Imagine a world where your investments deliver a consistent return, year after year. Argen Capital offers exactly that – a remarkable opportunity to earn an 8% fixed return per annum, designed for those who seek stability and security.

Our innovative approach, developed by Skybound Capital, provides you with the peace of mind that comes with a steady income stream, while also allowing you to take control of your financial future.

Discover how Argen Capital can work for you. Contact us today to learn more about this exclusive investment opportunity and take the first step towards securing your financial future.

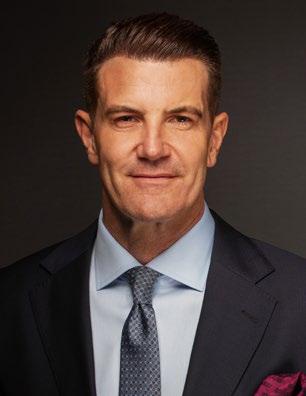

Mike Coady Chief Executive Officer

Peter Gollogly Regional Director - Europe

Veronica O’Brien Group Head of Corporate Affairs

Lily Johnson Group Head of Talent

Adeeb Khan Team Lead - Technology

Dmitriy Ermakov Group Head of Marketing

Danny Sutherland Group Financial Controller

Maria Darmanin Demajo Operations Manager – Cyprus

Maria Nikolaou Head of Compliance - Europe

Husain Rangwalla Chief Technology Officer

Carlo Casaleggio Group Head of Compliance

Carla Smart Group Head of Pensions

Craig Stokes Managing Director - UK

Richard Gartland Area Manager - Cyprus

Jaya Prakash Goulikar Head of Compliance – Middle East

Elyka Ygnacio Operational Finance Manager

Tyrone Witehira Regional Manager - Asia

Paul Pavli Executive Director - Cyprus

Skybound Wealth Management stands as a benchmark of excellence in the world of international wealth management. As an independent firm, we pride ourselves on delivering bespoke financial solutions tailored to meet the unique needs of our global clientele. Our innovative approach combines the agility of a boutique firm with the expertise and resources typically associated with a major financial institution.

Follow Us On Social Media

Just search for ‘Skybound Wealth Management’

Josh Burton Chief Financial Officer

Tom Pewtress Group Head of Proposition

Josh Watson Group Head of People

Bryan Bann Regional Manager - Europe

Taylor Condon Area Manager

Bethany Ward Partnerships Manager

Ashley Eyre Head of Compliance - UK

Michelle Koh Operations Manager - Asia

$1.3billion

of client assets under management

5,000 +

international clients & growing

Welcome to the latest edition of SOAR. We’re only halfway through the year, but 2025 is already shaping up to be a defining moment in our evolution. We’re accelerating toward something bigger, a globally connected advisory business with fully international coverage and the infrastructure to support it. With new offices opening in Malaysia, Mauritius, and the United States, and senior leadership appointments in key markets like the UK, this shift is well underway.

But this expansion is about more than locations. It’s about people - the advisers we’re empowering, the clients we serve, and the teams working behind the scenes to make our proposition stronger every day. That belief in the power of advice, and in the impact it has on people’s lives, is why I’m still here after two decades. Done right, advice brings clarity, direction, and the confidence to move forward.

This edition reflects that belief and our momentum. You’ll find updates from our new hubs, practical insight into complex financial topics like international mortgages, insurance planning across borders, and cross-jurisdictional pension strategies - as well as first-hand stories from clients and advisers navigating real decisions across continents. You’ll also see how we’re strengthening every part of our businessfrom adviser recruitment and support to better tools, technology, and client communications.

And while a lot has changed, our focus remains the same: to show up, to guide, and to help our clients build futures they understand and believe in.

Thanks for being part of that journey.

Mike Coady

Mike Coady Chief Executive Officer

How Skybound Wealth Is Redefining International Financial Advice 14. 10.

What Every Expat Needs to Know to Secure Their Future

Craig Stokes Appointed UK Managing Director 09.

Skybound Wealth appoints Craig Stokes as UK Managing Director, bringing over 20 years of expertise in pensions, retirement planning and holistic wealth advice.

How Skybound Wealth Is Redefining International Financial Advice 10.

From expanding our footprint, to redefining client experiences, our commitment to seamless, expert-led service is stronger than ever.

What Every Expat Needs to Know to Secure Their Future 14.

As featured in Khaleej Times, Mike Coady – CEO at Skybound Wealth, discusses what every expat needs to know to secure their future.

What You Need To Know To Get The Right Cover For Your Family 20.

Understand the essentials of Swiss health insurance, including LAMal, supplementary coverage, and the best options for expats.

Why Financial Advice Shouldn't Require A Translator 26.

Financial advice shouldn’t feel like a foreign language. Mike Coady, CEO of Skybound Wealth, shares why clarity is at the heart of great advice.

The 4 UK Benefits That Won’t Make The Move With You To Dubai 28.

Michael Sappal, Chartered Financial Planner at Skybound Wealth Management discusses the 4 UK benefits that won’t make the move to Dubai.

Why Women Are Retiring with Less and What You Can Do About It 32.

Carla Smart, Group Head Of Pensions at Skybound Wealth Management examines the gender pension gap and why women should act now.

Raising children abroad presents both incredible opportunities and unique financial challenges. Learn why planning ahead is essential.

Simon Athwal of Skybound Wealth Management Breaks Down the Pros and Cons of UK vs. Dubai Property Investment.

Callum Murphy, Financial Adviser at Skybound Wealth Management discusses why expats need life insurance.

Skybound Group Chief Investment Strategist Jabir Sardharwalla reviews fund Commentary: Q2 2025 Review & Q3 2025 Outlook.

Jeff Pollock, a UK-qualified mortgage adviser, offers expert advice to expats on UK mortgages, with experience advising clients both overseas and in the UK.

Introducing Skybound Wealth Academy’s 2025 Cohort

The Academy is shaping the next generation of financial leaders. See how this global initiative is preparing graduates to excel in an ever-evolving world.

Josh Burton highlights key tax mistakes British expats make and offers expert tips on avoiding costly errors, from nondom status to UAE pension planning. Swiss Pensions 101: What Expats Need to Know Before It's Too Late

Bryan Bann, Regional Manager - Europe at Skybound Wealth Management talks about Swiss Pensions and What Expats Need to Know Before It's Too Late. The Amount You Need to Retire Comfortably in the UAE

Senior Financial Planner Jonathan Lumb discusses the magic formula behind the amount you need to retire comfortably in the UAE.

In The Spotlight: Jonathan Lumb

Celebrating 15 years with Skybound Wealth, Jonathan Lumb has been an integral part of our journey, offering expert advice and building lasting relationships.

Mike Coady reflects on his journey, why he's still passionate about helping expats and how he's built a career focused on making a real difference for his clients.

Mark Tucker, Senior Financial Adviser at Skybound Wealth Management discusses the reality of returning home for expats in Europe.

Plan, Track, Manage & Succeed with the Skybound Wealth App. Exclusive to our Clients. Download the app today!

Scan the QR code or click here to download the app.

Skybound Wealth is pleased to announce the appointment of Craig Stokes as UK Managing Director, subject to final regulatory approval. This comes just days after the firm revealed plans to expand its UK presence with new offices, adviser growth, and further investment in infrastructure.

A Chartered Financial Planner, Fellow of the Personal Finance Society, and widely respected industry voice, Craig brings over 20 years of experience in retirement planning, pension transfers, and holistic wealth advice. He has held senior positions at firms including Prudential and, most recently, served as Managing Director of PFM Associates.

A Practitioner at Heart

But it’s not just his credentials that made him the right choice. Craig is a practitioner at heart, someone who understands the pressures, opportunities, and responsibilities of delivering advice first-hand.

