THE COMPLETE GUIDE TO

THE COMPLETE GUIDE TO

Your Essential Handbook for Estepona & Costa del Sol Success

By Brian Stevendale of Sandtons Luxury Property 2025

After three decades guiding international buyers through Spanish property acquisitions, I’ve witnessed firsthand the transformation of Spain from a holiday destination into a premier relocation choice for discerning British, American, and Dutch buyers. The numbers speak for themselves: over 50,000 Americans now call Spain home, with a 25% increase in just two years, while British buyers continue to dominate the Spanish property market despite Brexit complexities.

What draws sophisticated buyers to Spain isn’t just the 300+ days of sunshine or the world-renowned cuisine—it’s the quality of life that’s increasingly difficult to find elsewhere. In an era of rising global uncertainty, Spain offers something precious: safety, community, and a lifestyle that prioritises living well over merely working hard.

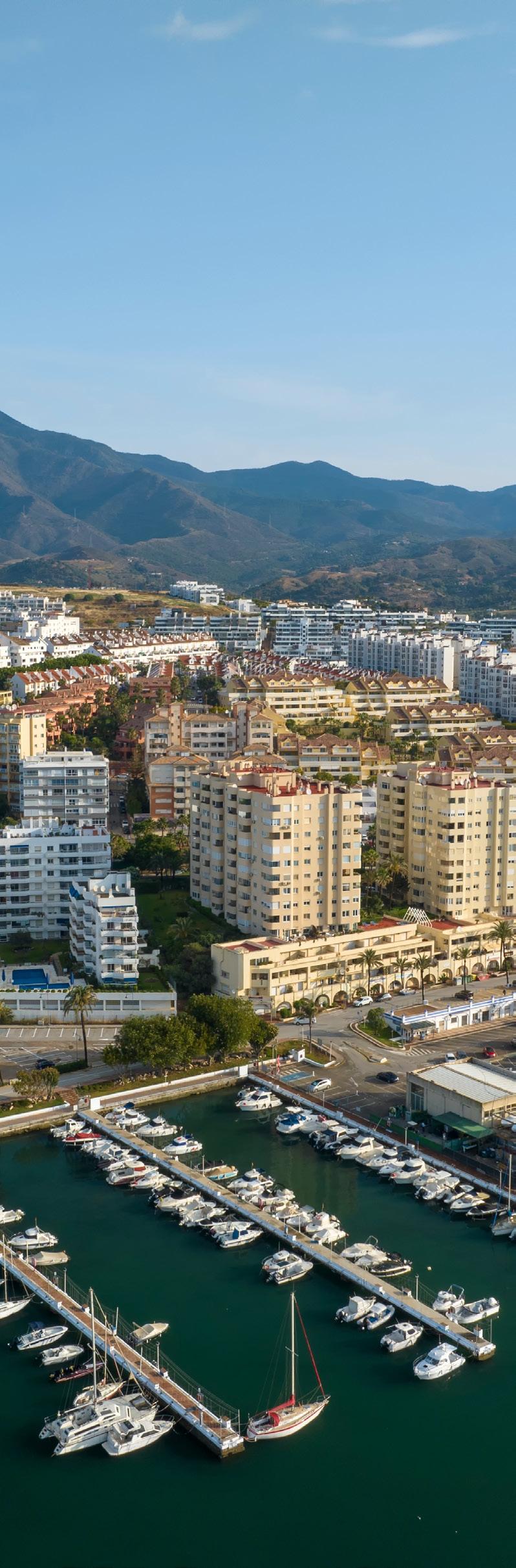

At the heart of this Spanish renaissance lies Estepona, on the Costa del Sol that perfectly exemplifies why Spain has become the destination of choice for international property buyers. Once a traditional fishing village, Estepona has evolved into a sophisticated coastal town that maintains its authentic Spanish character while offering world-class amenities and infrastructure.

The local government has transformed the municipality from one of the most indebted in 2010 to now, the leading shining light of success, with zero public debt, and a surplus allowing for immediate property tax reductions for it’s homeowners.

