LANDLORD TIMES

Monthly news for landlords brought to you by:

December 2024

FULL OF ADVERSITY OR FANTASTIC OPPORTUNITIES?

For everyone involved in the private rental sector (PRS), 2024 was the year of anxiety and apprehension. For two thirds of the year, stress and worry from both sides rose due to the unknown rather than the known.

It was this continued ambiguity throughout the year that caused landlords’ and tenants’ behaviour to stutter, delay, postpone or be put on hold until further information was released and certainty was met.

In the first half of 2024, the Conservative government’s Bill – Renters’ Reform Bill – began to get real traction and was a key piece of legislation which everyone acknowledged would shake up the PRS.

During this Bill’s progression, landlords were understandably nervous and this affected their behaviour such as whether to sell

or stick, increase rent or not, or when to serve notice. As it made its way through the parliamentary process, further details unfolded which allowed for some reassurance.

However, due to the snap general election called for July, the Bill did not pass before Parliament was dissolved.

In October 2023, the Conservative government had said banning no fault evictions would only happen when “sufficient progress had been made to improve the courts”. Seemed sensible…

Unfortunately, once the election was called and it became clear we were looking at an overwhelming Labour victory, it was clear from Labour’s manifesto

abolition of Section 21 was going to be immediate, regardless of the lack of court reforms. Such a crucial timescale change regarding such an important change in the PRS was of huge concern.

This was just one example of the to-ing and fro-ing both landlords and tenants had to deal with in 2024, changing their preparations constantly and slowly becoming more and more disillusioned with the industry.

There were many more examples within both Bills that showed how the differences in political views and both their lack of details would impact differently and caused further confusion –most notably the student rental market.

While this was all unfolding and the whirlwind was continuing the average UK private rents increased by *8.7% in the last 12 months to October 2024 and average rents increased to £1,348 in England in the same 12 months (*Office for National Statistics).

Regardless of the confusion the government managed to conjure up, it only masked the reality of the

continued imbalance of supply and demand in the PRS.

This imbalance had helped cause a year of strong rents and stronger yields, welcomed by landlords but who in the same year experienced the highest mortgage rates since April 2008. However, as a long-term industry direction, it cannot be viable.

From the unknown, now to the known. Labour swept to power in July and quickly binned the Renters’ Reform Bill. In its place is the Renters’ Rights Bill, a subtle change in the title but very obvious where the direction of travel was going to go.

And go it has with a very speedy tour of the parliamentary process and although it hasn’t yet got Royal Ascent, it’s well on its way.

Landlords may disagree with much of Labour’s Bill, but at least it’s out, it’s a certainty, and it’s here to stay.

NRLA chief Ben Beadle recently said “the property industry must now embrace it and look forward” and I completely agree.

Beadle added although some landlords had exited the market,

there had not been the feared exodus as predicted.

It is a future where the standard of housing will be improved and legislation will get tighter and rightly so. If landlords choose to withdraw, then the professional landlords who choose to stay will only benefit from it and in a time where home ownership in the UK is dwindling and rents continue to increase.

Interest rates have reduced and further reductions are predicted in 2025. Support and protection for all the impending changes are there for landlords, by way of the guiding hands of a reliable letting agent.

Charles Darwin famously said “it is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change”.

If landlords want to remain in the industry and continue to take advantage of being a landlord, then these changes should not be seen as obstacles but rather as a chance to adapt and reap the rewards.

Record turnout for NRLA Landlord Conference

Record numbers of property professionals turned out for this year's annual NRLA Landlord Conference.

The event, at Birmingham’s NEC, saw thousands of delegates pack the auditorium to hear more about the planned legislative changes, particularly how the Renters’ Rights Bill will impact the sector and how the sector can prepare itself, as well as investment tips and what the Budget and US election might mean for lending.

There were keynote speeches from Greater Manchester Mayor Andy Burnham and entrepreneur and former Dragon's Den star James Caan CBE and panels featuring high-profile industry figures such as Richard Donnell, Zoopla’s executive director and Paul Shamplina, TV star and founder of Landlord Action.

Fresh from his recent stint on Strictly, host with the most, Nick Knowles kept charge of proceedings asking pertinent questions of those on the four panels throughout the day.

As well as the speeches, delegates were able to network during the breaks and find out about organisations offering services for landlords.

