Key insights into the carbon impact of the top 100 food companies

Food production accounts for over a quarter of greenhouse gas emissions, with half the world’s habitable land used for agriculture. Household names like Nestle and PepsiCo don’t just rack up massive yearly profits, but a pretty huge carbon footprint too. And sure, you already know that foods like beef have the highest carbon footprint, but it’s more than just the food itself that makes a company a major polluter.

Throw in packaging, transport, and energy use, and the food industry comes out as one of the worst culprits when it comes to greenhouse gas emissions. But it’s not all doom and gloom. By better understanding the food industry’s Scope 1, 2, and 3 emissions, we can pinpoint where and how it can decarbonize, making reporting and analysis the first steps. And, with the food market set to grow by 6.58% in the next four years, getting a handle on carbon emissions is crucial.

Scoutbee and DitchCarbon have put together this in-depth report to look at the carbon emissions of the top 100 food companies, how they do (and sometimes don’t!) report figures, and what this means for the future of food production.

Scope 1, 2, and 3 emissions

Before we get started, here’s a quick breakdown of the emissions we’ll be talking about in this report - Scopes 1, 2, and 3.

Scope 1 emissions - direct emissions from the company’s actions – for example, driving cars. These occur as a direct result of the day-to-day running of the business.

Scope 2 emissions - these emissions are indirectly caused by a company’s operations. Scope 2 emissions include those generated from purchased energy, like electricity, heating, and cooling.

Scope 3 emissions - this is the biggie. For many companies, Scope 3 emissions account for more than 70% of their carbon footprint. Scope 3 emissions are not generated directly by a company, but instead by its value chain. Examples include the use of the end product by consumers, the energy used by suppliers, as well as the use of supplier resources. For a more detailed look at Scope 3 emissions and how they can be measured, check out Scoutbee’s blog post on the subject.

Understanding the different scopes of emissions is key to understanding the carbon output of the food industry’s main offenders.

Key insights

Emissions disclosure varies by company

While most of the top 100 companies (but not all) have disclosed at least one scope, others haven’t disclosed any. There are various reasons why companies could choose not to disclose emissions. Some might not make measuring emissions a priority in the first place. Others fear a bad reaction from investors and customers if emissions are high (given the increasing prioritization of green initiatives), and some companies might not have the money to invest in green action, so decide to avoid the pressure that disclosing emissions might create.

Factors that drive disclosure

• Legislation. Government legislation forces companies to disclose their Scope 1, 2, and 3 emissions.

• Pressure from supply chains . If other companies in the supply chain start to prioritize working with sustainable businesses, this can put pressure on brands to boost their own green initiatives. Luckily, there are solutions already available to make finding new, more sustainable suppliers easier for procurement, such as Scoutbee Discovery.

• Ease of measuring emissions. Bigger companies have the money and resources to accurately measure emissions, but it’s a different story for SMEs.

Factors that discourage disclosure

• High costs. If measuring emissions is costly, SMEs won’t prioritize this climate action - although it doesn’t tend to be an issue for big, global companies.

• Lack of incentives. Whether it’s financial incentives or having a better chance of working with other companies, if incentives don’t exist, companies are less likely to disclose their emissions.

If you want to decarbonize your supply chain, encouraging your suppliers to disclose in the first instance is a must. You can take advantage of the process of onboarding new suppliers by using it as an opportunity to capture all the data you need from a supplier when you have their full attention. Accountability starts with transparency.

Measuring or disclosing Scope 3 emissions is less common

Scope 3 emissions, as we covered earlier, are indirect emissions that occur down the value chain, whether it’s from a company’s suppliers or end customers. Scope 3 emissions even cover what happens to a product after it’s been used. If you own a business, the Scope 3 emissions associated with your suppliers might be what’s driving your carbon footprint sky high.

Most big companies now disclose their Scope 1 and Scope 2 emissions, but only just over half of large companies globally currently report Scope 3 emissions across industries. As we’ll see, the food and beverage industry is doing better in this regard than other sectors.

Scope 3 emissions can be a hidden risk for investors and partner companies. Since Scope 3 emissions are much higher than their Scope 1 counterparts, it’s tricky to accurately measure a brand’s sustainability credentials without them. This can also lead to “greenwashing”, where companies claim to be more eco-friendly than they really are.

