Scottish Beef Supply Chain Map

Farming of beef cattle

Livestock haulage

The Scottish beef supply chain includes calf producers, suckler beef producers, store producers and finishers, livestock procurement businesses for deadweight sales, auctioneers, hauliers, abattoirs, primary and secondary meat processors

Slaughter and dressing

Rendering

Primary processing (carcass halves/quarters, boning, preserving, chilling and packing)

Added value processing (cuts, steaks, mince, burgers, etc.; smoked, dried and salted products)

Edible by-products (5th quarter/offal)

10 livestock market businesses

Deadweight Procurement

E.g., Border Livestock Exchange, Farmstock

Abattoir and Meat Processing

large

ABP Perth, AK Stoddart, Dunbia, McIntosh Donald, Scotbeef, Woodheads

small

Millers of Speyside, PR Duff, John Scott Meat

Scotland’s beef herd (incl. calves) was ~1.474m cows according to the 2023 Agri Census

97.9% of Scottish beef cattle are Farm Assured

In 2021, the beef sector represented 26,5% of Scottish agricultural output and is worth £706m p.a.

Prime cattle slaughter fell by 3.2% to 370,100 heads in 2022

Abattoir output in 2021 from beef, offal and hides, was £668m

>3k people are employed in primary processing of red meat. Red meat sector employs ~50k people in farming and processing

65% of revenue for

Scottish beef processors is generated from rest of UK sales

Scottish beef exports generated £53m in 2022

Deadweight procurement agencies, auction marts, performance feedback

Full butchery cuts, processed products (e.g., joints, steaks, mince, burgers, pies), meals, chilling, blast freezing and packing

Calf producer farmers – breeding and rearing; Finishing farmers; Producers and finishers

Slaughter, dressing, primal cuts, fifth quarter offal products, chilling, blast freezing and packing

Marketing of fresh, chilled and frozen cuts of beef, processed beef products and ready meals - in UK and export wholesale, retail and foodservice markets

1/5 of establishments in Scotland had cattle in 2021

There are ~9,580 holdings with female beef cattle, 8,662 with male beef cattle and 8,559 with calves

At farm level, at 174%, Scotland is more than self-sufficient in beef

68.8% of the cattle breeding herd in Scotland is beef cattle ; 30% is dairy – the highest ratio of beef to dairy in Europe

Decline in Scotland's beef herd showed a further 3.3% reduction in December 2022, probably due to rising production costs and uncertainty around future agricultural policy

Cattle population in Scotland in June 2022 was 1.47m, down 3% on female beef cattle compared to the 5-year average

The average herd size is 49 cows with 79% of cattle held in holdings of at least 50 cows

Dumfries and Galloway remains the area with the larger number of beef cows (~120,075) followed by NE Grampian (~105,236)

Calf registrations decreased by 0.2% for the third year in a row, to 562k

Angus and Limousin remain the main breed groups

Farm output from beef was worth £849m in 2020, accounting for 24.4% of Scottish agricultural output and 14.4% of UK agricultural output

Until now, CAP subsidies have formed an important part of farm income

17 abattoirs slaughtered cattle in Scotland in 2022 (20 with cutting plants)

75.1% of the kill takes place in the largest five abattoirs

At abattoir level, Scotland is more than self-sufficient in beef at 153%

Prime cattle slaughter fell 3% to 370,100 heads in Sottish abattoirs in 2022, while the total number of cattle was 448,770

Total beef output slipped to 163,300t (-0.6%). The value of abattoir output from beef and offal reached £733m in 2022, with £24m from hides

Age at slaughter for males changed to more males slaughtered at 16-26 months (57.1%) while for females the share killed at 24-29 months increased to 31.4%

The average deadweight cow price in Britain was ~50% more expensive in 2022 than the five-year average

Slaughter, Primal Cuts, Full Butchery, Processed Products, Other Added Value 5th Quarter/Offal

The processing sector operates on low profit margins (0.2 to 1.6% in large abattoirs, much less in medium to small ones)

Sales distribution of primary production beef, by product category in 2022 kept boneless cuts as the main product for beef processors

For meat processing in the UK, 54.4% of the industry product segment comes from beef and veal

For meat product manufacturing in the UK, 23.8% of products manufactured are sausages, 17.8% bacon, 17.6% hams, 10% beef or veal and 18.5% other

A few retailers cut and process Scotch Beef products in other parts of the UK and some firms from Scotland add value, but it is not clear if they buy from Scotland. There are exceptions, such as Tarbert Fine Foods (Brown Brothers)

Variability of age at slaughter and carcass weights going to the same chilling regime causes impact on quality

