INTRODUCTION

Comparative Analysis: Workmen's Insurance Policy vs. General Liability Insurance. This presentation aim s to provide a form al evaluation of the two insurance policies, highlighting their key differences and benefits.

By the end, you will have a clear understanding of which policy suits your specific needs.

DEFINITION OF WORKMEN'S INSURANCE POLICY

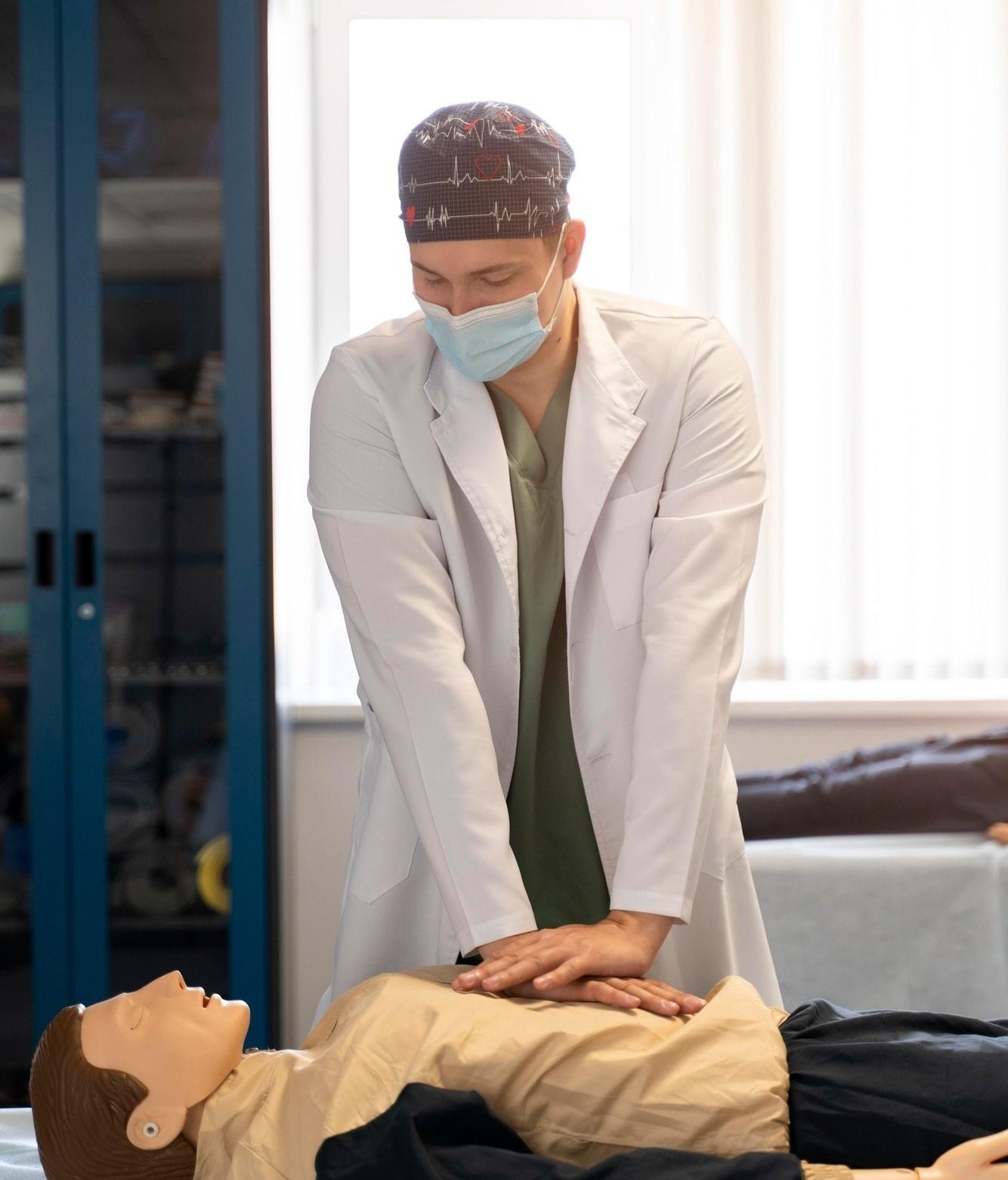

Workmen's Insurance Policy, also known as Workers' Compensation Insurance, provides coverage for injuries or illnesses sustained by employees while performing workrelated duties. It offers financial protection to employers against potential legal liabilities and medical expenses incurred by employees due to work-related accidents or illnesses.

DEFINITION OF GENERAL LIABILITY INSURANCE

General Liability Insurance is a comprehensive policy that protects businesses from third-party claims for bodily injury, property damage, or personal injury. It covers legal expenses, medical costs, and property repairs resulting from accidents, negligence, or productrelated issues. This policy safeguards businesses against potential financial losses and lawsuits.

COVERAGE COMPARISON

Workmen's Insurance Policy primarily covers work-related injuries and illnesses suffered by employees, ensuring their medical expenses and lost wages are compensated. On the other hand, General Liability Insurance protects businesses from claims arising from bodily injury, property damage, or personal injury caused to third parties.

POLICY LIMITATIONS

Workmen's Insurance Policy has lim itations such as exclusions for self-inflicted injuries, injuries caused by intoxication, or violations of company policies. General Liability Insurance may have exclusions for professional errors, intentional acts, or product defects. It is crucial to review the policy term s and conditions to understand the coverage lim itations.

CHOOSING THE RIGHT POLICY

When deciding between Workmen's Insurance Policy and General Liability Insurance, consider factors such as nature of business operations, number of employees, and potential risks. Workmen's Insurance Policy is essential for businesses with employees, while General Liability Insurance is suitable for businesses interacting with third parties or operating in public spaces.

In conclusion, Workmen's Insurance Policy and General Liability Insurance serve different purposes.

Workmen's Insurance Policy focuses on protecting employees from work-related injuries and illnesses, while General Liability Insurance safeguards businesses from third-party claims.

Assess your specific needs and consult with insurance professionals to make an informed decision.