Evolution of the Mining and Metals Industry

MINING INDUSTRY INSIGHTS How China's Financial Support Alters Global Trade Dynamics Rare Earth Elements (REEs) are crucial for the world economy, but their supply chain is intertwined with geopolitics. Sustainability, Technology, and Community Engagement in the Modern Era The New White Gold? An Investment Perspective Lithium A Round Table Discussion 32 28 24 38

of Subsidies Volume: 112. Issue.10. October 2023 www.skillings.net

Gary

Rivenes

,Joe Bennett , Terence Jordaan ,Bagus Zaqqie Khadafi

The Great Wall

2 Skillings.net | October 2023 BIG RESULTS SMALL TEAM Optiro is a resource consulting and advisory group. Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software. In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results. +$15 BILLION DEALS/ VALUATIONS >780 MILLION oz Au RESOURCE AUDITS >64 MILLION oz Au RESOURCE ESTIMATES >3,000 CLIENTS +2,000 PEOPLE TRAINED 24 COMMODITIES 53 COUNTRIES >4,300 MILLION lb NICKEL >5,100 MILLION lb COPPER +5 IRON ORE BILLION TONNES www.optiro.com contact@optiro.com +61 8 9215 0000

Evolution

The

Global Trade Dynamics

Rare Earth Elements (REEs) are crucial for the world economy, but their supply chain is intertwined with geopolitics.

The New White Gold? An Investment Perspective MINING INDUSTRY INSIGHTS A Round Table Discussion 05 New Mining Code: A Bold Move by Mali 06 Navigating Turbulent Waters Overcoming Challenges in Mining Financing 08 Protecting People and Progress The Urgent Need for Compulsory Human Rights Due Diligence in African Mining 12 Insurance Snub Calls for Saving for a Rainy Day: Coal Miners Left Vulnerable 14 Africa’s Struggle with Gold Mining, Climate Change, and the Imperative for Sustainable Transition 20 Navigating Uncharted Waters Uncertainty in the Mining Industry Shakes Global Profit Forecasts 27 Water ScarcityA Looming Challenge for the Mining Industry 36 Breaking Barriers Challenges for Minorities and Women in the Mining Industry 42 Sustainable Innovation in Mining: Transforming Scrap Metal into GreenEnergy Treasure 44 Gold Rush in the Tropics Unveiling the Severe Degradation and Deforestation Caused by Gold Mining

Lithium

Gary Rivenes ,Joe Bennett , Terence Jordaan ,Bagus Zaqqie Khadafi ,

Great Wall of Subsidies:

How China's Financial Support Alters

32 28 38 24

Metals

Technology,

Engagement

In the turbulent oceans of the global economy, the mining and metals industry sails as one of the most formidable yet volatile fleets. 16 Mining Industry Skills Shortage Hinders Digital Transformation 22 China's Role in DRC Cobalt Extraction Ethics Economic benefits and Ethical concerns 3 Volume: 112. Issue.10. October 2023

of the Mining and

Industry:Sustainability,

and Community

in the Modern Era

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284. Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

www.skillings.net

SKILLINGS MINING REVIEW NEWS ROOM

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service

All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284.

Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER

CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF

JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS

ROB RAMOS

AALIYAH ZOLETA

MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR

SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING

CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

4 Skillings.net | October 2023

New Mining Code: A Bold Move by Mali

Mali has adopted a new mining code to increase local ownership of gold concessions, aiming to reduce foreign control over the country's gold resources. The code, a result of stakeholder consultations, aims to increase economic empowerment and reduce foreign control over the industry.

Mali has adopted a new mining code to promote environmentally responsible practices and expand gold concession ownership. The code aims to increase transparency, strengthen local participation, and ensure sustainable development of Mali's mineral resources.

It requires mining companies to increase the government's stake in their ventures to 20%, ensuring the Mali government receives a larger portion of profits from the exploitation of its mineral resources. The new code also imposes stricter environmental and social responsibility standards on mining operations, requiring companies to comply with regulations to

minimize environmental degradation, safeguard biodiversity, and improve social support for affected communities.The government is actively engaging with foreign mining companies to ensure a seamless transition to the new code, engaging in dialogues and consultations to foster a collaborative approach and develop trust between all parties involved.

The provisions for increased transparency, local participation, and sustainable development are expected to have long-term advantages for all parties involved. Mali's Minister of Mines, Aissatou Sow Sidibe, praised the new legislation as a historic moment for the country.

5

Navigating Turbulent Waters

Overcoming Challenges in Mining Financing

This article examines the challenges currently facing the mining industry and explores strategies for overcoming them, thereby guaranteeing sustainable and responsible financing for mining operations.

The mining industry faces financing challenges due to economic uncertainty and environmental regulations. Rising costs, fluctuating commodity prices, and geopolitical risks impact profitability. To mitigate these, companies are exploring off-take agreements, hedging strategies, and long-term supply contracts. Geopolitical risks include political instability and legal disputes. Environmental and social responsibility are also a significant challenge. Innovative financing models and technological advancements are emerging, allowing the industry to support global economic growth while protecting the environment and communities affected by mining activities.

Breaking Ground: Strategies for Overcoming Financing Challenges in the Mining Industry

The mining industry is a crucial component of numerous economies, as it provides essential basic materials to numerous sectors. Yet, mining companies frequently encounter formidable obstacles when it comes to financing their operations.

Geopolitical risks, fluctuating commodity prices, and social and environmental issues can all make it more difficult to access financing. This article investigates the strategies mining companies can employ to overcome these financing obstacles and sustain their growth.

FINANCING MINING

6 Skillings.net | October 2023

VENTURES IS A difficult task. Rising expenses, fluctuating commodity prices, and geopolitical dangers can have a substantial impact on the profitability and viability of mining ventures. In addition, environmental and social concerns have become increasingly important in securing and maintaining mining project financing.

Strategies for Conquering Financing Obstacles in the Mining Industry

Mining companies face financing challenges due to geopolitical risks, fluctuating commodity prices, and social and environmental issues. To overcome these obstacles, companies can employ strategies such as hedging, off-take agreements, and long-term supply contracts. Geopolitical risks, such as political instability and legal conflicts, can disrupt mining operations, making it difficult to secure financing. To address these risks, companies should establish strong relationships with governments, local communities, and stakeholders, and implement sustainable practices like environmental and social impact assessments.

Ethical mining practices, such as implementing stringent environmental impact assessments and community development initiatives, are increasingly being demanded by investors and communities. Companies that prioritize sustainability objectives are more likely to attract socially responsible investors and secure financing. Technological advancements like

automation and data analytics can improve productivity and safety, but require substantial financial resources. Companies can diversify their financing sources, such as private equity, crowdfunding, royalties, and streaming agreements, to access capital from other sources. By implementing these strategies, mining companies can overcome financing obstacles and ensure sustainable growth.

7

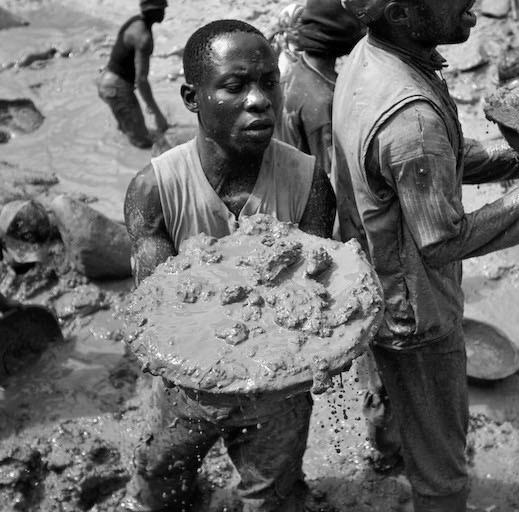

The Urgent Need for Compulsory Human Rights Due Diligence in African Mining

Mining in Africa is a vital economic sector that generates revenue and employment opportunities for many nations. However, recent reports of human rights violations in the mining industry have raised concerns about the impact on local communities, indigenous peoples, and vulnerable populations. These violations include displacement by force, land appropriation, hazardous working conditions, child labor, and environmental degradation.

To address these concerns, mandatory human rights due diligence is urgently required in the African mining industry. This systematic process involves identifying, preventing,

mitigating, and accounting for potential adverse impacts on human rights. It requires mining corporations to conduct comprehensive assessments and audits of their operations, identifying potential risks and detrimental effects on local communities, laborers, and the environment. Companies must take measures to prevent and mitigate these risks, such as establishing robust grievance mechanisms, ensuring fair compensation for communities impacted by mining activities, and prioritizing worker health and safety.

