Jupiter Medical Center’s Margaret W. Niedland Breast Center Marks 10 Years Of Caring For Women

Jupiter Medical Center is proud to celebrate a significant milestone: the 10th anniversary of The Margaret W. Niedland Breast Center at Jupiter Medical Center. This state-of-the-art facility features the most advanced imaging technologies and diagnostic equipment, all set within a soothing environment designed to promote healing.

With nearly 30 years of commitment to exceptional breast health care, Jupiter Medical Center has provided exceptional cancer care, profoundly impacting the lives of countless patients and their families. Their expert team specializes in screening and diagnostic mammography, including contrastenhanced mammography, ultrasound and MRI.

Patients benefit from access to breast imaging specialists and the most advanced technology available in the region. The American College of Radiology (ACR) has named the Margaret W. Niedland Breast Center a Breast Imaging Center of Excellence. The center is an integral part of Jupiter Medical

Philanthropist Lois Pope

Gives $10 Million To The University Of Miami

Focus On Research Into Alzheimer’s And Other Neurological Diseases And Disorders

To Name The Lois Pope Laboratory Wing In Memory Of Lorraine Pope In The Lois Pope LIFE Center

Lois Pope watched with dismay as her daughter Lorraine suffered from Alzheimer’s disease before her death earlier this year.

Wanting to honor Lorraine’s memory and do more to help others afflicted with the disease that progressively strips its victims of their memory, cognitive skills, and the ability to perform simple everyday tasks, Pope, who is one of the country’s foremost female philanthropists, announced

today that she is making a $10 million gift to name the Lois Pope Laboratory Wing in memory of Lorraine Pope, located at the University of Miami Miller School of Medicine in the Lois Pope LIFE Center. The donation will establish the Lois Pope Neuroscience Research Fund to support the advancement of research in Alzheimer’s disease and other neurological and neurodegenerative diseases and disorders.

The new donation is the third eight-figure contribution Lois Pope has made to the University of Miami. In 2000, her $10 million gift to The Miami Project led to the building of the Lois Pope LIFE Center, which is the permanent home to The Miami Project, the nation’s foremost center for research and treatment of spinal cord and traumatic brain injuries and other neurological diseases and disorders including Alzheimer’s, Parkinson’s, ALS, multiple sclerosis, and stroke. The center will now

Golden Cub Ambassadors Club

Philanthropist Lois Pope on page 2

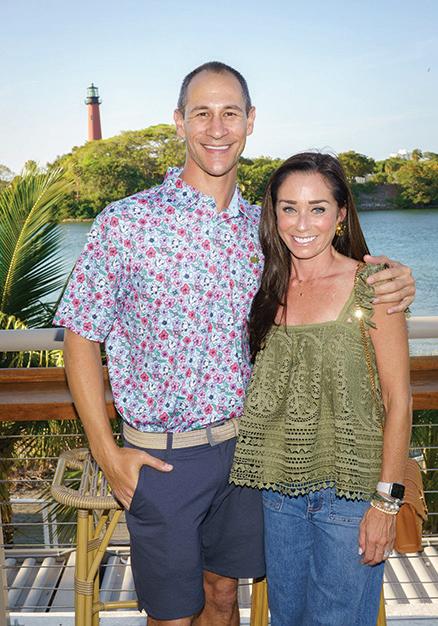

Cheers To Spring Success At The Beacon

The Golden Cub Ambassadors Club members gathered for a celebratory Spring Happy Hour on Tuesday, May 20, at The Beacon, the newly renovated restaurant at Charlie & Joe’s at Love Street. The evening recognized the club’s growing impact, with nearly $690,000 raised and granted to

children’s health initiatives since its founding in 2022.

The event not only celebrated past accomplishments but also

Lois Pope LIFE Center

Cochairs Christie Strunk, Todger Strunk

Dr. Rastogi and Suzanne Niedland

Jupiter Medical Center on page 2

James Molinari, Laura Molinari, Lindsay Saylor, Michael Saylor

Golden Cub Ambassadors on page 4

Financial Focus®

Should You Pay Off Debts Or Invest?

By Sally Sima Stahl, Edward Jones

Some financial decisions can be challenging — like whether to use your money to reduce your debt or to invest. If you already have a significant amount of debt and not a lot in savings or investments, it can be hard to figure out which issue should be a priority.

There’s no simple answer, and everyone’s situation is different, but here are a few suggestions for helping you make a good choice:

• Evaluate your cash flow. If you already have enough after-tax income to meet your monthly living expenses, you might lean toward investing any leftover cash, but if you are just getting by, possibly due to heavy debt payments, then you might be better off using your funds to reduce your debt load.

• Build an emergency fund. Paying off your debt as fast as possible may seem like the responsible thing to do, but not having an adequate emergency fund or saving for your future

Lois Pope from page 1

also be home to the newly named laboratory wing in honor of her generosity.

In 2020, Pope made a $12 million donation in honor of her mother, who was afflicted with macular degeneration, to establish the Lois Pope Center for Retinal and Macular Degeneration Research at the University of Miami’s Bascom Palmer Eye Institute and two years ago, Pope made another $1 million contribution to Bascom Palmer to advance its initiative to develop the world’s first whole eye transplant, and to create Lois’ Vision4Kids.

“Alzheimer’s is an insidious disease,” Pope said. “Knowing how it robbed my daughter of any recognition of who I and other family members were, and who she herself was, couldn’t have been more heartbreaking. So, I knew I had to do something to try and help to eradicate it or at least mitigate its symptoms. While there has been progress over the past few years in therapies to slow the

Center’s Comprehensive Breast Care Program, which is the first in the region to receive full accreditation from the National Accreditation Program for Breast Centers (NAPBC).

