Many of the companies featured in this issue for their sustainability efforts are based in Turkey. Most of the interviews were conducted before the 7.8 magnitude earthquake in February devastated southern and central Turkey and northern and western Syria. At press time, the death toll had exceeded 53,000.

There are no words for a catastrophe of that magnitude. A generic “how are you?” written to Turkish denim friends over email or social media can feel performative against that depth of grief and the years of rebuilding that stands before the country. One such friend drew a map for me to understand where denim companies were in proximity to the destruction. Though the drawing doesn’t even touch on their networks of farmers, suppliers, educators and customers who’ve been affected by the quake, it magnified how this is an industry where everyone knows everyone.

Support—be it messages exchanged over DMs or industry-wide efforts like Denim Donates and Kingpins’ Community Voices video project—is something that the denim industry excels at. There is a sincere warmth and humanity in this business, born from the shared experiences and relationships that carry over from one job to the next.

If you’re lucky, colleagues do become a pseudo-family—perhaps the know-it-all brother or pain-in-the-butt sister you never had—nevertheless, someone who always has your back at the end of the workday and with no genetic obligation to do so. That familiarity with one another, I believe, is especially evident across the denim sector, from a factory floor to an office on Eighth Avenue. It is the secret sauce behind some of its greatest collaborations, businesses and brands, and it is often a source of comfort and laughter during the most challenging moments.

Let’s continue to be present for each other.

Angela Velasquez Executive Editor, Rivet

Peter Sadera Editor in Chief, Sourcing Journal

Jessica Binns Managing Editor & Technology Editor

Vicki M. Young Executive Financial Reporter

Jasmin Malik Chua Sourcing & Labor Editor

Kate Nishimura Features Editor

Glenn Taylor Business Editor

Matt Hickman Business Reporter

Alex Harrell Staff Writer

Lauren Parker Director, SJ Studio

Sarah Jones Senior Editor, Strategic Content Development

Andre Claudio Staff Writer, Strategic Content

ART DEPARTMENT

Tirso Gamboa VP, Creative, Fairchild Media

Ken DeLago Art Director

Libby Groden Associate Art Director

Arani Halder Senior Designer

SOURCING JOURNAL ADVERTISING

Edward Hertzman Founder & President, Sourcing Journal & Rivet

Executive Vice President, Fairchild

Rebecca Goldberg VP, Strategy & Business Development

Eric Hertzman Senior Director, Sales & Marketing

Deborah B. Baron Advertising Director

Allix Cowan Manager, Audience Development

Darren Dort Media Coordinator

Sarah Sloand Executive Sales Assistant

Lisa Nusynowitz Sales Assistant

PRODUCTION

Kevin Hurley Production Director

John Cross Production Manager

Therese Hurter PreMedia Specialist

JAY PENSKE CHAIRMAN & CEO

GERRY BYRNE VICE CHAIRMAN

GEORGE GROBAR CHIEF OPERATING OFFICER

SARLINA SEE CHIEF ACCOUNTING OFFICER

CRAIG PERREAULT CHIEF DIGITAL OFFICER

TODD GREENE EVP, BUSINESS AFFAIRS AND CHIEF LEGAL OFFICER

PAUL RAINEY EVP, OPERATIONS & FINANCE

TOM FINN EVP, OPERATIONS & FINANCE

JENNY CONNELLY EVP, PRODUCT & ENGINEERING

DEBASHISH GHOSH MANAGING DIRECTOR, INTERNATIONAL MARKETS

DAN OWEN EVP, GM OF STRATEGIC INDUSTRY GROUP

DAVID ROBERSON SENIOR VICE PRESIDENT, SUBSCRIPTIONS

JESSICA KADDEN SENIOR VICE PRESIDENT, PROGRAMMATIC SALES

JUDITH R. MARGOLIN SENIOR VICE PRESIDENT, DEPUTY GENERAL COUNSEL

KEN DELALCAZAR SENIOR VICE PRESIDENT, FINANCE

LAUREN UTECHT SENIOR VICE PRESIDENT, HUMAN RESOURCES

MARISSA O'HARE SENIOR VICE PRESIDENT, BUSINESS DEVELOPMENT

NELSON ANDERSON SENIOR VICE PRESIDENT, CREATIVE

RACHEL TERRACE SENIOR VICE PRESIDENT, LICENSING & BRAND DEVELOPMENT

• One of a Kind Eco-Conscious Innovation

• >99% Biodegredable*

• Effective for Synthetic Fibers

• No Textile Waste Any More

• No Limit for Elasticity Level

• After Biodegration, There is No Toxicity Problem for Planting in the Soil**

* Standard Test Method for Determining Anaerobic Biodegradation of Plastic Materials Under High-Solids Anaerobic-Digestion Conditions (ASTM D5511-18)

** Testing Under the Standard OECD 208

THE RIVETING LIST

The latest news from denim brands.

LUCKY IN VEGAS

Meet the winners of the Rivet x Project Awards.

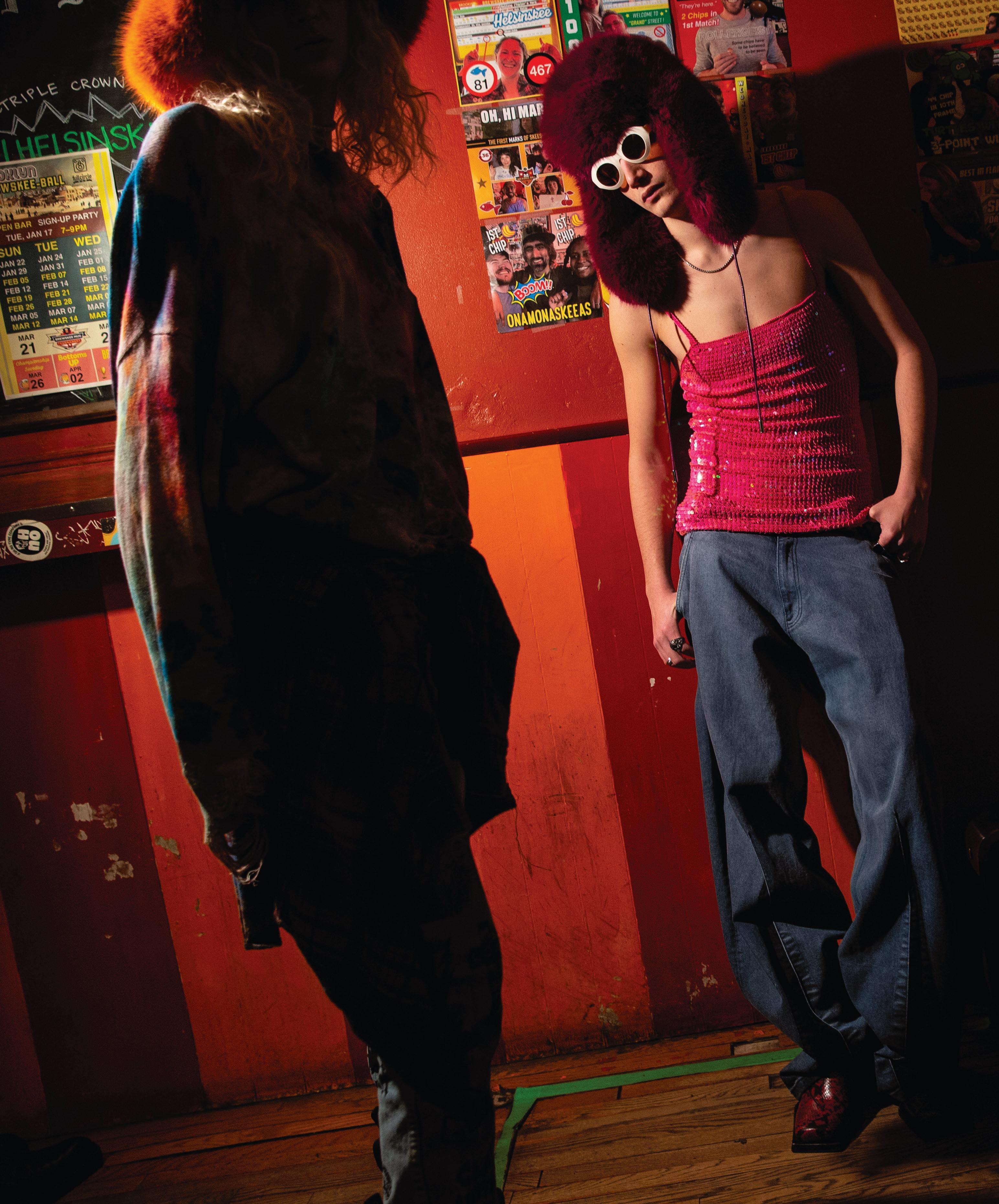

CULTURAL FORCE

Hip-hop fashion is in the spotlight as the genre celebrates 50 years of influencing youth culture.

PANTS ON FIRE

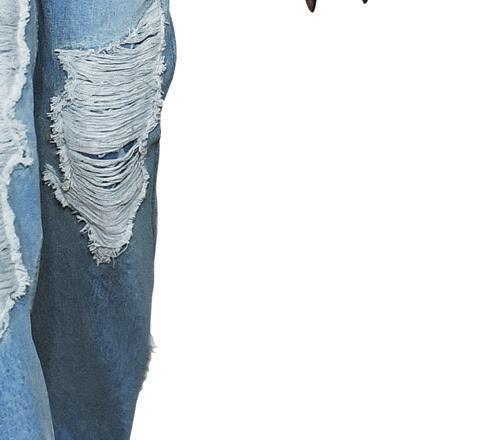

Cargos, chinos and trousers are enjoying a moment in the spotlight.

DESIGNER CHAT

Five designers dish on what’s next for Fall/Winter 2023-2024.

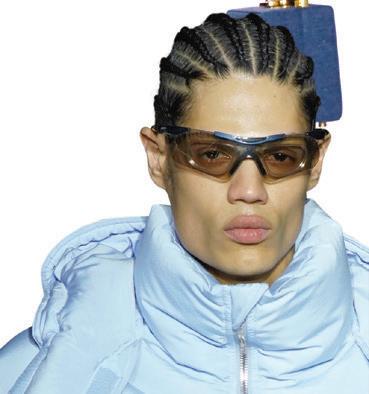

RUNWAY REPORT

From wide-leg jeans to suiting, denim’s versatility was on display at fashion weeks around the globe.

NGUYEN INC T-shirt over a HEAVEN BY MARC JACOBS mohair sweater; MOSCHINO tartan skirt over CLOSED jeans; R13 boots; PLAYBOY choker; MARA SCALISE cuff ring; SARA SHALA link ring and ring with diamonds; BOUNKIT turquoise ring.

34 58 64

14 22 46 50 54 RIVET NO.19 SPRING 2023 4

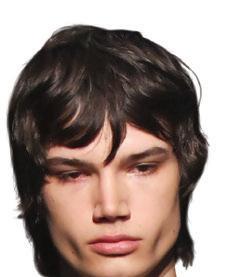

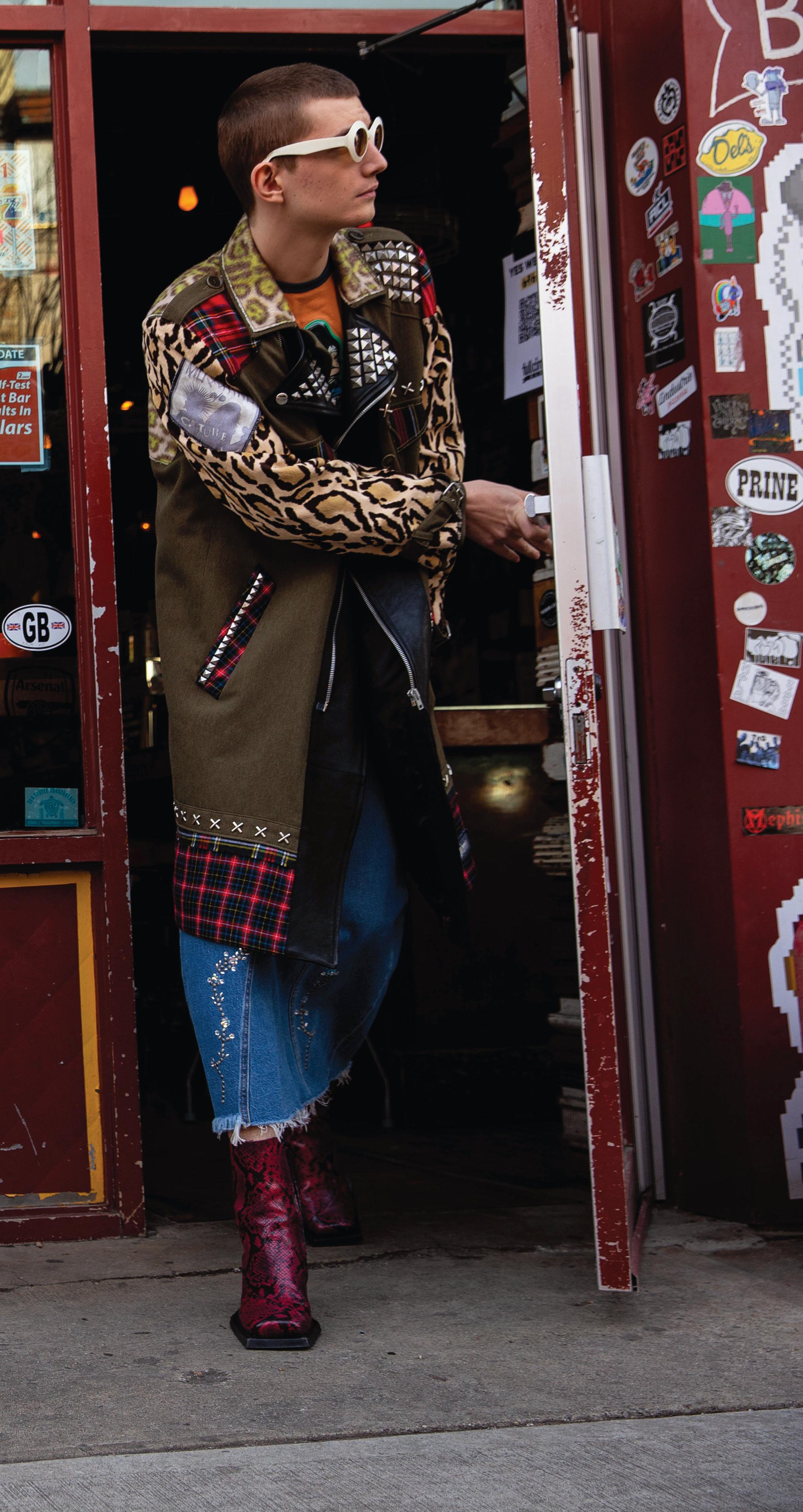

NEVERMIND

Grunge fashion is back with a Gen Z twist.

