta Shipping Index, Far East to U.S. West Coast container prices were $5,313 per 40-foot container (FEU), down 6.6 percent from the week prior but up 33 percent from the month-ago period as of Jan. 16. Similarly, Drewry’s World Container Index had prices from Shanghai to Los Angeles at $5,228 per FEU, down 5 percent from the week before but up 16 percent from the month prior.

At the time, Drewry expected spot rates to decrease slightly in the weeks after due to increased capacity freed up by vessels no longer burdened with excess cargo.

Luckily for U.S. importers, the pre-strike date upturn also pulled the typical pre-Lunar New Year demand forward, enabling ocean container rates to start leveling out earlier than usual.

As a result, ocean carriers reduced shortterm rates to both the U.S. East and West Coasts in January to help stimulate demand.

But that downturn in ocean freight rates may be brief, depending on the impact of tariffs levied by President Donald Trump, which primarily impact trans-Pacific trade coming out of China.

“That’s going to be the big driver. I would think that rates will go down after Lunar New Year, which is typical, but they’ll probably stay more elevated than what we will see for Asia-toEurope,” said Judah Levine, head of research at freight booking marketplace Freightos.

Levine noted that in 2024, Asia-to-Europe rates were roughly $3,000 to $4,000 per container after the Lunar New Year, before accelerating during the late summer peak shipping season. But by the end of the season in October, they went back down to the same $3,000-to-$4,000 rate.

However, while the trans-Pacific route saw the same $3,000-to-$4,000 floor after Lunar New Year, rates “never went down that low” after the peak season, instead staying at $5,000 per container.

Add in a new set of tariffs in 2025, and “I think that they’ll probably continue to be the case for the trans-Pacific to both coasts,” Levine said.

Looking at Trump’s first act as President, the tariffs could provide a rate bump for various months at a time. Both Xeneta and Drewry indicated that average spot freight rates out of China to the U.S. West Coast doubled shortly ahead of tariffs first introduced in July 2018.

Xeneta data showed average rates increased from $1,340 per 40-foot container on June 29 that year to $2,692 as of Nov. 1, while Drewry calculated a jump from $1,255 per FEU to $2,706 in the same time frame. These figures declined to $1,679 and $2,081 respectively by the start of 2019 but remained well ahead of pre-tariff averages.

Sand noted that this kind of bump isn’t a guarantee though, when accounting for surrounding market factors compared to 2018.

“We see it playing out slightly different at first, because shippers—American importers in particular—have been front-loading all year,” Sand said. “It’s not like they all of a sudden get this nasty surprise by seeing higher barriers to trade.”

NEWLY FORMED OCEAN ALLIANCES PLAY ROLE IN KEEPING FREIGHT RATES DOWN

While Trump’s presidency carries plenty of unknowns to the container shipping ecosystem, the industry now also contends with shifting alliances, which could also affect freight rates in a more positive way for shippers.

On Feb. 1, Maersk and Hapag-Lloyd officially commenced their Gemini Cooperation vesselsharing alliance, shaking up agreements both container shipping firms previously had been a part of with other carriers.

The new set of alliances now include the Gemini Cooperation, the Ocean Alliance and the newly founded Premier Alliance, while Mediterranean Shipping Company (MSC) operates a standalone service.

As the new coalitions seek to bring in new customers and switch port calls, they will compete for new volume on their ships and fight for market share. This likely would result in lower rates, at least in the short term, as the carriers look to generate new demand and broaden their coverage.

RATES COULD CONVERGE IN 2025

Philip Damas, founder and head of Drewry Supply Chain Advisors, said he expects spot rates and longer-term contract rates to go in opposite directions, in which the spot rates continue to decline further in 2025 depending on the tariff impacts, while contract rates will increase. Contract rates are traditionally cheaper than their spot counterparts, so the gap between the two would get closer if this plays out.

“Most medium and large companies prefer annual contract rates, which are, if possible, year-long, fixed with no variable surcharges,” Damas told Sourcing Journal. “So that’s a preference. But the issue now is some companies believe that we are going to move into a situation of overcapacity. They do not want to lock in rates at a high level.”

THE ISSUE NOW IS SOME COMPANIES BELIEVE THAT WE ARE GOING TO MOVE INTO A SITUATION OF OVERCAPACITY. THEY DO NOT WANT TO LOCK IN RATES AT A HIGH LEVEL.”

from

per 40-foot container on June 29 that year to $2,692 as of Nov. 1.

Large shippers, such as retail giants like Walmart, Amazon, Costco and Target among others, typically lock in contract rates because they require higher quantities of freight for a longer-term period and want more stability in volatile rate environments.

“One option is you ship spot, so when the spot rates fall, the companies as buyers will benefit from below-spot rate,” Damas said.

“The other option is you sign a yearlong contract, and we typically advise companies to have some sort of review clause in the contract when they can.”

These review clauses are designed to allow the shipper to have more flexible contract options in the event of wild swings in prices, as well as potential changes in volumes required. They also can benefit the carrier by better enabling them to plan ahead of capacity deployment.

The services differ depending on market coverage, reliability and costs, among other factors. by Glenn Taylor

Importers and exporters alike take note—ocean carriers are undergoing their biggest reshuffling in a decade, and their shifting alliances will play a key role in upcoming contract negotiations for 2025.

On Feb. 1, Maersk and Hapag-Lloyd officially commenced their Gemini Cooperation vessel-sharing alliance, shaking up agreements both container shipping firms previously had been a part of with other carriers.

