Youth Unplugged:

Decoding the New-Age Insurance Buyer

The Youth Mindset: quick to explore, sharp to decide. They deserve smart, flexible plans that fit right into their world- fast, digital, and future-ready!

Hallmarks of the Indian Youth

Works at entry-level / midlevel positions

Just started to work (aged 21-27 years) or has been working for 5-10 years (aged 27 -35 year)

Looks for secondary income to manage expenses

Source: https://www.business-standard.com/india-news/77-of-young-indians-now-spend-the-most-on?phones-apparels-report-123040200254_1.html

Hallmarks of the Indian Youth

Has witnessed the COVID-19 pandemic at the beginning of their professional journey and is wary of financial and health emergencies

They swipe for groceries, stream for knowledge, and scroll for choices including financial ones.

Source: https://www.business-standard.com/india-news/77-of-young-indians-now-spend-the-most-on?phones-apparels-report-123040200254_1.html

Strictly for internal circulation only. Solely for training and/or education of employees/agents/intermediaries and should not be further used for presentation/solicitation to a prospect or general public at large.

Youth’s Philosophy of Life

Believe in “You Only Live

Once” – chasing dreams, not just paychecks

Thinks “What if I fall behind?” – Comes under the pressure to keep up

YOLO FOMO

What does the Youth Need?

The youth is constantly exploring to improve their standard of living

Youth’s Underline Demand is

Consumption Focused

They prioritize short to mid term goals, targeting towards consumption:

How does the Youth fulfill

Consumption Goals?

Tendency:

Youth consumes more, saves less

Outcome:

