SOURCING JOURNAL

Whoever said time flies when you’re having fun clearly didn’t factor in global pandemics, shifting consumer behavior, social media, unstable economies, and rising social and political unrest.

Ten years ago, we launched SJ Denim. And while much of the journey has been exciting and rewarding, having a front-row seat to the denim industry’s evolving challenges and disruptions has been nothing short of eye-opening.

Industry veterans often point out that the denim world is perpetually nostalgic, frequently looking back on past decades as the golden age of denim, but it would be a mistake to overlook the significance and urgency the challenges denim is facing today. And it’s not just denim—nearly every apparel category (and arguably, every industry) has oscillated this year between uncertainty, pessimism, hope, and a pervasive sense of stagnation.

Still, I’m hopeful the denim industry can shake off this funk in this new season. There’s little value in dwelling for another six months—it’s time to confront the new realities of tariffs and market consolidation and start forging a fresh path forward.

One key source of hope is sustainability. In conversations with mills and suppliers for this issue, it’s encouraging to see that sustainability has evolved from a niche initiative into a non-negotiable mandate. Just a decade ago, it was often limited to capsule collections targeting a select audience— today, it’s embedded in core strategies across the board.

In “Saving Sustainability” on pg. 38, mills share how they’re preserving key programs amid shrinking budgets— and why, for many, sustainability isn’t just the right thing to do, but a smart cost-saving strategy. This issue also brings fibers into focus—the first link in the supply chain and a telling indicator of the direction denim is headed.

No matter how things feel right now, the reality is denim isn’t going anywhere—it’ll be around for the next decade and beyond, experiencing the same levels of highs and lows that SJ Denim has covered for the last 10 years. And the jeans you’re wearing today? If they’re made well, they’ll still be here too—either as a beloved staple in your own closet or getting scooped up by twenty-something Gen Alphas at vintage markets, eager to wear whatever aesthetic this strange era ends up being remembered for.

If the last 10 years have taught us anything, it’s that denim will always find a way to stay in style.

Angela Jean Velasquez EXECUTIVE EDITOR

Lauren Parker Director Fairchild Studio/SJ

INTERNATIONAL

SOURCING JOURNAL ADVERTISING

Deborah B. Baron Advertising Director

PRODUCTION

Anne Leonard Production Manager

Client Activation

Barbra Leung Director, Integrated Marketing

Alexa Dorfman Senior Marketing Manager

Kayla Gaussaint Associate Integrated Manager

OPERATIONS

Ashley Faradineh Executive Director, Operations

Rosa Stancil Media Planner

Emanuela Altimani Senior Sales Coordinator

SOURCING JOURNAL IS OWNED AND PUBLISHED BY PENSKE MEDIA

Jay Penske Chairman & CEO

Gerry Byrne Vice Chairman

George Grobar Chief Operating Officer

Sarlina See Chief Accounting Officer

Ryan Young Chief Security Officer

Craig Perreault Chief Digital Officer

Todd Greene EVP, Business Affairs & Chief Legal Officer

Celine Perrot-Johnson EVP, Operations & Finance

Paul Rainey EVP, Operations & Finance

Tom Finn EVP, Operations & Finance

Jenny Connelly EVP, Product & Engineering

Ken DelAlcazar EVP, Finance

Debashish Ghosh Managing Director, International Markets

Brian Levine Senior Vice President, Revenue Operations

Brooke Jaffe Senior Vice President, Public Affairs & Strategy

David Roberson Senior Vice President, Subscriptions

Frank McCallick Senior Vice President, Global Tax

Gabriel Koen Senior Vice President, Technology

Jerry Ruiz Senior Vice President, Oprations & Finance

Judith R. Margolin Senior Vice President, Deputy General Counsel

Karen Reed Senior Vice President, Finance

Lauren Utecht Senior Vice President, Human Resources

Marissa O’Hare Senior Vice President, Business Development

Nelson Anderson Senior Vice President, Creative

Andrew Root Vice President, Digital Marketing

Andy Limpus Vice President, Executive Search

& Head of Talent Acquisition

Anne Doyle Vice President, Human Resources

Constance Ejuma Vice President, Content Performance & Analytics

Courtney Goldstein Vice President, Human Resources

Dan Gerber Vice President, Strategic Partnerships

Danielle Levine Vice President, Associate General Counsel

Denise Tooman Vice President, Marketing, Strategic Solutions Group

Eddie Ko Vice President, Advertising Operations

Eugenia Miranda Richman Vice President, Editorial Innovation

Gurjeet Chima Vice President, International Markets

Hector Nino Vice President, Human Resources

Jennifer Garber Head of Industry, Travel

Joni Antonacci Vice President, Production Operations

Josh Qualy Vice President, Programmatic Sales

Karl Walter Vice President, Content

Kay Swift Vice President, Information Technology

Keir McMullen Vice President, Human Resources

Lise Berichel Vice President, Associate General Counsel

Matt Ullian Senior Vice President, Special Projects

Matthew Reed Head of Industry, Automotive Sector & DS Penske

Autosport Team

Michele Singer Vice President, Associate General Counsel

Mike Ye Vice President, Strategic Planning & Acquisitions

Richard Han Vice President, International Sales

Scott Ginsberg Head of Industry, Performance Marketing

Sonal Jain Vice President, Associate General Counsel

Tim Chan Vice President, E-Commerce

Tom McGinnis Vice President, Corporate Controller

A

To ensure each pair fits exactly right, customers begin with a short quiz, answering questions about their preferred style, rise and fit (there’s also a section where customers can upload inspiration pictures). After that, they submit their measurements, guided by Ali Grace’s step-by-step measurement guide to make sure everything is accurate.

Andre Claudio

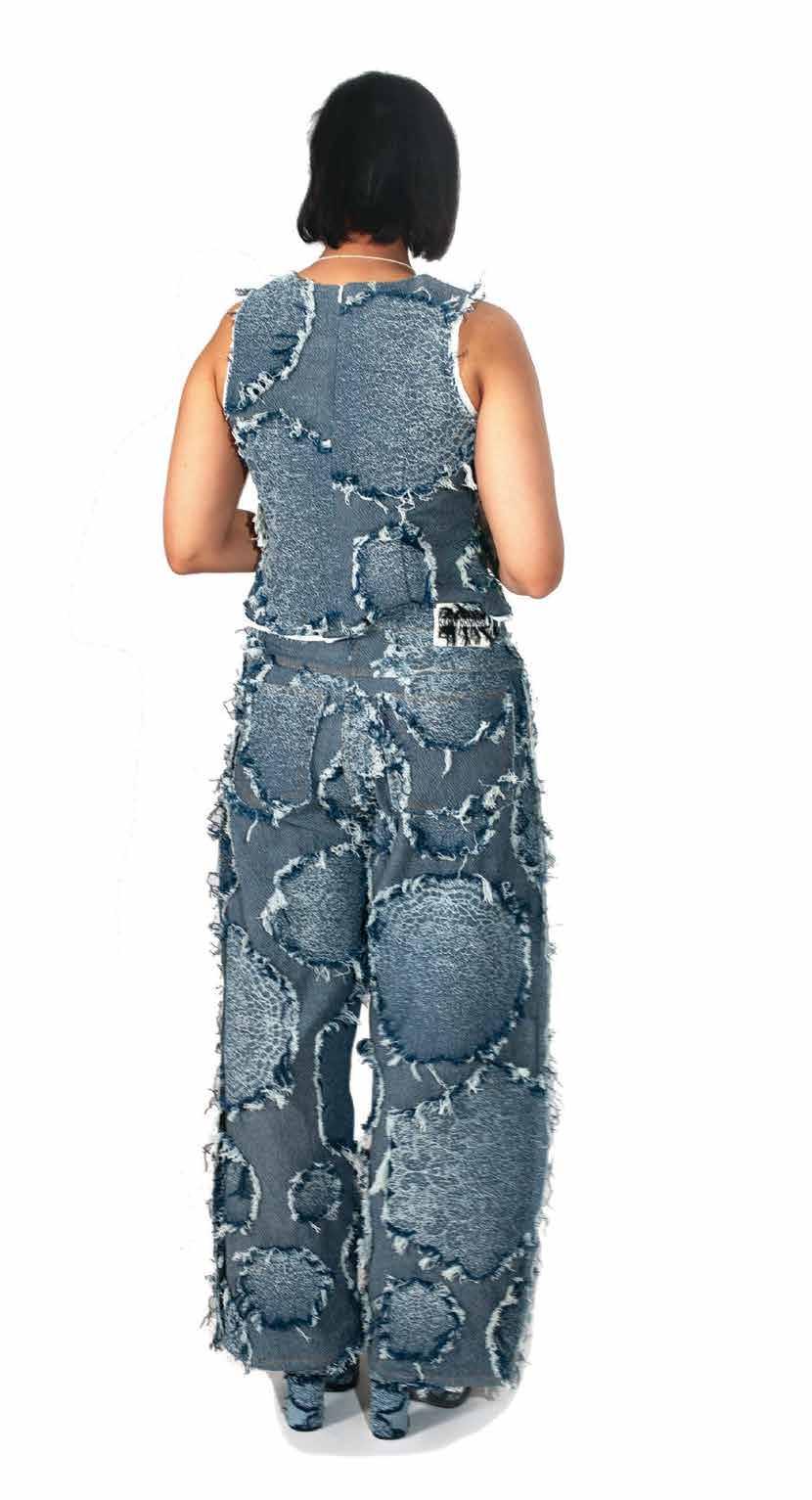

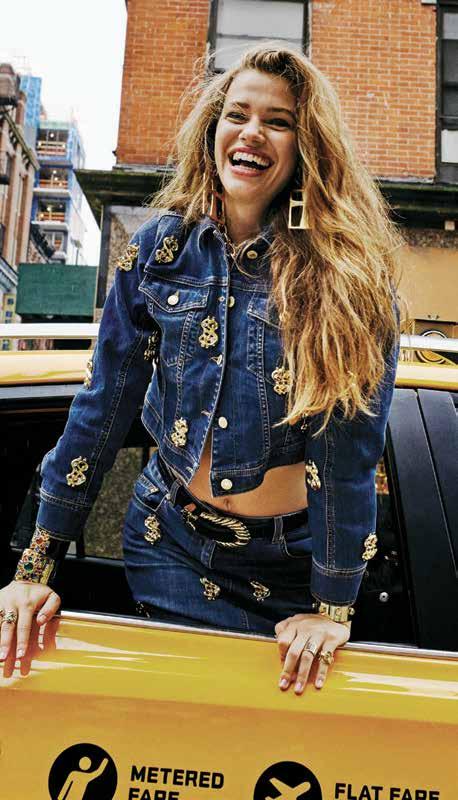

From reworking thrifted Levi’s in her dorm room to landing partnerships with retailers Revolve and Anthropologie, Ali Grace is building a denim brand rooted in custom fit and inclusivity. by

“it’s an absolute nightmare shopping for jeans.”

c In 2018, Ali Grace, founder and CEO of her namesake brand, was sitting in her dorm room at the University of Massachusetts Amherst when the frustration of finding jeans that fit finally hit a tipping point. c Instead of settling, though, she decided to launch a brand dedicated to giving women the perfect fit (something she’d been yearning for). c “Denim is a timeless product, but it’s also traditionally been very exclusive. When I started, there wasn’t anything like this—nothing that offered inclusivity through custom fit at scale. Brands like Abercrombie and Good American are doing a great job now, but back then there was a real gap,” Grace told SJ Denim. “I wanted to create a one-stop shop where people could get jeans tailored to their exact measurements, something the industry had never done before.” c For the brand, Grace reworks vintage Levi’s—hand-selected from thrift stores—and tailors them to fit “every body and every size.”

