IMPROVING THE FINANCIAL LIVES OF OUR MEMBERS

Letter from President & CEO, Brian McKay

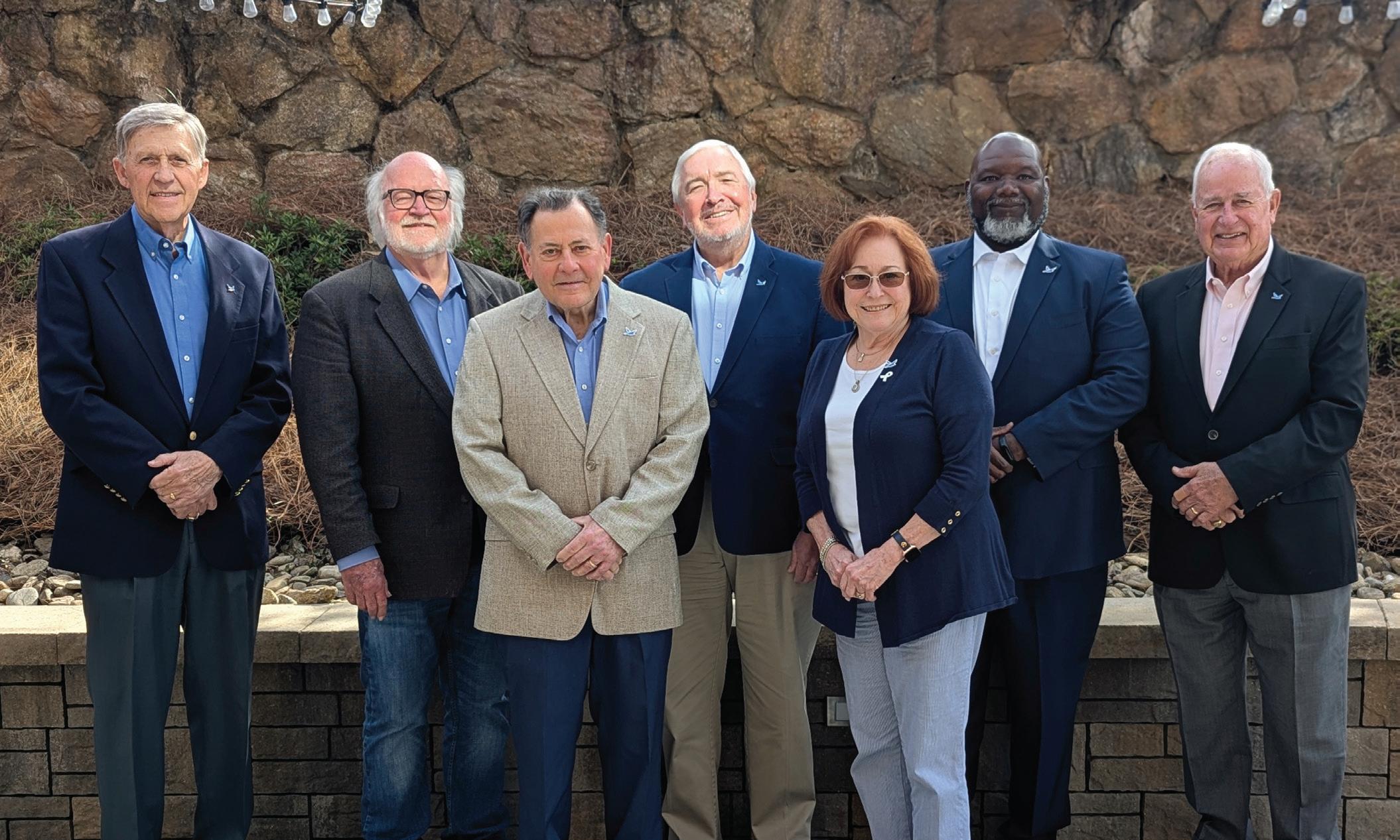

Letter from Chairman of the Board, Mike Strickland

Letter from Chair of Supervisory Committee, Frankie Nelson AND Five-Year Growth Analysis

IMPROVING THE FINANCIAL LIVES OF OUR MEMBERS

Letter from President & CEO, Brian McKay

Letter from Chairman of the Board, Mike Strickland

Letter from Chair of Supervisory Committee, Frankie Nelson AND Five-Year Growth Analysis

AS WE LOOK TOWARD the year ahead, I’d like to take a moment to share a bit about Spero Financial's future plans. As we focus on building a stronger, more efficient, and community-driven credit union, we are confident that our vision will bring even greater value to you, our members.

