When you have a limited liability company that owns assets, such as investment real estate, it provides you with personal liability protection but often doesn’t have any estate planning benefits. A living trust enables you to pass assets to your heirs immediately, outside of probate, but doesn’t provide any personal liability protection. To gain the liability protection of an LLC and the estate planning benefits of a living trust, consider making your living trust the sole member of your LLC.

When you put assets into a revocable living trust, the assets pass directly to your heirs when you die without going through probate court. This eliminates the delays associated with supervision from a probate judge and prevents public disclosure of the transaction. It’s also usually less expensive than probate court. While you’re alive, you can add assets to the trust, remove assets from the trust and control the current assets as the trustee.

When you form a company to hold assets, you must typically choose to organize it as a corporation, a partnership or a limited liability company. A corporation provides personal liability protection if someone wins a judgment against the company, but the government taxes you twice. A partnership eliminates double- taxation, but doesn’t provide personal liability protection to the general partner. A limited liability company, however, combines the liability protection of a corporation and the single taxation of a partnership in a single entity. When you die, however, your LLC ownership must pass to your heirs through a probate in many states.

While the rules regarding LLCs vary by state, most states don’t require more than one member to form an LLC. A member can be a person or an entity such as

a corporation, a partnership, another LLC, a foreign entity or a trust. The company’s operating agreement specifies who is responsible for making decisions and commitments on behalf of the company. If an LLC is member-managed, the members are responsible for running the company. It the company is managermanaged, the members appoint a manager with responsibility for company operations. An LLC can be manager-managed, with the single member of the LLC serving as the manager.

By making a living trust the sole member of an LLC,

the living trust becomes the owner of the company. If the company is member-managed, the trustee is responsible for running the company. If it’s managermanaged, the manager runs the company but the trustee can usually replace the manager at any time, depending on the provisions in the company’s operating agreement. When you die, company ownership passes to the trust’s beneficiaries without a probate, and your heirs also inherit personal liability protection as the new owners of the LLC and its assets.

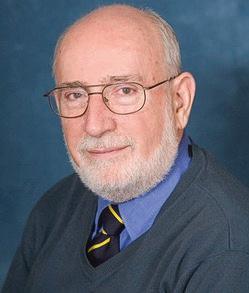

In Loving Memory In Loving Memory

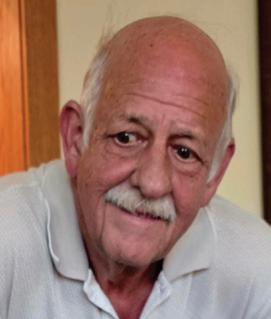

Aiko Von Achen 1932-2025

Anaheim, CA

In Loving Memory In Loving Memory

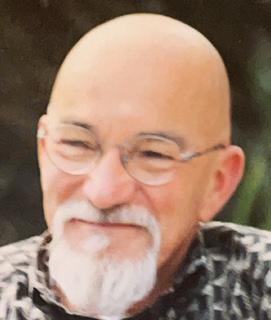

Charles Raymond Betz 1939-2025

Huntington Beach, CA

In Loving Memory In Loving Memory

Morris Boyaner 1938-2025

Los Angeles, CA

In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Margaret Armstrong 1934-2025

Mission Viejo, CA

In Loving Memory In Loving Memory

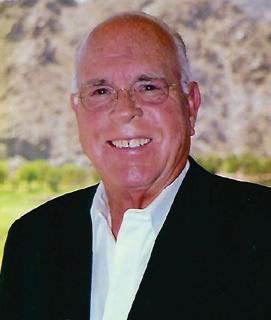

John C. Bilello 1938-2025

Dexter, MI

In Loving Memory In Loving Memory

June Budd 1931-2025

Laguna Beach, CA

In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Sandy Augenstein 1948-2025

Placentia, CA

In Loving Memory In Loving Memory

Michael N. Blewett Sr. 1937-2025

John Frederick Briscoe, Jr. 1952-2025 Huntington Beach, CA

In Loving Memory In Loving Memory

Rosemary “Rose” Busta 1953-2025

David Lawrence Chambers 1938-2025

Laguna Woods, CA

Laguna Hills, CA

In Loving Memory In Loving Memory

Don K. Chapman 1941-2025

Cary, NC

Sarah Bruck 1955-2025

In Loving Memory In Loving Memory

Beth M. Barlow 1943-2025

Fullerton, CA

In Loving Memory In Loving Memory

Nelloise Blue 1923-2025 San Juan Capistrano, CA

Laguna Beach, CA

Bonsall, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Monsignor John G. Campbell 1929-2025

