The Harsh Math Behind the Energy Transition

The Hidden Forces Driving Your Power Bill

AMERICA’S POWER GRID IS REACHING ITS BREAKING POINT

The Harsh Math Behind the Energy Transition

The Hidden Forces Driving Your Power Bill

AMERICA’S POWER GRID IS REACHING ITS BREAKING POINT

LEADING TEXAS THROUGH OPPORTUNITY AND ACCOUNTABILITY

U.S. OIL OUTPUT HITS RECORDS, BUT THE PARTY IS SLOWING DOWN

Why Your Power Bill May Suddenly Feel Like a Second Mortgage HOW THE SIBERIA 2 DEAL REWIRES GLOBAL GAS FLOWS

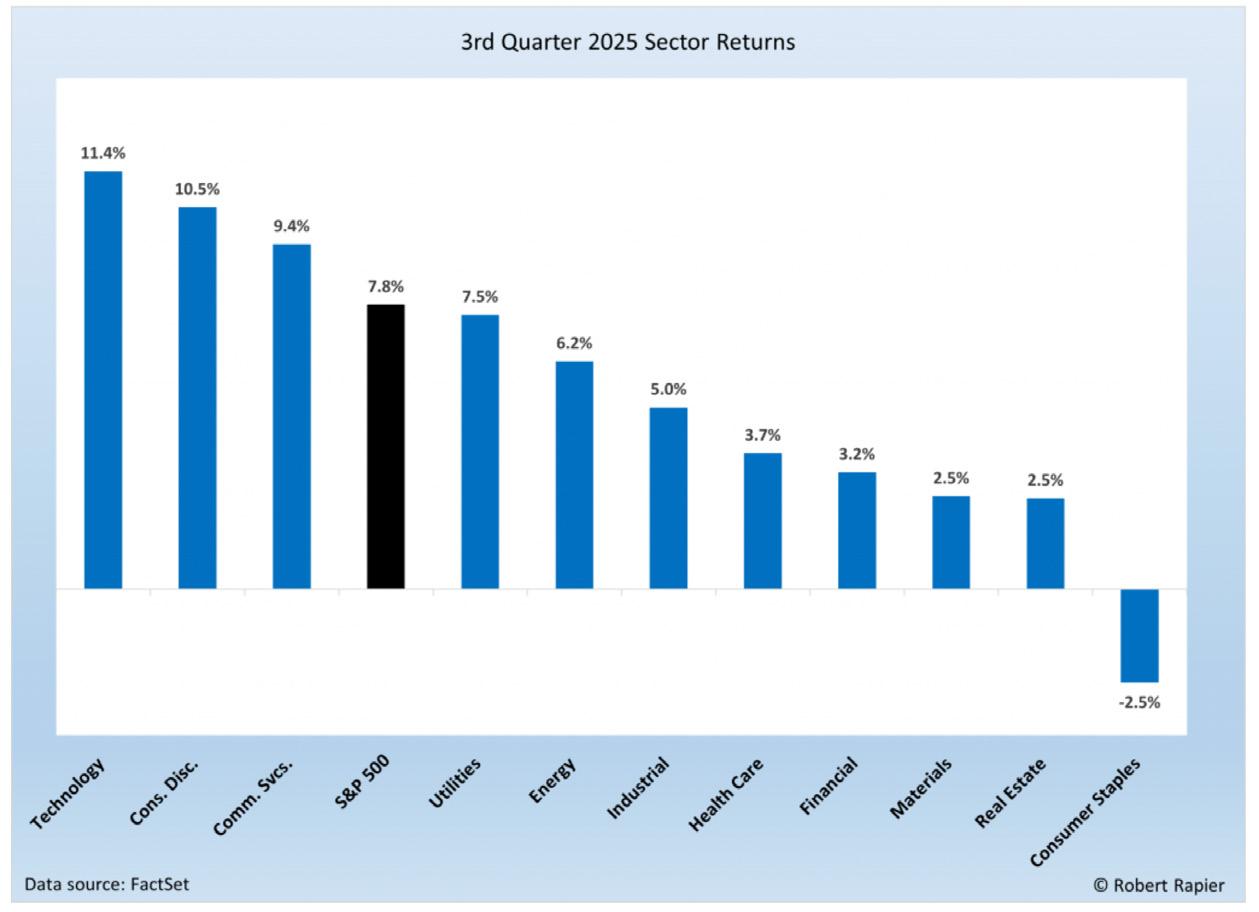

REFINERS AND TANKERS LEAD THE ENERGY SECTOR IN Q3 2025

We have moved to a new bigger station in San Antonio!

Sundays 2pm-3pm 930AM San Antonio

THE ONLY OIL AND GAS SYNDICATED NATIONAL RADIO SHOW

MOST listened to show on Sunday nights! Thank you HOUSTON!

Saturdays 7am KEYS 1440AM / 98.7FM Corpus Christi

Sundays 8pm-9pm KFXR 1190AM / simulcast on the iHeartRadio app Dallas / Fort Worth Worldwide

Saturdays 1pm-2pm KWEL 1070AM / 107.1FM Midland Odessa Permian Basin

Sundays 2pm-3pm The Answer 930AM San Antonio / New Braunfels / San Marcos / Austin

Sundays 8pm-9pm KTRH 740AM / Simulcast on the iHeartRadio app Houston / Worldwide

Saturdays 6am-7am, 11am-12 noon

Sundays 6am-7am, 5pm-6pm AM 1440

To listen to the show: Visit shalemag.com or download iHeart mobile app to listen live!

Finding and producing the oil and natural gas the world needs is what we do. And our commitment to our SPIRIT Values—Safety, People, Integrity, Responsibility, Innovation and Teamwork— is how we do it. That includes caring about the environment and the communities where we live and work – now and into the future.

EDITOR-IN-CHIEF

Robert Rapier

CHIEF FINANCIAL OFFICER Suzel Diego

PUBLICATION EDITOR Tyler Reed

ASSOCIATE EDITOR

David Porter

VIDEO CONTENT EDITOR

Barry Basse

STAFF WRITERS

Felicity Bradstock, Tyler Reed

DESIGN DIRECTOR

Elisa Giordano

SALES & MARKETING Gargi Bhowal / gargi@shalemag.com

ACCOUNT EXECUTIVES

John Collins, Ashley Grimes, Doug Humphreys, Matt Reed

SOCIAL MEDIA DIRECTOR Courtney Boedeker

DIGITAL COMMUNICATIONS MANAGER

Amanda Villarreal

CONTRIBUTING WRITERS

Felicity Bradstock, James Campos, Jess Henley, Robert Rapier

STAFF PHOTOGRAPHER

Malcolm Perez

EDITORIAL INTERN

LeAnna Castro

The Port of Corpus Christi’s Foreign Trade Zone 122 program helps increase global competitiveness of U.S.-based companies. Foreign Trade Zone 122 can defer or reduce duty payments, streamline supply chain costs and help companies thrive in competitive domestic and foreign markets.

The United States is on pace for yet another alltime high in oil output, nuclear generation just delivered one of its strongest years on record, and data-center electricity demand surged beyond even the most aggressive projections. At the same time, energy markets were repeatedly whipsawed by expanding conflicts, shifting trade alliances, and renewed debates over the realism of global decarbonization targets. This issue of Shale Magazine captures that tension—between ambition and constraint—with clarity and urgency. Our cover story spotlights Rick Figueroa, whose leadership at the Texas Commission of Licensing and Regulation blends accountability with opportunity. From streamlining bureaucracy to expanding access for foster youth and blue-collar workers, his broader vision shows that regulation is not merely about compliance—it is about people, pathways, and long-term workforce development. Figueroa’s journey from ranch life to boardrooms and public service is a reminder that durable progress emerges when values, community, and economic opportunity converge.