Jupiter Medical Center expresses its heartfelt gratitude to both the dedicated team members and the trusting community. Together, they will continue to lead in breast health, striving for the best possible patient outcomes.

For more information about The Margaret W. Niedland Breast Center, please visit jupitermed.com, call (561) 575-2000, or follow us on Facebook and Instagram @jupitermedicalcenter.

could leave your finances at a permanent disadvantage. It’s a good move to have an emergency fund containing three to six months’ worth of living expenses, with the money kept in a liquid, low-risk account. Once you have such a fund, you could use it, instead of going into debt — or adding to your debt — to pay for unexpected costs, such as a new furnace or a major car repair.

• Evaluate your debts. Some of your debts are actually more “expensive” to you than others. This expense level doesn’t necessarily refer to the size of the debt, however. You might have a large mortgage, for instance, but because your interest payments are typically tax deductible, your “after-tax” interest rate may be relatively modest. Therefore, you might consider investing rather than paying down your mortgage. But if you have consumer loans or credit cards that carry a high interest rate and whose interest payments are not deductible, you might be better off paying down or refinancing this debt.

• Take advantage of any employer match. If your employer sponsors a retirement plan and offers a match, you will want to prioritize contributing at least what is required to receive the match. It’s essentially free money. So, if your employer matches up to 3 percent of your contributions, for example, you should contribute at least 3 percent of your income to this retirement account. Additionally, some employers will match a portion of your contributions to a

disease, early detection methods, and even how the disease develops in the brain, I wanted to give this work a real jolt. Plus, I wanted to do it at a place that is not only in my home state but is also recognized for doing cutting-edge research in Alzheimer’s and other neurological diseases and disorders in the Lois Pope LIFE Center.”

“Lois Pope’s generosity has touched so many lives all over the world. We could not be more grateful for her continued belief in, and support of, the basic and translational research we conduct in the Lois Pope LIFE Center. Our approach to some of the most challenging neurological conditions, acute injuries and more progressive neurodegenerative disorders known to man uniquely positions us to advance new research findings and translate them with the goal of transforming

Health Savings Account. Eventually, you’ll likely want to get to a point of saving more than just the match, but you’ll have to weigh the benefit of additional contributions against the cost of any debt you’re carrying.

• Make it easier on yourself. To make achieving these goals easier, automate as much as you can. For example, you can divert part of your paycheck into an emergency savings account or a retirement account through automatic payments for any debt reduction or savings needs.

While it may seem like a huge endeavor to pay off your debt while still saving for the future, it doesn’t have to be. Taking small, incremental steps is key to helping you get to where you want to go.

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor, Edward Jones, Member SIPC. Edward Jones is a licensed insurance producer in all states and Washington, D.C., through Edward D. Jones & Co., L.P., and in California, New Mexico and Massachusetts through Edward Jones Insurance Agency of California, L.L.C.; Edward Jones Insurance Agency of New Mexico, L.L.C.; and Edward Jones Insurance Agency of Massachusetts, L.L.C.

Edward Jones, its employees and financial advisors cannot provide tax advice. You should consult your qualified tax advisor regarding your situation.

Contact us at (561) 748-7600, Sally Sima Stahl, CFP® AAMS™, 1851 W. Indiantown Road, Ste. 106, Jupiter, FL 33458.

people’s lives,” said W. Dalton Dietrich, Ph.D., scientific director of The Miami Project, the Kinetic Concepts Distinguished Chair in Neurosurgery, senior associate dean for Team Science, co-director of the Institute for Neural Engineering, and professor of neurological surgery. More than one billion people worldwide suffer from some form of neurological injury, disease and disorder. Brain injury is a significant risk factor leading to cognitive impairment and neurodegenerative disorders including Alzheimer’s disease and related dementias. Pope’s generous gift will help advance neuroscience programs to develop new diagnostic approaches and the development of novel therapeutic interventions to target disease mechanisms to ultimately improve the quality of life for patients.

Lois Pope, photo by Capehart

Philanthropist

Jupiter Medical Center from page 1

Extraordinary Charities’ ‘Talk Derby To Me’ Event Gallops To Success At The National Croquet Center

Extraordinary Charities’ signature spring fundraiser, Talk Derby To Me, raced ahead to a spectacular finish on Friday, May 3, at the National Croquet Center. More than 150 guests donned their Derby best— fabulous fascinators, bow ties, and bold florals—for an unforgettable evening of elegance, excitement, and philanthropy.

The success of the event was made possible thanks to the dedicated leadership of Event Chair Beth Fishel, whose creativity and commitment helped elevate every detail.

Extraordinary Charities was also honored to have Eddie Schmidt and Ozzie Medeiros, beloved co-owners of Table 26, serve as honorary chairs. Their enthusiastic support and community spirit helped drive both attendance and awareness for the cause.

Guests enjoyed Southern-inspired cuisine, signature mint juleps, and a lively viewing of the Kentucky Derby, followed by music, dancing, and spirited competition in the Best Hat and Best Dressed contests. The evening also featured entertainment by Digital Vibez, bourbon tasting from the Palm Beach Bourbon Society, live cigar rolling from Leyenda Cubana, an exciting live auction and festive atmosphere that brought the community together in true Derby Day style.

Proceeds from Talk Derby To Me benefit Extraordinary Charities’ mission to strengthen small but impactful

Golden Cub Ambassadors Club from page 1

welcomed the club’s ongoing expansion. Spearheaded by Christie Strunk, granddaughter of Jack and Barbara Nicklaus, and her husband Todger, the Golden Cub Ambassadors Club carries forward the legacy of the Nicklaus Children’s Health Care Foundation. The club brings together young professionals and philanthropic leaders who are passionate about supporting pediatric care across the region.

