U.S. Securities Litigation Risk Management Trends - Sept. 2025

2-YR accumulated market capitalization losses in IT exceed one quarter of the global quantum despite a 2.0 p.p. improvement in the Median SAR Risk Score in Sept. 2025.

• Frequency. Health Care exhibited the greatest increase in frequency of High-Risk Adverse Corporate Events (“ ACEs”) amounting to approximately 4% of the 2-YR accumulated quantum. Accumulated frequency of High-Risk ACEs in the Health Care sector account for 23.2% of aggregate 2-YR frequency.

• Severity. Despite a 30-day sector return of 7.2%, and a decline in frequency of High-Risk Adverse Corporate Events, accumulated market capitalization losses in IT increased by 2.4% to $3.6 trillion. Accumulated losses in the IT sector account for approximately 28% of 2-YR accumulated market capitalization losses.

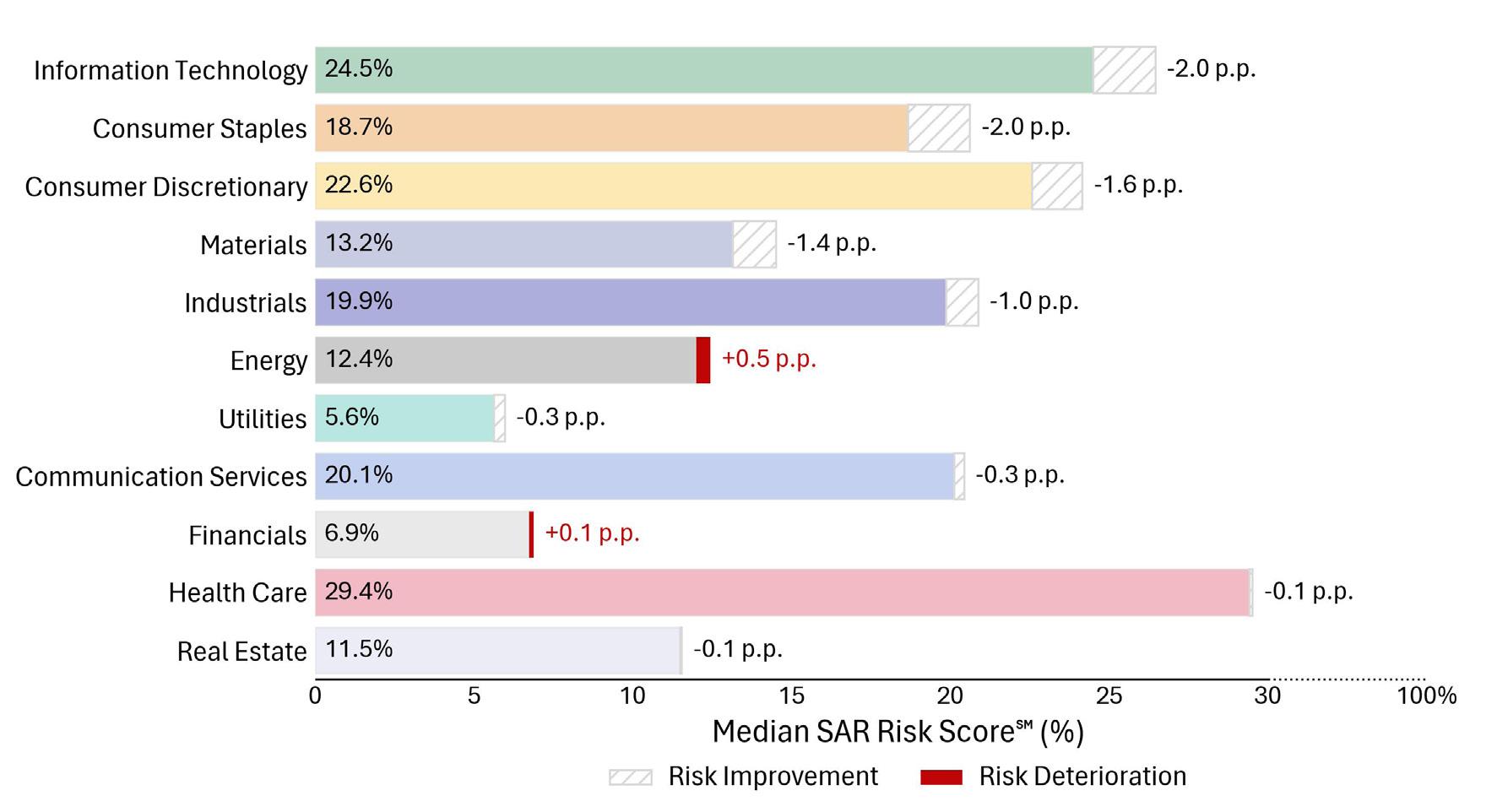

• SAR Risk Score. The constituent median company in the Health Care, IT, and Consumer Discretionary sectors exhibited the highest SAR Risk Score, thereby indicating higher securities class action risk on a median basis.

[1] Sectors are based on the company’s Global Industry Classification Standard (GICS).

[2] The returns of the respective GICS sectors’ S&P Composite 1500 indices over the preceding month. The indices comprise firms of small, medium, and large market capitalization in the given GICS sectors’ categories and for purposes of this risk management report, represent the corresponding sector’s performance in the U.S. equity markets. The firm specific event-study analyses for each issuer that supports this aggregate monthly analysis, apply a company-specific index that excludes the target company and is selected according to its industry categorization. The applied company-specific indices may or may not be the corresponding S&P Composite sector 1500 indices.

