Catalyst for success

Henrik Rasmussen, MD, The Americas at Topsoe, explains the role the company is playing in the transition from grey to blue to green fuels

Interview

Why digital technologies are essential to decarbonizing key industries

Supply chain

Scope 3 emissions and charting a course to net-zero

Wind energy

Decreasing LCOE and supporting the transition to wind power

Issue 210 - 2022

CEO Andrew Schofield

Group COO Joe Woolsgrove

Creative Director Tom Vince

Data & Insights Director Jaione Soga

Editor Libbie Hammond

Assistant Editor Mary Floate

Content Editors Daniel Baksi, Alex Caesari, Danielle Champ

Editorial Administrator Amy Gilks

Managing Art Editor Fleur Daniels

Art Editors Paul Gillings, David Howard, Charlie Protheroe, Lee Protheroe

Artwork Administrator

Rochelle Broderick-White

Sales Director Alasdair Gamble

Project Directors

Philip Monument, Joy Francesconi

Head of Content Management

Adam Blanch

Head of Global Media Programs

Mark Cawston

Project Managers Lewis Bush, Natalie Griffiths, Jo-Ann Jeffery, Ben Richell

Content Managers Johanna Bailey, Mark Cowles, Jeff Goldenberg, Wendy Russell, Richard Saunders, Kieran Shukri

Media Sales Executives Mike Berger, Jessica Eglington, Will Gwyther, Reid Lingle, Sam Surrell

General Manager Florida Division

Ryan Finn

Social Media Co-ordinator Rosie Clegg

IT Support Iain Kidd

Administration Natalie Fletcher, Rory Gallacher, Ibby Mundhir

Hello and welcome to the November issue of Energy, Oil & Gas. Among our feature selection this month is an interview with Ron Beck from AspenTech. He shared some insights with Dan Baksi from the EOG team, around the challenges facing the energy sector, and the pivotal role that digital technologies are playing and will continue to play in the energy transition. Ron says that more advanced companies are ‘pioneering the integration of digital twins, dynamic optimization, and utility optimization’ and he also notes that artificial intelligence is expected to further accelerate the pace of change. For the full story, visit page 6.

lh@finelightmediagroup.com

Our cover story this issue features an interview with Henrik Rasmussen, Managing Director, The Americas at Topsoe. Turn to page 66 to find out why he describes the business’ trajectory as ‘riding the wave of decarbonization’.

© 2022 Finelight Media Group

Corporate Head Office

Cringleford Business Centre, 10 Intwood Road. Cringleford, Norwich NR4 6AU U.K.

T: (312) 854-0123 T: +44 (0) 1603 274130

US Office

2240 West Woolbright Road, Suite 402 Boynton Beach. FI 33426

T: (561) 778-2396

Supply chain Scope 3 emissions and charting a Why digital technologies are essential to decarbonizing key industries Wind energy Decreasing LCOE and supporting the transition to wind power Henrik Rasmussen, MD, The Americas at Topsoe, explains the role the company is playing in the transition from grey to blue to green fuels Catalyst for success Please note: The opinions expressed by contributors and advertisers within this publication do not necessarily coincide with those of the editor and publisher. Every reasonable effort is made to ensure that the information published is accurate, and correct at time of writing, but no legal responsibility for loss occasioned by the use of such information can be accepted by the publisher. All rights reserved. The contents of the magazine are strictly copyright, the property of Finelight Media Group, and may not be copied, stored in a retrieval system, or reproduced without the prior written permission of the publisher.

energy, oil & gas at

Libbie Hammond, Editor

Follow

@EOG_magazine energy-oil-gas-magazine Welcome energy-oil-gas.com 1

Inside

Supply chain Motors 12 16 6 Technology 20 Interview Ron Beck, AspenTech Contents 2

this issue

Wind energy News 32 24 Nuclear 28 Exclusive Feature Glander International Bunkering 36 energy, oil & gas magazine energy-oil-gas.com 3

Capstone Infrastructure Corporation 48 Calumet 56 Cover Story Topsoe 42 Exclusive Feature TEPSA 66 Contents 4

Natgasoline LLC 82 The Andersons Motive Offshore Stanlow Terminals Briggs Marine & Environmental Services Graco Oilfield Services Energinet 88 76 110 92 104 100 energy, oil & gas magazine energy-oil-gas.com 5

Embracing the industry

optimum

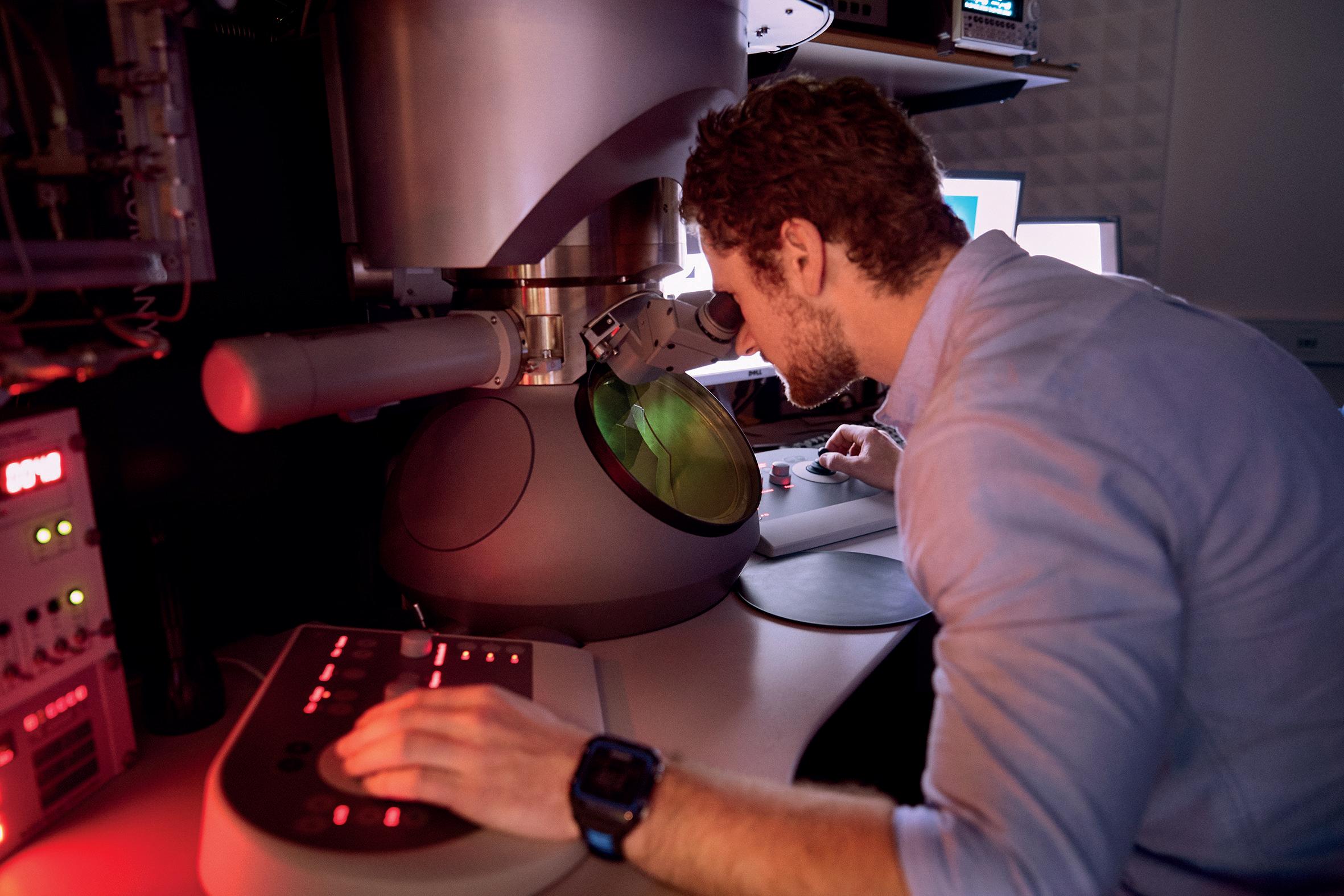

Ron Beck, Senior Director, Industry Marketing at AspenTech, explains how digital solutions can help tackle the challenges facing a changing energy sector

6

In April 2021, when the US President announced plans to halve US greenhouse gas emissions by 2030, and to reach net-zero emissions by 2050, it represented a significant event for the climate movement. As the world’s largest economy, and its second largest greenhouse gas emitter, the US had finally joined some other 130 nations in signaling its intention to act on climate change. For advocates of the policy, it signaled the continued shifting of the dial when it comes to attitudes towards decarbonization, and a major step on the road towards a more sustainable future.

