How PBM Scrutiny Threatens

Self-Insurance

State action seen as challenge to ERISA protection, while a crackdown on revenue sharing could drive up service costs

A SIPC PUBLIC A TION SIPCONL I NE.N E T SEPTEMBER 2023

Accident & Health Insurance

We’ll focus on risk, so you can take care of your business

Get the peace of mind and support it takes to self-fund your healthcare.

Self-insuring your healthcare benefits can open up new possibilities for your business — affording you greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your team and assets:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

• Special Risk Accident

We’ll find the right answers together, so no matter what happens next, you can stay focused on your future.

QBE and the links logo are registered service marks of QBE Insurance Group Limited. ©2023 QBE Holdings, Inc. This literature is descriptive only. Actual coverage is subject to the terms, conditions, limitations and exclusions of the policy as issued. Crop Specialty Commercial

To learn more,

us at

Download now: Accident & Health Market Report 2023

visit

qbe.com/us/ah

FEATURES

4 HOW PBM SECURITY THREATENS SELF-INSURANCE STATE ACTION SEENS AS CHALLENGE TO ERISA PROTECTION, WHILE A CRACKDOWN ON REVENUE SHARING COULD DRIVE UP SERVICE COSTS

By Bruce Shutan

14 PSYCHEDELIC-ASSISTED THERAPY EXPANDS EMPLOYER OPTIONS FOR MENTAL HEALTH

By Laura Carabello

By Laura Carabello

ARTICLES

31 ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES THE AFFORDABLE CARE ACT (ACA), THE HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA) AND OTHER FEDERAL HEALTH BENEFIT MANDATES

36 SIIA CONFERENCE EXPERTS LOOK AT 2023 TRENDS

42 3M MASS TORT SETTLEMENT REMINDS US THAT SUBROGATION MATTERS

50 SIIA ENDEAVORS

57 NEWS FROM SIIA MEMBERS

The Self-Insurer (ISSN 10913815) is published monthly by Self-Insurers’ Publishing Corp. (SIPC). Postmaster: Send address changes to The Self-Insurer Editorial and Advertising Office, P.O. Box 1237, Simpsonville, SC 29681,(888) 394-5688

PUBLISHING DIRECTOR Bryan Irland, SENIOR EDITOR Gretchen Grote, CONTRIBUTING EDITORS Mike Ferguson and Ryan Work, DIRECTOR OF ADVERTISING Shane Byars, EDITORIAL ADVISOR Bruce Shutan, CEO/Chairman Erica M. Massey, CFO Grace Chen

SEPTEMBER 2023 VOL 179 WWW.SIPCONLINE.NET

2023 3

TABLE OF CONTENTS

SEPTEMBER

How PBM Scrutiny Threatens Self-Insurance

State action seen as challenge to ERISA protection, while a crackdown on revenue sharing could drive up service costs

Written By Bruce Shutan

Acrackdown on pharmacy benefit managers, three of which control about 80% of the market, may prove to be a double-edged sword for self-insured health plans.

On the one hand, new or proposed laws at both the federal and state level are designed to transform an opaque part of the U.S. health care system with transparency for payers and patients alike. They are in lockstep with federal Transparency-in-Coverage rules, No Surprises Act and Consolidated Appropriations Act – all of which have been fully supported across the self-insurance community.

FEATURE A

4 THE SELF-INSURER

A growing appetite to regulate PBMs stem from a larger effort to curb out-of-pocket Rx costs for health plan members that keep rising 13 years after the Affordable Care Act was enacted. It doesn’t help that the cost of specialty drugs coming down the R&D pipeline are expected to further raise prices.

Another culprit is consolidation of these services. The so-called Big Three PBMs – CVS Caremark, Express Scripts and Optum – boast massive scale and ownership that includes health insurers, physician practices, retail pharmacies and specialty pharmacies.

But with PBMs now firmly in the crosshairs of U.S. congressional representatives, regulators, statehouses and jurists, well-intentioned reform efforts also pose a serious threat to Employee Retirement Income Security Act (ERISA) protections for self-insured employers. Moreover, employers worry that curtailing or eliminating PBM revenue-sharing agreements will result in higher-priced services.

Since a 2020 U.S. Supreme Court decision pertaining to PBMs, industry observers fear that an invitation to unintended consequences could widen. An overly broad interpretation of Rutledge v Pharmaceutical Care Management Association is responsible for a fresh assault on ERISA. In upholding an Arkansas law requiring PBMs to pay pharmacies no less than their acquisition costs for prescriptions, the high court ruled that it was not preempted by ERISA. That decision allows states to regulate health care costs, including health plan contractors such as PBMs.

Ryan Work, SIIA’s VP of government relations, says the case to some extent opens the floodgates for states to regulate PBMs, “and what they’ve done along the way is started cracking at that ERISA firewall. You can regulate PBMs and pharmacy benefits, but at what point does that stop and then it starts actually regulating ERISA-protected selfinsured plans?”

His hope is that at some point the federal court is going to better define the Rutledge decision, “take up some of these ERISA arguments and create buttresses and firewalls around it that, while providing more transparency in the pharmacy space, will offer better protections for risk of self-insured plans.” The case is currently seen as a way for state regulators to get their hands

on self-insured plans, he explains, noting that Louisiana and Texas are among a few states that have tried to eliminate the word ERISA from some of their insurance statues related to PBMs.

Some regulators are using the decision to test how far they can go, he adds, while others are targeting PBMs without actually understanding that they’re just a tool to help mitigate costs.

There has been growing scrutiny of PBMs at the state level. A dozen states enacted 19 pieces of legislation last year that imposed a variety of restrictions for PBMs, including licensing and reporting requirements, prohibitions on spread pricing and rules aimed to make costs more transparent enrollees. These bills, among a whopping 135 measures introduced in state legislatures across the nation, seek to curtail the influence that PBMs have

SEPTEMBER 2023 5

“Pharmaceutical manufacturers are responsible for the high costs of drugs, and the PBMs are providing them the plans,” Work notes, “and they’re both pointing the finger at each other.”

PBM Scrutiny & Self-Insurance

Ryan Work

Complete, customizable TPA solutions

From locally-focused to national-scale programs, AmeriHealth Administrators offers a full spectrum of third-party administration and business process outsourcing services. Our scalable capabilities service many unique customers, including self-funded employers, Tribal nations, international travelers, and labor organizations.

We offer innovative solutions, insight, and expertise to help you manage your health plan and capabilities, control costs, and support employees’ health.

Visit amerihealth.com/tpa

to learn more about how we can work with you.

over both pharmacies and drug pricing.

Much of the state legislation is being driven by community pharmacists who feel under attack by the role of PBMs and the large retail pharmacy chains, according to Work. In Louisiana, for instance, they have shopped around model legislation for every state to pass. He references a campaign to file a complaint with the Louisiana Department of Insurance every time a PBM claim from a self-insured plan was submitted, which generated 30,000 cases in the past year.

“One of the problems that I’ve seen is that patients will go in with a prescription, and their community pharmacy is requiring that they pay in cash,”

Work reports.

Similar efforts to regulate PBM activity are also afoot on Capitol Hill, including the Pharmacy Benefit Manager Reform Act (S. 1339), which was introduced in late April. Led by Sens. Bernie Sanders (I-VT) and Bill Cassidy (R-LA), it proposes several reforms that are universally reflected in other bills. They include a ban on spread pricing and certain PBM claw backs, as well as require rebates paid to PBMs be passed through to health plan sponsors.

Work predicts that Congress will pass federal PBM transparency legislation by the end of this year – an area that has garnered rare bipartisan support in divisive times. The wheels are already in motion. He says PBM legislation has been introduced in the Senate Finance Committee and Senate Health, Education, Labor and Pensions Committee, as well as the House on Ways and Means Committee,

SEPTEMBER 2023 7

“In some cases, they are saying, ‘we’re not even going to take insurance. You do that on your own, and if you want to get reimbursed by your insurance, you need to do it on your own.’”

PBM Security & Self-Insurance

House Committee on Education and Labor and House Committee on Energy and Commerce.

