March 2025

Forewords

1 An Introduction to Equiniti and its approach to Breaking Down Barriers 2 Breaking Down the UK’s Barriers

3 Benchmarking Equiniti’s Activity Against the Purpose Goals 4 Analysis 5 Recommendations and Next Steps

Financial resilience has never been more important. Post-pandemic, the country is still facing multiple economic and social challenges against a backdrop of continuing geopolitical uncertainty. Families and businesses are facing difficult financial decisions. On an individual and a corporate level, we need to ensure that we are as prepared as possible to weather the financial ups and downs of life, and confident enough in our understanding of the tools available to us that can help strengthen our hand.

Poor financial resilience nearly always accompanies poor social mobility, a feature of this country for decades, and its impact is felt most keenly by the disadvantaged and underrepresented. An inability to access savings or to be able to plan for the future will mean people cannot achieve the milestones in life that many aspire to - like buying a car or owning a home. It’s a significant barrier to opportunity and getting on in life. It’s also a huge waste of talent –that’s not only a personal loss for the individual but an economic and social loss for the country.

The financial services sector has a key role to play in making opportunity more accessible. Contributing 12 per cent to the UK’s economic output, it has the potential to play an important part in creating opportunity for individuals, families and communities across the country. That can be through the products it offers, the careers it can provide or the contribution it makes to a more digitalised business environment.

This report showcases how Equiniti is rising to the challenge of extending its social impact, building on its existing activities to make a tangible difference on the ground. The best purpose-led companies are intentional in exploring their capacity to drive change wherever they can, using their expertise and knowledge to create opportunity.

First and foremost for Equiniti, that means demystifying their operations so that the services they offer, and the opportunities they can create, are clear to the public, potential clients and policymakers. As a business which manages portfolios that range from pounds to millions, the report highlights its ability to deliver tailored solutions for everyone, regardless of worth.

The provision of inclusive and tax-efficient savings and the championing of education that improves financial literacy helps individuals of every income level develop greater resilience and stability, benefiting not just large corporates but also those in smaller enterprises or part-time roles. Offering transparent, straightforward pathways to saving and responsible borrowing enables people to invest in their future, reinforcing a more financially secure and equitable society for everyone.

The report also demonstrates how, even in difficult times, businesses can remain ambitious and determined to turn challenges into opportunities. Equiniti has shown itself willing to adapt to meet changing market demands and I hope our partnership has encouraged it to play an even greater role in delivering a positive social impact for its clients, its colleagues and the communities it serves.

The Breaking Down Barriers Commission was established to identify the obstacles that prevent people from getting on in life. Whether that is in early child development, workplace inclusivity or good health and wellbeing, they can stop people from accessing the sort of opportunities that would change their lives for the better.

Under a government which has made economic growth a key ambition, businesses have an important role to play. In addition to generating profits and dividends, they have a redefined role, operating as forces for good in the communities they serve, to address often deep-rooted and long-standing inequalities and to boost social mobility.

In a sector critical to the economy - the financial services sector - it is crucial that businesses work with government to tackle the key drivers of poor financial resilience, a barrier which has such

significant consequences for individual, business and national economic growth. At a time when pension reform in particular is under the spotlight, transparency and clarity are essential for clients, large and small, to understand the options available and the benefits likely to accrue.

Digitalisation will be integral to the success of any planned reforms. This report shows how Equiniti is working towards inclusive digital initiatives, accessible platforms and transparent AI use to expand digital literacy for individuals from all backgrounds, beyond its own operations. Its initiatives contribute directly to its broader efforts to improve financial resilience and signal that as a business it can have a much wider role as an industry and sector leader.

The report also highlights the range of work it undertakes to help people find positive and sustainable career pathways in the financial services sector regardless of academic background, to enable fair and equal routes into employment that tap into a much wider and more diverse talent pool and to foster an environment where colleagues can progress and thrive, in their jobs and in their wellbeing.

The Breaking Down Barriers Commission, which I chair, brings together like-minded businesses which are committed to delivering positive social impact and reducing inequality. Our partnership allows us to share best practice, develop innovative solutions, measure progress and identify areas for further growth. This approach provides a strong foundation for engagement with government and policymakers to shape a fairer society. Equiniti’s achievements – and its willingness to go even further in its efforts– mean that it can play a full part in creating opportunity which delivers meaningful change.

In today’s rapidly evolving financial landscape, resilience is more critical than ever. As the UK navigates economic uncertainty and shifting regulatory frameworks, individuals and businesses alike face increasing complexity in managing financial risk. At Equiniti, we recognise the vital role that financial resilience plays in enabling social mobility, economic stability, and long-term prosperity.

Financial resilience is not just about managing risk; it is about providing people and businesses with the tools, knowledge, and confidence to make informed financial decisions. A lack of access to savings, responsible credit, or financial education can be a significant barrier to opportunity. Addressing these challenges is essential if we are to foster a society where everyone, regardless of their background, has the chance to build a secure future.

Equiniti is committed to breaking down these barriers by championing financial inclusion, demystifying complex financial processes, and delivering accessible solutions that empower individuals and organisations. Whether through our administration of tax-efficient savings plans, our digital transformation initiatives, or our advocacy for transparent, customer-centric financial services, we are dedicated to ensuring that financial security is within reach for all.

Risk management sits at the heart of this mission. By embedding responsible financial practices into our services and operations, we help our clients, employees, and communities navigate uncertainty with confidence. From leveraging digital innovation to simplifying financial transactions to ensuring robust governance structures that protect customer interests, we continuously strive to make financial systems more resilient, equitable, and effective.

This report highlights the work Equiniti is doing to support financial resilience and social impact. It showcases our efforts to widen access to responsible financial products, invest in financial education, and foster a culture of inclusion within our organisation and beyond. As a business that plays a crucial role in the UK’s financial infrastructure, we remain committed to driving positive change and shaping a financial ecosystem that works for everyone.

We are proud of the progress we have made, but we know that there is always more to be done. By working collaboratively with policymakers, industry leaders, and our communities, we will continue to build on this foundation—ensuring that financial resilience is not a privilege, but a fundamental right for all.

Equiniti is a leading provider of share registration, pension administration and remediation services, operating at the heart of the UK and US financial systems, supporting over half of the FTSE100 and 35% of the S&P 500. Trusted by some of the world’s largest organisations, including Lloyds Banking Group, Tesco and EasyJet in the UK, and General Electric and Berkshire Hathaway in the US, Equiniti manages critical financial infrastructure, supporting millions of individuals and institutions.

Its role encompasses maintaining share registers, facilitating the smooth management of retail shareholdings, supporting companies taking their first steps into public markets through IPO, and serving as one of the largest payers of pensions in the UK - delivering payments on behalf of both public and private sector clients.

The company plays a vital role in enabling financial stability and growth, particularly for retail investors and pensioners. Through its share registration services, Equiniti supports retail holders with portfolios ranging from a few pounds to millions, offering a reliable and efficient platform for managing shareholdings, whilst advocating within the industry for further digitisation and enabling the shareholder voice. In pensions, Equiniti handles complex administration and payment systems, ensuring individuals receive their entitlements promptly and accurately. The business is also involved in the retail share offering market, reflecting its ambition to provide cost-effective, high-quality services that meet evolving market needs.

To ensure continued standards, parts of the Equiniti business are regulated directly by the Financial Conduct Authority (FCA), and Equiniti colleagues undergo regular compliance training to deliver a continued protection of assets to the highest standards.

Despite its services benefiting 33 million shareholders, pensioners and customers globally, Equiniti is better known to corporates than to the general public.

Equiniti is focused on demystifying its operations and building public trust. The company highlights the real-world benefits of its services, such as enabling individuals to use their shareholdings to fund major life milestones like purchasing a first home. By crafting relatable, human-centred narratives, Equiniti demonstrates how its work impacts ordinary people, dispelling the notion that share ownership and pensions are only for the wealthy. Engaging MPs and their constituents is a critical component of this strategy, with Equiniti developing tailored content and collateral to explain its services clearly and succinctly.