Individuals from age 21 to 45 are encouraged to join the Golden Cub Ambassadors Club. Pediatric health care programs or projects are voted on annually by members to receive the club’s collective proceeds. To become a member or to learn more, visit nchcf.org/goldencub.

nonprofits in Palm Beach County. Funds raised will directly support the organization’s Nonprofit Center—a collaborative hub for emerging charitable organizations, programming for its nonprofits network, and Extraordinary Charities’ Recipes for Success culinary training program, which provides life-changing workforce opportunities to individuals facing barriers to employment.

“We are so grateful to Beth, Eddie, Ozzie, and

all of our supporters for making this night such a success,” said Christine Raymond, executive director of Extraordinary Charities. “Their leadership and generosity embody the spirit of community that fuels our mission every day.”

Extraordinary Charities extends heartfelt thanks to its sponsors, volunteers, and guests for their generous support.

For more information on Extraordinary Charities and how to get involved or to donate, please call (561) 3667032 or visit www.ecpbc.org.

Barrett Kernon, Kristi Kernon, Bo Jahna

Alex Wittmann, Jen Wittmann, Bella Craft

Jorden Davis, Katy Fisher Aaron Abbadie, Jackson Sewell

Phil Doumar, Jaimee Reichert, Max Spanier

Nikki Cantlay, Cristal Eleazar

Cliff Budnick, Dara Budnick

Joe Floyd, Nikki Floyd Ashley Wolf, Colby Kempe

Barbara Nicklaus, Nan O’Leary, Chris O’Leary, MacKenzie O’Leary

Photos by Tracey Benson Photography

Committee Chair Beth Fishel, Executive Director Christine Raymond

John and Beverlee Raymond

Lisa Beek, Collin Adams Alisha Winn Ozzie Medeiros, Taylor Materio, Eddie Schmidt

Photos by Capehart

The Singles Scene Column©

Five Types Of Singles (The Sequel--Back By Popular Demand!)

By Kelly Leary, M.S. & Miranda Capparelli

Summer loving had me a blast Summer loving happened so fast

I met a girl crazy for me

Met a boy cute as can be.

~~ The Movie GREASE

Since January 2025, we have observed a happier clientele entering and pairing off in our club. Happy people are more magnetic, and therefore, they are coupling quickly. Many of our couples have been a “one and done” meaning their first date was the ONE. Summer is heating up for our clients and couples. We enjoy hearing about their lavish vacations planned this summer--which they would not have done as a single. As Matchmakers, this is the most incredible phenomenon to witness. You can’t measure the amount of joy we feel when we receive good news that the match was a hit. We are matchmakers because of all of you. You inspire us, and fortunately, we attract exceptional individuals who are far above settling for online dating. The cream rises to the top and we are blessed to be surrounded by so many leaders, doers, movers, and shakers here in our club.

The movie Grease said it best: “Summer loving can happen so fast.” It sure can but you need to be in the right place at the right time to meet the right person. Alignment and alliance are key. One of our female clients recently said: “Kelly and Miranda, I can’t believe how much my life has changed in just 30 days. I never expected this to happen so fast.” She and her beau just booked their first vacation together. They will be spending two weeks in the Hamptons.

Matchmaking success is contingent on what type of person we represent. Self-awareness is a sign of a good client. We challenge you to diagnose yourself today. Discover “What type

of single are you?” and/or “What type of person you are dating or have dated?” If motivated, you can change the trajectory of your summer in the very first meeting in our office. Thank you for sharing your time with us today. Be sure to share this message of love and hope with your single family and friends. Someone you know needs this message. Pass it on!

The Curmudgeon Single: This person can rise from the ashes. Key traits: cranky, pessimistic, over-critical, bitter, and judgmental. There is a chronic dilemma with a desire to date out of their “league.” This individual may have been cheated on or suffered a significant financial loss in life and never recovered. This person could benefit from therapy and a change in attitude. However, they become less likely to have an awakening as they age. Address this issue promptly. SIDE EFFECT: We occasionally meet this type in our office, and they scoff at the thought of paying to meet people. They are too blind to realize that they have been paying their whole life in one way or another in the form of wasted time, dating the wrong ones, divorce settlements, and heartache. These clients are tough to manage, and we often opt-out depending on the level of curmudgeon. We don’t want them around you or us.

The HopeFULL Romantic: In our opinion, this is the only way to fly! Luckily, “most” of the people we meet in our office are this type ... which is WHY they came to see us. This person has felt love. They have felt heartache and possibly betrayal, but they continue to love again, and they always do. WHY? Because they believe in love AND they know they are lovable. This person has a high success rate, and the odds are in their favor (especially if they have a community of like-minded single candidates). Their life is good financially, physically, and emotionally, but their ultimate desire is to find a special person. They want a partner. They don’t need a partner. SIDE EFFECT: This is our typical client...thank heavens!

The Lucy Goosey: Typically female. She is desperate and can’t stand to be alone. Often found in bars or online dating sites, this woman tends to jump from one man to another. She confuses physical intimacy with love and is often left with feelings of rejection, insecurity, and jealousy because she is rarely the “chosen one.” She lacks discretion when she dates and will date “anyone” who pays attention to her. She has low standards. This woman’s motive can be financial gain.

SIDE EFFECT: This type rarely comes into our office because she will settle for almost any man on a barstool or a dating site. She likely sees herself as unworthy of our caliber of gentlemen.

The Even Steven: Commonly divorced or never married. The male counterpart of Lucy Goosey. He wants love and intimacy but can’t seem to shake off his past failures in life and love. He self-sabotages and is self-destructive. This man blames women for all his failings and suffers from great insecurity in and out of the bedroom. He also over-compensates for his weakness by seeking multiple notches on his headboard to get EVEN with the opposite sex. SIDE EFFECT: We meet very few of these men in our office because most men like this prey in bars and online. Typically, they don’t meet Revolution Dating requirements.