Written by Josh Watson Group Head of People

Welcoming Craig to the team, Mike Coady, CEO of Skybound Wealth, said:

“Craig has walked the walk, built teams, delivered advice, and driven change, all while earning deep respect from clients and peers alike. As we build out our UK footprint, we knew we needed a leader who could match our ambition, protect our culture, and help shape the next chapter. I’ve worked closely with him during this process, and I’m confident that our advisers and clients in the UK will feel the benefits quickly.”

Craig’s appointment is more than a leadership change; it marks a long-planned shift in how Skybound Wealth further supports its growing British client base.

Craig Stokes commented:

“Skybound Wealth is doing something genuinely different, combining the intimacy of boutique advice with the global infrastructure that today’s clients demand. We’re seeing more people with lives, assets, and families across multiple countries.

“We’re investing in the right people, in the right places, for the right reasons.”

Those clients need advice that travels with them, and advisers need a platform that allows them to deliver it without compromise. That’s what drew me here. The vision is clear, the leadership is strong, and the opportunity to help build this next chapter is incredibly exciting.”

Under Craig’s leadership, the UK business will remain focused and specialist, while drawing on the full breadth of the Skybound Group’s capabilities, global investment teams, in-house research, and regionally based servicing hubs.

Mike Coady added:

“We’ve been building toward this for some time. Craig’s arrival shows we’re serious. We’re investing in the right people, in the right places, for the right reasons. For any advisers looking for a platform that supports true international planning, there’s no better home than Skybound Wealth right now.”

Craig will also play a key role in adviser development, acting as an anchor for senior talent seeking a modern firm that blends autonomy, compliance strength, and global reach.

His appointment is subject to regulatory approval and forms part of Skybound Wealth’s broader strategy to deliver long-term, sustainable growth in the UK and beyond.

How Skybound Wealth Is Redefining International Financial Advice

Written by Mike Coady Chief Executive Officer

We set out in 2025 not just to grow, but to evolve. To take everything we’ve built and reimagine it through a truly global lens. Today, we’re proud to share how that vision is becoming reality.

Skybound Wealth is entering a new phase. We’re shifting to a highly connected, and forward-looking business. And while geography plays a role, expanding our offices is just one part of the equation. The real focus is on delivering a better experience for our clients, making it more seamless and expert-led no matter where they are.

Let’s unpack what that looks like.

When Craig Stokes joined as Managing Director of our UK operations, it wasn’t just a leadership appointment, it was a strategic statement. Craig brings with him decades of experience in building and scaling advisory teams and his arrival signals our renewed focus on the UK as a growth market.

With increasing numbers of British expats returning home, and more outbound professionals relocating globally, our UK office is fast becoming a centre for supporting future cross-border clients. Under Craig’s leadership, we’re building a highly capable team that can work seamlessly with clients to ensure consistency and quality of advice at every stage of a client’s journey.

We’ve made significant progress this year in preparing for new market entry. Our license applications in Malaysia and Mauritius are well underway, and we’ve laid the groundwork for success with leadership appointments, operational readiness, and compliance structures aligned to local expectations.

These aren’t symbolic gestures. Rather, deliberate steps toward long-term client relevance in two of the most strategically important regions in the world.

In Malaysia, we’ve brought in regional expertise to ensure we understand the unique needs of Asian-based expatriates. And in Mauritius, we’re preparing for a future in which more clients require sophisticated, cross-border structuring, and we want to be ready.

Until approvals are granted, we remain focused on preparation, partnership, and progress.

The old idea of one or two regulated entities managing international clients is no longer fit for purpose. That’s why we’ve restructured our entire model.

Our approach today is globally distributed, but locally led. From the UAE to Switzerland, the UK to the US, and soon into Asia and Africa, our advisers are supported by regional hubs, shared infrastructure, and a client-first philosophy. This model ensures faster decision-making, deeper understanding of local client dynamics, and the ability to support mobile professionals no matter how complex their lives become.

We’re not just present in more places. We’re built to perform in more places.

We’ve seen a 25% increase in business volume so far in 2025, a number we’re proud of. But what excites me more is how we got there. Our growth has been powered by stronger client referrals, repeat business, and retention rates that speak to satisfaction. Behind every data point is a client who feels supported, understood, and welladvised. And that’s the real metric that matters.

“Skybound Wealth is entering a new phase. We’re shifting to a highly connected, and forward-looking business.”

This year, we conducted our most comprehensive client experience survey to date, and the results speak volumes. An impressive 92% of clients rated their adviser relationship as “Excellent” or “Very Good.” Additionally, 89% of respondents said they would recommend Skybound Wealth to others.

When asked if they felt more in control of their finances since joining Skybound, we received an overwhelming "yes" from the majority.

These numbers are not the product of any single initiative; they reflect the collective effort of our advisers, client managers, tech teams, and support staff. It’s their dedication to providing exceptional service, building trust, and fostering clear communication that drives our success and client satisfaction.

We’ve invested heavily in our tech stack this year, not for vanity, but for velocity. Our clients are global, mobile, and busy. They don’t want to chase paper trails or second-guess portfolio updates.

To meet these needs, we’ve built a proprietary digital ecosystem that offers real-time portfolio access, AI-enhanced financial dashboards, and cross-border tax residency tracking. Clients can securely store and access documents on-demand, and we’ve integrated streamlined onboarding and compliance workflows for added convenience.

Our clients don’t want different experiences in different regions. They want consistency with flexibility. That’s why our mission is not just to be in more countries, but to connect them.

When someone moves from Dubai to Spain, or from Geneva to London, their advisory experience shouldn’t be interrupted. At Skybound, it isn’t. Our systems, people, and processes are aligned across borders, meaning the relationship moves with them.

That’s not just convenient. That’s powerful.

As we look ahead to the second half of 2025, we’re focusing on several key initiatives. First, we’re scaling our UK operations under Craig’s leadership, ensuring we’re poised for growth and success in the market. We’re also preparing for market entry in new jurisdictions, strengthening our global presence and positioning ourselves for long-term success.

Skybound Wealth is not just reacting to change. We are building for it. And we’re doing it the right way: with intent, with integrity, and with a relentless focus on what matters most, the client.

Here’s to what’s next.

In addition, we’ll be rolling out our new European hub, bringing our expertise closer to more clients across the continent. We’re committed to expanding Women Like Us and other financial inclusion initiatives, furthering our mission to offer accessible financial advice to all.

We’re also preparing to launch the next phase of our digital client experience, enhancing the tools and technology we offer to make financial planning even more seamless. Lastly, we’ll be recruiting top-tier advisers across all major migration corridors, ensuring we continue to offer expert guidance to clients worldwide.

Every one of these initiatives is tied to a single, unwavering goal: to help globally-minded clients get the best financial advice, wherever they are, and wherever they’re headed.

What

Expat

Know

Earlier this month, I discussed the state of retirement planning in the UAE with Khaleej Times. We touched on the challenges and opportunities that expats face when it comes to securing their future in a region with no automatic pension schemes. Now, I want to dive deeper into the specifics: the options available, the traps to avoid, and how you can start planning today to ensure a comfortable retirement tomorrow.

Let’s face it, while the UAE gives you freedom, it doesn't offer you a fallback. For most expatriates, there’s no government safety net, no automatic pension contributions, and no monthly cheque when you clock out of your career. Your financial future? It's entirely up to you.

Having worked with thousands of expats over the past two decades, from Brits and South Africans to Australians, Indians, Lebanese, and beyond, I’ve noticed a common trend: the questions are always the same, but the urgency isn’t. The difference between those who thrive and those who panic at 55 is simple: planning.

Written by Mike Coady Chief Executive Officer

“Like many of you, I came here thinking it was a short-term opportunity, and never left.”