The implementation of mandatory human rights due diligence would have significant benefits for all involved parties. It would

Protecting

Progress

People and

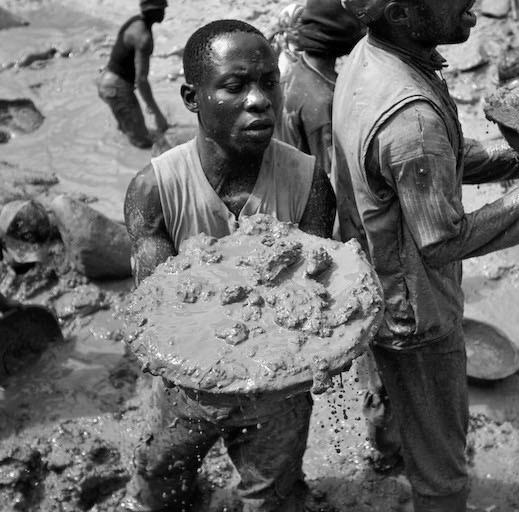

Artisanal Miners At Tilwizembe, A Former Industrial Copper-cobalt Mine, Outside Kolwezi, The Capital City Of Lualaba Province In The South Of The Democratic Republic Of The Congo, June 11, 2016. Reuters/kenny Katombe

8 Skillings.net | October 2023

The mining industry in Africa is crucial for economic development and job opportunities, but it also faces human rights violations that affect local communities, laborers, and vulnerable populations.

Integrated solutions that add value

ME Elecmetal o ers more than mill liners — we o er innovation, support, custom designs and valuable tools to develop a total comminution solution speci c to your needs. We are on the ground with our customers — setting common goals and providing timely responses based on e ective collaboration. Drawing on over 100 years of experience and advanced technologies, we will help you optimize processes, extend the lifespan of wear parts, reduce operational risks and increase pro tability.

Grinding Wear Parts

Innovative Mill Lining Solutions for AG, SAG, Ball, Tower and Rod Mills

• Rubber

• Composite

Grinding Media

Premium Quality Forged Steel Grinding Media for SAG, Ball and Rod Mills

Grinding Media Product Size Ranges:

• SAG Mills: 4.0” to 6.25”

• Ball Mills and Regrind Mills: 7/8” to 4.0”

• Rod Mills: 3.0” to 4.0” Diameter

Crusher Wear Parts

Wear Components for Primary, Secondary and Tertiary Crushers

• Gyratory Crushers

• Jaw Crushers

• Cone Crushers

www.me-elecmetal.com

Considerations regarding mandatory human rights due diligence

The Office of the United Nations High Commissioner for Human Rights (OHCHR) has developed guidance on mandatory human rights. The Guidance distinguishes three types of legislative approaches:

• Category 1: regimes that require com panies to prevent harm through the exercise of human rights due diligence (for which the occurrence of harm is a key element of the breach);

• Category 2: regimes that require companies to carry out human rights due diligence (i.e. liability arises from the failure to exercise human rights due diligence, and whether or not that failure has resulted in actual harm is immaterial to establishing non-com pliance); and

• Category 3: regimes that contain no explicit requirement to carry out human rights due diligence but which create strong incentives in that direction (e.g. regimes that permit the company to use the fact that it had carried out human rights due diligence as a defence to legal liability for causing harm, or which permit levels of compliance with human rights due diligence standards to be taken into account “in mitigation” in deciding on an appropriate sanction for a legal breach).

guarantee respect for human rights and provide adequate protections against violations, advance social equity, safeguard vulnerable populations, and pave the way for more inclusive and sustainable development in mining-affected regions. It would also improve the reputation and global competitiveness of the African mining industry, attract responsible investors, and foster trust between companies, governments, communities, and civil society. Multiple stakeholders must collaborate to realize the maximum potential of mandatory human rights due diligence in African mining. Governments

should enact legislation mandating human rights due diligence and establish effective regulatory enforcement frameworks, while companies must accept their responsibility to respect human rights and incorporate due diligence procedures into their operations.

Mining operations often occur in remote and disadvantaged communities, where regulatory supervision and access to justice are limited.

Forcible displacement and land appropriation are primary concerns, as mining operations disrupt communities' lives and livelihoods by severing their ties to ancestral lands, cultural heritage, and traditional practices. Inadequate health and safety standards pose a significant threat to miners' rights and safety, leading to accidents, injuries, and fatalities. Child labor is another issue, as poverty and restricted access to education force children into exploitative work environments.

Environmental degradation and pollution caused by mining operations negatively impact nearby communities and ecosystems, particularly Indigenous peoples who rely on land and natural resources for survival and cultural practices. Inadequate access to justice further exacerbates these human rights issues.

To resolve these issues, governments must strengthen their legal and regulatory frameworks, enforce labor laws, implement strict environmental regulations, and improve access to justice for affected communities. African-based mining corporations have a responsibility to respect human rights throughout their operations, conduct thorough human rights due diligence, engage with local communities, implement health and safety measures, and provide fair land acquisition compensation.

International partnerships and collaborations are also essential to address human rights issues in African mining. By fostering collaborative efforts, commitment to responsible mining practices, and enforcement of robust legal frameworks, a mining industry in Africa that respects human rights, promotes sustainable development, and empowers local communities can be established.

10 Skillings.net | October 2023

11

Coal Miners Left Vulnerable Insurance Snub Calls for Saving for a Rainy Day

In the aftermath of diminishing coal industry prospects and a shifting energy landscape, numerous coal miners face an uncertain future. This article examines the effects of the insurance exclusion on coal laborers and the significance of proactive financial planning.

Coal miners are realizing the need for proactive financial planning and saving for unforeseen circumstances. They are setting aside a portion of their income to create a safety net in the event of emergencies or job loss. Experts advise miners to prioritize the establishment of a robust emergency fund by setting aside at least six months' worth of living expenses.

Government agencies, non-profit organizations, and industry associations play a crucial role in assisting coal miners during this difficult time by facilitating programs for financial literacy and providing resources for effective financial planning and management. Policymakers must address the lack of insurance faced by coal miners by engaging with insurance companies, advocating for inclusive coverage and equitable policies, and considering government subsidies and incentives for insurers to offer affordable insurance options.

Arecent insurance rejection has left coal miners without coverage for workplace accidents and occupational diseases, posing a significant threat to their livelihoods and financial security. Insurance plays a crucial role in providing protection and support in the event of accidents or work-related ailments. However, recent reports indicate an alarming trend of insurance companies declining to provide coverage for coal miners, citing declining coal industries and environmental concerns as justifications.

Without insurance coverage, miners face the constant dread of workplace accidents and potential long-term health consequences associated with mining-related illnesses such as black lung disease. In the absence of insurance, miners and their families must shoulder the financial burden of medical bills, lost earnings, and rehabilitation costs, which threatens not only their means of subsistence but also their general well-being and quality of life.

Coal Industry Takes Action to Address the Insurance Snub Plaguing Miners

The coal industry is addressing the lack of insurance coverage for coal laborers due to the decline of the industry and environmental concerns. This has left miners without essential protection against workplace accidents and mining-related health issues, putting their financial well-being at risk. To address this issue, the industry is taking proactive measures, including engaging in dialogue with insurance providers, advocating for equitable insurance practices, and exploring alternative insurance options.

Industry associations and advocacy organizations are also playing a crucial role in addressing the refusal of insurance companies to purchase insurance. They are engaging insurers, government agencies, and other stakeholders to raise awareness and lobby for policy changes that will benefit coal miners.

12 Skillings.net | October 2023

MINING COMPANIES ARE INVESTING IN improving safety protocols, implementing cutting-edge technology, and adopting best practices to reduce workplace accidents and occupational health risks.The industry is also pursuing partnerships with government agencies and policymakers to address the insurance gap. By collaborating, they aim to establish regulations prohibiting discriminatory insurance practices and guaranteeing access to affordable and comprehensive coverage for all employees, including coal miners.

requirements. These programs could provide coverage for workplace accidents, occupational diseases, and disability, ensuring miners have the necessary protection and support when they need it most.

The industry is also investing in preventative measures and enhanced safety standards to reduce the risks its workforce faces. Mining companies are investing in improving safety protocols, implementing cutting-edge technology, and adopting best practices to reduce workplace accidents and occupational health risks.

Another significant avenue being pursued is exploring specialized insurance programs tailored to the coal mining industry's

The industry is also pursuing partnerships with government agencies and policymakers to address the insurance gap. By collaborating, they aim to establish regulations prohibiting discriminatory insurance practices and guaranteeing access to affordable and comprehensive coverage for all employees, including coal miners. Industry-wide education and awareness campaigns are being conducted to emphasize the importance of insurance coverage and encourage miners to make informed decisions regarding their financial security.