But there’s no guarantee that any reform efforts will actually lower prices. In fact, it may do just the opposite. If PBMs aren’t able to share in claw backs, rebates or spread prices, then Work worries about higher fees being imposed on their services for self-insured customers. “You can bring transparency, but at the end of the day, is that really going to move the needle on cost? And the answer is probably no,” he suggests. “It’s just going to be a cost shift.”

EDUCATION AND ADVOCACY

Given the elevated level of misunderstanding, or no understanding at all, about ERISA and how the nearly 50-year-old landmark law benefits self-insured plan sponsors and participants, Work points to the importance of education and advocacy. As this issue went to press, SIIA planned to release to an ERISA white paper to help policymakers and congressional staffers at both the federal and state level understand the importance of ERISA protection. It also will serve as a resource for SIIA members.

While SIIA’s Drug Pricing Taskforce disbanded after several years of producing helpful checklists for members, other opportunities are expected to rise with regard to assessing PBMs. “One of the things that I’m trying to do is kind of create a smaller working group to better understand where our members come down on PBMs and regulation,” Work says.

Marien Diaz, VP of stop-loss claims and medical management for Symetra who was part of the taskforce, expresses a related concern about state oversight. “The No. 1 concern that I see from a claims angle is how are employers able to even comply with some of these state regulatory requirements?” she wonders. “If you have a selffunded employer with multiple locations across the board, these reporting requirements may change from state to state. Anytime that you have to program or invest in meeting those requirements, there’s additional cost.”

8 THE SELF-INSURER

PBM Security & Self-Insurance

Marien Diaz

Somebody has to come in second. Make sure it’s not you.

There are no insurance MVP trophies, no best PowerPoint awards, no fantasy broker leagues. You show up first with the best option for your client, or you lose. We never take this for granted. That’s why we leverage all of our people, data and relationships to reach one goal: We help you win.

We help you win.

BENDING THE COST CURVE

importance of providing transparency alongside eliminating hidden fees associated with direct and indirect remuneration, Baldzicki explains.

Plan sponsors, particularly TPAs, also are stepping away from brokers who pocket money from the large PBMs.

While lawmakers and regulators hope that reining in PBMs ultimately will help reduce costs, it’s clear that certain marketplace practices can have an immediate effect.

In the face of tremendous influence the Big Three PBMs wield, for example, some self-insured employer groups are peeling away from them contractually and embracing regionalized or midsize entities known as pharmacy benefit administrators, according to Mike Baldzicki, chief commercial officer, specialty pharmacy for Premier Pharmacy Services and member board of directors for the National Association of Specialty Pharmacy.

He says PBAs, whose business model reflects the service’s late 1980s roots before layers of complexity were added, are driving fiduciary duties and defining clinically appropriately utilization. They understand the

Advanced technology has powered the rise of PBAs to provide deeper insight beyond pharmacy claims to also include overall medical claims.

10 THE SELF-INSURER

“I even see brokers changing the way their model works to bring in other regionalized PBMs like CAP RX or App Rx and win some business for the smaller guys that are doing the right things to change the model,” he reports.

Learn More 8 88-248-8952 selffunding@benefitmall.com ©2023 BenefitMall. All Rights Reserved. Stop-Loss Management Services Claim Risk Solutions Premier Broker Support Expect More FROM YOUR STOP-LOSS PARTNERS PBM Security & Self-Insurance

Mike Baldzicki

Don’t face your obstacles alone. Whether you’re facing benefits loading issues, limited reporting, integration problems, or any other challenges—we’ll conquer them by your side.

Rise above your hurdles with cloud-based software fully customized for you.

( Experience quick implementation ( Optimize your software with AI integration ( Maintain full compliance with the No Surprises Act ( Leverage price transparency and reference-based pricing tools Software that Rises to Any TPA’s Challenge Looking for a foundational partner to grow your business? Schedule a demo today. 908.813.3440 sales@hi-techhealth.com hi-techhealth.com

“I’ve seen it where medical benefits for an infusion drug still ranges gross profit margin 19% to 66%, depending on the drug, if you’re truly not gaining insight on that claim,” he says.

Diaz says it’s important to create greater alignment between PBMs and claims administrators that support self-funded health plans, as well as offer transparent pricing. The Big Three have an opportunity to willingly create more disclosure in their billing practices and provide reasonable incentives to help employers mitigate their plans rather than rely on the regulatory environment to force them into adapting, she observes.

But there’s another area where self-insured employers can gain considerable traction: having a solid contractual arrangement in place when engaging the services of a PBM.

“When we are underwriting stop-loss risk, one of the basic questions that we ask is, ‘when was the last time that you reviewed and updated your PBM contract?’” notes Diaz, suggesting that an annual review be done. “It is shocking to me that although pharma expenses continues to grow exponentially, the review of contracts doesn’t happen with enough frequency and discipline… So it’s very difficult for us to provide competitive pricing in a meaningful way unless those agreements are reviewed and updated regularly. Sometimes we find employers that haven’t even looked at their PBM arrangement in the past five years.”

It all comes down to pursuing a proactive approach to engage in a meaningful relationship with PBMs, which Diaz believes “is in the long run a much better prescription, no pun intended, as an industry than to have to wait on regulatory mandates.”

Whatever direction the Rx industry takes, experts agree that cooperation and collaboration need to displace divisiveness. Adds Baldzicki: “We have to stop bashing PBMs, which have a place in the healthcare ecosystem, because if you really rip that away the disruption would be huge.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 30 years.

12 THE SELF-INSURER

PBM Security & Self-Insurance

www.bhspecialty.com/msl A trusted business name. A stellar balance sheet. An executive team with 30 years of experience. Creative, tailored solutions. Berkshire Hathaway Specialty Insurance is proud to bring our exceptional strength, experience and market commitment to the medical stop loss arena. A medical stop loss grand slam. It’s a home r un for your organization. Atlanta | Boston | Chicago | Columbia | Dallas | Houston | Indianapolis | Irvine | Los Angeles | New York | Plymouth Meeting | San Francisco | San Ramon | Seattle | Stevens Point Adelaide | Auckland | Barcelona | Brisbane | Brussels | Cologne | Dubai | Dublin | Frankfurt | Hong Kong | Kuala Lumpur | London | Lyon | Macau | Madrid | Manchester | Melbourne | Munich Paris | Perth | Singapore | Sydney | Toronto | Zurich

PsychedelicAssisted Therapy Expands Employer Options for Mental Health Treatment

Written By Laura Carabello

WithWgrowing mainstream media coverage surrounding Psychedelic-Assisted Therapy (PAT) and its benefits to address staggering mental health issues such as anxiety, depression, substance use disorder (SUD) and chronic, unresolved posttraumatic stress disorder (PTSD), it’s no wonder that selffunded organizations are now paying attention to and adopting this treatment option.

PAT refers to therapeutic practices that involve the ingestion of a psychedelic drug, and since the early 1990s, a new generation of scientists has revived the research to support this treatment. A growing body of research is helping to dispel the social stigma surrounding “psychedelics” and employers are taking a healthcare perspective on covering this treatment as a meaningful health benefit.

FEATURE

14 THE SELF-INSURER

As science now better understands the health and wellness improvements derived from the medicinal use of psychoactive compounds, such as Ketamine, this novel, innovative approach introduces opportunities for cost effective mental health treatment that deviates from traditional pharmacological interventions.

“The effectiveness of ketamineassisted therapy has been demonstrated through multiple research studies and more than twenty years of accumulated clinical experience,” says Dan Rome, MD, chief medical officer at Enthea, the first and only licensed, turn-key third-party administrator (TPA) of psychedelic healthcare in the United States offering psychedelic healthcare as a workplace benefit.

Clinical trials have shown that ingesting a psychedelic in a carefully prescribed and monitored setting can induce an experience that is medically safe and that provokes profound, durable psychological and behavioral change.

Researchers have conducted highly regulated studies, using careful screening, therapeutic preparation, controlled settings and with trained monitors. Innovative therapies, such as Ketamine, are now FDA-approved and state-legal for use to effectively treat a range of behavioral disorders.