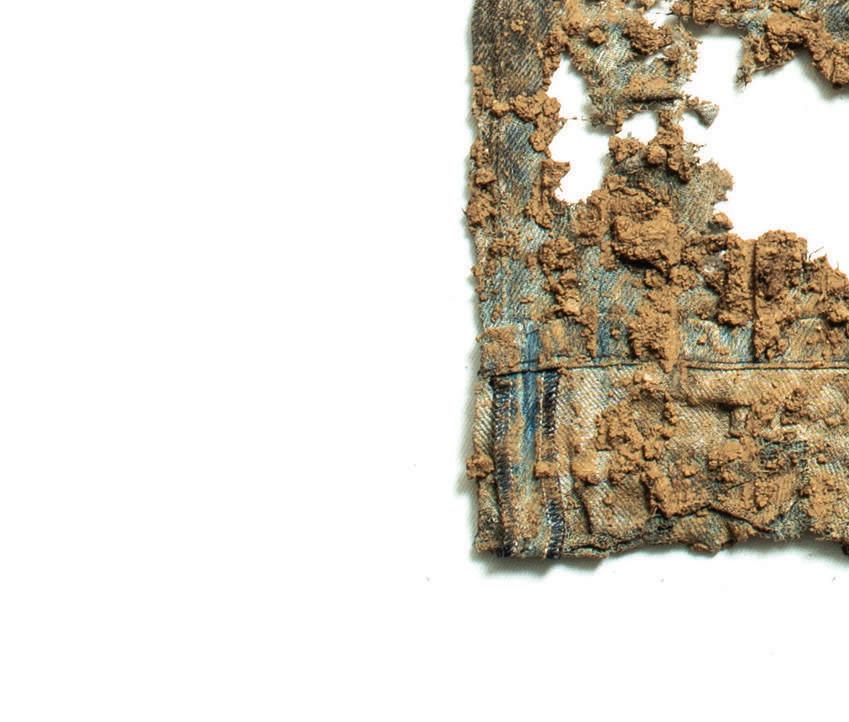

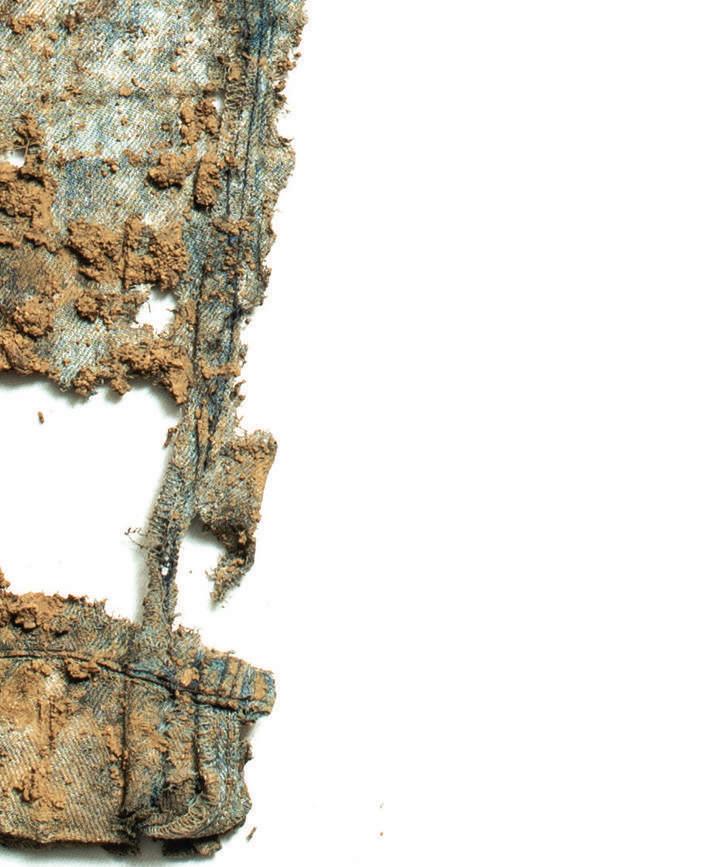

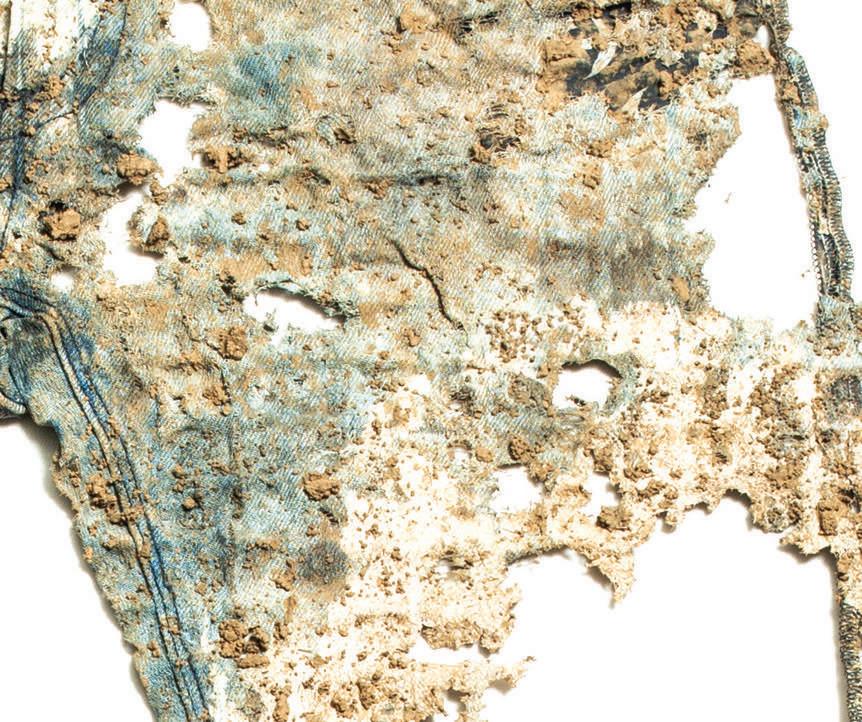

TRASH TALK

The quest for biodegradable jeans stirs up new certification requirements and greenwashing concerns.

NATURAL LIMITS

Natural dyes have the potential to become part of the denim industry’s sustainable toolbox.

The Pakistan Accord will afford the industry an extra layer of credibility and assurance, but it also comes with a new set of challenges.

GLOBAL COMMUNITY

The denim industry rallies behind Turkey following devastating earthquakes.

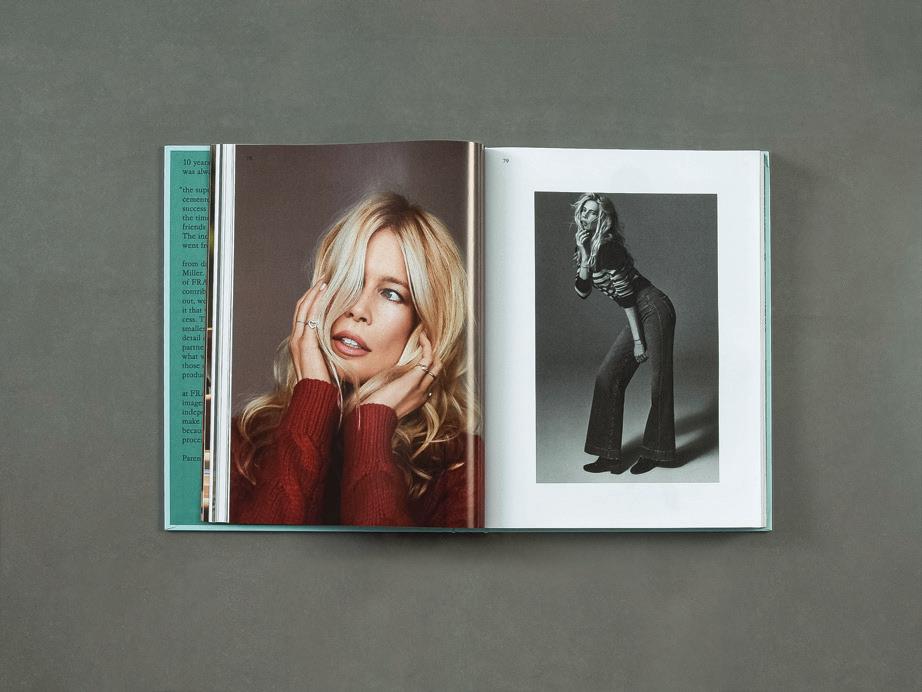

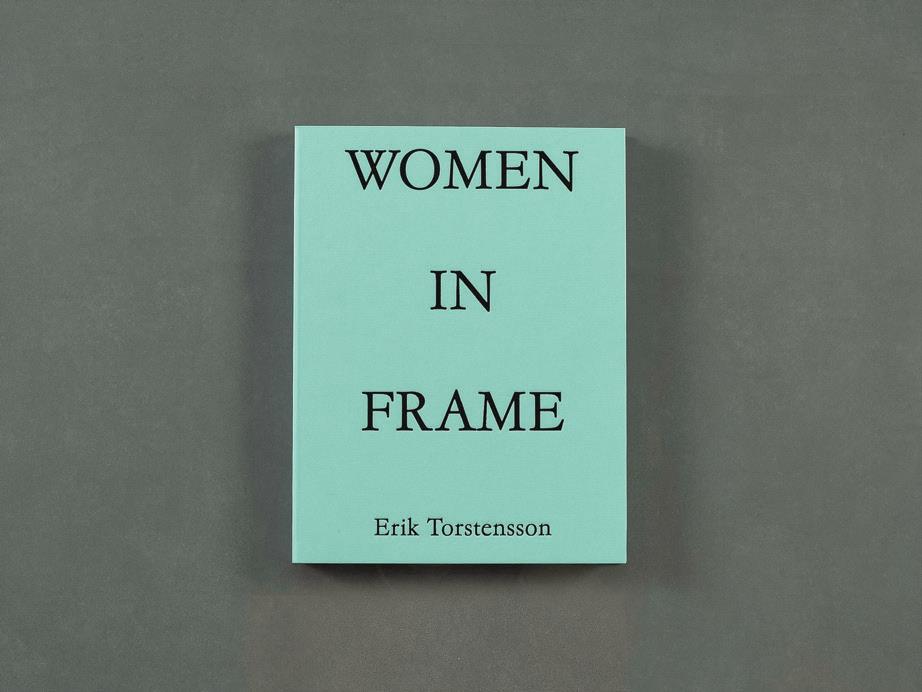

IN FRAME

Frame looks back at a decade of dressing women in a new book.

Reworked denim from past seasons is the focal point of Swedish fastfashion retailer Gina Tricot’s new collection called “Seams Like New.” Spanning tops, bottoms and accessories, the collection was produced in cooperation with XV Production, a Swedish studio focused on textile design and sustainable production. The garments were made at XV’s Borås micro factory, close to Gina Tricot’s corporate office.

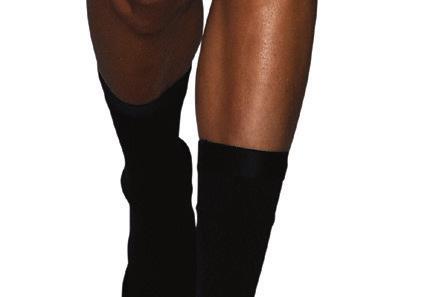

Style-wise, the collection hits on the buzziest trends. It includes a strapless ruffle top, rigid wide-leg jeans, a washed gray vest, cargo jeans and a pieced maxi skirt. Denim legwarmers cut from jeans legs and featuring pull tabs are the collection’s wild card. The legwarmers sit over shoes, creating a denim boot effect. It also offers denim rosettes—a nod to the early 2000s Carrie Bradshawapproved accessory that has been making a comeback as of late.