INDUSTRIAL GENERAL CONTRACTOR

13

crmeyer.com | 800.236.6650 Millwrighting • Ironwork • Piping • Concrete • Carpentry • Masonry Pile Driving • Boilermaking • Electrical • Demolition • Design/Build

Africa’s Struggle

Gold Mining, Climate Change, and the Imperative for Sustainable Transition

As the world confronts the realities of climate change, concerns arise regarding the viability of gold mining and its contribution to global warming. This article explores the intricate relationship between gold mining, climate change, and Africa’s transition, emphasizing the obstacles encountered and proposing strategies for a sustainable future.

local communities with sustainable mining practices can reduce environmental degradation. Government policies and international support are needed to prioritize sustainable practices while balancing economic growth. Transparency and responsible procurement are essential, and certification systems can help promote responsible mining practices. Collaborating with mining corporations, governments, and civil society organizations can strengthen responsible supply chains. This integrative strategy can set an example for the rest of the world. Powering Africa’s Future: Strategies for Transitioning to Sustainable Energy Sources

Gold extraction in Africa is a vital economic sector, but it poses environmental challenges like deforestation, land degradation, and greenhouse gas emissions. To mitigate these, Africa should adopt renewable energy, responsible waste management, and environmental regulations.

Transition in Africa and Sustainable Mining Practices

The mining industry is crucial for Africa's transition towards sustainability. Investing in renewable energy, sustainable agriculture, and ecotourism can reduce dependence on gold mining and promote sustainable development. Empowering

As the effects of climate change become more apparent, African nations will be required to transition to renewable energy sources. With abundant renewable resources, such as solar, wind, hydroelectric, and geothermal potential, the continent has the ability to harness clean energy and stimulate economic development while reducing carbon emissions. This article examines the strategies and obstacles involved in Africa’s transition to renewable energy sources, highlighting the potential benefits and delineating the steps necessary for a successful transition.

Unlocking the Renewable Energy Potential of Africa:

Africa's renewable energy potential is significant for sustainable transition. Solar power can be used for affordable, environmentally friendly electricity in remote regions. Wind energy can be harnessed in coastal regions, highlands, and deserts. Hydroelectric projects in rivers can generate electric-

14 Skillings.net | October 2023

ity, aid in water management, irrigation, and flood control. Geothermal resources in rift zones and volcanic regions can provide reliable baseload power.

Managing Obstacles and Ensuring Energy Access

Transitioning to sustainable energy sources requires African governments to encourage investment, establish regulatory frameworks, upgrade grid infrastructure, build local capacity, and cultivate international collaborations. Public-private partnerships and favorable investment frameworks can mobilize capital. Off-grid solutions and training programs can enhance access to renewable energy. Collaborative partnerships with development agencies, donor organizations, and technical experts can provide expertise and financial support for sustainable energy projects.

Utilizing Economic and Social Advantages:

Transitioning to renewable energy in Africa offers economic and social benefits, including job opportunities, improved energy access, and reduced greenhouse gas emissions. It

AFRICA'S RENEWABLE ENERGY

potential is significant for sustainable transition. Solar power can be used for affordable, environmentally friendly electricity in remote regions. Wind energy can be harnessed in coastal regions, highlands, and deserts. Hydroelectric projects in rivers can generate electricity, aid in water management, irrigation, and flood control. Geothermal resources in rift zones and volcanic regions can provide reliable baseload power.

also helps combat climate change. However, challenges like financing, regulatory frameworks, and capacity building need to be addressed. Despite these obstacles, the transition to sustainable energy can promote economic growth, expand energy access, and mitigate climate change. This requires commitment, collaboration, and innovation.

15

Mining Industry Skills Shortage Hinders Digital Transformation

The mining industry is suffering from a severe lack of technological expertise, which hinders its digital transformation efforts. Up to 75% of organizations are struggling to find talent to meet their needs, according to recent statistics. In this article, we investigate the mining industry’s lack of tech talent and its impact on the sector’s digital transformation.

ufacturing for tech expertise makes it difficult for the mining industry to attract and retain skilled professionals. In addition, traditional mining roles have historically emphasized manual labor over technological expertise, resulting in an underdeveloped technological workforce within the industry.

Changing Nature of Mining Occupations

As mining companies increasingly adopt advanced technologies such as automation, artificial intelligence, and data analytics to enhance operational efficiency and safety, the lack of qualified technology professionals is becoming a significant obstacle.

Increasing Demand for Technical Skills

The mining industry’s growing reliance on technology has resulted in a high demand for technological expertise. Technology is transforming the mining landscape, from autonomous vehicles and drones to remote monitoring sys-

tems and predictive maintenance tools. These technologies improve operational efficacy, safety, and environmental impact. The effective implementation of these technologies, however, requires a workforce with specialized technological skills, such as data analysis, programming, robotics, and automation.

Limited Supply of Technical Experts

The lack of technical experts in the mining industry is primarily attributable to the scarcity of individuals with the necessary skill set. Competing with industries such as IT, finance, and man-

The mining industry’s digital transformation is drastically altering the nature of mining employment. Traditional mining positions are being supplanted by technology-based, specialized positions. For instance, miners must now operate and maintain autonomous vehicles and sophisticated machinery, as well as analyze massive data sets and develop algorithms for predictive analytics.

Implications for Digital Transformation

The lack of technical expertise impedes the mining industry’s digital transformation efforts. Without a skilled workforce to drive innovation and effectively implement new technologies, mining companies struggle to realize digitalization’s maximum potential. This places

16 Skillings.net | October 2023

FloLevel Technologies

Consequences of Tech Skills Shortage in Mining Industry: Impeding Growth and Innovation

The lack of technical expertise in the mining industry has far-reaching effects, affecting the sector’s development potential and innovation capacity. In an effort to enhance operational efficiency and sustainability, mining companies are embracing digital transfor - mation.

However, the lack of qualified technology professionals presents significant challenges. This article examines the repercussions of the technology skills gap in the mining industry and its future implications for the sector.

Slower Adoption of CuttingEdge Technologies

The mining industry faces a competitive disadvantage due to a lack of technological expertise, hindering the adoption of innovative technologies like automation, artificial intelligence, and data analyt-

ics, which could enhance productivity, safety, and environmental sustainability.

Decreased Operational Productivity

Technological expertise in mining companies is crucial for optimizing operations, analyzing large data sets, and developing predictive maintenance algorithms. However, lack of this expertise leads to inefficiency, manual errors, and suboptimal decision-making, reducing operational excellence, productivity, and costs.

them at a competitive disadvantage compared to companies in other industries that have successfully utilized technology to boost productivity and obtain a competitive advantage. Lack of technical expertise also increases reliance on external consultants and vendors, resulting in higher costs and potential implementation delays for digital initiatives.

Collaboration between the Mining and Technology Industries

The mining sector and the technology industry must collaborate to address the skills gap in the technology industry. Companies in the mining industry can collaborate with technology firms and educational institutions to create training programs that equip workers with the necessary technological skills.

This partnership may include internships, apprenticeships, and specialized courses tailored to the requirements of the mining industry.

The mining industry can construct a more resilient and digitally savvy workforce by cultivating a pipeline of qualified technology professionals.

Investing in Advanced and Refresher Training

To close the technology skills divide, mining companies must invest in upskilling and reskilling their existing workforce. Technology training programs and initiatives can assist employees in acquiring the essential technological skills required for the digital transformation of their industry. In addition, mining companies should provide opportunities for continuous learning and professional growth so that their personnel can keep up with rapidly evolving technologies.

The lack of technical expertise in the mining industry poses a formidable obstacle to the sector’s digital transformation.

With the increasing adoption of sophisticated technologies, the demand for technology professionals in the mining industry is greater than ever. However, the limited availability of tech talent and the evolving nature of mining positions have resulted in a dearth of skilled professionals. To address this deficit, the mining and technology industries must collaborate and make targeted investments in upskilling and reskilling.

“ACCORDING TO BCG’S Digital Acceleration Index (DAI), the metals and mining industry is roughly 30% to 40% less digitally mature than comparable industries, such as automotive or chemicals.”

18 Skillings.net | October 2023

Safety Considerations

The mining industry faces challenges in implementing safety-focused innovations due to a lack of technical talent. Advanced technologies can reduce human involvement in hazardous duties and improve risk management systems. This lack of qualified professionals hinders the industry's ability to mitigate risks, leading to accidents, injuries, and environmental incidents. Digital technologies also offer opportunities for environmental sustainability, but the absence of qualified tech professionals hinders these efforts.

Competitive Weakness

The lack of technological expertise in the mining industry places businesses at a competitive disadvantage. In an era

in which digitalization is reshaping multiple industries, the ability to leverage sophisticated technologies is crucial for sustaining competitiveness.

Companies in the mining industry that lack skilled technologists struggle to compete with rivals who have effectively implemented digital solutions. This competitive disadvantage can result in a decline in market share, profitability, and growth rate.