Don’t have investible surplus

Consequence: Takes loan to fulfil consumption goals

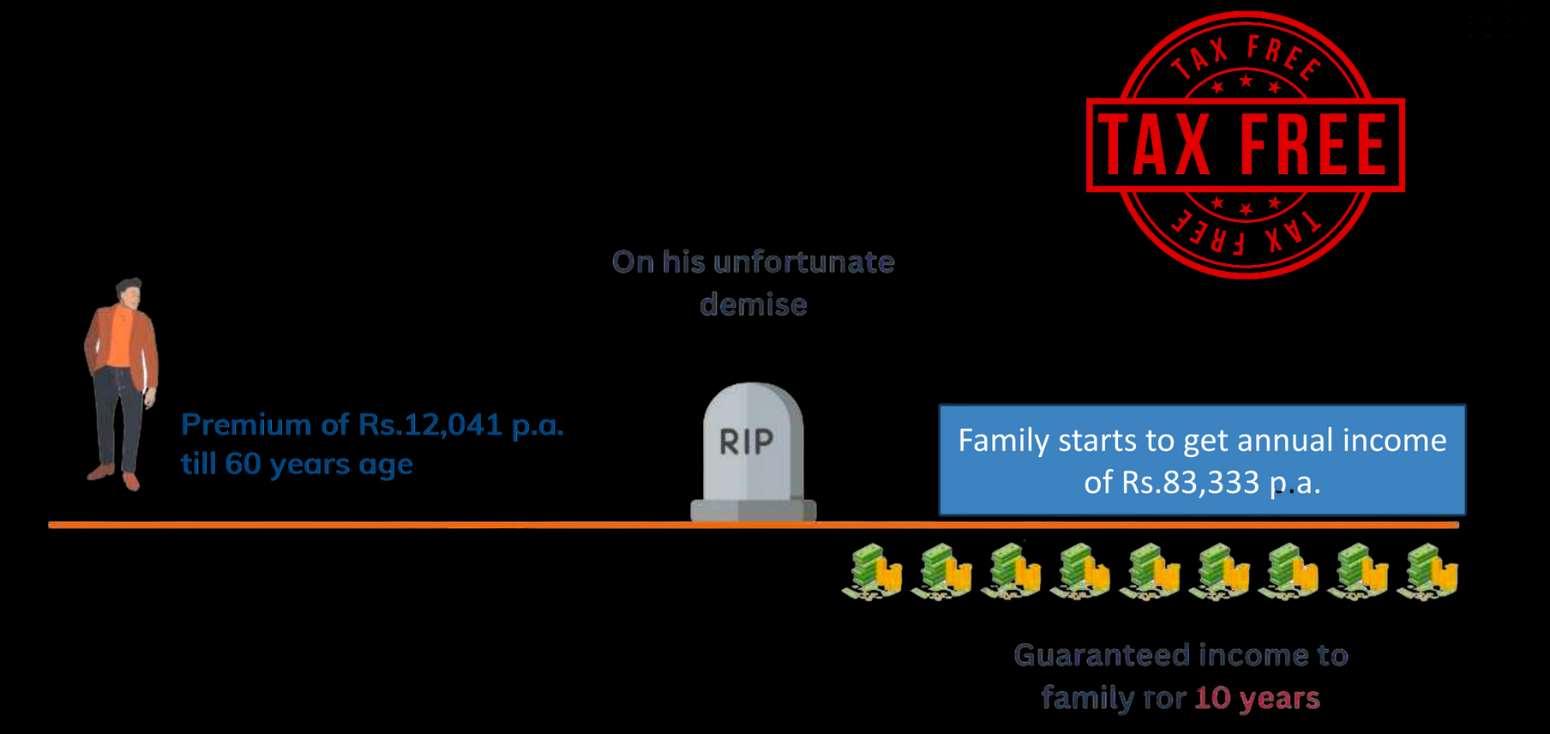

Youth Must Have Life Protection Cover

Goal: To safeguard their dependents from any uncertainty

to

Our Value Proposition Presenting

Annual Income

>=3L to <=7.5L (Mass)

<=35 years

S1 Mass Young

S3

Mass affluent Young >7.5L to 25L (Mass affluent)

S6A Affluent Young >=25L (Affluent)

Less surplus Context

• Pure Protection Value proposition

Have investible surplus + Long term goals with liquidity Can afford PNG, however, requires high sum assured

• Protect N Gain (PNG)

• More likely to go for Pure Protection

Let’s look at the each segment in detail

S1 & S6A Customer Segment

Annual Income

>=3L to <=7.5L (Mass)

<=35 years

S1 Mass Young

Less surplus Context

• Pure Protection Value proposition

>7.5L to 25L (Mass affluent)

S3

Mass affluent Young

S6A Affluent Young >=25L (Affluent)

Have investible surplus + Long term goals with liquidity

Can afford PNG, however, requires high sum assured

• Protect N Gain (PNG)

• More likely to go for Pure Protection

Meet Mr. Uday Meet Mr. Pankaj

(S1 segment)

Profile: Mr.Uday is a 35 yr. old businessman. His annual income is 5 lakhs. He is married and lives with his dependent parents.

Goal: Mr. Uday is looking for a basic protection plan to secure his family from any uncertainties

(S6A segment)

Profile: Mr.Pankaj is a 32 yr. old businessman. His annual income is 25 lakhs. He is married and lives with his dependent parents.

Goal: Mr.Pankaj is looking for protection plan with adequate life cover to secure his family from any uncertainties

iProtect Smart Plus

Conversation Starters

Protection comes first

Just like a security question helps you recover your mail account when something goes wrong, who is the answer to your family’s recovery plan in case of any uncertainty? A term insurance plan helps your family recover financially when life takes an unexpected turn.

How much money would you leave?

When you are away from home for a month how much money would you leave at home? God forbid if you are away from your home forever, have you ever thought how much money would you leave?

Sales Story: Term plan as

Income Replacement

Guard you and your family during uncertainties with..

The goals of the family are met.

Their lifestyle is sustained.

The loans / liabilities are paid off

Life insurance is meant to provide income replacement to the family in the breadwinner’s absence!

So, let’s calculate HLV for S1 Segment

Human Life value of Mr. Uday (35 years)

Total income earned in 20 years: 1 Cr

If he plans to retire by 55 years age, he will earn for next 20 years

Ideal Life cover should be between 75L-1Cr Life coverage should ideally be up to: 60 years

So, let’s calculate HLV for S6A Segment

Human Life value of Mr. Pankaj (32 years)

Total income earned in 30 years: 7 Cr approx.

If he plans to retires by 60 years age, he will earn for next 28-30 years

Ideal Life cover should be between 5Cr-7.5Cr Life coverage should ideally be up to: 60 years

To check

However, youth segment has few concerns

While Deciding To Buy Term Plan

“I

already have employer insurance, I don’t need to buy more term insurance cover”

“I

am too young to buy term insurance”

“I will buy term insurance later when I get married or earn more”

Tackle these concerns? What do we offer to

“I am too young to buy term insurance”

“I will buy term insurance later when I get married or earn more”

“I already have employer insurance, I don’t need to buy more term insurance cover”

Important to buy now; cost of delay can be much higher

Life stage protection plan as life-stage advances becomes more relevant

Get comprehensive cover against accidents and illnesses

Solution to the concern

“I will buy term insurance later when I get married or earn more”

“I am too young to buy term insurance”

“I already have employer insurance, I don’t need to buy more term insurance cover”

It

Get comprehensive cover against accidents and illnesses

I am too young to buy term insurance Objection:

Acknowledge

I completely understand concern sir, infact many of our young customers felt the same.

