Pure paper fibres, provides a good quality component from recyclers.

As pure paper, it’s broken down naturally where moisture and natures organisms are present.

Australian made paper converted into bubble. Locally produced, the product can be customised, with advertising print, roll length and paper colour.

The paper is sourced from FSC & PEFC Mills.

Bubble can be used as a direct replacement for bubble wrap and other plastic based packing products

• Easier to transport

• Less storage space

• No product sweating

• No cutting tools required

• Easier for the end client to recycle in commercial and domestic situations

• Dispensers not required

We would love to receive your feedback and your expressions of interest. Contact your State Sales Representative for further information.

Available in rolls of: 375mm x 25m 500mm x 50m 1.5m x 50m

SSAA BOARD OF DIRECTORS

Chairman – Michael Alafaci

Storage King Group, New South Wales

Aaron Alsweiler

Safe Store Self Storage, New Zealand

Ivor Morgan

Jims Self Storage, Victoria

Brent Hayes

Store and More Self Storage, Victoria

Sam Kennard

Kennards Self Storage, New South Wales

Anthony Regis

Regis Built, Victoria

Elizabeth Rutland

Monash Self Storage, Victoria

Thomas Whalan

Rent a Space, New South Wales

Adrian Wylde

All-Bay Mini Storage, Queensland

LIFETIME MEMBERS

Mark Bateman

David Blackwell

Frank Cooney

Elaine Coote

Liz Davies

Dallas Dogger

John Eastwood

Simone Hill

Neville Kennard

Sam Kennard

SSAA STAFF

Bob Marsh Paul McFadzien

Jim Miller

Jon Perrins

Phil Robbie

Mark Snooks

Michael Tate

Richard Whalan

Keith Edwards

Makala Ffrench Castelli

CEO

Sandra Evans

Office Manager

Priscilla Lee

Member Relations

Anna Mortimer

Marketing Communications Manager

www.selfstorage.org.au

TOLL FREE – AUS: 1800 067 313

TOLL FREE – NZ: 0800 444 356

T: +61 3 9466 9699

Address: Unit 4/2 Enterprise Drive, Bundoora Vic 3083

E: admin@selfstorage.com.au

Connect with us online!

8 trends shaping the future of self

WOMEN IN STORAGE

A morning of connecting and sharing stories

20 ALL ABOARD THE JACKSON

CAPITAL FLOWS

The Self Storage Opportunity

TRANSACTION TALKS

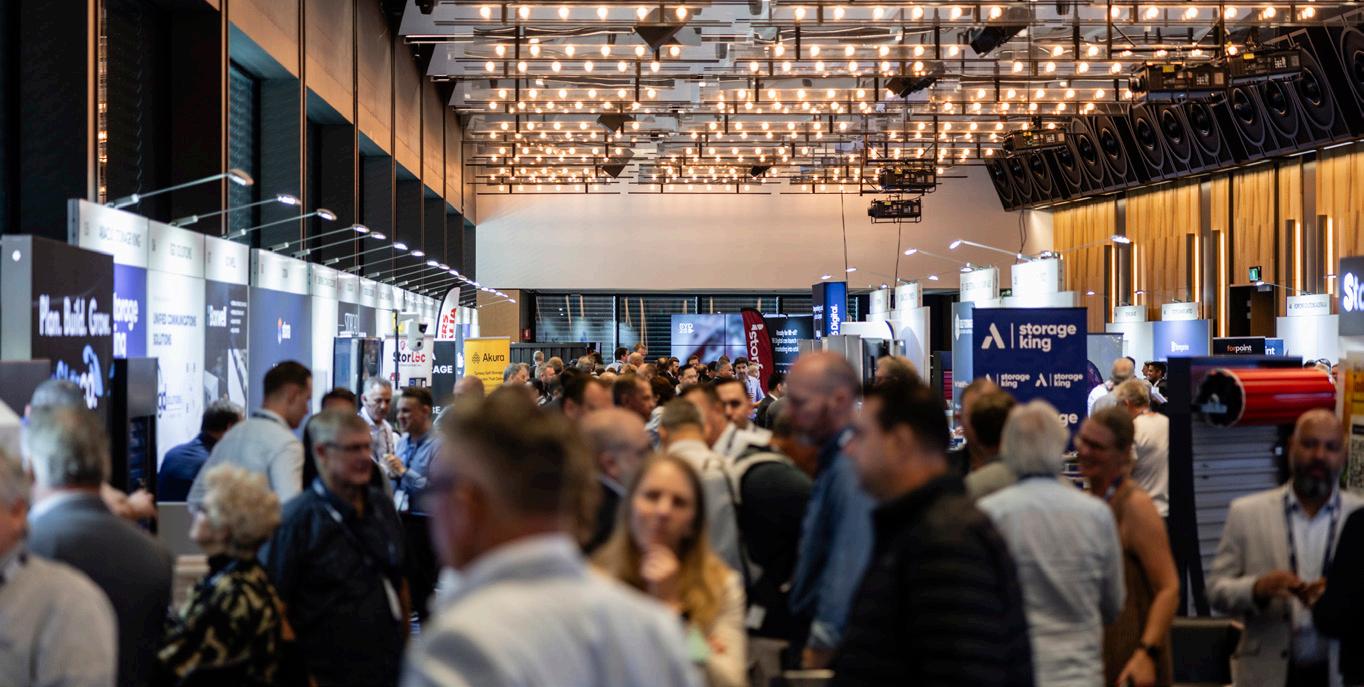

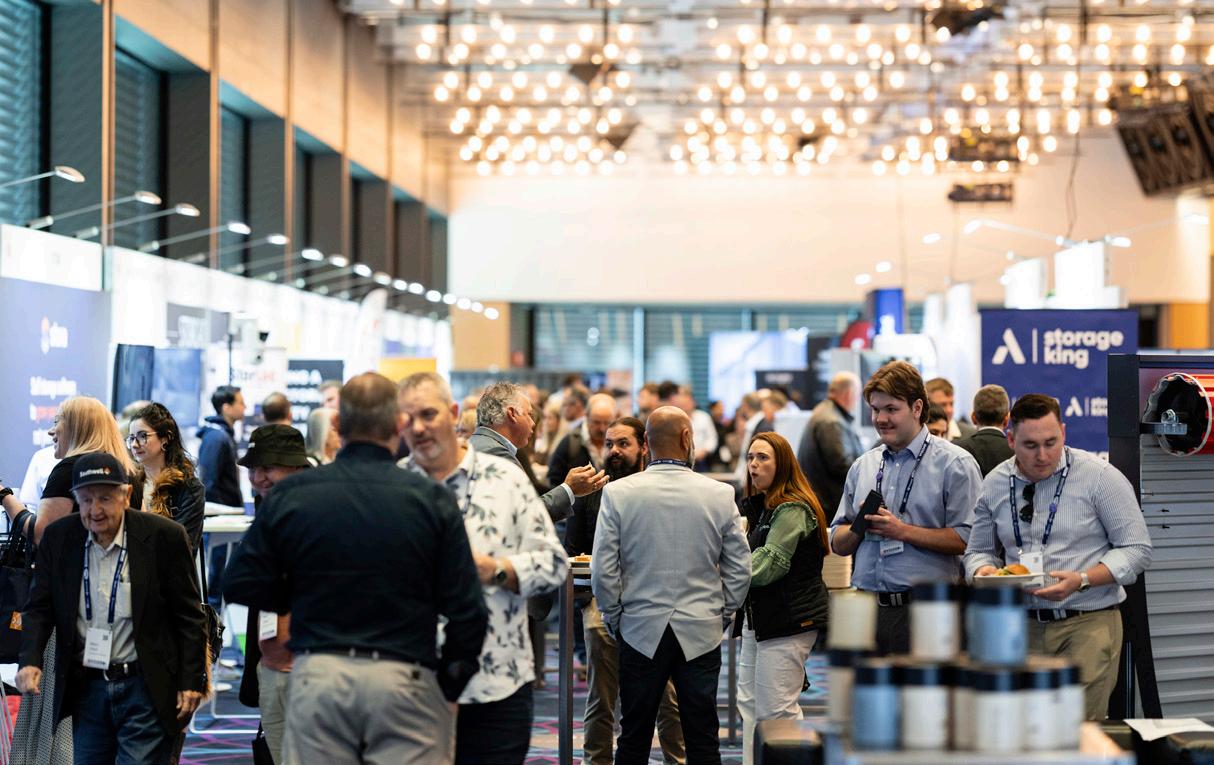

TRADE SHOW IN THE SPOTLIGHT

INDUSTRY SNAPSHOT A market in motion

FACILITY TOURS

Rent A Space Casula

Storage King, Leppington 34 SSAA AWARDS FOR EXCELLENCE WINNERS

Celebrating the remarkable achievements within our industry

LIFE MEMBER

Edwards

SYD25 PHOTO GALLERY

SERVICE MEMBERS

Hoolihan Property Consulting

Insider is published and edited by: Social Ties / E: vforbes@socialties.com.au

Designed by: Keely Goodall / E: keely@itsallgood.net.au

Printed by: Homestead Press / E: printing@homesteadpress.com.au

Insider magazine (Insider) is published bi-monthly by the Self Storage Association of Australasia Limited (ABN 23 050 341 725). This publication may not be reproduced or transmitted in any form, in whole or in part, without the express, prior written permission of the publisher. While every care has been taken in the preparation and publication of Insider, none of the Insider’s publisher, editor nor any of the publisher’s employees, subcontractors or contributors give any warranty as to the completeness or accuracy of the publication’s content, nor do any of them assume any responsibility or liability for any loss, damage or expense which may result from, or arise in connection with, any inaccuracy or omission in the publication. The views or opinions expressed in Insider are not necessarily those of Insider’s publisher or editor. Furthermore, Insider has the right to accept or reject any editorial and advertising material. All letters addressed to Insider will be regarded as ‘for publication’ unless clearly marked ‘Not for Publication’. All submissions to Insider may be edited for reasons of space or clarity and opinions expressed in letters published in Insider are those of the author, not of Insider’s publisher or editor.

Another convention is behind us and SYD25 was one to remember! Our inaugural Self Storage Week drew an outstanding turnout and each year it gets bigger and better. A heartfelt thank you must go to the SSAA team, who worked tirelessly to deliver four fabulous days of learning, inspiration and connections to the industry.

This year we also welcomed a strong international contingent from the US, UK, Asia and beyond. It is a clear vote of confidence in the strength of our sector and the level of interest in the Australasian market as we head towards 2026.

A highlight for me (other than captaining The Jackson) was recognising Keith Edwards with an Honourary Life Membership. You can read more about Keith’s Trans-Tasman journey in self storage in this edition of Insider. We extend our very best wishes to Keith as he embarks on the next chapter with All Secure.

As your Association wraps up another year, it’s clear we are ending this cycle in a strong and sustainable position, with the 2023–2025 strategic plan now drawing to a close. Over the past three

“As your Association wraps up another year, it’s clear we are ending this cycle in a strong and sustainable position, with the 2023–2025 strategic plan now drawing to a close.

years we’ve delivered meaningful outcomes for members, strengthened our advocacy voice and built the research foundations that will guide the sector for the decade ahead. With this momentum, we are well placed to turn our attention to the SSAA 2026–2029 strategy with clarity and a renewed commitment to delivering value for all members.

