U.S. Plans to Sell LNG to Asia via Mexico

WHERE IS ESG HEADING IN 2024

Biden Claims Economy is on the Up and Up

U.S. Climate Funding to Spur Economic Growth in Disadvantaged Regions

THE U.S. AIMS TO BECOME MAJOR GLOBAL COMPETITOR IN MICROCHIP MANUFACTURING

The White House Has Big Plans for U.S. Uranium Production ACCLERATED GREEN TRANSITION OUTLOOK 2024-2025

FUELING PROGRESS

A CONVERSATION WITH MIKE SOMMERS, DRIVING API’S VISION FOR ENERGY INNOVATION

OIL & GAS PLAYERS | BUSINESS

We have moved to a new bigger station in San Antonio!

Sundays 2pm-3pm

930AM

San Antonio

THE ONLY OIL AND GAS SYNDICATED NATIONAL RADIO SHOW

Nationally Syndicated

MOST listened to show on Sunday nights! Thank you HOUSTON!

In the Oil Patch

Radio Show with Kym Bolado

WHERE INDUSTRY COMES TO SPEAK

Saturdays 7am KEYS 1440AM / 98.7FM

Corpus Christi

Sundays 8pm-9pm

KFXR 1190AM / simulcast on the iHeartRadio app

Dallas / Fort Worth Worldwide

Saturdays 1pm-2pm

KWEL 1070AM / 107.1FM

Midland Odessa Permian Basin

Sundays 2pm-3pm

The Answer 930AM

San Antonio / New Braunfels / San Marcos / Austin

Sundays 8pm-9pm

KTRH 740AM / Simulcast on the iHeartRadio app

Houston / Worldwide

Saturdays 6am-7am, 11am-12 noon

Sundays 6am-7am, 5pm-6pm

AM 1440

To listen to the show: Visit shalemag.com or download iHeart mobile app to listen live!

MIDLAND | ODESSA | AUSTIN | DALLAS | SAN ANTONIO CORPUS CHRISTI | HOBBS, NM | LOUISIANA | MEXICO

| TECHNOLOGY | POLICY

®

YOUR PIPELINE TO PREMIUM DISCOUNTS AND INDUSTRY EXPERTISE

WORKERS’ COMP

FOR OIL AND GAS

DONE RIGHT

Oil and gas expertise. It’s just one of the many advantages of membership in our Texas Oil & Gas Association Safety Group. As a member, you’ll have access to information and resources specific to your industry, save about 12% on your workers’ comp premium and you can even earn double dividends. To see if your company qualifies, ask your agent or contact Group Administrator Neal Carlton at ncarlton@txogainsurance.com.

TEXASMUTUAL.COM/TXOGA

Dividends are based on performance and are not guaranteed.

5 SHALEMAG.COM

7 SHALEMAG.COM 14 VOLUME 2 // ISSUE 1 table of contents cover story 14 Fueling Progress A Conversation with Mike Sommers, Driving API’s Vision for Energy Innovation policy 24 U.S. Climate Funding To Spur Economic Growth in Disadvantaged Regions 26 The U.S. is Stealing Europe’s Green Energy Projects industry 32 Essential Outcomes of COP28 34 The U.S. Green Transition is Really Happening Following Successful Decarbonization in 2023 36 Acclerated Green Transition Outlook 2024-2025 38 Japan Earthquake Casts Shadow on Resurgant Nuclear Efforts 40 U.S. Wind Energy Industry Goes from Strength to Strength 42 U.S. Plans to Sell LNG to Asia via Mexico 44 Abandoned Oil Wells Continue to be a Problem 46 World Trade Concerns as Red Sea Shipping Slows 48 Where is ESG Heading in 2024 50 The White House Has Big Plans for U.S. Uranium Production 52 Biden Claims Economy is on the Up and Up 54 The U.S. Aims to Become Major Global Competitor in Microchip Manufacturing business 56 Navigating Pitfalls and Best Practices of Employment Background Checks 58 Smart Planning for Entrepreneurial Success in 2024 59 Strengthening Businesses Through Social and Community Engagement

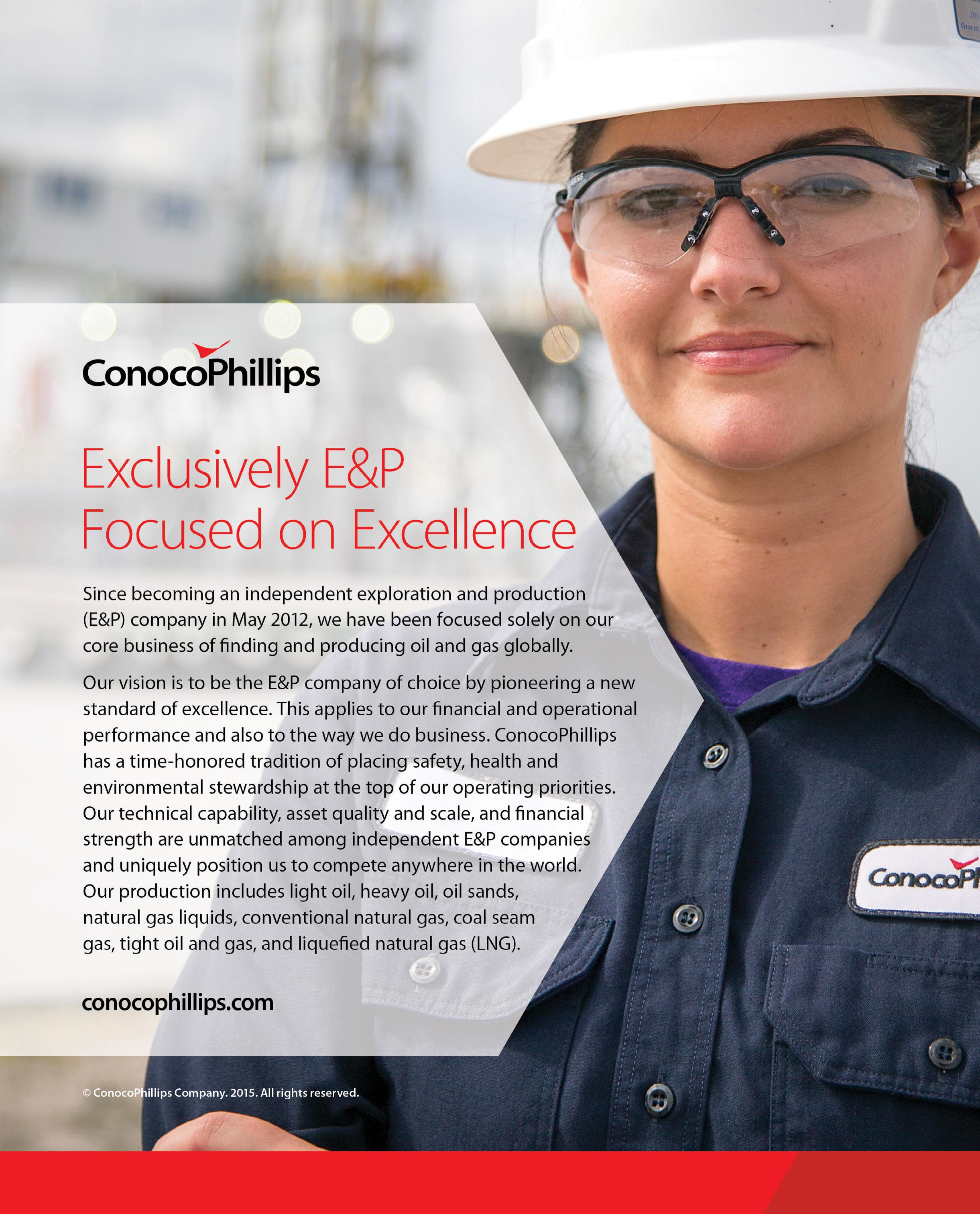

Providing energy for the world while staying committed to our values.

Finding and producing the oil and natural gas the world needs is what we do. And our commitment to our SPIRIT Values—Safety, People, Integrity, Responsibility, Innovation and Teamwork— is how we do it. That includes caring about the environment and the communities where we live and work – now and into the future.

EDITOR-IN-CHIEF

Robert Rapier

CHIEF FINANCIAL OFFICER

Suzel Diego PUBLICATION EDITOR

Tyler Reed

ASSOCIATE EDITOR

David Porter

VIDEO CONTENT EDITOR

Barry Basse

STAFF WRITERS

Felicity Bradstock, Tyler Reed

DESIGN DIRECTOR

Elisa Giordano

VICE PRESIDENT OF SALES & MARKETING

James Moreno / james@shalemag.com

ACCOUNT EXECUTIVES

John Collins, Ashley Grimes, Doug Humphreys, Matt Reed

SOCIAL MEDIA DIRECTOR

Courtney Boedeker

SOCIAL MEDIA MANAGER

Gargi Bhowal

DIGITAL COMMUNICATIONS MANAGER

Amanda Villarreal

CONTRIBUTING WRITERS

Alex Charfen, Jess Henley, Matt Jaye, Josh Simpson

CONTRIBUTING PHOTOGRAPHER

Fonzie Munoz

STAFF PHOTOGRAPHER

Malcolm Perez

EDITORIAL INTERN

LeAnna Castro

8 VOLUME 2 // ISSUE 1 VOLUME 2 // ISSUE 1 KYM BOLADO CEO Copyright © 2024 Shale Magazine. All rights reserved. Reproduction without the expressed written permission of the publisher is prohibited. SHALE MAGAZINE OFFICES: 9787 Katy Freeway, Houston, Texas 77024 5150 Broadway St., Suite 493, San Antonio, Texas 78209 For general inquiries, call 210.240.7188. www.shalemag.com For advertising information, please call 210.240.7188 or email james@shalemag.com For editorial comments and suggestions, please email editor@shalemag.com. ww w conocophillips com © ConocoPhi lips Company 2017. A l r ghts reser ved

17-0663 SHALE ad-3Q_FINAL.pdf 1 6/13/17 1:29 PM YOUR SOUTH TEXAS COMMERCIAL REAL ESTATE CONNECTION SINCE 1975 WE SELL, LEASE & MANAGE COMMERCIAL REAL ESTATE ( 3 6 1 ) 2 8 9 - 5 1 6 8 | C r a v e y R e a l E s t a t e . c o m TOP FIRM 2018-2022

MOVING

AMER IC A’S ENE RGY

The Port of Corpus Christi puts its energy into what matters most - the needs of our customers. With our proximity and connections to Eagle Ford Shale, the Permian Basin, and beyond, we are built to meet the increasing production throughout Texas and the rising demand for energy across the globe.

connect with us: portofcc.com

THE ENERGY INDUSTRY.