The Ocean Alliance of CMA CGM, Cosco Shipping, Orient Overseas Container Line and Evergreen remains the same, already extending its collaboration until March 2032. The alliance’s updated “Day 9” service network will go into effect in April.

And With Hapag-Lloyd leaving THE Alliance, remaining members Ocean |Network Express, Hyundai Merchant Marine and Yang Ming rebranded as the Premier Alliance, effective in February.

Mediterranean Shipping Company (MSC), Maersk’s former 2M alliance partner, now operates a stand-alone service.

The services differ depending on market coverage, reliability and costs, among other factors. For example, the Ocean Alliance has the widest reach, sharing 380 container ships across 37 services on major trade routes, and will lead the way in the trans-Pacific market with 15 sailings to the U.S. West Coast and eight sailings to the U.S. East Coast.

At the same time, MSC will remain the dominant player in the Mediterranean Sea with six weekly services in the region and 34 loops worldwide, and hangs its hat on establishing direct port calls worldwide over speed. Unlike other carriers, MSC has also kept the Suez Canal option on the table for shippers despite the lingering Red Sea crisis pushing the majority of container vessels around the Cape of Good Hope.

“Altogether we are going to provide 1,900 direct port combinations because we believe that clients want that certainty of a direct destination call, and that direct connections are more important than speed,” said MSC CEO Soren Toft, during the International Association of Ports Harbours annual World Port Conference in October. “Ours is a network that reflects the future of a more dispersed supply chain.”

Given the larger uncertainty that has spread across the global supply chain, whether it be the Red Sea-driven port congestion or geopolitical trade tensions, businesses are likely to benefit by working with multiple alliances at once.

“If you’re a shipper, you don’t want to put all your eggs in one basket,” Philip Damas, founder and head of Drewry Supply Chain Advisors, told Sourcing Journal.

DHL Global Forwarding is one logistics firm that has already committed to working with different alliances and shipping lines to hedge the risk of disruption and price volatility in the transition period.

“We think it’s important to spread the services and risk across all these alliances,” said Jacob Moe, global head of full container load at DHL Global Forwarding, on a January webinar. More noted that these agreements should be conducted with several different carriers to “balance your service profile, your cost profile and your risk profile.”

Even as businesses and logistics providers alike look to diversify their shipments, the

new pacts aren’t going to come without some short-term speed bumps.

Judah Levine, head of research at freight booking marketplace Freightos, expects some short-term disruption when the first of the alliances take shape in February.

“Vessels have to get to different services than they were scheduled on just a few weeks prior, so there’ll be an adjustment period that could mean poorer schedule reliability. There’s more of a possibility of vessel bunching and delays from that,” Levine said. “If things are disrupted and you have congestion, then that restrains capacity a little bit.”

For example, the number of blanked sailings at ports on both the Asia-Europe and transPacific routes in February are expected to be over 50 percent higher than last year, according to container shipping analysis firm Linerlytica.

With concerns over the future of service, Maersk and Hapag-Lloyd aim to stand out with their own reliability goals.

The Gemini Cooperation says that it will deliver schedule reliability of 90 percent when its new network is fully phased in after the Feb. 1 launch. That phase-in is supposed to take 13 weeks, putting both carriers under significant pressure to reach the lofty goal.

Damas noted that shippers are still skeptical of the carriers’ ability to reach this figure, and rightfully so.

While Maersk substantially outperformed 12 other major carriers in schedule reliability in November 2024 at 61.9 percent, the total

remains roughly 28 percentage points off the Gemini goal. Hapag-Lloyd has a much longer way to go, coming in at 53.5 percent, according to maritime trade advisory service Sea-Intelligence.

Both ocean carriers have defended the decision, with Maersk CEO Vincent Clerc saying in an Oct. 31 earnings call that the companies ran a lot of tests in recent years that gave them confidence that they could reach the 90 percent threshold across its 29 mainline services and 342 shared vessels.

“We did not go out with that number lightly,” Clerc said. “Doing it right the first time with high quality is going to be cheaper than operating a network with this 50 percent reliability.”

Clerc said the hub-and-spoke model will have fewer port calls and “cleaner” rotations, lowering the chance that an individual port disruption gets transmitted into the wider network.

Hapag-Lloyd CEO Rolf Habben Jansen said in a Nov. 14 earnings call that the ships will be better utilized than previously, as there won’t be situations where the vessel takes five or more ports to fill up.

“In the Gemini network, you will have two or three port calls, then the ship is full. Then we offload it in the hub and basically turn it around or make one or two more calls,” Habben Jansen said. “That gives you, on average, better asset utilization. if you have better asset utilization, you can transport more cargo with the same number of ships across the entire network.”

The carrier does not expect to see any significant loss of market share due to the alliance switch, but indicated that it will be hit by added costs in the first and second quarters.

Despite the overall concerns of the shipping shakeup, Sea-Intelligence has argued that the transition for the alliance networks will be smoother than expected given the time the carriers have been able to prepare for the switch.

THEY’RE COMPETING FOR NEW CUSTOMERS, ESSENTIALLY, AS THE ALLIANCES REWORKED. IF YOU HAVE INCREASED COMPETITION, THAT WOULD PUSH RATES DOWN.” Judah Levine, Freightos

E

“There will be some operational hiccups— that is unavoidable when hundreds of vessels change schedules,” Sea-Intelligence noted in a Jan. 12 report. “But this is happening during the slack season after Chinese New Year, and should hopefully be manageable.”

Analysts have noted that the shifting alliances could bring in a period of increased competition for the carriers—at least in the short term—which in the end benefits the shipper paying to transport the goods.