At this year’s AGM we also saw a number of director elections. I’d like to thank our outgoing directors for their contribution, congratulate those re-elected and welcome welcome back Ivor Morgan to the SSAA Board. We look forward to working with you to help shape the industry in the years ahead.

Wishing everyone a safe and happy festive season. I look forward to seeing you in 2026 for another big year in self storage. l

•

•

•

•

•

•

•

•

•

•

•

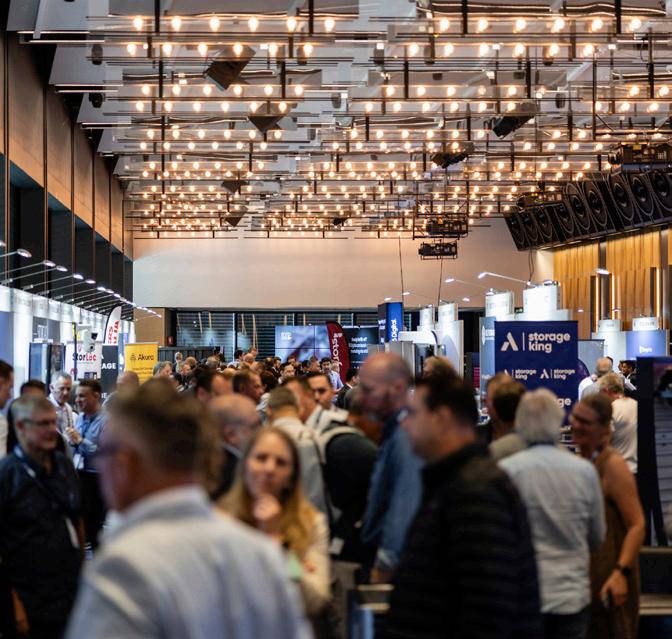

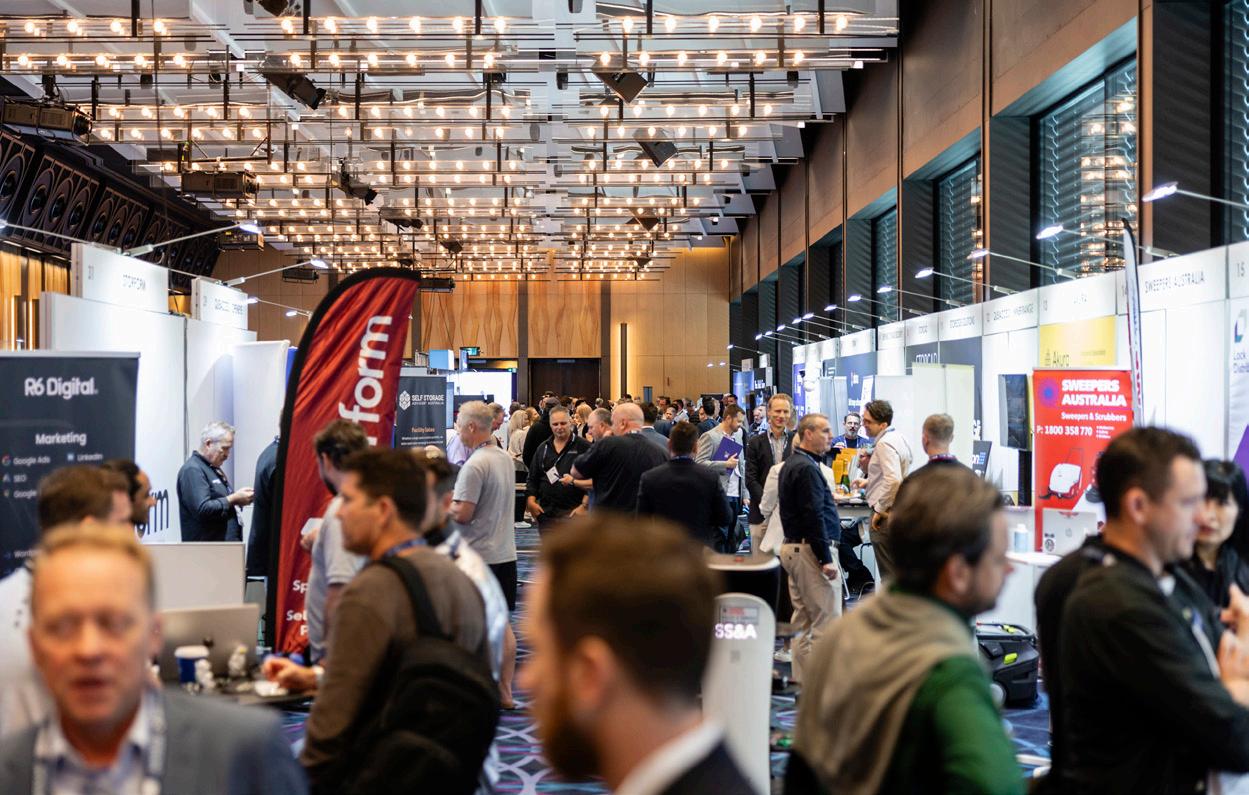

SYD25 set a new benchmark for industry as more than 500 self storage owners, operators, investors and suppliers gathered at the Hyatt Regency Sydney for four dynamic days of learning, inspiration and connection.

Across keynotes, panel discussions and workshops, attendees explored the forces reshaping self storage, from digital experience and automation to design, development and record levels of investment in the sector.

Highlights included tours of Sydney’s newest facilities, thought-provoking trend sessions, the buzzing trade show floor and vibrant networking events across Darling Harbour, capped off by the industry’s night of nights, the SSAA Awards for Excellence presented by VISY Specialties.

The energy and optimism confirmed what many already sensed: the sector is maturing and stepping confidently into its next chapter.

For those unable to join us in person, or keen to revisit a session, recordings, slide decks and selected resources are available via the SSAA

“

Member Portal. We will also continue to draw on SYD25 content, and insights from our 2025 Industry Snapshot: A market in motion, in upcoming editions of Insider.

On behalf of the SSAA, I would like to extend my sincere thanks to our partners, event sponsors, speakers, panellists, exhibitors and suppliers for their ongoing support, and to every member who travelled to Sydney to be part of Self Storage Week. Your participation and engagement are what make this community so strong.

I hope you enjoy this special convention edition of Insider and I look forward to welcoming you to Brisbane in 2026!

Wishing you and your families a wonderful festive season and well-earned break! l

More than 500 owners, operators, suppliers and industry leaders filled the Hyatt Regency Sydney in November for the inaugural Self Storage Week– four fast-moving days packed with strategy, stories and straight talk from the people steering the industry forward.

From the moment MC Luke Hannan stepped on stage, the tone was set for open conversations, big ideas and a genuine willingness to learn from each other. Whether you were a founder, a long-time operator or attending for the first time, everyone came ready to compare notes, challenge assumptions and look at the sector with fresh eyes.

Here are the biggest insights from SYD25, and what they signal for self storage in the years ahead.

If SYD25 made one thing clear, it’s that self storage is coming of age as an industry and asset class.

What was once an intuition-led, build-it-and-they-will-come market is now a more measured, disciplined and data-literate industry powered by sharper pricing, stronger operators and more informed

“ Self storage remains an industry full of opportunity. It’s built on strong fundamentals and it has a bright future ahead.

MAKALA FFRENCH CASTELLI

customers. Competition has intensified, capital has accelerated and expectations have risen on every front.

Fundamentals remain solid. Supply is rising across the east coast and into growth corridors, occupancy has normalised post pandemic, and while operating costs are shifting, revenue performance across the sector is holding up. With $1.36 billion in transactions recorded this year and private equity actively circling, the appetite for storage assets has never been stronger.

“Self storage is no longer the quiet achiever.,” said SSAA CEO Makala Ffrench Castelli. “It’s a sector with significant scale and momentum behind it.”

SSAA Industry Snapshot co-presenter, Four Leaves Property’s Linda Sharkey, reinforced this sentiment with a data-driven lens: “The numbers show a sector that’s stabilising, strengthening and making smarter decisions. This is a more informed industry than it’s ever been.”

Adrian Lee’s Big Insights From Big Yellow keynote echoed the same theme. “If you want a resilient business,” he said, “buy the freehold where you can think more deliberately about how your brand shows up, make your locations stand out, and build processes that deliver great experiences for both customers and staff.”

From the global stage, Janus International’s Terry Bagley observed that markets making the biggest gains overseas are those that

combine innovation with long-term discipline. His advice to operators? Focus on fundamentals, design for durability and understand that customer expectations are rising everywhere, not just locally.

And despite rising competition, industry confidence is unshakably high, with the Industry Snapshot revealing 73% of operators believe next year will be even better.

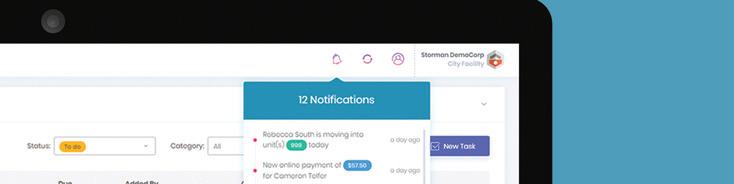

Digital touchpoints have seen a significant shift. What many operators once saw as a ‘nice to have’ has moved to the primary way customers judge and make decisions about a facility. SYD25 showed that operators need to stay current and keep pace with the speed of market change and the impact of the customer journey in online decision making.

The biggest shift isn’t the tech itself. It’s the way customers interact with it. Customers are:

l Researching storage through AI tools

l Comparing facilities with AI-generated summaries

l Completing whole bookings without speaking to staff

l Expecting accessible forms, instant clarity and transparent pricing

l Judging operators based on digital experience, not just the front-desk R6 Automate’s Stephen Hughes reminded delegates that customers make decisions emotionally and quickly. “They default to the provider that feels the least risky,” he said. “If your website feels unclear, outdated or hard to use, customers will assume your facility will be the same.”

Across the sessions, several customer-facing patterns emerged:

l Frictionless digital flows are now expected

l Personalisation signals trust and reduces uncertainty

l Mobile-first design is a baseline

l A/B testing is replacing guesswork

l Digital consistency is now part of brand credibility

Future Crunch Co-Founder Dara Simkin, pushed this idea even further, arguing that adaptability itself has become a competitive edge. “AQ, your adaptability quotient, is the number one skill you need to navigate this era of volatility,” she said.

The operators who succeed will redesign workflows around digital behaviour, build in flexible systems, modular processes and a culture that’s willing to test, learn and adjust in real time.

3

Automation isn’t anti-staff, it’s procustomer. Across the Automate Before It’s Too Late Panel, speakers were clear that automation isn’t about running facilities unattended. It’s about giving customers a choice in how they want to move through the journey. “Some customers want to talk,” said Michael Dogger. “Some want to tap. The goal is choice; a strong system lets them choose their own path.”

For digital-first users, a seamless flow from research to access should be possible without ever picking up the phone. For others, clarity, reassurance and a friendly voice still make all the difference. Hybrid models respect both, without forcing customers down a single pathway.