To get there, we’ve outlined four main areas of focus that will guide how we serve you.

The high-rate economic environment has pushed us to get creative in the way we do business. While staying competitive is key, improving your checking account options has been one of our top objectives. This year, we redesigned our Rewards Checking account and introduced Student Spend, an account made specifically for members who are in school or working on a certification or degree.

As a member-owned financial cooperative, providing excellent member service is — and always will be — our #1 priority. In 2024, we worked hard to make your digital experience smoother and give you easy access to your money wherever you need it. The new Digital Banking platform we launched in August 2024 is a prime example of how we’re building a digital foundation to meet your needs. We’re also committed to providing personalized service — ensuring you feel like a valued member-owner — while helping our communities become even greater places to live, work, and play.

I say it often, and I truly believe, the strength of our team drives the success of our Credit Union. As I reflect on all our team has accomplished for you, our members, I feel profound gratitude for Team Spero’s dedication and commitment to living out our mission daily. We will continue to create a workplace where our employees can thrive, and we will accomplish this by providing resources that elevate their well-being, offer opportunities for career growth and advancement, support their commitment to purpose-driven work, and encourage a true sense of belonging. A motivated and engaged team will always translate into better service for you.

As mentioned above, innovation and continued growth are big priorities for us. We’re always on the lookout for ways to enhance our offerings to you and stay ahead of the curve in this ever-changing landscape. I look forward to hearing more from you, our member-owners, on this topic in 2025.

With you and your communities always at the heart of what we do, our commitment to improving these four areas will keep us strong and on track for long-term success.

Thank you so much for your continued trust and support. As we look to the future, we are more committed than ever to helping you achieve your financial goals. Thank you for being a valued member of Spero. We look forward to serving you for years to come.

I appreciate you,

THE STRUCTURAL INTEGRITY of any building is contingent upon it being built on a solid foundation. No structure will survive resting on a weak, poorly designed base. The same is true in the business world. The long-term success of any company depends on a business model that keeps it strong financially while being able to adjust to ever-changing economic conditions.

Spero Financial's business model of providing traditional loans and savings for our members while avoiding risky, speculative products and services keeps us on a solid footing. Despite economic headwinds driven by high inflation and interest rates that negatively impacted earnings and profitability, our capital condition remained strong in 2024. We ended the year with a Net Worth/Total Assets ratio of 8.6%, well above the 7% of a “well capitalized” credit union as defined by the NCUA. While this bedrock foundational indicator remains strong, initiatives are underway in 2025 to correct the earnings and profitability issues and ensure we remain competitive in the marketplace.

Despite the financial challenges, 2024 proved to be a year of significant accomplishments that benefited our members. Spero continued to offer lucrative deposit products — specifically Kasasa Checking. We gave back over $331,000 in Kasasa Rewards to you, our members. An additional $19.6 million was given back to you in interest earnings across all share and share draft accounts.

Several strategic projects were completed under our Digital Transformation Initiative to enhance your banking experience and equip you to be successful in the ever-expanding digital economy. Understanding that change is not always easy, we appreciated your patience as we navigated these complex projects. We are very proud that we still held a member service quality score of 6.78 out of 7 — surpassing the 2023 ending score of 6.76. Completed projects included:

• We upgraded our digital banking platform to provide a more intuitive, all-in-one solution for managing your Spero accounts and loans. To date, 68% of you have enrolled in Digital Banking!

• We introduced advanced card control features: card alerts, report a card lost/stolen, request a replacement card, travel notices, etc.

• New Contactless Debit Cards were issued with tap-to-pay convenience and enhanced security. Over 85% of debit card holders activated their new debit card within 30 days of the launch.

• Credit Score Monitoring. This free credit score and credit report monitoring service empowers our members to elevate their financial health. Over 7,930 of you have taken advantage of this free financial service since its launch.

As we follow our model for success and work for the benefit of you, we will continue to thrive in 2025!

MICHAEL (MIKE) W. STRICKLAND Chairman of the Board

SPERO FINANCIALS' Supervisory Committee consists of five volunteer members who serve as representatives of the membership to the Board of Directors. I am proud to serve as Chairperson of the Committee. As a committee, we are responsible for ensuring that internal controls are properly maintained to mitigate organizational risk and that accounting records are accurately prepared to reflect financial operations. To ensure this, we work with an independent, external Certified Public Accountant firm to conduct an annual audit on the accuracy and fairness of the Credit Union’s financial statements. As of the printing of this report, this audit was still in progress.

