GRANVILLE CEMETERY MEMORIAL DAY CLEAN-UP

Granville Cemetery requests removal of ALL decorations except shepherd’s hooks and baskets that are RIGHT NEXT to or ON the monuments by June 9th. NO GLASS vases, jars or breakable containers should ever be placed in the cemetery. All shepherds’ hooks that are badly bent or rusted also need to be removed.

Families utilizing the Mausoleum are also reminded to remove any unsightly decorations or artificial flowers.

All items not cleared will be removed by the caretakers and discarded. Clearing these items represents an ever increasing expense to the cemetery. Your cooperation is greatly appreciated.

NO LIVE FLOWERS, PLANTS, BUSHES, ETC. ARE TO BE PLANTED AT ANY TIME! These make it impossible for the caretakers to do their job properly.

for an undated

supporter and Ottawa

• BELIEVE IN UGANDA

Continued from page 6

and no government support,” she said. “They see us as an answered prayer. We believe in these people.”

When the pigs have their first litter, the family keeps a pair, gives a pair to another family – thus the “revolving livestock” – and sells the remaining piglets. The program perpetuates good will and even survival, according to the release.

Since 2007, ITI has addressed poverty, famine, education, literacy, wellness and the impact of rampant HIV/AIDS, according to the release. Damron and her colleagues have worked alongside ITI and its director, Milton Tusingwire, much of that time.

Since 2008, Damron and her teams have built and continue to support Glory Primary School, a medical clinic, 14 new homes and 11 libraries, according to the release.

BIUG is currently providing financial assistance to 30 families and four homes are under construction.

“The villagers don’t care if we ever bring them anything,” Damron said in the release. “They just want us to be part of their lives. ... Their gratitude far outweighs anything we could ever give them.”

“These people have zero resources

“On piglet distribution day, women come in their finest dresses, sometimes with a child on their back. It is an exuberant event. When you hand over a pig, you are handing over a life-changing animal,” Damron said.

A pig operation can have immense benefit to a family by providing it the means to purchase medicine, food, seed and children’s tuition.

To contribute to Believe in UGanda and the revolving livestock program, visit srccf.org, call 815-252-2906 or stop in the Starved Rock Country Community Foundation at 116 W. Lafayette St., Suite 2, in Ottawa.

Photo provided by Starved Rock Community Foundation

Father Adonia poses

photo with his daughter, Tallent, and son, Kelvin. BIUG

Township High School teacher Kellee Granados sponsored the family.

County of Putnam

State of Illinois

Official publication of the general assessments of real property of record as of January 1, 2025 in the TOWNSHIP OF GRANVILLE, Putnam County, Illinois as certified to and equalized by this office. The Supervisor of Assessments has applied an equalization factor to the below listed classes of property in GRANVILLE township:

Senior Citizen tax Freeze Exemption- is for taxpayers who will be 65 or older during the assessment year and have total household income of less than $65,000 for the prior year. This exemption freezes your assessed value NOT your property taxes!

Home Improvement Exemption- reduces the value by the amount of increase in assessed value due to improvements being added to an existing residential structure or a rebuilding of residential structures following a catastrophic event. This is a four year exemption for improvements up to $25,000 in assessed value.

Pursuant to 35 ILCS 200/10-115, the farmland assessments for 2025 (payable 2026) will increase by 10% of the preceding year’s median cropped soil productivity index as certified by the Illinois Department of Revenue with data provided by the Farmland Assessment Technical Advisory Board.

NOTICE TO TAXPAYERS

All property in Putnam County, other than farmland and coal, are assessed at 33.33% of the fair market value. Your property is to be assessed at the above listed median level of assessment for the assessment district. You may check the accuracy of your assessment by dividing your assessment by the median level of assessment. (33.33%) The resulting value should equal the estimated fair cash value of your property. If the resulting value is greater than the estimated fair cash value of your property, you may be over-assessed. If the resulting value is less than the estimated fair cash value of your property, you may be under-assessed. Your assessment, less exemptions will be used to determine your 2025 payable 2026 property tax bill. For example: Take your equalized assessed value, subtract any exemptions to determine your net taxable assessed value. Take that number times the most current tax rate to get an estimated amount of your property tax bill.

Taxpayers who consider their property incorrectly assessed need to contact the Supervisor of Assessments at 815-925-7238 to discuss their property. If you are not satisfied with the result, you may file an assessment complaint with the Putnam County Board of Review by July 3rd, 2025 at 4:00 p.m.

YOU MUST FILE AN ASSESSMENT COMPLAINT WITH THE BOARD OF REVIEW TO PRESERVE YOUR RIGHT TO AN APPEAL.

All assessment complaints filed with the Board of Review must be in writing using the forms provided by the board. Assessment complaint forms and instructions can be acquired from the Putnam County Supervisor of Assessments office in the Putnam County Courthouse at 120 N. 4th Street, Hennepin, IL or downloaded and printed on line at putnamil.gov If you have questions about filing a complaint, you may contact the Assessor’s office at 815-925-7238.

You may be eligible for one or more of the following homestead exemptions if the property is your primary residence, you are liable for paying the property taxes, and in some instances, meet additional qualifications.

Owner Occupied Exemption: $6000 reduction in EAV

Senior Citizen Homestead Exemption- this exemption is for people ages 65 and older $5000 reduction in EAV

Disabled Veteran’s Standard homestead Exemption: If the veteran has a service connected disability of 30% but less than 50% the annual exemption is $2500. If the service connected disability of 50% or more but less than 70% then the annual exemption is $5000. If the service connected disability is 70% or more, then the residential property is exempt from taxation under this code.

Disabled Veteran Homestead Exemption- (Specially adapted housing) up to $100,000 reduction in EAV if the federal government has approved payment to construct or modify your home if you are a 100% disabled veteran.

Returning Veteran Exemption- $5000 reduction in EAV the year that you return from an armed conflict and the following year.

Disabled Person- $2000 reduction in EAV if you meet disability requirements.

If you have any question, please call my office at 815-925-7238

Tamara Mehalic C.I.A.O.

Putnam County Supervisor of Assessments

The following listing is in Parcel ID order.

GRANVILLE

County of Putnam State of Illinois

Official publication of the general assessments of real property of record as of January 1, 2025 in the TOWNSHIP OF HENNEPIN, Putnam County, Illinois as certified to and equalized by this office.

The Supervisor of Assessments has applied an equalization factor to the below listed classes of property in Hennepin township: Property

Pursuant to 35 ILCS 200/10-115, the farmland assessments for 2025 (payable 2026) will increase by 10% of the preceding year’s Continued on next page

Continued from previous page

median cropped soil productivity index as certified by the Illinois Department of Revenue with data provided by the Farmland Assessment Technical Advisory Board.

NOTICE TO TAXPAYERS

All property in Putnam County, other than farmland and coal, are assessed at 33.33% of the fair market value. Your property is to be assessed at the above listed median level of assessment for the assessment district. You may check the accuracy of your assessment by dividing your assessment by the median level of assessment. (33.33%) The resulting value should equal the estimated fair cash value of your property. If the resulting value is greater than the estimated fair cash value of your property, you may be over-assessed. If the resulting value is less than the estimated fair cash value of your property, you may be under-assessed. Your assessment, less exemptions will be used to determine your 2025 payable 2026 property tax bill. For example: Take your equalized assessed value, subtract any exemptions to determine your net taxable assessed value. Take that number X(times) the most current tax rate to get an estimated amount of your property tax bill.

Taxpayers who consider their property incorrectly assessed need to contact the Supervisor of Assessments at 815-925-7238 to discuss their property. If you are not satisfied with the result, you may file an assessment complaint with the Putnam County Board of Review by July 3, 2025 by 4:00 p.m.

YOU MUST FILE AN ASSESSMENT COMPLAINT WITH THE BOARD OF REVIEW TO PRESERVE YOUR RIGHT TO AN APPEAL.

All assessment complaints filed with the Board of Review must be in writing using the forms provided by the board. Assessment complaint forms and instructions can be acquired from the Putnam County Supervisor of Assessments office in the Putnam County Courthouse at 120 N. 4th Street, Hennepin, IL or downloaded and printed on line at putnamil.gov. If you have questions about filing a complaint, you may contact the Assessor’s office at 815-925-7238.

You may be eligible for one or more of the following homestead exemptions if the property is your primary residence, you are liable for paying the property taxes, and in some instances, meet additional qualifications.

Owner Occupied Exemption: $6000 reduction in EAV

Senior Citizen Homestead Exemption- this exemption is for people ages 65 and older $5000 reduction in EAV

Senior Citizen tax Freeze Exemption- is for taxpayers who will be 65 or older during the assessment year and have total household income of less than $65,000 for the prior year. This exemption freezes your assessed value NOT your property taxes!

Home Improvement Exemption- reduces the value by the amount of increase in assessed value due to improvements being added to an existing residential structure or a rebuilding of residential structures following a catastrophic event. This is a four year exemption for improvements up to $25,000 in assessed value.

Disabled Veteran’s Standard homestead Exemption: If the veteran has a service connected disability of 30% but less than 50% the annual exemption is $2500. If the service connected disability of

50% or more but less than 70% then the annual exemption is $5000. If the service connected disability is 70% or more, then the residential property is exempt from taxation under this code.

