LANDLORD TIMES

April 2024

All change to Renters’ Reform Bill

Tenants will have to commit to a minimum four-month rental agreement as part of changes to the Renters’ Reform Bill.

In a three-page letter sent to Conservative ministerial colleagues just before Easter, levelling up minister Jacob Young

MP announced amendments would be tabled to the Bill when it returns to Parliament later this month.

It followed lobbying by backbench MPs who campaigned for a series of suggestions and changes after the Bill’s second reading.

One of the most contentious aspects of the Bill was the end to fixed term tenancies. It also included a ban on Section 21 so called no-fault evictions, allowing tenants to bring in their pets and the creation of an ombudsman to settle disputes.

Now the government has tabled “improvements” to some of the original proposals including abolishing fixed terms but establishing an initial six-month period for tenants, providing an assessment on the county court possession system before abolishing Section 21 and undertaking a review of local authority licensing schemes.

In his letter Mr Young also alluded to scrapping proposals which would have forced landlords to upgrade their properties to reach a certain EPC rating.

He also promised his department would be required to publish an annual parliamentary update on the state of the PRS. This would include data on the supply, size and location of properties. He said it would be put before Parliament in the form of a written statement.

The Bill, which was first introduced to Parliament last May, was intended to make the private rental sector fairer to both landlords and tenants and Mr Young maintained his commitment to this pledge in his letter.

He said: “We have been clear the Bill must strike the balance between delivering security for tenants and fairness for landlords.

“For renters, the abolition of section 21 and new decency standards gives certainty of secure and healthy homes, and protections for pet owners.

“For landlords, we are safeguarding their investment through strengthened and expanded possession grounds, a modern court system and a Property Portal to clarify their responsibilities in one place.

“And for both tenants and landlords, a new ombudsman will resolve disputes and support those managing tenancies. This will help avoid disputes unnecessarily escalating and keep more out of the court.”

Sheldon Bosley Knight’s associate director Nik Kyriacou said: “All the rumours and speculation about what will and won’t be included have caused unnecessary concern and anxiety for all those involved.

“We all just want to see the Bill back in the House, debated properly - fairly, openly and transparently. ”

“We all just want to see the Bill back in the House, debated properly - fairly, openly and transparently.

“The two major changes proposed – that of fixed terms and Section 21 –are fundamental and will impact the private rental sector for our landlords.

“We want landlords to feel as though they and their concerns have been heard and addressed. We cannot have a situation where landlords feel there is no reason to stay in the sector which will further exacerbate the issue of supply – something which has been absent from any conversation with the government.”

A DLUHC spokesperson said:

"Our landmark Renters (Reform) Bill will deliver a fairer private rented sector for both tenants and landlords. It will abolish section 21 evictions - giving people more security in their homes and empowering them to challenge poor practices.

“The Bill must strike the balance between delivering security for tenants and fairness for landlords. We have listened to feedback from landlord and tenant groups and from MPs and will bring amendments forward at Commons Report Stage after Easter recess.”