While orders come with a four to seven week wait time, the process is highly personalized. In fact, someone from the Ali Grace team checks in directly with each customer to confirm details and flag anything that doesn’t look quite right.

“We ask for [each customer’s] Instagram, email and phone number because we want to have multiple ways to reach [them] in case something isn’t adding up,” Grace said.

“Since we’re working with vintage denim, we don’t want to make changes that can’t be undone. For example, if you say your inseam is shorter than it really is and you’re 5’10” asking for a 30-inch inseam, we know that’s going to be too short. Once it’s cut, it can’t be made longer. We’d rather preserve the integrity of the denim and get it right the first time. That’s why we ask for all that information…so we can deliver a pair of jeans that feels like it was made just for you.”

Like Grace, who once struggled to find the right fit, her customers are solving the same problem—and the demand is reflected in the sales.

While she initially launched the brand in college, Grace took a short hiatus during the Covid-19 pandemic. A few months later, she decided to relaunch. “I opened the site at midnight, went to bed, and woke up with $60,000 in sales in just 12 hours,” she recalled. That moment proved to be a turning point. Today, the brand is on track to generate $1.5 million in sales in 2025, with about 70 percent coming from wholesale—through partners like Revolve, FWRD and Anthropologie, and soon Neiman Marcus and Bergdorf Goodman—and 30 percent from direct-to-consumer.

“Waking up to $60,000 in sales was definitely a pivotal moment for me…it showed just how much interest there was in the brand,” Grace said. “This year, while we did fall short of our $1 million wholesale goal…it’s still surreal just to see how far [the brand has grown].”

Now, as Grace continues to scale, she has her sights set on transforming Ali Grace into a lifestyle brand that goes “beyond vintage denim.”

WAKING UP TO $60,000 IN SALES WAS DEFINITELY A PIVOTAL MOMENT FOR ME…”

While she plans to stay rooted in jeans, she’s working on a modern line—still under the Ali Grace umbrella—that takes inspiration from vintage but expands into new product categories (which are currently kept under wraps).

Part of that growth includes exploring men’s wear. Rather than diving in headfirst, Grace is testing the waters. For example, she’s been experimenting with styles designed for women that could translate well to men, tracking how they sell before bringing in male fit models to refine silhouettes.

The goal, according to Grace, is to eventually launch a small, curated men’s offering, and over time, develop a modern line that could be fully unisex.

“I know women’s bodies best…that’s what I built the brand on,” she said. “But now, we’re in a position to grow further, learn new categories and figure out how to perfect men’s fit.”

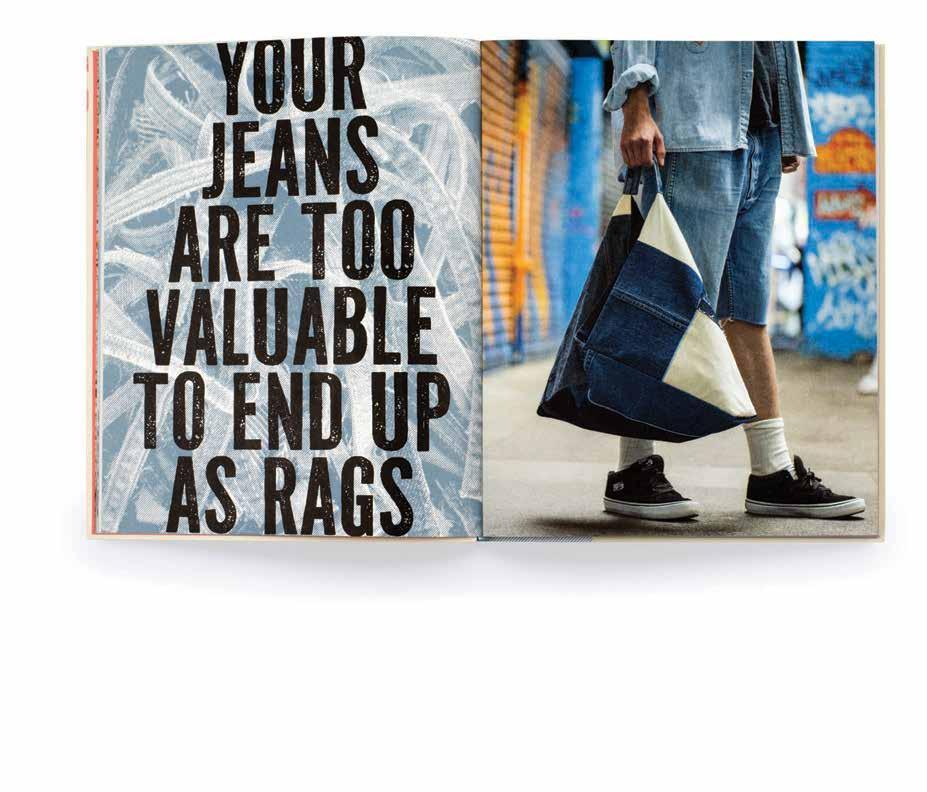

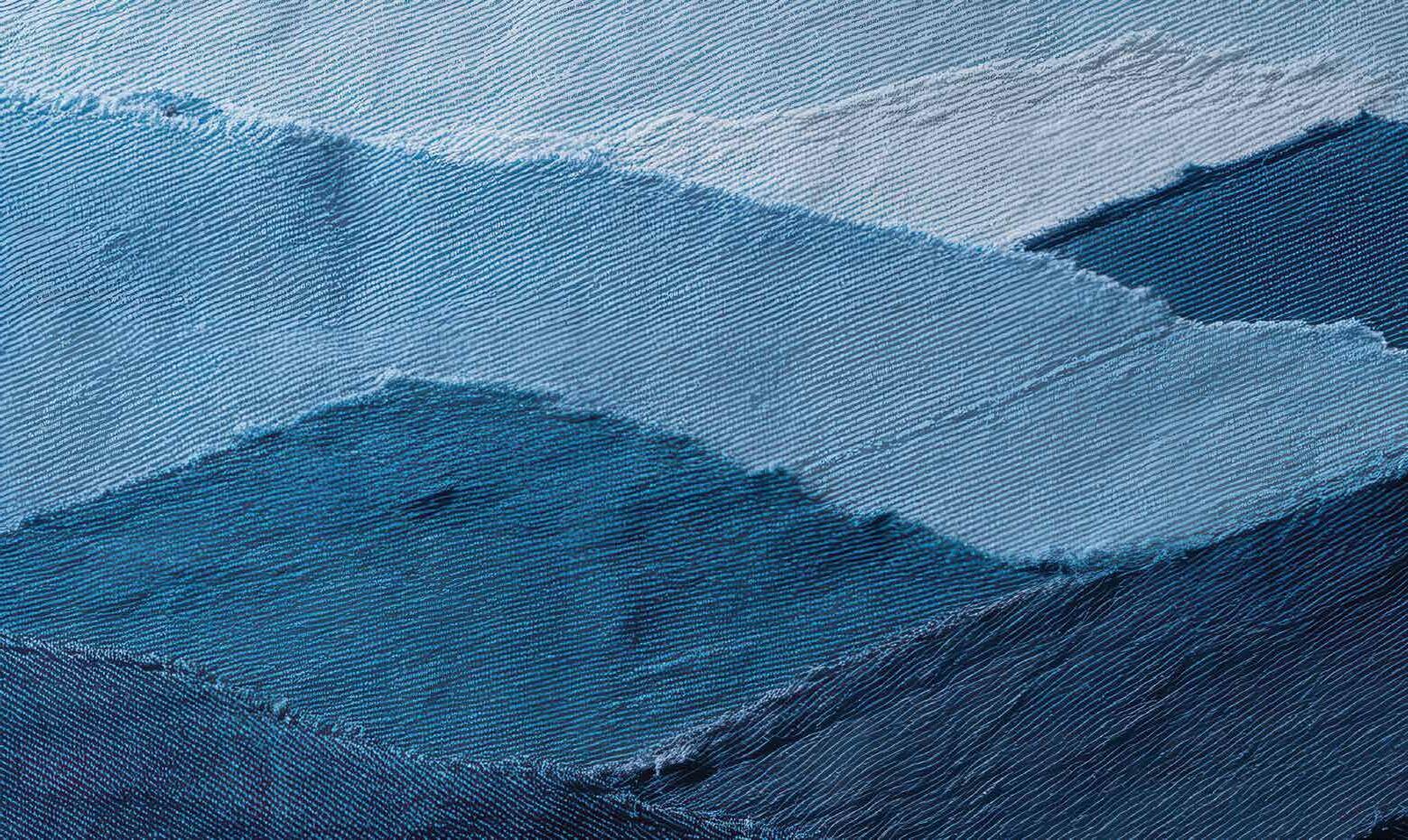

a new book shares the expert insights and practical guidance of Janelle Hanna—circular fashion consultant, denim specialist, and founder of White Weft—offering inspiration and know-how to DIY enthusiasts and aspiring upcyclers alike.