Challenges in Attracting Investment

The mining industry's lack of technological expertise can lead to a competitive disadvantage, hindering market share,

profitability, and growth rate, as digitalization is reshaping industries.

Effects on Job Creation

The mining industry faces challenges due to a lack of technological expertise, hindering job creation and innovation. The industry faces slower adoption of advanced technologies, decreased operational efficiency, safety concerns, missed sustainability opportunities, competitive disadvantages, and limited investment.

To address this, industry collaboration, investments in training, and a concentrated effort to attract and retain skilled tech professionals is needed.

19 SOLVING YOUR MOST COMPLEX CHALLENGES. With SEH, you are a true partner and collaborator. Engineers | Architects | Planners | Scientists 800.325.2055 | sehinc.com/subscribe

Navigating Uncharted Waters

Uncertainty in the Mining Industry Shakes Global Profit Forecasts

The global mining industry is no stranger to volatility, but the uncertainty introduced in recent years has sent shockwaves through profit forecasts. A confluence of factors, including economic instability, fluctuating commodity prices, and evolving environmental regulations, has left both mining companies and investors facing an uncertain future.

Profit forecasts are in turmoil.

Historically, commodity price fluctuations have caused boomand-bust cycles in the mining industry. Nevertheless, the recent increase in global economic uncertainty has exacerbated these fluctuations, making profit projections especially difficult.

This uncertainty is largely attributable to the COVID-19 pandemic, which disrupted supply chains, constrained labour forces, and precipitated unprecedented global economic difficulties. The pandemic highlighted the industry’s susceptibility to external disruptions and the need for resilience and adaptability.

Volatility in the Cost of Commodities

Profitability in the mining industry has always been significantly influenced by commodity prices. In recent years, technological advancements, renewable energy initiatives,

and urbanization have contributed to a robust demand for metals and minerals. However, this surge in demand may be short-lived, as some analysts anticipate a decline in the commodity markets.

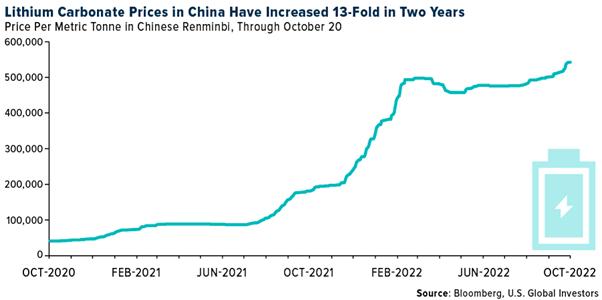

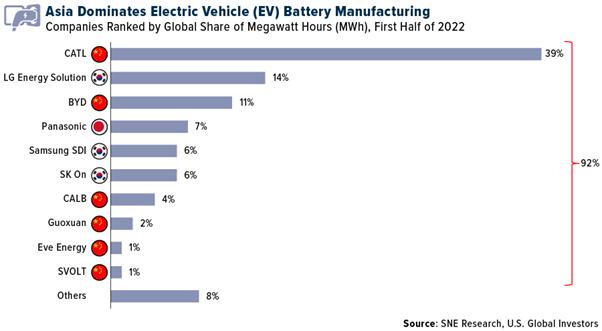

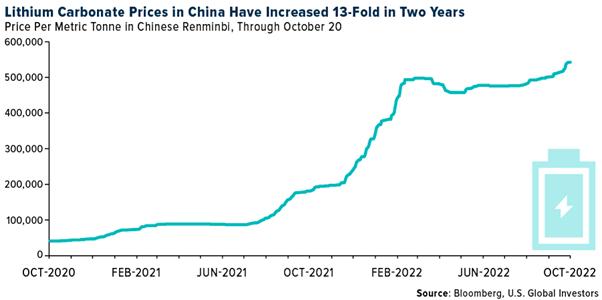

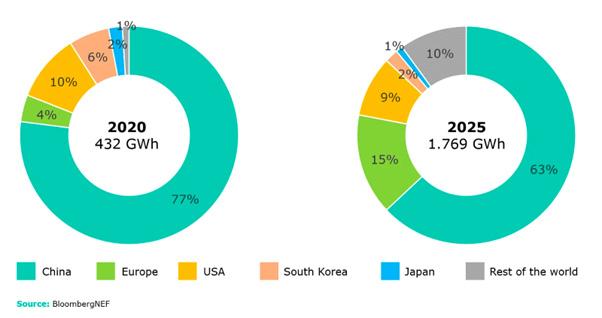

Specifically, the electric vehicle (EV) revolution has increased demand for lithium, cobalt, and nickel. This resulted in a windfall of profits for the miners in these sectors, but the long-term outlook is uncertain. Technological advancements, changes in battery chemistry, and recycling initiatives could disrupt traditional mining markets.

Environmental and Regulatory Constraints

The mining industry faces ambiguity due to changing environmental regulations and sustainability concerns. Governments, organizations, and communities demand stricter standards and responsible practices. The transition to sustainability

20 Skillings.net | October 2023

requires significant investments in research and development. Regulatory changes can impact mining operations, while the pandemic exposed weaknesses in global supply chains, affecting timing, cost, and profit projections.

Uncertainty Management

Mining companies are reassessing their strategies to navigate uncertainty. Diversification, investing in technology and automation, and focusing on environmental and social responsibilities are key strategies. The volatile profit projections of the industry, coupled with global economic conditions, commodity price fluctuations, and evolving regulations, have increased the stakes. To navigate these challenges, companies must prioritize sustainability, diversify

their portfolios, invest in technological innovations, and maintain a robust social license to operate.

Adapting Amid Uncertainty: How Mining Companies Navigate the Shifting Landscape

Mining companies are adapting to the unpredictable nature of the market by embracing agility, enhancing supply chain resilience, and focusing on cost efficiency. They are diversifying their mineral portfolios, exploring new locations, and adjusting production levels to meet market demand. They are also enhancing supplier collaboration, implementing risk management strategies,

and creating alternative sourcing options. Cost efficiency is also a priority, with energy-saving measures and operational process optimization.

Technological innovations like automation, AI, and data analytics are being adopted to improve efficiency and resource recovery. Sustainable practices are also being prioritized, with companies embracing responsible mining practices and environmental stewardship. Strategic partnerships and collaborations are being leveraged to share best practices and explore innovative solutions. Financial planning and risk management are also being prioritized to ensure stability and resilience. These strategies are crucial for the mining industry's long-term success amidst uncertainties.

Proud to be your reliable partner.

We have long supported the region’s mining industry by providing safe, reliable and competitively priced electricity. In 2021, half of the energy we provide to all of our customers will come from renewable sources. Together, we power northeastern Minnesota’s economy.

mnpower.com/EnergyForward

19260

21

China's Role in DRC Cobalt Extraction Ethics

Economic benefits and Ethical concerns

China’s involvement in the Democratic Republic of the Congo’s (DRC) artisanal cobalt mining industry has attracted considerable attention due to its insatiable demand for cobalt, a key component of lithium-ion batteries used in electric vehicles and smartphones.

China's involvement in the artisanal cobalt mining industry in the Democratic Republic of the Congo (DRC) has been a topic of interest due to its growing demand for cobalt, a crucial component of lithium-ion batteries used in electric vehicles and smartphones. The DRC, home to nearly two-thirds of the world's cobalt reserves, is an essential source for China's cobalt supply. However, the majority of cobalt mining in the DRC is conducted by artisanal and small-scale miners who operate under exploitative conditions.

Supply chain raises ethical concerns

China's role in DRC's artisanal cobalt extraction raises ethical concerns about labor conditions, human rights violations, and environmental impacts. Cobalt, mainly produced as a byproduct of copper and nickel, is mainly obtained from Kolwezi, a city where it was often overlooked in favor of more in-demand minerals.

22 Skillings.net | October 2023

Environmental impact of artisanal mining

The environmental impact of artisanal mining techniques in the DRC is also significant, with hazardous chemicals like mercury and uncontrolled waste discharge contributing to soil and water pollution, negatively affecting local ecosystems and communities. International human rights and environmental organizations have criticized China's participation in the DRC's cobalt industry, urging responsible and sustainable practices that prioritize worker safety and environmental protection.

International partnerships for supply chain transparency

Chinese corporations are implementing responsible sourcing procedures and supply chain mapping to address ethical issues in artisanal mining in the DRC. International partnerships like the Chinese Extractive Industries Transparency Initiative and Global Battery Alliance promote transparency and sustainable practices.

Grave ethical concerns in DRC mining

The Democratic Republic of the Congo's cobalt mining industry faces ethical issues due to hazardous conditions faced by artisanal and small-scale miners, who rely on the mineral for lithium-ion batteries.

