This report explores the current consumer behaviour challenges that Glossier faces, a beauty brand once popularised for its strong connections with its customers by catering perfectly to their wants and needs. The report identifies a thorough analysis of Glossier’s problem diagnosis which are linked to consumer behaviour theories such as The EngelBlackwell-Kollat model, self-image and perception, packaging theories to help explain why the brand is currently facing disconnect with its customer base in terms of its promotional tactics.

To validate findings from secondary sources, primary research was conducted, in the form of a survey. The survey revealed that although many respondents believe that Glossier is a high-quality and recommendable brand many still fail to purchase from the brand with 40% of respondents never having purchased from Glossier and all the respondents claim to not be loyal to the brand. The fact that nearly half go the respondents did not purchase Glossier products meant that many of the answers could have been wrongly answered as some required background knowledge into the brand that came from first-hand experience with Glossier. If the survey was repeated, an exit strategy should be created for those who have never purchased from Glossier to prevent this. This slight adjustment would aim to enhance the reliability and validity of the data, allowing for a more accurate understanding of Glossier’s consumers.

Secondary and primary resources helped to recommend for Glossier to have more of a connection with their Gen-Z customers through their store displays in retails shops such as Sephora. The brand should also aim to create more educational content in the form of captivating Instagram reels and TikTok’s for their Gen-Z customers. And lastly, to create an exclusivity atmosphere Glossier can launch limited edition campaigns that are unconventional to their brand assets to grab attention.

A 3-page data visualisation was also created to summarise the findings of the report with a marketing artefact that includes a mock-up to show an example of how Glossier can utilise their layout in Sephora to make it more attractive to Gen-Z. This was done through the suggestion of reintroducing Glossier’s partnership with Olivia Rodrigo.

In conclusion, Glossier’s current challenges are a combination of their brand perception and market dynamics. Glossier can regain its position in the industry if they align their marketing strategies to better suit their Gen-Z customers as their beauty preferences of soft and clean makeup align with the brands message.

Before launching Glossier in 2014, Emily Weiss started a beauty blog called "Into the Gloss" (ITG) in 2010 She wrote about the beauty routines of fashion influencers and celebrities like Karlie Kloss With her experience interning for Conde Nast and Vogue, Weiss saw a gap in the market between legacy brands and millennial customers She used her beauty insider knowledge to create a column called "Top Shelf," where readers could learn about celebrities' go-to skincare products. This column allowed readers to share their preferences and needs when shopping for products Through ITG, Weiss gained a deeper understanding of her target market When she launched Glossier, she could instantly connect with her customers because she knew what they wanted Glossier quickly became a brand "made by the people, for the people" (Waterson, 2020)

The official launch included four products: a moisturiser, face mist, skin tint, and lip balm. Glossier gained traction and became a sought-after brand. Customers eagerly waited for product launches and pop-up stores. However, Glossier's relevance declined in 2019 when they launched the "Play" line Despite customer demand, the line did not perform well, and the brand shut it down the following year (Segran, 2023) Since the launch of "Play," Glossier has lost its connection with customers (Edwards, 2023) The brand no longer engages with its consumer base like it did in its early days, when Glossier actively involved customers in decision-making processes and user-generated content

When it comes to Glossier's marketing mix, there are a few things to note Glossier's "downfall" cannot be attributed to just one element of the marketing mix Glossier has changed its marketing strategy, which may be connected to the current consumer problem This problem is specifically related to promotion, according to McCarthy's 1960 marketing mix model (McCarthy et al, 2011)

When Glossier first launched in 2014, they had a good understanding of the market and their customer base They utilized various social media channels, such as the ITG blog page, Facebook, Slack, and Reddit Each platform served a specific purpose: the blog for crowdsourcing product ideas, Facebook for feedback and discussions, Slack for direct communication with loyal customers, and Reddit for sharing collections and exchanging advice (Webflow, 2021 Brand communities “tend to be identified on the basis of commonality or identification among their members” (McAlexander et al, 2002, p 38) Glossier's channels allowed them to form a strong connection with their customer base, creating a tight-knit community. However, in recent years, the Glossier community has felt ignored by the brand as seen on its Instagram page comments (Sherryreviews, 2024).