Panellists also cautioned against the hype around ‘unmanned’ sites and were quick to debunk the myth that storage is never truly stafffree. As All Secure Self Storage’s Hamish Edwards put it, “There is no such thing as ‘unmanned’ storage.” Even the most automated facilities still rely on humans for empathy, community, escalation and brand experience.

Automation also unlocks something humans can’t do alone: deep behavioural insight. “Every click, skip, comparison and abandoned form becomes actionable data that sharpens conversion and exposes friction points.”

The consensus across the panel was simple: Tech creates efficiency. People create trust. The strongest operators blend both.

4 People are still the competitive advantage in culture, CX and leadership.

Across the week, one theme kept surfacing: this industry wins on people. In a sector where customers often arrive at moments of stress – moving, downsizing, separating, dealing with loss – the strongest operators aren’t necessarily the ones that are automated with the slickest tech. They’re the ones who show compassion, care and good judgement.

Sessions on culture and customer experience approached this from different angles, but landed in the same place: culture drives performance and people shape culture.

“ Storage is not a simple industry. Leaders must ‘get amongst the people’ to understand what’s actually happening on the ground.

MICHAEL TATE FOUNDER, STORAGE KING

In The Pursuit of Culture, Storage King Founder Michael Tate defined culture in the clearest terms. “Culture is the collective mindset and habits that determine how things are done around here,” he said. “It’s not slogans or posters, but rather daily behaviours. How teams communicate, take initiative, solve problems and support each other when things get busy.”

Tate’s essentials for highperforming teams were practical and deeply human: l Know your people. Know their names, their stories, their families l Give them autonomy and trust l Respond quickly when they raise something l Make inclusion a priority, not an afterthought l And never underestimate the power of a shared lunch

In his Creating Wonderful keynote, CX expert Peter Merrett drew a direct line between employee experience and customer experience “Customer experience mirrors employee experience,” he said. “When staff feel inspired, safe to contribute and proud of the environment they work in, customers feel it instantly.”

His call was to ‘think big, act small,’ because extraordinary CX is built through tiny, consistent moments of care. Looking up from the desk; checking in with empathy, noticing the details, celebrating small wins and leaving customers feeling lighter than when they arrived.

In self storage, people are the competitive advantage.

5

If there was one topic that rewired the room this year, it was AI, and the changes coming for self storage are structural. At this point, operators must understand that AI isn’t limited to speeding up admin or automating emails. It’s reshaping how customers find, choose and judge facilities long before they land on your website.

AI is already influencing every stage of the customer journey:

l How customers find storage

l How they compare providers

l How operators prototype apps, dashboards and workflows

l How pricing decisions are made

l How security is monitored and escalated

l How websites become intelligent, personalised experience engines

Pathfindr’s Laura Hatton put it plainly: “Faster and cheaper is a race to the bottom. Use AI to reimagine – new products, new revenue, new experiences.” The operators who experiment early will move faster, make smarter decisions and create experiences their competitors can’t match.

One of the biggest shifts was the rise of AEO, or AI Engine Optimisation. Tools like ChatGPT, Claude and Gemini are already recommending storage providers based on trust signals like clean metadata, up-todate pricing, consistent reviews and transparent policies. If your digital footprint is messy, AI simply won’t ‘see’ you, and customers won’t either.

Pathfinder CEO Dawid Naude warned operators about the emerging divide, citing leaders who use AI daily will make sharper decisions, innovate faster and pull ahead quickly, while AI-avoidant leaders risk falling permanently behind.

“ AI won’t replace operators, but operators who use AI will replace those who don’t.

DAWID NAUDE CEO & FOUNDER OF PATHFINDR

For years, pricing was treated as a functional lever; something tweaked occasionally to stay ‘competitive’. SYD25 made it clear that those days are gone. Pricing has become one of the most technical, highimpact parts of businesses, and the operators who win will be the ones who treat it like a science.

“Track RevPAM and occupancy monthly,” said Caroline Plowman, the outgoing CEO of National Mini Storage. “Patterns emerge faster than you expect.”

Revenue per available metre, rather than occupancy alone, is now the industry’s most honest metric and clearest indicator of performance. A facility can be full and still underperform; another at 88% occupancy can outperform a 98% site if the pricing and mix are right.

Thomas Whalan, CEO of Rent a Space, delivered a similar line during the Great Debate: “We’re not running a hostel. We don’t get points for being full. We get points for profit.” At the same time, he cautioned that overly aggressive pricing can create churn, regulatory risk and reputational damage.

The SSAA Industry Snapshot with Makala Ffrench Castelli and Linda

Sharkey sharpened this message. Modern operators must understand RevPAM, yield management, cap rates, cost structure, seasonality and the relationship between pricing and customer length-ofstay. As Linda put it, “We’re seeing the industry move from intuition to insight. Data-led decisions are no longer optional.”

R6 Automate’s Michael Dogger closed the loop with a note of caution operators needed to hear:

“ RevPAM is the clearest indicator of performance. It tells you the truth occupancy alone can’t.

CAROLINE PLOWMAN

OUTGOING CEO OF NATIONAL

MINI STORAGE

“Dynamic pricing is powerful, but only when applied responsibly.”

He reminded the room that pricing tools should never exploit customers; especially in an industry serving people at major life turning points.

From the finance stage to the debate floor, we learned the next decade belongs to operators who understand their data and balance commercial discipline with customer care.

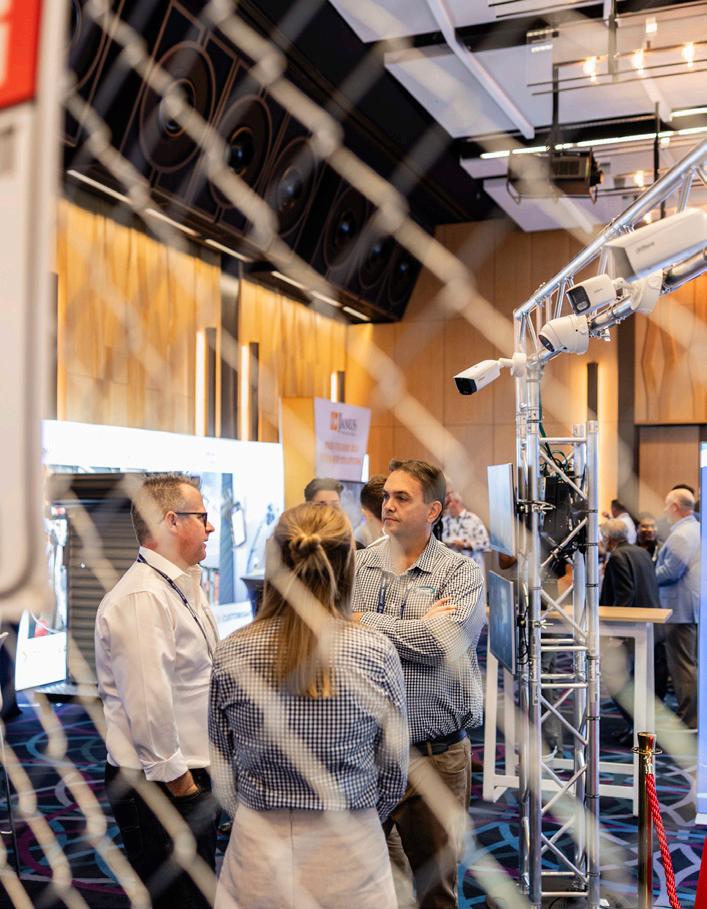

If one session jolted operators upright this year, it was the Safeguarding Self Storage panel, with a blunt reminder that security in 2025 looks nothing like it did a decade ago. The threats moving through facilities are more sophisticated, organised and adaptive than many operators realise.

Illicit tobacco storage is now one of the fastest-growing organised-crime use cases for self storage facilities across Australia. Criminal networks are targeting units because they are discreet, accessible and easy to rotate. Operators were urged to treat unusual patterns seriously – odd hours, unusual odours, rapid in-andout behaviour, or customers insisting on minimal interaction.

“Nothing good happens after midnight,” said Gary Steegstra, Storage King’s GM of Compliance & Asset Management. After-hours access remains one of the highest risk windows for break-ins, theft and illegal activity; not because of the technology, but because human behaviour becomes more

“ If you see something, say something. It builds the intelligence picture.

SUPERINTENDENT

predictable. Offenders know when sites are unstaffed, when response times are slow and when vigilance naturally dips.

The panel also revealed a tactic that some operators had not heard of: criminals are testing your alarms before the break-in. Small ‘probe’ triggers – a door rattle, a brief breach, a cut wire – allow offenders to time police and patrol response, assess blind spots and plan a second, more coordinated attempt.

Operators need to shift from passive surveillance to active intervention. Live audio warnings, AI-assisted monitoring, tighter ID verification and more robust onboarding checks are essential.

Self storage is now part of a much bigger intelligence network. “If you see something, say something,” said Australian Border Force Superintendent Ben Michalke. “It helps build the intelligence picture.”

Modern security is less about cameras on a pole and more about vigilance, collaboration and prevention, led by people on the ground who know their site best.

8 Independent operators have unique strengths, and they can win the next decade

For all the talk about automation, scale and global capital, the Independent Operator Forum was one of the most grounded sessions of the week. It brought together the people who know their customers by name, who sponsor the local footy club and who are as much a part of their suburb as the post office or bakery.

As Aaron Alsweiler from Safe Store put it, “We represent 50% of the industry. Don’t think for a second we’re insignificant. We’re not.”

Single-site and family-run facilities make up almost half of the sector, a reminder that the industry’s future is not owned solely by larger players. And independents are not only holding their ground, in many markets they are well placed to win the next decade.

Their competitive strengths are unmistakeable: deep community connection, hyper-personal service, the agility to pivot quickly, local knowledge that can’t be replicated from head office, and a long-term commitment to place, people and reputation.

Where larger brands bring scale, independents bring warmth, visibility and genuine care. Customers remember the

operator who greeted them by name, offered reassurance during a stressful move or remembered the story behind the boxes. In a category built around life transitions, emotional intelligence isn’t a soft skill, it’s a business strategy.

With bigger brands expanding into more postcodes, the advice from the panel was to resist panic discounting. Price wars only erode trust and revenue. Instead, independents were encouraged to stay focused on the things that actually convert customersservice, clarity, relationships and value.

Hiring remains another superpower. Independents can recruit people with hospitality DNA – warmth, calm communication, trustworthiness – even if they’ve never set foot in a storage facility before. “Hire for warmth,” said Monash Self Storage’s Lizzy Rutland. “If people trust your staff, they trust your business.”

Independent operators thrive by staying adaptable, authentic and deeply connected to their communities. Scale can be bought, but trust can’t.

Self Storage Week 2025 showed the power of a sector that learns together, shares openly and backs each other to grow. The technology, customers and expectations might be changing, but the ambition of this community remains rock solid. l

Sponsored by

On day one of the 2025 SSAA Convention, Visy Specialties proudly hosted the much-loved Golf Day at the stunning Moore Park Golf Course in Sydney.

Everyone was up bright and early, ready to take on the sweeping fairways and enjoy the city skyline backdrop. The course proved both challenging and rewarding, setting the stage for a fantastic day of friendly competition, networking –and plenty of laughs.