Speaking to Landlord Times, NRLA Chief Executive Ben Beadle said: “We are not going to sit around and mope! We have people here who are really resilient and we know it’s a bit rubbish at the moment and 2025 will be a challenging time, but we are here to see how we can help.

“We as landlords might have to do things differently and build resilience. We would also advocate doing your research and due diligence when it comes to property.

“This conference has been very positive with lots of great ideas, talks and networking. I want us to have a sense of optimism for the future.”

Sheldon Bosley Knight’s lettings director Rebecca Dean said: “The NRLA conference gets a big thumbs up from me and it was

great to be part of something so informative, interesting and inspiring.

“I’ve attended many conferences over the years but this is the first time I have been to the NRLA National conference and it was fantastic to hear the messaging and guidance being given to UK landlords, especially in light of the upcoming changes and planned introduction of the Renters Rights Bill (RRB) in 2025.

“My favourite parts of the day were the speakers - they were all great but my favourites were James Caan CBE who shared the amazing story of his career and how he has become a renowned entrepreneur and Alex Notay who spoke of her work with Radix Big Tent Housing Commission.

“It was also superb to hear from Nick Knowles who hosted the day - his work to help others is awe inspiring.

“I would urge any of our landlords to go along to the next one as it is well worth it.”

Burnham: Housing is the single best investment the UK can make

Quality housing is vital to both society and the economy. That was the message from Greater Manchester mayor Andy Burnham.

Speaking at the NRLA’s annual Landlord Conference Mr Burnham told the assembled landlords and property professionals a vibrant private rented sector (PRS) was an essential part of the housing market and he wanted good landlords to remain in the sector.

He said he remained committed to working with landlords in Greater

Manchester in particular to ensure regulation of the PRS is fair, and a ‘mixed market’ of housing tenures is essential, adding schemes such as his Greater Manchester Good Landlord Charter (GMGLC) can build trust between local authorities and the private rented sector.

He said: “Reputable landlords can be unfairly portrayed. If the GMCLC is to work it’s got to work for good landlords but also for tenants and the communities in which they operate.”

He said housing was one of the key components to economic growth, alongside education and health.

He said: “We need the UK to be a housing first country. It’s the single best investment this country could make - homes of all kinds to guarantee all citizens get secure homes. The impact it will have on social and economic will

“We [in Manchester] will be housing first city region. We are ready to build more new homes than anyone else in the country and we have got special framework to do so. Our aim is 75,000 homes in

“Our aim is also to drive up standards across the sector, not necessarily to ask good landlords to do more but allowing us to focus on those who aren’t doing that and those who want

improve their properties.

“We want to try a different approach on those operators who cause harm to our residents and in our communities. Alongside that we are investing in a new enforcement capability and apprenticeship careers for housing enforcement and have had our first young graduates coming through.”

Mr Burnham also voiced his commitment to getting other agencies to play a greater role in improving housing safety and standards, a new route for residents to request property checks and make greater use of compulsory purchase powers on those whose properties put people at risk and where landlords are not engaging.

He said: “It’s not my intention to go after people but encourage people to do the right thing. There are obligations on both landlords and tenants.

“I’m confident these measures will bring tangible benefits which will be a good thing.”

Sheldon Bosley Knight’s associate director Nik Kyriacou said: “Andy Burnham spoke a lot of sense and with a passion and conviction.

“We know more needs to be done to improve the supply of affordable, good quality rental homes for people but we also need our good landlords to stay in the sector.

“Both these things will enable the private rental sector to survive and thrive.”

Reasons to be cheerful

Landlords have plenty of reasons to be cheerful. That was the message from not one, but two delegates at the NRLA conference. Adam Lawrence, a landlord with more than 700 units said he felt optimistic about the future of the sector. Although he acknowledged recent tax and legislative changes had had an impact on the bottom line for some, he said most should be resilient enough to withstand the impacts.

Speaking to Landlord Times, he said: “I am not feeling negative about things. I’d suggest between 40% and 55% of landlords across the country haven’t got a mortgage and for those who have, rates have come down recently. “We must remember rents are up on new lets and we have had three years where rents have been rising. “The new Labour government has helped those on minimum wage by increasing it in the budget and many of these are renters. I think there are a lot of reasons to be positive.”

His view was echoed by property expert Russell Quirk who added advice for landlords to future

proof themselves. He said: “There has been a lot of hyperbole around the proposed abolition of fixed term tenancies and tenants leaving after two months. Most aren’t going to do that. I don’t think it will make much difference.