Counter

However, buying young is the smartest time- as your premiums are lowest now, and your health is strongest.

Close

So, instead of waiting, you can lock in a lower premium today, and increase your protection cover later when life demands it

Let’s understand in detail

Procrastination

Product: IPS Plus

Profile: Male, Non-Smoker, Self-employed, DOB: 1st August,1995

Male: 29 year old,

Policy Term: 36 Years

Yearly Premium –

₹14,600/-

5 years delay costs

Approx ₹40k more

Male: 34 year old, Policy Term: 31 Years

Yearly Premium –

₹18,175/-

While, Term plan is the need of the hour for family, Delay of term plan is not recommended from cost perspective as well

Detailed video to know more

“You don’t buy life insurance because you are going to die, but because those you love are going to live”

Kal Kare so Aaj Kar

Moreover, salaried profile gets

Available from sum assured: SA >= ₹50L

What

Let’s see

Solution to the concern

do we offer to Life stage protection plan as life-stage advances becomes more relevant

“I

already have employer insurance, I don’t need to buy more term insurance cover”

“I will buy term insurance later when I get married or earn more”

comprehensive cover against accidents and illnesses

Objection:

I will buy term plan later when I get married

Acknowledge I completely understand concern sir, infact many of our young customers felt the same.

Counter

However, buying young is the smartest time- as your premiums are lowest now. Plus, our plan will allow you to increase your cover in future as and when your responsibilities grow- like, when you get married/have children.

Close

So, instead of waiting, you can lock in a lower premium today, and increase your protection cover later when life demands it

Let’s understand in detail

Meet the

Young India!!

Just got into first job

Just got married

Just had his/her first child

With life stage advancement, need for protection of family becomes more relevant

iProtect Smart Plus

1 2 3 4

At key lifestages Marriage Birth of 1st child Birth of 2nd child Disbursement of home loan

Let’s see

Solution to the concern

“I

am too young to buy term insurance”

“I already have

“I

employer insurance,

will buy term insurance later when I get married or earn more”

I

don’t need to buy more term insurance cover”

Employer’s insurance cover may not be enough to sustain for family in case of any uncertainty. Having adequate insurance cover is important for entire working age, not just till one is employed in current workplace

Life stage protection plan as life-stage advances becomes more relevant

Moreover, comprehensive cover against accidents and illnesses is important

Important to buy now; cost of delay can be much higher

Objection:

I already have life insurance from my employer

Counter

Acknowledge

That’s great, having a life cover provided by employer is a great start to your financial protection journey

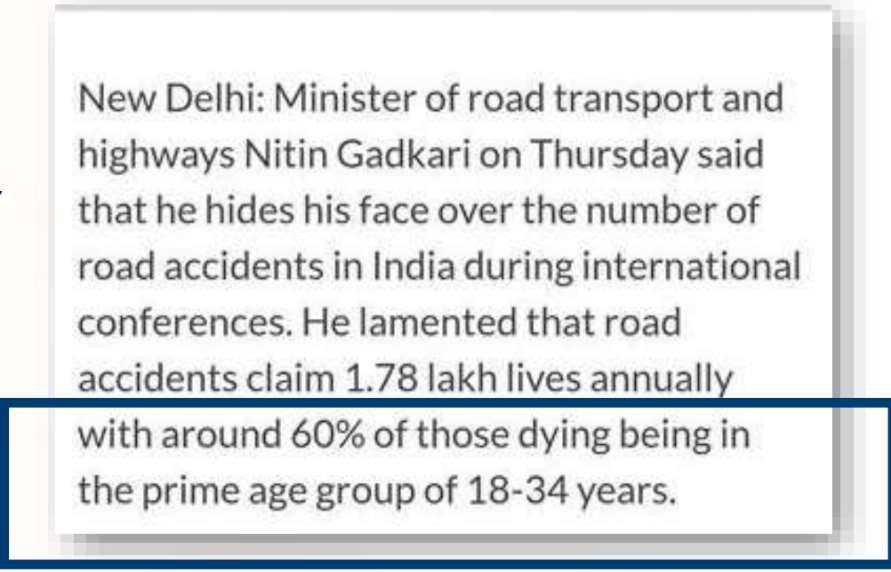

However, it’s important to have adequate life insurance cover to protect your family financially at every milestone, not just while you are employed! Especially with uncertainties around health, road accidents, having a comprehensive plan with riders like accidental death benefit rider & critical illness rider, ensures you are protected.