Estepona’s strategic location—just 20 minutes from Marbella, 45 minutes from Gibraltar, and an hour from Málaga airport—positions it perfectly for those seeking the Costa del Sol lifestyle without the crowds and premium pricing of more tourist-heavy destinations. The town’s ongoing urban renaissance, cantered around its charming Old Town, combines traditional Andalusian architecture with contemporary luxury developments, creating an environment that appeals to both permanent residents and astute investors.

This guide draws from my extensive experience helping hundreds of clients navigate the Spanish property market successfully. Whether you’re seeking a second home in the sun, planning a permanent relocation, or pursuing a strategic investment opportunity, the insights contained here will provide the clarity and confidence you need to make informed decisions in one of Europe’s most rewarding property markets.

The Spanish property market has undergone a remarkable transformation since the 2008 financial crisis. What emerged from that challenging period is a more mature, transparent, and internationally focused market that offers exceptional value compared to other premium European destinations.

The Costa del Sol, particularly the Estepona area, represents one of the strongest performing segments of the Spanish market. Several factors contribute to this success:

The region has benefited from significant public and private investment in infrastructure. The expansion of Málaga airport, improvements to the AP-7 motorway, and ongoing urban regeneration projects have enhanced both accessibility and quality of life.

Unlike purely domestic markets, the Costa del Sol attracts buyers from across Europe and beyond, creating a more resilient market less dependent on any single national economy.

Properties here command premiums not just for their physical attributes but for the lifestyle they enable—yearround outdoor living, proximity to world-class golf courses, marinas, and cultural attractions.

Within the broader Costa del Sol market, distinct micro-markets offer different opportunities.

Historic properties undergoing renovation, offering character and capital appreciation as the area continues its renaissance.

Traditional villas and fincas offering space, privacy, and value, increasingly popular with remote workers and families.

Luxury developments between Estepona and San Pedro, featuring contemporary architecture and premium amenities.

In walking distance of the Port, areas locals such as Seghers offer luxurious traditional and new build villas. While Estepona Golf and Las Mesas provide an eclectic selection of modern homes.

Waterfront living with direct access to boating and water sports, popular with international buyers seeking turnkey luxury.

Off-plan purchases in Estepona offer the advantage of modern specifications, energy efficiency, and often attractive payment terms. Developments like those emerging along the New Golden Mile & Estepona West provide contemporary luxury with strong rental potential.

The resale market offers immediate availability and established communities. Well-maintained properties in prime locations often provide better value than new builds, particularly for buyers prioritising character and mature landscaping.

Rental yields in Estepona range from 6-12% annually, depending on property type and location. Short-term holiday rentals often achieve higher returns but require more management, while long-term rentals offer stability and steady income streams.

Rental yields in Estepona range from 6-12% annually, depending on property type and location.

CHAPTER 2

In my three decades in Spanish property, I’ve watched Estepona evolve from a well kept secret into the Costa del Sol’s most desirable destination. What makes Estepona special isn’t just its pristine beaches or charming old town—it’s the authentic Spanish experience it offers without sacrificing modern conveniences.

Estepona has managed what many coastal towns struggle with: maintaining its soul while embracing progress. The town’s commitment to urban beautification is evident everywhere, from the flower-lined streets of the old town to the impressive promenade that stretches for over 20 kilometres along the coast.

Unlike some Costa del Sol destinations that cater primarily to tourists, Estepona maintains a strong local community. This creates an authentic Spanish atmosphere where expatriates can truly integrate into Spanish life while still enjoying international amenities.

While summer brings beaches and outdoor dining, Estepona’s mild winters make it equally appealing year-round. Golf courses remain playable, terraces stay busy, and the town’s cultural calendar continues throughout the year.

With excellent schools (including international options), safe streets, and abundant outdoor activities, Estepona appeals strongly to families considering relocation.