“What is going to become more important for landlords, will be the checking and assessing of tenants. The landlord has every right to make sure every tenant is financially sound so referencing, guarantors and proper credit reports, almost to the point of psychological profiles, will be very important.

“I generally think five years ago landlords had an exceptional time. There was less regulation, government left them alone and it was a fantastic time to be a landlord. Now there are more regulations and more costs on second homes.

It’s tougher and more challenging. “But this promise to build 300,000 homes hasn’t happened since the 1960s, demand is increasing and supply reducing. Many costs will also be reducing as the Bank of England is expected to cut the base rate, there will be rent growth and affordability will increase. “If landlords sell, where will they put the money? Stocks and shares are risky as are start ups? Where else are you going to get the investment growth?”

Nick knows what we need

For TV presenter of DIY SOS, Nick Knowles, one of his takeaways from the conference was that of ensuring everyone had access to a decent home.

Speaking to Landlord Times he said: “The biggest difficulty with any legislation on compliance is it

doesn’t always reach those who are not compliant.

“At the moment we are preaching to the converted and so it’s a question of getting to those who aren’t.

“In terms of housing provision, I think spending at the moment is

in the wrong place and there is no joined up thinking. We need the government to have a holistic view on the sector and provide accommodation for those who need it.”

MP pledges his support for landlords

An MP has promised to help in the fight to get changes made to the new Renters’ Rights Bill. Nigel Huddleston, MP for Droitwich and Evesham, made the pledge at a meeting with Sheldon Bosley Knight’s lettings manager Josh Jones.

Josh had invited him to the office to discuss the issues facing landlords in the area as well as concerns about specific elements of the Bill.

Of particular concern are the removal of fixed term tenancies, the need for urgent court reform to mitigate the impact of the abolition of S21s and the supply issues within the sector.

Using statistics gained over the past few years, Josh was able to highlight the legitimate concerns of landlords and tenants in the Evesham and wider West Midlands area as a result of government legislation over the past few years.

He said landlords were likely to be adversely affected by the Bill should it go through in its current form.

Josh said: “It was a pleasure to spend some time with Nigel last to discuss some of the challenges our landlords are set to face with the Renters’ Rights Bill.

“Although some can feel daunting, we must try to use our expertise to advise and provide true information on the rental market to the people who can influence it above.

“I would strongly encourage as many people as possible to write to their MP and voice their concerns with the unintended consequences the bill could have.

“We at Sheldon Bosley Knight are dedicated to ensuring that your voices are heard and do everything in our power to help where possible. Your MP is your voice.

“Change is on the horizon, but the more we can do to shape it, the better. We are the specialists, best placed to advise on what is happening within our industry, and we must do our utmost to improve this situation.”

Nigel said: “It was good to visit Sheldon Bosley Knight in Evesham and discuss the government's Renters' Rights Bill.

“I was grateful for the real evidence and statistics they provided, including data showing a significant drop in available rental properties in our area since the Bill was announced.

“This highlights some of the Bill's unintended consequences for both landlords and tenants.

“Although the Bill has passed its second reading, I am hopeful we can work toward sensible amendments that balance renters' rights with the needs of property owners.”

Billions needed for PRS EPC goals to be achieved

Almost £24 billion will be needed to fund energy improvements to homes in the private rental sector (PRS).

An estimated 2.9 million properties in the PRS need to be upgraded to reach the government’s ambitions of an EPC rating of C by 2030. The cost would be an average of £8,074 per property.

The figures were outlined in Rightmove’s latest Greener Homes Report, which tracks the progress toward sustainable homes.

This year, 43% of all properties for sale and 55% of rental properties have an EPC rating of C or above, reflecting a 2% increase across both markets compared to last year. The report suggests it is renters who are leading the call for stricter energy efficiency regulations, with 19% saying it’s the most important action for the new government. This is nearly double the 9% of home owners who think that.

However, half (50%) of landlords are concerned about potential financial penalties if rental properties fail to meet the government’s standards.

More than 14,000 home-owners and renters, along with over 1,000 landlords were surveyed for the report.

The research found eight in 10 renters say energy efficiency will impact their decision when they next look to move, compared to 74% of home-owners. Three quarters say they would be willing to pay more for energy efficient homes compared to 77% of home owners and 76% said they would encourage their landlord to make green upgrades to save on energy bills.