Silver Jeans Co. expanded Infinite Fit, the multi-size jeans concept it launched for women in 2021, to the men’s side of the business. The brand likens the jeans to a rubber band that stretches but snaps right back into place. The bottoms—an athletic skinny and a relaxed straight leg—are made with “super power stretch” denim fabric that provides more than 90 percent elasticity. This means the jean flexes to fit a variety of body sizes while maintaining its shape. Like its women’s counterpart, Infinite Fit offers men simplified letter sizing. Each size fits up to two waist sizes. Size small is suited for 29-30; medium sizes 31-31; large sizes 33-34; XL sizes 35-36 and XXL sizes 37-38.

Collaborations continue to be a source of newness for Wrangler The heritage denim brand and guitar manufacturer, Fender, have come together to launch a second collection that honors the “bridge between music and fashion” through stage-worthy denim and guitar accessories.

The first collaboration launched last April, offering denim staples and graphic T-shirts infused with rock ‘n’ roll and Western elements.

Wrangler x Fender 2.0 resurrects the bestselling men’s jacket featuring the Fender logo across the back.

New to the collection is a men’s leopard print corduroy western shirt and collage-print long-sleeve tee with distressing. The women’s line spotlights bold patterns and washes, as well as a black corduroy catsuit, silver coated flare jeans and leopard print jeans. Additionally, the collaboration brings a variety of men’s and women’s graphic tees, denim jackets and vests.

An assortment of guitar accessories is new to the partnership. A 3-ply hardshell guitar case is wrapped in Wrangler denim and is finished with the brand’s iconic pocket design. There’s also a set of co-branded 351 shaped guitar picks and a range of gold-stitched denim guitar straps.

Levi’s and Stüssy apply a new approach to logomania in their latest collaboration.

The Californian brands released a denim capsule collection featuring an embossed Stüssy and Levi’s motif that riffs on a traditional button shank design. The tactile logo is prominent on the back of a Type II Trucker jacket and on the front left and back right legs of 501 jeans.

The 501 jean comes in a rugged, worn indigo wash and an original fit jean cut with a straight leg, 5-pocket styling and button fly with co-branded shanks. A custom co-branded back patch combines Levi’s Two Horse Pull and Stüssy logos. To commemorate the 501’s milestone, the Stüssy x Levi’s 501 includes a special edition pocket bag print and anniversary pocket flasher.

The Type II Trucker jacket comes in the same wash and has a modified fit with a boxy body, relaxed armhole and added welt pockets. The jacket is supped up with a corduroy collar, co-branded button shanks, Baja-inspired pocket bags that nod to Stüssy’s So-Cal roots and inside lining with the surf brand’s eight-ball logo printed. ➝

Denim is the latest addition to the effortlessly cool uniform forged by La Ligne, the direct-to-consumer women’s ready-to-wear label known for modernizing Breton stripes.

The collection, available in sizes 23-34, includes the Molly, a vintageinspired rigid straight high rise in a dark and medium wash; the Valerie, a stretch slim fit in black and indigo that feels like second skin; and the Meredith, a semi-stretch cropped flare in cream and black made with 20 percent recycled cotton.

All La Ligne jeans have a vegan leather back patch, and in a nod to its signature striped tops, feature a singular, linear contrast belt loop. The jeans retail for $195 and are available exclusively at La Ligne stores and on the brand’s website.

Mother launched a collection that pays homage to David Bowie’s otherworldly Ziggy Stardust, the late musician’s alien rockstar alter ego and stage persona in the early ’70s.

“As a brand rooted in the experiences of growing up in the ’70s, the opportunity to design with the imagery and iconography of The Ziggy Stardust era felt like a full-circle moment,” said Tim Kaeding, Mother creative director and co-founder.

The collection is built around vintage-inspired concert T-shirts, tanks and sweatshirts. The tops feature glittery fonts and marquee-inspired graphics, which set the tone for the collection’s iconography. A cropped raglan cardigan features Bowie’s name on the back and his signature lightning bolt motif on the arms. The collection’s hero piece is the Super Cruiser flare jeans with gold stars and “The Jean Genie” printed across the backside.

Diesel launched Rehab Denim, a capsule collection that incorporates scraps from Diesel’s own cutting waste into the manufacturing process. Made in partnership with Spanish mill Tejidos Royo, each garment blends 100 percent recycled cotton and recycled elastane from pre-consumer waste with Tencel lyocell with Refibra.

Tejidos Royo’s Dry Indigo technology adds further environmental benefits. It eliminates water consumption from the dyeing process and reducing the amount of chemicals and energy used.

Rehab Denim features three washes: Fade Out, Bleach and Shadow, which combines indigo with gray. The men’s, women’s and all-gender silhouettes include “monster” cargo pants with a toggled waist, an oversized bomber jacket and a zip-up Trucker jacket. Jeans include a lowrise straight fit with “deconstructed trompe l’oeil” details and raw edges.

Brand-slash-innovation

Pangaia introduced Renu, jacket the first denim completely NuCycl, Seattle-based rm now-trademarked

Brand-slash-innovation platform introduced Renu, a $400 oversized that is the first denim product derived from Seattle-based textile recycling firm Evrnu’s now-trademarked lyocell fiber.

Evrnu uses post-consumer textile waste, down at a polymer them filaments that and in terms of tenacity The resulting recycled into or better quality same closed-loop up to five times. material is completely exhausted, it biodegrade, returning to the ground technical nutrient.

Evrnu uses a mix of pre- and post-consumer textile waste, chemically breaking them down at a level before re-extruding them into filaments that outperform polyester and nylon in terms of tenacity and strength. The yarn can be reinto fibers of similar or better using the same process up to five times. When the material is it will returning to the as a nutrient.

Renu, which debuts as part of Pangaia the brand’s arm, is the start of the companies’ ambitions. The however, is up

The fiber is churned out in the 1-to-5 metric ton range at Evrnu’s labs in New Jersey and from where it heads to to be spun into yarn, and then to to be woven into cloth and stitched into garments. Evrnu is to ramp things up with a commercial-scale in North Carolina, which is set to open in of 2024. ●

Renu, which as part of Pangaia Lab, the brand’s experimental only the start companies’ ambitions. The challenge, is scaling up NuCycl. The fiber is currently being churned 1-to-5 metric Evrnu’s labs in Washington, to Turkey to be and then to Portugal into cloth and Evrnu is looking with a commercial-scale facility in North Carolina, in the middle

Chosen for beauty, function and feel.

MATT HICKMAN

MATT HICKMAN

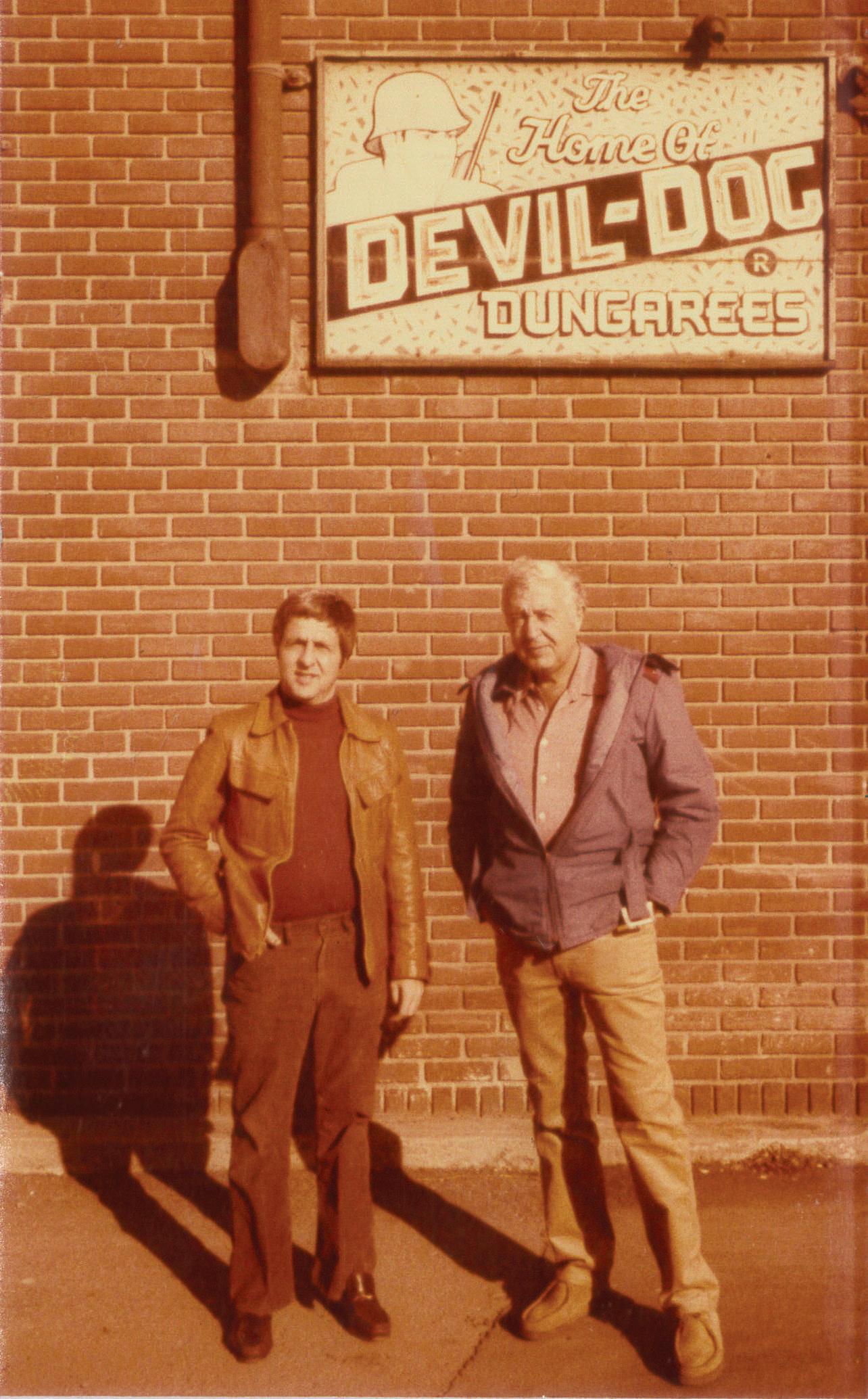

ON JAN. 5 1948, three years after U.S. Marines raised the American flag on Iwo Jima and 21 years after he began manufacturing his apparel line in the Catskills Mountains of New York, Louis Rosenstock, himself a veteran of World War I, launched Devil-Dog Dungarees. Buoyed by the slogan “Tough as a Marine!” the dungarees honored the fortitude and sacrifice of America’s original armed forces.

“World War II had just ended and everyone was feeling very patriotic,” said Jeff Rosenstock, Devil-Dog Dungarees president and the grandson of the company’s founder. “A pair of jeans stood for durability and comfort and my grandfather wanted to name it after the Marines and the armed forces who fought so bravely in World War II.”

The term ‘Devil-Dog’ traces its origins to World War I when German forces were recorded as referring to U.S. troops racing up a hill as “Teufel Hunden,” or DevilDogs as they were being fired upon by fighters crawling on all fours while wearing masks to protect against mustard gas attacks.

The Marines have worn the nickname proudly ever since, but four years after the launch of the brand, Louis Rosenstock moved the company from New York to Zebulon, N.C., and for reasons the company president isn’t sure of, dungarees disappeared from the Devil-Dog line sometime later that decade. In 2019, the younger Rosenstock decided it was time to bring them back as part of a full-

scale line complete with shorts, pants, polos, hoodies, crew neck, denim shirts, hats, leather goods, wallets—a “whole men’s lifestyle brand that’s really centered around denim,” Rosenstock said.

To celebrate its 75th anniversary, Devil-Dog Dungarees is donating $125,000 of sales from the yearlong effort to the Wounded Warrior Project, a Washington, D.C. nonprofit serving veterans and active service members. In 2021, the company donated $25,000 to the charity. It also released 75 limited-edition selvedge jeans made with fabric sourced from Louisiana-based Vidalia Mills. The fabric is made on American draper shuttle looms rescued from the Cone Denim’s shuttered White Oak plant in Greensboro, N.C.

The jeans, which were the brand’s first to made in the USA in decades, sold out the same day they went live. Nicaragua and Honduras are home to DevilDog’s near-shore production plants and all of its denim comes from Mexico, Rosenstock said.

To commemorate that staying power and perhaps to leave a light on for the return of denim manufacturing to the Carolinas, Rosenstock decided to celebrate 75 years by having the iconic neon sign atop the Zebulon headquarters re-lit.

