Vince Vasquez, Principal Investigator David Barnett

This study was developed with the support of the San Luis Obispo County Arts Council (SLO County Arts), the City of San Luis Obispo, and the City of Paso Robles. All conclusions, errors, and omissions are the authors’ sole responsibility. We thank SLO County Arts for their support. We also want to extend our appreciation and gratitude to Jordan Chesnut, Executive Director of the SLO County Arts, who was instrumental in the development of this report.

The San Luis Obispo County Arts Council commissioned this study to better understand the economic role of arts and culture in our region. Through data analysis, surveys, focus groups, and economic modeling, the report presents a detailed picture of how arts organizations, individual artists, and arts and cultural events contribute to San Luis Obispo County’s economy and community.

The arts in San Luis Obispo County are a vital part of our region’s identity, enriching our daily lives and driving economic activity. As we look ahead, questions of financial sustainability and access to the arts remain key concerns, and this study provides important context for those discussions. With a clearer understanding of the sector’s impact, we have a stronger basis for making informed decisions that support artists, arts organizations, and the broader community.

On behalf of the San Luis Obispo County Arts Council, we extend our sincere thanks to the authors of this report for their dedication and insight.

Signed,

Jordan Chesnut, Executive Director, SLO County Arts Council

This report provides a comprehensive look at the economic and societal role of arts and culture in San Luis Obispo County, revealing a sector that is both a major economic driver and a defining feature of the region’s identity. With a total economic impact exceeding $478 million, the arts and culture sector is far more than an aesthetic or recreational asset—it is a powerful force in employment, tourism, and community engagement.

Yet, for all its contributions, the sector operates within a landscape of challenges. Financial sustainability remains a persistent concern for both arts institutions and individual artists, as does the difficulty of retaining talent in a high-cost region. The arts in San Luis Obispo County are deeply interconnected with other industries, yet opportunities for collaboration—particularly with sectors such as wine and hospitality—are not fully realized. The study also highlights an undeniable truth: access to creative spaces and resources is a defining factor in the ability of artists and cultural organizations to thrive.

Despite these hurdles, the arts in San Luis Obispo County are dynamic, evolving, and integral to the region’s cultural and economic fabric. The numbers tell a compelling story of growth, community involvement, and broad economic influence, but just as important are the voices behind them— those of artists, leaders, and residents who see the arts not as an afterthought, but as a cornerstone of life here.

This study offers a clearer picture of where the arts and culture sector stands today—its strengths, its limitations, and its role in the regional economy. The findings provide a foundation for further research and discussion, ensuring that future decisions about the sector are grounded in data rather than assumption.

Overall, our key findings are:

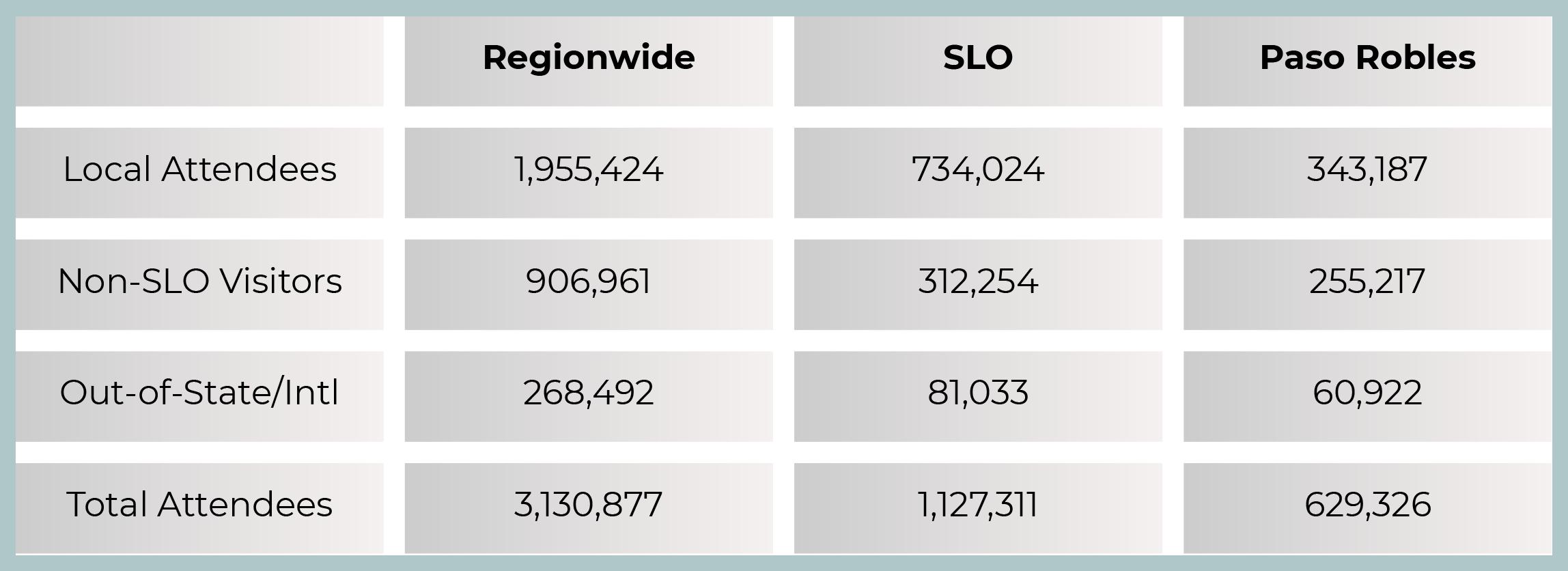

• SLO County’s arts and culture sector welcomed more than 3.1 million total attendees in fiscal year 2024. Our analysis found that Paso Robles had approximately 629,326 total attendees that year, and San Luis Obispo City had 1.1 million total arts and culture attendees.

• Arts and culture-related tourism contributed $291.1 million in visitor spending, yielding a total economic impact of $478.7 million, supporting 5,163 jobs countywide.

• The City of San Luis Obispo saw $99 million in arts

and culture-related visitor spending with a $163 million total impact, while Paso Robles recorded $70.2 million in visitor spending, generating a $115.5 million total impact.

• The arts and culture sector in San Luis Obispo County generated $35.4 million in direct sales in 2024, supporting 874 direct jobs and 1,343 total jobs in the region.

• In 2024, arts and culture visitor activity contributed more than $6.7 million in transient occupancy tax revenue and $1.5 million in local sales tax receipts, illustrating its direct value to public finances.

• Arts and culture organizations rely on various revenue streams, with 61% of organizations depending on merchandise sales, 56% on donations, and 48% on ticket sales as primary sources of income (these percentages indicate the proportion of organizations that identify each category as a primary revenue source, rather than summing to 100%).

• Overall, an estimated 2,580 volunteers contributed 197,000 hours at arts and culture institutions, organizations and festivals, valued at $7.6 million.

• Most (61%) arts organizations collaborate with wineries, and Paso Robles showed a higher rate of partnership, with 67% of organizations hosting events at wineries.

• Wineries support the arts through event hosting, sponsorships, co-branded events, and cross-promotion— creating economic synergies between the wine and arts sectors.

• Participants in focus groups and surveys identified financial sustainability, affordable artist housing and venues, and expanding audience engagement as major concerns, along with the need for increased government support and better sector coordination.

• Focus groups revealed a “recognized but overlooked” sentiment from participants, who emphasized the sector’s contributions but noted gaps in public investment.

• Respondents emphasized that leveraging public-private partnerships, fostering cross-sector collaborations, and expanding digital engagement could enhance the sector’s long-term stability and reach.

This study was conducted to facilitate greater insight and understanding of the economic challenges and contributions of arts and culture organizations, event organizers and companies in San Luis Obispo County. The primary focus of our investigation is exploring public policy considerations and economic relationships of the sector, which has not had an outside economic assessment since 2017. Few research efforts have been completed in this area of work nationally, and even fewer have focused on state or regional sectors. As one of the nation’s largest and most diverse states, California is an ideal place for a regional industry-related investigation into arts and culture, as it is home to the largest population of artists and culture practitioners and greatest amount of sector economic activity in the country. Despite this, California’s per capita arts spending is low, ranking around 36th in the nation. This contrast underscores a key policy issue: while the arts are a major economic force in California, public investment in the sector does not match its scale or impact.

San Luis Obispo County’s arts and culture sector is a key economic and social driver, encompassing artists, practitioners, institutions, and enterprises that collectively contribute to the region’s economy. Despite the sector’s presence, there has been a lack of current and comprehensive quantitative and qualitative data to fully assess and define the sector’s economic role and relationships with other local industries. This knowledge gap makes it challenging for elected officials, civic leaders and community stakeholders to shape effective policies and allocate resources in an informed way, decisions which may help to maximize the arts and culture sector’s contributions to the greater economy. To address this, our study employs federal datasets, econometric modeling, survey tools, and focus groups to evaluate the fiscal health, operational stability, and economic relationships of arts and culture establishments in the region. Our research provides new insights into the sector’s revenue composition, workforce structure, visitor engagement, and community benefits.

For the purposes of this research investigation, we defined artists as individuals engaged in creative or cultural work, including visual arts, music, performing arts, writing, and related disciplines. This includes independent (freelance) artists, musicians, writers, and those employed within arts organizations, museums, cultural institutions, and event production. Artists contribute to San Luis Obispo County’s arts and culture sector through creative expression, economic activity, and community engagement. Furthermore, we identified the arts and culture sector using two industry subgroups defined by the United States Bureau of Labor Statistics: “Performing Arts, Spectator Sports, and Related Industries Group (711)” and “Museums, Historical Sites, and Similar Institutions (712).” Performing Arts, Spectator Sports and Related Industries is defined as “establishments that produce or organize and promote live presentations involving the performances of actors and actresses, singers, dancers, musical groups and artists, athletes, and other entertainers, including independent (i.e., freelance) entertainers and the establishments that manage their careers. The classification recognizes four basic processes: (1) producing (i.e., presenting) events; (2) organizing, managing, and/or promoting events; (3) managing and representing entertainers; and (4) providing the artistic, creative and technical skills necessary to the production of these live events. Also, this subsector contains four industries for performing arts companies. Each is defined on the basis of the particular skills of the entertainers involved in the presentations.” We would note that this definition is inclusive of individual artists, musicians, and writers, in addition to formal entities. Museums, Historical Sites and Similar Institutions is defined as establishments that “engage in the preservation and exhibition of objects, sites, and natural wonders of historical, cultural, and/or educational value.” We feel these two industry subsector groups are of most particular interest in arts and culture policy conversations and prior research we discovered in our literature review. Still, we would note that, for the purposes of this study, we excluded any spectator sport industry establishments from our investigation.