Disabled Veteran Homestead Exemption- (Specially adapted housing) up to $100,000 reduction in EAV if the federal government has approved payment to construct or modify your home if you are a 100% disabled veteran.

Returning Veteran Exemption- $5000 reduction in EAV the year that you return from an armed conflict and the following year.

Disabled Person- $2000 reduction in EAV if you meet disability requirements.

If you have any question, please call my office at 815-925-7238

Tamara Mehalic C.I.A.O.

Putnam County Supervisor of Assessments

The following listing is in Parcel ID order.

HENNEPIN

County of Putnam

State of Illinois

Official publication of the general assessments of real property of record as of January 1, 2025 in the TOWNSHIP OF MAGNOLIA, Putnam County, Illinois as certified to and equalized by this office.

The Supervisor of Assessments has applied an equalization factor to the below listed classes of property in MAGNOLIA township:

Pursuant to 35 ILCS 200/10-115, the farmland assessments for 2025 (payable 2026) will increase by 10% of the preceding year’s median cropped soil productivity index as certified by the Illinois Department of Revenue with data provided by the Farmland Assessment Technical Advisory Board.

NOTICE TO TAXPAYERS

All property in Putnam County, other than farmland and coal, are assessed at 33.33% of the fair market value. Your property is to be assessed at the above listed median level of assessment for the assessment district. You may check the accuracy of your assessment by dividing your assessment by the median level of assessment. (33.33%) The resulting value should equal the estimated fair cash value of your property. If the resulting value is greater than the estimated fair cash value of your property, you may be over-assessed. If the resulting value is less than the estimated fair cash value of your property, you may be under-assessed. Your assessment, less exemptions will be used to determine your 2025 payable 2026 property tax bill. For example: Take your equalized assessed value, subtract any exemptions to determine your net taxable assessed value. Take that number times the most current tax rate to get an estimated amount of your property tax bill.

Continued on next page

Continued from previous page

Taxpayers who consider their property incorrectly assessed need to contact the Supervisor of Assessments at 815-925-7238 to discuss their property. If you are not satisfied with the results, you may file an assessment complaint with the Putnam County Board of Review by July 3rd, 2025 at 4:00 p.m.

YOU MUST FILE AN ASSESSMENT COMPLAINT WITH THE BOARD OF REVIEW TO PRESERVE YOUR RIGHT TO AN APPEAL.

All assessment complaints filed with the Board of Review must be in writing using the forms provided by the board. Assessment complaint forms and instructions can be acquired from the Putnam County Supervisor of Assessments office in the Putnam County Courthouse at 120 N. 4th Street, Hennepin, IL. or downloaded and printed on line at putnamil.gov . If you have questions about filing a complaint, you may contact the Assessor’s office at 815-925-7238.

You may be eligible for one or more of the following homestead exemptions if the property is your primary residence, you are liable for paying the property taxes, and in some instances, meet additional qualifications.

Owner Occupied Exemption: $6000 reduction in EAV

Senior Citizen Homestead Exemption- this exemption is for people ages 65 and older $5000 reduction in EAV

Senior Citizen tax Freeze Exemption- is for taxpayers who will be 65 or older during the assessment year and have total household income of less than $65,000 for the prior year. This exemption freezes your assessed value NOT your property taxes!

Home Improvement Exemption- reduces the value by the amount of increase in assessed value due to improvements being added to an existing residential structure or a rebuilding of residential structures following a catastrophic event. This is a four year exemption for improvements up to $25,000 in assessed value.

Disabled Veteran’s Standard homestead Exemption: If the veteran has a service connected disability of 30% but less than 50% the annual exemption is $2500. If the service connected disability of 50% or more but less than 70% then the annual exemption is $5000. If the service connected disability is 70% or more, then the residential property is exempt from taxation under this code.

Disabled Veteran Homestead Exemption- (Specially adapted housing) up to $100,000 reduction in EAV if the federal government has approved payment to construct or modify your home if you are a 100% disabled veteran.

Returning Veteran Exemption- $5000 reduction in EAV the year that you return from an armed conflict and the following year.

Disabled Person- $2000 reduction in EAV if you meet disability requirements.

If you have any question, please call my office at 815-925-7238

Tamara Mehalic C.I.A.O.

Putnam County Supervisor of Assessments

The following listing is in Parcel ID order. MAGNOLIA

Continued from previous page

FEDDERICKE, JOY L. 04-00-036-170 20,481 21,921

VILLAGE OF MAGNOLIA 04-00-036-175 0 0

HIGHSMITH, WILLIAM T 04-00-036-180 32,531 33,971

HOLMSTROM FAMILY PARTNERSHIP, 04-00-036-190 19,218

HIGHSMITH, WILLIAM T 04-00-036-200 6,348 7,788

SMITH, MATTHEW AND JONNELLE 04-00-037-011 56,659

SMITH, MATTHEW AND JONNELLE 04-00-037-012 0 1,440

SMITH, MATTHEW L. AND JONNELLE 04-00-037-020 20,988

LOGAN, JESSICA A 04-00-037-030 1,902 3,342

LOGAN, JESSICA A 04-00-037-040 39,719

LENCZEWSKI, CARL D 04-00-037-050 7,048

MAGNOLIA TOWNSHIP 04-00-037-060 0 0

WILLIAMS, STEPHEN and DEBRA 04-00-037-070 19,690 20,649

WILLIAMS, STEPHEN and DEBRA 04-00-037-080 801 2,720

WILLIAMS, STEPHEN and DEBRA 04-00-037-090 506 1,945

DIENST, WESLEY AND JENNIFER 04-00-037-100 49,593 53,910

WEST, MATTHEW, WELLWNREITER, C 04-00-037-110 36,927 38,367

SMITH, MATTHEW L. AND JONELLE 04-00-037-120 21,473 24,351

BILLUPS, CAROLYN 04-00-037-140 32,742 34,182

BILLUPS, MINDY J 04-00-037-150 42,747 44,187

MALONE, KEVIN T 04-00-037-160 29,956 31,396

KRUPKA, SYLVESER 04-00-037-170 69,991 72,869

KRUPKA, SYLVESER 04-00-037-180 0 1,439

GLENN, TERRILL ET UX 04-00-037-190 29,777 34,097

HOLMSTROM, BRETT 04-00-037-210 39,738 41,178

SMITH, DERRICK M 04-00-037-220 21,294 22,734

WENZLAFF, DUANE H 04-00-037-230 53,998 55,438

SMITH, MATTHEW AND JONELLE 04-00-037-240 18,507 21,385

SMITH, MATTHEW AND JONNELLE 04-00-037-250 3,634 5,074

PLASKY, MARY 04-00-037-260 36,138 40,458

HAHN, JACOB T 04-00-037-270 25,980 27,420

HAHN, JACOB 04-00-037-280 0 1,440

GARLAND , RANDALL S 04-00-037-290 0 1,440

KELLER, MARVIN R., KELLER, JEN 04-00-037-300 27,181 28,621

KELLER, MARVIN R., KELLER, JEN 04-00-037-310 0 359

KUPIEC, ANDRZEJ & ANNA 04-00-037-311 74,225 78,542

KELLER, MARVIN 04-00-038-010 0 1,079

HARRIS, JASON D AND KAYLA R 04-00-038-015 45,521 46,961

CIMEI, JAMES S ET UX 04-00-038-020 62,742 64,182

HOLMSTROM, PATRICK D 04-00-038-030 0 1,440

HOLMSTROM, PATRICK D 04-00-038-040 13,915 15,355

FOWLS, BRENDA 04-00-038-050 25,831 27,271

FOWLS, BRENDA 04-00-038-060 0 720

CIMEI, JAMES S ET UX 04-00-038-070 0 1,712

UNITED METHODIST CHURCH, 04-00-038-080 0 0

GLENN, ANDREW & JENNIFER 04-00-038-100 34,888 36,328 MILLER, KARI 04-00-038-110 34,345 37,223

MAGNOLIA CEMETARY ASSOCIATION 04-00-038-155 0 0

JUNKER, DON 04-00-038-161 46,128 54,069

CHICAGO TITLE LAND TRUST CO, 04-00-038-170 71,677 77,172

BATES, HENRY J. ET UX 04-00-038-180 0 1,440

MAGNOLIA CEMETERY ASSOCIATION 04-00-038-190 0 9,822

BATES, HENRY J. ET UX 04-00-038-200 0 1,492 AMERICA’S HEARTLAND PROP. MANA 04-00-038-210 51,407 55,824

KAYS, TRUST OF THE MARJORIE L 04-00-038-241 52,841 65,900

JURKAS, ROBERT J 04-00-038-250 68,902 85,443

BILLUPS, JERRY W 04-00-038-290 65,068 73,033

OLIVER, ALICE C. & OLIVER, CH 04-00-038-304 77,267 82,630

SMITH, CLARENCE AND LAURIE 04-00-038-310 0 2,878

GRAY, TRAVIS E. ET UX & GRAY, 04-00-038-321 47,395 50,273

RINGENBERG, STEVEN & JANICE 04-00-038-322 58,009

KAYS, NICOLE & KAYS, JUSTIN E 04-00-039-010 0

KAYS, NICOLE & KAYS, JUSTIN E 04-00-039-020 83,647

KAYS, NICOLE & KAYS, JUSTIN E 04-00-039-025 0 480

KAYS, NICOLE & KAYS, JUSTIN E 04-00-039-030 0 4,317

GIBSON, TOMMY LEE 04-00-039-040

TRAVIS E. ET UX & GRAY, 04-00-039-066

DAVID & CHERYL 04-00-039-150

MARVIN 04-00-039-160 0

MARVIN JR ET UX & MI 04-00-039-170

VASILIOS & KE 04-00-039-201

HOLMSTROM, PATRICK D ET UX & H 04-00-039-220

HOLMSTROM, PATRICK D ET UX & H 04-00-039-230 0 1,440 GARLAND, RANDALL S

MARK & SHERRIE 04-00-039-255

CUATE, DELTA, ZAVALA, JEREMY L 04-00-039-275 101,615

CIMEI, ANDREW S. AND AMBER L. 04-00-039-310 33,818

CUATE, DELTA, ZAVALA, JEREMY L 04-00-039-311 0

MARK A & DEBRA 04-00-040-025

ANTHONY I 04-00-040-045

KATHLEEN A 04-00-040-060

KOVAL, JAMES JOHN & CAROL J, 04-00-040-085

RACHEL L 04-00-040-130

LISA S.

