LANDLORD TIMES

Monthly news for landlords brought to you by:

June 2024

Failure to pass RRB is failure of all our MPs

Sheldon Bosley Knight’s associate director, Nik Kyriacou, gives his verdict on the abandonment of the Renters’ Reform Bill

After eight years talking about it, to a tortuous 12 months since it was first introduced to the House of Commons, it will now not make it on to the statute books, thanks to next month’s snap election.

Had Prime Minister Rishi Sunak held off going to the country by a few weeks, it may have stood a chance, as it was passing through the House of Lords at the time Parliament was prorogued.

Given how long it’s been in development and how important it is to make the sector fair for both landlords and tenants, it is a tragedy it has not been given the same priority as the Leasehold Bill which was at the same stage in the process and was granted approval.

Although it was by no means perfect, with many of the elements of the Bill contentious such as the abolition of periodic tenancies and Section 21, landlords and tenants had been demanding clarity and stability for the private rental sector and have been waiting too long for both.

Amendments as it progressed through the Lords could have addressed these concerns and

ensured a favourable outcome for both sides.

It now falls to the next government, likely a Labour one, to resurrect the Bill as a priority and ensure it is as clear and comprehensive as possible.

We need tenants to feel they can challenge rogue landlords and hold them to account whilst at the same time, ensuring responsible landlords are empowered to deal with irresponsible and bad tenants. Crucially we want these good landlords, of which they are the majority, to stay within the sector and continue to provide a roof over the heads of the thousands of tenants in the country.

However the biggest issue is the need for the incoming government to address the chronic undersupply of good quality rental homes.

“However the biggest issue is the need for the incoming government to address the chronic under-supply of good quality rental homes..”

So, to the next housing minister, please get a grip, put the provision of good quality rental housing and the Renters’ Reform Bill at the top of your to-do list.

EPCs remain a focus for landlords this year

Nearly three quarters of landlords (73%) plan to carry out energy efficiency improvements this year. The figures, from finance company Finbri, show a rise from 68% last year.

Since 2015, it has been a legal requirement in England and Wales for private rental properties to have an Energy Performance Certificate (EPC) rating of E or higher.

This was intended to increase to a C in 2025, but the government has moved this requirement to 2028.

The 2024 Landlord survey of 755 buy-to-let investors, found 77% consider the EPC rating important or very important when looking for rental properties. When asked

how important they thought EPC ratings were to their tenants, 39% said important and 31% said very important.

Among the ways landlords can improve the rating include insulating walls and hot water cylinders, install roof or loft insulation, draft proofing, upgrading to double or triple-glazed windows, switching to LED lighting and installing green roofs or walls.

Sheldon Bosley Knight’s lettings manager Josh Jones said: “Even though current rules state properties within the private rental sector must reach E, it is much more cost-effective and efficient to try and do better.

“With the issue of global warming and the cost of living having a huge impact on our lives, we would encourage all landlords, where possible, to upgrade their properties.

“It is also worth bearing in mind, with a general election next month, it could be the next government, whichever party that is, brings in environmental measures which will affect landlords and their properties.

“As ever if any of our landlords wish to speak to us about this or any other issue, please do so as we’d be happy to help.”

Labour calls for new renters’ charter

A Labour-commissioned review of the private rental sector has called for a new renters’ charter to strengthen tenants’ rights.

The Independent Review of the Private Rented Sector outlines five major recommendations the party hopes to implement if it gains power on July 4.

Launched by the Labour Housing Group last month, it was written by Stephen Cowan who looked at how to make plans for reforming private renting work in practice. He took evidence from a wide range of professional bodies, academics, policy think tanks and commentators, trade unions and renters’ groups, and political groups

potential to transform the private rented sector in the UK, giving tenants more choice and control over their homes, greater security, the right to make their home their own and most important of all, the right to live in a home fit for human habitation”.

It also said the crisis in the PRS “can only be solved by a holistic approach to fixing all parts of the housing market”.

