Shetland Islands Citizens Advice Bureau

Annual Report 2022-2023

SHETLAND ISLANDS CITIZENS ADVICE BUREAU

The demand for the services of Shetland CAB continues to rise with the number of client contacts increasing from 7716 in 2021/22 to 9454 in 2022/23. This year’s significant rise is due to the impact of the cost of living crisis and, in particular, support with fuel and energy costs. In 2021/22 this issue represented 10% of advice given by the Bureau but this has now increased to 17%. This is in addition to high on-going demand for advice about benefits, money and debt and housing to mention a few. Once again, the work of the Bureau has put money directly in the pockets and purses of local people with a financial gain for clients over the past year of £1,920,625.

Our services are provided by both paid staff and volunteers who have shown tremendous commitment during a time of increased pressure on our service. They continue to empower people within our community who need advice and information to enable them to make informed decisions and access their rights. The staff, volunteers and the Board of Directors pride themselves on the provision of a high quality service that is accessible to all in Shetland.

To meet the increasing demand and maintain the high quality of the service, the strategic decision was taken by the Board of Directors and senior staff to seek additional funding to create new posts. The success of this has led to the appointment of a full-time Assistant Session Supervisor and a part-time Finance and Governance Manager. The Board of Directors believe this will assist in the ongoing sustainability of the organisation. A priority for the future will be to secure further funding for these posts. There will be a period of transition and development in the coming year with the present Bureau Manager moving to the role of Finance and Governance Manager and our new Bureau

Manager, Della Armstrong, having started in May 2023.

On behalf of the Board I would like to thank all the staff and volunteers for their dedication to the work of Shetland CAB. I would especially like to thank Karen Eunson, as she departs her role as Bureau Manager, for the incredible work and impact she has had over the last eight years.

Our thanks are also extended to Shetland Charitable Trust, Shetland Islands Council, the Scottish Government and CAS (the national body of the Scottish Citizens Advice Bureaux Network) for the continued investment they provide. Their funding directly benefits the people of Shetland and it is vital to the on-going provision of our services.

Fiona Robertson Chair

My first involvement with the Citizens Advice Bureau was as a client. Although I was aware of CAB’s existence, I had never had the need to consult them until I suffered a stroke-like incident which changed my life overnight.

Once I had exhausted my sick pay entitlement and was still not well enough to return to work I was faced with the prospect of no income and, unable to pay my mortgage, I was at risk of losing my home. I approached CAB and their help was invaluable.

Like many people who have not accessed the benefits system, my knowledge of benefits and my entitlements was vague, to say the least, but the staff and volunteers at CAB guided me through my options, and negotiated with my mortgage company on my behalf, which gave me the breathing space to consider my future. Being able to discuss my circumstances with someone knowledgeable, and knowing their advice was relevant, impartial, and confidential was a great relief.

Once everything settled down (it took 3 years as my diagnosis was unclear) I was approached to see if I had ever considered volunteering with CAB, and knowing how helpful their assistance had been to me I thought volunteering would be a good way to give back to a service that helped me when I needed it. The ongoing weekly time commitment of 8 hours a week was something I thought I would be able to manage, and I decided to give it a try.

The initial training online was something I could work on at my own pace in my own time and once I completed

that, I was able to shadow other volunteers in the bureau dealing with clients before taking on cases on my own.

And then the pandemic hit. Like the rest of the world normal operations ground to a halt but after a few months I had the opportunity of volunteering from home. Client interaction moved from face-toface appointments to telephone or email contact, and a different way of working evolved. Gone was the social aspect of meeting colleagues at the office but working from home has its advantages. Fewer distractions at home mean I can concentrate on one case at a time and sometimes results in greater involvement with clients. I am often more aware of the progress and outcome of their initial enquiry than I was before.

There is always someone to ask or to point me in the right direction when I don’t know how to respond to a query.

Volunteering with CAB has given me a sense of purpose and improved my self-confidence which had taken a beating following a period of great uncertainty. It is very rewarding if I can help someone to navigate the difficulties they are facing in the way I was helped when I needed it.

Elizabeth WilliamsonIt is an on-going learning process keeping up with changes in legislation and regulations, but the staff and other volunteers are incredibly supportive and encouraging.

How easy was it for you to access advice?