I was born and raised in Choctaw County, Oklahoma. It was – ironically given my eventual career path – one of the only counties in Oklahoma never to produce any oil or gas. After growing up on a ranch there, I put myself through college, earning degrees in chemistry, and math, and finally a master’s degree in chemical engineering at Texas A&M University.

I have been interested in energy and environmental issues since childhood. In graduate school, I worked on converting trash and sewage sludge into fuel using microbes obtained from the stomachs of cows. After graduate school, I worked in petrochemicals, oil and gas, and renewables in multiple countries.

As I worked and traveled around the world, I was struck by the attitudes of people in different countries toward their energy industries. When I worked in the Netherlands, the Dutch viewed Shell with pride. Likewise, when I worked in the UK, BP – at least before the Deepwater Horizon accident –was a source of national pride.

But once I was back in the U.S., I saw that many Americans viewed ExxonMobil and Chevron with disdain. These companies that contribute so much to the economy and enable a level of mobility unprecedented in human history were hated by a large segment of the population. We revere the farmers that put food on our tables, but spew venom at the companies that provide the fuel that enables them to do so.

I understood why they were hated. It was because people often heard a one-sided story. They heard sordid tales of an industry receiving government handouts and gouging consumers while making record profits. Of course, if that’s your basic

understanding of an industry, you may learn to hate it. You may make it your life’s mission to work against it.

Perhaps if they understood a more complete picture of what the oil industry does, their attitudes might change. I made it my mission to educate people. I acknowledged the negatives, informed people of the positives, and debunked the misinformation. I pointed out that people risk – and sometimes lose – their lives every year to bring affordable energy to the masses. This energy gives the average person a quality of life that is far beyond that of royalty not that long ago.

But the critics – however misguided they may be at times – didn’t arise for no reason. Global carbon emissions are rising. Most agree this isn’t a good thing. Beyond that, sometimes pipelines leak. Sometimes there are oil tanker spills.

My point is that there is no free lunch. Energy production and consumption have consequences and trade-offs. Whether it is oil and gas, nuclear power, or even renewables, there are accidents, deaths, and environmental consequences associated with energy production and consumption. Our job is to ensure people are educated on those trade-offs. Critics should be addressed head-on, and criticisms should be acknowledged or rebutted.

We must tell the complete story of energy in an unbiased way – the good and the bad. It is especially important to inform those who pass the laws that impact the industry.

That is our mission. Until next time.

ROBERT RAPIER Editor-in-Chief

10 VOLUME 2 // ISSUE 1

FROM THE EDITOR-IN-CHIEF

LETTER

PLEASE ALLOW ME TO INTRODUCE MYSELF. I AM ROBERT RAPIER, THE NEW EDITOR-IN-CHIEF OF SHALE MAGAZINE. IF YOU WOULD INDULGE ME FOR A MOMENT, LET ME TELL YOU ABOUT MYSELF, AND WHY I AM PASSIONATE ABOUT