“They’re competing for new customers, essentially, as the alliances reworked,” Levine said. “If you have increased competition, that would push rates down.”

According to Peter Sand, chief analyst at freight benchmarking platform Xeneta, carriers are offering higher price ranges to existing customers than they are to new clients.

“They may seek to milk existing customers because they trust they will stick around in uncertain times,” Sand said. “They have been increasingly active in acquiring new customers, as opposed to offering significant discounts to existing ones.”

Bergen Logistics is a leading third-party logistics (3PL) provider with over 25 years of experience, trusted by thousands of fashion and lifestyle brands. With a global network of fulfillment centers across the US, Canada, Mexico, UK, EU, and Asia, we ensure fast, reliable, and efficient omnichannel fulfillment.

Our proprietary CloudX Systems WMS gives you full transparency into your inventory and order fulfillment processes. With real-time data at your fingertips, you can make informed decisions, optimize your supply chain, and focus on scaling your business.

bergenlogistics.com cloudxsystems.net

Focus on what you do best—let Bergen Logistics handle the rest.

Technology has gotten more attention as consumers demand speed and companies have a thirst to improve ROI and efficiency.

by Meghan Hall

automation has been having a bigger and bigger impact on the industry since the Industrial Revolution.

But today, the technology has begun to get even more attention as technologists continue to iterate, consumers demand speed for their e-commerce deliveries and companies have a thirst to improve ROI and increase efficiency.

In 2024, experts said companies implementing automation did so out of necessity—and to cut the time it took to complete tasks like transporting items across the warehouse. They did so in the face of labor shortages in the logistics sector, increased competition from new-entrant e-commerce players and a delicate consumer spending environment.

The technology is only expected to accelerate as complementary enhancements, like artificial intelligence, proliferate further and consumer demands continue to increase. Experts weighed in on where it might be headed next—and how logistics leaders should consider implementing it.

Andy Johnston, Geodis’ senior director of innovation, said the logistics company focused on lower-lift, but meaningful, technology implementation and use in 2024.

“We’re using our technology to automate the movement of inventory inside of the facility, so that our teammates have to travel less. So by traveling less, they’re increasing their productivity. That’s the very basic function of what a lot of the automation that’s out there is today,” Johnston said.

He noted that automation moving items from point A to point B have made the warehouse more efficient, in turn speeding up client processes.

Ahmad Baitalmal, chief technology officer and co-founder of warehouse automation startup Mytra, said that base-level automation has almost become a necessity because of the way retail and logistics moved in 2024.

As customers continue to value convenience and speed, it can be nearly impossible to achieve that by relying on humans’ work alone, he said.

“Five years ago, it was, ‘Wow, this is amazing that things are coming to me super fast.’ Today, it’s, ‘Why isn’t it here already?’” Baitalmal told Sourcing Journal. “[This is] no longer optional; it is required that you operate at a faster pace and deliver more with more capacity. That is your competitive advantage. Now, if you’re not doing that, your competitors are doing that, and so there’s a lot more attention to automation happening today.”

As companies worked to make their operations faster and more efficient, Jeremy Tancredi, partner at consulting firm West Monroe, said in 2024 he saw a move toward automation for specific use cases rather than sprawling aspirations.

“We’re seeing more companies move to more modular automation, so you have a lot of these very niche companies starting up,” he said.

Because Geodis has seen that automation positively impacts its efficiency and processes to date, Johnston said the logistics company has several areas in mind for the technology in 2025. While 2024 was focused on systems that could impact individual shipments or people, the company has plans to focus on more commercial use cases this year.

“Where we’re looking to now is B2B order shipments—so think picking cases instead of each item, a pallet instead of a box...where a smaller-format robot wouldn’t be able to handle it,” he said. “Another thing is looking toward the inbound side of the business—truck unloading, both for loose cases and for full pallets.”

In the at-large logistics industry, Johnston said he expects drone-based solutions with AI built into the background to become a popular use case to maximize inventory efficiency. He also hopes to see expanded use cases for humanoid robots, which, today, are good at completing repetitive tasks, but have limits in terms of what they can do, how many pounds they can lift and how they interact with human workers.

As technologists and startups continue to change automation with technology—and the results being shared start to look more and more exciting—Johnston warned that companies looking to automate should ensure the third-party technology providers approaching them can actually carry out the scope of their promises.

“There’s a lot of really cool robots out there, a lot of roboticists, a lot of stuff that looks awesome on the trade show floor, but that may be their entire robot fleet, is the one they bring to the show floor,” he said.

Still, Johnston and Tancredi expect to see a greater number of mid-major companies partnering with startups and third-party technology providers; for companies that lack the resources and technological prowess of the likes of Amazon and Walmart, building inhouse systems can take years.

Baitalmal said in the age-old “build vs. buy” equation, each side has its pros and cons.

“In 2025, manufacturing and supply chain companies weighing the choice between buying versus building robotics technology should consider factors like speed to market, cost, customization and adaptability,” Baitalmal said. “Buying offers quicker deployment and access to cutting-edge solutions but may limit customization and create dependency on external innovation. In contrast, developing in-house allows for tailored solutions enabled by recruiting and building a core team of innovative engineers, though it requires significant investment and time.”

While automation can have positive outcomes for companies’ efficiency and profitability, it can also have negative impacts on worker sentiment if not introduced in a way that gives employees confidence in their own roles.