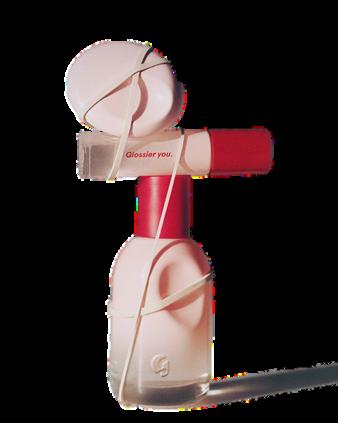

Glossier's millennial pink packaging has become synonymous with the brand. Customers used to look forward to receiving products because of the aesthetics. However, due to sustainability concerns, Glossier now offers the option to opt out of receiving secondary packaging, such as pink pouches, when placing an order (Barker, 2023 and Kotler, 2009, p 526) According to Kotler, packaging is split into three different forms which he calls primary, secondary and shipping packaging Glossiers primary packaging is its products such as the tube for the Balm DotCom or YOU (see figure 1) Secondary packaging would be the pink plastic pouches that Glossier is infamous for (figure 2) and lastly, shipping packaging is the cardboard box the products come inside of (figure 3). Consumers often judge primary packaging before purchasing and shipping packaging after purchasing (Bergendal and Welander, 2022, p.18). However, for Glossier's demographic, the shipping packaging is part of the shopping experience and brand identity Recently, Glossier customers have criticized the brand for being "boring and lacklustre” saying that the minimal packaging and advert styles do not work for the brand anymore (Reddit, 2022)

Part 1 identifies the consumer behaviour problem that Glossier currently faces This part aims to link the problem to some consumer behaviour theories to delve deeper and understand Glossier’s position. According to Michael Solomon's book Consumer Behaviour: buying, having and being (2019), consumer behaviour investigates the process customers go through when buying a product/service to satisfy their needs and wants. The Engel-Kollat-Blackwell model discovered in 1968 “is a consumer behaviour model of the cognitive process that helps to predict what customers are going to buy” (John, 2021). The model shown in Figure 4 consists of five different sections that costumers go through consciously and deliberately when faced with a buying decision For the case of Glossier, it is believed that potential/existing customers get “stuck “during the alternative evaluation phase; this may be due to several different factors one of which could be the fact that their “costumer base craved more newness” (Segran, 2023)

Glossier sells a wide variety of skincare and beauty products that are cruelty-free and aim to enhance the wearer ‘s natural beauty using lightweight formulas. Due to the rise of the “clean girl “aesthetic on TikTok, many brands have started to profit from this which has

left Glossier with many new competitors such as Rare Beauty, Rhode, Drunk Elephant, Glow Recipe, etc These brands provide a lot more options for consumers to choose from as they have a wider range of options beyond Glossier’s product line creating competition in the market that Glossier is unable to uphold. This all came down to the fact that Glossier’s message of promoting dewy and healthy skin became coined into the trend of “clean beauty” which meant that the brand did not stand out in its beauty sector anymore as ‘innovative’. The brands demographic, millennials, have also “aged-out” of the brand maturing in their tastes opting for different brands (Strugatrz, 2022).

Furthermore, Glossier may be losing customers to alternatives due to costumer dissatisfaction as a result of formula changes to their best-selling product the “Balm DotCom” (BDC). The company announced earlier this year that they are reformulating BDC to make it vegan and discontinuing the cherry flavour of the balm. This has left customers not only confused by the sudden change but also feeling very alienated from the brand as they are feeling unheard. Customers claim that the new formula is drying and does not last as long as the old one did. The brand has also come out with a newer version of their “YOU” fragrance that customers are not happy about with one stating “I love how every single post has ‘bring back the old formula As one customer noted: “I love how every single post has ‘bring back the old YOU formula’ but Glossier completely ignores them and comes out with new stuff!” (Edwards, 2023).