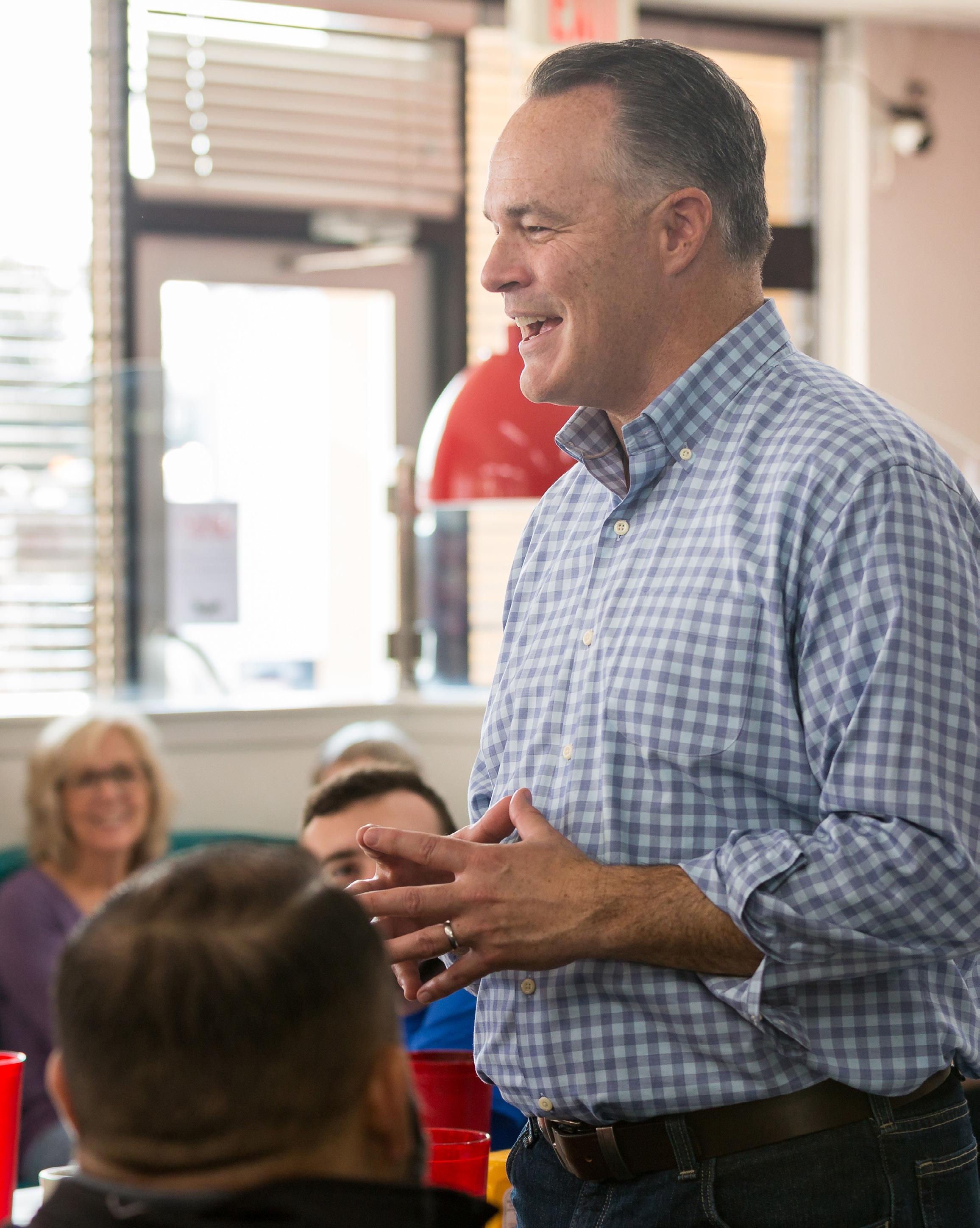

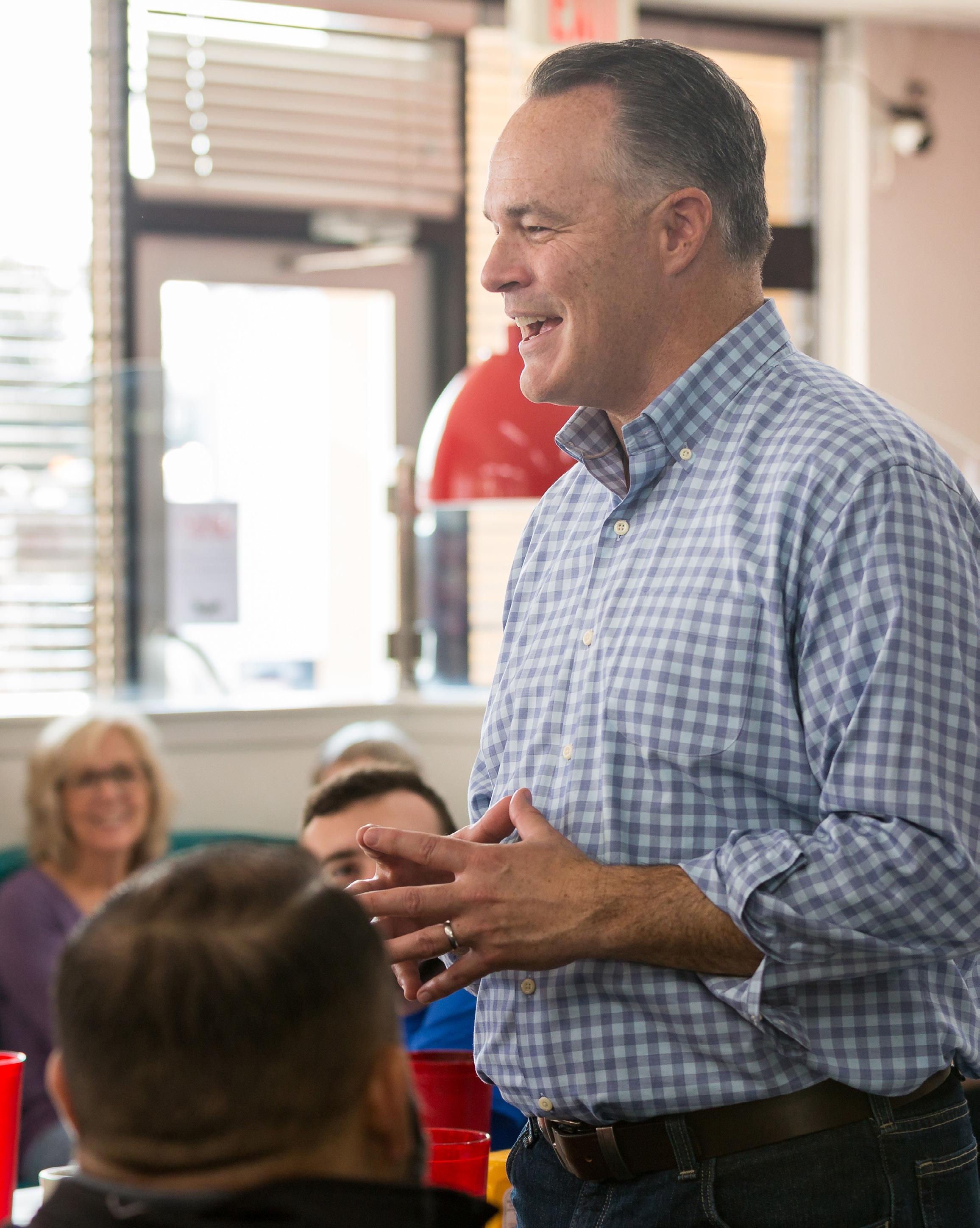

FUELING PROGRESS

A CONVERSATION WITH MIKE SOMMERS, DRIVING API’S VISION FOR ENERGY INNOVATION

By: Tyler Reed

VOLUME 2 // ISSUE 1 14 cover story

PHOTOS COURTESY OF MIKE SOMMERS

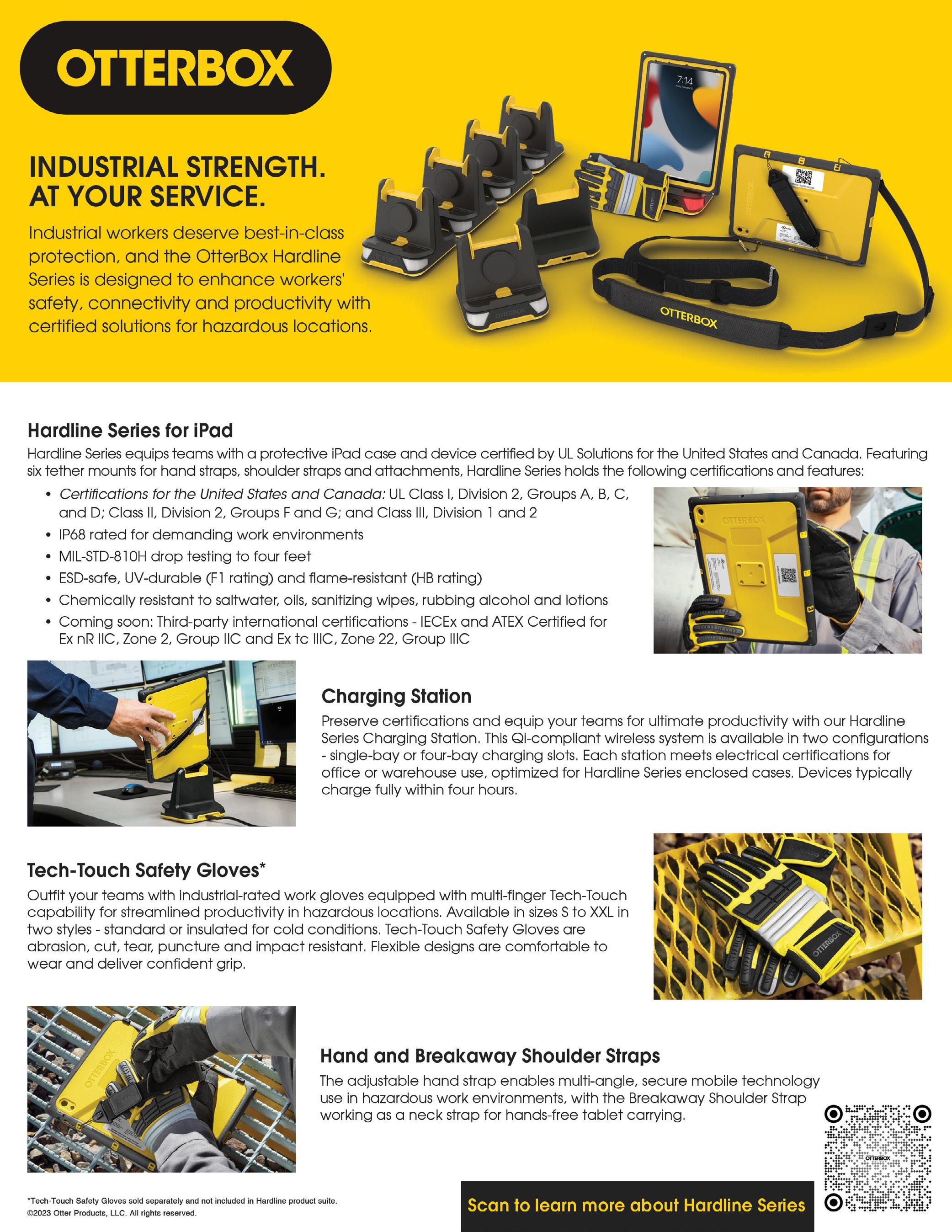

THE AMERICAN PETROLEUM INSTITUTE (API), THE LARGEST TRADE ASSOCIATION FOR THE OIL AND NATURAL GAS INDUSTRY IN THE UNITED STATES, IS SPEARHEADING INITIATIVES TO NAVIGATE THE DELICATE BALANCE BETWEEN INDUSTRY INTERESTS AND SOCIETAL CONCERNS.

In an exclusive interview with SHALE, Mike Sommers, President of API, unveiled the strategic initiatives of the organization in shaping the future of sustainable American energy.

API, established in 1919, represents nearly 600 members responsible for producing, processing, and distributing the nation’s energy. The organization has been at the forefront of setting industry standards and fostering innovation, with a mission to promote safety globally and influence public policy in support of a robust U.S. oil and gas sector.

Under Sommers’ leadership, API champions initiatives like API Energy Excellence®, which accelerates environmental and safety progress through technological advancements and transparent reporting. The organization conducts research, provides essential statistics, offers certification programs, and organizes industry events, making it a pivotal force in shaping the present and future of energy production and regulation–both domestically and internationally.

Sommers serves as the President of API, bringing a wealth of experience in both the public and private sectors to this critical role. In his interview with SHALE, he talked about his personal goals and initiatives to advance the organization’s mission, including navigating potential conflicts between industry interests and broader societal concerns.

17 SHALEMAG.COM

With a deep understanding of the nuances of modern energy policy, Sommers leads API in its efforts to promote responsible energy development and address critical challenges facing the industry.

When asked about reconciling API’s advocacy for fossil fuel development with growing concerns about climate change and the need for a renewable energy transition, Sommers emphasized that demand for affordable, reliable energy is growing, but we don’t have to choose between meeting that demand and addressing climate change. He pointed out that U.S. emissions are down to generational lows, and production is up. Switching to natural gas from coal in the power sector has reduced carbon emissions by more than 50%, and U.S. average methane emissions intensity declined by 66 percent across the seven major producing regions from 2011 to 2021.

In light of increasing public scrutiny on environmental impact, Sommers highlighted that American companies have proven they can produce energy more cleanly and efficiently than just about anywhere in the world. He emphasized that this is why so many nations are adopting API’s environmental and safety standards. Brazil, India, and Ukraine are three recent examples where API’s standards are being implemented.

Overall, API, under Sommers’ leadership, is shaping the future of sustainable American energy by promoting responsible energy development, addressing critical challenges facing the industry, and accelerating environmental and safety progress through technological advancements and transparent reporting.

About the author: Tyler Reed began his career in the world of finance managing a portfolio of municipal bonds at the Bank of New York Mellon. Four years later, he led the Marketing and Business Development team at a high-profile civil engineering firm. He had a focus on energy development in federal, state, and local pursuits. He picked up an Executive MBA from the University of Florida along the way. Following an entrepreneurial spirit, he founded a content writing agency. There, they service marketing agencies, PR firms, and enterprise accounts on a global scale. A sought-after television personality and featured writer in too many leading publications to list, his penchant for research delivers crisp and intelligent prose his audience continually craves.

20 VOLUME 2 // ISSUE 1

POLICY

U.S. Climate Funding To Spur Economic Growth in Disadvantaged Regions

By: Felicity Bradstock

The U.S. government aims to accelerate the green transition and support disadvantaged communities as part of the Biden administration's agenda. Traditional energy operations have taken place in select hubs with access to oil, gas, and coal, but green energy can be established in a much broader geographical space. Wind and solar farms can be located on rural land, while hydropower and geothermal operations may be best suited to entirely new energy regions in the U.S. As the government develops its renewable energy capacity, there is a chance to support the development of longneglected regions and communities, as well as to sustain the economic activities of prior mining and energy hubs.

Developing Disadvantaged Communities

In July, the Department of Energy (DoE) Office of State and Community Energy Programs (SCEP) opened applications for $27 million in funding from the Energy Future Grants (EFG) program. The program aims to foster collaboration between local, tribal, and state governments to benefit disadvantaged communities while supporting a green transition. The funding will provide jobs and economic growth in low-income areas, as well as enhance clean energy security for those most vulnerable to the effects of climate change.

Approximately 50 groups are expected to receive funding of around $500,000 as part of the EFG program. To determine eligibility, applicants were asked to submit a Community Benefits Plan (CBP) outlining how the project will achieve four goals: (1) support community and labor engagement, (2) invest in the American workforce, (3) promote diversity, equity, inclusion, and accessibility (DEIA), and (4) contribute to the President's goal that 40% of the overall benefits of certain federal investments flow to disadvantaged communities (the Justice40 Initiative).

In October, the SCEP unlocked a further $30 million in funding under the Energy Efficiency and Conservation Block Grant (EECBG) Program. The funding will be provided to improve energy efficiency and advance crucial clean energy and infrastructure upgrades in public and private spaces, including hospitals, homes, manufactured housing parks, and government buildings.

Investing in Clean Air

In November, the U.S. Environmental Protection Agency (EPA) launched the Greenhouse Gas Reduction Fund program, announcing plans to award $27 billion in funding for green energy and clean air investments across the country. Approximately $18.6 billion has been earmarked for low-income and disadvantaged communities in line with the Justice40 Initiative. The grants are expected to support job creation, decrease energy costs, enhance the air quality in these communities, and attract higher levels of private investment in the sector.

In November, the EPA made a further $2 billion available to community groups, states, and tribes to improve pollution and develop their clean energy capacity. The agency's administrator, Michael Regan, said the scheme "has the promise to turn disadvantaged and overburdened areas into healthy, resilient, and thriving communities for current and future generations."

Disadvantaged Communities Key to a Green Transition

President Biden adopted the Justice40 Initiative to deliver 40% of the funding from certain clean energy, clean transit, housing, and workforce development investments to communities "marginalized, underserved, and overburdened by pollution." The program responds to the needs of communities that were communicated during the Biden-Harris campaign, with many stating decades of underinvestment and environmental inequality. The Justice40 Initiative covers new initiatives, such as the Inflation Reduction Act, the Bipartisan Infrastructure Law, and the American Rescue Plan.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

24 VOLUME 2 // ISSUE 1

Approximately 50 groups are expected to receive funding of around $500,000 as part of the EFG program.

25 SHALEMAG.COM BEACH BOY 2024/DEPOSIT PHOTOS

POLICY

The U.S. is Stealing Europe’s Green Energy Projects

By: Felicity Bradstock

Since the introduction of the Inflation Reduction Act (IRA), the United States has become the forerunner in green energy, surpassing Europe. The IRA, which is the most far-reaching climate policy to date in the United States, has provided over $391 billion in grants, loans, and other financial incentives to support the development of renewable energy capacity and clean tech advancement. The policy has attracted investors from around the world who were previously eyeing Europe and other parts of the world for project development.