Estepona’s position on the AP-7 motorway provides excellent connectivity. Málaga airport is accessible within an hour, while Gibraltar airport offers additional flight options. The town’s efficient local bus system and bike-friendly infrastructure reduce the need for daily car use.

The town boasts excellent healthcare facilities, including the modern Hospital de Estepona, while proximity to Marbella and Málaga provides access to specialised medical services and international hospitals.

International schools in the area serve the expatriate community, while the town’s Spanish schools offer opportunities for children to become fully bilingual.

Estepona has shown consistent property value growth, outperforming many other Costa del Sol markets. The town’s ongoing development and increasing international recognition suggest continued appreciation potential.

Strong rental demand comes from both holiday makers and long-term residents. The town’s appeal to families and retirees creates stable rental markets, while its tourism infrastructure supports short-term rental investments.

Carefully managed development ensures growth without oversupply. New projects focus on quality over quantity, maintaining the town’s premium positioning.

Estepona offers authentic Spanish culture, great weather, and excellent connectivity, healthcare, and schools in a housing market that keeps growing.

New developments in Estepona offer compelling advantages for international buyers, particularly those seeking modern amenities and energy efficiency. Having guided numerous clients through off-plan purchases, I’ve seen firsthand how the right new development can provide exceptional value and peace of mind.

New developments incorporate the latest building standards, energy efficiency measures, and smart home technology. Properties meet current EU energy ratings, often achieving A or B classifications that result in lower utility costs and higher resale values.

Many new developments feature resort-style amenities—infinity pools, gymnasiums, spa facilities, and landscaped gardens—that would be prohibitively expensive to add to existing properties.

Off-plan purchases typically offer structured payment plans, allowing buyers to spread payments over the construction period. This can provide significant cash flow advantages and reduce the need for immediate large capital outlays.

Purchasing off-plan often allows for customisation of finishes, layouts, and fixtures, enabling buyers to create their ideal home without the cost and complexity of major renovations.

Not all developers are equal. I always advise clients to thoroughly research the developer’s track record, financial stability, and previous projects. Established developers with successful completion histories offer greater security.

Spanish law requires developers to provide bank guarantees for off-plan purchases, protecting buyers’ deposits. Ensure these guarantees are properly in place before committing funds.

Construction delays can occur. Factor potential delays into your planning, particularly if you’re coordinating property completion with other life changes like relocation or retirement.

The resale market in Estepona offers distinct advantages for buyers seeking immediate possession or unique character properties. After decades of experience, I’ve learned that some of the best value propositions come from carefully selected resale properties.

Resale properties are often located in proven areas with established communities, mature landscaping, and confirmed infrastructure. You can evaluate the neighbourhood, nearby amenities, and community dynamics before purchasing.

Resale properties allow for immediate possession, perfect for buyers who need accommodation quickly or want to begin enjoying their Spanish lifestyle without delay.

Many resale properties offer opportunities for value-add renovations. With proper planning and local expertise, renovations can create significant equity while allowing customisation to personal tastes.

Unlike new developments with fixed pricing, resale properties often allow for price negotiation, particularly for cash buyers or those with flexible timing.

The decision between new and resale depends on your priorities, timeline, and risk tolerance. New developments suit buyers prioritising modern amenities, energy efficiency, and turnkey convenience. Resale properties appeal to those seeking character, immediate possession, or renovation opportunities.

In my experience, the most satisfied clients are those who clearly understand their priorities before beginning their search. Whether new or resale, the key is finding a property that aligns with your lifestyle goals and investment objectives.

For many international buyers, purchasing Spanish property is just the first step in a broader relocation strategy. Understanding Spain’s residency options is crucial for tax planning, healthcare access, and long-term lifestyle goals.

Spain offers several residency pathways, each with distinct requirements and benefits. The key is selecting the route that best aligns with your circumstances and objectives.

This visa has become increasingly popular among British and American retirees and those with passive income. The Non-Lucrative Visa allows residence in Spain without the right to work, making it ideal for retirees, remote workers employed outside Spain, or those with sufficient passive income.