Self-image refers to how we perceive ourselves. It can be divided into two categories: ideal self and real self. The ideal self is who we aspire to be, while the real self is a more realistic version of who we are (Solomon, 2019, p 199) Glossier's current relationship with its consumers is incongruent. Incongruence occurs when a brand's identity does not align with its target market Although Glossier initially targeted millennial women, its consistent branding and failure to evolve has resulted in a stagnant image. While consistency is generally seen as a positive quality in consumer products, Glossier's reliance on its millennial pink colour palette has made it appear outdated. The brand's consistent messaging over the years has caused it to lose touch with its demographic, leading to feelings of disconnect among its initial loyal customers

As the beauty industry evolves, constant innovation is necessary to meet changing consumer demands Glossier's struggle to introduce new and diverse products that align with market demand has resulted in lost sales and potential customers exploring alternatives like Fenty Beauty However, it's worth noting that Glossier has introduced new lines and products, such as their Play line launched in 2019. Play aimed to address customer concerns with a colourful and eccentric makeup line However, the line was discontinued due to a lack of connection with the market and the Glossier brand (Sharp, 2021).

Figure 5 (Instagram, 2023)

) Glossier customers are typically more interested in lightweight, minimal to no makeup looks, rather than the full-face, glittery aesthetic offered by the Play line. This further highlights the incongruence between Glossier and its demographic The swift downfall of Play suggests a gap between customer preferences and Glossier, which was not evident when Glossier first launched.

Lastly, Glossier's packaging has been used as a promotional tactic for the brand rather than as physical evidence. According to Hasan (2022), packaging plays an important role in influencing product perceptions, particularly in low-involvement purchase decisions. The use of pouches served as a marketing ploy when the brand first started out, helping to influence potential customers to buy Glossier products This strategy has been particularly successful because skincare products are considered low-involvement, as most consumers have previous experience purchasing skincare products (MarketMarke, N D)

Consumer Behaviour: the attitudes that consumers have towards Glossier and the beauty industry

Brand perception and attachment: investigate customers views on Glossier’s identity and products and emotional connection towards them

Market trends and competitor analysis: the analysis of current beauty trends and competitors

Customer satisfaction: how content customers are with Glossier

Conclusions from the literature review have led to he creation of a survey consisting of 24 questions hat analyse the 4 consumer variables listed above. he survey mainly included Likert questions and ome written answer ones; it was created this way to nsure that respondents did not become bored as me went on (Kantar, 2020) It was also a short urvey that lasted around 5-10 minutes for the same eason. The survey was distributed through various ormats: social media, email and to friends and amily through convenience sampling (Saunders et al, 019) Convenience sampling involves the esearcher using participants that were easiest to btain for their sample or in this case the

-participants decided to self-select themselves onto the study voluntarily when seeing it posted on social media. The questions asked in the survey are as follows (see appendix for a copy of the survey):

-What type of beauty products do you frequently purchase? (Select all that apply)

-Where do you prefer to shop for beauty products?

-How much do current beauty trends influence your decision to purchase certain beauty products?

Are you loyal to Glossier, or do you like to try products from different brands?

-Please rank the following factors based on their importance to you when shopping for new beauty products. 1 being the most important and 5 the least important.

-I am emotionally connected to Glossier.

-I believe Glossier offers high-quality beauty products

-I believe that Glossier's brand values align with my personal values.

-Glossier remains relevant to my beauty needs and preferences

-I would recommend Glossier products to friends and family

-Describe in a few words the overall impression that comes to your mind when you think about Glossier

-I am well informed of current beauty trends in the market

-Please list any brands that you consider direct competitors to Glossier.

-In certain instances, do you prefer products from Glossier's competitors over Glossier?

-It is important for Glossier to differentiate itself from competitors in terms of product offerings and branding

-I believe Glossier's competitors have a notable influence on the overall beauty market

-I believe that customer feedback has a meaningful impact on changes to Glossier's products

-I believe that customer feedback significantly influences the decisions made by Glossier

-I believe Glossier actively learns from customer experiences to enhance its products

-What aspects of Glossier's products or services do you believe could be improved based on your experiences as a customer?