Mission Viejo, CA

In Loving Memory In Loving Memory

James H Cheney 1943-2025

Newport Beach, CA

Richard Bryson 1944-2025 Long Beach, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Frank H. Carrillo 1924-2025

Yorba Linda, CA

Antonio Ortega Becerra 1929-2025 Orange, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Daniel John Bott 1932-2025 Fountain Valley, CA

Thomas Buckbee 1936-2025 Anaheim, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Juan Casado and Dorothy Casado 1920-2025 1935-2025

Orange County, CA

Colleen Choate 1946-2025 Orange, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Carole Ann Christianson 1954-2025 Seal Beach, CA

In Loving Memory In Loving Memory

Stanley Cohen 1935-2025

Villa Park, CA

In Loving Memory In Loving Memory

Donna Scott Coleman 1923-2025

Gretchen Marie Davison 1965-2025

Costa Mesa, CA

Judith Ann Des Jardins 1940-2025

Laguna Beach, CA In Loving Memory In Loving Memory

Antonio “Tony” De Frenza 1926-2025

Santa Ana, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Marilyn (Mimi) Eads 1935-2025

San Clemente, CA

In Loving Memory In Loving Memory

John Al Gerbracht 1935-2025

Fullerton, CA

Newport Beach, CA In Loving Memory In Loving Memory

Loving Memory In Loving Memory

Francis (Fritz) Drees 1937 - 2025

Laguna Niguel, CA

Birgitta G. Elward 1939-2025

Loving Memory In Loving Memory

Elizabeth Anne Crawford 1957-2025

Dana Point, CA

Dennis Emile De Snoo 1949-2025

Loving Memory In Loving Memory

Kyle Dahl 1970-2025

Fountain Valley, CA

Loving Memory In Loving Memory

Linda Lee Dahncke 1955-2025

Lake Forest, CA

San Juan Capistrano, CA In Loving Memory In Loving Memory

Loving Memory In Loving Memory

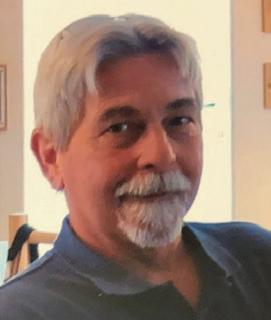

Kevin Dale Drum 1958-2025 Irvine, CA

Loving Memory In Loving Memory

Meta Degenhardt 1940-2025 Huntington Beach, CA

Loving Memory In Loving Memory

Brandon Dubois 1979-2025

La Mirada, CA

Loving Memory In Loving Memory

David Richard Delgado 1958-2025 Auburn, WA

Loving Memory In Loving Memory

Sharon Elaine Dumont 1943-2025 Irvine, CA

Fountain Valley, CA In Loving Memory In Loving Memory

Waithira Joyce Karanja Gethaiga 1944-2025

Fullerton, CA In Loving Memory In Loving Memory

Edwin Evans 1935-2025 Orange, CA In Loving Memory In Loving Memory

Eileen Gillett 1931-2025

Joseph Finnell 1933-2025

Laguna Woods, CA In Loving Memory In Loving Memory

Fountain Valley, CA In Loving Memory In Loving Memory

Loving Memory In Loving Memory

Richard David Goldstein 1957-2025 Tustin, CA

Richard A. Foster 1935-2025

Fullerton, CA In Loving Memory In Loving Memory

Charles O. Goodwin Jr. 1942-2025

Mission Viejo, CA In Loving Memory In Loving Memory

Reversing the roles of caregiver and dependent is complicated and emotional. Adult children can become caregivers of their parents inthe blink of an eye, and it can lead to doubt and anxiety for all.

As unfortunate as it may be in the moment, taking over the care of ailing parents is simply a part of life. It is the natural progression that most have to face.

Here are some tips to help you deal with progressing from someone’s child to their caregiver:

1. Accept what is happening. As difficult as it may seem, it is important to know the facts of the illness or condition that needs to behandled. If it is an illness that will eventually

lead to death (whether immediate or long-term), making arrangements for a written will, funeral, and legal determinations is crucial. Completing these steps will reduce future stress and worry.