“The response has been really incredible across the board,” Rosenstock said. “Customers are drawn to the name for obvious reasons, and some are drawn in through the Wounded Warriors cause, which is an incredible cause, and some people want to give it a shot. A lot of people are discovering us out there on their own and are really enjoying the comfort of the jeans.” ●

RETAILERS AND BRANDS gathered at Project Las Vegas in February to take stock of what’s next in denim. There, Rivet executive editor Angela Velasquez selected the best in Fall/Winter 2023-2024 denim across six categories: Best Women’s Collection, Best Men’s Collection, Editor’s Choice, Best New Brand, Best Collaboration and Best Sustainable Collection.

The Rivet x Project Awards highlight the various ways brands approach winning designs this year. Some pay homage to the classics and design for longevity, while others focus on offering consumers variety to help them find their perfect fit.

Congratulations to the winners.

♦Nudie Jeans is challenging the traditional seasonality of fashion collections and the number of SKUs a brand needs to succeed. Known for its organic cotton denim and classic fits, as well as its repair and takeback initiatives, the brand showed a video that explained its strategy to “create tomorrow’s vintage” and the questions about the effectiveness of sustainable capsule collections. Are capsules an attempt to clear consumers’ consciouses than reduce the industry’s impact on the environment? Does the frequency of sustainable capsule encourage consumers to discard clothing to buy more?

Nudie’s aims to slow down consumption with a F/W 2324 assortment that has the eccentricity of a vintage shop. Nothing matches exactly yet pieces go with one another. Key denim items include the Dry Onyx Selvedge jean that mirrors the slim/straight fit of a jean from the 1950s. A heavy indigo selvedge jean is washed down so the wearer doesn’t have to go through the process of breaking them in. The bottoms pair with pieces that have a retro twist, including a padded Buffalo check jacket, a black leather jacket with zipper pockets and a rodeo shirt with rabbit embroidery.

Small but meaningful steps add up to big wins for Mavi on its sustainability journey.

All Blue products—garments that follow Mavi’s sustainability strategy that encompasses people, planet and products— account for 83-84 percent of the brand’s Spring/Summer 2023 collection in the U.S. and the brand anticipates it will be larger for F/W 23-24.

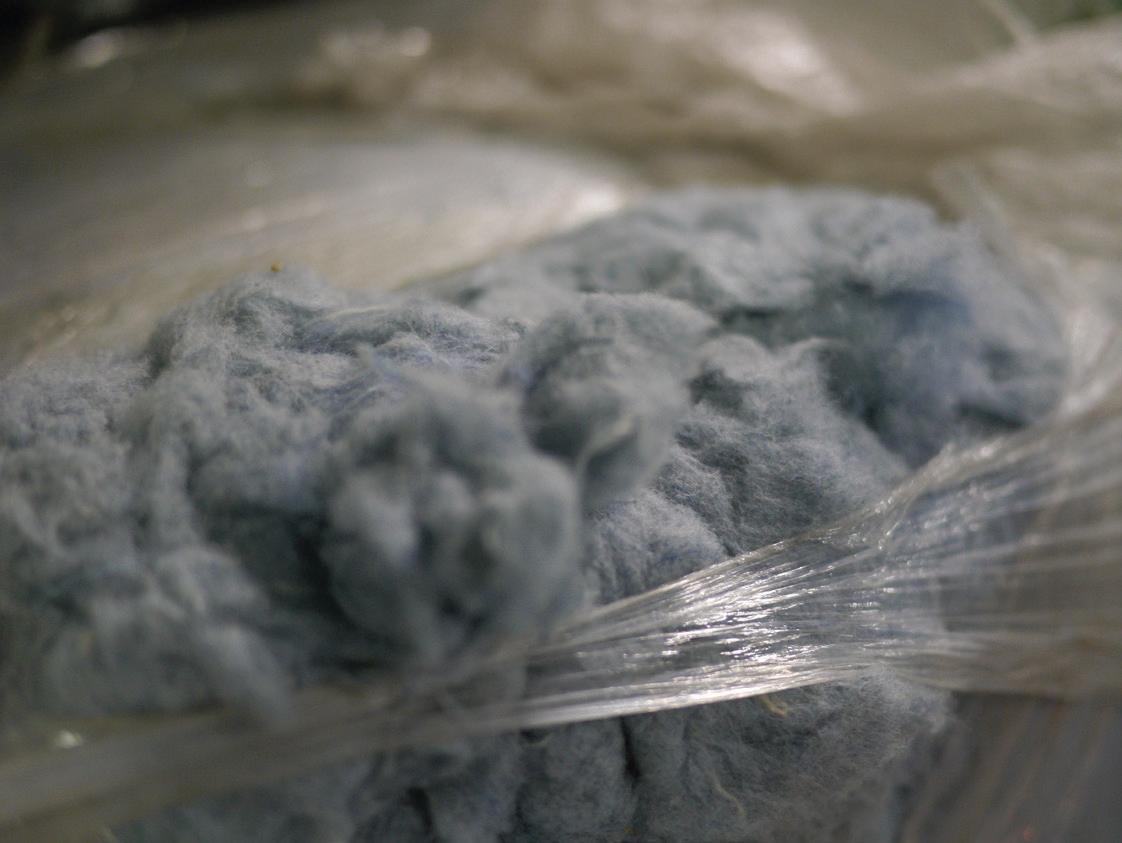

Helping Mavi’s efforts is Recycled Blue, a new women’s jeans collection that incorporates Tencel with Refibra technology. The technology gives a second life to pre- and post-consumer cotton textiles (which would otherwise be sent to landfills or incinerated) by upcycling them. These scraps are mashed into cotton pulp and then mixed with wood pulp, a renewable raw material sourced from sustainably managed forests. The closed-loop process uses 95 percent less water to produce than conventional cotton, Mavi reported. For this collection, Mavi blended the Tencel with Refibra with recycled cotton, resulting in jeans that have a vintage look with a soft handle.

Other sustainable stories in the F/W 23-24 collection include Pro Dark Tech, a rinse wash jean made with recycled polyester that doesn’t fade, an organic cotton selvedge jacket and jeans for men, and the continuation of clay-dyed jeans and shackets for men and women.

Fashion icons are made in arena sports tunnels and Hudson wants in on the action. The brand teamed with Brandon Williams, a celebrity stylist with a clientele of some of NBA, MBL, and NFL’s most fashionable athletes, to create a capsule collection of elevated denim streetwear.

The F/W 23-24 co-branded range centers on coordinates and wide bottoms. A boxy navy blue work shirt matches navy cargo pants with bungee cord hems. A vegan leather jacket coordinates with cargo pants. A cream knit top matches knit bottoms with released hems for a bootcut effect.

Standout denim pieces include super wide-leg jeans, available in dark indigo and vintage washes.

Variety is the spice of life and it’s also one of the reasons why consumers keep coming back to Liverpool Los Angeles. The brand, known for offering standard, petite, tall and plus sizing, launched in 2012 when the women’s market was ruled by skinny jeans, but Liverpool learned how to evolve with its clientele. While the “death of the skinny has been overblown,” according to a rep, “nothing too tight” is having a moment in the spotlight.

Liverpool’s F/W 23-24 collection sees the introduction of the “not-so-skinny” skinny, its “cool-girl” take on a straight/ slim jean available in high and regular rises. The brand also touts a variety of inseams.

“The seasonality of inseams is changing,” a rep said, adding that full-length, crop and ankle sell year-round.

After a slow start, girlfriend jeans and boyfriend fits are breakout stars. The latter satisfies the demand for relaxed and slouchy fits that feel vintage. Liverpool’s boyfriend jean is designed with a buttonfly and larger pockets, however, it is introducing its first zipper version for F/W 23-24. The brand ships them cuffed for styling, but not tacked.

Black and gray, raw hems and clean dark washes with minimal destruction round out the denim collection. The bottoms are complemented with garmentdyed tops and belted shackets— items that allow consumers to play with the new proportions instigated by the variety of denim that currently exists.

♦Celebrities like Halsey are not the only ones noticing Los Angelesbased Noend. The four-year-old label’s deconstructed approach to fashion denim caught the eye of buyers in its first time exhibiting at Project as well.

Made in L.A. with fabrics sourced from Turkey, Mexico and Japan, Noend balances women’s classic staples with the unique patchwork and pieced garments that denim fans love. A collection of skirts is made with patchwork denim, resulting in a mashup of washes and handkerchief hems. Jeans are pieced with various washes spanning bright indigo to bleached-out denim and a strapless top with a zip-up front is made with bands of different color denim.

Meanwhile, twill jumpsuits in utilitarian colors, denim jumpsuits with an ultra-soft vintage hand, flare jeans and high rise straight crop jeans are among the brand’s most wearable and versatile pieces.

Joe’s F/W 23-24 collection for men and women is an example of how denim plays nicely with other fabrications. For men, the brand expanded its assortment of Air Soft, a line of French terry jeans that combines the comfort of loungewear with classic 5-pocket styling. The concept soft launched in S/S ’23 with core indigo washes. Gray and rust red are new for fall.

Washed cargo pants in green and gray, brown-tinted jeans and washes with dimension add interest to men’s bottoms without relying on destruction and echo the market-wide shift to cleaner looks. The bottoms are complemented by a cozy chore jacket, a corduroy varsity jacket in earth tones, a suede Trucker and a suede shearling coat.

The cropped bootcut Callie and the wide-leg Mia are part of Joe’s coated denim story for women. The brand offers the Mia with a 34-inch inseam for a long and fluid fit. Indigo and rust versions of the Mia have pintucking on the front for a retro nod. A cropped Mia is also available in vegan leather. The leather alternative is also featured as a short trench coat, puff-sleeve blouse and dress with a knotted front.

A golden rod corduroy blazer and flare trousers are Joe’s coordinates of the season. Details like split hems and shiny gold hardware give the matching pieces an editorial edge. Dark rinse cargo jeans, black cargo trousers and rigid denim with a soft brushed surface round out the versatile collection.

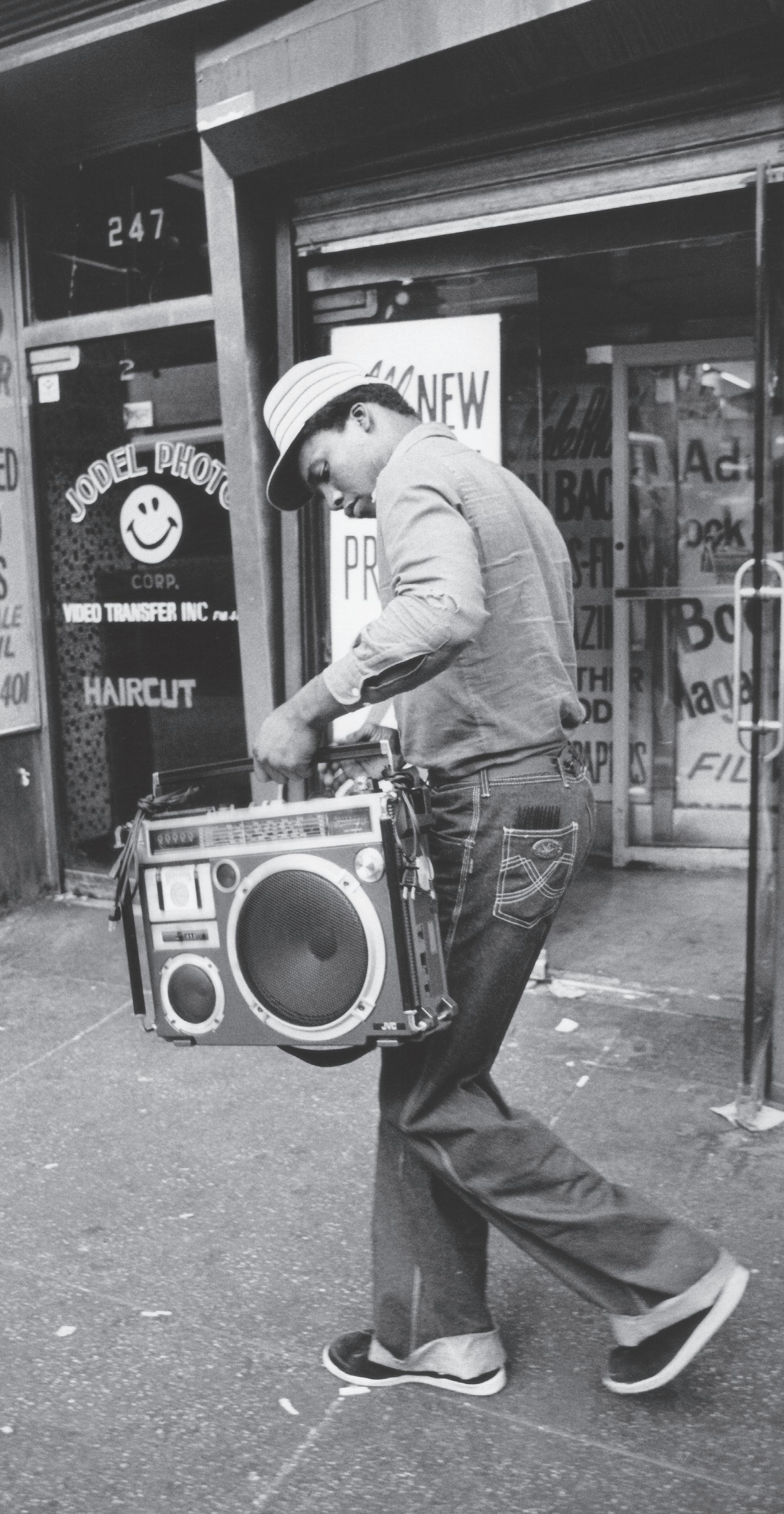

HIP HOP’S humble beginnings hardly hinted that it would grow to see a half-century of cultural influence, but the phenomenon is on display daily. Reaching far beyond music, the movement has developed its own aesthetic language that has permeated fashion, entertainment and the arts.