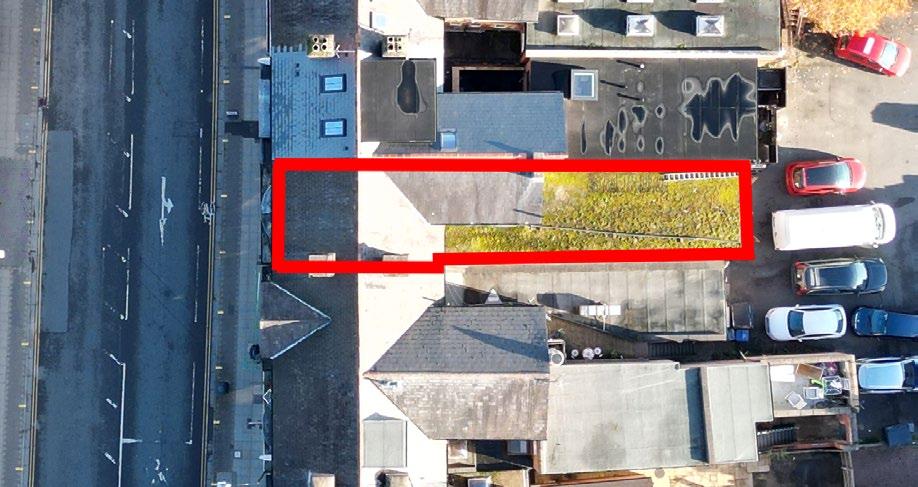

Opportunity knocks for Coventry

Coventry’s status as a place to live, work and invest in has been given a fresh boost thanks to approval for a development which will create nearly 1,000 homes.

It is the first phase of developer Shearer Property Regen Limited’s (SPRL) £450million mixed-use City Centre South project.

The homes, which will be available by early 2027, will be a mix of private sale (454), 200 affordable homes of which 145 are social rent and 55 shared ownership and 337 build to rent. They will be split across four buildings ranging in height from five to 19 storeys.

SPRL will deliver the scheme in partnership with the city council, housebuilder The Hill Group and with funding from the West Midlands Combined Authority (WMCA).

As well as the residential accommodation, 8,000 sqm of commercial floorspace and 17,000 sqm of public open space will be provided.

Elsewhere, figures from the Office for National Statistics (ONS) published last month show the number of people moving to the city is up 21% in the past five years.

It reported February’s monthly rents in the city averaged at £918, up 10.5% from £830 in February last year. This was higher than the rise in the West Midlands’ average of 9.2%.

Last month we reported on how Aldermore had rated Coventry third in its Buy-to-Let City Tracker league table.

Sheldon Bosley Knight’s lettings director, Rebecca Dean said:

“We have known for some time Coventry is a great place and full of potential.

“Property is generally priced below the national average so it represents a good opportunity for buy-to-let investors.

“Yields are also good and there is huge and growing demand for rentals especially given the high

student population as a result of the two universities in the city.

“The investment shown with the City Centre South project will only increase the desirability of the city as a great place to live and work and so those buy-to-let investors who wish to add to their portfolios should act now.”

In approving the plans, the council said the aim of the project was to bring people "back into the city to live, work, play, and socialise". Apartments will range in size from between studio and three bedrooms, and 200 will be affordable housing for local people. All will have either a balcony or terrace, and access to communal podium gardens, roof terraces and landscaped squares.

Coventry’s status was also elevated further last month when it was featured in the Sunday Times. The paper reported 68% of properties listed in Coventry’s sales market, are under offer or SSTC. This is far above the national average of 39%.

PRS supports nearly 400,000 jobs

More than 390,000 jobs in the wider economy are supported by the private rental sector (PRS) in England and Wales. The sector also makes a gross value added (GVA) contribution of £45 billion to the UK economy.

These are the findings from a report published by the National Residential Lettings Association (NRLA) and Paragon Bank.

It underlines the social as well as economic importance of the PRS across both countries.

The research, carried out by PwC, examined annual revenue for those landlords with fewer than 15 properties using regional data on the overall size of the PRS, as well as estimated revenue per rental property.

The analysis of various scenarios reveals the likely scale of the impact of a contraction in the size of the sector on landlords, tenants, and those whose jobs depend on it flourishing and surviving.

It is estimated 129,000 are directly

supported jobs and 260,000 are supported by the sector’s supply chain and through additional spending generated by it.

There are around 4.8 million households across England and Wales in the PRS, or around one in five households.

In the West Midlands, there are approximately 311,000 properties held by small to medium sized landlords. The GVA contribution is £3 billion and it is estimated the PRS supports 26,000 jobs.

In the East Midlands the estimated number of properties is 268,000, the GVA contribution is £2.4 billion and the estimated number of jobs supported is 21,000.

According to the report’s findings, a 10% reduction in the size of the sector could deprive the UK economy of £4.5bn of GVA.

