FROM THE CHAIRMAN

ROGER SEIVRIGHT

Chairman since 2019

Sandyport Homeowners Association Ltd.

Dear Owner,

It has been a pleasure serving our Community for the year 2022, and an even greater pleasure to present the 2022 Annual Report.

Once again, The Sandyport Community made it through another year with great success. We continued to experience the ups and downs of the economy and the uncertainty it holds. However, we managed to stay united and focused on the further development of our Community. We are grateful to all residents and owners who continue to be understanding and supportive during these challenging times.

In 2022, we worked feverishly on major projects to enhance our Community. We are pleased with the completion of several of these, including the replacement of the Northern boundary fence at the main entrance. Addition of a new Security booth near Tambearly fence. Installation of Drainage wells, and storm drains thru-out the Community. Construction of new walk path in front of main entrance tennis courts to Sandyport Drive #9. Fencing repairs thru-out the Community. Security patrol and enhancements. Installation of water pipe at every vacant lot. Additional solar lighting around the community. Phase 5 dog park renovation. Repairs to playground equipment. Removal of trees and roots in the common area parking lots. Refurbishment of all pools under a new vendor.

As our projects are ongoing, many will continue into 2023, namely the sewer plant expansion, the road paving of the entire Community, and additional drainage wells. In keeping with the standard of the Community and the restrictive covenants, we are continuing the enforcement of all commercial vehicles and vessels from the Sandyport Community. We continue to enforce the rules set forth in the restrictive covenants. We have strengthened our security measures for the protection and well-being of our owners, and residents.

We have added new security procedures. We are pleased to say we are 100% inhouse staff and have discontinued the outsource of the security services.

2022 also saw a tremendous increase in our Community development with the sale of a number of lots. As a result, we welcomed the addition of four beautiful new homes. This kind of investment in the Community, is both exciting and encouraging for property value.

2 FROM THE CHAIRMAN

The Community was able to host our annual Community social event. It was a success! We hope to continue hosting this event in 2023.

4 OUR BOARD OF DIRECTORS

5 MANAGEMENT TEAM

In closing, I would like to thank you for your continuous support of and love for our Community. There is an unmeasurable amount of evidence that boasts the work we have completed over the years. I extend my appreciation to my fellow directors for their support and for continuing to give their knowledge and expertise to serve the needs of the Community.

6 OPERATIONS SUMMARY 11 12

We are creating a better future!

OUR BOARD OF DIRECTORS

CHOSEN BY YOU TO SERVE OUR COMMUNITY

Our Articles of Association requires that a Board of 7 volunteer Directors each serve a term of 2 years. Every year at least 3 Directors’ tenure comes to an end and we vote at our Annual General Meeting to elect their replacements. Former Directors may be re-elected.

Chairman

Re-elected 2021

Treasurer

Elected 2020

Director

Elected 2020

Director

Re-elected 2021

Director

Re-elected 2021

Secretary

Re-elected 2020

roger seivright

Antionette Turnquest

Costantinos Berdanis

MICHELE MOODIE

craig lines

roger seivright

Antionette Turnquest

Costantinos Berdanis

MICHELE MOODIE

craig lines

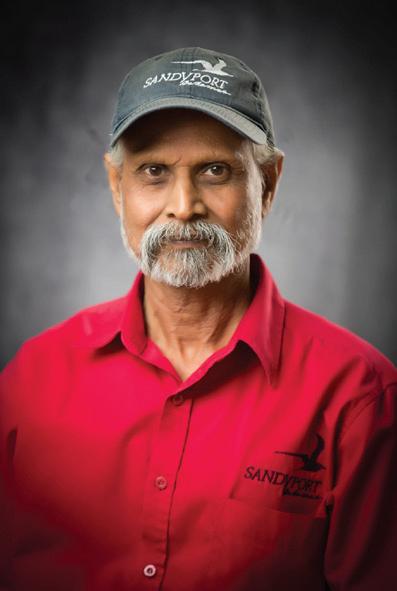

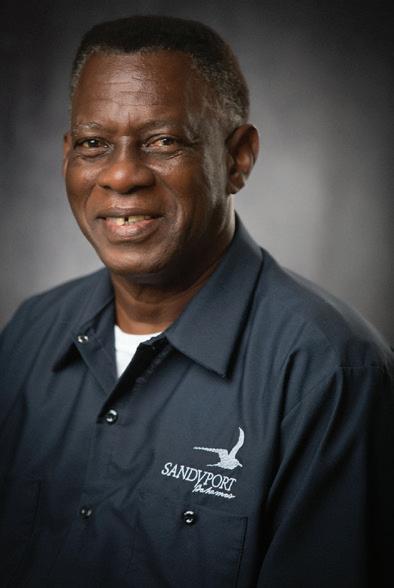

MANAGEMENT TEAM

Assistant Manager

Nicola Edgecombe

Accounts Receivable Accountant

Head of Security Services

ORPHEUS INGRAHAM

Head of Maintenance Services

CHARLES COOPER

Assistant Manager

Nicola Edgecombe

Accounts Receivable Accountant

Head of Security Services

ORPHEUS INGRAHAM

Head of Maintenance Services

CHARLES COOPER

OPERATIONS SUMMARY

SECURITY

The Sandyport Community thrives to be a safe and well-secured community. In 2022, the Board of Directors discontinued the use of contracting security companies and employed 28 security officers. There are now revised security procedures and protocols. Security officers are placed in quarterly training programs to tackle items such as:

1.Access control

2.Perimeter vigilance and security

3.Community rules enforcement

4.CPR/First Aid knowledge

5.Lifeguard skills

6.Crime prevention

7.Video surveillance

8.Parking enforcement

9.Boater's rules enforcement

10.Emergency response

11.Resident verification

COMMUNITY PROJECTS

The Waste Treatment Plant is currently operating at full capacity and there is a need to expand. The Board of Directors have instructed Management to seek an Engineer who specializes in Waste Treatment Plant Engineering. Water Mark & Plummer was identified as an acceptable company and Mr. Flint accessed the Waste treatment plant and provided a report on the current state and his recommendations on what needs to be done to expand the capacity to accommodate the current and future flow into the plant. This project is a joint effort between the HOA and Sandyport Development Company. The expansion is scheduled for June 2023.

