LANDLORD TIMES

Monthly news for landlords brought to you by:

INSURING AGAINST PET DAMAGE FALLS TO LANDLORDS

Last minute changes to the Renters’ Rights Bill will mean landlords having to take on the financial risk of potential property damage by pets.

An amendment proposed by Baroness Taylor of Stevenage on June 24 will reverse plans put forward as part of the Bill which would require tenants to have insurance to cover any potential pet damage.

The amendment is one of a series proposed ahead of the Bill returning to the Lords for the Report stage.

Once the Bill becomes law it will ban landlords from refusing a tenant on the basis they will be bringing their pet with them unless they can provide a good reason not to.

The changes come despite Housing Secretary Angela Rayner

MP stating in the House of Commons in October last year:

“Members will agree that pets are not just animals but family. That is why this Bill will make it easier for tenants to request the ability to have a pet in their home.

“It will also allow landlords to require insurance covering pet damage, so that everyone is covered and no one is left unfairly out of pocket.”

An MHCLG spokesperson said:

“Our landmark Renters’ Rights Bill will bring long overdue fairness to the market and deliver much needed reforms to the system. “It is only fair that tenants are given the same choice to keep a pet as homeowners, and landlords will remain protected from the cost of any damage caused by pets through their existing deposits.”

Sheldon Bosley Knight senior lettings manager Josh Jones said: “It is disappointing this amendment has been tabled so close to the Bill becoming law. “Landlords are once again being unfairly penalised as it is unfair they should have to foot the bill

The Q&A

We asked Rob Stanton, sales and distribution director at mortgage platform Landbay for his thoughts on the buy-to-let market, mortgages for landlords and his views on the Renters’ Rights Bill.

Established in 2014, Landay is an award-winning mortgage platform, created to support customers with better ways to buy-to-let. Landbay’s focus is on the broker and their clients.

Rob joined Landbay in August 2018 and, before this, spent 15 years at Paragon Bank. Rob’s areas of expertise include the specialist buyto-let market and the buy-to-let mortgage underwriting process.

How many BTL mortgage applications have you had this year compared to last year?

Last year was a really strong year for Landbay, both in terms of new business and refinancing. Even so, we are expecting mortgage applications this year to exceed those of 2024.

Given the changes we have seen in the market – including shifts in stamp duty policy and increasing worry around new regulation – this is a really strong result.

Maintaining positive levels of business in a period of uncertainty

is a real testament to the resilience of the sector.

It also speaks volumes about the strength of buy-to-let as a longterm investment and the work we have put in to make sure our range is competitive and accessible to landlords of all sizes and requirements.

Which parts of the country have had the best growth for new mortgage applications year-onyear, and which regions have had the lowest?

We are seeing a lot of demand from landlords with properties in London and the south east who are looking to expand their portfolios.

This has certainly been backed up by our most recent landlord survey which identified landlords in these areas with the biggest intention to purchase new rental properties. This is also in line with previous findings and business performance.

In addition, we continue to see landlords adapting to changes in the market and perhaps exploring opportunities outside their usual patch.

A key example is the growing

for any damage caused to their property by a tenant’s pet.

“It will make tenancy deposit and guarantee schemes even more important for landlords to ensure, if the worst does happen, they are not going to be out of pocket financially.”

trend among landlords to explore properties in the Midlands or the north in response to the changes to stamp duty on additional properties. With the help of an adviser with good market knowledge, landlords are taking advantage of opportunities wherever they present themselves.

How do you see the next couple of years going regarding landlords’ new mortgage applications?

With high rental yields and incredible demand across the country, property remains a strong investment vehicle.

As a result, I firmly believe we will continue to see investment into UK property and the private rented sector. Landlords will require funding to do so and will continue to rely on good quality advice from one of the many lenders active in the BTL market – such as Landbay.

The government remains committed to increasing housebuilding in the UK to improve supply. Even if it does hit its ambitious target or comes close, there is still no guarantee housing will be affordable enough to buy.