1 Americans for the Arts. Arts and Economic Prosperity 5. https://www.americansforthearts.org/sites/default/files/pdf/2017/by_program/reports_and_ data/aep5/map/CA_SanLuisObispoCounty_AEP5_OnePageSummary.pdf

2 Arts and Culture Satellite Account, U.S. and States, 2022. Bureau of Economic Analysis. https://www.bea.gov/sites/default/files/2024-03/acpsa0324_0.pdf

3 State Arts Agencies Revenues, 2023. National Assembly of State Arts Agencies. https://nasaa-arts.org/wp-content/uploads/2023/02/NASAA-FY2023State-Arts-Agency-Revenues-Report-rev032022.pdf

4 State Arts Agencies Revenues, 2023. National Assembly of State Arts Agencies. https://nasaa-arts.org/wp-content/uploads/2023/02/NASAA-FY2023State-Arts-Agency-Revenues-Report-rev032022.pdf

5 Id.

6 Id. 8

A review of existing economic literature and research is required to provide context and comparison for our investigation into the arts and culture sector in San Luis Obispo County. Past economic impact reports, market research studies, and business surveys provide some evidence of the economic effects of arts and culture establishments in the United States.

Nationally, the arts and culture sector contributed more than $1.0 trillion to the U.S. economy in 2021, accounting for 4.4 percent of total gross domestic product (GDP), according to the National Endowment for the Arts. Despite the lingering effects of the pandemic, the sector still employed 4.9 million Americans in 2021, demonstrating its continued role as a major workforce driver. The Americans for the Arts report, Arts and Economic Prosperity 6 (AEP 6), further highlights the power of nonprofit arts organizations, which generated an estimated $151.7 billion in economic activity in 2022, yielding $29.1 billion in tax revenue and supporting 2.6 million direct jobs. Beyond economic output, the arts are a proven catalyst for regional revitalization, social well-being, and workforce development. Research shows that arts-rich communities experience higher civic engagement, stronger local identity, and increased tourism spending. The AEP 6 report found that 80 percent of arts attendees feel a deepened sense of pride in their communities, while 86 percent stated they “would feel a great sense of loss” if local arts programs disappeared. This sentiment is especially relevant in San Luis Obispo County, where arts festivals, public art, and creative events not only fuel economic growth but also shape the region’s identity and livability. Moreover, the arts intersect with key industries such as tourism, education, wine, and technology, contributing to innovation and workforce training. From graphic designers in the wine industry to arts-integrated STEM education at Cal Poly, the creative sector generates cross-industry opportunities that sustain a competitive regional economy. As federal relief funding for the arts declines, ensuring long-term investment and policy support will be critical to maintaining the sector’s contributions—both economic and cultural— to San Luis Obispo County and beyond.

The California Jobs First Economic Blueprint offers additional insight into the broader economic landscape that informs the arts and culture sector’s role in regional development. The report highlights key economic drivers across the state, emphasizing the importance of workforce development, innovation, and sustainable industry growth. According to the Blueprint, California must focus on workforce pathways that align with industry needs, particularly in creative sectors that intersect with technology, tourism, and education. These insights reinforce the necessity of integrating arts education and workforce training into regional economic strategies, ensuring that arts and culture are not only preserved but also leveraged as essential economic assets. The Blueprint’s emphasis on regional collaboration also supports the argument for stronger cross-sector partnerships to enhance economic resilience, a strategy that aligns well with San Luis Obispo County’s existing arts initiatives.

Otis College conducted a study in 2024 that investigated the conditions of the broader “creative economy” in California, which includes film and television, fashion, creative goods, news media, fine and performing arts, and other key subgroups. The authors found that employment for the creative economy declined by 8 percent year-overyear in 2023, following a national trend which recorded a decline of 4 percent for the creative economy. However, the fine and performing arts sector was an outlier and recorded a 9 percent increase in employment over that same period. This study highlights recent struggles with the broader creative economy that reflect current growth conditions in San Luis Obispo County as discussed by our focus groups. Another key study on the creative economy for the neighboring Santa Barbara and Ventura Counties was published in 2020, offering insights applicable to the Central Coast region. The report found that the creative sector supported more than 10,300 direct jobs and over 38,000 total jobs, generating $6.5 billion in economic input and over $340 million in fiscal revenue. These figures illustrate how investment in the creative economy-whether through public funding, policy support, or cross-sector collaborations—can drive regional job growth and economic

7 California Jobs First. California Jobs First State Economic Blueprint. February 2025. Available at: https://jobsfirst.ca.gov/wp-content/uploads/Economic-Blueprint.pdf

8 Otis College. California’s Creative Economy, Key Highlights from 2023. https://www.otis.edu/about/initiatives/documents/otis-college-report-creative-economy-june-2024.pdf

9 Institute for Applied Economics, Los Angeles County Economic Development Corporation. The 2020 Report on the Ventura and Santa Barbara Creative Economics. https://edcollaborative.com/wp-content/uploads/2022/04/The-2020-Report-on-the-Ventura-and-Santa-Barbara-Creative-Economies. pdf

vitality. For San Luis Obispo County, these findings reinforce the need to support creative industries as essential contributors to a diversified and resilient local economy.

Prior research has also identified similar benefits to the regional economy. In 2017, the Americans for the Arts found arts and cultural nonprofits in San Luis Obispo County generated $27.7 million in economic activity, while supporting 916 full-time equivalent (FTE) jobs. The authors found that the industry also provided $1.1 million in revenue to local municipalities and $1.6 million to the state government. The 2017 report also found that “nonresident attendees” (those who live outside of San Luis Obispo County) of arts and cultural events accounted for 16.6% of total attendance. Nonresident event attendees also spent more on average per person than resident attendees (approximately $67.48 per person versus $23.37 per person, respectively). As a result, nonresident attendees accounted for 36.5% of total event-related expenditures, despite representing just 16.6% of the total attendee population. Visitors pay for lodging, tend to dine out at local restaurants more, and pay for more parking than resident attendees. While the 2017 report uses data from 2015, it provides a baseline understanding of the sector and an opportunity to evaluate changes over time.

had an annual payroll of $14.3 million. It should be noted that these figures are based from state unemployment insurance records, and exclude data from non-employers and gig-based workers, and is not comprehensive of the sector. Thus, we next looked at current employment data from the United States Census Bureau’s American Community Survey (ACS), which sources its data from a large demographic survey collected throughout the year from approximately 3.5 million addresses annually. The ACS survey captures data on non-traditional employment including gig-based jobs. The 2023 ACS 1-Year Estimates for the SLO County arts and culture workforce is 904 jobs (see Table 2).

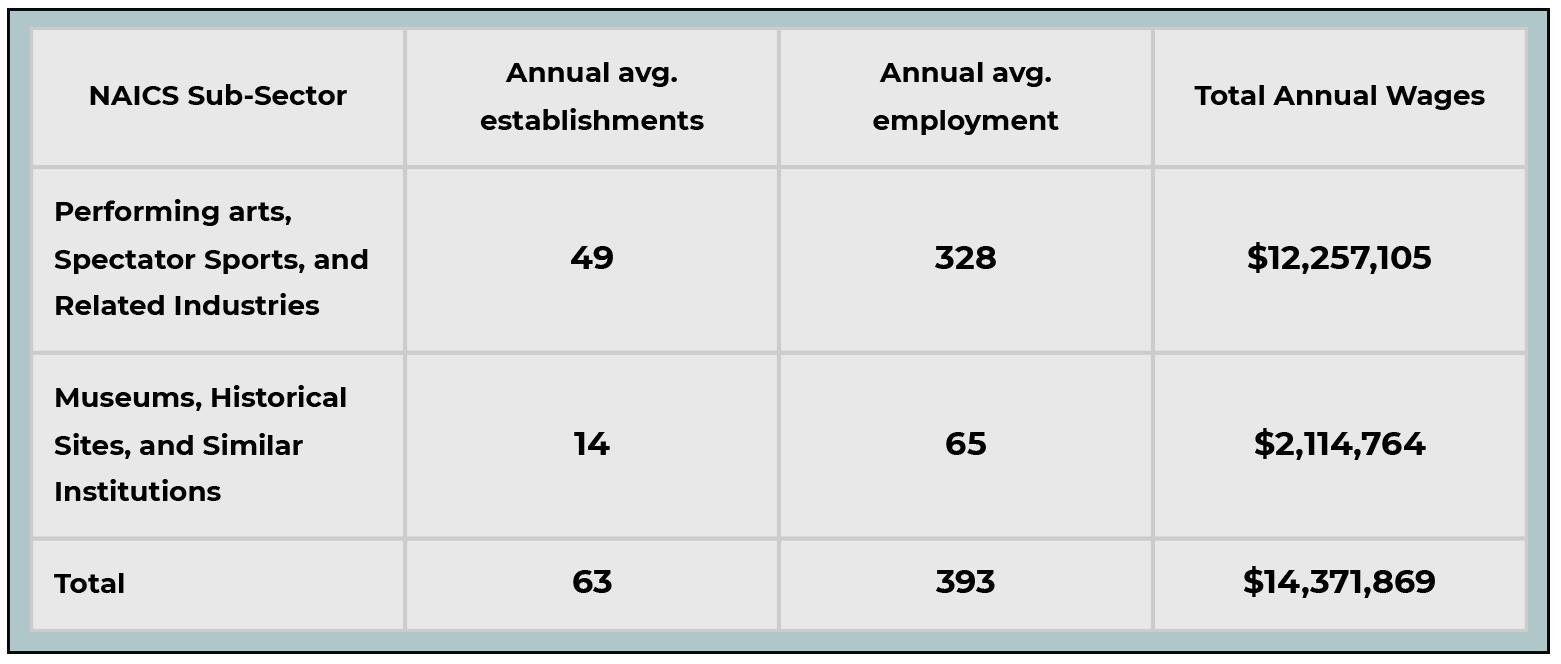

In addition to reviewing prior impact reports and future blueprints, it is necessary to identify how the sector fits into SLO’s greater economy as of right now. The San Luis Obispo-Paso Robles-Arroyo Grande Metropolitan Statistical Area (MSA) has a civilian workforce of 135,300 employees with an unemployment rate of 3.9 percent as of November 2024, according to the U.S. Bureau of Labor Statistics. To determine the workforce and employer size of the SLO arts and culture sector, we pulled the most current annual estimates (2023) for two key occupational categories under the U.S. Bureau of Labor Statistics’ Quarterly Census of Employment and Wages (QCEW), which identified that the regional arts and culture sector had sixty-three establishments, employed 393 workers, and

In SLO County, municipal governments support the arts and culture through various funding mechanisms. In Paso Robles, the city benefits from tourism-related revenues, such as the Transient Occupancy Tax (TOT), which generated approximately $9.8 million in the 2022 fiscal year. However, these funds are typically allocated to broader city services and are not exclusively designated for arts and culture. In San Luis Obispo, the Cultural Arts & Community Promotions (CACP) Grant Program provides funding for marketing and advertising expenses related to events or activities that offer cultural, social, and recreational benefits to residents and visitors of San Luis Obispo. It is important to note that the City funds its own public arts program and provides financial support for the SLO Repertory Theater, the new cultural arts district parking, and has an ongoing partnership with the Performing Arts Center since 1996. The city’s commitment to public art extends to private developments through the Private Art in Public Places (AIPP) ordinance. This ordinance requires that private, non-residential construction projects with costs exceeding $100,000 include public art valued at a minimum of 0.5% of the total construction cost. This integration of art into private projects ensures that the cultural and aesthetic benefits of public art are widespread, touching spaces across the City.