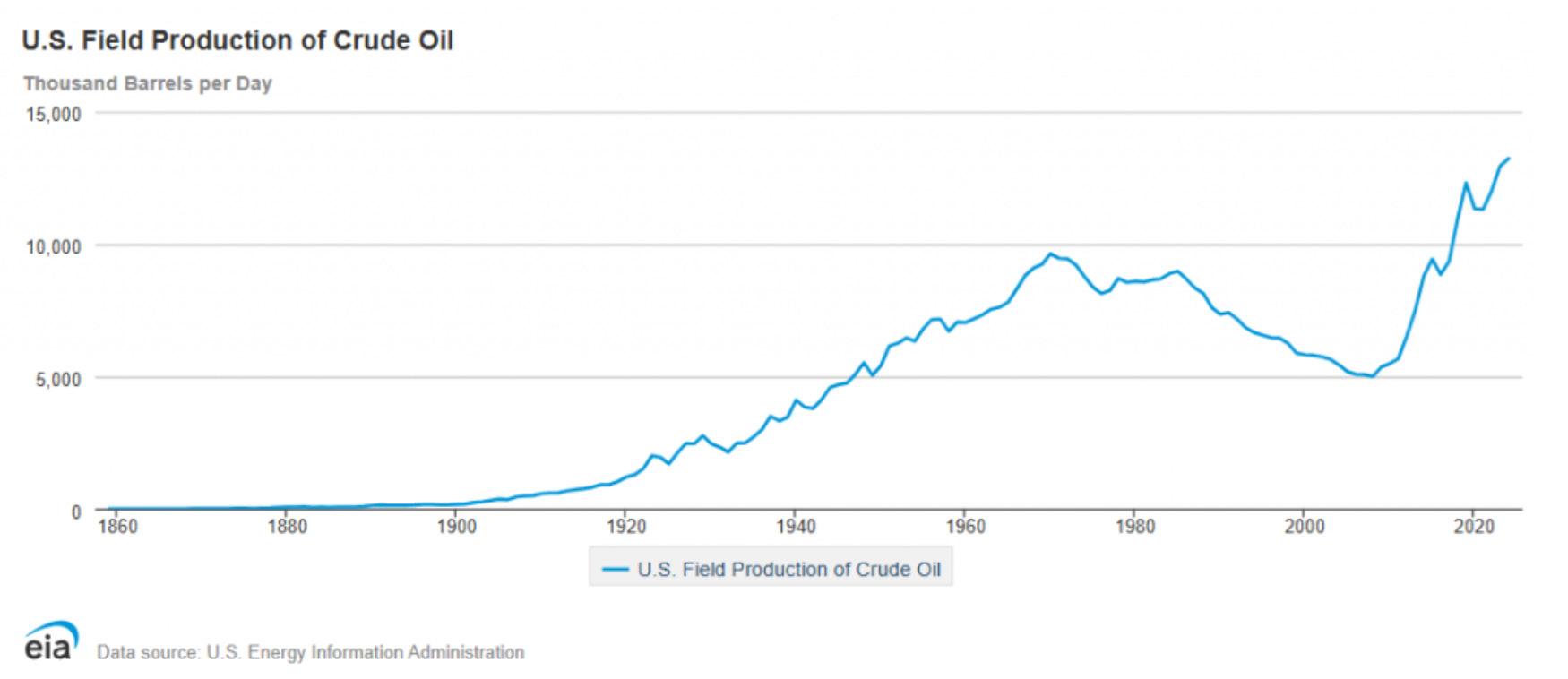

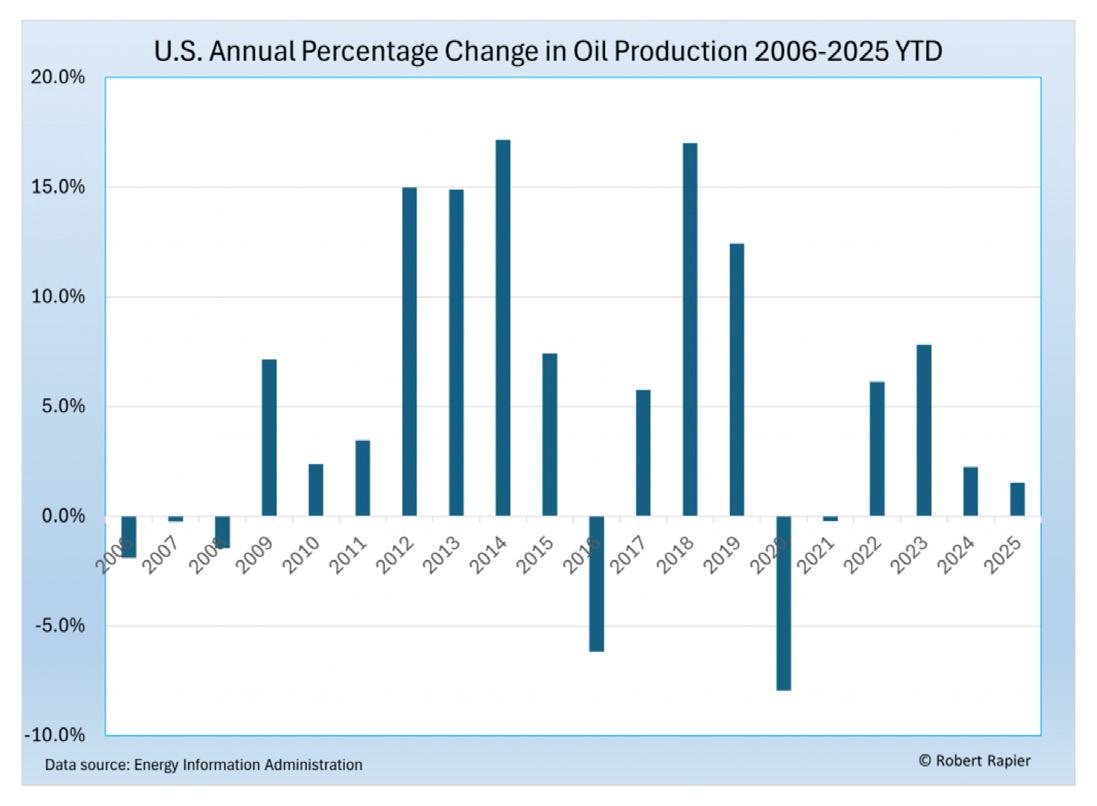

In our Industry section, we confront the hard math behind the energy transition with a feature that strips away rhetoric and lays bare the logistical, financial, and infrastructure challenges facing decarbonization. From the strain that hyperscale data centers are placing on an already fragile electric grid to the resurgence of nuclear power as a reliability anchor, we examine both the promise and the pressure points of America’s evolving power mix. Although U.S. oil production is on track to post its third consecutive annual record, the Dallas Fed’s latest survey injects a cautionary note, signaling that growth may be cooling just as global demand growth becomes increasingly uncertain.

Our Policy coverage explores a regulatory and diplomatic environment in motion. The EPA’s proposed reconsideration of the greenhouse

gas endangerment finding could redefine the legal foundation of federal climate policy for years to come. Abroad, the proposed Siberia 2 pipeline and shifting U.S.–Mexico energy cooperation underscore how supply routes are being shaped as much by geopolitics as by price. And in a world where rhetoric often races ahead of leverage, our examination of U.S. pressure on India’s Russian oil imports asks a fundamental question: where does policy influence meaningfully end?

In Business, we turn to the downstream effects of these macro forces. From the renewed sticker shock on power bills to the rapid adoption of battery storage as a utility-scale solution, the consumer impact of energy policy and market volatility is increasingly visible. Refiners and tanker operators continue to lead sector performance, even as upstream producers face tightening margins, capital discipline, and investor skepticism. Despite record output, the tone across the industry is noticeably more cautious—growth is no longer assumed.

Taken together, this issue reflects the complexity of the moment: a power grid under unprecedented strain, a policy environment in flux, and an energy business landscape adapting to forces both structural and cyclical. At Shale Magazine, our mission remains unchanged—to provide grounded, technically informed, and balanced coverage that helps our readers navigate the most consequential developments shaping the energy sector.

Thank you for joining us this quarter. May you have a wonderful holiday season, and we look forward to continuing the conversation in 2026.

ROBERT RAPIER Editor-in-Chief SHALE Magazine

LEADING TEXAS THROUGH OPPORTUNITY AND ACCOUNTABILITY

By: Felicity Bradstock

RICK FIGUEROA TALKED TO US FROM HIS RANCH IN BRENHAM, TEXAS, WHERE HE SPENDS MOST OF HIS TIME WITH HIS WIFE AND FOUR CHILDREN WHEN HE’S NOT

A BOARD OF ONE OF THE MANY SOCIAL ORGANIZATIONS HE SUPPORTS.

Juggling his many different roles is what Figueroa seems to do best. Despite managing a full workload and family life, Figueroa told us about his ambitious aims for the Commission. He also spoke about some of the new projects he’s working on, which are centered closely around diversity, something Figueroa says is key to building a successful project.

Figueroa has been chair of the Commission since 2019, after being appointed to the agency in 2016. He first decided to join the Commission after realizing it was where he could make the biggest impact.

As chair, he hopes to provide youths and blue-collar workers with every possible opportunity to get a license and practice their professions, while ensuring that only those with adequate skills and experience can gain access to a license.

The Commission, based in Austin, is the governing board and policy-making body for the Texas Department of Licensing and Regulation. It is led by seven volunteer members, all of whom are appointed by the state governor and confirmed by the Texas Senate. Unlike industry-specific advisory boards, Commission meetings address topics that relate to all industries regulated by the TDLR, which covers 39 sectors at present. The Commission is in charge of setting fees, adopting changes to administrative rules, imposing penalties, and hearing contested enforcement cases.

As chair, he hopes to provide youths and bluecollar workers with every possible opportunity to get a license and practice their professions, while ensuring that only those with adequate skills and experience can gain access to a license.

Figueroa strikes a balance between protecting public safety and reducing the regulatory burden by consulting extensively with each industry to understand the criteria needed to work in the field.

Figueroa caught the attention of Texas state Governor Greg Abbott because of his extensive experience in auditing, where he developed a deep understanding of the importance of best practices.

Figueroa holds a bachelor’s degree in accounting and a master’s in Land Economics and Real Estate from Texas A&M University. Upon graduating, Figueroa pursued a career in auditing at Arthur Andersen, before taking on roles at the oil service firm Halliburton and then at Merrill Lynch. His many years of experience across various sectors have made him well-suited for his role at the Commission.

The Commission currently provides licenses for professionals across 39 sectors, having just recently expanded its portfolio to include motor fuels. Figueroa said that the Commission’s coverage is ever-expanding thanks to its strong reputation in licensing and regulation.

Figueroa told us that as Commission leaders, it is impossible to understand the requirements and expectations of all 39 sectors, meaning that the Commission relies heavily on its sub-committees. The leadership team consults experts in each field who advise them on how to best manage sectoral regulation. Commissioners then use their regulatory expertise to streamline the licensing process for each sector.

Figueroa strikes a balance between protecting public safety and reducing the regulatory burden by consulting extensively with each industry to understand the criteria needed to work in the field. He encourages commissioners to focus on reducing the bureaucratic burden by streamlining application processes and avoiding repetition.

“I don’t think people mind being educated about standards or someone’s technical aptitude, but they hate having to write their name five times on different forms or tick five different boxes all saying the same thing,” said Figueroa.

Figueroa’s main aim is to ensure that those with the right criteria can gain access to a license without having to face unnecessary complications.

He also highlighted the importance of the ease of movement, making sure that licensed, capable professionals who move from one state to another can quickly and easily become licensed in their new location.

Leading the Commission successfully comes down to three things, according to Figueroa – humility, transparency, and being mission-focused.

Figueroa stressed the importance of being able to admit that “I don’t know,” and gaining a better understanding from experts in the field.

Clarity of message is also key for Figueroa, who says that if the various industries cannot communicate their criteria to licensees clearly or develop a streamlined application process, the system fails.

“Our job is to empower licensees who do their job well and ensure that consumers get the best of class service,” said Figueroa. This is the mission of the commission.

Transparency and accountability are two of the core values at the Commission, which holds public meetings and ensures that

each industry communicates clearly with its licensees to help them understand the entirety of the licensing process.

