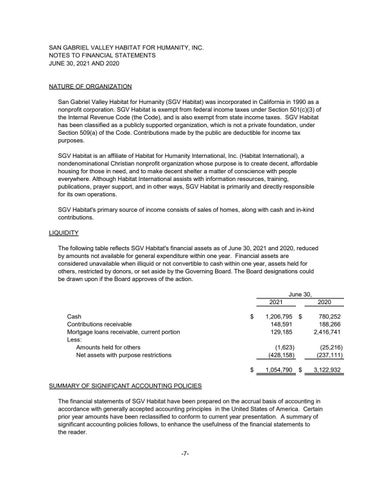

SAN GABRIEL VALLEY HABITAT FOR HUMANITY, INC. NOTES TO FINANCIAL STATEMENTS JUNE 30, 2021 AND 2020 NATURE OF ORGANIZATION San Gabriel Valley Habitat for Humanity (SGV Habitat) was incorporated in California in 1990 as a nonprofit corporation. SGV Habitat is exempt from federal income taxes under Section 501(c)(3) of the Internal Revenue Code (the Code), and is also exempt from state income taxes. SGV Habitat has been classified as a publicly supported organization, which is not a private foundation, under Section 509(a) of the Code. Contributions made by the public are deductible for income tax purposes. SGV Habitat is an affiliate of Habitat for Humanity International, Inc. (Habitat International), a nondenominational Christian nonprofit organization whose purpose is to create decent, affordable housing for those in need, and to make decent shelter a matter of conscience with people everywhere. Although Habitat International assists with information resources, training, publications, prayer support, and in other ways, SGV Habitat is primarily and directly responsible for its own operations. SGV Habitat's primary source of income consists of sales of homes, along with cash and in-kind contributions. LIQUIDITY The following table reflects SGV Habitat's financial assets as of June 30, 2021 and 2020, reduced by amounts not available for general expenditure within one year. Financial assets are considered unavailable when illiquid or not convertible to cash within one year, assets held for others, restricted by donors, or set aside by the Governing Board. The Board designations could be drawn upon if the Board approves of the action. 2021 Cash Contributions receivable Mortgage loans receivable, current portion Less: Amounts held for others Net assets with purpose restrictions

$

June 30,

1,206,795 148,591 129,185

$

(1,623) (428,158) $

1,054,790

2020 780,252 188,266 2,416,741 (25,216) (237,111)

$

3,122,932

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES The financial statements of SGV Habitat have been prepared on the accrual basis of accounting in accordance with generally accepted accounting principles in the United States of America. Certain prior year amounts have been reclassified to conform to current year presentation. A summary of significant accounting policies follows, to enhance the usefulness of the financial statements to the reader. -7-