Despite the novelty of the albatross game, players delivered an impressive display of skill and sportsmanship, making it another memorable highlight of the convention.

Andrew Eastwood – U-Store-It

Anthony Logiudice – Janus International

Adam Broadhead – Southwell Lifts and Hoists

Orhan Guzel – 3SIP Services

At the gala dinner, Sonja from Visy Specialties congratulated the winners and thanked all participants, highlighting how the tournament once again brought the industry together in a spirit of camaraderie, competition and fun. She encouraged everyone to keep the tradition alive and make next year’s event in Brisbane even bigger. l

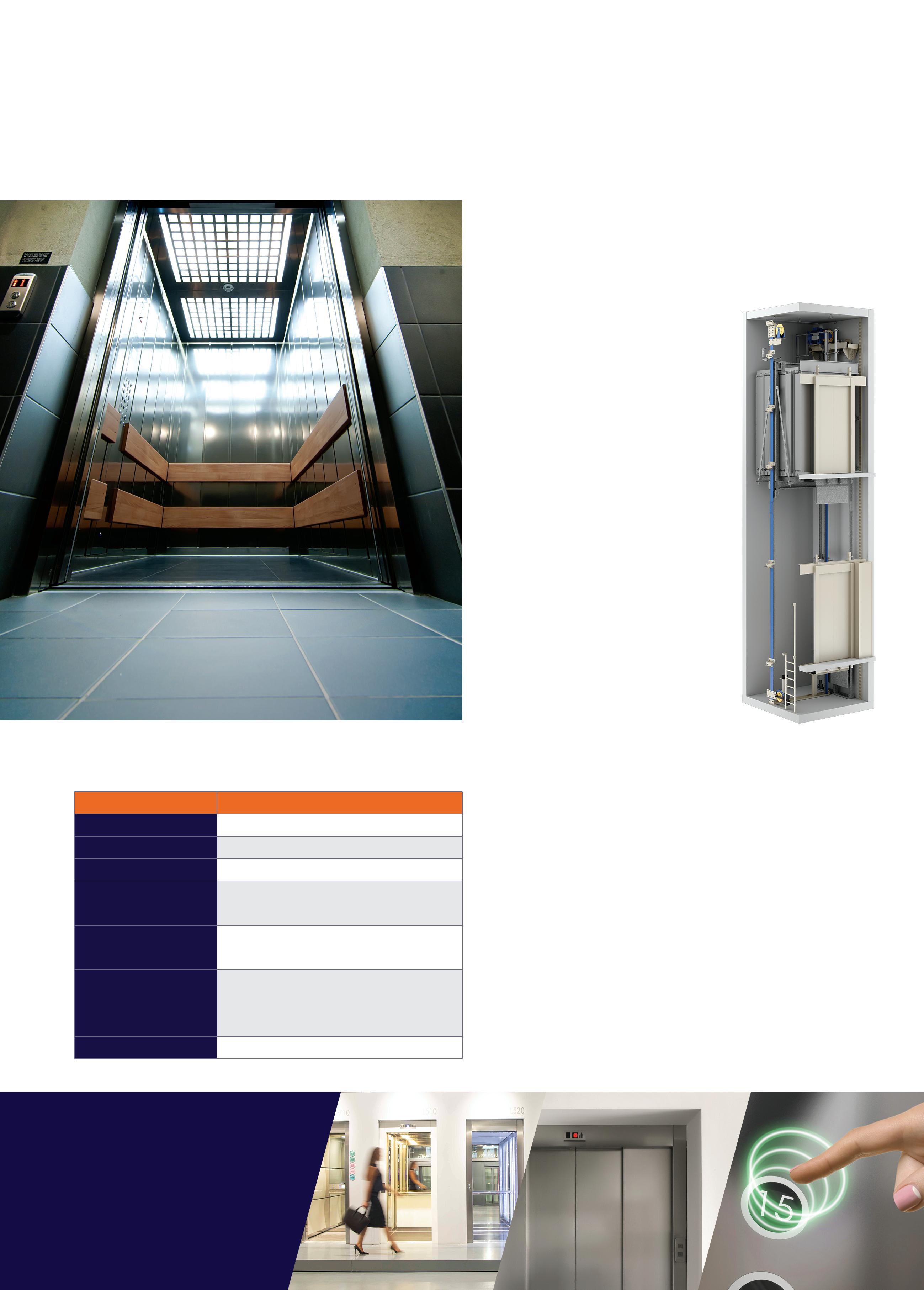

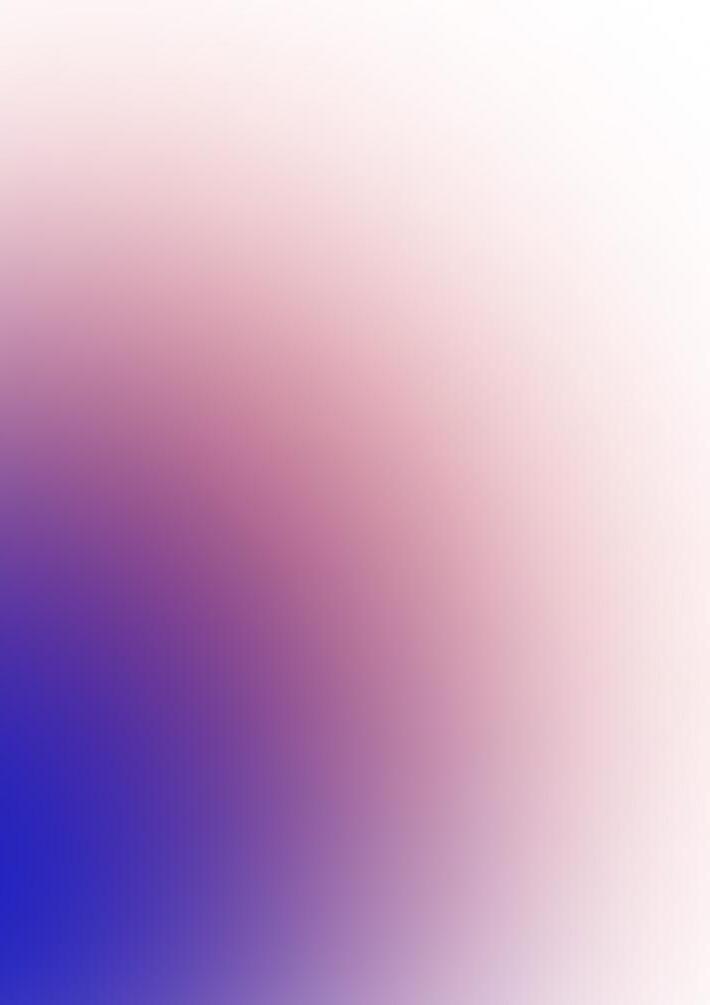

kg at 1.0 m/s

× 2350D × 2300H mm

× 2200H mm 4 panel centre opening with Infra-red safety device and 120 minute fire rating.

Traction Drive MRL (machine room option available)

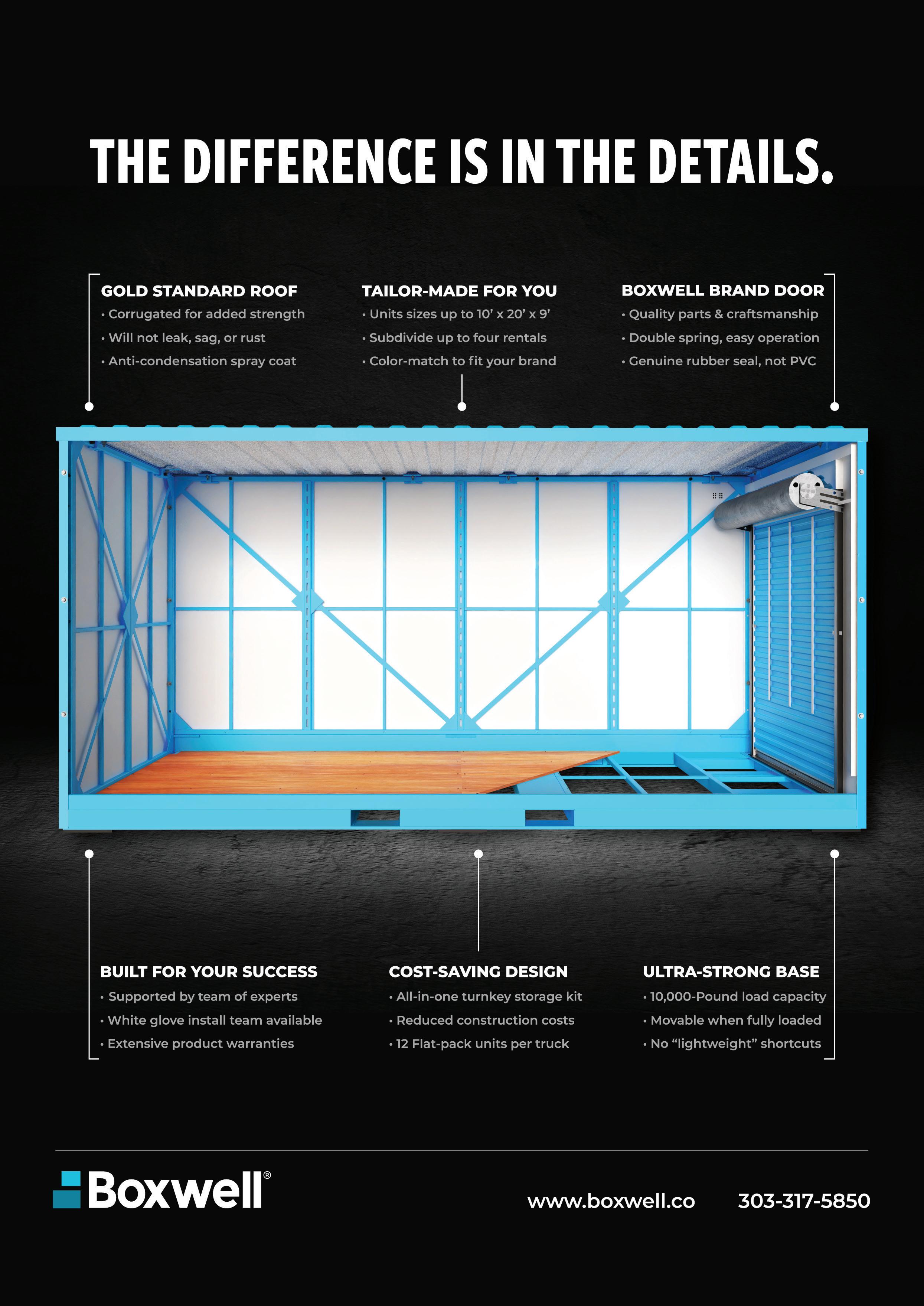

Southwell Lifts & Hoists delivers engineering excellence with robust, dependable solutions, perfect for the Self Storage industry. The ideal traction lift, combining high capacity with cutting-edge technology for outstanding performance.

HIGH CAPACITY: Rated for 2500 kg (33 Passenger), maximising what your customers can move.

SPACE OPTIMISATION: Our design maximises the car size to suit EN81-20 standards, ensuring you get the most usable space.

FAST & EFFICIENT: Fast speed of 1m/ second and compliant to 180 starts per hour.