As part of its strategic evolution, Equiniti is undergoing a significant digital transformation, ensuring its services remain accessible, efficient, and innovative. Equiniti is adapting to significant market pressures, including the need for digital transformation and rising labour costs. Viewing these challenges as opportunities, the company is digitising its services, refining processes, and embracing innovation to remain competitive. This includes developing seamless online platforms and apps for share registration and pension management, whilst keeping shareholders and pensioners secure through enhanced digital verification. These digital tools enhance customer experience while reinforcing Equiniti’s position as a forward-thinking leader in the financial services industry.

These advancements reflect the company’s dedication to meeting the needs of its customers while navigating the complexities of modern financial services. Equiniti prioritises a product-led and agile approach, leveraging data to create easy and accessible journeys for customers.

Central to Equiniti’s adaptability is its commitment to employee development. Employees are encouraged to take on new responsibilities, supported by robust internal training and promotion programmes. This not only enhances organisational agility but also empowers employees to advance their careers while contributing to Equiniti’s success.

Within its remediation service offering, Equiniti supports best practice open recruitment with its contractors and provides operational expertise and technology that supports regulatory requirements for delivering excellent service to customers. This includes identifying and providing the right support for all customers, including those with vulnerabilities. It also delivers customer complaint analysis that identifies areas for operational improvement that can further reduce barriers to effective customer use of financial products and services.

Equiniti’s operations are also shaped by public policy, particularly around labour and tax regulations. By engaging in long-term strategic planning, the company balances these external pressures while maintaining its focus on delivering high-quality services at sustainable costs. It highlights its contributions to the broader economy through workforce training and development, underscoring its role as a socially responsible employer.

All employee share plans have been helping workers save since the 80’s, with potential to evolve for a new UK workforce.

UK households with under £1k in savings1 11m three-year plan to put down a deposit. As a young working mum without the property ladder. The money came straight out of my wages each month so it was an easy way to save.”

19,990 UK companies with tax advantaged employee share schemes3

Laura Beckett, for mer Lloyds Bank employee, West Worthing*

Average number of eligible employees who participate in SAYE2 <40%

Of Millenials think they won’t work at their company long enough to benefit from a Share Incentive Plan6 47%

Of share plan participants check their company’s share price monthly5 83%

with no real risk – my money is safe and, if the share price falls, I can get my

back, so it’s a great way to build a nest egg.”

Nigel Youds, Drax employee, Tunbridge Wells

Equiniti is committed to breaking down barriers both within its organisation and across the wider community. This commitment is driven by its core values: being Trusted to deliver on commitments, remaining Commercial in building long-term value, fostering a Collaborative approach, and striving to Improve by continually enhancing skills and services.

Internally, Equiniti works to ensure that all colleagues, regardless of background, have access to opportunities and the support they need to thrive. It promotes fairness and consistency across its policies and procedures, ensuring an inclusive and equitable work environment. With dedicated colleague-led networks, mental health first aiders, and training programmes, colleagues are empowered to develop their careers while balancing their personal lives.

Equiniti also upholds human rights through responsible business practices. It identifies and mitigates risks related to labour rights within its workforce and supply chain, ensuring fair treatment for all. Its commitment to wellbeing and inclusion is reflected in initiatives like the Colleague Assistance Programme, which offers mental health and financial support.

Externally, Equiniti plays a key role in making financial services more accessible. Whether supporting customers through complex processes or ensuring clear communication for vulnerable individuals, it actively seeks to remove obstacles. Training on vulnerability awareness equips colleagues to better assist those facing financial or personal difficulties, ensuring no one is left behind.

Beyond its customer base, Equiniti extends its commitment to communities. Through its volunteering programme, colleagues are encouraged to dedicate time to causes that matter to them, contributing thousands of hours to charities, schools, and environmental projects each year. Equiniti also supports ShareGift, enabling shareholders to donate unwanted shares to charitable causes, a partnership which has raised millions of pounds over the past decade.

Equiniti recognises the environmental barriers that can impact businesses and communities. Through its Net Zero strategy, it is reducing carbon emissions, increasing energy efficiency, and promoting responsible procurement. By working with suppliers who share its sustainability values, Equiniti is helping to drive positive change across the industry.

At the heart of all these efforts is a commitment to continuous improvement. Embedding its values into every aspect of its operations, Equiniti is ensuring that barriers - whether social, financial, or environmental - are actively addressed, making a lasting difference for colleagues, customers, and communities.

Equiniti extends its commitment to communities.

The Purpose Coalition measures organisations against a set of sector-relevant social impact criteria. The Purpose Goals outline 15 interconnected impact barriers to opportunity. By drawing on expertise provided by academia and business, the Goals are designed to specifically address some of the unique challenges facing the UK.

The Coalition’s cross-party work brings together the UK’s most innovative leaders, parliamentarians and businesses to improve, share best practice, and develop solutions for improving the role that organisations can play for their customers, colleagues and communities by breaking down barriers to opportunity.

The Purpose Coalition is chaired by Rt Hon Justine Greening, the UK’s former Secretary of State for Education, Transport and International Development; and led by Nick Forbes CBE, who recently served in Sir Keir Starmer’s Shadow Cabinet, who leads the Purpose Coalition’s work with the Labour Party; Rt Hon Anne Milton, former Minister for Apprenticeships and a Minister in the Department for Health and Social Care; and Lord Walney, former No 10 Advisor to Gordon Brown and Labour Member of Parliament for Barrow and Furness.

The Goals were designed following Justine Greening’s experience - as Secretary of State for International Development - leading the UK’s delegation to the convention of the United Nations (UN) that established the 2015 UN Sustainable Development Goals (SDGs). The Purpose Goals apply the SDGs in a UK context.

The SDGs as interlinked goals emphasised the interdependent environmental, social, and economic aspects of development and centralised the role of sustainability. At the time, Justine recognised how transformative a common set of accessible but ambitious goals could be in galvanising action to effect change. After leaving Government in 2019, Justine established the Purpose

Coalition and Social Mobility Pledge with the intention of galvanising UK economic and social actors to improve social mobility in the UK.

The Purpose Goals focus on key life stages and highlight the main issues that need to be resolved to break down barriers to opportunity in the UK. The Goals are intended to guide ambition, provoke action, and measure progress.

Equiniti is active across most of the 15 Purpose Goals but is specifically focused on showcasing best practice and upscaling its social impact in key areas of strategic expertise as identified in this Impact Report.

3.1 Goal 3 - Positive Destination’s Post 16+

The UK faces a critical challenge in guiding young people toward sustainable career paths postGCSEs. While higher education remains valuable, many benefit from flexible, skills-based learning that blends practical experience with professional development - especially in regulated, evolving sectors like financial services.

Organisations like Equiniti play a key role by offering structured industry entry routes, addressing both talent needs and opportunities for those who may not thrive in academic settings.

Through a wide range of skilled employment opportunities, Equiniti enables young people to develop industry-specific expertise and progress from entry-level to advanced roles without requiring a university degree.

Investing in these pathways benefits both individuals and businesses, creating a skilled talent pipeline equipped for digital transformation and customer service demands. Equiniti’s approach dismantles barriers, unlocks potential, and expands access to diverse post-16 opportunities.

Equiniti’s apprenticeship strategy is designed to address current and future skill gaps within the organisation while focusing on growth for employees. The programme has evolved significantly, with monthly apprenticeship levy utilisation increasing from 30% to over 110% in just one year. This places Equiniti amongst just 4% of organisations who are using their full levy spend (vs the national average of 55% usage*)1.

One element of this successful increase is the comprehensive programme offering at Equiniti, part of its dedicated apprenticeship and workplace qualifications brand, EQ Horizons. The business has mapped every job role across its business functions to relevant apprenticeship standards, resulting in 87 different apprenticeship programmes. These range from advanced to master’s level qualifications, providing opportunities for all employees, regardless of career stage or skill level.