The Past Life Blessed: Here is where our heartstrings go. This is the most rewarding demographic to represent. Widow or widower of any age, although typically age 60 to 80 plus. This male or female has had a special marriage. They have grieved appropriately and are now ready to find a new companion. We have seen many widows and widowers find love again in our club. Like HOPEFULL ROMANTICS, there can be a chapter after the loss of a spouse. The generation of seniors today is different from that of our grandparents. They date without guilt. Our senior clients are having a ball (see photos on the next page). SIDE EFFECT: We see it all the time in the club. Seventy is the new fifty. This is our favorite demographic because they know how to get along with others, which includes their matchmakers.

Whatever you are (or are not), seek out the best in others, and they will find the best in you! No one is perfect. Let’s all enjoy the Summer of Love 2025. Come together in person and offline. It’s the perfect time to join our movement. We have six months until 2026. Some call this month “Christmas in July.” Where do you want to be in two months or how do you want to spend the holidays? Find your person Pre-Fall Season by reserving your first appointment today. You are the CEO of your life and it is in your power to choose happiness. You deserve it, right?

Wishing everyone a Happy Fourth of July…. I hope the passion of July stays with you forever. For priority scheduling,

The Singles Scene Column© on page 6

Jupiter Medical Center Welcomes Allison Viramontes As Chief Financial Officer

Jupiter Medical Center (JMC) is pleased to announce the appointment of Allison Viramontes, MHA, CPA, FACHE, as the health system’s vice president, chief financial officer (CFO). Viramontes brings nearly 20 years of experience in financial strategy and health care management, which includes financial planning and analysis, accounting, payer contracting, revenue cycle management and the integration of AI and automation in financial reporting and systems. Most recently, she served as the CFO of Mayo Clinic in Arizona. In her new role, Viramontes will lead all

please mention Code: LOVEJULY when you speak to your matchmaker on the phone.

XOXO, Kelly & Miranda

#MatchmakingRoyalty #ChristmasInJuly #CallStartLove

#DateOffline #TellYourFriends

financial functions at JMC, including budgeting, revenue cycle management, fiscal compliance and financial reporting. She will also spearhead initiatives to ensure fiscal responsibility while advancing the hospital’s longterm goals. Through her mission-driven leadership, Jupiter Medical Center aims to continue its legacy of excellence and innovation in health care.

“We are excited to welcome Allison Viramontes to the JMC leadership team,” said Amit Rastogi, M.D., MHCM, president and CEO of Jupiter Medical Center. “Her extensive experience and proven track record in health care finance make her a valuable addition to our evolving health care system.”

After starting her career at PricewaterhouseCoopers in Sacramento, Allison served as vice president of Revenue Cycle and Investments at Cottage Health in Santa Barbara, vice president of Finance at UC Health, and multiple financial leadership roles at Sutter Health. Her innovative

approach to financial planning has consistently driven improved fiscal performance, organizational efficiency, and enhanced patient services.

Viramontes holds a bachelor’s degree of science in business administration with a focus on accounting and finance from California State University, Sacramento, and a master’s degree in health administration from the University of Southern California. She has also completed an advanced finance program at the Wharton School of the University of Pennsylvania. Viramontes is a fellow of the American College of Healthcare Executives (FACHE) and a member of the Healthcare Financial Management Association (HFMA). She is vice co-chair of Vizient’s CFO Network Committee and holds an active CPA license.

For information about Jupiter Medical Center, visit jupitermed.com, call (561) 263-4400, or follow Jupiter Medical Center on Facebook and Instagram @ jupitermedicalcenter or on Twitter @JupiterMedCtr.

matchmaking firm which is loved up and down the coast of the United States. Revolution Dating specializes in screening and representing clients from the Northeast to Palm Beach for decades. A picture is worth one thousand words, so jump on in and make some fireworks for yourself. Isn’t it time you did something for you? If so, secure your first interview today or you could miss out on the power of “summer loving” that truly

family to yours! do #TellYourFriends #SummerLove2025

Kelly Leary, M.S.© is CEO and Founder of Revolution Dating which she launched in 2014. Kelly has 34 years in the dating industry and a master’s degree in clinical psychology. She has been written about in Modern Luxury Magazine Palm Beach and Modern Luxury Manhattan, The Palm Beach Post, The Shiny Sheet, Stuart News, Jupiter Magazine, and many more. Revolution Dating clients are pre-screened in person, including background checks and ID verification. Professional photos are taken by the staff. Revolution Dating is NOT online dating or blind dating. In addition to providing matchmaking services that make singles “UN-single” through their exclusive club memberships, Kelly and Miranda also provide feedback from dates when appropriate. Mock Dates are available by request. Single Coaching Sessions and Evaluations are also available by request for non-members or as an add-on to some memberships. *All inquiries are confidential *Specializing in representing jet-setting clients with a second home in the Northeast Area. Do call the central hotline at 561-630-9696 (XOXO) or scan the QR code to hold your place in the club. Why wait? Just Date!

Red Hot Summer At Revolution Dating!

Enjoy these Behind The Scenes photographs from the Corporate Headquarters of Love on PGA Boulevard where this landmark business has been for eleven successful years. Upscale single, divorced, and widowed clientele are attracted to the “love offline” approach to dating and the demand for quality matchmakers is soaring. Romance and opportunities are heating up at this

The Singles Scene Column© from page 5

Groomsmen, Groom, and Wedding Oh My! #TieTheKnot

New Hunk Dave with The Team! #SeniorDatingPros

Kelly Shoots Her Arrow!