SUPERIOR BUILD: Built tough, built to last. Featuring a durable and stylish finish, specifically designed for premium self storage requirements, including stainless steel bump rails for wall protection.

ENERGY EFFICIENT: Premium quality gearless motor and state-of-the-art inverter provide exceptionally low energy consumption and sound levels.

Locally designed and engineered solutions. European partners with high-quality products and parts.

Factory-trained technicians for dedicated service support.

Guaranteed operational, on-time, on budget, with no hassles.

Sponsored by

The Women in Storage breakfast brought together an incredible network of women from all levels of the industry for an inspiring morning hosted by Storage King. It was lovely to see so many familiar faces and plenty of new ones too.

Mimosa’s were the order of the day with champagne on arrival, while live illustrations by artist Belinda Xia were a crowd favourite, capturing the women of self storage at their best.

Inara Gravitis, COO of Storage King opened the breakfast with a personal reflection from her experience at SSA Las Vegas, where she met an inspiring woman quietly succeeding in self storage despite personal tragedy and professional challenges. That moment, she explained, made her determined to champion and elevate women’s voices and stories in self storage.

Storage King facilitators at each table guided conversations. From sliding-door moments that changed a career path, to “I can’t believe I did it” milestones and advice that goes against conventional wisdom. These simple questions opened the door to thoughtful discussions about

career milestones, confidence and professional growth. Very quickly, the room filled with honest, generous stories, practical advice and plenty of laughter.

For many, certain messages really stayed. Kelsie Gilbert, Marketing Manager at NatGen and

General Self Storage, reflected on an “incredible” story shared by Liz Davies about the transparency and collaboration within the sector: “We’re not competitors, we’re just smart enough to be in the same industry,” a line that resonated with her journey in self storage.

Kelsie also described Karen Jacobs from Total Construction as “an absolute powerhouse,” particularly her encouragement on leadership and visibility: “Take a seat at the table. Just take it and go for it, claim it.” l

Sponsored by

Hello Sydney! What a way to launch our inaugural Self Storage Week at SYD25! With spritz in hand, Co-Captains Michael Alafaci and Anthony Regis welcomed more than 320 delegates on board the Jackson for a twilight cruise proudly sponsored by Regis Built. Out on the harbour, Sydney turned it on. And with more than a little wind

in our hair, we cruised past the Opera House, Harbour Bridge and Luna Park, with the city skyline twinkling as the sun went down.

Guests enjoyed canapés and conversation, with the buzz carrying from the bars to the balconies and back again. By the time the DJ turned things up a notch, Self Storage Week had officially set sail. l

Self storage has arrived as a serious standalone asset class - and the smart money knows it.

For the first time at Convention, investors, owners and advisors came together for a Capital Flows Investment Lunch at Self Storage Week. Delegates heard from leading demographer Simon Kuestenmacher from The Demographics Group, and an industry panel featuring moderator Linda Sharkey (Four Leaves Property) with panellists Sam Kennard (Kennards Self Storage), Ben Hickey (BlackRock) and Adrian Lee (Big Yellow Group).

Kuestenmacher opened with the demand side of the story, charting how population growth, household formation, migration and urban change continue to underpin the need for more space. He noted that sectors tied more to people than to GDP cycles tend to outperform on a relative basis – and self storage sits squarely in that camp. Net overseas migration has remained surprisingly stable and housing is “expensive by choice,” with no major policy shift on the horizon.

These demographic tailwinds, combined with housing constraints, rising usage per capita and still-modest penetration have helped keep the sector’s demand engine running, positioning self storage as a “lucky industry in the lucky country” even as other real estate asset classes have slowed.

The panel then turned to how capital is reading those fundamentals. Ultimately, capital is seeking resilient income and self storage is screening well. Storage benefits from diversified income across large customer

“ The structural strengths of self storage do most of the heavy lifting in this capital flows story, with diversification, yield and earnings growth the foundation of the investment thesis.

bases and postcode spreads, short agreements that reprice quickly, and steady compounding earnings.

What really captured investor attention, however, was the model. Investors are not just buying buildings; they are effectively buying an operating company and a property company that work together. Owning both allows investors to capture more margin, maintain stronger pricing control and systemise growth at scale. That logic helps explain why portfolio deals, rather than single-asset acquisitions, remain a focus and why many interested parties are moving further up the risk curve in order to hit their return targets.

Return settings, the panel agreed, still stack up. On a spread basis, storage cap rates compare favourably with other real estate classes, and once operating margins are tuned, cash-on-cash yields look compelling. Development also remains investable, with yield on cost typically providing a buffer to stabilised cap rates. The caveat is execution: outcomes depend on site selection, functional layouts and smart operating systems, underpinned by high-quality data and experienced decision-making.

Cycle realities were also front of mind. New supply is arriving, occupancies have eased from their pandemic peaks and pricing power has softened in some submarkets. The demand engine remains intact, supported by population growth, higher usage per capita and rising penetration. Construction costs and land prices are a clear hurdle for new projects, while at the same time, customers are also more price sensitive. That combination, the panel noted, raises the importance of clear value propositions and straightforward communication with customers about any rental increases.

The BlackRock x StoreLocal case study illustrated how global capital is approaching the region, with the investment decision founded on three pillars: l High conviction on the market fundamentals. l Focus on operating margin as the core value lever. l Disciplined scaling through network density, measured development and data-led revenue management, rather than simply chasing flags on a map.

Regulatory and reputational considerations rounded out the conversation. Aggressive discounting strategies that have made headlines in the US won’t align with regulatory expectations here. As the sector matures, advertising, pricing and fee structures need to be fair, consistent and well documented to better manage risk and reputation.

The practical takeaway for investors and operators was clear: grow revenue with evidence rather than instinct, through smart unit-mix planning and datadriven, measured revenue management. Keep costs in check by standardising processes, automating where it is effective and designing facilities that are efficient to operate. If those fundamentals are done well, the structural strengths of self storage do most of the heavy lifting in this capital flows story, while diversification, resilient yields and steady earnings growth remain the foundation of the investment thesis.

This year alone, we’ve seen more than a billion dollars in transactions – from Kennards’ acquisition of National Mini Storage, to Barings’ move into the sector through Swift Storage, and BlackRock’s investment in StoreLocal – all signalling just how strong institutional appetite for this sector has become.

The pace and scale of activity is exciting. Capital is flowing, valuations are holding firm and global investors are interested and competing for assets. It’s a sign of confidence, but also change.

Transaction Talks brought together industry leaders who’ve been right in the middle of it – each bringing their own perspective on growth, investment, and the partnerships driving this new phase for the industry.

Some key takeaways from our panel:

On preparing for a deal: “Communication is important, but so is confidentiality,” shared Caroline Plowman, National Mini Storage. “Look at the people you trust and need for the transaction – get their buy-in early and give yourself the time to prepare properly.”

On building trust: “You’ve got to make sure you’re dealing with a counterparty who likes you more than you like them,” said Tamara Williams, Barings. “Things will go wrong – and if that relationship isn’t strong, everything will go wrong.”

On red flags: “Understand the DNA of who you’re partnering with,” added Robert Gregg, Swift Storage. “You don’t want to be known as the buyer who cuts the deal.” On staying grounded: “Try not to overcomplicate things,” advised Sam Kennard, Kennards Self Storage. “Keep it simple. Begin with the end in mind.” l

With 46 exhibitors on the floor, this year’s trade show was our biggest yet. From the moment the doors opened, the hall was humming –full of conversations, live demos, new ideas and plenty of coffee (thanks, Storco!).

Across two days, the trade show became the natural meeting place of Self Storage Week. Delegates dropped in between sessions to catch up with suppliers, compare notes with other operators and see what is coming next in technology, design and operations. It was an ideal chance to talk through the latest innovations and custom solutions for their businesses, all in one place.

Whether you were testing the latest software platforms, patting the Sweepers robot, or exploring new approaches to building design and fit-out, there were specialists from every corner of the industry ready to share their expertise.

But it wasn’t all business. Some took a breather in the TOTAL Construction Networking Lounge, others grabbed lunch and wandered the stands or met with suppliers for a quick chat. At every turn, there were opportunities to meet, eat and mingle on the trade show floor.

A big thanks to all our exhibitors for helping make this our biggest and most dynamic trade show yet. l

The SSAA’s Industry Snapshot 2025 points to a market that is maturing quickly and growing in scale, attracting global capital and delivering sustainable operational performance, as new supply reaches record levels.

The Industry Snapshot complements the SSAA’s biennial State of the Industry Report and draws on data from hundreds of independent, large and major owners and operators across Australia and New Zealand. Together, they map a $20 billion dollar industry, spanning 3,380 facilities, 7.5 million square metres of net storage area and around 730,000 units across Australasia.

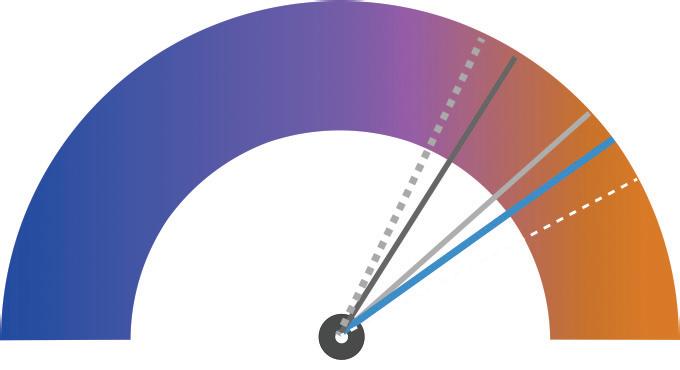

Beneath the headline numbers, the macro story still rests on two pillars: demographics and housing. Population growth, migration, urban density and housing turnover remain central to storage demand, with the SSAA Industry Gauge pointing to a stable market supported by movement in people, discretionary spend and residential sales activity.

The Snapshot reveals a confident asset class that has found its footing, and the picture for 2026 is of a market in motion. Record transactions, resilient operations, an expanding supply pipeline and a noticeable shift toward data-driven, technology-enabled operating models are now the hallmarks of the sector.

Despite ongoing consolidation, the sector remains highly fragmented. Independent operators continue to represent a significant portion of the market, holding 49% of total net storage area, while the three largest operators account for 41%, and larger operators a further 9%. National Storage remains the single biggest brand, with around 18% of total net storage area across both Australia and New Zealand. Overall market composition has remained broadly stable since 2024, with only minor rebalancing between categories. Independent operators have retained their strong presence, supported by new entrants and a slower pace of consolidation among the major groups. In recent periods, the market has seen the emergence of new private equity backed platforms and smaller independents looking to expand their presence and build portfolios, reinforcing the diversity of ownership across the region.