If you’re working with a company that doesn’t disclose its Scope 3 emissions, you aren’t seeing the full picture regarding its carbon footprint.

With no surveys required, DitchCarbon can get you the emissions insights you need, with an analysis of over 200,000 suppliers integrated into the tools you already use.

Do the biggest brands disclose?

Out of the top 100 food brands, 93% of companies disclosed at least one scope, with 92% disclosing Scope 1, 83% disclosing Scope 2, and 80% disclosing Scope 3 emissions. 7% of companies didn’t disclose any of their emissions.

Do the statistics change when we take just the top 20 into account? Given the resources and money available to the top 20 global food companies, you might expect that they’d be the brands most likely to disclose, so let’s put that theory to the test.

When we look at just the top 20 brands, 90% disclose at least one scope, with 10% not disclosing a single scope. Both of the brands that didn’t disclose a single scope are North American , which tracks with the rest of our research on regional disclosures. 85% of the top 20 food companies disclose their Scope 2 emissions, and 80% disclose their Scope 3 emissions. They disclose at roughly the same rates as the rest of the top 100, with the disclosure of Scope 3 emissions still behind where it should be.

Given the resources at these businesses’ disposal, disclosing Scope 3 emissions should be a priority, but complex supply chains can muddy the waters.

Regional differences

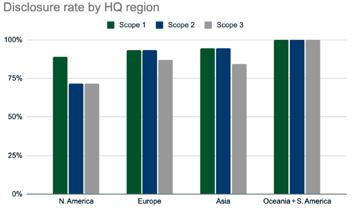

There are regional differences in how many companies disclose emissions, with Asian companies being more likely to disclose than their European or North American counterparts.

In emerging Asian markets, a whopping 87% of consumers say they want to adopt a more sustainable lifestyle, which could be driving the sustainability push. While large North American companies are more established, companies in emerging Asian markets may be trying to capture the attention of a new audience with green credentials. And with four out of five environmentally conscious consumers in AsiaPacific actively recommending sustainable products they like, this could be set to pay off. 30% of Chinese consumers , for example, have started buying sustainable products in just the last two years, proving this to be a rapidly expanding market, full of opportunities for supplier innovation.

What are the Scope 3 emissions of food companies?

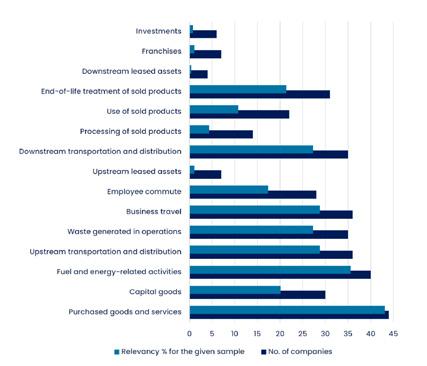

Scope 3 emissions are some of the most important to account for because they tend to be the biggest and can also represent hidden (environmental and financial) costs for investors. To some extent, Scope 3 emissions vary from sector to sector. In the food industry, we found the most common categories of emissions to be:

• Purchased goods and services

• Capital goods

• Fuel and energy-related activities

• Upstream transportation and distribution

• Waste generated in operations

• Business travel

• Employee commuting

• Downstream transportation and distribution

• Use of sold products

The table breaks down the relevance of different emissions categories for the companies in our data. You’ll notice that purchased goods and services are the biggest contributor to Scope 3 emissions, with downstream leased assets making the smallest difference. Other big contributors include fuel and energy-related activities, business travel, and upstream transportation and distribution.

While some Scope 3 emissions like business travel are most easily measured/impacted by company decisions, factors like the use of sold products are harder to control. Although an increasing number of companies have started providing categorywise Scope 3 emission data from 2019, by 2023, the growth in companies reporting this detail had plateaued, as shown by the table. Out of the 100 companies, 30% have disclosed category level Scope 3 data.

Emissions changes in recent years

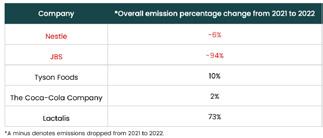

Are emissions increasing or decreasing? If we look at five of the biggest players in food and drink, it’s not so easy to say. While some have reduced their overall emissions, for others, emissions have gone up.