The 2021 Bipartisan Infrastructure Law (BIL) provides $550 billion in funding for infrastructure, including roads, bridges, mass transit, and water infrastructure. This law is supported by the IRA along with the CHIPS and Science Act of 2022. These policies have not only provided high levels of federal funding but have also helped attract even greater levels of private investment.

Private investors across a wide range of industries are flocking to the United States thanks to its favorable business environment. Energy segments including wind, solar, hydrogen, and nuclear power have seen substantial growth, as well as major investments in battery storage, mineral mining, electric vehicle (EV) manufacturing, and clean technologies. Silicon Valley in California and Houston, Texas have quickly become major green tech

hubs, building on their long-standing position in the tech and energy fields. Following the introduction of the IRA, European Commission President Ursula von der Leyen said that the EU must “adjust” its own rules on government aid to accelerate public investment in the energy transition. The EU has since introduced a range of climate policies, to remain competitive. These include the Fit for 55 climate law – aimed at reducing EU emissions by at least 55% by 2030, and the REPowerEU plan – in support of a green transition. However, it faces challenges in catching up with the United States as the regional body needs to convince its member states to invest large quantities of public funds into the green transition to compete with the financial incentives being provided in the United States.

Beating Europe at its Own Game

Europe is currently leading the world when it comes to green hydrogen, which is produced using renewable energy to power electrolysis, in contrast to grey and blue hydrogen which are produced using fossil fuels. Under its REPowerEU plan, the EU aims to produce 20 million tons of green hydrogen a year by 2030, supported by tens of billions of euros in investment. However, the IRA has encouraged several companies that were eyeing Europe for green hydrogen production to reassess, with many establishing operations

26 VOLUME 2 // ISSUE 1

Europe is currently leading the world when it comes to green hydrogen, which is produced using renewable energy to power electrolysis, in contrast to grey and blue hydrogen which are produced using fossil fuels.

in the United States. The IRA provides a $3-per-kilogram subsidy for green hydrogen production, as well as tens of billions of dollars in loans and financial incentives for international investors in the industry.

Jorgo Chatzimarkakis, the CEO of Hydrogen Europe, said, “We have a very robust framework in the EU, but we fail to attract our own companies because it’s all too complex… We have ambitious targets, but we don’t have simple and efficient instruments to incentivize businesses.” He added, “In their typical bureaucratic way, the Europeans will kill this business.”

Becoming Globally Competitive

In addition to overtaking Europe in several green energy and cleantech sectors, the Biden administration is developing its regional supply chains and enhancing its mining and battery manufacturing capacity to become more competitive at the global level. In 2023, the United States’ battery capacity pipeline overtook Europe’s for the first time. Between the launch of the IRA and the summer of 2023, an additional 436 GWh of battery capacity was added to the United States' pipeline, marking an increase of 57.9%. The United States' battery capacity pipeline for 2031 stands at around 1,190 GWh.

Evan Hartley, an analyst at Benchmark, stated, “Since the inception of the IRA last year, the US battery cell production capacity pipeline has experienced a growth rate significantly higher than Europe, and even China, highlighting the attraction the country now has for cell producers.”

The United States is now aiming to work with the EU to secure its supply of critical battery minerals. In January, the two powers failed to reach an agreement over the trade of these minerals, but they plan to continue discussions to establish a transatlantic marketplace for minerals and other components. The EU continues to view the IRA as discriminatory, suggesting it is too protectionist and does not leave room for international competition and growth. However, the creation of an international minerals market that rivals China’s dominance in the sector could help boost global energy security.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

27 SHALEMAG.COM

29 SHALEMAG.COM

KNOW HOW TO FEED TEXANS TEXANS

Reaping the earth’s bounty is what we do best. That’s why you should plan your next o site onsite by catering with Freebirds. From custom-rolled burritos to an entire burrito bar, your folks will attend this meeting and even look forward to the next.

Place your order now.

30 VOLUME 2 // ISSUE 1 Opening Doors in San Antonio Since 1974 5600 Broadway Avenue • San Antonio, TX 78209 KingRealtors.com tabitha@kingrealtors.com TABITHA KING 210.414.4255 KING REALTORS is dedicated to helping San Antonio and the oil industry with their real estate needs. If you are looking to buy or sell a property, call us and say you saw it in SHALE Magazine!

ONLY

Burrito San Antonio & South Texas Catering Sales Manager Josie Nieves P: 210-560-5002 F: 866-421-0876 jnieves@freebirds.com

Freebirds World

HOW HEALTHY IS YOUR DIGITAL PRESENCE?

Get one of our business snapshots today to find out how you rank.

LISTINGS

The Listings grade is a reflection of your business’s online listings. Each listing source is assigned a score based on how popular the site is. For example, having an accurate listing on a popular site like Google will have a greater influence on your Listing Score. The Listings grade is determined by the percentile range your business falls into when compared to other businesses in the same industry.

REVIEWS

Review grades are a reflection of your business’s online review performance. Each grade in the Reviews section is determined by the percentile range your business falls into when compared to other businesses in the same industry.

SOCIAL

Social grades are a reflection of your business’s social media presence. Each grade in the Social section is determined by the percentile range your business falls into when compared to other businesses in the same industry.

WEBSITE

Website grades are a reflection of your business’s website performance, based on Google’s PageSpeed Insights. Each grade in the Website section is determined by the percentile range your business falls into when compared to other businesses in the same industry.

ADVERTISING

The Advertising grade is a reflection of your business’s online campaign performance. The grade is determined by the percentile range your campaign’s estimated cost per click falls into when compared to other businesses in the same industry.

SEO

The Search Engine Optimization (SEO) grade is a reflection of your business’s search engine visibility. The grade is determined by the percentile range your keywords’ estimated value per click falls into when compared to other businesses in the same industry.

ALLOW SHALE TO HELP YOUR BUSINESS REACH ITS FULL DIGITAL POTENTIAL!

31 SHALEMAG.COM

GET YOUR GOOGLE FREE BUSINESS SNAPSHOT

MORE

INQUIRE ABOUT OUR BUSINESS SNAPSHOTS TODAY TO LEARN

more:

or email james@shalemag.com

The business snapshot rates and scores your business by your Google ranking. Easily see your strengths and weaknesses. Learn

210-240-7188

INDUSTRY

Essential Outcomes of COP28

By: Jess Henley

The 28th Conference of Parties (COP28) has come to an end, just like it did in 2023. This year’s summit was a crucial moment for the energy transition. The world’s largest climate conference was packed with critical discussions on climate change, industry, energy, and the impact of global emissions.

Our team of fact-finding reporters has the key takeaways and next steps from COP28. We’ll cover the major discussions, fundamental disagreements, and their potential impact on energy-wise investors. Here is everything you need to know from COP28.

Funds for Vulnerable Countries

From the very first day of the climate summit, delegates focused on the vulnerability of less affluent nations, particularly those that have been hit the hardest by disaster and devastation. The Loss and Damages Fund, which is designed to be a resource in catastrophic events like earthquakes, tsunamis, and other cataclysmic events, was put into motion during the UN talks.

The fund is intended to relieve vulnerable nations after any climaterelated event to rebuild infrastructure, farmland, and repair damages. According to the president and CEO of the World Resources Institute, people in vulnerable countries will face up to $580 billion in climate-related damages in 2030, with a significant increase in the following years.

Although the pledged contributions towards this fund on the first day of COP28 included a $100 million commitment from the United Arab Emirates, the pledges still fall woefully short of the estimated climate-related losses and damages. However, operationalizing the fund can help offset the disaster costs for nations in need.

Compared to two years ago, when it seemed impossible to get the fund off the ground, the number of pledges and countries that have stepped up is encouraging.

Assessing the Progress of the Paris Agreement

The first-ever Global Stocktake to assess the progress of the Paris Agreement of 2015 took center stage at this year’s conference. The stocktake provides an opportunity to analyze the collective progress towards the goal of decreasing temperature rise by 1.5° Celsius by 2030.

During this assessment, nations reported on the steps they are taking to adhere to the Paris Agreement goals. At the same time, the global analysis provides clarity on future goals, as well as identifies potential gaps in progress efforts. This year’s conference featured the first inventory of its kind, which is set to take place on a five-year rotational basis.

Dubbed the UAE Consensus, the climate assessment outlined an aggressive framework to reach net-zero emissions by 2050 through the extreme migration wave from fossil fuels as an energy source, which has long since been said to impact global temperatures significantly.

Additionally, the consensus mobilized a staggering $85 billion in funds for climate action. With 198 Parties committing to ramp up climate action, the UAE Consensus will prove to be a critical turning point in climate efforts moving forward.

Fossil Fuels on the Way Out?

Naturally, a key topic of COP28 was the rapid transition away from fossil fuels as an energy source. This year, for the first time, the decision to migrate away from oil, coal, and other fossil fuels was an official outcome set by the UN. Although

32 VOLUME 2 // ISSUE 1

oil and gas interests posed significant resistance, several countries refused to back down and reached an agreement that could be the beginning of the end for fossil fuel usage.

However, the call to move away from fossil fuels is not without contingency plans for the transition. The deal left wiggle room for transitional fuels, like natural gas, and gave leeway to oil and coal producers who invest in carbon-capturing technologies. Loopholes allow fossil fuel interests to continue the transition in an orderly fashion, as opposed to an abrupt cessation with potentially cataclysmic economic impact.

The key emphasis of the agreement entails tripling renewable energy resources and technologies to accommodate the global power necessities. This ambitious goal is set for the year 2030, with 130 nations on board with the sprint towards renewables.

Food Security and Course Correction

Continuing in a series of first-evers, global food production negotiations reached a milestone during this year’s conference. Prior to COP28, food scale and production have remained notably absent from UN climate talks. This year, 134 countries agreed to move food to the forefront of their climate efforts.

Within the agreement, nations resolved to implement sustainable agriculture systems to counteract waste, emissions, and imbalance caused by food production. The negotiations included encouragement to implement multi-sectoral solutions, including “resilient food systems,” which account for global climate change and ensure a food supply despite cataclysmic climate-related events.

Participating countries must implement food and food systems by 2025 to adhere to the substantial food policy reform.

Reduced Methane Emissions

Finally, the conference also focused on reducing methane emissions. Although methane is not the most significant greenhouse gas, it has a more potent warming potential than carbon dioxide. With that in mind, the Global Methane Pledge was announced, with over 100 countries committing to reduce methane emissions by 30% by 2030.

The pledge plans to reduce emissions from agriculture, oil and gas production, and waste management. The initiative could prevent up to 0.3°C of global warming by 2045, a significant step in the fight against climate change.