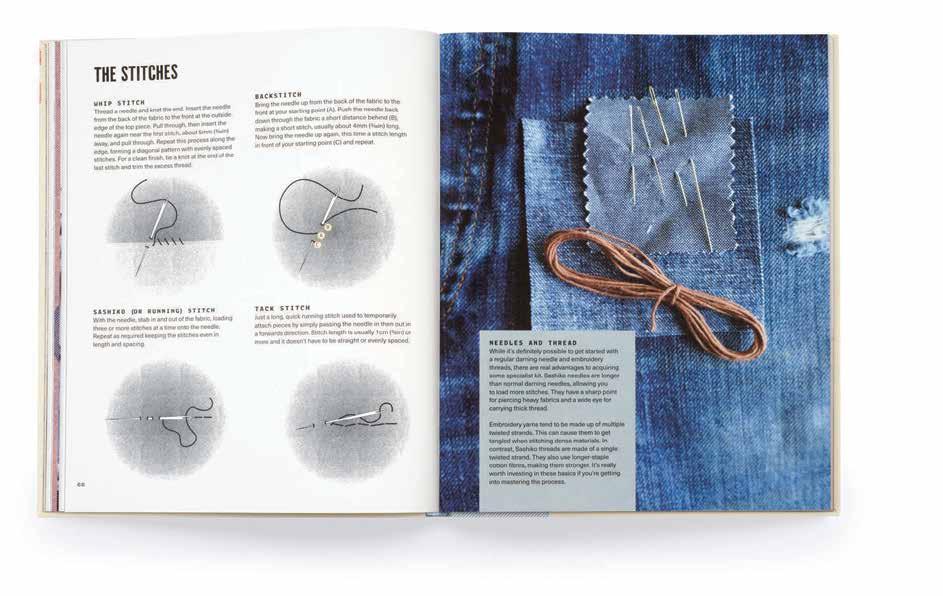

“Jean Genius: Repair, Restyle and Repurpose Your Denim” from Skittledog Publishing is a 160-page paperback that serves as a creative blueprint to help consumers give jeans a new lease of life. Packed practical tutorials, tool tips and ideas drawing from Hanna’s experience the paperback teaches sewers of all levels a range of genius jean repair, repurpose and restyling skills.

The idea for the book arrived in Hanna’s inbox. “Late one Friday afternoon, my inbox pinged,” she recalled. “For a change it wasn’t from someone offering to buy my business or quadruple my socials reach, but a publisher with a simple question: would I be interested in authoring a book on denim repair and upcycling?”

Hanna replied instantly and began work on the book in early 2024. “From the start we were very aligned on the book that we wanted to write—an accessible how-to guide for jeans lovers everywhere who can’t bear to part with

their favorite pair,” she said.

Start to finish, it took Hanna a year to nail down the 18 step-by-step repair and upcycling projects in the book. The book covers pocket, knee, crotch and belt loop repair techniques, taking in and expanding the waist, hemming, adjusting leg widths, transforming jeans to shorts and skirts, splicing. Readers will also learn how to repurpose existing garments into new items such as hats, bags, slippers and other patchwork pieces.

“People think that denim is a tricky fabric to sew but it’s quite forgiving. Things might go wrong but you can easily unpick and start again,” she said, adding that a common misconception about DIY-ing is that you need industrial machines. “Probably because too many of us have at some point broken a sewing machine needle in denim and that feels quite catastrophic and intimidating but most of the time you just need a different needle or a few tricks to get around the thickest areas.”

Through White Weft, Hanna provides design consulting services, upcycling support and denim repair for brands and individuals. She’s become master at invisible darning after acquiring a darning machine from a business

PEOPLE THINK THAT DENIM IS A TRICKY FABRIC TO SEW BUT IT’S QUITE FORGIVING.” Janelle

opposite her studio. However, her favorite projects are creative repairs where she can use her denim design skill set on commissions for brands and individuals.

White Weft is Hanna’s vision of what future business models for jean companies should look like—where brands and designers utilize old denim as they do with new denim. “I’ve realized that no amount of innovation could realistically be enough to lower our impact in line with climate targets unless we decreased production and kept the clothing we have in use for longer,” she said.

The book reflects this philosophy. “It explains to the average person why it’s so important to choose your denim well, explaining in simple terms the ins and outs of denim production. It gives them skills and confidence to try creative denim projects at home,” she said.

by Alex Harrell

how does a label last 20-plus years in an industry built on burnout? Better yet: how does it remain authentically cool? Many may chase relevance, but few set the tone. For Australian cult denim label Ksubi, survival (and success) hasn’t hinged on chasing trends—just the opposite: by holding fast to its DNA.

Born out of Sydney in 1999 by a group of friends fed up with cookie-cutter jeans, Ksubi staked its name on provocation with an ethos forged in defiance; its 2001 debut infamously included 200 live rats on the runway.

Now, with Pip Edwards named creative director—a multi-hyphenate who started her career at the label, had her son with co-founder Dan Single, and has returned in a full-circle twist—Ksubi is betting that consistency and chaos are still the right formula for staying power.

Edwards started back in 2004, initially in the PR department before moving to the design team. This early experience allows her to “slip in with the DNA” and make creative or product decisions “with a brand lens really quite seamlessly.”

Though her return comes nearly two decades after her first chapter there, the feeling was familiar—like slipping on an old pair of jeans,” Edwards told SJ Denim.

It’s a full circle moment for Ksubi, too. Since emerging in 1999, the anarchic denim label has become a mainstay in Australian fashion and beyond, amassing a loyal following with celebrities like Hailey Bieber and Travis Scott in tow.

There’s also the family subplot. Her son, Justice, now works in one of the brand’s stores. It’s a neat, generational twist: the kid who grew up with Ksubi now literally sells it, carrying forward its swagger for a new audience.

“It’s got so many parts and aspects; you couldn’t [even] script it, really,” Edwards said with a laugh.

Ksubi’s origin story is its anchor: it was born from a genuine need, a desire for denim that didn’t exist.

The brand’s foundational “lux rebellion” spirit is expressed through signature distressed denim and an iconic box-cross logo. It’s also how a Ksubi customer from 2004 and one from 2024 can recognize the same essential brand some 20 years apart.

From a product perspective, the brand’s DNA includes the distinctive distressed denim application—what Edwards noted as still being quite prominent—as well as the iconic box cross logo.

While that DNA is fixed, its expression is what evolves. The concept is not unlike the literary trope of regionalism or local color genre—telling the same core story, just tailoring the language and presentation for new audiences and global regions. In the fashion world, that means styles shift, markets expand, campaigns look different.

Edwards is clear on the distinction.

“I don’t think roots, brand roots, shouldn’t really change, don’t really change. It can evolve in terms of product and presentation and marketing,” she said. “But in terms of DNA? That’s never changed. I don’t think it should ever change.”

Need more evidence? Ksubi’s recent collab with L.A.-based Alice Hollywood was explicitly described as a love letter to the days of unapologetic denim: the early 2000s— aligns with Ksubi’s strategy of leaning into its heritage with a modern lens.

“We’re very community led,” Ksubi chief executive officer Craig King added. King has

been with the brand for over 20 years in various capacities; something the colleagues have in common. The two worked side by side at General Pants Co. 13 years ago, where Edwards served as design director until forming her athleisurewear brand, P.E. Nation.

“We sort of built this brand from the streets—from the people that really loved the brand—rather than trying to take too much of a lead position and trend preaching,” King said.

Featuring laser-cut leather appliqués, signature metal lighter clips and nods to indie sleaze, the synergistic capsule doesn’t invent something new. Instead, teaches a new audience about a pivotal moment in Ksubi’s history, suggesting that success lies in knowing how and when to reintroduce your past.

“Do things your way,” she said. For Ksubi, that way is rather big—even a “bit brassy,” per Edwards. But it’s their own.

FFOUNDED IN New York City in 1945 by Harry Copen, a visionary entrepreneur with a progressive spirit, Copen began its journey with a clear mission: to bring innovation, quality and reliability to the textile industry. Eight decades later, that vision has grown into a global legacy that continues to shape the future of garment interiors.

As we celebrate 80 years, we look back with pride at how Copen has become a trusted market leader in pocketing, linings and waistbands. From precision jacquards and smooth viscose linings, to sporty mesh fabrics and seasonal pocketing collections inspired by stripes, geometrics, checks, nature and abstract prints, our products combine technical performance with style and craftsmanship. This broad portfolio has helped our partners create garments where the inside truly matches the excellence of the outside.

Over the years, our strategic expansion has been key to success. With warehouses and sales offices across North Africa, Europe, Asia, the U.S. and Latin America, we have built a supply chain designed to deliver closer to the needle point. This global footprint ensures that our partners—from leading luxury houses to large-scale retailers— receive the service, consistency and reliability they expect.

Our leadership journey is also a story of continuity. From Harry Copen’s founding vision in 1945, to Barry Emanuel guiding Copen into the new millennium, to today’s third-generation leadership of Louis King and Avi Chamiel, our DNA has remained constant. Together, they are building Copen United Limited into the world’s most recognized and responsible supplier of pocketing, waistbands and linings—all while preserving the values that have defined us for 80 years.

“BUT OUR STORY IS NOT ONLY ABOUT GROWTH. IT IS ALSO ABOUT RESPONSIBILITY. IN TODAY’S WORLD OF SUSTAINABILITY TRANSPARENCY AND RESPONSIBLE SOURCING, COPEN HAS BEEN AT THE FOREFRONT OF CHANGE.”

HARRY COPEN , Founder, Copen

But our story is not only about growth. It is also about responsibility. In today’s world of sustainability, transparency and responsible sourcing, Copen has been at the forefront of change. Through our use of recycled polyester, we have removed more than 100 million plastic bottles from landfills—living up to our motto of “saving the

planet, one pocket at a time.”

Our sustainability journey continues with the introduction of regenerative cotton, as well as ongoing innovations that reduce impact and improve garment performance.

Looking ahead to 2026 and beyond, the future looks brighter than ever. From expanding into new regions, to advancing performance-

related fabrics, to investing in the next generation of textile talent, our mission remains the same as it was 80 years ago: to serve our partners with innovation, reliability, and passion for excellence.