In the Central California region, Fresno County voters

10 Americans for the Arts. Arts and Economic Prosperity 5. https://www.americansforthearts.org/sites/default/files/pdf/2017/by_program/reports_ and_data/aep5/map/CA_SanLuisObispoCounty_AEP5_OnePageSummary.pdf

11 U.S. Bureau of Labor Statistics. November 2024. https://www.bls.gov/eag/eag.ca_sanluisobispo_msa.htm

Table 1: Annual Average Establishments, Employment and Total Wages in the SLO Arts and Culture Sector, 2023, Bureau of Labor Statistics, United Status Bureau of Labor Statistics

passed Measure P, officially known as the Fresno Clean and Safe Neighborhood Parks Tax, a 3/8-cent sales tax approved in 2018 to fund improvements and maintenance of parks, recreational facilities, and arts and cultural programs within the city. This tax is projected to generate approximately $38 million annually over a 30-year period. Fresno maintains a Cultural Arts Plan which identifies the needs in the arts and cultural community, prioritizes outcomes and investments, and develops a vision and goals for the future of Fresno arts and cultural programs that are reflective of the cultural, demographic, and geographic diversity of Fresno. This measure proves the impact of dedicated funding streams, community investment, and structured oversight.

According to Visit SLO CAL, the countywide destina-

tion marketing organization (DMO) for San Luis Obispo County, overall tourism in the region achieved a “record-breaking $2.15 billion in direct travel spending impact” in 2022. This figure represented a 13.8 percent increase in direct spending from the prior year. The region brought in 7.47 million visitors to support this impact, just shy of its numbers recorded in 2019. Visit SLO CAL also found that the tourism industry accounted for 9.78 percent of the region’s total GDP, while it provided $116 million local tax revenue. These figures represent strong growth since the COVID-19 pandemic and broader economic recovery for tourism. A significant driver of this success is the county’s thriving arts and cultural scene, with major festivals and public art initiatives attracting visitors and bolstering the regional economy. Events like Festival Mozaic, the SLO International Film Festival, the Paderewski

15 Jaime Lewis. “SLO CAL Mural Trail: Immerse Yourself in Local Art with Murals Throughout SLO CAL.” Visit SLO CAL, May 1, 2023. Available at: https://www.slocal.com/blog/post/slo-cal-mural-trail-immerse-yourself-in-local-art/

16 San Luis Obispo Chamber of Commerce. Supporting Business, Key Industries. https://slochamber.org/supporting-business/data-center/key-industries/

Festival, Sensorio, among others, draw thousands of visitors annually, increasing hotel occupancy rates, restaurant revenue, and overall visitor spending. Contemporary art galleries with broad artist representation, like Left Field Gallery (Los Osos), Cruise Control (Cambria), EDNA Contemporary (SLO), and The Bunker (SLO), among others, encourage visitation. Additionally, increased investment in public art initiatives has enhanced the cultural appeal of San Luis Obispo County. The City of SLO’s partnership with the San Luis Obispo Museum of Art (SLOMA) has resulted in large-scale, high-visibility public art projects, including murals and sculptures that contribute to a dynamic urban landscape. Meanwhile, the SLO CAL Mural Trail, a growing collection of vibrant murals across the county, invites residents and tourists to explore local communities through art. These initiatives not only enrich the public experience but also strengthen the county’s reputation as a creative destination, driving cultural tourism and long-term economic benefits.

Beyond arts and culture, the SLO economy is driven by a number of key industries and employers. Its largest employers are County of San Luis Obispo Government, California Polytechnic State University (Cal Poly SLO) and the Department of State Hospitals in Atascadero. The San Luis Obispo Chamber of Commerce has also identified major industry clusters; these include knowledge and information services, specialized manufacturing, health services, building design and construction, wine and agriculture, and recreation and accommodation. With career pathway programs and industry partnerships with the Cal Poly SLO and Cuesta Community College, early-entrant employees can gain an education in agricultural chemical engineering, aerospace, pharmaceutical manufacturing, medical and diagnostic services, building construction, civil engineering, green energy implementation, among others. These two colleges enroll over 30,000 students annually and Cal Poly SLO is forecast to increase its enrollment through 2028.

Notably, agriculture, and the wine industry in particular, is identified as a significant contributor to the regional economy. San Luis Obispo is home to more than forty locally grown grape varietals and 280 wineries, with more than 30 of those in close proximity to the Pacific Ocean in Edna Valley and Arroyo Grande. One study in 2015 by

the University of California Agricultural Issues Center at UC Davis found that the Paso Robles American Viticultural Area (AVA) and Greater San Luis Obispo County had a total economic impact of $1.9 billion for the regional economy, which includes both wine grape production and winery sales. Wineries require skilled, trained employees with experience in viticulture, environmental science, manufacturing and hospitality, and more which can all be studied at the nearby colleges in the San Luis Obispo area. Lastly, it is estimated that regional wineries also accounted for 28 percent of all property tax revenue in the county in 2015. Wine festivals also spur economic activity through visitor spending on lodging, food, retail, entertainment and transportation.

The California Jobs First Economic Blueprint further underscores the need for workforce alignment in regional economies, particularly for sectors experiencing technological advancements and evolving consumer preferences. The arts and culture sector is uniquely positioned to benefit from this alignment, as creative fields contribute significantly to digital media, design, and experience-based industries. The Blueprint highlights the potential for state and regional policies to expand pathways for creative workers, a model that could be applied in San Luis Obispo County to strengthen career opportunities for artists, designers, and cultural workers. By integrating arts education into broader workforce development initiatives, the county can ensure that creative professionals are not only retained but also positioned to drive future economic growth. Investing in professional development and career pathways for artists can strengthen the creative economy and ensure that arts professionals remain in the region rather than relocating to more affordable areas. One example of regional investment in the creative economy is the Central Coast Creative Corps, a two-year initiative (2022–2024) in which SLO County Arts partnered with five other Central Coast arts agencies to fund artist residencies addressing public health, climate resilience, social justice, and civic engagement. Programs like these not only support local artists but also demonstrate the arts’ ability to drive cross-sector solutions, benefiting both the cultural sector and the broader economy. Ensuring the continuation of such initiatives, even as pandemic-era funding recedes, will be critical to maintaining the region’s economic and cultural vitality.

17 Visit SLO CAL. Wine Country. https://www.slocal.com/things-to-do/wine-country/

18 Matthews, William A. Medellin-Azuara, Josue. University of California Agricultural Issues Center at UC Davis. 2015. The Economic Impacts of the San Luis Obispo County and Paso Robles AVA Wine Industry

While Census Bureau datasets and prior surveys and research can help inform and guide our investigation, we need current data on the arts and culture sector in the region to develop a baseline understanding of their operating conditions and economic effects. With this in mind, in January 2025, we surveyed arts and culture non-profit organizations, event organizers and companies in SLO County.

We first developed our “sample frame” (a list or source from which a sample is drawn representing all the entities within a given population that can be sampled) by sourcing a directory of arts and cultural establishments from Dun & Bradstreet’s Hoovers Database, a best-in-class proprietary business record database. We extracted a list of all identified performing arts, music, museums, cultural and historical establishments that were geographically located in San Luis Obispo County in late December 2024 using Dun & Bradstreet database industry filters. We removed all inactive groups, duplicates, and professions that had a tenuous connection to the arts and culture sectors. We shared and verified this list with the client, who provided a small supplementary list of establishments that were not included in our data pull. We verified the active status of all establishments through Internet research. Ultimately, our compiled sample frame resulted in 140 unique establishments, which included nonprofit organizations, for-profit companies, entrepreneurs and event organizers. With guidance from SLO County Arts Council and key sector stakeholders in the region, we developed an eighteen-question survey questionnaire, covering diverse topics such as establishment revenue and payroll, event and visitor-related metrics, and intersection with the wine industry. This region’s arts scene is closely tied to tourism and the wine industry, with many organizations leveraging winery partnerships, event-based revenue, and visitor engagement to sustain operations. There was particular interest among stakeholders in an evaluation of the nexus between local wineries and the arts and culture sector, and the degree to which they partnered and worked together. We developed a contact and distribution list for our sample frame using contact information provided by Dun & Bradstreet and verified this information through social media and Internet research. We distributed our survey electronically across three rounds of email outreach to sample frame establishments in mid to late January and

reached out directly via telephone to all identified non-respondents. Additional mass and individual outreach efforts were made by SLO County Arts Council staff and key sector stakeholders. We ultimately gathered 62 survey responses, achieving a 44.3% survey response rate.

