SECRET LIVES OF SINGAPOREANS

#20

7

Issue

Week commencing

Nov 2022 Authored with pride by Clare Ong and Lavone Loh

Issue

Week commencing

Nov 2022 Authored with pride by Clare Ong and Lavone Loh

Secret Lives of

Singaporeans is an ongoing collection of marketer friendly briefs on the fascinating people of the little red dot, by planners and PR consultants from the big red agency. It’s not “thought leadership”, it’s “inspiration to DO”.

Each issue comprises

• One thing people in Singapore are talking about

• One thing people in Singapore are searching for

• One thing that’s in the news in Singapore

2

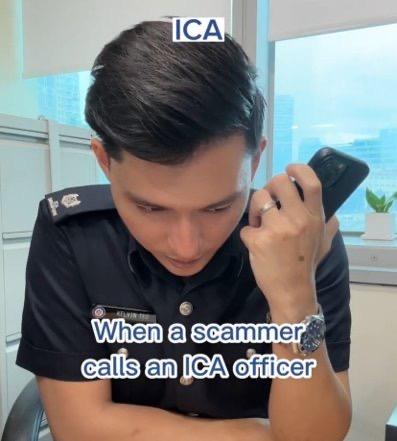

One thing people in Singapore are talking about:

ICA OFFICER SCAM CALL

Image Credits: Unsplash

3

Scams via calls or SMSes have been on the rise in Singapore, hitting a record high of 46,196 cases back in 2021. Almost 90 percent of Singapore consumers have received scam calls.

Victims receive calls from unknown numbers with the "+" prefix. Scammers would also assume the identity of a close friend our authorities to ask for confidential details or bank transfers. In 2021, the amount cheated rose to at least $91 million in 2021, from at least $217,000 in 2020.

Recently, the Immigration and Checkpoints Authority (ICA) uploaded a video on the ICA Facebook site where a real ICA officer calls out a scammer for impersonating one. It got over 200k views in just eight hours.

There’s been no shortage of anti scam education, but many Singaporeans continue to fall for scam.

The solution could lie in making education entertaining so that people will pay attention to, share and remember it.

Just look at TikTok’s latest local darlings like deputy prime minister Lawrence Wong, health minister Ong Ye Kung and senior parliamentary secretary Baey Yam Keng using the channel to talk about otherwise humdrum topics like raising funds for cancer (221.6k views), staying fit (189.3k views) and attending a Halloween party (41.5k views).

SO WHAT

Source: CNA (2022), Today Online (2022), Toku (2022), Immigration and Checkpoints Authority Facebook (2022), The Straits Times (2022)