To everyone who has supported Copen on this journey, thank you. Here’s to the next chapter of innovation, sustainability and growth. ■

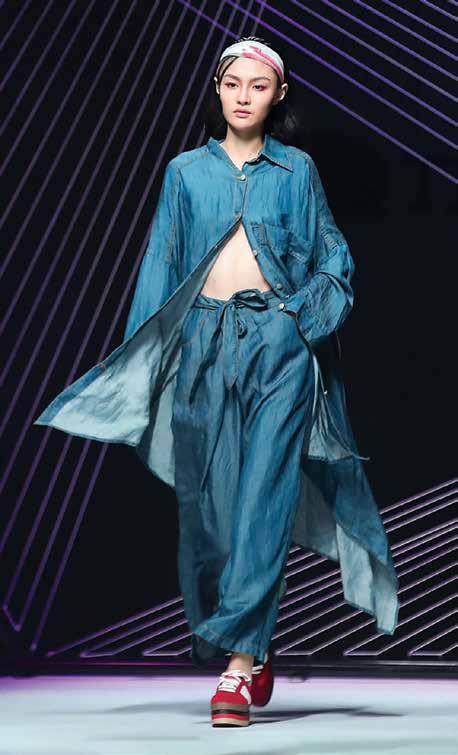

Designers have bold ideas for Spring/Summer 2026 denim. by Angela Velasquez

in a sea of safe , traditional blue jeans, some designers are taking a risk and reminding the world of denim’s boundless potential for reinvention. From Diesel’s introduction of satin denim to Harri’s mind-bending optical illusion laser work, and Area’s sculptural silhouettes that demand more than just a passing glance, these designers are pushing the boundaries of what denim can be. Spring/Summer 2026 collections are a canvas for innovation, expression and high-concept creativity.

Leaders inside denim brands give the scoop on their Spring/Summer

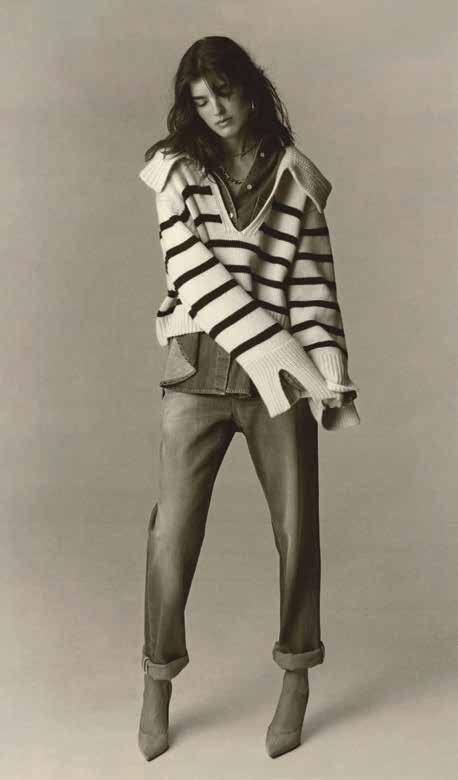

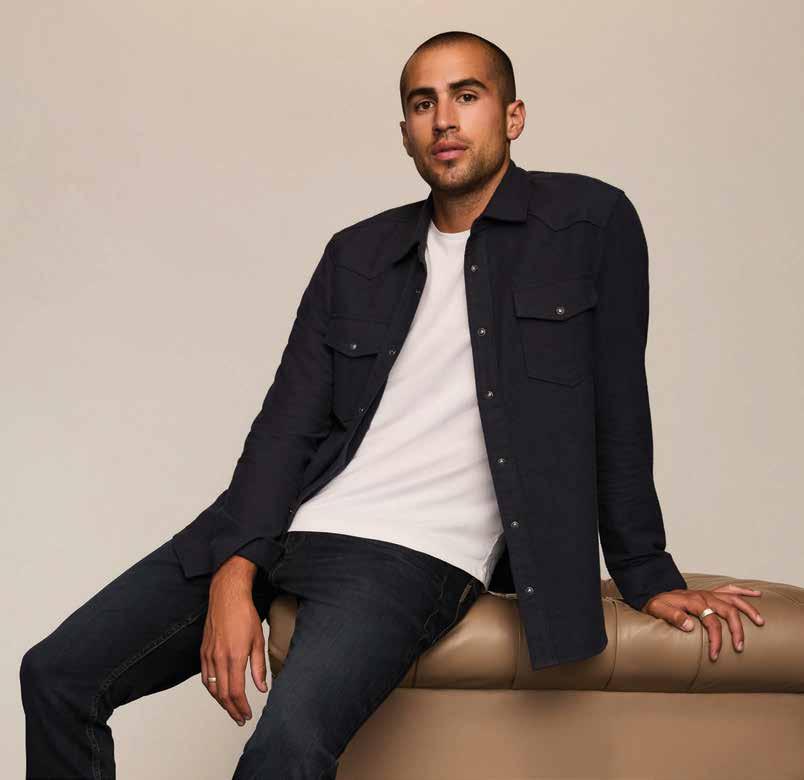

men’s denim is ready for a season of ease Brands have turned to vintage influence, Western roots and coastal cool as inspiration for their Spring/ Summer 2026 men’s collections. They’re delivering relaxed styles built for comfort, with looser fits, lighter fabrics and sun-streaked washes dominating the market for next year for a consumer interested in an effortless, easygoing feel. The market has displayed an openness for deviations from the status quo, and brands are counting on nostalgia-tinged, casual-coded styles to keep propelling their men’s businesses.

c Here, creatives and executives from crowd-favorite denim brands share more about the trends, ideas and innovation shaping their upcoming men’s collections.

Uwe Kippschnieder

senior denim developer and designer

On the men’s business [Men’s] is quite stable, but we’ve seen some growth since about a year [ago]. Our sales in the shops for full price are developing quite well. I [recently] got the news that we see growth on the menswear [side] in the U.S. For our main market, which is still in Germany, it’s steady. We have a few brand shops in Germany that are doing well, and online business is stable.

• On fits and washes We are trying to keep the overall selection for our men’s fits quite tight at the moment, so we have four existing fits that were complemented by just one new fit, which is, for us, also the most fashionable fit. It’s a mix of a five-pocket [style] but with slightly different pocket solutions in the front. It’s not like the regular scoop pocket, but we have more slanted, worker-related pockets, and it’s our widest fit for the denim. We are continuing a little bit of what we had focused on in winter, which is to play with the casts and with the tinting. We are giving denim a new approach by changing the blues, with sometimes more vintage-related beige tints. We also have a blue denim which we washed down over dyed black, washed again and then tinted with a brown, so there’s a lot of changing the casts by tinting. My favorite [for] summer was a blue denim which we washed and then overdyed with indigo.

• On non-jean denim styles This is, for us, always an important topic in the collection. We like the idea of building suits, which doesn’t necessarily mean that it’s combined with a formal jacket. It can also, as we have it in the [SS26] collection, mean that you have a postal zip-up denim jacket combined with a worker denim shirt, with this new, wider leg jean—and this is all in the same color. The denims we used for shirting come from the same mill; they have the same base color, and we also washed it exactly the same.

• On inspiration for S/S ’26 [This] is one of the few collections which does not have a real topic. We were having a look in our archives, which is always quite inspirational for us, especially when it comes to the workmanship and the details. We were pulling some [fit] inspiration from there—and same with some of the wash developments.

• On opportunities I personally hope that the customer will appreciate—even more than he’s doing it right now—the fact that we are making our denim production [more] ecologically friendly. This is something we’ve worked since 2018 on…and when we started, it was very heavily pushed by the mills and the laundries, but also the end consumer, especially the younger ones. For them, it’s not just nice to have, but they are really looking for the jeans, or clothing in general, that is made in a greener way.

Jon Geller, men’s president

On the men’s business Men’s, especially when you have a women’s counterpart as big as ours, tends to fly a little bit under the radar. But our business is fantastic, both domestically and internationally. I think we’ve seen a return to sort of classic denim dressing as silhouettes have started to move a little bit wider.

• On fits and washes Slim-straight and straight-leg are our two dominant fits. We saw a lot of guys transition from slim and skinnies into slim-straights, but there’s [also] the group of guys that were already in our slim-straight fit, not moving up to straight legs or relaxed. I think the super relaxed and super-relaxed straight legs have been left to the youngest consumers…Naturally, right now, slim straight is probably our biggest focus as we continue to move forward.

• On non-jean denim styles We tend to bring in our lightest-weight denims and chambray fabrics for summer. In terms of chambray for summer, we have both short-sleeve and sleeve offerings. And [for] a denim jacket, we brought in our lightest-weight denim fabric that we like to use in summer for the hotter months… [We’ll have] two different color offerings—there’s a summer pop color as well as a washed-out indigo for that sun-faded jean jacket look.

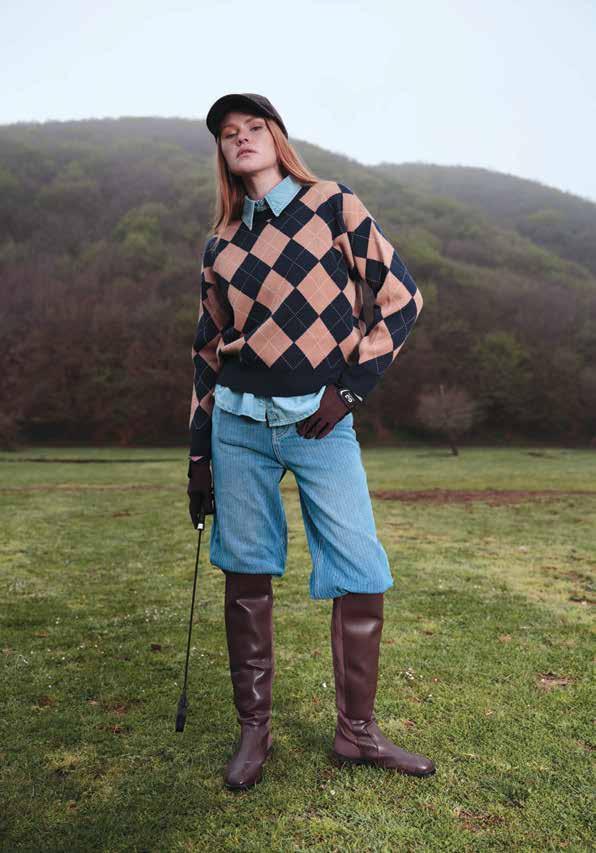

• On inspiration for S/S ’26 Spring and summer have one overarching, holistic theme for us as we move into next year, which is this idea of courtside polished. Sporting events have become fashion shows, not only in the

crowd, but also for the athletes as they enter the tunnel. The two things that grabbed our attention for the upcoming season was one, the U.S. Open last year—the color palette. There was a lot of crossovers with what we were doing: whites, pastel blues and yellows, this idea of courtside polish. And then as we move into summer 2026, we’re going to have the World Cup here in the U.S., and a lot of our design team are big sports fans and big European soccer fans. We pulled inspiration from World Cups from the past… and really leaned into some classic styling for the World Cup.

• On opportunities Most guys aren’t going to go back to wearing sandpaper or rigid denim once shown that you can look as good, if not better, wearing comfort fabrics… We’ve added additional fabrications, but we’re never going to go out and do 100 percent rigid denim. Other brands that do that stuff, and they do it great, [but] we feel that we do stretch and comfort denim better than anyone, and that’s where we want to continue to focus and bring that to the world. I’m yet to find the guy that you know puts it on, looks good, feels good and wants to wear something else.