Fast forward a year, and we’re facing a very different picture. While the decarbonization movement continues apace, the world finds itself in the grip of an energy shortfall, with rising prices driving up the cost of living for billions of people. It’s a period in which fresh questions are being raised about the future of the energy

sector, including the shift towards renewables. Albeit exacerbating in the short term, the consensus across the sector is that many of these issues are here to stay, as growing populations across the globe place an everincreasing strain on available resources.

“The world needs more energy, and that need is not going away,” says Ron Beck, Senior Director, Industry Marketing at AspenTech, a global asset management software provider. “Most projections foresee a 50 percent growth in our energy need by 2030, driven in part by the emphasis on electrification and the shift towards renewable energy sources. At the same time, demand for oil and gas will continue to rise, at least through the next decade.”

Ron, as he freely admits, is a little before his time. A student of Environmental Studies at Princeton University, he began his career within the field of sustainability, before turning to the energy and chemical industries approximately 30 years ago. Ron joined Aspentech in 2007, when he served as the company’s first industry marketing professional.

Now in his current role, Ron heads up a team that seeks to understand client needs and emergent trends, such as through its recent survey of EPC, and energy and chemical industries professionals, which sought to gauge attitudes towards sustainability and decarbonization. AspenTech’s findings found that such impacts were top-of-mind, particularly in Asia, Europe, and North America. In the case of the latter, 40 percent of respondents believed that sustainability represented

Interview 7

Ron Beck

energy-oil-gas.com

an existential impact for their company. Meanwhile, 77 percent of companies believed that having a strong CO2-reduction strategy represented either a moderate or significant competitive advantage.

“Particularly in the US, the political outlook when it comes to sustainability remains fragmented,” Ron comments. “In that context, these findings are really fascinating. On the one hand, they demonstrate how government policies are capable of driving consumer behavior, be it incentives for driving electric cars, the installation of heat pumps, or otherwise. At the same time, we’re seeing the impact of major financial houses, with investment banks such as JP Morgan Chase and

BlackRock taking a more active role in identifying sustainability risk factors, and scrutinizing their investment project on that basis. That, in turn, drives companies to report on their greenhouse gas emissions, if for no other reason than financial, and risk transparency.”

Despite the all-encompassing nature of the energy transition, Ron observes a significant divergence in strategic thinking when it comes to grappling with the change. “In the absence of upstream oil investment, US-based hydrocarbon producers such as Chevron and Exxon Mobil have established themselves among the largest global investors in carbon capture, as they seek to utilize their existing energy resources

“ “ “ “ 8

Nowadays, almost every refinery has some form of APC installed, with exact application determined by profitability and emissions reduction

more effectively,” he argues. “By contrast, European-based companies such as Shell and BP are diversifying down the energy pathway, viewing their future as broader energy companies, as opposed to operating strictly within oil and gas.

“This evolution is being driven by the EU itself, where sustainability reporting is now a legal requirement,” Ron adds. “As such, the pace of digital investment has soared, as companies seek to gain a better understanding of their emissions footprint, and develop support systems to help them make decisions to move towards carbon-zero.”

According to Ron, it’s these digital technologies that hold the key to accelerating

decarbonization of key industries. The majority of these fall under the umbrella of Advanced Process Control (APC), a broad range of techniques and technologies implemented within industrial process control systems, with proven ability to deliver energy savings of upwards of ten percent. For companies, such measures are a win-win: helping to reduce carbon emissions, while also driving enhanced profitability.

“Nowadays, almost every refinery has some form of APC installed, with exact application determined by profitability and emissions reduction,” Ron comments. “At the same time, more advanced companies are pioneering the integration of digital twins, dynamic optimization, and utility

Interview 9 energy-oil-gas.com

10

optimization, each of which deliver further energy savings.”

In tandem with the emphasis on decarbonization, another trend taking hold of industry is electrification. This, as Ron points out, is more than a matter of electric vehicles or domestic heat pumps, but involves the electrification of major chemical and industrial plants, by substituting fossil fuels for renewable alternatives.

“In the making of plastics, for instance, one of the basic building blocks are olefins, which consume a very significant portion of energy within the chemical value chain, through a process known as ethylene cracking,” Ron explains. “In Europe, pilot projects are already underway to test an electrified ethylene cracker, with large scale use a possibility within the next two decades. Exactly how fast that date arrives will largely depend on the incorporation of digital technologies, which once again have the potential to be huge accelerators as companies seek to roll out these and other energy-efficient processes.”

Any attempt to electrify industry isn’t without its challenges, such as regulatory issues, combined with an ageing international grid. “As it exists today, our grid was never designed to work in two directions,” Ron says. “Even many of the digital technologies that we’re now implementing were originally designed for a centralized grid. As rooftop solar arrays and batteries become more common, the question arises as to how we can use the grid more effectively, and what form the grid might have to take in the years to come if we’re to fully realize the potential that these technologies have to offer?

“If we’re hoping to achieve anywhere between 35-to-50 percent of vehicles running on electricity by 2035, then these are the kinds of innovations we need to pursue,” he insists. “Add to that the growth we’re seeing in the scale and number of cloud computing companies, which have already become very significant global consumers of energy, and the need for an intelligent grid is only going to increase.”

In particular, a growing uptake of artificial intelligence is expected to further accelerate the pace of change. “Looking beyond individual plants, and beginning to tackle questions such as how to optimize a network of plants across a whole country or region, you not only need proven optimization technologies, but you need to apply data in better ways,” Ron continues. “Introducing AI capabilities can help to achieve that, while also providing a solution to the growing shortage of experts who know how to intervene with operational software.

“Beyond that, we can expect to see far more transparency within the areas of carbon emissions and recycling,” he rounds off. “If a new fashion brand comes out with a new raincoat claiming to be made of 80 percent renewable plastic, technology will soon enable that to be tracked and reported. Similarly, at gas stations throughout North America, startups are harnessing the power of digitalization to offer different pricing options for gasoline containing varying proportions of biofuels, bringing unprecedented levels of dynamism to that product offering.” ■

“ “ “ “ Interview 11 energy-oil-gas.com

As rooftop solar arrays and batteries become more common, the question arises as to how we can use the grid more effectively

Motoring on

Five considerations to improve the efficiency of motors in the oil and gas industry.

By Marek Lukaszczyk

By Marek Lukaszczyk

According to McKinsey, most oil and gas operators have not maximized the production potential of their assets and offshore platforms are, on average, running at only 77 per cent of maximum production potential. Industry-wide, this shortfall represents a whopping $200 billion in annual revenue. Optimizing

motor performance can contribute to more efficient and effective production processers in the oil and gas industry.

Energy efficient oil and gas processing begins with efficient facility design and this includes the choice of each piece of equipment in each individual process. More and more, we are seeing an increasing number of oil

12

and gas companies adopting a wider range of technologies that are helping them become more efficient and minimizing costs.

While efficiency improvements should be considered as a facilitywide strategy instead of limited to one individual asset, electric motors play a key role in the oil and gas production and distribution infrastructure. They are widely used to drive equipment such as pump and compressor systems and thus offer great potential for efficiency gains. Let’s explore five considerations to improve the efficiency of motors in the oil and gas industry.

High efficiency motor upgrades

Europe has over eight billion electric motors in use across industry, consuming approximately 63 per cent of the electricity generated across the continent. Many motors used in oil and gas applications are either low efficiency or not properly sized for the application. Incorrect sizing can significantly impact the efficiency of motor performance.

Similarly, older motors may have been rewound, reducing their efficiency. For this reason, a cost benefit analysis should be completed prior to rewinding to determine if purchasing a higher efficiency motor is economically advantageous. Hazardous area motors are now available with high efficiency ratings to IE3 or IE4.