MATTHEW J 04-00-041-102

MATTHEW J 04-00-041-103 0 522 STUNKEL, AARON E. ET UX & STU 04-00-041-135

THOMPSON, ROBERT, % HUSTON BAI04-00-041-150 0 1,440

THOMPSON, ROBERT, % HUSTON BAI04-00-041-160 0

THOMPSON, ROBERT, % HUSTON BAI04-00-041-170 64,902

BBH FARMS INC 04-00-041-225 0 110 CRANE, JUDITH , RENINI, MATTHE 04-00-042-240 64,118

GIELOW, KENNETH C & MISCHELLE 04-00-042-250 53,328

SHANNON 04-00-043-020 37,011

SHANNON 04-00-043-030 0 2,878

DORENE 04-00-043-070 50,643 53,521 GORA, TRUST, DORENE 04-00-043-080 0 2,878

GORA, TRUST, DORENE 04-00-043-090 0 2,878 Continued on next page

Continued from previous page

GORA, TRUST, DORENE 04-00-043-100 0 2,878

JENKY, DANIEL R. MOST REV. 04-00-043-110 0 2,878

CLEMENS, DIANE R 04-00-043-120 0 2,878

JENKY, DANIEL R 04-00-043-130 0 1,939

JENKY, DANIEL R 04-00-043-140 0 1,939

JENKY, DANIEL R. MOST REV. 04-00-043-150 55,328 58,206

JENKY, DANIEL R 04-00-043-160 67,772 70,650

NIEMEYER, MATTHEW A ET AL 04-00-043-170 52,096 54,974

GORA, TRUST, DORENE 04-00-043-180 38,113 40,991

CHAMBERS, KENNETH D ET UX 04-00-043-220 69,288 75,046

DZIOPALA, THOMAS G 04-00-043-230 0 3,373

HERR, ELISA AND JOHN 04-00-043-240 0

HERR, JOHN D 04-00-043-250 0

HERR, JOHN D., SYVERSON, ELISA 04-00-043-260 0

HERR, JOHN D., SYVERSON, ELISA 04-00-043-270 66,304

HERR, JOHN AND ELISA 04-00-043-280 0

ALLEN, BLAINE R 04-00-043-290 0

JOHNSON, JAMES AND KAREN ET A 04-00-043-300 0

FOWKES, BRANDON L & JULIA M 04-00-043-310 86,307

FOWKES, BRANDON L & JULIA M 04-00-043-320 0 1,669

WILLIAMSON, JAMES M 04-00-044-010 57,889

WEIDE, EDWARD H. & HELEN R. 04-00-044-020 65,759 69,132

IMMACULATE CONCEP CHURCH & S 04-00-044-030 0 586

CAMPBELL,DAVID B, KING, DEBORA 04-00-044-050 107,278

BAELE, BRANDY 04-00-044-060 64,078 67,451

, PEGGY 04-00-044-090

GUYNN, RICKY A. & GUYNN, SCOT 04-00-044-100 64,379 67,752

HAUN, TERESA 04-00-044-110 72,802 76,175

MOSQUEDA, OLIVIA J ET AL 04-00-044-120 43,200 46,573

FOSTER, DAVID T AND TIFFANY P 04-00-044-130

PEGGY

SMITH, PEGGY 04-00-044-160 0

CAMPBELL, DAVID B, KING, DEBOR 04-00-044-170 0

BRESTER, LAURIE L. 04-00-044-180 41,460

CALBOW, DUANE & MARILYN 04-00-044-190 81,194

BERG, BRADLEY R. ET UX & BERG, 04-00-044-200 48,549

CAMPBELL, DAVID B, KING, DEBOR 04-00-044-210 0

CAMPBELL, DAVID B, KING, DEBOR 04-00-044-220 0 406

MAGNOLIA TOWNSHIP 04-00-044-225 0 0

SCHUMACHER, KENNETH W. 04-00-044-230 0 786

PARCHER, AARON M. AND ELIZABET 04-00-045-010 47,934 51,307

PARCHER, AARON M. AND ELIZABET 04-00-045-020 0 3,373

MCCAULEY, LEO & CHARLENE 04-00-045-045 44,723 50,481 DAY, THOMAS 04-00-045-065 6,212 11,970

SOEHRMAN, PAULA 04-00-045-080 44,712 47,590

HOLST, MATTHEW 04-00-045-090 35,281 38,159

PANTENBURG, DAVID F 04-00-045-100 0 2,878

PANTENBURG, DAVID F 04-00-045-110 35,978 38,856

WISE, THOMAS N 04-00-045-125 27,713 33,469 MAYERS, MARYLYNN & MAYERS, JR 04-00-045-145 43,082 48,840

CAMPBELL, RAYNOR & JENNIFER 04-00-045-170 38,685

CAMPBELL, RAYNOR & JENNIFER 04-00-045-180 0

CAMPBELL, RAYNOR & JENNIFER 04-00-045-190 0 2,878

OLIVET, JOHN ET UX 04-00-045-200 0 2,878

OLIVET, JOHN ET UX 04-00-045-210 25,966 28,844

MCNABB METHODIST CHURCH, 04-00-045-220 0 0

BUETTNER, RYAN & BRITTANY 04-00-045-240 50,284

HALBLEIB, CONSTANCE 04-00-045-255

KELLER, CHARLES, KELLER, MARTI 04-00-045-275

KELLER, MARTIN J. 04-00-045-280 0

KELLER, MARTIN J. 04-00-045-300

JONATHON

PAUL & KAREN 04-00-046-090 0 2,878

ROBERT, HAIR, DONNA 04-00-046-140

JOSEPH AND RENEE 04-00-046-160 0

TONIONI, JOSEPH G. & RENEE J J 04-00-046-170

STEVE ET UX & HALBL 04-00-047-040

COREY A., SIPE, TODD I. 04-00-047-120

VILLAGE OF 04-00-047-250

EVAN C 04-00-048-185

TRUSTEE, SHARON L 04-00-048-205

ENG, JACLYN L 04-00-048-225

Continued on next page

GRE HOLDINGS, LLC, 04-00-050-132 0 1,105 GRE HOLDINGS, LLC, 04-00-050-133 7,968 8,946

MORENO, LINDA 04-00-050-135 0 419

MORENO, LINDA 04-00-050-138 15,012 15,850 MORENO, LINDA 04-00-050-150 0 1,440

CAMPBELL, DAVID B ET AL & CHAM 04-00-050-160 20,199 21,304

PELLEGRINO, LLC, 04-00-050-170 26,401 28,610 GRE HOLDINGS, LLC, 04-00-050-182 16,768 19,714

SANDBERG, RYAN J. AND BRANDY L 04-00-050-183 17,166 23,056 GRE HOLDINGS, LLC, 04-00-050-266 4,693 5,246 EDGCOMB, MICHAEL S & TAMMY M 04-00-050-267 3,730 7,127