Eran Kaim

, chief product officer

On the men’s business Since we refined our denim vision and assortment in our F/W ’24 collection, we’ve experienced a strong positive response across multiple markets. Our e-commerce platform continues to lead in denim sales, reinforcing its importance as a primary channel. Retail stores and wholesale

MOST

partners now benefit from streamlined replenishment of key fits and washes, ensuring consistent availability and supporting sustainable growth.

• On fits and washes Our S/S ’26 collection draws heavily from our seasonal theme, Way Out West, showcasing a diverse range of fits. From authentic straight-leg cuts to flared silhouettes and workwear-inspired styles, the lineup reflects a noticeable shift toward looser, more expressive shapes, while still offering classic, timeless options.

Vintage-inspired blues continue to be essential, but this season we’re also introducing standout shades such as sun-bleached and faded yellow tones. These washes capture the essence of a sun-worn desert aesthetic, in line with our collection’s narrative.

• On non-jean denim styles This season, we’ve expanded our offering to include a denim jacquard fabric, crafted into coordinated shirt and short sets that add a unique, textured dimension to the collection. For more classic tastes, our chambray shirts— featuring signature Scotch & Soda detailing— offer a polished yet relaxed option. Additionally, for pre-Spring 2026, we’ve reintroduced our iconic denim jacket, now refreshed with heritage-inspired embroidery in celebration of our 40th anniversary. Seasonal washes will also be available to complement summer styling.

On inspiration Our collection, Way Out West, is inspired by the nomadic charm of Marfa and the boundless creativity of the Texas desert. Marfa embodies a free-spirited approach to living—where art, community and selfexpression unite under vast open skies. This ethos informs our latest collection, distilling desert craft through a modern lens.

Hand-finished embroidery, sun bleached fabrics, washed denim and soft tailoring pay homage to tradition while embracing effortless ease. Rooted in movement and individuality, Way Out West reflects the spirit of the modern nomad—where creativity knows no limits, and the journey is the destination.

• On opportunities We’re observing significant momentum in seasonal trousers, statement shirts and knitted sweaters. Outerwear, in particular, presents strong potential for future growth—both in terms of stylistic innovation and category expansion.

Janice Marks senior vice president of design

On the men’s business Our men’s denim business has remained a strong performer. Guys are shopping the way they always have, with comfort, durability and ease leading their choices. What’s changed is how we’re leaning into that mindset. Spring 2026 builds on those core values but brings in newness where it counts. We’ve expanded our Big Guy assortment with wider silhouettes, new workwear options and the introduction of Big Guy XL. That’s brought new energy to both our wholesale partners and our direct channels.

On fits and washes We’re seeing a strong move toward looser, more relaxed silhouettes. This season includes expanded baggy fits, updated Relaxed Straights with added volume, and more room in the thigh and rise for a better overall fit. A key addition is Big Guy XL, our widest silhouette yet, designed to offer more balance and comfort for larger builds. Long-line shorts are also gaining traction, hitting at the knee with a casual, easy shape.

workwear styles and ultra-wide silhouettes has shown there’s demand for modern denim that’s built to fit real bodies, not just standard sizes. There’s also room to grow in lifestyle dressing. Men are looking for more than just jeans. They want well-made staples like denim jackets, longer shorts, and soft washed tops that add value to their everyday wardrobes.

Vivian Rivetti vice president of global design

On the men’s business: Wrangler has always found strength in its core male consumer, who loves our original Cowboy Cut jeans and some of our other more “traditional” denim offerings. However, we’ve also been able to tap into a newer, and generally younger, male consumer in the past few years thanks in part to the ongoing Western fashion trends. However, we as a brand don’t necessarily see this as a trend, but as something that led consumers to what are now closet staples, like a great pair of jeans.

Spring 2026 features a well-balanced mix of light, mid, and dark washes that tie back to the Coastal Roots theme. Light and sunfaded blues are a standout, with mid-blue shades washed down to feel worn-in and easygoing. We’ve also grounded the collection with deeper tones like clean dark rinses and vintage-fade indigos, which add range and versatility… New this season are washed-down greys, green-grey casts and soft neutrals. These colors layer easily and transition well between casual and more elevated looks.

• On non-jean denim styles We’ve been thinking a lot about how guys want to wear denim beyond just jeans. That shows up in a range of new styles for Spring 2026, starting with the Knit Flex Field Jacket. It’s structured like a classic denim jacket but made from our Knit Flex fabric, so it wears more like a hoodie: soft, flexible and easy to move in. It’s a perfect spring layer and now comes in a wider range of colors to make it even more versatile.

Denim shorts are also a key focus this season. We’ve leaned into longer inseams, wider leg openings and a relaxed, utilityinspired fit. The washes are sun-faded and broken-in, which ties into the laid-back feel of the collection. We’ve added more denim shirts and overshirts too.

• On inspiration The Coastal Roots theme was our starting point. We were drawn to that feeling of being near the water—unrushed, grounded and easy. That translated into denim that feels lived-in from the start, through soft abrasions, faded tones and washes with natural highs and lows.

We also pulled references from ’90s coastal skate and surf culture, especially in the looser fits and long-line shorts. It wasn’t about nostalgia but about bringing that relaxed energy into something wearable today. As always, the biggest inspiration comes from real life, what guys are reaching for and how they want to feel when they wear it.

• On opportunities We see opportunity in reaching more men with better fit solutions. Expanding our Big Guy assortment with new

• On non-jean denim styles: In S/S ’25, we saw a lot of interest in our flare and bootcut jeans, which we attributed partially to Kendrick Lamar wearing flare jeans during his Super Bowl Half Time Show. However, for S/S ’26, the straight leg and looser fits are having a comeback. To match demand, Wrangler will be offering a Greensboro Jean, a straight jean with a mid-rise waist, and a Straight Loose Jean. Lighter washes are on the rise for S/S ’26 and will continue into fall. Our Wrangler brighter blue cast of indigo, whether light, mid or dark wash, has been an ongoing desire for a few seasons already and is continuing. Medium to dark to even raw denim washes are also important to consumers, especially from an occasion perspective; we are seeing more and more denim being dressed up, and the darker washes are amazing for a clean look.

• On non-jean denim styles Thanks to the ongoing Western trend, head-to-toe denim looks or really any look that incorporates denim is popular, and we’re taking that into consideration for S/S ’26… Though our jeans are still our best-selling men’s category, we have seen a lot of interest in our other denim offerings the past few seasons. For example, we’ll have fun new denim overshirts in the spring lineup to offer consumers a variety of denim options.

• On inspiration Always authenticity! Staying true to who you are as a brand and delivering to the consumer what they never knew they wanted.

• On opportunities Though men have historically tended to stick with the style of denim they know, we’ve recently seen an openness to trying new cuts and washes. As a brand that always incorporates its triedand-true pieces as well as new looks into each collection, this is an opportunity for Wrangler to either introduce new consumers to our classic denim (like the Cowboy Cuts) or to get the more traditional Wrangler denim fans into our newer styles. But no matter which style a male consumer ultimately chooses, we still pride ourselves on making sure that all of our denim is approachable from a price perspective, as well as durable and comfortable.

by Alex Harrel

amassing a cult-like following requires cultivating cult-like logic, and at Standard & Strange (S&S), that logic applies to both the brands it carries and the customers it serves. c From a 200-square-foot stable in Oakland, Calif. to a trio of stores in Berkeley, Santa Fe and New York, the retailer has grown by upholding high standards on both sides of the counter—and across coasts. Brands must show commitment to craft and longevity before making it onto the shelves. Customers receive equally exacting service. c S&S began in 2012 on Oakland’s Temescal Alley, where Jeremy Smith and Neil Berrett were creating Cali-made merino wool jerseys. The two met through the Bay Area cycling scene. The partners positioned the shop, located in a rather hip district, as a hub for quality, made-in-America apparel—particularly for denim and heritage styles.

Berrett parted ways with the indie retailer earlier this year. Though the business has evolved, its mission remains unchanged. The once-small indie has grown into a bicoastal men’s wear destination, continuing its focus on USA-made goods and rare brands out of Japan and Europe.

“We have a number of criteria that all need to be met in order to carry a brand of denim,” Smith said. “At one point, we had around 50 choices for fit—probably 100 or more counting variations in denim per style.”

S&S follows a more pared-down strategy for merchandising nowadays. While S&S has tried to carry some big brands like RRL and Red Wing Heritage, the heritage powerhouses were never quite the right fit. “We need that personal relationship in order for the brand to succeed with the way we do business,” Smith said. “If we can’t sit down with the founder or owner and designers of a brand, it’s not for us.”

Also not for S&S? One-hit wonders.

“There are a number of brands out there that, for lack of better words, are rather cynical and opportunistic in their choice to make denim in our category,” Smith said. These are also the brands that tend to drop off, he added; another reason it’s never worth engaging. “We want to work with people who are dedicated to denim and willing to put in the years of work that it takes to make a truly great brand,” Smith said.

That’s also why onboarding brands need to offer something that S&S doesn’t already have.

“There are an infinite number of Japanese denim brands—and denim brands around the world all using Japanese denim,” Smith said. “Very few offer a unique perspective.”

Take, for example, the Vocalion from Black Sign. Made from 100 percent cotton, the highrise, wide, straight leg jean boasts finished seams and bar tacks. It’s one of Standard & Strange’s top-selling jeans. “It’s a unique silhouette while still being legible as a fivepocket,” Smith said. “It’s wide without being overwhelming and has a shape that will still be wearable even after the fashion pendulum swings back to skinny jeans.”

WE WANT TO WORK WITH PEOPLE WHO ARE DEDICATED TO DENIM…” Jeremy Smith

H Standard & Strange has stores in NYC, Berkeley and Santa Fe.

E Freenote Cloth is one of the store’s popular selvedge denim brands.

G OrSlow’s militaryinspired designs are always in demand.

Considering these “nice and hairy” 15-ounce Japanese selvedge jeans cost a cool $300, S&S requires excellence in fit, construction and materials. This is non-negotiable, per Smith, applicable regardless of price point.

“We have significant expertise across our team in denim; we can spot products that don’t meet our standards,” he said. “We also have in-house hands-on patterning and sewing knowledge, which further allows us to dig into how a pair of jeans is sewn.”