Because energy consumption accounts for 96 per cent of the total life cycle cost of a motor, paying extra for a premium efficiency motor will result in return on investment over its lifespan. The recent introduction of stricter ecodesign requirements (EU 2019/1781) for electric motors has accelerated this trend.

Until 2021, some motors, including those designed for hazardous areas, were exempt from energy efficiency regulations. This is no longer the case under the current regulations. Additionally, these regulations also now apply to variable speed drives (VSDs). The legislative changes have impacted many industries, but sectors with high energy usage or using ATEX motors, such as the oil and gas industry, have seen the greatest transformation.

The new regulations replaced the regulation EC 640/2009 and have brought reductions in energy consumption related to motor use,

13 energy-oil-gas.com Motors

of safety. It is estimated that by 2030, this will deliver extra energy savings of ten TWh/yr and GHG emission reduction of three Mt CO2 equivalent annually.

Motor sizing

Significant improvement to motor design can be achieved, without substantially increased costs. However, the electric motor must always be properly dimensioned according to its real load. If a motor is oversized, with the actual load less than 50 per cent of the rated load, it will reduce efficiency and power factor values. For this reason, it’s important that efficiency and sizing considerations go hand in hand.

There may also be additional factors to bear in mind when choosing ATEX motors for oil and gas applications. As a result of safety requirements, explosion proof motors (Ex db, Ex dc) may face

as derating for VSD operation or reduced starting current. This may result in a larger frame size and additional considerations when retrofitting equipment with a need for motor interchangeability.

Installing a VSD or soft starter

Although very few oil and gas applications require 100 per cent flow continuously, many of the motors employed in these applications, such as pumping systems, are started at full speed and remain at full, fixed speed while in use. VSDs can effectively control rotating equipment and offer the best efficiency advantages in variable torque applications. In fact, according to the European Committee of Manufacturers of Electrical Machines and Power Electronics (CEMEP) a 20 per cent reduction in speed could lead to a 50 per cent reduction in energy.

14

To deliver the maximum energy saving potential, VSDs must be commissioned and installed correctly. This is where partnering with an expert like WEG really pays off. If the VSD hasn’t been properly configured this can impact the performance of the system. To maximize VSD reliability start by considering the application conditions and the required speed. Parameters usually have a ‘default’ setting which will probably be adequate for most applications. However, these should be checked and adjusted for optimum operation. Motors are often left to idle, which uses energy unnecessarily. This is where soft starters should be considered. As the name suggests, soft starters allow the motor to start the load more gradually by limiting the voltage to the motor and providing a reduced torque. In addition to reducing energy consumption, a reduced voltage soft starter helps protect the motor and connected equipment from damage by controlling the terminal voltage.

Digitalization and motor performance sensors

Correctly implemented data analytics systems and tools can overcome the operational complexity of oil and gas operations. By combining advanced engineering, the latest data science and computing power, there’s potential to make improvements across the board.

Instead of replacing conventional methods of operation, digitalization will supplement them. For example, to keep motors running optimally in oil and gas plants, managers can install retrofit sensors. With important metrics monitored in real-time, built-in predictive maintenance

analytics will identify future problems, preventing shutdown and potential safety concerns.

Correct maintenance practices

Regular maintenance should be carried out on the entire motor system. Performance will naturally decrease after prolonged heavy-duty use or the exposure to harsh conditions. Engineers should opt for products that can provide energy efficient operation in harsh oil and gas environments. Like many energy-intensive industries, the oil and gas sector is exploring new solutions to increase production and energy efficiency. As the sector continues to evolve, it will continue to rely on high efficiency technology as a reliable pillar in the wider energy efficiency drive. ■

For a list of the sources used in this article, please contact the editor.

Marek Lukaszczyk www.weg.net

Marek Lukaszczyk is European and Middle East marketing manager at WEG. Founded in 1961, WEG is a global electric-electronic equipment company, operating mainly in the capital goods sector with solutions in electric machines, automation and paints for several sectors, including infrastructure, steel, pulp and paper, oil and gas, mining, among many others.

WEG stands out in innovation by constantly developing solutions to meet the major trends in energy efficiency, renewable energy and electric mobility.

15 energy-oil-gas.com Motors

How to stay afloat

Why shipping is sink or swim for Scope 3 in oil and gas.

By Kris Fumberger

By Kris Fumberger

Reports from the IPCC and the International Energy Agency have dramatically raised the stakes for decarbonizing the oil and gas industry, imposing tough targets for transition to net zero by 2050. Investors have also piled on the pressure, with over 20 global investors last year outlining how companies must reduce and report emissions to qualify for inclusion in future net zero portfolios. Yet recent analysis reveals that the sector is on course to miss the 1.5°C mark by a significant margin, with the World Benchmarking Alliance predicting the top 100 oil and gas companies will overshoot the target by 2037.

This is worsened by the fact there is currently no sector-wide standard or best-practice methodology for

achieving net zero across the oil and gas industry. The Science-Based Targets initiative (SBTi) published a universal methodology for net zero in October 2021, while the independent Global Reporting Initiative (GRI) released a new sector standard for net zero emissions by 2023. Without a universal guide to decarbonization within scientifically advised limits, oil and gas companies are effectively left to chart their own course to net zero.

The hidden emissions in the industry’s wake

In the absence of universal standards, the oil and gas industry has instead adopted a widely varying array of individual approaches which do not necessarily cover the true scope and scale of their emissions.

16

One of the biggest challenges for oil and gas companies is accounting for Scope 3 supply chain emissions, including up and downstream shipping. This is despite the fact that Scope 3 emissions account for 88 percent of all oil and gas greenhouse gas emissions and that failure to curb supply chain CO2 could cause fossil fuel firms to miss net zero targets. Shipping emissions could soar 50 percent by 2050 which risks significantly increasing the carbon footprint of the oil and gas industry. Tankers largely powered by ‘dirty’ marine diesel and heavy fuel oil remain the primary mode of transport for intercontinental oil movement.

Pioneering oil and gas leaders are now using independent vessel selection criteria to analyze total supply chain shipping emissions and even predict future emissions

“ “

“ “

17 energy-oil-gas.com

Supply chain

Bringing transparency to shipping

It is a daunting task to calculate shipping related emissions, made exponentially more so due to diversification and globalization of supply chains. The industry is also falling behind on measuring as well as managing emissions. Ships have recently improved at digital data capture and communication but many are still failing to derive insights from that data, which could dramatically increase carbon accountability and energy efficiency across supply chains. Shipping lags behind many other industries such as automotive and aviation in adoption of technologies such as AI and data analytics. For example, there is no universal big data analytics framework for ship performance monitoring to improve operational energy efficiency.

Transparent, actionable data is critical to helping the oil and gas industry record and report as well as ultimately reduce its shipping related emissions. For example, RightShip has launched a digital platform that ranks ships on environmental performance by accurately assessing the relative energy efficiency and theoretical CO2 emissions of each ship relative

to vessels of a similar size and type. It even enables vessel companies to benchmark the performance of their fleet compared to the world fleet. Vessel owners can upload data such as recent energy-saving upgrades directly into the digital platform to create dynamic, data-driven GHG rankings. This data could ultimately be used to demonstrate compliance for bodies such as the SBTi, who introduced net zero standards and methodologies for oil and gas.

Transparent, data-driven vessel selection can give the oil and gas industry unprecedented visibility over their shipping related Scope 3 emissions and enable accurate carbon accounting for investors, governments and other stakeholders. Companies can benchmark annual progress towards net zero against equivalent vessels and even global fleets and accurately forecast future emissions. Independent vessel selection criteria, as part of a due diligence process, can also be used to select more energyefficient or even renewably powered vessel designs, driving decarbonization of supply chains at source.

18

Pioneering oil and gas leaders are now using independent vessel selection criteria to analyze total supply chain shipping emissions and even predict future emissions across everything from specific supply routes to ship and cargo types. This information can help to rank individual suppliers on carbon emissions, and to reveal and remove carbon-intensive logistics companies from the shipping supply chain. Independent carbon accounting can also facilitate more intelligent optimization of cargo loads, ship speeds and trade routes to cut CO2 emissions. Research has shown that distance is the main driver of shipping emissions and we have helped major logistics firms use voyage optimization to dramatically reduce CO2 output.