Three bids were received and ultimately the contract was awarded to Bahamas Hot Mix (BHM) Ltd. The budget for this major project is $1.4 million. A special assessment of $800 per property was made to assist with the cost of this project. We began the installation of drainage wells in 2022 in the Community to assist with the flooding. We will continue to install drainage wells in flood prune areas.

maintenance division

Our Maintenance team continues to move with passion. The small threemember team has tackled some of the projects and completed them using their talented skills. We have saved money and time by using inhouse labour skills rather than outsourcing to contractors. Some of the projects completed by our maintenance team include:

1.Dog park renovations

2.Walk paths

3.Repairs to security booths

4.Installation of wooden benches

5.Stairway repairs

6.Pool deck repairs

7.Construction of new security booth

8.Electrical shed repairs

9.Bridge repairs

10.Dock and deck repairs

11.Lighting repairs

12.Electrical repairs

water & sewerage

The much-needed road paving project is scheduled for March 2023 to assist in enhancing our growing Community.

Our dynamic team of just two men have maintained the Waste Treatment Plant for many years. Charles Cooper and his team continue to ensure the waste treatment plant and seven lift stations are operating in a normal capacity. It is a challenging job as this plant serves the entire Olde Towne and Sandyport Communities including all restaurants. The community receives potable water from the Bahamian Water and Sewerage Corporation and is locally served by a 100,000 GPD modular wastewater treatment facility (WWTF) that is owned and operated by the Sandyport Homeowners' Association (SHOA). The HOA monitors the daily inflows of the plant to assist with our knowledge of fluctuations in sewerage flows.

contractors & vendors

Gardening

Caribbean Landscape

Painting

Louis Painting Pressure Cleaning

Waste Disposal

Superior Waste

Electrical

One Shot Deal Electrical

Waste Treatment Plant Consultants

Allen's Environmental Construction, LLC

Angelo Turnquest

Canal Dredging

SJK Engineering & Construction Ltd.

CCTV Custom Computers

Richard Carey

Canal Maintenance

Van Mackey Construction and Marine

Wells and Storm Drains Maintenance

J&M Well Drilling & Water Services

Gardening Debris Removal Services

JLG Trucking & Heavy Equipment Services

Computer Repairs and Maintenance

Nassau Techies

Brent Lloyd

Irrigation Maintenance

CareyScape

Entry Barriers

Two-Way Solutions

Pool Maintenance

Geoffrey Eneas - Chlorine Depot & Pool Supply

2022 accomplishments

We continue to progress through various challenges in Community. Finding a balance between what is a priority and necessity has been taxing. The Board has been tasked with deciding what projects to complete taking into account priority level and cost.

Security

In 2022 the Board performed an analysis of the expense and risk of continuing to outsource a portion of security services versus performing the service in-house. The decision was made to discontinue the use of outside security vendors and to hire additional officers. We have now completed that task and can confidently say we have saved more costs in operating the security department with all in-house staff. This change has given us more control over our security team. We want our staff to work with a knowledge of all of our residents and to have more familiarity with how they live in the Community. We developed the security employees by providing them with monthly training sessions on CCTV, community awareness, and crime prevention. Every year they must register with The Ministry of National Security to obtain licenses. This process helps us to ensure that our security staff are qualified.

Recreation Areas

We refurbished the dog park near the Phase 5 location. Orpheus Ingraham and Charles Smith are responsible for the maintenance of the Community and took on construction tasks such as building all the wooden benches in the parks, adding lighting to vacant lots, and adding boundary fencing. They also replaced the broken parking headers and paving stones in common areas, repaired shed roofs, walls, concrete walk paths, and picket fences. Two new playhouses were constructed, one at the main playground, and one at Roberts Isle. We added solar light fixtures to all bridges for visibility at night.

Environmental Committee

We have a three-member team of owners that continue to make our environment healthy for residents, Mrs. Kim Lines, Mrs. Marla Skopelja, and Ms. Jacquline Lightbourne. They have organized mosquito traps to be placed around the Community to assist with the mosquito infestation, assisted with fogging, and arranged the removal of invasive trees and plants. Each year they organize the community clean-up which includes cleaning out the canal basin of trash and other items. The next project they plan to undertake is assessing the pond area to see what species are present and clean it up for the existing wildlife.

Roads and Lighting

To prevent flooding in the flood-prone areas throughout the Community we installed four new drains and two 150ft wells. We will continue to do this in additional areas of the Community to assist with flooding. We changed several hard-wired lights with solar lights. This project contributed to the reduction of our monthly electricity costs which has decreased by 15% thus far. A concrete walk path was constructed at the front entrance near the tennis courts to assist the pedestrians who enjoy their morning walks throughout the Community.

Landscape REPORT

We have contracted the services of Caribbean Landscape for the past six years. The Sandyport Community is pleased with their performance and continues to work closely with them to strengthen their relationship with the needs of our residents. What we see in the Community is a result of Caribbean Landscape strength and agility when it comes to reorganizing their team and the expertise that they bring as a company.

In 2021 we saw a change in their management which welcomed Rashad Strachan. Rashad is full of youth, experience and innovation. Having an extensive career in horticulture, Rashad was brought here to now manage the Sandyport landscaping team. He has a rather shy character but one thing for sure, he gets the job done. I see a great future for Rashad here. Let’s continue to welcome him to the team.