On that note, S&S provides hemming, tailoring and repairs for everything it sells. The retailer can renew almost any product it sells, too. As such, cultivating connections with players across the finish line (such as specialty leather shops and shoe cobblers) is of equal value—especially since most of those tweaks are made in-house.

So, what is Standard & Strange’s unique selling point, exactly? Combining stellar service with deep product and brand knowledge, while selling rare and hard-to-find brands from around the world.

“Our commitment to customer service runs deep and starts long before we enter into a relationship with a customer,” Smith said. “For every product online, we photograph it, measure it—by hand, not AI tools— write accurate and complete copy about the garments, and provide fit advice.”

That knowledge is used in-store as well, with staff staying current on all offerings. As it stands, S&S employs 16 people across the three storefronts. The bicoastal company brings as many team members to meet brands worldwide as possible and vice versa, Smith said.

A low turnover rate means employees have opportunities to build personal relationships with clients. These days, those clients are interested in taking things slow. The company’s most popular wash is “Used Wash” from OrSlow. The Japanese label takes its name from designer Ichiro Nakatsu’s desire to make the opposite of fast fashion.

“We mostly sell raw or one-wash denim, because that’s what we specialize in; the few heavily washed styles we have sell out quickly, but we don’t invest heavily in that category to avoid being stuck with excess inventory when the trend toward washed denim ends,” Smith said.

Other popular brands include USAmanufactured Freenote Cloth and the aforementioned OrSlow for its militaryinspired Japanese workwear. For velocity, Ooe Yofukuten takes the cake; Smith said S&S typically sells an entire 80-pair delivery from the Ichinomiya, Japan-based husband-wife duo, within 20 minutes.

“Our current top selling fits are wider—but with a well-fitting waist, rather than an antifit streetwear aesthetic,” he added, noting demand for all fits due to the fragmentation of trends in recent years.

While specialized, S&S doesn’t have a single customer type and refrains from making assumptions based on who walks through the doors of its three stores. Granted, the merchandise is about 80 percent overlapped across the locations, with each assortment dialed in for the local customer base.

“Every time we think we’ve nailed our customer profile, we discover another one,” Smith said. “The only commonality is the appreciation and understanding of quality— whether expressed explicitly or implicitly.”

With DL1961, CEO Sarah Ahmed

shows that style doesn’t have to come at the expense of substance.

when dl1961 was founded by Faisal and Maliha Ahmed in 2008, they weren’t just thinking about denim—they were thinking about the future. Backed by decades of expertise in fabric development from Artistic Denim Mills, the family’s mill in Karachi, Pakistan, the New York City-based women’s, men’s and children’s premium brand was uniquely positioned to rethink how jeans could be designed, produced and worn. c At the helm of the brand is Sarah Ahmed, DL1961 CEO and the daughter of Faisal and Maliha. Through innovative waterless treatments, circular fibers and a growing range of elevated, non-denim essentials, Ahmed—with the continued support of her family—is shaping a future where cuttingedge sustainability meets modern design. c In this conversation, Ahmed speaks with SJ Denim about how DL1961’s vertical integration and multi-generational insight contribute to a business that is as transparent and responsible as it is agile and trendsetting.

Take us back to 2008.

What inspiredthe launch of DL1961, and what gap in the denim market were you aiming to fill?

Sarah Ahmed: When we launched in 2008, the denim market was crowded, but most brands were relying on outdated, unsustainable manufacturing practices and producing jeans that either looked great but weren’t comfortable or were comfortable but didn’t hold their shape. We saw a clear opportunity to create premium denim that combined fashion and function—using innovation in fiber and fabric technology to design jeans that fit well, feel incredible, and are made responsibly.

How has your vision for the brand evolved since its launch?

SA: In the beginning, our focus was on making technically advanced jeans that solved fit issues. Over time, that vision has expanded to building a sustainable, vertically integrated essentials brand that challenges the fashion industry’s broken systems. Today, DL1961 is not just about great-fitting denim—it’s about creating a more responsible model for how clothes are made, from fiber to finished garment, while continuing to innovate in design and category expansion.

Can you walk us through what vertical integration looks like at DL1961—from raw fiber to finished product?

SA: All of our denim—from fiber to finished garment—is manufactured in our familyowned factory. We own and operate every step of the process, starting with spinning certified sustainable fibers into yarn, weaving them into fabrics, and cutting and sewing the final garments. Along the way,

by Angela Velasquez

we use advanced water recycling systems, solar-powered facilities, and state-of-theart finishing technologies that dramatically reduce water chemical use.

By overseeing the full supply chain, we’re able to prioritize traceable, scalable practices that minimize environmental impact without ever compromising on quality. Vertical integration also allows us to continually invest in new sustainable technologies and audit at each stage for accountability. And as we’ve expanded beyond denim, we’ve built a network of like-minded, highly vetted partners to produce the industry-leading knits and wovens that round out our wardrobe essentials.

How does DL1961’s vertical setup benefit the business?

SA: It gives us stability, agility and sustainability. Because we manage our own supply chain, we can better control costs, avoid many of the disruptions that impact brands reliant on third parties, and protect our margins even in volatile markets. It also allows us to scale innovations quickly—for example, implementing water recycling across facilities or developing proprietary fabric blends. And most importantly, it lets us stay true to our sustainability commitments because we aren’t outsourcing critical processes.

Have recent tariff policies impacted your sourcing or pricing strategy, and how has vertical integration helped buffer those effects?

SA: Tariff shifts always impact the industry, and we are no exception, but our vertical model does help insulate us to a degree.

DL1961 continues to expand into new categories. What’s your strategy for product expansion? Which are proving to be successful?

SA: Our expansion strategy is driven by our customers—they look to us for high-quality, versatile wardrobe staples for every stage of life, so we’re building out adjacent categories that complement denim, like tailored separates, shirting, outerwear, and kidswear. Denim remains the core, but categories like jackets and elevated everyday essentials have been especially successful, since they align with how people are dressing today.

When working outside your vertical denim setup, what specific qualities do you look for in suppliers and factories?

SA: We look for partners that share our values around sustainability, transparency and innovation. And beyond that, they have to deliver the quality that our customer expects from us. We have an amazing team who sources and explores partnership with different factories. It takes lots of trial and error to find an optimal partner.

What are some consumer trends that are shaping the future of denim right now?

SA: We’re seeing two major shifts. First, consumers expect jeans to feel effortless. Comfort, all-day wear and versatility are non-negotiables—and they also want to know how their clothes are made. Traceability and responsibility have moved from “nice-to-have” to essential. On the style front, the market is broadening in exciting ways. Relaxed and baggier fits continue to resonate, but for Fall ’25 we’re also seeing a strong return to tailored wide-leg silhouettes with clean, elongating lines that balance ease with refinement. Barrel and curved shapes are gaining traction as well, offering a sculptural, fashion-forward update that still works for everyday wear. And interestingly, after several seasons of looser fits dominating, there’s renewed appetite for refined skinnies—sleek and streamlined styles that pair perfectly with staples like knee-high boots, structured outerwear, and oversized knits.

Over the years, DL1961 has worked with notable influencers and models, partnered with Frieze London and collaborated with other brands. What is the brand’s current marketing strategy? And what is proving to be the most effective way to connect with consumers?

SA: Our most effective strategy has always been rooted in authentic storytelling. Whether that’s through collaborations, cultural partnerships or digital campaigns, we focus on highlighting the innovation and intention behind each product. We’ve found that consumers connect most when they understand the “why” behind our collections—why a fit was designed the way it was, or why a certain sustainability initiative

NEVER UNDERESTIMATE THE IMPORTANCE OF SUPPLY CHAIN—HOW YOU MAKE SOMETHING IS JUST AS IMPORTANT AS WHAT YOU MAKE.” Sarah Ahmed, DL1961

matters. For the upcoming year, we’re focusing on partnering with talent that resonates with our audience and with collaborators that bring something fresh to our assortment, while still speaking to our core customer. We have a well-rounded mix of marketing efforts lined up for the next year and we can’t wait for everyone to see them roll out.

What’s one piece of advice you’dgive to someone looking to build a fashion brand today?

SA: Start with your values and build around them. The market is too saturated to succeed with product alone—you need a clear purpose that resonates with consumers and guides your decision-making as you scale. And never underestimate the importance of supply chain—how you make something is just as important as what you make.

Where do you see DL1961 in the next five to 10 years?

SA: We’ll continue to push the boundaries of what sustainable fashion can look like. That means expanding globally, growing our lifestyle categories, and investing in new technologies that make production even more efficient and responsible. Ultimately, my vision is for DL1961 to be a leader not just in denim, but in reimagining how the entire fashion ecosystem operates. Beyond that, we’re excited to see DL1961 continue to evolve as a lifestyle brand, entering new categories that fulfill a need for our customer.

Do you have a favorite pair of DL1961 jeans—and what makes them special to you?

SA: Right now, I’m living in our Kaylen High Rise wide-leg. It’s polished enough to dress up, relaxed enough for every day, and really captures the balance we always strive for: timeless style, modern comfort, and sustainable design. When I’m looking for something a little more polished and elevated, I reach for our Kristy High Rise.

What’s the story behind DL1961’s name?

SA: “DL” stands for Denim Limited, and “1961” is the year my father was born. We’re a family business through and through, and there’s always a funny story behind every decision. My mom came up with the idea for Denim Limited, then when my dad went to register the name, he added 1961. Plus, it adds up to 8 in numerology, which means infinity. Very apt for a sustainable company aiming for circularity.

In what ways is DL1961 still a family business?

SA: DL1961 is very much a family business, and that spirit of family is embedded in everything we do. Over the years, we’ve expanded and brought in other company leaders, but my parents and I still work together every day to run the company. I have two siblings who are involved in the business as well, so there really isn’t much of a separation between our family life and our professional lives. My father built the foundation of our manufacturing business more than three decades ago, specializing in innovative denim fabrics made with stateof-the-art, sustainable processes. Today, I lead DL1961 along with my mother, and we continue to make decisions together with the same long-term, values-driven approach. That heritage allows us to combine decades of technical expertise with a forward-looking mindset—delivering jeans that embody the perfect fabric, fi t, and function while using significantly less water, dyes, and energy than traditional denim. For us, it’s never been about building for the next season—it’s about building for the next generation.

From home goods to beauty, denim brands are diversifying their offerings to meet consumer demand and drive new revenue.

by Andre Claudio

despite consumers becoming more cautious with spending and rising production costs squeezing profit margins, denim brands have emerged as one of the few players still showing growth.

Levi Strauss & Co. had a strong start to the year with net revenues up 3 percent on a reported basis and 9 percent on an organic basis compared to the first quarter of the year. The Levi’s brand alone posted an 8 percent increase in organic global sales.