This visa particularly appeals to American and British buyers who can demonstrate pension income, investment returns, or remote employment with non-Spanish companies.

Requirements:

• Proof of €28,000+ annual income (plus €7,000 for each dependent)

• Private health insurance covering Spain

• Clean criminal record

• No employment permitted

Benefits:

• Renewable residence permit

• Access to Spanish healthcare system after one year

• Path to permanent residency after five years

• Family reunification possible

Spain’s Digital Nomad Visa, introduced in 2023, targets remote workers and digital entrepreneurs. This visa recognises the growing trend of location-independent professionals seeking quality of life improvements.

Requirements:

• Stable income from remote work or digital business

• Employment relationship or business existence of at least one year

• Maximum 20% of income from Spanish sources

• Proof of accommodation in Spain

Benefits:

• Work authorisation for remote/digital activities

• Renewable up to five years

• Family reunification options

• Potential tax advantages under special regime

Understanding the distinction between legal residency and tax residency is crucial for international buyers. Legal residency grants the right to live in Spain, while tax residency determines tax obligations.

Spanish Tax Residency applies if you::

• Spend more than 183 days per year in Spain

• Have your main economic interests in Spain

• Have your spouse and minor children residing in Spain

Tax residency has significant implications for worldwide income taxation and should be carefully planned with qualified tax advisors.

British citizens face additional complexity following Brexit.

The Withdrawal Agreement protects rights of UK citizens resident in Spain before December 31, 2020, but new British residents must follow standard third-country national procedures.

Options for New British Residents:

• Non-Lucrative Visa for retirees

• Work visas for employment-based residence

• Student visas for education-based residence

• Investment visas for business investment

One of the most complex aspects of Spanish property ownership for international buyers involves understanding tax obligations.

The Spanish tax system affects property owners differently depending on their residency status, nationality, and how they use their property.

All property owners pay this local tax (Impuesto sobre Bienes Inmuebles - IBI) regardless of residency status. Rates vary by municipality but typically range from 0.4% to 1.1% of the cadastral value annually.

Non-resident property owners must pay annual tax on deemed rental income, regardless of whether the property is actually rented. The tax applies to 1.1% of the cadastral value (or 2% if cadastral value hasn’t been updated since 1994) at a rate of 19% net for EU residents and 24% gross for non-EU residents.

Some regions, including Andalusia (where Estepona is located), have reduced or eliminated wealth tax for residents. Non-residents may still be liable depending on their total Spanish assets.

Non-residents pay capital gains tax on property sales at 19% (EU residents) or 24% (non-EU residents). Spanish residents benefit from progressive rates and potential exemptions.

This local tax applies to all property sales based on land value increases. Recent legal changes have made this tax more reasonable, but it remains a consideration in sale planning.

Non-residents pay capital gains tax on property sales at 19% (EU residents) or 24% (non-EU residents). Spanish residents benefit from progressive rates and potential exemptions.

The Beckham Law (Régimen Especial de Trabajadores Desplazados) offers significant tax advantages for qualifying new Spanish residents, but requires careful consideration, particularly for American citizens.

Benefits:

• Flat 24% tax rate on Spanish income up to €600,000

• Tax only on Spanish-source income (not worldwide)

• Available for first five years of Spanish tax residency

• Must not have been Spanish tax resident in previous five years

• Must move to Spain due to employment or business activities

• Must remain Spanish tax resident for at least three years

Americans face unique challenges with the Beckham Law due to US worldwide taxation requirements. While the law provides Spanish tax benefits, Americans still must file US tax returns and may owe additional US taxes to meet their total obligations.

Professional tax advice is essential for Americans considering this regime.

New builds and off-plan properties are subject to 10% IVA (Spanish VAT). This is typically paid directly to the developer and is separate from other purchase costs.

Existing properties are subject to Transfer Tax (Impuesto de Transmisiones Patrimoniales) rather than IVA. In Andalusia, the rate is 7%.