I’ve lived in the UAE for over 20 years. Like many of you, I came here thinking it was a short-term opportunity, and never left. My journey mirrors that of many clients I now serve: two years turning into twenty, where life grows roots in the sand and financial decisions grow more complex, not less. I've seen the region change, mature, and modernise. But one thing hasn't changed: if you want security later, you need to build it today.

Here’s a closer look at what retirement in the UAE really means, and what you need to do now to secure your future.

Government & Public Sector: In 2022, Dubai introduced a voluntary pension scheme for government employees. It’s a positive step but applies to a small portion of the population.

Private Sector Employees: Most private companies offer an End of Service Gratuity (EOSG), a lump sum payout based on years worked and last basic salary. It’s not inflationlinked, not invested, and simply not enough.

New DIFC Model: Employees in the DIFC now contribute to the DEWS (DIFC Employee Workplace Savings) Plan. This mandates monthly employer contributions into managed investment plans, a pioneering model for the region.

But for most expats? You’re on your own. That means creating a plan from scratch.

Unlike many home countries, there is no state pension for expats. There are also no automatic employer contributions in most cases. Additionally, there is no mandatory retirement planning or need for tax relief on pension contributions. But here’s the good news: you’re not taxed on income here, which gives you an opportunity to build your retirement plan faster and more efficiently than in most other countries.

Let’s break this down by age bands. These are ballpark minimums, assuming a globally invested portfolio growing at ~7% per year.

Age 30: Save 15–20% of income monthly

Age 40: Save 25–35% of income

Age 50+: Save 40%+ or plan to retire later

If you want AED 20,000/month in retirement income starting at 60, you’ll need a pot of AED 4–5 million. Here’s how to achieve that:

AED 10,000/month in savings over 20 years (at 7%)

AED 6,000/month over 30 years

If you don’t start early, you’ll be forced to catch up later—or settle for less freedom in retirement.

“ It’s important to avoid overexposure to any single region or currency, whether that be your home country or the US dollar. A globally diversified portfolio reduces risk and helps ensure steady growth.”

Building retirement wealth in the UAE requires a tailored approach, as there is no one-size-fits-all plan. However, there are several strategies that work for most expats in the region.

One key strategy is using international platforms. By holding assets in tax-efficient, flexible investment accounts, expats can benefit from global withdrawal options, risk management, and growth potential. These platforms provide the flexibility needed to manage wealth across borders. For long-term savings, expats should also consider specific pension structures such as SIPPs for UK-based individuals, offshore personal pension plans (PPBs), or retirement accounts and mutual/ETF fund platforms. These options offer tax advantages and are ideal for those looking to secure their retirement while living abroad.

Diversification is another essential component of building retirement wealth. It’s important to avoid overexposure to any single region or currency, whether that be your home country or the US dollar. A globally diversified portfolio reduces risk and helps ensure steady growth. Lastly, getting regulated advice is critical. A disciplined, structured financial plan is far more effective than chasing short-term returns. Real advice, provided by professionals who understand the complexities of expat life, will help expats make informed decisions that align with their long-term goals.

“Retirement doesn’t just happen, it’s something you build. In the UAE, you have the perfect springboard: tax-free income, global investment access, and high earnings.”

The same mistakes pop up time and time again. First, many expats delay their retirement planning, thinking, "I’ll start next year," but that’s a luxury you won’t have at 55. Another common mistake is confusing EOSG with a retirement plan, but it isn’t one. Many also assume they’ll retire back home, but plans change, and returning home isn’t always financially optimal. Another error is saving in cash, which leaves your money vulnerable to inflation. Relying on EOSG payouts is another mistake, as it’s rarely more than a few months' salary. Finally, many expats go it alone, not realising that wealth management is complex and that expert help is essential.

What Impact Will Dubai’s Reforms Have on the Private Sector?

Dubai’s government pension reforms signal a broader trend: from lump-sum gratuities to structured savings. Over time, we’ll likely see more private companies offering pension or group savings schemes to attract talent, putting pressure on employers to formalise benefits. For now, though, it’s still on you to build your own savings plan.

What Role Should a Financial Adviser Play in This Process?

You can try to do this on your own, but very few people do it successfully. A qualified adviser brings discipline, structure, international tax, and regulatory knowledge, as well as planning for multiple jurisdictions.

A great financial adviser does much more than recommend funds or calculate numbers. They become your co-pilot, coach, and strategic partner. They provide accountability to ensure you stay on track. They offer behavioural coaching during market turbulence, help optimise your portfolio through asset allocation and diversification, and protect you from hype, whether it’s crypto, AI stocks, or property booms. They also help with budgeting and cash flow management to unlock more savings and offer strategic planning to adjust and optimise your retirement plan over time.

In short, a great adviser doesn’t just help you grow wealth, they help you keep it.

“Many also assume they’ll retire back home, but plans change...”

Retirement doesn’t just happen, it’s something you build. In the UAE, you have the perfect springboard: tax-free income, global investment access, and high earnings. But if you don’t act now, that freedom becomes your risk. No pension. No backup. Just lost time.

I’ve seen both the success stories and the regrets. I’ve helped people retire early and others rebuild after too many years of financial sleepwalking. The earlier you start, the less sacrifice you’ll need to make. So ask yourself: Are you where you need to be?

If not, start today. The cost of waiting is far higher than the cost of doing it right. And if you’re unsure where to begin, ask for help. You don’t have to do it alone, but you do have to do it.

In Switzerland, health insurance is a requirement for all residents, including expats. LAMal (L'Assurance Maladie) is the basic health insurance you’ll need to sign up for within three months of arriving in Switzerland. When I first moved here, I had to get this sorted fast. There’s no room for delays.

LAMal covers essential medical services like doctor visits, hospital stays, surgeries, and emergency care. However, it doesn’t cover everything. If you want more extensive coverage, especially for your family, you’ll need to look into supplementary insurance.

Written by Matthew Turnbull Financial Planner

While LAMal covers the basics, it often doesn’t include certain services like dental care, vision care (glasses, contacts), or alternative treatments (e.g., acupuncture). Many of my clients have young families so it’s vitally important to look for additional coverage for these areas, especially their children.

Enrolling in health insurance in Switzerland is fairly simple, but it’s something you need to do promptly. You’ll need proof of residency and your personal details. Be sure to do this within three months of your arrival. If you miss the deadline, you risk being assigned a default insurer, which isn’t ideal, and could leave you facing fines.

“...I quickly realised that while it covers the essentials, there are gaps.”

Basic vs. Supplementary Insurance: What’s the Difference?

When I first enrolled in LAMal, I quickly realised that while it covers the essentials, there are gaps. That’s where supplementary insurance comes in. It’s optional, but, it’s a good idea to consider.

Basic Insurance: This covers essential services like doctor visits and hospital stays. However, it won’t cover everything, especially for more personalised care or treatments.

Supplementary Insurance: These plans are designed to fill in the gaps. They cover things that LAMal doesn’t, like dental care, physiotherapy, and even private hospital rooms. This is especially important if you have children, as they often need dental and vision care that’s not covered under basic insurance.

Finding the Best Plan for Your Family When choosing the best plan for your family, there are a few things to consider:

• Family size: If you have children, dental care and vision coverage are essential to consider.

• Existing health conditions: If anyone in your family has ongoing health concerns, make sure your supplementary plan covers treatments for those conditions.

• Region of residence: Different areas of Switzerland have different insurance providers, so make sure to choose one that offers the best coverage in your region.

Tips for Comparing Providers

When comparing insurance providers, here are a few things I learned from experience:

• Premiums: While the basic premiums are set by law, supplementary premiums vary. Don’t just choose the cheapest option— look at the coverage included in the plan.

• Flexibility: Life changes, and your insurance needs will too. Make sure the insurer you choose allows you to adjust your coverage as your family’s needs evolve.