The current ubiquity of streetwear was preceded by eras of evolving hip-hop-inspired trends— some pulled from mainstream fashion, and others engineered from entirely new ideas. Denim weaved a common thread connecting past and present, according to Elizabeth Way, the Museum at FIT’s associate curator of costume: “Denim, especially jeans.”

By the ’70s, they’d become a staple of youth fashion in the U.S. So, when hip hop got its start, MCs, beat boxers, DJs and B-Boys were clad in blue, Way said. The New York City museum’s spring retrospective, “Fresh, Fly, and Fabulous: Fifty Years of Hip Hop Style,” is an exploration of the movement’s progression and its lasting impact on the way people dress.

Emerging in the South Bronx in 1973, hip hop originated “in a working-class area that was deeply impacted by discrimination, unemployment, and urban redlining,” the curator said. The museum traces the birth of hip hop to a “legendary back-to-school party” held at the apartment building of Cindy and Clive Campbell, also known as DJ Kool Herc, one August evening. From the beginning, “Hip hop kids were wearing the same jeans as young people around the country…but practitioners put their own spin on them,” Way said, from sewing permanent creases into the legs to adorning them with letter patches. Early favorites included Lee, Calvin Klein, and Jordache—“the same brands that were popular in mainstream youth fashion.”

A bona fide hip-hop aesthetic “blew up” in the mid-’80s when widely influential stars and rap groups from LL Cool J to Slick Rick and Run-D.M.C. hit the scene, according to Rolling Stone senior multimedia editor Kyle Rice. “Their music changed the way that people understood

hip hop,” he said. “Because they went so global, people started paying a lot more attention to what these artists were doing, and that included the things they were wearing.” Denim was a constant component of those looks “because it was such a utilitarian product,” Rice said. “A lot of working-class families already had it as part of their wardrobes.”

“Denim has been the fabric of choice for teens and music culture—from rock and punk to disco and hip hop,” Elena Romero, FIT assistant chair of marketing and communications, said. Early acts like Funky Four Plus 1 were known for wearing head-to-toe denim, while Run D.M.C. gravitated to straight leg fits and West Coast groups like N.W.A. donned dark washes and workwear, she said. Over the next 10 years, denim became “synonymous with rappers,” including Biggie Smalls, Tupac, Snoop Dogg, DMX, Jay-Z, Wu Tang Clan and TLC.

The 1990s were a golden era for hip hop and the fashion it inspired, leaving a mark on the industry still visible today. The baggy silhouettes that came to define the decade represented “an innovative change in proportion,” significantly impacting both men’s and women’s styling, Way said.

Founded in 1985, Tommy Hilfiger blended yacht club-prep school chic with Norman Rockwell Americana—an ethos that, on its face, would seem unlikely to resonate with the movement taking shape in urban enclaves. But as hip-hop acts began embracing the brand’s clothing, the label perceived an opportunity to reach a new audience.

Rapper Grand Puba gave the brand one of its first rap shoutouts, referencing his “Tommy Hilfiger top gear” in 1992’s “What’s the 411?” with

Mary J. Blige. The flame was lit. In 1994, Snoop Dogg performed on “Saturday Night Live” in an oversize red, white and blue long-sleeve polo shirt—a watershed moment that led to massive sellouts within a day of the show’s airing, the brand told Rivet.

Two years later, the label launched Tommy Jeans, a line of denim and casual apparel created to appeal to a younger set. Wu-Tang Clan’s Raekwon walked in the collection’s debut fashion show as Q Tip, Mary J Blige and TLC watched on. Tommy Jeans played to the prevailing hip hop denim trend—a mid-wash, roomy fit—adding identifying details that would become iconic, from carpenter loops to red, white and blue motifs on legs and waistbands, contrasting pockets and bold logos. Dungarees, cargo jeans and shorts were soon indispensable wardrobe staples.

It was one of the decade’s young female artists that shot Tommy Hilfiger into the stratosphere. Pop and R&B sensation Aaliyah was chosen as the face of the Tommy Jeans ad campaign in 1996, at the age of 17. Carefree and confident, she played to the camera in a midriff-bearing bandeau top and oversize jeans, sagged to reveal the waistband of her Tommy Hilfiger boxer shorts. The wide-leg, color-blocked, red, white and blue denim with bold graphic lettering became known as the “Aaliyah Jean” after the commercial aired. “I got Tommy Jeans—what else?” she quipped.

“We’re talking about a brand that for so long was catering to a white demographic. To now have this black woman as the face of his product—it was revolutionary,” Rice said of Hilfiger. “Brands weren’t going out of their way to feature black talent because for them, it was a risk factor.” Tommy Hilfiger’s embrace of hip-hop tastemakers “shifted the way people started looking

at the silhouette of denim—how you pair it, how you wear it and what’s interesting about it.”

The designer maintains that music and pop culture have always been his core influences. With the rise of hip hop, rappers became the new rock stars, and he wanted them in his clothes. “Since its emergence, hip-hop made an unmistakable mark on fashion,” Tommy Hilfiger told Rivet. “It drove trends in the ‘90s, as this street style look spread from the U.S.A. to the world. To this day, fashion and hip hop are deeply connected,” he added. “Streetwear evolved from being a subculture into one of the most powerful drivers of pop culture today.”

Other major mainstream brands, like Ralph Lauren, were propelled to greater heights as they were co-opted by hip-hop talents and their fans. But the mid-‘90s also ushered in the era of hiphop moguls—“artists entering the fashion business with their own fashion brands,” Romero said. Chuck D’s Rapp Style International, Russell Simmons’ Phat Farm, Naughty by Nature’s Naughty Gear, Wu-Tang Clan’s Wu Wear, Jay-Z and Damon Dash’s Rocawear, Pharell Wiliams’ Billionaire Boys Club and Ice Cream, Eve’s Fetish and T.I.’s Akoo Clothing were among the ventures launched during this time.

“One brand that was extremely influential was Sean John,” founded by Sean “P. Diddy” Combs, “because it created a space in the mainstream fashion industry for respected artists’ or ‘celebrity’ brands,” Way added. Combs became the first Black designer to win a Council of Fashion Designers of America (CFDA) award in 2004.

Founded by Daymond John, Carlton Brown, J. Alexander Martin and Keith Perrin in 1992 in Queens, N.Y., FUBU grew into the stuff of hiphop legend, grossing hundreds of millions of dollars annually at its peak. Built on distinctive styling and close ties to the music industry, its “focus and origination” stemmed from the desire to create “clothing that was really meant for us—‘For Us, By Us,’” Martin said.

“When we first started our company, we were just kids buying clothing that was available to us from different brands, but none of the brands really fit the way we wanted,” Brown added. “We’d buy the clothes three times larger so they would be baggier.” The founders set out

to develop a line that they, and their contemporaries, would want to wear straight off the rack. “This was a time when there was no ‘urban fashion,’” Brown said.

“It was easy for us to transcribe our thoughts into designs because we were the customer,” Martin explained. “We know what we like to wear. We know why we want to wear it. We know our own sensibilities as far as length, width, shanks, buttons and pockets.”

FUBU became known for its core staples, from brightly colored, heavyweight “FB” logo hoodies to athletic-inspired jerseys, baseball caps and oversized T-shirts. And of course, the jeans—billowing wide-legs in “hard,” rigid, dark denim. “From CAD all the way to production, from the stitching to the details, every little thing mattered, and we had a reason for it,” Brown said. A small stash-away pocket on the inner waistband offered discreet storage—a proprietary feature that the partners pushed as indispensable, even when suppliers balked. “The manufacturer asked, ‘Do you have to have this pocket in the jeans?’ and we said absolutely because we know how important things like that are.”

FUBU’s physical proximity to the borough’s up-and-coming hip- hop artists proved a major boon to the brand, according to Perrin. “We grew up in an area where Run D.M.C., Russell Simmons and LL Cool J lived, and on the Queens side, they were some of our first artists to make it big.” He credits Hype Williams with helping to spread the word about FUBU. Already a prolific director of music videos in the ’90s, Williams worked with “every hot artist out there,” and tipped off the FUBU team to opportunities to get their clothes on the small screen.

“He would call us and tell us, ‘Hey, I’m shooting this person,’ and we’d be on set for 10, 12, or 14 hours a day just to get one shirt or one hat on them,” Perrin said. “Sometimes we got it, sometimes we didn’t, but we got to know a lot of artists in the early days when they were just coming out.”

LL Cool J gave FUBU one of its winningest shoutouts—and in another brand’s commercial, no less. Hired to perform a freestyle in a 30-second ad for Gap menswear in 1999, the rapper slipped in the line, “For Us, By Us, on the low,” while wearing a FUBU cap. The spot blew up, and it took Gap weeks to recognize the unintentional cross-promotion.

Perrin said grassroots, on-the-ground marketing boosted recognition in the early ’90s before FUBU made it onto the backs of the greats. Touring expos and trade shows, the brand racked up orders, and soon demand outpaced supply. John placed an ad in the New York Times seeking financing. In 1996, Samsung’s fashion and textile division said it would help with distribution and

TO THIS DAY, FASHION AND HIP HOP ARE DEEPLY CONNECTED. STREETWEAR EVOLVED FROM BEING A SUBCULTURE INTO ONE OF THE MOST POWERFUL DRIVERS OF POP CULTURE TODAY.” —TOMMY HILFIGER

expansion if the brand could generate $5 million in business over three years. FUBU blew the sales target out of the water within weeks.

“[Samsung] said, ‘They did what they said we needed them to do—now let’s open up the floodgates,’” Perrin said. “That allowed us to jump out in the market in a huge way.” By 1998, yearly global sales amounted to more than $350 million.

Three decades since its founding, the brand is undergoing a resurgence, fueled by a wave of ’90s and early 2000s nostalgia. The music of the times has come roaring back with a vengeance, from the 2022 Super Bowl LVI halftime show, which featured Snoop Dogg, Dr. Dre, Eminem, Mary J. Blige, 50 Cent and Kendrick Lamar, to the Grammys in February. Music’s Biggest Night celebrated hip-hop’s golden anniversary with a whirlwind of performances that included RunD.M.C., Salt-N-Pepa, LL Cool J, Big Boi, Busta Rhymes, Grandmaster Flash, Ice-T, Nelly, Missy Elliott, DJ Jazzy Jeff and De La Soul.

“I’ve noticed that within the last year there has been a huge uptick in interest, especially from younger kids, 18 to 25,” Brown said. 2022 saw FUBU resurrect some of its famed silhouettes through a capsule with Forever 21. In February, the fast-fashion retailer teamed with hip hop supergroup Mount Westmore—comprised of California-based rappers Snoop Dog, Ice Cube, E-40 and Too Short—on a line of ’90s-inspired merch.

Brown is relishing the return to classic hiphop styling. “One thing I like that I’m starting to see is Offset and other rappers going for baggier jeans,” Brown said. “We’re actually talking about putting out a couple of older style jeans—more collectible, vintage type jeans,” Perrin added, along with two-piece denim suits.

Martin is eager to see a younger generation breathe new life into the brand, and sees serendipity in todays’ retro renaissance. “I just feel as a company, we’re blessed because we came at the right time,” he said. “We’ve touched a few different generations with one brand, and not too many people can say that.”

Founded 10 years after FUBU in Vernon, Calif., denim label True Religion is also finding itself the beneficiary of renewed interest in Y2K fashion. Breaking onto the scene in 2002 with ultra-low-rise flares, prominent stitching and a happy Buddha logo, the brand made waves with the era’s sartorial sovereigns, from It Girls and heiresses to rappers and R&B artists.

“We had a bold aesthetic, and that was no doubt the reason we were adopted by the hiphop community,” said Zihaad Wells, True Religion global brand creative director. “It was never

a conscious choice by us—we were just doing our thing, and luckily that heads-down, unapologetic attitude that we had resonated with the tastemakers in the hip-hop scene.”

The brand helped usher in an age of premium denim that spawned labels like, Citizens of Humanity and Rock & Republic. A far cry from the practical workwear of decades past, jeans in the early 2000s sold for upward of $200, and were encrusted with crystals and sequins and embellished with patches and distinctive stitching.

“Our stitch denim with the flaps were what really put us on the map within the music community,” Wells said. “The guys were rocking our Ricky with the stitch”—a loose-fitting straight leg—“while women were rocking the lowriders.” Elongated back pockets featured True Religion’s unmistakable calling card—a stitched horseshoe motif.

Throughout the decade, True Religion jeans became “a mainstay style choice” and a status symbol for artists, culminating in the ultimate callout from 2 Chainz in the form of a mixtape dubbed T.R.U. REALigion. “We had seen elements of exposure within the community, but that was the moment it became evident,” Wells said of the 2011 release. “It wasn’t a surprise as much as it was an, ‘Oh right, of course.’”