2. Have open communication with your parent. Explain that you will be handling the situation and stepping up into the caregiver role, so that there is no question or uncertainty. It is important to take over this responsibility while also aff ording your parent dignity, respect and any autonomy they can still have over their own care.

3. Prepare yourself. It will be a rough road to travel. Surround yourself with a reliable support system, plenty of positive energy, and tissues. Know that you will shed tears; you will fall; you will get back up; and you will do what needs done for your parent.

4. Approach your parent with love. Be gentle, loving and understanding, but be strong and courageous. When you are in the last moments with your parent, show them how much you love them. Let that message overshadow the message of fear. Assure your parent that they have had a wonderful life, and their pain will soon end.

5. Reach out to others. There are a number of helpful organizations whose mission

is to help caregivers. Don’t hesitate to reach out for help. Investigate your local social services organizations and speak to representatives about your situation. Take the help theyoffer. The stronger you are, the better you will take care of your parent during this difficult time.

You have a window of opportunity to make lasting memories and to develop your parent’s hardships into a unique loving and bonding

experience. Your parent brought you into the world, nurtured and enabled you to become the adult that you are today. This can be yourturn to nurture them in return.

Caring for your ailing parent may seem unnatural and stressful, but being prepared and approaching the situation with a full toolbox can help turn it into a natural, even beautiful, experience.

SATURDAY, N OVEMBER 1st 11am—2pm

Cantor Jonathan Neil Grant 2025

Orange County, CA In Loving Memory In Loving Memory

June Fundin Hardt

1936-2024

Yorba Linda, CA In Loving Memory In Loving Memory

Dennis Glenn Howe 1946-2025

San Juan Capistrano, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Eli Kazer 1940-2025

Fair Oaks, CA

Kimberly Hills Leibe 1973-2025

Memory

James Alexander Grimes 1938-2025

Santa Ana, CA

Loving Memory In Loving Memory

Jared Edward Harris 1977-2025

Bellingham, WA

Loving Memory In Loving Memory

Kathy Inman 1950-2025 Irvine, CA

Anthony (Tony) Albert Kinninger 1939-2025

Loving Memory

Loving Memory

Earl H. Gunnerson 1941-2025

Huntington Beach, CA

Barbara Heppner 1951-2025

Loving Memory In Loving Memory

Donald Guyer 1938-2025

Laguna Niguel, CA

Sister Rosaleen Hanlon 1937-2025 Orange, CA

Roseburg, OR In Loving Memory In Loving Memory

Loving Memory In Loving Memory

Gregory Joseph Isaac 1957-2025

Coto de Caza, CA

Loving Memory In Loving Memory

Karen Hill 1953-2025

Laguna Hills, CA

Loving Memory In Loving Memory

Olaf Brynjolfsson Johansen 1955-2025

Newport Beach, CA

Loving Memory In Loving Memory

Robert W. Howard 1933-2025

Laguna Woods, CA

Loving Memory In Loving Memory

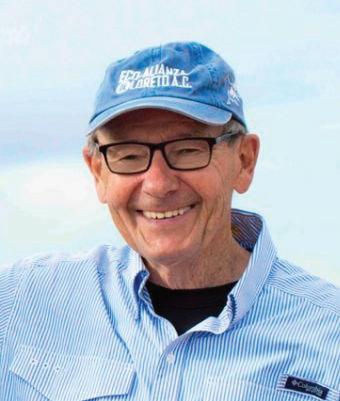

Martin H. Jurick 1937-2025

Tustin, CA

Loreto, Baja California Sur In Loving Memory In Loving Memory

Janice Sachiko Kitagawa 1944-2025

Newport Beach, CA In Loving Memory In Loving Memory

Deanna Livesey 1946-2025

Laguna Niguel, CA In Loving Memory In Loving Memory

La Palma, CA In Loving Memory In Loving Memory

Betty Lynch 1935-2025

Andrew Krycerick Jr. 1952-2025

Costa Mesa, CA In Loving Memory In Loving Memory

Lake Forest, CA In Loving Memory In Loving Memory

Loving Memory In Loving Memory

Paul MacMillin 1936-2025

Newport Beach, CA

Chisato Kubo 1928-2025

Fountain Valley, CA In Loving Memory In Loving Memory

Andrea Lynn Mahru 1977-2023

Santa Ana, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Mark Warren Masters 1957-2025