As part of the recommendations Labour proposes reforms of the planning and compulsory purchase compensation codes. It adds “measures must be taken that urgently increase the supply of social housing so low-income and homeless households do not have to rely on the PRS. Social housing should return to being the second largest sector in the housing market, with home ownership being the first”.

Standard.

Sheldon Bosley Knight’s lettings director, Rebecca Dean said: “Obviously this will be dependent on the outcome of the forthcoming general election and, should Labour win, how big a majority it may or may not have.

“However we can certainly expect the sector to see changes whichever party gets into power.

“Now that the Renters’ Reform Bill has been binned, it will be interesting to see which elements of it are resurrected and whether there is an appetite for beginning again, with the government of the day engaging with all those interested parties to make the sector fairer for all.

The charter promises renters they will have a right to include pets in their tenancy, the right to make alterations so the property feels like their home and the right to request quick repairs.

Tenants would also see an end to Section 21 evictions and an end to automatic evictions for rent arrears. A four-month notice periods for landlords would be introduced and deposits would be made

Underpinning it all will be a National Landlords’ Register which would legally require landlords to register themselves, provide details of their properties and rents, and demonstrate compliance with an annually updated PRS Decent Homes

“There are elements of this charter which we would support but it is imperative any government understands if landlords feel unduly penalised, they will exit the market, potentially forcing their tenants into homelessness – something no one wants.

“We will of course, do all we can to lobby for a fair deal for our landlords and their tenants.”

Sheldon Bosley Knight’s associate director Nik Kyriacou said: “The whole ‘make it my own home’ philosophy needs to be carefully thought through.

“The right balance needs to be struck so tenants feel settled and feel it’s their home, but remembering bottom line is it’s not owned by them, and any alterations should only be approved and carried out by the owner (the landlord).

“Landlords don’t work hard, and older generations build portfolios, only to have their most valuable assets be controlled and decided upon by others!”

No let up in tenant demand

Buy-to-let remains a strong investment as tenant demand shows no sign of weakening.

A series of reports and surveys released last month showed pressure on supply in the private rental sector (PRS) has not eased, giving landlords a much-needed reason to remain in the market.

As part of research carried out for Paragon Bank’s PRS Trends report, more than 80% of landlords reported strong levels of tenant need.

Of the nearly 800 landlords who were asked about pressure for their lets during the first quarter of the year, on average, 43%, said tenant demand is ‘very strong’, with a further 40% stating it is ‘quite strong’.

Conversely, just 1% of landlords noted ‘weak’ tenant demand, while 12% report it to be ‘average’.