However, as well as reducing fuel usage, ships will ultimately need to match other transport sectors and switch to renewable fuels. Hydrogen-derived green ammonia offers a sustainable fuel of the future for shipping supply chains. Ammonia can be made with renewable power, water and air, does not need to be stored in pressurized tanks or cryogenic dewars and can power both fuel cells and

internal combustion engines. Australian mining giant Fortescue recently pledged to convert its entire fleet of 100 vessels to green ammonia within the decade as part of a drive to bring its Scope 3 emissions to net zero by 2040.

The voyage to net zero

The oil and gas industry is steeped in history, but this has also meant it remains mired in old operating models and systemic behaviors that are hard to shift. Yet, confronting and changing shipping related emissions will be pivotal to ensuring the oil and gas industry meets its net zero targets within scientifically advised timelines.

The key is to use independent vessel selection processes to bring greater transparency to shipping related emissions and inform data-driven solutions from changing routes and suppliers to transforming technology. This is the key to bring greater central visibility over emissions across fragmented, far-flung supply chains and accelerate the drive to net zero across the value chain. ■

For a list of the sources used in this article, please contact the editor.

Kris

Kris Fumberger is Head of Sustainability and Environment at RightShip. Established in 2001, RightShip is one of the world’s leading ESG focused digital maritime platforms, providing expertise in global safety, sustainability and social responsibility practices. Founded with the mission to drive operational improvements in the global shipping industry, more than 4,500 people use RightShip’s due diligence, environmental and inspections services to help them manage risk and improve overall maritime safety standards.

Fumberger www.rightship.com

19 energy-oil-gas.com Supply chain

BLUE SKY THINKING

Using autonomous drones to inspect pylons

By Kathryn Fairhurst

Building a net zero power system fit for the demands of tomorrow means innovating today – and at National Grid Electricity Transmission (NGET) we know that innovation and collaboration are the best way to tackle some of the biggest challenges in energy.

As the body responsible for building and maintaining the infrastructure to transmitclean electricity to homes and businesses across the country, we have a key role to play in Britain’s decarbonization journey. But it’s a journey we’re on together with industry.

Over the last year we’ve teamed up with 19 partner organizations on over a dozen NGETled innovation projects funded by Ofgem’s Network Innovation Allowance (NIA) and its new Strategic Innovation Fund (SIF).

One project is particularly eye-catching, and sees us working with deep tech startups Keen AI and sees.ai to boost our field operations by harnessing the latest in artificial intelligence and autonomous flight technology.

We’ve launched trials of a system which, using computer-manned drones, aims to fully automate the capture and processing of data that tells us what condition our pylons and overhead lines are in.

This is a job our field ops teams have traditionally carried out on foot or by helicopter, which is an enormous task. We own 21,900 steel lattice pylons that carry overhead transmission conductor wires across England and Wales, each of which needs a routine close-quarter health assessment to monitor for corrosion which can affect them over time.

There’s only a certain number of pylons our field teams can assess in a year – normally around 3650 – owing to limitations with our current methods.

For example, our expertly trained engineers can ascend the pylons to inspect them. That’s much safer today with modern climbing equipment and precautions we have in place, but it’s slow and not without risk. Our helicopters can help us cover a wider area, but do not allowus to inspect the pylons up close – not to mention being less carbon-efficient.

More recently we’ve used manually-flown drones. This has significantly enhanced our capability – allowing closer inspections without associated risk – but these drones are still resource-intensive, needing a team of pilots and spotters to keep them in sight at all times to ensure safe operation.

20

21 energy-oil-gas.com Technology

Autonomous drones could be a game-changer, and it’s why we’re so

a pool of inspectors. With the help of sees.ai’s autonomous drone inspection system, in our trial the data and imagery are automatically transmitted to an AI system –courtesy of Keen AI’s technology – which assess corrosion, proposes maintenance work, and can even predict the future state of a pylon.

It’s not only enabling the capture of data that’s optimal for automated processing; it’s also increasing the speed, efficiency and consistency of

Currently, images from our helicopter and manned-drone flights are processed manually by

The trial brings another advantage over manned drones. While the latter needs carrying to the site of the pylons being inspected – and then kept in sight while being flown – our project will enable a fleet of

22

overhead lines to a higher capacity, boosting existing network capacity without the need to build new infrastructure – meaning lower costs for consumers and more renewable generation able to connect to the grid faster.

We’re also working with the European Space Agency to harness satellite data to improve grid resilience, enhancing the emergency response capability of Britain’s networks to extreme weather events.

Collaboration is the key ingredient in all of these projects: now more than ever is the time for the energy industry to work together to innovate for net zero. ■

Kathryn Fairhurst www.nationalgrid.com

Kathryn Fairhurst, is Head of Engineering Services, National Grid Electricity Transmission. National Grid Electricity Transmission (ET) owns and maintains the high-voltage electricity transmission network in England and Wales. The company transports electricity through over 5000 miles of power lines and 300 substations en route to Britain’s homes and businesses, and invests £1.3 billion in the network each year to connect more renewables to help achieve net zero.

23 energy-oil-gas.com Technology

True alternative

How to increase the affordability of wind energy.

By Wouter Maas

By Wouter Maas

The global transition to renewable energy is crucial to realize a more sustainable future for people and the planet. In fact, renewable energy and energy efficiency measures could achieve up to 90 percent of the carbon reductions needed to minimize climate change, according to the International Renewable Energy Agency.

Countries and organizations are feverishly reviewing their options as they strive to reach important

24

environmental targets. This includes the ambition set at COP26 to keep a maximum of 1.5 degrees Celsius of warming within reach, and the pledge made by 30 firms in the FTSE100 to eliminate their carbon emissions by 2050.

As the world urgently looks for solutions, offshore wind provides a cleaner, safer, and more sustainable energy source. However, even with the best intentions, buyers have unavoidable commercial considerations, and the cost of wind energy needs to be made more affordable. Offshore wind has made

significant strides in terms of cost and is now competitive with conventional sources, however more efficiencies are still needed, particularly at more challenging sites further away from the shore.

The pressure is on global wind farm operators to bring down the Levelized Cost of Energy (LCOE) and provide a financially feasible alternative to fossil fuels.

LCOE: The holy grail in the offshore industry

LCOE is the ratio between total discounted lifetime cost and total discounted lifetime production. This metric is the holy grail in the offshore industry – relied upon by wind farm operators to demonstrate that they can provide the most cost-efficient solution in a highly competitive arena. Indeed, across the sector, asset

Wind energy 25 energy-oil-gas.com

managers are under huge pressure to deliver against LCOE targets and secure new contracts.

With LCOE, buyers can also get a more accurate comparison between the cost of renewables and the cost of more conventional energy sources such as coal and gas. For business decision-makers, it is the most important measure to determine whether it is commercially viable to invest in renewables.

There are, of course, many costs associated with wind projects across the entire asset life cycle – from site characterization through to the design phase, installation, maintenance, and decommissioning. Any efficiencies applied across the value chain can help to bring down the overall LCOE and support the global transition to wind power.

The role of structural health monitoring in reducing LCOE

There is a significant opportunity for structural health monitoring to extend the life cycle of wind farms and, subsequently, reduce the LCOE. In fact, our own analysis suggests that having a wind farm in operation for just one more year could generate more than €165 million in extra revenue to a 77-turbine wind farm.

By monitoring offshore wind turbines remotely with a set of specific sensors, an operator can identify and correct issues such as fatigue, corrosion and scour before they impact the asset’s integrity or performance. Furthermore, if energy prices are low on a turbine with a high fatigue loading, the operator can simply turn it off to reduce its fatigue consumption. This can help to make sure turbines function efficiently to the end of their life cycle and beyond.

26

Structural monitoring can also help to increase production as it helps to reduce unexpected breakdowns. Tasks such as restoring a corrosion protection system or securing a free-floating cable involve a considerable period planning, however preventative measures can increase the wind farm availability and minimize downtime. This is in addition to costing significantly less than corrective actions. Indeed, a one percent increase in availability could add more than €43 million of production to a 77-turbine wind farm.

Industry innovation

To reap maximum cost rewards, operators should be aiming for subsea inspections to be carried out less frequently. In fact, a shift from four-yearly to five-yearly inspections could reduce OPEX of a 700 MW offshore wind farm by €2.5 million over the asset lifetime.