We are fortunate to have a talented Internal Audit Team at Spero Financial that reports to the Supervisory Committee. This team conducts annual audits based on an approved audit plan — evaluating operational, financial, IT security, and compliance processes to ensure risk mitigation. In 2024, Internal Audit conducted audits on various areas, including current expected credit losses, Regulation E dispute resolution, indirect lending, real estate lending, complaint management, and vendor management. Additionally, Spero Financial engages external firms to conduct specialized audits covering financial statements, information security, the Bank Secrecy Act, and compliance with Unfair, Deceptive, or Abusive Acts or Practices regulations, among others, to effectively mitigate risks.

The Supervisory Committee appreciates your trust and confidence. I encourage you to review the balance sheet, income statement, and other financial information included in this year’s report. You will find that Spero Financial continues to operate in a safe and sound manner, strategically focused on improving the financial lives of our members to soar into the future!

*At the time of printing, the financials were pending audit.

Travis

Vice President, Chief Technology Officer

· Senior Vice President, Chief Operating Officer

Jessica Baker ·Executive Vice President, Chief Strategy Officer

Brian McKay · President, Chief Executive Officer

Toni Davisson · Senior Vice President, Chief Financial Officer

David D'Alessio · Senior Vice President of Talent Management

NEW PRODUCTS LAUNCHES ARE EXCITING — but they require countless hours of research and planning to make them happen. When we launched Spero’s all-new Digital Banking platform in 2024, we had one goal in mind: to make your banking experience as easy as possible. We asked Damon Sipe, SVP of Technology, and Katie Mitchell, Director of Digital Experience, to give us a glimpse of what it took to make it happen.

Why was it important for Spero to reimagine the digital banking experience?

Damon: As technology in the financial space continues to advance and evolve, it is critical for Spero to keep pace with the industry. Reimagining and re-evaluating our partners in this space helps us stay relevant and meet our members where they need us in their financial lives.

Spero members count on us for personalized service and easy-to-use digital services. Reimagining our digital banking platform allows us to deliver what our members are asking for today — and what they’ll need in the future.

Katie: One of the most attractive enhancements was the integration of card services for both credit and debit cards. We also wanted to provide seamless integration between the mobile and online applications to ensure the same experience on whichever platform our members prefer to access their digital banking.

How is the new version of digital banking different from the original?

Damon: In addition to a more modern look and feel, one of the biggest differences is the consistency of our mobile banking app and online desktop banking, which Katie mentioned. Now, whether members are more familiar with the mobile or desktop version, they’ll automatically know how to use the other.

Katie: Plus, the registration process is much more streamlined, and the passcode and user ID reset features make it easy for members to access their digital banking. The new digital banking platform gives members customizable card alerts, easier access to check copies, and a more robust view of their monthly statements.

Add in the self-service options, such as stop payments for ACH and checks and the Skip-a-Pay feature for Spero loans, and it’s clear that Spero’s new digital banking experience gives members more control over their finances.

How did you decide which features to add?

Damon: This was a collaborative effort between our leadership team and multiple departments to determine which features would provide the most functionality for our members and employees, while also being good stewards of how much we were spending on those features. Trying to determine features that offered the most value required the input of multiple team members.

Was it challenging to launch a new product offering?

Katie: Absolutely! Launching our new digital banking platform took many months of planning and hard work, and we’re so proud of the end result. We have a very talented team at Spero that is committed to improving the financial lives of our members, and this launch was the perfect example of how we all work together to accomplish that goal.

Are there plans for further digital banking updates and enhancements?

Katie: Yes, we implement new releases every week with improvements that are automatically pushed out to the members. These include larger releases such as Digital Issuance/Push provisioning of debit and credit cards and additional mortgage payment functionality.

Damon: We constantly evaluate updates and enhancements that will bring more value to our members. By regularly assessing new developments that can be layered into our offerings, we can ensure that the enhancements we are considering bring sufficient value to their cost.

MAKING OUR COMMUNITIES

GREATER PLACES

TO LIVE, WORK, AND PLAY

At Spero Financial, we’ve been improving financial lives in the Upstate and Midlands for over 90 years. These numbers are more than just numbers — they represent real lives changed and communities strengthened!