When I first moved to Switzerland, I considered keeping my international health insurance, but I found that it didn’t meet all the requirements here. While some expats do keep their international plans, I’d suggest opting for Swiss coverage to ensure that you comply with local regulations and get full access to services.

Transitioning from a Foreign Health Plan

If you’re moving from another country, you might have international health insurance that covers you temporarily. I had to make sure my international policy would bridge the gap while I enrolled in Swiss insurance. There’s often a transition period where you’ll need both, so be sure to check if your international insurer allows for that.

“Many of my clients have young families so it’s vitally important to look for additional coverage for these areas, especially their children.”

Premiums and Cost Sharing

Health insurance in Switzerland can be costly, especially for families. Premiums are based on a variety of factors, such as your age and where you live. It’s important to compare different insurers and plans to find the best option for your family’s budget.

In addition to premiums, most plans have deductibles and co-payments. I found that the deductible can have a significant impact on your overall costs, so it’s worth choosing one that makes sense for your family’s needs.

Tax Deductions for Health Insurance

The good news for expats is that health insurance premiums are tax-deductible in Switzerland. This includes both your basic and supplementary insurance premiums, which can help reduce your overall tax burden. Depending on your income and the canton you live in, the amount you can deduct will vary, but it’s definitely worth looking into.

Choosing the right health insurance is a vital part of managing your financial health as an expat in Switzerland. However, it’s just one piece of the puzzle when it comes to securing your financial future. A comprehensive financial review will help ensure that you’re not only covered for healthcare but also have the right strategy in place for retirement, tax planning, and other essential areas of your financial life.

If you haven’t already reviewed your insurance or financial plan in Switzerland, now’s the time to do so. I recommend booking a holistic financial review to make sure your family’s needs are being met across the board. Together, we can look at your health insurance, investment strategy, and tax planning to ensure you're set up for a secure future, no matter what life throws your way.

“LAMal covers essential medical services like doctor visits, hospital stays, surgeries and emergency care. However, it doesn’t cover everything.”

Why

• Comprehensive coverage for expats and their families

• Tailored advice that fit your lifestyle, whether home or abroad

• Peace of mind with flexible life, health, and critical illness cover

• Expert advice to ensure your loved ones are fully protected ACT NOW

Safeguard your future today—speak to an adviser about a bespoke insurance plan.

Scan the QR code or click here to request your free quote.

Or contact your Skybound Wealth Financial Adviser today.

Written by Mike Coady Chief Executive Officer

I’ve sat in meetings where advisers sound like they’re auditioning for a financial dictionary. They throw out terms like cashflow modelling, alpha, beta, lifetime allowance, chargeable gains, discretionary trustee structures, and the client just nods politely, trying not to look lost. That’s not advice. I understand the technical side, deeply. You don’t advise expats for 25 years without mastering the complex cross-border stuff. But the real skill? It’s not in how much I know. It’s in how clearly I can make you understand it.

Because if you walk out of a meeting more confused than when you walked in, you haven’t been advised. You’ve been overwhelmed. And I’ve seen too many good people make bad decisions simply because no one had the courage, or the patience, to explain things properly.

What I’ve built my name on isn’t jargon, it’s clarity. Clients come to me with years of fragmented advice, product folders, and buzzwords. And the first thing I do is unpack it all and bring them back to one question: What are you actually trying to achieve?

I’ve worked with high-flying lawyers, surgeons, entrepreneurs, oil execs, retirees, and I’ll tell you this: the moment I break through the noise and show them a plan they actually understand, something incredible happens. They breathe easier, they lean in, they start to believe again. They go from uncertainty to ownership, and that shift is priceless. Because money isn’t just numbers. It’s emotion. It’s freedom. It’s legacy.

Simplicity doesn’t mean easy. Behind every simple explanation I give, there’s hours of thinking. Research. Strategy. Compliance.

Scenario testing. Hard conversations. Long nights. But that’s my job, not theirs.

My job is to take all of that complexity and make it digestible. So when they’re lying in bed at night, they’re not wondering what a trustee does, they’re sleeping, knowing their family is protected and their future is on track.

And that’s what great advice does. It gives you peace of mind when the room is quiet and no one’s watching.

I’ve had clients say to me, “Mike, you’re the first person who’s ever made this make sense.”

That’s the win. Not the sale. Not the structure. Not the shiny dashboard. The moment of understanding, that’s what builds loyalty. It’s not about transactions. It’s about transformation.

Let’s be clear, I don’t simplify because I think my clients aren’t smart. Quite the opposite. They’re successful, intelligent, and driven. But they’re not financial experts. That’s why they come to me. They don’t need to understand the tax code. They need to understand their plan. They want clarity. They want someone who can make them feel in control, not like they’ve just sat through a finance exam.

“if you walk out of a meeting more confused than when you walked in, you haven’t been advised. You’ve been overwhelmed.”

We don’t hide behind industry language. We don’t use complexity as a crutch. And we don’t ever forget that our job is to serve, not to show off.

I tell every adviser I work with: explain it to your clients like you’d explain it to your sister, your dad, your best friend. Respect them enough to be real. Earn their trust by being human. Because the person who makes the client feel calm, not clever, is the one they’ll come back to.

I lead from the front. Not just in results. In clarity. In trust. In how we speak to real people about real challenges. If I can’t explain it simply, I don’t deserve to be advising you.

I’ve seen what happens when advice goes wrong. When families are left picking up the pieces of financial plans they never really understood. When protection was overlooked. When growth was prioritised over security. When complexity got in the way of action.

That’s why I do this differently. Because real leadership in this profession means not just knowing the rules, but knowing how to relate. To listen. To translate. To guide.

I built my reputation on clarity. On trust. On showing up, year after year, in boardrooms, coffee shops, Zoom calls, living rooms, explaining big decisions in ways people could act on.

If you’re an expat, and you’ve sat through meetings that made you feel smaller, not stronger, I see you. You deserve advice that makes you feel confident, understood, and safe. So let’s change that. Let’s cut through the jargon. Let’s build a plan you believe in. And let’s do it in plain English.

Written by Michael Sappal Chartered Financial Planner

“Most people don’t think twice about writing a will in the UK, it’s simple and sensible to protect your assets.”

I’m fortunate to work in an industry that keeps me ahead of the curve when it comes to life in Dubai. However, for many people making the move, the focus is simple: a better lifestyle, a higher salary, and more opportunities than back home.

That’s the dream, right? But the truth is, earning more doesn’t automatically guarantee financial security.

You’ve got two choices: take control, make the right provisions, and protect your future, or leave it to chance, hoping it’ll all work out when you need it most. Which approach would give you more peace of mind?

In my view, here are the four most important financial considerations to ensure your journey is on the right path.

Goodbye

Pension AutoEnrolment, Hello Personal Responsibility

Back in the UK, saving for retirement was effortless. Your employer automatically enrolled you, pension contributions were deducted before your salary even landed in your account, and you didn’t have to think twice.

Now you’re in Dubai, and there’s no safety net. No one’s deducting savings from your salary for you. Instead, you watch your full pay land in your account, and suddenly, the idea of voluntarily parting with a portion of it feels... well, painful.

This is where most people trip up. Without automatic pension contributions, what’s your plan for retirement?

Most people don’t think twice about writing a will in the UK, it’s simple and sensible to protect your assets. However, if you live in Dubai, your UK will may not be valid.

That means the wealth you’ve built, the house, savings, investments you planned to pass on, could be distributed according to UAE inheritance laws, not your wishes.

Why? Because the UAE follows Sharia law principles, which enforce a fixed asset distribution formula, regardless of what your UK will says.

Here’s what you might face:

• Certain family members are entitled to set shares, even if you wanted a different arrangement.

• UAE courts may freeze your assets upon death, causing delays for your loved ones.

• Guardianship for children may not align with your wishes.