Carefully planning when to establish Spanish tax residency can provide significant advantages, particularly for those with variable income or substantial assets

Different ownership structures (individual, corporate, or through holding companies) can have varying tax implications. Professional advice is essential for optimising your structure.

Spanish tax residents can often deduct mortgage interest on their primary residence, providing additional tax benefits for financed purchases.

New builds and off-plan properties are subject to 10% IVA, and existing roperties are subject to a 7% Transfer Tax.

The Spanish mortgage market has evolved significantly to accommodate international buyers, offering competitive rates and reasonable terms for qualified purchasers. Understanding your financing options is crucial for optimising your property purchase strategy.

Loan-to-Value

New builds and off-plan properties are subject to 10% IVA (Spanish VAT). This is typically paid directly to the developer and is separate from other purchase costs.

Residents can often secure up to 80% financing with more favourable rates, reflecting the reduced risk banks perceive in lending to established residents.

Spanish mortgages typically offer terms of 15-30 years, with some banks extending to 40 years for younger borrowers with strong financial profiles.

Spanish banks require comprehensive documentation for international buyers:

Financial Documentation

• Three years of tax returns

• Bank statements (typically 12 months)

• Employment verification or business financial statements

• Proof of other income sources (pensions, investments)

• Credit reports from your home

Personal Documentation

• Valid passport

• NIE (Número de Identificación de Extranjero)

• Proof of address in home country

• Marriage certificate (if applicable)

Most Spanish mortgages offer variable rates tied to Euribor plus a margin. While this can provide lower initial rates, it exposes borrowers to interest rate risk.

Fixed-rate options are increasingly available, providing payment certainty but typically at higher initial rates than variable options.

Some lenders offer mixed-rate products with fixed rates for initial periods (typically 1-5 years) before converting to variable rates.

Opening a Spanish bank account early in your property search process demonstrates commitment and can expedite mortgage approval. Many international banks have Spanish operations that can facilitate this process.

Obtaining mortgage pre-approval provides several advantages:

• Clearer budget parameters for property search

• Stronger negotiating position with seller

• Faster transaction completion

• Rate protection during property search

High-net-worth individuals may access private banking services offering more flexible lending criteria and terms, though typically at higher rates.

Some international banks offer Spanish property mortgages to their existing clients, which can provide familiar service and potentially better terms for established customers.

Many international buyers choose cash purchases to avoid financing complexity and strengthen their negotiating position. Cash buyers often secure better prices and can close transactions more quickly.

Exchange Rate Risk

International buyers face currency exposure between their home currency and euros. Consider timing strategies and hedging options to manage this risk.

Currency Mortgages

Some banks offer mortgages in currencies other than euros, though this introduces additional complexity and risk that must be carefully evaluated.

Transfer Strategies

Large international transfers require careful planning for both cost efficiency and regulatory compliance. Specialist currency services often provide better rates than traditional banks.

The Spanish property purchase process follows established legal procedures designed to protect both buyers and sellers. Understanding this process helps international buyers navigate successfully while avoiding common pitfalls that can delay or complicate transactions.

Having guided hundreds of international clients through Spanish property purchases, I can attest that preparation and professional guidance are essential for smooth transactions. The process differs significantly from property purchases in the UK, US, or Netherlands, making local expertise invaluable.

Begin with clear criteria regarding location, property type, budget, and timeline. Online research provides valuable initial insights, but physical visits to potential areas are essential for informed decision-making.

Engaging qualified property professionals early in your search provides access to off-market opportunities and ensures you receive accurate market information and guidance.

Plan comprehensive viewing trips that allow you to see multiple properties and experience different areas during various times of day and week. This helps you understand neighborhood dynamics and amenities.

The Número de Identificación de Extranjero is required for all property transactions. This tax identification number can be obtained from Spanish consulates abroad or in Spain, but processing takes time, so apply early.

Engaging an independent lawyer specialising in Spanish property law is essential. Your lawyer should be independent of the seller’s representation and fluent in your language to ensure full understanding of all legal aspects.