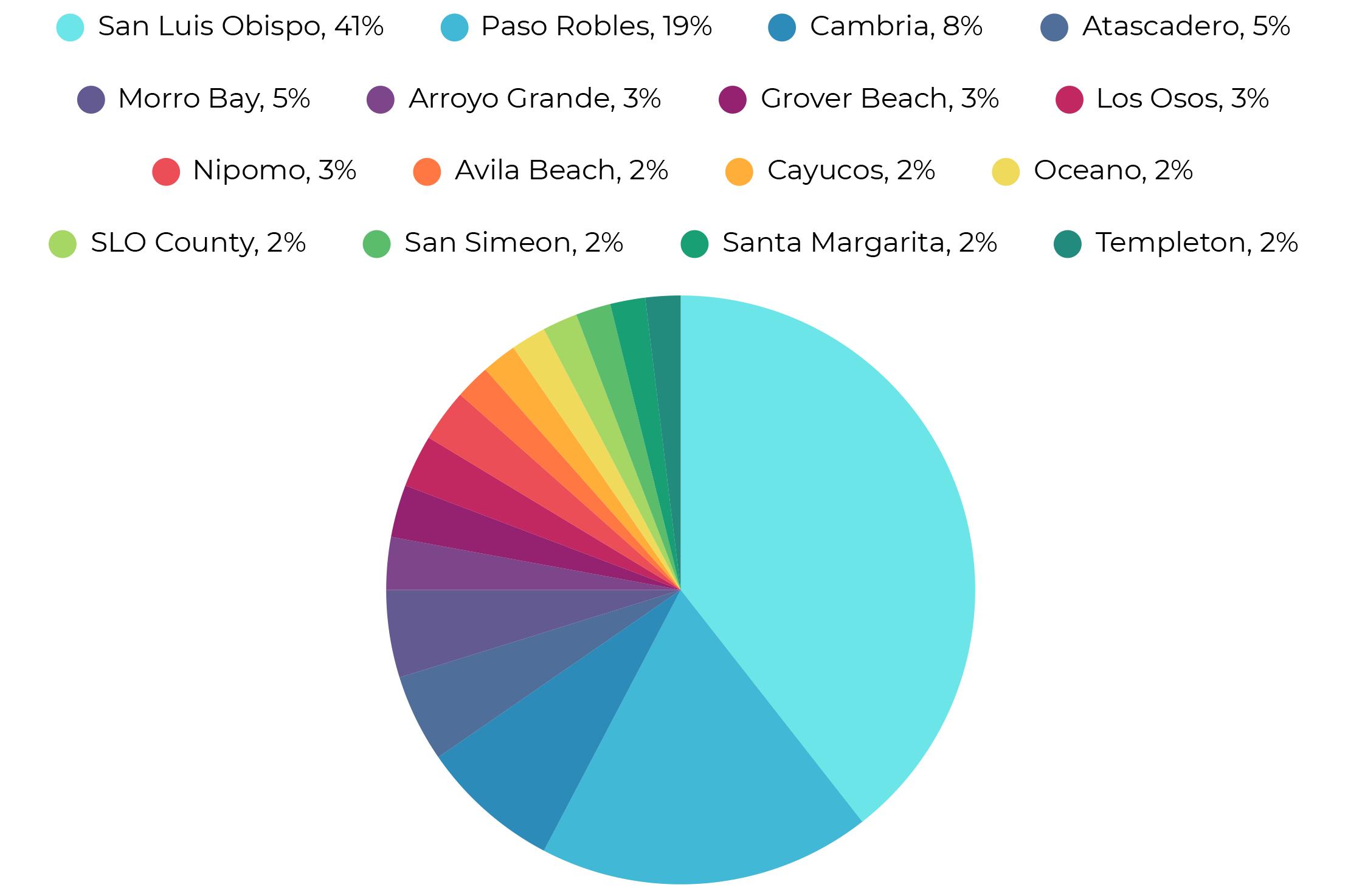

Overall, the survey responses indicate a diverse mix of arts and culture establishments in San Luis Obispo County. When asked “what type of organization do you represent? Select all that apply,” a plurality of establishments selected “Other” (40%), reflecting the broad range of creative establishments beyond traditional classifications (see Table 3 in Appendix A). Art galleries (24%) and performing arts organizations (23%) were among the most common defined organization types, with notable differences between Paso Robles and San Luis Obispo. Paso Robles had higher participation from art galleries (25%) and community arts programs (17%), whereas San Luis Obispo had a stronger representation of performing arts organizations (31%). This suggests that Paso Robles’ arts scene leans more toward visual arts and gallery spaces, while San Luis Obispo has a more developed infrastructure for live performances. We next asked respondents to indicate which city or unincorporated community their organization is located in (see Chart 1 in Appendix A). The City of San Luis Obispo accounts for 41% of all respondents, underscoring its role as the region’s cultural and institutional hub. This dominance is likely due to the presence of Cal Poly, established arts venues, museums, and a strong year-round audience for performing arts and gallery exhibitions. In North County (Paso Robles, Atascadero, and Templeton), Paso Robles alone represents 19% of respondents, making it the second-largest arts center in the county. Combined with Atascadero (5%) and Templeton (2%), North County accounts for roughly a quarter (26%) of respondents. The coastal communities (Cambria, Morro Bay, Cayucos, Los Osos, Avila Beach, San Simeon) collectively account for about 21% of arts organizations. Cambria (8%) leads this group, consistent with its reputation as an arts enclave featuring galleries and independent artists. Lastly, South County (Arroyo Grande, Grover Beach, Nipomo, Oceano, and Santa Margarita) accounts for approximately 13% of respondents. The South County region appears to have fewer formalized arts organizations compared to SLO City or Paso Robles.

San Luis Obispo County Tourism Business Improvement District, Highway 1 Road Trip (H1RT)

Highway 1 Road Trip (H1RT) is a unique business improvement district (BID) that connects and promotes economic activity in the artisan coastal communities of the San Luis Obispo County unincorporated area. Our investigation highlights this organization to illustrate its unique history and the attractions it represents in the region.

Highway 1 construction began in 1919 and has since become a sought-after destination for tourists. The 100-plus mile stretch of the highway provides access to 13 state parks and various other attractions. This includes Hearst Castle, which became a state monument in 1958, and today offers visitors an opportunity to explore the estate’s gardens, artwork, and architecture. Visitors to the area can also visit the Elephant Seal Rookery in San Simeon, the largest free viewing area of the seals in the state. The tourism draw of this coastal stretch led to the creation of the H1RT Business Improvement District. The area’s arts presence offers additional experiences for visitors, such as the Cruise Control Contemporary Art Gallery in Cambria or lifeguards tower murals at Avila Beach. Increased visitation since H1RT’s inception helped bring in an estimated $14.9 million in hotel tax revenue in the 2022-2023 year, which marks an increase of 226 percent since the group’s start.

The BID has made efforts to boost tourism since its inception and illustrates key themes identified in our investigation, namely marketing efforts and collaboration. H1RT has focused on marketing to enhance visitation and interest in the area. Similar to the findings in our focus groups, H1RT also identified a trend of younger audience and visitor makeup. According to its 2023 report, the group employed a variety of marketing methods including “utilizing paid media, email marketing, social media, content marketing/blog posts, and user-generated content.” The H1RT website receives an average of 75,000 visitors per month and recorded an increase of 30 percent year-over-year in Facebook engagement, according to the same report. H1RT collaborates and aligns with efforts of other organizations in the region, notably Visit SLO CAL. To highlight one example of such collaboration already, H1RT changed its branding (from Highway 1 Discovery Route) to align its messaging with Visit SLO CAL to increase overall awareness of the area.

19 U.S. Department of Transportation, Federal Highway Administration. https://www.fhwa.dot.gov/infrastructure/back0403.cfm

20 Highway 1 Road Trip. https://highway1roadtrip.com/san-simeon/

21 Unincorporated San Luis Obispo County Tourism Business Improvement District (CBID). Year-End Report 2023. https://highway1roadtrip.com/ wp-content/uploads/2024/06/CBID-Year-End-Report-2023.pdf