Transaction activity is one of the clearest signals of the sector’s maturity. Preliminary figures suggest 2025 will be the strongest year on record for self storage sales, with an estimated $1.36 billion in going concern transactions across Australia and New Zealand. Three major portfolio deals account for around $1 billion of that total, with further

3,380

ition

actions as private equity market

gest year on record for self storage transactions across iminary sales volumes estimated at approximately ng concern sales only).

storage transactions across ated at approximately

on record for self storage transactions across sales volumes estimated at approximately rn sales only).

deals account for around $1 billion of this share, and with lios currently on the market, the final 2025 result may

1 billion of this share, and with the final 2025 result may

count for around $1 billion of this share, and with ntly on the market, the final 2025 result may

onal investors have entered the sector this year, bringing a capital and strengthening the outlook for further Once dominated by the two REITs, private equity groups now lead the investment market, representing 84% of d

e sector this year, bringing a he outlook for further REITs, private equity groups arket, representing 84% of

ors have entered the sector this year, bringing a nd strengthening the outlook for further minated by the two REITs, private equity groups the investment market, representing 84% of

nsified, particularly among private equity groups aiming d their presence in key metropolitan markets. Off-market rong, particularly at the higher-price points, reflecting the ature of the sector and the scarcity of quality assets.

articularly among private equity groups aiming esence in key metropolitan markets. Off-market ularly at the higher-price points, reflecting the he sector and the scarcity of quality assets.

private equity groups aiming ropolitan markets. Off-market -price points, reflecting the scarcity of quality assets.

giant Public Storage for Abacus Storage King bal interest in the Australasian sector.

e for Abacus Storage King Australasian sector.

bid by US giant Public Storage for Abacus Storage King plified global interest in the Australasian sector.

as reinvigorated the market, with opportunistic vendors buyer appetite

orated the market, with opportunistic vendors etite

with opportunistic vendors

o carry into 2026, as new entrants pursue sitions and third-party management

s new entrants pursue arty management

bid by US giant Public Storage for Abacus Storage King mplified global interest in the Australasian sector.

dentiality NZD sales have been converted to AUD for consistency year

“ Rising deal activity has reinvigorated the market, with opportunistic vendors increasingly testing buyer appetite.”

xpected to carry into 2026, as new entrants pursue hrough acquisitions and third-party management

portfolios still in play as the year closes. Individual asset sales are projected to reach around $340 million, marking the largest annual total for single asset transactions to date.

D sales have been converted to AUD for consistency transactions as nsifies and private equity vestment market

as reinvigorated the market, with opportunistic vendors buyer appetite xpected to carry into 2026 as new entrants pursue hrough acquisitions and third-party management

ted to AUD for consistency

ew entrants steady market share industry consolidation continues

entrants steady market share industry consolidation continues

The buyer landscape has shifted. Once led by REITs, the market has tilted toward private equity and private investors who represent around 84% of recorded transactions. Key deals such as Kennards Self Storage’s purchase of National Mini Storage in Auckland, BlackRock’s majority acquisition of StoreLocal and Barings’ majority stake in Swift Storage illustrate the growing institutionalisation of the sector.

pendent operators continue to represent a significant portion of the ket, holding 49% of total net storage area (NSA).

inue to represent a significant portion of the net storage area (NSA).

ndent operators continue to represent a significant portion of the holding 49% of total net storage area (NSA).

top three major operators now account for 41%, while larger operators esent a further 9% National Storage continues to maintain the largest ket share, holding approximately 18% of the total net storage area across h markets.

ors now account for 41%, while larger operators onal Storage continues to maintain the largest roximately 18% of the total net storage area across

three major operators now account for 41%, while larger operators nt a further 9% National Storage continues to maintain the largest share, holding approximately 18% of the total net storage area across arkets.

rall market composition has remained broadly stable since 2024, with only nor rebalancing between categories. Independent Operators have ned their strong presence, supported by new entrants and a slower pace onsolidation among the Major Operators.

market composition has remained broadly stable since 2024, with only rebalancing between categories. Independent Operators have d their strong presence, supported by new entrants and a slower pace onsolidation among the Major Operators.

cent periods, the market has seen the emergence of new private equity roups and smaller independent operators seeking to expand their presence build portfolios.

has remained broadly stable since 2024, with only n categories. Independent Operators have ce, supported by new entrants and a slower pace Major Operators.

spite ongoing consolidation, the self storage sector across Australia and Zealand remains highly fragmented

t periods, the market has seen the emergence of new private equity and smaller independent operators seeking to expand their presence d portfolios.

t has seen the emergence of new private equity dent operators seeking to expand their presence

ongoing consolidation, the self storage sector across Australia and aland remains highly fragmented

on, the self storage sector across Australia and fragmented

A notable trend within this broader activity is the rise of turnkey facility sales. Over the past three years, multiple investors have entered this space, attracted by price certainty, reduced construction risk and the ability midlandinsurance.com.au

Whether it’s a converted warehouse or purpose-built facility, if you own or operate a self-storage business, we can tailor an insurance policy to suit your needs.

1300 306 571

to raise capital through the build period. In the current construction environment that trade-off is proving appealing

This weight of capital has intersected with a relatively thin pool of available investment-grade stock. Off-market deals remain common, especially at higher price points, and bidding tension is evident for quality assets in the capital cities. Capitalisation rates have shown modest movement across most segments. Prime self storage assets are indicated around 5.25%, with the broader market around 5.75%. Regional markets have shown only modest softening, with hints of sharpening where competition for stock is fiercest.

Valuation analysis indicates asset values are now being driven by earnings performance rather than further yield compression. Capitalisation rates remain firm in the face of elevated investor activity, and some record results in 2025 indicate strong competition for quality facilities.

The 2025 industry gauge results suggest the market remains stable

Increasing interstate migration (Movement of People) and positive levels of Discretionary Spend are expected to support ongoing demand for self storage, while a continued rise in housing transactions is also likely to boost demand

Operationally, the sector has moved into a more sustainable pattern. The pandemic surge has faded, but performance remains even and operators are learning to live with a more normalised demand profile. Average facility occupancy across Australasia has eased from 87 to 85% by area. This has been offset by continued fee rate increases, with the weighted average storage fee now $394 per square metre per annum, up from $380 a year earlier, lifting revenue per available square metre (RevPAM) to $335.

New supply forecasts continues to grow and this remains the strongest headwind moving forward

Apartment completion rates are static, but the gradual trend towards high density developments and increasing urbanization will support continued demand for self storage

The picture varies by city. Sydney and Adelaide have experienced only modest fee growth and flatter or slightly negative revenue per available metre as occupancy softened. Melbourne, Brisbane and Perth have recorded strong fee growth even as competition has intensified. Auckland is more noticeably under pressure, with declines in both fee rate and occupancy leading to a 6.83% fall in revenue per available metre over the 12 months to September 2025.

Operating metrics show that revenue growth remains positive overall, but occupancy has softened in some markets after several years of strong fee increases and a step-up in new supply. Other income has recovered as operators boost ancillary sales and reintroduce customer goods and protection offerings, while operating costs continue to rise.

Development activity has accelerated with the self storage pipeline set to continue expanding into 2026. Record levels of new supply are forecast with a further wave of projects due over the next two to three years. Across the seven major markets there are currently 198 proposed facilities, up about 21% on the previous year. Across Australia and New Zealand combined, there are roughly 350 known projects, an increase of around 26% year-on-year.

New development remains heavily concentrated in metropolitan east coast markets. Melbourne and Sydney together account for nearly 60% of total development activity, and the three east coast capitals are projected to have increased their total net storage area by about 7.5% during 2025, well above the pre pandemic average of 2-3% growth per annum.

The SSAA Industry Gauge result of 3.55 is broadly in-line with 2023 and 2024 and points to a stable but competitive market. Movement of people, discretionary spend and residential sales all show positive trends for storage demand, while new supply remains the strongest headwind. Apartment completions are static in aggregate, but the longer term move towards higher density living and continued urbanisation is expected to support demand for storage solutions.

The Snapshot highlights several important shifts in how facilities are being run. Most sites remain fully staffed, but around one in three operators now use some form of partially remote model, combining leaner on site teams with remote monitoring, digital access and automated processes. Most facilities remain fully staffed, with about 65% operating with a traditional on site model. Around 35% now use a partially remote model, blending on site presence with remote management, rather than moving to full automation. Technology costs are still a pressure point, but more operators are adopting digital process automation and exploring hybrid operating models to improve efficiency while maintaining the human element.

Automation continues to reshape how self storage facilities are managed. Remote access systems, online move-ins, digital identity verification and integrated CRM tools are now commonplace, with many operators investing in technology to streamline processes, reduce manual tasks and improve customer responsiveness. Building on these foundations, many operators are now adopting artificial intelligence to enhance automation and support more data-driven decision-making. Enthusiasm is strong, with 62% of the industry believing AI will become either transformational or important within the next decade.

Crime across Australia and New Zealand continues to climb, with Police data showing sharp increases in theft and burglary rates in most major cities. As facilities become more visible and valuable, they also become

“ Operators are adapting, by blending people and technology to run smarter facilities.

more exposed. Reports from Police reveal growing levels of both organised and opportunistic crime, including illicit tobacco, drug and vehicle theft syndicates. As offenders grow more organised and better equipped, commercial premises, industrial estates and self storage facilities have become increasingly vulnerable targets. Two-thirds of respondents (66%) say they are concerned about crime in the year ahead, highlighting the need for stronger collaboration between industry and law enforcement.

Operator sentiment and outlook

Survey responses suggest that confidence has firmed. 73% of operators expect to be better off over the next twelve months and 59% say their business is already performing ahead of last year. Plans to lift marketing spend, expand facilities and in some cases add staff point to a sector that still sees the current environment as worth investing into. Wage costs and localised competition remain front of mind, but most operators believe they are entering 2026 from a position of relative strength.

The Industry Snapshot is possible thanks to the valuable contributions of our members, as well as Four Leaves Property and Cushman & Wakefield, whose analysis and perspectives enrich our understanding of market trends and performance. l

Read the full Report on the Member Portal.

With five busloads of attendees on board, this year’s Facility Tours kicked off in full force — two facilities, big insights, and plenty of good vibes.

Attendees were welcomed in spectacular style, greeted by traditional Middle Eastern drummers — a nod to Casula’s vibrant cultural mix and strong Iraqi and Lebanese communities. The energy set the tone for the visit, perfectly reflecting the diversity and spirit of the area. This demographic mix helps shape the facility’s

customer focus, ensuring accessibility, affordability, and connection with the local community.

The facility opened in January 2024, and sets a new benchmark for self storage, featuring 650 units across 6,500 sqm of net lettable area, including 50 convenient driveway units. Large awnings provide weather-protected loading, while three rapid goods and passenger lifts ensure easy access to all levels.

When the principal contractor entered administration mid-build, Rent a Space acted decisively by forming its own construction company to complete the remaining 35% of works. Within eight months, the project was delivered on time and to an exceptional standard, demonstrating both leadership and resilience.

Attendees praised Thomas Whalan’s dancing style and the facility’s impressive design and attention to detail, highlighting its light-filled interiors and sustainable initiatives.

(continued page 31)

Opened 1 July 2025 and already a standout in one of Sydney’s fastestgrowing corridors

Attendees began their visit by observing a respectful minute’s silence for Remembrance Day — a moment that brought everyone together before the tour commenced. It set a thoughtful tone and highlighted the foresight behind establishing this impressive facility in a region on the brink of major transformation.

Situated among the market gardens and small farms of far south-west Sydney, Leppington is a community built on space, renewal, and opportunity. From the upper levels, green paddocks are still visible today, but development is rapidly approaching. With the Western Sydney International Airport (WSI) set to commence operations in the next 12–18 months, attendees noted Storage King’s

clear strategic vision in securing and developing this site early.

