Centenary Celebrations

Toge er, we’re greater!

Toge er, we’re greater!

I am delighted to take over as CEO and would like to extend my sincere thanks to Steve Fletcher for his leadership and dedication. His contributions have been instrumental in shaping the Vernon’s success, and I look forward to building on the strong foundation he has established.

I am pleased to report that 2024, our centenary year, has been another excellent year for the Society. It has been a year of growth, celebration, and reflection as we marked 100 years of the Vernon, all while staying true to our purpose: “Caring about what really matters, we help our Members build better futures and together, we’re greater.”

Celebrating our centenary has allowed us to reflect on our legacy while looking ahead with ambition and purpose to ensure we remain a thriving, modern mutual for generations to come.

Strong financial performance

We are proud of the Society’s financial performance this year, which demonstrates resilience, sustainability, and growth, and is aligned to our ongoing commitment to our Members.

For the first time in our history, total assets have exceeded £500 million, growing by 10% to £506m (2023: £461m). Our profit before tax also increased to £3.5m (2023: £2.2m), helped by a £0.5m net gain on hedge accounting, compared to a £1.0m loss the year before.

Our net interest margin has reduced slightly to 2.18% (2023: 2.28%), as we’ve carefully balanced the needs of both savers and borrowers, particularly in the face of a changing economic environment and two Bank of England base rate reductions.

Speaking of interest rates, since 2021, the Bank of England base rate has risen by

4.65% and, by the end of the year, stands at 4.75%. In response, we’ve increased our variable deposit rates by 2.70% and our Standard Variable Rate by 2.75%, ensuring our Members continue to benefit from competitive returns.

Operating costs have risen to £7.6m (2023: £6.5m), reflecting the impact of inflation; however, due to our growth, we remain in a strong financial position. Our liquidity has increased to 17.4% (2023: 15.0%), and our capital CET1 ratio remains strong at 18% (2023: 17.9%).

All in all, these results highlight our financial strength and ongoing focus on growth and sustainability. We’re well prepared for whatever comes next and, most importantly, remain committed to delivering real value to our Members.

The housing market in 2024 showed resilience, with modest house price growth and falling interest rates contributing to a strong year for our mortgage lending.

Our gross mortgage lending increased to £89.6m (2023: £76.4m), while total loans and advances to customers grew by 7.5% to £416m (2023: £387.1m).

We’re especially proud of the work we’ve done to help underserved markets, giving more people the chance to achieve homeownership, even those who once thought it was out of reach.

At the same time, we understand that affordability pressures have increased for some Members, and we remain committed to providing practical support where it’s needed most. While the percentage of mortgages in arrears (2.5% or more of the loan balance) has risen slightly to 0.51% (2023: 0.41%), our mortgage book remains high quality, with arrears levels still well below the industry average.

We remain focused on helping our Members navigate the evolving economic challenges, ensuring we continue to provide the right solutions and support for their individual needs.

It’s been a strong year for savings, with retail savings balances growing by 9%, an increase of £39.6m to £447m (2023: £407.4m). This planned growth has played a vital role in supporting the expansion of our mortgage book.

During the year we increased our membership, a reflection of our commitment to mutuality and our focus on creating products and services that genuinely meet the needs of our Members. We’ve continued to offer competitive interest rates, encouraging more people across Greater Manchester and Cheshire to save. Our Online Regular Saver account has been instrumental in helping individuals develop strong, consistent saving habits. Additionally, we’ve been proud to support local businesses and charities, safeguarding their savings while offering competitive returns.

This growth reflects our commitment to meeting the diverse needs of our Members, whether they’re first-time buyers, retired, home movers, landlords, or building their dream home.

At a time when many banks and building societies are phasing out passbooks in favour of online only accounts, we remain committed to offering this trusted method. We know that many of our Members still value the security, simplicity, and personal touch that passbooks provide.

Unlike others who have phased them out, we believe in choice, and for those who prefer a more physical, straightforward way

to manage their savings, passbooks remain an important part of what we offer.

Our Members are at the heart of everything we do, and in 2024, we made it a priority to create spaces and experiences that strengthen our relationship with you.

While many banks continue to shut branches, we’re proud to be going against the grain.

This year, we completed our £1.2m branch refurbishment programme, transforming our network into modern, community-focused spaces where Members can access highquality, face-to-face service.

These upgrades ensure that we can continue to offer a warm, welcoming environment, while maintaining a strong presence on the high street, which remains an essential part of our commitment to you.

Recognising the importance of choice, we’ve also invested in our digital capabilities to ensure our Members can manage their money in a way that suits them, whether that means visiting us in-branch or using our online services. Our online offering now allows Members to: open new savings accounts, view transactions and interest rates easily, and send faster payments to a nominated bank account.