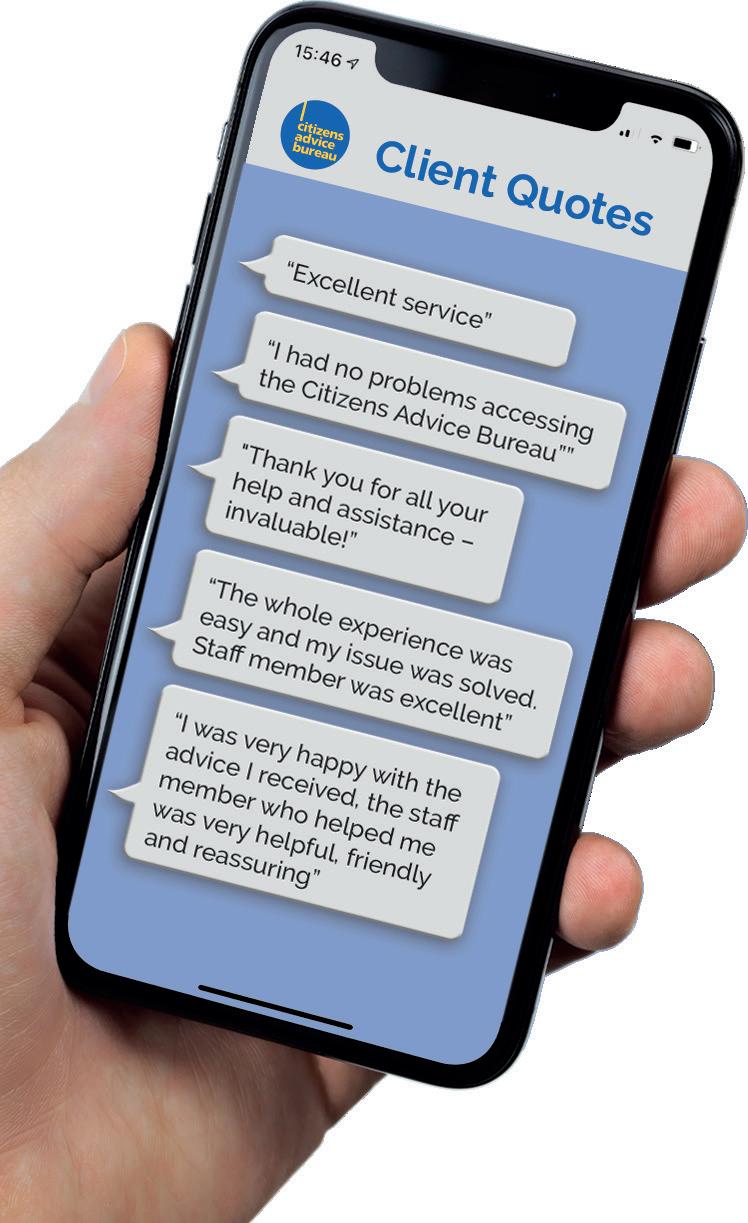

Each year we carry out a Client Satisfaction Survey to get feedback from our clients on the service we have offered them.

Here are the results of our 2022/23 survey.

How satisfied were you that the advice or information given to you helped you to sort out the problem you contacted us about?

Neither satisfied nor dissatisfied

Overall how satisfied were you with the service you received?

no

95% of CAB clients satisfied with the service they received!

A man in his 50’s, who lives alone in council rented accommodation contacted CAB for help. He has complex multiple health conditions and is in receipt of Employment and Support Allowance as he is too ill to work. He also receives full Housing Benefit and Council Tax Reduction.

He applied for a disability benefit, Personal Independence Payment (PIP), as he has difficulties with his daily living activities and getting around. However his claim was refused by the DWP. He consulted our Welfare Rights Adviser, who advised that he should have been awarded PIP at the highest rates to reflect the difficulties caused by his health conditions.

The Advisor asked the DWP to look at their decision again. They did so, but refused to change it. The Advisor then helped the client to appeal this decision by making an application to the Tribunal Service. This would allow an independent tribunal to look at his PIP application and make an assessment on whether or not he should receive this benefit. The Advisor contacted the client’s health care professional for supporting evidence.

Two months’ later the DWP contacted the client to confirm that they had reviewed his application again and had decided to award the highest rate daily living and highest rate mobility components of PIP. They would backdate payment of this benefit to the date when he first made application for it.

Because the client was now in receipt of PIP he also became entitled to an additional “severe disability” payment in his Employment and

Support Allowance, as well as the Warm Home Discount to help with the cost of his energy. The Adviser helped him apply for these.