We still have our beloved Oliver here with us. Oliver name reigns throughout the Sandyport Community. Almost all the residents ask for Oliver. Oliver knows every property, every resident, their specific requests, and their dislikes when it comes to their landscaping. This makes our residents feel special and that is what we are looking for in this Community. We want our residents to have confidence that the Caribbean Landscape team here in Sandyport can do the job.

We salute this fine team of men who are eager, passionate and agile in their skills as fine grounds men. Thank

TREASURER’S REPORT

2022 was a great year of progress for the community. Newly paved roads, sewerage plant improvements, and the valuable display of community involvement by the residents of Sandyport.

Compared to 2021's revenues of $3.62M, 2022's revenues increased by 3.59% to $3.75M, which more than doubled last year's increase of 1.51%. This increase was mainly due to the collection of overdue fees of almost $100K, compared to 2021's figures of $0. In addition, Sandyport's major revenue streams (Maintenance Fees) had collections from 2021's amount of $3.04M to 2022's amount of $3.05M, an increase of 0.21%. Six (6) homes were constructed in 2022. The table below shows the change in homes, lots and those under construction compared to the previous year.

The Association focused on extensive repairs to the northern and southern boundaries, a new walk path at the main entrance and annual canal dredging were highlights of the improvements to the community. Dredging cost were greatly reduced by 33% in 2022. Maintenance of common areas' cost remained steady compared to 2021 figures of $486K, with a reduction of 0.38% to $484K in 2022.

Along with the refurbishing of the 5 existing pools in 2022, the Association looks forward to major projects in 2023. To preparing wells and drains for road paving scheduled for 2023, the Association increased its cash balance by 45.27%, along with special assessment collected from the owners as of December 31st, 2022 of $369K.

2022 BOARD MEETINGS 2021 2.94%

*SQ. FT. amounts were Quick Books amounts

2022 FINANCIAL Budget

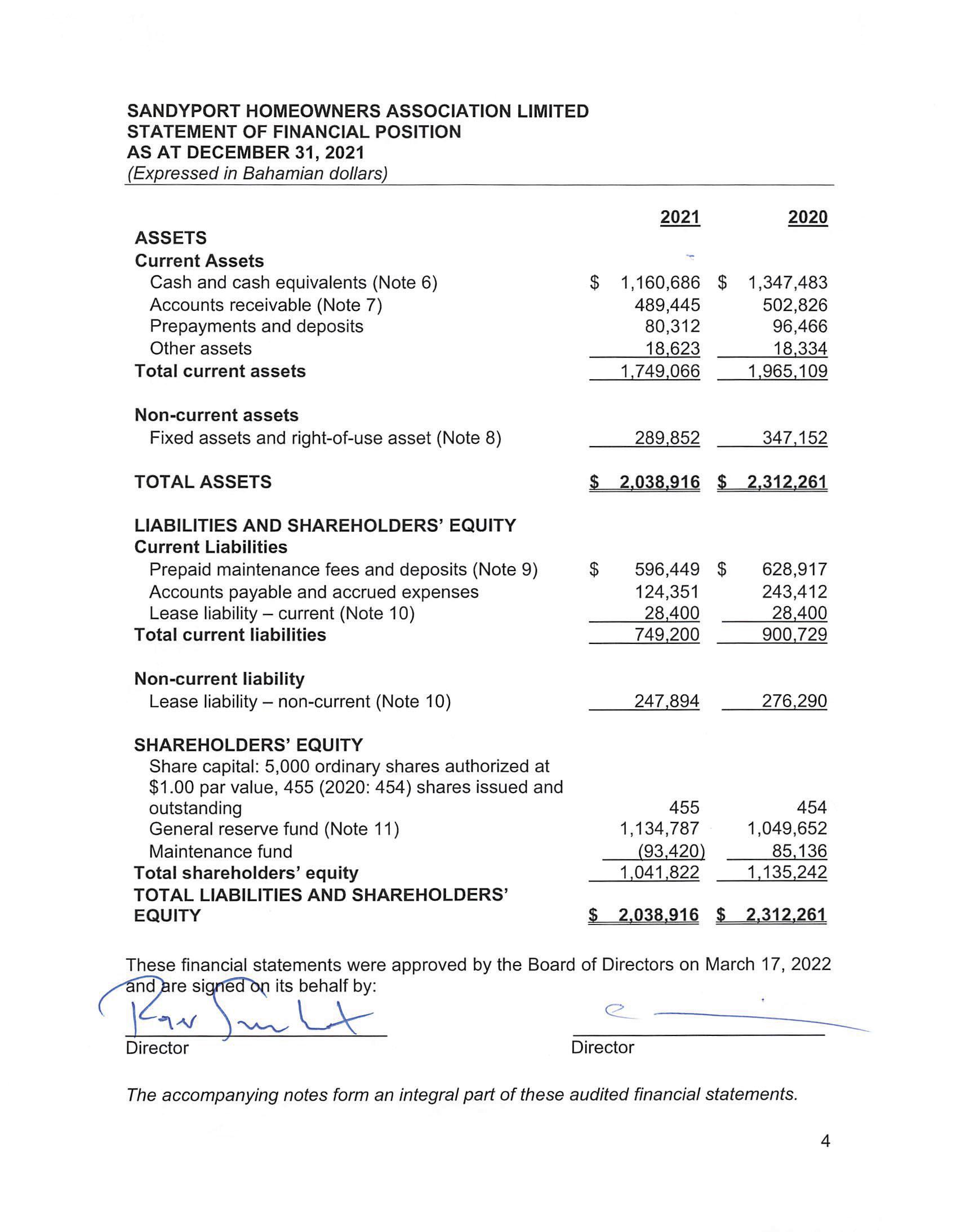

FINANCIAL STATEMENTS

AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 AND INDEPENDENT AUDITORS’ REPORT OPINION

We have audited the accompanying financial statements of Sandyport Homeowners Association Ltd (the “Homeowners Association”) which is comprised of the statement of financial position as at December 31, 2022 and the related statements of maintenance fund, changes in equity and cash flows for the year ended December 31, 2022 and a summary of significant accounting policies and other explanatory information.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Homeowners Association as at December 31, 2022, and of its financial performance and its cash flows for the year ended December 31, 2022 are in accordance with International Financial Reporting Standards (“IFRSs”).