We continuously gather feedback on our service through Smart Money People, an independent organisation recognised across the mutual sector. We’re delighted to share that all our key service measures were

rated as strong throughout 2024, with an overall satisfaction score of 99.2%, comparing favourably with our peers. Our Net Promoter Score (NPS), which reflects how likely members are to recommend us to family, friends, and colleagues, was also very positive at 94

These results reaffirm our commitment to delivering exceptional service and ensuring that every Member receives the support, value, and experience they deserve.

Our centenary year has been a wonderful opportunity to deepen our connections with the local community. On 27th March 2024, exactly 100 years after our founding, we marked the occasion by burying a time capsule at St. Joseph’s Catholic Primary School, which is next to our head office. This gesture will provide future generations with a snapshot of life in Greater Manchester today and symbolises our commitment to building a better future together.

Throughout the year, we hosted events that brought our community together, including a Family Fun Day at Vernon Park, organised in collaboration with Pure Innovations, and we sponsored Together Trust’s Join Together Festival and the Mayor of Stockport’s Charity Ball just to name a few. These events brought people of all ages together and reinforced our role as a community focused organisation.

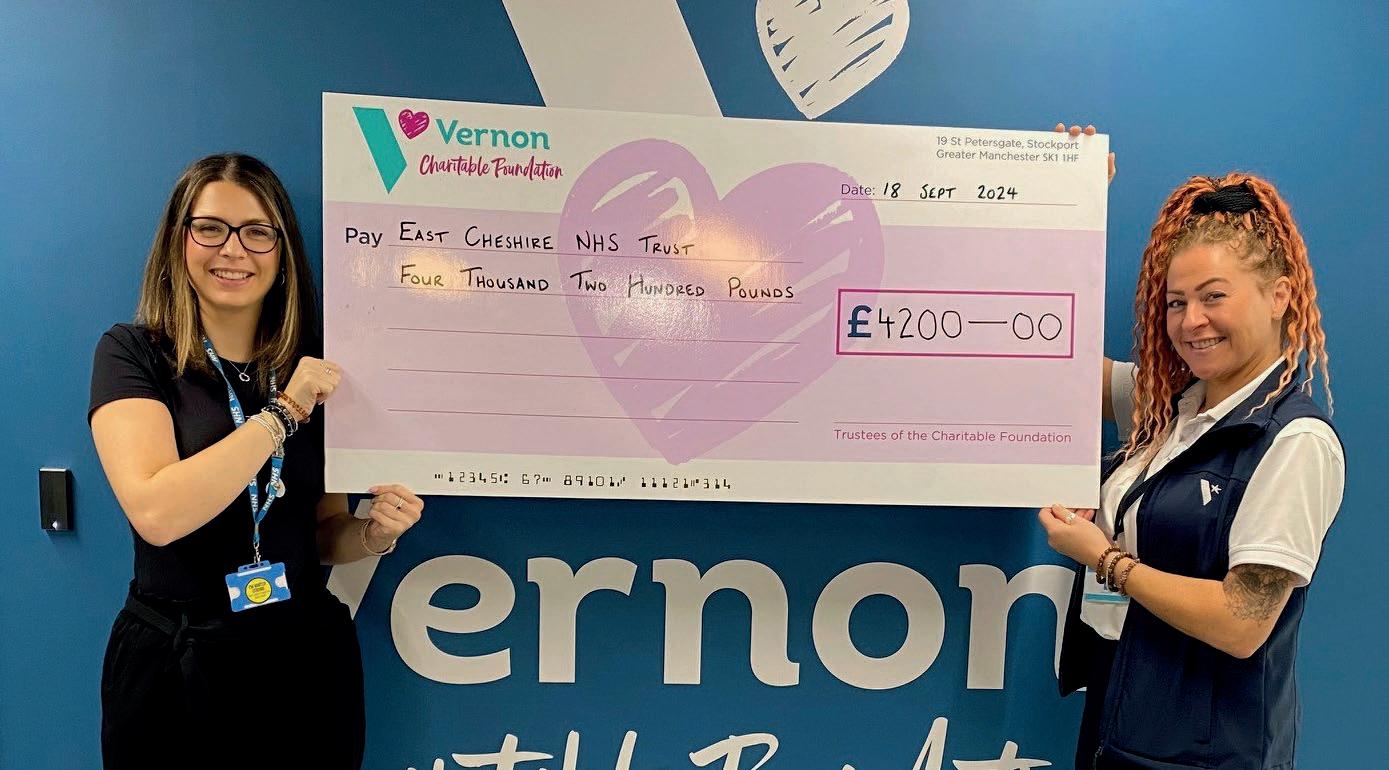

Our charitable initiatives have grown significantly this year, with the launch of the Vernon Charitable Foundation. The Foundation has supported 19 local charities with donations totalling £64,712, helping those focused on poverty relief and community development in Greater Manchester and Cheshire.

Our Community Stars Programme also expanded its reach, donating £12,000 to 40 local charities and community groups, ensuring even more grassroot organisations receive vital support.