Several reports show that psychedelics have surged in popularity over the past few years. According to National Survey on Drug Use and Health, prepared for the Substance Abuse and Mental Health Services Administration (SAMHSA), U.S. Department of Health and Human Services (HHS), 1.4 million Americans tried hallucinogens for the first time in 2020.

This level of enthusiasm, as reported in the New England Journal of Medicine, is partially the result of clinical trials showing that the drugs, notably psilocybin and ketamine, hold real promise in treating some mental health disorders, particularly depression. In fact, two states, Oregon and Colorado, have now legalized psilocybin for therapeutic use, and additional states are expected to follow suit.

Here’s the caveat: specialists who study these substances strongly urge that people only use them in supervised therapeutic settings, such as in a clinical trial or at an established ketamine clinic.

There are safety concerns attached to these substances and they are illegal outside of these venues.

Experts at Lancet advise that psychedelics have an extremely low chance of lethal overdose and there is little likelihood of addiction. As a result, authors classify them as some of the least harmful recreational drugs. But they do caution that they are not entirely without risk. Because of this, psilocybin trials and ketamine clinics have strict exclusion criteria to try to protect people who have physical or psychological vulnerabilities. The newest research published in Nature offers promise that psychedelic drugs may “reopen” the brain to help it recover from trauma. Scientists at Johns Hopkins University were investigating the drugs’ effects on “critical periods” for social learning, times when the brain is more open to new information that diminish as we age. They also anticipate that the therapeutic horizon for psychedelics could expand to other opportunities to retrain the brain, including recovery from a stroke, traumatic brain injury and even hearing loss and paralysis.

Some medical professionals and researchers say that PAT can be lifesaving when other traditional medications and therapies have failed. Researchers point to their remarkable efficacy in treating conditions that are often resistant

SEPTEMBER 2023 15

Assisted Therapy

Psychedelic

Dan Rome, MD

Psychedelic Assisted Therapy

to conventional treatments, with one promising arena in the treatment of substance abuse.

Employers are often ill-equipped to address these treatmentresistant conditions and welcome proven solutions. Given the current shortage of mental health providers and compromised access to care, this option is resonating among health decision-makers.

CALL FOR MORE EDUCATION AND MARKET AWARENESS

Don McCully, founder, Medical Captive Underwriters LLC, makes a good point: “Psychedelic assisted therapy is not widely known as an excellent treatment source. Education about the groundbreaking work in this area is largely muted. Employer decision making in this area requires additional education to allow for better informed decisions. PTSD and cancer were the first disease states approached for use of PAT and both experienced amazing outcomes. This needs amplification.”

He observes the inertia in health care for adoption of new and better treatments, saying, “It took 20 years to get sleep apnea patients assigned to pulmonologists. While there are no similarities or comparison between sleep disorders and PAT psychedelic assisted therapy, this is an example of the delayed response among decisionmakers.”

Emphasizing that the first step in any behavioral health treatment plan is a referral from the trusted family physician, preferably a Direct Primary Care provider, he highlights the importance of a referral for PAT from a provider with enough knowledge to pair up the patient with an estimable good fit. McCully says he has heard about a few employers that make this treatment available, noting that many first responders are aware of PAT and are incorporating it into plan offerings.

“The only way to offset the significant cost I estimate this treatment will run, it is only logical to have covered members contribute in the form of a deductible, co-pay or co-insurance,” he says.

Enthea counters this statement by demonstrating the cost-savings of ketamine-assisted therapy:

WHAT IS KETAMINE?

Ketamine is legal in the U.S. in all 50 states to clinically treat patients suffering from not only serious mental illness who have tried other medications with little or no relief, but also others who are struggling to a lesser severity.

Ketamine is a synthetic pharmaceutical compound, classified as a dissociative anesthetic. It is one of the most widely used drugs in modern medicine and is on the World Health organization’s List of Essential Medicines. It was developed in 1963, approved by the Food and Drug Administration for certain surgical procedures in 1970, and adopted by many hospitals and medical offices because of its rapid onset, proven safety, and short duration of action.

16 THE SELF-INSURER

Source: 2023 Enthea

Donald McCully

Is your payments solution delivering more to your bottom line? Expect more with ECHO® echohealthinc.com

Psychedelic Assisted Therapy

More recently, a growing body of research has found that lower doses of ketamine may be effective to treat a variety of mental health conditions. During the 1990s, investigators at the National Institute of Mental Health started to explore the antidepressant potential of ketamine while looking for alternatives to anti-depressants, commonly known as SSRIs and SNRIs.

In conjunction with this growing body of research, ketamine clinics and clinicians have proliferated across the United States, offering ketamine sessions for a range of psychiatric disorders either using ketamine-only treatments or ketamine in conjunction with psychotherapy (i.e., KAT).

Ketamine can induce a state of sedation -- feeling calm and relaxed – as well as relief from pain. Ketamine is an FDAapproved medical product as an injectable, short-acting anesthetic for use in humans and animals and esketamine (Spravato®; the active form of the drug) which was granted FDA-approval as a nasal spray for treatmentresistant depression.

(esketamine) nasal spray version (Spravato®) for treatment-resistant depression that is only available at a certified doctor's office or clinic.

According to Dr. Rome, “Unlike existing medicines, these compounds have a unique “neuroplastic” effect, meaning they put the brain in an unusually fresh, open and flexible state that is freed of longestablished assumptions and routines – ways of seeing things and experiencing ourselves, others and the world around us.”

He says to imagine the mind of a 2-year-old – curious, open, unburdened by anxiety and depressive thoughts:

In 1999, Ketamine became a Schedule III non-narcotic substance under the Controlled Substances Act. Ten years later, the FDA approved the S(+) enantiomer of Ketamine

18 THE SELF-INSURER

On average, aequum r esolves c laims within 297 days of p lacement aequum has generated a savings of 95.5% off disputed c harges f or self-funded pl ans aequum ha s ha ndled claims in all 50 states 297 95.5% 50 No Guarantee of Results – Outcomes depend upon many factors and no attorney can guarantee a particular outcome or similar positive result in any particular case. Protecting plans and patients across the U.S. 1111 Su perior A venue E ast Suite 1360 Cleveland, OH 44114 P 2 16-539-9370 www.aequumhealth. com

“Exploiting this neuroplastic effect combined with gently guiding talk therapy, many are finding lasting relief from depression, anxiety, PTSD and addictive disorders.”

KETAMINE-ASSISTED THERAPY (KAT)

KAT is a treatment that integrates prescribed doses of sub-anesthetic ketamine under the supervision of a clinician. Combined with integration sessions with KAT-trained therapists, this treatment improves mental health conditions. In low doses, ketamine can serve as an adjunct to psychotherapy, as it provides an opportunity for the temporary softening of psychological defenses, which may result in deeper self-reflection and psychotherapeutic processing.

Together, these components may help patients break long-standing, deeply ingrained thinking patterns associated with a variety of mental health conditions and, in turn, develop new ways of thinking and being. In this way, KAT involves the use of ketamine to enhance and deepen the therapeutic process, and the use of psychotherapy to amplify and prolong the curative effects of ketamine.

Ketamine is fast-acting and short-lived, making it very conducive to working with a therapist.

SEPTEMBER 2023 19 Psychedelic Assisted Therapy

Psychedelic Assisted Therapy

EMPLOYER ADOPTION OF PAT

A sure-fire sign that PAT has hit the self-funded community is the creation of Enthea as a TPA to help self-funded organizations, brokers, benefits consultants and other intermediaries with new choices, new and better ways to treat mental health issues that are apparent in the workplace.

Established in 2020 and thereafter re-organized as a Public Benefit Corporation, Enthea advocates for the safe and effective clinical use of psychedelics.

The Enthea approach is to offer employer-sponsored benefit plans new and better mental health treatment options that are proven to be safe. Standards of care emanate from Enthea’s evidenced-based medical policy, with treatment delivered through its proprietary network of KAT/ PAT therapists.