61 first mortgages ($14.8 million) to make members’ homebuying dreams come true

2,777 personal loans ($17.7 million) to fund members’ financial goals

2,152 new checking accounts to help members have easy access to their money

274,957 member transactions supported by Spero branches

367 HELOCs ($39.8 million) so members could tap into the equity of their home

2,643 auto loans ($64.5 million) that put our members in the driver's seat

89,560 member calls serviced in our Member Solutions Center

91,024 member transactions supported by TellerLink

Members received 24 million+ points for using their credit cards

$17 million+ points redeemed for rewards of member's choosing

$19.6 million given back to members in interest earnings

$331,824.86 given back to members in Kasasa Rewards

1,269 employee volunteer hours in our communities

$208,574 donated to non-profit organizations in the markets we serve

101 community events that Spero participated in with local non-profits and hosted for Spero members

8,403 community members impacted by Spero’s financial wellness initiatives

$9,000 granted to 3 Spero members to support higher-education aspirations

Since 2010, Spero Financial has invested over $100,000 into future generations by awarding three annual scholarships to Spero Financial members pursuing higher education. Congratulations to the 2024 Louis C. Addison College Scholarship winners!

Connor Jibben, an outstanding student with a perfect 4.0 GPA, is set to join Anderson University’s Class of 2028 as a finance major. His commitment to academics is matched by his dedication to service and leadership. As a Middle School FUSE Leader and member of NewSpring Church’s Teen Discipleship Group, he played a key role in a mission trip to Guatemala, leading a Vacation Bible School program. He further developed his leadership skills through the Anderson Area Chamber’s Junior Leadership Anderson program. His extensive volunteer work includes AnMed Health, Meals on Wheels, and United Way’s Youth Volunteer Corps. He has also participated in the Snack Pack Program and multiple community beautification projects.

Connor’s efforts earned him the Congressional Award Silver Medal for service, personal growth, and fitness. He’s also a successful entrepreneur who runs his own online business. His professionalism, dedication, and genuine desire to create a positive impact have earned him the admiration of his teachers and community leaders.

Julia McConnell, valedictorian of Powdersville High School with a 5.363 GPA, ranks first in her class of 236 and has excelled in dual enrollment at Tri-County Technical College. In Fall 2025, she will begin her studies in Biochemistry and Molecular Biology at the University of South Carolina’s College of Arts and Sciences. Beyond academics, Julia is a standout leader and dedicated volunteer. As Varsity Cross Country Captain and Student Council Leader, she motivates her peers to excel. She also serves as a Library Assistant and volunteers with the Center for Developmental Services, MUSC Spark!, and Autism Research.

Her strong work ethic extends to lifeguarding, where she advanced to Senior Lifeguard and earned certification as an instructor. Recognized for her intelligence, persistence, and compassion, Julia is a well-rounded individual committed to excellence in academics, leadership, and service.

Salfia is an accomplished poet and MFA candidate in poetry at Converse University. She earned a 3.97 GPA in Communication at Bob Jones University, where she served as Editor-in-Chief of Inkwell Literary Magazine, gaining valuable publishing experience and demonstrating her commitment to excellence. Her professional background includes roles as Proofreader, Content Editor, and Marketing Editor for BJU Press, each role showcasing her versatility. A strong leader, Salfia was President of her Greek organization and Public Relations Officer for the Criminal Justice Association.

She has volunteered with Servants for Sight, the Allan Jacobs Memorial Prayer Breakfast, and Greer Relief. She currently contributes to South 85 Journal as an Assistant Social Media Manager and Poetry Reader and serves as a Poetry Editor for Agape Review. With her creativity, dedication, and leadership, Salfia is poised for success in her MFA program and beyond.

• 48,675 Total Members

• $702 Million in Assets

• Named 2024 Best Places to Work in South Carolina (4th Year in a Row)

• Named 3rd (by asset size) in the Nation for Best Credit Unions to Work For

• Top 3 Finalist for Best Credit Union in the Upstate by Greenville News Community Choice Awards

• Top 3 Finalist for Anderson’s Best of Hometown by Anderson Independent Community Choice Awards

• Winner of the Carolinas Credit Union Foundation’s Dora Maxwell Award and Louise Herring Philosophy Award

• Five Diamond Awards by the Credit Union National Association

• Named Recipient of the Better Business Bureau’s Torch Award for Ethics

• President and Chief Executive Officer Brian McKay was named by Greenville Business Journal as one of the Top 50 Most Influential People in the Upstate (3rd year in a Row) and an SC Biz News Palmetto Power

• 172 employees serve the organization across 36 different departments

• 187 individuals provided with medical insurance – both employees and their families

• 29,150+ hours of paid time off were awarded

• 18 promotions and 5 transfers to roles in other departments

• 5,058 employee training hours

THANK YOU TO OUR STAFF, MEMBERS, & COMMUNITY