Never Too Young or Old for This Club! #Ages20s-80s

Commissioner’s Update

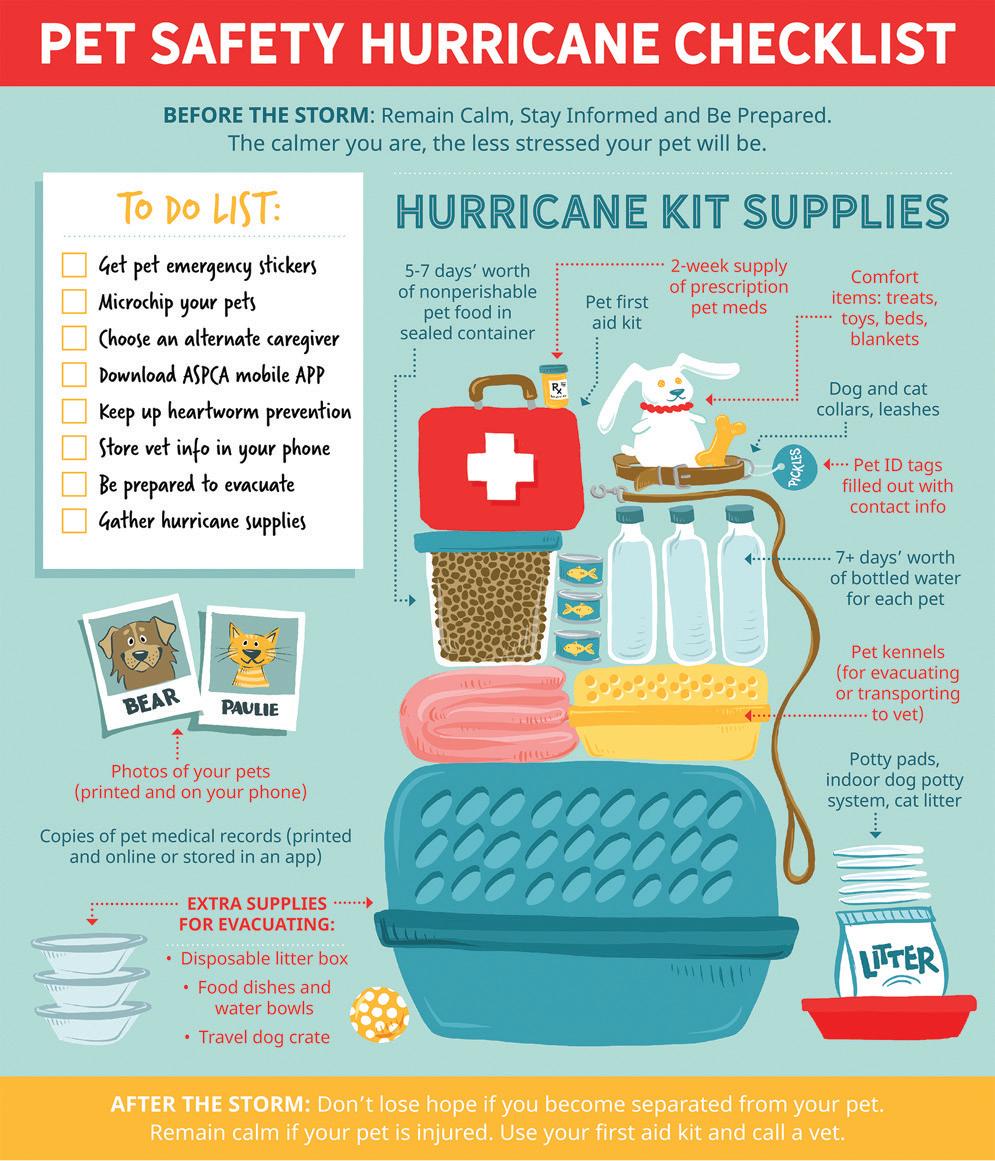

Hurricane Season In Palm Beach County: Prepare Now To Stay Safe

By Mayor Maria G. Marino

Palm Beach County has a long history of severe weather, including hurricanes, tornadoes, lightning storms, flooding, droughts, and wildfires. Frances, Jeanne, Wilma, Fay, Matthew, Irma, and more recently, Helene and Milton , have all left their mark on our community. These events underscore the importance of being ready and resilient.

The Atlantic hurricane season officially runs from June 1 through November 30. While we all hope South Florida will be spared, it’s essential that every resident takes time to prepare—by reviewing evacuation plans, securing their homes, and gathering necessary supplies. Familiarity with severe weather is part of life in Palm Beach County, but preparation can reduce disruptions and speed up recovery.

The Palm Beach County Division of Emergency Management provides a range of resources to help you get ready. One of the best tools is the Official Palm Beach

County Hurricane Planning Guide, available at https:// discover.pbcgov.org/publicsafety/PDF/Hurricane-Guide. pdf. It includes checklists, evacuation zone information, shelter options, and guidance on home preparation. If you need a printed copy, call the Emergency Information Center at (561) 712-6400 or contact our office.

Start by building an emergency supply kit. Stock several days’ worth of nonperishable food and water, first aid items, hygiene products, prescription medications (including a way to keep refrigerated medications cold, such as ice packs or a cooler), paper goods, flashlights with extra batteries, tools, cleaning supplies, and a waterproof container for important documents. Use tap water in reusable containers instead of buying bottled water—this is both cost-effective and environmentallyfriendly. Don’t forget your pets; they need supplies too.

If you have a generator, test it now and ensure you have fuel. Keep your vehicle’s gas tank at least half full throughout the season in case of evacuation orders. Electric vehicle owners should maintain battery levels between 50 and 80 percent, depending on the manufacturer’s recommendations.