The most concerning factors for meat processors are ensuring ongoing supply of beef, price impact on the consumer sales, eating quality and environmental impact of meat

Slaughter, Primal Cuts, Full Butchery, Processed Products, Other Added Value

5th Quarter/Offal

UK and Export

Wholesale, Retail, Foodservice, Food Manufacture

Beef prices increased by~20% in the year to Aug 2023 (AHDB)

Sales outwith Scotland to the rest of the UK generated 65% of sector revenue at £436 in 2022, while sales in Scotland represented 27% of the total sales (£179m)

An above-average beef consumption in Scotland vs the rest of the UK continues with 19.2kg/person/year (1.5% decrease compared to 2021)

UK supermarkets are the largest customers for red meat processors (52.4%), followed by food manufacturers (27%), foodservice (12%), wholesalers (3.2%) and butchers (4.5%)

For meat wholesaling, beef and veal represent 35.7% (£4.5bn), pork 12.4% (£1.6bn), lamb and mutton 7.4% (£933m), chicken and poultry 44.1% (£5.6bn)

For meat product manufacturing, sausages represent the biggest revenue (23.8%), followed by bacon (17.8%), pates and pastes (12.1%), beef and veal (10.2%), other products (18.5%), ham and other salted/dried or smoked pork (17.6%)

UK and Export

Wholesale, Retail, Foodservice, Food Manufacture

Scotland accounts for 9.5% of GB beef sales

Beef mince was the only product to increase sales in value and volume in 2023

Scotland pays cheaper price for beef vs the wider UK market (2% cheaper), mostly due to promotion

In Scotland, steaks have 9.8% share of beef products, burgers 10.5%, other cuts 15.7% and fillets 21.5%

In 2022, in Scotland the volume of red meat purchased fell by 8.9% driven by a decline in purchasing frequency and decrease in volume per trip. The average price per kg increased 6.6% to £8.93/kg

Scottish beef exports represent 8% of the total sales value at £53m

Beef imports to the UK increased to 15% in 2022 or 234,307t, mainly fresh and frozen boneless cuts

Scotch Beef PGI status and whole chain assurance

Farm accreditation is valued by consumers and plays an important role in decision making for purchases

Reputation of Scotch Beef, Scot PGI helped deliver additional £30-40 per animal over the last 10 years

Beef processing self-sufficiency is above 100% in farming and processing

Proposed Medicine Hub for sheep and cattle

Electronic traceability systems. BCMS change of cattle data to ScotEID

The industry has been subject to tighter regulations, labelling rules and daily animal welfare checks

The proportion of Scottish households buying beef remains slightly higher than in the rest of GB

Meat meals still dominate the market on prepared meal products despite the growth of meat free products

In 2022, 2/3 farmers reportedly took action to reduce GHG from farm

Scotland’s beef herd is continuing to decline, and calving rates are lower in Scotland than rest of UK and Ireland

Payment for meat does not incentivise quality, only yield. Around 1/3 Scottish carcasses (mainly steers) exceed customers’ target weight range specification

Heavy reliance on non-UK labour

Supermarket price wars squeezing producer and processor profits

In some instances, beef is delivered to processing and packing sites in the UK and exported or returned to Scotland in a shelf-ready pack for sale here

Low profitability of the slaughter/primary processing sector and cost of dealing with “fifth quarter”

Scottish processors export less beef than the UK as a whole and more is exported as UK beef rather than Scotch Beef

Negative consumer perception and media portrayal of the red meat industry

Due to increasing demand and supply chain shortages, some supermarkets removed their 100% British beef commitment

Broaden customer base in both UK and export markets to reduce price pressure risks, increase premiums and achieve carcass balance

Greater automation to combat labour shortages and improve efficiency

Technological research focusing on cost reduction, animal welfare, productivity and environmental management

The Government has indicated that standards will be kept high in future trade deal negotiations to protect the domestic industry

Long term agreements for frozen beef exports

Each QA member of QMS will engage in an emissions reduction programme

Ban on exporting male dairy calves brings supply chain opportunities

Use R and D to build distinctiveness (product innovation in food manufacturing)

New trade deals like Trans-Pacific trade partnership (July 2023)

Increased input and production costs

Labour shortages – on farm, in processing sector and ancillary services, such as vets (up to 23.6% for vets and 5.8% for a Meat Hygiene Inspector)

Changing export certification and verification requirements, increased shipping costs, timing uncertainties and custom check delays

Pricing pressures from UK supermarkets reducing profit margins

Competition from alternative meats/proteins

Forestry developments in farmland, impact of monocultives on biodiversity, ecology and employment