BASIS FOR OPINION

We conducted our audit in accordance with International Standards on Auditing (“ISAs”). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Homeowners Association in accordance with the ethical requirements that are relevant to our audit of the financial statements in The Commonwealth of The Bahamas, and we

have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

RESPONSIBILITIES OF MANAGEMENT AND THOSE CHARGED WITH GOVERNANCE FOR THE FINANCIAL STATEMENTS

Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRSs, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Homeowners Association’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Homeowners Association or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Homeowners Association’s financial reporting process.

AUDITORS’ RESPONSIBILITIES FOR THE AUDIT OF THE FINANCIAL STATEMENTS

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an Auditors’ Report that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgement and maintain professional skepticism throughout the audit. We also:

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management;

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Homeowners Association’s ability to continue as a going concern. If we conclude that a material uncertainty exists, then we are required to draw attention in our Auditors’ Report to the related disclosure in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to date of our Auditors’ Report. However, future events or conditions may cause the Homeowners Association to cease to continue as a going concern; and

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omission, misrepresentation or the override of internal control;

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Homeowners Association’s internal control;

•

• Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicated with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

March 1, 2023

Nassau, Bahamas

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED STATEMENT OF MAINTENANCE FUND FOR

THE YEAR ENDED DECEMBER 31, 2022

(Expressed in Bahamian dollars)

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED DECEMBER 31, 2022

(Expressed in Bahamian dollars)

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2022

SANDYPORT HOMEOWNERS

ASSOCIATION LIMITED NOTES TO THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022

(Expressed in Bahamian dollars)

1.GENERAL INFORMATION

Sandyport Management Association Limited was incorporated under the laws of the Commonwealth of The Bahamas on May 25, 1990 as a wholly-owned subsidiary of Sandyport Development Association Limited (“Devco”). On September 14, 1998, the name of the Association was changed to Sandyport Homeowners Association Limited (the “Homeowners Association”).

On May 21, 2008, ownership of the common areas and common infrastructure of the Sandyport residential community was transferred from Devco to the Homeowners Association.

The principal activity of the Homeowners Association is to manage the Sandyport residential community in accordance with the terms of the authority granted to Devco by licenses issued to each property owner defining their rights and obligations in regard to the common areas. Devco assigned the said authority under these licenses to the Homeowners Association on November 3, 2009.

On January 2, 2010, Devco transferred the ownership of the Homeowners Association to the property owners of the Sandyport residential community. As at December 31, 2022 the Homeowners Association had 35 employees (2021: 27).

2.STATEMENT OF COMPLIANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS

The Association’s audited financial statements are prepared in accordance with International Financial Reporting Standards (“IFRSs”) for Small and Medium-sized Entities, as issued by the International Accounting Standards Board (“IASB”) and are presented in Bahamian dollars, the Association’s functional currency.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO THE AUDITIED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

3.BASIS OF PREPARATION

a. Presentation of financial statements - The financial statements are presented in accordance with IAS 1, Presentation of Financial Statements (Revised 2007). The Homeowners Association has elected to present the Statement of Maintenance Fund.

b.Management’s use of judgments and estimates - The Association uses accounting estimates and assumptions in the preparation of the financial statements. Although these estimates are based on management’s best knowledge of current events and transactions, actual results may ultimately differ from those estimates. The effect of any changes in estimates will be recorded in the Association’s financial statements when determinable. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

4.NEW OR REVISED STANDARDS OR INTERPRETATIONS

Overall considerations

New and revised standards that are effective for annual periods beginning on or after January 1, 2023

The Association has not applied the following new and revised IFRSs that have been issued but are not yet effective:

•Amendments to IAS 1, Classification of Liabilities*

•Amendments to IAS 1 and Practice Statement 2, Disclosure of Accounting Policies*

•Amendments to IAS 8, Definition of Accounting Estimates*

•Amendments to IAS 12, Deferred Tax related to Assets and Liabilities arising from a single transaction*

•Amendments to IFRS 17, Insurance Contracts*

•Amendments to IFRS 10 and IAS 28, Sale or contribution of assets between an investor and its associate or joint venture**

*Effective for annual periods beginning on or after January 1, 2023.

**In December 2015, the IASB decided to defer the application date of this amendment until such time as the IASB has finalized its research project on the equity method.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

4.NEW OR REVISED STANDARDS OR INTERPRETATIONS (continued)

IAS 1 – Classification of Liabilities

In January 2020, IASB issued the final amendments in Classification of Liabilities as Current or Non-Current, which affect only the presentation of liabilities in the statement of financial position. They clarify that the classification of liabilities as current or non-current should be based on rights that are in existence at the end of the reporting period and align the wording in all affected paragraphs to refer to the ""right"" to defer settlement by at least twelve months. The classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of liability. They make clear that settlement refers to the transfer to the counterparty of cash, equity instruments, other assets or services. The Homeowners Association does not expect the amendments to have any significant impact on its presentation of liabilities in its statement of financial position.