Santa Ana, CA

In Loving Memory In Loving Memory

Pat Amondsen McBride 1937-2025

Buena Park, CA

In Loving Memory In Loving Memory

Caroline Miller 2025 Huntington Beach, CA

In Loving Memory In Loving Memory

Mary Patty Laubbacher O’Connor 1944-2025

In Loving Memory In Loving Memory

Kathleen Mathews 1947-2025

Laguna Woods, CA

In Loving Memory In Loving Memory

Maxine Olivia Mc Gaffigan 1942-2025

Newport Beach, CA

Mission Viejo, CA

In Loving Memory In Loving Memory

Raymond Poppa 1938-2025

Santa Ana, CA

In Loving Memory In Loving Memory

Carol Matsumoto 1956-2025

Anaheim, CA

In Loving Memory In Loving Memory

Joel Ray Medriano 1957-2025

Anaheim, CA

W. Richard Mills 1938-2025 La Quinta, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Joyce Oyenoki 1954-2025

Garden Grove, CA

In Loving Memory In Loving Memory

Susan Diane Porter 1945-2025

Anaheim Hills, CA

Audrey Morrow 1929-2025

Placentia, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Marilyn Penner 1931-2025

Fullerton, CA

In Loving Memory In Loving Memory

Jackie (Jack) G. Rawlings, Sr 1936-2025

Westminster, CA

Jacqueline Matthiessen 1952-2024 Orange, CA In Loving Memory In Loving Memory

Robert D. Mc Cumsey 1935-2025

Kenneth M Meyers Jr. 1949-2025 San Clemente, CA In Loving Memory In Loving Memory

Mark Mulligan 1955-2025 San Juan Capistrano, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Judy Petraitis 1941-2025

Menifee, CA

Newport Beach, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Marilynn Miller 1933-2025 Costa Mesa, CA

Christine Norris 1942-2025 Anaheim, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Robert “Bob” Pierce 1952-2025

Laguna Woods, CA

Sister Rose Marie Redding, CSJ 1928-2025 Orange, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Alix Olivia Rego 1980-2025

Mission Viejo, CA

Estate executors are trusted individuals who handle the settlement of a deceased person’s estate. The duties they perform ensure that property and other elements of the estate are distributed according to both the provisions of any existing will and current probate law. As an estate executor, a person must perform specific fiduciary duties. If a person does not specify the person they want to act as executor prior to their death, and if no one else comes forward to volunteer for the duties, the court appoints an estate administrator to carry out the executor’s tasks.

Estate executors perform multiple roles for the deceased’s estate. These roles include but are not limited to:

• Deciding if probate is necessary given the estate status.

• Entering the will of the deceased into the probate court.

• Identifying, locating, securing and listing the assets and property of the deceased, including making insurance arrangements.

• Notifying insurance companies of the death and providing copies of the death certificate to initiate payments to beneficiaries.

• Notifying non-insurance agencies or companies of the death in writing and, if necessary, terminating accounts. This can include the Social Security Administration, Medicare, United States Postal Service, and the United States Department of Treasury.

• Notifying creditors and heirs of the death in writing, including a newspaper announcement.

• Responding to information requests by creditors, heirs, attorneys and officers of the court.

Executors may have to deal with irate family, friends and creditors of the deceased as well.

• Providing tax information for the estate to a qualified lawyer or accountant by filing deadlines, applying for an Employer Identification Number (EIN) for the estate, and paying all taxes owed on the estate.

• Creating a list of all debts against the estate, including the funeral costs, and submitting the list to the court.

• Paying all debts and dispersing property and assets to heirs and creditors according to the will of the deceased and current property law. In order to accomplish this, it may be necessary to sell the deceased’s property or assets.

• Appearing in court as a representative of the estate if proceedings are necessary regarding the deceased’s will.

• Establishing a bank account in the name of the estate for distribution of property and assets.

• Keeping records of all matters relating to the settling of the estate for possible review by the probate court, heirs and creditors.

• Examining the existence of partnerships and similar agreements, and taking steps to meet clauses related to the estate within those agreements.

• Making arrangements for minor children of the deceased.

