PAYING FOR COLLEGE

Office of Student Financial Aid and Office of the Bursar

M – Money Sources

FAFSA (Free Application for Federal Student Aid)

Grants/Scholarships/Loans/Student Employment

Military/Tuition Waivers/College Savings Plans/Personal Savings

.

O – Offer from the University

N – Need

Cost - Aid = Need

.

E – Employment .

Y – Your Next Steps

Finalize loans (student and parent)

Check out the bill

True or False

“Why should I complete the FAFSA, I won't get anything anyway!”

*Free Application for Federal Student Aid

Financial Aid

Free Application for Federal Student

studentaid.gov

MyStudentAid app

Guarantees student loan eligibility

Determines need-based aid eligibility, which could be free money

A. In the mail

B. My parent/guardian has it

C.On my CougarNet account

D.All of the above

Summary of aid offered

Based on cost of attendance, the FAFSA results and available aid

Financial Aid > Award > Award for Aid

2023-2024 > Accept Award Offer

Accept award yearly

Confirm your financial aid

Financial Aid

Verification

Federal government randomly selects a percentage of students to ensure the information on the FAFSA is correct

SIUE will notify you if you have been selected CougarNet

May need to submit documentation to verify (tax documents, W2s, institutional forms, etc.)

Verification must be completed before an aid offer will be issued

Aid Offer

Listing of all the different types of aid for which the student is eligible.

Grants

Scholarships

Work Study

Subsidized Loans

Unsubsidized Loans

Based on Cost of Attendance

A. Yes

B. No

C. Ask my parent/guardian

D. I’m so confused!

Budget Worksheet

1. Do you have any of these?

Grants (state, federal, institution)

Scholarships (institution and/or private)

• Send to Financial Aid – will be applied once the money is received

2. What is your leftover cost once you subtract grants and scholarships?

3. Will you use your offered student loans? Do you still need more funding?

Student employment is available for all students

Some students will qualify for the Federal Work Study program, which has benefits when you file a FAFSA

Jobs available now! Students earn a paycheck

GradLeaders – apply for a job

www.siue.edu/student-employment/grad leaders/Student-Login.shtml

Accept the aid you wish to use on your CougarNet account (See CougarNet handout)

If using student loans (subsidized and/or unsubsidized):

Be enrolled in at least 6 credit hours per term

Complete Entrance Counseling

Sign Master Promissory Note

If additional aid is needed:

StudentAid.gov

Parent PLUS Loans – apply at StudentAid.gov

Alternative Loans – private loans through borrower’s choice of lender are available to both students and parents/guardians

Financial Aid

Maintain cumulative GPA of 2.00 and complete at least 67% of coursework

Know your institutional scholarship renewal criteria

Monitor your CougarNet Account

Adding or dropping a class can impact your financial aid

Complete FAFSA each year –the 24-25 FAFSA will be available December 2023

A. Someone paid my bill

B. My financial aid is complete

C. I am officially enrolled, my classes are safe, and I can access a variety of facilities on campus for the term

D. All the above

Does not mean:

Balance is paid in full

Financial aid status

Check clearance on CougarNet or SIUE app (keep notifications on)

Not Cleared - need to make payment to save your enrollment

Cleared - classes are locked in

Access to campus facilities

Meal plan activated

A. Today!

B. July 12, 2023

August 11, 2023

D. September 9, 2023

eBill – Bill notice emailed – July 12, 2023

View – CougarNet, SIUE app and Pay My Bill

At a Glance section summarizes:

Charges

Pending aid

Amount to pay in full

Installment amount: Four due dates/$30 a semester

Anticipated refund

First Installment Due: 4:30 p.m., August 11, 2023

Cleared – Saves your registration

A. Claim your education credit on your taxes

B. Issuing refund checks

C. Creating an SIUE bill

D. All of the above

Receive education credit - 1098T

Provide once - CougarNet

Update your phone and address

Pay My Bill and CougarNet to access tax documents

HOW OFTEN DO YOU NEED TO READ AND ACCEPT THE

A. Only once

B. Two times a year

C. Once a semester (Spring, Summer, Fall)

D. Every month

Accept every fall and spring semester

You, the student, are agreeing to pay the charges posted to your account

Check your bill often – eliminate surprises

A. This is not an option

B. Parents/Guardians

C. Anyone

D. The student

FERPA

Students own record

CougarNet

Authorization to Release Information

Phone and email – password

Other offices

Pay My Bill – online third-party access

Make payments (e-check or credit/debit card)

Bill (email notices)

1098 T

A. Drop a class

B. Excess Financial Aid

C. Late scholarship received

D. All of the above

Sign up on CougarNet

Anticipated refund released Friday before semester starts

Fall 23: Friday, August 18, 2023

Twice a week after that

Check issued once a month

Add/drop classes

September 1, 2023 – last day for changes

The following are available on Cougarnet:

B – Billing (Download the SIUE App) U – Update Personal Information .