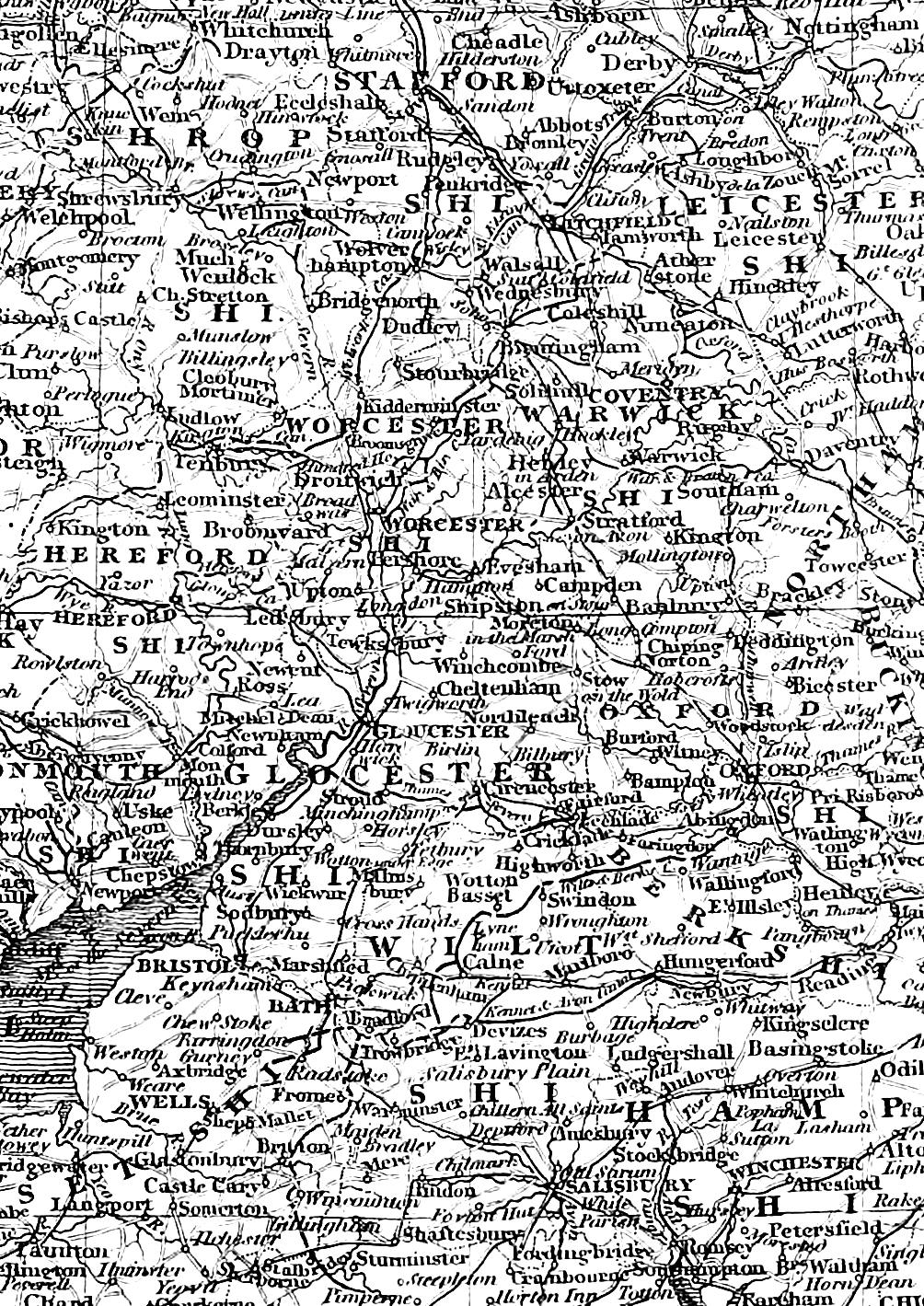

The research also uncovered regional

differences across England and Wales.

The highest proportion of landlords experiencing strong tenant demand were in the South West and North East. Yorkshire and The Humber was the region deemed to have the lowest levels of demand.

Elsewhere, many first time buyers are still struggling with affordability. Last month Rightmove announced the average asking price of a home in Great Britain had reached a new record, rising 0.8% from April’s figure to just over £375,000.

In the West Midlands the figure is £295,507, a monthly jump of 1.2% and a year-on-year change of 2.3%.

This, coupled with a deposit, inflation, mortgage and interest rates which are still relatively high, has proved to be prohibitive for many looking to buy and who are thus forced to continue to rent.

Sheldon Bosley Knight’s lettings manager Josh Jones said: “Demand for rentals has been increasing every month for the past few years and it does not show any signs of stopping.

“Many first time buyers are biding their time in the hope interest and mortgage rates decrease in the next few months. For others, the issue of being able to afford the deposit and the cost of the property is prohibitive.

“For landlords this is obviously good news and a great reason to not only stay in the sector but to think about expanding their portfolio.

“However for tenants there are also reasons to be cheerful as there are signs supply is showing signs of increasing, albeit slowly.

“If any of our landlords would like advice, please do get in touch with your local office and we would be glad to help.”