Elsewhere the research found 59% of flats available to rent for less than £1,250 per calendar month (pcm) have an EPC rating of C or above (an increase of 4% since 2019); 40% of houses available to rent for less than £1,250 pcm have an EPC rating of C or above (a rise of 7% since 2019); 73% of flats available to rent for over £1,250 pcm have an EPC C or above rating (up 12% since 2019); and 45% of houses available to rent for over £1,250 pcm have an EPC C or above rating (an increase of 12% since 2019).

Rightmove’s analysis suggests there has been a gradual increase in landlords exiting the market, with 18% of properties for sale in August previously on the rental market. This is compared with 8% in 2010. The previous five-year average for homes moving from the rental to sales market in Great Britain is 14%.

Sheldon Bosley Knight’s lettings manager Gavin Stokes said: “The government has been clear it wants all rental properties to reach a minimum EPC rating of C by 2030. This will benefit both landlords and tenants in terms of lower bills but it’s not going to be cheap to do and many landlords may struggle to find the cash to pay for the necessary works to be done.

“We would encourage our landlords to get in touch with us if they are struggling to finance any work as there are grants available.

“We would also urge the powers that be to provide more financial assistance to enable all properties to become more energy efficient as it will benefit everyone.”

Yields rise again

Landlords’ yields rose again in the third quarter of this year. According to buy-to-let mortgage specialist Paragon Bank, the average yield hit 6.72% in September, up from 6.69% at the end of the second quarter of 2024 and 6.48% a year previously. The yield – the proportion of rental income against the property value - at the end of the third quarter was based on the average buy-tolet property value of £343,356 and rental income of £23,076. Yields have strengthened since the summer of 2022 as house price inflation stabilised and rents increased due to constrained availability of rental stock.

Houses in Multiple Occupation (HMOs) generated the highest yields at 8.34%, followed by freehold blocks at 6.66%. Flats and terraced houses achieved 6.02% and 5.94% respectively.

“north of England achieved the highest regional yields, at 8.02%, followed by Wales at 7.95%”

Landlords in the north of England achieved the highest regional yields, at 8.02%, followed by Wales at 7.95%. Landlords in greater London achieved the lowest yields at 5.52%.

Fewer homes and higher rents forecast

Tenants looking for properties in 2025 look set to have to fight over an ever-dwindling supply of homes and with higher rents.

A new study found 79% of investors reported strong demand for private rented housing in the third quarter of this year. Compiled by Pegasus Insight on behalf of the National Residential Landlords Association (NRLA), the data shows those in the south east experienced the highest levels of demand with 84% saying Q3 was strong. In contrast the lowest demand was in the West Midland. However despite the high demand, 19% of landlords across England and Wales said they sold property in the past 12 months. This was

more than double the 8% who bought in the same period.

The research shows over the next 12 months 41% of landlords say they plan to sell at least some of their portfolio, compared to just 6% who plan to buy.

This could be attributed to the chancellor's Budget announcement to increase the stamp duty levy on homes to let from 3% to 5.

With inflation nudging upwards and mortgage rates expected to remain higher for longer than expected, the NRLA warns this potential sell off adds to the increasingly bad news for tenants. NRLA chief executive, Ben Beadle, said: “Whilst landlords selling up might benefit a minority of tenants

in a position to afford a home of their own, the vast majority will face a growing struggle to access rental homes.

“It’s time for a change of course. We need policies to support the provision of more decent quality homes for private rent alongside all other tenures.”

“It’s time for a change of course. We need policies to support the provision of more decent quality homes for private rent alongside all other tenures.”

Landlords’ profits hit two year high

Levels of profitability reported by landlords in the third quarter of this year have hit their highest point since the first quarter of 2022.

A survey of 720 landlords showed on average, almost nine in 10 (87%) reported making a profit in Q3 2024, the highest since Q1 2022.

The research, carried out by Pegasus Insight for Paragon Bank showed overall profitability in Q3 2024 is seven percentage points higher than the same period in 2023, following successive quarterly increases over the past year.

The figure is made up of 17% of landlords who report making a large profit and 70% a small profit, on average.

The proportion of landlords making a loss fell during the quarter, was down to 4% from 6% in Q2 and 8% during the same period last year. The remaining 9% of landlords broke even.

Net returns are highest amongst landlords operating in the East of England, with 90% recording making a profit, with above average levels of profitability achieved by lettings business owners in the East Midlands, at 88%.