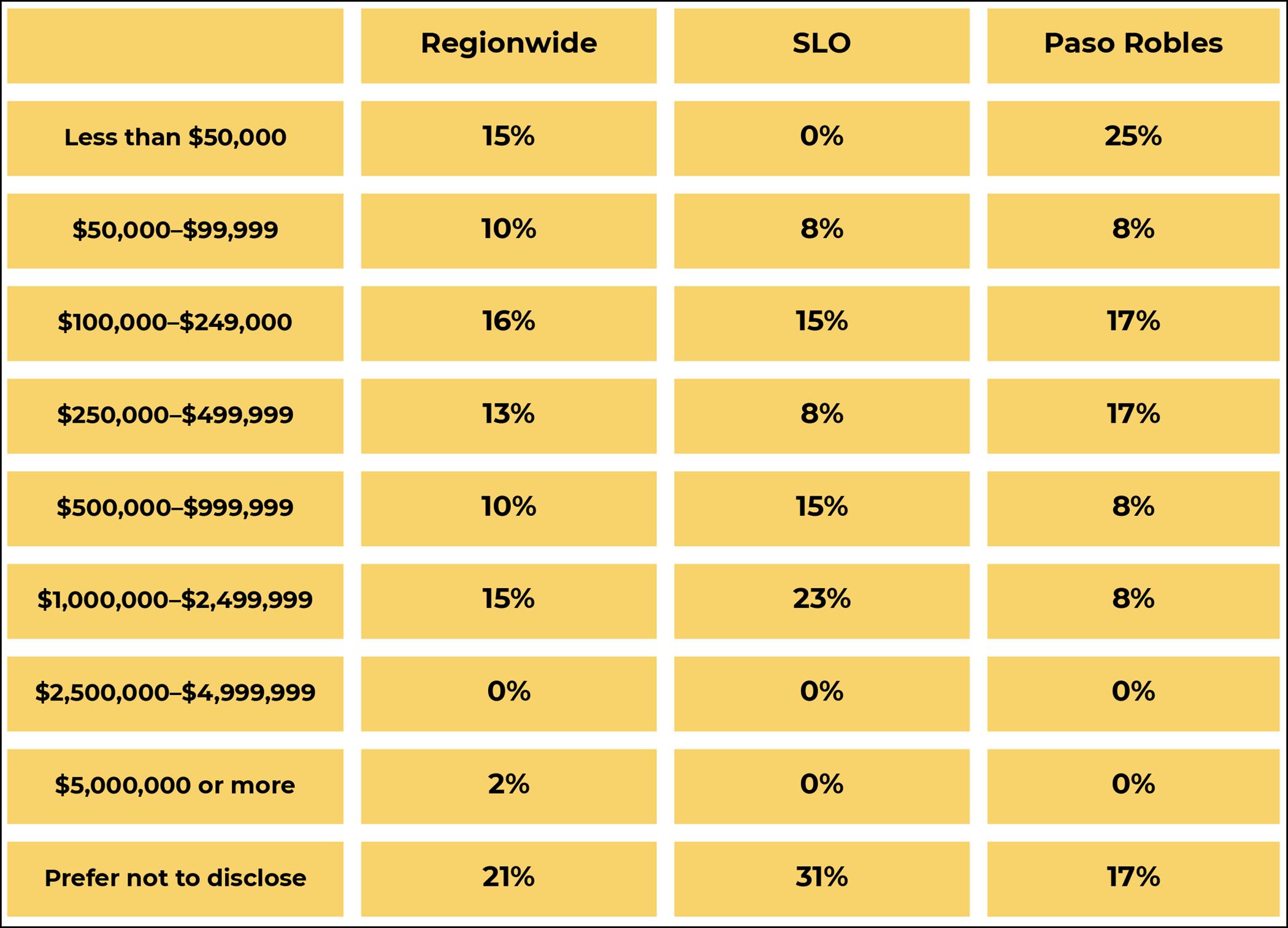

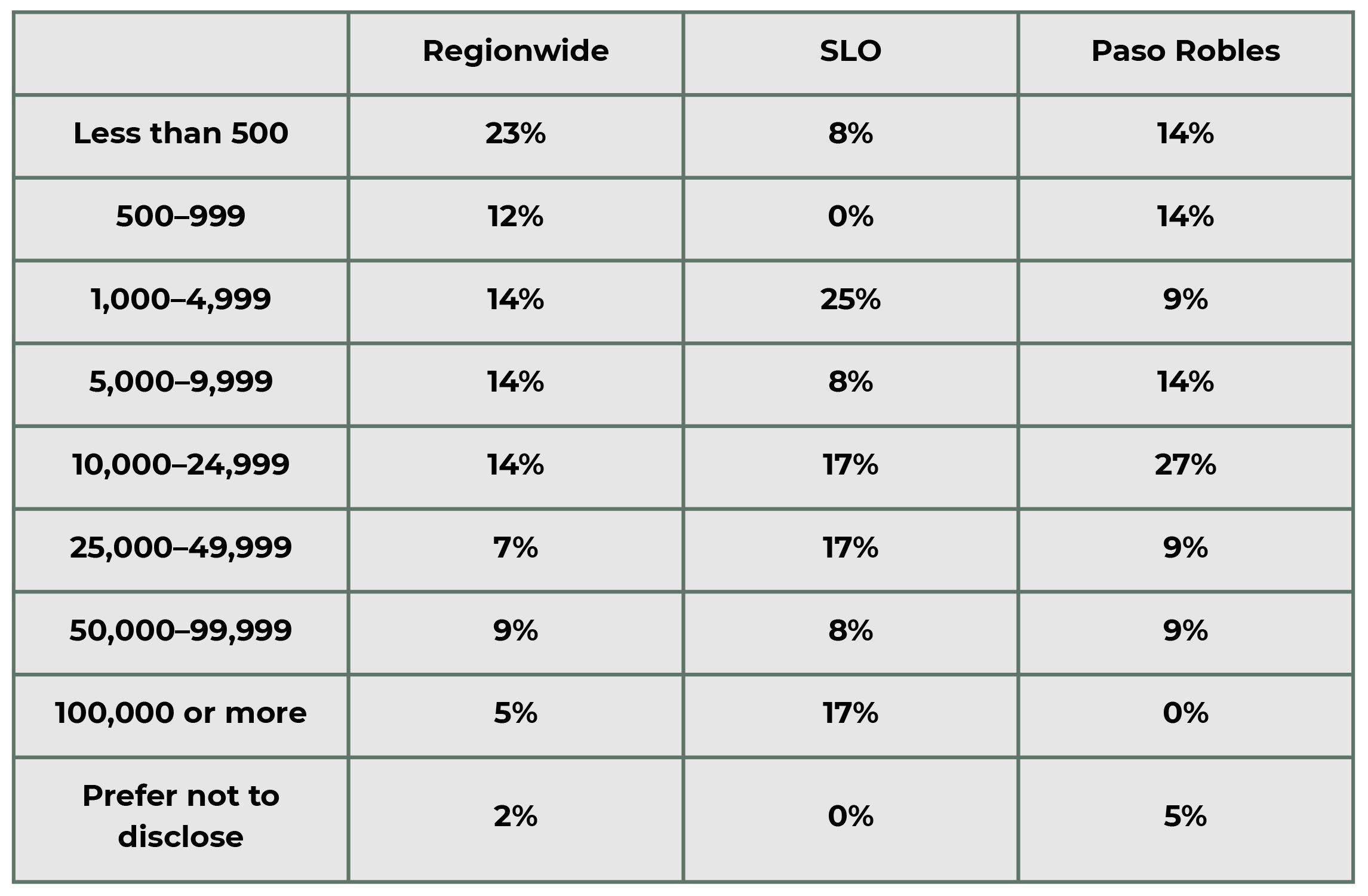

Annual revenue figures reveal a clear financial divide between arts organizations in San Luis Obispo, Paso Robles, and the broader county area (see Table 4). Regionwide, 15% of organizations reported earning less than $50,000 for Fiscal Year 2024, but this number was significantly greater in Paso Robles (25%), suggesting a prevalence of small, independent arts organizations there. In contrast, San Luis Obispo had a higher percentage of mid-sized and large organizations, with 23% earning over $1 million annually, compared to just 8% in Paso Robles. This may be

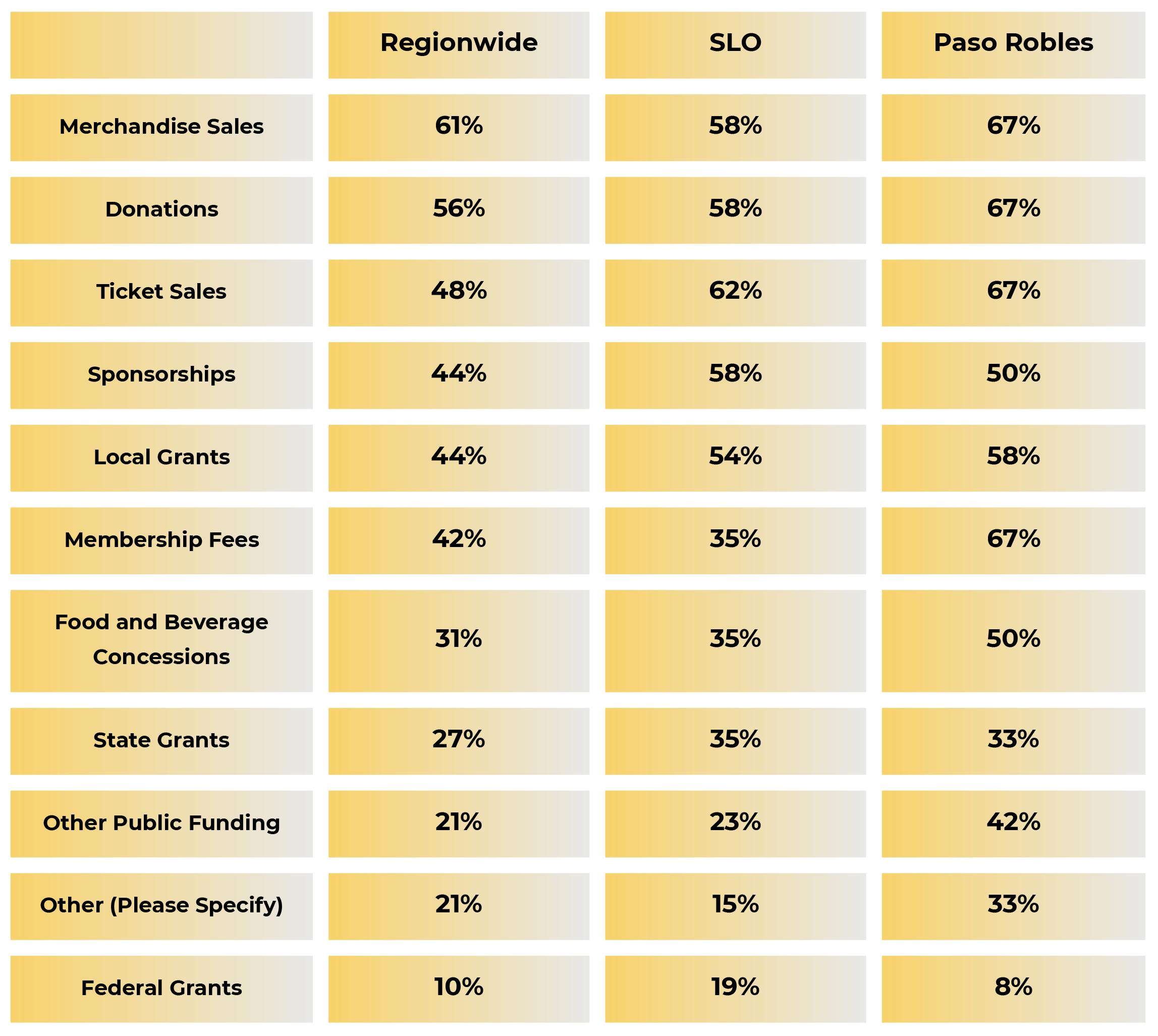

zations in San Luis Obispo County rely on a mix of funding sources, with merchandise sales (61%) and donations (56%) being the most common revenue streams (see Table 5). Interestingly, Paso Robles organizations were more likely to generate revenue from ticket sales (67%) and membership fees (67%) compared to the regionwide average (48% and 42%, respectively). This suggests that Paso Robles’ arts economy may be more dependent on event-driven revenue, whereas San Luis Obispo organizations might rely more on diversified funding, including grants and merchandise sales.

Table 4: Survey Responses to the Question,

“What was your organization’s total annual revenue for fiscal year 2024?”

due to San Luis Obispo’s access to institutional funding, larger venues, and university-affiliated programs, whereas Paso Robles’ arts organizations may rely more heavily on community engagement and tourism-based revenue.

It is worth noting that we observed a high rate of organizations that preferred not to disclose their revenue (31% in San Luis Obispo and 17% in Paso Robles). It may be that, beyond a desire for privacy, many organizations may operate in a more fluid financial environment, possibly relying on grants, donations, and event-based revenue rather than stable annual income streams.

The survey responses indicate that arts and culture organi-

Another key finding is the importance of public funding. Local grants were a key funding source for 54% of respondents in San Luis Obispo City, compared to 58% in Paso Robles and 44% countywide. It may be that arts organizations in both cities actively seek local government and foundation funding, though Paso Robles organizations may need to supplement this with more membership-driven support. Notably, only 10% of organizations regionwide reported receiving federal grants.

On the issue of total annual payroll, many respondents (29%) reported payrolls under $50,000, with a similar percentage in Paso Robles (18%) (see Table 6 in Appendix A). However, the biggest contrast emerges in the $100,000–$249,999 range, where 36% of Paso Robles organizations fall, compared to just 15% in SLO City. This suggests that Paso Robles’ arts economy may be characterized by small-to-mid-sized employers, while San Luis Obispo’s arts organizations either operate with very small or very large payroll budgets.

Higher payrolls in San Luis Obispo, such as the 15% of organizations paying between $500,000–$999,999 annually, reflect the presence of larger performing arts institutions and museum staff, which require full-time employees rather than freelance or seasonal workers. Paso Robles’

reliance on event-driven arts activities may lead to more contract-based or gig employment, rather than full-time staff positions. This suggests a need for more year-round employment opportunities in Paso Robles’ arts sector.

Countywide, roughly a quarter (23%) of survey respondents reported fewer than 500 annual attendees, showing that a significant portion of the sector serves small, niche audiences and/or clientele (see Table 6). However, Paso Robles had a higher share of organizations attracting between 10,000–24,999 attendees annually (27%), compared to 17% in San Luis Obispo. This suggests that Paso Robles benefits from large-scale, tourism-driven arts events, such as wine festivals, outdoor concerts, and public art installations.

In contrast, San Luis Obispo had a smaller percentage of organizations with fewer than 1,000 attendees, pointing to more large-scale venue-based experiences. These findings suggest that Paso Robles’ arts sector could benefit from sustained visitor engagement year-round, rather than concentrated attendance spikes during major events.

more structured but slightly lower event frequency compared to Paso Robles.

Another notable takeaway is that only 10% of organizations host more than 100 events per year, suggesting that large-scale, high-frequency arts programming is relatively

Table 5: Survey Responses to the Question, “How does your organization generate revenue? (Select all that apply)”