Sherry Rais, CEO and cofounder, Enthea, says, “Our goal is to make it easy for employers to expand their mental health package and offer psychedelic healthcare to their employees. Employers need and rely upon our developed protocols, guidelines and frameworks for integrating psychedelic therapy into their benefit program design. This practical perspective is vital for the industry as it moves towards broader adoption of psychedelic therapy.”

Rais points to Enthea data and scores over the past year which demonstrate the impact of KAT treatment for members:

• Post-traumatic stress disorder (PTSD) diagnosis reported an average of 86% symptom reduction

• Major depressive disorder (MDD) diagnosis reported an average of 67% symptom reduction

• General anxiety disorder (GAD) diagnosis reported an average of 65% symptom reduction.

“This is astounding considering that only 15% of people who use SSRIs find them highly effective, and the SSRIs, in contrast to ketamine therapy, come with many, many unwanted side effects,” says Rais.

POST TRAUMATIC STRESS DISORDER (PTSD)

PTSD is defined as a disorder that develops in some people who have experienced a shocking, scary, or dangerous event. Anyone can develop PTSD at any age, including combat veterans and people who have experienced or witnessed a physical or sexual assault, abuse, an accident, a disaster, or other serious events.

“As psychedelic treatments become better understood and widely accepted and practiced within healthcare, they will provide critical support to self-insured participants,” says Rais, noting that Enthea is building a nationwide network of credentialed providers. “We vet each clinic to ensure that they are staffed by credentialed PAT providers and follow guidelines that include:

• Evidence-based medical policies for psychedelic therapies that are regularly updated based on clinical developments and FDA approvals.

• Standards of care and credentials across the network to assure quality, positive patient experiences and positive treatment outcomes.

• Easy treatment authorization and reimbursements to providers, while shielding employers from Protected Health Information.

20 THE SELF-INSURER

Sherri Rais

Pharmaceutical Expertise Helps Clients Better Manage Costs

HM Insurance Group’s Pharmacy Operations Team Is Essential in Helping to Assess and Address Risk

Pharmacy expertise is critical to smart claims management, especially with high-cost gene therapies now entering the market regularly. The claims associated with these highcost treatment options can be catastrophic to self-funded employers without the right Stop Loss coverage in place.

Consider, for example, that a one-time infusion of Elevidys costs $3.2 million to treat a type of muscular dystrophy, and a one-time infusion of Hemgenix® costs $3.5 million to treat hemophilia B.1

That’s why HM Insurance Group (HM) has a Pharmacy Operations (RxOps) component among its Stop Loss solutions — to help with cost-containment opportunities, risk assessment, and client education.

Identifying Potential Financial Challenges

The RxOps team, led by our two expert PharmDs, watches the market and HM’s book of business to help anticipate how current and future advancements may impact financial risk for its client base in the current plan year and into the future. They review and audit current policies, monitor trends, and implement appropriate cost-saving techniques for specialty pharmaceuticals and gene and cell therapies.

Helping Clients Manage High-Cost Claims

Pharmaceutical developments continue to keep everyone — carriers, brokers, and employers alike — on alert, and HM has prioritized working together to better aid in managing claims expenses without compromising care, helping to achieve improved outcomes now and in the future.

Visit hmig.com to access a range of pharmacy-related informational publications, including our Pharmacy Focus articles, and other Stop Loss resources.

About HM Insurance Group

HM Insurance Group (HM) works to protect businesses from the financial risk associated with health care costs. A recognized leader in Employer Stop Loss, the company delivers protection for a range of group sizes. HM also offers Managed Care Reinsurance, including Provider Excess Loss and Health Plan Reinsurance, as well as accident and health specialty reinsurance.

HM Life Insurance Company, HM Life Insurance Company of New York and Highmark Casualty Insurance Company are all rated “A” (Excellent) by AM Best Company.* Through its insurance companies, HM Insurance Group holds insurance licenses in 50 states and the District of Columbia and maintains sales offices across the country.

For more information, contact your HM sales representative or visit hmig.com. MX2804006 (8/23) 800.328.5433 | hmig.com *AM Best Company, Best’s Rating Reports, August 2022. 1HM Insurance Group’s Pharmacy Focus: Elevidys – A New Gene Therapy for Duchenne Muscular Dystrophy (DMD), June 2023, hmig.com; and HM Insurance Group’s Pharmacy Focus: Hemgenix® – A New Gene Therapy for Hemophilia B, December 2022, hmig.com Stop Loss coverage is underwritten by HM Life Insurance Company, Pittsburgh, PA, in all states except New York under policy form series HMP-SL (08/19) or HMP-SL (06/20) or similar. In New York, Stop Loss coverage is underwritten by HM Life Insurance Company of New York, New York, NY, under policy form series HMP-SL (06/20) or similar. In all states except New York, Managed Care Reinsurance coverage is underwritten or reinsured by HM Life Insurance Company, Pittsburgh, PA, or Highmark Casualty Insurance Company, Pittsburgh, PA, under policy form series HM PEL 1105, HC PEL 1105, HMP PEL (08/19), HMP PEL (09/20), HML 1105 ELR, HMC 1105 ELR, HM 1005-ELR or similar. In New York, Managed Care Reinsurance coverage is underwritten under policy form series HMNY PEL 1105 or similar or reinsured by HM Life Insurance Company of New York, New York, NY.

Psychedelic Assisted Therapy

• A range of customizable options based on the company’s business and personnel needs.”

MICRODOSING OF PSYCHEDELIC SUBSTANCES

Microdosing involves taking sub-perceptual doses of psychedelic substances, such as psilocybin-containing mushrooms, in order to experience subtle cognitive and emotional benefits without the typical hallucinogenic effects associated with higher doses.

Psilocybin or magic mushrooms are naturally occurring and are consumed for their hallucinogenic effects. They are psychedelic drugs, which means they can affect all the senses, altering a person›s thinking, sense of time and emotions.

Robert A. Mines, Ph.D., Chairman and Chief Psychology Officer of MINES and Associates, an international business psychology firm providing behavioral health services for self-insured organizations, explains, “While there has been a growing interest in microdosing, it’s important to note that the scientific research on its effects and efficacy is still limited.”

Mines points to the “pros” of microdosing:

1. Enhanced Mood and Emotional Well-being: A study found that microdosers reported improvements in mood

Have you heard about our Premier Solution?

We’re partnering with local and national organizations to create customized plans that put the control back in employers’ hands.

The solution:

• Prevents unnecessary care

• Reduces plan spend

• Provides access to best-in-class providers

• Advocates for the members

• Distrups the status quo!

We love what we do. That’s the HPI difference.

22 THE SELF-INSURER

HPI Premier Solution HPI Premier Solution Healthcare navigation organizations Transparancy programs Local healthcare systems Member advocacy solutions

hpiTPA.com

Rober Mines

and emotional stability. Participants reported increased positive affect, reduced depressive symptoms, and enhanced emotional regulation.

2. Increased Creativity and Cognitive Flexibility: Research suggests that microdosing may enhance cognitive abilities associated with creativity. Microdosers reported improved divergent thinking, increased fluency, and enhanced cognitive flexibility, potentially leading to enhanced problem-solving skills.

3. Heightened Focus and Productivity: Microdosing has been associated with improved focus and concentration. Researchers found that microdosers reported increased energy levels and improved productivity, leading to enhanced work performance and efficiency.

4. Reduction in Anxiety and Stress: Preliminary evidence suggests that microdosing may have potential therapeutic effects on anxiety and stress. Researchers observed a reduction in anxiety symptoms among microdosers, indicating its potential as an alternative

approach for managing anxiety disorders.

Mines also cites some of the “cons”:

1. Lack of Standardized Protocols: One of the challenges with microdosing is the lack of standardized protocols. One study emphasized the need for careful dosage control, as individual responses to microdoses can vary. The absence of precise guidelines may lead to inconsistent effects and potential risks.

2. Potential Side Effects: While microdosing aims to avoid the acute psychedelic effects, some individuals may still experience side effects. One study reported increased irritability and restlessness in a subset of participants, suggesting the importance of monitoring individual responses to microdoses.

3. Legal and Regulatory Considerations: It’s important to note that the legal status of psilocybin-containing mushrooms varies across jurisdictions. In many places, their possession and use are still illegal. Individuals considering microdosing should be aware of the legal implications and potential risks involved.