Scope 1 emission changes

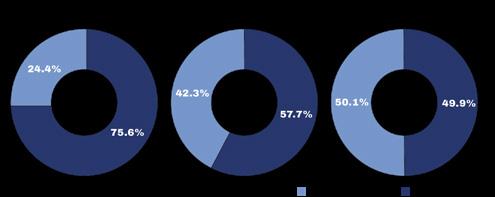

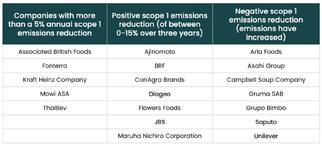

Using a list of companies that reported their emissions from 2019 to 2022, we established whether their emissions had increased or decreased. This study considered only Scope 1 emissions . Just like the top five companies, it was a mixed bag, although over 70% of the companies who reported decreased their emissions between 2019 and 2022.

Scope 2 emissions changes

The Scope 2 data is more promising, with a larger percentage of companies reducing their emissions.

Emissions have decreased

Emissions have increased

Scope 1, 2, and 3 emissions changes

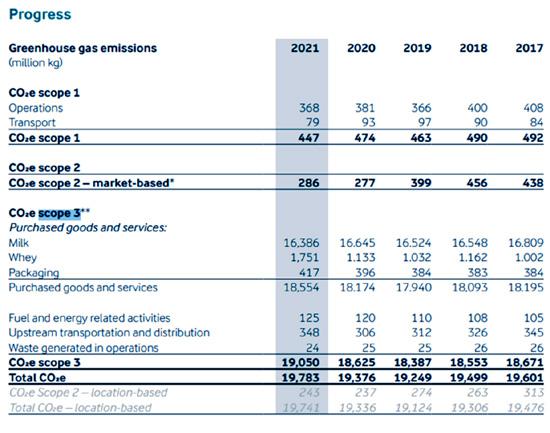

Another progress chart that maps greenhouse gas emissions from 2017 to 2021 shows things aren’t as straightforward as we’d like them to be. This chart breaks down emissions into Scope 1, Scope 2, and Scope 3.

Progress

While Scope 1 and 2 emissions have slightly decreased, Scope 3 emissions from categories such as purchased goods and services, fuel, transportation, and waste have actually increased, showing that companies are facing greater challenges from the upstream and downstream effects of their products.

Whether it’s a result of the post-COVID financial slump or a deprioritization of green initiatives in politics, not all companies in the food industry seem to be prioritizing reducing Scope 3 emissions. And for the green future we need, this is a big problem.

The financial crisis has undoubtedly played a part in this downgrading of emissions reductions on the priority list. According to a report by BIMA , expectations for brands to be sustainable were at an all-time high in 2020, before dropping in the following two years when consumer focus switched to price.

Luckily, the two don’t have to be mutually exclusive, so businesses should focus on the cost-saving benefits of sustainability and aim to pass these savings on to the consumer. For more on how working with sustainable suppliers can help with reducing costs and achieving other strategic goals, check out Scoutbee’s blog post by Nicole Verkindt, tech entrepreneur and sustainability expert.

CDP and SBTi initiatives -

increased then plateaued

CDP is a global non-profit organization that helps companies disclose their environmental impact. SBTi stands for Science Based Targets initiative, which aims to lead the way to a zero-carbon economy. Working with either or both CDP and SBTi signals that a company is prioritizing green credentials.

By 2023, 70% of companies from our top 100 list had committed to SBTi, while 77% work with the disclosure organization CDP. Although commitment to both SBTi and CDP was on the rise from 2019-2022, numbers have stalled since 2023, showing the need for further decarbonization of the food and beverage industry. The chart below shows the new and total numbers of companies from our list of top 100 food brands working with CDP or SBTi in a given year.

2020 saw record interest but this has petered out since, with the numbers remaining unchanged from 2022 to 2023. The post-COVID recovery has no doubt played a part in slowing these changes down. Increased costs in a global cost-of-living and inflation crisis might also mean that companies put environmental measures at the bottom of their priority list.

What’s next?

In the move to a green future, disclosure and transparency from companies will play a key role. The more we know about a company’s emissions, the better we can hold them to account in the form of action-oriented objectives.

Based on this report, it’s clear that procurement needs to work with sustainable suppliers who are committed to transparency about their carbon emissions. To find new, innovative, ESGcompliant suppliers who align with your goals – in a fraction of the time – check out Scoutbee Discovery’s AIpowered solution.

Request a demo today