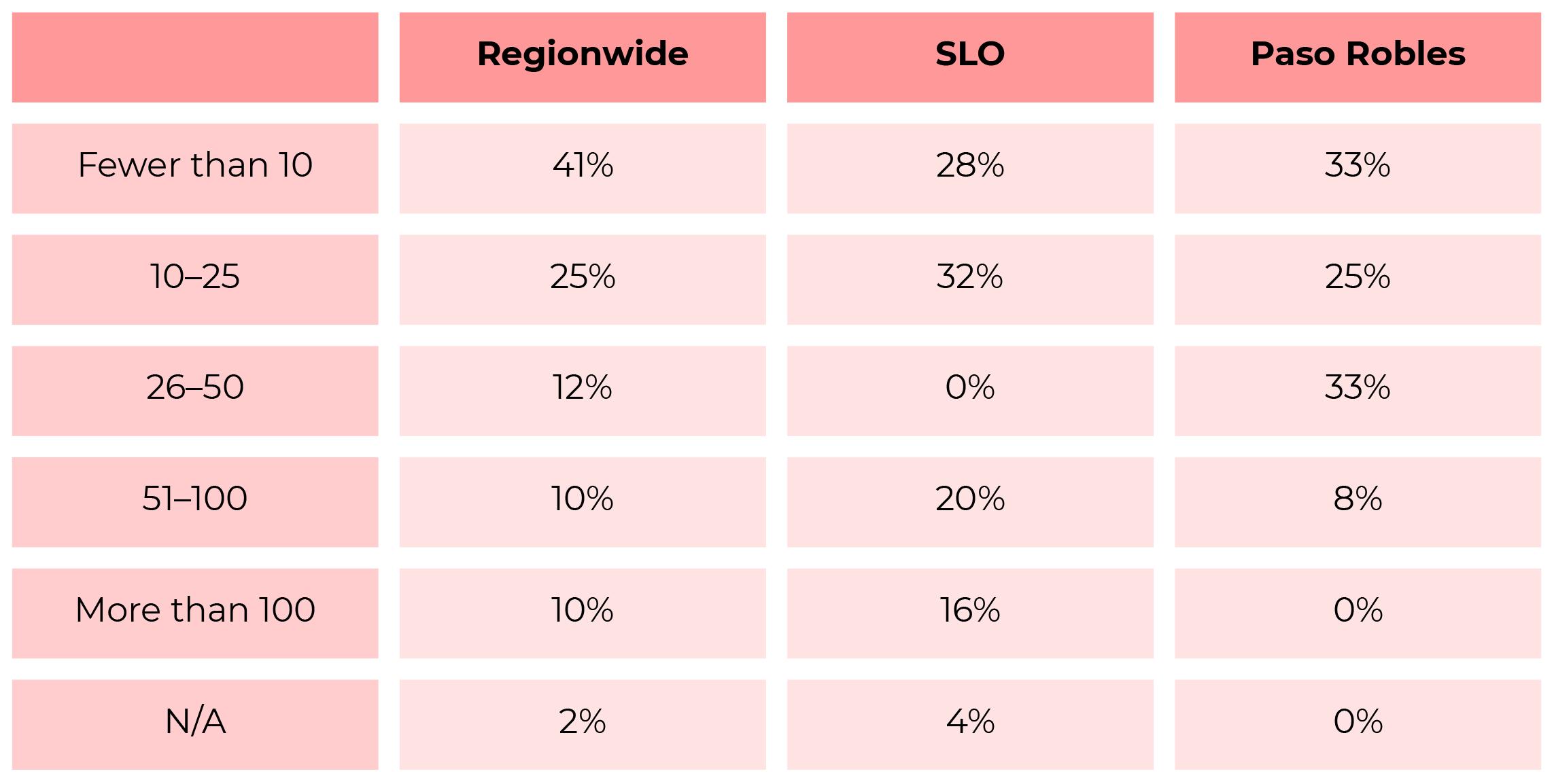

The survey results show that arts organizations in San Luis Obispo County host a wide range of events, with 41% regionwide reporting fewer than 10 events annually (see Table 8 in Appendix A). This suggests that a significant portion of organizations operate on a small scale, likely due to limited funding, staff, or venue access. However, Paso Robles organizations were more likely to host 26-50 events per year (33%), highlighting Paso Robles’ stronger focus on frequent arts programming, possibly linked to winery collaborations or tourism-driven events. Meanwhile, San Luis Obispo organizations were more likely to host between 10-25 events per year (32%), indicating a

rare in the county. However, San Luis Obispo had a higher share of organizations in this category (16%) compared to Paso Robles (0%). This difference may be influenced by Paso Robles’ emphasis on seasonal festivals and winery-hosted events, which tend to be concentrated rather than spread throughout the year, whereas San Luis Obispo’s permanent performing arts venues and museums likely maintain more regular year-round programming.

On the issue of average visitor attendance, most respondents reported moderate event attendance, with 42% drawing between 51–200 attendees per event (see Table 9 in Appendix A). Both San Luis Obispo and Paso Robles had a majority of respondents indicate that average atten-

dance was 200 or fewer patrons per event (52% and 75%, respectively), but SLO City had significantly higher response rate for larger attendance size answer choices. This finding could guide future local marketing efforts that are complementary to each city’s unique offerings in venues and event experiences.

Robles, where spending may be more distributed across food, wine, and hospitality.

Table 7: Survey Responses to the Question, “What was your organization’s total number of (attendees) for fiscal year 2024?”

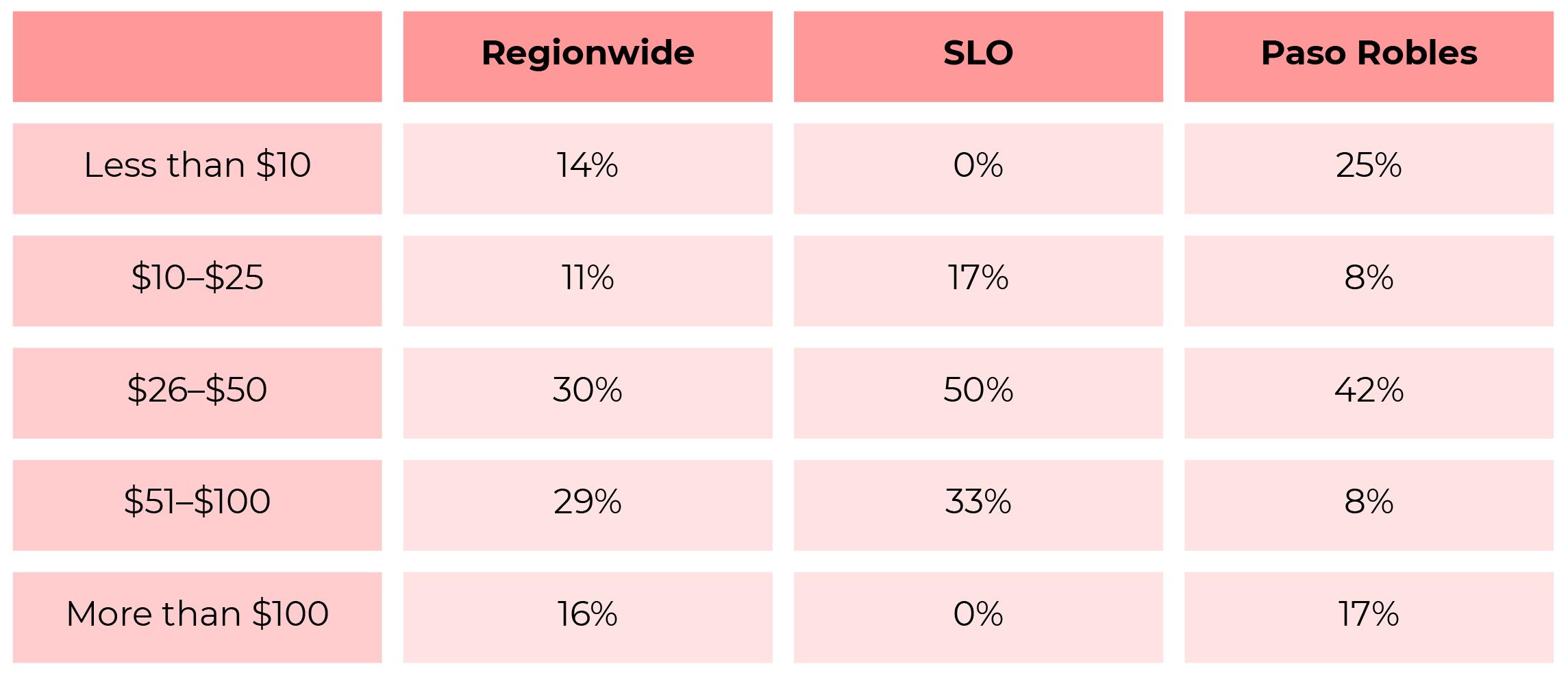

Our survey responses indicated meaningful levels of visitor spending on arts and culture (see Table 10 in Appendix A); the majority of attendees spent between $26–$100 per visit, indicating that arts events contribute significant revenue per visitor through ticket sales, concessions, and merchandise. However, spending differences between cities are notable: 33% of San Luis Obispo respondents reported visitor spending of $51–$100 per visit, while Paso Robles had a higher percentage of visitors spending less than $10 (23%).

This pattern in answer choices suggests that San Luis Obispo’s arts economy is structured around ticketed performances, museums, and formalized events with higher costs, while Paso Robles may be attracting more casual, tourism-driven spending at free or low-cost outdoor events. The higher spending levels in San Luis Obispo could also indicate a stronger local arts consumer base willing to invest in arts experiences, compared to Paso

When asked “how many volunteers supported your organization last year, responses varied (see Table 11 in Appendix A). To be clear, volunteerism plays a crucial role in the arts and culture sector, with only 35% of organizations reporting zero volunteers, while 26% had between 11–50 volunteers annually. This suggests that while many organizations function with minimal volunteer support, a significant portion rely on community engagement for their operations.

One key trend is that San Luis Obispo organizations were slightly more likely to report smaller volunteer pools. This may be due to a greater reliance on paid staff in performing arts organizations and museums. The data suggests that Paso Robles’ arts sector is more reliant on volunteer engagement, which may be essential for event-based and festival-driven organizations. If Paso Robles’ arts economy continues to expand, there may be a need to transition some of these volunteer-dependent roles into paid positions to support long-term growth and development.

The distribution of volunteer hours (see Table 12 in Appendix A) shows that many volunteers contribute relatively small amounts of time (1-50 hours per year, 47% regionwide), which may be an indicator of casual or youth-focused volunteering programs. Interestingly, Paso Robles organizations were more likely to have high-hour volunteers than San Luis Obispo City respondents (41% contributed over 50 hours annually versus 20%, respectively), which could reflect either a greater need for volunteer support in Paso Robles, and/or more capacity and interest for volunteer management. San Luis Obispo, in contrast, had more organizations with no or very limited volunteer engagement, reinforcing the idea that paid staff or contract workers

might play a more prominent role in the city’s performing arts and cultural institutions. This trend suggests that Paso Robles benefits from strong volunteer engagement.

In order to estimate the total volunteer and volunteer hours contributed to regional arts and culture establishments, we took the values from our survey responses and took the median value from the answer choice range selected. For those “more than” values selected, we conservatively doubled the value for calculation purposes. We declined to model volunteering metrics for non-respondents in our sample frame due to its relatively small size. Ultimately, we estimate that 2,580 volunteers contributed more than 197,000 volunteer hours to arts and culture institutions in 2024. We next calculated the monetary value of the volunteer hours contributed by the most current value of volunteer time by hour by state produced by the Independent Sector. This yields a dollar value of our estimated volunteering time total of $7,606,170, a sizeable figure that underscores broad community support for the arts.

We also sought to measure the degree to which arts and culture establishments are partnering with wineries; overall, we found that nearly four out of ten (39%) arts organizations in San Luis Obispo County do not currently collaborate with wineries, despite the industry’s strong regional presence. However, Paso Robles’ responses were far more likely to indicate that they engage in winery partnerships, with 67% collaborating on event hosting and 50% engaging in cross-promotion or marketing efforts.

San Luis Obispo respondents reported fewer winery collaborations overall, with 36% not engaging in any partnerships, which may be due to a stronger focus on traditional performing arts and venue-based experiences rather than wine tourism-driven events. However, the relatively high share of sponsorship-based partnerships in both cities (31% regionwide, 40% in San Luis Obispo, and 42% in Paso Robles) suggests that wineries broadly recognize the value of supporting the local arts sector as a way to reach more visitors.

Table 13: Survey Responses to the Question, “Does your organization currently collaborate with wineries? If yes, please select all collaboration methods”

22 Source: https://independentsector.org/wp-content/uploads/2024/04/is-vovt-report-all-years_v2-1.pdf

When asked “what percentage of your event revenue is linked to winery-hosted or winery-sponsored activities,” the vast majority of respondents (61% regionwide) reported that none of their event revenue is linked (see Table 14 in Appendix A). However, Paso Robles had a significantly higher share of organizations earning between 1%-10% of revenue from winery partnerships (55%), compared to just 32% in San Luis Obispo. This suggests that while many Paso Robles arts organizations benefit from winery collaborations, they do not rely on them as their primary revenue stream.