Figueroa tells those working at the Commission that they work for the people, and they must hold themselves accountable to their boss – the citizens of Texas. This helps drive success.

We asked Figueroa if he could share some of the major milestones he had experienced during his time at the Commission. He told us that, in the past, it was not possible to get a provisional license, but that has changed in recent years.

The Texas House Bill 1342 now provides licensees with access to a provisional license, which is extremely helpful for addressing issues around reinserting prisoners in society, said Figueroa.

Without a license, those released from prison have no access to work, which can restrict rehabilitation. However, offering someone a provisional license can provide them with limited access to the job market. For example, a construction worker can be given a license to work on purely commercial projects, rather than in a residential setting, to ensure public safety is upheld while enabling people to access much-needed job opportunities, Figueroa told us.

During his chairmanship, Figueroa has also launched a new scheme based on a cause close to his heart. He became aware of some of the difficulties faced in the foster care and adoption system because of his wife’s experience in the field.

“One of the biggest challenges that the state of Texas has is that at the age of 13 and beyond you’re not going to be adopted. These kids age out,” Figueroa told us.

Figueroa told us that he views the current situation as one of the greatest tragedies.

“Humans are the untapped resources, and we’re throwing these kids away when they age out of the system”.

Figueroa said that this can drive adolescents to have problems with addiction or even to commit suicide. In fact, studies show that youth in foster care are two and a half times more likely to contemplate suicide than youth not in foster care and are four times more likely to attempt suicide. https://tacfs.org/suicide-prevention-with-foster-youth/

For this reason, Figueroa has compelled the Commission to work with youths in the system to demonstrate to them how to get a license for a profession.

“So that as soon as they age out of the system at 18, they have a job, they can afford to pay their bills, they can afford to rent an apartment, they can do something with their lives, and they’re going somewhere.”

Figueroa now works closely with Arrow – Child & Family Ministries to understand how the Commission can equip youths with the tools they need to get well-paid jobs in key industries through vocational training, aiming to put them on the path to success.

Technology is driving change at the Commission. Figueroa emphasized the importance of being open to change and modernization. He expects artificial intelligence to play a key role in improving licensing efficiency, while the centralization of systems at the Commission is expected to significantly enhance efficiency in the coming years.

Beyond the Commission, Figueroa expects the power demand in Texas and the United States to grow significantly over the coming decades, as the power requirements for advanced technologies, such as quantum computing and artificial intelligence, continue to grow at a rapid rate.

Figueroa said that it is absolutely vital that no one company owns this sector, but rather, that it is distributed, much in the way we see with internet providers. This is key to cybersecurity, said Figueroa.

The role of the Commission will be to ensure that there is a high level of standardization in the industry to maintain quality, Figueroa told us.

Before working in his current role as Managing Partner at the wealth management firm Patron Partners, Figueroa worked as a senior financial advisor at the oil service firm Halliburton, which helped him understand the importance of sectoral regulation and being prepared for the growth of nascent energy markets.

“Energy is as dynamic as the internet; people don’t appreciate how fast it changes,” said Figueroa. “Energy and water are key to any successful community.”

Figueroa said that there is currently a gap in talent in services related to energy in Texas. He highlighted the lack of qualified electricians. It is the role of the Commission to do whatever it can to keep Texas on top in terms of energy, by encouraging youths to train in the field and by streamlining licensing, Figueroa stressed.

One of the sectors that Figueroa expects to grow in the coming years is the electric vehicle (EV) charging infrastructure segment. The Commission must consider several factors to prepare for the expansion, including the pricing of electric charging and the compatibility of charging infrastructure with different EV models, said Figueroa.

People want to see a replication of the gas station model, but developing that infrastructure is expensive. In addition, establishing clear safety standards needs to be at the core of development, said Figueroa.

Figueroa’s true passion is his work with the wealth management firm Patron Partners, which launched five years ago and has rapidly grown to become the largest Hispanic firm in the field in Texas, with a portfolio of almost $500 million.

Patron Partners offers investment advice to wealthy individuals, helping to guide them in making sensible choices that match their interests.

Figueroa has a long history of promoting diversity within organizations, having won the 2007 Leadership in Diversity and Inclusion Award for his work at Merrill Lynch.

The idea of diversity has been demonized, Figueroa told us. It shouldn’t be about just filling quotas, but, rather, it should focus on the inclusion of a broad range of people from different backgrounds with diversity of thought and experience, he stressed. Having multiple leaders with the same background and skills will not provide the same comprehensive understanding that having a broader range of people might.

“Diversity is power,” said Figueroa.

Not everyone starts from the same place, but different beginnings— good or bad—can have advantages, Figueroa told us. For example, overcoming a difficult situation can help someone to gain the skills needed to tackle challenges in the future, Figueroa said.

“When people ask me about my victories, it’s not the victories that I remember but the defeats. Defeats are what define character,” emphasized Figueroa.

Figueroa told us that he’s much rather hire the B-student who worked hard their whole life than an A-student to whom success came naturally. This has driven his approach to diversity across his various roles.

In his spare time, of which there is little, Figueroa is working to develop the first Hispanic-owned bank in the city of Houston.

In addition to his professional background, Figueroa has vast experience supporting the work of community organizations. Figueroa has used the recognition for his professional success to serve in key roles that respond to his passion for diversity and healthcare, as a member of the board for various organizations.

He is a board member for Hispanic 100, an organization dedicated to sharing free market principles in Hispanic communities across the United States. The organization was originally established to raise

money for mentoring workshops and annual scholarships, and focuses on developing the next generation of leaders.

Figueroa also currently serves on the board of directors for the Memorial Hermann Health System, one of the largest not-for-profit health systems in Southeast Texas. His interest in accessible healthcare is deeply rooted in his upbringing.

“Growing up poor, healthcare was never an option. You just dealt with your pain and suffering. So that’s why healthcare’s such a big deal.”

He does not want to simply hand over licenses to everyone asking, but instead, wants to provide everyone with the best possible opportunity to earn a license. He also hopes to encourage youths to become trained professionals and aims to equip them with the tools to understand how this can happen.

At the end of the day, “no vocation or job is more important than family,” said Figueroa. At the end of our discussion, Figueroa told us that he didn’t want this interview to just be about him; he wanted to use the opportunity to show others that if he can get to where he is, then anyone from any background can make it.

He grew up in Texas as the eighth child of a Mexican single mother, and spent his youth laboring on a ranch. But now, he owns and runs a ranch, which he said shows that anything is possible when you take the opportunity that is given to you.

Looking forward, Figueroa hopes to continue driving change in the Commission, to reduce bureaucracy and ensure the agency maintains rigorous standards and expertise across the 39 sectors it covers.

For Figueroa, the most important role of the Commission is to take the least (referring to bureaucracy) and give the most (opportunity).

We asked Figueroa to leave us with some words of advice that have helped him or may help others. He told us that he believes society has shifted in recent years to become more focused on the individual. He said that many people have become narcissistic in their view of success.

“Don’t make it all about you, create something bigger than you,” said Figueroa.

Focusing on something bigger than yourself ensures that the success is shared and benefits other people, Figueroa stressed. This reflects Figueroa’s strong attachment to family and community.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

By: Robert Rapier

In recent years, many optimistic narratives have overstated the impact of renewables on fossil fuel consumption. The reality is more sobering: renewables are not displacing fossil fuels—especially in non-OECD countries and energy-intensive sectors. They’re growing fast, but they’re still playing catch-up with rising global energy demand.

That is a key takeaway from the 2025 Statistical Review of World Energy. Yes, renewable energy posted impressive gains in 2024. But it still wasn’t enough to bend the curve on global fossil fuel use or carbon emissions.

In 2023, global energy consumption totaled 580 exajoules (EJ), with renewables providing just 29.97 EJ—or 5.2% of the total. By 2024, renewables increased to 32.74 EJ, yet only nudged their global share to 5.5%.

Of the 11.9 EJ growth in total energy demand from 2023 to 2024, renewables supplied just 2.7 EJ—about 23% of the total. Most of the rest came from fossil fuels, with natural gas leading the way at 4.1 EJ. That’s why carbon emissions continued rising in 2024, despite the record-breaking year for renewables.

There were some bright spots. In 2024, countries like Argentina, the Netherlands, Poland, New Zealand, the Czech Republic, the UK, and Japan saw renewable energy growth outpace that of fossil fuels. In the United States, renewables met approximately 67% of the year’s increase in energy demand—better than the global average, but still short of closing the gap without additional fossil fuel use.

Countries like China and India continue to drive much of the world’s coal and gas consumption, reinforcing their reliance on carbon-intensive fuels. The result is a structural paradox: renewables are accelerating, but not fast enough to displace fossil fuels. Instead, they’re merely supplementing growing demand— allowing carbon emissions to remain on an upward trajectory.

Solar Power: From Niche to Powerhouse

One bright spot is the meteoric rise of solar power. In 2024, global solar generation reached a new record of 7.7 EJ, up 27.5% year-over-year. Over the past decade, solar output has grown at a compound annual rate of 25.8%—the fastest of any major energy source.

Non-OECD countries accounted for 57% of all solar electricity last year. China alone produced 3.0 EJ, nearly 40% of the global total. India’s solar output jumped from just 0.02 EJ in 2014 to 0.5 EJ in 2024—a 23-fold increase fueled by government-backed rooftop programs and grid expansion.

The United States remains a major player, generating 1.1 EJ of solar electricity in 2024. That’s 14.6% of the global total. But with a 10-year compound growth rate of 24.4%, the U.S. is now trailing the global average.

Wind Energy: Steady, But Slower

Wind generation also hit a record high in 2024, reaching 9.0 EJ globally. But while impressive, wind’s 10-year compound annual growth rate of 7.2% pales in comparison to solar’s. Wind still leads in absolute generation, but the respective growth rates suggest that lead won’t last much longer.