The contract dispute between the International Longshoremen’s Association (ILA) and the East Coast U.S. ports, in which automation proved a major sticking point, is just one industry example of fear of job loss creeping in. But the longshoremen aren’t the only ones with that fear, and researchers believe that in many cases, those fears could be warranted. Forrester projects that, across industries, the U.S. could see a net loss of over 1.4 million jobs by 2032 because of automation.

To help quell employees’ fears, some organizations have started to upskill employees and train them alongside automated machinery. But Tancredi said that, as many companies have introduced automation, they’ve done so without properly explaining to employees what the purpose is, or how they can best interact with the technology, which can cause tension in the workplace.

“Traditionally, it’s been kind of an arrogant approach by management that says, ‘Oh, well, we can talk to the workers all we want about automation, but they won’t understand it.’ But that’s no longer the case. People are using technology in every aspect of their daily life. So whether it’s a warehouse worker or someone in the manufacturing facility or on a dock, they’re pretty tech savvy at this point,” he said.

With that in mind, Tancredi recommended transparent communication with employees whose day-to-day job responsibilities will be changed or impacted by automation. He noted that it’s also important to highlight the benefits automation could have for workers: particularly around health, safety and saving time, which could see workers sustaining fewer musculoskeletal injuries from heavy lifting and physical work in the warehouse, as well as incurring fewer unpredictable overtime hours.

“The long-term health benefits can help [people] to really see warehousing as a career, rather than just a job for the young,” he said.

Tancredi said many companies, particularly those that are small-to-medium enterprises

(SMEs) are more interested in applying warehouse automation technology in bits and pieces than they are in creating a fully automated warehouse within several months.

“We’re seeing more and more clients embrace small pieces of automation, as opposed to trying to boil the whole ocean,” Tancredi explained

And while some of that is often done as a way to test and learn, or to save money until the technology has been proven out, it can also be a way for workers to interact with automation in a low-stakes way, he noted.

Once they’ve seen that one process can be positively impacted by automation, workers may be more likely to embrace similar technology for other functions.

While many think of automation as being integral to physical processes, Johnston said it can be just as useful for tasks like translation; he noted that Geodis has used automation via screen to share directions or tasks in workers’ native languages, since about 30 percent of its workforce, English is a second language. That, he said, has helped training that might usually take weeks take mere days.

“With retail [and] fashion, we have these very high-peak seasons…so using some of the tools that automation offers for training to reduce training time,” he told Sourcing Journal.

For Geodis’ employees, it typically takes three to four weeks to become fully

comfortable with automated technology working in tandem with humans. And when he thinks about the industry on the whole, Johnston said he believes it’s still in early days in terms of what automation can truly offer.

As companies continue to set automation in motion, they’ll not be starved for choice around the technology.

Tancredi and Johnston expect many companies to adopt piecemeal automation capabilities, primarily powered by third-party providers.

Tancredi said that trend has a few reasons behind it—the first being that, as technology proliferates, startups honing in on one specific use case for warehouse automation have become increasingly popular. Most robots and automation systems are designed for a few main capabilities, and companies unsure about automation can make low-risk, lower-cost investments in those types of technologies, as compared with buying in on a wholly automated warehousing system.

“We have all these different styles of robots, from little modular ones that look like little Roombas, to full-scale cranes that are going up and down the aisles,” Tancredi told Sourcing Journal. “You can get in at a pretty low entry level—in some cases, only a few thousand

dollars to get a single robot...so it’s very easy to see if it works for you, to see if it’s the right investment for your company.”

But as companies sort out what kind of technology makes sense to implement, it’s important not to use technology for technology’s sake; identifying an area that could use stronger efficiency before evaluating solutions can help ensure investments make maximum impact when it comes to automation.

As those evaluations happen, it’s not just about looking externally; to find success with automation, Johnston said, companies need to ensure they have their ducks in a row on existing processes; automation, after all, isn’t a magic cure-all, and innovation and technology teams making recommendations on automation need to see improvement on key performance indicators (KPIs) to justify continued expenses.

“As you’ve selected the process that you want to automate, really dive deep into that process and its current state and make sure that it’s not a bad process, because adding automation to a broken process does not fix it. If anything, it’s just going to show you where it’s broken,” Johnston said. “Make sure you’ve got the house in order before you bring in automation, because if you bring in automation and [the process] was broken before...guess what’s going to get the blame? Automation, because it’s the new thing.”

ADDING AUTOMATION TO A BROKEN PROCESS DOES NOT FIX IT. IF ANYTHING, IT’S JUST GOING TO SHOW YOU WHERE IT’S BROKEN.” Andy Johnston, Geodis

There’s a lot of dry powder

waiting to be utilized, while regulatory changes under Trump will drive M&A activity, particularly in logistics. by

Vicki Young

The u.s. post-election environment is setting the stage for more deal making in the mergers and acquisitions market, one that could spur activity in the logistics sector.

In a December webinar hosted by S&P Global Market Intelligence, Anton Sahazizian, managing director and global head of M&A at Moelis & Company and the firm’s former head of U.S. M&A, said there has been a backlog of deals.

“It’s almost as if we’ve seen a light switch turn on since the election in the U.S.,” Sahazizian said. “The interesting thing is that backlog level is still very full, but what’s really happening is you’ve seen an acceleration of completions of deals that were in the backlog. At the same time, we’re seeing pitch activity increasing, and those pitches produce more additions to the backlog.”

He said his teams are “rapidly preparing a significant volume of deals which will come to market in 2025.” Not all will be in the first quarter, and some will come later depending on anticipated levels of financial performance. The deals that he is expecting will involve “very high-quality businesses” that will see a “very high level of interest from the buyer community,” Sahazizian said.