COLE’S SALES AND SERVICE INC., 04-00-050-301 19,752 28,329

EDGCOMB, MICHAEL S. & TAMMY M. 04-00-051-055 0 5,756

WHITNEY, BART AND CHRISTINA 04-00-051-075 34,739 39,059

TAYLOR, JACOB A 04-00-051-110 38,896

TAYLOR, JACOB A 04-00-051-120 0

TAYLOR, JACOB A 04-00-051-130 0

NANCE, JUSTIN, BILLUPS, MINDY 04-00-051-140 27,690 30,568

BURR, RICHARD ET UX 04-00-051-150 0 1,440

CARRILLO, MIGUEL ANGEL, PALACI 04-00-051-160 0

CARRILLO, MIGUEL ANGEL, PALACI 04-00-051-170 0

CARRILLO, MIGUEL ANGEL, PALACI 04-00-051-180 10,919

RICHARDSON, ROGER 04-00-051-190 0

RICHARDSON, ROGER 04-00-051-200 0

RICHARDSON, ROGER 04-00-051-210 0 1,440

HUFFSTODT, THOMAS J 04-00-051-220 0

HUFFSTODT, THOMAS J 04-00-051-230 0

HUFFSTODT, THOMAS J 04-00-051-240 0 2,878

HUFFSTODT, THOMAS J 04-00-051-250 38,118

BIMA, JOHN & VICKI 04-00-051-284 123,107 144,154

MCNAUGHTON, FRANK W. JR. 04-00-051-285 76,722 80,755

MCNABB FIRE PROT DIST 04-00-051-287 0 0

GRASSER, MICHAEL AND JOSLYN 04-00-051-291 0 8,966

MCNAUGHTON, JR., FRANK W. 04-00-051-292 0 4,033

GRASSER, MICHAEL KENNETH ET UX 04-00-051-293 149,749 153,782

GRASSER, MICHAEL K ET UX & GRA 04-00-051-294 0 4,033

KAZMIERCZAK, KEVIN J 04-00-052-020 51,503 60,475

KING, KATHY 04-00-052-030 48,756 53,411

BENCE, ANAHI A 04-00-052-040 49,786 57,327

JOHNSON, BETTY M 04-00-052-050 61,468 69,009

DAVIS, DANIEL & HOLLACE 04-00-052-060 41,203 45,858

HANSEN, LAURIE & HANSEN, BRET 04-00-052-075 60,200 65,243

SCHUSTER, ROBERT E ET UX 04-00-052-090 57,932 62,972

BIAGINI, AUSTIN PAUL 04-00-052-100 36,052 43,623

MCNABB VILLAGE 04-00-052-140 0 0

CAMPBELL, SUSAN M 04-00-052-150 54,702 62,425

COLEMAN, ROSELYNN 04-00-053-010 91,004 96,044

LORENTZEN, JASON L 04-00-053-020 42,971 47,626

HAAR, RICHARD AND CANDACE 04-00-053-030 49,239 54,279

HAAR, RICHARD F. AND CANDACE S 04-00-053-070 0 5,040

MEKLEY, JODY R 04-00-053-080 29,687 34,727

SANDBERG, SEAN S 04-00-053-090 27,214 32,254

MALONE, JANET 04-00-053-116 44,806

ANGELO, MARK A AND CHRISTINE M 04-00-053-117 0 828

KERKHOFF LLC 04-00-053-160 0

KERKHOFF LLC 04-00-053-170

RICHARD ET UX & PETE 04-00-054-090

DANIEL & ANNETTE 04-00-054-110

RICHARDSON, DANIEL & ANNETTE 04-00-054-120 0 4,987 CIMEI, KATHLEEN A & CIMEI, ST 04-00-054-130

McFADIN, MILES C, WALLACE, RHI 04-00-055-023 67,469

JEPPSON, AUSTIN LANE 04-00-055-030

AUSTIN LANE 04-00-055-040 0

SANDBERG, BRANDY L. & SANDBER 04-00-055-050

SANDBERG, BRANDY L. & SANDBER 04-00-055-060 0 2,911 LASALLE BANK NATIONAL ASSOC, T 04-00-055-071

BRUCE A ET UX 04-00-055-100

JR., ROGER ET UX 04-00-055-130

JUSTIN A, EAGER, GRACE 04-00-055-285

KURT & RHONDA 04-00-055-290 0

FOGLE, KURT R ET UX 04-00-055-310

LARRY & ZORZI, JE 04-00-056-010 55,795

JOHN D 04-00-056-020 65,436

KELLER, MARTIN J 04-00-056-030 82,919 85,451 VAZQUEZ, MONICA 04-00-056-040

JR., JAMES W 04-00-056-055

WIESBROCK, JR., JAMES W 04-00-056-060 0 2,532 CARREON-CHAVEZ, PERLA ANAHI 04-00-056-070 51,597

CREW, ROBERT ET UX & CREW, PAT 04-00-056-080 44,257 48,456

DANIEL T 04-00-056-140 29,687

PIERSKI, ROBERT A. & THOMAS 04-00-056-150 37,082

VOHS, JAMES, VOHS, ASHLEY 04-00-056-205 83,037

KESSINGER, FAMILY TRUST, KENNE 04-00-056-220 0 5,072

TRUSTEE, MICHAEL & JA 04-00-056-230

BOUXSEIN, DARRYL 04-00-056-240 0 5,072

BOUXSEIN, DARRYL L 04-00-056-250 0 5,072

BOUXSEIN, DARRYL L 04-00-056-260 0 5,072

LUTES, JORDAN 04-00-056-270 76,911 81,983 Continued from previous page

Continued on next page

Continued from previous page

LUTES, JORDAN 04-00-056-280 0 5,072

GENSINI, VITTORIO & MILLER, 04-00-056-295 66,190 73,793

FAY, RICHARD JUDD, CHERYL, PI 04-00-056-302 0 2,532

FAY, RICHARD JUDD, CHERYL, PI 04-00-056-310 68,980 74,052

ANDRACKE, ALAN G 04-00-056-320 67,297 72,369

AURORA GW CONSTRUCTION INC 04-00-057-010 7,006 12,078

MEKLEY, ELMER JR. 04-00-057-020 0 2,089

MEKLEY, ELMER JR. 04-00-057-030 0 628

MEKLEY, ELMER JR. 04-00-057-040 0 628

MEKLEY, ELMER JR. 04-00-057-050 0 628

MEKLEY, ELMER JR. 04-00-057-060 0 502

MEKLEY, ELMER JR. 04-00-057-070 0

TRONE, CARTER 04-00-057-100 42,576

TRONE, CARTER 04-00-057-110 0 4,224

ESHELMAN, CHRISTINA M., BORRI, 04-00-057-120 64,893 69,117

AZAROVA, GALINA B 04-00-057-130 28,842 33,066

BARRERA, DELORES 04-00-057-145 32,962 43,517

KRIEWALD, GERALD J. ET UX & KR 04-00-057-162 0 2,108

KRIEWALD, LYDIA A. & KRIEWALD 04-00-057-170 107,641

BRANDNER, AIMEE J. & BRANDNER 04-00-057-180 37,082

WINK, RAYMOND C ET UX 04-00-057-190 40,859

YUHAS, JAMES & DANELLE 04-00-057-200 65,864

YUHAS, JAMES & DANELLE 04-00-057-210 0 4,224

ROBERSON, KAREN 04-00-057-220 0 4,224

QUIGLEY-HOLMBECK, ALISIA N 04-00-057-230 24,721 29,985

BOLLENGIER, DAN E. AND PAMELA 04-00-057-240 51,016 59,464

LUTES, RICHARD L 04-00-057-260 66,954 71,178 LUTES, RICHARD L 04-00-057-270 0 4,224

NEWHALFEN, JOHN MARSHALL 04-00-057-280 51,503 55,727

HIESTER, LARRY & MARY 04-00-057-290 28,842 33,066

BROVIAK, EUGENE 04-00-057-300 0 4,224

SHAW, JR, JAMES G & PATRICIA 04-00-057-310 32,962 40,626

TONIONI, STEPHEN L. AND MICHEL 04-00-057-320 49,443 57,803

DAVIS, TODD & KARA, CODY, FIED 04-00-058-051 0

MIGLIORINI, RONALD ET UX & MIG 04-00-058-061 0

MIGLIORINI, RONALD ET UX 04-00-058-070 0 298

MIGLIORINI, RONALD ET UX 04-00-058-080 0 367

MIGLIORINI, RONALD ET UX 04-00-058-090 6,533 7,803

DOSE, ELMER 04-01-011-000 69,802

GRIFFITH FAMILY FARMS, LP, 04-01-012-000 0 1,382

GRIFFITH FAMILY FARMS, LP, 04-01-013-000 0 344

ERJAVSEK, NATHAN V. 04-01-020-000 68,156

MORRASY, DAVID & TRACY 04-01-025-000 56,868

WELCH, WESLEY & JANE 04-01-030-000 17,745 28,441

SCHUMACHER, KENNETH W. 04-01-041-000 62,876

FIRST STATE BANK, CUSTODIAN OF 04-01-050-000 0 3,826

PLETSCH, RONALD L.; TRUSTEE, P 04-01-060-000 99,247 110,541

KRAFT, JOHN H & SANDRA 04-01-070-000 0 4,109

FIRST STATE BANK, CUSTODIAN OF 04-01-080-000 0 5,705

MALAVOLTI, BRIAN D ET UX 04-01-085-000

PLETSCH; TRUSTEE, MARILYN 04-01-090-000 0

FIRST STATE BANK, CUSTODIAN OF 04-01-100-000 0

BUNTROCK, SUZANNE R 04-01-110-000 0

BUNTROCK, SUZANNE R 04-01-121-000 0

CHAMBERS, ANDREW J & ALEXIS I 04-01-122-000

WITZMAN, JOSHUA C., WITZMAN, K 04-01-135-000

CHARLES W

CHRISTOPHER & ELIZABET 04-03-021-000

KELLER, CHARLES W &

CHARLES W & KELLER, M 04-03-050-000 0

KELLER, CHARLES W & KLEER, MA 04-03-060-000 0

KELLER, CHARLES W & KELLER, 04-03-070-000

KELLER-STRANZ, JULIA M & KELL 04-03-160-000 0

Continued on next page

from previous page

MEKLEY, REVOCABLE TRUST, ELMER 04-03-183-000 0 1,247

ECKERT, MICHAEL J. & DARLA J. 04-03-190-000 0 35,829

SHEVOKAS TESTAMENTARY FAMILY T 04-03-211-000 22,615 113,932

BRASSFIELD, DAVID J & EEB TR 04-03-212-000 0 110

STADEL, LYNN A, MISTELE, HEATH 04-03-221-000 97,250 102,613

THE MCNABB FARM, LLC % PETER J 04-03-223-000 92,449 103,640

MEKLEY, JEFFREY ET AL & ECKERT 04-03-224-000 0 1,983

ZIANO, DAVID P. 04-03-240-000 36,319 41,542

MEKLEY, SCOTT & JODY 04-03-250-000 0 2,033

WEBB, SAMUEL & CALLY 04-03-270-000 71,945 79,541