China again leads the pack in wind output, with 3.6 EJ in 2024—slightly more than the U.S. and EU combined. The United States came in second at nearly 1.7 EJ, with wind accounting for roughly 10% of U.S. electricity in 2024. However, like solar, U.S. wind is bumping up against permitting delays and grid constraints.

Europe remains the only region where wind consistently outpaces solar, thanks to long-standing investments in offshore infrastructure, especially in the North Sea.

Hydropower: Stuck in Neutral

Hydropower still accounts for the bulk of global renewable electricity—around 16.0 EJ in 2024—but it’s increasingly running out of steam. Growth over the past decade has averaged just 1.4% annually, constrained by geography, environmental concerns, and diminishing returns on new capacity.

In countries like Norway, Sweden, Brazil, and Canada, hydropower continues to supply more than 10% of overall energy demand. But the momentum is shifting. Distributed solar is rapidly gaining traction in Brazil’s agricultural sector, while Canada’s reliance on hydro has left it trailing in solar and wind adoption.

Perhaps the most important trend emerging from the data is the shifting balance between OECD and non-OECD countries. In 2014, the OECD led global deployment of most renewable technologies. Today, the tables

have turned. Non-OECD countries now produce more non-hydro renewable electricity than OECD countries and are growing at a faster clip.

This growth isn’t just about ambition. It’s also about economics. Solar and wind have become competitive sources of new power in much of the world, and developing nations are embracing them to reduce fuel imports, create local jobs, and improve grid reliability.

The data makes one thing clear: renewable energy is no longer niche. But it is still not transformative—at least not yet.

The world’s energy transition is being outpaced by growth in total energy demand. Solar is rising faster than wind. Non-OECD countries are leapfrogging traditional leaders. Hydropower is fading into the background. And fossil fuels continue to dominate the global energy mix.

There are reasons for optimism. Costs keep falling. Innovation continues. And emerging markets are proving they can scale renewables quickly. But for the foreseeable future, renewables will remain in an uphill race against ever-rising demand.

About the author: Robert Rapier is a chemical engineer in the energy industry and Editor-inChief of Shale Magazine. Robert has 30 years of international engineering experience in the chemicals, oil and gas, and renewable energy industries and holds several patents related to his work. He has worked in the areas of oil refining, oil production, synthetic fuels, biomass to energy, and alcohol production. He is author of multiple newsletters for Investing Daily and of the book Power Plays. Robert has appeared on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS. His energy-themed articles have appeared in numerous media outlets, including the Wall Street Journal, Washington Post, Christian Science Monitor, and The Economist.

By: Felicity Bradstock

The United States government has been exploring possible ways to overhaul the country’s transmission system for several years to no avail. Now, with the imminent rollout of several large-scale data centers threatening to make the country’s energy demand soar within the next decade, more needs to be done to prepare U.S. electricity infrastructure for the shift.

The U.S. grid is highly fragmented, with different states and regions controlling various sections of the country’s transmission network, each of whom have varying opinions on how best to manage the grid. Much of the infrastructure is outdated and requires modernizing to connect new renewable energy projects from nontraditional energy-producing regions. In addition, much of the country’s transmission network needs expanding and upgrading to prepare for the anticipated growth in electricity demand in the coming decades.

U.S. Energy Demand to Soar Tech companies have invested heavily in the development of giant data centers, capable of powering advanced technologies, such as artificial intelligence (AI), in recent years, with many more expected to follow. The country’s 5,400 data centers now consume enough electricity to power an estimated 13 million homes, accounting for around 3% of U.S. electricity consumption.

Meanwhile, the building of new data centers is far outpacing the development of new electrical energy supply and transmission, which could lead demand to outstrip supply. Estimates suggest that data centers could contribute up to 9% of the country’s power demand by the end of the decade.

Companies such as Amazon, Google, Meta, and Microsoft as well as private equity and infrastructure investors, have announced hundreds of billions of dollars in near-

term AI investments. In January, the CEOs of OpenAI, Oracle, and SoftBank unveiled plans to invest $500 billion in AI data centers over the next four years, with support from President Donald Trump.

In reference to the anticipated growth in energy demand, Facebook’s CEO Mark Zuckerberg said, “I actually think before we hit [computing constraints], we’ll run into energy constraints.” Meanwhile, OpenAI’s CEO Sam Altman said, “I think we still don’t appreciate the energy needs of [AI]. We need [nuclear] fusion, or we need, like, radically cheaper solar plus storage, or something, at massive scale — a scale that no one is really planning for.”

In July, the U.S. Department of Energy (DoE) published a Report on Evaluating U.S. Grid Reliability and Security. The analysis shows that existing generation retirements and delays in adding new firm capacity will likely lead to a surge in power outages and a growing gap between electricity demand and supply, particularly as more data centers are built. This threatens U.S. energy security and highlights the clear need for grid expansion and modernization.

The U.S. federal government has previously been unable to carry out the necessary modernization of the U.S. transmission system due to the grid’s fractured nature, with Infrastructure investments being managed by a multitude of local, state, and regional regulators, making it impossible to

overhaul the system as a whole. This means that individual states are trying to tackle the problem, largely in isolation.

PJM Interconnection, the largest power grid operator in the U.S., is currently battling to provide a stable electricity supply in the face of a growing energy demand from data centers continues as its power plants age. Electricity bills in the state are expected to increase by around 20% this summer in parts of the PJM’s territory, which covers 13 states including Illinois, Tennessee, Virginia, and New Jersey.

PJM has lost over 5.6 GW of power over the last decade, as power plants closed and not enough new projects were developed to fill the gap. While new projects totaling around 46 GW have been approved, which would be enough to power 40 million homes, local opposition, supply chain disruptions, and financing issues have prevented much of them from being developed. Meanwhile, PJM expects 32 GW of increased demand on its system by 2030.

In reference to the anticipated growth in energy demand, Facebook’s CEO Mark Zuckerberg said, “I actually think before we hit [computing constraints], we’ll run into energy constraints.”

In Arizona, the state utility, Arizona Public Service, expects data centers to contribute around half of all new power demand by 2038. In Texas, data centers could account for the equivalent of half of all new customers by the end of the decade. Meanwhile, since 2023, Georgia Power has tripled its demand forecast over the coming decade.

In addition to investing heavily at the state and federal levels in enhancing the U.S. transmission network, the introduction of strict regulations on data centers will be vital to managing demand.

Establishing rigorous federal regulations on data centers could help to reduce the burden on the grid. For example, in April, Illinois filed a bill that would require firms operating data

centers in the state to report their annual water and energy consumption to the Illinois Power Agency beginning next spring or face a possible fine of $10,000 for non-compliance.

The fruits of stricter regulation can already be seen in some regions, as tech companies begin to improve practices. For example, in August, Google signed agreements with Indiana Michigan Power and Tennessee Power Authority to decrease its AI data center power consumption during times of high demand on the grid.

“It allows large electricity loads like data centers to be interconnected more quickly, helps reduce the need to build new transmission and power plants, and helps grid operators more effectively and efficiently manage power grids,” Google said in a blog post.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

By: Robert Rapier

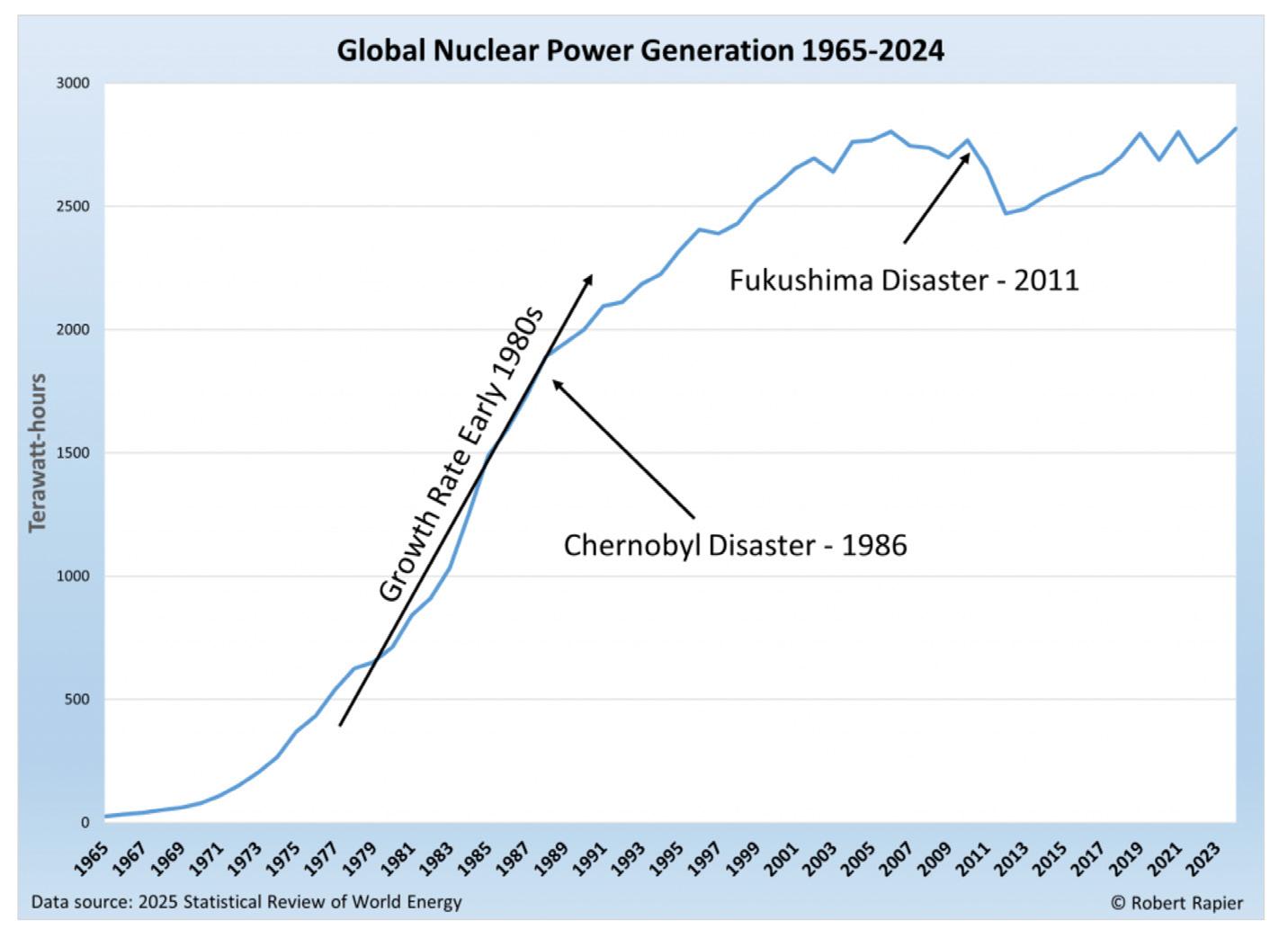

Nuclear power has always been a paradox. It can produce massive amounts of low-carbon electricity, yet it must constantly battle the headwinds of politics and public perception.