Juvenile labor

Juvenile labor is a primary concern in cobalt mines, with children as young as six often employed in hazardous mining activities, depriving them of their right to education and exposing them to hazardous working conditions. Human rights organizations have documented cases of children working long hours, being exposed to toxic chemicals, and enduring accidents and injuries on mining sites.

Economic exploitation

Adult miners also face issues of destitution and economic exploitation, as they often work in unregulated and informal mines with inadequate safety equipment, leading to high accident and injury rates. Additionally, these miners are often compensated poorly, exacerbating issues of destitution and

economic exploitation.

Environmental challenges

The DRC's cobalt mining industry faces environmental and ethical challenges like mercury and cyanide use, pollution, and corruption. To address these, stakeholders must collaborate, ensure transparency, and establish traceability and auditing mechanisms.

Young children at work in Kipushi, Katanga.

Young children at work in Kipushi, Katanga.

23

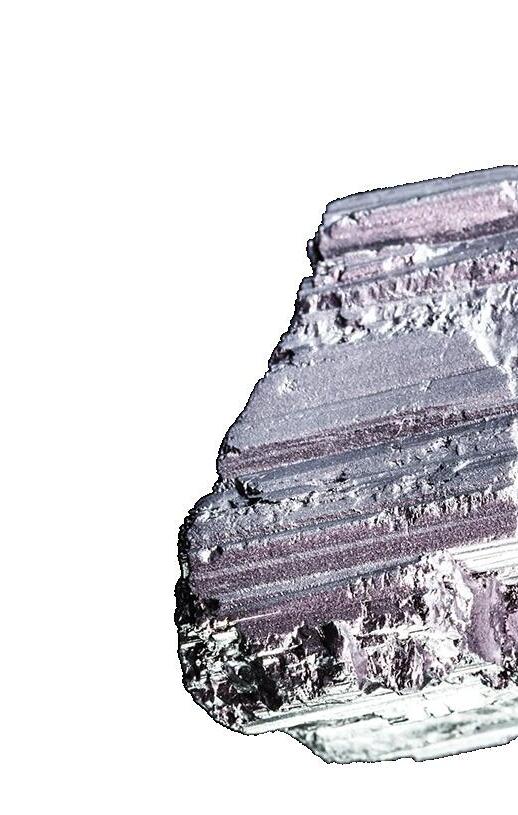

Chunks of cobalt ore mineral rocks in an iron barrel

A Round Table Discussion

In light of recent developments and challenges within the mining industry, we engaged four seasoned professionals to share their insights and experiences in a round table discussion.

meet the panelists.

Gillette, Wyoming, United States

A seasoned Operations Executive from Wyoming, USA passionate about leadership, people safety, and business improvements.

The Role of Leadership

Warehouse Logistics ManagerLove2Shop (part of Pay Point). Mill Bank College, Liverpool Liverpool, England, United Kingdom

A UK Liverpool-based Logistics professional who believes in the power of practical experience and commitment to the job.

Leadership stands out as a key component for success. Gary underlines its importance, attributing a significant portion of productivity to effective leadership. Joe, despite not having a formal academic background, echoes this sentiment, attributing his varied career to leadership. Terence and Bagus further stress its significance, hinting at its essentiality across different geographies.

Mining Development enthusiastPT Nipindo Primatama Banten, Indonesia

A geological engineering enthusiast from Indonesia with experience in exploration and development.

Formal Education vs. RealWorld Experience

Gary believes formal education opened numerous "mental doors" for him. In contrast, Joe’s practical experience, devoid of academia, carved out his career path. Terence and Bagus acknowledge the importance of formal education but emphasize the value of on-the-job experiences.

CEO Terra Group

Centurion, Gauteng, South Africa

CEO of Terra Group in South Africa, with an aim to make the world a better place.

Commitment as a Management Tool

Commitment emerged as a universal tool for successful management. Gary feels it’s essential for success, and Joe resonates with this, suggesting it is a part of a motivated workforce. Terence speaks of it as a key success factor, while Bagus believes commitment engenders trust, which he deems crucial in the industry.

MINING INDUSTRY INSIGHTS

Gary Rivenes Leader - Operations Executive, Independent and Leadership Consultant with Balmert Consulting

Bagus Zaqqie Khadafi

Terence Jordaan

Joe Bennett

24 Skillings.net | October 2023

Towards a More Resilient Industry Image

A forward-looking perspective emerges when discussing the industry's image. Gary’s focus on advertising technical capabilities underscores the importance of highlighting the industry’s modernity and innovation.

Joe, meanwhile, addresses a persistent concern: the balance between vocational and academic pathways. His viewpoint indicates a growing trend – the shift towards recognizing vocational qualifications, which could democratize the industry. Terence and Bagus remind us of the human factor, emphasizing the roles of leadership and trust, respectively.

It becomes evident that while our panelists hail from diverse backgrounds, their experiences intersect and diverge in fascinating ways. Their collective insights not only shed light on the mining industry's present but also pave the way for its promising future.

In the intricate world of the mining industry, voices from the ground highlight the

universal importance of leadership, the intertwining relationship between formal education and hands-on experience, the multifaceted nature of commitment, and the labyrinth of career progression.

Gary Rivenes and Joe Bennett, each coming from distinct academic backgrounds, bring to light an intriguing balance between theoretical and practical realms. For Gary, academia acts as a catalyst, unlocking mental doors, while Joe’s trajectory showcases the undeniable power of experience.

This duality raises an essential question: In a rapidly evolving industry, what holds more weight - the grounded realities of experience or the expansive knowledge from formal education?

The theme of commitment, woven through their narratives, reveals itself to be more than just work dedication. Instead, it emerges as a bridge between staff, management, values, and personal growth.

Navigating Career Goals and Promotions

Gary views job goals as consistent throughout his career, with promotions contingent on performance. Joe has always centered on customer and supplier satisfaction to drive profit. Terence and Bagus, coming from CEO and engineering backgrounds respectively, have had diverse views on job goals but agree on the importance of designing one’s career path.

Company Culture and Managerial Promotions

Our panelists concur on the need for new employees to gel with company culture. However, they differ slightly on managerial promotions. Gary and Terence advocate for a balance of technical and managerial skills, while Joe stresses the importance of connecting with people. Bagus places trust above all, implying it's more about interpersonal relationships than technical prowess.

Work-Life Balance

All our experts underline its importance, especially in today’s fast-paced environment. Terence believes in designing the life you want, while Gary stresses getting this balance right.

This commitment takes on different hues, from streamlining operations to fostering trust and human relationships, reflecting the industry's intricate fabric.

The path to career progression and managerial promotions, as painted by our experts, isn’t linear. While meritocracy plays a role, adaptability, intuition, and a keen understanding of human dynamics often tip the scales. Promotions, in this light, transform from mere upward movement to a complex dance of technical skills, interpersonal aptitude, reliability, and credibility.

As the industry hurtles forward, a renewed focus on its image surfaces. The need to highlight its modernity, the push for recognizing vocational qualifications, and the perennial emphasis on leadership and trust together chart a promising course. Thus, the insights from our panelists not only mirror the present-day intricacies of the mining sector but also beckon a future brimming with potential.

Joe, while valuing it, admits that personal sacrifices might be required early in one’s career. Bagus views it as integral to achieving life goals.

Advice for Young Professionals and Improving Industry Image

Gary urges young professionals to enjoy their roles and avoid hastening to the next big thing. Joe emphasizes commitment, learning, and deriving joy from it. Terence, with a playful jab, suggests avoiding being a mere "idea sidekick", while Bagus emphasizes the importance of trust.

On industry image, Gary suggests advertising technical capabilities and ensuring work flexibility, given the demanding 24-hour operations. Joe recommends easier access to vocational qualifications. Terence emphasizes leadership improvement, and Bagus believes the industry’s trust quotient needs bolstering. The plethora of perspectives provided by our panelists serves as a testament to the dynamic nature of the mining industry, offering valuable guidance for both industry novices and veterans.

25

Mining Industry Perspectives: Diving Deeper

Upon delving into the diverse thoughts of our panelists, a series of nuances emerge. Here, we further break down these insights to paint a detailed picture of the challenges, triumphs, and transformations within the mining industry.

Leadership: A Universal Pillar

The recurring emphasis on leadership's importance highlights its role as a universal bedrock across sectors. Gary, with his vast experience in operations, paints a picture of the repercussions of absent leadership - a team slowed down and veering off course.

Navigating the Labyrinth of Career Progression

COMMITMENT, AS SEEN

The career progression narratives offered by our experts reveal a landscape filled with varied challenges. Gary’s journey suggests a meritocratic environment, with promotions hinging on demonstrable results. Joe, however, portrays a more autonomous path where one's drive charts the course. Terence and Bagus add layers of complexity, suggesting that while set paths exist, adaptability and intuition often determine success.