IAS 1 - Disclosure of Accounting Policies

In February 2021, IASB issued 'Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)' which is intended to help entities in deciding which accounting policies to disclose in their financial statements. The amendments to IAS 1 require entities to disclose their material accounting policies rather than their significant accounting policies. The amendments to IFRS Practice Statement 2 provide guidance on how to apply the concept of materiality to accounting policy disclosures. The Homeowners Association does not expect this amendment to have any significant impact on its financial statements.

IAS 8 – Definition of Accounting Estimates

In February 2021, IASB issued 'Definition of Accounting Estimates (Amendments to IAS 8)' to help entities to distinguish between accounting policies and accounting estimates. The definition of a change in accounting estimates has been replaced with a definition of accounting estimates. Under the new definition, accounting estimates are “monetary amounts in financial statements that are subject to measurement uncertainty”. Entities develop accounting estimates if accounting policies require items in financial statements to be measured in a way that involves measurement uncertainty. The Homeowners Association does not expect this amendment to have any significant impact on its financial statements.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

4.NEW OR REVISED STANDARDS OR INTERPRETATIONS (continued)

IAS 12 - Income Taxes

In May 2021, IASB issued Deferred Tax related to Assets and Liabilities arising from a Single Transaction (Amendments to IAS 12), which clarifies how companies account for deferred tax on transactions such as leases and decommissioning obligations. The amendments narrowed the scope of the recognition exemption in paragraphs 15 and 24 of IAS 12 (recognition exemption) so that it no longer applies to transactions that on initial recognition, give rise to equal taxable and deductible temporary differences. The Homeowners Association will evaluate the impact if any, in its financial statements.

IFRS 17 - Insurance Contracts

IFRS 17 was issued in May 2017 as a replacement for IFRS 4 Insurance Contracts. It requires a current measurement model where estimates are remeasured in each reporting period. Contracts are measured using the building blocks of:

•discounted probability-weighted cash flows

•an explicit risk adjustment, and

•a contractual service margin (CSM) representing the unearned profit of the contract which is recognized as revenue over the coverage period.

The standard allows a choice between recognizing changes in discount rates either in the statement of maintenance fund. The choice is likely to reflect how insurers account for their financial assets under IFRS 9. An optional, simplified premium allocation approach is permitted for the liability for the remaining coverage for short-duration contracts, which are often written by non-life insurers.

There is a modification of the general measurement model called the ‘variable fee approach’ for certain contracts written by life insurers where policyholders share in the returns from underlying items. When applying the variable fee approach, the entity’s share of the fair value changes of the underlying items is included in the CSM. The results of insurers using this model are therefore likely to be less volatile than under the general model. The new rules will affect the financial statements and key performance indicators of all entities that issue insurance contracts or investment contracts with discretionary participation features.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

4.NEW OR REVISED STANDARDS OR INTERPRETATIONS (continued)

IFRS 17 - Insurance Contracts (Continued)

Targeted amendments made in July 2020 aimed to ease the implementation of the standard by reducing implementation costs and making it easier for entities to explain the results of applying IFRS 17 to investors and others. The amendments also deferred the application date of IFRS 17 to 1 January 2023

Further amendments made in December 2021 added a transition option that permits an entity to apply an optional classification overlay in the comparative period(s) presented on initial application of IFRS 17. The classification overlay applies to all financial assets, including those held in respect of activities not connected to contracts within the scope of IFRS 17. It allows those assets to be classified in the comparative period(s) in a way that aligns with how the entity expects those assets to be classified on the initial application of IFRS 9. The classification can be applied on an instrument-byinstrument basis.

IFRS 10 and IAS 28- Sale or contribution of assets between an investor and its associate or joint venture

The IASB has made limited scope amendments to IFRS 10 Consolidated Financial Statements and IAS 28 Investments in Associates and Joint Ventures.

The amendments clarify the accounting treatment for sales or contribution of assets between an investor and their associates or joint ventures. They confirm that the accounting treatment depends on whether the nonmonetary assets sold or contributed to an associate or joint venture constitute a ‘business’ (as defined in IFRS 3 Business Combinations).

Where the non-monetary assets constitute a business, the investor will recognise the full gain or loss on the sale or contribution of assets. If the assets do not meet the definition of a business, the gain or loss is recognised by the investor only to the extent of the other investor’s interests in the associate or joint venture. The amendments apply prospectively.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a.Financial instruments

i.Recognition and derecognition

Financial assets and financial liabilities are recognized when the Homeowners Association becomes a party to the contractual provisions of the financial instrument. Financial assets are derecognized when the contractual rights to the cash flows from the financial asset expire, or when the financial asset and substantially all the risks and rewards are transferred. A financial liability is derecognized when it is extinguished, discharged, cancelled or expires.

ii.Classification and initial measurement of financial assets

All financial assets are initially measured at fair value adjusted for transaction costs (where applicable).

Financial assets, other than those designated and effective as hedging instruments, are classified into the following categories:

•amortized cost;

•fair value through profit or loss (FVTPL); and

•fair value through other comprehensive income (FVOCI)

The classification is determined by both:

•the entity’s business model for managing the financial asset; and

•contractual cash flow characteristics of the financial asset.

All income and expenses relating to financial assets that are recognized in the statement of profit or loss and other comprehensive income are presented within revenue and expenses.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

a.Financial instruments (Continued)

iii.Subsequent measurement of financial assets

Financial assets at amortized cost

Financial assets are measured at amortized cost if the assets meet the following conditions (and are not designated as FVTPL):

o they are held within a business model whose objective is to hold financial assets and collect its contractual cash flows; and

o the contractual terms of the financial assets give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding.

After initial recognition, these are measured at amortized cost using the effective interest method. Discounting is omitted where the effect of discounting is immaterial.

As at December 31, 2022, the Homeowners Association’s cash and cash equivalents, accounts receivable, prepayments and deposits, other assets, fixed assets and right of use assets fall into this category.