4. Lack of Long-Term Safety Data: Although the existing research on microdosing is promising, the long-term safety and potential risks associated with prolonged microdosing are yet to be fully understood. Further research is needed to evaluate the potential long-term consequences and safety profile of microdosing practices.

“Microdosing with mushrooms has gained popularity due to anecdotal reports of positive experiences and potential benefits,” continues Mines. “While the available peer-reviewed literature on microdosing is still limited, it suggests potential advantages such as enhanced mood, creativity, and focus. However, it is essential to consider the lack of standardized protocols, potential side effects, legal considerations, and the need for long-term safety data.

Mines asserts that science advantages from an initial clinical observation and set of case studies through preliminary peer reviewed studies to gold standard double blind studies.

“Microdosing has received significant social media attention with many individuals self-microdosing and sharing their experiences,” he states. “How these experiences translate to treatment for depression, generalized anxiety or PTSD much less other conditions is unknown regarding the actual dosage levels. Furthermore, as in many areas of psychotropic medications, the actual causal pathways of deficiencies

SEPTEMBER 2023 23

Psychedelic Assisted Therapy

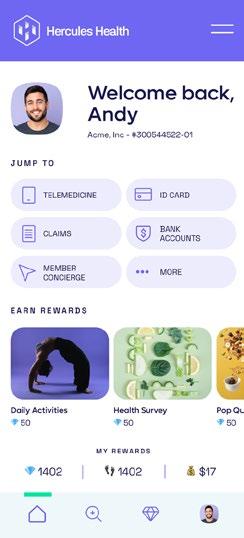

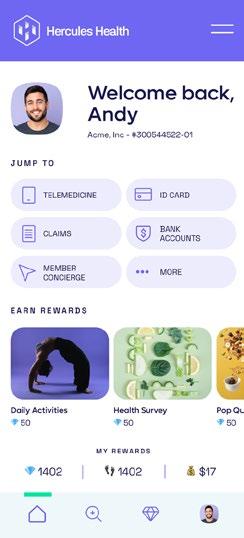

Bringing the Power of Consumerism to Healthcare

A first-of-its-kind healthcare SuperApp for self-funded plan sponsors that helps members make better decisions around quality medical care delivery, so everyone wins.

The only self-funded healthcare engagement platform of its kind.

Hercules Health rewards habitual app utilization by giving cash incentives earned through intelligent healthcare shopping tied to quality and cost. More app use equals more savings for members and plan sponsors alike.

Comprehensive Compliance

Hercules Health delivers best-in-class price transparency that is fully compliant with the Transparency in Coverage (TiC) and the No Surprises Act (NSA) rules and regulations.

Contact us today.

info@herculeshealth.com herculeshealth.com

at the neurochemical level is not known in the research to date”

He says there are a number of correlational studies that associate improvement in symptoms with taking psilocybin. The basis for the effects could be a number of factors ranging from actual biochemical positive changes to placebo effects.

“We just do not know at this time,” he advises. “From the selfinsurance perspective, I suggest the industry proceed with its usual caution on experimental medications. It is premature to endorse the use of microdosing until the research clarifies what does may be effective -- assuming further research does support the next step related to effectiveness, for whom, and at what dose levels, plus long term effects, and for those who it may be contraindicated.”

COMPANIES INTRODUCE PAT

“By building a provider network for safe and legal clinical pathways to psychedelic therapy, Enthea services come at a critical time when self-funded companies recognize that mental health issues are significantly impacting the workplace in terms of employee wellness, attendance and productivity,” says Rais, referring to the companies

that offer PAT to their employees via the Enthea network:

Dr. Bronner’s

Dr. Bronner’s is leading the way as an early adopter and advocate of psychedelic medicine. The USbased, family-owned company expanded its healthcare benefits as a first step in prioritizing their support of employee mental health and wellness. Founded in the U.S. in 1948, Dr. Bronner’s is the top-selling natural brand of soap in North America and a leading brand worldwide.

“The health and wellbeing of our employees is the primary driver in how we think about benefits and compensation,” explains

For

SEPTEMBER 2023 25

product

Amalgamated Life Insurance Company Medical Stop Loss Insurance— The Essential, Excess Insurance Amalgamated Family of Companies Amalgamated Life ▲ Amalgamated Employee Benefits Administrators ▲ Amalgamated Medical Care Management ▲ Amalgamated Agency ▲ AliGraphics Group • Stop Loss • Voluntary Amalgamated Life Insurance Company 333 Westchester Avenue, White Plains, NY 10604 914.367.5000 • 866.975.4089 www.amalgamatedbenefits.com As a direct writer of Stop Loss Insurance, we have the Expertise, Resources and Contract Flexibility to meet your Organization’s Stop Loss needs. Amalgamated Life offers: VOLUNTARY SOLUTIONS—KEEPING PACE WITH TODAY’S NEEDS • Accident • AD&D • Critical Illness • ID Theft • Dental • Disability • Hearing • Whole Life Insurance • Specialty Rx Savings Programs and Discounts • “A” (Excellent) Rating from A.M. Best Company for 47 Consecutive Years • Licensed in all 50 States and the District of Columbia • Flexible Contract Terms • Legal • Portable Term Life • Excellent Claims Management Performance • Specific and Aggregate Stop Loss Options • Participating, Rate Cap and NNL Contract Terms Available Policy Form ALSLP-2020* *Features & form numbers may vary by state. A M BEST S A E F nan ia St ength Rat ng Psychedelic Assisted Therapy

information, contact: marketing@amalgamatedbene ts.com

Psychedelic Assisted Therapy

Michael Bronner, president, Dr. Bronner’s. “Offering coverage for ketamine-assisted therapy is in the interest of providing tools to our workforce to have the best quality of life and best options for mental health care.”

Dr. Bronner’s employees and their dependents receive assistance from Enthea, either electronically or by phone, to connect with a ketamine-assisted therapy provider. Once a patient/provider relationship is established, 100% of services are covered for Dr. Bronner’s benefit eligible employees.

Bronner continues, “Our family and Company are no strangers to depression and anxiety. We are deeply concerned about the mental health crisis society is facing, especially in the context of the Covid-19 pandemic. Considering all our advocacy on this issue, this employee benefit is the next logical step.”

Dr. Bronner’s supports a number of public education efforts, advocacy organizations, and political campaigns around the country working to advance the acceptance and availability of psychedelic-assisted therapy and medicines to treat depression, anxiety, PTSD, and other conditions.

PLEXIS Healthcare Systems

PLEXIS Healthcare Systems is a leading payer technology company delivering trusted enterprise core administration

and claims management solutions to healthcare payers and delivery systems worldwide. More than 100 organizations trust PLEXIS core administrative enterprise solutions to manage over 55 million lives in all 50 states and around the world. PLEXIS provides mission-critical solutions that catalyze efficiencies and connect evolving business ecosystems to a wide range of payer organizations.

“The reality is the vast majority of all illnesses and diseases are psychosomatic,” says Jorge Yant, founder and CEO, PLEXIS Healthcare Systems. There are things that we can heal with our minds just as much as we can create with our minds. And so, tools that help expand consciousness and help you see more clearly the truth of how things are will help you just naturally heal effortlessly.”

He says we’re just at the beginning, adding, “I see several reports from our insurance companies that give me a sense of the types of medications and the types of services, in general, that our employees and their family members are using. It’s shocking the number of people on antidepressants. Psychedelic therapeutics could change this dependency.”

Yant believes that KAT, if properly administered and applied in in the right setting, can be extremely helpful and useful to people, not only for mental illness issues, but also physical problems.

“We’re covering the cost of the benefit which is included our very rich benefits package,” he explains. “My aim is always to try to find new benefits to give our employees. A healthier healthy employee is a productive employee.”