About the author: Jess began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

33 SHALEMAG.COM KEVRON2002/DEPOSIT PHOTOS

(CONTINUED NEXT PAGE)

The U.S. Green Transition is Really Happening Following Successful Decarbonization in 2023

By: Felicity Bradstock

Thanks to reduced coal use and successful decarbonization schemes, the United States saw a significant fall in its carbon emissions last year, suggesting it is achieving its aim for an accelerated green transition. Following the introduction of the Inflation Reduction Act (IRA) in the summer of 2022, the US has attracted high levels of private investment in renewable energy, clean technologies, and decarbonization schemes. This has mainly been spurred by the favorable business environment created by the IRA and other supporting policies, which are expected to continue driving investment in the sector over the coming years.

In 2023, greenhouse gas emissions in the US fell by 1.9%, largely thanks to reduced coal burning to provide electricity. The practice fell to its lowest level in over 50 years, which has resulted in a reduction in US emissions of approximately 17.2% since 2005. Further, over the last few years, the US government approved a record amount of federal money for low-emissions technologies, such as solar panels, wind turbines, nuclear reactors, electric vehicles, and hydrogen fuels.

Climate Achievements

Since his inauguration in 2021, President Biden has set out an ambitious list of climate pledges for the US. These include rejoining the Paris Agreement and committing to international aims, such as net-zero carbon emissions by 2050. Over the last three years, the Biden administration has made significant progress in decarbonizing the US economy and tackling climate change, through the introduction of the most far-reaching climate policy to date; the rollout of financial incentives for green investment and collaboration with international partners.

34 VOLUME 2 // ISSUE 1 INDUSTRY

Since his inauguration in 2021, President Biden has set out an ambitious list of climate pledges for the US. These include rejoining the Paris Agreement and committing to international aims, such as netzero carbon emissions by 2050.

In 2021, Biden introduced a national goal to reduce emissions by 50% to 52% from 2005 levels by 2030. Based on significant reductions over the past couple of years, the US is on track to achieve this goal. Biden has also succeeded in his campaign pledge to introduce meaningful climate policies. His government introduced the IRA in 2022, as well as the Infrastructure Investment and Jobs Act (or Bipartisan Infrastructure Law) in 2021, spurring investment in clean energy manufacturing projects. In 2023, the administration announced draft tax credit guidance for clean hydrogen production, which is expected to further support the green transition.

The Biden administration has also made significant progress in reducing the emission of super-pollutants like hydrofluorocarbons (HFCs) and methane. In 2022, the Senate ratified the international Kigali Amendment on reducing HFCs and the US Environmental Protection Agency (EPA) has issued regulations to reduce HFCs. The government then introduced the $20 billion Methane Action Plan, which includes 50 specific measures to decrease HFCs. The IRA also includes a methane emissions fee for some oil and gas sites, with charges commencing in 2024. Biden, alongside other country leaders, launched the Global Methane Pledge at the COP26 climate summit in 2021. The pledge now has 155 signatures from countries committing to reduce their methane emissions by at least 30% by 2030.

Further to Go

The Biden administration introduced a goal for 50% of new passenger vehicles sold to have zero emissions by 2030, as well as an executive order making it compulsory for federal agencies to purchase 100% zero-emission light-duty vehicles by 2027. In 2022, the Department of Transportation also approved plans to build a $5 billion national electric vehicle (EV) charging network, with funds coming from the Bipartisan Infrastructure Law. Greater funding for EV manufacturing and uptake

and stricter standards on vehicle emissions are expected to contribute significantly to the goal of requiring all new passenger vehicles sold after 2035 to produce zero emissions.

Meanwhile, the government has taken steps towards the goal of increasing clean electricity standards to 55% by 2025, 75% by 2030, and 100% by 2035. An executive order has made it compulsory for federal agencies to procure 100% carbon-free electricity by 2030. Tax credits provided by the IRA are also expected to contribute to this goal. However, the government must take significant steps to develop additional electricity transmission capacity. At present, there is a significant backlog of clean energy projects waiting to be connected to the grid, a challenge that must be tackled to achieve the clean electricity aim.

In terms of home appliances, stricter regulations must be introduced to help reduce emissions. While the IRA offers tax incentives for the adoption of clean electricity in new buildings, there is currently no federal ban on the use of fossil fuel appliances, with most progress to date taking place at the state level.

There has also been some progress in the reduction of emissions in the cement, steel, and plastics industries through the instruction of carbon capture and storage technologies, as well as encouraging the purchase of low-carbon building materials. But more needs to be done to decarbonize hard-to-abate industries. The introduction of lowcarbon product standards, coupled with federal funding for research and development, could help accelerate progress in this area.

About the author: Felicity

Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

35 SHALEMAG.COM

SCHARFSINN/DEPOSIT PHOTOS

INDUSTRY

Acclerated Green Transition Outlook 2024-2025

By: Felicity Bradstock

The Biden administration has been implementing strong climate policies and accelerating the US green transition over the past three years. This began with the initial ban on new oil and gas leases and continued with the introduction of a range of favorable climate policies. Although the US is still a major producer of fossil fuels, its green energy capacity has grown significantly in recent years with a huge pipeline of renewable energy and clean tech projects for the next decade. As the US government continues to invest in the renewable energy sector, attracting high levels of private investment, we can expect to see an accelerated green transition over the next couple of years, to put the country in a competitive position at the global level.

Expectations for 2024 to 2025

Thanks to increased public and private investment in green energy and clean technologies, the US is experiencing an accelerated green transition that many other countries are striving to match. The introduction of favorable climate policies, such as the Bipartisan Infrastructure Law (BIL) – which includes several energy infrastructure overhauls – and the Inflation Reduction Act (IRA), has demonstrated the Biden administration’s commitment to a green transition. This has encouraged a wide range of private companies to invest in green energy and clean tech to support decarbonization efforts.

The government’s introduction of financial incentives, such as tax breaks and grants, has

made green energy and clean technologies more accessible to companies across the US and is supporting a shift away from fossil fuels to cleaner alternatives. As energy companies and industry strive to decarbonize, we are seeing huge growth in the US renewables market. For example, utility-scale solar generation is expected to increase by around 75% over the next two years, through the addition of around 79,000 MW of new capacity. Utility-scale solar, wind and hydro power are expected to provide around double the electricity supplied by coal by 2025, with wind and solar together expected to contribute 18.5% of the total electricity generated in the US.

As wind and solar energy production overtakes fossil fuels, battery storage will be key to managing the reliability issues associated with renewable energy. To that end, US battery storage capacity is expected to double between the end of 2023 and 2026. To over 40 GW. This is a huge leap from the 1 GW of battery storage that existed in the US in 2019.

The increase in renewable energy capacity has not just been supported by climate policies but also through the falling costs associated with solar, wind and other green energy projects. Thanks to greater investment in research and development, there have been several breakthroughs seen in recent years that have resulted in the production of more powerful green energy equipment at a lower cost. This is not just at a national level but also globally, with companies worldwide

competing to develop innovative green energy equipment.

Over $1.7 trillion in investment was expected to be spent on technologies such as wind, solar power, electric vehicles, and batteries worldwide in 2023. This is higher than the investment in fossil fuels, which stood at just over $1 trillion. Fatih Birol, the executive director of the International Energy Agency, explained, “We look at energy data on a daily basis, and it’s astonishing what’s happening.” He added, “Clean energy is moving faster than many people think, and it’s become turbocharged lately.”

A Shift Away from Fossil Fuels

As US renewable energy capacity increases substantially over the next few years, we can expect a reduction in the contribution of fossil fuels to electricity

36 VOLUME 2 // ISSUE 1 OLIVERDELAHAYE/DEPOSIT PHOTOS

generation. In 2023, the market share of gas and coal was 58.5%, a figure that is expected to fall to 54.4% by 2025. According to the Energy Information Administration (EIA), coal generation is expected to drop by nearly 18% over the next two years, to supply just 13% of US electricity by 2025. Renewable energy sources and lower-priced gas – which is also lower in carbon emissions – will become more widely used for electricity production. The Institute for Energy Economics and Financial Analysis (IEEFA) expects around 18 GW of coal plant capacity to be shut down or converted to burn gas by the end of 2025.

Nevertheless, the US fossil fuel industry is still investing in new coal mines, oil rigs, and gas pipelines, and the government has supported an elevated oil and gas output in response to energy shortages following the Russian invasion of Ukraine and subsequent global energy shortages. The US has also been

criticized for continuing to fund new large-scale gas operations as the world begins its transition to green, with many energy experts worried that the supply will overtake demand.

The Mid-Term Outlook

Following recent successes in raising US green energy capacity, following the introduction of favorable climate policies and financial incentives, we can expect a rapid rise in the country’s green energy capacity over the next few years.

About the author: Felicity

Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

Over $1.7 trillion in investment was expected to be spent on technologies such as wind, solar power, electric vehicles, and batteries worldwide in 2023.