An executor has a fiduciary duty to the deceased. This means that they have to act in the best interest of the deceased at all times. This sometimes pits the executor against friends and family members of the deceased if the deceased’s wishes were contrary to what friends and family members want.

Fiduciary duty also means that the estate executor cannot benefit from his work beyond what is allowed in the deceased’s will or state estate executor fee law.

Estate executors also take on legal responsibilities when they handle an estate. For example, they can be held liable for any taxes not paid related to the estate. Additionally, being an executor takes considerable time and effort—it is not unusual for it to take a year or more to close an estate.

It is legal for an estate executor to charge a fee for their services, given the extent of responsibility the executor accepts. The state typically sets the fee, but roughly three percent of the value of the estate is standard. Courts have the right to determine what is reasonable compensation for acting as executor if state law does not specify a fee limit numerically. Individuals also may specify in their wills how much they want their executors to receive if they feel the executor deserves more than the state guideline.

Taking on the responsibility of being an executor is a lasting way to honor the final wishes of someone who has passed away. It’s also a lot of hard work. Be sure you are prepared to undertake these duties before agreeing to be the executor of an estate.

-

In Loving Memory In Loving Memory

Mary C. Repine 1929-2025

Buena Park, CA

In Loving Memory In Loving Memory

Carol Ann Schick 1930-2025

Fullerton, CA

In Loving Memory In Loving Memory

Gloria Selzer 1933-2025

Laguna Niguel, CA

In Loving Memory In Loving Memory

Barbara Smith 1950-2025

Garden Grove, CA

In Loving Memory In Loving Memory

Teka Diane Summers 1950-2025

Las Vegas, NV

Memory

Phyllis Ann Routledge 1933-2025 Fullerton, CA

In Loving Memory In Loving Memory

John H. Schlegel 1946-2025

Newport Beach, CA

Jose de Jesus Serio 1922-2025 Irvine, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Ted Smith 1929-2025

Newport Beach, CA

In Loving Memory In Loving Memory

Joyce Tabata 1922-2025

Midway City, CA

Loving Memory

Loving Memory

Gina Royalty 1937-2025 Corinth, TX

In Loving Memory In Loving Memory

Darrell Robert Schmidt 1933-2025

Mission Viejo, CA

In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Adele “Dolly” Dove Sadell 1928-2025 Aptos, CA

In Loving Memory In Loving Memory

Isabella (Mabel) More Schargitz 1922-2025 Westminster, CA

Russell Schmitt 1942-2025 Anaheim, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Joyce Schoenegge 1936-2025 Fountain Valley, CA