We are proud of the volunteering efforts of our colleagues, who dedicated 563 hours to local organisations, an increase of 200 hours compared to last year. We also continued our partnership with Wize Up, a programme that delivers financial education to schools. In 2024, 1,456 students participated, benefiting from over 3,000 hours of teaching funded by the Society.

In March, we opened a brand-new community space in St Petersgate, which has already become a hub for local organisations, training workshops, and networking events.

From supporting charities and schools to bringing people together through events, we’re proud of everything we’ve achieved this year, and we’ll continue working to make a real difference in our community for years to come.

Our colleagues are the driving force behind our success. We aim to be the employer of choice in Stockport by fostering a supportive, inclusive workplace that encourages growth and engagement. With just under 100 employees, our team remains the heart of our Society. This year, we were thrilled to see our employee opinion survey confirm that employee engagement is at the highest level we have achieved to date. This reflects the strong, positive culture we’ve built at the Society.

We believe in fair pay for all, which is why we conduct annual salary benchmarking to ensure every role stays aligned with market rates. As a Real Living Wage employer, we’re proud to support our colleagues’ financial wellbeing.

We are passionate about developing local talent and our apprenticeship programme continues to thrive. In 2024, five apprentices successfully completed their training and secured permanent roles. Currently, three apprentices and three existing colleagues are studying through the apprenticeship framework.

Our people are what make us who we are, and we’ll continue to invest in their growth, wellbeing, and success, because when our team thrives, so does our Society.

As we look ahead, our vision remains clear: to be the preferred choice building society in Greater Manchester and Cheshire by helping Members grow their savings and buy their own home. Building a better future together.

Sustainable growth remains at the heart of our strategy. We are excited to be expanding our services across Greater Manchester and Cheshire, ensuring that more people can benefit from the security and support of a trusted, Member focused building society.

To achieve this, we will continue investing in what matters most to our Members. Our branches will remain a cornerstone of our service, increasing our presence on the high street through innovative collaborations with community partners. At the same time, we are enhancing our technology to improve the Member experience and ensure sustainability for the future.

Our commitment to the communities we serve remains unwavering, and we will continue supporting local initiatives that make a real difference where we live and work.

I would like to express my thanks to all my colleagues across the Society. Their dedication and hard work throughout the year have been instrumental in delivering such a strong performance in our centenary year.

Most importantly, I want to thank our Members for their continued trust and support. Together, we have achieved so much, and we look forward to building on this success in the years to come, because together, we’re greater

Darren Ditchburn Chief Executive

in new mortgage lending

£40m Savings growth in savings balances in 2024

Mortgage book growth during 2024 7.5%

4,170 Saving accounts opened Savings Accounts

Helped 102 first-time buyers

First-time buyers

Savings Financial Education programme to 1,456 students across 8 high schools Financial Education

Granted £64,712 to 19 charities across Greater Manchester and Cheshire

Helped 20 people build their own home

Self Build

£12,000 shared across 40 local not-for-profit groups

563 hours to our communities and local charities

It’s been a year of growth, celebration, and reflection as we marked 100 years of the Vernon, all while staying true to our purpose: “Caring about what really matters, we help our Members build better futures and together, we’re greater”.

As a mutual building society, we’re owned by our Members, not shareholders, so Member feedback is important to ensure we deliver on our purpose.

In 2024, we received 1,845 Member reviews and, thankfully, our Members still love us! Our Net Promoter Score is ahead of our peer group at 94, and up 10% on 2023. A big thank you to our Members for taking the time to let us know how we’re doing and where we can improve, and to our colleagues for working hard to deliver our first-class Member service.

Treated fairly

Customer service Value for money

Source: 2024 Smart Money People Reviews, Mortgage Completion Surveys and our Annual Member Survey.

“

Always able to get through to speak to someone, which is very rare these days. Always friendly, helpful staff that know what they are talking about... If they say they will call you back, they always do...They could certainly teach the big banks and other financial companies a thing or two.

The Vernon is a truly local building society with great staff. They still have a branch in Marple where you can speak face-to-face, a luxury rarely provided these days!

A friendly and professional service that still manages to feel like a local building society and not a faceless bank...They have a good knowledge of local area and community and are keen to support those in it.

In our centenary year, our commitment to supporting the local community has been stronger than ever.

We support great local causes through five key building blocks: the NEW Vernon Charitable Foundation, which provides grants of up to £5,000 for registered charities; Community Stars, which offers smaller donations of up to £650 to grassroots organisations and social enterprises; staff volunteering days; sponsorship of community events; and investment in financial education programs delivered with WizeUp.

In celebration of our centenary, we launched Vernon Charitable Foundation (VCF), with more than £100,000 to support charities in Greater Manchester and Cheshire In 2024, the Foundation granted £64,712 to 19 charities doing great work in our area. The grants went to various organisations, including a boxing club, a community café, a scout group, and a children’s first aid training charity.