37 SHALEMAG.COM

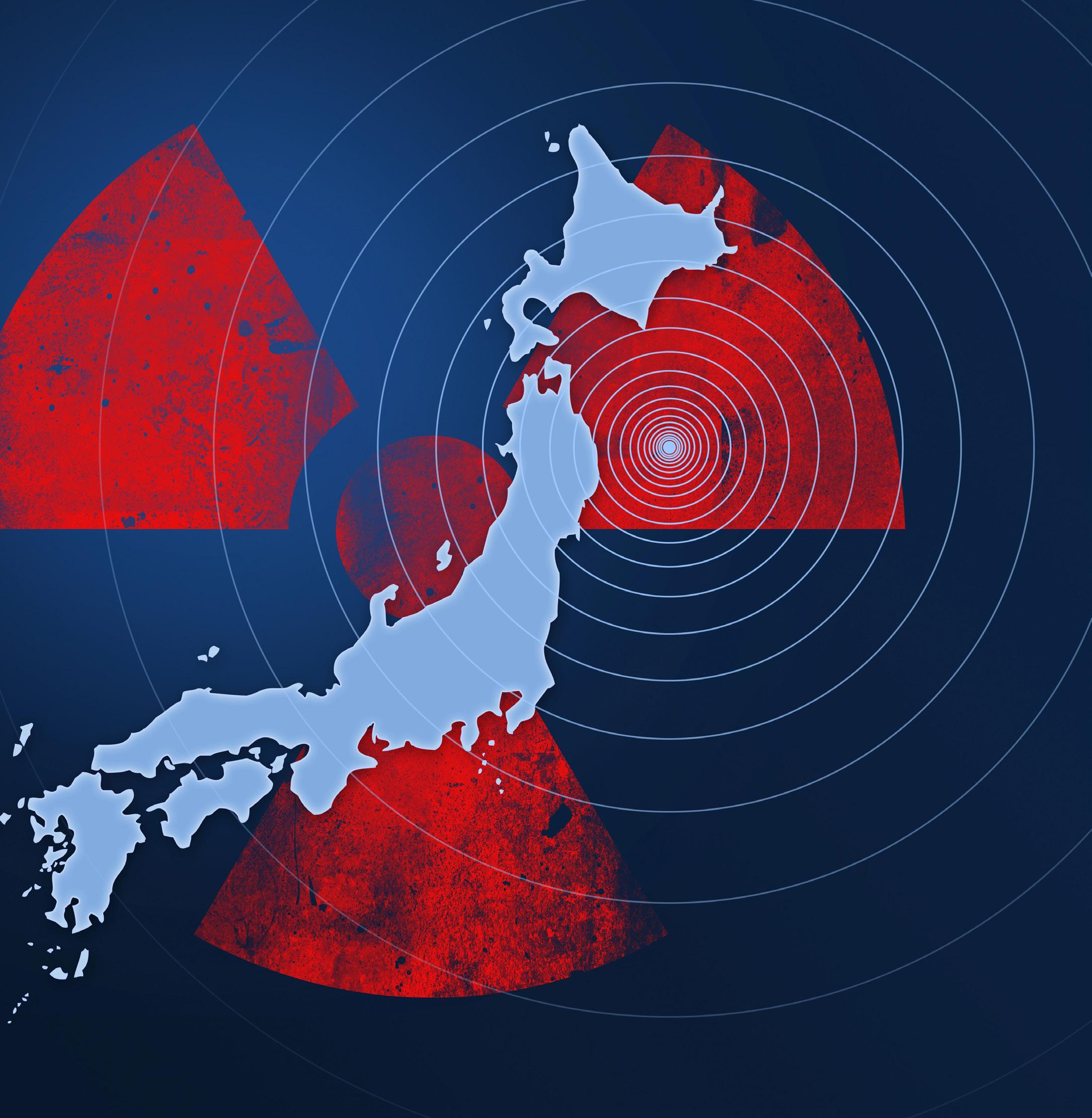

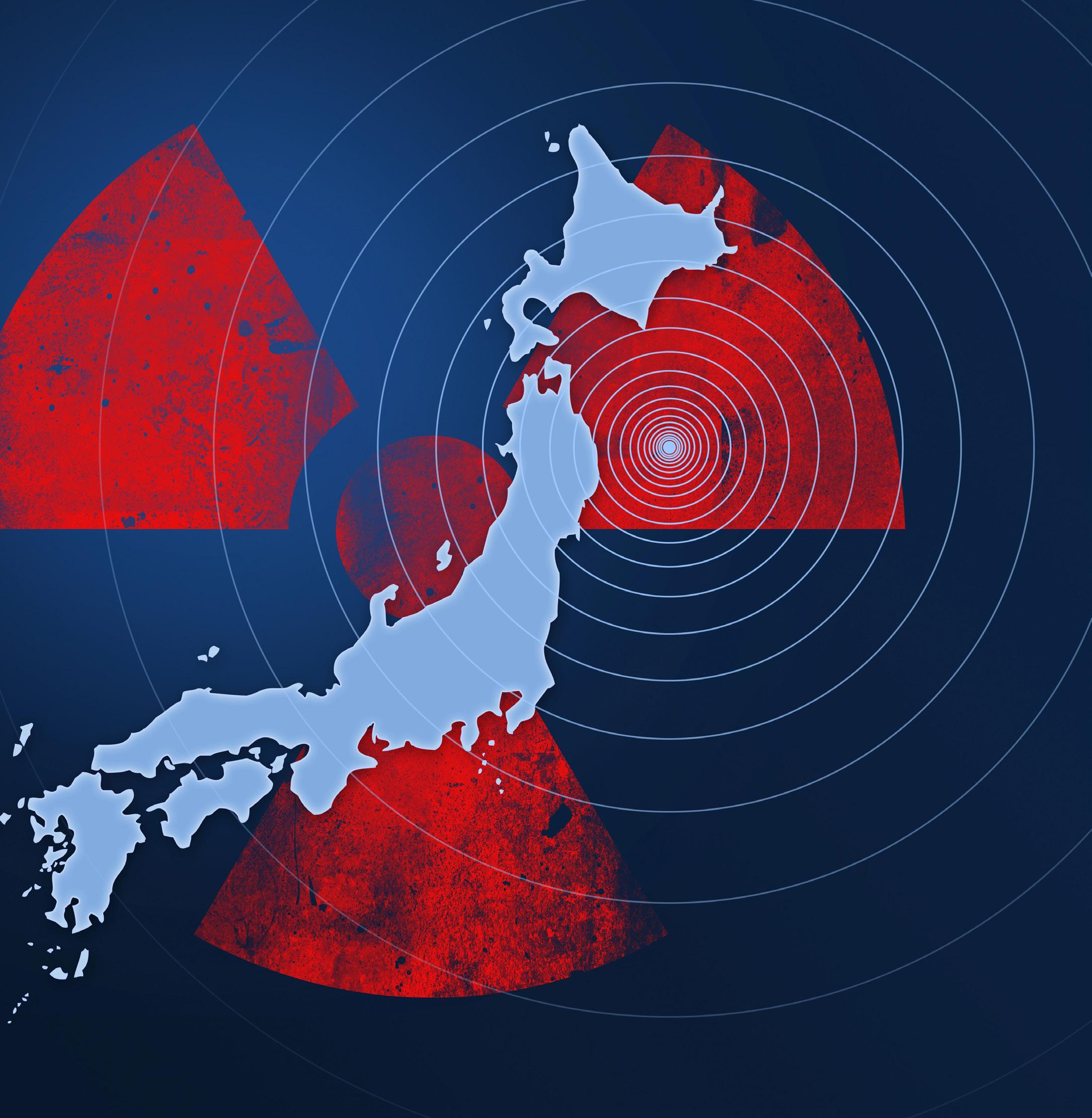

Japan Earthquake Casts Shadow on Resurgant Nuclear Efforts

By: Jess Henley

A7.6 magnitude earthquake struck a remote Japanese peninsula on January 1, causing devastation along the northwestern coast. As the country deals with the aftermath, Japan’s nuclear activity is facing a grim outlook. The disaster has resulted in the Japanese people being less enthusiastic about reopening atomic power plants.

The earthquake caused a death toll of 161 and left over 2,000 people stranded from rubble and severely damaged roads. The Japanese military has offered aid, distributing emergency supplies to the victims. Over 6,000 troops have been deployed to help with disaster relief efforts. Aftershocks are still being felt, and officials are encouraging residents in the most affected areas to remain in place for safety. More than 1,200 tremors had been recorded since New Year’s Day.

Fortunately, nuclear facilities throughout Japan did not suffer significant damage. Only two atomic facilities reported minor damages, including a small amount of leaked water from nuclear fuel pools. However, with the immediate tsunami warnings that followed the earthquakes, much of the public was reminded of the tragic events that took place in 2011, when a massive tsunami wrecked Japan, causing the Fukushima nuclear meltdown.

The Shika nuclear reactor is the closest to the epicenter of the earthquake, at nearly 65 km distance. However, the Shika facility has remained dormant since the Fukushima incident. Regular inspections have been held at the Shika facility and other nuclear reactors since the initial quake to ensure no further damage caused by the events of January 1st or any of its aftershocks.

The January 1st quake struck mere days after Japanese regulators lifted the ban on operation for Tokyo’s Kashiwazaki-Kariwa nuclear power plant, which has been offline since 2012. The plant, which lies roughly 120 kilometers away from the earthquake’s epicenter, has had a rough history, being banned from operation in 2021 due to safety concerns and mishandling of nuclear materials.

Tokyo Electric Power Company (Tepco) hopes to reopen the power as soon as possible after the earthquake but will likely face more resilient opposition. Despite increasing energy demands, the Japanese government is wary of jumping back into a full-scale nuclear power program.

Following the January 1st earthquake, Tepco reported that water had spilled from a nuclear fuel pool at the Kashiwazaki-Kariwa plant. Approximately 15 liters of radioactive water spilled from two separate pools due to the earth’s tremors. Though officials said the radiation levels were in the normal range, the Japanese people can’t help but think of Japan’s nuclear disasters in the past, such as the Fukushima meltdown in 2011.

Japan has experienced several nuclear disasters, including the Fukushima meltdown, which displaced over 100,000 Japanese citizens. Prior to the disaster, nuclear power provided Japan with roughly 30% of its power supply. Approximately 72 nuclear reactors were in full operation until the 2011 tsunami. However, only ten months after Fukushima, nuclear power dwindled to just over 8% of the nation’s electricity supply. Due to public opinion, Japan had plans to shut down its nuclear efforts.

A decade later, rising energy costs and increasing power demands spurred a rekindled movement to re-explore nuclear power in Japan. Nuclear power remains one of the cleanest forms of energy production while being relatively affordable to produce after the initial investment.

Though the hope was to reinstate the KashiwazakiKariwa plant by the end of 2026, the January 1st earthquake has cast public doubt and a sense of fear. This public position on a nuclear power resurgence may prevent a nuclear return to Japanese interests.

Japanese power companies have already felt the economic impact of the disaster and the reluctance to restart nuclear facilities.

About the author: Jess began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

38 VOLUME 2 // ISSUE 1 INDUSTRY

39 SHALEMAG.COM CHUONGY2/DEPOSIT PHOTOS

U.S. Wind Energy Industry Goes from Strength to Strength

By: Felicity Bradstock

The United States has set ambitious plans for the development of its wind energy sector despite facing supply chain disruptions and rising material costs. However, the country must overcome several challenges to achieve its goal of developing its wind capacity in line with climate pledges and a green transition.

In December, the U.S. announced that electricity from wind power is expected to overtake coal-fired electricity generation as early as 2026. This is thanks to the rollout of a massive wind energy project pipeline and the cutting of coal operations across the country. This is a significant achievement, as the U.S. still relies heavily on coal, which is the secondlargest source of U.S. electricity after natural gas. In the first 10 months of 2023, coal-fired energy production was around 60% higher than electricity generation from wind sources.

Over the last year, the Biden administration has introduced the Inflation Reduction Act (IRA) and other favorable climate policies to accelerate the green

transition. This has spurred a significant amount of private investment across the renewable energy and clean technology sectors, including wind power. It has also led to plans to decommission several plants in the coming years, helping to reduce the country’s greenhouse gas emissions and tackle climate change, thereby making good on its climate pledges.

Despite several countries around the world investing heavily in the development of their wind energy capacity in recent decades, such as in Europe and China, the U.S. has been trailing far behind. It is only since 2015 that the U.S. has accelerated the development of its wind power, increasing its capacity by over 90%. It is now considered the biggest source of clean electricity in the country.