Equiniti works closely with its training providers to ensure that the needs of learners are met, and programmes are customised to their requirements. A key example is the Data Analyst Apprenticeship, where Equiniti worked with training providers to reconfigure the course content, ensuring that critical skills like Power BI were delivered earlier in the programme to meet business needs.

Equiniti has also recently launched a High Potential Development Programme, utilising the Level 7 Senior Leader Apprenticeship, as part of its wider commitment to the development of future leaders and wider development. This programme equips participants with advanced leadership and management capabilities, preparing them for strategic roles within the organisation.

Since launching in England, the offering has widened to Scotland, Wales and India, with the U.S. next in plan.

Equiniti’s newly introduced internship programme provides meaningful opportunities for those at the very beginning of the talent pipeline.

The pilot involved a first-year university student who supported a team with a critical research project. The success of this initiative has prompted plans to expand the programme, with the goal of hosting four to six UK interns annually.

Equiniti extends its impact beyond its workforce by supporting community-based educational and vocational programmes through levy gifting.

Working with Innov8, an educational charity based in Suffolk, which supports young people aged 11 - 16 who have been excluded from mainstream schools, funding was provided for four of their tutors to complete the Learning and skills teacher Level 5 apprenticeship.

A critical barrier to opportunity across the UK today is the need to ensure that every individual, regardless of their background, has access to fair and equal pathways into employment. Open recruitment practices - those that actively remove barriers and biases - play a vital role in harnessing the full potential of the nation’s talent pool.

Beyond initial entry into the workforce, continued professional development and clear routes for progression are also critical. Through promoting an environment where ongoing growth is encouraged, businesses position themselves to benefit from diverse skill sets and perspectives, improving innovation and competitiveness.

In highly regulated, complex industries like financial services, these principles of open and transparent hiring take on added significance.

Organisations operating in this space depend on a broad range of expertise, from compliance to customer engagement. Through implementing robust, data-informed recruitment systems and placing an emphasis on inclusivity throughout the hiring process, Equiniti is working to tap into a wider pool of qualified candidates. It also takes a structured approach to continuous learning, internal mobility, and skill development, helping to retain top talent, ensuring employees remain both challenged and engaged well beyond their initial onboarding.

Equiniti is working to tap into a wider pool of qualified candidates.

Equiniti has established a recruitment strategy that prioritises transparency and equality of access. The company tracks demographics through specific recruitment KPIs, which measure progress against census data and local labour market benchmarks. This approach ensures that hiring practices align with its broader goals of achieving equity in gender, ethnicity, and overall representation.

Equiniti closely monitors candidates throughout the hiring process to identify and address any disparities. This data is used to shape recruitment campaigns aimed at attracting a diverse range of talent, with a particular focus on underrepresented groups.

While it recognises the benefits of artificial intelligence in recruitment, it remains cautious. Human judgment is valued over algorithmic decisions to prevent the exclusion of candidates who may offer an excellent cultural fit. Equiniti’s philosophy balances technological efficiency with a nuanced understanding of human capabilities.

The firm’s commitment to its pipeline is demonstrated further by its recruitment practices and the measures it has introduced to reduce bias. All hiring managers must complete mandatory unconscious bias training, which forms part of a comprehensive interview preparation programme. Regular refresher courses help maintain these principles over time.

In terms of job descriptions, Equiniti deliberately removes unnecessary academic or professional qualifications unless essential. This means that, for example, a university degree is not always required; the emphasis is instead on relevant skills and practical experience. Additionally, interview questions for entry-level roles are standardised to ensure a fair and consistent process, while senior roles are increasingly assessed by diverse interview panels.

Equiniti’s approach to the recruitment of contracting staff within the specialist resourcing arm of its Customer Resolutions division also follows open recruitment principles to help avoid conscious bias and embed the latest DE&I best practice into the process.

Applicants are judged solely on the skillsets within their CV and how well this matches the client requirements. Any rejections are based on the lack of relevant experience, missing skills and/ or poor CV format and content. The team do not discriminate if contractors ask for reasonable adjustments or flexible working patterns.

Some of the approaches used include ensuring adverts for roles are open to everyone, and that applicants can choose to respond via the channel that suits them best (phone, email, LinkedIn, other social media or apps etc.).

The team actively collaborates with groups such as The Better Hiring Institute and Reed Screening, who along with the Modernising Employment APPG are striving to make all employ/contract with individuals faster, fairer and safer. Reed and the Better Hiring Institute are contributing to the guidance and steer of digital hiring including guidance on the use of AI in the hiring process.

Equiniti, operating across a number of markets globally, takes a strategic approach to sourcing diverse candidates across each of its locations.

In the US, it partners with Circa to access underrepresented talent pools. While this platform is not yet available in the UK, Equiniti utilises LinkedIn and other job boards to build an inclusive pipeline.

More widely, referrals from existing employees play a significant role in diversifying Equiniti’s talent pool, with data showing that referred hires tend to perform better and stay longer.

In India, Equiniti piloted a Career Returners Programme, targeting individuals who had taken significant time away from the workforce due to caregiving or other responsibilities. The programme was a resounding success and is being considered for expansion to the UK.

The onboarding experience for new employees is equally thorough, and is absolutely critical for retention, the final stage of a successful recruitment process.

All new starters attend a digital Welcome to EQ session, hosted by a member of Equiniti’s Executive team, engaging them with the business from the outset.

Equiniti has introduced new starter communities, accessible through Microsoft Teams, where new hires can connect with peers and access resources to support their transition into the organisation.

This contributes to a sense of belonging from the beginning of the employee journey, ensuring that employees feel valued and integrated.

Equiniti’s buddy programme also pairs new starters with experienced colleagues, offering informal guidance on navigating company culture and expectations.

Fair career progression

A key obstacle to opportunity in many sectors, including financial services, is the absence of clear, equitable pathways for career progression. Beyond simply increasing salaries, fair career progression helps colleagues maintain a sense of challenge and personal growth long after they have left full-time education. Employers that implement transparent and inclusive systems for professional development often find themselves at a competitive advantage, benefiting both their employees and their broader organisational goals.

Within complex, fast-evolving environments like share registration and pension administration, it is especially critical to ensure employees can progress based on merit, performance, and potential.

Equiniti has taken concrete steps to build such an environment, weaving diversity and inclusion objectives into its leadership pipeline, development programmes, and internal metrics. Through actively supporting underrepresented groups and providing opportunities that allow any employee to gain leadership exposure, Equiniti illustrates a commitment to fair and equitable career progression. This not only helps individuals chart their own paths to success, but also equips the organisation with a strong, diverse talent base capable of meeting the dynamic needs of the industry.

Equiniti illustrates a commitment to fair and equitable career progression.

At the core of Equiniti’s approach to breaking down the barriers to opportunity is a focus on the importance of internal talent.

It actively encourages employees to explore new opportunities within the organisation, supporting career growth and reducing turnover. Internal mobility is central to Equiniti’s Learning and Development (L&D) strategy, reflected in the following practices:

• Internal Hiring Policy – approximately 20% of open roles are filled internally, with 80% of those being promotions. This demonstrates a clear commitment to employee development and career progression.

• Exclusive Internal Application Windowemployees are given an exclusive period to apply for roles before external candidates are considered, ensuring that internal talent has the first opportunity to advance.

• Prominent Job Listings - internal vacancies are prominently displayed on Equiniti’s platforms like the company intranet and weekly communications. Featured roles or ‘hot jobs’ are highlighted to encourage applications from current employees.

• Career Development Tools - Equiniti utilises Workday’s Career Hub, where employees can list skills and job interests. This system recommends relevant opportunities and training courses, enabling employees to proactively manage their career development.

• EQ Horizons - Equiniti revitalised its apprenticeship offerings, increasing its levy utilisation by 80% and investing significantly in employee development. Events like National Apprenticeship Week promote awareness and participation, supported by leadership involvement.

• Succession planning – in 2024 Equiniti began digitally mapping talent across its organisation to identify successors for key and critical roles. This year it will introduce further initiatives aimed at developing this talent pipeline.