Organise all required documentation for mortgage applications or international money transfers. This includes obtaining apostilled documents from your home country, which can take several weeks.

Professional market analysis helps determine appropriate offer levels. Spanish property negotiations can be more direct than in some other markets, but understanding local practices is important.

Formal offers should specify price, conditions, and timeline. Include proof of financial capability to demonstrate serious intent.

Once your offer is accepted, you’ll typically sign a private purchase contract and pay a deposit (usually 5-10% of the purchase price). This contract binds both parties to complete the transaction under agreed terms.

Once your offer is accepted, you’ll typically sign a contract and pay a deposit of 5-10% of the purchase price.

This critical phase involves comprehensive verification of all legal and technical aspects of the property:

Legal Due Diligence

• Verification of clear title and ownership

• Confirmation of all permits and licenses

• Review of community obligations and fees

• Investigation of any debts or charges against the property

Technical Due Diligence

• Professional property survey

• Verification of utilities and services

• Assessment of any required repairs or maintenance

• Review of energy efficiency certificates

Financial Due Diligence

• Final mortgage approval (if applicable)

• Currency exchange arrangements

• Insurance arrangements

• Tax planning confirmation

Your lawyer will review all final documents, including the deed (escritura), to ensure accuracy and completeness.

International fund transfers should be completed in advance to ensure availability for completion. Spanish law requires proof of funds’ origin for large transfers.

The transaction completes at the notary’s office with the signing of the public deed. Both parties (or their representatives) must attend, and the buyer pays the balance of the purchase price plus all applicable taxes and fees.

Registration

Your lawyer will register the deed with the Property Registry, officially recording your ownership

Arrange for utility accounts to be transferred to your name, including electricity, water, gas, telephone, and internet services.

Insurance

Ensure property insurance is in place from completion date. Many mortgage lenders require specific insurance coverage.

Understand your ongoing tax obligations as a Spanish property owner, including annual property taxes and any non-resident income tax requirements.

If your property is part of a community, introduce yourself to the administrator and understand community rules and fee payment procedures.

One of the most important aspects of Spanish property purchase planning involves understanding the full cost structure.

Many international buyers focus primarily on the property purchase price but are surprised by additional costs that can add 10-12.5% to the total investment.

You can expect:

• Purchase-Related Costs

• Ongoing Ownership Costs

• Mortgage-Related Costs

• Currency and Transfer Costs

• Renovation and Improvement Costs

Transfer Tax (Impuesto de Transmisiones Patrimoniales)

• Applies to resale properties

• In Andalusia it is 7%.

• Applies to new builds and off-plan properties

• Rate: 10% of purchase price

• Paid directly to developer

Notary Fees

• Typically, €600-€1,500 depending on property value

• Set by government tariff, non-negotiable

Property Registry Fees

• Usually €300-€600

• Required for official ownership registration

Legal Fees

• Typically1% of purchase price

• Essential for protecting your interests

Annual Property Tax (IBI):

• Municipal tax on property ownership

• Typically 0.4-1.1% of cadastral value annually

• Varies by municipality

Community Fees

• For properties in developments or apartment buildings

• Ranges from €50-€500+ monthly depending on amenities

• Covers maintenance, insurance, and shared services

• Electricity: €100-€300 connection fee plus deposit

• Water: €200-€500 connection fee plus deposit

• Gas: €100-€200 connection fee if applicable

• Internet/Phone: €50-€150 installation

Insurance

• Property insurance: €300-€800 annually

• Contents insurance: €200-€500 annually

• Public liability: Often included in community fees

Ongoing ownership costs depend on property typ and municipality, so it’s best to plan ahead.