The client received a lump sum backdated payment of £10,983 for his PIP as well as an ongoing weekly payment of £156.90. His Employment and Support Allowance was increased by £69.40 per week, with a backdated lump sum paid of £4858.

The client was very happy with the outcome. It gave him peace of mind that his health conditions had been acknowledged and financial security in that he received a lump sum totalling over £15,000 and an increase to his regular weekly income of £226.30.

A young couple with one child under six, living in private rented accommodation were referred to CAB by their health visitor. The couple had energy arrears which they could not afford to pay and they were worried about how they were going to keep the heating on. It would have been extremely difficult for them over the winter months with a young child and the prospect of this was causing them stress and anxiety.

One of the couple works full time but as his earnings are low, they are entitled to Universal Credit to top up their income. They had an earlier overpayment of Universal Credit which was being deducted off their monthly payments. They had no other debts.

In 2018/19, Shetland CAB advisers started using the CASTLE electronic case recording system to record the work we do with clients. This helps us to work more efficiently and keeps our client case records secure and confidential. It also means we can record standardised statistics on the numbers of people we help, the types of advice we give and the impact we make. We now have 5 years of data on the work of Shetland CAB.

The CAB Energy Adviser met with the clients who were paying £285 on a monthly direct debit to their energy provider, which they could not afford. The Energy Adviser could see from their current energy statement that their arrears calculation was based on estimated bills so he asked the clients to supply current meter readings.

The Energy Adviser contacted the clients’ energy supplier and asked them to re-calculate the clients’ bill. The energy supplier confirmed that the clients’ arrears were £715. With this information, the Energy Adviser completed a Home Heating Advice Scotland support fund application. This was successful and the clients were awarded £1435 to cover their arrears and the next couple of monthly payments.

The Energy Adviser also checked the clients’ benefits to see if they were entitled to any additional income. This showed they were entitled to claim Scottish Child Payment of £25 per week, so they were advised how to make an application. They were also entitled to free school meals and the Scottish Child Payment bridging payments. The clients were advised on eligibility for the Warm Home Discount Scheme of £150 and informed about payments they will receive from the Government Energy Bills Support Scheme.

The Energy Adviser offered to contact the clients again in a few months to get a further set of meter readings from them so he could ask the energy supplier to calculate how much they need to be paying monthly to cover their usage. The clients were also advised on energy efficiency tips to reduce their usage.

The case is ongoing but the clients are already feeling less stressed about their financial situation. They now have additional income, no fuel debt and more affordable monthly energy outgoings. They no longer have to worry about how to keep their home warm during the cold weather.

A married woman in her 50’s with health issues and living in an owner occupied property contacted CAB. She is in receipt of a private pension, Personal Independence Payment and works part time.

The client came to the Bureau as she was struggling to make minimum monthly repayments on her credit cards. She declined a benefit check as she had recently completed one and their total household income was too high for any incomerelated benefits.

The Money Adviser prepared a Financial Statement from the client’s income and expenditure information which showed that the client had £200 free income each month but was trying to service 3 credit cards with minimum repayments totalling £450 per month. She had been taking from one to pay another for some time until all the cards were now maxed out and she owed nearly £15,000.

The Money Adviser negotiated a repayment plan with the client’s 3 creditors and was successful in getting all interest and charges stopped, meaning that all the money the client is paying now is going towards the debt and not being eaten up by interest and charges. The Money Adviser advised the client to set up direct debits for agreed payments which would make sure payments are made regularly and on time.

The creditors agreed to a repayment plan for an initial period of 12 months when the Money Adviser will contact the client again to carry out a case review.

The client is relieved that her payments are now affordable and her debt manageable.

5,300+ individual clients have sought advice, over a quarter of Shetland’s adult population.

£8.9m+ has been achieved in monetary gains for over 1,300 clients

with an average gain per client of over £6.5k

Balance sheet 31 March 2023

The figures contained within the income and expenditure account and the balance sheet shown above were extracted from the charity’s financial statements. These were approved by the board of directors on 19 July 2023.

A copy of the charity’s financial statements for the year ended 31 March 2023 can be obtained from our main office or by writing to the following address: Companies House, 4th Floor, Edinburgh Quay 2, 139 Fountainbridge, Edinburgh EH3 9FF (quoting ref SC176817)

Fiona Robertson Chair

Sue Beer Vice Chair

Richard Lewis Treasurer

Lucy Flaws

Jeff Gaskell

Kerry Geddes

David Marsh

Gordon Mitchell

Jane Morton

Karen Eunson has stepped out of her role as Bureau Manager and into a new role as Finance and Governance Manager. We thank Karen for 8 years of service. Della Armstrong was appointed as the new Bureau Manager in May 2023.