The latest Statistical Review of World Energy shows that while nuclear generation is growing globally—setting a new record high in 2024—the trend is anything but uniform. Some countries are charging ahead, while others are stepping back.

Global Output: Modest Growth, Unevenly Shared

In 2024, global nuclear generation reached 2,817 terawatt-hours, a modest uptick from 2023, but surpassing the previous all-time high set in 2021.

Over the past decade, output has grown at a 2.6% annual rate—slow, but a clear recovery from the post-Fukushima slump. That growth is heavily skewed toward non-OECD countries, which are building new capacity at a faster pace (3.0% annual growth) than the flat-todeclining trend in OECD nations (2.5%).

Asia Pacific: The New Center of Gravity

The most dramatic shift is happening in Asia Pacific, now responsible for over 28% of global nuclear output—over double its share from a decade ago:

• As with renewables, China is in a league of its own, with output soaring from 213 TWh in 2014 to more than 450 TWh in 2024—an annual growth rate near 13%.

• India and South Korea also posted steady gains, though on a smaller scale.

This marks a clear geopolitical shift. Nuclear power is no longer dominated by Western democracies, but by countries with state-driven, long-term infrastructure agendas.

The United States still leads the world in nuclear output at roughly 850 TWh annually (29.2% of the world’s total nuclear output), but beneath the stability is a slow attrition of older plants and a lack of new construction.

But the U.S. had its biggest nuclear milestone in decades in 2023 and 2024 with the startup of Vogtle Unit 3, followed by Unit 4. Located in Georgia, Vogtle is the first newly built nuclear power plant in the United States in more than 30 years, and its completion marks the end of a long, costly construction saga plagued by delays and budget overruns. Together, the two new reactors added more than 2,200 megawatts of capacity—enough to power over a million homes—and provide a rare example of nuclear expansion in a country where most growth has come from extending the lives of existing plants. Canada’s output has slipped from 106 TWh in 2016 to 85 TWh in 2024, reflecting plant refurbishments and changing policies. Mexico, a small player, has seen big year-to-year swings, which may indicate operational challenges.

Western Europe is drifting away from nuclear:

• France, long the gold standard for nuclear reliability, has seen output fall from 442 TWh in 2016 to just 338 TWh last year, hampered by maintenance issues and political uncertainty.

• Germany is now at zero after completing its nuclear phase-out.

• Belgium, Switzerland, and Sweden are split between retirements and life extensions.

In Eastern Europe, the picture is brighter. The Czech Republic, Hungary, and Slovakia are increasing output, while Ukraine has managed to maintain over 50 TWh annually despite wartime disruptions.

In Latin America, Brazil and Argentina are holding steady around 15–25 TWh, with Brazil inching

higher. Africa’s only nuclear producer, South Africa, remains flat at about 13 TWh. The Middle East has a new entrant in the UAE, which ramped from zero in 2019 to over 40 TWh in 2024 thanks to the Barakah plant—an impressive buildout in such a short time.

• Japan has restarted some reactors, but its output remains far below pre-Fukushima levels—84 TWh last year versus more than 300 TWh in 2010.

• Taiwan is phasing out nuclear, with production falling from 42 TWh in 2016 to just 12 TWh in 2024.

• Pakistan and Iran continue steady, if modest, growth.

The global nuclear landscape is diverging. Some countries are doubling down, driven by the twin imperatives of energy security and climate action, while others are walking away. The center of gravity is moving away from traditional Western producers toward nations prepared to back nuclear with long-term capital and policy support. For investors, the next wave of growth is likely to come from Asia and the Middle East, not the historical powerhouses of Europe and North America. That shift carries environmental upside as well—especially in China, the world’s largest carbon emitter. Every gigawatt China moves from coal to nuclear represents a major win in the fight to reduce carbon emissions.

About the author: Robert Rapier is a chemical engineer in the energy industry and Editor-in-Chief of Shale Magazine. Robert has 30 years of international engineering experience in the chemicals, oil and gas, and renewable energy industries and holds several patents related to his work. He has worked in the areas of oil refining, oil production, synthetic fuels, biomass to energy, and alcohol production. He is author of multiple newsletters for Investing Daily and of the book Power Plays. Robert has appeared on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS. His energythemed articles have appeared in numerous media outlets, including the Wall Street Journal, Washington Post, Christian Science Monitor, and The Economist.

By: Robert Rapier

America’s power grid is straining under the weight of a fastchanging energy landscape.

Beyond the usual summer hum of air conditioners, power demand is surging from electric vehicle chargers and sprawling new data centers. At the same time, the infrastructure built to deliver reliable electricity is aging and showing its limits. From Texas heatwaves to California blackouts, the warning signs are impossible to ignore.

This isn’t a technical challenge—it’s an economic and political reckoning. If the grid fails, it won’t be because we lacked solutions. It will be because we didn’t act quickly enough.

For nearly two decades, U.S. electricity demand was flat. Now, consumption is climbing, driven by technologies that arrived faster than planners expected.

Artificial intelligence has unleashed a wave of data center construction. These facilities,

dense with high-performance servers and cooling systems, are among the most powerhungry assets in the country. In 2023, AI data centers consumed about 4.4% of U.S. electricity, and that share could triple by 2028, according to Penn State’s Institute of Energy and the Environment.

Northern Virginia—“Data Center Alley”— now handles 70% of global internet traffic, pushing utilities like Dominion Energy to scramble for capacity. Meanwhile, Microsoft and Google warn that a shortage of skilled electricians could delay expansion, with estimates that the U.S. will need 500,000 more electricians in the next decade.

Electric vehicles, heat pumps, and electrified industry are adding further strain. The Pacific Northwest Utilities Conference Committee projects growth equivalent to seven Seattle-sized cities within ten years. The Energy Information Administration (EIA) expects U.S. electricity sales to rise from 4,097 billion kWh in 2024 to 4,193 billion kWh in 2025, with similar gains to follow.

And finally, there’s climate. As extreme heat events multiply, cooling demand in places like Texas and Arizona is surging—driving peak loads to new records.

Just as demand is accelerating, the U.S. is retiring some of its most dependable sources of power.

The EIA projects 12.3 gigawatts (GW) of capacity will retire in 2025, a 65% jump over 2024. That includes 8.1 GW of coal, such as the 1,800-MW Intermountain Power Project in Utah, plus another 2.6 GW of natural gas. These plants provide round-the-clock power that intermittent sources cannot yet replace. Wind and solar capacity continue to grow, but not fast enough. The Department of Energy’s July 2025 Resource Adequacy Report warns that only 22 GW of firm generation is expected by 2030—well short of the 104 GW needed for peak demand. Transmission bottlenecks, permitting delays, and slow

adoption of long-duration storage compound the problem.

Grid operators from PJM, MISO, ERCOT, and others told Congress bluntly in March 2025: “Demand is accelerating, supply is lagging, and current tools may not be enough to bridge the gap.”

Beyond the supply-demand imbalance, the grid faces mounting risks.

Heatwaves, wildfires, and storms are stressing transmission systems nationwide. Events once considered rare—like the 2003 Northeast blackout that hit 50 million people—are now seen as precursors of larger disruptions.

As smart grids and distributed resources proliferate, so do digital entry points for hackers. In 2024, DOE funded 16 cybersecurity projects, including Georgia Tech’s AI-based “DerGuard” system to monitor risks in distributed energy.

Sabotage at substations and transmission lines is also rising. With more than 160,000 miles of high-voltage lines and 7,300 plants, much of it decades old, the system is a sprawling, exposed target. Homeland Security now classifies grid protection alongside nuclear and water infrastructure.

Despite the alarms, policy responses remain sluggish.

Jurisdiction is a big part of the problem. Regional transmission operators manage the grid but don’t own generation or lines. Utilities do, while states control siting and permitting. The result is a patchwork that slows progress.

As of mid-2024, transmission projects across the U.S. faced delays of five to seven years due to permitting hurdles, interconnection bottlenecks, and supply chain constraints. By mid-2025, lead times for large power transformers had stretched beyond 30 months, with some units requiring up to four years for delivery—posing serious risks to grid reliability and expansion.

Even bipartisan efforts like the CIRCUIT Act—introduced in February 2025 to incentivize domestic transformer production through a 10% tax credit—remain stalled in committee, despite widespread industry support and urgent supply chain concerns. Meanwhile, subsidies continue to favor intermittent renewables over firm capacity. The Inflation Reduction Act accelerated clean energy deployment, but without parallel investment in balancing technologies, reliability risks grow.

As of mid-2024, transmission projects across the U.S. faced delays of five to seven years due to permitting hurdles, interconnection bottlenecks, and supply chain constraints.

Federal and private efforts are ramping up, though often as short-term fixes.

DOE has delayed retirements of coal and gas plants and issued reliability directives under the Federal Power Act. These measures keep the lights on but do little to build longterm resilience. DOE also aims to increase long-distance capacity 16% by 2030, adding 7,500 miles of new lines. But permitting delays and local resistance remain obstacles.