New innovations are helping to make this a reality. Automated data delivery, for example, can provide real-time access to data and continuous remote monitoring of assets. This can provide early indications of fatigue or failure, helping to reduce the LCOE, enhance asset performance, minimize downtime and failures, and improve safety for wind farms. Overall, better access to realtime data will help operators and asset owners to make informed decisions and implement strategies based on the reality of the situation, versus relying on gut feel. This technological advancement will help to increase the speed from observation to action, improve operational efficiency, and reduce the frequency of subsea inspections.

Operators should also consider the long-term benefit of integrating all available GEO data – from site investigation to asset inspection and

monitoring – into a digital twin of their offshore asset. This will enable conditionbased and preventative maintenance strategies to be implemented on a per turbine basis, maximizing the total value of the asset, and speed, facilitating any decision-making process, and at the same time, extending its lifetime and its value.

Ultimately, structural monitoring combined with remote inspection solutions whether above or below water, will optimize maintenance and extend the wind turbine life cycle beyond 25 years, making it a priority activity for operators and asset owners alike. Those that look beyond daily operations and take steps to ensure the long-term structural health of their assets will unlock significant additional value –helping to decrease LCOE and win a competitive advantage in the market. ■

For a list of the sources used in this article, please contact the editor.

Wouter Maas

www.fugro.com

Wouter Maas is Strategy Director Offshore Wind O&M at Fugro, the world’s leading GEO data specialist. Adopting an integrated approach that incorporates acquisition and analysis of GEO data and related advice, Fugro provides solutions. With expertise in site characterization and asset integrity, clients are supported in the safe, sustainable and efficient design, construction and operation of their assets throughout the full lifecycle. Employing approximately 9000 people in 59 countries, Fugro serves clients around the globe.

Wind energy 27 energy-oil-gas.com

Power for tomorrow ?

The potential for small modular reactors (SMRs) in the future of nuclear energy

By Daniel Garton, Richard Hill, Andrew McDougall QC, Kirsten Odynski, Vit Stehlik and Dipen Sabharwal QC

TerraPower’s recent equity raise of $750 million shows how SMRs are gaining the attention of governments and power providers across the world. The champions of the SMR must work hard to ensure its full potential is reached.

Why SMRs hold such potential in nuclear power projects

Nuclear plants have a role to play in the energy transition. They have a small environmental footprint and keep air clean, requiring only a small amount of fuel compared to gas or coal while taking up a fraction of the space needed for wind and solar farms. In fact, a report published last August by the UN’s Commission for Europe, argued for the crucial role nuclear power can play in the transition to a clean energy future.

28

29 energy-oil-gas.com Nuclear

almost 70 different SMR technologies under development, a significant jump from just a couple of years ago. This is particularly pertinent in light of recent events in Ukraine. Many countries are taking a fresh look at energy independence, as opposed to relying on fossil fuels from neighboring nations. Nuclear power is one of the clearest avenues to secure energy independence and SMR technology will be one way in which to facilitate this for those looking to achieve autonomy.

The challenges at play

Regulation has long been a challenge in nuclear plant development, and this will likely be no different for SMRs. Licensing risk has been a difficult and controversial issue in nuclear power, and has driven significant attention from policy makers, the public and

environmentalists. The proliferation of nuclear plants envisaged by the widespread rollout of SMRs will be unlikely to avoid this scrutiny.

In tandem, the industry must overcome previous generations’ perceptions of nuclear power, in particular that the projects are too costly and complex. This is especially true when compared to both traditional fossil-fuel power generation and the breakneck rollout of renewables.

There is also the issue of waste. NuScale says that because SMRs contain less radioactive material and can be located below ground, their risks are lower. However, this point of view has received criticism from some experts.

There is currently no guarantee that SMR producers will not face the same obstacles that have plagued

30

developers of traditional nuclear power. It will also be a challenge to convince industrial users that it can compete with low-cost natural gas or proven renewables such as wind and solar. And the nature of SMRs mean they will have to be built close to the communities they serve, raising new challenges for public engagement, especially around the waste problem.

The introduction of a new generation of nuclear power will undoubtedly lead to legal and commercial disputes. The intense scrutiny from policymakers and the public will likely cause delays and conflicts. As will jockeying for position in a potentially more competitive nuclear industry marketplace. With first-of-a-kind designs, and potentially new and less experienced players entering the market, comes increased risk of regulatory issues, time lags, cost barriers and general conflicts. It’s vital to understand the nuclear regulatory framework and the nature of risks that commonly arise concerning the nuclear projects, in order to navigate these issues and minimize their impact.

Unlocking SMRs full potential

The SMR has widespread support, from politicians to global companies. The technology’s offering is compelling: carbon-free power that’s reliable, safe, more affordable and can be built and deployed without the significant costs and complexity of traditional nuclear power.

In a world where investment decisions are increasingly measured against climate impact and compatibility with the Paris climate goals, the SMR offers a solution

without many of the drawbacks that have hindered its larger predecessors.

As with all new technologies, there are of course challenges to overcome, and with nuclear power specifically, these can be expensive and protracted. The champions of the SMR will have to work with all stakeholders, from governments and investors to the wider public, to ensure its potential can be fully unlocked. ■

www.whitecase.com

31 energy-oil-gas.com Nuclear

Daniel Garton, Richard Hill, Andrew McDougall QC, Kirsten Odynski, Vit Stehlik and Dipen Sabharwal QC are partners at law firm White & Case. White & Case is a leading global law firm with lawyers in 45 offices in 31 countries. Among the first US-based law firms to establish a truly global presence, it provides counsel and representation in virtually every area of law that affects cross-border business. Its clients value both the breadth of its global footprint and the depth of its US, English, and local law capabilities.

Daniel Garton, Richard Hill, Andrew McDougall QC, Kirsten Odynski, Vit Stehlik and Dipen Sabharwal QC

For a list of the sources used in this article, please contact the editor.

Andrew McDougall QC

Richard Hill

Daniel Garton

Kirsten Odynski Vit Stehlik Dipen Sabharwal QC

Crucial contract

Saipem has been awarded a contract by Qatargas worth approximately $4.5 billion. The project encompasses two offshore gas compression complexes in Qatar, and represents the largest single offshore contract by total value in the company’s history.

The scope of work covers the engineering, procurement, fabrication and installation of two offshore natural gas compression complexes aimed at sustaining the production of the North Field, including two of the largest fixed steel jacket compression platforms ever built, flare platforms, interconnecting bridges, living quarters and interface modules.

Saipem will leverage its own assets and competences in offshore engineering, installation and fabrication, as well as its capability to maximize local content. With this contract, Saipem accelerates its strategic repositioning in the offshore segments.

Reliable emissions reduction

Utonomy, the developer of patented hardware and AI technology that optimizes pressure in the gas network, has been awarded a $150k contract by US-based GTI Energy to assess the potential of its technology to reduce methane emissions across North American utility networks.

The project will see Utonomy adapt its technology to control US gas regulator types and carry out testing at a flow laboratory in North America. This follows a successful technical review and evaluation of the

Progressive partnership

Glacier Energy, experts in the design and manufacture of large, high pressure and high temperature pressure vessels, has been awarded funding in partnership with Robert Gordon University (RGU) from Interface through the Scottish Funding Council (SFC), to work in collaboration on a new hydrogen project.

The project will conduct a feasibility study on affordable and portable hydrogen storage pressure vessels. Glacier Energy and RGU will work in collaboration to provide a lightweight, cost-effective, safe and scalable hydrogen storage pressure vessel.

Andy Scott, Heat Transfer Director at Glacier Energy highlights: “This is a major step to support our strategic diversification into the renewable market. We are applying our extensive expertise from oil and gas projects to support renewable energy scopes as we move towards a zero-carbon future.”

Utonomy Smart Regulator by GTI Energy last year. Assuming the flow laboratory tests are successful, the next phase of the project will be North American utility field trials.

The capability to reduce methane leakage is now a major legislative agenda issue across the US following the publication of its Methane Emissions and Reduction Plan in November 2021. As Dennis Jarnecke, Research & Development Director at GTI Energy, explains: “GTI Energy brings partners together to find the optimal tools and insights for gas operations to maintain a safe and reliable infrastructure.”