Mortgage Arrangement Fee

• Typically, 1-2% of loan amount

• Some banks waive this fee for preferred clients

Valuation Fee

• €300-€600 depending on property value

• Required by all mortgage lenders

Mortgage Deed

• Notary and registry fees for mortgage documentation

• Typically, €400-€800

Bank Guarantee Insurance

• Often required by lenders

• Annual premium varies by loan amount and terms

Tax Planning Costs, Tax Advisory Services

• Essential for understanding obligations

• €500-€2,000 annually depending on complexity

Accounting Services

• For non-resident tax obligations

• €300-€800 annually

NIE Application

• €15 application fee

• Additional costs if using professional services

Total Purchase Budget 01

Plan for 110-114% of property purchase price to cover all acquisition costs.

Annual Ownership Budget 02

Budget €3,000-€8,000 annually for typical ongoing costs, varying by property size, location, and amenities.

• Bank wire transfers: €25-€50 plus exchange rate margin

• Specialist currency services: 0.5-2% of transfer amount

• Consider exchange rate fluctuations in budget planning

• Forward contracts to protect against exchange rate movements

• Costs vary by amount and term

Many buyers plan renovations or improvements, which involve additional considerations

• 8-15% of construction costs for major renovations

• Fixed fees for minor modificatio

Building

• €500-€3,000 depending on scope of work

• Processing times vary by municipality

Construction Costs

• Basic renovations: €400-€800 per square metre

• High-end renovations: €1,000-€2,000+ per square meter

Understanding these costs upfront prevents unwelcome surprises and ensures you can budget accurately for your Spanish property investment. Professional guidance helps optimise cost structures and identify potential savings opportunities.

Maintain reserves for unexpected repairs, utility deposits, or currency fluctuations.

Allocate 2-3% of purchase price for professional services (legal, tax, surveying, etc.).

In three decades of guiding international buyers through Spanish property purchases, I’ve observed recurring mistakes that can turn dream purchases into stressful experiences.

Understanding these common pitfall and how to avoid them can save you significant time, money, and frustration.

Using the seller’s lawyer or choosing legal representation based solely on cost rather than expertise and independence.

Conflicts of interest, inadequate due diligence, and lack of proper buyer protection.

Always engage independent legal counsel specialising in Spanish property law and fluent in your language. This investment provides invaluable protection and peace of mind.

Underestimating the time required to obtain a NIE number, especially during peak season or from certain consulates.

Transaction delays, potential loss of favourable exchange rates, or missing purchase deadlines.

Apply for your NIE number as early as possible in your property search process. Allow 4-6 weeks for processing.

Rushing through the due diligence process or failing to investigate property history, debts, or legal status thoroughly.

Inheriting previous owners’ debts, discovering illegal constructions, or facing unexpected legal complications.

Ensure comprehensive legal and technical due diligence, including property registry searches, debt investigations, and verification of all licenses and permits.

Be prepared by getting specialized legal counselling, applying for your NIE number as early as possible and doing your due dilligence when dealing with legal and technical information.

Budgeting only for the property purchase price without accounting for additional costs, taxes, and fees.

Cash flow shortages, borrowing pressure, or inability to complete the purchase.

Budget for 110-114% of the property purchase price to cover all acquisition costs, plus additional reserves for immediate post purchase expenses.

Failing to consider exchange rate fluctuations when budgeting or transferring funds for property purchases.

Significant cost increases due to unfavourable exchange rate movements.

Consider currency hedging strategies and factor potential rate fluctuations into your budget planning.

Beginning mortgage applications too late in the process or failing to prepare comprehensive documentation.

Completion delays, missed opportunities, or unfavourable lending terms.

Begin mortgage discussions early, obtain pre-approval when possible, and ensure all documentation is properly prepared and apostilled.

Avoid financial surprises by budgeting 110-140% of the property purchase price, considering currency hedging strategies and discussing your mortgage early.

Emotional Decision Making

Making purchase decisions based on emotion rather than rational analysis of location, value, and suitability.

Overpaying for properties, choosing unsuitable locations, or purchasing properties that don’t meet long-term needs.

Establish clear criteria before viewing properties and stick to them. Take time to evaluate properties objectively, preferably with professional guidance.