Thanks to the VCF grant, patients with dementia at Macclesfield District General Hospital will benefit from a newly created therapeutic garden. Lisa Nixon, Activities Coordinator at MDGH said:

We are thrilled to receive this generous grant, which is allowing us to create a therapeutic environment where patients can engage in activities, enjoy nature, and find moments of peace and relaxation. It will be a wonderful addition that significantly enhances their well-being during their stay with us.

This project is a lasting legacy in the local community, and a great example of how, together, we’re greater.

Our Community Stars programme has been running for 13 years and has a strong tradition of championing local great causes, helping to support grassroots, not-for-profit groups and charities making a positive impact throughout Greater Manchester and Cheshire. This year, we awarded £12,000 amongst 40 remarkable grassroots organisations, receiving donations from £100 - £650, including local sports clubs, food banks and a local theatre group.

Marie-Anne Eckersall from Transport for Sick Children in Reddish said:

As a small charity covering all of Greater Manchester, this will make a big difference, helping our volunteer drivers to support more families who are struggling to attend vital medical appointments for their children.

As you can imagine, financial education is important to us. It’s a life skill that enhances wellbeing, preparing students to understand and manage their income as adults.

In 2024, we launched our partnership with educational charity, Wize Up. Together, we supported eight local high schools to take part in the scheme. That’s 1,456 students to have better financial education because of the Vernon and its Members!

Staff Feedback

Angela Milnes, Assistant Principal at Stockport Academy said:

We prefer to have professionals with expertise deliver on these topics.

How many students have we seen in 2024?

1,456

How many student hours we have delivered in 2024?

3,210

We’ve had a fantastic year of centenary celebrations; here are a few highlights:

Marked our official Centenary date, with celebrations of our branches. It’s hard to believe it’s been 100 years since our founders first gathered on St. Petersgate! To commemorate this special milestone, we buried a time capsule in the peace garden at St. Joseph’s Catholic Primary School, with the help of enthusiastic students. Our time capsule will offer a sneak peek into life in Greater Manchester in 2024 for school children in 2124!

Our family fun day, Vernon in the Park in partnership with Pure Innovations, was an absolute blast! This free event at Vernon Park in Stockport drew in a big crowd, complete with lots of activities, a variety of stalls, and our fabulous Vernon Poynton Brass Band playing some well-known tunes. Let’s not forget Vernon Bear, our friendly mascot, who made an appearance!

We were thrilled to be one of the main sponsors at the Lord Mayor of Stockport’s Annual Charity Ball at the beautiful Stockport Town Hall, which raised £7,000 for the Sea Scouts

We had a fantastic time at the Together Trust Festival, our biggest event of the year! As the main sponsor, we welcomed around 2,000 people to the festival in Cheadle. It was a full day of family fun, brilliant musical performances, wonderful activities and great food, that brought the community together and raised funds.

2024 was an exciting year for our community! We kicked things off with the fun-filled Bramhall Duck Race, celebrated with joy at Stockport Pride, and enjoyed the lively Marple Carnival. As the year wrapped up, we participated in the heartwarming Mission Christmas. A special highlight was when the Poynton Brass Band appeared on Granada ITV! They shared their wonderful impact on the community and reflected on our amazing 40 years of support. What a year it has been!

A huge thank you to all our amazing colleagues and Members! We especially want to shout out to the wonderful charities and partners who made our centenary such a special celebration: Pure Innovations, Together Trust, Poynton Brass Band, Smartworks, and Stockport Pride.

“

We’re committed to the High Street

If you’ve visited us recently, you’ll see that we’ve completed our £1.2 million investment into our high street branch network. Our Bramhall branch was relocated and, like our other branches, refurbished with a fresh and contemporary interior, making better use of space while reflecting the Vernon’s modern look and feel. Additional meeting rooms have been added to ensure a better experience for Members and colleagues.

We’re super proud of our new look and hope that you like it too. We know it’s important to our Members, so we’re committed to staying local and accessible on the high street. We’re even looking at opening further branches soon, so watch this space!

We care about supporting local businesses and therefore, our local economy. We’d like to say a big thank you to Monks Morton Design Interiors, Flexible Office Furniture, Concept Commercial Interiors and Sharp for their incredible job of delivering the project.

Our St Petersgate branch benefited from a new community area, offering community groups a free space to use.

Since it’s opening in March 2024, the community space has been utilised by 14 organisations and groups, totalling 259 hours, ranging from weekly money guidance workshops, networking events, and training sessions.

Refurb Member Feedback

Stockport’s new branch is fantastic

Very nice branch, the modernisation is great

Love the refurb

I am looking forward to seeing the new office in Marple

Our commitment to installing defibrillators outside every branch made great progress. We’ve completed installations outside at St. Petersgate, Hazel Grove, Reddish, Marple, and our newly located branch in Bramhall. There’s already one near our Poynton branch, but we’re adding another at the church hall in Poynton, to ensure everyone has access to these lifesaving devices.