A market contraction on this scale would also mean 39,000 jobs would need to be supported by alternative sources in order to prevent a rise in unemployment.

By contrast, should the sector grow by 10% it is estimated the GVA supported by the market could increase by £4.5bn, whilst those whose employment is supported by the PRS would also rise by approximately 39,000.

This report underlines how crucial it is that, at a time of chronic supply issues across the PRS, all stakeholder groups take into account its wider importance to landlords and tenants.

Sheldon Bosley Knight’s lettings manager Josh Jones said: “Alongside the importance of providing a roof over peoples’ heads, the PRS clearly plays an important role elsewhere in the economy.

“It is therefore no surprise the number of jobs supported by the sector, whether directly or indirectly is so high.

“As demand shows no sign of abating, it is imperative the PRS survives and thrives and governments of all political persuasions appreciate the value it brings to the wider economy and society as a whole.”

Making tax digital will cost landlords more

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) will cost landlords both extra money and time.

MTD will apply from April 2026 for those with qualifying income over £50,000 and from April 2027 for those with qualifying income over £30,000.

The new regulations require those affected to keep and preserve their tax records electronically and to submit reports to HMRC using approved software.

They also require qualifying landlords to submit a detailed

report for each tax year, encompassing the business’s trading or property income, allowable expenditure, and any claims for allowances or reliefs.

Additionally, interim cumulative reports must be submitted quarterly on fixed dates, ensuring continuous digital tracking of financial activities.

HMRC estimates an average transitional cost of £350 and an average annual additional cost of £110 for those within the £30,000 to £50,000 threshold.

Those in the above £50,000

Rents rise by average of 9%

Rents in the year to February have increased on average by 9%. It is the largest rise since the Office for National Statistics (ONS) started its rental price index.

In some areas, such as North West Leicestershire, the West Midlands, Coventry and Leicester the figure has been higher.

Landlords’ increased mortgage costs and a lack of demand which in turn is pushing up rents have been blamed for the rise.

According to ONS figures, North West Leicestershire saw average monthly rents rise by 10.8% to £777, Coventry’s average rents were up 10.5% to £918, Leicester was up 10.2% to £887 and the West Midlands saw rents jump to £853, 9.2% above last year’s figure.

However, North Warwickshire saw a rise of just 7.2% bringing the average monthly rent to £807. In Nuneaton and Bedworth the figure

was £725, up 4.7%, Stratford-uponAvon saw average monthly rents rise 4.5% to £1,011 and Oadby and Wigston rents were up 8.5% to £866 per month.

Warwick was bang on the national average with average monthly rents up 9% to £1,118.

Sheldon Bosley Knight’s lettings manager Temaera Moore said: “I feel it’s important to acknowledge that during the Covid 19 Pandemic, many landlords extended support to tenants by pausing rental increases, fostering stability during such uncertain times.

“However, as the market gradually rebounds, we're witnessing a correction where rental prices, previously kept below market standards, are now aligning with the prevailing economic conditions.

“Consequently, the notable increase in rental rates for 2024 reflects this adjustment, as landlords amend

threshold may incur an estimated average transitional cost of £285 and an average annual additional cost of £115.

Sheldon Bosley Knight’s associate director Nik Kyriacou said: “Digitalising tax returns may be beneficial in terms of reducing errors, but if it costs landlords more it will eat into their already fragile bottom line and is yet another cost which has been foisted on them.

“I hope it does not give them an incentive to leave the sector as this is something which we can ill-afford.”

their pricing structures in response to shifting market dynamics.”