PAT: A BETTER SOLUTION FOR MENTAL HEALTH

Novel Treatment Approach: Psychedelic therapy introduces a novel treatment approach that deviates from traditional pharmacological interventions. By combining the administration of psychedelic substances, such as psilocybin, MDMA, or LSD with prescribed dosage under doctor-supervision and with therapeutic support, this treatment offers a unique and potentially more effective way to address mental health conditions. This shift from symptom management to a more holistic, transformative approach can revolutionize the field of mental healthcare.

Breakthrough in Treatment-Resistant Conditions: Psychedelic therapy has shown remarkable efficacy in treating conditions that are often resistant to conventional treatments. For example, clinical trials have

26 THE SELF-INSURER

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health. Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

Stop Loss | Group Captives | Managed Care | Specialty Accident ©2022 Berkley Accident and Health, Hamilton Square, NJ 08690. All rights reserved. BAH AD2017-09 2/22 www.BerkleyAH.com

Psychedelic Assisted Therapy

demonstrated the potential of psychedelics in reducing symptoms of treatment-resistant depression, PTSD, addiction, and anxiety.

Accelerated Therapeutic Process: Psychedelic therapy has the potential to accelerate the therapeutic process by facilitating deep introspection, emotional breakthroughs, and heightened states of consciousness. The psychedelic experience can help individuals gain new perspectives, access repressed memories, and confront underlying emotional traumas. This accelerated process can potentially lead to profound insights, personal growth, and lasting therapeutic benefits in a shorter time frame compared to traditional therapy approaches.

Shift towards Personalized Medicine: Psychedelic therapy aligns with the growing emphasis on personalized medicine and patient-centered care. The treatment is tailored to the individual’s unique needs, focusing on their personal experiences, traumas, and aspirations. This personalized approach recognizes the multidimensional nature of mental health and aims to address the underlying causes rather than merely suppressing symptoms. The shift towards personalized medicine holds the potential to revolutionize the healthcare industry, leading to more tailored and effective treatments.

Subrogation Management

Potential Cost Savings: While the cost-effectiveness of psychedelic therapy is still being studied, early evidence suggests that it may lead to tremendous cost savings in the long term. Therapy

session costs are dependent on location, provider, and type of service, however, a typical session can range from $150-$400 per session.

By potentially reducing the need for long-term medication use, hospitalizations, and ongoing therapy sessions, PAT

Reach out for more information on how we can help your insurance business.

Marie Noble, MBA, AIC VP of Subrogation Management

Marie Noble, MBA, AIC VP of Subrogation Management

Marie.Noble@us.davies-group.com

28 THE

SELF-INSURER

At Davies, we provide thorough investigations and subrogation support specifically tailored to all classes and entities within the insurance sector.

davies-group.com/us

has the potential to alleviate the financial burden on individuals and healthcare systems. Health economists are calculating a $25,000 savings per individual with effective treatment.

PAT: ADDRESSING MENTAL HEALTH TREATMENT ACCESS CHALLENGES

Accessing mental health services remains a challenge for employees. A recent report, based on a survey of 2,794 patients conducted by NORC, a nonpartisan research organization at the University of Chicago, found:

• More than half of patients (57%) who sought mental health or substance use care were unable to access any care on at least one occasion between January 2019 and April 2022.

• Of patients in employersponsored health plans, 39% reported using at least one out-of-network provider for mental health or substance use outpatient care, compared to just 15% for physical health care.

• Of patients using out-ofnetwork provider, 80%

reported using out-of-network mental health or substance use providers “all of the time” versus only 6% for physical health care.

• Even among patients who successfully made an appointment with a new in-network mental health or substance use provider, 40% had to contact four or more providers.

Immediate access to PAT can help employers to resolve these challenges by providing a meaningful solution that can be rapidly and cost-effectively implemented.

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel, and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

SEPTEMBER 2023 29

Psychedelic

Therapy

Assisted

Psychedelic Assisted Therapy

Sources

https://www.thelancet.com/journals/lancet/article/PIIS01406736(10)61462-6/fulltext

Psychedelics for Therapy: What to Know About Benefits and RisksThe New York Times (nytimes.com)

https://www.nejm.org/doi/full/10.1056/nejmoa2032994

https://www.samhsa.gov/data/sites/default/files/reports/rpt35325/ NSDUHFFRPDFWHTMLFiles2020/2020NSDUHFFR1PDFW102121.pdf

https://www.nature.com/articles/s41586-023-06204-3

https://www.psychologytoday.com/us/basics/habit-formation

https://www.dea.gov/factsheets/ketamine

https://www.ptsd.va.gov/professional/assessment/adult-sr/ptsdchecklist.asp#:~:text=The%20PCL%2D5%20is%20a,Making%20 a%20provisional%20PTSD%20diagnosis

https://www.psychiatry.org/psychiatrists/practice/dsm

https://adf.org.au/drug-facts/psilocybin/#:~:text=Psilocybin%20 or%20magic%20mushrooms%20are,sense%20of%20time%20 and%20emotions.

https://pubmed.ncbi.nlm.nih.gov/30604183/

https://pubmed.ncbi.nlm.nih.gov/31152167/

https://pubmed.ncbi.nlm.nih.gov/31778967/

https://pubmed.ncbi.nlm.nih.gov/30357434/

https://pubmed.ncbi.nlm.nih.gov/30478716/

https://www.psychologytoday.com/us/basics/ocd

https://www.psychologytoday.com/us/basics/alcohol

https://www.psychologytoday.com/us/basics/depression

https://www.psychologytoday.com/us/basics/shyness

https://www.psychologytoday.com/us/articles/201705/radical-newapproach-beating-addiction

https://www.ncbi.nlm.nih.gov/ pmc/articles/PMC3363299/

https://www.ncbi.nlm.nih.gov/ pmc/articles/PMC9053551/

https://jamanetwork.com/ journals/jamapsychiatry/ fullarticle/668195

https://www.ncbi.nlm.nih.gov/ pmc/articles/PMC6767816/

https://www.ncbi.nlm.nih.gov/ books/NBK470357/

https://www.ncbi.nlm.nih.gov/ pmc/articles/PMC8959757/

https://www.dea.gov/sites/ default/files/2020-06/ Ketamine-2020.pdf

https://norc.org/

https://www.maketheconnection. net/conditions/ptsd/

30 THE SELF-INSURER

ACA, HIPAA AND FEDERAL HEALTH BENEFIT MANDATES:

PRACTICAL Q & A

Q & A

TheAffordable Care Act (ACA), the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and other federal health benefit mandates (e.g., the Mental Health Parity Act, the Newborns and Mothers Health Protection Act, and the Women’s Health and Cancer Rights Act) dramatically impact the administration of self-insured health plans. This monthly column provides practical answers to administration questions and current guidance on ACA, HIPAA and other federal benefit mandates.

Attorneys John R. Hickman, Ashley Gillihan, Carolyn Smith, Ken Johnson, Amy Heppner, and Laurie Kirkwood provide the answers in this column. Mr. Hickman is partner in charge of the Health Benefits Practice with Alston & Bird, LLP, an Atlanta, New York, Los Angeles, Charlotte, Dallas and Washington, D.C. law firm. Ashley, Carolyn, Ken, Amy, and Laurie are senior members in the Health Benefits Practice. Answers are provided as general guidance on the subjects covered in the question and are not provided as legal advice to the questioner’s situation. Any legal issues should be reviewed by your legal counsel to apply the law to the particular facts of your situation. Readers are encouraged to send questions by E-MAIL to Mr. Hickman at john.hickman@alston.com.

SEPTEMBER 2023 31

AGENCIES ISSUE FAR-REACHING RULES RELATING TO MENTAL HEALTH PARITY COMPLIANCE OBLIGATIONS FOR NQTLS

On July 25, 2023, the tri-agencies (Internal Revenue Service, Department of Labor, and Department of Health and Human Services) released new proposed regulations under the Mental Health Parity and Addiction Equity Act (MHPAEA) that, if finalized, would provide significant clarifications and new compliance obligations for group health plans and issuers subject to the MHPAEA’s provisions. These rules are part of a Biden Administration push to improve access to in-network mental health care. Comments on the proposed rule will be due 60 days after publication in the Federal Register.