R – Read and Accept Student Financial Agreement .

S – Social Security Number for 1098-T .

A – Authorization for Third-Party Contact

By phone or email

Online account for bill pay (on Pay My Bill) R – Refunds - set up direct deposit

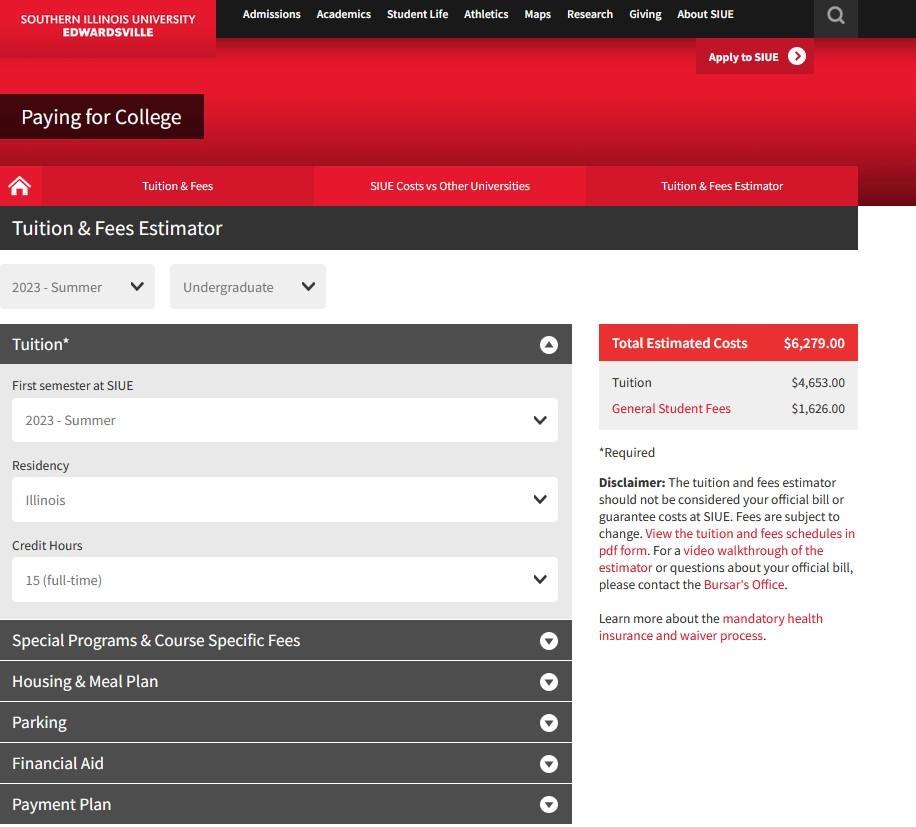

Video Instructions

1. Accept Financial Agreement

2. Register for Classes

3. Use Estimator to Calculate Charges

4. Include Award Letter Amounts from Cougarnet

5. View Installment Plan

Are you prepared to finance the term, or do you need to adjust charges or financial aid accepted to cover the cost for the semester?

Friday, Aug. 11 Confirm first installment is paid by 4:30 p.m. CST

Installment Plan

Paying first installment secures course registration

Monday, Aug. 21 First day of classes, Fall 2023 term

Friday, Sep. 1 Last day to drop 16-week fall classes for a full refund

Friday, Sep. 29 Second installment payment deadline

Friday, Oct. 20 Third installment payment deadline

Friday, Nov. 10 Fourth installment payment deadline

Dec. 11-15 Final exam week

Saturday, Dec. 16 Textbook return due by 5 p.m. CST

Friday, Dec. 8 Spring 2024 - First installment due, pay by 4:30 p.m. CST

get behind, meet the deadline!