Joe echoes this sentiment with a more grassroots perspective. His hands-on experience reveals the direct correlation between leadership and career progression. Meanwhile, Terence's stance as a CEO showcases leadership as a top-down necessity for a company's overall vision. Bagus, with his boots-on-the-ground experience, implies that even the most technically-driven sectors require that leadership touch.

The Academia vs. Experience Debate

A juxtaposition emerges when looking at Gary and Joe's takes on formal education. For Gary, the academic world expanded his horizons, suggesting that theoretical knowledge acts as a catalyst for practical application. Joe, however, is testament to the old adage: experience is the best teacher. His trajectory reminds us that practical knowledge and innate skills can often outweigh degrees. This balance between academic grounding and real-world learning becomes pivotal in an industry as dynamic as mining.

Commitment: Beyond Just Work

Commitment, as seen through our panelists’ eyes, is not just about work dedication but also about interpersonal relationships. Gary and Joe place commitment at the forefront of management, but their reasons diverge.

While Gary sees it as a tool to streamline operations, Joe views it as a bridge between staff and management. Terence and Bagus, however, present a more holistic view. For them, commitment extends beyond tasks to include company values, goals, and even personal growth.

The Multifaceted Nature of Managerial Promotions

Managerial promotions, as per our panelists, are a cocktail of skills, ranging from technical know-how to interpersonal aptitude. Gary and Terence lean towards a balanced approach, suggesting that neither can be neglected.

Joe's emphasis on interpersonal connections aligns with his hands-on approach, underscoring the importance of human relationships even in a tech-driven industry. Bagus, on the other hand, pivots the conversation to trust, suggesting that promotions should be based on reliability and credibility.

through our panelists’ eyes, is not just about work dedication but also about interpersonal relationships. Gary and Joe place commitment at the forefront of management, but their reasons diverge

26 Skillings.net | October 2023

Water Scarcity

A Looming Challenge for the Mining Industry

In recent years, the global mining industry has been confronted with a number of environmental obstacles. The negative effects of mining on ecosystems, air pollution, and climate change have been identified as significant causes for concern.

However, the imminent water shortage crisis is a pressing matter that requires immediate attention. With numerous mines operating in water-stressed regions across the globe, the mining industry must confront this challenge head-on to ensure responsible and sustainable operations.

Water is undeniably a valuable resource. Not only is it essential for human survival, but also for the health of ecosystems and the operation of numerous industries. The mining industry, which is notorious for its high water consumption, must recognize the need to reduce its dependence on freshwater sources and implement innovative water management practices.

Mining operations, including mineral processing and equipment cooling, extract significant amounts of water from local sources, exacerbate water scarcity in stressed regions and potentially lead to water contamination.

To address these obstacles, the mining industry must adopt sustainable water management practices. Implementing water recycling and reuse systems represents a potential solution. By treating and repurposing wastewater, mines can substantially reduce their consumption of freshwater. Innovative technologies, such as desalination and membrane filtration, can also play an important role in reducing the industry’s dependence on freshwater sources.

Responsible mine planning and design can minimize water resource impacts by conducting thorough assessments of local water availability and potential hazards. Collaborating with local communities and stakeholders is crucial for water scarcity mitigation. Regulatory frameworks and technological innovations can help ensure sustainable water use in mining. Remote sensing technologies and data analytics can optimize water consumption, facilitating proactive decision-making and early identification of potential hazards. The mining industry must prioritize water scarcity to ensure long-term viability and environmental stewardship. By implementing recycling systems, responsible planning, stakeholder collaboration, and technological advancements, the industry can work towards a more sustainable future.

Sustainable Solutions: How the Mining Industry Can Reduce Water Usage

Water scarcity is a global concern, and the mining industry is a key player in addressing this issue. To reduce water usage while extracting resources, companies can adopt innovative technologies and responsible strategies.

Water recycling and reuse systems can reduce dependence on freshwater sources, while optimizing water utilization through processes like dry stacking and paste backfill can minimize water consumption. Responsible mine planning can improve water resource management and reduce the risk of depleting water sources in water-stressed regions. Technological advances, such as real-time monitoring systems and data analytics, can also improve water management.

Collaborating with local communities and stakeholders is crucial for understanding local water needs and concerns. Regulatory frameworks and guidelines are essential for promoting sustainable water use. By prioritizing sustainable water management practices, the mining industry can contribute to a more water-secure future for all.

27

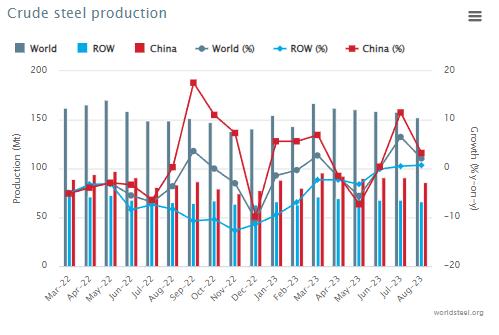

The Great Wall of Subsidies

How China's Financial Support Alters Global Trade Dynamics

Rare Earth Elements (REEs) are crucial for the world economy, but their supply chain is intertwined with geopolitics. Experts and policymakers are debating ways to reduce dependency on China, including geographical diversity, innovation, recycling, international collaborative ventures, and policy changes. In the October Issue of Skillings Mining Review Senior Correspondent Mike Harris looks at the Chinese dominance of rare earths and its effect on Western dependence.

A Brief History of the Rise of the REE

Titan: China entered the REE industry in 1980.

1990: Complete mastery of REE separation.

2005: Aggressive efforts to gain control of non-Chinese REE mining.

2010: A monopoly is established, and REE shipments to Japan are terminated.

2015: Western competitors, such as Molycorp and Lynas, have financial constraints.

2022: Despite outsourcing 40% of REE mining, China maintains a solid hold on the lucrative REE metals and magnets manufacture.

28 Skillings.net | October 2023

Rare earths have emerged as the twenty-first century's equivalent of oil, a strategic commodity with significant impact over the global landscape. As Guillaume Pitron points out, our reliance on China for these materials mirrors the 1970s' hazardous reliance on OPEC. This inquiry dives into the depths of China's strategic monopoly on rare earths, as well as the implications for Western economies and government.

Rare Earth Elements (REEs) are important elements at the heart of the world economy. These minerals are essential to the fundamental foundation of our highly advanced civilization, from cellphones to green technology. However, its supply chain is a fragile web, intricately intertwined with geopolitics, owing mostly to China's dominance over the majority of REE mining and processing.

Experts and policymakers are debating the best way to lessen the world's dependency on China for these critical materials as they enter this complex sector. Some argue for geographical diversity of supply chains, analogous to an adventurer spreading their risk by sourcing treasures from many locations rather than betting everything on one trove. Countries with untapped REE reserves, such as the United States, Canada, and Australia, could become alternate centres in this scenario. However, like with any new company, this technique may be vulnerable to the vagaries of global market changes or the environmental consequences of mining.

Then there's the way of the innovators who are avidly searching for new materials with an eye to the future. Instead of avoiding China, this method seeks to potentially alter demand. If successful, this might be more than a sidestep, but a major leap in reducing the global demand for REEs.

However, not all solutions are concerned with the outside world. Turning inward, some professionals advocate for the cause of recycling. Discarded electronics, like a phoenix rising from the ashes, might be given new life by providing REEs

with a second cycle. However, one cannot help but wonder if present recycling efforts are sufficient to satiate the world's ever-increasing desire for these elements.

International collaborative ventures are also on the table in a world where teamwork often yields the sweetest fruits. Nations may unite their talents, resources, and brains here, creating a picture of global solidarity in the face of the REE issue. However, as with any delicate diplomatic dance, the timing and rhythm of such agreements might be surprising.

There is a press from the corridors of power for policy and regulatory changes that will allow nations to strengthen their internal capacity by either easing REE mining or investing resources in alternatives.

No thread stands alone in the great fabric of REE solutions. A combination of methods, intertwined with foresight and adaptability, could be the key to shaping a future in which the global economy is no longer at the mercy of a single dominant player in the REE sector.

Environmental Implications and Considerations:

Environmental problems have hampered China's rise in the REE extraction arena. The Bayan Obo mines have wreaked havoc, producing massive water pollution and raising concerns about radioactive waste. However, the West's devotion to strong environmental rules, while ensuring safer extraction methods, inadvertently raises costs, making competing with China difficult.

At this critical point in history, there is a tug of war between harnessing REEs for eco-friendly technologies and comprehending the environmental consequences of their extraction. This scenario highlights the critical need for novel mining technology and recycling solutions to reduce environmental damage.