He also said he and his teams aren’t seeing a shortage of capital in the debt markets, adding that there’s plenty of capital available, whether from private lending to credit funds to sovereign wealth funds and family offices. The key to getting a deal done will be centered more on buyers and sellers agreeing on the equity value of the business rather than on the availability of capital.

Jay Hofmann, a managing director and the co-head of J.P. Morgan’s North American M&A business, said he’s seeing the same pattern.

The recovery is due to confidence levels among decision-makers, and the impact of the new administration.

“The biggest variable that drives M&A activity is confidence levels amongst decision makers, and that means for strategics in the C-suite, in the boardroom, and for private equity firms amongst the deal partners and the firm leadership in investment committees,” Hofmann said. “And there are a number of things that ultimately end up feeding into that, but you can definitely feel that growing.”

Some of the factors he cited include a narrative around the macro economy that sees high levels of employment and decent GDP growth, as well as positive energy sentiment coming out of Washington and what a new administration likely means for overall business development.

And while the expectation is that tariffs should be inflationary, there is also the dynamic where interest rates are expected to go down, which in turn has valuations going up, he said. Hofmann added that his team is planning for a very strong 2025, one that includes seeing volumes and deal account “up at least 15 percent” for the year.

Hofmann also said there’s an expectation that the second administration of President Donald J. Trump (Trump 2.0) will be much more favorable to deal making than the administration under former President Joe Biden. As for antitrust regulation, he doesn’t expect the Trump administration to be as accommodating as a traditional Republican administration but did note that in Trump’s first administration from Jan. 20, 2017, to Jan. 20, 2021, there were instances where certain industries drew more— and others less—scrutiny.

According to a PwC M&A Outlook for 2025, it forecasts rising activity due to the large amount of funds on the sidelines waiting to be used and declining interest rates. Regulatory changes as certain Biden-era reforms reverse under Trump 2.0 are another reason for the expectation that dealmaking activity would increase in 2025.

While some sectors such as oil and gas could benefit from deregulation, Big Tech could face more scrutiny. PwC cautioned that volatility is to be expected, particularly in the area of cross-border deals due to tariffs and trade wars impacting the geopolitical backdrop. The report also concluded that the drought in private equity exits over the past two years will ease as “more certainty” has returned to the market. That is expected to result in an increase in exits that could spur more potential targets for corporate acquirers.

As for the global transportation and logistics sector, PwC said the 71 disclosed transactions for the six months ended Nov. 15, 2024, had a total deal value of $51.5 billion. That compares with the prior six months ended May 15, 2024, that saw 69 transactions with a total deal value of $39.5 billion. The report noted that with deal value rising, that could be one indication of improving investor confidence. Another factor that could spur a rise in dealmaking is the anticipation of profitability improvements, which in turn bolsters valuations.

Both trucking and maritime freight were dealing with prolonged lower freight rates, but those rates have rebounded because of escalating consumer demand and strategic supply rationalization. And the trucking industry has seen its distressed assets acquired through M&A activity.

While Trump’s push on tariffs could impact ocean freight, the PwC report said that domestic North American trucking may see some gains from a renewed focus on onshoring strategies. In addition, a soft landing for the U.S. economy could result in

IT’S ALMOST AS IF WE’VE SEEN A LIGHT SWITCH TURN ON SINCE THE ELECTION IN THE U.S.” Anton Sahazizian, Moelis & Company

higher consumer demand, which could result in M&A opportunities as transportation and logistics activity rebounds.

And in another shift under Trump 2.0, a focus on economic stability and growth may “lead to greater Federal Trade Commission (FTC) tolerance for dealmaking.”

The start of 2024 saw dealmakers in transportation and logistics face a high degree of uncertainty due to rising interest rates and questions over whether the U.S. economy would have a soft landing. Challenges to valuations were impacted by low freight rates and capacity overhang.

For the most part, the bigger deals haven’t surfaced, with the exception of September’s disclosure of DSV acquiring DB Schenker from German railway Deutsche Bahn for 14.3 billion euros ($15.9 billion) to create the world’s largest freight forwarder by revenue. Smaller deals did get done, including RXO Inc.’s $1.025 billion acquisition of Coyote Logistics. Completed in September, RXO joined the ranks of the big players as the deal catapulted it to the third largest North American freight broker, essentially taking over the spot held by Coyote.

And then there’s U.S.-based freight forwarder GXO Logistics Inc., which in October was reported to have explored a sale after receiving investor interest. But rumblings of sale talks soon waned after logistics

G A PwC report cited trucking consolidation as one key trend to watch in 2025 as companies focus on automation and effeciency.

competitors DHL and Maersk indicated they weren’t interested. GXO never confirmed that any sale talks were in progress. Meanwhile, GXO last April completed its $965 million takeover offer of U.K.-based logistics services provider Wincanton plc. But it is still awaiting clearance following a probe by the U.K. Competition and Markets Authority (CMA). The CMA is the U.K.’s antitrust watch dog.

Toward the end of 2024, the U.S. election created some complexities for dealmaking in transportation and logistics. They include trade policies that could impact supply chains, nearshoring and importing activity. But shifts in regulatory stances could create more openness to large-scale M&A.

PwC said the trucking and railroad sectors “will warrant close attention.” The impact of consolidation at the lower end of the market and easing of regulations could become the key trends in 2025. It cited innovation in first and last mile logistics—using robotics and software for the loading and unloading of goods—as an area where railroads could look for ways to expand their ecosystem. For logistics, investor interest is expected to focus on innovations that reshape supply chains and improve the customer experience, both of which also serve to improve the efficiency of how businesses operate.