This internal-first approach promotes loyalty and aims to make employees feel valued and invested in the company’s success.

Equiniti has created a centralised L&D framework that ensures consistency and fairness across its UK, US, and Indian operations.

Employees and managers engage in formal quarterly discussions to set development goals, review progress, and identify necessary support. This ensures that employees’ career progression remains a priority throughout the year.

The LEAP (Lead, Engage, Align, Perform) programme represents Equiniti’s largest standalone learning initiative, designed to align leadership capabilities with its values. This rolled out across the entire organisation in 2023, and the framework and principles have since been embedded into all new manager training and ondemand learning, to ensure long-term retention and application of key learnings.

Equiniti also promotes a culture of learning and engagement through initiatives like the Fraud Fighters programme. The gamified

training module blends skill development with interactive challenges, helping employees retain knowledge while fostering accountability and vigilance.

More widely, Equiniti rolled out LinkedIn Learning globally, offering over 20,000 courses that cater to the wide range of needs across its workforce. The platform’s accessibility and integration with existing systems have driven a high activation rate - 56%, compared to the 28% benchmark. This move is critical to colleagues, and the system’s integration into the employee process is a leading benefit.

Equiniti works towards a culture that celebrates individual and collective achievements, creating a positive environment for professional growth. Success is regularly championed through internal communications and through industry awards.

New peer-to-peer recognition programme IconEQ saw 13,000 recognition cards sent in 2024 (its first year of launch), celebrating colleagues living EQ’s values. The scheme is monetised with each global colleague given a budget to award to peers each year. Equiniti’s Global Colleague Forum representatives vote for the top e-cards each month, to receive an extra prize, with the best of the best invited to an annual award ceremony.

Apprentices who complete programmes are celebrated through dedicated events, including an annual graduation lunch and Apprentice of the Year awards, as well as being recognised at Equiniti’s annual Leadership Conference and Awards. These events serve to inspire colleagues and show a commitment to employee development.

The organisation also offers its reward platform – EQWins. The platform discounts at a range of retailers, exclusively for Equiniti employees.

A worryingly increasing barrier to opportunity across the UK is the lack of access to both savings and responsible credit for individuals and families. No matter how talented an individual may be, limited financial resources - be it an inability to build savings or access capital - can significantly restrict personal and professional prospects. Having the means to cover everyday essentials, set aside funds for retirement, or invest in personal development can make a fundamental difference in a person’s ability to realise their full potential.

In the financial services sector, organisations like Equiniti are uniquely positioned to address this challenge across the UK. Providing inclusive, tax-efficient savings options and championing much-needed education that improves financial literacy, through its services, these businesses help individuals at all income levels develop greater resilience and stability. This approach not only benefits workers in large corporates but also extends to those in smaller enterprises or part-time roles. Offering transparent, straightforward pathways to saving and responsible borrowing enables people to invest in their future, reinforcing a more financially secure and equitable society for everyone.

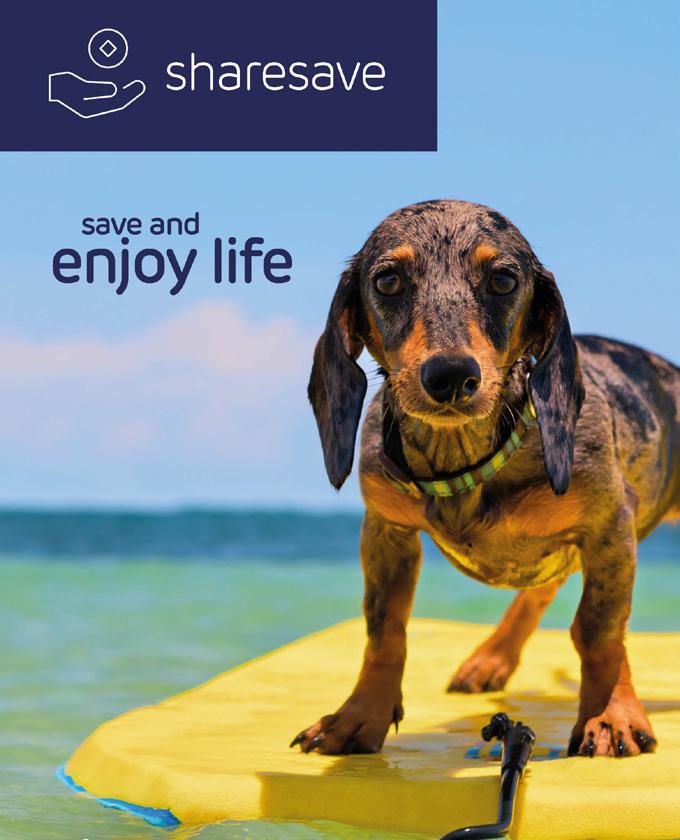

A central pillar of Equiniti’s efforts to widen access to savings is through its administration of employee share plans

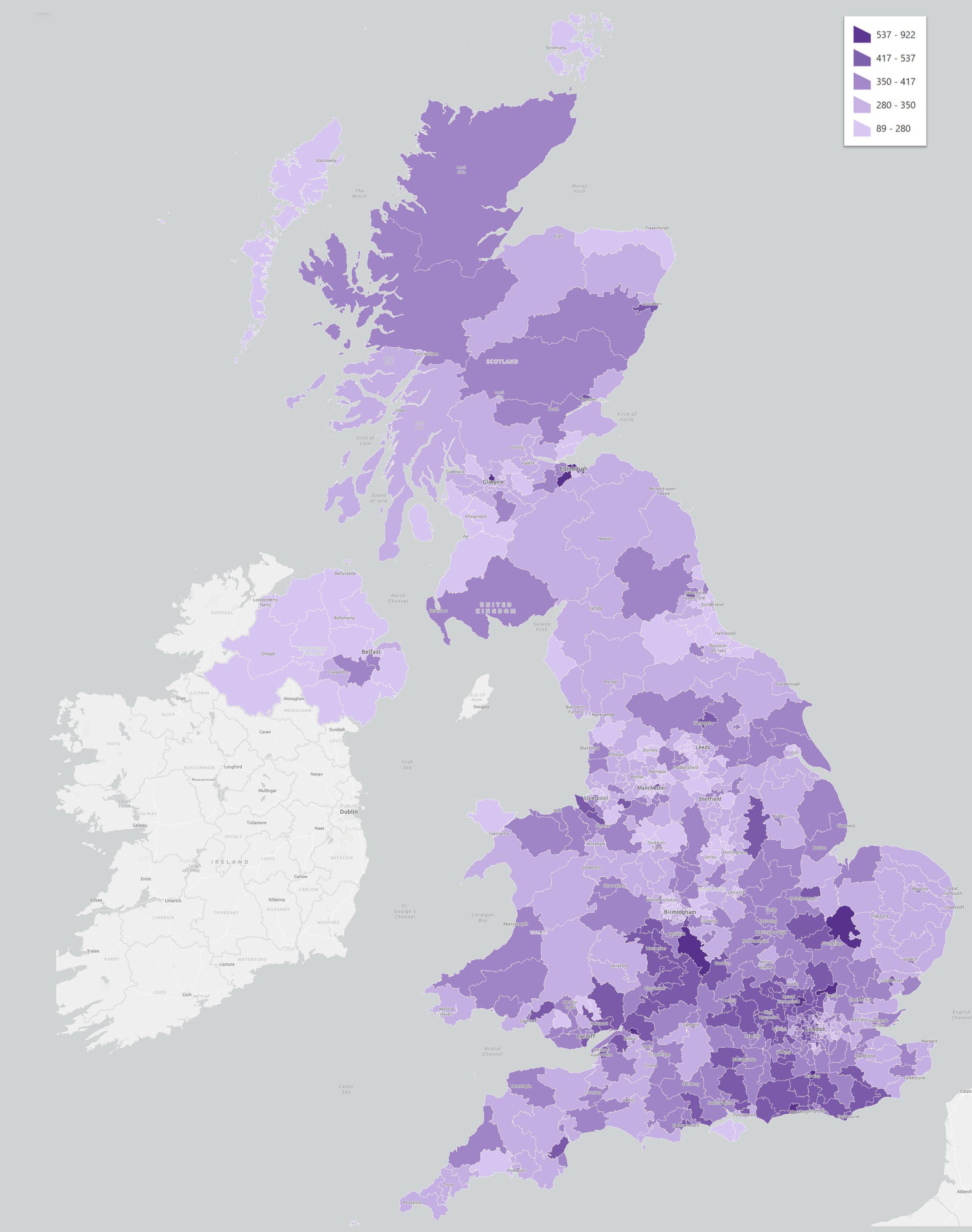

A central pillar of Equiniti’s efforts to widen access to savings is through its administration of employee share plans, which allow employees to build wealth by participating in schemes such as Save As You Earn (SAYE) and Share Incentive Plans (SIPs). It serves some 1.1m employee share plan participants spread across all corners of the UK.