Meanwhile, by tenant type showed that those letting to students were most likely to be profitable (91%), followed by families with children (88%) and couples (87%).

Sheldon Bosley Knight’s lettings manager Claire Paginton said: “While not all landlords achieve

these levels, these studies show what can and is being achieved and the worth of staying in the sector.

“While not all landlords achieve these levels, these studies show what can and is being achieved and the worth of staying in the sector.”

“Rents and yields continue to rise given the ever-growing gap between demand and supply. Currently we see these figures only going up so we would urge our landlords to continue to provide the vital service they do, that of providing a home for people to live in.”

Alouise House, Coventry

• Development with two six-bedroom apartments, four four-bedroom apartments and two three-bedroom apartments

• Excellent location for Warwick and Coventry Universities

• Current rent value of £243,480 pa, potentially rising to £257,400 pa

• Tenants in situ

• EPC - B

• No upward chain

• Conveniently located close to town centre

• Two-bedroom second floor apartment

• Single parking space with barrier access

• Potential rent value of £900 pcm

• Communial grounds

• EPC - B

yield of 7.4% £145,000

Coach House Court, Loughborough

• Two-bedroom retirement apartment

• Refurbished throughout

• Highly sought-after town centre location

• Vacant possession

• Potential rent value of £950 pcm

• Minimum age of 60

• EPC - C

• Two-bedroom mid terraced house

• Close to Walsgrave Hospital

• Well refurbished property

• Popular location

• Two-bedroom, second floor apartment

• No upward chain

• Allocated parking space

• Easy reach of mainline rail to London Marylebone

• Current rental value of £950 pcm

• Tenants in situ

• EPC - C

Court, Alcester Road

• Two-bedroom, first floor apartment

• No upward chain

• Walking distance to the town centre

• Allocated parking space

£160,000

• Potential rental value of £900-£950 pcm

• Allocated parking space

• EPC - B

Gross yield of 6.3% £180,000

Brookfield

Rosemary Drive, Banbury

The Hawthorn apartments

The Hawthorn apartments

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer Taylor Wimpey.

Ranging from one-bed apartments at 525 sq ft to executive five-bedroom detached houses at 1,986 sq ft, there is plenty to suit your investment needs.

> Locations include Hatton, Warwick, Gaydon, Nuneaton and Kersley.

> House types range from two-bedroom semi – detached, three-bedroom detached, four-bedroom detached and executive five-bedroom detached houses.

> Three blocks of apartments including one-bedroom apartments at 525 sqft and two-bedroom apartments at 750sqft.

> House styles include the Gosford, the Byford, the Beauford, the Rossdale and the Lavenham.

> Multiple unit discounted packages available.

> Whole blocks available as single purchase.

> Potential for great yields.

*Discounts and

For more information please contact Nik Kyriacou and the New Homes Team on 01789 333 466

• Two-bedroom end terraced house

• No onward chain

• Highly sought-after location

• Close to excellent road links across the city •

• A charming and characterful terraced home

• Excellent central location

• Perfect for a first-time buyer or investor

• Kitchen with built in/fitted appliances

• Current rent value of £825 pcm

Melbourne Road, Coventry

• 15 minutes walk to Coventry train station

• Highly sought after location of Earlsdon

• No upward chain

• Close proximity to Coventry city centre

• Current rental value of £800 pcm

• Kitchen with appliances

• Well maintained property

• EPC - D

Harcourt Estate, Harborough Road

• Three-bedroom property

• Village location

• Breakfast kitchen with built in appliances

• Modern bathroom suite

• Potential rental value of £1,300 pcm

• Car standing

• EPC - D

Gross yield of 4.7% £330,000

Haven Lodge

> Development of 35 studio apartments

> Modern fitted kitchenettes and bathrooms

> Highly sought-after location

> Allocated parking spaces

> Current rent value of £269,285.10 pa

> Tenants in situ

> EPC - B

Gross yield of 8% £3,250,000

• Stunning town house

• Sought after location close to town centre

• Secure gated parking for two cars

• Three bedrooms and three bathrooms

•

• Current payable rent of £1,850.00 pcm

• Exceptional finish

• Rare opportunity for investment

• EPC - B

• Six self-contained flats within property

• No onward chain

• Current rental value of £1,100 pcm

• Prominent building on Regent Street Regent Street, Nuneaton

• Three rooms vacant offering flexibility

Potential yield of 10% £500,000

• Excellent condition

• Sought after location within walking distance of Nuneaton

Milverton Crescent West, Leamington Spa

• Prominent mixed use property with return frontage

• Newly refurbished

• Prominent for passing traffic Class E Business and Commercial

• Estimated rent of £26,600 per annum

• 144.15m2 (1,550 sqft2)