Choosing properties based on limited visits or failing to understand neighbourhood dynamics, seasonal variations, and local amenities.

Disappointment with the area, difficulty with resale, or lifestyle incompatibility.

Visit potential areas multiple times, during different seasons if possible. Research local amenities, transportation, and community characteristics thoroughly.

Focusing only on personal preferences without considering future resale appeal or market demand.

Difficulty selling when needed, extended marketing times, or below-market sale prices.

Consider broad market appeal even for personal-use properties. Features like good locations, reasonable layouts, and quality construction appeal to most buyers.

Take property selection seriously: have clear criteria, visit areas multiple times and consider market appeal.

01

Underestimating Language Barriers

Assuming English will be sufficient for all property-related dealings and daily life integration.

Communication difficulties with contractors, community administrators, local authorities, and service providers.

Begin Spanish language learning early and consider professional translation services for important documents and meetings.

02

Ignoring Community Dynamics

Failing to understand community rules, fee structures, or decision-making processes in developments or apartment buildings.

Conflicts with neighbours, unexpected fee increases, or disagreements about community decisions.

Review community statutes and budgets thoroughly. Meet with community administrators and other residents to understand the dynamics before purchasing.

Don’t assume you needn’t know know Spanish or underestimate the importance of engaging the community. Familiarize yourself with tax legislation and plan accordingly with professional help.

Inadequate Tax Planning

Failing to understand Spanish tax obligations or the interaction between Spanish and home country tax systems.

Unexpected tax liabilities, penalties, or suboptimal tax positions.

Engage qualified tax advisors familiar with international tax issues before completing your purchase and establishing residency.

Ignoring Community Dynamics

Misunderstanding the difference between legal residency and tax residency, or failing to plan residency status strategically.

Unintended tax consequences or complications with residency applications.

Clearly understand your residency goals and plan accordingly with professional guidance.

Choosing Based on Price Alone

Selecting lawyers, surveyors, or other professionals based primarily on cost rather than expertise and track record.

Inadequate service, missed issues, or professional liability problems.

Invest in qualified professionals with proven track records in international property transactions. The cost difference is minimal compared to the protection provided.

Lack of Communication

Failing to maintain regular communication with your professional team or not asking questions when uncertain.

Misunderstandings, missed deadlines, or inadequate service.

Be proactive in communication by asking questions, scheduling regular updates and voicing your honest concerns.

Invest in quality service professionals and be proactive in how you communicate with them.

Strategically based in Estepona’s Old Town, we understand the nuances of each neighbourhood, from the historic centre to the modern developments along the coast.

Having personally bought, invested, developed, and sold properties across Spain, I bring unmatched expertise to every transaction.

We concentrate on luxury properties and new developments, understanding the preferences and needs of international buyers seeking quality and investment potential.

From initial consultation through completion and beyond, we guide you through every step of the Spanish property journey.

Our satisfied clients consistently highlight our professionalism, market knowledge, and commitment to making their property dreams reality.

We’re here to guide you every step of the way.

• Investment, lifestyle, or retirement focus?

• Budget range and financing requirements

• Preferred locations and property type

• Obtain mortgage pre-approval if needed

• Plan currency exchange strategy

• Budget for all associated

• Subscribe to our market updates

• Follow our YouTube channel for expert insights

• Read our Spanish lifestyle blog for local knowledge

• Schedule a free 30-minute consultation

• Discuss your specific requirements

• Receive personalised market recommendations

Contact Sandtons Property today to start your Spanish property journey with confidence.

Our expertise, local knowledge, and commitment to excellence ensure you’ll find not just a property, but your perfect Spanish lifestyle.

With over 30 years of experience and deep local expertise, we transform what can be a stressful process into an easy, enjoyable experience. — Sandtons Property, Your Estepona-Based Property Experts in the heart of Estepona’s Old Town.

Whether you’re searching for your dream home or pursuing a strategic investment opportunity, you can trust that you’re working with true experts who understand both the Spanish market and your unique needs.