Interestingly, a small but notable portion of Paso Robles organizations (9%) reported that more than 50% of their revenue is tied to wineries, showing that for certain organizations, wine tourism plays a central role in financial sustainability. This trend could indicate an opportunity for further economic integration between the arts and wine industries, particularly through formal partnerships or co-branded events that increase direct financial contributions to the arts.

The survey reveals that arts organizations contribute significantly to local economic and social well-being, with 81% reporting that they attract out-of-town visitors, reinforcing their role as a driver of regional tourism (see Table 14). Notably, 100% of Paso Robles respondents said they contribute to tourism, compared to 65% in San Luis Obispo, reflecting Paso Robles’ stronger reliance on visitors and destination-driven arts events.

Table 15: Survey Responses to the Question, “What community benefits did your organization generate in 2024? (Select all that apply)”

In addition to tourism benefits, San Luis Obispo organizations were more likely to provide free or low-cost arts programs (77%), compared to 58% in Paso Robles,

Paso Robles may be more strategically aligned with local businesses and visitor activity. More research is required to make conclusive findings.

suggesting a stronger emphasis on community accessibility in SLO’s arts institutions. However, Paso Robles organizations were more likely to report supporting local businesses through partnerships and increased foot traffic (75%), highlighting the arts sector’s role in boosting local commerce. These findings suggest that San Luis Obispo’s arts sector may lean toward general public accessibility, while

To better understand the challenges and opportunities facing the sector, we asked an open-ended question to respondents, “please share your ideas and thoughts on how local community leaders and elected officials can best support your organization and the greater arts and culture community in San Luis Obispo County.” The following is a summary of the written responses, which ranged from brief to detailed in length.

Overall, the most frequently mentioned concerns revolved around the need for increased funding and grant opportunities. Many respondents emphasized that stable and increased financial support would allow them to expand programming, enhance marketing efforts, retain staff (especially through mid-career positions, livable wages, and benefits) and provide more no- and low-cost access to the arts. Other recurring topics included challenges related to marketing support, public engagement, and the need for affordable spaces to host events and exhibitions.

Organizations based in SLO City commonly cited concerns regarding accessibility and affordability, particularly in relation to parking availability and cost in downtown. Responses from Paso Robles organizations shared many similarities with those from San Luis Obispo, particularly regarding financial support. However, organizations in Paso Robles placed a greater emphasis on increased civic support for marketing and promotion, and new opportunities to showcase visual and performing arts in public spaces and facilities (murals, rotating art installations, allowing schools as venues, et al). It is worth noting that the county government does not provide a specific funding mechanism to support arts and culture institutions in the region.

As part of our research study, we took a closer look at the economic dynamics of the SLO arts and culture sector through the prism of econometric modeling. Understanding the “ripple effects” of jobs created and revenue generated from arts and culture can help provide meaningful metrics for economic development professionals and inform strategic planning and civic discussions about the sector. Further quantifying data from sector establishments we have highlighted in this study can also bring greater understanding and awareness of the value of the data to the public in a more relevant way, and one which lends itself well within the public policy process.

We evaluated our sample dataset using the Regional Input-Output Modeling System (RIMS II), a widely used “input/output” econometric modeling program developed by the Bureau of Economic Analysis, an agency of the United States Department of Commerce. Input/output models are an econometric technique that explores economic relationships within a defined geographic area. An “economic impact” or “multiplier effect” is created when new dollars are recirculated in an economy, indirectly supporting more jobs and additional business activities. In economic literature, “indirect effects” refer to those supply chain impacts that result as businesses procure goods and services from other companies (and, in turn, these businesses buy goods and services from others). “Induced effects” refer to the impacts when workers spend their wages on goods and services (and, in turn, the effects associated with these expenditures continue to circulate through a local economy). The RIMS II model provides “multipliers” (ratios of inter industry relationships within regions) which allow us to estimate the total change in gross output, earnings and employment in a defined geographic area for each additional dollar spent in an industry. For our analysis, we used “final demand” (spending) RIMS II multipliers for our analysis, which measure the sum of direct, indirect and induced effects, often referred to as the “total economic impact”, resulting from a $1 increase in spending for a given industry in a region.

As part of our economic and visitor impact investigation, we first looked at the impact that SLO arts and cultural

establishments have on the regional economy and workforce. We began by evaluating employee headcount and payroll data from survey participants and supplemented omitted values and figures for non-participants in our sample frame using sales and payroll data (actual and modeled) which were included in our Dun & Bradstreet’s Hoovers data pull. Overall, we estimate that SLO County’s arts and culture sector generated $35.4 million in direct sales in 2024 and employed 874 workers, 81% of which are part-time or gig-based, based upon survey responses (see Table 16).

For econometric modeling purposes, we next classified our data using the most pertinent 2017 North American Industry Classification System (NAICS) codes, which is “performing arts, spectator sports, and related industries; and museums, historical sites, and similar institutions.” We next estimated economic impact by applying RIMS II Type II final demand multipliers to the sales and workforce data using our NAICS classification, and adjusted our RIMS II results from 2022 dollars to 2024 dollars using the Gross Domestic Product (GDP) Implicit Price Deflator.

Our model found that SLO arts and culture establishments have a total economic impact of $59.3 million, and a total jobs impact of 1,343 jobs, which includes full-time, part-time, and seasonal positions. We also used RIMS II final demand earnings multipliers to estimate the total earnings impact of arts and culture establishments, which estimates the direct total payroll of the sector along with the indirect and induced earnings generated; this yielded $17.5 million in total earnings impact. Our analysis also included breakout figures for the City of San Luis Obispo and Paso Robles, which are also detailed in Table 16. Overall, both municipalities are home to a significant share of sector sales, jobs and economic activity.

We next looked at visitor-related impacts of the arts and culture sector. We began our analysis by first determining the out-of-county arts and culture visitor universe in SLO. We used our survey questionnaire responses to model the visitor population. We asked respondents, “does your

organization or company have regular visitors? If so, please complete the following two questions. If not, please skip these questions and move to the next question.” Our first question was “what was your organization’s total number of visitors for fiscal year 2024?” and provided a range of answer choices (Less than 500, 500-999, 1,000-4,999, 5,000-9,999, 10,000-24,999, 25,000-49,999, 50,000-99,000, 100,000 or more, Prefer not to disclose). We took the visitor responses and used the median range value, and in the case of those that did not disclose their visitor attendance or those that did not participate we used the smallest answer choice value that respondents of similar type and geographic choice selected. This effort yielded a total regional arts and culture attendee population of 3.1 million in fiscal year 2024 (see Table 16). Sorting by municipality, we see that Paso Robles had approximately 629,326 attendees that year, and San Luis Obispo County had 1.1 million arts and culture attendees.

Our second part of the two-part question series was an open-ended question, “approximately what percentage of your (attendees) are: Local (residents of SLO County), Regional (residents of California but outside SLO County), or out-of-state or international?” We took these responses to create three separate categories of attendees. To model visitor estimates for non-respondents, we took the average answer choice values provided by small to medium-sized respondents, which is 72% local visitors, 26% non-SLO Californians, and 2% out of state or international. We then multiplied our modeled visitor attendance figures by institution by these ranges, which generated a total local attendee population of 1.9 million (63%), a non-

SLO California visitor population of 906,961 (29%), and an out-of-state/international visitor population of 268,492 (8.6%).

With our visitor population modeled, we next sought to model total visitor spending and its effects on the regional economy. We began by taking our non-SLO California visitors and out-of-state/international visitor population and adjusting for visitors who may have frequented more than one art and culture establishment or experience on their trip. For methodological purposes, we conservatively estimate this to be 20%, and thus adjusted down our visitor population by that value. We next sorted our populations by overnight visitors and day visitors. Based upon prior visitor data from the region, we estimate that 65% of nonSLO California visitors are overnight visitors that stayed at a hotel, resort or inn, and 35% are either day visitors or may be staying with a friend or family member or at a short-term rental.

To estimate average visitor spending, we took the most current data available at the time of developing this report, which was a 2017 SLO Cal Visitor Economic Impact Report authored by Tourism Economics, which identified overnight visitors spent an average of $288.54 per visit, and day visitors spending $123.58 per visit. We next adjusted these figures to 2024 dollars using the Consumer Price Index (CPI) and adjusted them to reflect the overall rate of change in visitor spending in San Luis Obispo County, using 2014-2023 regional spending data found in Visit California’s 2023 Economic Impact of Travel report. For out-of-state and international visitors,

we increased their spending levels to approximately 26% more than out-of-region California visitors, based on prior visitor spending research findings of comparable regions. We then reduced our overall visitor spending estimates to account for underreported budget travelers, spending leakages, and comparable figures from other regions. This resulted in a 2024 SLO trip expenditure for overnight visitors of $349.71 per trip, and a spending estimate for day visitors of $163.71 per trip.

We next took our overall spending figures, sorted by overnight and day visitors, and by geography (regionwide vs. SLO City vs. Paso Robles) and divided spending by

major categorical spending areas identified through prior research studies. We then adjusted spending to remove local taxes from applicable spending categories (accommodation, food and beverage, retail, local transportation) and combined the total visitor spending categorical totals between overnight and day visitors. This yielded a $291.1 million regional total visitor spending estimate, a $99 million figure for SLO City, and a $70.2 million estimate for Paso Robles. We next analyzed these spending estimates using RIMS II multipliers, and determined the total jobs impact, earnings impact, and economic impact for the respective municipalities, and adjusted for 2024 dollars using the California Consumer Price Index. Overall, we estimate that the total economic impact of arts and culture visitor

23 Economic Impact of Tourism in San Luis Obispo County, California – 2017. Tourism Economics. Published May 2018. Average spending per visit – day and overnight. Page 20.

24 The Economic Impact of Travel 2023- California. Dean Runyan Associates. Visit California. Page 201.

spending in SLO County was $478.7 million in 2024, the total economic impact in SLO City was $163 million, and the total impact in Paso Robles was $115.5 million.

We would note the high jobs multiplier in RIMS II for Performing Arts, Spectator Sports, Museums, and Related Activities is likely largely driven by the labor-intensive nature of the industry, lower average wages per job, and broad economic “spillover effects.”

Unlike more capital-intensive sectors, arts and culture rely heavily on human interaction, with jobs for performers, technicians, event staff, and other support personnel. Many of these roles are part-time, gig-based or seasonal, and as such visitor spending supports more workers compared to high-wage industries like finance or technology. Additionally, visitor spending plays a significant role in amplifying employment impact, as tourists attending performances or museums generate demand in hospitality, retail, and transportation. Beyond direct employment, the sector fosters substantial indirect and induced job creation, in such key areas as marketing, security, concessions, and logistics, while in-

duced jobs arise as arts workers spend their wages on local goods and services. The industry’s unique supply chain—including costume design, set construction, ticketing, advertising, and equipment rental—further increases employment multipliers. Together, these factors enhance the sector’s economic ripple effect.

Our analysis also finds that the arts and culture sector have a measurable effect on taxable sales in SLO County (see Table 18). We evaluated our estimated arts and culture visitor spending by category and by municipality, and multiplied by local hotel tax rates (transient occupancy tax) and the local share of state sales tax rates for San Luis Obispo County. Ultimately, we determined that SLO arts and culture visitor spending generated more than $6.7 million in hotel taxes and $1.5 million in local sales tax receipts in 2024.