We believe that investing in our people is key to delivering a first-class, personal service for our Members.

In 2024, eight colleagues passed their CeMAP qualification, further growing our mortgage team.

We’re passionate about recruiting and investing in local talent. One of the ways we do this is through our apprenticeship program.

Our apprenticeships range from AAT, IT Data, Marketing, Chartered Accountancy to Customer Services. We can’t wait to see Alex, Leon, Emily & Georgia progress their careers. Here’s how two former apprentices are progressing after their studies:

George said: “I joined the Vernon in September 2021 as a Digital Marketing Apprentice, and since then, I’ve completed my studies—gaining valuable skills relevant to my role—transitioned into a full-time position, travelled across Asia, and progressed to my current role as Marketing Manager. Throughout my journey, the Vernon has been incredibly supportive, not just to me but to all colleagues, helping everyone achieve their goals and grow within the organisation”

Joe said: “Working while studying has been incredibly beneficial, enabling me to complete my Level 3 apprenticeship and progress to my current Level 7 one; working towards gaining my ACA qualification. The Vernon has been really supportive, helping me with my studies and providing opportunities to apply my learning in the workplace. Being able to put my skills into practice has been invaluable, as it has reinforced my understanding and allowed me to see the real impact of my studies in a professional setting”

In July, our 10 Mental Health First Aiders completed refresher training with Millie’s Trust. We’re proud to have trained MHFA colleagues on-site across the Society to support our people when needed.

In October, the Samaritans led a session on World Mental Health Day, offering additional guidance to help our MHFAs better support colleagues.

Our Employee Hardship Fund enables colleagues to apply for up to £1500 to support with cost of living pressures.

We take pride in helping in our local community whenever we can. As part of our Community Volunteering Programme, our Vernon Team is given two paid days a year to help. This equated to 563 hours, which helped 17 organisations across Greater Manchester and Cheshire In 2024, our colleagues were busy; planting 1000 trees with the RSPB at Dovestone, tidying up at Marple Garden House and helping out at the Smartworks pop-up shop in Merseyway.

Volunteering highlights:

• Helped to prepare Easter treats for families in need across Greater Manchester with Together Trust Easter Festival

• Painted the Restbite Café and helped to clear the centre for a refurb at Jump Space

• Prepared toothpaste packs for homeless and vulnerable families with Bare Necessities

The cafe looks fabulous! It was great to meet you all. Thanks again, we really appreciate everything you and the Vernon are doing for the community.

• Planted 1000 alder and oak trees at Dovestones Reservoir with RSPB

• Organised clothing and helped to move stock into the Smartworks pop-up shop in Merseyway

• Packed presents for children for Mission Christmas

“We had great couple of days and the teams were really brilliant; overall we did the 1000 trees.

We’ve been helping our Members save for 100 years, and we’re proud to continue that tradition. Whether you’re putting money aside for something special or simply want a safe place for your savings, we have an account that’s right for you.

We’re also flexible, giving you the freedom to manage your money in a way that suits your lifestyle. That’s why most of our savings’ accounts can be accessed both in-branch and online. If you prefer the convenience of digital services, you can manage your savings from the comfort of your home, anytime, anywhere. On the other hand, if you value face-to-face service, our branches are here to provide expert support and a personal touch.

For us, it’s not about one-size-fits-all—it’s about choice. Whether you like to check your balance on your phone, visit a branch

for a chat, or keep track of your savings with a traditional passbook, we’re here to support you every step of the way.

Rates correct as of 03/03/2025. Terms and conditions apply. *Gross Rate is the interest rate without tax deducted. Tax-Free means that interest is not subject to income tax. AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

For many of our Members, passbooks are more than just a way to track savings—they’re a familiar and trusted part of their experience. While we embrace modern technology, we also know that not everyone wants to manage their money online. Passbooks provide a simple, secure, and personal way to save, especially for those who prefer face-to-face service.

We believe in keeping personal service at the heart of what we do. Visiting a branch with a passbook isn’t just about making a transaction - it’s a chance to connect with our friendly team and get the support you need. Some may think passbooks are old-fashioned, but for us and our Members, they’re a valued part of both the present and the future.

Meet our New Customer Services Manager, Paul Lester

In July 2024, we welcomed Paul, who brings extensive experience in customer service across various sectors. With his wealth of knowledge, Paul helps ensure the Society delivers on its promise of first-class service to our Members.

I’ve spent my entire career in financial management and am passionate about creating positive experiences for people. I love interacting with others, solving problems, and ensuring everyone feels valued. Outside of work, I’m a family man who enjoys spending quality time with loved ones and friends.

What’s your role at the Vernon?