Uncertainty around CAP replacement funding

Increasing consumer concerns over health, environmental impact and affordability reducing demand for red meat

Changes in the level of real household disposable income, affecting the amount available to spend on meat (food price inflation reached 13.1% in Aug 2022)

UK agricultural inputs cost surged for the second consecutive year by 28%, including a 113.5% rise in fertiliser cost in 2022, 50% increase in fuel costs and 30% in feed costs

Scotland represents 11.8% of all meat processing establishments in the UK

National Craft Butchers consultation found that more than 50% of small abattoirs are at risk of closing by 2026, due to staff shortages

Meat wholesalers have come under pricing pressures from supermarkets encouraging bypass

Meat prices increased considerably in 2021/22, fuelled by the rising costs of labour, energy and raw materials. Domestic (UK) price of beef is expected to increase at an annual rate of 2.8% over the next five years, averaging 256p/kg in 2023-24 (2% more than previous years)

The focus of the industry in the next 5 years, underpinned by the QMS strategy, is on sustainability credentials, traceability and environment

Due to vertical integration and the sheer scale of processors, many food manufacturers are bringing meat product use inhouse to achieve efficiency gains, establishing their own brands

Foodservice customers are more interested in sourcing British meat, e.g., McDonalds and Burger King. They purchase from dedicated abattoirs to ensure provenance and quality

Beef and veal are most vulnerable to decline in household consumption as disposable incomes decrease, as they are some of the most expensive products to produce and buy

Concerns for health, sustainability and fears over contamination and disease will drive growth in butchers' sales

Cost of living crisis has impacted sales of organic beef, with a reduction of sales of 12% in 2023

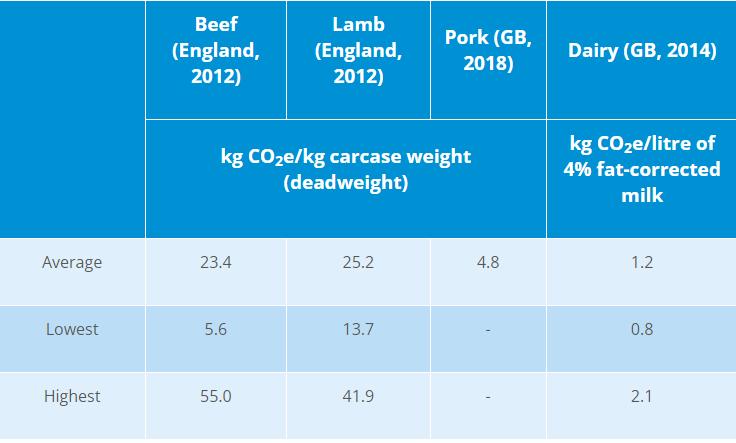

Life cycle analysis demonstrates that UK beef has a carbon footprint of 23 kg CO2 equivalents per kg. This is almost exactly level with the EU average of 22.1kg carbon dioxide equivalents per kg beef

For Scottish suckler beef, QMS6 estimated EIs for different production systems based on the AgreCalc Carbon Calculator. It reports that rearer/finisher units had the lowest intensity (18.4 kg CO2 equivalents per kg of meat) and hill suckler herds the highest (29.9 kg CO2 equivalents per kg of meat). However, the QMS EIs include fewer emissions sources than the UK and European figures above, and so they are not comparable

Increase customer base to avoid pricing pressures for farmers and meat processors

More certainty with the replacement of CAP subsidies with more environmentally focused payment schemes

Need for more stable supply contracts for producers

Increase market penetration of PGI Scotch beef as leading sustainable red protein available in GB

Campaign stronger against health and environmental concerns and consumption of meat

Stabilisation of input costs for fertiliser, feed and energy

Increasing attention from the public has also led to rising regulatory costs for operators

Improve profit margins within the processing sector to regain ability to invest

Growing interest in small volume direct sales and local

• Establish brand names, key to creating customer trust and loyalty

The Scottish Red Meat Resilience Group has committed to producing a Route Map to Net Zero by end of 2023. Aim is for industry to achieve Net Zero by 2045

Net Zero 2045 Scotland programmes: Climate Change Plan, Agrienvironmental Climate Scheme, Farm Advisory Scotland (FAS), Monitor Farm Programme, Net Zero and Nature Restoration Plan

QMS, AHDB and Meat Promotion Wales collated an industry toolkit of facts and figures relating to the role the red meat sector plays in three key areas: health and wellbeing, sustainability, buying local