QUIGLEY, DOUGLAS, % QUIGLEY-HO 04-03-290-000 75,451 89,087

FOERSTER, JILL ET AL 04-03-300-000 0 22,482

CLAUSEN, BENJAMIN, CLAUSEN, EL 04-03-310-000 0 66,559

QUIGLEY, DOUGLAS, %QUIGLEY-HOL 04-03-320-000 0 8,290

HATTON, JOSEPH, SALE, BETH ANN 04-03-341-000 69,950 76,950

GRASSER, BRADLEY T. 04-03-342-000 97,753 104,399

OXBOW PRAIRIE FARMS, LLC 04-04-010-000 0 35,295

BUMGARNER & MCGRADY, % FIELD L 04-04-020-000 0 49,443

OXBOW PRAIRIE FARMS, LLC 04-04-030-000 0 9,784 NOE, ANDREW G & JENNIFER L 04-04-040-000 44,974 63,462

AARON WHITEAKER CEMETARY, 04-04-049-000 0 0

ANDREW G & JENNIFER L 04-04-050-000 0

NOE, ANDREW G & JENNIFER L 04-04-060-000 0

NOE, ANDREW G & JENNIFER L 04-04-090-000

A KUNKEL TRUST, %HOMET04-05-261-000

KATHYRN SELBY, TRUSTEE 04-05-265-000

KUHN, GREGORY ET AL & KUHN, DA 04-05-271-000 0

KUHN, GREGORY ET AL & KUHN,

HAUN, MICHAEL 04-04-123-000 41,202 47,716 HAUN FARMS

PRAIRIE FARMS, LLC 04-04-160-000 1,450 32,876

HOSTETLER TRUST, LENORA 04-04-170-000 0 41,198 FORNEY; TRUSTEE, BERNICE 04-04-200-000 0 52,499

KELLER , CHARLES & KELLER, M 04-04-210-000 114,136 166,913

KELLER, CHARLES W & KELLER, M 04-04-220-000 0 19,075

BUMGARNER & MCGRADY, % FIELD L 04-04-230-000 2,600 37,242 CLEAR CREEK PROPERTY COMPANY, 04-04-240-000 0 29,194

JONATHON SHIRLEY BUMGARNER TRU 04-04-250-000 0 14,059

OXBOW PRAIRIE FARMS, LLC 04-04-260-000 0 2,711

OXBOW PRAIRIE FARMS, LLC 04-04-270-000 0 12,802

CLEAR CREEK PROPERTY COMPANY 04-04-280-000 0

HAUN FARMS INC, % STEVE HAUN 04-04-291-000 0

HAUN, MARK D. ET UX & HAUN, DE 04-04-292-000 122,414

HAUN, MARK D. AND DEBORAH 04-04-293-000 12,945 16,305

KELLER, BRANDON W 04-04-301-000 8,500 15,290

FORNEY; TRUSTEE, BERNICE 04-04-302-000 0 13,331

FORNEY, BERNICE 04-04-310-000 0

KELLER, CHARLES W & KELLER-ST 04-05-010-000 0

FORNEY , BERNICE 04-05-020-000 0 3,691

KELLER, CHARLES W & KELLER, 04-05-030-000 0

MUDGE, JOHN M, % JOHN MUDGE JR 04-05-050-000 0

MUDGE, JOHN M, % JOHN MUDGE JR 04-05-060-000 0

MUDGE, JOHN M, % JOHN MUDGE JR 04-05-070-000 0

MUDGE, JOHN M, % JOHN MUDGE JR 04-05-080-000 0 3,779

SCHUMACHER, ANTHONY M 04-05-090-000

04-05-100-000

HOPKINS, PHILLIP N 04-06-140-000

ALLEMAN LLC, BARBARA WOLF, % B 04-06-151-000 0

VILLAGOMEZ, RODOLFO 04-06-152-000

AAC FARMS OF HENNEPIN, LLC, AT 04-06-165-000 0

AAC FARMS OF HENNEPIN, LLC, 04-06-171-000 0

ERJAVSEK, LARRY ET AL & CIMEI 04-06-181-000

KRUMWIEDE, NORMAN & PATRICA 04-06-200-000 72,979

PLETSCH; TRUSTEE, MARILYN 04-06-220-000 0

PLETSCH; TRUSTEE, MARILYN 04-06-230-000 0

REHN, ROBERT ET UX 04-06-240-000 0

AAC FARMS OF HENNEPIN, LLC, AT 04-06-260-000 0

JOHN & MAYME MEKLEY HEIRS,

TRUSTEE,

Continued on next page

Continued from previous page

TROYAN, TRUST, KENNETH R 04-07-033-000 76,129 85,016

GLENN, LAURIE 04-07-040-000 0 93,030

HUELSTER, TRUSTEE, JANET 04-07-050-000 0

SCHROEDER-NIELSEN, WILMA, % JE 04-07-060-000 0

SOULSBY, JUDITH L & JOHN R, 04-07-070-000 0 27,121

GLENN, LAURIE L. 04-07-090-000 128,019 163,293

GLENN, LAURIE L. 04-07-100-000 0 35,470

GEORGAS, CAROL W.;TRUSTEE, GEO 04-07-110-000 0 49,660

GEORGAS, TRUST, CAROL W. T 04-07-140-000 0 6,083

NELSON, D.MATTHEW 04-07-151-000 0 40,655

IL YEARLY MTG OF RELIG SOC OF 04-07-164-000 0 343

REHN, E ROBERT ET UX 04-07-165-000 0

GRIFFITH, TRUST, ROBERT TRENT 04-07-180-000 0

GRIFFITH FAMILY FARMS, LP, 04-07-191-000 0

IL YEARLY MTG OF RELIG SOC OF 04-07-202-000 0

COOK, TRUSTEE, CHARLES F ET EX 04-07-203-000 0

NELSON, D.MATTHEW 04-07-221-000 0

COOK, TRUSTEE, CHARLES F, % CO 04-07-231-000 0

IL YEARLY MTG OF THE RELIGIOUS 04-07-232-000 0

HULL, BEVERLY A ET AL 04-07-240-000 0

WILSON, ETUX, REED 04-07-270-000 83,271

KASPERSKI, PETER J & DEBRA 04-07-280-000 0 5,700

IL YEARLY MTG. OF THE RELIGIOU 04-07-291-000 0 0

IL DEPT OF TRANSPORTATION ATTN 04-08-011-010 0 0

GRIFFITH, TRUST, ROBERT TRENT 04-08-011-020 0

GRIFFITH, TRUST, ROBET TRENT & 04-08-012-000 59,576

ILLINOIS DEPARTMENT OF TRANSPO 04-08-022-000 0 0

GRIFFITH FAMILY FARMS, LP, 04-08-023-000 18,373 90,884

GRIFFITH FAMILY FARMS, LP, 04-08-040-000 107,469 121,332

WILSON, STEPHEN J ET UX 04-08-052-000 0

GRIFFITH FAMILY FARMS, LP, 04-08-061-000 0

WILSON, STEPHEN ET UX 04-08-071-000 0 32,109

WILSON, STEPHEN J. ET UX & WIL 04-08-072-000 0 9,706

WILSON, STEPHEN J ET UX 04-08-092-000 200,613 206,435

LINDSAY, TODD C. AND MONIQUE M 04-08-122-000 80,859

LINDSAY, TODD AND MONIQUE 04-08-123-010 0

LINDSAY, TODD AND MONIQUE 04-08-123-020 0 0

KAWIECKI, CONNIE L ET AL 04-08-130-000 0

PUTNAM COUNTY HIGHWAY DEPT 04-08-141-010 0 0

KAWIECKI, CONNIE ET AL 04-08-141-020 765 20,622

ASHDOWN, TRUSTEE, RICHARD H 04-08-150-000 1,972 4,100

DRAKE, KAY A 04-08-151-000 0 1,484

ASHDOWN, TRUSTEE, RICHARD H 04-08-155-000 0 5,733

HAFLEY, LORI K 04-08-170-000 44,640

EDGEWOOD PARK GOLF INC 04-08-195-000

SEIFERT, ROBERT & SUSAN 04-08-202-000 65,058

ASHDOWN, TRUSTEE, RICHARD H 04-08-206-000 14,576

KETTER, BRYAN & CARRIE 04-08-220-000 72,104

ZELLMER, NICOLE C 04-08-232-000 94,508

BURCHAM, SIMON ANDREW 04-08-241-000 38,798

PASCOE, SUSAN E 04-08-250-000 35,709 37,362

PHILLIPS, JAMES W. ET UX & PHI 04-08-261-000 0

GRIFFITH FAMILY FARMS, LP, 04-08-262-000 0

PHILLIPS, JAMES W. ET UX & PHI 04-08-270-000 68,671

PUTNAM COUNTY HIGHWAY DEPT, 04-08-280-010

PUTNAM COUNTY HIGHWAY DEPT, 04-08-289-010

PUTNAM COUNTY CUSD 535 04-08-289-020 0

STEPHEN ET UX 04-09-082-000

DOROTHY J 04-09-091-000

STEPHEN J ET UX 04-09-094-000 0 14,250 WILSON, STEPHEN J. AND KIMBERL 04-09-100-000 0

WILSON, STEPHEN J. AND KIMBERL 04-09-110-000 0

HOYLE FARMS LTD PARTNERSHIP %F 04-09-120-000 0

HOYLE FARMS LTD

STEPHEN J. AND KIMBERL 04-09-140-000 0

STEPHEN J. AND KIMBERL 04-09-151-000

KAY A 04-09-181-000 0 23,265 WILSON, DOROTHY J 04-09-182-000 0

TRUSTEE, RICHARD H 04-09-185-000 0 4,052

CREEK FRIENDS CEMETERY % 04-10-031-000 0

TRUSTEE, RICHARD H 04-10-090-000 0

KEENE BARR FAMILY FARM, L 04-10-120-000 0

CONNIE L ET AL 04-10-140-000 0

DAVID & JENNIFER D 04-10-142-000 0

KAWIECKI, CONNIE L ET AL 04-10-150-000 0

CONNIE L ET AL 04-10-160-000 0

DEBRA M 04-10-170-000 0

SHIRLEY BUMGARNER TRU 04-11-010-000 0

JONATHON SHIRLEY BUMGARNER TRU 04-11-020-000 0

FARMS INC 04-11-030-000 0

CLEAR CREEK PROPERTY COMPANY, 04-11-040-000

from previous page

NODER, DAVID M 04-11-120-000 39,192

MONDRELLA, JAMES R & CAROL 04-11-131-000 52,900

BICKERMAN, WILLIAM D 04-11-145-000 0

SMITH, ADAM & CARRIE 04-11-151-000

CREEK

SMITH, DAVID & JENNIFER 04-11-260-000

STURM, WILLIAM ET UX & STURM, 04-11-271-000

L & G ACRES 04-11-280-000 0

L & G ACRES 04-11-290-000 0 998

SWEEZEY, NATHAN, JOZWIAK, ELLE 04-11-300-000

WILLIAM D

ESHELMAN, CHRISTINA M., BORRI, 04-12-021-000

MONDRELLA, JAMES R ET AL 04-12-110-000 0 299

SORRENTINO, RONALD E. AND LYNN 04-12-123-000 0 3,206

DOEHLING, STEVEN L & KARA 04-12-124-000 146,742 151,522

DOEHLING, STEVEN L & KARA 04-12-125-000 0 3,318 VILLAGOMEZ, RODOLFO 04-12-131-000 0 14,245 FOX, JAMES & GINA 04-12-132-000 80,516 95,147