This is also the right time to trim trees and manage yard debris. Once a storm watch is issued, collection isn’t guaranteed. Yard waste pickup is limited to one pile of up to 6 cubic yards weekly. If you’re disposing of expired storm supplies like fuel, propane tanks, or batteries, use the Solid Waste Authority’s Home Chemical and Recycling Centers. A convenient site is the North County Transfer Station at 14185 North Military Trail in Jupiter.

Visit swa.org or call (561) 697-2700 or (866) SWA-INFO for more details.

Stay informed by signing up for AlertPBC, the county’s emergency notification system, at https://discover.pbcgov. org/publicsafety/dem/Pages/Alert-PBC.aspx. You’ll receive alerts by phone, text, or email about local hazards and emergencies. Your information is protected and used only for public safety. You can also download the Disaster Awareness and Recovery Tool (DART) app to check evacuation zones, shelter openings, and storm updates on your phone. More information can be found at: https:// discover.pbcgov.org/publicsafety/dem/Pages/dart.aspx. Check in with your neighbors—especially seniors, individuals with disabilities, and those who may be new to the area. Remember, we are a community first. A small gesture can make a big difference during an emergency. Stay safe and take action now. Preparedness truly makes all the difference. If I can assist you, contact me at (561) 355-2201 or email mmarino@pbc.gov.

Your Child Might Have A Language Impairment

By Jim Forgan, Ph.D., Licensed School Psychologist

A third-grade teacher wrote me her observations, “Sara is a hard worker who seems to compensate. She needs repeated practice and overlearning for the material to be remembered and mastered. Sara’s parents work with her at home which has helped her, but she still struggles. Sara needs time to process and complete her own work. When she is confused about a question, she shuts down easily and it’s hard to get her moving forward to complete the task at hand.”

Sara’s mom brought her in for school neuropsychological testing to help her understand why Sara struggled.

In our pre-evaluation phone conversation mom revealed that when Sara was in kindergarten, she had a public-school individualized education plan (IEP) for a speech language impairment. However, Sara’s support from the speech therapist ended in second grade. At home Sara still had difficulty understanding and following mom’s verbal directions and she explained when she asked a question, Sara would often shrug her shoulders and stand without saying anything. Mom explained it was like Sara could not find the words to speak. Sara could read fluently and accurately but she had difficulty with reading comprehension.

My one-to-one testing revealed that Sara’s reading comprehension was so low she met the criteria for a learning disability. The testing also showed that Sara’s language impairment was still a primary cause of her school struggles. She could read words, but she could not understand or tell me the meaning of age-appropriate words. Thus, it was very surprising that Sara had been discontinued from school-based support. With these new results, Mom quickly arranged a private speech language therapist to begin working with Sara. At home they also began playing games like Simon Says which require listening and following directions. Each night they spent time reading and discussing the meaning of words and passages. Mom has submitted the testing report to Sara’s school and requested a new IEP.

Call (561) 625-4125 if you would like to discuss your child and your concerns for possible learning disabilities, dyslexia, ADHD, autism, or anxiety. Learn more at www. JimForgan.com.

Jupiter Senior Softball News

Jupiter Senior softball players paid tribute in a May 26 Memorial Day ceremony to all members of the Armed Forces who died in service to our nation and the many freedoms we enjoy.

A crowd of about 50 attended the event at Maplewood Park led by John Cariero, executive director of the Jupiter Senior Softball Association. Cariero noted that Memorial Day differs from Veterans Day: “Today is reserved specifically for those who made the ultimate sacrifices while defending the ideals that make us the greatest country on earth,” Cariero said. When asked if anyone wanted to remember a person who made the ultimate sacrifice for their country, several in the crowd called out the names of a friend or loved one who died in combat.

The ceremony concluded with players removing their caps and silently reflecting as they listened to the solemn sounds of Taps. The ceremony was in accord with the softball association’s tradition of observing Memorial Day, Veterans Day and the Fourth of July observances with patriotic ceremonies prior to games.

The year-round slow-pitch senior softball program is open to persons 55 and over and there is no upper age limit. New players are always welcome and those who register will help fill rosters of pickup games that are every Monday, Wednesday and Friday morning beginning at 8:30 a.m. at Jupiter Community Park.

Also, the league’s threedivision format accommodates persons of all skill levels, from recreational play to very competitive. Registration can be made online at www. leaguelineup.com/jssa. For more information contact Gary Newman at (917) 623-0791.

My Child Just Started High School —I Don’t Need To Worry About College Planning

By Peggy Forgan, M.Ed., College Planner

It’s a common belief among parents: “My child just started high school; college is still years away.” While it may seem early, the truth is that the high school years fly by—and the choices your student makes now can significantly impact their college opportunities later.

Freshman and sophomore years set the academic and extracurricular foundation colleges look for. Grades earned early in high school contribute to GPA, and course selection determines eligibility for more advanced classes. Involvement in clubs, sports, volunteering, or other passions during these years helps students build a resume that reflects genuine interests and leadership.

College planning isn’t just about choosing schools and filling out applications—it’s about helping students

discover who they are, what they’re passionate about, and how to align those interests with potential career paths. Exploring majors, building strong study habits, developing time management skills, and seeking academic support early on all pay off in the long run.

Starting the conversation early also reduces stress. Rather than rushing through decisions in junior or senior year, families who begin planning during freshman or sophomore year can approach the college process with clarity and confidence. This proactive approach often leads to better financial planning, increased scholarship opportunities, and a well-balanced college list.

At Class 101, we help families navigate every step

of the journey, starting as early as ninth grade. From academic planning and test prep to career exploration and building strong student resumes, we’re here to support your student’s growth every step of the way.

So, while college might feel far off now, taking small, intentional steps today can make a big difference tomorrow. Don’t wait until it feels urgent—start early, and give your child the gift of preparation, confidence, and choice.