These schemes are particularly impactful for employees with modest or middle incomes, as they provide a straightforward, tax-efficient way to save and invest in the organisation they work for.

Crucially, employee share plans are shown to act as a stepping stone to personal investment and improved financial education. Equiniti’s research shows that once employees own shares via their employee share plan, they are more likely to invest in a wider range of companies, building their resilience.

For example, SAYE allows employees to save a portion of their salary over a set period, with the option to purchase company shares at a discounted price once the savings period concludes. If the share price drops below the option price, the employee may choose not to buy shares at the end of the period, making SAYE close to a risk-free investment. SIPs, similarly, enable employees to purchase shares in their employer company through salary deductions, with added tax benefits. These plans are designed to be accessible, even for employees with lower pay grades, providing a unique opportunity for wealth accumulation and financial security.

Equiniti’s broad reach, handling the administration for several major corporate clients, ensures that these schemes are available to a wide range of employees across various sectors.

This promotes inclusion and gives workers, often those in roles that would not traditionally have access to investment opportunities, a chance to engage with financial markets (often their first foray into investment) and potentially benefit from capital gains.

Over the past few years, Equiniti has seen a large increase in the number of employees transferring their shares into Individual Savings Accounts (ISAs) as part of their medium-term financial plans. This works alongside pension scheme contributions, which are looking to the long term.

Equiniti’s focus on share plan engagement through engaging collateral and a newly launched app has led to improved access for employees in the plans it administers.

UK Share Incentive Plan Participation by Constituency

Kier Group plc, one of the UK’s leading providers of infrastructure services, construction, and property development, sought to extend the benefits of its employee share plan to its entire workforce. With a strong commitment to environmental and social sustainability, Kier recognised the value of broadening participation in its SAYE scheme (Sharesave) but faced significant challenges in reaching its diverse workforce. Around half of its 10,000 employees work offline, often outdoors and during non-standard hours, making traditional email-based communication ineffective.

To address this, Kier partnered with Equiniti to develop a strategy that ensured all employees had access to the information and tools needed to explore their share plan options.

Equiniti implemented a multi-channel approach focused on accessibility, consistency, and inclusion. While technology played a central role, the campaign also used traditional methods to ensure maximum reach. Employee roadshows, team briefings, printed brochures, letters, emails, and intranet updates were all used to create a fully integrated communication plan.

Recognising that many employees regularly use mobile devices, Equiniti also developed an app, allowing employees to fully register without needing to access the employee portal. This made participation significantly easier, particularly for those who may not frequently engage with workplace systems. The app provided employees with a seamless way to manage and monitor their share plans anytime, reinforcing Kier’s branding to strengthen the connection between employees and the scheme.

Equiniti implemented a multi-channel approach focused on accessibility, consistency, and inclusion.

A microsite was also introduced to remove barriers to engagement, allowing all employees to access key information without the need to log in. The calculator tool enabled individuals to explore potential returns based on share price fluctuations, making the scheme more tangible and appealing. While these digital solutions were crucial, Equiniti ensured that all communications were visually and thematically aligned, making the campaign instantly recognisable and easy to engage with. Language was kept clear and accessible, catering both to those wanting a quick overview and those seeking more detailed information.

The increased communications and engagement have also benefitted Kier’s other all-employee share plan, its Share Incentive Plan, with an almost 40% increase in participation during 2024, to over 2,000 employees.

Beyond the technical solutions, Equiniti and Kier worked together to promote a sense of community around Sharesave, encouraging open conversations across the organisation. Special efforts were made to simplify the registration process, including the use of QR codes in printed materials that linked directly to the website or app. Kier’s ‘stand-down’ days, which bring together employees from various contracts, provided another valuable opportunity to promote the scheme through direct conversations. Employees often signed up on the spot after a brief explanation and a quick scan of the QR code.

Since this communication strategy has been in place, take-up has increased, and the results have already proved outstanding. Historic take-up

levels sat at around 15%. Take-up has continued to increase from 20% in 2021 to 30% in 2024 – over 3,100 employees signing-up. Kier was delighted that over 39% of employees are in one or more Sharesave plans.

The increased communications and engagement have also benefitted Kier’s other all-employee share plan, its Share Incentive Plan, with an almost 40% increase in participation during 2024, to over 2,000 employees.

Kier’s commitment to its share plans has earned industry-wide recognition, winning an award from the ESOP Centre as well as winning ‘the most effective communication of an employee share plan’ at the 2024 ProShare Awards.

Equiniti help to provide the financial products that support ISAs and Lifetime ISAs, helping individuals to make their savings work harder.

The Lifetime ISA, in particular, is a vital tool for first-time homebuyers, offering both tax relief and government bonuses to help individuals save for their first property. Through these products, Equiniti extends the opportunity for savings and investment to individuals at different stages of their lives, particularly those who might be excluded from traditional banking services due to income or financial knowledge barriers.

Equiniti provides a Stocks and Shares ISA, and importantly provides share plan participants with a pathway from the maturity of their SAYE plan, to buying their shares, to directly transferring those shares into the EQi flexible Stocks and Shares ISA, giving participants a straightforward way to continue on their investment journey.

Equiniti recognises that simply providing access to financial products is not enough - it also focuses on empowering individuals with the knowledge to make informed financial decisions.

Equiniti recognises that simply providing access to financial products is not enough - it also focuses on empowering individuals with the knowledge to make informed financial decisions.

Through engagement with its clients and organisations such as WEALTH at Work, employees participating in share plans receive financial information, helping them understand the implications of their investments, the tax benefits, and the broader financial landscape.

For example, employees who invest through SIPs or SAYE plans are provided with detailed information to help them understand how to manage their savings and investments, including the potential tax liabilities they may face.

This education ensures that employees are not only saving but are also equipped with the tools to manage their finances more effectively, ultimately leading to better financial outcomes and more financially secure communities across the UK.

Drax Group plc, a global leader in sustainable energy, partnered with Equiniti and WEALTH at Work to improve employee engagement through its allemployee share plans. With a workforce of around 2,500 in the UK and a strong commitment to share ownership from the Board and senior leadership, Drax sought to make its SAYE scheme (Sharesave) more inclusive, particularly among underrepresented groups such as younger employees and women. Equiniti played a central role in helping to transform Drax’s share plan strategy, improving accessibility (particularly digital options), and making participation as straightforward as possible.

A key breakthrough came from listening to employees and rethinking how Sharesave was presented. The communications strategy was redesigned to emphasise affordabilityhighlighting that employees could participate from as little as £5 a month - while also enlisting employee advocates to share real-life success stories. This was complemented by redesigned campaign visuals and targeted engagement through workforce engagement “MyVoice” forums. The impact was immediate: nearly a third of participants in the 2020 invitation were new to Sharesave, driving total participation to 57.1%, and by 2024, this had reached a record 71%. Participation among women also surged from 37.7% in 2019 to 70% in 2024, almost closing the gender gap in take-up (73% amongst men).