In 2025, DOE launched $32 million in pilot projects for smart EV charging, responsive buildings, and distributed energy integration. These solutions could eventually scale, but utilities and regulators must buy in.

For investors, grid instability is a risk, but also an opportunity.

Companies like NextEra Energy, Dominion, and Avangrid are investing billions in grid modernization and diversified generation. Avangrid alone plans $20 billion through 2030 across 23 states.

Independent power producers are also benefiting from the shifting landscape. NRG Energy, one of the nation’s largest competitive power suppliers, has seen its shares climb sharply as rising demand boosts wholesale electricity prices. Unlike regulated utilities, NRG and its peers compete in deregulated

markets, where higher load growth and tighter capacity directly translate into stronger margins. That dynamic could make competitive generators an overlooked winner in a strained grid environment.

Firms like Fluence, Stem Inc., and Tesla Energy are seeing growing demand for storage and microgrid solutions. Pilot programs backed by DOE may open new markets for software-driven load management.

With coal exiting and renewables constrained, power generated by nuclear energy and natural gas retain a “reliability premium.” Deloitte estimates the U.S. power sector will need $1.4 trillion in new capital between 2025 and 2030, with similar levels required through 2050. Firms able to supply firm generation or grid services stand to benefit.

The U.S. power grid isn’t collapsing—but it is under pressure like never before. Demand growth, baseload retirements, extreme weather, and policy paralysis are colliding to create a fragile system.

Whether this moment becomes a crisis or a correction depends on how quickly policymakers, utilities, and investors adapt. The tools exist—firm generation, smart load management, and modern transmission. But without faster coordination and realistic incentives, the U.S. risks trading energy abundance for energy fragility.

About the author: Robert Rapier is a chemical engineer in the energy industry and Editor-inChief of Shale Magazine. Robert has 30 years of international engineering experience in the chemicals, oil and gas, and renewable energy industries and holds several patents related to his work. He has worked in the areas of oil refining, oil production, synthetic fuels, biomass to energy, and alcohol production. He is author of multiple newsletters for Investing Daily and of the book Power Plays. Robert has appeared on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS. His energy-themed articles have appeared in numerous media outlets, including the Wall Street Journal, Washington Post, Christian Science Monitor, and The Economist.

By: Robert Rapier

The Dallas Federal Reserve’s latest Energy Survey, which tracks activity across Texas, northern Louisiana, and southern New Mexico, shows a clear cooling in the U.S. oil sector. After years of relentless growth driven by the shale boom, responses this quarter point to a sector that is slowing down and recalibrating in the face of new pressures.

For the second consecutive quarter, drilling and completion activity declined. Operators are scaling back exploration budgets, and the aggressive growth that defined shale’s early years has given way to more measured operations. That shift comes despite oil prices that, while still historically high, are no longer delivering the outsized returns that emboldened companies a decade ago.

Three themes dominate the survey responses. The first is rising costs. Inflation has not spared the oilfield, and many firms noted that input prices for labor, steel casing, and other critical supplies remain elevated. One executive summed it up bluntly: “We can make money at today’s oil prices. But with costs climbing and politics in play, we’d rather pay dividends than take big risks.” Breakeven prices are higher, leaving fewer projects comfortably in the sweet spot of profitability.

Second, there’s the issue of price uncertainty. Crude trading in the $70s and $80s is not low by historical standards, but producers are wary. Weak demand growth in China, paired with ongoing geopolitical instability, makes planning difficult. As one respondent put it: “Prices aren’t bad, but volatility is killing our ability to plan. We’d rather stay disciplined than chase barrels.”

The third—and perhaps most powerful— force is capital discipline. During the early shale boom, “growth at any cost” was the prevailing mindset. Those days are gone. Shareholders now demand returns, and public companies in particular are under pressure to prioritize buybacks and dividends over drilling. That’s a dramatic cultural shift, and it shows in the cautious tone of the survey’s responses.

Labor shortages remain another consistent challenge. Even with activity

slowing, executives say finding and retaining skilled workers is difficult. Wage inflation continues to bite, and oilfield service providers are competing not just with one another but also with other industries offering steadier work. Meanwhile, regulatory uncertainty looms large. From federal permitting delays to climate-related rules, many firms view the policy landscape as unpredictable at best and hostile at worst.

The survey also highlighted a growing divide by company size. Smaller independents are relatively optimistic, citing their nimbleness and ability to seize local opportunities. Larger firms, by contrast, are increasingly conservative, emphasizing balance sheet strength and operational flexibility over aggressive drilling programs.

For investors, the survey carries several implications. Slower drilling today could mean tighter supplies tomorrow, which may help support oil prices and stabilize cash flows. That in turn makes disciplined producers attractive, even if headline production growth moderates. In many ways, the U.S. oil patch is maturing—less focused on breakneck expansion and more focused on efficiency, capital returns, and resilience.

The Dallas Fed survey is valuable not just for the data it collects, but for the sentiment it captures. And sentiment is clearly shifting. The shale revolution hasn’t run out of steam, but it has entered a new phase. Growth is harder to come by, costs are higher, and the easy barrels have largely been tapped. What remains is an industry grappling with the reality of being both the world’s supplier of last resort and a lightning rod in the global energy transition.

One respondent may have summed it up best: “We’re not done drilling, but the frenzy is over. This is about steady, smart growth now—not boom and bust.”

The U.S. oil industry still holds an enviable position in global markets. But the story of shale today is not how fast production can grow. It’s how effectively producers can adapt to a world where capital, labor, and political certainty are increasingly scarce.

The Dallas Fed survey is valuable not just for the data it collects, but for the sentiment it captures. And sentiment is clearly shifting. The shale revolution hasn’t run out of steam, but it has entered a new phase.

About the author: Robert Rapier is a chemical engineer in the energy industry and Editor-inChief of Shale Magazine. Robert has 30 years of international engineering experience in the chemicals, oil and gas, and renewable energy industries and holds several patents related to his work. He has worked in the areas of oil refining, oil production, synthetic fuels, biomass to energy, and alcohol production. He is author of multiple newsletters for Investing Daily and of the book Power Plays. Robert has appeared on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS. His energy-themed articles have appeared in numerous media outlets, including the Wall Street Journal, Washington Post, Christian Science Monitor, and The Economist.

By: James Campos

As America moves towards an AIenabled economy, the demand for reliable, high-density power is reaching unprecedented levels. Data centers, which serve as the backbone for artificial intelligence, cloud computing, and national-security applications, now consume more energy than entire cities once did. While advanced nuclear and alternative energy sources will eventually provide the long-duration, carbon-free baseload necessary for this growth, the reality is that nuclear power cannot be constructed and deployed overnight. Therefore, natural gas remains a crucial bridge to meet the urgent energy demands of AI and the data-center boom.

The statistics are compelling: recent studies indicate that

data center power consumption could triple by 2030, largely due to the significant energy requirements of generative AI. A single generative AI query can use up to ten times the power of a simple Google search. Additionally, many renewable sources, such as wind and solar, lack the reliability that data centers require. The long-term solution lies in nuclear power, likely through small modular reactors, but until these can be deployed at scale, natural gas is the only energy source capable of providing the massive, dispatchable baseload power needed to keep data centers operational around the clock. Nuclear power offers unmatched potential with decades of stable output, exceptional energy density, and a long-term pathway for resilient U.S. infrastructure.

However, even under the most ambitious timelines, next-generation reactors will take years for development, licensing, construction, and grid integration. In the meantime, data centers cannot afford to wait. Companies investing billions in AI and cloud capacity need power immediately, not a decade from now.

Natural gas, especially through modern combined-cycle power plants, effectively fills this gap. It provides immediate dispatchable generation that can be quickly sited, permitted, and brought online, ensuring the continuity and reliability essential for AI workloads. Its flexibility stabilizes the grid, reduces volatility, and creates the operational runway necessary for nuclear power to scale effectively.

Using gas as a strategic bridge is not a compromise—it

is an enabler. By supporting the grid during the nuclear buildout, gas ensures that datacenter growth does not stall, AI innovation does not slow, and U.S. leadership in digital infrastructure remains secure.

A strong gas-nuclear partnership strengthens economic competitiveness and reinforces national security by keeping mission-critical systems powered without interruption. China, Russia, and other competitors are not slowing down, nor are they allowing their pursuit of AI dominance to be constrained by inadequate energy supplies. AI dominance could well end up being the defining geopolitical contest of our time, making it crucial for the U.S. to remain at the forefront of this rapidly advancing technological race. In the short term, this means embracing natural gas, with the understanding that America’s AI future will ultimately be powered by nuclear. We must utilize pragmatic, reliable and market driven sources of energy in the most responsible way.

The Honorable James E. Campos currently serves as Executive Director of the Virginia Tobacco Region Revitalization Commission (TRRC) /Energy under Governor Glenn Youngkin.

By: Felicity Bradstock

In late July, the United States Environmental Protection Agency (EPA) announced plans to rescind the Endangerment Finding that was passed by the Obama administration a decade and a half ago. In 2009, the EPA formally declared carbon dioxide a public danger, giving the agency the legal basis to cap greenhouse gas (GHG) emissions from major sources such as coal power plants and cars.

At the time, the former head of the EPA, Lisa Jackson, said, “Climate change has now become a household issue… This administration will not ignore science or the law any longer, nor will we ignore the responsibility we owe to our children and our grandchildren.”

Now, the Trump administration and current EPA head Lee Zeldin aim to undo this move.

During a recent visit to an auto dealership in Indiana, Zeldin announced plans for the EPA to rescind the 2009 Endangerment Finding, which helped raise billions in funding for green energy projects, including the development of the electric vehicle (EV) industry. If finalized, the proposal would repeal all resulting GHG emissions regulations for motor vehicles and engines, Zeldin said. He added that both the auto manufacturing industry and American consumers had suffered because of higher costs associated with the Finding over the past 15 years.