Financial assets at fair value through profit or loss (FVTPL)

Financial assets that are held within a different business model other than “hold to collect” or “hold to collect and sell” are categorized at fair value through profit and loss. Further, irrespective of the business model financial assets whose contractual cash flows are not solely payments of principal and interest are accounted for at FVTPL. All derivative financial instruments fall into this category, except for those designated and effective as hedging instruments, for which the hedge accounting requirements apply.

Assets in this category are measured at fair value with gains or losses recognized in the statements of profit or loss and other comprehensive income. The fair values of financial assets in this category are determined by reference to active market transactions or using a valuation technique where no active market exists.

As at December 31, 2022, the Homeowners Association had no financial assets at FVTPL.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

a.Financial instruments (Continued)

iii.Subsequent measurement of financial assets (continued)

Financial assets at fair value through other comprehensive income (FVOCI)

The Homeowners Association accounts for financial assets at FVOCI if the assets meet the following conditions:

o they are held under a business model whose objective it is “hold to collect” the associated cash flows and sell; and

o the contractual terms of the financial assets give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding.

Any gains or losses recognized in other comprehensive income (OCI) will be recycled upon derecognition of the asset.

As at December 31, 2022, the Homeowners Association had no financial assets at FVOCI.

iv.Impairment of financial assets

IFRS 9’s impairment requirements use more forward-looking information to recognize expected credit losses - the “expected credit loss (ECL) model”. This replaces IAS 39’s “incurred loss model”. Instruments within the scope of the new requirements included loans and other debt-type financial assets measured at amortized cost and FVOCI, trade receivables, contract assets recognized and measured under IFRS 15 and loan commitments and some financial guarantee contracts (for the issuer) that are not measured at fair value through profit or loss.

Recognition of credit losses is no longer dependent on the Homeowners Association first identifying a credit loss event. Instead, the Homeowners Association considers a broader range of information when assessing credit risk and measuring expected credit losses, including past events, current conditions, reasonable and supportable forecasts that affect the expected collectability of the future cash flows of the instrument.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

a.Financial instruments (Continued)

iv.Impairment of financial assets (continued)

In applying this forward-looking approach, a distinction is made between:

• financial instruments that have not deteriorated significantly in credit quality since initial recognition or that have low credit risk (“Stage 1”);

• financial instruments that have deteriorated significantly in credit quality since initial recognition and whose credit risk is not low (“Stage 2”); and

• “Stage 3” would cover financial assets that have objective evidence of impairment at the reporting date. “12-month expected credit losses” are recognized for the first category while “lifetime expected credit losses” are recognized for the second category.

v.Classification and subsequent measurement of financial liabilities

As the accounting for financial liabilities remains largely the same under IFRS 9 compared to IAS 39, the Homeowners Association’s financial liabilities were not impacted by the adoption of IFRS 9. However, for completeness, the accounting policy is disclosed below.

Financial liabilities are initially measured at fair value, and, where applicable, adjusted for transaction costs unless the Homeowners Association designated a financial liability at fair value through profit or loss. Subsequently, financial liabilities are measured at amortized cost using the effective interest method except for derivatives and financial liabilities designated at FVTPL, which are carried subsequently at fair value with gains or losses recognized in profit or loss (other than derivative financial instruments that are designated and effective as hedging instruments).

All interest-related charges and, if applicable, changes in an instrument’s fair value that are reported in profit or loss are included within other expenses. The Homeowners Association’s financial liabilities include accounts payable, and accrued expense are measured at amortized cost using the effective interest rate method.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

a.Financial instruments (Continued)

vi.Fair value of financial instruments

transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of financial assets and liabilities traded in active markets are based on quoted market prices at the close of trading on the reporting date. If a significant movement in fair value occurs subsequent to the close of trading on the period end date, valuation techniques will be applied to determine the fair value. A significant event is any event that occurs after the last market price for a security or close of market, but before the Homeowners Association’s valuation time that materially affects the integrity of the closing prices for any security, instrument or securities affected by that event so that they cannot be considered “readily available” market quotations.

Management applies valuation techniques to determine the fair value of financial instruments where active market quotes are not available. This requires management to develop estimates and assumptions based on market inputs, using observable data that market participants would use in pricing the instrument. Where such data is not observable, management uses its best estimate. Estimated fair values of financial instruments may vary from the actual prices that would be achieved in an arm’s length transaction at the reporting date.

b.IFRS 15 Revenue from Contracts with Customers

Revenue is recognized when a customer obtains control or consumes the services. Determining the timing of the transfer of control, at a point in time or over time, requires judgment. The Homeowner Association recognizes revenue from contract customers based on a five-step model as set out in IFRS 15:

Step 1 – Identify the contract(s) with a customer: A contract is defined as an agreement between two or more parties that creates enforceable rights and obligations and sets out the criteria for every contract that must be met.

Step 2 – Identify the performance obligations in the contract: A performance obligation is a promise in a contract with a customer to transfer goods or render the services to the customer.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

b.IFRS 15 Revenue from Contracts with Customers (continued)

Step 3 – Determine the transaction price: The transaction price is the amount of consideration to which the Homeowners Association expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties.

Step 4 – Allocate the transaction price to the performance obligations in the contract: For a contract that has more than one performance obligation, the Homeowners Association will allocate the transaction price to each performance obligation in an amount that depicts the amount of consideration to which the Homeowner Association expects to be entitled in exchange for satisfying each performance obligation.

