Blockchain plays a crucial role in crypto token development by providing a secure, decentralized, and transparent framework for issuing, managing, and transferring digital assets. It ensures immutability, trust, and automation through smart contracts, enabling seamless transactions and innovative financial applications.

Definition: Digital assets built on blockchain platforms.

Examples: ERC-20 (Ethereum), BEP-20 (Binance Smart Chain).

Purpose: Represent value, utility, or ownership in a project.

Fact: Over 600,000 tokens exist today (CoinMarketCap, 2025).

Decentralized ledger technology no central authority.

Key features: Transparency, immutability, security.

Enables trust in token ecosystems without intermediaries.

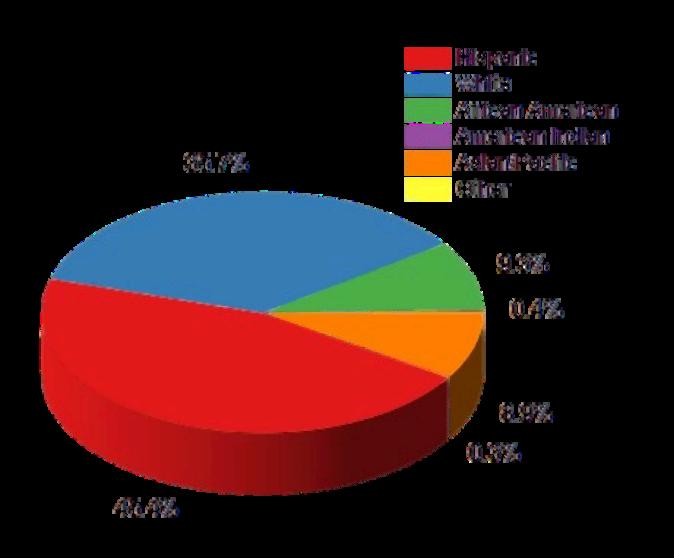

Stat: 80% of tokens run on Ethereum

Step 1: Choose a blockchain (Ethereum, Solana, etc.).

Step 2: Write smart contracts to define token rules.

Step 3: Deploy on the blockchain tokens go live.

Example: ERC-20 tokens take ~1 hour to deploy

Self-executing code on blockchain— automates token functions.

Functions: Minting, transferring, burning tokens.

Security: Immutable once deployed (if coded right).

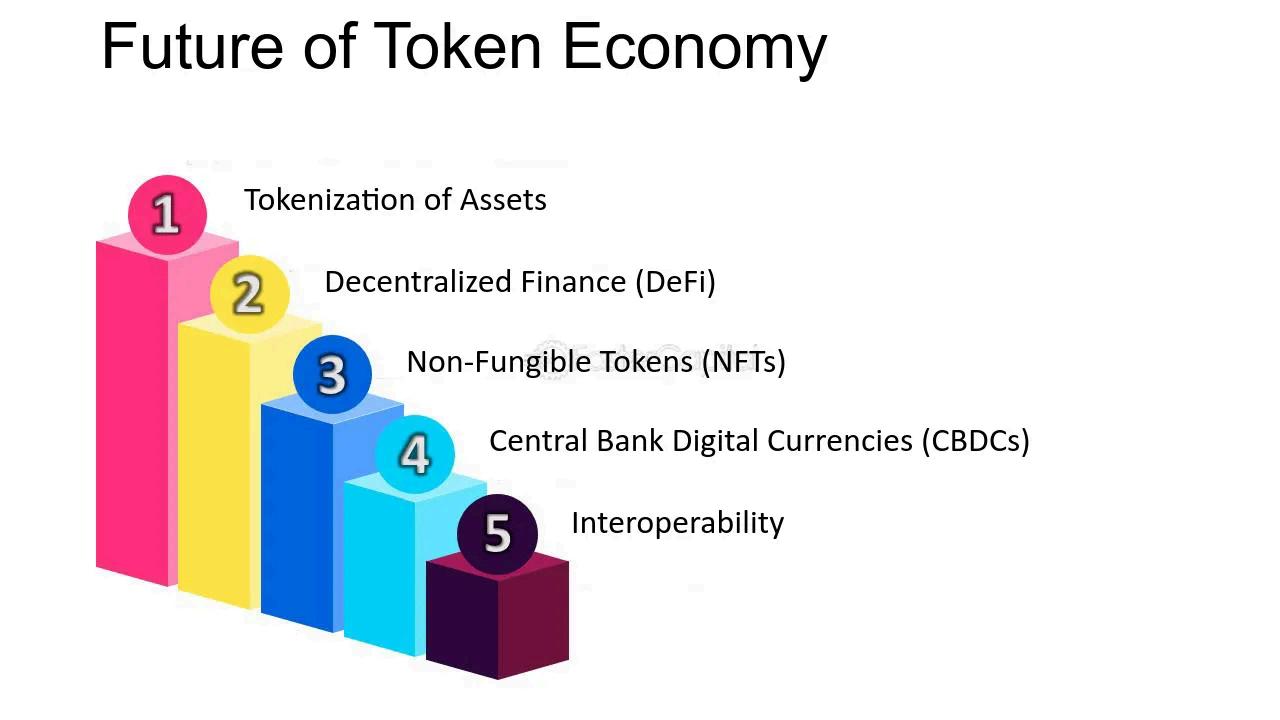

Fact: $1.5 trillion in DeFi transactions via contracts

Ethereum: Most popular, high fees ($5–50/tx).

Binance Smart Chain: Fast, low-cost ($0.10/tx).

Solana: 65,000 TPS, growing in adoption.

Polygon: Ethereum-compatible, $0.01/tx.

Blockchain’s cryptography prevents tampering. Audits critical: $600M Poly Network hack (2021) from contract bugs. Decentralization reduces single-point failures. Tip: Use OpenZeppelin libraries for secure code.

Manages supply: Fixed or inflationary via code.

Enables trading: Peer-to-peer on-chain marketplaces.

Supports staking: Lock tokens for rewards.

Stat: P2E games generated $12B in 2025

Scalability: Ethereum handles ~15 TPS; Solana scales better.

Costs: Gas fees can deter small projects.

Complexity: Coding errors cost $2M in a 2024 BSC exploit (DeFi data).

Regulation: SEC scrutiny on security tokens growing.