[3] Number of companies analyzed by SAR in each sector as of September 30, 2025. This sample includes every issuer that traded as common stock or ADR on the NYSE or NASDAQ with sufficient trading data to meet SAR standards of quality control.

[4] Aggregate market capitalization of all analyzed companies within the given GICS sector as of September 30, 2025.

[5] High-Risk Adverse Corporate Events (“ACEs”) of all analyzed issuers during the preceding two years. ACEs are identified by estimating statistically significant single-trading day negative stock price movements that coincide with company-specific disclosures. High-Risk ACEs correspond to both direct corporate communications and SEC filings.

[6] The difference between [5] and the salient statistic relative to last month.

[7] The cumulative quantum of market capitalization losses on identified High-Risk ACEs for issuers during the preceding two-year period.

[8] The percent change between [7] and the salient statistic relative to last month.

[9] The SAR Risk Score is a proprietary score assigned to every public company listed on the NYSE or NASDAQ according to the frequency and severity of ACEs during a two-year period from the designated evaluation date. The SAR Risk Score is equal to the market capitalization losses observed on High-Risk ACEs divided by the issuer’s market capitalization as of the preceding trading day. For more details on the estimation of the SAR Risk Score, see our latest U.S. Securities Litigation Risk Report at https://www.sarlit.com/us-securities-litigation-risk-report Figure 1 displays the percentage point (p.p.) difference in the SAR Risk Score of the median constituent company in the sector relative to last month. A +1.0 (deterioration) implies that a sector’s median SAR Risk Score during the corresponding month increased by one percentage point relative to the preceding month. A -1.0 (improvement) implies a reduction.

SAR LLC U.S. Securities Litigation Risk Trends Report Disclaimer

This securities litigation risk management research report presents the monthly change in frequency of High-Risk Adverse Corporate Events and the impact on the accumulated two-year market capitalization losses on the universe of issuers that trade on the NYSE and NASDAQ. SAR LLC (“SAR”) tracks and publishes 2-Year loss accumulation linked to High-Risk Adverse Corporate Events for both U.S. and non-U.S. issuers to evaluate and report the monthly change in magnitude of sector-specific securities litigation risk factors. SAR applies uniform, back-tested, regression-based event study analyses with court-approved parameters for accurate and objective identification of Adverse Corporate Events that impact the securities litigation risk of issuers that trade in the NYSE and NASDAQ.

All content published by SAR and presented in this monthly securities litigation risk management research report is based on securities analytics research performed by professionals employed by SAR. SAR does not apply or rely on machine learning (ML) or artificial intelligence (AI) to compute the quantitative and statistical analyses presented herein. Securities litigation risks associated with observed Adverse Corporate Events independently identified by SAR may or may not materialize into securities claims filed by allegedly harmed shareholders. Such claims, if brought, may be directed against the corporate directors and officers of the defendant issuers, or against the underwriters of the related public securities offerings. Securities claims may include, but are not limited to, securities class actions whereby investor plaintiffs allege violations of the federal securities laws under Section 11, Section 12(a)(2), and Section 15 of the Securities Act of 1933 (“Securities Act”), and under Section 10(b) and 20(a) of the Securities Exchange Act of 1934 and Securities Exchange Commission (“SEC”) Rule 10b-5 promulgated thereunder (“Exchange Act”). Securities litigation risks may also materialize from enforcement actions filed in federal court by the SEC for alleged violations of the anti-fraud provisions of the securities laws of the Exchange Act, Securities Act, or the Investment Advisors Act of 1940.

Publicly available research published by SAR that contains economic estimates on the impact of securities litigation risk are only estimates, and actual results may vary from those estimates or projections, which are based on many variables, assumptions, and forecasts, many of which are beyond the control of SAR and any of which may present differences with estimates that are quantified using different techniques that may not be accepted in legal proceedings in the U.S. Federal Judiciary.

No fraud or wrongdoing of any kind is alleged or implied by the information published and made publicly available by SAR in this research report.

Sources: SAR ACE Database as of September 30, 2025, FINRA, Securities and Exchange Commission, S&P Global Market Intelligence, and S&P Down Jones Indices.

About SAR: SAR is a specialized, independent, data analytics company focused on securities litigation risk management, founded in 2018. Through the SAR Platform, SAR licenses verifiably independent and high-quality company and claim-specific securities litigation risk and settlement valuation estimates to multinational insurance carriers and intermediaries, defense and insurance coverage counsel, C-suite, board of directors, and event-driven funds. SAR specializes in licensing substantive independent estimates of securities litigation risk and economic impact according to an issuer’s publicly available corporate disclosure record by applying the court-approved event study methodology. SAR renders verifiably independent settlement valuation estimates as evidentiary support in mediated negotiations to resolve complex claims that allege violations of the federal securities laws under the Exchange Act or Securities Act against directors and officers of U.S. public companies. SAR provides on-going, empirical, third-party, claim-specific and aggregate settlement loss severity valuation estimates on Exchange Act and Securities Act claims for reinsurance actuarial, audit and portfolio transaction support. SAR does not underwrite or place capital at risk on behalf of insurance carriers or reinsurers. SAR does not actively trade, hold, or intend to hold positions on the universe of equity issuances listed on the NYSE or NASDAQ, and whose principals and full-time professionals are restricted from actively trading.

Inquire.

For specific inquiries contact Nessim Mezrahi, CEO, or Stephen Sigrist, SVP of Data Science.

Nessim Mezrahi CEO