OGILVY 4

WHAT

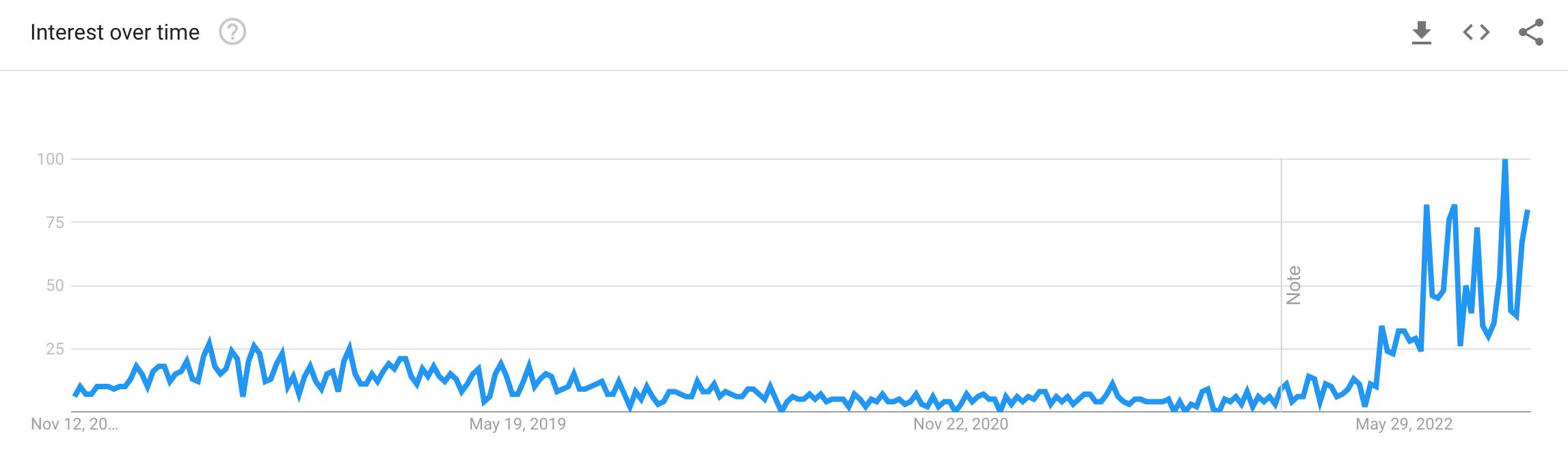

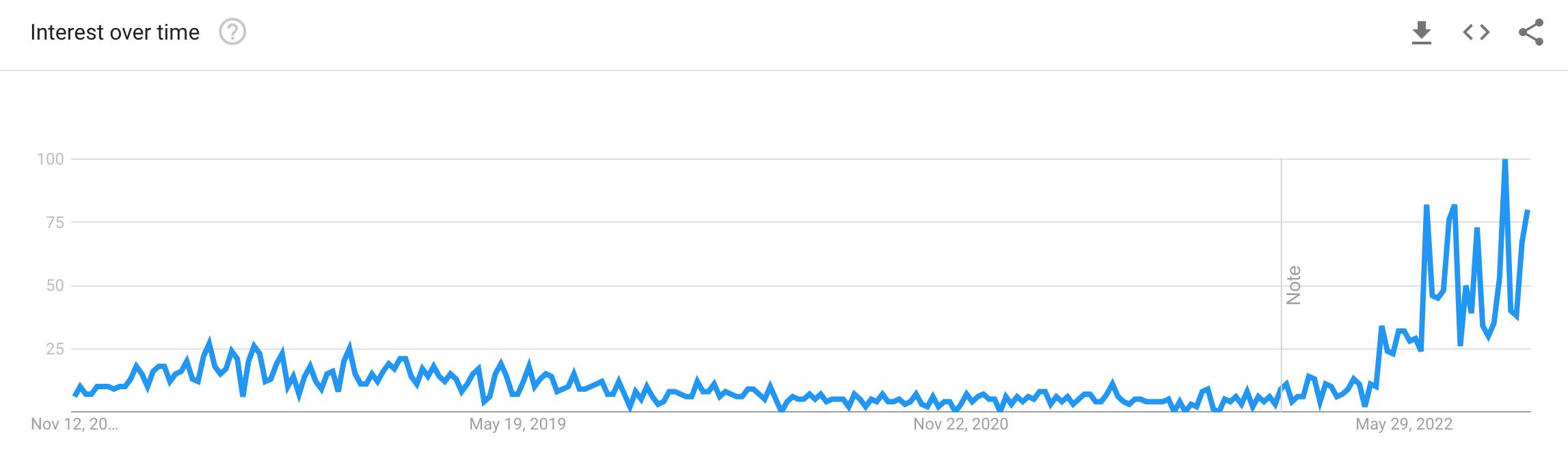

One thing people in Singapore are searching for:

SINGAPORE SAVINGS BONDS

Image Credits: Unsplash

6

Introduced in 2015, the Singapore Savings Bond (SSB) is a kind of Singapore Government Securities (SGS) issued and guaranteed by the Singapore government. The latest tranche, in November 2022, was oversubscribed by 2.4x, leading the government to raise the amount of SSBs on offer in December by $100 million to a total of $1 billion.

Why are SSBs so popular?

1) Interest rates are at an all time high.

2) SSBs are accessible, with investment amounts starting from as low as $500.

3) Perhaps most importantly, they are seen as very low risk, with no lock in period and negligible likelihood of losing their capital.

The huge interest in SSBs is a strong reflection of Singaporeans’ inclination to minimise risk in the face of uncertain economic conditions.

What can financial services brands take away from this?

That at this time, the psychology of temporal discounting is at work (seeing a desired result in the future as being less valuable than what they can feel in the near term).

Communications about flexibility and guaranteed loss avoidance could therefore appeal more than that about distant, long term potential wins.

SO WHAT

Source: CNA (2022), The Straits Times (2022), Google Trends (search interest in past five years)

Source: IPSOS (2022)

OGILVY 7

WHAT

One thing in the news in Singapore:

SAFEGUARDS FOR ‘BUY NOW, PAY LATER’

Image Credits: Google Images

10

WHATA new code of conduct was formalised to protect consumers against over-indebtedness amid a growing ‘buy now, pay later’ (BNPL) industry. Customers will not be able to incur more than $2,000 in outstanding payments with a BNPL provider unless they pass an additional credit assessment. BNPL is a payment service that allows payment for purchases over time, essentially turning any purchase into an instalment plan without interest or service fees charged. Some providers include Atome, Shopback PayLater and Grab PayLater. This mode of payment gained popularity during the pandemic when both sellers and consumers were struggling with cash flow.

At the heart of BNPL is the psychological principle of chunking: breaking something big and daunting into smaller, manageable pieces.

On one hand, it could be a slippery slope to debt. On the other, what if financial services brands tapped on this in positive ways? For example: Frank by OCBC BCIP and Syfe Trade encourage customers to start small in their investments by allowing the purchase of shares in amounts below the standard lot size (fractional investing).

Hugosave empowers consumers to save and invest using their “spare change”.

For consumers, it’s access to good financial habits. For brands, it’s access to a much wider base than they would otherwise have had.

SO WHAT

Source: Straits Times (2022), CNA (2022)

OGILVY 11

more?

us

Hungry for

Talk to

at secretlivessg@ogilvy.com

Issue

Week commencing

Nov 2022 Authored with pride by Clare Ong and Lavone Loh

Issue

Week commencing

Nov 2022 Authored with pride by Clare Ong and Lavone Loh