In addition to the Proposed Rules, the agencies released the second report to Congress on the MHPAEA comparative analysis for nonquantitative treatment limitations. This report for the first time, as required by the Consolidated Appropriations Act, 2021, names specific plans that were found by the agencies to not be compliant with the comparative analysis requirement.

BACKGROUND

Under current law, group health plans and health insurance issuers subject to the MHPAEA must comply with detailed compliance obligations for both quantitative treatment limitations (QTLs) and nonquantitative treatment limitations (NQTLs) that impact mental health and substance abuse disorder (MH/ SUD) benefits.

While guidance for the QTL obligations (such as monetary caps or limitations on the number of days of treatment) has been in place for some time, significant recent agency attention and guidance has addressed NQTL obligations (such as provider contracting, network

Get All the Tea on Advanced RBP Let’s talk more control, less cost. imagine360.com Your company’s health plan can do better. We promise. 32 THE SELF-INSURER

requirements, and utilization review). The Proposed Rules expand and clarify the NQTL requirements.

WHEN ARE THE NEW REQUIREMENTS EFFECTIVE?

If finalized as proposed, the new requirements would be generally effective starting the first plan year starting on or after January 1, 2025. However, certain clarifications of existing rules are currently effective.

WHAT ARE THE MAJOR PROPOSED RULE CHANGES FOR NQTLS?

Upon initial review, notable provisions include the following:

• Application of substantially all/ predominant test to NQTLs. The Proposed Rules require that the “substantially all/ predominant” test currently applicable to QTLs also apply to NQTLs. This means that for an MH/SUD NQTL to be permissible, it must apply to at least two-thirds of the medical benefits in the same classification (i.e., inpatient, in-network;

inpatient, out-of-network; outpatient, in-network; outpatient, out-of-network; emergency care; and prescription drugs). In addition, only the predominant (most frequent) variation of the NQTL can apply. This will likely significantly limit the issuer’s or plan’s ability to apply certain NQTLs, such as clinical utilization review techniques, to MH/SUD benefits.

• Meaningful benefit requirement. Under the Proposed Rules, if a plan provides any benefits for an MH/SUD condition in any classification of benefits, meaningful benefits for that MH/ SUD condition must be provided in every classification in which medical/surgical benefits are provided, as determined in comparison to the benefits provided for medical/surgical conditions in the classification.

• Design and application requirement. Under the Proposed Rules, NQTLs are subject to a new “design and application” requirement under which the NQTL analysis will also apply “in designing and applying the limitation.”

• Data gathering requirement as part of the NQTL process. There is a specific data collection requirement for network composition that “includes, but is not limited to, innetwork and out-of-network utilization rates (including data related to provider claim submissions), network adequacy metrics (including time and distance data, and data on providers accepting new patients), and provider reimbursement rates (including as compared to billed charges).”

SEPTEMBER 2023 33

The Technical Release issued at the same time as the Proposed Rules provides technical details, includes a request for information concerning this data gathering, and discusses a possible safe harbor on network composition based on this data gathering.

• For NQTLs other than network composition, a “material difference” in the metrics/data gathering for the NQTL as applied to MH/SUD and medical/surgical benefits would be a “strong indicator” of a violation, and the Proposed Rule details action that should be taken.

• As to network composition, the Proposed Rule goes beyond a “strong indicator” and provides that there would be an NQTL violation if “the relevant data show material differences in access to in-network mental health and substance use disorder benefits as compared to in-network medical/surgical benefits in a classification.”

• Further clarification on comparative analysis demonstrations. The Proposed Rules contain further detail on the contents of an NQTL comparative analysis and the timing to respond to a request for a comparative analysis from one of the agencies.

We will expand our analysis of these far-reaching rules in a forthcoming article.

Comprehensive self-funded plan management, including medical, dental, vision, COBRA, and reimbursement account administration combined with:

• Award-winning support

• Experienced, dedicated partnership and guidance

• Health plan performance management approach

• Optimized costs and health trends

• URAC-accredited UM and CM with in-house clinical team

SEPTEMBER 2023 35

YOUR SITUATION IS UNIQUE. YOUR HEALTH PLAN SHOULD BE TOO.

Looking for a better way? We’ll help you find it. AskNova@novahealthcare.com novahealthcare.com/services

2023 Nova Healthcare Administrators, Inc.

©

SIIA CONFERENCE EXPERTS LOOK AT 2023 TRENDS

Written By Caroline McDonald

Witha widening knowledge of captives and a greater need for them in an ever-changing environment, businesses and a growing number of insurance industry professionals are looking to captives for long term stability for their risks.

At SIIA’s 2023 National Conference, Oct. 8-10 in Phoenix, Arizona, industry experts will discuss different areas and trends in the captive insurance industry. Results of SIIA’s 2023 Captive Survey will also be released.

Some preliminary observations of conference panel experts are discussed below.

W

36 THE SELF-INSURER

EMERGING TRENDS

Bailey Roese, partner at Dentons Bingham Greenebaum LLP, who will serve on the panel for Emerging Trends in Captive Insurance, believes that captives are a well-established and valuable risk management tool.

“We are still seeing a lot of growth in the captive space,” she said. “I’m getting tons of calls.” This includes cyber and errors & emissions policies as well as growth in traditional coverages like general liability and property-casualty.

In the past, Roese said, “We had a niche of small captives, but we’re getting calls from larger insurers that want to form a bigger captive, so that speaks to the increased interest in captives.”

Their interest, she said, is partially driven by the hard market and the economy, “and certain lines of coverage disappearing in Florida and California, due to the extreme climate events we’re having.”

In hard-hit areas, insurers are pulling out of certain markets, because of extreme weather events and wildfires. “State Farm announced in January that it is stopping property coverage in Florida and has also exited the market in California,” Roese said.

This has led more companies to explore options to self-insure. “Captives are one of those options,” she said. “In the big picture I think there will continue to be a trend of more captives formed for property lines of coverage, and anything that is difficult to get in the commercial market for a consistent premium.” Added to that is the growing number of exclusions, Roese said.

Another trend, she noted, is the move away from § 831(b) captives –which have been targeted by the Internal Revenue Service – towards § 831(a). “It’s not clear whether the IRS will finalize rules surrounding § 831(b) captives as is or with some tweaks,” she said, “but we might see companies looking harder at whether they want to set up an § 831(b) or exit the one they have.

As it stands, she said, the only way to exit one “is to get a private letter ruling from the IRS, or they can wind down the captive. I think we will see people considering that. They can then start fresh with an § 831(a).”

Overall, “It’s an exciting time to be in the industry, it’s going to continue to grow,” Roese said. “It’s such a creative industry and people are always striving to answer questions, and it moves faster than the commercial market in response to emerging risks. It’s a great option for a lot of industries and businesses.”

UNDERSTANDING CAPTIVE STRUCTURE

Jeff Fitzgerald, vice president, employee benefits at Innovative Captive Strategies is a member of the panel, Understanding Captives: Structure, Risk and Ownership, which will discuss major issues facing captive owners, brokers, and captive management firms.

“While captive owners are more knowledgeable than they have been in the past,” he said, “The brokerage community is now the bigger driver of people’s participation in captives.” Brokers, he said, “are much more aware of captives as an option and more comfortable presenting them to their clients.”

Informed brokers know that captives are a viable option, “and for some clients it’s the primary option,” Fitzgerald said.

The vast majority of growth in the captive space, he added, has been through smaller groups moving into group captives. “Five or 10 years ago, the questions were about the captive—is it sustainable, is it something I can trust, what happens if we have a bad year?” he said, “Now, I hear that somebody who is already looking at one type of captive wants to know how it compares to another.”

The current situation is, less about explaining the basics of the captive, “and more about comparing what else is out there in the captive world or in the larger self-funded world,” Fitzgerald said.

SEPTEMBER 2023 37

IF YOU PLAN PLANNING TIME WITH YOUR PLANNER

We know what it’s like to feel FOMA, or Fear Of Missing Anything. That’s why we invented Curv®, so you can zero in on catastrophic claims risks with the industry’s most predictive and trusted risk score, making it easier than ever to see more stop loss risks and opportunities—and competitively price plans across your spectrum of underwritten groups.