-How likely are you to continue purchasing Glossier products in the future?

The survey targeted people aged 18-24 who regularly use social media and are aware of current trends. This is because trends like the "clean girl" originated on TikTok and have been embraced by Gen Z consumers. To understand their attitudes and shopping behaviours, it is important to thoroughly examine Gen Z as Glossier explores potential growth opportunities. Gen Z has reported a 13% increase in preference for light coverage products for daily use (Pitt, 2022).

The survey targeted people aged 18-24 who regularly use social media and are aware of current trends. This is because trends like the "clean girl" originated on TikTok and have been embraced by Gen Z consumers To understand their attitudes and shopping behaviours, it is important to thoroughly examine Gen Z as Glossier explores potential growth opportunities. Gen Z has reported a 13% increase in preference for light coverage products for daily use (Pitt, 2022)

The survey results revealed that 40% of the 35 participants have never shopped at Glossier The survey did not have a two-part exist strategy, however, looking back one should’ve been included as the results are now negatively skewed due to this Interestingly, 89% frequently shop for skincare products and 86% for makeup. When asked to describe Glossier in a few words, 7 people described it as "clean" or "clean girl", with many also using words like "minimal", "glowy", and "cute". These findings indicate that consumers are aware of Glossier as a brand, but lack the motivation to purchase their products, which may explain why nearly half have never made a purchase from Glossier

Furthermore, 25 participants believe that Glossier offers high-quality products Among them, 24% believe this without having ever purchased from the brand. This raises the question of why more people recommend the brand than trying it out There could be several reasons for this

One possibility is that because an exit strategy was not created, participants may have answered questions blindly, introducing response bias and affecting the validity and reliability of the survey. Another reason could be that respondents are influenced by social-desirability bias and are answering in a way that they believe is favourable to Glossier Lastly, these responses could be genuine, with respondents who are not Glossier shoppers thinking of friends and family who would truly enjoy Glossier products

When asked to list Glossier’s direct consumers most answers included Milk Makeup, Rare Beauty, Rhode and Refy These four brands have a lot in common; mostly the fact that they are currently popular on social media with many people classifying them as “clean” brands when it comes to minimal makeup. This is very interesting as Glossier was once a market dominator and people would, but it has since fallen off leading to 72% of participants preferring products from Glossier’s competitors as opposed to Glossier even though their perception of the brands products seems to be good This combined with the fact that over 80% believe that Glossier’s competitors have a strong influence on the industry strongly suggests that Glossier needs to distinguish and set themselves apart from the market through branding and promotion to attract new customers and remind their older customers of what they are missing out on.

Recommendations:

Connectivity with Gen-Z: The survey revealed that 25 out of the 35 respondents fell between the ages of 18-24 who prefer to shop at retail shops like Sephora and drugstores like Boots. Glossier can utilise this information to form a stronger connection with Gen-Z instead of focusing on targeting Millennials. This can be done through reintroducing Olivia Rodrigo as the face of Glossier (Valenti, 2022) to help bring in more footfall. For instance, Glossier can add a cardboard cutout of Olivia’s face next to their stand in Sephora to attract a younger audience

Create educational content: Through social media, consumers have started to realise that ingredients and formulas really do matter (Rohani, 2023) Glossier can take advantage of this and create videos in the form of Instagram Reels or TikTok’s which talk about the benefits of a certain product and shows its uses. This was proven through the primary research collected where 16 respondents listed ingredients in their top 3 most important factors when shopping for beauty products.