In addition to our survey of art and culture business owners and community leaders, our investigation included four focus group sessions with themes developed and informed from our initial research findings. The purpose of facilitating these focus groups was to supplement our quantitative data analysis and document the dimensions and sentiment of the arts and culture sector that may not be visible or readily apparent in survey responses or public datasets. Focus group sessions provide an opportunity for participants to offer more detail and nuance on complex topics, as well as a broader context for relevant themes such as revenue generation and government support for the arts and culture sector.

The four focus group themes were split by different areas of expertise: economic impact, cultural leadership, tourism and visitor experience, and artists and cultural practitioners. Each focus group comprised of issue experts, sector professionals and practitioners identified from our sample frame, and with consultation with SLO County Arts and regional stakeholders. The focus groups were semi-structured with questions related to funding opportunities, collaboration and infrastructure, workforce and economic dynamics, as well as visitor behavior. Each group was given questions that reflected each group’s area of expertise on the current and future sentiment of arts and culture and its impact in San Luis Obispo County. Considerable effort was made to invite prospective focus group panelists with different perspectives, experiences and geographic location, to foster robust conversation and diverse contributions. Invitations to participate were made by SLO County Arts Council staff, and panelists were provided general discussion themes in advance of their sessions. These focus group sessions were held virtually for 90 minutes and facilitated by the Policycraft Institute from February 28th to March 11th.

group sessions that contribute to our understanding of the art and culture sector’s impact on the region.

The regional arts and culture sector was frequently characterized by panelists by its “small” size, a trait that has its advantages and limitations. On the one hand, this intimacy fosters a strong sense of community and connection among artists and organizations. This allows for close-knit networking and support. However, the limited scale also translates into a scarcity of opportunities, venues, and diverse artistic expressions. Artists face challenges in finding affordable spaces for creation, performance, or exhibition. These

limitations hinder artistic offerings. One participant noted “people have concerns and are hesitant to shake things up.”

Our team identified four key patterns from the focus

The tension between the close-knit community and the limited scope of the scene is a feature that influences the economic and creative potential of the arts in the region. While the sense of community provides a valuable support system, the lack of opportunities and diversity can hinder growth and innovation. This dual nature of “small” presents both a strength and a challenge and requires sector establishments to find ways to leverage its connectedness.

Financial challenges were a persistent theme throughout the discussions, cited by both individual artists and representatives of arts and cultural institutions in the region. The high cost of living in the region was discussed in the focus groups and concerns were also raised on attracting and retaining artists and employees from out of the area to work at sector organizations and events on a full-time or part-time basis.

Beyond the individual level, there was shared concern about the financial health of the sector in general. Organizations rely on a small but generous pool of donors in a sector that was described as “crowded” and “underfunded.” There was concern that, long term, this may impact innovation and growth amid an evolving audience that is craving more experiences. Participants expressed that there is often little funding “left over” to take risks and incorporate newer programming.

The role of local government and community support was a significant point of discussion, with varying perspectives on its effectiveness. While some acknowledged supportive efforts at the city-level, there were fewer mentions of support from higher levels of government. Across our focus groups, participants called for increased government funding of the arts, incentives for property owners to make spaces available for artists, and policies that address affordable housing. While the arts are viewed as a critical element of the community and its identity, there was an expressed need to quantify the economic contributions of the arts in order to advocate for greater financial investment and partnership opportunities. As one expert mentioned, the arts’ economic impact is “is recognized, but overlooked.”

engagement, and connect with diverse communities. Emphasizing the importance of breaking down sector silos, fostering cross-disciplinary collaboration, and creating spaces for intellectual exchange, participants discussed opportunities to grow the sector through, among other areas, consistent messaging, unified event calendars, and interdisciplinary events.

For a detailed summary of individual focus group conversations and findings, see Appendix B.

Participants recognized the need for the arts sector to adapt to evolving audience behaviors, embrace digital

While this report establishes new sector metrics and greater clarity to the conditions of arts and culture, more research should be conducted to expand the volume of data and knowledge in this field, which is limited. The SLO County arts and culture sector is diverse, growing, and has significant connections to the regional economy and workforce. However, due to the scarcity of disaggregated local data, many key questions about sub-sectoral performance, artist retention, and cross-industry collaborations remain unexplored. Future studies could better segment the types of arts organizations—such as festivals, museums, performing arts companies, and freelance practitioners—and evaluate their unique contributions and challenges.

We see value in a longitudinal study of the arts and culture sector in the region, which would track the financial and operational experiences of both artists and formal establishments over time. We are particularly concerned that the regional cost of living and housing market may significantly worsen in coming years, which will have a greater negative impact on smaller economically vulnerable individuals and entities. Exogenous events (natural

disasters, global recessions, et al), and changes in political climate and public funding are also key indicators to monitor and evaluate for policy planning purposes.

Moreover, we encourage future research efforts to evaluate the long-term challenges and opportunities that may emerge with sector development over the next 10 to 20 years. This includes evaluating the role of technological innovation, such as digital performances, AI-assisted creative work, and the expansion of remote arts education. Such an investigation should provide both city and county officials insight and guidance on how to develop a resilient sector, one that is well aligned to capitalize and add value to future strategic investments and opportunity for economic development. Special attention should be paid to how regional marketing and branding, creative placemaking, and arts-related tourism evolve alongside broader demographic shifts and migration patterns, especially as younger and more diverse populations engage with arts in new ways. Comparative studies with similar mid-sized cultural regions could also shed light on successful models for sustainability and growth.

The SLO County arts and culture sector provides measurable economic and community benefits to the region, and is interconnected with other key industries in the area in meaningful ways. As the regional economy changes and develops over time, we anticipate that artists, practitioners, cultural institutions and sector enterprises will play a

greater part of it, and help shape future partnerships and programs of economic value. When regional strategic investments and decision-making are being considered, it is our hope that this report can help inform and guide those efforts, for the betterment of all.

Since 1981, the San Luis Obispo County Arts Council has worked to strengthen the visual, literary, and performing arts by promoting public access, arts education, local arts planning, and opportunities for artists and arts organizations. The San Luis Obispo County Arts Council coordinates programs such as Art After Dark, the Open Studios Art Tour, Poetry Out Loud, and the Poet Laureate. The Council supports community organizations and artists via providing grant support and fiscal sponsorships. Through research, education, and advocacy, the Council highlights the value of the arts and culture sector, helping to expand cultural opportunities for the community. By building a strong infrastructure, the Council supports a thriving local arts and culture ecosystem.”

Vince Vasquez is the President and CEO of Policycraft Institute LLC, a public policy think tank based in Carlsbad, California. Vince has more than 20 years of experience in public policy research and writing, survey design and economic data analysis. He has previously authored policy papers and economic impact reports on a number of California business sectors and issues, including wineries and breweries, business improvement districts and commercial corridors, and Asian American, Native Hawaiian and Pacific Islander-owned businesses in the state. Vince earned his master’s in business administration from National University and a Bachelor of Arts in Political Science from the University of California, San Diego.

David Barnett is the Research Director of the Policycraft Institute. He previously served as the Director of Research and Thought Leadership for the Greater Los Angeles region at CBRE and Director of Work Dynamics Research for the Americas at JLL. David has more than 10 years of research experience focused on real estate, economic development, and public policy. David has authored more than 30 research reports, and his work has appeared in the New York Times, NPR, San Diego Union-Tribune, Los Angeles Business Journal, OC Register, Chicago Tribune, Commercial Observer, Dallas Morning News, and more. David earned his Master of Arts in Public Policy and Administration from Northwestern University and his Bachelor of Arts in Political Science from California State University, San Marcos.

Table 3: Survey Responses to the Question, “What type of organization do you represent? Select all that apply.”

Chart 1: Survey Responses to the Question, “Which city or unincorporated community is your organization located?”

Table 6: Survey Responses to the Question, “What was your organization’s total annual payroll for fiscal year 2024?”

Table 8: Survey Responses to the Question, “How many individual events or programs did your organization host last year?”

Table 9: Survey Responses to the Question, “What is the average attendance at your events?”

Table 10: Survey Responses to the Question, “What is the average total spending per visitor at your venue or event (e.g., tickets, concessions, merchandise)?”

Table 11: Survey Responses to the Question, “How many volunteers supported your organization last year?”

Table 12: Survey Responses to the Question, “What is the estimated number of hours they each contributed annually, on average?”

Table 14: Survey Responses to the Question, “What percentage of your event revenue is linked to winery-hosted or winery-sponsored activities?”

The economic impact focus group highlighted a complex economic landscape for arts and culture in SLO County, characterized by both recognized potential and challenges. Participants emphasized the perceived undervaluation and lack of data surrounding the sector’s economic contributions while also highlighting the sector’s role in creating community identity and sense of place. One expert summarized the sector’s economic relationship as “recognized but overlooked.” The panelists acknowledged that there are many art events that increase business traffic and there is an opportunity for those to “certainly scale up.” The participants identified a special relationship between arts and culture and the SLO community; as one panelist put it, they would be “hard-pressed to define these towns without these pieces,” referring to SLO’s cultural and creative institutions and communities.

Panelists also discussed challenges and opportunities for wages and workforce stability for the arts and cultural sector. Compared to other sectors, the nonprofit arts lack clear career pathways that lead to sustainable employment and higher wage jobs. One expert stated, “the reason (economic professionals spend time and resources fostering investment and growth in) tech manufacturing and aerospace is because the career paths are clearer.” The participants cited cost of living, housing affordability, and seasonality of tourism as challenges for sustaining arts employment. The focus group discussion touched on the fact that arts and culture professionals in the area often work in a career outside of their art to make a living, or supplement their “day job” with creative gig-based work or contract positions. Panelists highlighted opportunities in the greater creative sector, such as architecture and landscape design, which are supported by larger companies in the area.

Panelists identified a need for greater funding for the local arts from the state and federal level to grow and sustain the sector beyond local support. One participant emphasized “we are hitting a point in the region that we need to start leveraging and leveling up on state and federal funds.” This may mean that stronger coordinated advocacy efforts across local, state and federal governments are of value and desired as a solution. One challenge in

gaining more support is how policymakers view and value the arts. Another expert noted policymakers “think it’s important, but maybe not for economic reasons.” Participants reflected on how making funding for the arts a higher priority for policymakers is viewed as a challenge and is “hard to do because everyone is fixing potholes.” Overall, panelists shared that while there was progress in policy recognition of the arts and culture sector, there’s still a need for advocacy to fully demonstrate its economic value. Larger attractions that have grown, like Sensorio, were highlighted by the group as an example that can be leveraged for its track record for future arts events and opportunities.

Our discussion with the tourism and visitor experience focus group illustrated that the region’s art sector is evolving, moving towards experiential and interactive attractions that cater to a diverse audience, including younger demographics seeking active engagement. As one participant noted, there is a shift away from the “dusty museum…the guest of today and tomorrow are looking to come and do, not come and see.” This shift includes blending art with other regional assets like wine, nature, and technology. All participants in the group discussed the need for art to be more accessible for wider audiences through multiple forms of art, including music. Panelists shared that the visitor profile is a mix of local and regional tourists (LA, South Bay, Central) which may shift depending on the art exhibit or performance.