As the Customer Services Manager, I oversee the customer service team and work with other departments to improve Member experiences and meet our customer satisfaction goals.

What’s special about how the Vernon handles customer outcomes?

What sets the Vernon apart is our personalised approach. We treat each Member as an individual, tailoring our solutions to meet their specific needs. We don’t just handle issues; we focus on creating long-term relationships and best possible outcomes for our Members.

What does delivering personal service mean to you?

For me, delivering personal service is about making our Members feel heard and understood. It’s more than just solving a problem; it’s about building trust and showing that we care.

Why did you get into customer service management?

I’ve always been drawn to roles where I can make a direct impact on people’s experiences. Customer service management offers the perfect opportunity to influence outcomes and lead a team towards achieving the best results for both the business and our Members.

What do you like most about your role?

The best part of my role is seeing the team succeed. When I see our customer service specialists handling tough situations with go out of their way to exceed a Member’s expectations, it’s incredibly rewarding. I also love the challenge of constantly evolving the services we offer and finding new ways to improve the experience for our Members.

What does a typical day look like?

A typical day is dynamic! I spend time supporting my team, ensuring they have the tools and resources they need. I enjoy supporting my team, ensuring they have what they need, and brainstorming ways to improve from member feedback. Together, we solve problems and celebrate our little wins!

What do you find most challenging about your role?

One of the most challenging aspects of my role is balancing the needs of the business with the needs of our Members. Finding creative solutions to meet both is a constant challenge, but it’s something that keeps me engaged and motivated.

What makes a Vernon Member special?

Our Members are at the heart of everything we do, and what makes them special is their loyalty and trust. They’re not just customer’s; they’re part of the Vernon family. Many of our Members have been with us for years, and they appreciate the personalised attention we give them.

In 2024, with the Bank of England’s three interest rate cuts, we achieved £90 million in new mortgage lending, driving an impressive 7.5% growth. We’re proud to have helped 102 first-time buyers’ step onto the property ladder, supported 7 students with Buy for Uni, and empowered 20 buyers to build their dream homes with our Self-Build mortgage.

With house prices rising with seemingly no end in sight, purchasing a home, for many, is becoming more and more out of reach. That’s why, back in 2022, we launched our Head Start mortgage, our way of helping homebuyers with the assistance of their family.

A Head Start Mortgage is a great way for family members to help a loved one buy their home - without needing to gift a large sum of money upfront. Instead of a

traditional deposit, a parent or close relative can use their savings or property equity as security for the mortgage.

The family member’s savings or equity aren’t lost - as long as the mortgage is repaid as agreed, and after five years they’ll get their money back. Plus, if the security is provided in cash, it’s held in a 35-Day Notice Account where it earns interest during the term of the mortgage.

Ella and Maggie found their dream home in Widnes, it was bright, spacious, and only a 10-minute walk from Ella’s parents, but faced with the ever-increasing cost of the rental market, they couldn’t raise the full deposit required for a traditional mortgage. They would’ve had to walk away, until Ella’s mum – Sandra – offered them a chance to buy the property. Ella was aware of us, and after looking at our website, found a solution in the form of our Head Start mortgage.

Using Head Start, the couple, along with the help of Ella’s parents, were able to purchase the pair’s dream home. Without the help, Ella and Maggie believed it would’ve taken another five years until they got onto the property ladder.

Moving in day was also a happy day for another couple – Ella’s parents.

“ “

As a parent, you only want the best for your children and so we really wanted to help Ella get her first home. The Vernon made being a guarantor easy. They clearly explained how it would work and kept us fully updated along the process. It was so lovely to be able to see her and her wife move into their own place.

We couldn’t be happier that the couple now have a place to call their own, and we’re very proud to have helped them make it happen.

Like most young adults, we want to be independent but that’s quite tough given today’s property prices. We really didn’t want my parents to gift or loan us the money so having them add it to a savings account that they get interest on sat much better with us.

“ “

At the time, the average rental price for a two-bedroom flat in their area would cost approximately £650, but Ella and Maggie have a monthly mortgage payment of £550 What’s more, with a repayment mortgage they have already started to pay it off and hope their property will increase in value over the coming years.

Maggie, a videographer and copywriter from Portugal and living hundreds of miles from home, was as delighted as Ella to be living close to Sandra and Carl.

“ “

The Vernon made the whole process so simple; the stressful part was waiting for the surveys and the solicitor’s searches. They’ve helped us build foundations for the future. We’ve made a great investment and have a home to call our own. In the future, we may buy a house with a garden, but for now we’re really settled.

I am delighted to join the Vernon as CEO, leading a modern and forward-looking building society with deep community roots, strong values, and a clear sense of purpose. Supported by a passionate and talented team, the Vernon is thriving in an exciting period of growth. I look forward to building on its strong foundation, guiding the Society through the next phase, and ensuring its continued success for generations to come.