And finally, while interest from financial buyers has slowed, strategic acquirers have been the ones driving deals, especially as freight rates and profitability stabilize. The PwC report cited trucking consolidation, railroad logistics innovation, and advancements in logistics technology as key trends to watch in 2025.

Multiple acquisitions to lead off 2025 are already setting the tone for logistics sector.

DHL’s contract logistics arm, DHL Supply Chain, is expanding its retail returns prowess in acquiring Inmar Supply Chain Solutions, a division of healthcare and retail loyalty services provider Inmar Intelligence. Terms of the transaction have not been disclosed.

The acquisition will give DHL Supply Chain 14 return centers and about 800 employees, expanding the company’s North American footprint of over 520 warehouses supported by 52,000 associates.

According to the company, the addition of the Inmar solutions now strengthens its returns capabilities to include product re-marketing, recall management and supply chain performance analytics.

As part of the deal, Inmar Intelligence will retain its pharmaceutical returns business.

“This acquisition strengthens our existing capabilities, allowing us to offer our customers a single-source solution for their entire supply chain, including the critical and complex area of returns management. This enhances the value we deliver to our customers by streamlining their operations, reducing complexity, and improving their overall supply chain efficiency,” said Patrick Kelleher, CEO of DHL Supply Chain, North America, in a statement. “It also puts us on the right path to support DHL Group’s plan to achieve 50 percent revenue growth by 2030 compared to 2023 as outlined in our recently announced Strategy 2030.”

The move comes as retailers continue to struggle with handling more returns every year. According to data from the National Retail Federation (NRF) and returns management software Happy Returns, retailers saw $890 billion in returns in 2024, equivalent to 16.9 percent of their total annual sales. This is nearly double the $428 billion in goods that were returned in 2020.

Major logistics providers have recognized the growing need for reverse logistics specialization, with UPS acquiring Happy Returns in October 2023 for $465 million.

The other U.S. parcel shipping giant, FedEx, already teamed with Inmar and last-mile delivery company Doddle last year to add nearly 2,000 return drop-off stations at FedEx Office locations.

Beyond the DHL-Inmar acquisition, more deals have been finalized in the first two weeks of the year.

Third-party logistics (3PL) provider BlueGrace Logistics has acquired online transportation solutions provider FreightCenter for an undisclosed sum. That announcement was made the same day another 3PL, AIT Worldwide Logistics, unveiled it was acquiring freight forwarder Krupp Trucking.

The move expands BlueGrace’s customer base by integrating FreightCenter’s clients with BlueGrace’s suite of logistics tools and services.

Currently, Tampa, Fla.-based BlueGrace has 10,000 customers and 250,000 carriers on its proprietary transportation management system, BlueShip.

FreightCenter customers will gain access to BlueGrace’s unified

transportation management system, BlueShip TMS, enabling freight management across various shipping modes. They will also benefit from BlueGrace’s truckload and lessthan-truckload (LTL) services, supported by the carrier network and competitive pricing options.

Under the deal, FreightCenter’s customers will now get access to the Evos load optimization platform that BlueGrace acquired in 2024.

As for AIT Worldwide Logistics’ purchase, the Krupp Trucking business transferred all its assets and employees to AIT and commenced operations as the AIT-St. Louis office effective Jan. 1. Terms of the deal have not been disclosed.

Previously an independent contractor with Seko Logistics, Krupp manages shipments across multiple U.S. and international air, ocean and road lanes for a broad range of customers, shipping nearly 2.5 million kilograms of freight each year.

The acquisition includes a 115,000-square-foot office and warehouse in Earth City, Mo., a fleet of more than 60 over-the-road and local trucks, and a staff of nearly 100 employees.

Outside of the apparel supply chain, UPS revealed Wednesday that it has completed the acquisitions of European healthcare cold chain logistics providers Frigo-Trans and its sister company BPL. Those two deals were made to enhance UPS’s logistics capabilities throughout Europe for healthcare customers who increasingly require temperaturesensitive and time-critical logistics.

Additionally, investment firms are paying up big money for warehouse space amid the turn of the year.

Blackstone acquired a 2-millionsquare-foot portfolio of 18 last-mile logistics warehouses in the U.K. for 200 million pounds ($247 million) from PGIM, the asset management arm of Prudential Financial. The facilities are close to urban areas including Manchester, Birmingham, Reading and Leeds.

And last month, Stonepeak announced it had paid up of six logistics assets totaling 2.3 million square feet in Houston. That deal went for a reported $244 million.

Deals could continue to pick up as the year progresses, if the latter half performance of 2024 is any indicator.

According to PwC, the global transportation and logistics sector recorded a total deal value of $51.5 billion with 71 disclosed deals for the six-month period ending Nov. 15, compared to $39.5 billion and 69 deals for the prior six months ending May 15.

“While deal volume remains stable, the increase in deal value may be indicative of improving investor confidence, driven by anticipated profitability improvements amid rising demand and supply adjustments,” the report said.

Another potential deal to look out for in 2025 could involve Forward Air Corporation, which may be put on the market in the next few months. The board of directors at the LTL, truckload and logistics services provider began a strategic review of the company after multiple activist investors have been pushing for a sale process for months. That review could potentially end up with Forward being sold off or merged with another company T

the logistics industry continues to benefit from technology—from SaaS and AI systems guiding routes and optimizing returns, to hardware like drones and robots in the warehouse. J Behind many of the advancements supercharging some of the industry’s largest players is a web of startups, testing and refining technology for their partners. J Here’s a look at four nascent companies hungry to change the logistics landscape via technology.

