RATIO ANALYSIS TECHNIQUE IN 2008-

09

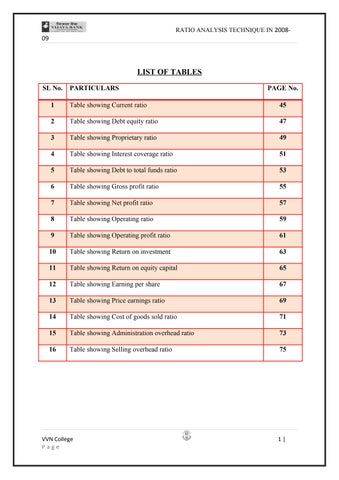

LIST OF TABLES SL No.

PARTICULARS

PAGE No.

1

Table showing Current ratio

45

2

Table showing Debt equity ratio

47

3

Table showing Proprietary ratio

49

4

Table showing Interest coverage ratio

51

5

Table showing Debt to total funds ratio

53

6

Table showing Gross profit ratio

55

7

Table showing Net profit ratio

57

8

Table showing Operating ratio

59

9

Table showing Operating profit ratio

61

10

Table showing Return on investment

63

11

Table showing Return on equity capital

65

12

Table showing Earning per share

67

13

Table showing Price earnings ratio

69

14

Table showing Cost of goods sold ratio

71

15

Table showing Administration overhead ratio

73

16

Table showing Selling overhead ratio

75

VVN College Page

1|