29

The Alternatives Race:

Recycling REEs from old devices appears to be a viable alternative. However, the economic feasibility of scaling this technology remains debatable. Countries such as Japan, which has led the way in this field, may be able to provide significant insights to others.

Concurrently, research organizations are working hard to discover synthetic REE replacements. While some leads appear promising, the scalability of these alternatives is still an issue. Bio-mining is an intriguing area being investigated, with scientists exploring using microorganisms to extract REEs, providing an eco-friendly alternative.

The Long Journey Ahead:

Navigating the complex maze of the REE challenge necessitates imaginative leaders capable of balancing economic, geopolitical, and environmental considerations. As the world addresses this common threat, international collaboration in research and policymaking becomes critical. The current status quo, with all of its complications, begs for change. While difficult, this shift is not insurmountable. A diverse and environmentally conscious REE landscape can be sculpted with deliberate efforts.

struggle in which every move has ramifications for global trade, the environment, and geopolitics.

Further investigation reveals that the drive for REE independence is about more than just minerals or technology. It is also about power dynamics, influence, and the basis of long-term planning. REEs have become the sought item, the modern-day spice that nations are clamoring for, much as salt and spices defined trade routes and alliances in ancient civilizations.

However, unlike in the past, the twenty-first century provides a greater understanding of sustainability and environmental responsibility. As countries consider expanding mining operations, they must also consider the environmental impact. Balancing economic prosperity with environmental prudence becomes a delicate dance. For example, Australia's unspoiled terrains, which are rich in REEs, are also home to unique ecosystems. The question then becomes, can we afford to damage these natural havens in our pursuit of technological dominance?

THE TWENTY-FIRST CENTURY provides a greater understanding of sustainability and environmental responsibility. As countries consider expanding mining operations, they must also consider the environmental impact. Balancing economic prosperity with environmental prudence becomes a delicate dance.

The story of rare earth elements is a significant reflection on world politics and economic structures. It highlights the need for forethought, collaboration, and inventiveness. Solutions to these difficulties require more than just economics or technology; they necessitate a strategic, long-term vision. The story of REEs is still being told, with future paths awaiting judgment and action.

The multiple consequences of rare earth elements highlight the complicated dance of geopolitics and global economics. It's a narrative about hardships, but also about the limitless opportunities that await those who are bold enough to take them. As the story progresses, the pen is in our hands, and the result, while unpredictable, is loaded with possibilities. The economic chessboard, on which pawns and knights symbolize REEs and nations, is a study in strategy and foresight. However, this is not a two-player game. It's a multifaceted

Similarly, while recycling is frequently lauded as a cure, it is not without its challenges. The infrastructure and technology necessary to extract REEs from discarded electronics are both complex and costly. Furthermore, the question of whether there will ever be enough discarded electronics to meet world demand remains unanswered.

On the other hand, technological innovation, which has always been a wild card, remains unpredictable. Breakthroughs cannot be planned or predicted. Waiting for a revolutionary material to replace REEs may be likened to waiting for Godot - full of anticipation but with an uncertain payoff. Furthermore, the threat of geopolitics looms enormous. The geopolitics of trust and national interests emerge as governments negotiate international joint ventures. While such partnerships appear to be promising on paper, they may become embroiled in the greater web of diplomatic complexities.

The story of REEs is more than just a supply chain concern; it is a contemporary drama. It addresses issues such as the environment, the economy, diplomacy, innovation, and global power dynamics.

30 Skillings.net | October 2023

China's Dominance in Rare Earths: A Threat to Western Dependence

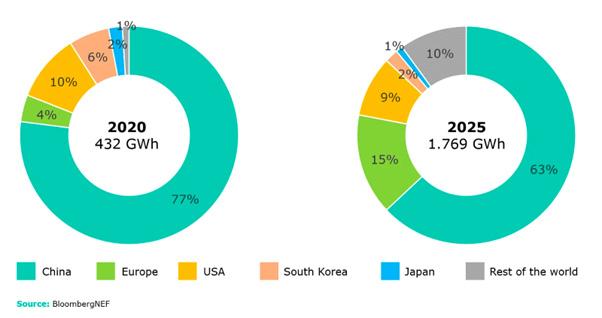

China's dominance in the rare earth elements (REE) arena is well known. A deeper investigation, however, reveals an ingeniously integrated strategy that is about global leverage as much as it is about business. China has established itself as the hub of REE production and innovation through a combination of subsidies, technological control, and extensive research ecosystems.

The Dominance Tools:

Several approaches demonstrate China's market dominance in rare earth elements (REE). The country purposefully uses a 13% VAT to stimulate the export of finished magnets while discouraging the export of raw REE. This strategy puts producers outside of China in a difficult position. China uses soft subsidies in addition to harsh subsidies. Their competitive labour force, excellence in education, commitment to environmentally friendly methods, and research funding make it difficult for others to compete.

Furthermore, the commercialization of REE technologies from the United States in China raises concerns about potential intellectual property infringements and technology transfers. China's unique structure, in which the state and enterprises interact smoothly, adds to their edge, as does their refining capacity and cost-effective capital approach.

China's Control of the REE Value Chain:

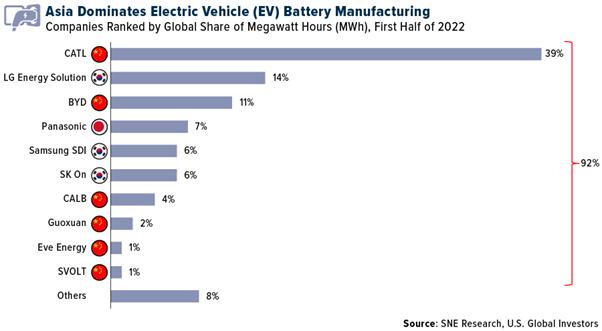

China has expertly rewritten the laws of the REE sector, giving it unprecedented sway over global pricing. Such control has spread to critical industries, such as EV batteries, underscoring China's significance in the arena.

Ecosystem of R&D and Innovation:

China has a thriving REE research ecosystem, complete with national laboratories and a patent filing rate that dwarfs Western endeavors. This points to a future in which China will continue to lead in REE innovation.

Legislative Dilemmas:

The West's efforts to confront China can feel reactive and, at times, unproductive. For example, while legislation such as HR 2849 may have excellent intentions, it may end up benefiting China.

Unpacking the Issue:

China's monopoly ensures its dominance over premium NdFeB (neodymium) magnets. Policymakers' jobs are made more difficult by misinformation and misleading data. Furthermore, the West may be unintentionally boosting China's supremacy through technological transfers as a result of thorium-centric rules.

An In-Depth Look at Human Capital:

China's human resources in the REE field vastly outnumber those of the West. It is estimated that about 12,000 full-time researchers operate in this subject in China. This emphasis on R&D, which began in the mid-1980s, demonstrates China's forward-thinking policy. Their mining capabilities, illustrated by the Bayan Obo mine, provide them with unrivaled advantages.

The REE Geopolitical Strategy of China:

China's Belt and Road Initiative (BRI) is more than just infrastructure development; it places China at the forefront of the global REE supply chain. They secure vital REE deposits by investing in nations like Myanmar.

The Asia Infrastructure Investment Bank (AIIB) strengthens their plan even further. China's control over the REE supply chain gives them enormous political influence, as evidenced by the 2010 limitation on REE exports to Japan during a territorial dispute. As the world moves toward a greener future, the demand for rare earth elements (REEs) will increase. China, having identified this transformation early on, is well positioned to play a key role.

US and Allied Reactions:

Despite acknowledging the strategic importance of REEs, the U.S. Initiatives by the Department of Defense, such as the Defense Production Act, have not made a dent in China's hegemony. Collaborations with Australian-based Lynas, for example, have only produced temporary answers. When compared to China, the United States lags in REE R&D, while they are investigating potential breakthroughs. Efforts are being made to develop new mines in the United States, however environmental rules, particularly those pertaining to thorium, pose difficulties.