The following staff, volunteers and board members have left Shetland CAB – we thank them for their many years of service: Margaret Fiddy, Joanne Fraser, Louis Keogh, Graham March, Linda Nicholson, Eleanor Pottinger, Neil Ruthven, Gordon Silver & Allan Wishart.

Generalist Advisers

Jenny Anderson, Malcolm Ferguson, Christabel Garrick, Grizel McGregor, Elizabeth Williamson, Helen Wilson,

Bureau Manager

Della Armstrong

Senior Adviser/Money Adviser

Vivienne Tulloch

Session Supervisor/Assistant Manager

Paula Dunn

Assistant Session Supervisor

Robert Jones

Finance and Governance Manager

Karen Eunson

Energy Advisers

Janice Hawick, Brian Leask

Outreach Adviser/ Patient Support Adviser

Philomena Leask

Welfare Rights Advisers

Gail Finnie, Ros Owen, Nancy Queally

Community-Based Energy and Benefits Adviser

Laura Betney

Community Engagement Officer

Iona Leask

Pension Guide

Isla McGhee

Triage Adviser

Marek Barecki

Administrative Assistant

Alexis Robertson

Shetland Islands Citizens Advice Bureau

HOUSE,

A ch aritab le c ompany l imit e d by guaran te e re giste re d in S cotl an d No . 17 68 17

Re giste re d O ce Mar ke t H ouse , 1 4 Market Stree t, Le rw ick , S hetland, ZE1 0JP

Market House, 14 Market Street

MARKET HOUSE, 14 MARKET ST RE ET

Company Se cre ta ry K are n Eunson ( Manage r)

MARKET HOUSE, 14 MARKET ST RE ET

MARKET HOUSE, 14 MARKET ST RE ET

A charitable company limited by guarantee registered in Scotland No. 176817

MARKET ST RE ET

SICAB@SHETLAND.ORG

Lerwick, Shetland ZE1 0JP

MARKET HOUSE, 14 MARKET ST RE ET

T EL:

Re cognise d by t he I nl an d Reve nue a s a Sc ot tish Charit y No SC01 97 8

T

T

TEL: 01595 694696

EMAIL: sicab@shetland.org

SICAB@SHETLAND.ORG

SICAB@SHETLAND.ORG

SICAB@SHETLAND.ORG

A ch aritab le c ompany l imit e d by guaran re giste re d in S cotl an d No 17 6817

Registered Office: Market House, 14 Market Street, Lerwick, Shetland, ZE1 0JP

A ch aritab le c ompany l imit e d by guaran re giste re d in S cotl an d No 17 6817 Re giste re d O ce Mar ke t H ouse , 1 4 Mark Le rw ick , S hetland, ZE1 0JP Company Se cre ta ry K are n Eunson ( Re cognise d by t he I nl an d Reve nue

Company Secretary: Della Armstrong

Re giste re d O ce Mar ke t H ouse , 1 4 Mark Le rw ick , S hetland, ZE1 0JP Company Se cre ta ry K are n Eunson ( Manage Re cognise d by t he I nl an d Reve nue a s a Sc ot tish Charit y No SC01 97 8

EMAIL: SICAB@SHETLAND.ORG

SICAB@SHETLAND.ORG

dvice Opening Hours AY AY

Drop In Advice Opening Hours

Drop In Advice Opening Hours MONDAY

Drop In Advice Opening Hours

Recognised by the Inland Revenue as a Scottish Charity No. SC019785

Authorised and regulated by the Financial Conduct Authority FRN: 617481

WEDNES DAY

MONDAY

TUESDAY

WEDNES DAY

THURS DAY

FRIDAY

DAY

DAY

DAY

DAY TURDAY ro gramme of out re ach in rural areas at health cent re si n

Hours out re ach in rural areas at health cent re si n

SATURDAY Ro llin gp ro gramme of out re ach in rural areas at health cent re si n

Ro llin gp ro gramme of out re ach in rural areas at health cent re si n

Ro llin gp ro gramme of out re ach in rural areas at health cent re si n

llin gp ro gramme of out re ach in rural areas at health cent re si n

www.facebook.com/ShetlandCAB

www.facebook.com/ShetlandCAB

www.facebook.com/ShetlandCAB

www. shetlandcab.org.uk

www. shetlandcab.org.uk