The broader South-West Sydney region is planning 105,000 new homes, supported by the Aerotropolis and an anticipated 200,000 new jobs — all within minutes of WSI. Storage King Leppington has been designed to meet both present and future needs, offering 690 units across a 7,642 sqm footprint. The layout includes ground-floor commercial units and three upper levels catering to residential customers, with storage sizes ranging from 2 sqm to 40 sqm.

Attendees admired the facility’s smart planning, modern fit-out, and readiness to grow alongside its rapidly evolving community.

There was plenty of glitz and glamour as SSAA members gathered at the Hyatt Regency Sydney on November 13 for the self storage industry’s ‘night of nights’ – the 2025 SSAA Awards for Excellence, presented by Visy Specialties.

A highlight of the SYD25 Convention and inaugural Self Storage Week, the gala dinner celebrated remarkable achievements across a diverse range of categories. From clever conversions and regional success stories to excellence in industry leadership and inspiring community engagement, these Awards recognise the people, facilities and service providers leading the way in self storage.

Hotly contested across all ten categories, entries were assessed by an independent judging panel who praised the exceptional standard of submissions, acknowledging the thoughtful strategy, strong execution and genuine innovation behind this year’s winners.

Thank you to our award sponsors:

Sponsored by

R6 Automate has taken a leadership role in guiding the self storage sector through the shift to remote management. Its freely available Remote Management Guide helps operators of all sizes understand and implement remote and hybrid models with confidence. Judges described the guide as a useful and generous open educational resource, giving operators the tools to transition or optimise their management approach with clarity and confidence.

Sponsored by

Storage King’s annual participation in STEPtember 10,000 steps-a-day challenge, continues to unite its national network in support of the Cerebral Palsy Alliance. This year was their best yet, raising a remarkable $53,000! Championed by Sharon Dorward and Lachlan Strada, the campaign came to life through a live fundraising meter, weekly staff challenges and facility-wide events that inspired friendly competition and team spirit.

Driven by generosity, teamwork and genuine care, STEPtember has become a defining part of Storage King’s culture and a powerful example of industry-led community impact.

Sponsored by

Developed by Millennium Technology, gxStorAccess unifies complex site operations into a sleek, userfriendly app experience. The technology integrates gate access, CCTV, climate systems and alarm monitoring into one intuitive interface. Judges described gxStorAccess as a ‘leap forward’ in facility management technology – intelligent, scalable and user-focused technology, delivering benefits well beyond the self storage industry.

by

Rising energy costs and a commitment to lead on sustainability were the driving force behind KeepSafe Storage Joondalup’s investment in renewable energy. The facility has implemented one of the most advanced solar and battery systems in the sector, powering core operations with more than 90% renewable energy and reducing emissions by around 80 tonnes each year. The project combines commercial performance with real environmental gains and a strong return on investment.

Sponsored by

Roomia Springfield impressed judges with its transformation of a former snack-food manufacturing plant into a modern, 690-unit storage hub. The redevelopment blends clever design with smart technology, including Bluetooth access, integrated booking systems and advanced security to deliver a premium customer experience. Major enhancements included a purpose-built twolevel loading bay with undercover access and two new hoists. A partial roof demolition created room for a new mezzanine and a highway-facing façade to maximise exposure.

Sponsored by

Sponsored by

Safe ’n’ SOUND Self Storage East Maitland is a purpose-built facility that goes beyond traditional self storage. The team’s partnership with GenesisCare brought vital cancer treatment services to the region, while a major expansion added 400 new units. Judges praised the project for its thoughtful design, strong operational performance and meaningful community contribution.

Simone Riviere has played a leading role in establishing StorHub’s first Australian facility at Rouse Hill. Under her leadership, the facility was named Best Self Storage in the Hills Shire, occupancy has grown by 12%, and it has maintained consistent five-star reviews. Her local marketing initiatives including the on-site Business Hub, have strengthened both business and community connections. Judges believe Simone’s ability to deliver results, inspire her team and connect with community, makes her a truly deserving recipient of this award.

The ProEdge Smart Latch simplifies door security for both operators and tenants with its next-generation Bluetooth technology that provides keyless access, automated rental possibilities, and overlocking functionality. With many customers worldwide, this one latch is all that is needed to accommodate left or right latch mounting and is designed for both flat and corrugated doors. Tenants just need to swipe left on the app to unlock the latch.

DUAL-METHOD ACCESS

Tenant access controlled using next-gen bluetooth via the StorID app, or via keypad if they do not have their phone.

TAMPER RESISTANT BREAKAWAY TAB

A breakaway tab, with onboard accelerometer, mitigates forced entry efforts and notifies both tenant and owner in real-time.

DIGITAL KEY SHARING

Using the StorID app, tenants can easily provide other users with access to their unit for a specific period of time or indefinitely.

STORLOGIX CLOUD INTEGRATION

StorLogix Cloud connectivity through a robust mesh network provides operators with information on tenant access and overlocking capabilities.

3 YEAR BATTERY PERFORMANCE

A single lithium manganese dioxide battery performs up to 3 years.

2 YEAR WARRANTY

All PTI products including ProEdge come with a 2-year warranty from the installation date, giving you complete peace of mind.

StorLogix Cloud, ProEdge gateway, and ProEdge subscription required. Contact PTI Sales for further information.

Sponsored by

iBidOnStorage had a clear goal in sight; To change the way the self storage industry manages abandoned goods. Since launching in 2016, founders Grant McNamee and Brennan McLoughlin have hosted more than 48,000 auctions, returning over $15 million to operators. The platform has brought structure, transparency and consistency to a process once marked by uncertainty, helping facilities recover debt, reduce risk and improve efficiency across the sector.

by

A proudly independent, family-run Gold Coast business, U Can Store It has built a reputation for genuine service, community connection and operational excellence. Despite being surrounded by big-name competitors, their commitment to personalised service, long-term relationships and local impact sets them apart. The Judges agreed the perfect blend of good old-fashioned customer service and modern technology make for excellence in self storage.

Sponsored by

With a striking four-level design, dual drive-through loading bays, rapid lifts and rooftop solar, Rent A Space Oran Park sets a new benchmark in large-scale facility design. Designed for both performance and sustainability, the facility is powered entirely by rooftop solar and rainwater harvesting is also in place. Judges cited exceptional design, sustainability features and a commitment to innovation through the new Rent a Space app, as markers of multi-site excellence.

For his outstanding leadership, enduring service, and dedication to advancing self storage, we proudly recognise Keith Edwards of All Secure as a Life Member of the Self Storage Association of Australasia.

Keith’s journey in self storage spans more than two decades and reflects a deep commitment to excellence, innovation, and continuous improvement.

After 17 years in the Blues, Keith transitioned from policing to private investigation, which soon evolved into a nationwide security business.

In 1997, he and his wife Lynley turned their focus to property –where they discovered that the 24 storage sheds behind one commercial site generated higher returns than the retail out front. Recognising an opportunity, Keith dove headfirst into the world of self storage.

At his first SSAA Conference, plans in hand, he met two men at the bar – Sam Kennard and Angus Miller. They offered candid feedback, completely reworking his concept. That sketch became the blueprint for

“ Keith’s legacy lies not only in what he’s built for his family, but in the people and businesses he’s helped flourish.

Elected to the SSAA Board in 2012 and serving as Chair from 2016 to 2018, Keith strengthened the trans–Tasman connection, ensuring New Zealand’s voice was represented and members across both countries felt valued. He worked tirelessly to improve the Association – his contribution evident in his governance, data initiatives, and personal engagement with operators at every level.

All Secure’s first facility.

In 1999, Keith and Lynley joined forces with Peter and Fiona James to open a small facility in Lower Hutt. Joined later by their son Hamish, that single facility has grown from humble beginnings into New Zealand’s largest privately owned self storage group.

From building and operating

All Secure to shaping the industry’s direction, Keith has combined business acumen with integrity and a genuine desire to see others succeed.

An advocate for best practice, he improved operator resources, built stronger ties with New Zealand Police, and helped create storage insurance products for New Zealand members.

Known for his generosity of time and spirit, Keith continues to mentor, share knowledge, and encourage collaboration. A proud proponent of family business, his legacy lies not only in what he has built with and for his family, but in the people and businesses he has helped flourish. l

Akura has been shaping industrial and commercial spaces since 1976, delivering buildings designed for durability and long-term use. Their fully integrated approach brings together design, engineering, steel fabrication, precast manufacturing, logistics, installation and construction within one coordinated team, creating a streamlined, predictable and high quality delivery process.

For the self storage industry, this in-house capability reduces complexity, avoids delays and ensures consistency from concept through to handover. With clearer communication and tighter control, facilities are delivered efficiently and built for long-term performance.

Akura has delivered both single-level and multilevel self storage facilities, creating durable, efficient and commercially strong assets. Recent projects with Roomia Self Storage, Storage Spot, National Storage and StoreLocal demonstrate how considered design, robust materials and practical construction methods combine to deliver smooth operations and lasting value.

Every project is guided by a people-first approach. We work closely with clients to understand operational needs

Red Deer Capital is a commercial debt advisory firm based in Melbourne, founded in 2022 by Vincent Marotta. Backed by two decades of industry experience, the firm delivers tailored financing solutions to high-net-worth individuals and enterprises across Australia.

The team works across multiple sectors, providing advice shaped by strong market insight and a practical understanding of complex financing requirements.

Red Deer Capital has a strong track record in the self storage sector, having assessed more than A$1 billion in self storage assets. This experience enables the team to secure competitive interest rates, improve access to capital, and customise lending structures that support long-term growth.

The firm’s approach prioritises strong relationships, transparency and clear communication. Clients benefit from a single point of contact, simplifying lender engagement and supporting confident decision-making.

Red Deer Capital looks forward to supporting SSAA members with strategic debt advisory solutions.

For a no-obligation conversation, contact Vincent on 0400 974 144 or vincent@reddeercapital.com.au or visit www.reddeercapital.com.au.

and investment goals, ensuring each facility supports long-term outcomes. Whether delivering a first facility or expanding an established network, Akura provides the capability and experience to deliver with confidence.

To learn more, visit www.akura.com.au or contact the team on 1800 501 575.