Wrangler also notched gains, with global revenue up 3 percent to $420 million, while Gap Inc. saw a 2 percent rise in both net and comparable sales, totaling $3.46 billion in the first quarter of fiscal 2025.

The momentum isn’t limited to a handful of players either. The global jeans market is projected to reach roughly $91.2 billion this year, with steady growth expected in the years ahead, according to the Denim Jeans Market trends analysis report.

So, with denim showing no signs of slowing down, what factors are fueling its resilience in a market where most categories are losing steam?

Well, according to Greg Petro, CEO of First Insight, the denim players seeing the strongest momentum are the ones expanding their offerings and services beyond jeans.

“What we’re seeing isn’t just diversification for revenue’s sake—it’s about loyalty, frequency, relevancy and pulling the next generation into the brand,” Petro told SJ Denim. “Denim is often a seasonal or twice-ayear purchase, but categories like beauty and accessories are bought far more frequently and are generally considered lower risk. If retailers can get a shopper to add a fragrance, mini lip gloss or travel spray while they’re buying jeans, you’ve grown both the trip frequency and the basket size.”

For Citizens of Humanity, product expansion was an opportunity for the Los Angeles-based brand to bring its regenerative agriculture story into home goods. In August, the brand partnered with Moda Operandi to launch an exclusive line of denim placemats, napkins, coasters a farmer’s market tote and apron.

A press trip last year to Bloom Farm, a 300-year-old property in Pennsylvania’s Oley Valley, hosted by Citizens of Humanity, inspired the collection.

Licensing deals are another way that denim brands are extending their reach into new categories.

Wrangler offering everything from blankets and pillows to sheets, luggage, duffel bags, knives, lunch boxes and more through licensing partnerships. By diversifying into these categories, the brand is strengthening its position as what Douglas Parker, director of licensing at Wrangler, calls a “360 lifestyle brand—one that builds the kind of loyalty that can last generations.”

“The ‘Wrangler way of life’ isn’t just about what you wear; it’s a mindset rooted

in authenticity, comfort and durability,” Parker told SJ Denim. “By offering products like bedding and home décor, we’re not just selling a blanket or a pillowcase. We’re providing a way for our loyal fans to infuse their homes with the same heritage and quality they trust in our denim. It’s about taking the feeling of a well-worn pair of Wrangler jeans and extending that comfort into the most personal spaces of their lives.”

WITHit.

The Kontoor Brands-owned label recently partnered with companies like tech accessories company, WITHit, to launch Apple Watch bands and phone cases.

“This expansion is about creating new touchpoints for consumers and deepening their emotional connection to the brand,”

Joe Broyles, vice president of collaborations at Wrangler, told SJ Denim. “When a customer can find a Wrangler-branded product in multiple areas of their life…it reinforces the idea that Wrangler is a trusted companion for any adventure [and] turns a product purchase into a brand relationship.”

Broyles added that Wrangler is “Essentially transitioning from a brand people wear to a brand people live. This strategic expansion allows us to extend our brand equity and connect with consumers in a way that goes far beyond a single pair of jeans, building a more expansive and enduring legacy for the next 75 years.”

The strategy has also paid off for partners. WITHit calls its licensing deal with Wrangler a “pivotal moment for the business.”

“rigorous, multi-stage approval process” to ensure every licensed product upholds the brand’s quality and design standards.

Beyond revenue, the company also measures success through social engagement, repeat purchases and cross-category shopping— whether that’s a customer who first encounters Wrangler through a collaboration and later returns for denim or home goods.

“For us, a strong licensing partnership isn’t just a business transaction; it’s a deep, strategic connection. The most important factor is finding a partner who truly understands and respects the brand’s core values,” Parker said. “It’s not about slapping a logo on a product—it’s about ensuring the licensee shares our commitment to quality, authenticity and the ‘Wrangler way of life.’ We look for partners who can translate the rugged durability and timeless style of our denim into their own categories, whether that’s footwear, home goods or other lifestyle items.”

Lee is also expanding reach through new licensing deals.

Last year, the Kontoor Brands-owned U.S. heritage brand announced that it entered a licensing agreement with U.S. footwear manufacturer, wholesaler and retailer Jack Schwartz Shoes, marking the first major expansion into footwear for the brand.

While the line hasn’t officially launched yet, Steve Armus, Kontoor’s vice president of global licensing and collaborations, said it focuses on contemporary takes on athletic and casual styles including a classic court sneaker, basketball and skate-inspired designs, a casual comfort/city sneaker and a heritage lace-up boot inspired by ’90s footwear. He added that each style balances style and value, offering a variety of options for our customers.

“Our partners align with our commitment to quality and craftsmanship and appreciate the heritage that Lee has. They understand our target audience, and how the brand is evolving through our new creative vision and the global ‘Built Like Lee’ campaign,” Armus said. “[Like Lee], Jack Schwartz Shoes has

WHAT WE’RE SEEING ISN’T JUST DIVERSIFICATION FOR REVENUE’S SAKE— IT’S ABOUT LOYALTY, FREQUENCY, RELEVANCY AND PULLING THE NEXT GENERATION INTO THE BRAND.” Greg Petro, First Insight

“[Wrangler] embodies a legacy of authenticity, craftsmanship and durability that has resonated with generations of consumers,” said Bill Devaney, chief operating officer and co-founder of WITHit. “By extending their influence into wearable technology accessories, we’re giving consumers the chance to experience the brands they know and love in fresh and relevant ways.”

Expansion comes with a cautious approach. According to Parker, Wrangler uses a

a long-standing heritage and is an expert in this industry. They understand how to create quality products that provide value.”

Furthering its commitment to outfitting customers beyond denim, Lee has also branched into home goods and travel accessories, including luggage. Most of its accessories today—including socks, belts, wallets and hats, to name a few—are designed to complement its mainline collections, according to Armus, and are distributed both through Lee.com and mid-tier or value retailers.

“It’s important to understand our target audience and what they want,” Armus said. “Our global ‘Built Like Lee’ campaign is grounded in research on today’s denim enthusiasts and how they’re discovering Lee.”

Other denim players are taking a different route, moving into entirely new markets like beauty, which is projected to surpass $100 billion in revenue this year, according to Euromonitor.

Just last month, Gap Inc. announced its expansion into beauty and accessories, calling it a way to reinforce [its] commitment to

becoming a high-performing house of “iconic American brands that shape culture.”

Gap’s entry will begin with a “test-andlearn” rollout at Old Navy this fall, including curated assortments of beauty and personal care products in 150 stores. Select locations will feature dedicated shop-in-shops staffed by Beauty Associates. By 2026, Gap plans to scale the business within Old Navy while introducing “brand-right” beauty concepts across its broader portfolio, the brand noted.

The company will also merchandise its private-label products alongside established names like e.l.f. and Mario Badescu—a move analysts say can help build shopper trust.

“When a private-label line sits next to established names, it gives shoppers permission to believe the quality is there,” Petro said. “But credibility alone isn’t enough—discovery has to feel easy and low-risk. That’s why trial sizes, bundles and introductory offers are so effective; they make it simple for shoppers to experiment. And when those products are tied to the core shopping mission—offered as an add-on to apparel or accessories—it builds trial, bigger baskets and loyalty across categories.”

On top of beauty, Old Navy reintroduced its handbag range—the brand’s most cohesive lineup to date. Spanning three collections, the bags offer refined materials, clean lines and thoughtful utility details.

“We drew inspiration from beloved designer styles, but made each piece uniquely Old Navy, creating a cohesive assortment that can’t be found anywhere else. Our goal was to create durable bags designed for every moment in life—all at an accessible price point that delivers incredible value,” said Zac Posen, Old Navy chief creative officer.

While expanding into new categories seems to be paying off for Kontoor and Gap Inc., not every apparel brand will be successful.

In fact, nearly 80 percent of new products fail, Petro noted, often because retailers lean too heavily on instinct or chase fleeting trends. The rare successes, he added, are the brands that bring customers into the process from the very beginning.

“Retailers must ask consumers what feels authentic, test concepts and validate pricing and positioning. When customers and artificial intelligence [AI] are part of the process, the odds of success rise dramatically,” Petro said.

“Expanding into new categories is not just about adding more stock keeping units [SKU]— it’s about extending a brand’s identity in a way that feels natural to the customer. The retailers that succeed will be the ones with a strong community, a clear lifestyle point of view and the discipline to execute consistently.”

Success will also hinge on how well brands connect with the next generation of shoppers.

Petro noted that younger consumers— specifically Gen Z, with an estimated global spending power of more than $450 billion in 2024, and Gen Alpha, whose annual direct spending power topped $100 billion by mid-2025, according to Statista—see brands as more than just product providers. To them, Petro said, brands function as cultural markers.

“Gen Z and now Gen Alpha expect the brands they trust to extend naturally into other parts of their lives, and they’re quick to reward those that feel authentic in doing so,” Petro added. “That means loyalty isn’t tied to a single category, but to whether a brand reflects their lifestyle and values—a much higher bar, and one that only a handful of apparel players are likely to clear.”

Vintage festivals and markets are more than just shopping events—

they’re spaces where sustainability, community and creativity intersect.

once a niche pursuit for collectors and creative outliers, vintage fashion has exploded into the mainstream— driven by new festivals and markets that showcase secondhand style and promote sustainable consumption. c Beloved events like Brimfield Antique Flea Market, —a multi-day treasure hunt for antique fashion and furniture held in New England three times year— A Current Affair, which welcomes a wide cross-section of vintage vendors on the West and East Coast, and ThriftCon, the traveling exhibition of vendors specializing in ’70s to 2000s clothing and collectibles, have not only grown in popularity but also inspired a new host of events celebrating vintage culture, sustainable fashion, and niche collecting communities across the country.

Vintage has reached critical mass—perhaps even oversaturation—a shift that surprises some longtime dealers, according to Abe Lange, founder of Distressed Fest. “Vintage used to be this very eclectic, off-the-beatenpath interest like folk art and craft. And now we’re seeing young bro types who would have been into sneakers five or 10 years ago now getting into vintage,” he said.

This rise in vintage festivals reflects more than changing tastes—it signals a generational shift in shopping habits. Ryan Smith, founder of Pensacola Vintage Collective, said young consumers are turning away from mass retail in favor of peer-to-peer exchanges, where every seller and purchase tells a story.