After that it all clicked—“Legends like Chief Keef, Skepta, and Fergie ran it up and made True Religion a signature within the world of hip hop to this day,” he added. A decade after the mixtape drop, True Religion teamed with 2 Chainz on a capsule collection of apparel and denim. “It’s become part of the DNA—we’re constantly turning to our community of hiphop artists to see how we can evolve our designs,” Wells said. That includes “collaborating with the artists that put us on the map many years ago.”

The brand feted its 20th year in business— and the 10-year anniversary of Chief Keef’s song, “True Religion Fein”—with a denim and streetwear drop last year. In November, it released a women’s collection with hip hop and R&B singer Dreezy, which included a denim trucker jacket, jeans, cargo midi skirt, and a denim wrap top and bustier. “This year we’re cooking up something with a bunch of new hip-hop artists,” Wells added.

The brand is eager to deepen these associations as it works to cultivate a connection with a new generation. “Young people have always looked to artists to see what they should be wearing, and hip-hop artists have looked to the younger generation to see what’s cool,” the designer said.

“Hip-hop has a huge influence on mainstream fashion because of its synchronicity with youth culture,” he added. “It’s all intertwined.” ●

“GIRL YOU WORE THESE JEANS AND YOU MADE A THUG WANT TO CRY SOMETHING TERRIBLE” —GINUWINE “IN THOSE JEANS” 2003 “SHE HAD THEM

JEANS (JEANS), BOOTS WITH THE FUR (WITH THE FUR)” —FLO RIDA

2007 “I'M A TRUE RELIGION FEIN, I GOT ON TRUE RELIGION JEANS”

KEEF “TRUE RELIGION FEIN” 2012 “BUT DON'T I LOOK SO HANDSOME

THESE POLO JEANS?” —MAC MILLER “POLO JEANS” 2014

still love their jeans,but they are also seeking dressier bottom options. Interest in non-denim pants is rising as many consumers return to their pre-pandemic routines of going to work and attending social functions.

According to the New York-based data analytics firm Trendalytics, variations of cargo pants have been a top search item over the past six months. Searches for “parachute cargo pants” rose 6,533 percent over the past six months, while “wide leg cargo pants” were up 138 percent. Searches for “women’s linen pants” rose 70 percent over the same comparable period. Other items that saw increases on the search front were “baggy trousers,” ahead 59 percent, and “wide leg joggers,” growing 52 percent.

Seasonal changes also impacted consumer searches, with many non-denim items performing better in the early fall from August through October. Denim searches typically pick up in late fall and winter from November through January.

“Although we specialize in denim, our customers always love our non-denim options. Since 2021, we have seen a significant rise in our faux leather pants, and we expect this trend will continue through 2023,” said Estelle Dahan, NYDJ vice president of design.

Dahan said that as spring approaches, NYDJ will see a rise in non-denim sales as “those months lend themselves to cooler fabrics with breathability.” During

resort season, NYDJ’s stretch linen offerings are a top seller, available in Bermuda shorts and cropped and ankle pants. “Twill also grows in popularity during the spring and summer because of its classic laidback style,” Dahan said, adding that the fabrication is offered in a variety of styles from Bermuda shorts to trousers.

Comfort and performance fabrications are a key factor in consumers’ purchases, whether in women’s or men’s. Chico’s brand director Suzi Reynolds said customers consistently choose its Brigette pant, which can be dressed up or down and features a 360-degree hidden slimming technology. The pant, available in various lengths, also includes a pull-on waistband to provide all-day comfort.

Over at Chico’s sister brand White House|Black Market (WHBM), seasonality plays a role in whether customers opt for fulllength, ankle and cropped pant lengths. “This preference is across the board in all of our bottoms in both denim and tailored fabrications,” said Julianne Hobbs, WHBM brand director.

She said that while customers are buying denim and nondenim trousers, the brand has seen non-denim bottoms trend faster post-covid. “Trousers have been a staple at WHBM within our customers’ work wardrobe, with a trend into more stretch fabrications and utility details.”

High-rise bottoms are still trending, and Hobbs said there aren’t any major shifts now, although bootcut has become a staple.

Men are also shifting gears and adding more clothing options to their closets. At Tommy Bahama, denim represents nine percent of its men’s business, while “nondenim is growing at 48 percent,” according to Dawn Brandl, senior vice president of men’s design.

Regardless of fabrication, bottoms are currently 25 to 27 percent of the overall men’s business. She said that in the last seven years, Tommy Bahama has added stretch, performance yarns and movement to its five-pocket denim business.

Customers love the “soft hand,” as well as being able to feel comfortable in what they are wearing, she said. The denim business is steady and has grown alongside its knits and woven counterpart in bottoms. “Usually, you don’t have such a strong bottoms business and you see growth in only one area, but [our customers love] what we are giving them,” Brandl said.

When she started, Tommy Bahama’s business was primarily camp shirts and silk pants. Options have expanded to include different wearing occasions. One option that performs well is the Boracay five-pocket jean, a soft and slightly stretchy cotton blend that includes Tencel lyocell. The Boracay is also offered in a flat-front chino in 13 colors. With the non-denim business showing growth, Tommy Bahama is getting ready to introduce a new men’s pant line in August called Harbor Point, a brushed knit pant. Over at Kontoor Brands Inc., chairman and CEO Scott Baxter said during the company’s fourthquarter earnings call in February that its U.S. denim business grew 11 percent in 2022, while nondenim rose 13 percent and now represents 38 percent of its global mix. Both Kontoor’s Wrangler and Lee brands are well-positioned for 2023, according to Baxter. At Wrangler, diversified strategies that include tops and non-denim bottoms now account for over 40 percent of the brand’s business.

While there’s opportunity for Kontoor to expand in categories beyond denim, “We still focus a lot of our demand creation in our consumer platforms around

CARGOS, CHINOS AND TROUSERS ARE ENJOYING A MOMENT IN THE SPOTLIGHT.David Dee Delgado/Stringer

our denim categories, and we will stay laser focused on that going forward,” Baxter said.

Among younger consumers, one fashion item that’s “new” to younger millennials and older Gen Z cohorts is the “pant” category. According to Fran Horowitz, CEO of Abercrombie & Fitch Co. “They’ve never worn them before. And now they’re going back to the office and they’re going out socially,” she said.

A favorite dress-up option among Abercrombie’s women customers is the Sloane tailored pant, an ultra-high rise tailored wide-leg bottom with pleating and a partially elasticated waistband. One fabrication option is a polyester/viscose/elastane blend. Another is a 100 percent polyester crepe. The Sloane is also available in a linen/cotton combination.

Abercrombie’s younger sibling Hollister is seeing teens buying both high rise and low-rise options. While bottoms in cargo and utility options in different fabrications are newer additions to their closets, Horowitz said they still love their denim.

The shift from skinny fits to wider legs is ongoing but Horowitz added that consumers are looking now for cleaner denim looks. “Denim is still a very important category for us. It’s still a fashion category for us,” she said. “There are still some exciting things happening in denim.” ●

DENIM BUYING is entering a new era. While economic anxieties boiled over during the fall, spring represents a clean slate, according to industry insiders. ➝ “2022 was a challenge, for sure—I think everyone was feeling kind of cautious, waiting for this impending recession,” said Jill Gindi, Blank NYC sales director. “But now it feels more cautiously optimistic—I think people have a better outlook for how 2023 is going to unfold, and it’s a fresh start.”

Gindi said the brand noted a pronounced shift in buyer attitudes in January as many retailers closed the books on a frustrating fourth quarter. “I think they’re just turning the page and trying to move forward with a new season,” she said.

The brand ushered in spring with denim in a buoyant palette of pink, Kelly green and lavender, she said. “Anything with cargo or utility pockets is strong, and in all different iterations,” from small to large. There’s a rebounding interest in stretch and comfort fabrications in light and medium weights, Gindi said. “We’re finding that’s our sweet spot.”

Blank NYC, which sells to department stores, specialty stores, e-commerce and off-price channels, has seen a much more pronounced trend toward buying in-season, Gindi added. “It’s really a challenge for us to make sure that we’re projecting and over-cutting on certain styles that we feel like are going to be strong,” she said. “More are open to buy, and retail is chasing a lot, which is always good.” Social media has also prompted a faster trend cycle, she added.

Price point has played a major role in buyer attitudes and flexibility in 2023, according to Taylor Young, Kut from the Kloth Midwest account executive. The highest MSRPs in the line are $109—up about $10 over the past year with changes to the price of raw materials, she said.

Raising prices was not a decision the brand made lightly. “We’re coming off of our best year ever as a brand,” Young said.

Kut has a history of “doing well during periods of economic hardship,” she explained. During the 2008 recession, the brand’s sub-$100 price point helped it remain accessible. “We didn’t suffer like other premium brands would have, because you could buy an $89 jean and get the top, too,” without feelings of guilt, she said. When a pair of denim costs more than $200, by contrast, the consumer feels compelled to make a practical choice. “It’s a totally different shopping experience,” Young added. Specialty boutiques in communities across the country are driving Kut’s business, underscoring to the brand’s desire to maintain price stability.

Buyers have shown a renewed interest in denim styles that can pull double duty between the office and everyday wear.

“With people going back to work, we’re designing our line more for that customer—a little cleaner, a little less destruction,” she said. Wide legs, full-length flares and bootcuts have sold strongly for fall, all developed in lighter weight, stretch formulations. Prominent seaming and front pleats add visual interest to several styles, along with waxy coatings on dark washes.

“I think covid changed the way we dress, and our expectations for how we

feel when we’re dressed,” said Christine Loule, Liverpool Los Angeles vice president of sales and merchandising. “Comfort continues to drive style,” she said, and “being in sweatpants for two years showed us that we don’t necessarily need to be all tucked in and wearing skin-tight jeans.”

With most styles retailing for around $100, the VP said Liverpool occupies a “sweet spot” for buyers—“the opening price point for premium.” While the

brand feels attainable for a wide range of shoppers, “I think it reads longevity to the customer,” Loule said. Classic styling and quality are high on retailers’ checklists for the upcoming seasons, she added.

While Hudson Jeans is also leading with wide-leg fits, the brand serves a different subset of shoppers willing to spend between $185 and upwards of $500 on a pair of the brand’s jeans. Economic angst has colored some conversations with buyers, but hasn’t stopped them from placing fall orders, according to men’s specialty account executive Sophie Kalb. “There’s been talk of recession, and the fact that over the years, prices have been increasing,” she said.

The brand is known as much for its streetwear-inspired styles as its mainstream, contemporary silhouettes. Kalb said that specialty stores in the Midwest, including Detroit, are the largest consumers of streetwear and trend-forward styles replete with fading, distressing, undone hems, workwear details and paint splatters. But it’s the buyers of core styles who are commenting most often on the difficulties of selling luxury denim, Kalb said, despite some reports that 2022 was “their best year ever,” even topping the stimulus check era of the pandemic.

The movement away from skinny jeans persists on the women’s side, according to Paola Garza, Hudson’s women’s specialty account executive. “We’re definitely starting to see a shift towards a wider leg and a higher rise; people want that like baggy look,” she said.

Many retailers already have the brand’s best-selling core styles on order, but specialty stores and boutiques are most likely to buy into trends. “When you get into novelties, that will vary depending on how conservative their store is on trends.”

“Our accounts are really good about knowing what works for them, and they’re sticking to what they know that they can sell,” Garza added. “Every once in a while you can convince a few of them to do something different and take a risk.” If there’s no reward, the brand will work with its accounts to find another fix. “If [a style] is sitting for months, it hurts both of us, so we’ll find a solution and swap out the style for something else,” she said.

Joe’s Jeans also works with retailers to replace stagnant product at the end of the selling season, according to West Coast women’s account executive Lauren Grant. The brand’s buyers are gravitating toward polished, practical styles, she said. “The fashion has definitely slowed down lately.”

“People are accepting a more casual look, but they want to be able to wear their jeans to work,” and are therefore looking for comfortable, versatile fits. Price point is high on the list of considerations for both spring and fall. “Our denim that’s right at or slightly under $200 is definitely retailing best,” she added.

“I think that everybody’s buckling down on their budgets,” added Todd Picciano, director of sales. “I think receipts are being cut to a degree, whether it be majors or specialty stores.” Most premium denim vendors work with their accounts to reconcile products that remain on shelves, he echoed. “At the end of the day, your relationship is a partnership that you build, and you want to make ensure that they’re never stuck with products.”

Retailers are also pushing out the decision-making timeframe to give themselves more runway to gauge consumer demand. “It’s hard to think about six months from now when you’re trying to move inventory now,” Picciano said. “So I think people are buying a little bit closer to season.”

Men’s buyers are gravitating to straight legs and slim-leg straight fits, he added. Cargos and camos remain popular in some markets, but “Denim’s getting clean again,” after a period where jeans where distressing was the norm. “Now, everybody’s gone back to work,” he added. “That’s what they need versatility in aesthetic.” ●

WITH PEOPLE GOING BACK TO WORK, WE’RE DESIGNING OUR LINE MORE FOR THAT CUSTOMER...”