Harvey “Eddie” Edward Sheldrake Jr. 1926-2025 Fullerton, CA

In Loving Memory In Loving Memory

Gloria Castillo Solis 1935-2025 Corona, CA

In Loving Memory In Loving Memory

Tracy Robin Thomas 1956-2025

Los Angeles, CA

Andrew George Sligar 1925-2025

Laguna Woods, CA In Loving Memory In Loving Memory

In Loving Memory In Loving Memory

Jean Stefanik 1934-2025

Worthington, OH

In Loving Memory In Loving Memory

Genetha Shankle Thomas 1942-2025 Cypress, CA

In Loving Memory In Loving Memory

Irene May Smith 1929-2025

Fullerton, CA

In Loving Memory In Loving Memory

Merle A. Stelter 1934-2025

Huntington Beach, CA

In Loving Memory In Loving Memory

Amelita Carlos Tiernan 1943-2025

Yorba Linda, CA

Donna Louise Tripp 1928-2025

Anaheim, CA In Loving Memory

Donald Philip Ward 1932-2025

Orange, CA In Loving Memory In Loving Memory

Robert L. Zentner 1939-2025

Santa Ana, CA In Loving Memory In Loving Memory

Jeanine Veje 1929-2025 Tustin, CA In Loving Memory In Loving Memory

Irvin A. Ward 1924-2025

In Loving Memory In Loving Memory

Barbara Wade 1933-2025

Anaheim Hills, CA

Loving Memory In Loving Memory

Robert Wahlstrom 1932-2025

Los Alamitos, CA

Renee Walsh 1938-2025

Ladera Ranch, CA

Laguna Woods, CA

Loving Memory In Loving Memory In Loving Memory In Loving Memory

Judy Bolin 1961-2025

Costa Mesa, CA

Margaret Wolk 1921-2025 Orange, CA

Loving Memory

Loving Memory

Lucky Shoso Yamaga 1928-2025

Costa Mesa, CA

Linda Kay Youngquist 1940-2025

Newport Beach, CA

Maureta “Reta” Bunge 1929-2025 Parker, AZ

Melinda “Shreading” Lange 1954-2025

Laguna Niguel, CA

Loving Memory In Loving Memory

Loving Memory In Loving Memory

Loving Memory

Loving Memory

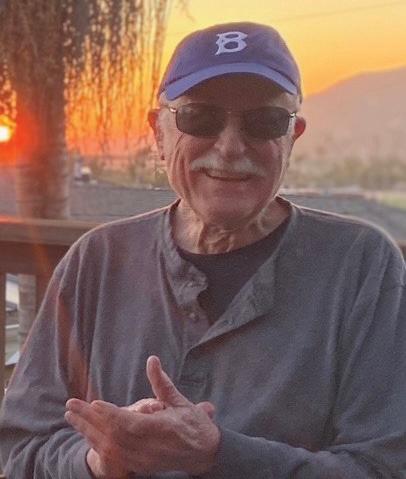

Richard Ortwein 1941-2025

Newport Beach, CA

Loving Memory

Frank Rodriguez 1945-2025

Pico Rivera, CA

May the constant love of caring friends soften your sadness. May cherished memories bring you moments of comfort. May lasting peace surround your grieving heart.