Close

Would you be open to a more detailed discussion on comprehensive protection with riders for 360 degree protection?

Let’s understand riders in detail

Road fatalities are

Prevalent Amongst Youth

Over 1.78 lakh die annually in road accidents

Top causes: Over speeding, non-usage of helmet/seatbelt, distracted driving, bad infrastructure

• Most impacted states: Uttar Pradesh, Tamil Nadu, Karnataka, Madhya Pradesh

Source: https://www.hindustantimes.com/india-news/around-60-roadaccident-victims-in-18-34-age-group-min-101734029422301.html

Youth’s Lifestyle Choices

As per the latest report and survey, 1 in 5 heart attack patients are now under 40. This big concern trend emerged after cases of cardiac problems in younger individuals were found in hospitals across India between 2020 and 2023, indicating that 50% of heart attack patients are below the age of 40

Source: https://www.guardian.in/blogs/livewell/youth-in-danger-1-in-5-heart-attack-patients-nowunder-40

Source: https://www.newindianexpress.com/xplore/2025/Feb/24/50-of-heart-attack-cases-since2020-among-adults-below-40

Thus, just having a

Base Life Cover is not enough…

…Additional cover against CI and accidents is crucial

Ensure 360 degree financial protection for your family

Financial goals are achieved

There is no financial burden on family in case something unfortunate happens

Peace of mind as family and their future is protected

Add ADB rider For extra protection

Up to double the protection by paying a little extra

• Get additional protection against Accidental Death with up to double the life cover

• Quite affordable and no hassle of underwriting due to ADB

Pay less than ₹ 20 per day for a double protection

Age : 35 years |Sum assured :1crore|

ADB sum assured: 1crore |PPT : Regular Pay| PT: 30 years

Base premium ₹ 19,001 ADB ₹7,080

Total premium ₹ 26,081

Add Comprehensive coverage with

Critical illness Cover

Cover of 20 or 60 critical illnesses

Get additional payout on diagnosis of any of the covered critical illnesses, without any impact on base sum assured

Covers illnesses like cancer, heart attack, kidney failure, and so on Premium guarantee of 20 years

USP’s of our flagship protection plan

iProtect Smart Plus Key Benefits

Comprehensive coverage with additional payout on illness

Premium Break:

Option to defer premium payment by 1 year

Option to increase life cover at key milestones

Instant payout on claim intimation

Option to convert Regular Pay policies into Limited Pay

Enhanced discount offering to salaried individuals

Detailed video to know more

Boundary conditions of

iProtect Smart Plus

Pay premiums for 5, 7, 10, 15 years or till age 60 or regularly or just once Life Cover for Min: 5 years; Max: Till age 85 or till age 99

Min entry age : 18 years

Max Age at entry : 60 years

Min / Max Sum Assured

50L/ Subject to underwriting

Financial eligibility grid

Claims Efficiently

Let’s see

S3 Customer segment

Annual Income

>=3L to <=7.5L (Mass)

<=35 years

S1 Mass Young

Less surplus Context

• Pure Protection Value proposition

>7.5L to 25L (Mass affluent)

S3

Mass affluent Young

S6A Affluent Young >=25L (Affluent)

Have investible surplus + Long term goals with liquidity

Can afford PNG, however, requires high sum assured

• Protect N Gain (PNG)

• More likely to go for Pure Protection

Meet Mr. Sahil (S3 Segment)

Profile: Mr. Sahil is a 35 yr. old businessman. His annual income is Rs.14 lakhs. He is married and has 3 year old daughter.

Goal: Mr. Sahil wants to create wealth for his mid to long term goals with liquidity. However, he also wants to financially protect his family in case of any uncertainty

Conversation Starter

Best of both the worlds

There’s a saying – “Killing two birds with one stone”. we have something similar providing life cover like that of a term plan and returns like investment plans

Time for a Pro Tip!

This is a generation that will warm up to insurance if it promises more than just protection—like wealth creation, tax savings, or loan eligibility

Pro Tip: Pitch insurance as a multi tool—security + savings + tax edge.