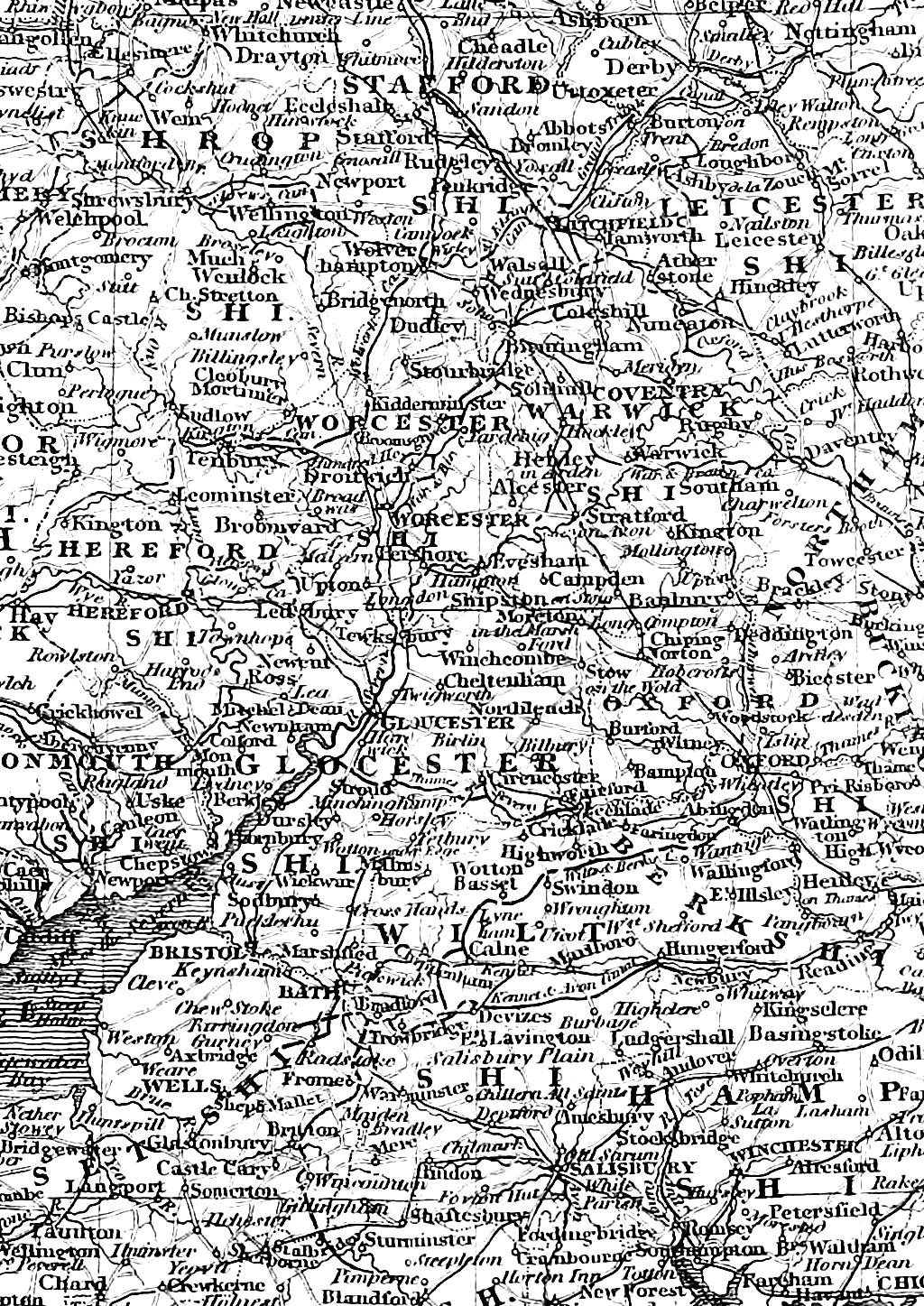

Rural renting sees dramatic rise

Rural renting has seen a dramatic rise over the past 10 years. Research shows the number of privately rented households has increased by 31% to a total of 450,000 extra households in county and rural areas.

Figures published by the County Councils Network show it’s higher than London’s increase of 25%.

According to the research, shire counties have seen a decrease in people buying homes in the same time period with high house prices being to blame.

With a general election expected to take place this year, councils are calling for stability and for the next administration to set out a long-term plan for housing, with local government a key player in discussions.