• EPC - E

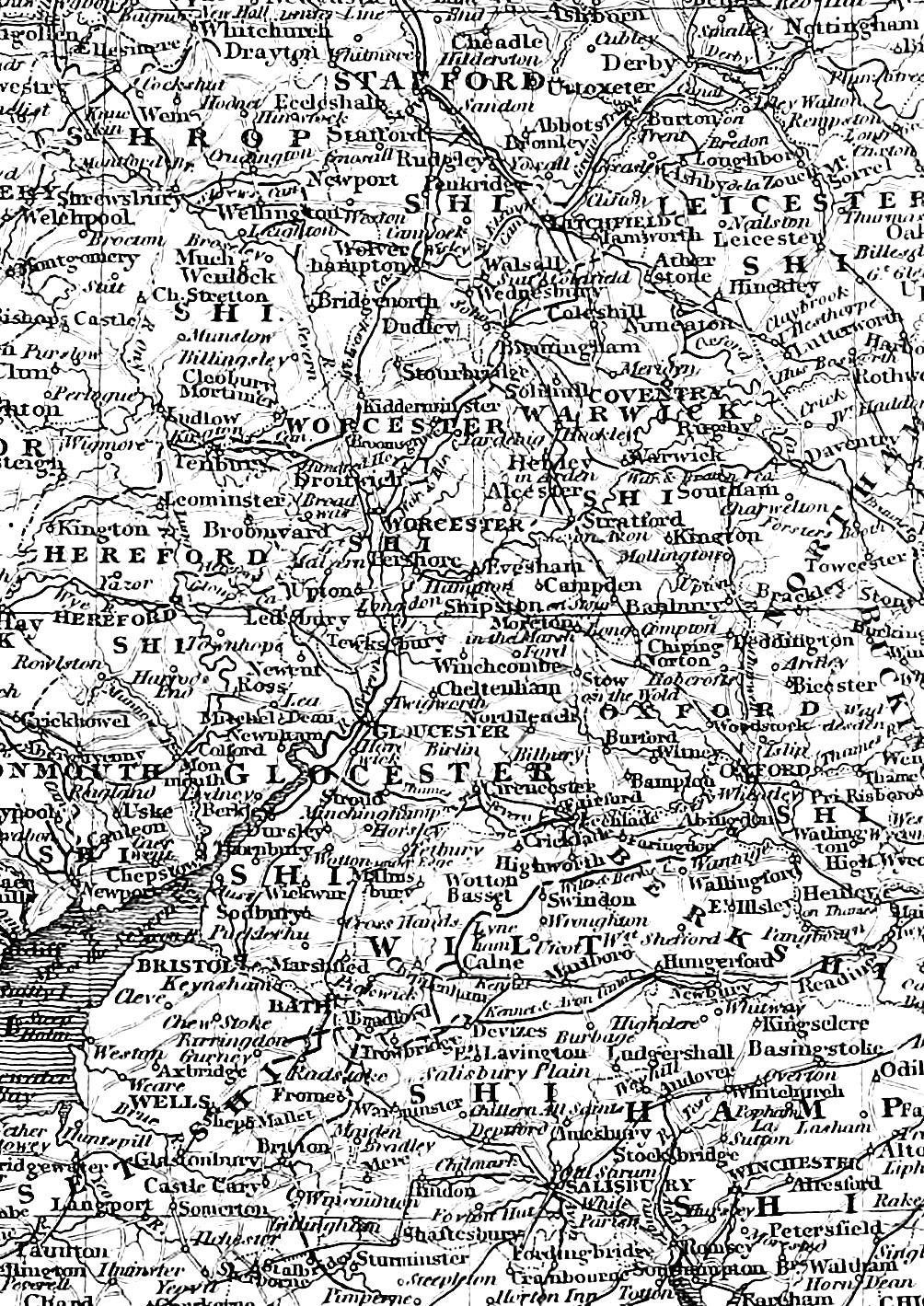

West Midlands Leicestershire Worcestershire