Drax’s long-term commitment to employee ownership was further strengthened by its focus on financial education. Recognising that many employees would be experiencing their first Sharesave maturity in 2023where gains reached around 333% - Drax, Equiniti and WEALTH at Work worked together to provide employees with comprehensive financial guidance. A structured education programme was rolled out, featuring CEO messages, instructional videos, live webinars, one-to-one guidance calls, and step-by-step maturity guides. The response was overwhelming, with 82% of eligible employees engaging and hundreds taking advantage of one-to-one financial guidance.

The results speak for themselves. Within the first month of the 2023 maturity, 96% of participants exercised their options, 85% took steps to mitigate Capital Gains Tax, and not a single employee opted for repayment. Drax’s commitment to fostering financial wellbeing and share ownership has earned industry-wide recognition, winning multiple awards, including “Best Financial Education Initiative for Employees” and “Best Overall Performance in Fostering Employee Share Ownership” at the 2023 ProShare Awards, as well as global recognition at the 2024 GEO Awards.

Through its partnership with Equiniti, Drax has set a new standard for employee share ownership, creating long-term value for both its employees and the business.

Equiniti takes its role as an industry thought leader and powerful advocate seriously as an organisational imperative.

It is involved in advocating for policy changes that improve financial inclusion. For example, lobbying for improvements to government schemes like SAYE and SIPs, arguing for a reduction in the qualification period for tax benefits and allowing employees who leave a company to benefit from their participation up to the date of their leaving, to buy shares at a discounted option price.

These changes would make it more attractive for employees, particularly younger employees and those in lower-paying jobs or part-time roles, to join these saving and investment plans.

Equiniti’s advisory arm plays a key role in influencing corporate policies around employee remuneration and benefits, ensuring that companies are not only adhering to best practices but also aligning their strategies with the expectations of both investors and wider society. This commitment to breaking down the barriers to financial security of lower to middle income workers is considered when designing its employee benefit programmes.

Equiniti also encourages its employees to get involved in community engagement through volunteering.

Employees are given volunteer days, which they can use to contribute to a number of good causes, including those that promote financial literacy and inclusion.

Employees are given volunteer days, which they can use to contribute to a number of good causes, including those that promote financial literacy and inclusion. This grassroots engagement boosts a deeper understanding of the financial challenges faced by underrepresented communities, while also providing employees with the opportunity to give back in meaningful ways. Employees contributed almost 7,000 hours to good causes in 2024 using their EQ Volunteer Days. Within its India operation, colleagues have given their time and donations to rebuild two community schools, part of their EQ Cares community outreach initiative.

Good health and well-being 8

A fundamental barrier to opportunity in the UK is the stark inequality in health and wellbeing. As highlighted by comprehensive research studies, individuals struggling with poor physical or mental health often find themselves at a significant disadvantage, unable to fully tap into their talents or progress in their careers. The COVID-19 pandemic has only amplified these disparities, demonstrating how access to good health and wellbeing can vary dramatically even between neighbouring communities.

In recognition of this challenge, organisations operating within critical sectors like financial services have a central role to play. Equiniti has placed the wellbeing of its workforce at the heart of its culture. Addressing mental, emotional and physical health through a holistic framework, and investing in environments and initiatives that support employee resilience, the organisation helps its people thrive. This not only benefits individuals on a personal level but also works towards a more engaged, productive workforce better positioned to seize new opportunities and drive Equiniti’s success.

A key pillar of Equiniti’s colleague wellbeing approach is the emphasis on mental health support.

It has significantly expanded its network of Mental Health First Aiders, ensuring colleagues in need can access immediate assistance and guidance. These first aiders participate in regular training and refresher sessions, maintaining a high standard of care.

It also provides all colleagues with access to a free employee assistance programme, connecting them to counselling and 24/7 advice on a huge range of topics which may impact their wellbeing. Additional mental wellbeing services are available through its Vitality partnership, such as meditation and mindfulness tools via Headspace.

Equiniti also collaborates with the Employers’ Initiative on Domestic Abuse (EIDA), a UK organisation which provides resources and training for managers. This enables leaders to handle sensitive issues with empathy and understanding, reinforcing a supportive workplace where all employees feel safe.

In January 2024, Equiniti launched the Vitality Wellbeing App as part of its commitment to proactive health management.

This platform offers personalised health insights, activity challenges, and rewards for healthy behaviours, encouraging employees to take ownership of their wellbeing. The app has already achieved an impressive uptake, with 50% of UK employees actively engaging in its features.

Equiniti utilises a People Dashboard to track key metrics, including sickness absence, holiday usage, and stress-related leave. Closely monitoring these indicators, the HR team can identify trends and implement targeted initiatives before issues escalate.

It also uses the Dashboard to run stress management workshops and campaigns encouraging employees to take their full holiday entitlement, ensuring that everyone has the opportunity to recharge.

Employees are empowered and encouraged to set regular breaks, schedule interruption-free focus time and discourage out-of-hours emails using a suite of digital tools. This includes the automatic scheduling of meetings 25 or 50 minutes in length to promote breaks between meetings. In 2025 Equiniti gifted all colleagues an additional day of annual leave - placing it in the upper quartile of the market.

Through its commitment to its people, Equiniti recently invested £3.2 million to modernise its office spaces.

These improvements include collaborative zones and informal meeting areas, designed to boost productivity and a sense of community. Creating more inviting and flexible work environments, Equiniti supports the physical and mental health of its employees.

A pressing barrier to opportunity across the UK is the growing digital and AI divide. While some communities lack even the most basic internet infrastructure, others struggle with affordabilityunable to purchase reliable devices or cover the cost of data. Even where technology is accessible, many people lack the skills or confidence to engage with it effectively, leaving them excluded from learning and employment opportunities.

Organisations that operate sectors with a key interest in digital technology have a critical role to play in bridging this gap. Equiniti demonstrates how inclusive digital initiatives, accessible platforms, and transparent use of AI can expand digital literacy and empower individuals from all backgrounds.

It is investing in education, ethical AI deployment and user-centric design, exemplifying how to work towards a more equitable digital landscape. These efforts not only benefit those seeking immediate access to online tools but also helps build longterm resilience and opportunity in an increasingly tech-driven world.

Recognising that not all customers have the same familiarity with technology, Equiniti takes a digital-first yet omnichannel approach to ensure inclusion.

It has significantly improved its customer portals, enabling individuals to perform tasks like updating bank details, accessing statements, and managing personal preferences. These platforms are designed with accessibility first, incorporating text-to-speech compatibility and optimised navigation for screen readers. Equiniti has also integrated QR codes into letters and other communications to encourage customers to explore digital options, leading to a notable increase in portal engagement.

A particularly unique step is Equiniti’s use of real-time monitoring and AI integration to improve customer experiences.

In addition, all Equiniti’s own complaints and customer management software meets the Web Content Accessibility Guidelines level of accessibility conformance to an AA standard and has also been tested to be useable with screen readers.

Equiniti’s Boost programme illustrates its focus on innovation in promoting digital engagement, already launched to over 200,000 shareholders including M&S investors. Allowing client shareholders to reinvest dividends for rewards, the programme incentivises digital participation while delivering tangible financial benefits. Alongside this, Equiniti ensures that no customer is left behind by rewriting communications in plain English and training staff to identify and support vulnerable individuals, providing tailored assistance to those who may struggle with digital tools. Its UK customer experience representatives all undergo Dementia Friends training and within its Retirement Solutions business, platforms have been adapted to record vulnerability.

In a particularly unique step, Equiniti is introducing use of real-time monitoring and AI integration to improve customer experiences. Pilot programmes using generative AI chatbots will offer 24/7

assistance, addressing common queries, and reducing wait times. Call centre systems are also being upgraded to detect phrases indicating customer confusion or distress, to enable staff to provide immediate support.

Through strategic messaging in essential paper-based communications, Equiniti also encourages tens of thousands of shareholders each year to switch to digital, reducing reliance on physical documents while enhancing accessibility and convenience. Equiniti’s commitment to a chequeless future is gaining momentum, with 39 corporate clients, including 22 FTSE100 firms, fully transitioning away from cheque payments. Ongoing communication ensures shareholders are informed and supported through this shift, making digital transactions the default for Corporate Sponsored Nominees.