“With this proposal, the Trump EPA is proposing to end sixteen years of uncertainty for automakers and American consumers,” said Zeldin. “In our work so far, many stakeholders have told me that the Obama

and Biden EPAs twisted the law, ignored precedent, and warped science to achieve their preferred ends and stick American families with hundreds of billions of dollars in hidden taxes every single year… If finalized, rescinding the Endangerment Finding and resulting regulations would end $1 trillion or more in hidden taxes on American businesses and families.”

There has been a significant response to the EPA’s plan to rescind the Endangerment Finding, with certain industries in favor of the move while many environmental groups have shown concern. Several industries, such as automakers, could benefit from the move, while EV makers and the green energy industry would likely suffer.

Indiana’s Governor Mike Braun said, “The Obama-Biden EPA used regulations as a political tool and hurt American competitiveness without results to show for it. Today’s announcement is a win for consumer choice, common sense, and American energy independence.”

Meanwhile, the Texas Railroad Commissioner, Wayne Christian, stated, “Because America reduced EPA’s six major regulated pollutants by 77% over the last half century, the radical environmental movement had to invent CO₂ as a pollutant – creating a boogeyman – to justify their continued war on fossil fuels. U.S. CO₂ emissions have already declined by 20% over the past two decades, and our oil production is 23% cleaner than the global average. Meanwhile, large fossil fuel-producing nations like China and Russia continue to emit with impunity.”

Meanwhile, the American Consumer Institute (ACI) Energy Analyst Kristen Walker said, “Revisiting the Endangerment Finding is essential in determining whether EPA has statutory authority to regulate greenhouse gas emissions on vehicles. Consumers deserve choice and affordability when buying cars and should not be hamstrung by bureaucrats in D.C. who restrict their options and hurt their pocketbooks.”

While some industry players are enthusiastic about the EPA’s plans, others are concerned about what scrapping the Endangerment Finding would mean for the environment and human health.

One New York Times article reads, “The proposal is President Trump’s most consequential step yet to derail federal climate efforts. It marks a notable shift in the administration’s position from one that had downplayed the threat of global warming to one

that essentially flatly denies the overwhelming scientific evidence of climate change.”

“It would not only reverse current regulations, but, if the move is upheld in court, it could make it significantly harder for future administrations to rein in climate pollution from the burning of coal, oil and gas.”

Critics of the move argue that if the U.S. takes a step back in its efforts to undergo a green transition, it could significantly hinder international efforts to limit global warming to 1.5 degrees Celsius, or 2.7 degrees Fahrenheit, above preindustrial levels, which could prompt widespread severe weather events that put the environment and human lives at risk.

In a 150-page report following the EPA announcement, scientists from the Department of Energy (DoE) criticized the computer models that are used to predict climate change, suggesting that they often overestimate warming. They also said that carbon dioxide has positive effects, as it helps plants grow and increases agricultural productivity, and suggested that the EPA regulations have a limited effect on global temperature rise.

Environmentalists and lawyers have responded by criticizing those arguments, stating that transportation is the largest source of GHG emissions in the United States and if the U.S. motor vehicle sector were a country, it would be the fourth-biggest emitter of GHGs in the world, according to EPA data.

According to the EPA, repealing the Finding would “save Americans $54 billion in costs annually through the repeal of all greenhouse gas standards, including the Biden EPA’s electric vehicle mandate, under conservative economic forecasts.”

However, Dan Becker, the leader of transport policy for the environmental group the Center for Biological Diversity, said the EPA GHG rules were aimed at preventing 7 billion metric tons of emissions from entering the atmosphere, as well as saving the average U.S. driver around $6,000 in fuel and maintenance over the lifetime of vehicles built under the standards. “The E.P.A. is revoking the biggest single step any nation has taken to save oil, save consumers money at the pump and combat global warming,” explained Becker.

On average, scientists have slammed the

Trump administration’s climate report as a ‘farce’ full of misinformation, saying that many claims made in the report were based on long-debunked research.

Naomi Oreskes, an expert in climate misinformation, said that the purpose of the DoE report was to “justify what is a scientifically unjustifiable failure to regulate fossil fuels”. “Science is the basis for climate regulation, so now they are trying to replace legitimate science with pseudoscience,” she added.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

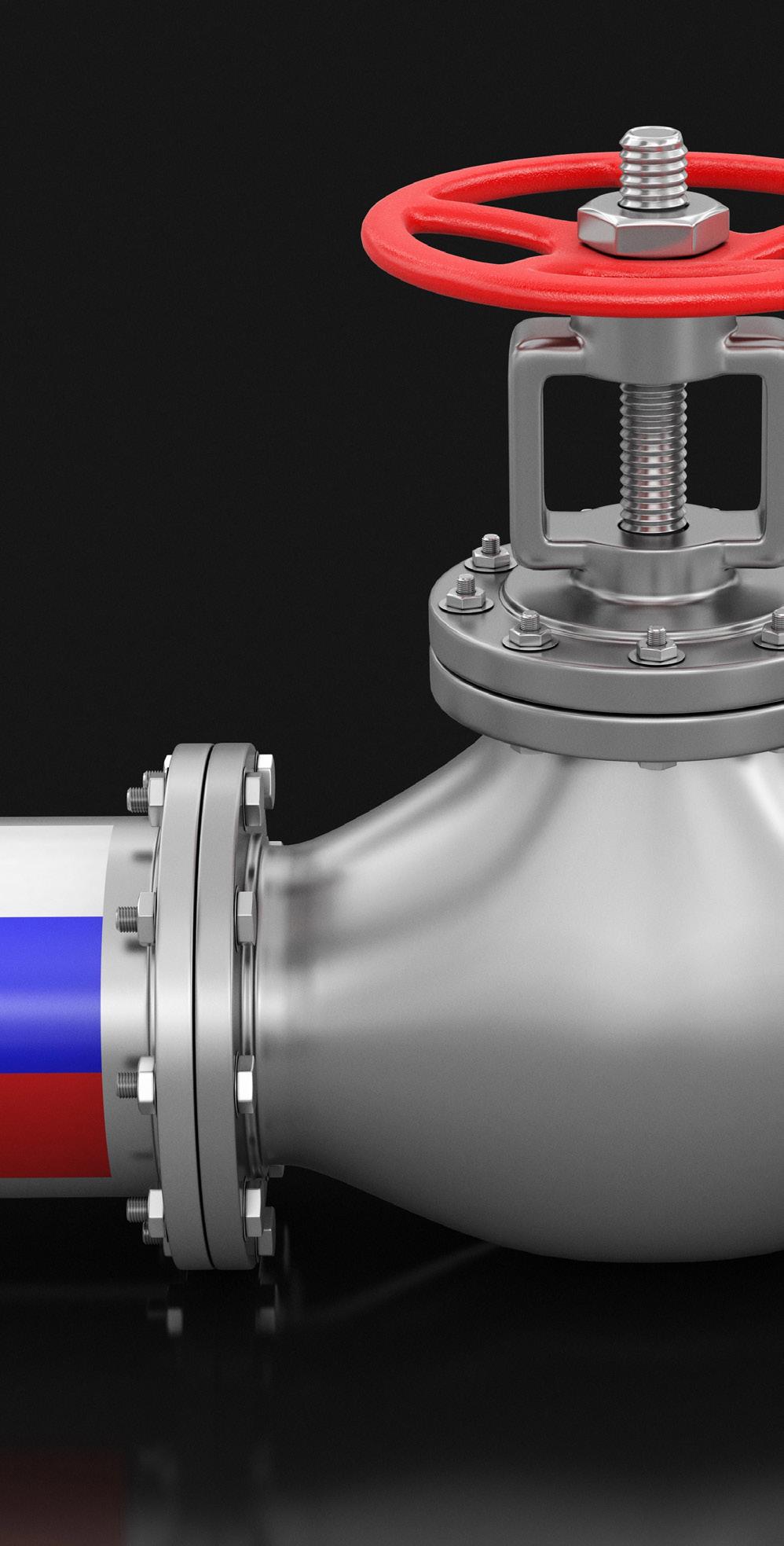

By: Jess Henley

Russia and China have signed a binding deal to build the Power of Siberia 2, a long-delayed gas pipeline that will have the capacity to deliver 50 billion cubic meters (bcm) of gas for 30 years. The pipeline will span from western Siberia to northern China via Mongolia, an incredible feat of engineering.

The arrangement marks a significant shift as Moscow seeks to strengthen its energy position after losing the European and American markets due to Western sanctions and import bans following Russia’s invasion of Ukraine. As the global flow of liquid natural gas (LNG) decouples from the West, the geopolitical and economic aftershock will be felt across the LNG market, pipeline politics, and strategic planning in Brussels and Washington.

What’s in the Deal and What’s Not

According to Reuters, the Gazprom CEO announced that Moscow and Beijing signed a “legally binding memorandum” regarding the Power of Siberia 2, which entails approximately 50 bcm per year of pipeline gas from West Siberia to Northern China. The agreement entails a pipeline that will run through Mongolia, dramatically increasing supply under the existing arrangements.

Furthermore, the arrangement includes a broader increase on the original Power of Siberia route, increasing the footprint and output.

However, for now, key commercial building blocks remain in place, including price, financing, contractors, and construction timelines. These arrangements remain unfixed at this point, but should be agreed upon in the near future as the pipeline venture progresses.

Although the agreement is legally binding, it doesn’t present the economic

impact right away. Instead, it alters the LNG flow for future prospects, pointing to a future geopolitical and supply chain shift for the East. For China, the world’s largest consumer, this means less dependence on Western gas, positioning the world power toward Russia, it strengthens ties with its primary ally and circumnavigates Western sanctions and import bans.

The agreement between China and Russia comes at a pivotal point for the Russian economy as the European Union proposes ending Russian gas imports by the year 2027, according to a European Commission report in June. This decision comes from a broader drive to hamper or cut off Russian energy revenues tied to the war in Ukraine.

Even if the Power of Siberia 2 were to operate at full capacity of 50 bcm per year, it would not entirely replace the energy revenues it’s lost or stands to lose from Europe. Still, it would shift the bargaining leverage for future sanctions and operations. If Russia strengthens its ties with China, securing financials for LNG imports, it limits the West’s power to leverage energy revenues as a negotiation fulcrum.