For more information or to schedule a complimentary 30-minute consultation, contact Peggy Forgan at (561) 418-7897 or email pforgan@class101.com. Website at Class101.com/northpalmbeachfl.

Senior softball players reflect silently as Taps is played at the Memorial Day ceremony.

John Cariero, right, leads a Memorial Day ceremony, May 26.

Northern Notes

Family Communication During And After Disasters

By Katie Roundtree, Director of Finance and Administration, Northern Palm Beach County Improvement District

Your family may not be together when disaster strikes, so plan how you will stay in touch with one another. Think about how you will communicate in different situations. Consider the following questions when making a plan.

• How will my family or household receive emergency alerts and warnings?

• How will my family or household get to safe locations in the event of relevant emergencies?

• How will my family or household get in touch if cell phone, Internet, or landline service doesn’t work?

• How will I let loved ones know I am safe?

• How will my family or household get to a meeting place after the emergency?

Complete a contact card for each adult family member and print them out. Have them keep these cards handy in a wallet, purse, backpack, or other convenient location— additionally, complete contact cards for each child in your family. Put the cards in their backpacks or book bags. Information should include contact details for family, friends, and neighbors, as well as doctors and school information. You can find an example of an emergency contact card on redcross.org. Identify a contact, such as a friend or relative, who lives out of state for household members to notify if they are safe. An out-of-town contact may be in a better position to communicate among separated family members.

Technology has made it easier than ever to prepare for emergencies. Still, it can be unreliable in an emergency if you haven’t kept your gadgets protected and powered up. Here are some tips to make sure you are tech-ready.

Be Informed

• Download the FEMA app. Get weather alerts from the National Weather Service for up to five different locations anywhere in the United States.

• Sign up for FEMA text messages to get updates from FEMA (standard message and data rates apply).

• You can download either or both from here: https://www. fema.gov/about/news-multimedia/mobile-products

Here are basic commands to get started:

• To sign up to get preparedness tips, text PREPARE to 43362 (4FEMA).

• To search for open shelters (for disaster survivors), text SHELTER and a ZIP code to 43362.

• To get a list of all keywords you can subscribe to, text LIST to 43362.

• To unsubscribe (at any time), text STOP to 43362.

• Before a disaster, follow local governments on social media to stay up-to-date with official information before, during and after a disaster. Sign up for Twitter alerts from trusted government agencies to get notified when critical information goes out.

Make A Plan

• Use text messages, social media, and email to stay connected with friends and family during emergencies.

• Mobile networks can become overwhelmed during emergencies, making it hard to make and get phone calls. Text messages require less bandwidth, which means they can be transmitted more reliably during situations when many people are trying to use their mobile phones at the same time.

• Social media channels such as Facebook and Twitter can also be an effective way to update family and friends during emergencies. Facebook’s Safety Check feature enables users to quickly post a status update confirming their safety during a disaster.

• Have an emergency charging option for your phone and other mobile devices. Smartphones have become a vital tool to get emergency alerts and warnings, so it’s essential to make sure you can keep them powered up in an emergency.

• At home: Before severe weather, fully charge all of your electronic devices. If the power goes out, save battery power by minimizing device use. Keep a backup power source on hand.

• In your car: Keep a portable phone charger in your vehicle at all times and consider purchasing a backup power supply to keep in your car as well.

• Change the settings on your phone to low power mode or enable airplane mode to conserve energy.

• Store important documents on a secure, passwordprotected jump drive or in the cloud.

• Several mobile device apps allow you to use your phone’s camera as a scanning device. The apps enable you to capture electronic versions of important documents, such as insurance policies, identification documents, and medical records. Don’t forget to include your pet’s information.

• Back up your computer to protect photos and other critical electronic documents.

• Scan old photos to protect them from loss.

• Keep your contacts updated and synced across all of your channels, including phone, email and social media. This will make it easy to reach the right people quickly to obtain information and provide updates. Consider creating a group listserv of your top contacts.

• Create a group chat via a texting app or a thread for family, friends, or coworkers to communicate quickly during a disaster.

• Sign up for direct deposit and electronic banking through your financial institution so you can access your paycheck and make electronic payments wherever you are.

Through the use of everyday technology, individuals, families, responders, and organizations can successfully prepare for, adapt to, and recover from disruptions brought on by emergencies and disasters. With adequate planning, it is possible to take advantage of technology before, during and after a crisis to communicate with loved ones and manage your financial affairs.

Information courtesy Ready.gov.

NPDES tip: Before a storm, make sure all of your grass clippings and tree trimmings have been properly stored – do not leave them outside to become potential projectiles, and clog the storm drains and canals.

IMPERIUM HOME REMODELING

The Pet Cottage Post

Freedom Found: A Golden Journey Of Love And Belonging

By Wendy Derhak, Founder of The Pet Cottage Freedom.

It’s something we celebrate each July, often with flags, fireworks, and fanfare. But at The Pet Cottage, we witness a quieter, deeper kind of freedom—one found in safety, in companionship, and in the sacred promise that no pet will be left behind.

Recently, we were honored to help a trio of beautiful golden retrievers—Marlee (10), Miles (8), and Maks (4)— find their way to freedom after heartbreak.

Their story began with unimaginable loss. A local family of six was devastated when their mom passed away unexpectedly from a rare illness. Just months later, their dad died from a sudden heart attack. Four teenagers were left grieving, and so were their beloved dogs.

Family from Georgia came quickly to help pick up the pieces. The decision was made for the youngest sibling to relocate to live with her grandmother and uncle, while the older siblings stayed in Florida. But there was one heartbreaking hurdle: The dogs couldn’t make the move.

That’s when The Pet Cottage was called.