Many British expats assume their UK will protects them everywhere, but what if it doesn’t? Would you want your estate handled by rules you never agreed to?

Having UK critical illness cover is smart, you’ve taken steps to protect yourself. But does it still work the way you expect now that you’re in Dubai?

The truth is, this part is often overlooked. Many people don’t realise that some insurers won’t process a claim unless it’s confirmed by a UKregistered doctor, meaning you could be forced to fly back to the UK just to get a diagnosis.

Imagine facing a serious health issue, only to find out your location is a barrier to getting the support you thought you had.

Would you want that uncertainty at the worst possible time? Or is it time to rethink a plan that actually works, wherever you live?

“Not only are you missing out on pension auto enrolment, but you might also be unknowingly losing valuable years on your National Insurance (NI) record.”

Not only are you missing out on pension auto enrolment, but you might also be unknowingly losing valuable years on your National Insurance (NI) record. These are the years that could count towards your eligibility for a State Pension or increase your pay-out at retirement.

Back in the UK, your NI contributions were automatically deducted, with no effort on your part. Now that you're in Dubai, the system changes. No employer is making contributions for you, and you’re no longer automatically building up your NI record.

But here's the good news: it's easier and more affordable than you might think to fix. British expats can make voluntary NI contributions (Class 2 or Class 3, depending on your circumstances) to keep their UK State Pension on track. You can check your National Insurance record and see if you're missing any contributions by visiting the official UK government website.

Failing to stay on top of your contributions could cost you thousands. The full UK State Pension is worth almost £12,000 per year, and missing out on contributions now could mean losing decades of future income.

Would you want to reach retirement and realise you’ve lost access to this vital safety net? Or would it make sense to take action now and secure your options before it’s too late?

To sum it up: no one’s deducting taxes from your salary or telling you where your money should go. It’s all yours, and this is your chance to build wealth faster than you could back home. But as we’ve discussed, without enforced contributions, financial security is entirely up to you.

That freedom can be your greatest advantage, or your biggest liability. Yes, you have full control over how you grow and manage your wealth, but you also bear full responsibility. There’s no safety net to ensure your retirement, your family’s security, or your long-term stability.

It’s not just about how much you can earn; it’s whether you’re making the right moves to protect what you have.

Written by Carla Smart Group Head of Pensions & Chartered Financial Planner

Retirement should be a time to enjoy the rewards of years of hard work, whether it’s traveling, spending time with family, or simply relaxing. But for many women, the financial gap in pensions is hard to ignore. Even with progress on gender equality, women are still retiring with far less than men. It’s time to ask: why is this happening, and how can we fix it?

In this piece, we’ll explore the gender pension gap, why it persists, and what steps you can take to address it for yourself.

When we talk about the gender pension gap, it’s one thing to hear about it. But when you look at the numbers, the issue becomes much clearer.

Take Switzerland. In 2022, the average pension for women was CHF 36,433, while men received CHF 52,672, a gap of CHF 16,239, or 30.8%. This isn’t simply about personal savings choices; it’s a structural issue. And the trend is consistent across many countries.

In the UK, for instance, women retire with around £100,000 less than men. That’s a huge difference, and it’s not improving. Meanwhile, in Germany, women receive 46% less pension income than men, often due to factors like part-time work and extended parental leave.

This is a global issue, but it’s one that individuals can take action on, if they know how.

The Causes of the Gender Pension Gap

Why does this gap exist in the first place? Several key factors contribute:

Part-time work and caregiving: Women are more likely to work part-time, especially during caregiving years. In many systems, this results in fewer contributions to pensions, particularly in cases where part-time work doesn’t count toward pension savings.

Career interruptions: Maternity leave and time spent caring for children or elderly relatives mean lost years of contributions.

Lower lifetime earnings: On average, women earn less than men over the course of their careers, which means smaller pension contributions and less growth over time.

Longevity risk: Women generally live longer than men, meaning their retirement savings need to last longer. A smaller pension becomes more problematic when you factor in a longer life expectancy.

The gender pension gap is more than just numbers. It reflects inequality that has long-term consequences for women in retirement.

A smaller pension means a lower quality of life, a greater reliance on state support, and a higher risk of poverty in later years. This gap is more than an issue of financial security; it’s an issue of fairness. How to Start Closing the Gap

The good news is there are steps you can take to help close the gap, both personally and through systemic changes.

Get informed: Financial literacy programs aimed at women can help you understand your pension options and make smarter decisions earlier in life. Review pension policies: Employers and governments have an important part to play. Adjusting pension systems to include part-time workers or offer contribution credits during career breaks can make a meaningful difference.

Act early: Regularly review your pension and make adjustments as needed. Major life changes, like having children or changing jobs, can affect your contributions, so it’s important to stay on top of things.

Contribute voluntarily: Consider topping up your pension when possible, or look into spousal contributions if you take time off work to care for family. Even small contributions can make a difference in the long run.

The gender pension gap is a significant challenge, but it’s one we can begin to address today. By understanding the reasons behind the gap, taking proactive steps, and seeking advice when needed, you can work toward a more secure retirement.

If you’re unsure where to begin, or if you’d like more personalised guidance, don’t hesitate to reach out. Our team can help you assess your pension and develop a plan that works for you.

Need help understanding your pension plan or closing the gap in your retirement savings?

Schedule a consultation with our experts today, and we’ll work with you to build a strategy that secures your financial future.

“When we talk about the gender pension gap, it’s one thing to hear about it. But when you look at the numbers, the issue becomes much clearer.”

Unlock the full potential of your wealth with tailored strategies for expats.

Scan the QR code or click here to find out more.

Or contact your Skybound Wealth Financial Adviser today for more information.

Can You Really Afford the Life You Want Them to Have?

Written by Paul Butler Senior Financial Planner

Raising children abroad offers great opportunities but comes with financial challenges, especially when securing their future. As an expat parent, it’s essential to plan ahead for the education and opportunities your child deserves.

As both a financial adviser and a father of three living in Dubai for over 10 years, I know first-hand how crucial education planning is. Without careful preparation, the financial demands can quickly become overwhelming. The financial burden of education can easily catch you off guard. But with proper planning, you can be prepared, allowing you to focus on your child's growth, rather than worrying about tuition fees.

In the UAE, the cost of education is already significantly higher than the global average. Families spend an average of USD $99,378 on their child’s education from kindergarten through university. This figure includes tuition, books, transportation, and accommodation, but doesn’t fully capture the total cost, especially if considering international education.

University fees can add another layer. For expat children classified as ‘overseas’ students, UK undergraduate fees range from £10,000 to £35,000 per year, excluding living expenses, which can quickly accumulate.

Education costs are rising, often faster than inflation, so planning early is essential. Starting now helps you account for future increases in school and university fees, ensuring they don’t become a financial burden.

Early savings also allow you to take advantage of long-term investment opportunities, helping your money grow over time. Expats, in particular, may face relocations that change education costs, but a solid financial plan gives you the flexibility to manage these shifts.

Planning ahead also helps you avoid relying on loans or depleting savings, protecting your financial future.

If you haven’t begun planning yet, now is the time to act. Start by consulting a financial adviser with expat experience to create a personalised plan tailored to your family’s needs.

Next, explore different investment options that align with your goals and give your savings the potential to grow. Be sure to account for all potential costs, including accommodation and travel, especially when considering university education.

Finally, ensure your plan is flexible enough to adapt to changes, such as a relocation or shifts in your child’s educational journey.

“Education costs are rising, often faster than inflation, so planning early is essential. Starting now helps you account for future increases in school and university fees, ensuring they don’t become a financial burden.”

While preparing for school year expenses is crucial, the largest financial burden often comes later with university costs, accommodation, and living expenses. For families considering international education, these costs can be significant, so it’s important to plan ahead.