Darren Ditchburn February 2025

Darren joined the Society as CEO in December 2024, bringing over two decades of experience in the building society sector. He has held Executive and Board positions at other Societies, including serving as Deputy CEO at Leek Building Society. Darren has a proven track record of developing a strong culture, driving strategic transformation, and delivering excellent business results.

Joined the Society in September 2016 as Finance Director. Judith is a Chartered Accountant and an Associate Member of the Association of Corporate Treasurers. She has extensive knowledge of managing financial risk, having held senior positions in Treasury and Finance in a high street bank.

Joined the Board in September 2019 and previously chaired the Risk & Compliance Committee. He was appointed as Chair from January 2023. Mike is a Chartered Certified Accountant and Associate Member of the Association of Corporate Treasurers. He has extensive experience of managing retail financial services businesses, having worked in retail banking for over 28 years, previously as CEO of Turkish Bank and Commercial Director of Bank of Ireland in the UK.

Jenny is a Chartered Management Accountant with many years of Board level experience in the financial services sector. Jenny joined the Board in January 2018 and brings experience of managing organisational change and financial risk management, having held senior level roles both with a major building society and a high street bank.

Ken joined the Board in March 2022 and is Chair of the Risk & Compliance Committee. He has over 25 years’ experience leading financial services businesses. He held Board positions in regulated firms in the UK and Ireland and was previously CEO of Ireland’s largest mortgage lender, AIB Mortgage Bank. He runs a successful strategic advisory business and has extensive strategic, commercial and risk skills.

Steve joined in October 2023 and has over 20 years’ experience in leading digital transformations, sales, marketing and customer communications in large regulated businesses. Steve is currently CEO of a successful fibre broadband business.

Paula joined the Board in January 2021 and became Chair of Remuneration Committee in November 2021. She was a commercial real estate lawyer for over 30 years, acting for developers, investors and financial institutions. She served on the Board of two international law firms, as well as being Vice Chair of Opera North and was the first female President of Leeds Chamber of Commerce. Paula is an independent Non-Executive Director of a large accountancy firm, a director of a hotel company and a qualified executive coach.

This report is to inform Members of the current policy for the remuneration of the Society’s executive and non-executive directors. It provides details of directors’ remuneration and explains the basis of its calculation.

The Remuneration Committee comprises three non-executive directors, with Paula Dillon as the Committee Chair; and Michael Joyce and Ken Burke as members.

The Remuneration Committee reviews and recommends to the Board the policy and practice on the remuneration of executive directors and senior managers. It seeks to ensure that executive remuneration levels are fair and reasonable, reflecting market comparatives from similar financial institutions and each individual’s personal development and contribution to the Society’s performance.

The Remuneration Committee also ensures that executive remuneration policies encourage the prudent identification and effective management of the risks facing the Society and the fair treatment of its Members.

The Remuneration Committee determines the annual incentive scheme that provides non-pensionable rewards linked directly to achieving key performance targets aligned to business objectives.

In light of the UK Corporate Governance Code and the FCA’s Remuneration Code, the Remuneration Committee has reviewed the relevance and appropriateness of the executive directors’ and senior managers’ scheme. Given the prudent culture of the Society, the management structure, and the low proportion of incentive remuneration to total executive directors’ remuneration,

the Committee believes it appropriate to continue the scheme in its current form. The Society bonus scheme covers all employees. Executive directors are employed on rolling six-month service contracts and, unless opted out, are members of the Society’s defined contribution personal pension scheme. All pension costs attributable to executive directors are fully disclosed in this report.

Non-executive directors have contracts for services. They are remunerated solely by a fee which reflects the time spent on Society affairs including membership of Board committees, preparation for meetings and attendance at external seminars and training events. They do not receive any other salary, pension, incentives or other benefits from the Society.

Item 6 in the Notice of the Annual General Meeting invites Members to vote on this Directors’ Remuneration Report for the year ended 31 December 2024.

Total Directors’ emoluments of £587k (2023: £563k) are analysed as shown in the table below.

1 Resigned as Director 31 December 2023

2 Appointed as Director 1 October 2023

3 Appointed as Director 16 December 2024

4 Resigned on 15 December 2024, contract was for 60 days holidays per year

This Summary Financial Statement is a summary of our audited Annual Accounts, Directors’ Report and Annual Business Statement; all of which are available to Members and depositors on our website or in branch by request.

Visit www.thevernon.co.uk/about-us/corporate-information/ to view our full Report and Accounts.

The Summary Directors’ Report requirements for the year ended 31 December 2024 are in the Chief Executive’s Summary on pages 2-5. The Directors consider that the Society has adequate resources to continue in operational existence for the foreseeable future; therefore, a going concern basis has continued to be adopted in preparing the Annual Report and Accounts.

Approved by the Board of Directors on 3rd March 2025.