Aim to reduce 75% of carbon emissions by 2030

Ageing agricultural workforce and succession planning required

Difficulty attracting new entrants to beef farming

Heavy reliance on non-UK workforce in processing

Staff turnover and retention in primary processing an issue

Economic

Environmental

Social

Secondary

Scottish new Agriculture Transformation Programme

RUMA, antibiotic responsible use of medicine in livestock

Sustainable Producers Networks (QMS)

R and D projects (Harbro) to decrease ammonia emissions

Research on nutritional properties of alternative protein and methane reducing potential

Having positive conversations around Meat ToolKit (QMS)

Farming

ScotEID Grasscheck Programme

Agri -Env Climate Scheme

Scotch Potential

Eligibility Cattle Checker (SPECC)

Monitor Farm Programmes

Farm Advisory Service

New Agriculture Bill

Agricalc and Carbon Positive calculators

QMS Red Meat Resilience Group

Suckler Beef Climate Group (SBCS)

Scottish Beef Climate Group

Genomic data collection at tagging (QMS)

Primary Processing

SPCA accreditation of farms and abattoirs

Processing/Added

Value

QMS, AHDB and Meat Promotion Wales Industry Toolkit

ALDI’s initiative of selling Scotch and Galloway meat only

Global Feed Cycle analysis database for life cycle assessment of ingredients

ABP’s Carbon Trust Standard

Bakkavor pledge to eliminate single use plastic by 2025

Meat Eating Quality Strategy 2022

The Scotch Butchers Club

ABP’s Nurture Nature Programme / Advantage

Beef Programme

Dunbia investment on Highlands Meat Facilities (new deboning and packaging tech)

Development of “Red

Meat Industry Net Zero Pathway”

Raising the Steak Campaign (QMS 2022)

Farming Footsteps Programme

The Scotch Beef Club

“Meat the Market” Groups “Make it Scotch” website and cookery demos (QMS)

IAAS qualificationauctioneering, welfare and management

Back British farming Campaign (AHDB)

Quality Assurance/Policy/ Regulation

QMS, RSPCA, SSPCA, FSS, Export Health Cert., Food Information REG., Food Safety Act., Red Tractor, BRC, Beef PGI Research Institutes

Moredun, Agri-Epi, SRUC, Meat Trade journals (market insight)

Primary Production

Trade Bodies

QMS, SAMW, AHDB, SFMTA, Scottish Beef Association, Scottish Craft Butchers, NFUS, National Federation of Meat and Food Traders, BMPA

Breeding, Rearing and Finishing

Primary Processing Secondary Processing

Slaughtering and Primal Cuts

Full Butchery

Processed Products

Export: wholesale, retail and foodservice Markets

UK: processors, wholesalers, retail and foodservice

Strategic investment in AV processing, cold stores

Develop UK and export markets – greater customer range for premium price and carcass balance

Need to combat labour shortages

Pricing pressures Narrow customer base Consumer health and environmental concerns

Supply Chain

Issues

References

The Scottish Red Meat Industry Profile, 2023 Edition

Scottish Agricultural Census, June 2023

Putting Our Steak in the Ground

Meat and Poultry Deep Dive Report: GB Retail, Dec23

Meat Processing in the UK

Meat Product M anufacturing in the UK

Domestic Price of Beef (April 2023)

Tackling Antimicrobial Use and Resistance in Food Production

Meat Wholesaling in the UK

Prepared Meat Manufacturing in the UK

QMS Beef Sector Strategy 2030

Scotland: The Choice for Premium Red M eat, 5-year strategy

Quality by Name, Quality by Nature - A study into red meateating quality

Positive Impact, Positive Results- QMS I ndependent I mpact Report

Celebrating the Positives of Red M eat-QMS Toolkit

Greenhouse Gas Emissions: Agriculture | AHDB

UK Beef Carbon Footprint Is EU Average | The Beef Site

Quality Meat Scotland

Scottish Government

Scottish Red Meat Resilience Group

The Knowledge Bank

UK I ndustry Report, IBIS WORLD, 2023

UK I ndustry Report, IBIS WORLD, 2023

UK Business Environment Report, IBIS WORLD

FAO,Veterinary Medicine Directorate, 2022

UK Industry Report, IBIS World 2023

UK Industry Report, IBIS World 2023

Quality M eat Scotland

Quality M eat Scotland

Quality Meat Scotland

Quality Meat Scotland

Quality Meat Scotland

Scottish Environment, Food and Agriculture Research Institutes (SEFARI) Fellowship Blog - 14 July 2020 (nfus.org.uk)

*March 2024 Reviewed regularly as new reports and statistics become available.