Loving Memory

Loving Memory

Sue Ellen Canfield 1940-2024

Garden Grove, CA

Richard Lee Hopping 1928-2024

Fullerton, CA

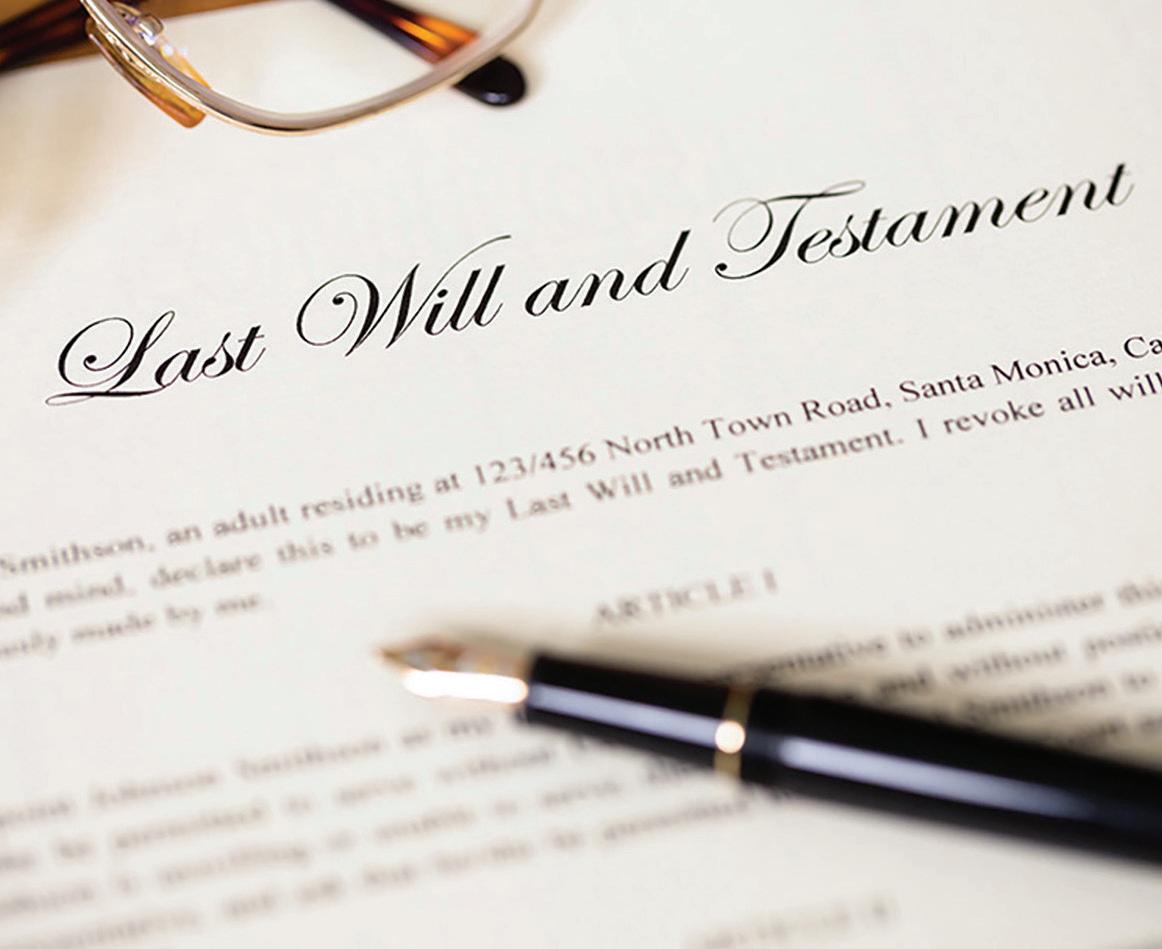

As with being born and having to pay taxes, we all face the prospect of our own death. If you plan on living to a ripe old age, it’s important to make things easier on those you leave behind by preparing a proper last will and testament.

Benefits of creating a last will and testament

When you file a will, your final wishes are laid out in black and white, leaving no ambiguity about how you want your assets divided. By creating a will that is watertight, you can make your death less stressful for your survivors. You should also have peace of mind knowing your survivors will be taken care of when you are gone. Although it’s unsettling to think of your own death and the world without you in it, consider how you’d like your assets to be distributed once you are gone. Typically people contemplate how they’d like to leave their children, spouse, favorite charities and other loved onesin the event of their death.

When is a good time to start planning your final wishes?

Consider preparing a last will and testament once you’ve acquired assets or dependents. If you work full time, have a spouse orchildren, own a home, or have savings, it’s the right time to start planning.

Preparing the will

Don’t know how to get started? Follow these steps to begin planning your final wishes.

1. Account for all of your assets and debts

Create a comprehensive list of everything you own or are entitled to. This includes, but is not limited to:

• Real estate holdings

• Life insurance policies

• Vehicles

• Cars

• Boats

• Recreational vehicles

• Financial investments

• Owned businesses

• 401(k)

• RRSPs

• Home equity

• Stocks

• Bonds

• Pensions

• Other retirement savings and portfolios

• Debts and liabilities

2. Assign a trustee

A trustee, or executor, is the person who you assign to carry out the instructions held in your last will and testament. Their duties can include the distribution of assets, funeral planning, death announcement, services, cremation or care of your final remains, and distribution of your assets as set out in your will.

want your body to be cremated and your ashes scattered over your favorite lake, ski hill, ocean vista or other special place. Your wishes are yours alone, andcan be as personal as you like. Whatever they may be, ensure your requests are clearly identified in your will.

5. Make it legal

Ensure that the person you select to administer your estate is okay with being appointed as such before assigning them. The job of anexecutor or trustee is complex and stressful, usually taking months or years to conclude. Make sure they are up to the task.

3. List all beneficiaries

Construct a list of relatives, friends and charities that you would like to remember in your will. This can include your spouse, children, siblings, parents and in-laws, charities you support, and any other people or organizations that you want to leave some of your accumulated wealth to. Write down the exact assets or percentage of the total estate that each person or organization will receive.

4. Final wishes for your bodily remains

Perhaps you want to be interred in a tomb, with a simple grave, or extravagant headstone. Or maybe you

Contact a lawyer that specializes in estate law. They know the current rules and regulations regarding wills, how they may affect your wishes, and the best ways to take care of those left behind. It’s better to be safe than sorry. There is no substitute for a legal will. Writing a letter or informal statement about how you’d like your assets divided might be a nice gesture to your survivors, but does not take the place of a will. Don’t risk your financial legacy being mismanaged. Don’t jeopardize the understanding of your final wishes. You can purchase a kit to create a will yourself. This will be less expensive than using a lawyer, but may not be as binding and watertightas you might like. If your will has complex instructions, it’s best to consult a lawyer.

Divorces, new marriages, new children, grandchildren, great-grandchildren, favorite charities or new circumstances may raise the need to change your will, to either include new entries to your will, or have some taken out of it. After having your last will and testament written up, signed and witnessed, you will have to make changes to it as your life unfolds.

Make it a habit to revisit your final wishes when life changes occur, or every few years. That way, you can rest assured loved ones will be taken care of when you are gone.

-