M Joyce, Chair. D Ditchburn, Chief Executive. J Aspin, Finance Director.

FINANCIAL POSITION

Gross capital comprises reserves. The ratio gives an indication of the extent to which the Society is funded by retained earnings. The higher the figure the greater the protection for investors’ funds.

Free capital represents gross capital and provisions for collective impairment losses, less tangible and intangible assets as shown within the Statement of Financial Position.

The liquid assets as a percentage of shares and borrowings ratio is a measure of the proportion of the Society’s total shares and borrowings that are matched by assets in the form of cash or are readily convertible to cash.

Profit for the year as a percentage of mean total assets measures the proportion that profit after taxation bears to the average asset balance during the year. The Society aims to make a sufficient profit to maintain its financial strength and stability.

expenses

The management expenses ratio measures the proportion that the Society’s management expenses bears to mean total assets. Mean total assets are calculated as the average of 2023 and 2024 total assets at the year end.

We have examined the Summary Financial Statement of Vernon Building Society set out on pages 24 and 25.

The directors are responsible for preparing the Summary Financial Statement in accordance with applicable United Kingdom law.

Our responsibility is to report to you our opinion on the consistency of the Summary Financial Statement within the Annual Review with the full Annual Accounts, Annual Business Statement and Directors’ Report and its conformity with the relevant requirements of Section 76 of the Building Societies Act 1986 and regulations made under it.

Our examination of the Summary Financial Statement consisted primarily of:

• Agreeing the amounts included in the Summary Financial Statement to the corresponding items within the full Annual Accounts, the Annual Business Statement and the Directors’ Report of the Society for the year ended 31 December 2024 including consideration of whether, in our opinion, the information in the Summary Financial Statement has been summarised in a manner which is not consistent with the full Annual Accounts, the Annual Business Statement and Directors’ Report of the Society for the year;

• Checking that the format and content of the Summary Financial Statement is consistent with the requirements of section 76 of the Building Societies Act 1986 and regulations made under it; and

• Considering whether information has been omitted which although not specifically prescribed by section 76 of the Building Societies Act 1986 and regulations made under it, in our opinion, is necessary to ensure

consistency with the full Annual Accounts, the Annual Business Statement and Directors’ Report of the Society for the year ended 31 December 2024.

We also read the other information contained in the Annual Review and consider the implications for our statement if we become aware of any apparent misstatements or material inconsistencies with the Summary Financial Statement. Our report on the Society’s full Annual Accounts describes the basis of our opinions on those annual accounts, the Annual Business Statement and Directors’ Report.

In our opinion the Summary Financial Statement is consistent with the full Annual Accounts, the Annual Business Statement and Directors’ Report of Vernon Building Society for the year ended 31 December 2024 and complies with the applicable requirements of Section 76 of the Building Societies Act 1986 and regulations made under it.

This statement is made solely to the Society’s Members as a body and the Society’s depositors as a body in accordance with section 76(5) of the Building Societies Act 1986. Our audit work has been undertaken so that we might state to the Society’s Members and depositors those matters we are required to state to them in such a statement and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Society and the Society’s Members as a body and the Society’s depositors as a body for our audit work, for this statement, or for the opinions we have formed.

Forvis Mazars LLP, Statutory auditor, Leeds, 3rd March 2025.

Head Office

19 St Petersgate

Stockport

Greater Manchester

SK1 1HF

Tel: 0161 429 6262

Email: info@thevernon.co.uk

Poynton

87 Park Lane

Poynton

Stockport

Cheshire East

SK12 1RD

Tel: 01625 855 830

Email: poynton@thevernon.co.uk

Bramhall

21a Bramhall Lane South

Bramhall

Stockport

Greater Manchester

SK7 1AL

Tel: 0161 429 4312

Email: bramhall@thevernon.co.uk

Hazel Grove

190 London Road

Hazel Grove

Stockport

Greater Manchester

SK7 4HF

Tel: 0161 429 4313

Email: hazelgrove@thevernon.co.uk

Marple

1 The Ridgedale Centre Hollins Lane

Marple

Stockport

Greater Manchester

SK6 6AW

Tel: 0161 429 4316

Email: marple@thevernon.co.uk

Reddish

4 Gorton Road

Stockport

Greater Manchester

SK5 6AE

Tel: 0161 429 4315

Email: reddish@thevernon.co.uk

Although our centenary year is drawing to a close, our commitment to our communities continues to thrive.

Looking ahead to 2025, we already have a number of community events in the calendar.

We’re proud to be supporting:

• Bramhall Duck Race

• Armed Forces Day

• Stockport Pride

To keep our Members updated on what’s going on in their local community, we’ve fitted NEW community boards in all our branches.

Our colleagues will be happy to help promote your local events/community groups on the boards, so pop in to see us! Don’t forget to check out the board in your local branch on your next visit. Sharing with our communities remains at the core of the Vernon, together we’re greater.