Average gross rental yield highest level since 2018

The average gross rental yield reported by landlords has reached its highest level since the second quarter of 2018.

Research carried out on behalf of Paragon Bank revealed average gross rental yields have increased for the third successive quarter, hitting 6.1% in Q1, 2024.

It is the first time they have gone past the 6% mark since the end of 2021. They are also the highest since Q2, 2018 when they achieved 6.2%.

Almost 800 landlords were surveyed by Pegasus Insight for the study. The results also revealed how Houses in Multiple Occupation (HMOs) have

the potential to generate higher rental yields compared to single selfcontained properties - 7% compared to 5.8% on average.

Geographically, the highest average yields of 7% were achieved by landlords in the North East, followed by those in neighbouring Yorkshire & The Humber who reported yields of 6.6%.

The East Midlands saw average gross yields of 6.5% and the West Midlands, 6%.

Sheldon Bosley Knight’s lettings manager Natalie O’Sullivan said: “HMOs appeal to landlords due to their strong yield generation

potential. There is still also a considerable demand for affordable homes and as such HMOs represent an attractive option for some renters.

“However, it is good to see yields in our patches of East and West Midlands a little above or on the national average.

“While the yield is dependent on many factors – property type, area, number of rooms – investment in property is still worthwhile and a good income generator,

“If any of our landlords would like to speak to us about further investment in the area, please do give us a call."

Landlords’ Forum Special...

Landlords and managing agents in south Warwickshire have taken part in a focused industry meeting. The Landlord Forum was led by the private sector housing teams from both Warwick and Stratfordupon-Avon district councils and run in partnership with the National Residential Landlords Association (NRLA) and the local Landlord Steering Group.

The event, at the SYDNI Centre in Leamington Spa last month, featured a series of short presentations on a range of topics including how to be a self-managing landlord, policy and legislation changes and advice on how to apply for local improvement grants as well as a big section on crime prevention.

There was also information on new local licensing arrangements for HMOs and a chance for landlords to network.

Solicitor with Davisons Law, Lisa Shocker said: “I found it to be a very useful day, as it’s open to everyone who has a connection to rented property.

“It has a sense of unity and ‘you are not alone’ feel for landlords who have found themselves in a sticky situation or with troublesome tenants. People get to share their experiences.

“I found on the day a lot of questions regarding the Section 21 notice and tenants being allowed pets. I found people approaching us were concerned about the future of the Section 21 and how it would affect the renting sector. Hopefully now it has been abolished, they are more relieved.

“I also found a few landlords asking me about how to structure AST and whether it’s better to have management agency’s helping

them or whether they should do everything themselves in terms of drafting AST.”

Sheldon Bosley Knight lettings manager Claire Paginton said: “This was a very informative forum to attend. It was a chance to network as well as pick up useful tips and advice on some of the issues facing landlords today.

“Many of the legislative information has now changed as a result of the general election announcement, but I’m sure many landlords will have found the crime prevention advice invaluable.

“I look forward to the next event and hope as many of our landlords as possible can also attend.”

The next event takes place at Stratford racecourse on Tuesday, October 22 between 12.30 and 4pm.

Be vigilant over cannabis farms

Landlords need to be vigilant when it comes to their rental properties being used as cannabis factories.

Speaking at the Landlord Forum in Leamington Spa last month, DS Con Ryan told delegates it was vital to check tenants’ documentation thoroughly, ensure proper references were obtained and undertake regular inspections.

Showing the audience videos and stills from a raid on a property in north Warwickshire, DS Ryan explained how the damage such activity causes can be extensive and expensive.

DS Ryan, who is part of the regional organised crime unit, said rental properties were particularly vulnerable as many criminals rely on few property visits by landlords and their agents and a failure to check documentation and references properly.

He explained signs to look out for include windows which are boarded up, electricity meters tampered with and people visiting the property at odd times of the day and night.

He said: “In the year ending March 2023, an estimated 9.5% of people aged 16 to 59, which equates to 3.1 million people, reported using drugs and 7.6% were using cannabis.