Create limited edition campaigns: Glossier could attract attention through unconventionally marketing themselves Whilst the brand is known for it’s “millennial pink” aesthetic, it can be known for a lot more than a trademarked shade of pink Pink mania has been very popularised over the last couple years especially with the Barbie 2023 movie. The saturation of the colour has caused it to be “ruined” (Friedman, 2023). To break out of this, Glossier can choose to do a Valentine’s Day campaign for instance that revolves around different colours associated with the brand such as earthy greens and pastel blues that they have used in some of their product packages

“Why the brand’s tunedin community is turning on the company” Edwards, 2023"

The problem is incongruence between customer base and Glossier

This is a result of failure to keep up with market trends due to stagnant approach

Glossier’s current store display in Sephora

Proposed display to connect more with Gen-Z customers by adding images and designs that go with the brands aesthetic. The reintroduction of Olivia Rodrigo’s partnership ignites buzz around the brand grabbing people’s attention

Barker, M (2023) Glossier https://research.contrary.com/reports/glossier

Bergendal E and Welander H, (2022) Is it really what is on the inside that counts? https://lup.lub.lu.se/luur/download? func=downloadFile&recordOId=9096147&fileOId=9096148

Edwards, C (2023) The Cult of Glossier: Why the brand’s tuned-in community is turning on the company over product complaints https://corq studio/insights/the-cult-of-glossier-why-the-brands-tunedin-community-is-turning-on-the-company-over-alleged-productchanges/#:~:text=Glossier%20has%20lost%20its%20customer%20conne ction&text=As%20one%20customer%20noted%3A%20%E2%80%9CI,onl y%20company%20ignoring%20customer's%20concerns.

Ford, H (2024) Gen-Z, Social Media, and the Crisis of Beauty https://www.redbrick.me/gen-z-social-media-and-the-crisis-of-beauty/

Friedman, V (2023) All Pinked Out https://www.nytimes.com/2023/07/24/style/all-pinked-out.html

Hasan, M (2022) Application of Theory of Planned Behavior To Understand Sustainable Clothing Consumption: Testing the Effect of Materialism and Sustainability as Fashion https://ir.library.illinoisstate.edu/cgi/viewcontent.cgi? article=2600&context=etd

Kotler, P (2009) Marketing Management https://libsearch.arts.ac.uk/cgibin/koha/opac-detail.pl? biblionumber=218906&query desc=kw%2Cwrdl%3A%20kotler%20mark eting%20management

BarMarketMarke, (N.D) How to use Consumer Involvement in Marketing https://magnetmarke.com/consumer-involvement/

McAlexander et al, (2002), p.38 Building Brand Community https://www.researchgate.net/publication/230873898 Building Brand Community/link/0fcfd505997ef695cc000000/download?

tp=eyJjb250ZXh0Ijp7ImZpcnN0UGFnZSI6InB1YmxpY2F0aW9uIiwicG FnZSI6InB1YmxpY2F0aW9uIn19

McCarthy et al, (2011) Basic Marketing: a marketing strategy planning approach https://libsearch arts ac uk/cgi-bin/koha/opac-detail pl? biblionumber=234869&query desc=kw%2Cwrdl%3A%20basic%20mark eting

Pitt, S (2022) A Generation of Tren Setters: Gen-Z’s Beauty Must-Haves https://beautymatter.com/articles/a-generation-of-trendsetters-gen-zsbeauty-must-haves

Reddit (2022) The fall of Glossier? https://www.reddit.com/r/Makeup/comments/tktplu/the fall of glossi er/

Rohani, S (2023) TikTok Video

https://www.tiktok.com/@sahar.rohani/video/7268719827680808235 ? r=1& t=8jRg3l47f2O&social sharing=1

Segran, E (2023) What Happened to Glossier https://www.fastcompany.com/90849720/glossiers-sephora-launch-ispart-of-a-bigger-transformation

Sharp, E (2021) An in-depth investigation into why Glossier quietly discontinued its Play line https://www.verygoodlight.com/2021/01/05/glossier-playdiscontinued/

Sherryreviews, (2024) Instagram comment

https://www instagram com/p/C2plRuYxsPb/?img index=1

Solomon, M (2019) Consumer Behaviour: Buying, Having and Being https://www proquest com/docview/2284632287/bookReader? accountid=10342&sourcetype=Books

Strugatz, R (2022) How Glossier Lost Its Grip https://www.businessoffashion.com/articles/beauty/how-glossier-lostits-grip/