They are also calling for the Renters’ Reform Bill to be passed as soon as possible.

With figures suggesting rural renting is increasing in popularity, it could represent a good opportunity for landlords to think about investing in this area.

In Shipston-on-Stour, Sheldon Bosley Knight’s lettings manager Sarah Scaysbrook said: “I have definitely seen an increased demand in more rural properties in the last few years since Covid.

“I have found properties on the very edge of villages or in small hamlets have been some of our most popular, especially if they have a lovely view. The increase in demand has even pushed some rents above the asking price.”

In Pershore, Sheldon Bosley Knight’s lettings manager Natalie O’Sullivan added: “I usually find this is age dependant where they need to be able to walk into town for independence or on the other hand they want to be ‘out of the way’.

“With the cuts to many bus routes, it is more appealing I believe for the older generation to be closer to town and amenities, but with the working age tenant they can work from home, so enjoy the peace of being rural.

“Not many new landlords bring rural properties to the market despite the desire for people to let them. I would expect this is because

they are usually more expensive to buy in the first instance, so it isn’t as much of an attractive deal in terms of yield.”

Although many areas have seen a rise, it is not the case everywhere.

Sheldon Bosley Knight’s Leamington lettings manager, Claire Paginton said: “Many high end homes have large price tags and there aren’t the numbers of prospective tenants.

“We find families opt to be closer to town for ease of access to amenities.”

A CCN spokesman said: “It is widely accepted that the housing crisis is one that is worsening, with rising unaffordability locking hundreds of thousands out of getting onto the property ladder.

“This report does not suggest we alleviate these issues by concreting over our countryside. Instead it sets out a number of important yet easily deliverable recommendations that, taken together, could accelerate the delivery of new homes of all tenures where there is most need.”

No interest rate respite

Against a backdrop of a fall in inflation, the Bank of England chose last month to maintain interest rates at their current level of 5.25%.

With inflation now 3.4%, and widely expected to fall further in the next few months, it was hoped the Bank would cut interest rates.

For homebuyers or those looking for buy-to-let investments, the lack of downward movement was a little disappointing.

Sheldon Bosley Knight’s associate

director, Nik Kyriacou said: “The high cost of borrowing remains a significant obstacle for many and it’s disappointing there has been no incentive for those looking to buy.

“That said, it is encouraging inflation looks set to follow a downward trajectory and it is hoped interest rates would follow suit later in the year.

“Landlords in particular need an incentive to stay within the sector. While many outsiders have bemoaned the fact rents are rising,

Let sleeping men lie

There is plenty of uncertainty in life in general and the private rental sector in particular. However one thing is certain, sometimes it’s best to let sleeping dogs lie. Or in the case of one of our agents, a man. Not so long ago, our agent was with a client who was being shown around a potential buy-to-let apartment.

The tenant had been asked by the agent to vacate the property while the viewing took place but as it transpired had forgotten or lost the memo.

Nothing seemed amiss as the agent and client stepped into the apartment but there was a very odd sound – one which seemed to get louder as they went round the property.

The agent, sensing something was not quite right, decided to open the door to the bedroom with caution. He was wise to do so because as he did, he saw the curtains were closed and the noise, which by now was deafening, was emanating from the bed.

the vast majority of landlords do so only as a direct result of having to cover their own mortgage costs and their own very fragile bottom line.

“The high rates, born out of the disastrous Truss budget were a real kick in the teeth and a rate cut would have filtered through to tenants which would have been welcome for everyone.

“We can only hope the Bank thinks again and gives a much-needed boost next time it meets.”

There under the duvet was the tenant, sleeping like a baby and snoring like a tractor.

Despite this, the client wanted a quick look around the room to make sure it was of a decent size. So he tip-toed around and then he and the agent both left the sleeping man alone and made a swift exit.

The moral of the story is – always make sure you always set your alarm to go off at the correct time!

•

•

•

•

•

•

•

•

•

18,

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•