GAUWITZ, HENRY JACOB 04-12-141-000 51,503 68,625

MATHIS, EDWARD J., % GREENE FA 04-12-150-000 0 3,851

NIELSEN, JERALD T 04-12-162-010 2,225 18,038

KEEGAN JR., KENNETH, KEEGAN, K 04-12-162-020 0 9,839

LRD HOLDINGS LLC 04-12-163-000 12,551 25,820

MONDRELLA, JAMES R. & MONDREL 04-12-164-000 0 110

SORRENTINO, RONALD E. LYNNE M. 04-12-173-000 127,800

DOEHLING, STEVEN L & KARA 04-12-174-000 0 219

MONDRELLA, JAMES R ET AL 04-12-180-000 0 114

MONDRELLA, JAMES R ET AL 04-12-211-000 0 11,754

KEEGAN, KENNETH & KELLY JR 04-12-217-000 0 34,154

KEEGAN, KENNETH & KELLY JR 04-12-218-000 171,004 176,194

MONDRELLA, JAMES R ET AL 04-12-220-000 0 11,055

MATHIS, EDWARD ALAN & CAROL A. 04-12-230-000 0 13,534

MONDRELLA, JAMES R ET AL 04-12-241-000 0 5,906

MATHIS, EDWARD ALAN & CAROL A. 04-12-250-000 0 897

MATHIS, EDWARD ALAN & CAROL A. 04-12-260-000 0 1,544

WAGNER FAMILY GIFT TRUST, % DE 04-12-270-000 0

KENYON, WILLIAM L 04-12-280-000 0

WAGNER FAMILY GIFT TRUST, % DE 04-12-291-000 121,247

KENYON, WILLIAM L 04-12-300-000 0

HOSTETLER, NORMAN L & GLORIA J 04-13-010-000 0 21,522

L & G ACRES 04-13-020-000 0 1,008

HOSTETLER, NORMAN & GLORIA J 04-13-030-000 46,962 69,517

LENKAITIS, JASON ET UX & LENKA 04-13-040-000 58,370

LENKAITIS, JASON AND TANYA 04-13-050-001 0 515

KEEGAN, KENNETH AND KELLY 04-13-050-002 0 12,839

DOHERTY, JOHN 04-13-070-000 0

SCHLOSSER, JEFFREY AND AMY 04-13-080-000 0

SCHLOSSER, JEFFREY AND AMY 04-13-090-000 0

BYRON N 04-13-117-000

MARTIN & BEVERLY 04-13-125-000 0

NORMAN & GLORIA J 04-13-160-000

NORMAN & GLORIA J 04-13-170-000

NORMAN & GLORIA J 04-13-190-000 0

CONNIE L ET AL 04-14-010-000

PRAIRIE FARMS, LLC 04-14-030-000 0

DAVID

JAMES H. AND BARBARA J 04-14-282-000 0

ROBERT W 04-15-010-000 0

CONNIE L 04-15-040-000 69,345

KERKHOFF LLC 04-15-052-000 45,141

GRIFFITH, TRUST, ROBRT TRENT & 04-15-053-000 0

FAMILY FARMS, LP, 04-15-065-000 0

SCHROEDER-NIELSEN, WLMA, % JER 04-15-090-000 0

WRIGHT, JOYCE D & SCHROEDER- 04-15-100-000 0

SUSAN C. & KENNETH R. 04-15-130-000 0

GRIFFITH FAMILY FARMS, LP, 04-15-137-000 0

KNAPP, SUSAN C. & KENNETH R. 04-15-150-000 0 17,188 REHN, ROBERT 04-15-160-000

Continued on next page

Continued from previous page

KNAPP, SUSAN C. & KENNETH R. 04-15-170-000 0 59,603

KENNETH R. KNAPP GST TRUST #1, 04-15-190-000 0 55,943

KENNETH R. KNAPP GST TRUST #1, 04-15-200-000 99,924 151,039

COLLEGE FARMS LLC, KATHRYN N. 04-15-211-000 0 119,664

BRIZGIS, ALAN AND RUTHANN 04-15-220-000 8,098 45,888

BRIZGIS, LAWRENCE J & MARGARET 04-15-232-000 19,942 45,898

BILLUPS, JERRY 04-15-233-010 0 1,197

WHITNEY, ROBERT E. ET UX & WHI 04-15-234-000 0 7,688

WHITNEY, TRUSTEE, MAX BROOKS 04-15-240-000 0 49,226

KENNETH R. KNAPP GST TRUST #1, 04-15-250-000 0 100

BRIZGIS, ALAN & RUTHANN 04-15-261-000 0

BRIZGIS, ALAN AND RUTHANN 04-15-262-000 0

ENTWISTLE, WILLIAM E JR & ELLE 04-16-012-000 0

COLLEGE FARMS LLC, KATHRYN N. 04-16-021-000 0

WEASEL FARMS, LLC, % MS LOUSIA 04-16-030-000 0

WEASEL FARMS, LLC, % MS LOUISA 04-16-041-000 0

WEASEL FARMS, LLC, % MS LOUISA 04-16-042-000 0

IRVEN, CLARK & LAUREL 04-16-050-000 0

KIMME, DENNIS A. ET UX & KIMME 04-16-061-000 0

ALLEMAN, KIMREY D. 04-16-062-000 59,965

BILLUPS, NATHAN 04-16-065-000 0

COLEMAN, JESSICA D. & COLEMAN 04-16-067-000 107,251

COLEMAN, CHAD AND JESSICA 04-16-068-000 0

POIGNANT, BILLY J, TRUSTEE, PO 04-16-069-000 0 5,275 IRVEN, CLARK & LAUREL 04-16-070-000 68,310

NEWSOME, CHRISTOPHER & EMILY 04-16-081-000 153,525

CROSSROADS COMMUNITY CHURCH OF 04-16-090-000 0 0 BILLUPS, NATHAN AND JESSICA, B 04-16-102-010 3,335

BILLUPS, NATHAN, BILLUPS, JESS 04-16-102-020 0

WHITNEY, ROBERT E. ET UX & WHI 04-16-103-000 0

BILLUPS, NATHAN, BILLUPS, JESS 04-16-110-000 0

BRIZGIS, LAWRENCE 04-16-121-000 0

BRIZGIS, LAWRENCE AND MARGARET 04-16-122-000 0

ALLEMAN, KIMREY D. 04-16-131-000 3,109 6,004

KNAPP, TRUSTEE, KEVIN 04-16-132-000 0 11,285

BILLUPS, NATHAN 04-16-133-000 1,470 12,641

POIGNANT, BILLY J. AND RACHEL 04-16-135-000 0

COLEMAN, JESSICA D. & COLEMAN 04-16-136-000 0

NEIMAN, MILTON L. AND AMIE R. 04-16-150-000 0

MAGNOLIA CEMETERY ASSC 04-16-160-000 0 60,899

DO-ED-NE ACRES INC 04-16-170-000 0 7,143

DO-ED-NE ACRES INC 04-16-180-000 0 9,557

OXBOW PRAIRIE FARMS, LLC 04-16-190-000 0

R A COOPER LTD PARTNERSHIP, 04-16-200-000 0

R A COOPER LTD PARTNERSHIP, 04-16-210-000 7,950

JOHNSON, TRUSTEE; GENE S., ELL 04-16-220-000 123,864

R A COOPER LTD PARTNERSHIP, 04-16-230-000 84,560 90,629 IRVEN, CLARK & LAUREL 04-16-240-000 0 15,735

QUAKER LANE ENTERPRISES, INC., 04-16-251-000 0

GLENN, TERRILL WAYNE 04-16-260-000 64,306 69,521

MAGNOLIA CEMETERY ASSC 04-16-270-000 0 14,060 IRVEN, CLARK & LAUREL 04-16-280-000 0 1,422

BILLUPS, JERRY W. 04-16-292-000 715 1,598

KRYSIAK, CYNTHIA S. 04-16-293-000 0 14,938

BILLUPS, JERRY W. 04-16-294-000 0 14,938

DO-ED-NE ACRES INC 04-17-010-000 0

R A COOPER LTD PARTNERSHIP, 04-17-020-000 0

BOYLE, DAVID G 04-17-030-000 0

RUTH KEENE BARR FAMILY FARM, L 04-17-040-000 0

RAMENOFSKY, CHAR ESTATE 04-17-050-000 0

RAMENOFSKY, CHAR ESTATE 04-17-060-000 0

OXBOW PRAIRIE FARMS, LLC 04-17-070-000

TRUSTEE, THERESA

55,280

BARNETT, TRUSTEE, THERESA 04-19-081-000 0 3,021

LAURIE 04-19-083-000 108,201

JR., TRUST, MELVIN

DAVID 04-19-144-000 0

& LOOKOUT FARMS, LLC, 04-19-150-000 0

FRAATZ

HOLDINGS, LLC 04-19-221-000 0

GARY L. AND KATRINA 04-19-252-000 0

HOLMSTROM, MICHAEL L 04-20-010-000 0 13,117

HAWS, TRUST, MARJORIE E. & D 04-20-020-000 0

HAWS, TRUST, MARJORIE E. & 04-20-030-000