Valenti, L (2022) Olivia Rodrigo On Her New Glossier Partnership And Why Her Approach To Beauty Is Ever-Evolving https://www.vogue.co.uk/beauty/article/olivia-rodrigo-glossier

Waterson, B (2020) 5 Simple Reasons Why Glossier is a Marketing Genius https://www.brittanywaterson.com/glossier-marketing-genius

Webflow, (2021) How Glossier Built a Community Led Digital Strategy

Skincare & Cosmetics https://uploadsssl.webflow.com/5e459e61116466aa9af84140/60afe6a2fd0815456857 b1e7 How%20Glossier%20Built%20A%20Community%20Led%20Digital %20Strategy%20%E2%80%94%20Glossier%20%E2%80%94%20Food%2 0%26%20Beverage%20%E2%80%94%20Q2%202021.pdf

Front cover: CW, 2018 https://d3 harvard edu/platformdigit/submission/glossier-a-direct-to-consumer-beauty-disruptor/ Skin first, Makeup second: Glossier, 2017

https://twitter com/glossier/status/857368443800223745

Page 1: British Vogue, 2019 https://www vogue co uk/article/glossierbecomes-unicorn

Page 2 (woman smiling): Integer, 2018 https://integer.com/shopper culture/glossier-a-people-poweredbeauty-ecosystem/

Page 2 (ITG Logo): Glossy, 2023 https://www.glossy.co/beauty/thereturn-of-into-the-gloss-glossier-beauty-website/

Page 2 (Facebook Logo): Freebie Supply, N.D https://freebiesupply.com/logos/facebook-logo-2/

Page 2 (Slack Logo): Wijaya, R N.D https://iconscout.com/freeicon/slack-3185099

Page 2 (Reddit Logo): IconPacks N.D https://www.iconpacks.net/freeicon/reddit-logo-2436.html

Figure 1: AdsoftheWorld and Pinterest, N.D https://www.pinterest.co.uk/pin/7318418132476777/ https://www.adsoftheworld.com/campaigns/glossier-you

Figure 2: Bustle, 2016 https://www.bustle.com/articles/156953-canyou-buy-the-glossier-pink-pouch-the-brands-packaging-is-reusablecute-photos

Figure 3: Collengian and Redjai, N D https://medium com/swlh/theeasiest-way-to-get-customers-to-advertise-your-brand-for-you7e05707edf66

Figure 4: Product Mindset, 2022 https://productmindset.substack.com/p/ekb-model-of-consumerbehaviour

Page 5: (bottom picture): Dezeen, 2021

https://www dezeen com/2021/12/06/glossier-los-angeles-store-westhollywood/#

Page 6: Issu, 2019

https://issuu com/oliwiadomorosla/docs/glossier brand book single pages #:~:text= fonts%20Aper%C3%A7u%20is%20the%20primary,all% 20the%20marketing%20material%20unified.

Figure 5: Instagram, 2023

https://www.instagram.com/p/C1UngUAOYxB/

Page 11: Business Insider, 2018

https://www.businessinsider.in/slideshows/miscellaneous/wildlypopular-beauty-startup-glossier-just-opened-its-first-flagship-store-innew-york-city-heres-what-its-like-to-shopthere-/slidelist/66570041.cms

Page 12: Good Housekeeping, 2023

https://www.goodhousekeeping.com/uk/beauty/makeup/a43682667/gl ossier-g-suit-lip-creme/

Data Visualisation:

https://stylecaster com/beauty/skin-care/1054382/glossier-futuredewserum/

https://www dearmondayblog com/blog/categories/beauty

https://www glamourmagazine co uk/gallery/glossier-pouch-ways-toreuse

https://stock adobe com/uk/images/cartoon-stick-drawing-conceptualillustration-of-ordinary-nice-and-slim-woman-or-girl-looking-at-herselfin-the-mirror-and-seeing-yourself-ugly-fat-and-obese-concept-of-lowself-esteem-or-confidence/228895010