31

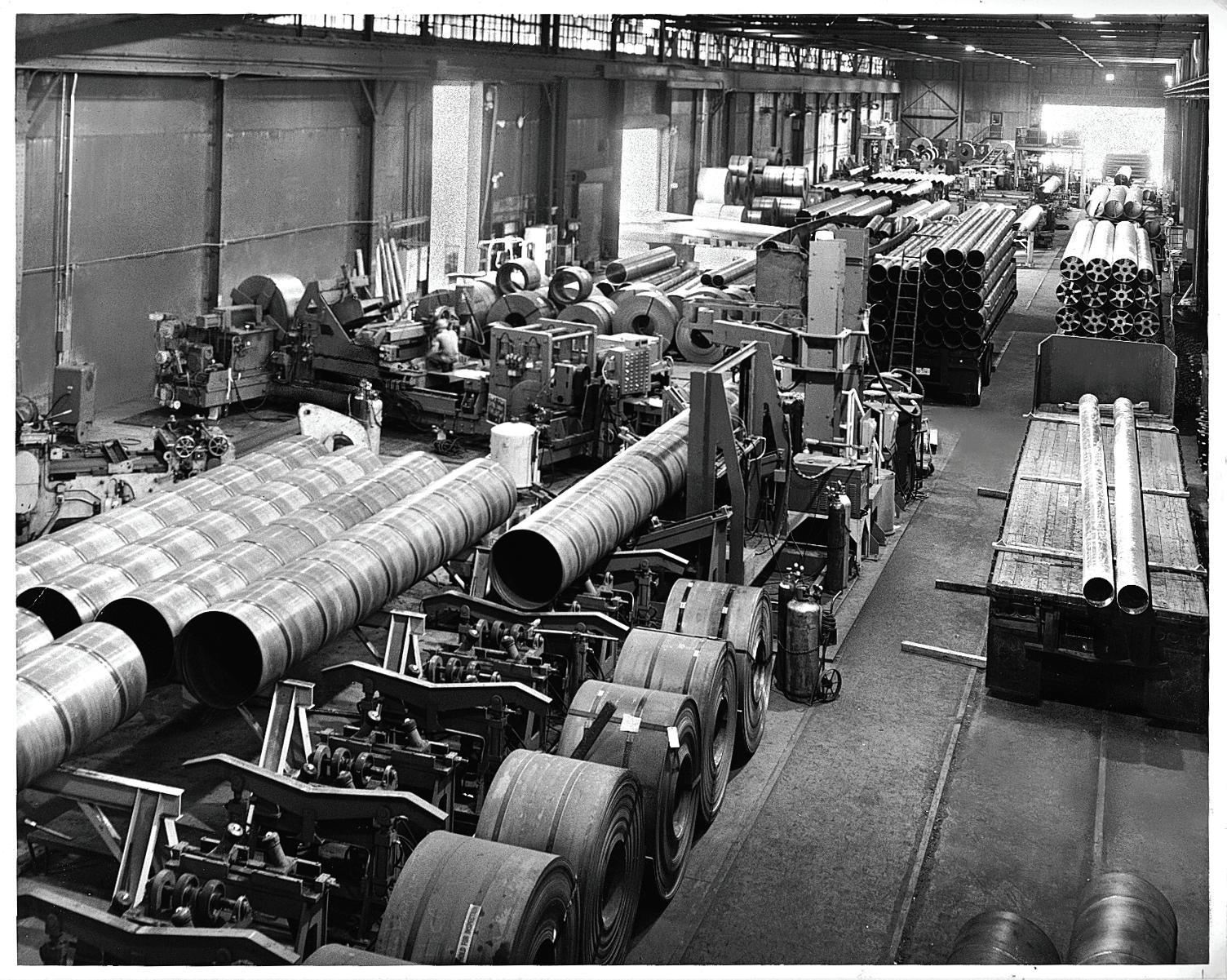

Evolution of the Mining and Metals Industry

Sustainability, Technology, and Community Engagement in the Modern Era

In the turbulent oceans of the global economy, the mining and metals industry sails as one of the most formidable yet volatile fleets. With a history interwoven with the industrial revolution, urbanization, and the rise of modern infrastructure, this sector plays a pivotal role in the world's development. Yet, as we forge ahead into a new decade, it's also riddled with an ever-evolving set of risks and opportunities.

32 Skillings.net | October 2023

Environmental conservation, once a sideline conversation in boardrooms, has escalated to global mandates. Mines, with their historical baggage of significant environmental footprints, from land degradation to water contamination, find themselves at a crossroads. Companies that relegate sustainability to the background not only face potential regulatory repercussions but may also find themselves sidelined by stakeholders and investors who prioritize eco-conscious operations.

Meanwhile, the global political landscape adds layers of complexity. Trade wars, regional conflicts, and a resurgence of protectionist policies challenge the very fabric of global supply chains, making long-term planning an intricate dance for mining and metals companies.

Parallel to these are the waves of technological disruption that the industry must navigate. As digital transformation sweeps across sectors, the mining world grapples with the dual challenge of integrating these new technologies, with all the accompanying cybersecurity threats, while also facing the stark reality of traditional jobs becoming obsolete in the face of automation.

Yet, for all its challenges, the current era presents mining and metals firms with rich seams of opportunity, waiting to be unearthed. Sustainability, rather than being a challenge, can be a unique selling proposition. Companies can embrace 'Green Mining' initiatives, like minimizing emissions and ensuring post-mining land rehabilitation, not just as regulatory obligations, but as brand differentiators that can woo a new generation of eco-conscious investors.

The digital revolution, too, brings promise. Automation, artificial intelligence, and the Internet of Things (IoT) are not just buzzwords but tools for achieving operational efficiency. Mines transformed by real-time data analytics can not only streamline operations but can also drastically reduce costs and enhance safety measures.

Market diversification is another avenue rife with potential. With the rise of electric vehicles and renewable energy technologies, minerals like lithium, cobalt, and nickel find themselves in high demand. This shifting demand offers mining companies the chance to pivot, catering to these emergent, high-growth sectors.

Moreover, the role of mining companies is evolving in the communities they operate within. Gone are the days of a

purely transactional relationship. Modern mining firms have the opportunity to embed themselves more holistically, ensuring not just operational smoothness but also building long-lasting, positive brand associations.

Innovation continues to push the industry's boundaries. New technologies are allowing companies to tap into previously inaccessible or non-viable resources. Deep-sea mining, and even the tantalizing prospect of extracting minerals from asteroids, present frontier opportunities.

To thrive amidst these swirling currents, adaptability is the industry's compass. Mining and metals companies must stay attuned to global shifts, ensuring strategies are fluid and responsive. By adopting a holistic approach where decisions balance profit with environmental, social, and governance factors, and by investing in research, employee upskilling, and community relations, the industry can not only navigate its present challenges but also lay the foundation for sustainable growth in the decades to come. In its long history, the mining and metals sector has been emblematic of human progress and innovation. By capitalizing on today's opportunities and rising to its challenges, it can continue to play this pivotal role in our shared future.

As the global stage evolves, the narrative for the mining and metals industry also experiences shifts, painting a tableau of both challenges and potential. The onset of a more globally connected world, marked by rapid technological advancements and a heightened awareness of environmental imperatives, has brought forth unique considerations for industry professionals.

Consider the financial landscape. With the digital economy accelerating, there's an increased emphasis on financial transparency and robust auditing. Traditional financial models within the mining industry now face scrutiny. The need to integrate newer digital transaction methods, including the rise of cryptocurrencies and blockchain for traceability, offers both a challenge and an opportunity. While the digital shift provides potential for greater efficiency and security, it also demands upskilling, investment, and a renewed approach to financial management.

Then, there's the societal lens to consider. The contemporary ethos leans heavily towards corporate social responsibility (CSR). Communities worldwide demand more than just economic partnerships; they seek ethical and communal engagements. For mining companies, this means a move beyond mere job creation. There's a pressing need to integrate more deeply

33

with local cultures, support community initiatives, and ensure that the benefits of mining extend beyond the extraction site and into the heart of the communities. Those that succeed in these engagements will find themselves viewed not just as industrial entities, but as community partners and pillars.

On the talent front, the dynamics are changing rapidly. The modern workforce, especially the younger generation, prioritizes workplaces that offer more than just financial compensation. They seek purpose, growth, and a sense of belonging. For the mining industry, historically seen as rugged and challenging, this necessitates a shift in corporate culture. Progressive HR policies, emphasis on work-life balance, continuous learning opportunities, and a commitment to safety and wellness are no longer optional—they're imperative. Embracing these tenets not only attracts top talent but also fosters loyalty and boosts productivity.

Nevertheless, one of the most significant paradigms shaping the industry's future is innovation in exploration and extraction techniques. As easily accessible resources diminish, the push is towards more challenging terrains and deeper earth layers. Here, technology becomes the beacon. Advanced geospatial analytics, drone-based surveys, and AI-driven predictive models are transforming how companies identify and access resources. These tools not only enhance efficiency but also reduce environmental disruption, ensuring that the earth's bounty is accessed sustainably.

Yet, amidst these prospects, one must not lose sight of the evolving regulatory environment. Governments, armed with a deeper understanding of environmental science and driv-

en by international sustainability agreements, are framing stricter regulations. While these are designed to protect the planet and its inhabitants, they also demand a shift in how businesses operate. Forward-thinking companies are those that not only adhere to these norms but actively participate in shaping them, collaborating with regulators, environmentalists, and local communities.