As awareness of fast fashion’s environmental toll grows, it’s weighing more heavily on consumers—especially younger ones. With many sustainable brands priced out of reach, vintage shopping has become a popular, ecofriendly alternative. “Younger generations feel a moral responsibility,” said Sarah Frick, founder of Time Travelers Vintage Expo. “For them, supporting fast fashion or dismissing secondhand clothing is almost unthinkable.”

Expressing individuality through fashion is also more celebrated by younger people. Distressed Fest was born from Lange’s passion for vintage fashion, which began in his teenage years in North Carolina, and from a growing frustration with the sameness of the vintage festival circuit.

Determined to shake things up, the now 28-year-old, who also serves as a vintage clothing appraiser on PBS’s “Antiques Roadshow,” set out to create the kind of event he wanted to attend. At Distressed Fest, shoppers can find almost anything with “visible history” like patinas or repairs. Most pieces are from the 1940s to the 1980s, though there are some items from the 1890s that have come through.

Beyond denim, shoppers can find graphic tees, old sweatshirts and vintage French and European workwear—like canvas chore jackets and trousers splattered with paint. “Some vendors are super on-brand and sell exclusively this kind of stuff. And others will bring a curation of their distressed stuff, plus whatever flavor they can add to it,” he said.

What you won’t find at Distressed Fest is Y2K or ’90s band tees. While technically vintage because they’re over the 20-year mark, Lange said Distressed Fest “is a little bit more nuanced than that.”

Indeed, the vintage scene is splintering into two factions—an “old guard” focused on “true vintage” (typically pre-1975), and a newer wave embracing broader eras, including ’90s and 2000s fashion.

Distressed Fest debuted in Brooklyn in March 2024 with 10 curated exhibitors. Its success led to a fall expansion in Los Angeles with over 40 vendors. To support the West Coast edition, Lange partnered with local vintage dealer Connor Gressitt.

Since then, second editions have been held in both cities, with strong attendance and celebrity interest. Lange said vendors— including some from as far away as France—have praised the event’s gallerylike atmosphere and the engaged, thoughtful shoppers. Drawing musicians, visual artists and other creatives, Distressed Fest has a community-driven atmosphere, where vintage fans can geek out over pieces. “Our event is more tantamount to people who are leading an examined life and want something that’s meaningful to them and makes them happy to see,” he said.

Most of the aged garments at Distressed Fest fall short of traditional valuations and are less likely to have an established book value. “You can’t look up a completed eBay listing to see what it goes for. A lot relies on gut feeling and aesthetic sensibility from other things,” Lange said.

It’s a sharp contrast to the typical vintage market scene that he described. “A lot of shows have the same energy where people are running in, looking to find steals. They are primarily vintage dealers buying from other vintage dealers, which is both weird and a little incestuous and unsustainable,” he said.

Smith acknowledged that the vintage scene can be competitive, saying, “This is a very cannibalistic world.” But as a vendor at other events, he sees the benefits. “As the vendor, you don’t really mind,” he said, pointing out that at the last Pensacola Vintage Collective, some vendors made up to $1,000 just on setup day—selling exclusively to each other.

This peer-to-peer model benefits both parties, allowing sellers to offload inventory

while ensuring items reach the right audience. For example, Y2K fashion like baby-doll tees and low-rise jeans is a hot commodity in Pensacola. The event draws a wide mix of vendors, from Western and rockabilly specialists to Levi’s collectors and T-shirt dealers. “Everyone gets to celebrate their niche passion. It’s like a walk down memory lane, even if you don’t buy anything,” Smith said.

Amy Abrams, founder of Shop Extraordinary Enterprises—the parent company of Artists & Fleas and Manhattan Vintage—is driven by the evolution of the vintage market. When she acquired Manhattan Vintage in 2021, a 25-yearold event held three times a year in New York City, she recognized its deep roots in the industry. “The previous owners were pioneers who really put it on the map,” she said.

Originally known as an insider event catering to stylists and collectors, Abrams saw an opportunity to broaden its reach. Her vision was to transform Manhattan Vintage into a retail experience that is accessible to a wider audience beyond just industry professionals. Rigid definitions of what qualifies as vintage can take the fun out of the hunt— and run counter to the spirit of conscious consumption. “I think any opportunity for people to wear and consume things that exist already is really positive,” Abrams said. That philosophy drives her inclusive approach to curating vintage—offering a wide range of eras, styles, and price points. “People respond to different things,” she explained, emphasizing that vintage means something different to everyone. “For some, having something that’s 50 years old is really important. For others, it’s just about finding something they absolutely love.” Her goal, she added, is to “invite everybody to the table who’s interested in buying things that exist already.”

Extending the flagship event from two days

IT’S LIKE A WALK DOWN MEMORY LANE, EVEN IF YOU DON’T BUY ANYTHING.”

E Distressed Fest draws collectors, artists, musicians

to three days and curating a wider variety of dealers—90 in total—has enhanced the Manhattan Vintage experience. Abrams has also introduced smaller pop-up events such as a denim edition in New York City and destination markets in the Hamptons and Austin, Texas.

“I think that vintage is the future of fashion. The more that people have access and opportunities to buy vintage, the better,” Abrams said, adding her goal is to grow the vintage community—not just by supporting our existing dealers who are eager to reach new cities, but also by bringing the unique Manhattan Vintage experience to new audiences across the country.

Smith, who also runs Obsolete Heat Vintage Clothing, launched the Pensacola Vintage Collective in July 2024 after years of hosting smaller markets. The first event featured 50 vendors. The second, held this summer, expanded to 75 and attracted nearly 3,000 attendees, with vendors traveling from cities like New Orleans, Atlanta, Nashville, and Mobile.

“Pensacola is not a particularly giant market, but, you know, the need is there,” Smith added.

While cities like New York and Los Angeles remain meccas for vintage, markets are trickling into mid-size cities and smaller ones.

Appealing to all ages with products that span decades, Time Travelers began in 2022 as a small local market held in the backyard

I WORRY ABOUT HOW LONG WE REALLY HAVE UNTIL THE GREAT STUFF BECOMES IMPOSSIBLE TO FIND.” Adam Irish, Threadbare Show

of a Tulsa bar. It now takes place across 16 cities in the Midwest and Southwest. “We call them the ‘underdog’ cities, where maybe they don’t have as much access to vintage stores, or they don’t have a very established vintage community. We always have done well in those cities because I think the people there are hungry for it,” Frick said.

While Frick said it varies by city, most Time Travelers events showcase an equal number of local businesses and vendors trying to reach new markets. “Every city we go to, we pick up new people on the caravan that start traveling with us, and we have seen growth every year,” she said.

Regional demand plays a big role—what sells in one city might be overlooked elsewhere. L.L. Bean staples may appeal to New Englanders but hold little sway in the South, where Nascar T-shirts are prized, Smith said. Team merchandise, too, fluctuates in value based on geography. “Some teams are so hot, they go for so much money. Then you go 500 miles down the road and nobody cares about it,” he said.

Lange pointed out that vintage, once resistant to fashion trends, is now seeing regionally distinct preferences emerge. In New York, demand is skewed toward sleek, wearable black fashion. On the West Coast, shoppers gravitate toward hippie and rockabilly styles, though graphic tees remain universally popular. Even international buyers are rethinking their approach. “It’s been fun to see the transition of how people think about [vintage],” he said, referencing how Tokyo-based dealers are now considering more tattered items once overlooked.

The Threadbare Show emerged from Adam Irish’s years vending at the Sturbridge Show. More of an antiquarian show for vintage clothing, antiques and textiles, Sturbridge drew an industry audience of dealers and fashion designers. However, the event has changed as the clientele for traditional antique textiles aged out.

To fill that void, Irish launched Threadbare in 2021. The market features vintage and antique textile dealers selling across categories—men’s and women’s vintage, early fabrics, quilts, advertising, and more. Held in Southbridge, Mass., just before Brimfield, it also travels to Brooklyn each June.

Vendors at Threadbare range widely, offering goods from the 19th century through the 1970s, with occasional ’90s “strays.”

“The thing about vintage is, it’s just a matter of time. Eventually, everything becomes true vintage,” Irish said.

Still, he stressed that older garments typically offer superior construction. “There’s a remarkable change in quality that occurs basically from the mid or early ’90s going forward. The quality of manufacturing is nothing like it once was,” he said. “Take a brand like Banana Republic, for example— what they produced in the ’80s and early ’90s is a completely different caliber of quality compared to what came later. It’s like comparing apples to oranges.”

While pieces like denim and workwear can last generations, not all Y2K items may stand the test of time. He added, “I worry about how long we really have until the great stuff becomes impossible to find.”

Despite clear divides between “true vintage” and newer interpretations, organizers share a purpose: to keep clothing in circulation and encourage conscious consumerism.

Frick envisions vintage festivals becoming key dates on the shopping calendar, much like the back-to-school season. “I would love to see people really save up and plan for these kinds of events so that they can do as much of their shopping secondhand as possible,” she said.

Irish is optimistic about the resurgence of vintage, especially as the older generations of antique dealers fade away. “I’m 39 and I would consider myself one of the oldest people in the room,” he said. “What’s exciting about the vintage clothing space is that there are so many young dealers interested in getting involved, and it’s a very vibrant market for younger folks.”

Festivals and markets are also economic lifelines for small businesses, many of which began during the pandemic when unemployment soared. Smith added that most vendors are one or two-people operations, and for many, vintage is their side hustle. And as Irish pointed out, these gatherings also double as networking spaces where new relationships form—and sometimes lead to collaborations with major designers.

At the heart of it all is a shared love for vintage and the community it fosters. “I’m just really happy that we’ve created this environment for vintage,” Lange said. “Connor and I both had a love for this stuff, not just when it was worth less, but when it was literally worthless. We were into it before it was good business, so it’s nice to see how it’s paid off.”

by Jessica Binns

along a quiet strip in kurashiki , Japan, known as Kojima Jeans Street, denim purists from around the world make their pilgrimage. It’s not just a shopping destination—it’s a living museum of Japanese craftsmanship, home to some of the finest selvedge denim in the world and city buses wrapped in Jeans Street branding. Yet, while the indigo-dyed legacy remains strong, Kojima’s denim culture is undergoing a transformation, shaped by shifting customer preferences, global demand, and the pressures of succession in a labor-intensive industry. c Once considered a niche destination for denim aficionados, Kojima is now enjoying a moment of renewed visibility. The coastal city, long known as the birthplace and bedrock of Japanese jeans, is churning out more denim than ever, thanks in part to the post-covid rise in e-commerce and international collaborations. But the real story lies in the streets: who’s keeping the legacy alive, what’s changing, and what Kojima’s future might look like.