—TAYLOR YOUNG

2023-2024

BY ANDRE CLAUDIO ▲ SAM KU AG PRESIDENT AND CREATIVE DIRECTOR

On F/W 23-24 trends: The biggest denim trend that continues for us through Fall ’23 is playing with proportion. Our design team is especially into a fit called the Kora, which reads like a trouser leg that is relaxed, but not too wide. Additionally, we have a big collaboration coming up for Fall ’23 featuring trousers and cargos with interesting volume and shape.

On balancing sustainability and design: For us, sustainability is something we are mindful of from the start. From the beginning, we consider the fiber content and the mill producing the product. Choices

that we make in the fiber content can result in enormous savings in water usage and harmful chemical reduction. Our facilities for denim manufacturing— which we own—have a water recycling system that saves us approximately 50,000 gallons of water per day. We also use the most up-to-date washing processes, which reduces water and chemical usage.

Our latest sustainability innovation involves us collecting used and lovingly worn AG jeans, which will be recycled into new cotton yarns and turned into new, recycled denim. The cotton used in the recycled product will be 100 percent recycled content, including the stretch component. There has been a lot of progress on the sustainability front in the past few years, and it’s exciting to see all facets of the garment manufacturing process improve in this respect.

On what I want to see more of from the denim industry: If all facets of the denim industry continue to strive to be more sustainable, I think we’ll get to a good place.

On finding inspiration: For fashion, I love shopping for vintage clothing. Non-fashion stuff, I am interested in automobile design. I think it’s fascinating to see what design decisions have been made, and how they all work together to complete a vehicle. In a way, there are a lot of similarities between the two.

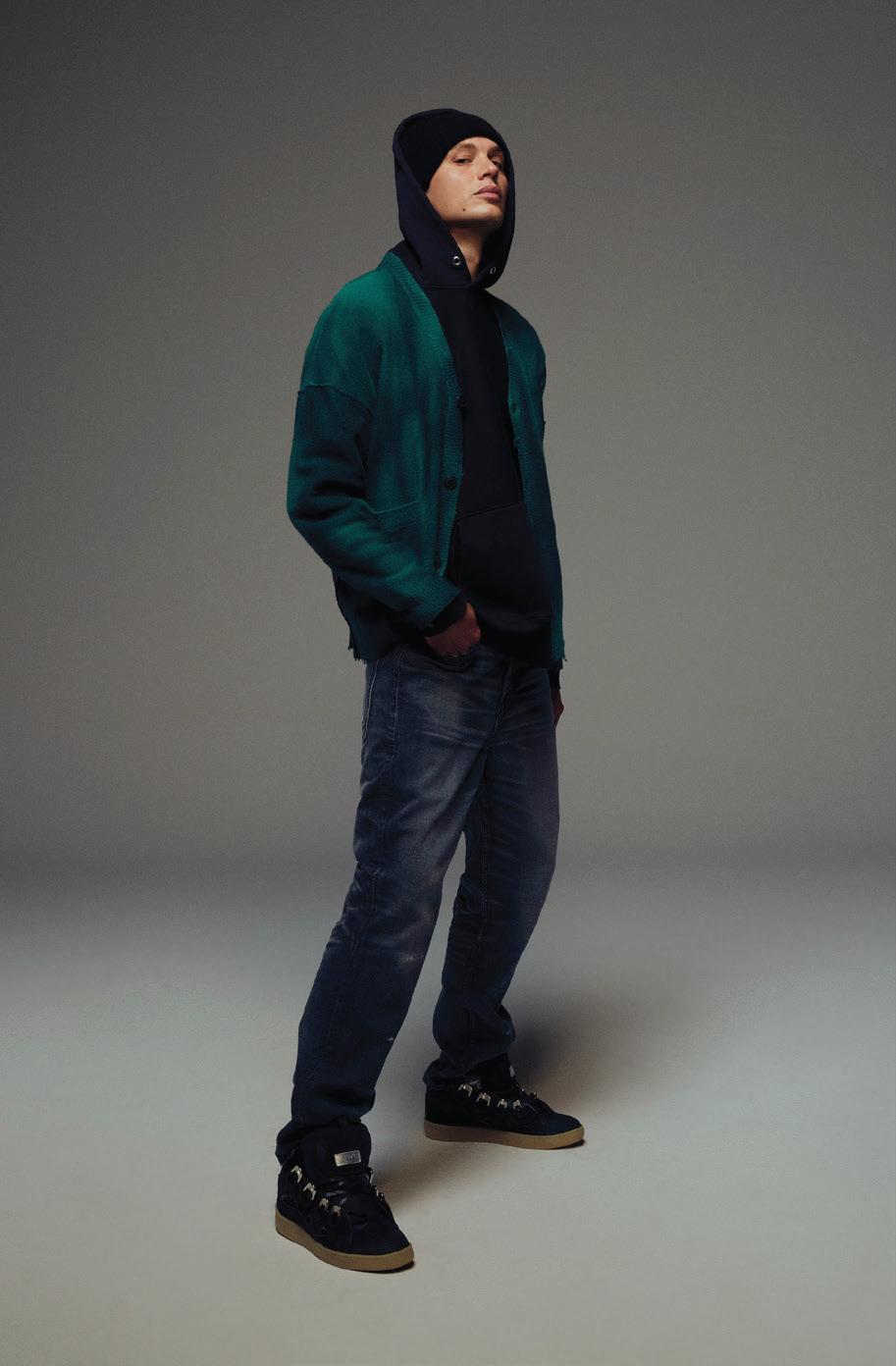

LOOSE FITS, vintage influences and signature styles collide in Fall/ Winter 2023-2024 collections. And without compromising design, sustainable sourcing is becoming an even bigger part of the story as brands make responsible fibers and water-saving washes a part of their DNA.

Here, designers and executives from five leading brands share what’s next for denim.

FIVE

DISH ON WHAT’S NEXT FOR FALL/WINTER

On F/W 23-24 trends: We see women wanting to get dressed up with their denim this fall. Vibrant reds, indigo washes and sophisticated, cleaner rinse washes—that pair nicely with black—are key.

We also see fits evolving beyond the classic straight-leg camp—which has dominated for the past few years—to more exciting and animated silhouettes. For women, we see lower rises in flared and baggy silhouettes as the biggest fit trends for Fall ’23. For men, we see a growing interest in baggier fits and more relaxed rises.

On balancing sustainability and design: Sustainability is rooted in every step of our design process. One of the biggest areas in which we can make an impact as designers is through the selection of our materials and development of our denim washes.

We’ve conducted thorough research to narrow our fabric list to the best combination of sustainable fibers—including organic cotton, regenerative cotton and Tencel—along with performance and versatility. We

always aim to keep these fabrics in rotation to avoid waste from unused inventory and extraneous fabric development at the mills. In fact—toward the beginning of each season—we’ll visit our team of experts at our laundry facility to use the most sustainable wash methods possible to achieve our wash direction. Fortunately, washes are trending cleaner and darker, which tend to be relatively less impactful to the environment.

On what I want to see more of from the denim industry: With sustainability being at the forefront of conversation within the denim industry, I’m interested to see where brands take their efforts in 2023 and beyond.

On finding inspiration: I find traveling to new places the best source of inspiration. There’s nothing that can quite compare to the experience of seeing how people dress in an unfamiliar place, as well as how I decide to pack and dress in that new setting that can spark ideas.

▼ SARAH AHMED DL1961 CEO AND CO-FOUNDER

On F/W 23-24 trends: We still see steady growth in both sectors with straight legs, wider fits and an emphasis on vintage-inspired washes. You can see this shine through in our collections because we made our denim look and feel as if they are a pair you’ve owned for years. For women, we’re leaning into the ’90s and Y2K resurgence with lower rises, slouchier fits and denim skirts of all lengths. Plus, we’re reintroducing leather into our women’s line and a plush new corduroy in our men’s line. We also developed a new fit for men’s—a familiar straight leg that looks like we pulled it right out of the ’90s. In either case, we are looking to the past for inspiration but updating the techniques, fabrics and more for the modern day.

On balancing sustainability and design: Sustainability is at our core. We are vertically integrated, which allows us to keep tighter control of the entire design and manufacturing process from fiber to finished garment. We also invest heavily into sustainable technologies—such as ozone and laser—to achieve the vintage and dynamic washes you see in our collections in a manner that is better for the planet and the people who physically produce our denim. Even with fabrications, we use the best materials, such as certified cotton, Recover fibers and Tencel lyocell.

On what I want to see more of from the denim industry: The denim industry is improving, and we want to see this trend

continue. More companies are looking toward sustainable models and methods, but this change isn’t happening fast enough, which also speaks to the fashion industry at large.

On finding inspiration: What makes a good designer is the ability to draw inspiration from anywhere, anything or anybody. Of course, you can be inspired by an underlying theme or message, but the ability to grow, transform or change your perspective showcases that you can break out of your comfort zone and be innovative. Right now, we are inspired by vintage and relaxed past styles, but who knows what will inspire us next—that’s what makes this industry so exciting.

On F/W 23-24 trends: The pandemic made people appreciate comfort, but now there is an increased appetite to look more refined without losing the comfort. Denim is coming back

WHO KNOWS WHAT WILL INSPIRE US NEXT—THAT’S WHAT MAKES THIS INDUSTRY SO EXCITING.”

—SARAH AHMEDGUESS COH DL1961

in a big way, and I am very happy about that because this is part of our DNA. We are shifting from a skinny leg to a wider range of fits—specifically straight, bootcut, flares and wide legs. People are gravitating toward looser, relaxed fits, but are also interested in returning to the classic staples of modern dressing with attention to quality and details.

On balancing sustainability and design: Sustainability is an integral part of our values and goals. Specifically, we work directly with mills to ensure we can develop fabrics with sustainable fibers. We look for water-efficient, low-impact indigo innovations such as laser or ozone. When it comes to dyes, we opt for the natural dying process. Our entire organization from top management to design and R&D is very vocal and active in advancing our sustainability programs in all aspects of our product development.

On what I want to see more of from the denim industry: I would like to see brands be more transparent about their sourcing and manufacturing product cycle, focusing less on the marketing aspect of sustainability and more on making a true impact on the manufacturing cycle. We all need to take responsibility and continue to focus on sustainable game-changing innovations to create a real change in the denim industry.

On finding inspiration: Traveling inspires me so much. I always bring back so many ideas after my trips. Art, music and films also inspire me a lot.

On F/W 23-24 trends: More than ever, we are seeing the lines blur for men and women regarding both silhouettes and overarching trends. The popularity of bootcut and flare is growing across both, while seasonally there remains a diverse range of key fits—straight, slim and loose. There is a desire for denim, but the consumer doesn’t want to sacrifice comfort. They expect ease and comfort in innovative yet authentic ways.

Individuality of style has become more important, and one way that shows up is with seasonless dressing. For example, you will see a summer piece paired and layered with other pieces in similar fabrics and tones to create a new expression for winter. It shows versatility and the value of a piece year-round; denim is a perfect vehicle for seasonless dressing.

Consumers also appreciate versatility and quality that will last. Expect to see some of Lee’s most beloved styles—our icons like the Union-All, Rider Jacket and 101 Rider jeans—both in classic and fresh iterations.

On balancing sustainability and design: Lee’s global sustainability program, For a World that Works, helps ensure the integration of sustainability throughout the process from the factories to the products. We have a dedicated sustainability team, and each season we partner with them to identify preferred materials and practices. Having a shift in mindset in everything we do as creators, producers a nd consumers is crucial as we aim toward full circularity in his industry.

One of the key areas we focus on is water savings. Lee has committed to ensuring we continue using less water in the dying of denim. Our Indigood process can save up to 90 percent of water used during dying compared to traditional practices. We increase the use of this process each season.

On what I want to see more of from the denim industry: I’m excited about the renewed appreciation for authenticity and dedication to quality, timeless products and honoring brands’ heritage through a modern lens. I also love the resurgence of vintage and think there are many opportunities to tell stories and create new moments for brands. There is a collective goal to make the industry more sustainable and create more opportunities for circular design. I feel like there is more opportunity to share best practices across regions, brands, suppliers and others to propel the industry forward

On finding inspiration: I am very passionate about the secondhand market. I find it inspiring and refreshing to see all the creative ways brands and designers are entering that arena—from upcycling, reconstructing and re-purposing, collaborations and partnerships to collecting and curating vintage shops. I am obsessed with vintage textiles and apparel, so it is amazing to see how an appreciation for vintage has grown over the past few years. Lee recently launched its Lee Archive, and it’s been a great way to teach younger consumers about the brand and its iconic product. There is such an emotional connection to vintage and this dressing of new and old, customizing and wearing it in your own way that resonates, particularly with Gen Z shoppers. Additionally, staying curious, working with other creatives and learning every day also inspires me and keeps me going. I love books, interiors, art and a lot of worlds beyond apparel. They all cross-pollinate with each other and fuel creativity. ●

WE LOOK FOR WATEREFFICIENT, LOW-IMPACT INDIGO INNOVATIONS...”

—PAUL MARCIANO

I AM OBSESSED WITH VINTAGE TEXTILES AND APPAREL, SO IT IS AMAZING TO SEE HOW AN APPRECIATION FOR VINTAGE HAS GROWN OVER THE PAST FEW YEARS.”