With Europe planning to end imports of Russian LNG by the year 2027, Moscow is in a time crunch to move quickly towards China, both in terms of infrastructure and geopolitical ties.

When it comes to leverage, China holds a massive trump card, being the world’s largest consumer of energy. Reports indicate that China leverages its market power to negotiate favorable pricing and financing terms from Russia, giving it an edge over Moscow.

China is not only the world’s largest consumer, but the world’s foremost energy importer.The pipeline deal poses a boon to the ever-growing Chinese energy demand. When combined with the rapid renewal, expansion, and nuclear power build-out, the Power of Siberia 2 pipeline deal grants China a potentially

discounted core pillar of its energy mix.

While pricing will be negotiated at a later time, it’s clear that Beijing will push for steep discounts, given its potential volume and near-exclusive buying desire for Russian energies. A lot is riding on the decision: the pipeline LNG cost will determine how costs are allocated, who funds the infrastructure, and how Moscow meets its financial needs.

Major moves like this are never in isolation, and could have ripple effects throughout the global LNG market. A pipeline between Russia and China, in which China benefits directly from a direct source would mean it relies less on other import sources. With a significant portion of its LNG demands met directly from Russia, China would no longer require other exporters as sources, directly affecting nations that have aggressively targeted China as a significant energy consumer.

The United States, under President Trump’s “energy dominance” ambition, would be directly impacted if China ceased to utilize American exports of LNG.

In 2024, China imported 105 billion cubic meters of gas as LNG, according to the Statistical Review. While only 5.8 billion of that came from the United States, significant portions came from Australia, to the tune of 35.8 billion. Another 25.2 billion came from Qatar. If China requires a lower import volume from these

countries in the future, the United States will undoubtedly feel the ripple effect as those countries seek to replace the market they could lose to Russia.

While the demand for LNG remains strong, geopolitically shifting the export flow could radically complicate the matter, with potential uncertainty for future exports to the East Asian market.

Despite giving a blessing to the pipeline, negotiations are far from over. The agreement notably leaves financing and construction investment vague, providing room for potential bargaining in the future. Financially and structurally, a pipeline from Siberia to China is a massive undertaking, involving a considerable risk. Not only will contractors face the terrain challenges of the harsh Siberian and Mongolian environments, but the financial investment will be significant. It remains yet to be seen who will foot the bill for the pipeline, whether that will be considered in the past negotiation, and whether the mega-project can be completed within an agreeable time frame.

Negotiating who will carry the construction risk and cost liability could take several years alone. Additionally, the potential for sanctions, both current and future, could be a deciding factor in which country bears the majority of the liability.

History tells us of several indicators to watch for in

the following months and years for market and policy signals. These include:

1. Pricing terms: China will seek to negotiate the best pricing terms for long-term pipeline LNG imports. However, a lower price could hamper Russia’s financial bottom line, especially given the European Commission’s movement to stifle Russian energy dependence for the EU.

2. Financing and contractor: The next thing to be negotiated will be who will underwrite the mega-project and who will carry the construction liability. In the negotiation, this is a pivotal point, as it determines much of the infrastructure progression and construction timeline.

3. A shift in LNG flow: As China benefits from Russian LNG, the global market could see a shift away from reliance on the current major exporters, including the U.S.

4. European policy action: With the 2027 deadline posed by the European Commission, Russia is on a time crunch to finalize negotiations with China as quickly as possible.

While the deal may be mutually beneficial for China and Russia, it could have a long-term and broad impact on the global market, introducing risk and a shift in the LNG flow. If the Power of Siberia 2 pipeline negotiations fare favorably for China, it will mark a significant change for the global energy flow.

About the author: Jess Henley began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

By: Felicity Bradstock

Following the Russian invasion of Ukraine in February 2022, and the subsequent sanctions imposed by the United States and Europe on Russian energy, Russia began to seek out new markets that were still interested in its discount crude, and one of those was India. As Russia reduced the price of its energy products, countries such as China and India were not dissuaded from purchasing Russian energy in the face of international sanctions, as they increased their import levels.

India’s Russian crude oil imports reached an average of almost 1.8 million barrels per day in May, after 10 months of steady increases. However, United States President Donald Trump is threatening to bring an end to that trend by introducing new tariffs on India. So, will India continue to buy oil from Russia, and is Trump serious or bluffing about adding new tariffs?

India’s Oil Supply

India is the world’s third-largest oil importer and consumer, and the government is constantly looking for competitively priced crude to meet the country’s energy needs. In recent months, crude distillation unit shutdowns at India’s main refineries have increased the need to import more crude for feedstock, according to Jay Shah, a senior oil analyst at Rystad Energy.

The Southeast Asian country’s rising energy needs have made it turn to Russia for oil, with Moscow offering competitively priced crude for countries that are willing to shun international sanctions on Russian energy. In 2023, India more than doubled its import of Russian crude year-on-year. It is now the second-biggest

importer of Russian crude, after China, with it contributing around 35% of India’s oil supplies. Its other main oil exporters are Iraq and Saudi Arabia, followed by the United States.

In August, President Trump signed an executive order “to impose an additional ad valorem duty on imports of articles of India, which is directly or indirectly importing Russian Federation oil.” In signing the order, Trump threatened to introduce additional 25% tariffs on Indian imports starting August 27.

If Trump follows through with the move, tariffs on numerous Indian exports to the United States will increase to 50%, which would affect key Indian goods such as textiles, gems and jewellery, auto parts, and seafood. Meanwhile, electronics, including iPhones, and pharmaceuticals would remain exempt from additional levies for now.

Earlier in the month, Trump said on social media that the Indian government was purchasing “massive amounts” of Russian oil and selling it on the open market. Trump stated, “They don’t care how many people in Ukraine are being killed by the Russian War Machine.”

India’s Foreign Ministry responded to President Trump’s order by emphasizing the difficulties in meeting the energy needs of 1.4 billion people. In a statement, the ministry said, “It is therefore extremely unfortunate that the U.S. should choose to impose additional tariffs on India for actions that several other countries are also taking in their own national interest.” The agency also suggested that India intended to continue buying Russian crude.

Trump’s executive order does not threaten India alone; rather, it means the U.S. could impose additional tariffs on any country that continues to purchase Russian crude. In recent interviews, Trump has threatened the introduction of secondary sanctions, with up to 100% tariffs, on any country that maintains its energy ties with Russia.

Industry Response

While experts fear the impact that such high tariffs would have on India’s economy, the oil and gas industry is less concerned about the threat of new levies. Some believed that Trump used the threat of tariffs to garner leverage ahead of his meeting with Russian President Vladimir Putin last week.

India is the world’s third-largest oil importer and consumer, and the government is constantly looking for competitively priced crude to meet the country’s energy needs.

Before the meeting, Trump appeared undecided about whether he would go ahead with the tariffs or not, stating that they would be “very devastating” for China, especially and suggesting that Russia had already “lost an oil client” in India. “If I have to do it, I’ll do it. Maybe I won’t have to do it,” said Trump.

After the meeting, Trump said the Alaska summit had been a “great and very successful day”. During a post-summit interview with Fox News presenter Sean Hannity, Trump said he planned to hold off on imposing secondary tariffs on China for purchasing Russian crude after making progress with President Putin. However, he did not mention India directly.

“Because of what happened today, I think I don’t have to think about that now,” Trump said. “I may have to think about it in two weeks or three weeks or something, but we don’t have to

think about that right now.”

It continues to remain unclear whether Trump will introduce additional tariffs on Indian products in the coming weeks. However, his threat could well make the Southeast Asian country reassess its reliance on Russian crude.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

By: Felicity Bradstock

The United States and Mexico have a long trade history together. As North American neighbors, they have a wide range of industries that are closely intertwined, particularly energy. The two countries have the potential to enhance power sharing to benefit from one another’s resources and improve regional energy security, but Trump tariffs and other factors could limit the deepening of ties.

Despite a high level of connectivity between the United States and Mexico when it comes to energy, the two North American countries rarely work together to align their energy policies. Under former Mexican President Andrés Manuel López Obrador (AMLO), Mexico’s energy industry was largely closed off from foreign investment, as the president sought to nationalize the country’s energy. At the time, regulatory changes triggered several legal disputes, as the United States and Canadian governments claimed violations of the US-Mexico-Canada Agreement (USMCA) free trade agreement. AMLO made it so that Mexico’s Federal Electricity Commission (CFE) was required to supply at least 54% of the country’s electricity demand, limiting private generators to 46%. This has resulted in an underinvestment in Mexico’s aging transmission network as CFE has struggled to meet national needs. According to a recent study, “In 2024, there were around 9 GW of

installed capacity running on fuel oil and 5 GW of coal, plants exceeding or close to their 30-year technical life. Replacing this capacity with new natural gas and clean energy generation could represent an investment of approximately $5.6 billion, an investment that would require private participation given CFE’s budgetary limitations.”

According to the U.S. Energy Information Administration, in 2023, the United States imported more crude oil from Mexico and paid less per barrel than in 2022, with U.S. crude oil imports from Mexico averaging 733,000 barrels per day, 15% higher than in 2022.

The United States, meanwhile, exports vast quantities of natural gas to Mexico, at a record 6.2 billion cubic feet per day in 2023, or 8% more than in 2022. U.S. natural gas exports to Mexico represented 13% of all U.S. energy exports to Mexico for the year.

The United States and Mexico trade a small amount of electricity, primarily into California, New Mexico, and Texas where transmission lines cross the U.S.-Mexico border, according to the EIA.

In April, the Trump administration introduced 25% tariffs on products from Mexico and Canada that do not comply with the USMCA on free trade, plus 25% on automobile, auto parts, steel, and aluminum exports.

Then, in July, Mexico avoided the implementation of a new 30% tariff

on exports to the U.S. that was scheduled to take effect on August 1, as Trump called for a 90-day pause on the introduction of tariffs. However, the looming threat of higher tariffs has deterred private companies from investing in Mexico in recent months.