Education planning is a major financial commitment for expat parents. If you haven’t started planning yet, now is the time to create a plan that ensures your children have the opportunities they deserve, without compromising your long-term financial security.

Paul Butler recently delved into this topic in greater detail on our web series, From Suitcase to Settlement. You can watch the full episode here.

Written by Simon Athwal Global Partners Senior Advisor

Investing in property is one of the most reliable ways to build wealth, but the playing field isn’t the same everywhere. If you’re eyeing the UK or Dubai for your next investment, it’s like picking between two powerhouses in a heated rivalry. The question is: which one wins in the battle for long-term wealth?

Let’s break down the pros and cons of two of the biggest names in the world of property.

The UK: The UK property market is the seasoned pro, the one you trust with your long-term goals. Stable, reliable, and backed by a solid legal framework, it’s the choice for investors who want peace of mind. It’s not flashy, but it gets the job done year after year. Sure, it might not give you the quick wins some might crave, but when you’re in it for the long haul, this is where the slow, steady growth is often found.

Key Strengths:

Stability and long-term growth: The UK offers a predictable, regulated market with legal protections that ensure transparency and security for investors. Even in times of economic uncertainty, the market tends to recover, offering long-term security for those in it for the long haul.

Stability & Growth

Legal & Regulatory Protections

Market Demand

Tax Benefits

Legacy & Long-Term Investment

Strong legal protections and a regulated market: Property laws in the UK are established and investor-friendly. Clear ownership laws and tenant rights are crucial for minimizing risk.

Chronic housing undersupply: This is especially notable in major cities like London, Manchester, and Leeds, where housing demand consistently outpaces supply, creating reliable rental demand and long-term capital growth.

A safe bet for legacy wealth: Property in the UK is often viewed as a long-term investment that can be passed down through generations, providing financial security for future generations.

But no one’s perfect, right? The UK has its costs.

Stamp Duty, Capital Gains Tax – it adds up. And liquidity? It’s slower than Dubai’s fast-paced game. But for those willing to wait, the rewards are there.

Stable, long-term growth with steady capital appreciation

Strong legal protections and well-established property laws

Chronic housing under-supply, especially in major cities like London

Capital Gains Tax and Stamp Duty apply, but manageable with planning

Ideal for legacy wealth and multigenerational investments

High rental yields, but market can be volatile

High demand driven by tourism and expats, especially in luxury sectors

High demand driven by tourism and expats, especially in luxury sectors

No income tax on rental income, tax-free returns

Short-term investment opportunities with potential for lifestyle benefits

Dubai: In the other corner, we’ve got the (relatively) new kid on the block, but don’t let that fool you, Dubai’s been making waves for a reason. Its appeal lies in high rental yields, taxfree income, and a property market that doesn’t shy away from luxury. With average rental yields of 6-8% and the chance to tap into a booming tourism-driven market, Dubai’s investment opportunities are tempting, especially for those chasing faster returns.

Key Strengths:

High yields and tax-free income: No income tax on rental income is a major plus. Investors can earn a much higher return on rental properties in Dubai compared to many other global markets.

Thriving market for luxury, short-term rentals: Areas like Dubai Marina, Downtown Dubai, and Jumeirah Beach offer stunning views, high-end facilities, and proximity to landmarks like the Burj Khalifa and Palm Jumeirah. These areas attract affluent tourists, making short-term rental opportunities highly profitable.

A vibrant, ever-growing expat community: Dubai’s position as a global hub for business and tourism means a constant influx of expats looking for rental properties. This consistent demand drives up the rental market and ensures a steady stream of tenants for your property.

A chance to live the dream while you earn: Many foreign buyers purchase properties in Dubai not just for rental returns but as second homes or holiday getaways. This is a key differentiator; property in Dubai allows investors to live a luxurious lifestyle while earning passive income.

But Dubai doesn’t come without risks. The market can be volatile, the highs are high, but the lows can be sharp. Plus, with all that new development, there’s the question of oversupply in certain areas. The competition for renters is fierce, and there’s still a lack of the regulatory depth you get in more established markets like the UK.

So, let’s bring in the data. On paper, Dubai comes out strong with its rental yields. In 2024, yields hovered around 6.97%, a solid figure, but just slightly down from 2023’s 7.13%. On the other hand, the UK property market continues to show slow but steady capital growth, with property prices up 2.48% in Q3 2024, even amidst wider economic uncertainty.

The Verdict:

Dubai: The short-term champion, bringing in those quick wins with its high rental yields and tax-free income.

UK: The long-term player, offering stability and gradual but reliable growth, perfect for building wealth over generations.

While both Dubai and the UK offer solid financial opportunities, there's more to consider when choosing the right market for your lifestyle.

Dubai stands out as a lifestyle investment. The city’s world-class infrastructure, luxury developments, and expat-friendly atmosphere make it a prime choice for those seeking a luxurious lifestyle. With state-of-the-art residential buildings, stunning views of the Persian Gulf, and tax-free income, it’s easy to see why many investors are not just looking for financial returns but also a piece of Dubai’s aspirational living. Short-term rental opportunities cater to the growing number of tourists, allowing property owners to earn passive income while enjoying the benefits of living in a fast-paced, cosmopolitan city.

On the other hand, the UK offers a different kind of lifestyle, one rooted in heritage, stability, and long-term security. Property here isn’t just about earning money; it’s about legacy. Many UK property investors look to purchase homes in sought-after areas that they can eventually pass down to future generations. Additionally, the UK's diverse property market, with everything from city apartments to country estates, gives investors a wide range of lifestyle choices. The appeal here is not just in the investment itself but in the peace of mind knowing your property will likely appreciate over time, with the security of a well-regulated market.

Final Round:

Which Investment Wins for You?

So, which one takes the crown? It depends on what you’re after. If you’re in it for high yields and a tax-free income with a side of luxury living, Dubai is your pick. But if you’re thinking about long-term wealth building, legacy investments, and steady growth, the UK is the smarter choice. The key takeaway? Both markets have their strengths. It’s not about one being better than the other; it’s about aligning your investment goals with the right strategy.

The world of property investment is full of opportunities, but navigating it requires strategy. Whether you’re looking to take advantage of Dubai’s high yields or want to secure a stable, long-term investment in the UK, Skybound Wealth is here to guide you.

Ready to talk property? Book your free consultation today.

“Ultimately, whether you need income protection insurance depends on your personal financial situation. However, considering life’s uncertainties, it’s better to be prepared.”

Written by Callum Murphy Financial Planner

You’re earning tax-free in Saudi Arabia, stacking up savings and building wealth like never before. But what happens if that earning power disappears tomorrow? If something were to happen to you, how would your family survive without your income?

As an expat in Saudi Arabia, it's easy to focus on the present. You’re enjoying tax-free earnings, making progress on your financial goals, and living a life that feels secure. However, many expats overlook one important aspect of their financial plan: what happens if the worst occurs?

If something were to happen to you before reaching your savings targets, your entire financial foundation could collapse. Without life insurance and mortgage protection, your family could be left with significant financial challenges.

Let’s break it down. Picture this:

Scenario 1: No Life Insurance

Without life insurance or mortgage protection, your family would face the financial burden of mortgage payments, living expenses, and other obligations. The wealth you’ve worked hard to accumulate could be quickly wiped out, and your family could be forced to sell assets or even their home to stay afloat.

Scenario 2: With Life Insurance and Mortgage Protection

On the other hand, having life insurance and mortgage protection means your family is financially secure in case something happens to you. Your insurance policy would cover the financial gaps, allowing your loved ones to grieve without the added stress of financial uncertainty.

“Securing your income and protecting your family’s future should never be an afterthought.”

Income protection insurance is often overlooked, but it can be the difference between financial stability and uncertainty if you’re unable to work due to illness or injury.

