3 minute read

Life Extension

Overview

GEO satellites are designed for an operational life of up to 15 years, components have high reliability, consequently, fuel becomes the main limiting factor.

Advertisement

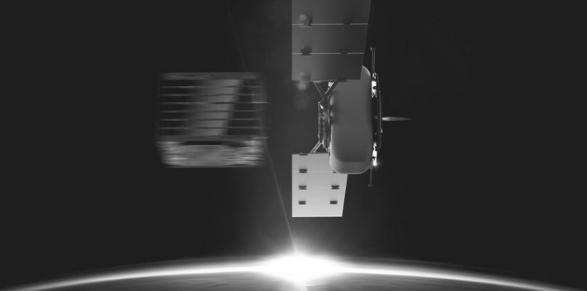

Life Extension (LE) refers to sending satellites to rendezvous with ageing satellites and extend their useful lifetimes so they can generate further revenues.

Additional activity may be to move the satellite to a graveyard orbit if an end of life regime has not been enacted in the original mission.

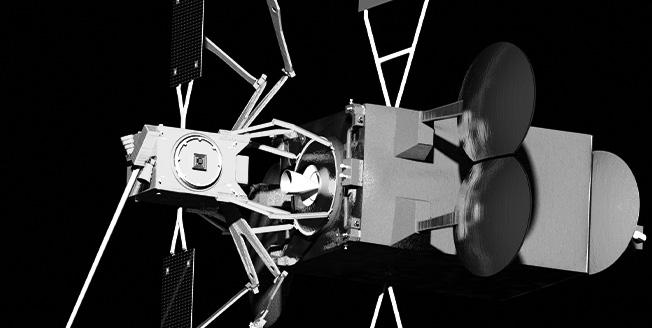

Several technical solutions are proposed to achieve this including docking with the client satellite to

Control various subsystems

Refuel the satellite The technical solution will vary by client satellite, either using a space tug or refuelling, but the value proposition and market are very similar.

The value proposition is dependent on the cost of satellite replacement and to a lesser extent, the added revenue from an additional operation period.

The largest market for LE is geostationary telecommunications satellites, though other satellites may benefit from LE.

Commercial companies are early adopters. Although government satellites, especially for security related communications, offer the main potential, especially once the technology is proven in the commercial sector.

Market drivers

GEO Telecommunication operators face some market uncertainty due to potential low-cost LEO constellations which may lead to delay in ordering new satellites and could make the extension of the life of older one’s satellites cost effective.

Satellites in the broadcast sector use mature technologies and are less likely than broadband satellites to adopt innovation. Providing an opportunity for Life Extension.

Broadband satellite operators may be delaying ordering new satellites until new technologies are developed, such as software defined radios and beamsteerable antennas.

Market barriers

Broadband satellite technology is advancing rapidly, with increasing demand for higher data rates. This means broadband satellite revenues decline after 5-7 years and new satellites are required. LE may be less commercially appealing for broadband satellites.

The declining use of chemical propulsion systems may reduce the need for refuelling missions, though electrification is still evolving and will take up to ten years to be widely adopted. Further, even all electric craft currently use a finite chemical fuel such as Xenon which may provide an opportunity for Life Extension.

Regulations regarding international missions have not been created. For current and planned missions, the client and servicing satellites are under only one national regulator, leading to variation in regulations.

The US Government may apply certain requirements to allow foreign organisations to dock with US registered satellites. NonUS corporations are in an inferior position to address the substantial budgets from NASA for the industry in the In-Space Services market

In Europe both ESA and UKSA make a clear distinction between civil and National Security projects, restricting cross fertilization of funds and R&D.

Market Scale

Data on satellites currently in orbit was taken from the Union for Concerned Scientists satellite database. An average lifespan of 14 years was assumed and the number of satellites reaching the end of life plotted. The database does not differentiate between the application of the satellite.

There may be a slight overestimation due to double counting of dual use commercial/ government satellites.

Total Accessible Market of 414 GEO satellites 2020-2035 (280 commercial, 134 government). From the graph on page 17, the number of GEO satellites reaching the end of life by 2030 is expected to be 33 satellites.

Any calculation of a Serviceable Available Market (SAM) should consider the application, propulsion system and owner of each satellite. While the immediate market is for GEO satellite life extension, other use cases such as MultiOrbit and Cross-Orbit services exist. Examples include the Firefly OTV launcher adapter with propulsion (case study below).

In GEO, there are several services beyond life-extension including - ‘Bringing-into-use’ of orbital slots, satellite relocation, deorbiting, inclination correction and orbit correction.

The first commercial Life Extension satellite was launched on 9th October 2019, Northrop Grumman’s MEV-1 will extend the life of 18-year-old Intelsat-901 for five years and has a contract costing $13 million per year.

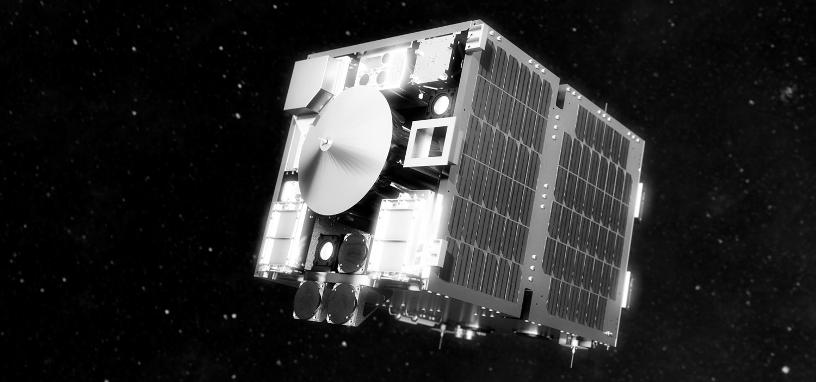

UK Capability

The UK is home to Effective Space Limited aiming to launch LE spacecraft in 2020. Their first contract, signed in 2017 with an international satellite operator, will see two Space Drone craft designed to extend the life of two existing satellites, and is expected to generate revenues of more than US$100 million.

Infinite Orbits, a company looking at providing life extension services, also has an office in the UK and is aiming for an In-Orbit-Rendezvous demonstration mission in 2020.

The UK also registers some geostationary satellites (e.g. Inmarsat and Avanti) potentially providing the expertise to enable the licensing of LE activities in UK.

Source: Satellite Applications Catapult