Utonomy CEO, Adam Kingdon, reiterates: “Using smart, AI-based solutions will provide network operators with cost-effective tools to target leakage reduction, helping support national and international emissions reduction targets.”

32

Go with the flow

Flogas Britain, one of the UK’s leading LPG suppliers, announces that it has been granted planning permission to construct a gas pipeline from Bristol Port into the nation’s largest above ground LPG storage terminal, at Avonmouth, near Bristol.

Once complete, the pipeline will link the UK to a diverse, global supply of off-grid gas, providing security of supply and enhancing affordability for off-grid commercial and residential customers.

The pipeline will also have the capability to import Bio-LPG, which is a fully renewable green gas alternative. Additionally, it will provide access to emerging sources of renewable fuels, helping to further future-proof Britain’s supply of low carbon off-grid fuels.

Running safely underground and out of site, the twin-pipeline will vastly increase the

availability of LPG and Bio-LPG, enabling up to 20,000 tons of commodity to be safely and securely discharged from a ship in 24 hours.

Lee Gannon, Flogas Britain’s Managing Director explains: “The next phase of design is currently underway and with completion of construction potentially as early as 2025, we will soon have locked in a direct link between our storage facility and world supply of existing and upcoming carbon free fuels.”

energy-oil-gas.com 33 Industry News

Smooth shipping

In 1961, Clifford Mallory and Otto Glander founded CD Mallory & Co. in New York, building on a six-generation heritage of ship ownership and brokerage. Upon Mallory’s retirement in 1980, the company rebranded as Glander International – and it was under that name that the company established itself on the US bunkering scene, contributing to the development of the world scale system – a method of calculating the payment rate for freight still used by shipowners and charterers today.

Glander International relocated to Florida in 1991. It spent two decades there before, in 2013, the company merged with Dubaibased International Bunkering Middle East. The move precipitated a series of expansions for what then

became Glander International Bunkering. Now one of the world’s leading trading and brokerage firms within the bunker industry, the company boasts a total of nine global offices, employing approximately 100 members of staff. More than 60 years after that first founding, Carsten Ladekjær, CEO of Glander International Bunkering, sat down to discuss the company’s successful past, and ambitious future, with Energy, Oil & Gas. Glander Bunkering International’s role, in Carsten’s own words, is “to facilitate and enable the smooth movement of goods across the globe.” Amid a critical period for supply chains worldwide, it’s a responsibility that’s more vital than ever.

With the maritime industry in the grip of volatility, Glander International Bunkering is coming to the fore

Exclusive Feature 36

International Bunkering energy-oil-gas.com 37

Carsten Ladekjær, CEO of Glander International Bunkering

Glander

“There are several facets and factors that affect the energy supply chain, and we consider ourselves partners to shipowners, charterers, and energy suppliers, every step of the way,” Carsten elaborates. “How do we do that? We offer a competitive supply of all grades of marine fuel and lubricants worldwide. Our professional and responsive teams are placed strategically in nine different cities to assist the global maritime trade. This encompasses everything from planning, procurement, supply, and post-fixture services of bunkers and marine lubricants.”

As a responsible legal counterpart, Glander International Bunkering also secures flexible terms and conditions for its clients. “The sea accounts for

approximately 90 percent of global trade, so we see it as our responsibility to use our expertise to make it easier for our clients,” Carsten points out. “We provide tailored project solutions and contracts based on special requirements, in addition to spot sales, risk management, claims mitigation, and resolution. Our commercial and technical advisors can also provide guidance, fuel management, and post-fixture operational services.”

The shipping sector has demonstrated considerable resilience throughout the last few years, and unlike many sectors – such as aviation – escaped Covid-19 relatively unscathed. But it did pose challenges. As Carsten notes: “the ones hit worst

Exclusive Feature 38

in our industry, without a doubt, were all the brave seafarers who were forced to endure excessive tenures at sea without crew changes. It was a historic time period that defined new heroes in the world.”

Nor is the disruption over. The Russian invasion of Ukraine earlier this year has triggered a febrile political situation, causing ripple-effects for both shipping and bunkering across the continent, following the imposition of fresh sanctions and further supply chain disruption. A steep increase in the price of oil, coupled with supply premiums, have also precipitated a squeeze within bunker markets.

“We’re impacted along with everyone else,” Carsten notes. “We

have to adhere to these changes and help our customers navigate safely through these uncertain times by enabling them to move legal cargo smoothly from A to B. Fortunately, our financial results continue to be strong, so we are well positioned to weather any potential economic storms and rough seas ahead.”

Turning to the long term, Glander International Bunkering’s sights are firmly set on a completely different challenge: decarbonization. While emissions within the sector have grown since 2008, the carbon intensity of shipping has nevertheless shown a marked improvement in recent years, due in part to the introduction of more modern vehicles. A reduction of emissions by at least

“ “

Our organization is working closely with various partners enabling us to supply LNG, biofuels, and carbon certificates

“ “ energy-oil-gas.com 39 Glander International Bunkering

50 percent by 2050 is now the target for many industry players, including shipyards, engine manufacturers, and energy companies, as part of a long-term ambition of realizing commercially viable net zero maritime transportation.

In an effort to underline its own status as a reliable, ESGdriven partner, 2021 saw Glander International Bunkering extend its partnership with ECOUREA, a full-service solutions provider to businesses wishing to preserve the environment and maintain sustainability emission compliance. Under the terms of the new agreement, Glander International Bunkering will provide shipping companies with a complete emissions control package, from the system design to the supply of Marine Urea (AUS40) – a product that neutralizes marine fuel NOx, reducing emission levels by up to 98 percent.

“Apart from offering Urea as a NOx reduction agent, we are assisting customers from all over the world with other innovative solutions,” Carsten comments. “Our organization is working closely with various partners enabling us to supply LNG, biofuels, and carbon certificates. Naturally, we are also looking into the more long-term fuels such as ammonia and methanol, and we strive to be able to provide these as and when the market is ready, and the framework is in place.”

The company has also acted to cement its own credentials as a responsible business. “We want to contribute positively to local societies, not only where our business operations are represented – but also in other countries that need our

support,” Carsten insists. “As a result, we’ve been involved in numerous CSR projects over the years, several of them on a long-term basis. We’ve also taken measures to reduce our carbon footprint in our offices and operations, and we’ve implemented one of the most advanced and comprehensive compliance systems and procedures known in our industry.”

“As of August this year, we’re also granting employees worldwide a 20week paid parental leave – this applies to both mothers and fathers,” he adds. “We’ve also established a new important position in our company, the Wellbeing Manager, whose role

Exclusive Feature

“ “ “ “ 40

We offer a competitive supply of all grades of marine fuel and lubricants worldwide

is to make people the priority. This is more complex that it sounds –because it emphasizes emotional, physical and mental wellbeing. Our Wellbeing Manager is a former emergency room nurse who brings a high level of emotional intelligence to her role.

“It’s initiatives like these that help inject the concept of ESG into our corporate culture and day to day life,” Carsten notes. “Motivating our staff is an ongoing task, and we will never cease improving our efforts towards being an attractive workplace.”

Before we conclude, Carsten is keen to emphasize the importance of the employees who make up Glander

International Bunkering. “After 27 years in the shipping industry, I still feel privileged to work with so many fantastic people,” he tells us. “This is truly a fast-paced global industry where the people and the professional relations between them make up all the magic. In my view, that’s never going to change.” ■ www.gibunkering.com

energy-oil-gas.com 41 Glander International Bunkering

Enabling energy flows

Recently acquired by bulk liquid specialist, Rubis Terminal, TEPSA is now targeting a new era of efficient logistics solutions

Bulk liquid storage company, TEPSA, began its operation in 1964 in Barcelona, working from the 7200-cubic-meter terminal on the port’s old Contradique Quay. From there, operations accelerated. The year 1966 saw the inauguration of the first Valencia terminal, located on the Turia Quay, also with a capacity of 7200 cubic meters. The 7500-cubic-meter Santurce terminal, situated in the northern city of Bilbao, followed in 1968.