Continued on next page

RENINI, IRMA, % CRANE, JUDITH, 04-20-040-000 0 1

POTTHOFF, STEPHEN J 04-20-050-000 0 106

WATKINS, SCOT D 04-20-060-000 0 14,089

WATKINS, SCOT D 04-20-070-000 0 10,949

JOHNSON, TRUST; GENE S., ELLEN 04-20-080-000 0 6,540

DAHL-YOHNKA, KENDRA 04-20-100-000 0 2,684

JOHNSON, TRUSTEE; GENE S., ELL 04-20-110-000 0 1,686

JOHNSON, TRUSTEE; GENE S., ELL 04-20-120-000 0 1,266

JOHNSON, TRUSTEE; GENE S., ELL 04-20-130-000 0 1,274

HILTABRAND, RONNIE 04-20-140-000 40,168 45,081

HILTABRAND, RONNIE R 04-20-152-000 0 1,135

LINDSTROM, BRADLEY AND LISA 04-20-153-000 3,270 59,236

GLENN, LAURIE L. 04-20-173-000 0 26,438

SCHWIDERSKI, DOUGLAS & PAT 04-20-174-000 0 9,806

DONNA, WILLIAM & DONNA 04-20-175-000 52,362 65,665

NAUMAN, JESSE R & JOSHUA T 04-20-200-000 0 25,289

NAUMAN, JESSE R & JOSHUA T 04-20-210-000 0 26,741

SMITH, JOSEPH F 04-20-220-000 74,164 82,049

SMITH, JOSEPH F 04-20-232-000 0 361

SMITH, SCOTT S, RINGENBERG, CY 04-20-233-000 61,865 67,139

PIENTA, JOSEPH & TONI 04-20-240-000 115,795 124,111

KELLY, CHRISTOPHER AND KAYLEA 04-20-271-000 72,104 85,444

KNAPP, KENNETH R 04-21-010-000 0 53,428

KNAPP, SUSAN C. & KATHERINE E 04-21-020-000 0 4,528

KNAPP, SUSAN C. & KATHERINE E 04-21-030-000 0 26,976

BBH FARMS INC 04-21-040-000 0 8,741

KNAPP, GST TRUST # 1, KENNETH 04-21-062-000 0 16,956

DAVIS, ALEC MICHAEL & ALLISON 04-21-063-000 127,176

KNAPP, SUSAN C. & KATHERINE E 04-21-100-000 0 6,321

NAVARRETTE, LUIS & MARIA 04-21-110-000 2,157 3,784

NAVARRETTE, LUIS & MARIA 04-21-120-000 0 1,627

WEIDE, EDWARD J 04-21-131-000 67,291 74,293

WEIDE, EDWARD J 04-21-132-000 0 107

MARIE A FRAATZ TRUST #8986-MAF 04-21-141-000 0 772

KENNETH R. KNAPP GST TRUST #1, 04-21-151-000 0 32,719

HAUGER, DOUGLAS 04-21-172-000 0 3,799

NAUMAN, LONNA J. 04-21-190-001 111,761 116,203

NAUMAN, JESSIE R & JOSHUA T 04-21-190-002 0 9,491

NAUMAN, JESSE R & JOSHUA T 04-21-200-000 0 5,281

KENNETH R. KNAPP GST TRUST #1, 04-21-211-000 0 2,455 DAVIS, DAVID J 04-21-220-000 0 1,779

AHLERS, ANTHONY 04-21-230-000 0 5,827

BARACANI, WILLIAM 04-21-240-000 12,793 14,572

DAVIS, DAVID J ET UX 04-21-250-000 57,340 59,519

OCONNOR, PATRICK ET UX 04-21-260-000 57,524 66,077

HOLMSTROM, MICHAEL 04-21-282-000 33,570 35,509 ALLEMAN, KIMREY 04-21-288-000 0 13,002

HAUGER, ROBERT DANIEL ET UX & 04-22-011-000 59,057 64,861

DOMBROWSKI, ROBERT 04-22-020-000 0 11,360

MCGOUGH, JEROME J 04-22-040-000 0 62,533

KENNETH R. KNAPP GST TRUST #1, 04-22-060-000 0 63,121

VILLAGE OF MAGNOLIA 04-22-080-000 0 0

VILLAGE OF MAGNOLIA, 04-22-090-000 0 0

VILLAGE OF MAGNOLIA 04-22-091-000 0 0

NEIMAN, MILTON L. AND AMIE R. 04-22-110-000 0

NEIMAN, MILTON L. AND AMIE R. 04-22-120-000 4,720

BRIZGIS TRUST, MARIAN J 04-22-131-000 0 45,200

BRIZGIS, LAWRENCE 04-22-132-000 0 15,067

KNAPP, KENNETH R 04-22-140-000 0 60,796

McGOUGH, TRUSTEE, GLORIA K 04-22-150-000 7,305

McGOUGH, TRUSTEE, GLORIA K 04-22-160-000 0

JOHNSON, BETTY 04-22-171-000 40,093

TRUSTEE, KEVIN & SARAH 04-24-090-000 0

DIOCS OF PEORIA

WILLIAM 04-24-180-000

Continued on next page

Continued from previous page

BUDACH, WESLEY C. & MEGAN D. 04-25-080-000 0 8,553

SAULTERS, KEVIN W & DEBORAH A 04-25-095-000 0 9,370

RANDALL, ROYAL 04-25-100-000 48,131 60,968

RANDALL, ROYAL ET UX & RANDALL 04-25-105-000 0 4,637

BOCKELMAN, ANTHONY 04-25-106-000 0 1,702

MORINE, JOHN A ET UX 04-25-111-000 0 8,646

SAWMILL LAKE INC 04-25-130-000 0 50,614

LILJA, BRIDGET LYN 04-25-136-000 0 2,916

MURPHY, GERARD 04-25-137-000 0 4,430

KEITH, WILLIAM AND CARLA 04-25-142-000 0 382

HACKLER DDG, LLC, 04-25-143-000 14,249 16,713

SHAREEF TAHER, MOHAMMED, SULTA 04-25-151-000 0 291

GAVIN, STEPHEN & CASSIE 04-25-152-000 43,949 51,234

PODABINSKI, RAE A. 04-25-160-000 57,795 63,122

PODABINSKI, JOSEPH P 04-25-170-000 0

PODABINSKI, JOSEPH P 04-25-180-000 0

HOFER, JAKE 04-25-192-000 0 914

STUNKEL, JOSHUA F 04-25-200-000 61,941 73,491

MORINE, JOHN A ET UX 04-25-210-000 0 3,511

SMITH, ROBERT ET UX 04-25-223-000 0 1,996

KEITH, WILLIAM AND CARLA 04-25-224-000 0 491

HOFER, GARY AND JENNIFER 04-25-225-000 0 914

CONNOLLEY, JAMES & RITA,TRUSTE 04-26-010-000 0 18,695

MANFERDINI, JOSEPH E III 04-26-015-000 87,063 100,799

KINKADE, RONALD ET UX 04-26-020-000 54,640 80,632

ROCKET MORTGAGE, LLC, 04-26-030-000 55,795 65,309

DILLON, PHILLIP H & JOYCE A 04-26-041-000 0 17,362

TRUSTEE, KEVIN & SARAH 04-26-042-000 0 30,815 DILLON, PHILLIP H & JOYCE A 04-26-051-000 0 5,937

BLAKELEY; TRUSTEE, HOLLIE K 04-26-070-000 5,940 21,589

KNIGHT, RUSSELL & LISA 04-26-080-000 54,624 70,273

MORINE, JOHN A ET UX 04-26-090-000 0 3,142

JOHN A ET UX 04-26-100-000 0

BLAKELEY; TRUSTEE, HOLLIE K & 04-26-105-000 90,130

MORINE, JOHN A ET UX 04-26-110-000 0 18,767

BOHM-OSBORN, BARBARA 04-26-120-000 0 1,423

KINKADE, RONALD ET UX 04-26-130-000 0 10,867

LUTES, MATTHEW E 04-26-140-000 0 6,467

KINKADE, RONALD ET UX 04-26-150-000 0 13,439

MORINE, JOHN A ET UX 04-26-160-000 48,516 88,039

SCHLEINING, JOSHUA A. ET AL & 04-26-170-000 0 1,571

NAUMAN, BENJAMIN D. AND JENNIF 04-26-180-001 0 1,035

ILLINOIS DEPARTMENT OF TRANSPO 04-26-181-002 0 0

SMUCKER, MARC A. 04-26-187-000 45,323 50,479

CORDES, DAVID E. 04-26-188-000 0 25,455

YUHAS, JAMES D. ET UX & YUHAS, 04-26-189-000 0 8,837

HOLLOWAY, RODNEY 04-26-191-000 0 10,043

NAUMAN, THOMAS & VICKY 04-26-195-000 0 893

NAUMAN, ANNE M 04-26-198-000 57,683 75,479

NAUMAN, THOMAS & VICKY 04-26-200-000 56,309 73,396

NAUMAN, DAVID L 04-26-210-000 63,770 73,284