While we hoped to keep all three together, we also knew that each dog’s needs would guide us. Marlee, the oldest at 10, was slower and calmer. She found her perfect Forever Guardians in Nancy and John—longtime golden lovers in their 70s who wanted to give one more golden girl a safe, loving home. Marlee now spends her days gently loved on, with all the comfort and dignity she deserves.

The boys, Miles and Maks, were more energetic and deeply bonded. We worked with our trusted trainer to evaluate their behavior and ensure we could find the right family. That’s when the Myers family came into the picture. A vibrant family of six with two gentle dogs, chickens, and open hearts—they were ready to grow their pack.

With careful introductions at the sanctuary and their home, and guidance from our team, the boys officially made the leap. Now, they’re thriving—running, playing, swimming, and soaking up the joy of being truly part of a family again.

This is what freedom means to us: Freedom to grow old gracefully. Freedom to be safe, content, and cared for. Freedom to run, to belong, and to be loved.

Each pet we place carries a story—of loss, of transition, and of renewal. And each guardian who steps forward helps write a new chapter.

This July, as we celebrate our nation’s independence, we also celebrate the quiet victories. The kind that wag their tails and rest their heads on your lap. The kind that remind us that love—especially after loss—is a freedom worth fighting for.

If you believe, like we do, that every pet deserves to live out their life with dignity and love, we invite you to join us.

The Pet Cottage, www.thepetcottage.org, wendy@thepetcottage.org, (561) 818-5025, FL EIN: 47-4011633

Leave A Legacy Of Love

Our Legacy Circle honors those who include The Pet Cottage in their estate plans, ensuring their love for animals continues to make a difference for generations to come. It’s not just about caring for pets—it’s about celebrating the people whose love makes it all possible.

John, Nancy and Marlee

Miles

Marlee

Miles and Maks

Miles and Maks

Myers Family with Miles and Maks

Five Reasons Uncle Bill May Not Make A Good Trustee

By Anné DesormierCartwright, JD, Esq.

If you’ve created a trust meant to last for decades, choosing the right trustee is vital to its long-term success.

You might initially consider a trusted family member—say, Uncle Bill— as the ideal trustee for your children. He knows their personalities and needs, he’s frugal, and you assume he’ll manage the trust responsibly while keeping costs down. But while Uncle Bill may have good intentions, he may not be the best fit for such an important and complex role. Trustees have serious legal and financial duties that can require expert knowledge, significant time, and impartial judgment. In many cases, a professional or corporate trustee—such as a trust company or bank—may be better equipped to manage your trust effectively.

Here are five key reasons to reconsider Uncle Bill as trustee.

1. Stability And Continuity

Professional and corporate trustees don’t experience personal life disruptions that could affect their duties. Uncle Bill might get sick, move away, or pass away. He could also face personal distractions, such as family obligations or travel, that prevent him from dedicating the necessary time to trust administration.

Corporate trustees, on the other hand, offer continuity. If one employee becomes unavailable, another can step in seamlessly. This ensures that your trust is always administered without delays or disruptions.

2. Unbiased Administration

A professional trustee doesn’t take sides. Unlike a family member who might unintentionally favor one beneficiary over another, a corporate trustee will make fair and impartial decisions—following your instructions exactly as written in the trust document. That neutrality can help avoid family drama or accusations of favoritism, especially when tensions rise or difficult distribution decisions must be made.

3. No Conflicts Of Interest

While Uncle Bill might have good intentions, being part of the family can blur the lines. Would he sell the family vacation home to a cousin at a discount? Could he resist pressure from other relatives?

Professional trustees are bound by strict fiduciary duties and internal policies to avoid self-dealing or conflicts of interest. They follow the trust’s instructions and make decisions at arm’s length, with the beneficiaries’ best interests—and the law—in mind.

4. Financial Expertise

Managing trust assets takes more than common sense. Professional trustees have access to experienced investment teams and use sound, diversified investment strategies. They understand how to balance the needs of current and future beneficiaries and avoid risky or speculative investments that might jeopardize the trust’s value.

In contrast, Uncle Bill may lack the financial background or knowledge to properly manage investments—especially if your trust includes complex assets like business interests or real estate.

5. Legal And Tax Knowledge

Trust administration involves complying with tax laws, filing returns, providing reports to beneficiaries, and interpreting legal terms in the trust document. A professional trustee stays updated on these requirements and can handle them in-house.

Uncle Bill may need to hire outside advisors for nearly every issue, driving up costs—sometimes exceeding what a corporate trustee would charge for full-service administration.

Final Thought

Trustee duties go far beyond distributing money. They include legal compliance, investment management, reporting, tax filings, and impartial decision-making. While Uncle Bill may have your trust and affection, he may not be prepared for the demanding and technical role a trustee plays—especially over the long term.

Choosing a professional or corporate trustee may offer better protection, stability, and peace of mind for your loved ones. If you’re unsure about the right trustee for your plan, contact our office. We can help you evaluate your options and make the best decision for your family’s future.

If you have questions about your estate plan and what documents you should have in place to plan your estate to avoid having unclaimed funds, schedule a free consultation today by calling our office at (561) 694-7827, Anné DesormierCartwright, Esq., Elder and Estate Planning Attorneys PA, 480 Maplewood Drive, Suite 3, Jupiter, FL 33458.

The content of this article is general and should not be relied upon without reviewing your specific circumstances by competent legal counsel. Reliance on the information herein is at your own risk, as it expresses no opinion by the firm on your specific circumstances or legal needs. An attorney client relationship is not created through the information provided herein.

To comply with the U.S. Treasury regulations, we must inform you that (i) any U.S. federal tax advice contained in this newsletter was not intended or written to be used, and cannot be used, by any person for the purpose of avoiding U.S. federal tax penalties that may be imposed on such person and (ii) each taxpayer should seek advice from their tax advisor based on the taxpayer’s particular circumstances.