“This means there is a ready market and so the criminals look for appropriate places to set up their factories. They aren’t concerned about the damage they cause – both physically and mentally – and it can be significant.

“All the properties here are normal houses and you wouldn’t know the cannabis factories were there.

“Landlords and agents need to be vigilant but also do their due diligence when it comes to renting

out their properties.

“Right to rent checks, regular visits and making sure all documentation such as references are correct are vital to help stop these incidents. These criminals often offer cash and won’t come with the right references and will be vague about giving them to you. If you are concerned about the validity of these documents, then ask for more.

“We live in a nice part of the country and it’s not nice to think people could do this to your property. But you are professional landlords and by being suspicious you will help avoid this kind of activity happening in your properties.

“I would also urge you to get in touch with your local police if you suspect any criminal behaviour or activity.”

Keeping your rental property secure

Keeping your property and tenants secure was a key message from the Landlord Forum.

Speaking at the event in Leamington Spa last month, PC Graham Martin of Warwickshire Police outlined various crime prevention ideas for landlords. These included secure entry points, lighting and surveillance and joining or establishing a Neighbourhood Watch.

He said: “It’s crucial for landlords to take crime seriously. You have to ensure the safety of your tenants and your property. The property is yours so you need to make sure it’s secure.

“Make your property, including any outside areas such as sheds and garages, look lovely but make it look as though it can’t be penetrated from the outside. A ring doorbell and strong sensor lighting will help. Yale locks are not great but other types of locks are better and more secure.

“I’m sure tenants like to be left alone but regular property inspections are also essential as seeing who is inside will be very informative and will show you whether

the tenants are looking after it as you would expect it to be.

“Being part of a Neighbourhood Watch is one of the most valuable and informative things you can do. So, if you are not already, I would strongly suggest getting involved. It does act as a deterrent.

“The other thing I would suggest is collaborate with your local authority and police. If you go on to your local police force’s website, on the front page there is a very clear box where you can put in your property address and it will tell you who you local

Safer Neighbourhood Team is.

“Knowing who is on your local team is invaluable. We want to know who has moved into the area and with information you provide us, we can do something about any problems that arise.

“Finally it’s all about education and educating your tenants to be responsible, shut and lock all doors and windows and get decent insurance.”

• Private entrance

• EPC - D Woodlands Court, Coventry

• Current rent value of £625 pcm

• Modern fitted kitchen

• Spacious shower room

• Lease length - 59 years remaining

• Recently renovated

• Modern fitted kitchen and bathroom

• Highly sought after location

• Allocated parking space

£70,000

• Current rent value of £850 pcm

• EPC - C

£135,000

Old School Court, Nuneaton

• Spacious lounge

• Two bedrooms

• GFCH and PVCu double glazing

• Vehicle parking space

• Current rent value of £895 pcm

• EPC - C

• Downstairs reception/bedroom

• Fitted kitchen

Coventry Street, Stoke, Coventry Gross yield of 5.8% £195,000

• Current rent value of £950 pcm

• EPC - C

• Three bedrooms to first floor

• Large rear garden

• One-bedroom house

• Living room with feature open fireplace

• Charming and characterful period terraced cottage

• Sizeable garden • Current rent value of £895 pcm. • EPC - D

• Prominent high street location

• One upper floor apartment

• Ground floor commercial premises

• Net internal area 383.7m²(4,130 sq ft)

• EPC - TBC 18,

• Apartment £7,200 per annum

• Development potenial (STP)

• Pershore town centre

• Freehold

• Shop - £18,000 per annum

• Town centre freehold

• Potential for residential conversion (STP)

• Prominent for passing traffic

• Vehicular access and parking

Gross yield of 6.6% £380,000 SOLD

• Rateable value: £16,000

• Three-storey commercial property

• 154.37m (1,662 sq ft)

• EPC - D

Gross yield of 5.4% £295,000