Rented accommodation will continue to play a vital role in the UK housing mix, whether it’s for students, individuals, transient workers, would-be buyers or even ‘never-buyers’.

How has the remortgage market been over the last 12 months and how has it impacted the lettings market?

Remortgaging has been incredibly busy which is not surprising given the high levels of maturity we are seeing across the market.

We know payment shocks are a reality for many landlords looking to refinance as well as stress testing

Cleary MARLA

challenges from other lenders.

While we’d always recommend speaking to a broker first, we know it may encourage some to dispose of properties. However, our data tells us this is still the exception rather than the rule.

I think a big factor in this is the innovation we have seen in the BTL space to support with refinancing. A key example is the arrival of product transfers, which allow landlords to stay with their existing lender and refinance in a much more efficient and cost-effective way.

Due to the complex nature of BTL lending, product transfers have not always been readily available. At Landbay however, this is something we are now able to offer through an intermediary partner.

How are portfolio landlords reacting to current market conditions?

Speaking to landlords and our intermediary partners, we are hearing and seeing portfolio landlords are invested for the long term. While there are certainly those just maintaining a holding pattern at the moment, we know there are more looking to expand and actively exploring investment opportunities.

Our most recent survey found more than half of landlords plan to purchase properties in the next 12 months, which is hugely positive.

Just as important is the fact the majority have no intention of selling any properties.

What are your views on the impending Renters’ Rights Bill?

The Renters’ Rights Bill does promise a major shakeup in the way the PRS operates in the UK. If you speak to any decent landlord, they will tell you they have fully agreed with protecting the rights of tenants.

However, it must be balanced with the same protections for the property owner – the person who has invested the time and money to make that rental opportunity available.

We certainly agree there is a need for balance and where reform is required, it must be practical and proportionate.

There’s no question this presents a significant challenge, but in truth, the BTL sector has overcome countless challenges and crises over its 30-year history.

Key to that has been the resilience of landlords who continue to adapt to changes in the market or regulation and deliver for the one in five households relying on the PRS.

While we can’t change regulation, we can do everything in our power as a lender to support landlords through our intermediary partners – helping them to build, scale or

LANDLORD AND INVESTOR EVENING

Industry focused event for landlords and investors

Landlords and investors are being encouraged to take part in a focused industry event.

The Landlord and Investor Evening will be at Stratford-upon-Avon town hall on Thursday, September 18.

Organised by the Sheldon Bosley Knight lettings department, it will feature a series of short presentations covering a range of topics including updates on the Renters’ Rights Bill, financial advice, rent guarantee and referencing and EPCs.

Speakers will include representatives from flatfair and Homelet and there will also be an opportunity to network.

Josh Jones, senior lettings manager said: "The private rental market is currently undergoing significant transformations and staying ahead of these changes is absolutely crucial for landlords.

“We're hosting this free event specifically to provide in-depth, practical information on the latest legislative updates and evolving market dynamics.

“Our goal is to equip landlords with the knowledge they need to not only understand these shifts but also to thrive within them.”

“Our goal is to equip landlords with the knowledge they need to not only understand these shifts but also to thrive within them.

“We want to demonstrate clearly how Sheldon Bosley Knight is uniquely positioned to guide landlords through these complexities, offering expert advice and tailored solutions to ensure

they remain compliant, profitable and confident in their investments.

“We urge all landlords to join us to gain vital insights and discover how we can support you every step of the way for future success."

Doors will open at 5.30pm for a 6.30pm start. For more information please email Josh Jones at jjones@sheldonbosleyknight.co.uk

Rents rise more in renewals than new lets

Rental growth on tenancy renewals rose faster than new lets in May.

Tenants staying put saw rents rise by an average of 3.7% to £1,267 per month in May. It is the 20th consecutive month growth on renewals has risen faster than new lets.

This leaves the average tenant renewing a contract paying £99 per month less than a tenant moving into a new home.

The figures, from Hamptons, show new lets command an average of £1,366 per month, a rise of 1.5% over the last 12 months.