PTI SECURITY SYSTEMS

T: Sales: 1300 798 860

Support: 1300 159 473

E: sales@ptistoragesecurity.com.au www.ptistoragesecurity.com.au

NOKĒ™ SMART ENTRY

T: +61 7 3865 1600

E: sales@janusintl.au www.janusintl.au/noke

Access 1 Security Systems

Andrew Herrmann

T: +61 417 907 061

E: andrew@access1security.com.au www.access1security.com.au

AD-TECH Security

Adrian Rostirolla

T: 1300 306 090

E: adrian@ad-tech.com.au www.ad-tech.com.au

ADT Security Australia Pty Ltd

Chris Petrie

T: 131 238

E: Christopher.Petrie@adtsecurity.com.au

AlarmQuip Security Systems

Evan Richardson

T: 1300 552 520

E: admin@alarmquip.com.au www.alarmquip.com.au

Cobra Security Electric Fencing

Matthew Golland

T: +61 413 901 007

E: sales@cobraelectricfencing.com.au www.cobrasecurityelectricfencing. com.au/

Digital Surviellance Solutions

Access Control, Fire & Security

Brett Archer

T: +61 3 8360 3055

E: brett@digitalss.com.au www.digitalss.com.au

Gallagher Group Limited

T: +64 7 838 9800

E: sales.nz@security.gallagher.com www.security.gallagher.com

Inside Out Security

Brendon Neal

T: +61 7 4243 6235

E: service@insideoutsecurity.com.au www.insideoutsecurity.com.au

Millennium Technology

David Hore

T: 0800 724 376

E: info@millenniumtechnology.co.nz www.miltech.co.nz

OpenTech Alliance

T: +44 7825 557 826

E: ANZSales@opentechalliance.com www.opentechalliance.com

QueAccess Pty Ltd

Mike Bristol

T: 1300 783 222

E: office@queaccess.com.au www.queaccess.com.au

Rhombus

T: +44 7 5453 47323

E: sales@rhombus.com www.rhombus.com

Security Vision Networks

T: 1300 500 606

E: sales@secvision.com.au www.secvision.com.au/self-storage

Self Storage Security Ltd

T: +64 22 493 7700

E: mark@selfstoragesecurity.nz www.selfstoragesecurity.nz

Sentinel Storage Security

Jason Keane

T: 1300 852 117/+61 3 9988 2035

E: sales@storagesecurity.com.au www.storagesecurity.com.au

StorAxxS

T: +61 7 3088 8091

E: support@storaxxs.com www.storaxxs.com

Trilect Automation Ltd

T: +64 9 271 2493

E: sales@trilect.co.nz www.trilect.co.nz

PEDY Property Services Pty Ltd

Yasemin Ozbey

T: +61 3 9650 0348

E: y.ozbey@pedypropertyservices.com.au www.pedypropertyservices.com.au

Sweepers Australia Pty Ltd

Michelle Maxwell & Vaughan Rose

T: +61 3 9562 7533

E: info@sweepersaustralia.com.au www.sweepersaustralia.com.au

LOCKS

Astute Access

Nick Mooyman

T: +64 2191 0799

E: sales@astutesmartlocks.com www.astutesmartlocks.com

Lock Distributors Australia

Martin Coote

T: 1800 28 77 24

E: sales@lockdistributors.com.au www.lockdistributors.com.au

LOGISTICS

IAS Logistics P/L

Kingsley Mundey

T: +61 2 8988 7507

E: kmundey@iaslogistics.com.au www.iaslogistics.com.au

PACKAGING

VISY SPECIALTIES

Sonja Becke

T: 13 84 79

E: vbm_vic@visy.com.au www.boxesandmore.com.au Branches across AUS and NZ

PRINTING

Homestead Press

T: +61 2 6299 4500

E: printing@homesteadpress.com.au www.homesteadpress.com.au

SIGNAGE

Informe Global Pty Ltd

T: Marcus Baker

E: +61 3 8001 7175

marcus.b@in-forme.co www.in-forme.co

STORAGE AUCTION

iBidOnStorage

Brennan McLoughlin

T: +61 2 4302 0605

E: info@ibidon.com.au www.ibidonstorage.com.au

TELECOMMUNICATION

IGD Computer Solutions Pty Ltd

T/A 3SIP Services

Orhan Guzel

T: 1300 843 256

E: sales@igd.com.au www.igdsolutions.au

URL Networks

Ashley Breeden

T: 1300 331 178

E: support@url.net.au www.url.net.au

DESIGN & CONSTRUCTION

JANUS INTERNATIONAL

AUSTRALIA

Stephen Boxall

T: 1300 991 321

E: sales@janusintl.au www.janusintl.au

STORCO STORAGE SYSTEMS

Jonathan Layton

T: +61 2 6391 2800

E: sales@storco.com.au www.storco.com.au

Akura

Luke Irwin

T: +61 2 6338 1900

E: admin@akura.com.au www.akura.com.au

Bruac Design

Michael Bruton

T: +61 416 352 057

E: admin@bruacdesign.com.au www.bruacdesign.com.au

Datum Group Constructions

John Clarke

T: +61 2 9789 1018

E: services@datumgroup.com.au www.datumgroup.com.au

Gliderol Garage Doors

Tom Ainscough

T: +61 8 8360 0000

E: sales@gliderol.com.au www.gliderol.com.au

Indecon Pty Ltd

T: +61 8 6209 5432/+64 7 809 4003

E: info@indecon.com.au www.indecon.com.au

Patterson Building Group Pty Ltd

Gary Heald

T: +61 2 9662 6522

E: garyh@pattersonbuild.com.au www.pattersonbuild.com.au

Regis Built

Anthony Regis

T: 1300 388 224

E: info@regisbuilt.com.au www.regisbuilt.com.au

Steel-Line Garage Doors

Jim Tomlin

T: +61 7 3717 6624

E: jtomlin@steel-line.com.au www.steel-line.com.au

Storcad Pty Limited

Javier Rezzonico

T: +61 447 566 988

E: info@storcad.com.au www.storcad.com.au

Storcon

Stephen Fitzgerald

T: +64 21 547 077

E: stephen@storcon.nz

Storform Pty Ltd

Oscar Keddy

T: +61 407 271 212

E: oscar@storform.com.au www.storform.com.au

Structor Projects Pty Limited

Shayne White

T: +61 2 6331 5428

E: shayne@structorprojects.com.au www.structorprojects.com.au

Taurean Door Systems

Vikram Indugula

T: +61 3 9721 8366

E: Vikram.Indugula@stramit.com.au www.taureands.com.au

Total Construction Pty Ltd

Steve Taylor

T: +61 2 9746 9555

E: stevet@totalconstruction.com.au www.totalconstruction.com.au

Big Budda Boom Pty Ltd

Andy Pudmenzky

T: 1300 660 937 / +61 412 630 064

E: info@bigbuddaboom.com.au www.bigbuddaboom.com.au

Digital First

Robbie Cameron

T: +27 216 713 233

E: info@digitalfirst.co.uk www.digitalfirst.co.uk

Jigsaw Ensemble Pty Limited

Chinthaka Mampitiya

T: +61 413 440 086

E: chinthaka@jgsw.com.au www.jgsw.com.au

R6 Automate

Curt Dogger

T: +61 7 3889 9822

E: sales@r6automate.com www.r6automate.com

R6 Digital Pty Ltd

Michael Dogger

T: +61 7 3485 0771

E: sales@r6digital.com.au www.r6automate.com

StorNow Digital

Gavin Koorey

T: +61 2 9432 2880

E: gavin@stornowdigital.com www.stornowdigital.com

StorTrack

Angela Kilkenny

T: +1 650 539 2480

E: angela@stortrack.com www.stortrack.com

VerifiMe Digital Services

T: +61 2 7208 7799

E: hello@verifime.com.au www.verifime.com/selfstorage

INSURANCE SERVICES

AON Risk Services

Darren Clauscen

E: darren.clauscen@aon.com

T: +61 2 9253 8350 www.aon.io/4iiNlnY

AON Risk Services New Zealand

Jeffery Nathan

E: jeffery.nathan@aon.com

T: 0800 266 276 www.aon.co.nz

Aviso Marine & Logistics

T: +61 2 9007 2491

E: info@avisoml.com.au www.avisoml.com.au/storeprotect

Basil Fry

Adam Kellaway

T: +44 74 1586 8590

E: adamk@basilfry.co.uk https://basilfry.co.uk

Howden Group

Simon Keenan

T: 0800 500 510 / +64 9 358 7233

E: simon.keenan@howdengroup.com www.howdengroup.com

Midland Insurance Brokers Australia

Gilda Mihran

T: 1300 306 571

E: storage@midlandinsurance.com.au www.midlandinsurance.com.au

Self Storage Insurance Australia (SSIA)

Jackson Wall

T: 1300 477 662

E: storesafe@ssia.au www.ssia.au/facility-approval

Storage Secure

Joel Morrell

T: +61 475 744 111

E: Joel.morrell@avisospecialty.com.au www.avisospecialty.com.au

LIFTS & HOISTS

SOUTHWELL LIFTS & HOISTS

Hamish McGregor

T: +61 2 4655 7007

E: sales@southwell.com.au www.southwell.com.au

GoingUp Elevators

Derek Dixon

T: 1800 855 127

E: sales@goingup.com.au www.goingup.com.au

Loadmac Pty Ltd

Chris Walker

T: +61 431 281 108

E: chris.w@loadmac.com www.loadmac.com

Safetech Lifts & Hoists

Tony Krlevski

T: +61 3 5127 4566

E: sales@safetech.com.au www.safetech.com.au

Kennards Self Storage Management Services

Fiona Harding

T: +61 2 9764 9815

E: fiona@kss.com.au www.kss.com.au

Pioneer Performance

Leigh Thewlis

T: 1300 857 903

E: admin@pioneerperformance.com.au www.pioneerperformance.com.au

Storage King Management Services

Martin Richards, Australia/ New Zealand

T: +61 2 9460 6660

E: martin@storageking.com.au www.storageking.com.au

StorEdge Solutions

Andrew French

T: +61 497 178 283

E: solutions@storedge.com.au www.storedge.com.au

StoreLocal

Mark Greig

T: +61 499 110 599

E: partners@storelocal.com.au www.storelocal.com.au

StorKeeper

Apryl Hawker

T: +61 439 367 032

E: info@storkeeper.com.au www.storkeeper.com.au

Action OHS Consulting Pty Ltd

Tim Callinan

T: 1300 101 647

E: Tim.Callinan@actionohs.com.au www.actionohs.com.au

Bishop Collins Pty Ltd

Phillip Keenan

T: +61 2 4353 2333

E: mail@bishopcollins.com.au www.bishopcollins.com.au

Commonwealth Bank of Australia

Franky Cheng

T: +61 436 664 753

E: franky.cheng@cba.com.au www.commbank.com.au

Forpoint Solutions Australia Pty Ltd

T: 1300 795 564

E: info@forpoint.com.au www.forpoint.com.au

HR Central

Cath Nicholson

T: 1300 717 721

E: cath.nicholson@hrcentral.com.au www.hrcentral.com.au

Hunt & Hunt Lawyers

Tony Raunic

T: +61 3 8602 9200

E: traunic@huntvic.com.au www.hunthunt.com.au

Progress Accounting Pty Ltd

Ewen Fletcher

T: +61 3 4344 4322

E: efletcher@progressaccounting.au www.progressaccounting.au

Red Deer Capital

Vincent Marotta

T: +61 400 974 144

E: vincent@reddeercapital.com.au

(continued next page)

Storage Finance Co.

Mick Kuzmanoski

T: +61 402 653 733

E: mick@sfco.au

www.storagefinance.com.au

Suncorp Bank

Steve Hammond

T: +61 459 836 982

E: steven.hammond@suncorpbank.com.au www.suncorpbank.com.au

The Brokerage

Troy Williamson

T: +61 476 767 626

E: troy@thebrokerage.au www.thebrokerage.au

@realty

Phillips Ung

T: +61 478 800 700

E: phillips@atrealty.com.au www.atrealty.com.au

CBRE

Dylan Adams