Step 5 – Recognize revenue: When or as the entity satisfies a performance obligation. The Company satisfies a performance obligation and recognizes revenue over time, if one of the following criteria is met:

1.The customer simultaneously receives and consumes the benefits provided by the Homeowners Association’s performance as the Homeowners Association performs; or

2.The Homeowners Association’s performance creates or enhances an asset that the customer controls as the asset is created or enhanced; or

3.The Homeowners Association’s performance does not create an asset with an alternative use to the Homeowners Association and the entity has an enforceable right to payment for performance completed to date.

For performance obligations where one of the above conditions are not met, revenue is recognized at the point in time at which performance obligation is satisfied.

4.When the company satisfies a performance obligation by delivering the promised goods or services, it creates a contract asset based on the amount of consideration earned by the performance. Where the amount of consideration received from a customer exceeds the amount of revenue recognized, this gives rise to a contract liability.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL

STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

c.Cash and cash equivalents - Cash and cash equivalents include cash on hand and at bank and short-term deposits which have a maturity period of less than three months.

d.Trade and other receivables - Accounts receivable is stated at cost less provision for doubtful accounts and any impairment losses. Management records provisions when in their opinion, amounts are irrecoverable based on historical performance and solvency of the customer. The provision for doubtful accounts policy is based on accounts that are 360 days old and remains unpaid.

e.Fixed assets and right-of-use asset - Fixed assets and right-of-use asset are stated at cost less accumulated depreciation and any impairment losses. Historical cost includes expenditures that is directly attributable to the acquisition of the items. Right-of-use asset is stated at present value of lease payments and is presented with fixed assets in the statement of financial position. Depreciation is calculated on the straight-line basis to write-off assets over their estimated useful lives as follows:

Waste water system - 3 - 5 years

Maintenance equipment - 3 years

Computer and office equipment - 3 years

Security equipment - 3 years

Right-of-use asset - 10 years

f.Income and expense recognition - Income and expenses are recorded on an accrual basis of accounting

g.Improvements - These are various projects that are undertaken for the improvement of common areas. These projects are additions and modifications to existing infrastructure within the community. The costs associated with these projects are expensed in the period incurred but is accounted for on the accrual basis for projects not completed within the fiscal year. Improvements are itemized separately and by project for clarity.

h.Related party transactions - Related parties include members of the Board who are also homeowners.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL

STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

i.Impairment of assets - An assessment is made at each financial position date to determine whether there is any indication of impairment of any assets, or whether there is any indication that an impairment loss previously recognized on an asset in prior years may no longer exist; the asset’s recoverable amount is estimated. An asset’s recoverable amount is computed as the higher of the asset’s value in use or its net selling price. An impairment loss is recognized only if the carrying amount of an asset exceeds its recoverable amount. An impairment loss is charged to operations in the period in which it arises unless the asset is carried at a revalued amount in which case the impairment is charged to revaluation. A previously recognized impairment is reversed only if there has been a change in the estimates used to determine the recoverable amount of the asset, however, not to an amount higher than the carrying amount that would have been determined (net of any depreciation), had no impairment loss been recognized for the asset in prior years.

j.Leases – IFRS 16 was adopted as from January 1, 2020. The finance lease contract was recognized on the statement of financial position by recognizing right-of-use assets and corresponding lease liabilities at the transition date. The Homeowners Association applied the modified retrospective transition method, and consequently comparative information is not restated. At the adoption date, lease liabilities were recognized for leases previously classified as operating leases applying IAS 17. These lease liabilities were measured at the present value of the remaining lease payments and discounted using the prime rate in effect for 2021. In general, a corresponding right-of-use asset was recognized for an amount equal to each lease liability, adjusted by the amount of any prepaid or accrued lease payments relating to the lease contract.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED

DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

6.cash and cash equivalents

As at December 31, 2022, cash at bank is comprised of following balances:

The Homeowners Association does not earn interest on cash at bank at the prevailing market interest rates. The current accounts earned no interest during the years ended December 31, 2022 and December 31, 2021. The Homeowners Association’s current account is non-interest bearing.

7.accounts receivable

Accounts receivable consist of the following balances:

The movement in the provision for doubtful accounts is as follows:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

8.FINANCIAL INSTRUMENT BY CATEGORY

Assets as per the statement of financial position

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

8.FINANCIAL INSTRUMENT BY Category (continued)

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED

DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

9.FIXED ASSETS and right-of-use asset

The movement in fixed assets and right-of-use asset during the year is as follows:

Depreciation

by functional categories is comprised of the balances:

10.prepaid maintenance fees and deposits

Prepaid maintenance fees and deposits are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL

STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

11.lease liability

The Homeowners Association rents office space from Artech Bahamas Ltd. at$41,760 per annum, inclusive of electricity and water. The lease will expire on August 31, 2024. Set out below is the carrying amount of the lease liability and the movement during the year:

The following are the amounts recognized in the statement of maintenance fund:

12.deferred income

Deferred income of $379,649 represent maintenance fee income of $10,918 and special assessment fee income for the road project of $368,731 to be recognized in 2023.

13.general reserve fund

This amount represents a reserve established to provide for future contingencies.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

14.security expenses

15.maintenance of common areas

The expenses associated with the maintenance of common areas are comprised of the following balances:

16.gardening expenses

Gardening expenses are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2022 (CONTINUED)

(Expressed in Bahamian dollars)

17. water and meters

Water and meters expenses are comprised of the following balances:

18. painting expenses

Painting expenses are comprised of the following balances:

19.WASTE WATER MANAGEMENT

Waste water management expenses are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO the audited FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

20.CONTINGENT LIABILITy

Seawall - With the exception of a few unstable and incomplete sections of the wall noted in an engineer’s report commission by the Homeowners Association, the seawall is in fair condition with primary corrosion damage to the coping beam. Engineers have advised that the durability and appearance of the wall can be improved significantly by completing the noted repairs and coating the concrete surface. The overall cost of the repairs has not been fully quantified. The seawall is repaired by request, according to the assessment given by the contractor and based on the level of the damage to the retaining wall.