—MEGHAN BROWNLEE

Already operating mills in Mexico that are RCS (Recycled Claim Standard)-certified for fabric production, Cone Denim is going above and beyond to fortify its supply chain by getting its third-party fiber supplier certified as well.

This certification will allow Cone Denim to provide customers with full third-party verification of the recycled content comprising its denim fabrics.

“Our customers are prioritizing recycled cotton content in denim to meet their sustainability goals,” said Caitlyn Holt, director of business and product innovation, Cone Denim. “The demand for recycled cotton continues to grow, and along with this demand we recognize that our customers benefit from having third-party verification on where recycled content is sourced.”

and confidence in knowing the recycled fiber coming into our manufacturing process has been produced from 100 percent postindustrial waste (PIW) recycled cotton.”

At its mill in Parras, Mexico, Cone Denim can produce up to 50 percent recycled cotton (PIW) in denim fabric with an open-end yarn construction. While the volume of recycled fiber being used at the facility ultimately depends on customer demand, the manufacturer wants to track the success of the program as part of its commitment to the UN Sustainable Development Goals (SDG #12) in reducing waste and incorporating recycled content into its products.

As such, the company focuses on a sustainable future and has established targets across water conservation, energy reduction and raw material sourcing.

“We’re extremely proud of our water conservation efforts in Mexico, which helps us reach our 2025 sustainability goal to reduce water usage by 25 percent,” said Holt. “Our Zero Liquid Discharge wastewater treatment system located at our Parras mill plays a key role in reducing our water footprint by saving up to 100 million gallons of water a year. Our customized ultrafiltration and reverse osmosis system recycles 90 percent of the wastewater at the facility and treats 11,000 gallons per hour. The recovered water is recycled back into the manufacturing process and eliminates wastewater being discharged into the environment.”

Serving a diverse and global customer base, Cone Denim values partnering with brands to meet their sustainability targets. For example, the manufacturer works with some brands that request up to 30 percent recycled cotton in fabric construction.

The focus on recycled cotton is part of Cone Denim’s commitment to sustainable innovation, with the company having used post-industrial waste for over 25 years.

Workers at Cone Denim aim to push boundaries and keep challenging themselves as responsible denim producers, according to Holt, by developing styles that have the highest impact when it comes to water conservation and recycled content.

As part of Cone Denim’s Fall/Winter 2024 collection, the company is introducing its first fabric made of 100 percent postindustrial recycled cotton that is GRS certified. Part of the Nothing Goes to Waste collection, this fabric is 100 percent mono-fiber and when combined with Cone’s Distilled Indigo, uses less water and chemicals to bring the simplest fiber, dye and construction to life.

The Greensboro, N.C.-based denim manufacturer partnered with the third-party supplier in Mexico in October 2022, with the firms working together to certify their process for producing recycled cotton. This process is aimed at meeting the certification standards established by Textile Exchange and verified by Control Union.

For Cone Denim’s clients, the new certification alleviates some headaches associated with the cotton sourcing process. For example, it is often more complex to source recycled yarn in the Western Hemisphere. The waste streams in Mexico are not as established as those in the Eastern Hemisphere and it’s common for mills to import recycled fibers for manufacturing into North America. This practice not only adds to shipping costs and lead times but also contributes to the total carbon footprint in producing denim.

“We’re proud to have established a small footprint for producing recycled yarn in Mexico for our manufacturing process,” Holt said. “Our customers will have transparency

“Our customers benefit from having third-party verification on where recycled content is sourced.”

BY ANGELA VELASQUEZ

BY ANGELA VELASQUEZ

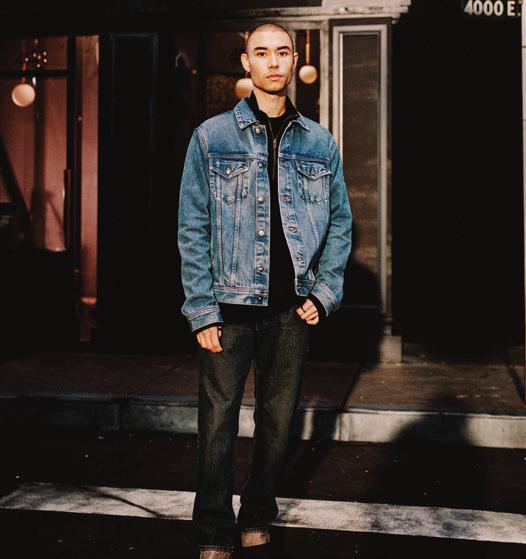

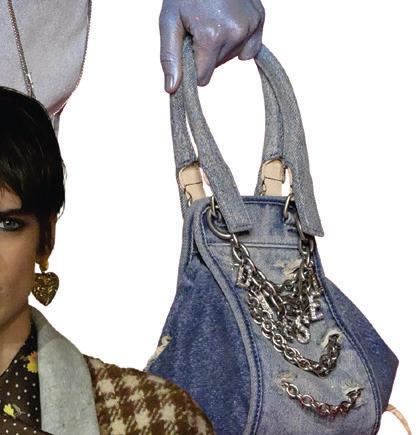

DENIM WAS on the world stage from January to March as Fall/Winter 2023-2024 fashion weeks took place around the world.

In a departure from the colorful, Y2Kinspired designs that have dominated post-pandemic collections, brands returned to denim’s roots.

Collections celebrated denim’s heritage in workwear, the versatility of indigo and the fabric’s future in unexpected categories like suiting and eveningwear. However, delicate textures, glossy coatings and unique styling—from stacked belts to dresses over jeans—provided the novelties that will keep consumers coming back for more.

Here’s a look at the highlights.

The men’s and dual-gender collections presented at fashion weeks highlighted denim’s ability to play in all categories. A mainstay in F/W 23-24 collections, the fabric was present in collections that leaned heavily on tailored looks and others that borrowed loose and relaxed fits from streetwear.

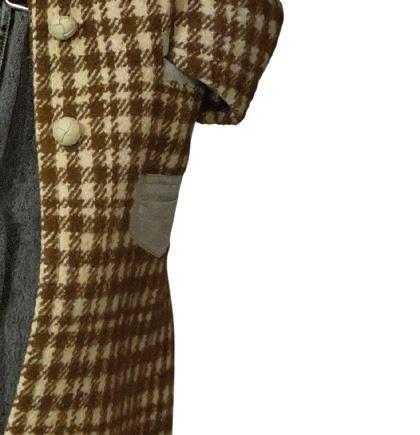

Denim was predominately presented as head-to-looks with jeans and denim skirts being paired with denim jackets or button-down shirts. Feng Chen Wang’s laser-printed coordinates were embellished with studs. Juun J matched the destroyed details on jeans to an oversize denim blazer. Zadig & Voltaire kept it simple with a Trucker and straight fit jeans in the same wash.

There was a softness in collections, executed in rounded legs, drop shoulders and dreamy blue washes. Kenzo showed a collarless jacket and jeans with a cloud-like wash. Solid Homme paired balloon jeans with pastel blue varsity jackets. Alaïa presented light wash barrelshaped jeans.

Contrasting fades were part of Blue Marble’s and Namesake’s collections. The fades segued into more robust ombre effects by Botter, Casablanca and Jordanluca.

Garments with DIY-inspired details and artisanal handiwork took on many personas. Airei’s jackets and jeans featured deconstructed quilting with delicate undone threads. Acne Studio went for a vintage aesthetic with a bleached quilted jacket and plaid patchwork jeans. Large floral embroideries and multi-color faux-fur inserts distinguished Blue Marble’s jeans.

Creative patchwork was part of Dsquared2’s homage to the early aughts. Low-slung jeans were decorated with star-shaped knee patches and wilderness landscapes made with pieced denim, while others were shredded or embellished with sequins. The nostalgic story was compounded by bootcuts, stacked legs and micro miniskirts and dresses paired with ironic slogan tees.

The dirty-looking denim trend from S/S ’23 evolved toward claytinted washes. Egonlab and RtA featured orange-tinted bottoms.

Copenhagen Fashion Week was home to collections that mixed denim with colorful outerwear, unique knitwear and monochromatic sets.

Double denim looks with a medium wash were all the rage in collections by Munthe, Rabens Saloner, and Skall Studio. Slouchy bottoms were typically paired with a relaxed button-down shirt or Trucker jacket. Operasport went darker with its workwearinspired shacket and trouser jeans.

(Di)vision continued to focus on dual-gender reconstructing denim garments. A maxi skirt was upcycled from a pair of jeans. Rainbow-hued stitching added a youthful touch to carpenter jeans. The brand also brought back Y2K styling by pairing a belted tunic-length knit tank over ripped bootcut jeans.

TG Botanical took a similar approach to styling by layering a denim tube dress over bootcut jeans. A denim corset top paired back to a maxi skirt. Though brighter shades of indigo were present, these pieces stood out for their brown- and green-tinted washes.

Spray-paint effects colored Wood Wood’s grunge-inspired range. Alpha’s deconstructed approach spanned “cuffed” denim skirts to religious-themed coordinates embellished with clear crosses and pieces that mimicked a nun’s habit.

A bodice with corset-inspired seaming broke up the long line of Gestuz’s long-sleeve denim dress. The collection leaned into its cool-girl aesthetic with sleek denim suiting, skirts in mini and maxi lengths, low-slung slouchy jeans and shimmery black denim coordinates.

Washed black denim was a focal point for Holzweiler. Black tulle peaked from its button-front jean dress. Loose-fitting jeans and a front-slit midi skirt were styled with intentionally imperfect knitwear.

Grown-up but playful was the inspiration behind Ganni’s collection. The vibe was illustrated in suiting, tailoring, and denim that already feel like wardrobe staples—some made with Circulose.

Washed black denim featured prominently in an assortment of elongated Truckers and frayed skirts worn over jeans. Indigo maxi and midi skirts were paired with button-down shirts with balloon sleeves, indicating a move from the puff shoulder silhouettes the brand is known for. The playful side was seen in a range of metallic coated denim corset tops, blazer/Trucker hybrids, skirts and jeans. The collection introduced a new butterfly logo. For Ganni, F/W 23-24 is “all about transformation, change, and positivity, all things the butterfl symbolizes,” said creative director Ditte Reffstrup. “It’s a new chapter for Ganni. Our team has come so far since we first started out and makes me so proud to think about where we are today. The collection has a more mature and grown-up feel this time, it’s sleek and strong yet totally Ganni…”

positivity, all the butterfly said creative director Ditte Reffstrup. “It’s a new chapter Ganni. Our team come so since we out it makes me so proud to think about where we are The collection has a more mature and grown-up feel this time, it’s sleek and strong

Denim suiting, dark washes and cargo pockets made a strong appearance at New York Fashion Week.

strong appearance at New York

The Y2K-inspired glitz blitz of previous seasons gave way to applications that felt more sentimental and nostalgic. Agbobly presented dark-wash cargo jeans and denim sets decorated with multicolored topstitching and Swarovski beads. The long strands of beads were inspired by earrings that founder Jacques Agbobly’s aunts would wear for Sunday service.

and Swarovski beads. The strands of beads were earrings that founder Jacques aunts would

“joyous memories of carefree with friends,

featured a vest and jeans embellished with ’90s-era studs, gems and buttons, and acid-wash jeans

Tanner Fletcher’s collection, inspired by “joyous memories of long, carefree nights with friends, indulging in the youthful spirit of mischief and camaraderie,” featured a vest and jeans embellished with ’90s-era studs, gems and buttons, and acid-wash jeans embellished with denim bows.

Bows led to other girly details like Aknvas’ denim miniskirt wrapped with oversized ruffles.

Bows led to other details

1 2 3 4 5

Grommets added a rocker edge to Colin Locascio’s tiered ruffle midi skirt.

Utility trends like cargo jeans and shackets may have reached the masses, but they still maintain a strong hold on the runway. A menagerie of pocket designs decorated Colin Locascio’s jacket, jeans and zip-up miniskirts. Cargo jeans were also present in collections by Christian Cowan and Alice & Olivia, which added leather flaps to its pockets.

The utility trend is helping raise the profile of another heritage staple: raw denim. The edgy dark denim looks that put G-Star Raw on the radar of now-Louis Vuitton men’s creative director Pharrell Williams in the 2010s is back. Dark indigo was seen in Luar’s collection as a collarless jacket and jeans, Et Ochs’ as wide-leg jumpsuit, minidress, deconstructed strapless top and trouser jeans, and Brandon Maxwell’s as widecut cuffed shorts.

as a collarless and jeans, Et Ochs’ as a jumpsuit, deconstructed strapless top and trouser jeans, as cut Latta raw jeans as well as a version with a coating for a liquid-like Foo Foo to punk and skate subcultures with purple-tinted jeans with loops and carabiners, with

Eckhaus Latta served raw wideleg jeans as well as a version with a glossy coating for a liquid-like effect. and Foo nodded to punk skate subcultures with purple-tinted indigo jeans with loops carabiners, styled with stacked belts.

surge of denim suiting pitched as a cool,

Veronica Beard paired a cropped one-button with pleated denim trousers, while proportions updated Luar’s suit.