One key step is the use of QR codes on dividend documents, replacing traditional paper forms for tasks like bank mandate updates and dividend elections. Over 85% of EQ’s dividend-paying corporate clients have adopted these templates, driving a significant increase in online registrations via Shareview, EQ’s shareholder portal.

Equiniti is building digital literacy among both its customers and workforce in the UK.

One of its most impactful initiatives is its use of AI-generated educational videos. These short, engaging tutorials simplify complex financial processes, like share maturity or savings options, making them accessible to users with varying levels of digital fluency. This approach to education is complemented by digital health checks within customer accounts, which prompt users to update outdated information and optimise their interactions with the platform.

Equiniti also significantly invests in workforce training to ensure its employees are equipped to support digital adoption. All employees have access to LinkedIn Learning, a platform offering over 20,000 courses on topics including AI, digital tools, and creative technologies. Customer service teams receive specialised training to handle increasingly technical queries, ensuring they can guide users through digital processes effectively. Apprenticeship programmes are also tailored to technology, future-proofing its workforce and equipping employees with the skills needed to thrive in a digital-first environment.

Equiniti is integrating AI technologies into its services in ways that are both innovative and ethical. This ensures that the benefits of AI are accessible to all users, while maintaining a focus on transparency and fairness.

Once fully implemented, AI-driven features will improve customer experiences by providing personalised insights and simplifying interactions. For example, predictive prompts are being developed within the platform to offer tailored guidance to help customers make

informed decisions. Generative AI chatbots will also improve accessibility by delivering immediate support for routine queries, allowing customer service representatives to focus on more complex issues.

More widely, Equiniti uses data analytics to refine its services and identify barriers to digital engagement. Tracking customer interactions, it develops targeted solutions, including simplified user-focused onboarding journeys for shareholders who may be unfamiliar with digital tools.

AI is also embedded in Equiniti’s customer service and learning platforms, simplifying complex processes and enhancing user experiences.

Equiniti’s commitment to closing the digital divide extends beyond its own operations, it actively supports initiatives that promote digital literacy and inclusion within the wider community.

Its partnership with Marks & Spencer’s Share Your Voice campaign, aims to modernise shareholder engagement through digital platforms, including virtual AGMs. These make it easier for shareholders to participate, increasing accessibility and a more inclusive approach to governance.

On top of partnerships, Equiniti is a vocal advocate for improving public understanding of digital tools. It produces interactive guides and video tutorials to demystify processes like shareholder registration and pension management. By engaging with policymakers, Equiniti helps shape standards that address systemic barriers to digital adoption, reinforcing its leadership in this space.

Equiniti plays a vital role in easing the administrative burden of bereavement through the Death Notification Service (DNS). As the UK’s largest handler of bereavement notifications, it helps families navigate a process that can otherwise be overwhelming, allowing them to inform multiple financial institutions simultaneously and reducing the emotional toll of repeated notifications.

Developed in collaboration with UK Finance and leading banks, the DNS has facilitated nearly 610,000 notifications, improving both customer experience and operational efficiency. By verifying deaths and the identities of notifiers, it streamlines a traditionally fragmented process while maintaining security and accuracy.

However, the challenge extends beyond financial services. Bereaved families still face significant hurdles in dealing with insurers, utilities, and telecom providers, where processes remain inconsistent. Equiniti continues to advocate for these sectors to adopt similar efficiencies, ensuring bereavement support is not dependent on the industry in question. In 2024, it added a further 14 general insurance brands to the service, covering motor and home insurance.

At its core, this work reflects a broader shift towards digital solutions that make essential services more accessible and responsive to real-life challenges. Equiniti is closing gaps in bereavement administration, demonstrating how thoughtful innovation can remove barriers at life’s most difficult moments.

We validate We validate used by 30 610,000

notifications to date

30%

2,440,000 14 of all deaths submitted without the need for a death cert of Notifier ID at point of notification of notifications received outside core office hours 88% 90%

Omnichannel

A dedicated help line complements our digital service mins of call time saved of the UK’s biggest banks UK insurers used by

A customer using our Death Notification Service (DNS) has been so impressed with our service following the passing of her Mum last March she has written in to let us know her thoughts.

My Mum died in March this year following a cancer diagnosis in the preceding October. She was an incredible person in so many ways, one of which was being highly organised and very practical. She kept records, files and details for all her accounts and investments. These were all stored in logical order and she told us where to find all her important documents, passport, tax details etc. Let us not underestimate how incredibly helpful that was and how much time and stress it saved us.

“I first read about DNS in a bereavement brochure from Nationwide Building Society”

As we knew the prognosis and she was so keen to have everything in order, I had already started to research end of life planning for her.

It was then that I first learnt about the DNS, which I read about in a bereavement brochure from Nationwide Building Society. Whilst I remembered it later, I didn’t really think about it too much at the time, assuming that all financial institutions would do the same.

After Mum died, our priority was to register the death and, due to Covid restrictions, we arranged a telephone appointment with Guildford Register Office.

The Registrar was extremely helpful, courteous and efficient. She asked if we had heard of the Government’s Tell Us Once service, which I had but she gave us a little more detail about everything it would cover. I remember her saying Tell Us Once would even take care of Mum’s bus pass and library card – silly little things but none the less, two more ‘phone calls we wouldn’t have to make and the relief that someone, somewhere had the sense and empathy to think of such small details.

The Registrar then mentioned the Death Notification Service and said there would be a link to the DNS website in her email.

“When I logged on to DNS to register, I had expected a long, arduous form to be completed but instead found a very simple form and clear instructions and information.”

I received an email acknowledgement from DNS and within days, started to receive letters from the companies themselves. These were simple acknowledgements with information about what they would do next.

The fact that we didn’t need to make ‘phone calls to that small handful of companies was very welcome. Aside from making the actual call, and gearing yourself up for it each time, you save the time spent on the call itself but also the time spent trawling through each company’s website trying to find the right department to contact. Some have their own online notification forms, others are ‘phone only.

It sounds strange but with every ‘phone call you have to make, you receive the telephonist’s well-intentioned condolences, as you would expect.

They have to say it – it would be wrong not to – but how sincere can they be after saying it numerous times day after day? Something else which is perhaps not factored in is retention.

Everything these people were saying made sense and was clear but when your brain is overloaded with all this new information, the myriad things you have to do at such times, not to mention lack of sleep, stress and grief, you simply cannot retain everything they say. Did company ‘X’ say I had to put it in writing, or would they write to me first? Do I have to send a death certificate to company ‘Y’ or wait for their forms? With DNS, you do it once, they respond, you have something in writing. It is just literally one less thing to remember. You still, of course, must deal with the information they subsequently send you, but that is to be expected. It allows you to take those next steps at your own pace, at a time that suits you.

“I’m so grateful that DNS exists, and I’m pleased to see that more companies are starting to participate”

I feel more positively disposed towards those companies who have signed up. I recently checked all the financial institutions I personally have dealings with and was appalled to find that only 4 out of 12 have joined. If I was planning on closing any of my accounts, I would probably drop those nonmembers first.

I wouldn’t hesitate to recommend friends and family to use the DNS. I have yet to find any reason why one wouldn’t want to. I appreciate that not everyone is online or comfortable filling in forms on the internet (although the benefits far outweigh those potential issues), but I believe that one can also register for DNS by calling their helpline number.

Going forward, I would love to see every financial organisation signed up and, ideally, all the other major corporations, utilities, telecoms etc. too. Death is a fact of life, so it has to be a fundamental part of every company’s service offering.

“DNS is a hugely helpful resource which I cannot praise highly enough”

My final thoughts

The DNS is hugely helpful resource which I cannot praise highly enough. I would like to see it become compulsory, but I hope that the companies themselves do genuinely want to do the right thing and help the families of their late clients and will see the advantages and benefits of becoming part of the scheme.