Pennsylvania-based Gather AI uses computer vision and machine learning to help warehouse employees gain visibility into the facility’s inventory. The cameras feeding the AI models information are affixed to drones that fly around the warehouse, seamlessly snapping images of pallets, products and barcodes.

The company collects half a million data points each week to serve its customers across the U.S. and in the Middle East; Gather AI uses off-the-shelf drones and cameras, but the secret to its success is in the software, said Sankalp Arora, the company’s CEO and co-founder.

Once one of those drones has snapped images of various locations in the warehouse,

a machine learning algorithm analyzes the data captured in the images. The system then helps humans better track inventory, get visibility into whether standard operating procedures around stacking have been followed and more. Current customers include the likes of Geodis, Langham Logistics and Barrett Distribution.

According to the company, customers typically see up to a 66 percent reduction in warehouse inventory data errors. The efficiency doesn’t end there, though, Arora said. Once the system is deployed in a warehouse, employees spend less time manually counting and moving inventory.

“Warehouses are getting taller and taller, and you don’t want big, bulky equipment—that’s energy inefficient. You would rather have this little [drone] flying around and taking images of your inventory and converting it into data,” Arora said.

According to Arora, one drone powered by Gather AI’s technology can scan around 300 pallet locations using the same amount of energy it would take to hoist a single employee to a rack once.

Part of Arora’s hope for the technology is that it will enable smaller companies to compete with the Amazons of the world. In 2025, Gather AI plans to focus part of its efforts on moving the technology beyond drones.

“We focus on data gathering using cameras; we don’t care where the cameras are. Right now, our cameras tend to be flying, but...they can be on docks, they can be on the aisles [themselves]; they can be anywhere,” he said.

Mothership wants to change the game on how same-day, less-thantruckload (LTL) shipments are handled.

The Texas-headquartered startup allows companies to book last-minute, low-mileage routes to be picked up, transported and delivered by truckers within hours. The company interested in transporting its items—usually pallets—can input the pickup and delivery locations, as well as the size and weight of pallets and receive a near-instant quote at lowerthan-market rates, said Aaron Peck, the company’s founder and CEO.

Peck, who formerly worked in manufacturing, said shipments like these are typically extremely costly and companies unnecessarily pay exorbitant rates to get the job done. Meanwhile, some trucks roam the roads with capacity to complete jobs and earn money they otherwise wouldn’t have seen. For him, the goal is mutual benefit between the truckers and the companies trying to move their goods.

Mothership’s proprietary system uses AI to match the shipment with a nearby carrier to complete the run within the day; once a driver has accepted the job, customers can see real-time delivery updates on the way— from reroutes, to traffic updates and more.

Current customers include 12th Tribe, apparel wholesaler Beimar and Lane Seven Apparel.

Peck said the company brokers tens of thousands of shipments each month, primarily with independent drivers, which fill spaces on trucks that otherwise may be driving around half filled or completely empty.

“If you start with efficiency, you end up with sustainability as a byproduct; these two things, in trucking, actually go hand in hand,” Peck said. “It’s [important to] make sure that the miles are not wasted carrying nothing. There’s a legitimate business reason to do that—a full capitalist reason to not have that truck be empty. What’s so great is that it aligns exactly with also reducing emissions. Everyone wins.”

In 2025, Mothership plans to introduce generative AI capabilities for quotes on longerhaul LTL with major carriers.

Shift Robotics is using robotic shoes to make warehouse workers’ lives easier and feet faster.

The startup’s proprietary shoes, called Moonwalkers, are worn over top of users’ typical shoes. They are embedded with algorithms that help them to recognize the gait of the user within 30 to 40 steps; from there, they adapt to that gait and enable wearers to move faster, increasing efficiency in the warehouse.

Because of the way the algorithms powering the shoes work, they can be shared between multiple associates within the same warehouse.

To date, the company has seen warehouse workers fitted with the shoes taking 40 percent fewer steps while wearing them and increasing their productivity by 20 to 30 percent because of time saved. The shoes are often worn by workers walking back and forth around large warehouses—whether to pick and pack products, take inventory or otherwise.

The company is continuing to pilot test the Moonwalkers X, its latest warehouse-friendly model of the robotic shoes, with home and furniture retailer Ikea, as well as some smallto-medium enterprises.

How do they work? Powered by ShiftOS software, the shoe reacts instantaneously to the way that you walk and adjusts power accordingly.

Moonwalkers are both a consumer-facing and enterprise-focused products, and to date, sales have been stronger on the B2C side; Xunjie Zhang, CEO and founder of Shift Robotics said that’s because the pilot tests, like the one with Ikea, were needed to show logistics companies that the Moonwalkers X would be safe to use in the warehouse. To date, clients have not reported any injuries resulting from employees wearing the technology.

“After a year of multiple pilot case studies, we have seen a great safety track record, and

IF YOU START WITH EFFICIENCY, YOU END UP WITH SUSTAINABILITY AS A BYPRODUCT; THESE TWO THINGS, IN TRUCKING, ACTUALLY GO HAND IN HAND.” Aaron Peck, Mothership

E Shift Robotics’ Moonwalkers.

G Mothership allows companies to book last-minute, lowmileage routes to be picked up, transported and delivered by truckers within hours.

so...this year, we expect the conversion is going to be way better this year than last in the B2B area,” Zhang said.