Here’s why it’s worth considering:

Income Security: If you’re the primary earner in your household, income protection ensures that your family still receives an income if something prevents you from working.

Peace of Mind: Knowing that your income is protected can give you peace of mind, so you can focus on enjoying your time abroad without constantly worrying about the “what ifs.”

Filling the Gaps: Even with savings or life insurance, income protection adds an extra layer of security, ensuring ongoing financial support during tough times.

Ultimately, whether you need income protection insurance depends on your personal financial situation. However, considering life’s uncertainties, it’s better to be prepared.

You might feel financially secure as an expat in Saudi Arabia, but life insurance isn’t just about what you have today, it’s about protecting your family’s future.

Here are a few reasons why life insurance and mortgage protection should be included in your plan:

Financial Security for Your Family

Life insurance ensures that if something happens to you, your family can maintain their lifestyle and avoid financial strain due to immediate expenses like bills and mortgage payments.

Peace of Mind

It’s not just about money. Life insurance offers peace of mind, letting you live your life knowing your family will be protected, even in your absence.

Protection Beyond the Tax-Free Earnings

While you’re benefiting from tax-free income in Saudi Arabia, your family’s financial security still depends on planning for the unexpected. Life insurance acts as a safety net, protecting your hard-earned wealth from being lost.

Many expats get caught up in the benefits of living in Saudi Arabia, no taxes, more disposable income, and a better lifestyle. However, this short-term focus can blind you to longterm risks that could severely impact your family’s future. Don’t gamble with your financial security. Protect your family and your future by acting now, before it’s too late.

“While you’re benefiting from taxfree income in Saudi Arabia, your family’s financial security still depends on planning for the unexpected.”

Taking the first step toward securing your financial future can be simple. Here’s how you can begin:

Assess Your Needs: Calculate how much coverage you need, considering your income, debts, and your family’s living expenses.

Compare Policies: Look for life insurance options that offer coverage, along with mortgage protection, to keep your home secure.

Consult a Specialist: Work with a financial advisor who understands the specific needs of expats in Saudi Arabia. They can help guide you to the right policy for your situation.

“As an expat in Saudi Arabia, it's easy to focus on the present.”

Understanding where to seek financial help in Saudi Arabia is essential for expats. If you're looking for life insurance, mortgage protection, or financial advice, there are several resources available that cater specifically to the needs of expats.

Here’s where to start:

Local Financial Advisors: Many advisors specialize in expat financial planning, helping you secure the right life insurance and mortgage protection in Saudi Arabia.

International Banks: Several international banks offer tailored financial services, including life insurance and other essential products. Expat Communities and Forums: Reach out to expat groups for recommendations and insights from others who’ve been through similar financial decisions.

Finding the right financial help is crucial to making sure your family is protected, no matter what happens.

Living and working as an expat in Saudi Arabia has its benefits, but it’s also essential to plan for the unexpected. Securing your income and protecting your family’s future should never be an afterthought.

Don’t wait for a crisis. Take the necessary steps today to safeguard your wealth, your home, and most importantly, your family. Protect what you’ve worked for, and give them the peace of mind they deserve.

Report

Q2 2025 Review & Q3 2025 Outlook

Written by Jabir Sardharwalla Chief Investment Strategist

If you had been away since the start of the year without access to media and just returned, one look at the table below would suggest everything is fine. The YTD (Year-To-Date) performance numbers are impressive. Equities have been flying and, in a risk-on mode, Europe and EM has outperformed strongly. Germany and Hong Kong are standouts, both delivering in excess of 20% YTD.

* Refers to the change in the yield

However, those with access to media will know what scary times we have gone through in Q2! I am not going to dwell on the geopolitical situation other than to say things between Israel and Iran reached a key moment. For now, we have a cautious ceasefire in place and it seems to be holding.

Throughout this, markets never sold off. Whether it comes down to complacency or just a genuine belief things would remain contained is hard to say. That aside, markets seem to be on a tear and, once again, tech seems to be rallying.

The second chart below (DB) is more discering. It splits performance over the recent quarter vs YTD for a select group of financial assets (expressed in US$ terms).

“...Q2 began with the historic sell-off immediately after the “Liberation Day announcement” on 2nd April.”

Source:

Deutche Bank, Bloomberg Finance LP

“For now, we have a cautious ceasefire in place and it seems to be holding. Throughout this, markets never sold off. Whether it comes down to complacency or just a genuine belief things would remain contained is hard to say.”

Certain things are striking:

1. FX: There is a definite US$ correction taking place as implied by the EM FX Index. Though not shown on there, the US$ Trade-Weighted Index conveys the same message.

2. Energy: After a brief spike during the height of the Israeli-Iranian conflict, oil prices very quickly collapsed back to their usual lows (mid-$60s). This will help reverse imminent inflationary concerns (primary and secondary).

3. Precious Metals: Gold, Silver, Copper, Platinum….are all flying! The latter two are very much a lack of inventory story while Gold is a central bank story particularly amongst certain Emerging Nations.

4. Countries/Regions: Germany, Spain, Italy, China & Brazil are standout performers.

5. Sectors: Mag-7 had quite a comeback to finish positive YTD. If you missed that by being uninvested, then you took a big hit. The wider Nasdaq is a similar story.

6. Bonds: gained across the board to differing degrees.Like sectors, these gains were against a background of weakening US$ so, for non-US$ portfolios, the gains were even better in local FX terms.

Essentially, Q2 began with the historic sell-off immediately after the “Liberation Day announcement” on 2nd April. The S&P 500 fell over -10% marking its 5th biggest, two-day decline since WWII. Then came the 90-day announcement which sparked quite a bounce back. The US$ is down almost -11% YTD while sovereign bonds have shown good resilience with Italian 10y Bond (BTP) yields declining -26 bps (i.e. BTPs gained in value). Fiscal fears is the main worry (see Q3 Outlook section) and resulted in the long end, 30y Treasuries momentarily reaching 5.15% before falling below to 4.77%.

1828 Tariff of adominations 1861 Morrill Tariff

The following factors are going to define the outlook for Q3 and indeed the rest of the year and it will be largely driven by the US: Tariffs

Based on negotiations so far, the effective tariff rate is around 15% mark (see chart below):

Average US Tariff Rate On All Imports, %

Underwood law 1930 Smoot-Hawley

Gatt

Source: Invesco, Macrobond, Tax Foundation and Yale Budget Labs as of 16th May 2025, https://budgetlab.yale.edu/research/state-us-tariffs

15% is probably not too far from where tariffs will eventually settle when all is concluded. A study conducted by the Tax Foundation concluded the estimated impact on US GDP would be as follows:

[Conventional = impact on revenue adjusted for changes in import behaviour (e.g. reduced volumes, substitution, etc). Dynamic = Conventional minus adjustments for revenue lost from an economic slowdown. Dynamic Tit-for-Tat = Dynamic minus adjustments for Tit-for-Tat behaviour.]

GDP is a poor story for other nations and regions: in real terms, the Euro-area is achieving half of its target, Japan is similar and China is under its top end range of 5% coming in at 4.3% to 4.7%.

“Debt burdens of prior years were not an issue because we lived through a decade of easy money.”

US debt would be in the order of 125% to 130% of GDP – well above what is considered a good balance (90%). Critics argue above 90% implies a tipping point – the level of growth (GDP) needed starts to become too big a mountain to climb to then pay for that debt. By contrast, the Euro-area is just about on the mark (90%) vs its own target of 80% to 85%. The excess will come from Germany ramping up fiscal spending. Japan’s debt (mostly domestic) stands at around 255% of GDP (vs a target of 200%) while China’s is officially 84%.

Currently, over 3% of US GDP is required just to pay for interest servicing! Contrast that with the Euro-area (2%), Japan (3%) and China (3%). The debt-servicing side of these major economies is the problem child.