As of September, the U.S. had nearly 52 GW of offshore wind projects in operation or in the development and planning stages, which could provide electricity for over 18 million households if completed. Meanwhile, the global wind power capacity is expected to reach between 380 GW and 394 GW by 2032.

Between January 2022 and May 2023, the government leased three new areas in the Gulf of Mexico. In 2022, the U.S. offshore wind industry invested $2.7 billion in ports, vessels, supply chain development, and transmission.

However, the U.S. must overcome several challenges to achieve its ambitious project pipeline. Several major wind companies, such as Siemens, Orsted, and Vestas, have found it hard to make a profit due to supply chain disruptions and sharply rising material costs. Additionally, the race to develop

the biggest, strongest, and most efficient wind turbine has resulted in production mistakes and recalls, costing the companies heavily. This has led to production and project development delays, with wind companies investing both time and money to rectify previous project mistakes.

In November, Anja-Isabel Dotzenrath, the head of gas and low carbon at BP, stated that the U.S. offshore wind industry is “fundamentally broken” as BP and its partner Equinor looked into options to develop huge projects off the coast of New York

40 VOLUME 2 // ISSUE 1 INDUSTRY MAJAFOTO/DEPOSIT PHOTOS

Between January 2022 and May 2023, the government leased three new areas in the Gulf of Mexico. In 2022, the U.S. offshore wind industry invested $2.7 billion in ports, vessels, supply chain development, and transmission.

after writing down $840 million of their value. Orsted, the world’s biggest offshore wind producer, was forced to announce write-downs of $5.6 billion after it paused several U.S. offshore wind developments. Several companies have faced difficulties in permitting in the U.S., with a delay between when purchase agreements are signed and when the projects are developed, as well as a lack of inflationary adjustment mechanisms. Dotzenrath emphasized that “there is a fundamental reset needed in the speed of permitting, security of permitting, etc.” Although she does not doubt that the planned projects will eventually be built.

Project cancellations due to high inflation and interest rates, supply chain bottlenecks, and the high cost of installation are putting increasing pressure on 2024 wind auctions. State regulators across the U.S. East Coast have refused to increase the price of agreed-upon electricity contracts, making it increasingly difficult for producers to make a profit in new wind projects. At least ten East Coast projects have attempted to renegotiate prices and contract cancellations to no avail.

Some developers are now hoping to re-bid in 2024 instead of exiting the market. However, this will depend on the prices offered by regulators in the auctions. Whatever the outcome, this is expected to have a significant impact on project development, with major delays expected and Biden’s pledge to install 30 GW offshore wind by 2030 under threat. To ensure the U.S. continues to develop its wind energy sector, significant challenges must be addressed and overcome.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

41 SHALEMAG.COM

U.S. Plans to Sell LNG to Asia via Mexico

By: Felicity Bradstock

The United States is ramping up its liquefied natural gas (LNG) exports following a surge in production over the past two years. The country has seen a rise in demand for its natural gas due to global shortages following the Russian invasion of Ukraine and subsequent sanctions on Russian energy. Additionally, many countries are turning to gas as a transition fuel from dirtier fossil fuels like coal and oil.

However, the U.S. must establish strong trade routes to ensure it can deliver its LNG to various locations worldwide. One major market the U.S. is trying to break into is Asia. To achieve this, it will need to develop an efficient link between North America and Asia. The U.S. is now planning to create a shortcut between the two continents by way of Mexico.

The route is expected to reduce travel time by around half by transporting gas to a shipping terminal on the Mexican Pacific Coast, allowing it to bypass the highly congested Panama Canal – which has been facing a drought in recent months.

Mexico’s Energía Costa Azul gas terminal was originally constructed to transport gas from Asia to the U.S., via California and Arizona. However, with the growth of the fracking industry, the U.S. hopes to reverse this trade route, supported by a $2-billion investment in transforming the facility. This is one of five gas export facilities planned for the west coast of Mexico. If all five export terminals are approved and built, it could make Mexico the fourthlargest exporter of gas in the world.

Environmentalists are concerned about the impact the proposed fossil

The U.S. is now planning to create a shortcut between the two continents by way of Mexico.

42 VOLUME 2 // ISSUE 1 INDUSTRY FAHRONI/DEPOSIT PHOTOS

fuel projects could have on Mexico’s biodiversity. Fernando Ochoa, the manager of the Northwest Environmental Defense, explained, “The operation of those export projects would mean not only a great deal of carbon and methane emissions but also the industrialization of a pristine ecosystem.”

Mexico’s president Andres Manuel Lopez Obrador (AMLO) has come under fire since his inauguration in 2018 for pursuing fossil fuel projects at the expense of a green transition. Although Mexico has excellent conditions for a wide range of renewable energy projects, AMLO has favored the expansion of the country’s oil and gas industry, pumping funds into the construction of new refineries and continuing to support Mexico’s debt-ridden oil company Pemex.

In January, President Biden paused a decision on whether to approve a project that would develop the largest natural gas export terminal in the United States. The pause is expected to last for several months, potentially going beyond the November presidential election date. It could create major delays for that project as well as several others. Project approval now depends on the findings of the U.S. Department of Energy (DoE), which has been asked to evaluate the gas project in terms of its impact on climate change, the economy, and national security.

The DoE has not previously rejected any natural gas project on these grounds, however, the government’s support for a green transition – supported by far-reaching climate policies and environmental pledges – could change

this. The U.S. has already faced criticism from environmentalists who view the country’s LNG project pipeline as being at odds with its climate aims. As the world’s biggest gas producer, many question whether the added capacity will lead to an oversupply of gas as the world rapidly increases its renewable energy capacity.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

43 SHALEMAG.COM

Abandoned Oil Wells Continue to Be a Problem

By: Felicity Bradstock

Environmentalists and state governments have been fighting for decades to get abandoned oil wells plugged, with little success. Although the situation has improved in recent years, thanks to improved efforts by oil and gas companies and federal funding, there continues to be an abundance of oil wells across the country that were never decommissioned to be made safe. Abandoned wells can leak toxic gasses, such as methane, which are detrimental to the health of populations in the surrounding area and the environment, making it highly important that the wells be rapidly plugged.

Abandoned Wells in the U.S.

Over a century of oil exploration in the US has left thousands of abandoned oil wells in its wake. Around 4.5 million oil and gas wells have been drilled in the US since the 1850s, with around 3.5 million of these wells being abandoned as they could no longer be used for production.

While some of these wells were plugged before they were left, using filling and sealing materials, some were not formally decommissioned. If a well is not properly plugged, it can emit methane and other harmful gasses, leach contaminants into the surrounding soil and water, and create safety hazards, preventing the surrounding land from being used for other purposes.

In 2018, the Interstate Oil and Gas Compact Commission recorded just over 60,000 orphan wells nationwide, a figure that later rose to over 130,000, according to a 2021 study. The Environmental Protection Agency estimated that non-producing oil and gas wells emitted 275,000 metric tons of methane in 2020, equivalent to the emissions produced by around 1.7 million gasoline vehicles.

While there has been an increasing call for greater environmental awareness in recent years, with activists and the government

Over a century of oil exploration in the US has left thousands of abandoned oil wells in its wake.

Around 4.5 million oil and gas wells have been drilled in the US since the 1850s, with around 3.5 million of these wells being abandoned as they could no longer be used for production.

putting pressure on oil and gas companies to formally decommission their wells, this often still fails to happen. While major companies typically follow these practices, some smaller companies cannot afford to do so. Further, hundreds of bankrupt oil companies have left orphaned wells in their wake, which the government must plug.

Federal Funding

In 2021, the Biden administration approved the Bipartisan Infrastructure Law, which provided $4.7 billion in federal funding for states and federal agencies to carry out wellplugging activities. This money was earmarked for “orphan wells” that have no owner. Adam Peltz, a lawyer with the Environmental Defense Fund, an advocacy group, stated “There has never been federal money made available to plug these wells.”

Plugging these wells is extremely costly, with the closure of a single well costing up to tens of thousands of dollars. The federal National Park Service began a project to identify the dirtiest orphan wells over more than 84 million acres of federal land to plug them.

Efforts Still Falling Short

West Virginia is home to thousands of orphaned oil wells, and the state government

has long been working hard to fix the problem. As part of the federal funding plan, the state will receive around $117 million in formula grant funding and potentially another $70 million through the performance grant to address the problem.

The recent boost in federal funding for the decommissioning of orphan wells is expected to speed up the process, helping to plug as many as 1,700 wells. However, this is only around 26% of the documented orphaned wells in West Virginia, with far more undocumented wells still out there.

Holding Oil and Gas Companies Responsible

In January, Chevron stated it would take non-cash write-downs on US oil and gas production for decommissioning abandoned wells and pipelines in the US Gulf of Mexico that had been previously sold. This is expected to total somewhere between $3.5 billion and $4 billion. Chevron and other companies have contested claims that they must pay to plug wells that were sold to Fieldwood Energy and firms that went bankrupt in 2020. The bankruptcy places the responsibility of paying to plug Fieldwood’s abandoned wells on the former owners, which includes Chevron.

The US has increasingly placed the burden of decommissioning orphan wells on oil

44 VOLUME 2 // ISSUE 1 INDUSTRY CTA88/DEPOSIT PHOTOS

The

recent boost in federal funding for the decommissioning of orphan wells is expected to speed up the process, helping to plug as many as 1,700 wells.

majors, to reduce the burden on the state and hold oil and gas companies responsible for ensuring that they adhere to higher environmental standards. The combination of federal funding and improved efforts by oil and gas companies to plug orphan wells is expected to improve the situation in the US in the coming years. However, significantly more funding will need to be made available to ensure that all the country’s abandoned wells are plugged.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

45 SHALEMAG.COM

World Trade Concerns as Red Sea Shipping Slows

By: Jess Henley

In response to an attack by Yemenbased Houthi militants, shipping company Maersk has announced a freeze on shipping routes through the Red Sea, citing safety concerns for their cargo and crew. The Israeli-Hamas conflict and rising tensions in the area have already spurred many transportation companies to

abandon the shorter, cheaper routes through the Red Sea in exchange for more expensive pathways. This move by Maersk is expected to have ripple effects on global trade, inflation, and oil prices.

The attack on a Maersk container ship on December 31st was a significant event. The attack began with an unknown aircraft

before quickly evolving into a naval battle with the Houthi boats firing on the cargo vessel. Fortunately, the US military responded quickly and sank three of the four fighting vessels, killing ten Houthi militants. No Maersk personnel were seriously injured, but this event marks the first time the US military has returned fire on the Iran-backed Houthi in the area.