In 2025, Zhang said the company will work toward building a new, refined model, which it expects to release in 2026; Shift announced the Moonwalkers X at the Consumer Electronics Show (CES) in 2024. As it completes a new model, Zhang said his team plans to look into sizing—today, Moonwalkers are one-size-fitsall, but that may not be the case going forward; the company is looking to provide an even stronger user experience.

London-headquartered Swap Commerce started out trying to help brands solve their return woes.

But Juan Pellerano-Rendón, chief marketing officer of the company, said that, since then, it has worked to integrate into the backend of companies’ business in a more complete way—from powering shipping and returns, to handling cross-border commerce with fewer worries.

Current clients include Motel Rocks, Pangaia and Retrofête.

The company helps its partners in the UK handle the physical side of returns through a partnership with InPost; in 2025, it may offer a similar capability in the U.S.

But for now, much of the onus on the U.S. market is still on the digital side, in helping brands streamline return processes, streamlining data on which items have high return instances and automating refunds, store credits and exchanges.

The company recommends that brands use the automated systems in place, even in the face of return fraud challenges faced by brands and retailers today.

“You already are losing on the return. It’s not worth holding up the process and preventing a future sale. So our recommendation is always to automate, automate, automate,” Pellerano-Rendón said. Still, Swap offers customization for brands who want to implement special rules around returns or prefer to handle some pieces of the digital side of the returns process manually.

Swap’s dashboards also offer insights that can help retailers get ahead of returns, Pellerano-Rendón noted. That’s because the dashboards aggregating data about the reasons for returns are updated in real time. So, for instance, if return rates are higher on a recently launched product and 70 percent of returners say the item runs small, the brand may be able to add information to the site reflecting that. That, in turn, could help prevent returns before an item ever gets ordered by the consumer.

“[Swap helps by] aggregating available data and making them actionable insights, versus putting the onus on the customer to actually have to go and dig through and find what the insights are,” Pellerano-Rendón told Sourcing Journal.

When the acquisition closes later this year, robotics company Symbotic will automate Walmart’s Accelerated Pickup and Delivery centers. by Meghan Hall

Symbotic revealed it will acquire Walmart’s Advanced Systems and Robotics business unit. The two companies have partnered on Walmart’s automation systems since 2017.

Symbotic will pay Walmart $200 million for the transaction, along with up to $350 million in additional future payments. The company will be tasked with building and deploying an automation system for Walmart’s accelerated pickup and delivery centers (APDs), which will help the retailer speed up the systems that power its in-store pickup and same-day home delivery services. Walmart will fund a development program to help Symbotic develop that technology; the retailer will pay the technology provider a total of $520 million for the development program.

Greg Cathey, senior vice president of transformation and innovation at Walmart, said implementing Symbotic’s automated systems will give Walmart consumers a better, faster experience.

“We’re excited about what this means for our customers. We anticipate the synergy between Symbotic’s expertise and our nearly decade-long relationship in innovating the

supply chain technologies to elevate customer service and rapidly advance our in-store Accelerated Pickup and Delivery capabilities,” Cathey said in a statement.

The transaction shows that retail and e-commerce’s biggest players have a keen interest in using artificial intelligence and related technologies to streamline operations in their stores. And consumers seem to have a strong interest in in-store pickup options; according to Locally data, nearly half of e-commerce shoppers abandoned their carts if local pickup was unavailable during the 2024 holiday season.

The AI-enabled robotics company noted that, “if performance criteria are achieved,” the superstore giant has committed to purchase and deploy Symbotic systems for 400 APDs throughout the United States; Walmart could also add more APDs in the next several years if the results appear promising. Symbotic did not disclose what kind of strategic targets it needs to meet to please Walmart.

Symbotic expects the transaction with Walmart could boost its backlog by $5 billion and that the new solution could expand its total addressable market to the tune of hundreds of billions of dollars. That, said Rick

WE ANTICIPATE THE SYNERGY BETWEEN SYMBOTIC’S EXPERTISE AND OUR NEARLY DECADE-LONG RELATIONSHIP IN INNOVATING THE SUPPLY CHAIN TECHNOLOGIES TO ELEVATE CUSTOMER SERVICE AND RAPIDLY ADVANCE OUR IN-STORE ACCELERATED PICKUP AND DELIVERY CAPABILITIES.”

Cohen, chairman and CEO of Symbotic, is an exciting prospect for the Wilmington, Mass.based company.

“This is a highly strategic transaction for Symbotic as we expand upon our long-term relationship with Walmart and broaden our product offering beyond the traditional warehouse to e-commerce settings for lastmile delivery,” Cohen said in a statement.

The companies expect the financial transaction to close in the second fiscal quarter of this year. Since the announcement, which happened before the market opened, Symbotic’s stock is up more than 18 percent. Walmart stock is slightly down, as of Thursday afternoon.

A Teamsters VP told The Oregonian that “a small percentage” of jobs would return to a Portland warehouse set to temporarily close July 1. by Glenn Taylor

Ups is temporarily closing a package processing facility in Portland, Ore. over the summer as the logistics giant powers ahead with its warehouse automation push.

America’s largest delivery company has sought to flow more package volume into automated warehouses as part of its “Network of the Future” plan, which is aimed at saving $3 billion in costs by 2028.

By the end of that period, UPS expects to implement major automation projects at 63 sites, saying last March that it would triple the number of buildings with automated technologies to 400 across the U.S.

UPS confirmed the Portland facility will close July 1, and expects the building to reopen in 2026 after the enhancements are made.

The company has yet to file a Worker Adjustment and Retraining Notification Act (WARN) notice in Oregon, so the exact number of workers impacted by the closure is unclear.