Throughout the ensuing decades, TEPSA has continued working to become a strategic ally for its clients, through effective, flexible, and highquality service. To-date, the company

boasts more than 900,000 cubic meters dedicated to petroleum products, chemicals, biofuels, and foodstuffs, spread across four terminals, located in the main ports on the Iberian Peninsula, following the addition of its Tarragona terminal in 1986.

But TEPSA isn’t done making history. One of the most significant milestones in more than half a century of the company’s operation arrived in the fourth quarter of 2020, upon TEPSA’s acquisition by Rubis Terminal Infra SAS (Rubis Terminal), a specialist in the storage and handling of bulk liquids and gases, such as chemicals, fertilizers, biofuels, and fuels that are fundamental to the economy.

42

Exclusive feature

energy-oil-gas.com 43 TEPSA

Headquartered in Paris, France, Rubis Terminal is jointly owned and controlled by Rubis SCA and Cube Storage Europe HoldCo Ltd, managed by I Squared Capital.

As Nuria Blasco, Managing Director at TEPSA explains, the acquisition makes Rubis Terminal a stronger, more diversified group. “From the first day, it’s been evident that the two companies shared a similar culture, and a willingness to improve and grow together,” she says. “It’s a move that allows Rubis Terminal to take advantage of a growing Spanish biofuel market, thanks in large part to ample feedstock availability, mainly due to an oversupply of animal fats.

“This creates an opportunity for liquid storage providers with the operational knowhow and expertise,” Nuria notes. “We are the clear biofuel leader in Spain, thanks to locations close to key producing areas and

refineries, multimodal connections, and vertical integration, with the ability to handle raw feedstocks arriving by vessel, send them to production plants and receive them back for storage and onward distribution to the end customer.”

Sustainable storage

Bolstered by the addition of TEPSA’s four sites within Spain, Rubis Terminal boasts a footprint that spans continental Europe. The company operates a total of nine terminals in France, where it is the leading independent liquid bulk storage operator. Further terminals in Antwerp and Rotterdam in the Netherlands placed the company at the heart of northwestern Europe’s product trading hub.

“Our Antwerp and Rotterdam terminals were built according to the latest construction standards to limit environmental impact,

44

Exclusive feature

including best-in-class Net Zero direct emission facilities,” Nuria notes. “The conversion of our Rotterdam terminal from fossil-fuel to biodiesel illustrates the flexibility of our assets: we are emptying, cleaning the tanks, and modifying the connections to safely receive and store biodiesel – a shift that is also taking place at terminals in Spain. Moreover, with storage in our Netherlands facilities comprised entirely of chemicals and biofuels, we have ensured that our terminals are ready for the future of liquid bulk storage.”

A core value for both TEPSA and Rubis Terminal’s shared vision is a commitment to connecting industries with people through safe storage solutions. “When I look back over the past five years, I realize we have implemented innumerable small initiatives in terms of sustainability and CSR,” Nuria reflects. “We’ve increased energy efficiency with LED lighting; installed more efficient pumps and better insulation in tanks; introduced biofeedstock storage to help our clients make the green transition; promoted gender equality and employee welfare, and actively supported charitable initiatives. Some actions were small, some were extremely substantial, but none

was inconsequential. In terms of CSR and sustainability, every grain of sand, every action, no matter how small, is important.

“Today’s market is changing, and we are adapting again, contributing to the sustainability transition as an enabler of new energy flows,” she goes on. “Rubis Terminal has more than 200 contracts throughout its portfolio. Each one of these serves as an essential link in the logistics chains of fuel and biofuel companies, chemical groups, agricultural cooperatives, refiners, distributors, and traders, by storing local and imported products. We also provide services such as blending, additivation, and markering, and ensure a bulk transport connection as close as possible to the product’s destination.”

As Nuria is keen to emphasize, all industries have a role to play in the energy transition, and the storage of bulk liquid products is no exception. An uptick in demand for sustainable fuels and chemicals worldwide is contributing to significant market growth, resulting in an increasing need for storage.

“A global consensus is also emerging regarding the key role to be played by hydrogen in the energy transition, with

energy-oil-gas.com 45 TEPSA

prototypes now under development,” Nuria points out. “Supply chains need to be prepared to meet exponential demand growth once these technologies scale up. Rubis Terminal is already participating in the strengthening of the French hydrogen ecosystem, as part of the Elemanta H2 project framework, developed by Sofresid, which aims to accelerate the energy transition in maritime and river transport, in particular in the port of Rouen.”

People, planet, profit

As it continues to work towards the energy transition, Rubis Terminal has set out its Triple Bottom Line Roadmap under three headings: People, Planet, Profit. “Our success depends on the skill and dedication of our people,” Nuria insists. “We have strong ethical, social, and environmental values, and we empower the women and men who work in our company to uphold and promote them. Our corporate culture emphasizes diversity, innovation, and efficiency, and we invest in the growth of our teams through training. In an industry

historically dominated by men, we are committed to achieving greater genderbalance in the workplace. Today, 25 percent of members of our General Management Committee are women, and we have a goal to increase this percentage in the near future.

“At the same time, ‘Planet’ signals our commitment to the use of natural resources, and to protect, in a broader manner, the environment in which we work,” she elaborates. “The diversification of Rubis Terminal’s product mix towards non-fuel products has led to an increase in the energy consumption of our terminals since chemicals require more heating during storage than traditional fuels. Our objective is now to optimize our energy consumption, thereby reducing our environmental impact, all while meeting the changing needs of our clients. For example, we’re already utilizing steam produced in chemicals handling to heat up tanks and office buildings at our Rotterdam terminal.”

In 2021, TEPSA Barcelona increased its by train transit by an impressive 50 percent. It’s an indication of the company’s alignment

46

Exclusive feature

with the vision of Rubis Terminal, and TEPSA’s commitment to becoming more efficient and sustainable in its logistics, a growing concern among clients.

“We have set ambitious decarbonization objectives for 2025 and 2030, and we’re refining our trajectory with a thorough review of our assets and operations to reach our sustainability goals,” Nuria adds. “We’re currently developing projects and strategies aligned with our decarbonization trajectory that will have an impact across all scopes, including investments in pipe heating system controls, land use, and knowledge sharing between our Rotterdam and Antwerp Zero Emissions terminals. We’re also set to further diversify our product mix, and engaging our stakeholders where possible in the development of

aim to operate at a sustainable level of profitability to ensure we continue to invest in innovation, decarbonize our activities and contribute to the transition to net zero while upholding the highest standards of safety and efficiency. While providing a vital link in the value chains for energy, chemicals, and agri-food, we work to ensure prosperity for all our stakeholders.

“Looking ahead to next year, huge uncertainty remains,” Nuria concludes. “There is a potential for recession on the horizon; our challenge is to help our clients as best we can by remaining flexible. While we have historically supported the storage, shipping, and transportation of fossil fuel products to end consumers, we have successfully diversified our product mix and reduced the share of fossil fuels, which

TEPSA

Uncapped potential

Why the fast-growing Capstone Infrastructure Corporation is looking west to expand its renewable energy portfolio

48

It has been a momentous year for Capstone Infrastructure Corporation (Capstone) since we last spoke with CEO David Eva in 2021. Founded in 2004, the Canadian developer, owner, and operator of clean and renewable energy facilities has made short work of investing in and operating clean power businesses, such as wind, solar, hydro, biomass, and natural gas co-generation power plants. Subsequently, Capstone has become a reputable name in

the Canadian energy industry, pioneering the drive for greener energy usage.

During our last discussion, we covered the development of the 132 MWac Claresholm Solar Project – as of 2021, Canada’s largest solar facility – which achieved commercial operation and is successfully producing clean power. “Just over half of Claresholm’s generation capacity is contracted by TC Energy, but certainly, the plant has been running well in a period of robust merchant

construction-today.com 49

Capstone Infrastructure Corporation

pricing in Alberta,” David reveals. He highlights how the company has also secured purchase agreements with Keyera Corporation, Pembina Pipeline Corporation, and the City of Edmonton, which is the largest direct procurement of renewables by a Canadian municipality to date. The purchase agreements allowed Capstone to accelerate the development of over 300 MW of new wind and solar projects in Alberta,

with the Michichi, Kneehill, and Buffalo Atlee projects already in construction, and the 192 MW Wild Rose 2 wind farm following closely behind.