46 VOLUME 2 // ISSUE 1 INDUSTRY CRISTICROITORU/DEPOSIT PHOTOS

The Red Sea route is critical for global trade and oil companies, as it dramatically shortens the journey from Middle-Eastern oil refineries and global shipping lines. With much of the world’s trade in oil and goods passing through this maritime passage, commerce, inflation, and shipping costs heavily rely on the viability of the Red Sea. However, due to the rise in tension from the Israeli-Hamas conflict and recent uptick in hostilities, shipping companies are concerned about escalation should they continue transporting through the Red Sea route.

Oil companies, like BP, have been forced to change routes to a much longer and more costly shipping pathway. With the only alternative being sailing through potentially dangerous waterways, most

shipping companies and oil transporters have opted to take the longer option and stick to safer transport. While there are alternate routes, none are as lucrative or pivotal as the Red Sea, which connects to the Suez Canal. As companies were forced to alter routes or increase shipping distances, the cost of oil and transportation increased almost immediately.

The December 31st attack proved the necessity of increased security in the Red Sea, and the aftershock of the attack has many concerned about global trade routes and what may be next for transportation corporations. Roughly 30% of the world’s container commerce flows through the Red Sea and Suez Canal, making a disruption a devastating turn of events.

The Red Sea route is critical for global trade and oil companies, as it dramatically shortens the journey from Middle-Eastern oil refineries and global shipping lines.

Oil and natural gas prices surged when BP stopped shipping through the Red Sea following the attack. “In light of the deteriorating security situation for shipping in the Red Sea, BP has decided to pause all transits through the Red Sea temporarily. We will keep this precautionary pause under ongoing review, subject to circumstances as they evolve in the region,” said a spokesperson for BP.

About the author: Jess began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

47 SHALEMAG.COM

Where is ESG Heading in 2024

By: Jess Henley

Although there is no formal definition of Environmental, Social, and Governance (ESG) criteria, it is widely accepted as a system to mitigate risks and impact a company's corporate interests. Many companies have implemented ESG strategies as a means of adhering to internal and external pressures from stakeholders.

Over time, ESG strategies have made their way into corporation infrastructure as a long-term transition to sustainable and accountable energy interests. However, the new generation of ESG investors is changing the landscape for corporate accountability and the transition to sustainable energy. The consensus is that ESG strategies are here to stay and will only increase as Gen Z becomes proactive investors and consumers.

Insight from an ESG Expert: We reached out to Rebecca Davis, a partner with the law firm Arnall, Golden & Gregory in Atlanta, GA. As a partner in Litigation and Dispute Resolution and Environmental Practices and with over 20 years of experience in litigation and consulting on environmental matters, Davis provides critical insight into her counsel. Davis holds a wealth of knowledge on regulation compliance, remediation, alternative energy projects, and due diligence.

With adept skill in navigating complex environmental litigation and enforcement cases, Davis has hands-on experience in both state and federal courts in cases involving toxic mold, stormwater violations, and others.

In an exclusive one-on-one, we sat down with Davis to glean from her insight and experience with the following questions on the 2024 ESG outlook.

Where is ESG in 2024, and why is it now considered a key part of a company's financial value proposition?

Davis: ESG, as the concept of socially conscious capitalism, is not going to go away. However, in the near future, we may see more division based largely on increasing political divides. But politics will not be the only driver. As to the energy sector and climate-related initiatives, although more states that traditionally lean blue will likely implement more stringent emissions policies, we will still see other more traditionally red states invest in renewable energy initiatives if there is a business case for doing so. That business case will be largely created by both federal grants and tax incentives, as well as increased interest by Millennials and Gen Z as they look at more environmentally and socially sensitive investments.

There also may be increased focus on certain areas of ESG over others, especially with respect to supply chains. ESG-

The consensus is that ESG strategies are here to stay and will only increase as Gen Z becomes proactive investors and consumers.

48 VOLUME 2 // ISSUE 1 INDUSTRY

related goals and initiatives will continue to be part of the discussion in the boardroom.

Companies within the U.S. will see more pressure, especially as to disclosure and emissions, from regulations passed in California and some other states, as well as the European Union through

the Corporate Sustainability Reporting Directive.

Regardless of the political climate in the U.S., companies will be forced to respond to global pressures as we continue to exist in a global economy.

What percentage of S&P

500 companies publish ESG reports, and what does this suggest about the future of ESG initiatives?

Davis: ESG reporting remains complex. Companies have become and will continue to remain cautious about ESG and even sustainability reporting amid the upcoming presidential and congressional elections. Republican candidates are expected to attack “woke” initiatives, while democratic candidates are likely to focus on diversity and inclusion and climate change. Promises of proand anti-ESG legislation are also expected from both sides.

Thus, ESG reporting in 2024 may be complex, even for companies who reported their results in prior years. As to the numbers, by 2021, 99% of S&P 500 companies were publishing ESG-related information, either in the form of a stand-alone ESG or sustainability report or at least through website information. By 2021, most companies also were using at least some established framework (e.g., the Sustainability Accounting Standards Board (SASB) standards, Global

Reporting Initiative, International Sustainability Standards Board (ISSB), etc.). But notably, that does not mean that these same companies are talking about these initiatives as much as in previous years. Since 2021, mention of ESG initiatives in earning calls have become less prevalent, and the topics are more muted, even if public-facing reporting still exists.

Indeed, ESG-related reports have already become so widespread, and companies have already incorporated their sustainability plans into their core business strategies, which has reduced the need to rely on or highlight certain ESGcomponents as part of their corporate messaging.

How do Gen Z consumers and investors view ESG, and what might this mean for companies in the coming years?

Davis: Millennials and now Gen Z have grown up in the face of climate-change, and they are more likely to accept global warming as a truth rather than a political debate topic. The familiarity and fear of climate change has thus, in many respects, shaped the overall focus of ESG investing for these generations. As such, companies will need to be mindful of the expectations of younger generations as they become investors and consumers who demand more environmentally and socially conscious practices.

About the author: Jess began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

49 SHALEMAG.COM BIANCOBLU/DEPOSIT

PHOTOS

The White House Has Big Plans for U.S. Uranium Production

By: Felicity Bradstock

The United States is seeking to ramp up domestic production of High-Assay, LowEnriched Uranium (HALEU) to develop nuclear energy capacity and enhance energy security.

HALEU is enriched up to 20%, compared to the current 5% enriched form of uranium that powers most U.S. plants, and is necessary to power modern, advanced nuclear reactors.

However, TENEX, which is part of the Russian state-owned nuclear energy company Rosatom, is the only commercial supplier of HALEU.

To secure a domestic supply of uranium, the U.S. Department of Energy (DoE) established the HALEU Consortium. However, there is currently minimal public or private capacity to produce HALEU within the country, which restricts the ability to deploy advanced nuclear reactors and deters private investment.

Various nuclear projects have been put on hold over the last two years due to concerns about non-Russian HALEU’s unavailability to power advanced reactors. The Biden administration sees

the development of the country’s nuclear capacity as crucial to meeting its climate commitments. In January, the DoE announced that it was seeking contractors’ bids to establish domestic HALEU production for use in new reactors, with contracts for up to 10 years from enrichment service providers.

Centrus Energy is the only U.S. company that currently holds a HALEU production license, and it is currently providing the DoE with a small amount of the uranium for demonstration processes. Lindsey Geisler, Centrus Energy’s spokesperson, stated that the company “looks forward to the opportunity to compete for the funding necessary to expand our production.”

The HALEU industry’s development could help overcome barriers to launching new nuclear projects that could support a green transition. The Biden administration has emphasized the importance of U.S. nuclear power in achieving a green transition. In January, the government finalized a $1.1 billion aid package to keep California’s last nuclear power plant operational as the sector faced financial difficulties.

50 VOLUME 2 // ISSUE 1 INDUSTRY

To secure a domestic supply of uranium, the U.S. Department of Energy (DoE) established the HALEU Consortium. However, there is currently minimal public or private capacity to produce HALEU within the country, which restricts the ability to deploy advanced nuclear reactors and deters private investment.

While nuclear power has been criticized due to several infamous nuclear disasters, the move towards more environmentally friendly alternatives has resulted in a growing interest in nuclear power. Additionally, nuclear power has been shown to be safer than many other forms of energy production, as it does not emit carbon and is overseen by strict safety regulations.

In 2022, TerraPower, a nuclear power company backed by Bill Gates, announced that its advanced reactor demonstration would be delayed by at least two years due to the lack of nonRussian HALEU availability. The company had initially aimed to complete the development of its first reactor in Wyoming by 2028. Chris Levesque, the CEO of TerraPower, stated, “In February 2022, Russia’s invasion of Ukraine caused the only commercial source of HALEU fuel to no longer be a viable part of the supply

chain for TerraPower, as well as for others in our industry... Given the lack of fuel availability now, and that there has been no construction started on new fuel enrichment facilities, TerraPower is anticipating a minimum of a two-year delay to being able to bring the Natrium reactor into operation.”

TerraPower and the UAE’s state-owned nuclear company ENEC signed a memorandum of understanding at the COP28 climate summit in Dubai to explore the potential development of advanced reactors in the UAE and worldwide.

Nuclear proliferation experts have expressed concerns that increased dependence on HALEU worldwide could raise proliferation risks, as the fuel is more similar to the fissile material used in nuclear weapons than traditional uranium. Therefore, licensing and industry regulation should be handled with care.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

51 SHALEMAG.COM

MULDERPHOTO/DEPOSIT PHOTOS

Biden Claims Economy is On the Up and Up

By: Jess Henley

President Biden has been boasting about the supposed upturn in the economy as the nation heads into the election year. However, despite the claims of Democrats, the American people are not as optimistic about the economic growth leading into 2024.

While inflation has declined in 2023 thanks to the Federal Reserve, the cost of living continues to rise, and the majority of American citizens still struggle with increased costs of food inflation. The grocery bill has risen steadily, with a rate of nearly 3%, and restaurant costs have gone up by 5.3%, making it more expensive to eat out.

Federal agencies may look at pivoting from interest rate spikes to lower rates in 2024, which could provide a much-needed relief to taxpayers in the ongoing battle of inflation. The Federal Reserve could decrease interest rates as many as four times in 2024, according to some economists. Reduced interest rates

could be a welcome reprieve for potential home buyers in 2024.

The final quarter of 2023 ended with a significant rally for the stock market, with the majority of the boom taking place in the final two months of the year. However, it remains to be seen if the swift turn in the last two months of 2023 is enough to predict good things in 2024.

While the unemployment rate is just 3.7%, which is lower than the previous half-century, there are concerns about the global job market in 2024. The International Labor Organization predicts an additional 2 million workers will be seeking jobs in the coming year, and global unemployment rates are expected to rise to 5.2%, indicating celebrations of fewer layoffs in 2023 may be short-lived. Disposable income has declined in the last year, meaning consumers have less money to spend in general.