They are, at the end of the day, in business to make a profit. For every telephone call they no longer have to take, each perhaps saving 20 minutes, that time that could be spent on the actual administration of dealing with those accounts, freeing-up all those man-hours, speeding up the process for the bereaved families and easing the stress on the families and on their own staff.

A critical principle of a fair society is the belief that everyone - no matter their background - should have the chance to succeed. Research consistently shows that more diverse organisations make better, more creative decisions, thanks to broader perspectives and reduced groupthink. Recent efforts across both the public and private sectors in the UK and beyond are steps forward, but much remains to be done before leadership roles across business, government, and other institutions truly reflect the diversity of the modern UK.

Within the financial services industry, Equiniti demonstrates the importance of taking these commitments seriously. It is embedding equal opportunity and fair access to opportunity directly into its strategy - supporting employee-led networks, listening to feedback from around the globe, and offering wide-ranging development initiatives, like LinkedIn Learning licenses for every employee. Through which, Equiniti aims to ensure every individual has the opportunity to succeed. This not only promotes fairness but also improves organisational success through richer perspectives and more nuanced decision-making.

Central to Equiniti’s internal equal opportunities strategy are its Employee Resource Groups: the Inclusion, Wellbeing, Multicultural and Eco networks. These groups offer safe spaces for colleagues to share experiences, provide mutual support, and advocate for change. They also organise awareness events - including World Mental Health Day activities and Pride celebrationsthat reinforce a sense of community and belonging.

On top of driving awareness, the ERGs contribute to policy development. Their insights helped shape a global policy refresh, streamlining over 120 policies into 30 clear and accessible guidelines. Through involving employees in this process, Equiniti ensures that its policies reflect diverse perspectives and promote an environment where every colleague can excel.

On top of driving awareness, the ERGs contribute to policy development. Their insights helped shape a global policy refresh, streamlining over 120 policies into 30 clear and accessible guidelines.

Equiniti’s Global Colleague Forum is a key mechanism for capturing feedback from employees across all regions. This ensures that DEI initiatives are tailored to local needs and cultural nuances.

In the United States, for example, forum feedback led to improvements in the IconEQ Recognition Programme. As a result, this celebratory initiative has seen greater engagement, boosting employee motivation and highlighting achievements across the organisation.

Events like the Annual Leadership Conference consistently reinforce Equiniti’s culture of appreciation and collaboration by recognising and celebrating individual and team successes.

For those moving into managerial roles, Equiniti has introduced a 22-action onboarding journey designed to equip leaders with the knowledge and skills needed to manage inclusively. This helps to build a strong, diverse talent pipeline, ensuring that people from all backgrounds can progress within the organisation.

Recognising the importance of guidance and support in career progression, Equiniti also offers tailored mentorship programmes, particularly for underrepresented groups. These aim to foster diversity in leadership and specialist roles by offering targeted advice, coaching, and networking opportunities:

• Women in the Workplace - mentorship schemes specifically support women, including those in regions like India, where female representation in senior roles is limited.

• Broader DEI Mentorships - beyond gender, other mentoring programmes provide support based on employees’ individual needs and ambitions, ensuring that a range of inclusion challenges are addressed.

• EmpowHer - within its India operations, an extensive programme is supporting growth opportunities for female colleagues, such as personalised career counselling using a specialist provider, networking opportunities and inspirational speakers.

• Leadership Accelerate - a dedicated coaching and mentoring program, launched in 2025, focusing on personalised support and guidance over a four-month period for 14 senior women leaders at EQ India.

Equiniti operates at the heart of British financial services, providing critical infrastructure for share registration, pension administration, and payment services.

While its range of activities operate mostly out of public view, its core mission is clear: to make financial processes fair, transparent, and accessible for everyone.

Throughout its efforts, the organisation focuses on breaking down barriers to opportunity through inclusive recruitment, nurturing talent, championing financial inclusion, improving health and wellbeing, and tackling digital inequality.

Central to Equiniti’s role as a purpose-led employer is the creation of varied routes into careers, especially for those who may not follow a traditional academic path.

Through apprenticeships, internships, and community partnership – it provides hands-on learning and practical experience.

Most notably, Equiniti has mapped out a wide range of apprenticeship pathways – from data analytics to leadership – aligning with each business function’s needs. This not only works to meet skills gaps within the organisation and the wider sector but empowers employees to get on at every stage of their career.

Equiniti’s hiring practices reflect a commitment to transparency and diversity. Through careful monitoring of recruitment data at each stage of the process, the business identifies and removes biases, helping candidates from all backgrounds succeed on merit.

Job descriptions are kept accessible, prioritising skills over formal qualifications wherever possible. Mandatory training for managers on unconscious bias, standardised interview scripts for entrylevel roles, and diverse panels at senior levels all reinforce Equiniti’s pledge to ensure equal access to opportunities.

Once onboard, Equiniti offers clear structures on professional growth so that employees can continually develop new skills and access opportunities for advancement at every stage.

Dedicated programmes like LEAP, equip leaders with strategic and people-management capabilities. It also offers frequent performance reviews and comprehensive succession planning.

Equiniti strongly encourages internal mobility, with a formal ‘internal-first’ hiring window and user-friendly platforms – Workday Career Hub for example – helping current employees to explore and apply for new roles. This approach to progression promotes loyalty, boosts engagement, and widens the talent pipeline.

While its range of activities operate mostly out of public view, its core mission is clear: to make financial processes fair, transparent, and accessible for everyone.

A key underpinning to Equiniti’s impact is in creating wider access to tax-efficient financial products.

Through its administration of employee share plans – like SIP and SAYE plans – Equiniti supports its clients’ employees in organisations across the UK, to benefit from tax-efficient saving and investing. As well as ISAs, Equiniti also supports Lifetime ISAs, a crucial financial product for first-time homebuyers.

Beyond supplying financial products, it provides support to clients providing financial information to employees, ensuring that individuals understand how to manage their money and build more secure futures.

Equiniti recognises that not only is financial security and inclusion a critical contribution to overall wellbeing, but also that career progress can often be hindered by poor health and wellbeing.

It maintains a network of Mental Health First Aiders, invests in digital wellbeing tools, and works to build supportive relationships with organisations like EIDA for domestic abuse awareness.

Through creating modern, collaborative workplaces, and actively tracking employee engagement data, Equiniti seeks to intervene early when stresses arise. This work underpins Equiniti’s belief that a healthy workforce –physically, mentally, and emotionally – is essential to removing the barriers that hold people back from fulfilling their potential.

In a rapidly digitalising world, industry leaders like Equiniti seek to help both customers and employees make the most of new technologies. For customers, user-friendly portals and accessible online tools are prioritised, often improved by AI features that detect and support those who struggle with digital processes.

Internally, Equiniti invests in training its workforce through platforms like LinkedIn Learning, ensuring colleagues keep pace with emerging trends in technology. Pilot projects involving generative AI chatbots and automated call centre support shows how Equiniti aims to broaden digital access while remaining mindful of privacy, productivity, and fairness.

Equiniti builds towards an inclusive culture by actively listening to its employees through Peakon. From its monthly engagement survey, supporting its Employee Groups, to streamlining global policies, the organisation ensures workers’ voices shape how the organisation operates.

Mentorship programmes pay special attention to underrepresented groups, particularly women in leadership roles. This commitment to inclusion is reflected in the firm’s global forums and regional feedback loops, which inform ongoing improvements and help drive employee recognition.

Overall, Equiniti’s approach to impact is defined by practical, targeted measures that open doors for employees, customers, and wider communities. Through demystifying share ownership, facilitating cost-effective pension services, and embracing digital transformation –Equiniti demonstrates leadership in breaking down the barriers to opportunity.

Equiniti should implement a system to track the socioeconomic background of its workforce, based on four simple questions developed by the Social Mobility Commission and The Purpose Coalition.

Through the introduction of voluntary self-reporting for employees, Equiniti can gain valuable insights into the barriers to career progression and ensure that its recruitment strategies are truly inclusive.