MOUTRAY, TYLER & ERIN 04-26-215-000 54,399 67,922

KNAPP, KENNETH R. ET UX 04-26-221-000 36,443 45,859

KNAPP, KEVIN F AND SARAH E 04-26-223-000 0 4,230

KENNETH R. KNAPP GST TRUST #2, 04-26-224-000 105,034 261,926

CONNOLLEY, JAMES 04-26-230-000 0 27,185

KENNETH R. KNAPP GST TRUST #2, 04-26-240-000 0 4,971

MATTERN, GEORGE E AND MARGARET 04-26-251-000 0 46,122

ENGEL, KEVIN M. & BRITTANI D. 04-26-253-000 74,164 90,054

KNAPP, GARY L 04-26-254-000 0 560

KOLOTKA, ALICIA F. 04-26-255-000 0 1,659

ZAESKE, MATTHEW P 04-26-256-000 64,740 80,877

SIKORA, MALGORZATA & SIKORA, 04-26-257-000 667 4,007

SPRADLING, JASON R & MEGAN J 04-26-258-000 88,147

MAKNAUSKAS, ARUNAS, BALCIAUSKI 04-26-259-000

CORDES, DAVID E 04-26-260-000 0

WILDEY, MICHAEL JEFFREY 04-26-261-000 0

ENGEL, KEVIN M AND BRITTANI

County of Putnam State of Illinois

Official publication of the general assessments of real property of record as of January 1, 2025 in the TOWNSHIP OF SENACHWINE, Putnam County, Illinois as certified to and equalized by this office

The Supervisor of Assessments has applied an equalization factor to the below listed classes of property in SENACHWINE township: Property Class Equalization Factor

Pursuant to 35 ILCS 200/10-115, the farmland assessments for 2025 (payable 2026) will increase by 10% of the preceding year’s median cropped soil productivity index as certified by the Illinois Department of Revenue with data provided by the Farmland Assessment Technical Advisory Board.

NOTICE TO TAXPAYERS

All property in Putnam County, other than farmland and coal, are assessed at 33.33% of the fair market value. Your property is to be assessed at the above listed median level of assessment for the assessment district. You may check the accuracy of your assessment by dividing your assessment by the median level of assessment. (33.33%) The resulting value should equal the estimated fair cash value of your property. If the resulting value is greater than the estimated fair cash value of your property, you may be over-assessed. If the resulting value is less than the estimated fair cash value of your property, you may be under-assessed. Your assessment, less exemptions will be used to determine your 2025, payable 2026 property tax bill. For example: Take your equalized assessed value, subtract any exemptions to determine your net taxable assessed value. Take that number times the most current tax rate to get an estimated amount of your property tax bill.

Taxpayers who consider their property incorrectly assessed need to contact the Supervisor of Assessments at 815-925-7238 to discuss their property. If you are not satisfied with the results, you may file an assessment complaint with the Putnam County Board of Review by July 3rd, 2025 at 4:00 p.m.

YOU MUST FILE AN ASSESSMENT COMPLAINT WITH THE BOARD OF REVIEW TO PRESERVE YOUR RIGHT TO AN APPEAL.

All assessment complaints filed with the Board of Review must be in writing using the forms provided by the board. Assessment complaint forms and instructions can be acquired from the Putnam County Supervisor of Assessments office in the Putnam County Courthouse at 120 N. 4th Street, Hennepin, IL or downloaded and

Continued on next page

printed on line at putnamil.gov If you have questions about filing a complaint, you may contact the Assessor’s office at 815-925-7238. You may be eligible for one or more of the following homestead exemptions if the property is your primary residence, you are liable for paying the property taxes, and in some instances, meet additional qualifications.

Owner Occupied Exemption: $6000 reduction in EAV

Senior Citizen tax Freeze Exemption- is for taxpayers who will be 65 or older during the assessment year and have total household income of less than $65,000 for the prior year. This exemption freezes your assessed value NOT your property taxes!

Home Improvement Exemption- reduces the value by the amount of increase in assessed value due to improvements being added to an existing residential structure or a rebuilding of residential structures following a catastrophic event. This is a four year exemption for improvements up to $25,000 in assessed value.

Disabled Veteran’s Standard homestead Exemption: If the veteran has a service connected disability of 30% but less than 50% the annual exemption is $2500. If the service connected disability of 50% or more but less than 70% then the annual exemption is $5000. If the service connected disability is 70% or more, then the residential property is exempt from taxation under this code.

Disabled Veteran Homestead Exemption- (Specially adapted housing) up to $100,000 reduction in EAV if the federal government has approved payment to construct or modify your home if you are a 100% disabled veteran.

Returning Veteran Exemption- $5000 reduction in EAV the year that you return from an armed conflict and the following year.

Disabled Person- $2000 reduction in EAV if you meet disability requirements.

If you have any question, please call my office at 815-925-7238

Tamara Mehalic C.I.A.O.

Putnam County Supervisor of Assessments

The following listing is in Parcel ID order.

SENACHWINE

TODAY IN SPORTS HISTORY

1998: Harut Karapetyan of the LA Galaxy scores three goals in five minutes for the fastest hat trick in MLS history in an 8-1 rout of the Dallas Burn.

2011: French Open: Li Na becomes first Chinese player to win a Grand Slam singles title.

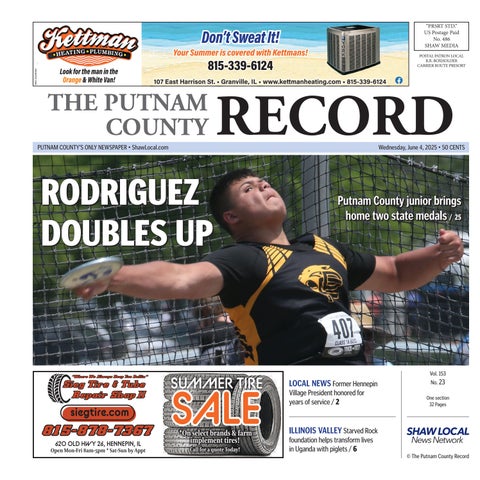

BOYS TRACK & FIELD: CLASS 1A STATE FINALS