For tenants moving into a new property, rental growth remains highest in the north and the Midlands.

In the West Midlands, the average monthly rent on a newly let property was £1,074, a year-on-year rise of 2.9% but on a renewal the average rent shot up 7.6% to £983.

Tenants in the East Midlands who were taking on a new let saw average rents increase 3.4% to £995. Those renewing saw average rents go up 5.6% to £897.

Despite this, there are signs of a slight increase in supply and a weaker demand.

Hamptons reports at the end of May there were 5% more homes on the rental market than at the end of May 2024.

More than half of rental stock in England below EPC C rating

More than 1.8m privately rented homes in England are still below the government’s proposed minimum energy efficiency standard of EPC rating C.

As of Q2 2025, only 42.3% of privately rented homes in England currently meet EPC band C or above. In contrast 1.82million rental properties remain rated D or below, many requiring significant retrofit works to comply.

The figures from LandlordBuyer were compiled using data from MHCLG and EPC Register.

Landlords have just three years to

go before the 2028 compliance deadline.

The average cost of upgrading a D-rated property to C is estimated between £7,400 and £10,000, depending on property type and region.

With the average private landlord owning 1.4 rental properties, the cumulative cost of meeting the EPC target could exceed £15 billion nationally. There is also a concern about how landlords will afford the necessary upgrades and the potential knock-on effect for tenants.

RRB enters final stages

The Renters’ Rights Bill is due to move to the Report stage this month.

Mike Cleary MARLA

Co-Owner

Following the completion of the committee stage in the House of Lords, it will be back in the upper chamber for the first of three Report stage debates – on July 1, 7 and 15. It looks increasingly unlikely the Bill will receive Royal Assent ahead of the summer recess which runs from July 22 until September 1. It means it

will be unlikely to become law until well into the autumn.

The report stage will be one of the final opportunities to propose and debate changes to the legislation before it gets final approval.

Sheldon Bosley Knight’s lettings director, Rebecca Dean said: “We still have concerns about the Bill not least the fact none of the nongovernment amendments were taken into consideration.

However, tenants in lower-rated homes typically face higher energy bills than those in more energy efficient properties.

Jason Harris-Cohen, managing director at LandlordBuyer, said there was a need for targeted financial support for landlords and clear government enforcement timelines.

He said: “This represents a significant retrofit challenge for landlords, many of whom face difficult decisions between absorbing costly upgrade expenses, raising rents, or exiting the market altogether.”

“However we are working hard to ensure our landlords are kept up-todate and informed so that when it does become law, they will be in a strong and knowledgeable position.”

For further information visit our youtube channel here to see our latest podcast.