Traditionally the type of captive used is determined by the type of risk that it will cover, he said. “Captives are a broad term that covers a lot of risks, a lot of different opportunities and a lot of industries.”

Currently, most people’s conception of a captive is very specific to their past experience. “So, one of the things that’s interesting on the SIIA captive committee is that we have two very related, but individualized groups that we try to support,” Fitzgerald said.

One group are those involved in the medical stop loss fund management, “The others are what we call enterprise risk captive arrangements, which is really more about balancing the risk that individual companies face, that they can’t find in the marketplace,” he said.

He noted that the two populations are both using single captives and are both self-insured, “but the risks up front that they are being used for are very different.”

So, the first questions he asks those considering a captive, are “What is your concern, your pain and your frustration?” He said. “And then seeing if there is a captive out there that can solve it, or that we can create for them.”

DOMICILES AND REGULATION

When considering regulation or a domicile, Fitzgerald said, the domicile’s location doesn’t make a big difference. Some domicile meetings, for example, are

beneficial, but attendance at every meeting isn’t a necessity.

The most important thing, he said, is how well the regulator understands what the captive is set up to achieve, “because there are multiple ways these issues can be looked at.”

Most importantly, he said, is that “most people, including regulatory bodies and many in the insurance agency world don’t understand selfinsurance.”

So, while self-insurance is broader than the captive world, “it all is under the same umbrella. Self-insurance has been around for a long time,” Fitzgerald said.

he said. “So, the more the larger population, including regulatory bodies, agencies and the general public, understands that there is a self-insurance option for them, the more the perceptions of captives can be clarified.”

SEPTEMBER 2023 39

“There are multiple risks self-insurance can cover and the majority of the time, once somebody does self-insure, they are appreciative that they did,”

We Know ... Risk

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 45 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

Visit us online at tmhcc.com/life Tokio Marine HCC - Stop Loss Group A member of the Tokio Marine HCC Group of Companies TMHCC1189 - 09/2023 HCC Life Insurance Company operating as Tokio Marine HCC - Stop Loss Group

SIIA CAPTIVE SURVEY

SIIA’s 2023 survey results will be released at the annual conference in October. The survey is designed to increase knowledge and understanding of the captive insurance industry.

Questions for service providers include the areas of interest in captive use, types of and numbers of structures formed most, numbers of closures, areas of growth, numbers of captives redomiciled and where they are domiciled.

Questions for captive owners include how they first heard of captives, how many captives they have set up for business, the risks covered, the type of captive formed, whether they were able to find coverage for their risk in the commercial market, and their board meetings.

Prospective owners’ questions include the company’s gross revenues, number of employees, hurdles encountered when looking at a captive and unusual risks that insurers cannot or will not cover.

HIGHLLIGHTS FROM SIIA’S 2022 SURVEY

• Captive formation growth significantly outpaced captive closures, with survey results showing positive signs for the industry.

• A sharp increase in the average number of captives under management was shown, reflecting growing confidence in the captive model.

• A wide range was seen in the total captive premium amount, raising questions about the disparity.

• 36% of captives reported COVID-related claims in the past year.

• The average COVID-related claim amount was down.

• IRS audits were slightly lower.

• Roughly 40% of respondents had clients settle with the IRS.

• 66.7% of respondents reported adding staff in the past year–including a significant number of legal specialists.

Caroline McDonald is an award-winning journalist who has reported on a wide variety of insurance topics. Her beat has included in-depth coverage of risk management and captives.

SEPTEMBER 2023 41

3M MASS TORT SETTLEMENT REMINDS US THAT SUBROGATION MATTERS

Written By Ron E. Peck

OnThursday, June 22, 3M followed other companies’ example by announcing that it had reached an agreement to settle claims that their polyfluoroalkyl and perfluoroalkyl substances (PFAS), known as “forever chemicals,” had contaminated water supplies in the United States.

Specifically, the settlement will see 3M pay up to $10.3 billion over 13 years to municipalities in the U.S. that have detected these chemicals in their drinking water. This is only the most recent in a series of settlements regarding water contamination by PFAS producers, who also announced that they would pay over $1 billion to settle similar lawsuits; with this likely heralding a new series of litigation and settlements, akin to the well-known asbestos proceedings.

O

42 THE SELF-INSURER

Many are familiar with the recent advent of PFAS testing conducted by municipal water authorities, and the resultant identification of unacceptable PFAS levels in drinking water. This in turn led to various lengthy and costly remediation procedures, to remove the offending chemicals from public drinking water.

The aforementioned settlement is primarily meant to address abatement claims, compensating municipalities for damage suffered to property and costs incurred in said remediation projects.

As entities funding and/or servicing self-funded health benefit plans, the importance and relevance of this news to our industry cannot be overstated. That is because these settlements are not focused on potential illness caused by exposure to and consumption of PFAS chemicals, nor do they resolve what promises to be a substantial number of medical claims.

The lawsuits and settlements we are witnessing now are more likely than not just the tip of the iceberg. That is why it is so important for health benefit plans to act now and assert their and their participants’ rights – at the beginning of what promises to be a long process.

Furthermore, this type of lawsuit – and opportunity – is not unique. Class actions, and the lesser-known toxic tort and mass tort cases, represent substantial chances for health benefit plans to recoup funds they had previously paid – sometimes years prior – through specialized subrogation.

As a refresher, whenever a third party causes – or potentially causes – an illness or injury to a participant of a health benefit plan, and that plan pays to treat those illnesses or injuries, subrogation enables the aforementioned benefit plan to either “step into the shoes” of the injured participant – and pursue a claim against the liable third party –or, seek to recoup what the plan paid from the plan participant; (after that participant has recovered from a liable third party funds that are meant to pay for illness or injuries that are deemed to be the liable third party’s responsibility, but were already paid by the plan).

Subrogation is a legal concept grounded in fairness. It is one of those few rights, supported by both statute and equity, that has repeatedly withstood judicial review at every level.

The reason why subrogation is so durable is because society recognizes the justice inherent in ensuring parties pay for the damages they cause; guaranteeing that victims and their health benefit plans are not left paying for damages caused by someone else.

The most common and recognizable “type” of subrogation case usually involves one victim, one liable party, and one incident. These often take the form of a car accident, slip and fall at a place of

business, or injury at one’s place of employment… resulting in subrogation against automobile insurance carriers, businesses, and workers’ compensation. There exist other types of subrogation cases which, despite being far less common, represent a massive opportunity for health benefit plans and their participants to recoup substantial funds. These cases are often called class action, toxic tort, or mass tort cases, and they occur when a substantial entity – such as 3M – is deemed to be responsible (or avoids liability through settlement) for injuries or illnesses caused to a large population over a meaningful period.

These lawsuits usually occur in Federal Court, following consolidation into multi-district litigation (“MDL”) by the judicial panel on multidistrict litigation (“JPML”). As a result, there are many plaintiffs involved, at least one – but sometimes more than one – sizeable defendant organization, and a lot of money at stake.

Identifying such subrogation opportunities is no easy feat. Unlike a motor vehicle accident – where the accident, injury, and treatment all occur within days (if not hours) of each other –with mass torts, exposure to the hazard, development of the illness or injury, identification of the link between the two, and filing of the case can take years or even decades to unfold.

SEPTERMBER 2023 43

Your employer stop loss partner

A true partnership means you have a passionate team of experts who collaborate with you to bring cost effective solutions for managing your medical risk. Our streamlined organizational structure creates a quick and transparent decision-making process – because the best solutions should come without red tape.

Discover the advantages of true partnership. www.partnerre.com/health

That means plans and their service providers must remain aware of developing cases, know which conditions are deemed to be caused by the accused tortfeasors, and exercise a capacity to audit old claims to flag treatments that are indicative of said conditions, before investigating whether the affected participants encountered the accused tortfeasors’ substance or device in question.

Is it worth the effort? Absolutely. Setting aside the tremendous plan funds at stake, consider also every plan administrator’s fiduciary duty to prudently manage plan assets and enforce the terms of the plan. As such, it is arguably every plan administrator’s duty to investigate and pursue such cases.