21.FINANCIAL RISK MANAGEMENT

Risk is inherent in the Homeowners Association’s activities but is managed through a continuing and pro-active process of identification, measurement and monitoring. The process of risk management is critical to the Homeowners Association’s continuing profitability. The Homeowners Association’s overall risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Homeowners Association’s financial performance.

a.Market risk

Market risk is the risk of loss to future earnings, fair values or future cash flows that may result from changes in the price of a financial instrument. The value of a financial instrument may change as a result of changes in foreign currency exchange rates, equity prices and other market changes.

i.Price risk

Price risk is the risk that the value of an instrument will fluctuate as a result of changes in market prices whether caused by factors specific to an individual investment, its issuer or all factors affecting all instruments traded in the market. As of December 31, 2022, the Homeowner Association has no significant exposure on price risk

ii.Currency risk

Currency risk is the risk that the fair value of a financial instrument will fluctuate because of changes in foreign exchange rates. The Homeowners Association may invest in financial instruments denominated in currencies other than Functional Currency. As of December 31, 2022, the Homeowner Association has no significant exposure on currency risk.

iii.Interest rate risk

Interest rate risk is the risk that changes in the market interest rates will reduce the Homeowners Association’s current and future earnings or economic values. As of December 31, 2022, the Homeowner Association has no significant exposure on interest rate risk.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO

FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2021 (CONCLUDED)

(Expressed in Bahamian dollars)

21.FINANCIAL RISK MANAGEMENT (CONTINUED)

b.Credit risk

Credit risk is the risk that a counterparty to a financial instrument will fail to discharge an obligation or commitment that it has entered into with the Homeowners Association. Credit risk is generally higher when a non-exchange-traded financial instrument is involved, as the counterparty is not backed by an exchange clearing house. The carrying amount of financial assets best represents the maximum credit risk exposure at the reporting date.

At the reporting date the Homeowners Association’s financial assets exposed to credit risk amounted to the following:

At December 31, 2022 substantially, all transactions were cleared through First Caribbean International Bank (Bahamas) Ltd. and Scotiabank (Bahamas) Limited.

Bankruptcy or insolvency of the custodians may cause the Homeowners Association’s rights with respect to cash at bank to be delayed or limited. The Homeowners Association regularly monitors its risk by monitoring the credit quality of the custodians. There is no credit rating available for the custodians mentioned above.

c.Liquidity risk

Liquidity risk is the risk that the entity will encounter difficulty in meeting obligations associated with its financial liabilities. The table below summarizes the maturity profile of the Homeowners Association’s financial instruments based on undiscounted contractual payments.

SANDYPORT

HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE

YEAR ENDED DECEMBER 31, 2021 (CONCLUDED)

(Expressed in Bahamian dollars)

21.FINANCIAL RISK MANAGEMENT (CONTINUED)

c.Liquidity

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONCLUDED)

(Expressed in Bahamian dollars)

21.FINANCIAL RISK MANAGEMENT (CONTINUED)

b.Custody risk

custody risk. Custody risk is the risk of a loss being incurred on financial assets in custody as a result of a custodian's insolvency, negligence, misuse of assets, fraud, poor administration or inadequate record-keeping. Although an appropriate legal framework is in place that reduces the risk of loss of value of the securities held by the custodian in the event of its failure, the ability of the company to transfer the securities might be temporarily impaired.

e.Capital risk management

The Homeowners Association's objectives when managing capital are to safeguard its ability to continue as a going concern and to maximize the return to stakeholders. The capital structure of the Homeowners Association consists of other financial liabilities. The Homeowners Association's directors manage the Homeowners Association's capital and make adjustments to it in light of changes in economic conditions. The capital structure is reviewed on an ongoing basis.

22.RELATED PARTIES

Parties are considered to be related if one party has the ability to control the other party or exercise significant influence over the other party in making financial or operational decisions. Related parties include the Directors, Insurance Agents and Brokers as well as the Insurance Companies.

23.SUBSEQUENT EVENTS

There were no material events subsequent to December 31, 2022 to the date of this report which necessitate a revision of the figures or disclosure thereof in the financial statements.

PROFESSIONAL ADVISORS

Auditors:

HLB Bahamas

Building 12, Office 1

Caves Village

P. O. Box N-3205

Nassau, The Bahamas

Tel: (242) 327-0689

Fax: (242) 327-0696

Web: www.hlbbahamas.com

Bankers:

CIBC First Caribbean

Sandyport Branch

P.O. Box N-8350 / N-7125

Nassau, The Bahamas

Tel: (242) 327-8364 / 327-4957

Fax: (242) 327-4955

Account: 200-167527

Web: www.cibcfcib.com

Scotiabank

Legal Advisors:

Kahlil D. Parker

Cedric L. Parker & Co.

Chambers No.9 Rusty Bethel Drive

P.O. Box N-1953

Nassau, The Bahamas

Tel: (242) 322-4954/5

Fax: (242) 328-3706

Email: kdp@parkerslaw.net

Consulting Architects:

Alberto G. Suighi

Artech Bahamas Ltd.

Lagoon Court

Nassau, The Bahamas

Tel: (242) 327-2335

Fax: (242) 327-2337

Web: www.artechbahamas.com

Cable Beach

P.O Box N-7518

Nassau, The Bahamas

Tel: (242) 702-8100

Fax: (242) 327-5728

Account: 70045-72613

Web: www.bahamas.scotiabank.com

Insurance Agents:

Tavares & Higgs

Blake Road

P. O. Box SP-64003

Nassau, The Bahamas

Tel: (242) 327-8606

Fax: (242) 327-8607

Email: stavares@tavareshiggs.com