• Allocated parking space

• Ground floor apartment

• Modern and well presented

• Convenient location and close to town

• Potential rent value of £825 pcm

• EPC - C

• 102 year lease remaining

• Two-bedroom flat in Cheylesmore

• Excellent public transport links

• Highly sought-after location

£125,000

• Potential rent value of £800 pcm

• A charming and characterful terraced home

• Excellent central location

• Perfect for a first-time buyer or investor

• Kitchen with built-in/fitted appliances

• Current rent value of £825 pcm

• No onward chain

• EPC - D

• End-terraced family home

• Ground floor W/C and upstairs bathroom

£185,000

Road, Coventry Gross yield of 4.9% £190,000

• Prime Earlsdon location

• Finham Park and Earlsdon Primary catchment

• Current rent value of £1,200 pcm

• EPC - E

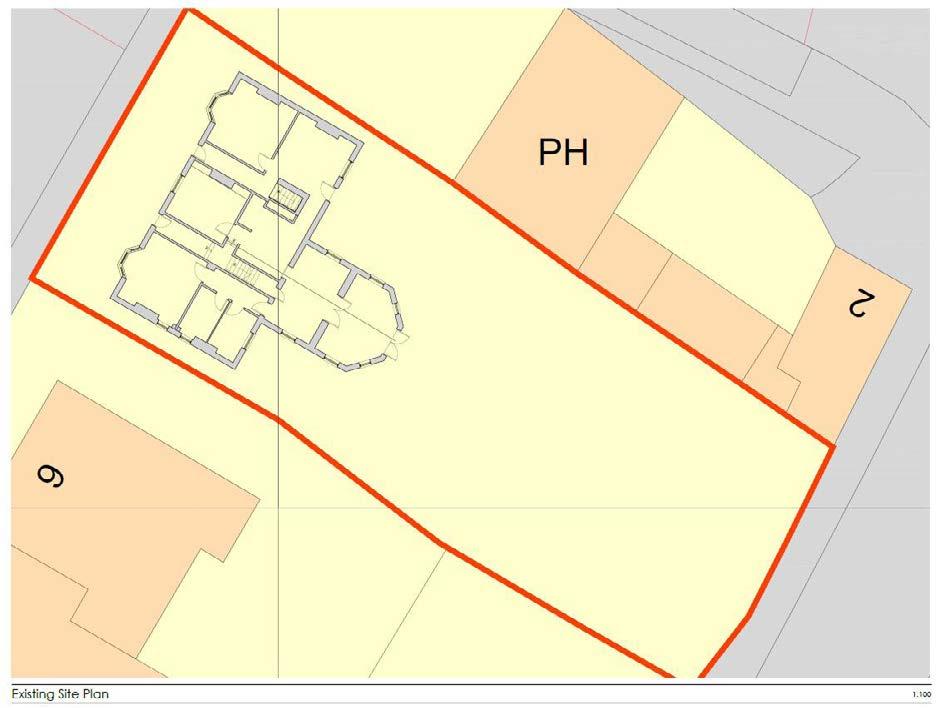

Knightthorpe Road, Loughborough Gross

• Ideal development/investment opportunity (Subject To Necessary Planning Permissions)

• Currently three-bedrooms, with two additional multi-use rooms upstairs

• Current rent value of £15,00 pa

• Driveway, garage and workshop store with front and rear gardens

• 28ft Lounge/Diner

• No onward chain

Brookshaw Way, Coventry Gross yield of 5.8% £255,000

• Potential rent value of £1,250pcm

• EPC - C

• Three bedroom family home

• Fitted kitchen

The Hawthorn apartments

The Hawthorn apartments

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer Taylor Wimpey.

Ranging from one-bed apartments at 525 sqft to executive five-bedroom detached houses at 1,986 sqft, there is plenty to suit your investment needs.

> Locations include Hatton, Warwick, Gaydon, Nuneaton and Kersley.

> House types range from two-bedroom semi–detached, three-bedroom detached, four-bedroom detached and executive five-bedroom detached houses.

> Three blocks of apartments including one-bedroom apartments at 525 sq ft and two-bedroom apartments at 750 sq ft.

> House styles include the Gosford, the Byford, the Beauford, the Rossdale and the Lavenham.

> Multiple unit discounted packages available.

> Whole blocks available as single purchase.

> Potential for great yields.

*Discounts and

For more information please contact Nik Kyriacou and the New Homes Team on 01789 333 466

Kensington Road, Earlsdon, Coventry Potential

• Beautifully presented six-bedroom property

• No onward chain

• Fantastic Earlsdon location

• Six en-suites

• £650-£675 pcm per room

• Great addition to portfolio

• EPC - C

Church Street, Leamington Spa

• Prominent mixed use property with return frontage

• Newly refurbished

• Prominent for passing traffic

• Class E business and commercial

£450,000

• Estimated rent of £26,600 per annum

• 144.15 spm (1,550 sq ft)

• EPC - E

Gross yield of 5.6% £430,000

• Development potential STPP

• Investment opportunity

• EPC - D Forest Road, Loughborough

• Current rent £20,000 per annum

• 255m2 (2,739.81 Sq Ft)

• Centrally located close to the town centre

Large Car park

LOCAL BRANCHES ACROSS THE MIDLANDS