CONCLUSION:

Debt burdens of prior years were not an issue because we lived through a decade of easy money (QE = Quantitative Easing). The result was nonexistent/negative rates, ultra-low inflation and high growth. That’s all changing – money is no longer easy and comes with a cost (an opportunity cost).

The debt-servicing costs are enough to fund a major department – at least boost several existing ones. The hurdle is rising and at some point, the athlete will trip over that hurdle because he/she cannot run any faster or jump any higher!

How can it be fixed?

For developed nations, it has to be from reducing costs and improving productivity and this will be a function of technology. We are already seeing it in application in many areas – healthcare, defence, agriculture and industry are some top examples. The benefit to GDP growth will be limited in matured markets – that’s the reason they are called Developed Markets!

What are the key risks we face?

Resurgent inflation (trade-driven supply shocks PLUS fiscal loosening) and deep recession (if business sentiment sinks and they start cutting back). The other risk is a Goldilocks scenario (led by an AI-productivity surge PLUS easing global tensions, both of which reignite inflation).

US: growth is slowing but no signs it is collapsing. The supply-side will come under pressure given the clampdown on migrants while the OBBB (One Big Beautiful Bill) will provide a big fiscal splurge. Together, these are inflationary.

Europe: Germany’s fiscal bazooka will be a boost and, given its better valuation metrics vs the US, will be attractive. Its innovation also should not be underestimated.

China: there are signs of property market stabilisation while it is developing its own exceptionalism driven by technology (especially AI and Robots). Together, this will be a much-needed confidence boost for its domestic economy.

Thank you for your continuing support as always – we really value it and please reach out to us if you have any queries.

Written by Jeff Pollock Financial Planner

As an expat, managing a UK mortgage while living abroad can seem like a daunting task.

Whether you're maintaining a property in the UK, looking to buy a new one, or planning to remortgage, understanding the complexities of securing a mortgage as an international worker is crucial. But don't worry, getting the best deal is entirely possible with the right advice and support.

As a UK-qualified mortgage adviser with extensive experience providing holistic financial advice to clients both overseas and in the UK, I specialise in helping expats secure the best possible deals on UK mortgages, no matter where they live. Having worked extensively with expats, I fully understand the unique challenges you face when managing a mortgage abroad, and I’m here to guide you through the process with expert advice tailored to your needs.

Managing a UK mortgage from abroad can be complex, especially as the criteria for securing a mortgage differ when you are living outside the UK. Unlike standard UK mortgage processes, expats need tailored advice that accounts for international circumstances. Whether you're interested in buying a new property, remortgaging, or just making sure you're getting the best possible deal, understanding the rules and having expert guidance is essential.

Booking a review with a qualified mortgage adviser is crucial because you will receive expert advice tailored to your situation. Our UK-qualified advisers are here to provide you with support specifically designed for expats. Mortgage rates fluctuate and staying updated ensures you are not paying more than necessary. Additionally, we understand the unique circumstances of international clients and can provide advice that reflects your specific needs.

If you have family back home and want to secure a property to live in, a residential mortgage may be the best option for you, even though you're living overseas. Residential mortgages are intended for properties you plan to occupy as your main home. This type of mortgage typically offers lower interest rates and deposit requirements. However, if you’re considering renting out your UK property, you may need to look into a buy-to-let mortgage, which is specifically designed for landlords. Keep in mind that buy-to-let mortgages may require a larger deposit and have slightly higher interest rates due to the perceived risk.

When you book a free review with us, we will conduct a detailed assessment of your current mortgage terms. We will take a close look at your existing mortgage to determine if you can improve your terms or refinance to a better deal. If there’s a chance to secure a more favourable rate or better terms, we’ll explore these options with you.

Living abroad introduces challenges like currency fluctuations, income tax issues, and more. As part of our review, we’ll offer advice that takes these factors into account and ensures your mortgage is managed effectively while you are overseas.

Securing a mortgage in the UK as an expat can be more complicated than it is for those living in the country. Many expats face challenges like not having a UK credit record if they’ve been living abroad for several years, which can make it harder for lenders to assess your borrowing history. If you have been living abroad for a longer period, you might not have any credit history in the UK at all.

Lenders also need to verify that you can make your repayments. This can be tricky when you’re earning in a foreign currency, and you may need to provide proof of income, such as payslips that need to be translated into English. Some lenders may prefer your earnings to have been paid into a UK bank account.

Expat mortgages typically require a larger deposit, often at least 25% of the property’s value, which can be a barrier for some expats. However, with the right advice and support, we can help you secure the best deal regardless of these challenges.

Securing a mortgage as an expat doesn’t need to be difficult. Our team at Skybound Wealth specialises in international mortgage advice and will support you every step of the way. Whether you’re buying a new property, remortgaging, or maintaining an existing property, we’ll guide you through the entire process and ensure you secure the best possible deal.

We have access to a wide range of UK mortgage products from top lenders, even for expats. Our tailored financial advice will help you get the most competitive rate available, and we’ll manage the paperwork for you, making the process as smooth and stress-free as possible.

“Unlike standard UK mortgage processes, expats need tailored advice that accounts for international circumstances.”

Our International Mortgage Process

Securing an international mortgage can seem overwhelming, but it doesn’t have to be. At Skybound Wealth, we make it easy by offering a streamlined process for expats. Here's how we work with you:

We assess your circumstances: We begin by understanding your unique financial situation, including where you live, your income, and your mortgage requirements.

We search for the best mortgage deals: We have access to a wide range of UK mortgage products and will match you with the best option based on your needs.

We handle the paperwork: We manage all the necessary paperwork and ensure everything is in order, saving you time and hassle.

Ongoing support: We’re here to support you throughout the mortgage process and beyond, ensuring you remain on track with your financial goals.

If you're ready to invest in UK property or need guidance on remortgaging, our team of experts is here to help. Contact us today for a free, no-obligation consultation, and let's get started on securing the best mortgage deal for you.

Managing a UK mortgage while living abroad can be tricky. Claim your free mortgage review to make sure you're getting the best possible rate.

Why Book a Free Review?

Expert Advice: Our UK-qualified, UK-based advisers are here to provide tailored support.

Stay Ahead of Changing Rates: Mortgage rates can change, and it’s important to stay updated to ensure you’re not paying more than necessary.

International Flexibility: We understand the unique situation of international clients like you and can help with specific considerations.

Booking your free review is easy –simply click the link below to choose a time that works best for you:

Scan the QR code or click here to book your free review.

Or contact your Skybound Wealth Financial Adviser today.

WHAT I'VE LEARNED AFTER 20 YEARS OF ADVISING EXPATS:

Written by Mike Coady Chief Executive Officer

It was 1997. I was young, ambitious, and just starting out in financial advice with Prudential. My manager handed me the keys to his BMW before my first client meeting in Shirley, Birmingham. Not because I needed a lift, but because he wanted me to feel what was possible. That meeting was with a Rover factory worker in a modest semi. We spoke about pensions and protection, of course. But what stayed with me was when he pointed next door and said, “You should speak to him too.”

He didn’t realise it, but he taught me something no training manual ever could: great advisers don’t just serve clients, they earn trust, and that trust gets passed on. That’s when you know you’re doing it right.

This line of work isn’t known for its longevity. Plenty of advisers burn out. Some disappear behind boardroom titles. I didn’t.

I stayed because I still care about the work. I care when someone shifts from thinking insurance is unnecessary to understanding it’s about protecting the people they love. I still enjoy the detail, the challenge, the accountability.

Most of all, I value being the one they call when life doesn’t go to plan. I’ve been in the room when the bad news hits. When the claim form matters more than the brochure. That’s when proper planning proves itself.

“There are corners of this industry where everything feels transactional. Chase the win, move on. That’s never been my approach. Real advice is personal.”