“Alberta is known as the birthplace of wind energy in Canada,” David says. “The province supports the only open electricity market in the country, providing opportunity for corporations to reduce their carbon footprints by purchasing emissions-

Above: Claresholm Solar Project, Alberta

Above: Claresholm Solar Project, Alberta

50

free electricity and carbon offsets directly from renewable power producers. Further, by taking advantage of Alberta’s world-class wind and solar resources and capturing those resources with modern wind turbines and solar PV modules, we are able to provide our customers with exceptionally competitive and reliable solutions to achieve their decarbonization goals,” he notes, adding that the area continues to be a significant market for the company.

Building from its success in Canada, Capstone is now entering the US market, exploring more opportunities in California, which is looking to be just as promising. “When we began this journey, we saw great potential in Alberta, but we have seen similarities regarding market demand and growth in California, where there is an exceptional amount of support for renewable energy. Another advantage is the stability of

Capstone Infrastructure Corporation

Astroenergy

The Astronergy panels supplied for this Claresholm Solar Project is ASTRO Series; a reinforced bifacial module with double glass. Enhanced with excellent encapsulation structure and strengthened frame, this type is specially designed for severe hail (45mm, 30.7m/s), and unfriendly environments with high reliability requirements. The module has passed severe damp and heat 2000 hours, thermal cycle 600 and PID 300 tests, which were verified and approved by CSA certificate-C450 and PVEL certificate-PQP.

Astronergy is proud of the delivery of ASTRO series PV panels for Claresholm Solar Project, and has a very good cooperation experience with Capstone Infrastructure. The quality policy of Astronergy is to create a world-famous brand and to provide lasting, quality products and solutions for customers.

To find out more visit www.astro-energy.com/en

construction-today.com 51

The Skyway 8 Wind Farm is a 9.48 megawatt (MW) wind energy project near Southgate, Ontario

The Skyway 8 Wind Farm is a 9.48 megawatt (MW) wind energy project near Southgate, Ontario

I am pleased to share that despite the obstacles of the last two years, the demand for renewable energy continues to grow and Capstone continues to deliver in a challenging environment 52

“ “ “ “

the regulatory regime in the state, which will help further encourage a dynamic market.”

To this end, Capstone recently announced a new joint venture with Eurowind Energy, a Danish renewable energy company, to advance several of the projects in its California development pipeline.

“Several years ago, we also added energy storage projects to our development efforts, which is where we see the next major opportunity in our business. With the extensive growth of wind and solar, and the long-term need to further decarbonize our power grid, as an industry, we must address the need to have power available when customers need it – and do so with non-emitting sources. For example, energy storage allows us to capture excess energy when wind is blowing and the sun is shining, and then re-inject that electricity into the grid when it’s required. That is a big part of

Capstone Infrastructure Corporation

BIrd Construction Your partner for a sustainable future

As one of Canada’s leading construction companies, with operations coast-to-coast, Bird Construction (Bird) provides a comprehensive range of construction services to all of Canada’s major markets.

Bird’s collaborative culture and innovative, solutions-focused approach, helps our clients meet their sustainability goals. Drawing from our 100-year history and multi-disciplinary expertise, Bird delivers deep carbon retrofits and sustainable building construction, as well as self-perform services for renewable power, low-carbon energy, carbon innovation, energy efficiency and small modular reactors.

There’s a roll for all of us to play in decarbonization, let Bird be your partner of choice

construction-today.com 53

our strategy in California, and we are starting to take some of the successes we are seeing there and apply them in places like Alberta and Ontario.”

With more than 110 MW of construction projects underway, and 192 MW Wild Rose 2 project planned for 2023, Capstone stands in good stead to achieve its goal of a total installed capacity of 1 GW. “We are very pleased with the level of progress we’re making, and I am particularly proud of our team for making this possible,” David adds.

“Alongside Alberta and California, we are also very active in Ontario with multiple energy storage development projects in the province currently underway,” David notes. “What we are seeing is a big push towards capacity projects that are either dispatchable, have generation, or have storage potential. In addition, over the next five years, we expect to expand into several additional markets in North America.”

Being able to make impressive ground so quickly has not been

Above and left: First panels installed at the Michichi Solar Project, Alberta

54

an easy journey. However, considering the challenges inflicted by the pandemic, David is proud of the efforts the business has implemented to remain a leader in the energy industry. “We have been in this sector for a long time, and our projects can take years to complete. Fortunately, in some instances, they can move quicker than anticipated, and I am pleased to share that despite the obstacles of the last two years, the demand for renewable energy continues to grow and Capstone continues to deliver in a challenging environment.”

Taking this strategy forward, David highlights that the near future will be focused on the completion of current projects, as well as continuing to drive forward development efforts, with a focus on looking after supplier relationships. “There is an urgency for businesses to establish themselves as leaders in their sectors, and demonstrate they can overcome the challenges within the industry as best as possible. This is why it is crucial for

Capstone to maintain strong supplier relationships, and invest time in developing our networks to ensure that our quality is not neglected. This will ultimately be our strategy over the next five years as we strive to become a multi-gigawatt North American player in renewable energy, and energy storage.”

Beyond these plans, David is excited about the development of renewable energy and storage in markets that the business deems to be attractive, and is determined to maintain the business’ high level of innovation to meet the demands of its customers. “Whether this is through speed of execution, specific products on renewables, or continuing to conduct ourselves to the highest standards, we know that the years ahead will be even more prosperous than the ones before,” he concludes. “I am so proud to be part of this journey.” ■

www.capstoneinfrastructure.com

Above: CEO David Eva addresses stakeholders at the Michichi Solar Project, Alberta

Capstone Infrastructure Corporation construction-today.com 55

A transformed company

Have you met Calumet? Find out about one of the world’s leading specialty products manufacturers as it shifts its focus towards sustainable solutions

56

Calumet energy-oil-gas.com 57

In June, we featured renewable diesel producer Montana Renewables, the sustainably focused segment of the Calumet family. In this issue of Energy, Oil & Gas, we turn our attention to Calumet’s broader business, exploring its history, increasing emphasis on sustainability, and rapidly growing host of capabilities.

While many of its businesses are more than 100 years old, Calumet in its current form was founded in 1990 with the purchase of a Princeton, Louisiana-based naphthenic lubes facility. Since then, the company has transformed into a well-refined and profitable powerhouse within the specialty products business niche. Growth inevitably means progress, and with Calumet it is no different. The company has ventured out into new terrain over the last three decades, blazing trails in areas that naturally supplement its existing footprint.

This business has been built one customer, one product, and one asset at a time

“ “

58

“ “

Now one of the most highly integrated specialty products players in the industry, that growth mindset has undoubtedly paid dividends. Headquartered in Indianapolis, Indiana, Calumet operates in over 90 countries from ten integrated production and formulation facilities across the US and a host of distribution points. The company is split into three distinct segments: specialty products and solutions; performance brands; and, as mentioned previously, Montana Renewables, where Calumet is currently focused on converting a large part of its Great Falls facility into an innovative, renewable feedstock processing plant.

Across its businesses, Calumet finds solutions to sustain and enhance life’s essential products – from the tires on your car to the balm on your lips – and delivers them to medical and pharmaceutical, industrial, personal care, transportation, energy and

Innospec

Innospec is at the forefront of Renewable Diesel (RD) fuel additive technology supporting partners, like Calumet, working side-by-side on their Montana Renewables project. Innospec is the leading RD additive provider with over half of all RD currently being produced domestically treated with Innospec additives. Our product line is designed to meet our customers’ lubricity, conductivity, and cold temperature operability requirements for RD and RD / Biodiesel blends. We help ensure fuels leave the refinery on specification, and continue to benefit downstream customers that choose low-emission sustainable fuels. Contact our team today to find out how we can help you.

energy-oil-gas.com 59 Calumet

60

chemical, food and agriculture, and home and electronics markets.

Products include base oils, food grade white oils, solvents, esters, waxes, petrolatum, fuels, asphalts, finished lubricants, greases, horticultural spray oils, renewables, and gels. Base ingredients such as these find their way into familiar household items like ointments, baby oil, lubricants, paints, and candles. Calumet also owns high-end retail and industrial brands such as Royal Purple, TruFuel, Bel-Ray, and Orchex.