PNG Life Alpha

Market-linked wealth creation with up to 125X life cover + ADB cover + Accidental disability cover

Protection like a term plan and returns like of investment plans

Cost-efficient plan that returns 2x-4x of mortality charges and 2x of premium allocation charges

Enhanced maturity value with addition of 20% of fund value as booster payout

Choice of portfolio strategies and wide range of 25 funds

Unlimited switches to capitalize market situations

Detailed video to know more

Boundary Conditions

S3 & S6A Customer Segment

Goals of Youth Fixed Consumption Goals

Sporadic Goals

Bike Ride to Leh – Ladakh/

Going on cruise

Purchasing gaming gadgets

Buying jewellery for mother

Buying luxury/branded items

Repaying parent’s loan

Meet Mr. Sanjay…

Profile: Mr. Sanjay is a 30 yr. old businessman. His annual income is 9 lakhs. He is married & has a 2 year old daughter, Samira. He already has a term insurance policy with adequate sum assured.

Goal: Mr. Sanjay is thinking of buying his own house some years down the lane.

Lifetime Classic

Conversation Starter

Invest today, Thrive tomorrow

Embrace a long-term wealth-building journey with our market linked plan. As you are young, you can capitalize on market trends by staying invested for long term, diversify your portfolio with 25 funds available across equity/debt/balanced funds, and enjoy the peace of mind that comes with a life cover.

How to plan for down payment of

A Decent 2BHK House?

For house loan, the maximum you can borrow is capped at 80% of the property value. Remaining 20% has to paid as down payment. For a property costing Rs.50 Lakhs today, a down payment of Rs.10 Lakhs has to be planned. Considering inflation over period of 15 years, it’s suggested to invest in markets for capital growth

Source:

https://economictimes.indiatimes.com/howto-plan-the-down-payment-on-your-firsthouse/tomorrowmakersshow/70670452.cms

With Lifetime Classic..

Mr.Sanjay will get tax free Lump-sum amount of ₹20L after 17 years by paying ₹75K every year, along with Life insurance during entire policy term. Benefits of Investing in LTC: ✓ Tax free returns with scope of beating inflation ✓ Life cover during entire PT

Pay 75K for 15 yrs Get Rs.20 Lakhs tax free return For down payment of

Regarding Investment Concerns of Youth

“Investing for long term right now will delay my lifestyle goals, like traveling, buying gadgets”

“I want higher returns by investing only in small regular installments, like SIP

Tackle These Concerns? What do we offer to

“I want higher returns by investing only in small regular installments, like SIP”

Our ULIP plan offers SIP oriented tax efficient, market linked returns

“Investing for long term right now will delay my lifestyle goals, like traveling, buying gadgets”

Sporadic goals can be fulfilled through partial withdrawal feature in ULIPs

Lifetime Classic Presenting our ULIP proposition

Create wealth with market linked returns to beat inflation Choice of 4 portfolio strategies and wide range of 25 funds

Partial Withdrawal option to withdraw money for sporadic goals after 5th policy year

Free unlimited switches between the funds depending on your financial priorities

Enjoy tax benefits U/S 80C on premiums paid and 10(10d) on benefits received, as per prevailing tax laws

Death Benefit (For entry age<50 years): Sum assured + Fund Value

Boundary Conditions

Get additional protection in

LTC Through Rider

Accidental Death Rider cover as high as 3X of basic Sum Assured

Tackle Objections Like A Pro

Objection: I don’t want to

Get Locked in For Long Term

Acknowledge I understand your point of view, Sir/ Ma’am

Counter

The simple and most effective rule for investments is to stay invested for a longer period and earn more. Also many important financial life goals – such as building a strong financial base, providing for children’s education, retirement planning etc. are also long term. Life insurance is the only long term investment tool which also offers the much needed financial protection

Close

Thus it helps in achieving the long term financial goals of a family

Let’s hear from our expert

Benefits of investing regularly for long term

Objection: I invest in Mutual funds,

Why should I invest in ULIP?

Acknowledge I completely understand your preference for mutual funds; they are a popular choice for many investors.

Counter

However, life insurance forms a solid foundation to your financial planning. ULIP not only offers potential returns from market, but also provides protection for your loved ones with tax advantages. It complements your existing investments, adding a layer of security.

Close

Would you be open to a more detailed discussion on how life insurance can enhance your overall financial portfolio?

Let’s watch a video

To understand benefits of investing in ULIP

DID YOU KNOW?

of working millennials (aged 25-35) start saving without any clear financial goal or investment plan

Source: ET Money GenZ & Millenial Financial Habits Report, 2023

Your Role as Financial Advisor for Youth!

Hence your role as a financial advisor is not just about investments- it’s about helping turn money into a plan , and plan into a purpose to achieve peace of mind!

Time for a Pro Tip!

The youth buys into “why”, not just “what”.